Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended April 30, 2016

OR

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 0-14625

TECH DATA CORPORATION

(Exact name of Registrant as specified in its charter)

|

| |

Florida | No. 59-1578329 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

5350 Tech Data Drive Clearwater, Florida | 33760 |

(Address of principal executive offices) | (Zip Code) |

(Registrant’s Telephone Number, including Area Code): (727) 539-7429

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated Filer | x | Accelerated Filer | ¨ |

| | | |

Non-accelerated Filer | ¨ | Smaller Reporting Company Filer | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

| |

Class | Outstanding at May 20, 2016 |

Common stock, par value $.0015 per share | 35,196,695 |

TECH DATA CORPORATION AND SUBSIDIARIES

Form 10-Q for the Three Months Ended April 30, 2016

INDEX

|

| | |

| | PAGE |

PART I. | | |

ITEM 1. | | |

| | |

| | |

| | |

| | |

| | |

ITEM 2. | | |

ITEM 3. | | |

ITEM 4. | | |

PART II. | | |

ITEM 1. | | |

ITEM 1A. | | |

ITEM 2 | | |

ITEM 3. | | |

ITEM 4. | | |

ITEM 5. | | |

ITEM 6. | | |

| |

EXHIBITS | |

CERTIFICATIONS | |

PART I. FINANCIAL INFORMATION

| |

ITEM 1. | Financial Statements |

TECH DATA CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(In thousands, except par value and share amounts)

|

| | | | | | | |

| April 30, 2016 | | January 31, 2016 |

| (Unaudited) | | |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 825,734 |

| | $ | 531,169 |

|

Accounts receivable, less allowances of $45,851 and $45,875 | 2,580,799 |

| | 2,995,114 |

|

Inventories | 2,092,742 |

| | 2,117,384 |

|

Prepaid expenses and other assets | 135,917 |

| | 178,394 |

|

Total current assets | 5,635,192 |

| | 5,822,061 |

|

Property and equipment, net | 71,179 |

| | 66,028 |

|

Goodwill | 212,882 |

| | 204,114 |

|

Intangible assets, net | 158,518 |

| | 159,386 |

|

Other assets, net | 113,125 |

| | 106,699 |

|

Total assets | $ | 6,190,896 |

| | $ | 6,358,288 |

|

| | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 3,157,646 |

| | $ | 3,427,580 |

|

Accrued expenses and other liabilities | 455,231 |

| | 487,003 |

|

Revolving credit loans and current maturities of long-term debt, net | 17,939 |

| | 18,063 |

|

Total current liabilities | 3,630,816 |

| | 3,932,646 |

|

Long-term debt, less current maturities | 348,816 |

| | 348,608 |

|

Other long-term liabilities | 76,382 |

| | 71,279 |

|

Total liabilities | 4,056,014 |

| | 4,352,533 |

|

Commitments and contingencies (Note 7) |

| |

|

Shareholders’ equity: | | | |

Common stock, par value $.0015; 200,000,000 shares authorized; 59,245,585 shares issued at April 30, 2016 and January 31, 2016 | 89 |

| | 89 |

|

Additional paid-in capital | 676,886 |

| | 682,227 |

|

Treasury stock, at cost (24,048,956 and 24,163,402 shares at April 30, 2016 and January 31, 2016) | (1,072,331 | ) | | (1,077,434 | ) |

Retained earnings | 2,467,571 |

| | 2,434,198 |

|

Accumulated other comprehensive income (loss) | 62,667 |

| | (33,325 | ) |

Total shareholders' equity | 2,134,882 |

| | 2,005,755 |

|

Total liabilities and shareholders' equity | $ | 6,190,896 |

| | $ | 6,358,288 |

|

The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements.

TECH DATA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF INCOME

(In thousands, except per share amounts)

(Unaudited)

|

| | | | | | | |

| Three months ended April 30, |

| 2016 | | 2015 |

Net sales | $ | 5,963,362 |

| | $ | 5,887,229 |

|

Cost of products sold | 5,664,751 |

| | 5,595,340 |

|

Gross profit | 298,611 |

| | 291,889 |

|

Operating expenses: | | | |

Selling, general and administrative expenses | 246,496 |

| | 248,462 |

|

LCD settlements, net | (443 | ) | | (38,511 | ) |

| 246,053 |

| | 209,951 |

|

Operating income | 52,558 |

| | 81,938 |

|

Interest expense | 5,601 |

| | 5,722 |

|

Other (income) expense, net | (1,034 | ) | | 161 |

|

Income before income taxes | 47,991 |

| | 76,055 |

|

Provision for income taxes | 14,618 |

| | 24,778 |

|

Net income | $ | 33,373 |

| | $ | 51,277 |

|

Earnings per share: | | | |

Basic | $ | 0.95 |

| | $ | 1.39 |

|

Diluted | $ | 0.94 |

| | $ | 1.38 |

|

Weighted average common shares outstanding: | | | |

Basic | 35,127 |

| | 36,822 |

|

Diluted | 35,370 |

| | 37,036 |

|

The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements.

TECH DATA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(In thousands)

(Unaudited)

|

| | | | | | | |

| Three months ended April 30, |

| 2016 | | 2015 |

Net income | $ | 33,373 |

| | $ | 51,277 |

|

Other comprehensive income: | | | |

Foreign currency translation adjustment | 95,992 |

| | 8,480 |

|

Total comprehensive income | $ | 129,365 |

| | $ | 59,757 |

|

The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements.

TECH DATA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(In thousands)

(Unaudited) |

| | | | | | | |

| Three months ended April 30, |

| 2016 | | 2015 |

Cash flows from operating activities: | | | |

Cash received from customers | $ | 7,093,723 |

| | $ | 6,506,634 |

|

Cash paid to vendors and employees | (6,793,778 | ) | | (6,389,994 | ) |

Interest paid, net | (8,369 | ) | | (8,301 | ) |

Income taxes paid | (15,821 | ) | | (1,005 | ) |

Net cash provided by operating activities | 275,755 |

| | 107,334 |

|

Cash flows from investing activities: |

| | |

Expenditures for property and equipment | (7,166 | ) | | (4,227 | ) |

Software and software development costs | (4,397 | ) | | (3,017 | ) |

Proceeds from sale of subsidiaries | — |

| | 18,747 |

|

Net cash (used in) provided by investing activities | (11,563 | ) | | 11,503 |

|

Cash flows from financing activities: | | | |

Payments for employee tax withholdings on equity awards | (4,093 | ) | | (4,352 | ) |

Net (repayments) borrowings on revolving credit loans | (1,187 | ) | | 3,035 |

|

Proceeds from the reissuance of treasury stock | 146 |

| | 104 |

|

Cash paid for purchase of treasury stock | — |

| | (47,003 | ) |

Principal payments on long-term debt | — |

| | (118 | ) |

Acquisition earn-out payment | — |

| | (2,736 | ) |

Net cash used in financing activities | (5,134 | ) | | (51,070 | ) |

Effect of exchange rate changes on cash and cash equivalents | 35,507 |

| | 8,421 |

|

Net increase in cash and cash equivalents | 294,565 |

| | 76,188 |

|

Cash and cash equivalents at beginning of year | 531,169 |

| | 542,995 |

|

Cash and cash equivalents at end of period | $ | 825,734 |

| | $ | 619,183 |

|

Reconciliation of net income to net cash provided by operating activities: | | | |

Net income | $ | 33,373 |

| | $ | 51,277 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Loss on disposal of subsidiaries | — |

| | 363 |

|

Depreciation and amortization | 14,047 |

| | 14,179 |

|

Provision for losses on accounts receivable | (1,305 | ) | | (408 | ) |

Stock-based compensation expense | 3,657 |

| | 3,818 |

|

Accretion of debt discount and debt issuance costs on Senior Notes | 208 |

| | 187 |

|

Changes in operating assets and liabilities: | | | |

Accounts receivable | 519,337 |

| | 237,196 |

|

Inventories | 93,260 |

| | (8,122 | ) |

Prepaid expenses and other assets | 50,479 |

| | (28,690 | ) |

Accounts payable | (381,928 | ) | | (134,682 | ) |

Accrued expenses and other liabilities | (55,373 | ) | | (27,784 | ) |

Total adjustments | 242,382 |

| | 56,057 |

|

Net cash provided by operating activities | $ | 275,755 |

| | $ | 107,334 |

|

The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements.

