Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, 2017

OR

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 0-14625

TECH DATA CORPORATION

(Exact name of Registrant as specified in its charter)

|

| |

Florida | 59-1578329 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

5350 Tech Data Drive Clearwater, Florida | 33760 |

(Address of principal executive offices) | (Zip Code) |

Securities registered pursuant to Section 12(b) of the Act:

Common stock, par value $.0015 per share

Securities registered pursuant to Section 12 (g) of the Act: None

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated Filer | x

| Accelerated Filer | ¨ |

| | | |

Non-accelerated Filer | ¨ | Smaller Reporting Company Filer | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Aggregate market value of the voting stock held by non-affiliates was $2,700,010,239 based on the reported last sale price of common stock on July 31, 2016 which is the last business day of the registrant’s most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

| |

Class | March 15, 2017 |

Common stock, par value $.0015 per share | 38,012,882 |

DOCUMENTS INCORPORATED BY REFERENCE

The registrant’s Proxy Statement for use at the Annual Meeting of Shareholders to be held on June 7, 2017, is incorporated by reference in Part III of this Form 10-K to the extent stated herein.

TABLE OF CONTENTS

|

| | |

| | |

| | |

ITEM 1. | | |

ITEM 1A. | | |

ITEM 1B. | | |

ITEM 2. | | |

ITEM 3. | | |

ITEM 4. | | |

| | |

| | |

ITEM 5. | | |

ITEM 6. | | |

ITEM 7. | | |

ITEM 7A. | | |

ITEM 8. | | |

ITEM 9. | | |

ITEM 9A. | | |

ITEM 9B. | | |

| | |

| | |

| |

ITEM 10 | | |

ITEM 11 | | |

ITEM 12 | | |

ITEM 13 | | |

ITEM 14. | | |

| | |

| | |

ITEM 15. | | |

| |

| |

Exhibits | |

Certifications | |

PART I

ITEM 1. Business.

In this report, we use the terms "Tech Data,” "we," "our," "us" or the “Company” to refer to Tech Data Corporation and its consolidated subsidiaries. Because this report relates to a period ending prior to the consummation of our acquisition of Avnet Inc.'s Technology Solutions business ("TS"), except as expressly noted, this report, including the discussion of our business below, does not give effect to the TS acquisition.

Tech Data Corporation is one of the world’s largest wholesale distributors of technology products. We serve as an indispensable link in the technology supply chain by bringing products from the world’s leading technology vendors to market, as well as providing our customers with advanced logistics capabilities and value-added services. Our customers include approximately 105,000 value-added resellers (“VARs”), direct marketers, retailers and corporate resellers who support the diverse technology needs of end users. We sell to customers in more than 100 countries throughout North America, South America, Europe, the Middle East and Africa. The two primary geographic markets we serve are the Americas and Europe. For a discussion of our geographic reporting segments, see Item 8, "Financial Statements and Supplementary Data.”

Some of our key financial objectives are to gain share in select product areas in the geographies in which we operate and to improve operating income by growing gross profit faster than operating costs. In addition, we focus on deploying the right level of capital that yields solid operating cash flow generation and a return on invested capital that is above our weighted average cost of capital. To achieve this, we are focused on a strategy of execution, diversification and innovation that we believe differentiates our business in the marketplace.

Execution is fundamental to our business success. We have 22 logistics centers where each day, tens of millions of dollars of technology products are received from vendors, picked and packed and shipped to our customers. Products are generally shipped from regionally located logistics centers the same day the orders are received. In addition, execution is marked by a high level of service provided to our customers through our company’s technical, sales and marketing support, electronic commerce tools, product integration services and financing programs.

Our diversification strategy seeks to continuously remix our product, customer and services portfolios towards higher growth and higher return market segments through organic growth initiatives and acquisitions. We believe that as converged and hyperconverged infrastructure, data analytics, cloud computing, mobility, the Internet of Things ("IoT") and other potentially disruptive factors transform the way technology is used and delivered, we will leverage our highly efficient infrastructure to capture new market opportunities in our strategic focus areas of data center, software, mobility, consumer electronics, integrated supply chain services and other value-added service offerings.

The final tenet of our strategy is innovation. Our IT systems and e-business tools and programs have provided our business with the flexibility to effectively navigate fluctuations in market conditions, structural changes in the technology industry, as well as changes created by products we sell. These IT systems and e-business tools and programs have also worked to strengthen our vendor and customer relationships, while at the same time improving the efficiency of these business partners.

We believe our strategy of execution, diversification and innovation will continue to strengthen our value proposition with vendor partners and reseller customers while positioning us for continued market expansion and profitable growth.

Tech Data was incorporated in 1974 to market data processing supplies such as tapes, disk packs, and custom and stock tab forms for mini and mainframe computers directly to end users. With the advent of microcomputer dealers, we made the transition to a wholesale distributor in 1984 by broadening our product line to include hardware products and withdrawing entirely from end-user sales.

From fiscal 1989 through fiscal 2012, we expanded geographically through the acquisitions of several distribution companies in both the Americas and Europe, strengthening our position in certain product and customer segments. Additionally, in fiscal 2008, we established a joint venture in Europe with Brightstar Corp. ("Brightstar"), one of the world's largest wireless products distributors and supply chain solutions providers, to distribute mobile phones and other wireless devices to a variety of customers including mobile operators, dealers, agents, retailers and e-tailers in certain European markets. In fiscal 2013, we acquired Brightstar’s fifty percent ownership interest in this joint venture.

In fiscal 2013, we completed the acquisition of several distribution companies of Specialist Distribution Group (collectively "SDG"), the distribution arm of Specialist Computer Holdings PLC, a privately-held IT services company headquartered in the United Kingdom. The acquisition of SDG supports the Company’s diversification strategy by strengthening its European data center and broadline offerings in key markets and expanding the Company’s vendor and customer portfolios, while leveraging the Company’s existing pan-European infrastructure.

During fiscal 2016, we completed the sale of our business operations in Chile and Peru and also completed our plan to exit our business operations in Uruguay as we did not believe these operations would generate consistently acceptable returns on invested capital. In fiscal 2016, we also completed the acquisition of Signature Technology Group, Inc. ("STG"), a partner-led provider of data center and professional services throughout North America.

On September 19, 2016, we entered into an interest purchase agreement with Avnet, Inc. (“Avnet”) to acquire Avnet's Technology Solutions business. The acquisition of TS was completed on February 27, 2017, subsequent to the end of our fiscal 2017. We acquired TS for an aggregate purchase price of approximately $2.672 billion, comprised of approximately $2.425 billion in cash and 2,785,402 shares of Tech Data's common stock, with the cash consideration subject to certain working capital and other adjustments. TS delivers technology services, software, hardware and solutions across the data center. We believe the TS acquisition diversifies our end-to-end solutions, deepens our value added capabilities and balances our solutions portfolio. The addition of TS also extends our geographic reach into the Asia-Pacific region while broadening our capabilities in Europe and the Americas, including re-entering Latin America with a focus on the delivery of new technologies that drive and complement the data center in this market. The combined business extends our operations into forty countries spread across five continents with approximately 14,000 employees.

The wholesale distribution model has proven to be well suited for both manufacturers and publishers of technology products (also referred to in this document as “vendors”) and resellers of those products. The large number of IT resellers makes it cost efficient for vendors to rely on wholesale distributors to serve this diverse and highly fragmented customer base.

Resellers in the traditional distribution model are able to build efficiencies and reduce their costs by relying on distributors, such as Tech Data, for a number of services, including multi-vendor solutions, product configuration/integration, marketing support, financing, technical support and inventory management, which includes direct shipment to end-users and, in some cases, provides end-users with the distributors’ inventory availability.

Due to the large number of vendors and products, resellers often cannot, or choose not to, establish direct purchasing relationships with vendors. As a result, they frequently rely on wholesale distributors, such as Tech Data, who leverage purchasing costs across multiple vendors to satisfy a significant portion of the resellers' product procurement, logistics, financing, marketing and technical support needs.

