UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2016 OR |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

COMMISSION FILE NUMBER: 000-19960

DATAWATCH CORPORATION

(Exact name of registrant as specified in its charter)

| DELAWARE | 02-0405716 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification No.) |

4 CROSBY DRIVE

BEDFORD, MASSACHUSETTS 01730

(978) 441-2200

(Address and telephone number of principal executive office)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Common Stock $0.01 PAR VALUE | NASDAQ | |

| (Title of Class) | (Name of Exchange on which Registered) |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2).Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of the registrant, based on the closing price of the registrant’s common stock on March 31, 2016, the last business day of the Company’s most recently completed second fiscal quarter, as reported by the NASDAQ Capital Market was $46,637,207.

The number of shares of the registrant’s common stock, $0.01 par value, outstanding as of November 8, 2016 was 11,923,786.

Documents Incorporated By Reference

Registrant intends to file a definitive Proxy Statement pursuant to Regulation 14A within 120 days of the end of the fiscal year ended September 30, 2016. Portions of such Proxy Statement are incorporated by reference in Part III of this report.

DATAWATCH CORPORATION

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| 2 |

GENERAL

Datawatch Corporation (NASDAQ-CM: DWCH) (“Datawatch”, “We”, “Us”, “Our”) provides self-service data preparation and visual data discovery software that optimizes multiple sources and a variety of data – regardless of its variety, volume, or velocity – delivering next generation analytics to reveal valuable insights for improving business. Its ability to integrate structured, unstructured, and semi-structured sources like reports, PDF files and EDI streams with real-time streaming data into visually rich analytic applications allows users to dynamically discover key factors that impact any operational aspect of their business. We believe this ability to perform visual discovery against multiple sources and a variety of data sets Datawatch apart in the Big Data and visualization markets. Organizations of every size, worldwide use Datawatch products, including 99 of the Fortune 100. Datawatch is headquartered in Bedford, Massachusetts, with offices in New York, London, Stockholm, Singapore, and Manila, and with partners and customers in more than 100 countries worldwide.

Datawatch is a Delaware corporation, formed in 1986, with executive offices located at 4 Crosby Drive, Bedford, MA 01730 and our telephone number is (978) 441-2200. Periodic reports, proxy statements and other information are available to the public, free of charge, on our website, www.datawatch.com, as soon as reasonably practicable after they have been filed with the SEC and through the SEC’s website, www.sec.gov. Such reports, proxy statements and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, N.E., Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330.

OUR MARKET

We sell and compete in the data preparation and visualization market, which is an emerging and fast growing segment of the overall business analytics space. The analytics market has evolved over the past several years from large systems implemented and managed by IT, to more agile, self-service systems owned and operated by the various business functions.

The self-service data preparation market addresses the needs of business users who are creating and analyzing data without IT intervention. Users need to access, clean and blend data from a wide variety of systems before it can be visualized. It is estimated that up to 80% of user time is spent preparing data versus analyzing data.

The visual data discovery market continues to evolve with new requirements that make Datawatch a more relevant player in this market. While ease of use is still a critical factor in the adoption of visualization technologies, the types of use cases that organizations are applying these technologies to have changed. To support these new use cases visual data discovery technologies are evolving from products to platforms that deal with not only the development of visualizations, but also the acquisition, preparation, automation and management of any source of data to be used in visual data discovery applications. Datawatch’s extensive experience in these areas has allowed us to take on these challenges and deliver high value results to our customers in these mission critical use cases. Two use cases that have dramatically changed how visualization technologies are used are the emergence of the internet of things (“IoT”), specifically the industrial internet, and the expanded use of enterprise content management sources as data in visualization applications.

The Internet of Things (IoT)

With billions of connected “smart objects” generating information from everything from toasters to jet engines, and that number set to grow to over 50 billion devices by 2020 according to the Industrial Internet Consortium, the IoT promises to change the way businesses view everything from their customers to every aspect of their operations. While there is unlimited potential for the use of data from the IoT, the area that holds the highest value is in the use of data from the industrial internet – the monitoring and management of equipment, logistical information and supply chain related to industries such as energy, transportation, manufacturing and health care. To leverage this type of information, organizations will require a visual data discovery platform that can ingest, prepare and blend high velocity in-motion data from these sensors with business data that provides historical perspective and context to this information. We believe that Datawatch is unique in its ability to provide this capability coupled with a self-service end-user design experience and that this combination will place Datawatch at the forefront of this growing market, opening up partnership opportunities with key IoT infrastructure providers.

| 3 |

Enterprise Content Management (ECM)

For years, organizations have stored vast amounts of unstructured and semi-structured content in enterprise content management (“ECM”) systems. While some of this data was stored originally as a result of compliance requirements, many organizations are now looking to do more with that information to better understand their businesses or to utilize Big Data sources to drive decisions within their businesses. Traditional enterprise content management systems are not equipped to do much more than search and retrieve documents. Their inability to take any action against the returned information is a significant limitation. By including Datawatch as part of the solution, ECM systems can be transformed from simple search technologies into “search-to-action” solutions, providing better analytical information to users. This information can be included as another data source in Next Generation Analytics applications, thus providing even greater insight to organizations’ operations.

While IoT and ECM based visual data discovery solutions are only two of many examples of changes in the market that are driving new requirements for visual data discovery vendors, they are not alone. An increase in the use of NoSQL data and other multi-structured sources coupled with the desire for a more manageable and governed deployment of visualization solutions are also driving additional changes in industries such as capital markets, government, retail, and telecommunications.

OUR PRODUCTS

The Datawatch product family enables organizations to maximize the return on all of their information assets, regardless of the form of that data. Datawatch Monarch, the self-service data preparation solution, is the first step in unlocking value from data contained in a wide variety of sources. Datawatch Panopticon enables real-time preparation of streaming data for fast data analysis. Both of these data preparation engines are integrated technically. Monarch and Panopticon provide the broadest solution for unlocking, preparing and visualizing the widest variety of enterprise data. Using all available information enables organizations to make more insightful decisions that yield better and faster results

The Datawatch product family includes the following products:

Datawatch Monarch™ — Access and Prepare Data from Virtually Any Source

Datawatch Monarch is a self-service data preparation tool which lets users explore, manipulate and merge new data sources. With Datawatch Monarch, users can bring all the data that is needed to manage the business to life, whether that information is stored in structured sources like databases, or in less conventional places like unstructured or semi-structured content including PDF files, reports, EDI or text files. Products in the Monarch family include Datawatch Monarch and Datawatch Monarch Server.

Datawatch Panopticon™ — Visually Design, Discover and Explore New Insights

Datawatch Panopticon lets users quickly start asking questions to see hidden patterns, spot problems and identify missed opportunities without programming or scripting. Our in-memory analytics engine enables on-the-fly aggregations and intuitive navigation and integration of data from virtually any data source. With a simple drag-and-drop interface, users can set up hierarchies and filters in their dashboards to make it easier to spot outliers and to see how different subsets of data correlate with each other. Datawatch Panopticon provides a range of specialized visualizations designed specifically to make analyzing streaming data, time series data and historical data, more impactful. Integrated data preparation capabilities and pre-built connectors make it simple to access and combine information from any data source, including data streams from message brokers and complex event processing engines. Products in the Panopticon family include Datawatch Panopticon Designer and Datawatch Panopticon Server.

| 4 |

Datawatch Report Mining Server™ — Unlocking the Power of Content

Datawatch Report Mining Server (“RMS”) is a web-based report analytics solution that integrates with any existing enterprise content management system such as Datawatch Report Manager On-Demand, IBM Content Manager On-Demand, Microsoft SharePoint, Hyland OnBase, ASG Mobius ViewDirect and others. Datawatch RMS opens up the corporate data locked in content management systems, static reports and business documents, enabling dynamic business-driven analysis of information using Datawatch Panopticon Designer or other productivity tools with no user programming.