TECH DATA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 — BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Description of Business

Tech Data Corporation (“Tech Data” or the “Company”) is one of the world’s largest wholesale distributors of technology products. The Company serves as an indispensable link in the technology supply chain by bringing products from the world’s leading technology vendors to market, as well as providing customers with advanced logistics capabilities and value-added services. Tech Data’s customers include value-added resellers, direct marketers, retailers and corporate resellers who support the diverse technology needs of end users. The Company is managed in two geographic segments: the Americas and Europe.

Principles of Consolidation

The consolidated financial statements include the accounts of Tech Data and its subsidiaries. All significant intercompany accounts and transactions have been eliminated in consolidation. The Company operates on a fiscal year that ends on January 31.

Basis of Presentation

The consolidated financial statements have been prepared by the Company, without audit, pursuant to the rules and regulations of the United States Securities and Exchange Commission (“SEC”). The Company prepares its financial statements in conformity with generally accepted accounting principles in the United States (“GAAP”). These principles require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. In the opinion of management, the accompanying unaudited consolidated financial statements contain all adjustments (consisting of only normal recurring adjustments) necessary to present fairly the consolidated financial position of the Company as of April 30, 2016, and its consolidated statements of income, comprehensive income and cash flows for the three months ended April 30, 2016 and 2015.

Seasonality

The Company’s quarterly operating results have fluctuated significantly in the past and will likely continue to do so in the future as a result of currency fluctuations and seasonal variations in the demand for the products and services offered. Narrow operating margins may magnify the impact of these factors on the Company's operating results. Recent historical seasonal variations have included an increase in European demand during the Company’s fiscal fourth quarter and decreased demand in other fiscal quarters. Given that the majority of the Company’s revenues are derived from Europe, the worldwide results closely follow the seasonality trends in Europe. The seasonal trend in Europe typically results in greater operating leverage, and therefore, lower selling, general and administrative expenses as a percentage of net sales in the region and on a consolidated basis during the second semester of the Company's fiscal year, particularly in the Company's fourth quarter. Additionally, the life cycles of major products, as well as the impact of future acquisitions and dispositions, may also materially impact the Company’s business, financial condition, or consolidated results of operations. Therefore, the results of operations for the three months ended April 30, 2016 and 2015 are not necessarily indicative of the results that can be expected for the entire fiscal year ended January 31, 2017.

LCD settlements, net

The Company has been a claimant in proceedings seeking damages from certain manufacturers of LCD flat panel and cathode ray tube displays. The Company reached settlement agreements with certain manufacturers in the amount of $0.4 million and $38.5 million, respectively, during the three months ended April 30, 2016 and 2015, net of attorney fees and expenses.

Accounts Receivable Purchase Agreements

The Company has uncommitted accounts receivable purchase agreements under which certain accounts receivable may be sold, without recourse, to third-party financial institutions. Under these programs, the Company may sell certain accounts receivable in exchange for cash less a discount, as defined in the agreements. Available capacity under these programs, which the Company uses as a source of working capital funding, is dependent on the level of accounts receivable eligible to be sold into these programs and the financial institutions' willingness to purchase such receivables. In addition, certain of these agreements also require that the Company continue to service, administer and collect the sold accounts receivable. At April 30, 2016 and January 31, 2016, the Company had a total of $430.6 million and $554.2 million, respectively, of accounts receivable sold to and held by financial institutions under these agreements. During the three months ended April 30, 2016 and 2015, discount fees recorded under these facilities were $1.2 million and $1.0 million, respectively. These discount fees are included as a component of "other (income) expense, net" in the Consolidated Statement of Income.

Recently Adopted Accounting Standards

In April 2015, the FASB issued an accounting standard which provides guidance to customers about whether a cloud computing arrangement includes a software license. If a cloud computing arrangement includes a software license, the license element should be accounted for consistent with the acquisition of other software licenses. If the cloud computing arrangement does not include a software license, the customer should account for the arrangement as a service contract. The Company adopted this standard during the quarter ended April 30, 2016. The adoption of this standard did not have a material impact on the Company’s consolidated financial statements.

In March 2016, the FASB issued an accounting standard which modifies how companies account for certain aspects of stock-based payments to employees. The new standard revises the accounting treatment for excess tax benefits, statutory income tax withholding requirements, and forfeitures related to stock-based awards. The standard is effective for annual periods beginning after December 15, 2016; however, early adoption is permitted. The Company early adopted this standard during the quarter ended April 30, 2016. The Company has elected to continue to estimate the number of stock-based awards expected to vest, as permitted by the new standard, rather than electing to account for forfeitures as they occur. The adoption of this standard did not have a material impact on the Company’s consolidated financial statements; however, as a result of the adoption of this standard, the classification of certain amounts in the Consolidated Statement of Cash Flows for the three months ended April 30, 2015 was retrospectively adjusted.

Recently Issued Accounting Standards

In May 2014, the FASB issued an accounting standard which will supersede all existing revenue recognition guidance under current GAAP. In March and April 2016, the FASB issued additional accounting standard updates which provide supplemental adoption guidance and clarification to the May 2014 accounting standard update. The new standards require the recognition of revenue to depict the transfer of promised goods or services in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods and services. The standards will be effective for the Company beginning with the quarter ending April 30, 2018. The Company would have the option to adopt one year earlier and the standard may be adopted with either a full retrospective or a modified retrospective approach. The Company is currently in the process of assessing what impact these new standards may have on its consolidated financial statements.

In July 2015, the FASB issued a new accounting standard that simplifies the subsequent measurement of inventory. Under the new standard, the cost of inventory will be compared to the net realizable value (NRV). Net realizable value is defined as the estimated selling prices in the ordinary course of business less reasonably predictable costs of completion, disposal and transportation. The standard should be applied prospectively and will be effective for the Company beginning with the quarter ending April 30, 2017. The Company does not expect the adoption of this standard to have a material impact on its consolidated financial statements.

In February 2016, the FASB issued an accounting standard which requires the recognition of assets and liabilities arising from lease transactions on the balance sheet and the disclosure of additional information about leasing arrangements. Under the new guidance, for all leases, interest expense and amortization of the right to use asset will be recorded for leases determined to be financing leases and straight-line lease expense will be recorded for leases determined to be operating leases. Lessees will initially recognize assets for the right to use the leased assets and liabilities for the obligations created by those leases. The new accounting standard must be adopted using a modified retrospective approach for leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements. The accounting standard is effective for the Company beginning with the quarter ended April 30, 2019, with early adoption permitted. The Company is currently in the process of assessing what impact this new standard may have on its consolidated financial statements.

Reclassifications

Certain reclassifications have been made to prior period amounts to conform to the current period presentation. These reclassifications did not have a material impact on previously reported amounts.

