UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-4626

THE CASCADES TRUST

(Exact name of Registrant as specified in charter)

120 West 45th Street, Suite 3600

New York, New York 10036

(Address of principal executive offices) (Zip code)

Joseph P. DiMaggio

120 West 45th Street, Suite 3600

New York, New York 10036

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 697-6666

Date of fiscal year end: 3/31/16

Date of reporting period: 3/31/16

FORM N-CSR

|

ITEM 1.

|

REPORTS TO STOCKHOLDERS

|

|

||||||||||||||||||||||||||

|

Annual Report

March 31, 2016

|

||||||||||||||||||||||||||

|

|

Aquila Tax-Free

Trust of Oregon

“The Importance of Infrastructure” Serving Oregon investors since 1986

|

|

May, 2016

Dear Fellow Shareholder:

For nearly three decades we have sought to give you as comprehensive a picture of your Fund as possible by highlighting, in each report letter, a topic we believe you will find of interest.

This year’s focus will be upon benefits not only to you, as individual shareholders, but also to the overall quality of life in Oregon – infrastructure development and enhancement.

More than likely, when you decided to invest in Aquila Tax-Free Trust of Oregon, you were seeking double tax-free income and capital preservation - the two components of your Fund’s investment objective.

The benefit you may not have considered -- when you invested in the Fund -- was that Aquila Tax-Free Trust of Oregon would not only provide you with tax-free income, but it would also provide benefits to others within your community and throughout Oregon. These broader benefits are derived from the fact that municipal bonds, such as those in which your Fund invests, serve as the primary source of funding for our infrastructure.

While infrastructure is a relatively vague term, it is, in fact, vital to our economy. Infrastructure comprises the fundamental structures, systems and facilities that serve our nation and local communities and enable our economy to function smoothly. When you translate the word “infrastructure” into such commonly used words as roads, bridges, water facilities, pollution control, airports, schools, hospitals and fire and police stations, then you begin to more fully appreciate its significance.

We oftentimes take for granted a broad variety of public projects, fully expecting them to be there, day after day and year after year. We never really think about the fact that they might not be available were it not for municipal bond financing.

These projects and facilities are not the kind of items which are expendable or used up in a year or so and which towns and cities put in their yearly operating budgets. Rather, because they are there for the longer-term convenience, economic development and quality of life of the citizens of the community, they are rightfully financed by intermediate to long-term municipal obligations.

Your money invested in Aquila Tax-Free Trust of Oregon goes toward buying those municipal bonds, which in turn finance these long-term facilities and projects from which we all benefit.

NOT A PART OF THE ANNUAL REPORT

Given the criticality of infrastructure to our daily needs and our overall economy, it is important to not only maintain our current infrastructure but to enhance it in anticipation of future population growth. So, for example, by maintaining and enhancing our roadways, we can improve traffic flow and reduce consumption of fuel. Furthermore, by maintaining and enhancing our infrastructure, we can hopefully avoid future crises that could result from decrepit infrastructure.

A number of organizations have commented upon or assessed the state of our nation’s infrastructure. One such group is the American Society of Civil Engineers (“ASCE”), the oldest national engineering society in the U.S.

Every four years, ASCE publishes a comprehensive assessment – a report card – of the nation’s major infrastructure. The most recent 2013 report gives an overall grade of D+. This was a slight improvement over the 2009 overall grade of D, which is defined as poor: at risk, with many elements approaching the end of their service life. The report also provides grades across 16 categories, including roads, bridges, dams, drinking water, wastewater, schools, inland waterways, rail and ports, taking into consideration such factors as capacity, condition, future need and public safety.

Now, some might view this type of report with skepticism. For example, is it really appropriate to rate old infrastructure using current health and safety standards that are significantly different from those that existed when much of our infrastructure was originally built? And, clearly there is the potential for conflicts of interest with a report written by engineers on matters which may impact their livelihood.

At the same time, such reports can be useful in that they may serve as a wake-up call or reminder to us all. Similar reports of note include

|

•

|

a 60 Minutes report entitled “Falling Apart: America’s Neglected Infrastructure;”

|

|

•

|

Move:Putting America’s Infrastructure Back in the Lead by Rosabeth Moss Kanter of Harvard Business School;

|

|

•

|

The Road Taken:The History and Future of America’s Infrastructure by Duke University’s Henry Petrowski; and,

|

|

•

|

It’s Time for States to Invest in Infrastructure by the Center on Budget and Policy Priorities.

|

As the population and economy of Oregon grow, new and additional municipal projects are needed for the benefit of the citizens of Oregon and the various communities throughout the state. Without prioritization of infrastructure needs, conditions could very well deteriorate and, ultimately, this could place a drag on our economy.

These projects include a whole array of useful public purpose works and are financed through municipal bond investments, such as your investments in the Fund. In essence, your money has helped pay for that new road, airport, school, etc. that you and your neighbors now depend upon and enjoy.

Just as the needs of Oregon are many and varied, so, too, are the securities that make up Aquila Tax-Free Trust of Oregon’s portfolio of investments. You might be interested to know that included in the Fund’s March 31, 2016 portfolio were 249 separate municipal issues representing participation in many of Oregon’s major municipal projects throughout the state. So, as an investor in Aquila Tax-Free Trust of Oregon, you can take pride in knowing that you are playing a vital role and a very real part in maintaining, and enhancing, the quality of life for your family, friends, neighbors and future generations of Oregonians.

NOT A PART OF THE ANNUAL REPORT

In summary, we are very proud of the fact that Aquila Tax-Free Trust of Oregon has, in our view, not only met its investment objective of providing you with as high a level of tax-free income as is consistent with preservation of capital, but that your Fund has also served thousands of residents and local projects very well over the years through its support of Oregon’s vital infrastructure.

Sincerely,

Diana P. Herrmann, Vice Chair and President

Any information in this Shareholder Letter regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. These statements should not be relied upon for any other purposes. Past performance is no guarantee of future results, and there is no guarantee that any market forecasts discussed will be realized.

NOT A PART OF THE ANNUAL REPORT

|

Aquila Tax-Free

Trust of Oregon

ANNUAL REPORT

Management Discussion

Serving Oregon investors since 1986

|

|

Oil markets, geopolitical climate, U.S. Presidential race, Chinese economy and continuing saga of the Euro all contributed to the unease investors felt over much of 2015. Japan’s central bank (Bank of Japan) gave investors even more to think about when they surprised financial markets with the adoption of negative interest rate policy (“NIRP”). Once thought to be unlikely, NIRPs have now been deployed by several central banks, including Switzerland, Sweden, Denmark, the Eurozone, and now Japan in an attempt to fight deflationary forces, weaken their currencies and stimulate growth.

Prior to the Federal Reserve (the “Fed”) raising rates in December, the capital markets were relatively calm in 2015. The Fed capped a year’s worth of expectation with a single rate increase late in 2015. The long anticipated Fed Funds rate increase had the effect of flattening the yield curve, with most of the impact absorbed by the short end of the curve; the 2-year Treasury yield rose 39 basis points ( a basis point is equal to 1/100th of 1%, or 0.01%) to 1.05%. Early in 2016, concerns that a combination of lower oil prices and further weakness in China's growth and currency ignited fears of spillover effects, including possible emerging market turmoil and even recession. Oil prices were driven lower, due to oversupply following years of high investment and steady demand, resulting in reductions to both capital spending and rig counts. While we believe it is likely the oil surplus will shrink as marginal, high-cost production is idled, inventories remain stubbornly at their highs.

Treasury bills and money market equivalent yields, while sensitive to Fed policy, have also been supported by flight to quality flows as foreign economies and political environments generally remain vulnerable to downturns and uprisings. In recent months the primary drivers of price performance have become longer-term bonds as investors have extended seeking higher yields. The yield on the 10-year Treasury bond for example fell 50 basis points to end the first quarter of 2016 at 1.77%. Overall, the bond market experienced a strong start to 2016 as evidenced by declining interest rates and improved price performance across the bond spectrum.

