| AQUILA TAX-FREE TRUST OF OREGON | |||||||||||||||||||||||||||||||||||||||||||||||||||

| AQUILA TAX-FREE TRUST OF OREGON | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||||||||||||||||||

The Trust’s objective is to provide you as high a level of current income exempt from Oregon state and regular Federal income taxes as is consistent with preservation of capital.

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Trust | |||||||||||||||||||||||||||||||||||||||||||||||||||

This table describes the fees and expenses that you may pay if you buy and hold shares of the Trust. If you invest in Class A Shares, you may qualify for sales charge discounts if you and your immediate family invest, or agree to invest in the future, at least $25,000 in the Trust or in other funds in the Aquila Group of Funds. More information about these and other discounts is available from your financial advisor and in "Alternative Purchase Plans” on page 25 of the Trust's Prospectus, "Sales Charges - Class A Shares and Class T Shares” on page 28 of the Prospectus, “Broker-Defined Sales Charge Waiver Policies” on page 43 of the Prospectus, and “Purchase, Redemption, and Pricing of Shares” on page 41 of the Statement of Additional Information (the “SAI”). If you invest in Class F Shares or Class Y Shares, you may be required to pay a commission to a broker, which is not reflected in the Expense Example.

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Trust Operating Expenses (Expenses that you pay each year as a percentage of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Trust with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Trust for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Trust’s operating expenses remain the same. Six years after the date of purchase, Class C Shares automatically convert to Class A Shares. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| You would pay the following expenses if you did not redeem your Class C Shares: | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||||||||||||||||||||||||||||

The Trust pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Trust shares are held in a taxable account. These costs, which are not reflected in annual Trust operating expenses or in the example, affect the Trust's performance. During the fiscal year ended March 31, 2017, the Trust's portfolio turnover rate was 13% of the average value of its portfolio.

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||||||||||||||||||||||||||||

Under normal circumstances, at least 80% of the Trust’s net assets will be invested in municipal obligations that pay interest exempt, in the opinion of bond counsel, from Oregon state and regular Federal income taxes, the income paid upon which will not be subject to the Federal alternative minimum tax on individuals. In general, almost all of these obligations are issued by the State of Oregon, its counties and various other local authorities; these obligations may also include certain other governmental issuers. We call these “Oregon Obligations.” These securities may include participation or other interests in municipal securities and variable rate demand notes. Some Oregon Obligations, such as general obligation issues, are backed by the issuer’s taxing authority, while other Oregon Obligations, such as revenue bonds, are backed only by revenues from certain facilities or other sources and not by the issuer itself. These obligations can be of any maturity, but the Trust’s weighted average maturity has traditionally been between 5 and 15 years. At the time of purchase, the Trust’s Oregon Obligations must be of investment grade quality. This means that they must either

The Sub-Adviser selects obligations for the Trust’s portfolio in order to best achieve the Trust’s objective by considering various characteristics including quality, maturity and coupon rate.

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Risks | |||||||||||||||||||||||||||||||||||||||||||||||||||