NOTE 2 — EARNINGS PER SHARE ("EPS")

The Company presents the computation of earnings per share on a basic and diluted basis. Basic EPS is computed by dividing net income by the weighted average number of shares outstanding during the reported period. Diluted EPS reflects the potential dilution related to equity-based incentives (further discussed in Note 3 – Stock-Based Compensation) using the treasury stock method. The composition of basic and diluted EPS is as follows:

|

| | | | | | | |

| Three months ended April 30, |

| 2016 | | 2015 |

(in thousands, except per share data) | | | |

Net income | $ | 33,373 |

| | $ | 51,277 |

|

| | | |

Weighted average common shares - basic | 35,127 |

| | 36,822 |

|

Effect of dilutive securities: | | | |

Equity based awards | 243 |

| | 214 |

|

Weighted average common shares - diluted | 35,370 |

| | 37,036 |

|

| | | |

Earnings per share: | | | |

Basic | $ | 0.95 |

| | $ | 1.39 |

|

Diluted | $ | 0.94 |

| | $ | 1.38 |

|

For the three months ended April 30, 2016 and 2015, there were 200,383 and zero shares, respectively, excluded from the computation of diluted earnings per share because their effect would have been antidilutive.

NOTE 3 — STOCK-BASED COMPENSATION

For the three months ended April 30, 2016 and 2015, the Company recorded $3.7 million and $3.8 million, respectively, of stock-based compensation expense, which is included in “selling, general and administrative expenses” in the Consolidated Statement of Income.

At April 30, 2016, the Company had awards outstanding from two equity-based compensation plans, only one of which is currently active. The active plan was initially approved by the Company’s shareholders in June 2009 and includes 4.0 million shares available for grant of which approximately 2.2 million shares remain available for future grant at April 30, 2016. Under the active plan, the Company is authorized to award officers, employees, and non-employee members of the Board of Directors restricted stock, options to purchase common stock, maximum value stock-settled stock appreciation rights, maximum value options, and performance awards that are dependent upon achievement of specified performance goals. Equity-based compensation awards have a maximum term of 10 years, unless a shorter period is specified by the Compensation Committee of the Board of Directors ("Compensation Committee") or is required under local law. Awards under the plans are priced as determined by the Compensation Committee, and under the terms of the Company’s active equity-based compensation plan, are required to be priced at, or above, the fair market value of the Company’s common stock on the date of grant. Awards generally vest between one and three years from the date of grant.

A summary of the Company’s restricted stock activity for the three months ended April 30, 2016 is as follows: |

| | |

| Shares |

Nonvested at January 31, 2016 | 496,329 |

|

Granted (a) | 219,407 |

|

Vested | (161,148 | ) |

Canceled | (3,959 | ) |

Nonvested at April 30, 2016 | 550,629 |

|

(a) Includes 18,563 shares of performance-based restricted stock units, which assumes maximum achievement.

The Company’s policy is to utilize shares of its treasury stock, to the extent available, to satisfy its obligation to issue shares upon the exercise of awards.

NOTE 4 — SHAREHOLDERS' EQUITY

The Company’s common share issuance activity for the three months ended April 30, 2016 is summarized as follows:

|

| | | | | | |

| Shares | | Weighted-average

price per share |

Treasury stock balance at January 31, 2016 | 24,163,402 |

| | $ | 44.59 |

|

Shares of treasury stock reissued | (114,446 | ) | | |

Treasury stock balance at April 30, 2016 | 24,048,956 |

| | $ | 44.59 |

|

There were no common shares repurchased by the Company during the three months ended April 30, 2016. The reissuance of shares from treasury stock is based on the weighted average purchase price of the shares.

NOTE 5 — FAIR VALUE MEASUREMENTS

The Company’s assets and liabilities carried or disclosed at fair value are classified in one of the following three categories: Level 1 – quoted market prices in active markets for identical assets and liabilities; Level 2 – inputs other than quoted market prices included in Level 1 above that are observable for the asset or liability, either directly or indirectly; and Level 3 – unobservable inputs for the asset or liability. The classification of an asset or liability within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

The following table summarizes the valuation of the Company's assets and liabilities that are measured at fair value on a recurring basis (in thousands):

|

| | | | | | | | | | | | | | | |

| April 30, 2016 | | January 31, 2016 |

| Fair value measurement category | | Fair value measurement category |

| Level 1 | | Level 2 | | Level 3 | | Level 1 | | Level 2 | | Level 3 |

ASSETS | | | | | | | | | | | |

Foreign currency forward contracts | | | $ | 2,115 |

| | | | | | $ | 3,412 |

| | |

| | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | |

Foreign currency forward contracts | | | $ | 3,997 |

| | | | | | $ | 2,274 |

| | |

The Company's foreign currency forward contracts are measured on a recurring basis based on foreign currency spot rates and forward rates quoted by banks or foreign currency dealers (Level 2 criteria) and are marked-to-market each period with gains and losses on these contracts recorded in the Consolidated Statement of Income on a basis consistent with the classification of the change in the fair value of the underlying transactions giving rise to these foreign currency exchange gains and losses in the period in which their value changes, with the offsetting amount for unsettled positions being included in either "prepaid expenses and other assets" or "accrued expenses and other liabilities" in the Consolidated Balance Sheet. See further discussion below in Note 6 – Derivative Instruments.

The Company utilizes life insurance policies to fund the Company’s nonqualified deferred compensation plan. The life insurance asset recorded by the Company is the amount that would be realized upon the assumed surrender of the policy. This amount is based on the underlying fair value of the invested assets contained within the life insurance policies. The gains and losses are recorded in the Company’s Consolidated Statement of Income within "other (income) expense, net." The related deferred compensation liability is also marked-to-market each period based upon the returns of the various investments selected by the plan participants and the gains and losses are recorded in the Company’s Consolidated Statement of Income within "selling, general and administrative expenses." The net realizable value of the Company's life insurance investments and related deferred compensation liability is $33.0 million and $33.0 million, respectively, at April 30, 2016 and $30.2 million and $30.5 million, respectively, at January 31, 2016.

In September 2012, the Company issued $350.0 million aggregate principal amount of 3.75% Senior Notes in a public offering (the "Senior Notes") which are carried at cost, less unamortized debt discount and debt issuance costs. As of April 30, 2016 and January 31, 2016, the estimated fair value of the Senior Notes was approximately $356.2 million and $359.6 million, respectively, based upon quoted market information (Level 1 criteria). The carrying amounts of cash and cash equivalents, accounts receivable, accounts payable and accrued expenses approximate fair value because of the short maturity of these items. The carrying amount of debt outstanding pursuant to revolving credit facilities and loans payable approximates fair value as the majority of these instruments have variable interest rates which approximate current market rates (Level 2 criteria).

NOTE 6 — DERIVATIVE INSTRUMENTS

In the ordinary course of business, the Company is exposed to movements in foreign currency exchange rates. The Company’s foreign currency risk management objective is to protect earnings and cash flows from the impact of exchange rate changes primarily through the use of foreign currency forward contracts to hedge both intercompany and third party loans, accounts receivable and accounts payable. These derivatives are not designated as hedging instruments.

The Company’s foreign currency exposure relates primarily to international transactions where the currency collected from customers can be different from the currency used to purchase the product. The Company’s transactions in its foreign operations are denominated primarily in the following currencies: British pound, Canadian dollar, Czech koruna, Danish krone, euro, Norwegian krone, Polish zloty, Swedish krona, Swiss franc and U.S. dollar.

The Company considers inventory as an economic hedge against foreign currency exposure in accounts payable in certain circumstances. This practice offsets such inventory against corresponding accounts payable denominated in currencies other than the functional currency of the subsidiary buying the inventory when determining the net exposure to be hedged using traditional forward contracts. Under this strategy, the Company would expect to increase or decrease selling prices for products purchased in foreign currencies based on fluctuations in foreign currency exchange rates affecting the underlying accounts payable. To the extent the Company incurs a foreign currency exchange loss (gain) on the underlying accounts payable denominated in the foreign currency, a corresponding increase (decrease) in gross profit would be expected as the related inventory is sold. This strategy can result in a certain degree of quarterly earnings volatility as the underlying accounts payable is remeasured using the foreign currency exchange rate prevailing at the end of each period, or settlement date if earlier, whereas the corresponding increase (decrease) in gross profit is not realized until the related inventory is sold.