National Municipal Market

Municipal bond fund flows were healthy for 2015, adding over $13 billion for the year. These inflows, and a diminished new issue calendar, contributed to positive returns and relatively high municipal bond valuations going into year end. Though many market participants were concerned about reduced participation by banks due to certain provisions under the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Federal Reserve’s Flow of Funds Report on Municipal Bond Ownership shows that banks, have in fact, continued to add to their municipal bond portfolios. On April 1, 2016, the Federal Reserve Board finalized a rule to include certain U.S. general obligation state and municipal securities in the range of assets large banking organizations may use to satisfy liquidity requirements. The Household sector, however, continues to be the largest participant in the municipal market, with over 41% of the $3.7 trillion in municipal bonds outstanding at the end of 2015.

1 | Aquila Tax-Free Trust of Oregon

MANAGEMENT DISCUSSION (continued)

Despite high levels of demand, 2016 municipal bond issuance has been relatively low to date. While national issuance has improved on a month-over-month basis for each of the first three months, March issuance was approximately 14% below 2015 levels. A combination of reduced supply, higher tax rates in some states, and relatively few national fiscal challenges have collectively renewed demand for the municipal sector. Municipal bond issuance has, however, been slow to bounce back, despite temptingly low interest rates for issuers. Although the economy has generally improved and local governments have been adding to payrolls and we are observing improved reserve levels, issuers remain cautiously conservative about encumbering new debt. Approximately 50% of bonds issued last year were for the purpose of achieving debt service savings by refunding existing debt. As a result, the stock of refundable bonds has been largely depleted during this extended period of historically low rates. At time of this report, the current expectation is for issuance to increase in April with continued momentum heading into summer. Despite improved issuance levels, we would expect additional supply to be easily digested by the market due to pent-up demand, particularly following tax season.

Although there remain pockets of risk in the municipal bond market, in general we find that municipal bond issuers are relatively stable and are benefitting from the effects of the economic expansion. Notwithstanding the attention-grabbing headlines surrounding the credit challenges for Puerto Rico, Illinois & others, “actual” municipal bond defaults registered their lowest point since 2009, over the past year. Although the market is currently treating these incidents as isolated, they have the potential to create volatility. Moreover, virtually all the $3.85 billion in defaults in 2015 were concentrated in “risky sectors” (retirement, local housing, land secured, etc.), which are very project-specific, and not the broadly supported or “essential services” which generally offer greater investor security. This belies the continued concerns over growing pension and retirement obligation funding as state and local governments manage budgets in a slow growth recovery.

Local Municipal Market

Many of the major themes in the Oregon municipal market are being driven by the recent drought of bonds discussed above. The November election is often revealing of upcoming bond issuance and 2016 has not been an exception. The November 2015 election authorized less than $15 million of new bond issuance versus over $700 million in bonds authorized the prior year. Due to a slow-down in issuance at year-end and the absence of money measures on the 2015 ballot, we do not have a large unsold supply of bonds to bolster the market. In addition, investor appetite has been strong with the few new issues being several times oversubscribed in the prime maturities. However, we believe there is some light at the end of the tunnel as there are several issues on the May 2016 ballot including a $59 million measure for Clackamas County, $125 million for Mt. Hood Community College, $85 million for Centennial School District, $73.445 million for Molalla River School District, and $77 million for Washington County.

2 | Aquila Tax-Free Trust of Oregon

MANAGEMENT DISCUSSION (continued)

The State of Oregon’s March 2016 Revenue Forecast for gross General Fund revenues for the 2015-17 biennium was $18.006 billion, up $8.3 million from the Close of Session forecast, and down $22.8 million from the December 2015 Revenue Forecast. Excluding the impact of laws enacted during the 2015 regular session, the General Fund forecast for the 2015-17 biennium has remained relatively unchanged over the past year. Revenues are currently tracking close to the forecast and the underlying economic outlook is generally considered stable, yet uncertain due to volatility in equity markets and the State budget’s heavy reliance on personal income tax collections tied to realization of capital gains.

In January, Oregon tied for second in the nation for year over-year job growth, with a 3.4% gain. Oregon’s unemployment rate has steadily dropped over the past 12-months and recently reached 4.5% in March, the lowest level since comparable record-keeping began in 1976. This combination of strong job growth and declining unemployment has resulted in a tighter labor market with increased hiring rates for the unemployed and even those not currently in the labor force. While the U.S. economy is not fully healthy today, we believe considerable improvement has been made in recent years and the pace of improvement remains strong. Local governments have also been adding to payrolls. In Multnomah County alone, full-time-equivalent local government employment increased by 4% over the past year. The largest employment gains were prompted by the County, community colleges and regional service districts, each growing significantly.

Housing data for Oregon has shown similar gains over the past year. According to data released by S&P/Case-Shiller on March 29, January marked the fourth straight month the Portland-area housing market posted the nation's largest year-over-year gains in home values. Prices in the region increased 11.8% in January from the same month a year earlier, followed by Seattle which grew 10.7%, and San Francisco with a 10.5% increase. Much like the bond market, the housing market prices are generally being propped-up by low supply and high demand. Housing inventory has dipped to levels as low as 1.2 months, the lowest inventory since 1999. Months of supply provides an estimate for how long it would take for all the homes currently on the market to sell, given monthly sales volume. A balanced housing market will typically have 4 to 6 months of supply.

Nationally and locally pensions continue to make headlines. We remain concerned about the relatively high contribution levels many issuers face due to recent legislative changes, and as a result, our credit research includes a review of each issuer’s pension exposure. In addition, we seek to maintain a focus on Oregon healthcare issuers and have placed them under close scrutiny as hospitals continue to face cost challenges and the uncertain impact of the Affordable Care Act.

Performance

The total reurn for the Aquila Tax-Free Trust of Oregon (the “Trust”) Class A Share based on net asset value (“NAV”) was 2.91% for the year ended March 31, 2016. The Barclays Quality Intermediate Index returned 3.16% for the same period. Portfolio factors that contributed to slightly unfavorable Index comparisons were higher exposure to pre-refunded bonds with shorter average maturities, higher average credit quality, and reduced exposure to hospital bonds. As a part of our overall portfolio strategy we have purposely maintained a heightened exposure to pre-refunded bonds as a source for liquidity and current yield. Characteristics that provided favorable comparisons to the Index included higher concentration in 8 to 12-year maturities, overall outperformance of the Oregon market, and higher exposure to bonds callable in 6 years or less.

3 | Aquila Tax-Free Trust of Oregon

MANAGEMENT DISCUSSION (continued)

Strategy

The portfolio characteristics have become slightly more defensive over the past year with the weighted average maturity declining to 8.35 years. Credit quality has remained very high with over 89% of the portfolio rated AA or higher. Tight supply and declining interest rates have pushed down yields on longer maturity, lower quality bonds as investors have stretched for yield to meet their income requirements. Having raised the Fed Funds rate just once during 2015, the Fed now seems content to let the Fed Funds rate remain where it is until they have a clearer picture of how global economic and political developments will settle out. We contend that now is not the time to add additional risk to fixed income portfolios as we approach a cyclical low in interest rates and the compensation for risk has declined. While it is possible the Federal Reserve will raise short term interest rates again in June, the market has anticipated this event and it should not, in our view, be a major disruption. We do not expect a sharp rise in interest rates this year, but rather a slight upward bias in shorter maturities driven by Federal Reserve activities. This could allow us to take advantage of higher yields by replacing some securities that we purchased during the very low interest rate environment of the past 3 years.

The Trust currently benefits from legacy holdings purchased in higher interest rate environments. These high quality, liquid securities provide an attractive current yield for our shareholders as well as offering the flexibility to reinvest in higher yielding bonds should interest rates rise. We intend to continue our defensive investment strategy by striving to maintain an intermediate average portfolio maturity, emphasizing investment grade credit quality, and a balanced exposure to callable bonds. Furthermore, we intend to continue to perform in-depth credit research on all portfolio holdings, as we believe it is critical during the current rapidly changing economic environment.

4 | Aquila Tax-Free Trust of Oregon

Mutual fund investing involves risk and loss of principal is possible.

The market prices of the Fund’s securities may rise or decline in value due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment. When market prices fall, the value of your investment may go down. In the past several years, financial markets have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. These conditions may continue, recur, worsen or spread.