The technology distribution industry continues to address a broad spectrum of reseller and vendor requirements. While some vendors have elected to sell directly to resellers or end-users for particular customer and product segments, we believe that a vast majority of vendors continue to embrace traditional distributors that have proven capabilities to manage multiple products and resellers, provide access to fragmented markets, and deliver products in a cost-effective and efficient manner.

New products and market opportunities have helped to offset the impact on technology distributors of vendor direct sales. Further, vendors continue to seek the logistics expertise of distributors to penetrate large and highly fragmented markets such as the small- and medium-sized business (“SMB”) sector, which relies on VARs, our primary customer base, to gain access to and support for new technology. The economies of scale and global reach of large well-capitalized distributors are expected to continue to be significant competitive advantages in this marketplace.

We distribute and market hundreds of thousands of products from approximately 1,000 of the world’s leading technology hardware suppliers, networking equipment suppliers, software publishers and other suppliers of technology peripherals, consumer electronics, digital displays and mobile phone hardware and accessories. These products are typically purchased directly from the vendor on a non-exclusive basis. Conversely, our vendor agreements do not restrict us from selling similar products manufactured by competitors, nor do they require us to sell a specified quantity of product. As a result, we have the flexibility to terminate or curtail sales of one product line in favor of another due to technological change, pricing considerations, product availability, customer demand or vendor distribution policies. Overall, we believe that our diversified and evolving product and solutions portfolio will provide a solid platform for continued growth.

We continually evolve our product line in order to provide our customers with access to the latest technology solutions. However, from time to time, the demand for certain products that we sell exceeds the supply available from the vendor. In such cases, we generally receive an allocation of the available products. We believe that our ability to compete is not adversely affected by these periodic shortages and the resulting allocations.

We believe that our vendor agreements are in the form customarily used by manufacturers and distributors. Agreements typically contain provisions that allow termination by either party upon a short notice period. In most instances, a vendor who elects to terminate a distribution agreement will repurchase the vendor’s products carried in the distributor’s inventory.

Many of our vendor agreements also allow for stock rotation and price protection provisions. Stock rotation rights give us the ability, subject to certain limitations, to return for credit or exchange a portion of those inventory items purchased from the vendor. Price protection situations occur when a vendor credits us for declines in inventory value resulting from the vendor’s price reductions. Along

with our inventory management policies and practices, these provisions reduce our risk of loss due to slow-moving inventory, vendor price reductions, product updates or obsolescence.

Sometimes the industry practices discussed above are not embodied in agreements and do not protect us in all cases from declines in inventory value. However, we believe that these practices provide a significant level of protection from such declines, although no assurance can be given that such practices will continue or that they will adequately protect us against declines in inventory value. We sell products in various countries throughout the world, and product categories may vary from region to region. Our consolidated revenue mix may fluctuate between and within our operating segments as well as within our product categories. These fluctuations can be influenced by our diversification strategies, new product offerings and supply and demand fluctuations within our operating regions.

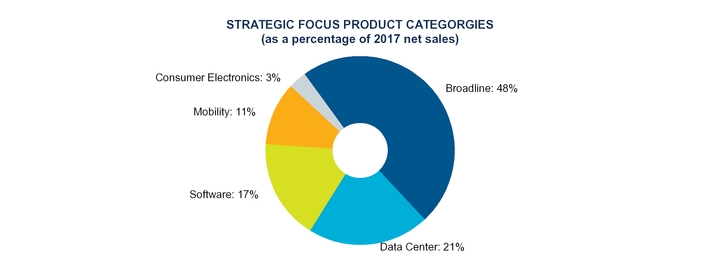

Our product mix is divided into five strategic focus product categories, which are primarily comprised of the following products:

|

| |

Broadline | notebooks, tablets, desktops, printers, printer supplies and components |

Data center | industry standard servers, proprietary servers, networking and storage |

Software | virtualization, cloud, security, desktop applications, operating systems and utilities software |

Mobility | mobile phones and accessories |

Consumer electronics | TV's, digital displays, consumer audio-visual devices and network-attached consumer devices |

Our consolidated net sales for fiscal 2017, 2016 and 2015 within our strategic focus product categories approximated the following:

|

| | | | |

Year ended January 31: | | 2016 | | 2015 |

Broadline | | 46% | | 47% |

Data center | | 22% | | 22% |

Software | | 18% | | 18% |

Mobility | | 11% | | 10% |

Consumer electronics | | 3% | | 3% |

The following table provides a comparison of sales generated from products purchased from vendors that exceeded 10% of our consolidated net sales for fiscal 2017, 2016 and 2015 (as a percent of consolidated net sales):

|

| | | |

| 2017 | 2016 | 2015 |

Apple, Inc. | 20% | 20% | 15% |

HP Inc. | 13% | | |

Hewlett-Packard Company (a) | | 13% | 19% |

Cisco Systems, Inc. | 10% | | |

(a) Effective November 1, 2015, Hewlett-Packard Company split into two companies, HP Inc. and Hewlett Packard Enterprise. Amounts presented for fiscal years 2016 and 2015 represent the sales generated from products purchased from Hewlett-Packard Company prior to the split.

Our products are purchased directly from vendors in significant quantities and are marketed to an active reseller base of approximately 105,000 VARs, direct marketers, retailers and corporate resellers. No single customer accounted for more than 10% of our net sales during fiscal 2017, 2016 and 2015.

The market for VARs is attractive because VARs generally rely on distributors as their principal source of technology products and the related financing for the products. This reliance is due to VARs typically not wanting to invest the resources to establish a large number of direct purchasing relationships or stock significant product inventories. Direct marketers, retailers and corporate resellers may establish direct relationships with vendors for their highest volume products, but utilize distributors as the primary source for other product requirements and an alternative source for products acquired directly.

In addition to an extensive product offering from the world's leading technology vendors, we provide resellers a high level of customer service through our training and technical support, suite of electronic commerce tools, customized shipping documents, product configuration/integration services and access to flexible financing programs. We also provide services to our vendors by providing them the opportunity to participate in a number of special promotions and marketing services targeted to the needs of our resellers.

As part of our aforementioned diversification strategy, our other strategic areas of focus for the company are integrated supply chain services designed to provide innovative third party logistics and other service offerings to our business partners, as well as value-added, professional services designed to augment our customers' technical capabilities. Service revenues were less than 10% of our consolidated net sales during fiscal 2017, 2016 and 2015.

We provide our vendors with access to one of the largest bases of resellers throughout the Americas and Europe, delivering products to those resellers from our 22 regionally located logistics centers. We have located our logistics centers near our customers which enables us to deliver products on a timely basis, thereby reducing the customers’ need to invest in inventory (see also Item 2, "Properties" for further discussion of our locations and logistics centers).

|

| | | | |

SALES AND ELECTRONIC COMMERCE |

Our sales team consists of field sales and inside telemarketing sales representatives. The sales representatives are provided comprehensive training on our policies and procedures, the technical specifications of products and attend product seminars offered by our vendors. Field sales representatives are typically located in major metropolitan areas in their respective geographies and are supported by inside telemarketing sales teams covering a designated territory. Our team concept provides a strong personal relationship between our customers’ representatives and Tech Data. Customers typically call our inside sales teams on dedicated telephone numbers or contact us through various electronic methods to place orders. If the product is in stock and the customer has available credit, customer orders are generally shipped the same day from the logistics center nearest the customer or the intended end-user.

Customers often utilize our electronic ordering and information systems. Through our website, customers can gain remote access to our information systems to place orders, or check order status, inventory availability and pricing. Certain of our larger customers have electronic data interchange ("EDI") services available whereby orders, order acknowledgments, invoices, inventory status reports, customized pricing information and other industry standard EDI transactions are consummated online, which improves efficiency and timeliness for the Company and our customers.

We operate in a market characterized by intense competition, based on such factors as product availability, credit terms and availability, price, speed of delivery, effectiveness of information systems and e-commerce tools, ability to tailor solutions to customers' needs, quality and depth of product lines and training, as well as service and support provided by the distributor to the customer. We believe we are well equipped to compete effectively with other distributors in all of these areas.