The Company recognizes foreign currency exchange gains and losses on its derivative instruments used to manage its exposures to foreign currency denominated accounts receivable and accounts payable as a component of “cost of products sold” which is consistent with the classification of the change in fair value upon remeasurement of the underlying hedged accounts receivable or accounts payable. The Company recognizes foreign currency exchange gains and losses on its derivative instruments used to manage its exposures to foreign currency denominated financing transactions as a component of “other (income) expense, net” which is consistent with the classification of the change in fair value upon remeasurement of the underlying hedged loans. The total amount recognized in earnings on the Company's foreign currency forward contracts, which depending upon the nature of the underlying hedged asset or liability is included as a component of either “cost of products sold” or “other (income) expense, net”, was a net foreign currency exchange loss of $7.4 million and $8.0 million, respectively, for the three months ended April 30, 2016 and 2015. The gains and losses on the Company’s foreign currency forward contracts are largely offset by the change in the fair value of the underlying hedged assets or liabilities.

The notional amount of forward exchange contracts is the amount of foreign currency to be bought or sold at maturity. Notional amounts are indicative of the extent of the Company’s involvement in the various types and uses of derivative financial instruments and are not a measure of the Company’s exposure to credit or market risks through its use of derivatives. The estimated fair value of derivative financial instruments represents the amount required to enter into similar offsetting contracts with similar remaining maturities based on quoted market prices.

The Company's average notional amounts of derivative financial instruments outstanding during the three months ended April 30, 2016 and 2015 were approximately $0.5 billion and $0.5 billion, respectively, with average maturities of 30 days and 37 days, respectively. As discussed above, under the Company's hedging policies, gains and losses on the derivative financial instruments are largely offset by the gains and losses on the underlying assets or liabilities being hedged.

The Company’s foreign currency forward contracts are also discussed in Note 5 – Fair Value Measurements.

NOTE 7 — COMMITMENTS & CONTINGENCIES

Synthetic Lease Facility

The Company has a synthetic lease facility with a group of financial institutions (the “Synthetic Lease”) under which the Company leases certain logistics centers and office facilities from a third-party lessor, that expires in June 2018. Properties leased under the Synthetic Lease are located in Clearwater and Miami, Florida; Fort Worth, Texas; Fontana, California; Suwanee, Georgia; Swedesboro, New Jersey; and South Bend, Indiana. The Synthetic Lease is accounted for as an operating lease and rental payments are calculated at the applicable LIBOR rate plus a margin based on the Company's credit ratings.

Upon not less than 30 days notice, the Company, at its option, may purchase one or any combination of the properties, at an amount equal to each of the property's cost, as long as the lease balance does not decrease below a defined amount. Upon not less than 270 days, nor more than 360 days, prior to the lease expiration, the Company may, at its option, (i) purchase a minimum of two of the properties, at an amount equal to each of the property's cost, (ii) exercise the option to renew the lease for a minimum of two of the properties or (iii) exercise the option to remarket a minimum of two of the properties and cause a sale of the properties. If the Company elects to remarket the properties, the Company has guaranteed the lessor a percentage of the cost of each property, in the aggregate amount of approximately $133.8 million. Future annual lease payments under the Synthetic Lease are approximately $2.9 million per year.

Guarantees

The Company has arrangements with certain finance companies that provide inventory financing facilities to the Company’s customers. In conjunction with certain of these arrangements, the Company would be required to purchase certain inventory in the event the inventory is repossessed from the customers by the finance companies. As the Company does not have access to information regarding the amount of inventory purchased from the Company still on hand with the customer at any point in time, the Company’s repurchase obligations relating to inventory cannot be reasonably estimated. Repurchases of inventory by the Company under these arrangements have been insignificant to date. The Company believes that, based on historical experience, the likelihood of a material loss pursuant to these inventory repurchase obligations is remote.

The Company provides additional financial guarantees to finance companies on behalf of certain customers. The majority of these guarantees are for an indefinite period of time, where the Company would be required to perform if the customer is in default with the finance company related to purchases made from the Company. The Company reviews the underlying credit for these guarantees on at least an annual basis. As of April 30, 2016 and January 31, 2016, the outstanding amount of guarantees under these arrangements totaled $4.0 million and $4.6 million, respectively. The Company believes that, based on historical experience, the likelihood of a material loss pursuant to the above guarantees is remote.

Contingencies

Prior to fiscal 2004, one of the Company’s subsidiaries, located in Spain, was audited in relation to various value added tax (“VAT”) matters. As a result of those audits, the Spanish subsidiary received notices of assessment from the Regional Inspection Unit of Spain’s taxing authority that allege the subsidiary did not properly collect and remit VAT. The Spanish subsidiary appealed these assessments to the Madrid Central Economic Administrative Courts beginning in March 2010. Following the administrative court proceedings the matter was appealed to the Spanish National Appellate Court. During 2013, the Spanish National Appellate Court issued an opinion upholding the assessments for several of the assessed years. During fiscal 2015, the Madrid Central Economic Administrative Court issued a decision revoking the penalties for certain of the assessed years. During fiscal 2016, the Spanish Supreme Court issued final decisions which barred the assessments for several of the assessed years. The Company believes that the Spanish subsidiary's defense to the remaining assessments has solid legal grounds and is continuing to vigorously defend its position by appealing to the Spanish National Appellate Court. The Company estimates the total exposure for these assessments, including various penalties and interest, was approximately $4.9 million and $4.6 million at April 30, 2016 and January 31, 2016, respectively, which is included in "accrued expenses and other liabilities" in the Consolidated Balance Sheet.

In December 2010, in a non-unanimous decision, a Brazilian appellate court overturned a 2003 trial court which had previously ruled in favor of the Company’s Brazilian subsidiary related to the imposition of certain taxes on payments abroad related to the licensing of commercial software products, commonly referred to as “CIDE tax.” The Company estimates the total exposure related to the CIDE tax, including interest, was approximately $20.3 million and $17.3 million at April 30, 2016 and January 31, 2016, respectively. The Brazilian subsidiary has appealed the unfavorable ruling to the Supreme Court and Superior Court, Brazil's two highest appellate courts. Based on the legal opinion of outside counsel, the Company believes that the chances of success on appeal of this matter are favorable and the Brazilian subsidiary intends to vigorously defend its position that the CIDE tax is not due. However, due to the lack of predictability of the Brazilian court system, the Company has concluded that it is reasonably possible that the Brazilian subsidiary may incur a loss up to the total exposure described above. The Company believes the resolution of this litigation will not be material to the Company’s consolidated net assets or liquidity.

In addition to the CIDE tax matter discussed above, the Company’s Brazilian subsidiary has been undergoing several examinations of non-income related taxes. Given the lack of predictability of the Brazilian tax system, the Company believes that it is reasonably possible that a loss may have been incurred. However, due to the complex nature of the Brazilian tax system and the absence of communication from the local tax authorities regarding these examinations, the Company is currently unable to determine the likelihood of these examinations resulting in assessments or to estimate the amount of loss, if any, that may be reasonably possible if such assessment were to be made.

The Company is subject to various other legal proceedings and claims arising in the ordinary course of business. The Company’s management does not expect that the outcome in any of these other legal proceedings, individually or collectively, will have a material adverse effect on the Company’s financial condition, results of operations or cash flows.