OUR SERVICES

Datawatch complements its core products with a range of services to ensure successful deployment and usage of our self-service data preparation and visual data discovery software. This includes educational services for customers and partners implementing and learning about the platform, maintenance and support, and professional services to provide in-depth technical assistance for software implementations.

Educational Services

Datawatch Educational Services offers a number of training choices to customers and partners to support the knowledge and skills development needed to take advantage of their investment in our self-service data preparation and visual data discovery software. We offer an array of live and virtual classroom instruction, including private onsite classes. Courses include training on all aspects of our platform, from beginning model building basics to the deployment of sophisticated dashboards sourced from data harvested by our platform.

Professional Services

To assist customers in achieving rapid time-to-value, Datawatch has established a professional services team. This team supports customers and partners with more in-depth technical consulting and best practices about our platform including advanced modeling, application design, implementation and configuration and process optimization.

Customer Support

Datawatch’s customers pay for one year of software maintenance and support with their purchase of our software license platform and have the option to annually renew their maintenance agreements. These annual maintenance agreements provide customers the right to receive software updates on a when-and-if available basis, maintenance releases and patches, and access to telephone support services. The maintenance agreement also allows access to an on-line user forum where experienced users from around the world can share their tips and tricks.

Datawatch has determined that it has only one operating segment. See Note 10 to our accompanying consolidated financial statements for information about our revenue by geographic operations.

MARKETING, SALES AND DISTRIBUTION STRATEGY

We market and sell our products and services through our direct sales force, a distribution channel and an indirect sales channel comprised of a global partner network. Our direct sales force consists of professional sales and pre-sales personnel who typically have several years of experience selling and demonstrating enterprise software solutions. Our distribution channel is predominantly for our Datawatch Monarch product and consists of a two-tier reselling network in North America and single-tier resellers in the rest of the world. Our global partner network brings significant technological and industry expertise, as well as added geographic presence, that enable us to reach customer organizations around the world. These indirect sales channels often help to shorten sales cycles with prospective customers.

Our global partner network includes strategic, geographic and product-specific resellers. These partners are typically authorized to sell licenses, implement and, in some instances, provide first line support for our software products. Additionally, we work with global, national and local system integrators, implementation partners and referral partners who may sell licenses and provide complementary skills, domain or industry experience, as well as geographic coverage.

| 5 |

Our global partner network also includes original equipment manufacturer (“OEM”) partners and value-added reseller (“VAR”) partners who use our technologies as an embedded or bundled add-on features in their products and services. Typically, OEM and VAR partners include software companies, SaaS vendors and information providers. More broadly, this category includes any organization seeking to leverage Datawatch products to access and analyze semi-structured and unstructured data for use in an existing or new product or in a service offering. We invest both development and business resources to ensure that Datawatch products are optimized and certified for leading technology platforms, allowing our customers to benefit from these expanded solutions with seamless integration.

We support our global partner network based on three fundamental principles:

| · | enable partners through sales training, demonstration training, technical support and education; |

| · | market with and for partners through lead generation programs, customer marketing and awareness; and, |

| · | position and sell Datawatch products with effective sales tools and sales support. |

As of September 30, 2016, our global partner network was comprised of more than 100 partners worldwide. No one customer accounted for more than 10% of our total revenue for the years ended September 30, 2016 and 2015. One distribution partner, Lifeboat Distribution (“Lifeboat”), accounted for 15% of total revenue for the year ended September 30, 2014. Other than this customer, no other customer accounted for more than 10% of our total revenue in fiscal 2014. Our agreement with Lifeboat expired in early 2015 and, to manage the transition, we refocused part of our Inside Sales Team to manage and pursue the book of business previously handled by Lifeboat.

Prior to the expiration of our agreement, we offered Lifeboat the ability to return slow-moving and obsolete versions of our products for credit. Based on our historical experience relative to products sold to distributors, we believe that our exposure to such returns was minimal. While the agreement was in place, we recorded a provision for such estimated returns in our accompanying consolidated financial statements.

Our software products are sold under warranty against certain defects in material and workmanship for a period of 30 days from the date of purchase. We also offer a 30 day money-back guarantee on our Datawatch Monarch product sold directly to end-users. To date, we have not experienced any significant product returns under our money-back guarantee.

We focus our marketing efforts on generating qualified sales leads for our direct sales force and our global partners, increasing brand awareness, communicating our positioning in the market and promoting product advantages. We rely on a variety of marketing initiatives including internet-based marketing campaigns, user group meetings, trade shows, our website, industry research, public relations and advertising. In addition, we work closely with a number of our global partners on co-marketing and lead generation initiatives in an effort to broaden our marketing reach.

Our revenues from outside of the United States are primarily the result of sales through the direct sales force of our wholly-owned subsidiaries, Datawatch International Limited, which is located in the United Kingdom and its subsidiaries which are located in Germany, Singapore and Australia, and Datawatch AB, which is located in Sweden, as well as through international resellers. Such international sales represented 14%, 21% and 17% of our total revenue for fiscal 2016, 2015 and 2014, respectively. Further geographic information is included in Note 10, “Segment Information and Revenue by Geographic Location,” to our accompanying consolidated financial statements.

OUR RESEARCH AND DEVELOPMENT OPERATIONS

We believe that timely development of new products and enhancements to our existing products are essential to maintain strong positions in our markets. We intend to continue to invest significant amounts in research and product development to ensure that our products meet the current and future demands of our markets as well as to take advantage of evolving technology trends.

| 6 |

Our product managers work closely with developers, whether independent or in-house, to define product specifications. The initial concept for a product originates from this cooperative effort. The developer is generally responsible for coding the development project. Our product managers maintain close technical control over the products, giving us the freedom to designate which modifications and enhancements are most important and when they should be implemented. The product managers and their staff work in parallel with the developers to produce printed documentation, on-line help files, tutorials and installation software. In some cases, we may choose to subcontract a portion of this work on a project basis to third-party suppliers under contracts. Our personnel also perform extensive quality assurance testing for all products and coordinate external beta test programs.

Datawatch products have been developed through in-house software development, by offshore software development companies hired under contract or by acquisition. We maintain source code and full product control for these products, which include Datawatch Monarch, Datawatch Monarch Server, Datawatch Panopticon Designer, Datawatch Panopticon Server, Datawatch Software Developers Kit, Datawatch Report Mining Server and legacy products including Datawatch Report Manager On-Demand.

Our total engineering and product development expense was $8.2 million, $8.9 million and $9.1 million for fiscal years 2016, 2015 and 2014, respectively.

OUR COMPETITION

The differentiated technology underlying Datawatch’s self-service data preparation and visual data discovery software enables us to compete within the broader, highly competitive, business analytics market and specifically the data visualization market. While we believe that there is no single competitor that addresses the full range of capabilities of our software, we face competition from several companies that are offering, or soon may offer, products that compete with portions or aspects of our software.