We compete against several distributors in the Americas market, including broad-based IT product distributors such as Ingram Micro Inc. ("Ingram Micro"), Synnex Corp. ("Synnex"), and to a lesser extent, more specialized distributors such as Arrow Electronics, Inc. (“Arrow”) and prior to the acquisition of TS, Avnet, Inc. (“Avnet”), along with some regional and local distributors. The competitive environment in Europe is more fragmented, with market share spread among several regional and local competitors such as ALSO Holding and Esprinet, as well as international distributors such as Ingram Micro, Westcon Group, Inc., Arrow and prior to the acquisition of TS, Avnet.

The Company also faces competition from companies entering or expanding into the logistics and product fulfillment and e-commerce supply chain services market. Additionally, certain direct sales relationships between manufacturers, resellers and end-users continue to introduce change into the competitive landscape of our industry. As we expand our business into new areas, we may face increased competition from other distributors as well as vendors. However, we believe vendors will continue to sell their products through distributors, such as Tech Data, due to our ability to provide them with access to our broad customer base and serve them in a highly cost-effective and efficient manner. Our logistics capabilities, as well as our sales and marketing, credit and product management expertise, allow our vendors to expand their market coverage while lowering their selling, inventory and fulfillment costs. On January 31, 2017, we had approximately 9,500 employees (as measured on a full-time equivalent basis). Certain of our employees in various countries outside of the United States are subject to laws providing representation rights to employees through workers' councils. Our success depends on the talent and dedication of our employees and we strive to attract, hire, develop and retain outstanding employees. We believe significant benefits are realized from having a strong and seasoned management team with many years of experience in technology distribution and related industries. We consider relations with our employees to be good. |

| | | | |

FOREIGN AND DOMESTIC OPERATIONS AND EXPORT SALES |

We operate predominately in a single industry segment as a distributor of technology products, logistics management and other value-added services. While we operate primarily in one industry, we manage our business in two geographic segments: Americas and Europe.

Over the past several years, we have expanded our presence in certain existing markets and exited certain markets based upon our assessment of, among other factors, our earnings potential and the risk exposure in those markets, including foreign currency exchange, regulatory and political risks. To the extent we decide to close any of our operations, we may incur charges and operating losses related to such closures and recognize a portion of our accumulated other comprehensive income in connection with such a disposition. For information on our net sales, operating income and identifiable assets by geographic region, see Note 14 of Notes to Consolidated Financial Statements. We manage our inventories in a manner that allows us to maintain sufficient quantities to achieve high order fill rates while attempting to stock only those products in high demand that have a rapid turnover rate. Our business, like that of other distributors, is subject to the risk that the value of inventory will be impacted adversely by suppliers’ price reductions or by technological changes affecting the usefulness or desirability of the products comprising the inventory. Our contracts with many of our vendors provide price protection and stock rotation privileges to reduce the risk of loss due to manufacturer price reductions and slow moving or obsolete inventory. In the event of a vendor price reduction, we generally receive a credit for the impact on products in inventory and we have the right to rotate a certain percentage of purchases, subject to certain limitations. Historically, price protection and stock rotation privileges, as well as our inventory management procedures, have helped reduce the risk of loss of inventory value.

We attempt to control losses on credit sales by closely monitoring customers’ creditworthiness through our IT systems, which contain detailed information on each customer’s payment history and other relevant information. In certain countries, we have obtained credit insurance that insures a percentage of the credit extended by us to certain customers against possible loss. The Company also has arrangements with certain finance companies that provide inventory financing facilities to our customers as an additional approach to mitigate credit risk. Certain of the Company’s vendors subsidize these financing arrangements for the benefit of our customers. Customers who qualify for credit terms are typically granted net 30-day payment terms in the Americas. While credit terms in Europe vary by country, the vast majority of customers are granted credit terms ranging from 30 to 60 days. We also sell products on a prepayment, credit card and cash-on-delivery basis.

|

| | | | |

ADDITIONAL INFORMATION AVAILABLE |

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended. We therefore file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements, and other documents with the Securities and Exchange Commission (the “SEC”). Such reports may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at (800) SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements and other information.

Our principal Internet address is www.techdata.com. We make available free of charge, through our website, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports, as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. Information on Tech Data’s website is not incorporated into this Form 10-K or the Company’s other securities filings and is not a part of them.

The following table sets forth the name, age and title of each of the persons who were serving as executive officers of Tech Data as of March 30, 2017:

|

| | | | |

Name | | Age | | Title |

Robert M. Dutkowsky | | 62 | | Chief Executive Officer |

Charles V. Dannewitz | | 62 | | Executive Vice President, Chief Financial Officer |

Richard T. Hume | | 57 | | Executive Vice President, Chief Operating Officer |

John A. Tonnison | | 48 | | Executive Vice President, Chief Information Officer |

David R. Vetter | | 57 | | Executive Vice President, Chief Legal Officer |

Beth E. Simonetti | | 51 | | Executive Vice President, Chief Human Resources Officer |

Joseph H. Quaglia | | 52 | | President, Americas |

Patrick Zammit | | 50 | | President, Europe |

Alain Amsellem | | 57 | | Senior Vice President, Chief Financial Officer, Europe |

Joseph B. Trepani | | 56 | | Senior Vice President, Chief Financial Officer, Americas |

Jeffrey L. Taylor | | 50 | | Senior Vice President, Corporate Controller |

Robert M. Dutkowsky, Chief Executive Officer, joined Tech Data as Chief Executive Officer and was appointed to the Board of Directors in October 2006. His career began with IBM where, during his 20-year tenure, he served in several senior management positions including Vice President, Distribution - IBM Asia/Pacific. Prior to joining Tech Data, Mr. Dutkowsky served as President, CEO, and Chairman of the Board of Egenera, Inc. (a software and virtualization technology company), from 2004 until 2006, and served as President, CEO, and Chairman of the Board of J.D. Edwards & Co., Inc. (a software company) from 2002 until 2004. He was President, CEO, and Chairman of the Board of GenRad, Inc. from 2000 until 2002. Starting in 1997, Mr. Dutkowsky was Executive Vice President, Markets and Channels, at EMC Corporation before being promoted to President, Data General, in 1999. Mr. Dutkowsky holds a Bachelor of Science in Industrial and Labor Relations from Cornell University.

Charles V. Dannewitz, Executive Vice President, Chief Financial Officer, joined the Company in February 1995 as Vice President of Taxes. He was promoted to Senior Vice President of Taxes in March 2000, and assumed responsibility for worldwide treasury operations in July 2003. In February 2014, he was appointed Senior Vice President, Chief Financial Officer, Americas. In June 2015, he was promoted to Executive Vice President, Chief Financial Officer. Prior to joining the Company, Mr. Dannewitz was employed by Price Waterhouse from 1981 to 1995, most recently as a tax partner. Mr. Dannewitz is a Certified Public Accountant and holds a Bachelor of Science in Accounting from Illinois Wesleyan University.

Richard T. Hume, Executive Vice President, Chief Operating Officer, joined the Company in March 2016 as Executive Vice President, Chief Operating Officer. Prior to his appointment at the Company, Mr. Hume was employed for more than thirty years at IBM. Most recently, from January 2015 to February 2016, Mr. Hume served as General Manager and Chief Operating Officer of Infrastructure and Outsourcing. Prior to that position, from January 2012 to January 2015, Mr. Hume served as General Manager, Europe where he led IBM’s multi-brand European organization. From 2008 to 2011, Mr. Hume served as General Manager, Global Business Partners, directing the growth and channel development initiatives for IBM’s Business Partner Channel. Mr. Hume holds a Bachelor of Science in Accounting from Pennsylvania State University.