NOTE 8 — SEGMENT INFORMATION

The Company operates predominantly in a single industry segment as a distributor of technology products, logistics management, and other value-added services. While the Company operates primarily in one industry, it is managed based on geographic segments: the Americas and Europe. The Company assesses performance of and makes decisions on how to allocate resources to its operating segments based on multiple factors including current and projected operating income and market opportunities. The Company does not consider stock-based compensation expense in assessing the performance of its operating segments, and therefore the Company reports stock-based compensation expense as a separate amount. The accounting policies of the segments are the same as those described in Note 1 – Business and Summary of Significant Accounting Policies.

Financial information by geographic segment is as follows (in thousands): |

| | | | | | | |

| Three months ended April 30, |

| 2016 | | 2015 |

Net sales to unaffiliated customers: | | | |

Americas (1) | $ | 2,388,004 |

| | $ | 2,339,260 |

|

Europe | 3,575,358 |

| | 3,547,969 |

|

Total | $ | 5,963,362 |

| | $ | 5,887,229 |

|

| | | |

Operating income: | | | |

Americas (2) | $ | 31,275 |

| | $ | 62,359 |

|

Europe | 24,940 |

| | 23,397 |

|

Stock-based compensation expense | (3,657 | ) | | (3,818 | ) |

Total | $ | 52,558 |

| | $ | 81,938 |

|

| | | |

Depreciation and amortization: | | | |

Americas | $ | 4,890 |

| | $ | 4,041 |

|

Europe | 9,157 |

| | 10,138 |

|

Total | $ | 14,047 |

| | $ | 14,179 |

|

| | | |

Capital expenditures: | | | |

Americas | $ | 6,097 |

| | $ | 3,864 |

|

Europe | 5,466 |

| | 3,380 |

|

Total | $ | 11,563 |

| | $ | 7,244 |

|

|

| | | | | | | |

As of: | April 30, 2016 | | January 31, 2016 |

Identifiable assets: | | | |

Americas | $ | 1,976,795 |

| | $ | 2,078,443 |

|

Europe | 4,214,101 |

| | 4,279,845 |

|

Total | $ | 6,190,896 |

| | $ | 6,358,288 |

|

| | | |

Long-lived assets: | | | |

Americas (1) | $ | 32,184 |

| | $ | 29,402 |

|

Europe | 38,995 |

| | 36,626 |

|

Total | $ | 71,179 |

| | $ | 66,028 |

|

| | | |

Goodwill & acquisition-related intangible assets, net: | | | |

Americas | $ | 35,034 |

| | $ | 35,615 |

|

Europe | 281,944 |

| | 274,401 |

|

Total | $ | 316,978 |

| | $ | 310,016 |

|

| |

(1) | Net sales to unaffiliated customers in the United States represented 88% and 87%, respectively, of the total Americas' net sales to unaffiliated customers for the three months ended April 30, 2016 and 2015. Total long-lived assets in the United States represented 95% of the Americas' total long-lived assets at both April 30, 2016 and January 31, 2016. |

| |

(2) | Operating income in the Americas for the three months ended April 30, 2016 and 2015 includes a gain related to LCD settlements, net, of $0.4 million and $38.5 million, respectively (see further discussion in Note 1 – Business and Summary of Significant Accounting Policies). |

ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q, including this Management's Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), contains forward-looking statements, as described in the “safe harbor” provision of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks and uncertainties and actual results could differ materially from those projected. These forward-looking statements regarding future events and the future results of Tech Data Corporation (“Tech Data”, “we”, “our”, “us” or the “Company”) are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances, are forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Readers are referred to the cautionary statements and important factors discussed in Part I, Item 1A. Risk Factors in our Annual Report on Form 10-K for the year ended January 31, 2016 for further information. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

OVERVIEW

Tech Data is one of the world’s largest wholesale distributors of technology products. We serve as an indispensable link in the technology supply chain by bringing products from the world’s leading technology vendors to market, as well as providing our customers with advanced logistics capabilities and value-added services. We manage our business in two geographic segments: the Americas and Europe.

Some of our key financial objectives are to gain share in select product areas in the geographies in which we operate and to improve operating income by growing gross profit faster than operating costs. In addition, we focus on deploying the right level of capital that yields solid operating cash flow generation and a return on invested capital that is above our weighted average cost of capital. To achieve this, we are focused on a strategy of execution, diversification and innovation that we believe differentiates our business in the marketplace.

RESULTS OF OPERATIONS

The following table sets forth our Consolidated Statement of Income as a percentage of net sales:

|

| | | | | | | |

| Three months ended April 30, |

| 2016 | | 2015 |

Net sales | 100.00 |

| % | | 100.00 |

| % |

Cost of products sold | 94.99 |

| | | 95.04 |

| |

Gross profit | 5.01 |

| | | 4.96 |

| |

Operating expenses: | | | | | |

Selling, general and administrative expenses | 4.13 |

| | | 4.22 |

| |

LCD settlements, net | 0.00 |

| | | (0.65 | ) | |

| 4.13 |

| | | 3.57 |

| |

Operating income | 0.88 |

| | | 1.39 |

| |

Interest expense | 0.09 |

| | | 0.10 |

| |

Other (income) expense, net | (0.01 | ) | | | 0.00 |

| |

Income before income taxes | 0.80 |

| | | 1.29 |

| |

Provision for income taxes | 0.24 |

| | | 0.42 |

| |

Net income | 0.56 |

| % | | 0.87 |

| % |

NON-GAAP FINANCIAL INFORMATION

In addition to disclosing financial results that are determined in accordance with generally accepted accounting principles in the United States (“GAAP”), the Company also discloses certain non-GAAP financial information. Certain of these measures are presented as adjusted for the impact of changes in foreign currencies (referred to as “impact of changes in foreign currencies”). Removing the impact of the changes in foreign currencies provides a framework for assessing our financial performance as compared to prior periods. The impact of changes in foreign currencies is calculated by using the exchange rates from the prior year comparable period applied to the results of operations for the current period. The non-GAAP financial measures presented in this document include:

| |

• | Net sales, as adjusted, which is defined as net sales adjusted for the impact of changes in foreign currencies and the impact of the exit of business operations in Chile, Peru and Uruguay (referred to as "impact of exited operations"). The impact of exited operations is calculated by removing the net sales generated in Chile, Peru and Uruguay from the comparable period in the prior year; |

| |

• | Gross profit, as adjusted, which is defined as gross profit as adjusted for the impact of changes in foreign currencies; |

| |

• | Selling, general and administrative expenses (“SG&A”), as adjusted, which is defined as SG&A as adjusted for the impact of changes in foreign currencies; |

| |

• | Non-GAAP operating income, which is defined as operating income as adjusted to exclude LCD settlements, net, restatement and remediation related expenses, loss on disposal of subsidiaries and acquisition-related intangible asset amortization; |

| |

• | Non-GAAP net income, which is defined as net income as adjusted to exclude LCD settlements, net, restatement and remediation related expenses, loss on disposal of subsidiaries, acquisition-related intangible asset amortization and the income tax effects of these adjustments; and |

| |

• | Non-GAAP earnings per share-diluted, which is defined as earnings per share-diluted as adjusted for the per share impact of the items described above. |

Management believes that providing this additional information is useful to the reader to better assess and understand our financial performance as compared with results from previous periods. Management also uses these non-GAAP measures to evaluate performance against certain operational goals. However, analysis of results on a non-GAAP basis should be used as a complement to, and in conjunction with, data presented in accordance with GAAP. Additionally, because these non-GAAP measures are not calculated in accordance with GAAP, they may not necessarily be comparable to similarly titled measures reported by other companies.