You may lose money by investing in the Trust. Following is a summary description of certain risks of investing in the Trust. Market Risk. The market prices of the Trust’s securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political or regulatory conditions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment. When market prices fall, the value of your investment will go down. In the past several years, financial markets throughout the world have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. Governmental and non-governmental issuers have defaulted on, or been forced to restructure, their debts. These conditions may continue, recur, worsen or spread. Events that have contributed to these market conditions include, but are not limited to, major cybersecurity events; terror attacks; measures to address budget deficits; downgrades of sovereign debt; declines in oil and commodity prices; dramatic changes in currency exchange rates; and public sentiment. The U.S. government and the Federal Reserve, as well as certain foreign governments and their central banks, have taken steps to support financial markets, including by keeping interest rates at historically low levels. This and other government intervention may not work as intended, particularly if the efforts are perceived by investors as unlikely to achieve the desired results. The Federal Reserve has reduced its market support activities and has begun raising interest rates. Certain foreign governments and central banks are implementing or discussing so-called negative interest rates (e.g., charging depositors who keep their cash at a bank) to spur economic growth. Further Federal Reserve or other U.S. or non-U.S. governmental or central bank actions, including interest rate increases or contrary actions by different governments, could negatively affect financial markets generally, increase market volatility and reduce the value and liquidity of securities in which the Trust invests. Interest Rate Risk. The value of your investment will generally go down when interest rates rise. A rise in rates tends to have a greater impact on the prices of longer term or longer duration securities. Interest rates in the U.S. have been historically low, so the Trust faces a heightened risk that interest rates may rise. A general rise in interest rates may cause investors to move out of fixed income securities on a large scale, which could adversely affect the price and liquidity of fixed income securities and could also result in increased redemptions from the Trust. The maturity of a security may be significantly longer than its effective duration. A security’s maturity and other features may be more relevant than its effective duration in determining the security’s sensitivity to other factors such as changes in credit quality or in the yield premium that the market may establish for certain types of securities. Credit Risk. If an issuer or obligor of a security held by the Trust or a counterparty to a financial contract with the Trust defaults or is downgraded, or is perceived to be less creditworthy, or if the value of the assets underlying a security declines, the value of your investment will typically decline. Securities in the lowest category of investment grade (i.e., BBB/Baa) may be considered to have speculative characteristics. Rating Agency Risk. Investment grade debt securities may be downgraded by a major rating agency to below investment grade status, which would increase the risk of holding these securities. In addition, a rating may become stale in that it fails to reflect changes to an issuer’s financial condition. Ratings represent the rating agency’s opinion regarding the quality of the security and are not a guarantee of quality. In addition, rating agencies are subject to an inherent conflict of interest because they are often compensated by the same issuers whose securities they grade. Risks Associated with Investments in Oregon and Other Municipal Obligations. The Trust may be affected significantly by adverse economic, political or other events affecting Oregon and other municipal issuers in which the Trust may invest. Municipal issuers may be adversely affected by rising health care costs, increasing unfunded pension liabilities, and by the phasing out of federal programs providing financial support. The strength of the Oregon economy will be affected by, among other factors, employment growth and the strength of the national economy, as well as by uncertainty related to Federal fiscal policy, slower growth in the global economy, geopolitical risks, and business and consumer uncertainty related to these issues. The durability of the housing market is a particular concern; a downturn in the housing market could significantly affect the Oregon economy. Oregon’s debt levels are high in relation to its economic base. The state is highly vulnerable to budgetary strain due to its high reliance on volatile income taxes. The unfunded liability in the Oregon Public Employees Retirement System (“PERS”) has increased to over $18 billion. The PERS Board has increased public employers’ contribution rates to address the unfunded liability. The high contribution rates will significantly affect public budgets, potentially impacting the repayment ability of PERS employers across the State, including most Oregon municipal bond issuers. The PERS Board’s ability to make plan design changes affecting the accounts of certain long-term public employees has been negatively affected by Oregon court decisions. Unfavorable conditions and developments relating to projects financed with municipal securities can result in lower revenues to issuers of municipal securities, potentially resulting in defaults. Issuers often depend on revenues from these projects to make principal and interest payments. The value of municipal securities also can be adversely affected by changes in the financial condition of one or more individual municipal issuers or insurers of municipal issuers, regulatory and political developments, tax law changes or other legislative actions, and by uncertainties and public perceptions concerning these and other factors. In recent periods an increasing number of municipal issuers have defaulted on obligations, been downgraded or commenced insolvency proceedings. Financial difficulties of municipal issuers may continue or get worse. Tax Risk. The income on the Trust’s Oregon Obligations and other municipal obligations could become subject to Federal and/or state income taxes due to noncompliant conduct by issuers, unfavorable legislation or litigation or adverse interpretations by regulatory authorities. Liquidity Risk. The Trust may make investments that are illiquid or become illiquid after purchase. Illiquid assets may also be difficult to value. If the Trust is forced to sell an illiquid security to meet redemption requests or other cash needs, the Trust may be forced to sell the security at a loss. The Trust may not receive its proceeds from the sale of certain securities for an extended period (for example, several weeks or even longer). In extreme cases, this may constrain the Trust’s ability to meet its obligations (including obligations to redeeming shareholders). Prepayment or Call Risk. Many issuers have a right to prepay their securities. Issuers may be more likely to prepay their securities if interest rates fall. If this happens, the Trust will not benefit from the rise in the market price of the securities that normally accompanies a decline in interest rates, and will be forced to reinvest prepayment proceeds at a time when yields on securities available in the market are lower than the yield on prepaid securities. The Trust may also lose any premium it paid on prepaid securities. Extension Risk. If interest rates rise, repayments of fixed income securities may occur more slowly than anticipated by the market. This may drive the prices of these securities down because their interest rates are lower than the current interest rate and they remain outstanding longer. Portfolio Selection Risk. The value of your investment may decrease if the Sub-Adviser’s judgment about the quality, relative yield, value or market trends affecting a particular security, industry, sector or region, or about interest rates, is incorrect. Valuation Risk. The sales price the Trust could receive for any particular portfolio investment may differ from the Trust’s valuation of the investment, particularly for securities that trade in thin or volatile markets or that are valued using a fair value methodology. Investors who purchase or redeem Trust shares on days when the Trust is holding fair-valued securities may receive fewer or more shares or lower or higher redemption proceeds than they would have received if the Trust had not fair-valued securities or had used a different valuation methodology. The Trust’s ability to value its investments may be impacted by technological issues and/or errors by pricing services or other third party service providers. Redemption Risk. The Trust may experience heavy redemptions that could cause the Trust to liquidate its assets at inopportune times or at a loss or depressed value, which could cause the value of your investment to decline. Non-Diversification Risk. The Trust is classified as a “non-diversified” investment company under the Investment Company Act of 1940 (the “1940 Act”). Thus, compared with “diversified” funds, it may invest a greater percentage of its assets in obligations of a small number of issuers. In general, the more the Trust invests in the securities of specific issuers or issues of a similar project type, the more the Trust is exposed to risks associated with investments in those issuers or types of projects. Also, the Trust may be more risky than a more geographically diverse fund. These risks are discussed in more detail later in the Prospectus or in the SAI.