John A. Tonnison, Executive Vice President, Chief Information Officer, joined the Company in March 2001 as Vice President, Worldwide E-Business and was promoted to Senior Vice President of IT Americas in December 2006. In February 2010, he was appointed Executive Vice President, Chief Information Officer. Prior to joining the Company, Mr. Tonnison held executive management positions in the U.S., United Kingdom and Germany with Computer 2000, Technology Solutions Network and Mancos Computers. Mr. Tonnison was educated in the United Kingdom and became a U.S. citizen in 2006.

David R. Vetter, Executive Vice President, Chief Legal Officer, joined the Company in June 1993 as Vice President, General Counsel and was promoted to Corporate Vice President, General Counsel in April 2000. In March 2003, he was promoted to Senior Vice President, and effective July 2003, was appointed Secretary. In January 2017, Mr. Vetter was promoted to Executive Vice President, Chief Legal Officer. Prior to joining the Company, Mr. Vetter was employed by the law firm of Robbins, Gaynor & Bronstein, P.A. from 1984 to 1993, most recently as a partner. Mr. Vetter is a member of the Florida Bar Association and holds Bachelor of Arts degrees in English and Economics from Bucknell University and a Juris Doctorate Degree from the University of Florida.

Beth E. Simonetti, Executive Vice President, Chief Human Resources Officer, joined the company in September 2015 as Senior Vice President, Chief Human Resources Officer and was promoted to Executive Vice President in January 2017. Prior to joining Tech Data, Ms. Simonetti served as Senior Vice President, Human Resources at Baker & Taylor, Inc. since 2010. Previously, she was an executive search consultant and was with Cardinal Health for 12 years in various HR leadership positions. Ms. Simonetti holds a Bachelor of Science degree from Miami University in Ohio and a Masters of Hospital and Health Services Administration from Ohio State University.

Joseph H. Quaglia, President, Americas, joined the Company in May 2006 as Vice President, East and Government Sales and was promoted to Senior Vice President of U.S. Marketing in November 2007. In February 2012, he was appointed to the additional role of President, TDMobility and he was promoted to President, Americas in November 2013. Prior to joining the Company, Mr. Quaglia held senior management positions with CA Technologies, StorageNetworks Inc. and network software provider Atabok. Mr. Quaglia holds a Bachelor of Science in Computer Science from Indiana State University and an M.B.A. from Butler University.

Patrick Zammit, President, Europe, joined the Company in February 2017 through Tech Data's acquisition of Avnet’s Technology Solutions business as President, Europe. Prior to his appointment at the Company, Mr. Zammit was employed for more than twenty years at Avnet, Inc. Most recently, from January 2015 to January 2017, Mr. Zammit served as Global President of Avnet Technology Solutions. Prior to that position, from October 2006 until January 2015, Mr. Zammit served as President of Avnet Electronics Marketing EMEA. From 1993 to 2006, Mr. Zammit served in management positions of increasing responsibilities. Prior to joining Avnet, Mr. Zammit was employed by Arthur Andersen from 1989 to 1993. Mr. Zammit holds a Masters in Business Administration equivalent from Paris Business School ESLSCA.

Alain Amsellem, Senior Vice President, Chief Financial Officer, Europe, joined the Company in 1994 through Tech Data’s acquisition of French distributor, Softmart International S.A. and served as France Finance Director until September 1999 when he was promoted to France Managing Director. In August 2004, Mr. Amsellem was promoted to Senior Vice President of Southern Europe, and was appointed Senior Vice President - Europe Finance & Operations in 2007. In February 2014, he was appointed Senior Vice President, Chief Financial Officer, Europe. Mr. Amsellem is a Chartered Accountant and holds a degree in management and chartered accountancy from Paris Dauphine University.

Joseph B. Trepani, Senior Vice President, Chief Financial Officer, Americas, joined the Company in March 1990 as Controller and held the position of Director of Operations from October 1991 through January 1995. In February 1995, he was promoted to Vice President, Worldwide Controller and to Senior Vice President, Corporate Controller in March 1998. In June 2015, he was appointed Senior Vice President, Chief Financial Officer, Americas. Prior to joining the Company, Mr. Trepani was Vice President of Finance for Action Staffing, Inc. from 1989 to 1990. From 1982 to 1989, he was employed by Price Waterhouse. Mr. Trepani is a Certified Public Accountant and holds a Bachelor of Science in Accounting from Florida State University.

Jeffrey L. Taylor, Senior Vice President, Corporate Controller, joined the Company in May 2007 and held the position of Vice President, Corporate Accounting through April 2011. Mr. Taylor rejoined the Company in October 2012 serving in the same capacity until July 2013 when he was appointed Vice President, Assistant Corporate Controller. In June 2015 he was promoted to Senior Vice President, Corporate Controller. Prior to rejoining the Company in October 2012, Mr. Taylor served in executive financial management with a value-added reseller and previously was employed by Deloitte & Touche ("Deloitte") from 1992 to 2003, most recently as Audit Partner in Russia and including three years in Deloitte's U.S. national office in the Quality Assurance and SEC Services groups. Mr. Taylor holds a Bachelor of Science in Accounting from San Diego State University.

ITEM 1A. Risk Factors.

The following are certain risk factors that could affect our business, financial position and results of operations. These risk factors should be considered in connection with evaluating the forward-looking statements contained in this Annual Report on Form 10-K because these factors could cause the actual results and conditions to differ materially from those projected in the forward-looking statements. Before you buy our common stock or other securities, you should know that making such an investment involves risks, including the risks described below. The risks that have been highlighted below are not the only risks of our business. If any of the risks actually occur, our business, financial condition or results of operations could be negatively affected. In that case, the trading price of our common stock or other securities could decline, and you may lose all or part of your investment. Risk factors that could cause actual results to differ materially from our forward-looking statements are as follows:

Our ability to earn profit is more challenging when sales slow from a down economy as a result of gross profit declining faster than cost reduction efforts taking effect.

High levels of unemployment in some of the markets we serve, as well as austerity measures that may be implemented by governments in those markets, can constrain economic growth resulting in lower demand for the products and services we sell. When we experience a rapid decline in demand for products we experience more difficulty in achieving the gross profit and operating profit we desire due to the lower sales and increased pricing pressure. The economic environment may also result in changes in vendor terms and conditions, such as rebates, cash discounts and cooperative marketing efforts, which may also result in downward pressure on our gross profit. As a result, there is pressure to reduce the cost of operations in order to maximize operating profits. To the extent we cannot reduce costs to offset such decline in gross profits, our operating profits typically deteriorate. The benefits from cost reductions may also take longer to fully realize and may not fully mitigate the impact of the reduced demand. Should we experience a decline in operating profits, especially in Europe, the valuations we develop for purposes of our goodwill impairment test may be adversely affected, potentially resulting in impairment charges. Deterioration in the financial and credit markets heightens the risk of customer bankruptcies and delays in payment. Future deterioration in the credit markets could result in reduced availability of credit insurance to cover customer accounts. This, in turn, may result in our reducing the credit lines we provide to customers, thereby having a negative impact on our net sales.

Our competitors can take more market share by reducing prices on vendor products that contribute the most to our profitability.

The Company operates in a highly competitive environment. The technology distribution industry is characterized by intense competition, based primarily on product availability, credit terms and availability, price, effectiveness of information systems and e-commerce tools, speed of delivery, ability to tailor specific solutions to customer needs, quality and depth of product lines and training, service and support. Our customers are not required to purchase any specific volume of products from us and may move business if pricing is reduced by competitors, resulting in lower sales. As a result, we must be extremely flexible in determining when to reduce price to maintain market share and sales volumes and when to allow our sales volumes to decline to maintain the quality of our profitability. The Company competes with a variety of regional, national and international wholesale distributors, some of which may have greater financial resources than the Company.

We are dependent on internal information and telecommunications systems, and any failure of these systems, including system security breaches, data protection breaches or other cybersecurity attacks, may negatively impact our business and results of operations.

The Company is highly dependent upon its internal information and telecommunications systems to operate its business. Failures of our internal information or telecommunications systems may prevent us from taking customer orders, shipping products and billing customers. Sales may also be impacted if our customers are unable to access our pricing and product availability information.