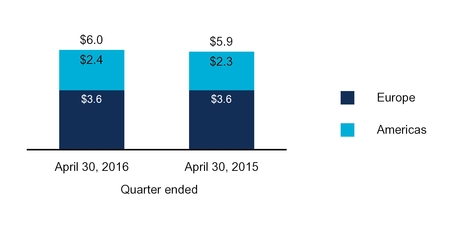

NET SALES

The following tables summarize our net sales and change in net sales by geographic region for the three months ended April 30, 2016 and 2015 (in billions):

|

| | | | | | | | | | | | | | |

| Three months ended April 30 | | Change |

| 2016 | | 2015 | | $ | | % |

(in millions) | | | | | | | |

Consolidated net sales, as reported | $ | 5,963 |

| | $ | 5,887 |

| | $ | 76 |

| | 1.3 | % |

Impact of changes in foreign currencies | 21 |

| | — |

| | | | |

Impact of exited operations | — |

| | (21 | ) | | | | |

Consolidated net sales, as adjusted | $ | 5,984 |

| | $ | 5,866 |

| | $ | 118 |

| | 2.0 | % |

| | | | | | | |

Americas net sales, as reported | $ | 2,388 |

| | $ | 2,339 |

| | $ | 49 |

| | 2.1 | % |

Impact of changes in foreign currencies | 20 |

| | — |

| | | | |

Impact of exited operations | — |

| | (21 | ) | | | | |

Americas net sales, as adjusted | $ | 2,408 |

| | $ | 2,318 |

| | $ | 90 |

| | 3.9 | % |

| | | | | | | |

Europe net sales, as reported | $ | 3,575 |

| | $ | 3,548 |

| | $ | 27 |

| | 0.8 | % |

Impact of changes in foreign currencies | 1 |

| | — |

| | | | |

Europe net sales, as adjusted | $ | 3,576 |

| | $ | 3,548 |

| | $ | 28 |

| | 0.8 | % |

NET SALES COMMENTARY

|

| |

AMERICAS | EUROPE |

Americas net sales, as adjusted, increased by $90 million primarily due to growth in the broadline product category. | The increase in net sales in Europe, as adjusted, of $28 million is primarily due to growth in the broadline product category, partially offset by lower sales of mobility and data center products. |

The following table provides an analysis of sales generated from products purchased from Apple, Inc., HP Inc. and Hewlett-Packard Company ("HP") (as a percent of consolidated net sales):

|

| | |

Three months ended April 30: | 2016 | 2015 |

Apple, Inc. | 17% | 16% |

HP Inc. (a) | 14% | —% |

HP (a) | —% | 19% |

(a) Effective November 1, 2015, HP split into two companies, HP Inc. and Hewlett Packard Enterprise. Amounts presented for the three months ended April 30, 2015 represent the sales of HP prior to the split.

There were no other vendors or any customers that exceeded 10% of our consolidated net sales for the three months ended April 30, 2016 and 2015.

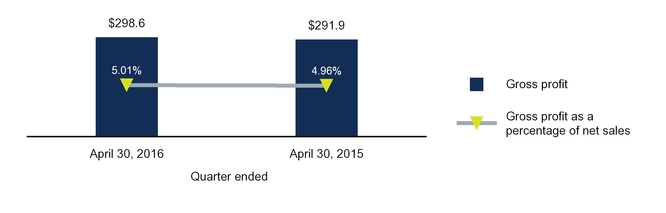

GROSS PROFIT

The following tables provide an analysis of our gross profit and gross profit as a percentage of net sales for the three months ended April 30, 2016 and 2015 (in millions):

|

| | | | | | | | | | | | | | |

| Three months ended April 30 | | Change |

| 2016 | | 2015 | | $ | | % |

(in millions) | | | | | | | |

Gross profit, as reported | $ | 298.6 |

| | $ | 291.9 |

| | $ | 6.7 |

| | 2.3 | % |

Impact of changes in foreign currencies | 0.6 |

| | — |

| | | | |

Gross profit, as adjusted | $ | 299.2 |

| | $ | 291.9 |

| | $ | 7.3 |

| | 2.5 | % |

The increase in gross profit, as adjusted, of $7.3 million is primarily due to increased sales, as adjusted for the impact of changes in foreign currencies.

OPERATING EXPENSES

SELLING GENERAL AND ADMINISTRATIVE EXPENSES

The following tables provide an analysis of our selling, general and administrative expenses:

|

| | | | | | | | | | | | | | |

| Three months ended April 30 | | Change |

| 2016 | | 2015 | | $ | | % |

(in millions) | | | | | | | |

SG&A, as reported | $ | 246.5 |

| | $ | 248.5 |

| | $ | (2.0 | ) | | (0.8 | )% |

Impact of changes in foreign currencies | 0.5 |

| | — |

| | | | |

SG&A, as adjusted | $ | 247.0 |

| | $ | 248.5 |

| | $ | (1.5 | ) | | (0.6 | )% |

| | | | | | | |

SG&A as a percentage of net sales, as reported | 4.13 | % | | 4.22 | % | |

| | (9) bps |

|

The year over year decrease in SG&A as a percentage of net sales is primarily due to greater operating leverage as we generated sales growth while keeping our SG&A expenses relatively flat.

LCD SETTLEMENTS, NET

We have been a claimant in proceedings seeking damages from certain manufacturers of LCD flat panel and cathode ray tube displays. We reached settlement agreements with certain manufacturers in the amount of $0.4 million and $38.5 million, respectively, during the three months ended April 30, 2016 and 2015, net of attorney fees and expenses.

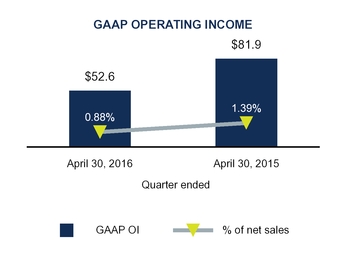

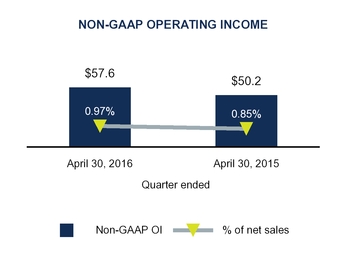

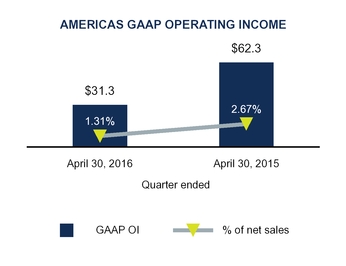

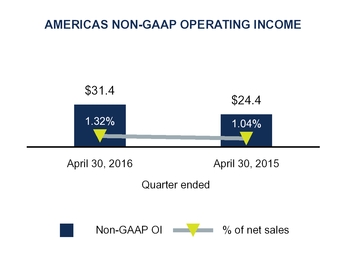

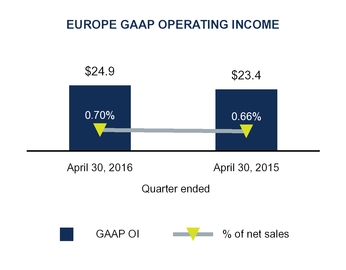

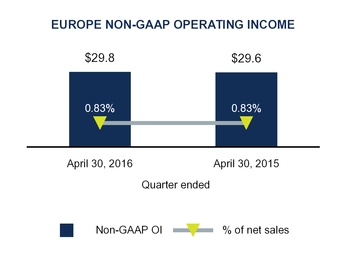

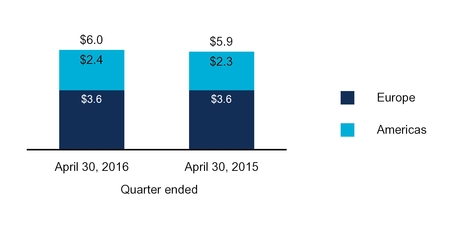

OPERATING INCOME

The following tables provide an analysis of GAAP operating income ("GAAP OI") and non-GAAP operating income ("non-GAAP OI") on a consolidated and regional basis as well as a reconciliation of GAAP operating income to non-GAAP operating income on a consolidated and regional basis for the three months ended April 30, 2016 and 2015 (in millions):