The value of your investment may go down when interest rates rise. A rise in interest rates tends to have a greater impact on the prices of longer term securities. Conversely, when interest rates fall, the value of your investment may rise. Interest rates in the U.S. recently have been historically low , so the Fund faces a heightened risk that interest rates may rise. A general rise in interest rates may cause investors to move out of fixed income securities and could also result in increased redemptions from the Fund.

Investments in the Fund are subject to possible loss due to the financial failure of the issuers of underlying securities and their inability to meet their debt obligations.

The value of municipal securities can be adversely a ected by changes in the financial condition of one or more individual municipal issuers or insurers of municipal issuers, regulatory developments, legislative actions, and by uncertainties and public perceptions concerning these and other factors. The Fund may be a ected significantly by adverse economic, political or other events a ecting state and other municipal issuers in which it invests, and may be more volatile than a more geographically diverse fund.

If interest rates fall, an issuer may exercise its right to prepay its securities, and the Fund could be forced to reinvest prepayment proceeds at a time when yields on securities available in the market are lower than the yield on the prepaid security.

A portion of income may be subject to local, state, Federal and/or alternative minimum tax. Capital gains, if any, are subject to capital gains tax.

These risks may result in share price volatility.

Past performance is no guarantee of future results, and there is no guarantee that any market forecasts discussed will be realized.

Any information in this Annual Report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. These statements should not be relied upon for any other purposes.

5 | Aquila Tax-Free Trust of Oregon

PERFORMANCE REPORT

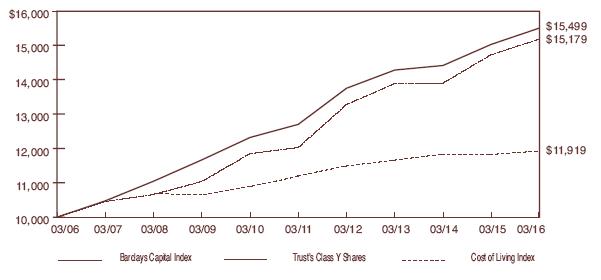

The following graph illustrates the value of $10,000 invested in the Class Y shares of Aquila Tax-Free Trust of Oregon for the 10-year period ended March 31, 2016 as compared with the Barclays Capital Quality Intermediate Municipal Bond Index (the “Barclays Capital Index”) and the Consumer Price Index (a cost of living index). The performance of each of the other classes is not shown in the graph but is included in the table below. It should be noted that the Barclays Capital Index does not include any operating expenses nor sales charges, and being nationally oriented, does not reflect state-specific bond market performance.

|

Average Annual Total Return

|

|||||||||||||||||

|

for periods ended March 31, 2016

|

|||||||||||||||||

|

Since

|

|||||||||||||||||

|

Class and Inception Date

|

1 Year

|

5 Years

|

10 Years

|

Inception

|

|||||||||||||

|

Class A since 6/16/86

|

|||||||||||||||||

|

With Maximum Sales Charge

|

(1.20 | )% | 3.76 | % | 3.68 | % | 5.30 | % | |||||||||

|

Without Sales Charge

|

2.91 | 4.61 | 4.10 | 5.44 | |||||||||||||

|

Class C since 4/5/96

|

|||||||||||||||||

|

With CDSC**

|

1.03 | 3.73 | 3.23 | 3.73 | |||||||||||||

|

Without CDSC

|

2.05 | 3.73 | 3.23 | 3.73 | |||||||||||||

|

Class Y since 4/5/96

|

|||||||||||||||||

|

No Sales Charge

|

3.08 | 4.77 | 4.26 | 4.77 | |||||||||||||

|

Barclays Capital Index

|

3.16 | 4.07 | 4.48 |

5.26

|

* | (Class A) | |||||||||||

|

4.76

|

(Class C & Y) | ||||||||||||||||

Total return figures shown for the Trust reflect any change in price and assume all distributions, including capital gains, within the period were invested in additional shares. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Trust distributions or the redemption of Trust Shares. The rates of return will vary and the principal value of an investment will fluctuate with market conditions. Shares, if redeemed, may be worth more or less than their original cost. A portion of each class’s income may be subject to Federal and state income taxes. Past performance is not predictive of future investment results.

* From commencement of the index on 1/1/87.

** CDSC = 1% contingent deferred sales charge imposed on redemptions made within the first 12 months after purchase.

6 | Aquila Tax-Free Trust of Oregon

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and the

Shareholders of Aquila Tax-Free Trust of Oregon:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Aquila Tax-Free Trust of Oregon as of March 31, 2016 and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the three years in the period then ended, the six month period ended March 31, 2013 and each of the two years in the period ended September 30, 2012. These financial statements and financial highlights are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2016, by correspondence with the custodian and with brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Aquila Tax-Free Trust of Oregon as of March 31, 2016, the results of its operations, the changes in its net assets, and the financial highlights for the periods indicated above, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

May 27, 2016

7 | Aquila Tax-Free Trust of Oregon

| AQUILA TAX-FREE TRUST OF OREGON |

| SCHEDULE OF INVESTMENTS |

| MARCH 31, 2016 |

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

General Obligation Bonds (42.3%)

|

(unaudited)

|

Value

|

||||||

|

City & County (4.7%)

|

|||||||||

|

Bend, Oregon

|

|||||||||

| $ | 2,435,000 |

4.000%, 06/01/24

|

Aa2/NR/NR

|

$ | 2,741,226 | ||||

|

Canby, Oregon

|

|||||||||

| 1,405,000 |

4.000%, 12/01/24 AGMC Insured

|

A2/NR/NR

|

1,560,070 | ||||||

| 1,060,000 |

5.000%, 06/01/27

|

A2/NR/NR

|

1,227,968 | ||||||

|

Clackamas County, Oregon Refunding

|

|||||||||

| 1,135,000 |

4.000%, 06/01/24

|

Aa2/NR/NR

|

1,289,065 | ||||||

|

Clackamas County, Oregon Tax Allocation

|

|||||||||

| 705,000 |

6.500%, 05/01/20

|

NR/NR/NR*

|

718,310 | ||||||

|

Gresham, Oregon Full Faith and Credit

|

|||||||||

|

Refunding and Project Obligations

|

|||||||||

| 1,545,000 |

5.000%, 05/01/23

|

Aa3/NR/NR

|

1,897,229 | ||||||

|

Hillsboro, Oregon

|

|||||||||

| 390,000 |

3.500%, 06/01/16 Series B

|

Aa3/NR/NR

|

391,856 | ||||||

| 345,000 |

3.500%, 06/01/17 Series B

|

Aa3/NR/NR

|

356,137 | ||||||

|

Lebanon, Oregon Refunding

|

|||||||||

| 1,050,000 |

5.000%, 06/01/24

|

A2/NR/NR

|

1,258,236 | ||||||

|

Lebanon, Oregon Refunding

|

|||||||||

| 1,165,000 |

5.000%, 06/01/25

|

A1/NR/NR

|

1,435,222 | ||||||

|

McMinnville, Oregon Refunding

|

|||||||||

| 2,075,000 |

5.000%, 02/01/27

|

Aa3/NR/NR

|

2,559,118 | ||||||

|

Portland, Oregon Public Safety

|

|||||||||

| 1,345,000 |

5.000%, 06/15/25 Series A

|

Aaa/NR/NR

|

1,713,409 | ||||||

| 2,130,000 |

4.125%, 06/01/26 Series A

|

Aaa/NR/NR

|

2,303,041 | ||||||

|

Portland, Oregon Limited Tax, Improvement

|

|||||||||

| 630,000 |

4.000%, 06/01/22 Series A

|

Aa1/NR/NR

|

633,030 | ||||||

| 525,000 |

4.000%, 06/01/24 Series A

|

Aa1/NR/NR

|

577,416 | ||||||

|

Redmond, Oregon Refunding

|

|||||||||

| 735,000 |

5.000%, 06/01/23 Series A

|

A1/NR/NR

|

873,334 | ||||||

|

City of Salem, Oregon

|

|||||||||

| 1,585,000 |

4.000%, 06/01/17

|

NR/AA/NR

|

1,645,832 | ||||||

| 1,750,000 |

5.000%, 06/01/29

|

NR/AA/NR

|

1,961,068 | ||||||

|

Washington County, Oregon

|

|||||||||

| 3,800,000 |

5.000%, 06/01/26

|

Aa1/NR/NR

|

4,887,294 | ||||||

|

Total City & County

|

30,028,861 | ||||||||

8 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

General Obligation Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Community College (4.5%)