Additionally, the IT security landscape is constantly changing with increasing risks of cybercrime including phishing, social engineering, attempts to overload our servers with denial-of-service attacks, or similar disruptions from unauthorized access to our systems that could cause critical data loss or the disclosure or use of personal or other confidential information. Outside parties may attempt to fraudulently induce employees to disclose personally identifiable information or other confidential information which could expose us to a risk of loss or misuse of this information. If the Company were to experience a security breakdown, disruption or breach that compromised sensitive information, it could harm our relationships with vendors and customers. The occurrence of any of these events could have a negative impact on our business and results of operations.

We may not be able to ship products if our third party shipping companies cease operations temporarily or permanently.

The Company relies on arrangements with independent shipping companies for the delivery of its products from vendors and to customers. The failure or inability of these shipping companies to deliver products or the unavailability of their shipping services, even temporarily, may have an adverse effect on the Company's business.

If our vendors do not continue to provide price protection for inventory we purchase from them, our profit from the sale of that inventory may decline.

It is very typical in our industry that the value of inventory will decline as a result of price reductions by vendors or technological obsolescence. It is the policy of many of our vendors to protect distributors from the loss in value of inventory due to technological change or the vendors' price reductions. Some vendors, however, may be unwilling or unable to pay the Company for price protection claims or products returned to them under purchase agreements. Moreover, industry practices are sometimes not embodied in written agreements and do not protect the Company in all cases from declines in inventory value. No assurance can be given that such practices to protect distributors will continue, that unforeseen new product developments will not adversely affect the Company or that the Company will be able to successfully manage its existing and future inventories.

Failure to obtain adequate product supplies from our largest vendors, or terminations of a supply or services agreement, or a significant change in vendor terms or conditions of sale by our largest vendors may negatively affect our net sales and operating profit.

The Company receives a significant percentage of revenues from products it purchases from certain vendors, such as Apple, Inc., HP Inc. and Cisco Systems Inc. These vendors have significant negotiating power over us and rapid, significant and adverse changes in sales terms and conditions, such as reducing the amount of price protection and return rights as well as reducing the level of purchase discounts and rebates they make available to us, may reduce the profit we can earn on these vendors' products and result in loss of revenue and profitability. The Company's gross profit could be negatively impacted if the Company is unable to pass through the impact of these changes to the Company's customers or cannot develop systems to manage ongoing vendor programs. In addition, the Company's standard vendor distribution agreement permits termination without cause by either party upon 30 days notice. The loss of a relationship with any of the Company's key vendors, a change in their strategy (such as increasing direct sales), the merger or reorganization of significant vendors or significant changes in terms on their products may adversely affect the Company's business.

We conduct business in countries outside of the United States, which exposes us to fluctuations in foreign currency exchange rates that result in losses in certain periods.

Approximately 64%, 65% and 68% of our net sales in fiscal 2017, 2016 and 2015 were generated in countries outside of the United States, which exposes the Company to fluctuations in foreign currency exchange rates. The Company may enter into short-term forward exchange or option contracts to hedge this risk. Nevertheless, volatile foreign currency exchange rates increase our risk of loss related to products purchased in a currency other than the currency in which those products are sold. While we maintain policies to protect against fluctuations in currency exchange rates, extreme fluctuations have resulted in our incurring losses in some countries. The realization of any or all of these risks could have a significant adverse effect on our financial results. The translation of the financial statements of foreign operations into U.S. dollars is also impacted by fluctuations in foreign currency exchange rates, which may positively or negatively impact our results of operations. In addition, the value of the Company's equity investment in foreign countries may fluctuate based upon changes in foreign currency exchange rates. These fluctuations, which are recorded in a cumulative translation adjustment account, may result in losses in the event a foreign subsidiary is sold or closed at a time when the foreign currency is weaker than when the Company made investments in the country. In addition, our local competitors in certain markets may have different purchasing models that provide them reduced foreign currency exposure compared to the Company. This may result in market pricing that the Company cannot meet without significantly lower profit on sales.

We have international operations which expose us to risks associated with conducting business in multiple jurisdictions.

The Company's international operations are subject to other risks such as the imposition of governmental controls, export license requirements, restrictions on the export of certain technology, political instability, trade restrictions, tariff changes, difficulties in staffing and managing international operations, changes in the interpretation and enforcement of laws (in particular related to items such as duty and taxation), difficulties in collecting accounts receivable, longer collection periods and the impact of local economic conditions and practices. There can be no assurance that these and other factors will not have an adverse effect on the Company's business.

In June 2016, the United Kingdom ("U.K.") held a non-binding referendum in which voters approved an exit from the European Union ("EU"), commonly referred to as "Brexit." Given the lack of comparable precedent, it is unclear what financial, trade and legal implications the withdrawal of the U.K. from the EU would have and how such a withdrawal would affect the Company.

Changes in tax laws or tax rulings in the jurisdictions in which we operate may materially impact our financial position and results of operations. The Organization for Economic Cooperation and Development has been working on the Base Erosion and Profit Sharing Project, and has issued and will continue to issue, guidelines and proposals that may change various aspects of the existing framework under which our tax obligations are determined in many of the countries in which we do business. Certain countries, including the United States, are evaluating their tax policies and regulations which could affect international business and may have an adverse effect on our overall tax rate, along with increasing the complexity, burden and cost of tax compliance.

In addition, while the Company's labor force in the Americas is currently non-union, employees of certain European subsidiaries are subject to collective bargaining or similar arrangements. The Company does business in certain foreign countries where labor disruption is more common than is experienced in the United States and some of the freight carriers used by the Company are unionized. A labor strike by a group of the Company's employees, one of the Company's freight carriers, one of its vendors, a general strike by civil service employees or a governmental shutdown could have an adverse effect on the Company's business. Many of the products the Company sells are manufactured in countries other than the countries in which the Company's logistics centers are

located. The inability to receive products into the logistics centers because of government action or labor disputes at critical ports of entry may have an adverse effect on the Company's business.

We may encounter difficulties in fully integrating TS into our business and may not fully achieve, or achieve within a reasonable time frame, expected strategic objectives and other expected benefits of the acquisition.

The success of the acquisition of TS will depend, in part, on our ability to realize the anticipated growth opportunities and potential synergies and cost savings from the integration of TS with our existing business. There may be substantial difficulties, costs and delays involved in the integration of TS with our own business, including distracting management from day-to-day operations, potential incompatibility of corporate cultures, and costs and delays in implementing common systems and procedures. In addition, the process of integrating the operations of TS could cause an interruption of, or loss of momentum in, the activities of one or more of our combined businesses and the possible loss of key personnel or distribution partners. Any one or all of these factors may increase our operating costs or lower our anticipated financial performance. Our failure to fully integrate TS and achieve the expected benefits of the proposed acquisition of TS within a reasonable time frame or at all could have a material adverse effect on our financial condition and results of operations.

TS may underperform relative to our expectations.

Following the acquisition of TS, we may not be able to maintain the levels of revenue, earnings or operating efficiency that we and TS have achieved or might achieve separately. The business and financial performance of TS are subject to certain risks and uncertainties. We may be unable to achieve the same growth, revenues and profitability that TS has achieved in the past. Our failure to do so could have a material adverse effect on our financial condition and results of operations.

We have incurred substantial indebtedness that may impact our financial position and subject us to financial and operating restrictions, decrease our access to capital, and / or increase our borrowing costs, which may adversely affect our operations and financial results.

Our business requires substantial capital to operate and to finance accounts receivable and product inventory that are not financed by trade creditors. We have historically relied upon cash generated from operations, bank credit lines, trade credit from vendors, proceeds from public offerings of our common stock and proceeds from debt offerings to satisfy our capital needs and to finance growth. The incurrence of debt under our Senior Notes and other credit facilities subject us to financial and operating covenants, which may limit our ability to borrow and our flexibility in responding to our business needs.