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Trust Performance | |||||||||||||||||||||||||||||||||||||||||||||||||||

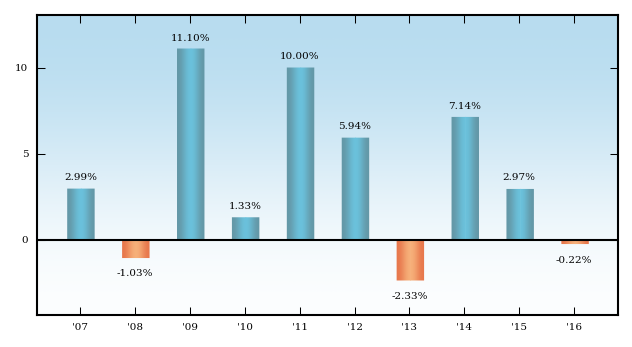

The following bar chart and table provide some indication of the risks of investing in the Trust by showing changes in the Trust’s performance from year to year and by showing how the Trust’s average annual total returns for the designated periods compare with those of a broad measure of market performance. No performance information is presented for Class F or Class T Shares because Class F Shares and Class T Shares are newly offered and do not have annual returns for at least one calendar year. The returns for Class F Shares and Class T Shares would differ from the returns shown because Class F Shares and Class T Shares have different expenses. The Trust's past performance (before and after taxes) is not necessarily an indication of how the Trust will perform in the future. Updated performance information is available at www.aquilafunds.com or by calling 800-437-1000 (toll-free).

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| ANNUAL TOTAL RETURNS - as of December 31 Class Y Shares - 2007 – 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

During the 10-year period shown in the bar chart, the highest return for a quarter was 5.51% (quarter ended September 30, 2009) and the lowest return for a quarter was -3.17% (quarter ended September 30, 2008). The year-to-date (from January 1, 2017 to June 30, 2017) total return for Class Y Shares was 2.47%.

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns for the Periods Ended December 31, 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

After-tax returns are calculated using the highest individual Federal marginal income and capital gains tax rates in effect at the time of each distribution and redemption, but do not reflect state and local taxes. Actual after-tax returns will depend on your specific situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold Trust shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. (Please note that an investment in shares of the Trust may not be suitable for you if you are investing through a tax-deferred account). The total returns reflect reinvestment of dividends and distributions. After-tax returns are shown only for Class Y Shares. After-tax returns for other classes of shares will vary.

| |||||||||||||||||||||||||||||||||||||||||||||||||||