|

|||||||||

|

Blue Mountain Community College

|

|||||||||

|

District, Umatilla County

|

|||||||||

| $ | 970,000 |

4.000%, 06/15/27

|

NR/AA+/NR

|

$ | 1,110,252 | ||||

|

Central Oregon Community College

|

|||||||||

|

District

|

|||||||||

| 1,850,000 |

4.750%, 06/15/22

|

NR/AA+/NR

|

2,126,853 | ||||||

| 2,195,000 |

4.750%, 06/15/23

|

NR/AA+/NR

|

2,522,494 | ||||||

| 2,175,000 |

4.750%, 06/15/26

|

NR/AA+/NR

|

2,496,617 | ||||||

|

Chemeketa, Oregon Community College

|

|||||||||

|

District

|

|||||||||

| 2,000,000 |

5.000%, 06/15/25

|

NR/AA+/NR

|

2,506,280 | ||||||

|

Clackamas, Oregon Community College

|

|||||||||

|

District

|

|||||||||

| 1,405,000 |

5 .000%, 06/15/27 Series A

|

Aa1/AA+/NR

|

1,730,820 | ||||||

|

Columbia Gorge, Oregon Community

|

|||||||||

|

College District, Refunding

|

|||||||||

| 1,000,000 |

4.000%, 06/15/24

|

Aa1/NR/NR

|

1,126,510 | ||||||

|

Lane, Oregon Community College

|

|||||||||

| 1,840,000 |

5.000%, 06/15/24

|

NR/AA+/NR

|

2,213,520 | ||||||

|

Linn Benton, Oregon Community College

|

|||||||||

| 1,520,000 |

5.000%, 06/01/27

|

NR/AA+/NR

|

1,895,410 | ||||||

|

Oregon Coast Community College

|

|||||||||

|

District State

|

|||||||||

| 1,770,000 |

5.000%, 06/15/25

|

Aa1/NR/NR

|

2,128,142 | ||||||

|

Portland, Oregon Community College

|

|||||||||

|

District

|

|||||||||

| 7,915,000 |

5.000%, 06/15/28

|

Aa1/AA/NR

|

8,891,869 | ||||||

|

Total Community College

|

28,748,767 | ||||||||

|

Higher Education (1.5%)

|

|||||||||

|

Oregon State Higher Education

|

|||||||||

| 1,000,000 |

5.000%, 08/01/25 Series C

|

Aa1/AA+/AA+

|

1,255,060 | ||||||

| 1,795,000 |

5.000%, 08/01/27 Series C

|

Aa1/AA+/AA+

|

2,233,913 | ||||||

|

Oregon State, Oregon University System

|

|||||||||

| 1,170,000 |

4.000%, 08/01/25 Series B

|

Aa1/AA+/AA+

|

1,328,383 | ||||||

| 1,090,000 |

5.000%, 08/01/25 Series N

|

Aa1/AA+/AA+

|

1,349,333 | ||||||

9 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

General Obligation Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Higher Education (continued)

|

|||||||||

|

Oregon State, Oregon University System

|

|||||||||

|

Projects

|

|||||||||

| $ | 2,365,000 |

4.000%, 08/01/26 Series H

|

Aa1/AA+/AA+

|

$ | 2,650,881 | ||||

|

State of Oregon Board of Higher

|

|||||||||

|

Education

|

|||||||||

| 820,000 |

zero coupon, 08/01/16

|

Aa1/AA+/AA+

|

818,442 | ||||||

|

Total Higher Education

|

9,636,012 | ||||||||

|

Housing (0.2%)

|

|||||||||

|

State of Oregon Veterans’ Welfare

|

|||||||||

| 550,000 |

4.800%, 12/01/22

|

Aa1/AA+/AA+

|

574,860 | ||||||

| 400,000 |

4.900%, 12/01/26

|

Aa1/AA+/AA+

|

418,776 | ||||||

|

Total Housing

|

993,636 | ||||||||

|

School District (20.9%)

|

|||||||||

|

Clackamas County, Oregon School

|

|||||||||

|

District #12 (North Clackamas)

|

|||||||||

| 2,450,000 |

5.000%, 06/15/25

|

Aa1/AA+/NR

|

3,053,215 | ||||||

| 1,500,000 |

5.000%, 06/15/26

|

Aa1/AA+/NR

|

1,865,430 | ||||||

|

Clackamas County, Oregon School

|

|||||||||

|

District #46 (Oregon Trail)

|

|||||||||

| 1,000,000 |

5.000%, 06/15/22

|

NR/AA+/NR

|

1,129,820 | ||||||

| 1,865,000 |

5.000%, 06/15/28 Series A

|

NR/AA+/NR

|

2,098,312 | ||||||

| 1,800,000 |

5.000%, 06/15/29 Series A

|

NR/AA+/NR

|

2,022,750 | ||||||

| 2,000,000 |

5.000%, 06/15/32 Series A

|

NR/AA+/NR

|

2,239,460 | ||||||

| 3,780,000 |

4.750%, 06/15/32 Series A

|

NR/AA+/NR

|

4,180,415 | ||||||

|

Clackamas County, Oregon School District

|

|||||||||

|

#62 (Oregon City)

|

|||||||||

| 1,000,000 |

5.000%, 06/01/29 MAC Insured

|

A1/AA/NR

|

1,185,000 | ||||||

|

Clackamas County, Oregon School

|

|||||||||

|

District #86 (Canby)

|

|||||||||

| 1,800,000 |

5.000%, 06/15/24

|

Aa1/AA+/NR

|

2,171,304 | ||||||

| 1,110,000 |

5.000%, 06/15/25 Series A

|

Aa1/AA+/NR

|

1,339,703 | ||||||

|

Clackamas & Washington Counties, Oregon

|

|||||||||

|

School District No. 3JT

|

|||||||||

|

(West Linn-Wilsonville)

|

|||||||||

| 3,500,000 |

5.000%, 06/15/26

|

Aa1/AA+/NR

|

4,401,180 | ||||||

10 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

General Obligation Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

School District (continued)

|

|||||||||

|

Clackamas & Washington Counties, Oregon

|

|||||||||

|

School District No. 3JT

|

|||||||||

|

(West Linn-Wilsonville) (continued)

|

|||||||||

| $ | 5,500,000 |

5.000%, 06/15/27

|

Aa1/AA+/NR

|

$ | 6,858,390 | ||||

| 1,115,000 |

5.000%, 06/15/28

|

Aa1/AA+/NR

|

1,381,942 | ||||||

|

Columbia & Washington Counties,

|

|||||||||

|

Oregon School District #47J (Vernonia)

|

|||||||||

| 3,430,000 |

5.00%, 06/15/27

|

NR/AA+/NR

|

3,956,985 | ||||||

|

Deschutes County, Oregon School

|

|||||||||

|

District #6 (Sisters)

|

|||||||||

| 1,735,000 |

5.250%, 06/15/19 AGMC Insured

|

A2/AA+/NR

|

1,960,966 | ||||||

| 1,030,000 |

5.250%, 06/15/21 AGMC Insured

|

A2/AA+/NR

|

1,232,550 | ||||||

|

Deschutes and Jefferson Counties,

|

|||||||||

|

Oregon School District #02J (Redmond)

|

|||||||||

| 80,000 |

5.000%, 06/15/21 NPFG/ FGIC

|

||||||||

|

Insured

|

Aa1/NR/NR

|

80,290 | |||||||

| 1,025,000 |

zero coupon, 06/15/23

|

Aa1/NR/NR

|

897,172 | ||||||

|

Hood River County, Oregon School

|

|||||||||

|

District Refunding

|

|||||||||

| 250,000 |

4.000%, 06/15/16

|

NR/AA+/NR

|

251,658 | ||||||

|

Jackson County, Oregon School District #9

|

|||||||||

|

(Eagle Point)