Competitors can be classified into four broad categories:

| · | Large software companies, including suppliers of traditional business intelligence products that provide one or more capabilities that are competitive with our products, such as IBM, Microsoft, Oracle and SAP. |

| · | New and emerging vendors focused on data preparation, such as Informatica, Alteryx, Paxata and Trifacta. |

| · | Business analytics vendors focused on real-time visualization, such as First Derivatives and Zoomdata. |

| · | Independent vendors that focus on extracting specific data formats or sources such as machine data, data in content management systems, EDI, XBRL, HTML and PDFs. These competitors include Splunk, Actuate (Xenos) and Informatica, among others. |

We believe that generally, we compete favorably with respect to these companies and competitive offerings; however, some of our current competitors and potential competitors have advantages over us, including:

| · | longer operating histories, |

| · | significantly greater financial, technical, marketing or other resources, |

| · | stronger brand and business user recognition, and |

| · | broader global distribution and presence. |

Competition in our industry is likely to intensify as current competitors expand their product lines and as new competitors enter the market.

| 7 |

OUR EMPLOYEES

As of November 8, 2016, we had 146 full-time and 7 contract, temporary or part-time employees, including 60 engaged in marketing and sales; 27 engaged in product consulting, training and technical support; 43 engaged in product management, development and quality assurance; and 23 providing general, administrative, accounting, IT and software production and warehousing functions.

OTHER BUSINESS CONSIDERATIONS

Product Protection

We rely on a combination of trade secrets, copyright and trademark laws, nondisclosure and other contractual agreements, and technical measures to protect our rights in our products. Additionally, on June 30, 2015, we applied with the United States Patent and Trademark Office (USPTO) for patent protection for our proprietary systems and methods for automatically generating tables using auto-generated templates and, on January 12, 2016, we applied with the USPTO for patent protection for our proprietary systems and methods for generating tables from print-ready digital source documents. Despite these precautions, unauthorized parties may attempt to copy aspects of our products or to obtain and use information that we regard as proprietary. We believe that, because of the rapid pace of technological change in the software industry, the legal protections for our products are less significant than the knowledge, ability and experience of our employees and developers, the frequency of product enhancements and the timeliness and quality of our support services. We believe that none of our products, trademarks, and other proprietary rights infringes on the proprietary rights of third parties, but there can be no assurance that third parties will not assert infringement claims against us in the future.

Backlog

Our software products are generally shipped within three business days of receipt of an order. Accordingly, we do not believe that backlog for our product is a meaningful indicator of future business. We do maintain a backlog of services commitments primarily related to Datawatch Monarch Server and Datawatch Report Manager On-Demand business. While this services backlog will provide future revenue to Datawatch, we believe that it is not a meaningful indicator of future business.

We do not provide forecasts of our future financial performance. However, from time to time, information provided by us or statements made by our employees may contain “forward looking” information that involves risks and uncertainties. In particular, statements contained in this Annual Report on Form 10-K that are not historical facts (including, but not limited to statements contained in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” of Part II of this Annual Report on Form 10-K relating to liquidity and capital resources) may constitute forward looking statements and are made under the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. We caution readers not to place undue reliance on any such forward looking statements, which speak only as of the date they are made. We disclaim any obligation, except as specifically required by law and the rules of the Securities and Exchange Commission, to publicly update or revise any such statements to reflect any change in our expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. Our actual results of operations and financial condition have varied and may in the future vary significantly from those stated in any forward looking statements. Factors that may cause such differences include, without limitation, the risks, uncertainties and other information discussed below and within this Annual Report on Form 10-K, as well as the accuracy of our internal estimates of revenue and operating expense levels. The following discussion of our risk factors should be read in conjunction with the financial statements contained herein and related notes thereto. Such factors, among others, may have a material adverse effect upon our business, results of operations and financial condition.

| 8 |

Risks Relating to our Business

Actions of activist stockholders against us could be disruptive and potentially costly and the possibility that activist stockholders may seek changes that contest, or conflict with, our strategic direction could cause uncertainty about the strategic direction of our business.

Activist stockholders may from time to time attempt to effect changes in our strategic direction and, in furtherance thereof, may seek changes in how the Company is governed. While our Board of Directors and management team strive to maintain constructive, ongoing communications with all of the Company’s stockholders, including activist stockholders, and welcome their views and opinions with the goal of working together constructively to enhance value for all stockholders, activist campaigns that contest, or conflict with, our strategic direction could have an adverse effect on our business because:

| · | Responding to proxy contests and other actions by activist stockholders can disrupt our operations, be costly and time-consuming, and divert the attention of our Board of Directors and senior management from the pursuit of business strategies, which could adversely affect our results of operations and financial condition; |

| · | Perceived uncertainties as to our future direction as a result of changes to the composition of our Board of Directors may lead to the perception of a change in the direction of the business, instability or lack of continuity which may be exploited by our competitors, cause concern to our current or potential customers, may result in the loss of potential business opportunities and make it more difficult to attract and retain qualified personnel and business partners; |

| · | These types of actions could cause significant fluctuations in our stock price based on temporary or speculative market perceptions or other factors that do not necessarily reflect the underlying fundamentals and prospects of our business; and |

If individuals are elected to our Board of Directors with a specific agenda, it may adversely affect our ability to effectively implement our business strategy and create additional value for our stockholders.

A Weak Global Economy and Softening in the Computer Software Market May Result in Decreased Revenues or Lower Revenue Growth Rates

The growth and profitability of our business depends on the overall demand for computer software and services, particularly in the financial services markets and other markets in which we compete. Tighter credit and negative financial news that may result from challenging economic conditions worldwide and, in the U.S., have an adverse effect on capital spending by corporations, including the demand for computer software. Because our sales are primarily to major corporate customers, poor economic conditions may soften the demand for computer software and services which may result in decreased revenues, lower revenue growth rates and reduced profitability. In addition, a weak global economy may result in longer sales cycles, reduced, deferred or cancelled orders, or greater than anticipated uncollectible accounts receivables. In a weakened economy, we cannot be assured that we will be able to effectively promote future growth in our software and services revenues or operate profitability.

Our Dependence on our Principal Products, our Failure to Develop Enhanced or New Products and our Concentration of Customers within the Financial Sector May Have a Material Adverse Effect on our Business, Financial Condition or Results of Operations

Our future financial performance will depend in part on the successful introduction of new and enhanced versions of these products and development of new versions of these and other products and subsequent customer acceptance of such new and enhanced products. We are primarily dependent on our ability to successfully market and sell our self-service data preparation and visual data discovery products. Currently customers in the financial sector, and particularly in capital markets, comprise a significant portion of our customer base. Any factor adversely affecting the financial sector and capital markets in particular could adversely affect sales of our products within such sector, which could have a material adverse effect on us.

| 9 |

Fluctuations in Quarterly Operating Results Could Have a Material Adverse Effect on our Business, Financial Condition or Results of Operations