As of January 31, 2017, we had approximately $1.4 billion of total debt and in conjunction with the completion of the acquisition of TS, an additional $1.0 billion of debt has been incurred under the Term Loan Credit Agreement (as defined herein). If we are not able to maintain compliance with stated financial covenants or if we breach other covenants in any debt agreement, we could be in default under such agreement. Such a default may allow our creditors to accelerate the related debt and may result in the acceleration of any other debt to which a cross acceleration or cross-default provision applies. Our overall leverage and terms of our financing could, among other things:

| |

• | limit our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions or for general corporate purposes; |

| |

• | make it more difficult to satisfy our obligations under the terms of our debt; |

| |

• | limit our ability to refinance our debt on terms acceptable to us or at all; |

| |

• | make it more difficult to obtain trade credit from vendors; and |

| |

• | limit our flexibility to plan for and adjust to changing business and market conditions and increase our vulnerability to general adverse economic and industry conditions. |

Changes in our credit rating or other market factors may increase our interest expense or other costs of capital.

Certain of our financing instruments involve variable rate debt, thus exposing us to the risk of fluctuations in interest rates. Increases in interest rates would result in an increase in the interest expense on our variable rate debt, which would reduce our profitability. In addition, the interest rate payable on the 3.70% Senior Notes and the 4.95% Senior Notes (each as defined herein) and certain other credit facilities would be subject to adjustment from time to time if our credit rating is downgraded.

We cannot predict what losses we might incur in litigation matters, regulatory enforcement actions and contingencies that we may be involved with from time to time, including in connection with the restatement of prior financial statements.

The SEC has requested information from the Company with respect to the restatement of certain of our consolidated financial statements and other financial information from fiscal 2009 to fiscal 2013, and the Company is cooperating with the SEC request. See Item 3, “Legal Proceedings.” This pending SEC request for information and other potential proceedings could result in fines and other penalties. The Company has not reserved any amount in respect of these matters in its consolidated financial statements.

The Company cannot predict whether monetary losses, if any, it experiences in any proceedings related to the restatement will be covered by insurance or whether insurance proceeds recovered will be sufficient to offset such losses. Potential civil or regulatory proceedings may also divert the efforts and attention of the Company’s management from business operations.

The Company cannot predict what losses we might incur from other litigation matters, regulatory enforcement actions and contingencies that we may be involved with from time to time, including in relation to claims that may arise related to the operations of TS prior to the date of the completion of the acquisition. There are various other claims, lawsuits and pending actions against us. We do not expect that the ultimate resolution of these other matters will have a material adverse effect on our consolidated financial position. However, the resolution of certain of these matters could be material to our operating results for any particular period, depending on the level of income for such period. We can make no assurances that we will ultimately be successful in our defense of any of these other matters.

ITEM 1B. Unresolved Staff Comments.

Not applicable.

ITEM 2. Properties.

Our executive offices are located in Clearwater, Florida. As of January 31, 2017, we operated a total of 22 logistics centers to provide our customers timely delivery of products. Eleven of these logistics centers are located in each of the Americas and Europe.

As of January 31, 2017, we leased or owned approximately 7.2 million square feet of space. The majority of our office facilities and logistics centers are leased. Our facilities are well maintained and are adequate to conduct our current business. We do not anticipate significant difficulty in renewing our leases as they expire or securing replacement facilities.

ITEM 3. Legal Proceedings.

Prior to fiscal 2004, one of the Company’s subsidiaries, located in Spain, was audited in relation to various value added tax (“VAT”) matters. As a result of those audits, the Spanish subsidiary received notices of assessment related to fiscal years 1994 through 2001 from the Regional Inspection Unit of Spain’s taxing authority that allege the subsidiary did not properly collect and remit VAT. The Spanish subsidiary appealed these assessments to the Madrid Central Economic Administrative Courts beginning in March 2010. During fiscal 2015, the Madrid Central Economic Administrative Court issued a decision revoking the penalties for certain of the assessed years. As a result of that decision, during the fiscal year ended January 31, 2015 the Company decreased its accrual for costs associated with this matter by $6.2 million, which is recorded in "value added tax assessments" in the Consolidated Statement of Income. During fiscal 2016, the Spanish Supreme Court issued final decisions for the assessments related to fiscal years 1996 through 2001 which barred certain of the assessed amounts. As a result of these decisions, during fiscal 2016, the Company decreased its accrual for costs associated with this matter by $25.4 million, including $16.4 million related to an accrual for assessments and penalties recorded in “value added tax assessments” and $9.0 million related to accrued interest recorded in “interest expense” in the Consolidated Statement of Income. The Company paid the remaining assessed amounts for fiscal years 1996 through 2001 of $12.3 million during fiscal 2016.

During the second quarter of fiscal 2017, the Spanish National Appellate Court issued an opinion upholding the assessments for fiscal years 1994 and 1995. Although the Company believes that the Spanish subsidiary's defense to the assessments has solid legal grounds and is continuing to vigorously defend its position by appealing to the Spanish Supreme Court, certain of the amounts assessed for fiscal years 1994 and 1995 are not eligible to be appealed to the Spanish Supreme Court. As a result, the Company increased its accrual for costs associated with this matter by $2.6 million during fiscal 2017, including $1.5 million recorded in "value added tax assessments" and $1.1 million recorded in "interest expense" in the Consolidated Statement of Income. The Company estimates the probable liability for these remaining assessments, including various penalties and interest, was approximately $7.3 million at January 31, 2017 which is included in "accrued expenses and other liabilities" in the Consolidated Balance Sheet.

In December 2010, in a non-unanimous decision, a Brazilian appellate court overturned a 2003 trial court which had previously ruled in favor of the Company’s Brazilian subsidiary related to the imposition of certain taxes on payments abroad related to the licensing of commercial software products, commonly referred to as “CIDE tax”. The Company estimates the total exposure related to CIDE tax, including interest, was approximately $22.8 million at January 31, 2017. The Brazilian subsidiary has appealed the unfavorable ruling to the Supreme Court and Superior Court, Brazil's two highest appellate courts. Based on the legal opinion of outside counsel, the Company believes that the chances of success on appeal of this matter are favorable and the Brazilian subsidiary intends to vigorously defend its position that the CIDE tax is not due. However, due to the lack of predictability of the Brazilian court system, the Company has concluded that it is reasonably possible that the Brazilian subsidiary may incur a loss up to the total exposure described above. The Company believes the resolution of this litigation will not be material to the Company’s consolidated net assets or liquidity.

The SEC has requested information from the Company with respect to the restatement of certain of our consolidated financial statements and other financial information from fiscal 2009 to 2013. The Company is cooperating with the SEC’s request for information.

The Company is subject to various other legal proceedings and claims arising in the ordinary course of business. The Company’s management does not expect that the outcome in any of these other legal proceedings, individually or collectively, will have a material adverse effect on the Company’s financial condition, results of operations, or cash flows.

ITEM 4. Mine Safety Disclosures.

Not applicable.

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is traded on the NASDAQ Stock Market, Inc. (“NASDAQ”) under the symbol “TECD.” We have not paid cash dividends since fiscal 1983 and the Board of Directors has no current plans to institute a cash dividend payment policy in the foreseeable future. The table below presents the quarterly high and low market prices for our common stock as reported by the NASDAQ. As of March 15, 2017, there were 212 holders of record and we believe that there were 14,111 beneficial holders.