|

|||||||||

| 1,445,000 |

5.500%, 06/15/16 NPFG Insured

|

Aa1/NR/NR

|

1,458,814 | ||||||

|

Jefferson County, Oregon School District

|

|||||||||

| #509J | |||||||||

| 1,400,000 |

5.000%, 06/15/25

|

Aa1/NR/NR

|

1,707,342 | ||||||

|

Klamath County, Oregon School District

|

|||||||||

| 1,250,000 |

5.000%, 06/15/24

|

NR/AA+/NR

|

1,532,950 | ||||||

|

Lane County, Oregon School District #4J

|

|||||||||

|

(Eugene) Refunding

|

|||||||||

| 1,130,000 |

4.000%, 06/15/23

|

Aa1/NR/NR

|

1,268,843 | ||||||

| 2,850,000 |

4.000%, 06/15/24

|

Aa1/NR/NR

|

3,223,037 | ||||||

| 4,575,000 |

5.000%, 06/15/26

|

Aa1/NR/NR

|

5,646,419 | ||||||

|

Lane County, Oregon School District #19

|

|||||||||

|

(Springfield)

|

|||||||||

| 1,000,000 |

5.000%, 06/15/25

|

Aa1/AA+/NR

|

1,257,480 | ||||||

| 1,735,000 |

5.000%, 06/15/27

|

Aa1/AA+/NR

|

2,163,510 | ||||||

11 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

General Obligation Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

School District (continued)

|

|||||||||

|

Lincoln County, Oregon School District

|

|||||||||

| $ | 2,370,000 |

4.000%, 06/15/24 Series A

|

Aa1/NR/NR

|

$ | 2,616,267 | ||||

|

Marion County, Oregon School District

|

|||||||||

|

#103 (Woodburn)

|

|||||||||

| 2,140,000 |

5.000%, 06/15/27

|

Aa1/NR/NR

|

2,674,636 | ||||||

| 2,260,000 |

5.000%, 06/15/28

|

Aa1/NR/NR

|

2,811,756 | ||||||

|

Marion & Clackamas Counties, Oregon

|

|||||||||

|

School District #4J (Silver Falls)

|

|||||||||

| 1,260,000 |

5.000%, 06/15/24

|

Aa1/NR/NR

|

1,552,900 | ||||||

|

Morrow County, Oregon School

|

|||||||||

|

District #1

|

|||||||||

| 1,710,000 |

5.250%, 06/15/19 AGMC Insured

|

A2/AA+/NR

|

1,940,799 | ||||||

|

Multnomah County, Oregon School

|

|||||||||

|

District #1J (Portland)

|

|||||||||

| 2,970,000 |

5.000%, 06/15/26 Series B

|

Aa1/AA+/NR

|

3,743,269 | ||||||

|

Multnomah County, Oregon School

|

|||||||||

|

District #7 (Reynolds)

|

|||||||||

| 5,680,000 |

5.000%, 06/15/26 Series A

|

Aa1/NR/NR

|

7,191,732 | ||||||

| 1,500,000 |

5.000%, 06/15/27 Series A

|

Aa1/NR/NR

|

1,884,780 | ||||||

| 1,825,000 |

5.000%, 06/15/28 Series A

|

Aa1/NR/NR

|

2,280,940 | ||||||

|

Multnomah County, Oregon School

|

|||||||||

|

District #7 (Reynolds) Refunding

|

|||||||||

| 1,165,000 |

5.000%, 06/01/29

|

Aa3/NR/NR

|

1,330,174 | ||||||

|

Multnomah County, Oregon School

|

|||||||||

|

District #40 (David Douglas)

|

|||||||||

| 1,500,000 |

5.000%, 06/15/23 Series A

|

NR/AA+/NR

|

1,812,375 | ||||||

|

Multnomah and Clackamas Counties,

|

|||||||||

|

Oregon School District #10

|

|||||||||

|

(Gresham-Barlow)

|

|||||||||

| 4,275,000 |

5.250%, 06/15/19 AGMC Insured

|

Aa1/AA+/NR

|

4,834,640 | ||||||

|

Multnomah and Clackamas Counties,

|

|||||||||

|

Oregon School District #28JT

|

|||||||||

|

(Centennial)

|

|||||||||

| 2,680,000 |

5.250%, 12/15/18 AGMC Insured

|

Aa1/NR/NR

|

2,986,565 | ||||||

|

Polk, Marion & Benton Counties, Oregon

|

|||||||||

|

School District #13J (Central)

|

|||||||||

| 1,515,000 |

4.000%, 02/01/28

|

NR/AA+/NR

|

1,718,252 | ||||||

12 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

General Obligation Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

School District (continued)

|

|||||||||

|

Union County, Oregon School District #1

|

|||||||||

|

(La Grande)

|

|||||||||

| $ | 1,000,000 |

5.000%, 06/15/27

|

Aa1/NR/NR

|

$ | 1,230,960 | ||||

|

Wasco County, Oregon School District #12

|

|||||||||

|

(The Dalles)

|

|||||||||

| 1,400,000 |

5.500%, 06/15/17 AGMC Insured

|

A2/AA/NR

|

1,480,640 | ||||||

| 1,790,000 |

5.500%, 06/15/20 AGMC Insured

|

A2/AA/NR

|

2,099,097 | ||||||

|

Washington County, Oregon School

|

|||||||||

|

District #48J (Beaverton)

|

|||||||||

| 2,750,000 |

4.000%, 06/15/25

|

Aa1/AA+/NR

|

3,108,243 | ||||||

| 2,275,000 |

4.000%, 06/15/23 Series B

|

Aa1/AA+/NR

|

2,600,075 | ||||||

| 5,290,000 |

4.000%, 06/15/24 Series B

|

Aa1/AA+/NR

|

6,005,684 | ||||||

| 3,000,000 |

5.000%, 06/15/25 Series 2014B

|

Aa1/AA+/NR

|

3,736,050 | ||||||

| 3,000,000 |

5.000%, 06/15/28 Series 2014B

|

Aa1/AA+/NR

|

3,671,970 | ||||||

| 1,845,000 |

5.000%, 06/15/29 Series 2014B

|

Aa1/AA+/NR

|

2,242,708 | ||||||

| 1,280,000 |

5.000%, 06/01/31 AGC Insured

|

Aa3/AA/NR

|

1,428,467 | ||||||

| 1,000,000 |

5.125%, 06/01/36 AGC Insured

|

Aa3/AA/NR

|

1,112,280 | ||||||

|

Washington Multnomah & Yamhill Counties,

|

|||||||||

|

Oregon School District #1J (Hillsboro)

|

|||||||||

| 1,535,000 |

4.000%, 06/15/25

|

Aa1/NR/NR

|

1,742,670 | ||||||

|

Yamhill County, Oregon School District

|

|||||||||

|

#40 (McMinnville)

|

|||||||||

| 2,255,000 |

4.000%, 06/15/26

|

Aa1/NR/NR

|

2,571,985 | ||||||

|

Total School Districts

|

132,974,851 | ||||||||

|

Special District (3.6%)

|

|||||||||

|

Bend, Oregon Metropolitan Park &

|

|||||||||

|

Recreational District

|

|||||||||

| 1,430,000 |

4.000%, 06/01/27

|

Aa3/NR/NR

|

1,594,507 | ||||||

|

Metro, Oregon

|

|||||||||

| 4,000,000 |

4.000%, 06/01/26 Series A

|

Aaa/AAA/NR

|

4,456,200 | ||||||

|

Tualatin Hills, Oregon Park & Recreational

|

|||||||||

|

District

|

|||||||||

| 3,480,000 |

5.000%, 06/01/23

|

Aa1/NR/NR

|

4,300,758 | ||||||

| 4,725,000 |

5.000%, 06/01/24

|

Aa1/NR/NR

|

5,932,190 | ||||||

| 2,775,000 |

5.000%, 06/01/26

|

Aa1/NR/NR

|

3,518,728 | ||||||

13 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

General Obligation Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Special District (continued)

|

|||||||||

|

Tualatin Valley, Oregon Fire & Rescue

|

|||||||||

|

Rural Fire Protection District

|

|||||||||

| $ | 1,235,000 |

4.000%, 06/01/26

|

Aaa/NR/NR

|

$ | 1,363,045 | ||||

| 1,170,000 |

4.000%, 06/01/27

|

Aaa/NR/NR

|

1,288,287 | ||||||

|

Total Special District

|

22,453,715 | ||||||||

|

State of Oregon (6.2%)