Our future operating results could vary substantially from quarter-to-quarter because of uncertainties and/or risks associated with such matters as current economic conditions, technological change, competition, delays in the introduction of new products or product enhancements, and market acceptance of those new products and product enhancements, and general market trends. In addition, as we focus on increasing enterprise sales to large customers, the timing of significant orders may cause fluctuations in quarterly operating results. Large enterprise sales arrangements often involve multiple elements and may require more complex accounting than the sales transactions we have entered into in the past, which also makes projecting future operating results more difficult. Historically, we have operated with minimal backlog of orders because our software products are generally shipped as orders are received. As a result, net sales in any quarter are substantially dependent on orders booked and shipped in that quarter. Further, any increases in sales under our subscription sales model or cloud offering could result in decreased revenues over the short term. Because our staffing and operating expenses are based on anticipated revenue levels and a high percentage of our costs are fixed in the short-term, small variations in the timing of revenues can cause significant variations in operating results from quarter-to-quarter. In addition, at September 30, 2016, we had no unrecognized compensation costs related to options, and $3.0 million of unrecognized compensation costs related to RSUs, which is expected to be recognized over a weighted-average period of 1.91 years, which costs will have a negative effect on our profitability on a GAAP reporting basis. Because of these factors, we believe that period-to-period comparisons of our results of operations are not necessarily meaningful and should not be relied upon as indications of future performance. We can give no assurance that we will not experience such variations in operating results in the future or that such variations will not have a material adverse effect on our business, financial condition or results of operations.

The Sales Cycle for our Enterprise Products is Long and Unpredictable, Particularly with Respect to Large Customers, and our Sales Efforts Require Considerable Time and Expense

Our operating results may fluctuate, in part, because of the resource intensive nature of our sales efforts, the length and variability of the sales cycle of our enterprise software licensing offerings and the short-term difficulty in adjusting our operating expenses. Our operating results depend in part on sales to large customers and conversions of users that have downloaded the desktop version of our Datawatch Monarch software into enterprise customers. The length of our sales cycle, from initial evaluation to delivery of and payment for the software license, varies substantially from customer to customer. It is difficult to predict exactly when, or even if, we will make a sale with a potential customer or if a user that has licensed desktop versions of our Datawatch Monarch software will upgrade to a larger server license. As a result, large individual sales may, in some cases, occur in quarters subsequent to those we anticipate, or not at all. The loss or delay of one or more large transactions in a quarter could impact our operating results for that quarter and any future quarters for which revenue from that transaction is delayed. As a result of these factors, it is difficult for us to forecast our revenues accurately in any quarter. Because a substantial portion of our expenses are relatively fixed in the short-term, our operating results will suffer if revenues fall below our expectations in a particular quarter, which could cause the price of our common stock to decline.

If we are Unable to Attract New Customers and Expand Sales to Existing Customers, our Growth Could be Slower than we Expect and our Business May Be Harmed.

Our future growth depends in part upon increasing our customer base. Our ability to achieve significant growth in revenues in the future will depend, in large part, upon the effectiveness of our marketing efforts, both domestically and internationally, and our ability to attract new customers. If we fail to attract new customers and maintain and expand those customer relationships, our revenues will grow more slowly than expected and our business operations and financial results will be harmed.

Our future growth also depends upon expanding sales of our products to and renewing license and maintenance agreements with existing customers. In particular, part of our sales strategy is to leverage our desktop Monarch data preparation product to drive enterprise sales of our managed analytics platform. In order for us to improve our operating results, it is important that our existing customers make additional significant purchases of our products. If our customers do not purchase additional licenses or capabilities, our revenues may grow more slowly than expected, may not grow at all or may decline. Our customers’ renewal rates may decline or fluctuate as a result of a number of factors, including their satisfaction or dissatisfaction with our products or services, our pricing or pricing structure, the pricing or capabilities of products or services offered by our competitors, the effects of economic conditions, or reductions in our customers’ spending levels. If our customers do not renew their agreements with us, or renew on terms less favorable to us, our revenues may decline and our business operations and financial results may be harmed.

| 10 |

The Markets for our Self-Service Data Preparation and Data Visualization Products are Emerging and May Not Grow

Because the market for our self-service data preparation and visual data discovery products are still emerging, it is difficult to predict customer adoption and renewal rates, customer demand for our enterprise software licenses, the size and growth rate of these markets, the entry of competitive products or the success of existing competitive products. Any expansion in our markets depends on a number of factors, including the cost, performance and perceived value associated with such software licenses. If the markets for our enterprise software licenses do not achieve widespread adoption or there is a reduction in demand for software in these markets caused by a lack of customer acceptance, technological challenges, competing technologies and products, decreases in corporate spending, weakening economic conditions, or otherwise, it could result in reduced customer orders, early terminations, reduced renewal rates or decreased revenues, any of which would adversely affect our business operations and financial results.

Dependence on New Product Introductions and New Product Delays or Defects Could Have a Material Adverse Effect on our Business

The markets for data preparation and visual data discovery products is evolving rapidly. Growth in our business depends in substantial part on the continuing introduction of new products, to address the emerging needs of this market. The length of product life cycles depends in part on end-user demand for new or additional functionality in our products and our ability to update our products to meet such demands. If we fail to accurately anticipate the demand for, or encounter any significant delays in developing or introducing, new products or additional functionality in our products, there could be a material adverse effect on our business. Our product life cycles can also be affected if suppliers of software systems with which we interact introduce new or changed functionality within their products. Our failure to anticipate the introduction of additional functionality in products developed by such suppliers could have a material adverse effect on our business. In addition, our competitors may introduce products with more features and lower prices than our products. Such increase in competition could adversely affect the life cycles of our products, which in turn could have a material adverse effect on our business.

Software products, whether developed internally or licensed from third parties, may contain undetected errors or failures when first introduced or as new versions are released. There can be no assurance that, despite testing by us and by current and potential end-users, errors will not be found in new products after commencement of commercial shipments, resulting in loss of or delay in market acceptance. Any failure by us to anticipate or respond adequately to changes in technology and customer preferences, or any significant delays in product development or introduction, could have a material adverse effect on our business.

A Significant Percentage of our Total Revenue is Subject to Risks Associated with International Sales

In the years ended September 30, 2016, 2015 and 2014, international sales accounted for 14%, 21% and 17%, respectively, of our total revenue. We anticipate that international sales will continue to account for a significant, and perhaps increasing, percentage of our total revenue. A significant portion of our total revenue will therefore be subject to risks associated with international sales, including deterioration of international economic conditions, unexpected changes in legal and regulatory requirements, changes in tariffs, currency exchange rates and other import or export controls, political and economic instability, possible effects of war and acts of terrorism, difficulties in accounts receivable collection, difficulties in managing distributors or representatives, difficulties in staffing and managing international operations, difficulties in protecting our intellectual property overseas, seasonality of sales and potentially adverse foreign tax consequences.

| 11 |

On June 23, 2016, the United Kingdom held a referendum in which United Kingdom voters approved an exit from the European Union commonly referred to as “Brexit”. As a result of the referendum, it is expected that the British government will begin negotiating the future terms of the United Kingdom’s relationship with the European Union, including the terms of trade between the United Kingdom and the European Union. The announcement of Brexit caused significant volatility in global stock markets and currency exchange rate fluctuations that resulted in the strengthening of the U.S. dollar against foreign currencies in which we conduct business. The future effects of Brexit will depend on any agreements the United Kingdom makes to retain access to European Union markets either during a transitional period or more permanently. The measures could potentially disrupt the markets we serve and may cause our customers to closely monitor their costs and reduce their spending budget on our products and services. In addition, Brexit could lead to legal uncertainty and potentially divergent national laws and regulations as the United Kingdom determines which European Union laws to replace or replicate. Given the lack of comparable precedent, it is unclear what financial, trade and legal implications the withdrawal of the United Kingdom from the European Union would have and how such withdrawal would affect us. Adverse consequences such as deterioration in economic conditions, volatility in currency exchange rates, and prohibitive laws and regulations could have a negative impact on our business, operating results, and financial condition.