MARKET PRICE

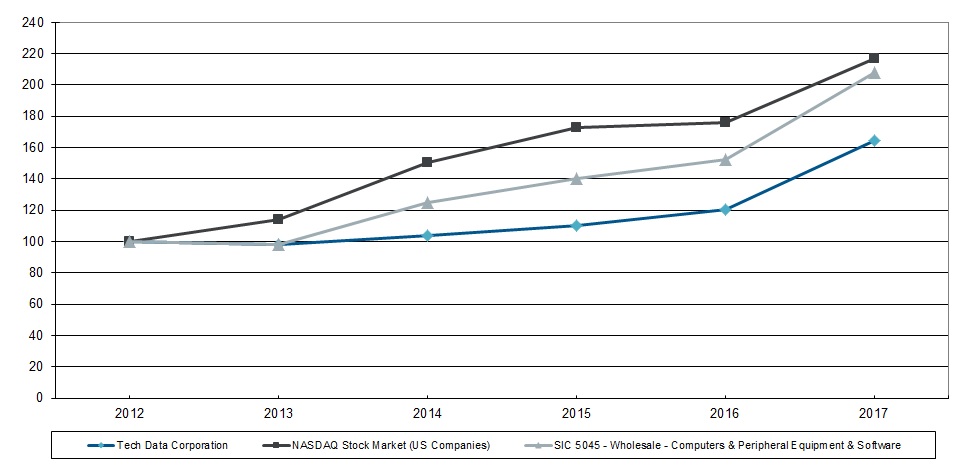

STOCK PERFORMANCE CHART

The five-year stock performance chart below assumes an initial investment of $100 on February 1, 2012 and compares the cumulative total return for Tech Data, the NASDAQ Stock Market (U.S.) Index, and the Standard Industrial Classification, or SIC, Code 5045 – Computer and Peripheral Equipment and Software. The comparisons in the table are provided in accordance with SEC requirements and are not intended to forecast or be indicative of possible future performance of our common stock.

Comparison of Cumulative Total Return

Assumes Initial Investment of $100 on February 1, 2012

Among Tech Data Corporation,

NASDAQ Stock Market (U.S.) Index and SIC Code 5045

|

| | | | | | | | | | | |

| 2012 | | 2013 | | 2014 | | 2015 | | 2016 | | 2017 |

Tech Data Corporation | 100 | | 98 | | 104 | | 110 | | 120 | | 165 |

NASDAQ Stock Market (U.S.) Index | 100 | | 114 | | 151 | | 173 | | 176 | | 217 |

SIC Code 5045 – Computer and Peripheral Equipment and Software | 100 | | 98 | | 125 | | 140 | | 152 | | 208 |

Securities Authorized for Issuance under Equity Compensation Plans

Information regarding the Securities Authorized for Issuance under Equity Compensation Plans can be found under Item 12 of this Report.

Unregistered Sales of Equity Securities

None.

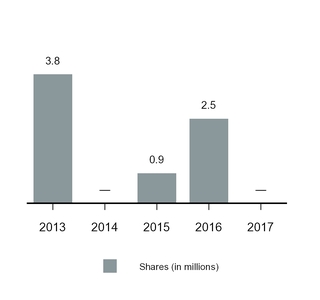

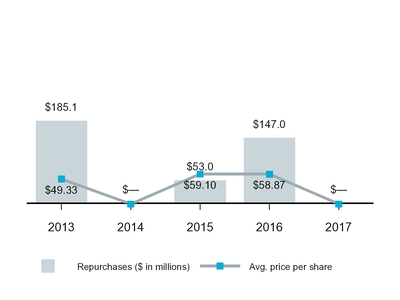

Issuer Purchases of Equity Securities

There were no shares repurchased by the Company during the quarter or year ended January 31, 2017. Cumulatively since fiscal 2006, the Company has repurchased approximately 30 million shares at an average price of $43.25 per share, for a total cost, including expenses, of approximately $1.3 billion.

ITEM 6. Selected Financial Data.

The following table sets forth certain selected consolidated financial data. This information should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and our consolidated financial statements and notes thereto appearing elsewhere in this Annual Report.

|

| | | | | | | | | | | | | | | | | | | |

FIVE-YEAR FINANCIAL SUMMARY

|

Year ended January 31: | 2017 | | 2016 | | 2015 | | 2014 | | 2013 |

(in thousands, except per share data) | | | | | | | | | |

Income statement data: | | | | | | | | | |

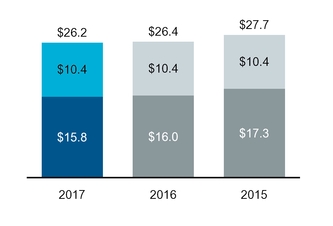

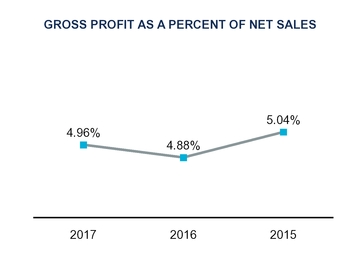

Net sales | $ | 26,234,876 |

| | $ | 26,379,783 |

| | $ | 27,670,632 |

| | $ | 26,821,904 |

| | $ | 25,358,329 |

|

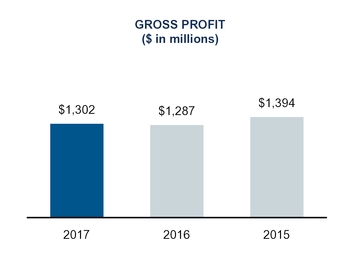

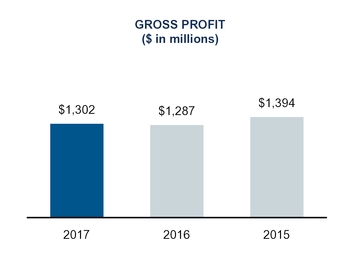

Gross profit | 1,301,927 |

| | 1,286,661 |

| | 1,393,954 |

| | 1,362,346 |

| | 1,303,054 |

|

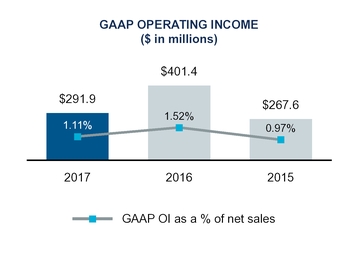

Operating income (1) (2) (3) (4) | 291,902 |

| | 401,428 |

| | 267,635 |

| | 227,513 |

| | 263,720 |

|

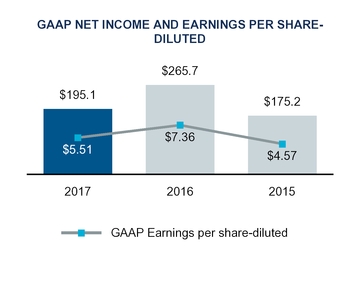

Consolidated net income (3) (5) | 195,095 |

| | 265,736 |

| | 175,172 |

| | 179,932 |

| | 183,040 |

|

Net income attributable to noncontrolling interest | — |

| | — |

| | — |

| | — |

| | (6,785 | ) |

Net income attributable to shareholders of Tech Data Corporation | $ | 195,095 |

| | $ | 265,736 |

| | $ | 175,172 |

| | $ | 179,932 |

| | $ | 176,255 |

|

Earnings per share attributable to shareholders of Tech Data Corporation—basic | $ | 5.54 |

| | $ | 7.40 |

| | $ | 4.59 |

| | $ | 4.73 |

| | $ | 4.53 |

|

Earnings per share attributable to shareholders of Tech Data Corporation—diluted | $ | 5.51 |

| | $ | 7.36 |

| | $ | 4.57 |

| | $ | 4.71 |

| | $ | 4.50 |

|

Dividends per common share | — |

| | — |

| | — |

| | — |

| | — |

|

|

| | | | | | | | | | | | | | | | | | | |

Balance sheet data: | | | | | | | | | |

Working capital (6) | $ | 2,701,472 |

| | $ | 1,889,415 |

| | $ | 1,834,997 |

| | $ | 1,851,447 |

| | $ | 1,700,485 |

|

Total assets | 7,931,866 |

| | 6,358,288 |

| | 6,136,725 |

| | 7,167,576 |

| | 6,828,291 |

|

Revolving credit loans and current maturities of long-term debt, net | 373,123 |

| | 18,063 |

| | 13,303 |

| | 43,481 |

| | 167,522 |

|

Long-term debt, less current maturities | 989,924 |

| | 348,608 |

| | 351,576 |

| | 352,031 |

| | 351,789 |

|

Equity attributable to shareholders of Tech Data Corporation | 2,169,888 |

| | 2,005,755 |

| | 1,960,143 |

| | 2,098,611 |

| | 1,918,369 |

|

| |

(1) | During fiscal 2017, the Company recorded acquisition and integration expenses of $29.0 million associated with the acquisition of Avnet's Technology Solutions business (see further discussion in Note 5 of Notes to Consolidated Financial Statements). |