|

|||||||||

|

State of Oregon

|

|||||||||

| 750,000 |

5.000%, 05/01/25 Series A

|

Aa1/AA+/AA+

|

939,150 | ||||||

| 3,000,000 |

5.000%, 05/01/23 Series L

|

Aa1/AA+/AA+

|

3,565,830 | ||||||

| 1,125,000 |

5.000%, 05/01/24 Series L

|

Aa1/AA+/AA+

|

1,328,670 | ||||||

| 1,470,000 |

4.000%, 11/01/26 Series M

|

Aa1/AA+/AA+

|

1,655,676 | ||||||

| 2,125,000 |

4.000%, 05/01/25 Series O

|

Aa1/AA+/AA+

|

2,384,611 | ||||||

|

State of Oregon Alternative Energy Project

|

|||||||||

| 1,255,000 |

4.750%, 04/01/29 Series B

|

Aa1/AA+/AA+

|

1,393,640 | ||||||

| 500,000 |

6.000%, 10/01/29 Series B

|

Aa1/AA+/AA+

|

566,735 | ||||||

|

State of Oregon Article XI-G Community

|

|||||||||

|

College Projects

|

|||||||||

| 1,160,000 |

5.000%, 08/01/27 Series J

|

Aa1/AA+/AA+

|

1,457,969 | ||||||

|

State of Oregon Article XI-G Higher

|

|||||||||

|

Education

|

|||||||||

| 500,000 |

5.000%, 08/01/25 Series O

|

Aa1/AA+/AA+

|

639,695 | ||||||

| 1,000,000 |

5.000%, 08/01/26 Series O

|

Aa1/AA+/AA+

|

1,265,620 | ||||||

| 1,000,000 |

5.000%, 08/01/27 Series O

|

Aa1/AA+/AA+

|

1,256,870 | ||||||

|

State of Oregon Article XI-Q State Projects

|

|||||||||

| 2,300,000 |

5.000%, 05/01/28 Series F

|

Aa1/AA+/AA+

|

2,861,223 | ||||||

|

State of Oregon Department of

|

|||||||||

|

Administrative Services

|

|||||||||

| 3,270,000 |

5.000%, 11/01/27 Series C

|

Aa2/AA/AA

|

3,706,905 | ||||||

| 2,155,000 |

5.000%, 11/01/28 Series C

|

Aa2/AA/AA

|

2,439,675 | ||||||

| 5,000,000 |

5.125%, 05/01/33

|

Aa2/AA/AA

|

5,564,500 | ||||||

|

State of Oregon Department of

|

|||||||||

|

Administrative Services, Oregon

|

|||||||||

|

Opportunity Refunding

|

|||||||||

| 6,210,000 |

5.000%, 12/01/19

|

Aa1/AA+/AA+

|

7,113,866 | ||||||

|

State of Oregon Higher Education

|

|||||||||

| 1,000,000 |

5.000%, 08/01/28 Series A

|

Aa1/AA+/AA+

|

1,250,100 | ||||||

|

Total State of Oregon

|

39,390,735 | ||||||||

14 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

General Obligation Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Water & Sewer (0.7%)

|

|||||||||

|

Gearheart, Oregon

|

|||||||||

| $ | 1,060,000 |

4.500%, 03/01/26 AGMC Insured

|

A2/NR/NR

|

$ | 1,190,603 | ||||

|

Pacific City, Oregon Joint Water -

|

|||||||||

|

Sanitary Authority

|

|||||||||

| 1,830,000 |

4.800%, 07/01/27

|

NR/NR/NR*

|

1,848,520 | ||||||

|

Rockwood, Oregon Water Peoples

|

|||||||||

|

Utility District Water Revenue Refunding

|

|||||||||

| 1,270,000 |

4.250%, 08/15/26

|

A1/NR/NR

|

1,422,108 | ||||||

|

Total Water & Sewer

|

4,461,231 | ||||||||

|

Total General Obligation Bonds

|

268,687,808 | ||||||||

|

Revenue Bonds (35.2%)

|

|||||||||

|

City & County (2.8%)

|

|||||||||

|

Local Oregon Capital Assets Program

|

|||||||||

|

COP Cottage Grove

|

|||||||||

| 2,375,000 |

5.000%, 09/15/25 Series 2013A

|

Baa2/NR/NR

|

2,596,944 | ||||||

|

Newport, Oregon Urban Renewal

|

|||||||||

|

Obligations, Refunding

|

|||||||||

| 565,000 |

4.500%, 06/15/22 Series B

|

NR/AA-/NR

|

645,772 | ||||||

|

Portland, Oregon Revenue Refunding

|

|||||||||

|

Limited Tax, Oregon Convention Center

|

|||||||||

| 2,825,000 |

5.000%, 06/01/24

|

Aa1/NR/NR

|

3,339,913 | ||||||

| 4,265,000 |

5.000%, 06/01/27

|

Aa1/NR/NR

|

5,007,494 | ||||||

|

Portland, Oregon Revenue Refunding

|

|||||||||

|

Limited Tax

|

|||||||||

| 1,000,000 |

4.000%, 04/01/22 Series A

|

Aa1/NR/NR

|

1,078,900 | ||||||

|

Portland, Oregon River District Urban

|

|||||||||

|

Renewal and Redevelopment

|

|||||||||

| 1,600,000 |

5.000%, 06/15/22 Series B

|

A1/NR/NR

|

1,913,312 | ||||||

| 1,830,000 |

5.000%, 06/15/23 Series B

|

A1/NR/NR

|

2,168,221 | ||||||

|

Portland, Oregon Urban Renewal and

|

|||||||||

|

Redevelopment, Refunding,

|

|||||||||

|

North Macadam

|

|||||||||

| 1,000,000 |

4.000%, 06/15/25 Series B

|

A1/NR/NR

|

1,072,130 | ||||||

|

Total City & County

|

17,822,686 | ||||||||

15 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Electric (1.6%)

|

|||||||||

|

Eugene, Oregon Electric Utility

|

|||||||||

| $ | 5,635,000 |

5.000%, 08/01/30

|

Aa3/AA-/A+

|

$ | 6,123,836 | ||||

|

Eugene, Oregon Electric Utility Refunding

|

|||||||||

|

System

|

|||||||||

| 2,000,000 |

5.000%, 08/01/27 Series A

|

Aa3/AA-/A+

|

2,344,440 | ||||||

|

Northern Wasco County, Oregon Peoples

|

|||||||||

|

Utility District, McNary Dam Fishway

|

|||||||||

|

Hydroelectric Project, Refunding

|

|||||||||

| 1,585,000 |

5.000%, 12/01/21 Series A

|

NR/AA-/NR

|

1,893,235 | ||||||

|

Total Electric

|

10,361,511 | ||||||||

|

Higher Education (3.1%)

|

|||||||||

|

Forest Grove, Oregon Student Housing

|

|||||||||

|

(Oak Tree Foundation)

|

|||||||||

| 5,480,000 |

5.500%, 03/01/37

|

NR/NR/NR*

|

5,581,106 | ||||||

|

Oregon State Facilities Authority (Lewis

|

|||||||||

|

& Clark College Project)

|

|||||||||

| 1,000,000 |

5.250%, 10/01/24 Series A

|

A3/A-/NR

|

1,178,400 | ||||||

| 3,000,000 |

5.000%, 10/01/27 Series A

|

A3/A-/NR

|

3,480,870 | ||||||

|

Oregon State Facilities Authority (Linfield

|

|||||||||

|

College Project)

|

|||||||||

| 1,180,000 |

5.000%, 10/01/22 Series A

|

Baa1/NR/NR

|

1,351,891 | ||||||

| 1,000,000 |

5.000%, 10/01/23 Series A

|

Baa1/NR/NR

|

1,151,340 | ||||||

| 1,220,000 |

5.000%, 10/01/31 Series A 2010

|

Baa1/NR/NR

|

1,340,036 | ||||||

|

Oregon State Facilities Authority Revenue

|

|||||||||

|

Refunding (Reed College Project)