Future Acquisitions May be Difficult to Integrate, Disrupt our Business, Dilute Stockholder Value or Divert Management Attention

In the future, we could acquire additional products, technologies or businesses, or enter into joint venture arrangements, for the purpose of complementing or expanding our business and to address the need to develop new products. Integrating the operations of an acquired company, product or business successfully or otherwise realizing the anticipated benefits of an acquisition, including additional revenue opportunities, involves a number of challenges and risks. The failure to meet these integration challenges could seriously harm our results of operations, and the market price of our common stock may decline as a result. Realizing the benefits of an acquisition will depend in part on the integration of technology, operations, personnel and sales activity of the two companies. These integration activities are complex and time-consuming, and we may encounter unexpected difficulties or incur unexpected costs, including:

| · | challenges in combining product offerings, including integration of the underlying technology, and sales and marketing activities; |

| · | our inability to achieve the cost savings and operating synergies anticipated in the transaction, which would prevent us from achieving the positive earnings gains expected as a result of the transaction; |

| · | diversion of management attention from ongoing business concerns to integration matters; |

| · | difficulties in consolidating and rationalizing information technology platforms and administrative infrastructures; |

| · | complexities in managing a larger and more geographically dispersed company than before the completion of transaction; |

| · | difficulties in the assimilation of personnel and the integration of two business cultures; |

| · | challenges in demonstrating to our customers and to customers of the acquired company that the transaction will not result in adverse changes in product and technology offerings, customer service standards or business focus; and |

| · | possible cash flow interruption or loss of revenue as a result of change of ownership transitional matters. |

We Recorded Substantial Impairment Charges in Fiscal 2015. Any Future Impairments of Our Assets Could Negatively Impact Our Results of Operations.

Non-amortizing intangible assets, including goodwill, are tested for impairment annually or whenever events or changes in circumstances indicate that the carrying value may not be recoverable. An impairment test is also required for other long-lived assets if events or changes in circumstances indicate that the carrying value may not be recoverable. Examples of events or changes in circumstances indicating that the carrying value of such intangible assets may not be recoverable could include a significant adverse long term outlook; unanticipated competition or the introduction of disruptive technology; failure of an anticipated product or product line; testing for recoverability in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 360-10 Impairment or Disposal of Long-Lived Assets; loss of key personnel; or a more-likely-than-not expectation that a significant portion of the company will be sold or otherwise disposed of. During the first quarter of fiscal 2015, the Company recorded an impairment of goodwill and long-lived assets in the amount of $32.0 million, related to assets obtained in the acquisition of Panopticon Software AB (now known as Datawatch AB) (“Panopticon”), as a result of revenue shortfalls and operational changes in the sales organization as well as a sustained decline in our share price. Any future impairment of goodwill, other intangible assets, or other long-lived assets, and the performance issues underlying any such impairment, could have a negative impact on our profitability and financial results.

| 12 |

If Material Weaknesses or Other Deficiencies are Discovered in our Internal Accounting Procedures, our Stock Price May be Adversely Affected

Section 404 of the Sarbanes-Oxley Act requires that management report annually on the effectiveness of our internal control over financial reporting and identify any material weaknesses in our internal control and financial reporting environment. If management identifies any material weaknesses, their correction could require remedial measures which could be costly and time-consuming. We are not currently an “accelerated filer”, and as a result, our independent registered public accounting firm does not attest to, and report on, management’s assessment of the effectiveness of internal control over financial reporting. In addition, at such time, if any, as we are no longer a “smaller reporting company,” our independent registered public accounting firm will have to attest to and report on management’s assessment of the effectiveness of such internal control over financial reporting. Any identification by us or our independent registered public accounting firm of material weaknesses, even if quickly remedied, could damage investor confidence in the accuracy and completeness of our financial reports, which could affect our stock price and potentially subject us to litigation.

The continuous process of maintaining and adapting our internal controls and complying with Section 404 is expensive and time-consuming, and requires significant management attention. We cannot be sure that our internal control measures will continue to provide adequate control over our financial processes and reporting and ensure compliance with Section 404. Any failure by us to comply with Section 404 could subject us to a variety of administrative sanctions and harm our reputation, which could reduce our stock price.

We Face Significant Competition in the Software Industry

Our self-service data preparation and visual data discovery products compete with other companies in the Big Data and business analytics market. These markets are highly competitive and include companies such as Tableau Software, TIBCO Spotfire (a subsidiary of TIBCO Software Inc.), Qlik Technologies, Inc, Informatica, Alteryx, Paxata, Trifacta and First Derivatives, as well as larger technology companies such as IBM, SAP, MicroStrategy, Inc., SAS and Oracle. Many of the competitors in these markets have longer operating histories, greater name recognition and substantially greater financial, marketing and technological resources than we do. No assurance can be given that our business will have the resources required to compete successfully in the future. In addition, many of these competitors have strong relationships with current and potential customers and extensive knowledge of the business analytics industry. As a result, they may be able to respond more quickly to new or emerging technologies and changes in customer requirements. If we are unable to compete successfully against current and future competitors, the business, results of operations and financial condition of the combined business would be harmed. In addition, competitive pressures or other factors may result in significant price erosion that could have a material adverse effect on our business, financial condition, results of operations, or cash flows.

Maintaining and enhancing the Datawatch brand and our reputation is critical to our relationships with our customers and channel partners and to our ability to attract new customers and channel partners. We believe that the importance of our brand recognition and reputation will continue to increase as competition in our market continues to develop. The failure to maintain or enhance our brand recognition or reputation would likely adversely affect our business and results of operations.

Our Success is Dependent on Proprietary Software Technology

Our success is dependent upon proprietary software technology. We do not currently own patents on any such technology and we rely principally on a combination of trade secrets, copyright and trademark laws, nondisclosure and other contractual agreements and technical measures to protect our rights to such proprietary technology. Additionally, on June 30, 2015, we applied with the United States Patent and Trademark Office (USPTO) for patent protection for our proprietary systems and methods for automatically generating tables using auto-generated templates and, on January 12, 2016, we applied with the USPTO for patent protection for our proprietary systems and methods for generating tables from print-ready digital source documents. Despite such precautions, there can be no assurance that such steps will be adequate to deter misappropriation of such technology.

| 13 |

Our Use of Open Source Software Could Negatively Affect our Ability to Sell our Products and Subject us to Possible Litigation.

We use open source software in our products and expect to continue to use open source software in the future. We may face claims from others claiming ownership of, or seeking to enforce the terms of, an open source license, including by demanding release of the open source software, derivative works or our proprietary source code that was developed using such software. These claims could also result in litigation, require us to purchase costly licenses or require us to devote additional research and development resources to change our products, any of which would have a negative effect on our business and operating results. In addition, if the license terms for the open source code change, we may be forced to re-engineer our products or incur additional costs. Finally, we cannot assure that we have incorporated additional open source software in our products in a manner that is consistent with our current policies and procedures.