| |

(2) | During fiscal 2017, 2016, 2015 and 2014, the Company recorded a gain of $4.1 million, $98.4 million, $5.1 million and $35.5 million, respectively, associated with legal settlements, net of attorney fees and expenses, with certain manufacturers of LCD flat panel and cathode ray tube displays (see further discussion in Note 1 of Notes to Consolidated Financial Statements). |

| |

(3) | During fiscal 2017, 2016, 2015 and 2013, the Company recorded a net benefit/(expense) in operating income of $(1.5) million, $8.8 million, $6.2 million and $(29.5) million, respectively, related to its accrual for assessments and penalties on VAT matters in its European subsidiaries. During fiscal 2017, 2016 and 2013, the Company also recorded a net benefit/(expense) in interest expense of $(1.1) million, $9.0 million and $(11.5) million, respectively, related to its accrual for associated interest expense (see further discussion in Note 13 of Notes to Consolidated Financial Statements). |

| |

(4) | During fiscal 2015 and 2014, the Company recorded restatement and remediation related expenses of $22.0 million and $53.8 million, respectively (see further discussion in Note 1 of Notes to Consolidated Financial Statements). |

| |

(5) | During fiscal 2017, 2015, 2014 and 2013 the Company recorded income tax benefits of $12.5 million, $19.2 million, $45.3 million and $25.1 million primarily related to the reversal of deferred tax valuation allowances in certain jurisdictions in Europe. During fiscal 2015, the Company also recorded income tax expenses of $5.6 million related to undistributed earnings on assets held for sale in certain Latin American jurisdictions (see further discussion in Note 6 of Notes to Consolidated Financial Statements). |

| |

(6) | Working capital represents total current assets less total current liabilities in the Consolidated Balance Sheet. |

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

| | | | |

FORWARD-LOOKING STATEMENTS |

This Annual Report on Form 10-K, including this Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), contains forward-looking statements, as described in the “safe harbor” provision of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks and uncertainties and actual results could differ materially from those projected. These forward-looking statements regarding future events and the future results of Tech Data Corporation (“Tech Data,” “we,” “our,” “us” or the “Company”) are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances, are forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Readers are referred to the cautionary statements and important factors discussed in Item 1A, "Risk Factors" in this Annual Report on Form 10-K for the year ended January 31, 2017 for further information. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Tech Data is one of the world’s largest wholesale distributors of technology products. We serve as an indispensable link in the technology supply chain by bringing products from the world’s leading technology vendors to market, as well as providing our customers with advanced logistics capabilities and value-added services. Our customers include value-added resellers, direct marketers, retailers and corporate resellers who support the diverse technology needs of end users. We manage our business in two geographic segments: Americas and Europe.

We believe our strategy of execution, diversification and innovation differentiates us in the markets we serve. We continually evaluate the current and potential profitability and return on our investments in all geographies and consider changes in current and future investments based on risks, opportunities and current and anticipated market conditions. In connection with these evaluations, we may incur additional costs to the extent we decide to increase or decrease our investments in certain geographies.

We also continually evaluate targeted strategic investments across our operations and new business opportunities and invest in those markets and product segments we believe provide us with the greatest opportunities for profitable growth. On September 19, 2016, we entered into an interest purchase agreement with Avnet Inc. (“Avnet”) to acquire Avnet’s Technology Solutions business ("TS"). The acquisition of TS was completed on February 27, 2017, subsequent to the end of our fiscal 2017. We acquired TS for an aggregate purchase price of approximately $2.672 billion, comprised of approximately $2.425 billion in cash and 2,785,402 shares of Tech Data’s common stock, with the cash consideration subject to certain working capital and other adjustments.

TS delivers technology services, software, hardware and solutions across the data center. We believe that through the TS acquisition we will diversify our end-to-end solutions, deepen our value added capabilities and balance our solutions portfolio. The addition of TS also extends our geographic reach into the Asia-Pacific region while broadening our capabilities in Europe and the Americas, including re-entering Latin America with a focus on the delivery of new technologies that drive and complement the data center in this market. The combined business extends our operations into forty countries spread across five continents with approximately 14,000 employees.

In connection with the acquisition of TS, on January 31, 2017, the Company issued $500.0 million aggregate principal amount of 3.70% Senior Notes due 2022 (the “2022 Senior Notes”) and $500.0 million aggregate principal amount of 4.95% Senior Notes due 2027 (the “2027 Senior Notes”). Additionally, at the consummation of the acquisition on February 27, 2017, the Company borrowed $1.0 billion under its Term Loan Credit Agreement (as defined herein), comprised of $250.0 million aggregate principal amount of three-year term loans and $750.0 million aggregate principal amount of five-year term loans.

|

| | | | |

NON-GAAP FINANCIAL INFORMATION |

In addition to disclosing financial results that are determined in accordance with generally accepted accounting principles in the United States (“GAAP”), the Company also discloses certain non-GAAP financial information. Certain of these measures are presented as adjusted for the impact of changes in foreign currencies (referred to as “impact of changes in foreign currencies”). Removing the impact of the changes in foreign currencies provides a framework for assessing our financial performance as compared to prior periods. The impact of changes in foreign currencies is calculated by using the exchange rates from the prior year comparable period applied to the results of operations for the current period. The non-GAAP financial measures presented in this document include:

| |

• | Net sales, as adjusted, which is defined as net sales adjusted for the impact of changes in foreign currencies and the impact of the exit of business operations in Chile, Peru and Uruguay (referred to as "impact of exited operations") which is reflected in our results of operations by removing the impact from the periods presented; |

| |

• | Gross profit, as adjusted, which is defined as gross profit as adjusted for the impact of changes in foreign currencies; |

| |

• | Selling, general and administrative expenses (“SG&A”), as adjusted, which is defined as SG&A as adjusted for the impact of changes in foreign currencies; |

| |

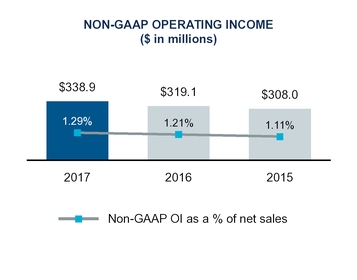

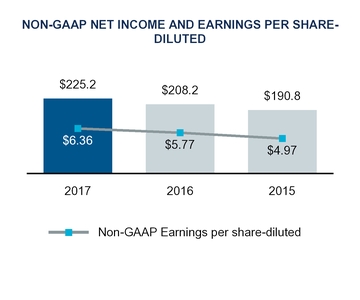

• | Non-GAAP operating income, which is defined as operating income as adjusted to exclude acquisition and integration expenses, LCD settlements and other, net, value added tax assessments, restatement and remediation related expenses, loss on disposal of subsidiaries and acquisition-related intangible asset amortization; |

| |

• | Non-GAAP net income, which is defined as net income as adjusted to exclude acquisition and integration expenses, LCD settlements and other, net, value added tax assessments and related interest expense, restatement and remediation related expenses, loss on disposal of subsidiaries, acquisition-related intangible asset amortization, acquisition-related financing expenses, the income tax effects of these adjustments, the reversal of deferred tax valuation allowances and income taxes on undistributed earnings of assets held for sale; |

| |

• | Non-GAAP earnings per share-diluted, which is defined as earnings per share-diluted as adjusted to exclude the per share impact of acquisition and integration expenses, LCD settlements and other, net, value added tax assessments and related interest expense, restatement and remediation related expenses, loss on disposal of subsidiaries, acquisition-related intangible asset amortization, acquisition-related financing expenses, the income tax effects of these adjustments, the reversal of deferred tax valuation allowances and income taxes on undistributed earnings of assets held for sale. |