|

|||||||||

| 1,500,000 |

5.000%, 07/01/29 Series A

|

Aa2/AA-/NR

|

1,716,795 | ||||||

|

Oregon State Facilities Authority

|

|||||||||

|

(Willamette University)

|

|||||||||

| 1,000,000 |

4.000%, 10/01/24

|

NR/A/NR

|

1,086,730 | ||||||

| 2,500,000 |

5.000%, 10/01/32

|

NR/A/NR

|

2,638,625 | ||||||

|

Total Higher Education

|

19,525,793 | ||||||||

16 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Hospital (7.6%)

|

|||||||||

|

Deschutes County, Oregon Hospital

|

|||||||||

|

Facilities Authority (Cascade Health)

|

|||||||||

| $ | 3,250,000 |

5.375%, 01/01/35 AMBAC Insured

|

A2/NR/NR

|

$ | 3,451,988 | ||||

|

Medford, Oregon Hospital Facilities

|

|||||||||

|

Authority Revenue Refunding, Asante

|

|||||||||

|

Health Systems

|

|||||||||

| 9,000,000 |

5.500%, 08/15/28 AGMC Insured

|

NR/AA/NR

|

10,472,670 | ||||||

|

Oregon Health Sciences University

|

|||||||||

| 11,550,000 |

zero coupon, 07/01/21 NPFG Insured

|

Aa3/AA-/AA-

|

10,009,115 | ||||||

| 2,000,000 |

5.000%, 07/01/23 Series A

|

Aa3/AA-/AA-

|

2,411,420 | ||||||

| 1,250,000 |

5.000%, 07/01/28 Series B

|

Aa3/AA-/AA-

|

1,551,125 | ||||||

|

Oregon State Facilities Authority Revenue

|

|||||||||

|

Refunding, Legacy Health Systems

|

|||||||||

| 2,000,000 |

4.250%, 03/15/17

|

A1/AA-/NR

|

2,065,560 | ||||||

| 3,000,000 |

4.500%, 03/15/18

|

A1/AA-/NR

|

3,204,690 | ||||||

| 1,000,000 |

4.750%, 03/15/24

|

A1/AA-/NR

|

1,120,340 | ||||||

| 1,000,000 |

5.000%, 03/15/30

|

A1/AA-/NR

|

1,116,450 | ||||||

|

Oregon State Facilities Authority Revenue

|

|||||||||

|

Refunding, Samaritan Health Services

|

|||||||||

| 1,500,000 |

4.375%, 10/01/20

|

NR/BBB+/NR

|

1,665,165 | ||||||

| 2,000,000 |

4.500%, 10/01/21

|

NR/BBB+/NR

|

2,195,600 | ||||||

| 1,520,000 |

5.000%, 10/01/23

|

NR/BBB+/NR

|

1,683,126 | ||||||

| 1,795,000 |

4.875%, 10/01/25

|

NR/BBB+/NR

|

1,955,832 | ||||||

| 2,000,000 |

5.000%, 10/01/30

|

NR/BBB+/NR

|

2,145,960 | ||||||

|

Salem, Oregon Hospital Facility Authority

|

|||||||||

|

(Salem Hospital)

|

|||||||||

| 2,000,000 |

5.750%, 08/15/23

|

NR/A+/A+

|

2,221,600 | ||||||

| 1,075,000 |

5.000%, 08/15/27 Series A

|

NR/A+/A+

|

1,092,383 | ||||||

|

Total Hospital

|

48,363,024 | ||||||||

|

Housing (0.5%)

|

|||||||||

|

Clackamas County, Oregon Housing

|

|||||||||

|

Authority Multifamily Housing Revenue

|

|||||||||

|

(Easton Ridge Apartments Project)

|

|||||||||

| 1,310,000 |

4.000%, 09/01/27 Series A

|

Aa3/NR/NR

|

1,416,608 | ||||||

17 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Housing (continued)

|

|||||||||

|

Portland, Oregon Urban Renewal and

|

|||||||||

|

Redevelopment, Interstate Corridor

|

|||||||||

| $ | 1,390,000 |

5.000%, 06/15/27 Series B

|

A1/NR/NR

|

$ | 1,623,117 | ||||

|

State of Oregon Housing and Community

|

|||||||||

|

Services

|

|||||||||

| 295,000 |

5.350%, 07/01/30

|

Aa2/NR/NR

|

305,021 | ||||||

|

Total Housing

|

3,344,746 | ||||||||

|

Lottery (4.3%)

|

|||||||||

|

Oregon State Department of Administration

|

|||||||||

|

Services (Lottery Revenue)

|

|||||||||

| 1,015,000 |

5.250%, 04/01/26 Series A (unrefunded

|

||||||||

|

portion)

|

Aa2/AAA/NR

|

1,205,901 | |||||||

| 1,715,000 |

5.000%, 04/01/24 Series B

|

Aa2/AAA/NR

|

2,065,203 | ||||||

| 1,500,000 |

5.000%, 04/01/25 Series B

|

Aa2/AAA/NR

|

1,800,585 | ||||||

| 1,000,000 |

5.000%, 04/01/25 Series B

|

Aa2/AAA/NR

|

1,248,930 | ||||||

| 3,000,000 |

5.000%, 04/01/26 Series C

|

Aa2/AAA/NR

|

3,796,290 | ||||||

| 8,500,000 |

5.000%, 04/01/26 Series D

|

Aa2/AAA/NR

|

10,756,155 | ||||||

| 4,000,000 |

5.000%, 04/01/28 Series D

|

Aa2/AAA/NR

|

4,979,040 | ||||||

| 1,000,000 |

5.000%, 04/01/29 Series D

|

Aa2/AAA/NR

|

1,237,350 | ||||||

|

Total Lottery

|

27,089,454 | ||||||||

|

Transportation (6.2%)

|

|||||||||

|

Oregon State Department Transportation

|

|||||||||

|

Highway Usertax, Senior Lien

|

|||||||||

| 3,605,000 |

5.000%, 11/15/24 Series A

|

Aa1/AAA/AA+

|

4,429,355 | ||||||

| 2,425,000 |

5.000%, 11/15/25 Series A

|

Aa1/AAA/AA+

|

2,967,521 | ||||||

| 1,040,000 |

5.000%, 11/15/26 Series A

|

Aa1/AAA/AA+

|

1,308,133 | ||||||

| 1,000,000 |

5.000%, 11/15/26 Series A

|

Aa1/AAA/AA+

|

1,237,860 | ||||||

| 8,000,000 |

5.000%, 11/15/28 Series A

|

Aa1/AAA/AA+

|

9,946,880 | ||||||

|

Port Portland, Oregon Airport Revenue

|

|||||||||

|

Refunding, Portland International

|

|||||||||

|

Airport Series Twenty Three

|

|||||||||

| 2,525,000 |

5.000%, 07/01/26

|

NR/AA-/NR

|

3,175,566 | ||||||

| 1,000,000 |

5.000%, 07/01/28

|

NR/AA-/NR

|

1,234,790 | ||||||

| 1,545,000 |

5.000%, 07/01/29

|

NR/AA-/NR

|

1,894,695 | ||||||

18 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Transportation (continued)

|

|||||||||

|

Tri-County Metropolitan Transportation

|

|||||||||

|

District, Oregon Capital Grant Receipt

|

|||||||||

| $ | 1,685,000 |

5.000%, 10/01/24 Series A

|

A3/A/NR

|

$ | 1,961,778 | ||||

| 3,480,000 |

5.000%, 10/01/26 Series A

|

A3/A/NR

|

4,047,658 | ||||||

| 3,000,000 |

5.000%, 10/01/27 Series A

|

A3/A/NR

|

3,480,870 | ||||||

|

Tri-County Metropolitan Transportation

|

|||||||||

|

District, Oregon Senior Lien Payroll Tax

|

|||||||||

| 1,000,000 |

5.000%, 09/01/25 Series A

|

Aaa/AAA/NR

|

1,279,710 | ||||||

| 2,010,000 |

5.000%, 09/01/29 Series B

|

Aaa/AAA/NR

|

2,501,224 | ||||||

|

Total Transportation

|

39,466,040 | ||||||||

|

Water and Sewer (9.1%)