We May be Subject to Intellectual Property Rights Claims by Third Parties, Which are Extremely Costly to Defend, Could Require us to Pay Significant Damages and Could Limit our Ability to use Certain Technologies.

Companies in the software and technology industries, including some of our current and potential competitors, own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. We may receive notices that claim we have misappropriated, misused or infringed other parties’ intellectual property rights, and, to the extent we gain greater market visibility, we face a higher risk of being the subject of intellectual property infringement claims, which is not uncommon with respect to the business analytics software market.

There may be third-party intellectual property rights, including issued or pending patents that cover significant aspects of our technologies or business methods. Any intellectual property claims, with or without merit, could be very time-consuming, could be expensive to settle or litigate and could divert our management’s attention and other resources. These claims could subject us to significant liability for damages, potentially including treble damages if we are found to have willfully infringed patents or copyrights. Such claims could also result in our having to stop using technology found to be in violation of a third party’s rights or to seek a license to use such technology, which may not be available on reasonable terms or may require us to pay significant royalties, increasing our operating expenses. As a result, we may need to develop alternative non-infringing technology, which could require significant effort and expense. If we cannot license or develop technology for any infringing aspect of our business, we would be forced to limit or stop sales of our software and may be unable to compete effectively. Any of these outcomes would adversely affect our business operations and financial results.

Government Regulation of the Internet and e-commerce and of the International Exchange of Certain Technologies is Subject to Possible Unfavorable Changes, and our Failure to Comply with Applicable Regulations Could Harm our Business and Operating Results

As Internet commerce continues to evolve, increasing regulation by federal, state or foreign governments becomes more likely. For example, increased regulation is likely in the area of data privacy, and laws and regulations applying to the solicitation, collection, processing or use of personal or consumer information could affect our customers’ ability to use and share data, potentially reducing demand for our products and services. In addition, taxation of products and services provided over the Internet or other charges by government agencies or by private organizations for accessing the Internet may also be imposed. Any regulation imposing greater fees for Internet use or restricting the exchange of information over the Internet could result in reduced growth or a decline in the use of the Internet and could diminish the viability of our Internet-based services, which could harm our business and operating results.

| 14 |

We May Not be Able to Hire and Retain Highly Skilled Employees, Which Could Affect our Ability to Compete Effectively Because our Business is Technology-Based

Qualified personnel are in great demand throughout the software industry. Our success depends, in large part, upon our ability to attract, train, motivate and retain highly skilled employees, particularly technical personnel and product development and professional services personnel, sales and marketing personnel and other senior personnel. Our failure to attract and retain the highly trained technical personnel that are integral to our product development, professional services and sales and marketing teams may limit the rate at which we can generate sales and develop new products or product enhancements. We have hired a number of key executives during the past three years, including key executives in sales, marketing, finance and human resources functions. A loss of these personnel or other changes in key management could have a material adverse effect on our business, operating results and financial condition.

Evolving Regulation of Corporate Governance and Public Disclosure May Result in Additional Expenses and Continuing Uncertainty

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the Sarbanes-Oxley Act of 2002 and related SEC regulations as well as the listing standards of the NASDAQ Stock Market, have created and are continuing to create uncertainty for public companies. We continually evaluate and monitor developments with respect to new and proposed rules and cannot predict or estimate the amount of the additional costs incurred or the timing of such costs. These new or changed laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We are committed to maintaining high standards of corporate governance and public disclosure. As a result, we have invested resources to comply with evolving laws, regulations and standards. This investment has resulted and may continue to result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, regulatory authorities may initiate legal proceedings against us and we may be harmed.

The Failure of Indirect Distribution Channels Could Have a Material Adverse Effect on our Operating Results

We sell a significant portion of our products through distributors, value-added resellers, OEMs and other business partners, none of which are under our direct control. Sales to indirect distribution channels accounted for 35%, 40% and 44%, of total sales for fiscal years 2016, 2015 and 2014, respectively. Our agreement with Lifeboat expired in early 2015 and, to manage the transition, we have refocused part of our Inside Sales Team to manage and pursue the book of business previously handled by Lifeboat. The loss of major distributors or resellers of our products, or a significant decline in their sales, could have a material adverse effect on our operating results. We actively seek to develop new distributor and reseller relationships on the basis of their business credentials and their ability to add value through expertise in specific vertical markets or application programming expertise, although there can be no assurance that we will be able to attract or retain qualified distributors or resellers or that the distributors or resellers will be able to effectively sell our products. In addition, we may rely on resellers to provide post-sales service and support, and any deficiencies in such service and support could adversely affect our business.

Failure to Maintain an Adequate Sales Returns Reserve Could Have a Material Adverse Effect on our Financial Position and Results of Operations

Revenue from the sale of all our software products (when separately sold) is generally recognized at the time of shipment. We estimate and maintain reserves for potential future product returns from distributors based on our experience and history with our various distributors and resellers. While actual returns have historically been within the range estimated by management, future actual results could differ from the reserve for sales returns recorded, and this difference could have a material effect on our financial position and results of operations. As of September 30, 2016, we had no distributors.

| 15 |

Our Subscription Sales Model for our Enterprise Products Could Result in Decreased or Delayed Revenues and Cash Flows

We sell our enterprise products through the sale of perpetual licenses and through a subscription pricing model. The subscription pricing model allows customers to use our products at a lower initial cost of software acquisition when compared to the more traditional perpetual license sale. Although the subscription sales model is designed to increase the number of enterprise solutions sold and also reduce dependency on short-term sales by building a recurring revenue stream, it introduces increased risks for us primarily associated with the timing of revenue recognition and reduced cash flows. The subscription model delays revenue recognition when compared to the typical perpetual license sale and also, as we allow termination of certain subscriptions with 90 days’ notice, it could result in decreased revenue for solutions sold under the model if we experience a high percentage of subscription cancellations following the first 12 months of the subscription. Further, as amounts due from customers are invoiced annually over the life of the subscription, there are delayed cash flows from subscription sales when compared to perpetual license sales.

If our Security Measures are Breached or Other Unauthorized Access to Customer Data is Otherwise Obtained, our Software May be Perceived as not being Secure, Customers May Reduce the Use of or Stop Using our Software, and we May Incur Significant Liabilities

Our software, when installed on our customer’s premises, may involve the storage and transmission of customer data, and security breaches could result in the loss of this information, litigation, indemnity obligations and other liability. While we have taken steps to protect the confidential information that we have access to, including confidential information we may obtain through our customer support services or customer usage of our products, we do not have the ability to monitor or review the content that our customers store, and therefore, we have no direct control over the substance of that content. Therefore, if customers use our software for the transmission or storage of personally identifiable information and our security measures are breached as a result of third-party action, employee error, malfeasance or otherwise, our reputation could be damaged, our business may suffer, and we could incur significant liability. Because techniques used to obtain unauthorized access or sabotage systems change frequently and generally are not identified until they are launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. Further, while we have taken steps to maintain compliance with laws and regulations relating to privacy and data security, including the adoption of internationally recognized standards of data protection and security, the loss, retention or misuse of certain information and/or alleged violations of such laws and regulations may expose us to significant liability. Any or all of these issues could negatively impact our ability to attract new customers and increase engagement by existing customers, cause existing customers to elect to not renew their subscriptions, or subject us to third-party lawsuits, regulatory fines or other action or liability, thereby adversely affecting our financial results.