FIRST QUARTER COMMENTARY

| |

• | The decrease in GAAP operating income of $29.3 million is primarily due to a decrease of $38.1 million in gains related to settlement agreements with certain manufacturers of LCD flat panel and cathode ray tube displays, net of attorney fees and expenses, partially offset by an increase in net sales. |

| |

• | The increase in non-GAAP operating income of $7.4 million is primarily due to an increase in net sales while keeping SG&A expenses relatively flat. |

|

| | | | | | | |

CONSOLIDATED GAAP TO NON-GAAP RECONCILIATION OF OPERATING INCOME |

Three months ended April 30: | 2016 | | 2015 |

(in millions) | | | |

Operating income | $ | 52.6 |

| | $ | 81.9 |

|

LCD settlements, net | (0.4 | ) | | (38.5 | ) |

Restatement and remediation related expenses | — |

| | 0.6 |

|

Loss on disposal of subsidiaries | — |

| | 0.4 |

|

Acquisition-related intangible assets amortization expense | 5.4 |

| | 5.8 |

|

Non-GAAP operating income | $ | 57.6 |

| | $ | 50.2 |

|

OPERATING INCOME BY REGION

We do not consider stock-based compensation expenses in assessing the performance of our operating segments, and therefore the Company reports stock-based compensation expenses separately. The following table summarizes our operating income by geographic region.

|

| | | | | | | |

Three months ended April 30: | 2016 | | 2015 |

(in millions) | | | |

Americas | $ | 31.3 |

| | $ | 62.3 |

|

Europe | 24.9 |

| | 23.4 |

|

Stock-based compensation expense | (3.6 | ) | | (3.8 | ) |

Total | $ | 52.6 |

| | $ | 81.9 |

|

AMERICAS FIRST QUARTER COMMENTARY

| |

• | The decrease in GAAP operating income of $31.0 million is primarily due to a decrease of $38.1 million in gains related to settlement agreements with certain manufacturers of LCD flat panel and cathode ray tube displays, net of attorney fees and expenses, partially offset by an increase in net sales. |

| |

• | The increase in non-GAAP operating income of $7.0 million is primarily due to an increase in net sales. |

|

| | | | | | | |

AMERICAS GAAP TO NON-GAAP RECONCILIATION OF OPERATING INCOME |

Three months ended April 30: | 2016 | | 2015 |

(in millions) | | | |

Operating income - Americas | $ | 31.3 |

| | $ | 62.3 |

|

LCD settlements, net | (0.4 | ) | | (38.5 | ) |

Loss on disposal of subsidiaries | — |

| | 0.4 |

|

Acquisition-related intangible assets amortization expense | 0.5 |

| | 0.2 |

|

Non-GAAP operating income - Americas | $ | 31.4 |

| | $ | 24.4 |

|

|

| | | | | | | |

EUROPE GAAP TO NON-GAAP RECONCILIATION OF OPERATING INCOME |

Three months ended April 30: | 2016 | | 2015 |

(in millions) | | | |

Operating income - Europe | $ | 24.9 |

| | $ | 23.4 |

|

Restatement and remediation related expenses | — |

| | 0.6 |

|

Acquisition-related intangible assets amortization expense | 4.9 |

| | 5.6 |

|

Non-GAAP operating income - Europe | $ | 29.8 |

| | $ | 29.6 |

|

OTHER (INCOME) EXPENSE, NET

Other (income) expense, net, consists primarily of gains and losses on investments in life insurance policies to fund the Company's nonqualified deferred compensation plan, interest income, discounts on the sale of accounts receivable and net foreign currency exchange gains and losses on certain financing transactions and the related derivative instruments used to hedge such financing transactions. Other (income) expense, net, was $1.0 million of income in the first quarter of fiscal 2017 compared to $0.2 million of expense in the first quarter of the prior year. The change in other (income) expense, net, during the first three months of fiscal 2017 is primarily attributable to higher gains on investments in life insurance policies of $1.1 million, as compared to the same period of the prior fiscal year.

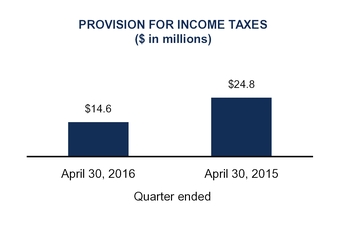

PROVISION FOR INCOME TAXES

|

| | | | |

Three months ended April 30: | | 2016 | | 2015 |

Effective tax rate | | 30.5% | | 32.6% |

The decrease in the effective tax rate of approximately 2 percentage points is primarily the result of the relative mix of earnings and losses within the tax jurisdictions in which we operate as well as the impact of certain favorable discrete tax items. The decrease in the absolute dollar value of the provision for income taxes in the first quarter of fiscal 2017 as compared to the first quarter of fiscal 2016 is primarily due to a decrease in taxable earnings and the relative mix of earnings and losses within the taxing jurisdictions in which we operate.

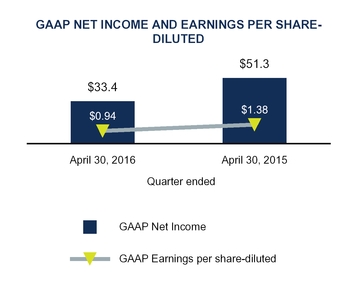

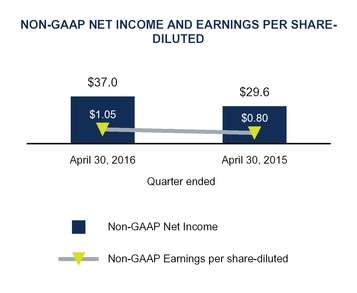

NET INCOME AND EARNINGS PER SHARE-DILUTED

The following tables provide an analysis of GAAP and non-GAAP net income and earnings per share-diluted as well as a reconciliation of results recorded in accordance with GAAP and non-GAAP financial measures for the three months ended April 30, 2016 and 2015 ($ in millions, except per share data):

|

| | | | | | | |

CONSOLIDATED GAAP TO NON-GAAP RECONCILIATION OF NET INCOME |

Three months ended April 30: | 2016 | | 2015 |

(in millions) | | | |

Net income | $ | 33.4 |

| | $ | 51.3 |

|

LCD settlements, net | (0.4 | ) | | (38.5 | ) |

Restatement and remediation related expenses | — |

| | 0.6 |

|

Loss on disposal of subsidiaries | — |

| | 0.4 |

|

Acquisition-related intangible assets amortization expense | 5.4 |

| | 5.8 |

|

Income tax effect of the above adjustments | (1.4 | ) | | 10.0 |

|

Non-GAAP net income | $ | 37.0 |

| | $ | 29.6 |

|

|

| | | | | | | |

CONSOLIDATED GAAP TO NON-GAAP RECONCILIATION OF EARNINGS PER SHARE-DILUTED |

Three months ended April 30: | 2016 | | 2015 |

Earnings per share-diluted | $ | 0.94 |

| | $ | 1.38 |

|

LCD settlements, net | (0.01 | ) | | (1.04 | ) |

Restatement and remediation related expenses | — |

| | 0.02 |

|

Loss on disposal of subsidiaries | — |

| | 0.01 |

|

Acquisition-related intangible assets amortization expense | 0.15 |

| | 0.16 |

|

Income tax effect of the above adjustments | (0.03 | ) | | 0.27 |

|

Non-GAAP earnings per share-diluted | $ | 1.05 |

| | $ | 0.80 |

|

LIQUIDITY AND CAPITAL RESOURCES

Our discussion of liquidity and capital resources includes an analysis of our cash flows and capital structure for all periods presented.