|

|||||||||

|

Ashland, Oregon Refunding

|

|||||||||

| 1,025,000 |

4.000%, 05/01/17 AGMC Insured

|

NR/AA/NR

|

1,061,623 | ||||||

|

Grants Pass, Oregon

|

|||||||||

| 1,000,000 |

4.000%, 12/01/23

|

NR/AA-/NR

|

1,135,380 | ||||||

|

Klamath Falls, Oregon Water

|

|||||||||

| 455,000 |

5.500%, 07/01/16 AGMC Insured

|

A2/AA/NR

|

460,155 | ||||||

|

Lane County, Oregon Metropolitan

|

|||||||||

|

Wastewater

|

|||||||||

| 2,500,000 |

5.250%, 11/01/28

|

Aa2/AA/NR

|

2,777,250 | ||||||

|

Madras, Oregon

|

|||||||||

| 725,000 |

4.500%, 02/15/27

|

Baa1/NR/NR

|

781,231 | ||||||

|

Portland, Oregon Sewer System,

|

|||||||||

|

Second Lien

|

|||||||||

| 3,005,000 |

5.000%, 03/01/28 Series A

|

Aa3/AA-/NR

|

3,445,563 | ||||||

| 2,000,000 |

5.000%, 10/01/25 Series B

|

Aa3/AA-/NR

|

2,492,820 | ||||||

|

Portland Oregon Sewer System Revenue

|

|||||||||

|

Refunding Second Lien

|

|||||||||

| 5,000,000 |

5.000%, 06/15/33 Series B

|

Aa3/AA-/NR

|

5,396,600 | ||||||

|

Portland, Oregon Water System (First Lien)

|

|||||||||

| 3,230,000 |

5.000%, 05/01/27 Series A

|

Aaa/NR/NR

|

3,992,345 | ||||||

| 3,500,000 |

5.000%, 06/01/28 Series A

|

Aa2/AA/NR

|

4,351,200 | ||||||

|

Portland, Oregon Sewer System (Second

|

|||||||||

|

Lien)

|

|||||||||

| 2,000,000 |

5.000%, 06/01/26 Series B

|

Aa3/AA-/NR

|

2,512,980 | ||||||

| 2,000,000 |

5.000%, 06/01/27 Series B

|

Aa3/AA-/NR

|

2,484,520 | ||||||

19 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

Revenue Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Water and Sewer (continued)

|

|||||||||

|

Portland, Oregon Water System Revenue

|

|||||||||

|

Refunding (Sr. Lien)

|

|||||||||

| $ | 1,275,000 |

4.000%, 05/01/25 Series A

|

Aaa/NR/NR

|

$ | 1,396,214 | ||||

|

Portland, Oregon Water System Revenue

|

|||||||||

|

Refunding (Jr. Lien)

|

|||||||||

| 2,000,000 |

5.000%, 10/01/23

|

Aa1/NR/NR

|

2,462,800 | ||||||

|

Prineville, Oregon Refunding

|

|||||||||

| 1,255,000 |

4.400%, 06/01/29 AGMC Insured

|

NR/AA/NR

|

1,420,898 | ||||||

|

Seaside, Oregon Wastewater System .

|

|||||||||

| 1,000,000 |

4.250%, 07/01/26

|

A3/NR/NR

|

1,106,630 | ||||||

|

Tigard, Oregon Water System Revenue

|

|||||||||

|

Refunding

|

|||||||||

| 2,025,000 |

4.000%, 08/01/21

|

A1/AA-/NR

|

2,300,785 | ||||||

| 2,565,000 |

5.000%, 08/01/24

|

A1/AA-/NR

|

3,116,603 | ||||||

|

Washington County, Oregon Clean

|

|||||||||

|

Water Services

|

|||||||||

| 4,000,000 |

5.000%, 10/01/28

|

Aa2/AA+/NR

|

4,538,400 | ||||||

|

Washington County, Oregon Clean Water

|

|||||||||

|

Services Sewer Revenue Senior Lien .

|

|||||||||

| 1,010,000 |

4.000%, 10/01/22 Series B

|

Aa2/AA+/NR

|

1,147,128 | ||||||

| 1,500,000 |

4.000%, 10/01/23 Series B

|

Aa2/AA+/NR

|

1,693,500 | ||||||

| 2,850,000 |

4.000%, 10/01/26 Series B

|

Aa2/AA+/NR

|

3,165,267 | ||||||

| 2,745,000 |

4.000%, 10/01/28 Series B

|

Aa2/AA+/NR

|

3,003,606 | ||||||

|

Woodburn, Oregon Wastewater Revenue

|

|||||||||

|

Refunding

|

|||||||||

| 1,090,000 |

5.000%, 03/01/21 Series A

|

A2/NR/NR

|

1,266,962 | ||||||

|

Total Water and Sewer

|

57,510,460 | ||||||||

|

Total Revenue Bonds

|

223,483,714 | ||||||||

|

Pre-Refunded Bonds (20.0%) ††

|

|||||||||

|

Pre-Refunded General Obligation Bonds (11.6%)

|

|

||||||||

|

City & County (0.4%)

|

|||||||||

|

Washington County, Oregon

|

|||||||||

| 2,465,000 |

5.000%, 06/01/23

|

Aa1/NR/NR

|

2,531,678 | ||||||

20 | Aquila Tax-Free Trust of Oregon

|

AQUILA TAX-FREE TRUST OF OREGON

|

|||

|

SCHEDULE OF INVESTMENTS (continued)

|

|||

|

MARCH 31, 2016

|

|

Rating

|

|||||||||

|

Moody’s, S&P

|

|||||||||

|

Principal

|

and Fitch

|

||||||||

|

Amount

|

Pre-Refunded Bonds (continued)

|

(unaudited)

|

Value

|

||||||

|

Community College (0.9%)

|

|||||||||

|

Chemeketa, Oregon Community College

|

|||||||||

|

District

|

|||||||||

| $ | 1,010,000 |

5.500%, 06/15/24

|

NR/AA+/NR

|

$ | 1,114,676 | ||||

| 1,235,000 |

5.000%, 06/15/25

|

NR/AA+/NR

|

1,349,583 | ||||||

| 1,540,000 |

5.000%, 06/15/26

|

NR/AA+/NR

|

1,682,881 | ||||||

|

Clackamas, Oregon Community

|

|||||||||

|

College District

|

|||||||||

| 1,535,000 |

5.000%, 05/01/25 NPFG Insured

|

Aa3/AA/NR

|

1,540,311 | ||||||

|

Total Community College

|

5,687,451 | ||||||||

|

Higher Education (0.4%)

|

|||||||||

|

State of Oregon Board of Higher Education

|

|||||||||

| 500,000 |

5.750%, 08/01/29 Series A

|

Aa1/AA+/NR

|

556,700 | ||||||

| 1,000,000 |

5.000%, 08/01/34

|

Aa1/AA+/NR

|

1,096,190 | ||||||

| 1,000,000 |

5.000%, 08/01/38

|

Aa1/AA+/NR

|

1,096,190 | ||||||

|

Total Higher Education

|

2,749,080 | ||||||||

|

School District (7.7%)

|

|||||||||

|

Clackamas County, Oregon School

|

|||||||||

|

District #12 (North Clackamas)

|

|||||||||

| 8,000,000 |

5.000%, 06/15/27 AGMC Insured

|

||||||||

|

Series B

|

Aa1/AA+/NR

|

8,419,200 | |||||||

| 9,250,000 |

5.000%, 06/15/29 AGMC Insured

|

Aa1/AA+/NR

|

9,734,700 | ||||||

|

Clackamas County, Oregon School

|

|||||||||

|

District #46 (Oregon Trail)

|

|||||||||

| 2,000,000 |

4.500%, 06/15/30 AGMC Insured

|

Aa1/AA+/NR

|

2,092,920 | ||||||

|

Clackamas & Washington Counties,

|

|||||||||

|

Oregon School District No. 3JT

|

|||||||||

|

(West Linn-Wilsonville)

|

|||||||||

| 1,110,000 |

5.000%, 06/15/26

|

Aa1/AA+/NR

|