We May Require Additional Capital to Grow our Business, and Our Financing Arrangements Expose us to Interest Rate and Default Risk

Our business may require additional capital to operate and expand. We have historically relied upon cash generated from operations and bank credit lines to satisfy our capital needs and finance growth. If we determine in the future to make significant investments in our business, including by acquiring assets or businesses from third parties, we may attempt to raise additional funds by securing additional debt financing or selling equity securities in either the public or the private markets. As the financial markets change and new regulations come into effect, the cost of acquiring financing and the methods of financing may change. We may not be able to obtain additional debt or equity financing on favorable terms, if at all. If we raise additional equity financing, our security holders may experience significant dilution of their ownership interests and the value of shares of our common stock could decline. If we engage in debt financing, we may be required to accept terms that restrict our ability to incur additional indebtedness, force us to maintain specified liquidity or other ratios or restrict our ability to make acquisitions. Our inability to do any of the foregoing could reduce our ability to compete successfully and adversely affect our results of operations. Changes in our credit rating or other market factors may increase our interest expense or other costs of capital, or capital may not be available to us on acceptable terms to fund our needs.

| 16 |

Catastrophic Events May Adversely Affect Our Business

Our company is a highly automated business which relies on our network infrastructure and enterprise applications, internal technology systems and website for development, marketing, operational, support and sales activities. A disruption or failure of these systems in the event of a major storm, earthquake, fire, telecommunications failure, cyber-attack, terrorist attack or other catastrophic event could cause system interruptions, reputational harm, delays in our product development and loss of critical data and could affect our ability to sell and deliver products and services and other critical functions of our business.

Risks Relating to an Investment in our Common Stock

The Market Price of our Stock Has Been and May Continue to Be Volatile

As has recently been the case with the stocks of high technology companies, the market price of our common stock has been, and may continue to be, volatile. Our stock price may be adversely affected by many factors, including:

| · | actual or anticipated fluctuations in our operating results, including those resulting from changes in accounting rules; |

| · | increased competition; |

| · | general market conditions; |

| · | announcements of technical innovations; |

| · | announcements related to the Board’s review of strategic alternatives to increase shareholder value; |

| · | new products or services offered by us, our suppliers or our competitors; |

| · | expenses or other difficulties associated with assimilating companies acquired by us; |

| · | changes in the mix of sales channels; |

| · | the timing of significant customer orders; |

| · | changes in estimates or recommendations by securities analysts of our future financial performance, failure to obtain analyst coverage of our common stock or our failure to achieve analyst earnings estimates; |

| · | the issuance of additional shares to obtain financing or for acquisitions; |

| · | our compliance with SEC and NASDAQ rules and regulations, including the Sarbanes-Oxley Act of 2002; |

| · | trading volume of our common stock; |

| · | the timing of stock sales under 10b5-1 plans or otherwise by our shareholders in the future; and |

| · | political instability, natural disasters, war and/or events of terrorism. |

Even though we do not presently provide forecasts of our future financial performance, any shortfall in revenue or earnings from the levels anticipated by securities analysts or investors could have an immediate and significant adverse effect on the market price of our common stock in any given period. In addition, the stock market has from time to time experienced extreme price and volume fluctuations, which have particularly affected the market price for many high technology companies and which, on occasion, have appeared to be unrelated to the operating performance of such companies. Finally, to maintain our stock listing with NASDAQ, we must be in compliance with NASDAQ Marketplace Rules. If we are not able to maintain compliance with these rules, and if our common stock does not qualify for, or is subsequently delisted from, the NASDAQ Capital Market, investors may have difficulty converting their investment into cash efficiently. The price of our common stock and the ability of holders to sell such stock would be adversely affected.

Because We do Not Expect to Pay Dividends on Our Common Stock, Stockholders Will Benefit from an Investment in our Common Stock Only if it Appreciates in Value

We have never paid cash dividends on our common stock and have no present intention to pay any dividends in the future. We are not profitable and may not earn sufficient revenue to meet all operating cash needs for at least several years, if at all. As a result, we intend to use all available cash and liquid assets in the development of our business. Any future determination about the payment of dividends will be made at the discretion of our board of directors and will depend upon our earnings, if any, our capital requirements, our operating and financial conditions and on such other factors as our board of directors may deem relevant. As a result, the success of an investment in our common stock will depend upon any future appreciation in its value. There is no guarantee that our common stock will appreciate in value or even maintain the price at which stockholders have purchased their shares.

| 17 |

Sales of a Substantial Number of Shares of Our Common Stock in the Public Market by Us or by Existing Stockholders, or the Perception that they may Occur, Could Cause our Stock Price to Decline.

Insiders presently hold a significant percentage of our stock, and our shares are thinly traded in the public market. Sales of substantial amounts of our common stock by us or by our stockholders, announcements of the proposed sales of substantial amounts of our common stock or the perception that substantial sales may be made, could cause the market price of our common stock to decline. We may issue additional shares of our common stock in follow-on offerings to raise additional capital or in connection with acquisitions or corporate alliances and we plan to issue additional shares to our employees and directors in connection with their services to us. Any issuance of additional common stock will dilute the ownership interest of existing common shareholders. All of the currently outstanding shares of our common stock are freely tradable under federal and state securities laws, except for shares held by our employees, directors, officers and certain greater than five percent shareholders, which may be subject to volume limitations. Sales of a substantial number of shares of our common stock in the public market could occur at any time and could reduce the market price of our common stock.

We Can Issue Shares of Preferred Stock that May Adversely Affect the Rights of Holders of Our Common Stock

Our certificate of incorporation authorizes us to issue up to 1,000,000 shares of preferred stock with designations, rights, and preferences determined from time to time by our board of directors. Accordingly, our board of directors is empowered, without stockholder approval, to issue preferred stock with dividend, liquidation, conversion, voting or other rights superior to those of holders of our common stock. For example, an issuance of shares of preferred stock could:

| · | adversely affect the voting power of the holders of our common stock; |

| · | make it more difficult for a third party to gain control of us; |

| · | discourage bids for our common stock at a premium; |

| · | limit or eliminate any payments that the holders of our common stock could expect to receive upon our liquidation; or |

| · | otherwise adversely affect the market price or our common stock. |

If Securities or Industry Analysts Publish Research or Reports About Our Business, or if they Change their Recommendations Regarding Our Stock, the Price of Our Stock and Trading Volume Could Decline

The trading market for our common stock is influenced by the research reports and opinions that are published about our business. If the analysts that cover us fail to publish reports in a regular manner, we could lose visibility in the financial markets, which could cause a significant and prolonged decline in our stock price due to lack of investor awareness. Furthermore, if one or more analysts downgrade our stock or comment negatively about our prospects or the prospects of other companies operating in our industry, our stock price could decline significantly.

Our Governing Documents and Delaware Law may Discourage the Potential Acquisition of Our Business and Adversely Affect the Rights of our Common Stock

Our certificate of incorporation and bylaws contain provisions that may make the acquisition of our company more difficult without the approval of our board of directors. In addition, we are subject to anti-takeover provisions of Delaware law. These provisions may deter or discourage takeover attempts and other changes in control of us not approved by our board of directors. If potential acquirers are deterred, you may lose an opportunity to profit from a possible acquisition premium in our stock price.

Item 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

| 18 |

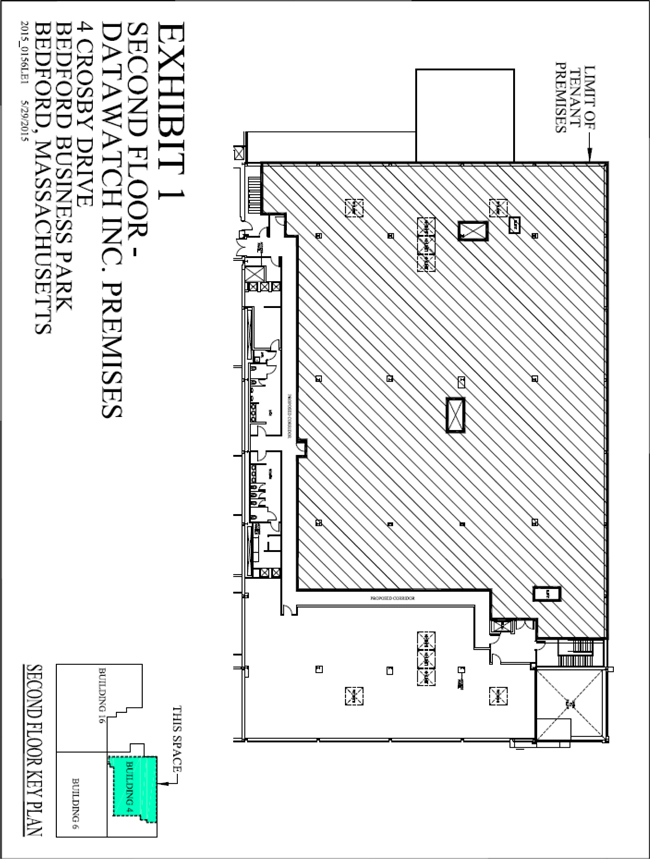

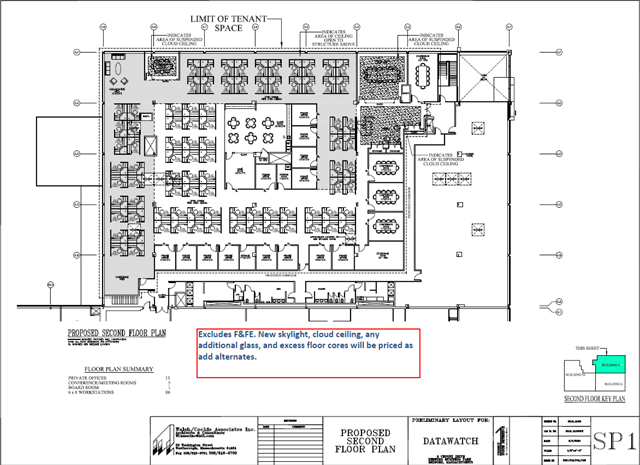

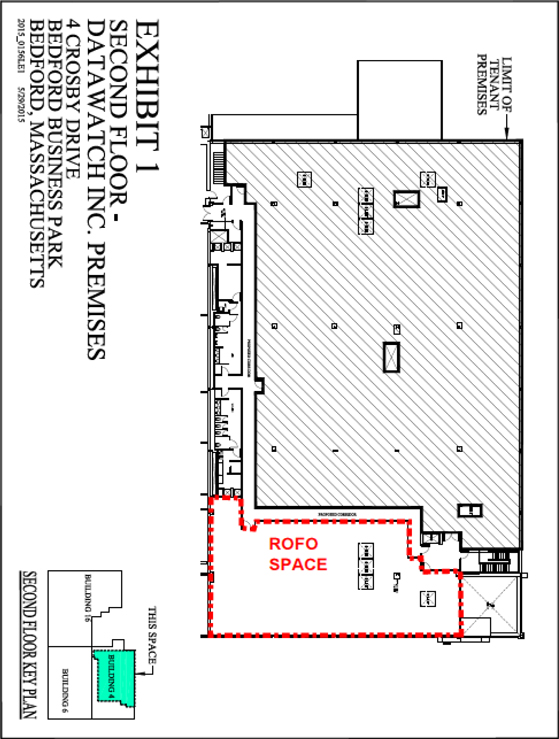

Datawatch is currently headquartered in 20,360 square feet of leased office space in Bedford, Massachusetts pursuant to a lease agreement executed on June 23, 2015. The lease expires in December 2022. The aggregate rent expense for the remaining term of the lease is $3.5 million. In addition to rent, the lease requires us to pay certain taxes, insurance and operating costs related to the leased facility based on our pro-rata share of such costs. In conjunction with entering into the lease, the Company was required to deposit $0.2 million into a restricted cash account as collateral for a Letter of Credit, which is included under the caption “Other long-term assets” in our consolidated balance sheets, for the period ended September 30, 2016.

We also maintain sales and development offices in the U.S., and international sales, administrative and development offices in the U.K., Singapore and Sweden. In addition, we maintain a software development and testing facility in the Philippines.

We are occasionally involved in legal proceedings and other claims arising out of our operations in the normal course of business. We are not party to any litigation that we believe will have a material adverse effect on our consolidated financial condition, results of operations or cash flows.

Item 4. MINE SAFETY DISCLOSURES

Not applicable.

| 19 |

Item 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY AND RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is listed and traded on the NASDAQ Capital Market under the symbol DWCH. The range of high and low closing prices during each fiscal quarter for the last two fiscal years is set forth below:

| For the Year Ended | Common Stock | |||||||

| September 30, 2016 | High ($) | Low ($) | ||||||

| 4th Quarter | 7.65 | 5.45 | ||||||

| 3rd Quarter | 5.65 | 4.56 | ||||||

| 2nd Quarter | 6.09 | 3.57 | ||||||

| 1st Quarter | 6.65 | 5.14 | ||||||

| For the Year Ended | Common Stock | |||||||

| September 30, 2015 | High ($) | Low ($) | ||||||

| 4th Quarter | 7.02 | 4.73 | ||||||

| 3rd Quarter | 8.10 | 6.39 | ||||||

| 2nd Quarter | 8.70 | 5.37 | ||||||

| 1st Quarter | 11.14 | 8.38 | ||||||

Holders

There were 81 shareholders of record as of November 8, 2016. We believe that the number of beneficial holders of common stock is 2,534. The last reported sale of our common stock on November 8, 2016 was at $6.55.

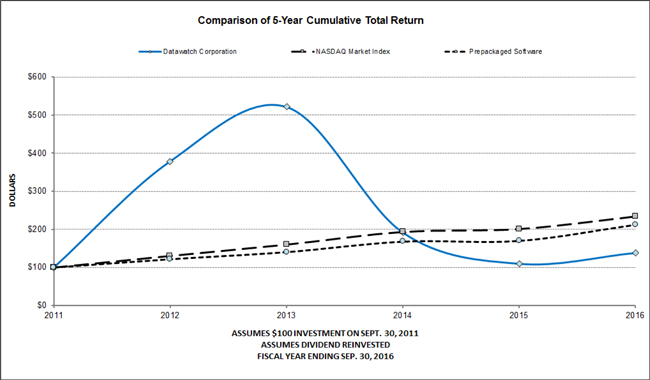

Dividends