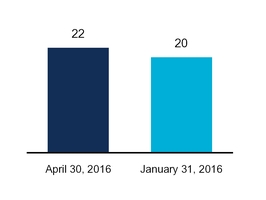

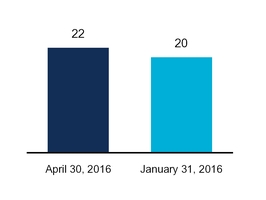

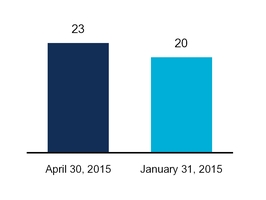

CASH CONVERSION CYCLE

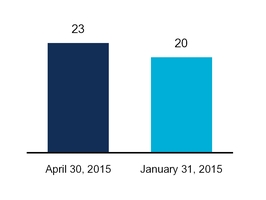

As a distribution company, our business requires significant investment in working capital, particularly accounts receivable and inventory, partially financed through our accounts payable to vendors. An important driver of our operating cash flows is our cash conversion cycle (also referred to as “net cash days”). Our net cash days are defined as days of sales outstanding in accounts receivable ("DSO") plus days of supply on hand in inventory ("DOS"), less days of purchases outstanding in accounts payable ("DPO"). We manage our cash conversion cycle on a daily basis throughout the year and our reported financial results reflect that cash conversion cycle at the balance sheet date. The following tables present the components of our cash conversion cycle, in days, as of April 30, 2016 and 2015, and January 31, 2016 and 2015.

NET CASH DAYS

|

| | | | | | | | | | | | | |

As of: | | April 30, 2016 | | January 31, 2016 | | As of: | April 30, 2015 | | January 31, 2015 |

DSO | | 39 |

| | 37 |

| | DSO | 40 |

| | 35 |

|

DOS | | 34 |

| | 27 |

| | DOS | 32 |

| | 26 |

|

DPO | | (51 | ) | | (44 | ) | | DPO | (49 | ) | | (41 | ) |

Net cash days | | 22 |

| | 20 |

| | Net cash days | 23 |

| | 20 |

|

CASH FLOWS

The following table summarizes Tech Data’s Consolidated Statement of Cash Flows:

|

| | | | | | | |

Three months ended April 30: | 2016 | | 2015 |

(in millions) | | | |

Net cash provided by (used in): | | | |

Operating activities | $ | 275.8 |

| | $ | 107.3 |

|

Investing activities | (11.6 | ) | | 11.5 |

|

Financing activities | (5.1 | ) | | (51.0 | ) |

Effect of exchange rate changes on cash and cash equivalents | 35.5 |

| | 8.4 |

|

Net increase in cash and cash equivalents | $ | 294.6 |

| | $ | 76.2 |

|

The increase of $168.4 million in cash resulting from operating activities in the first quarter of fiscal 2017 compared to the same period of the prior year is primarily due to changes in working capital, including an increase in cash received from customers, and cash received of approximately $44 million related to prior year LCD settlements.

The increase in net cash used in investing activities of $23.1 million can be attributed to $18.7 million of proceeds in the prior year from the sale of our subsidiaries in Chile and Peru and an increase of $4.4 million in capital expenditures. The decrease of $45.9 million in cash used in financing activities can be primarily attributed to the repurchase of shares of common stock in the prior year under our December 2014 share repurchase program in the amount of $47.0 million.

CAPITAL RESOURCES AND DEBT COMPLIANCE

Our debt to total capital ratio was 15% at April 30, 2016. We believe a conservative approach to our capital structure will continue to support us in the current global economic environment. As part of our capital structure and to provide us with significant liquidity, we have a diverse range of financing facilities across our geographic regions with various financial institutions. Also providing us liquidity are our cash and cash equivalents balances across our regions which are deposited and/or invested with various financial institutions. We are exposed to risk of loss on funds deposited with these financial institutions; however, we monitor our financing and depository financial institution partners regularly for credit quality. We believe that our existing sources of liquidity, including our financing facilities, cash resources and cash provided by operating activities are sufficient to meet our working capital needs and cash requirements for at least the next 12 months. Apart from our working capital needs, we expect to incur total capital expenditures of approximately $44 million during fiscal 2017 for equipment and machinery in our logistics centers, office facilities and IT systems.

At April 30, 2016, we had approximately $825.7 million in cash and cash equivalents, of which $769.0 million was held in our foreign subsidiaries. As discussed above, the Company currently has sufficient resources, cash flows and liquidity within the United States to fund current and expected future working capital requirements. Historically, the Company has utilized and reinvested cash earned outside the United States to fund foreign operations and expansion, and plans to continue reinvesting such earnings and future earnings indefinitely outside of the United States. If the Company’s plans for the use of cash earned outside of the United States change in the future, cash and cash equivalents held by our foreign subsidiaries could not be repatriated to the United States without potential negative income tax consequences.

The following is a discussion of our various financing facilities:

Senior notes

In September 2012, the Company issued $350.0 million aggregate principal amount of 3.75% Senior Notes in a public offering (the "Senior Notes") resulting in cash proceeds of approximately $345.8 million, net of debt discount and debt issuance costs of approximately $1.3 million and $2.9 million, respectively. The debt discount and debt issuance costs incurred in connection with the public offering are amortized over the life of the Senior Notes as additional interest expense using the effective interest method. We pay interest on the Senior Notes semi-annually in arrears on March 21 and September 21 of each year, ending on the maturity date of September 21, 2017. We may, at our option, redeem the Senior Notes at any time in whole or in part, at a redemption price equal to the greater of (i) 100% of the principal amount of the Senior Notes to be redeemed or (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the Senior Notes being redeemed, discounted at a rate equal to the sum of the applicable Treasury Rate plus 50 basis points, plus accrued and unpaid interest up to the date of redemption. The Senior Notes rank equal in right of payment to all of our other senior unsecured indebtedness and senior in right of payment to all of our subordinated indebtedness.

Other credit facilities

We have a $500.0 million revolving credit facility with a syndicate of banks (the “Credit Agreement”). The credit agreement was amended in November 2015, which, among other things, provides for (i) a maturity date of November 5, 2020, (ii) an interest rate on borrowings, facility fees and letter of credit fees based on our non-credit enhanced senior unsecured debt rating as determined by Standard & Poor’s Rating Service and Moody’s Investor Service, and (iii) the ability to increase the facility to a maximum of $750.0 million, subject to certain conditions. We pay interest on advances under the Credit Agreement at the applicable LIBOR rate (or similar interbank offered rates depending on currency draw) plus a predetermined margin that is based on our debt rating. There were no amounts outstanding under the Credit Agreement at April 30, 2016 and January 31, 2016.

We also have an agreement with a syndicate of banks (the "Receivables Securitization Program") that allows us to transfer an undivided interest in a designated pool of U.S. accounts receivable, on an ongoing basis, to provide collateral for borrowings up to a maximum of $400.0 million. Under this program, the Company transfers certain U.S. trade receivables into a wholly-owned bankruptcy remote special purpose entity. Such receivables, which are recorded in the Consolidated Balance Sheet, totaled $654.8 million and $721.1 million at April 30, 2016 and January 31, 2016, respectively. As collections reduce accounts receivable balances included in the collateral pool, the Company may transfer interests in new receivables to bring the amount available to be borrowed up to the maximum. The Receivables Securitization Program was renewed in August 2015 with a maturity date of November 16, 2017, and interest is to be paid on advances at the applicable commercial paper or LIBOR rate plus an agreed-upon margin. There were no amounts outstanding under the Receivables Securitization Program at April 30, 2016 and January 31, 2016.

In addition to the facilities described above, we have various other committed and uncommitted lines of credit and overdraft facilities totaling approximately $316.3 million at April 30, 2016 to support our operations. Most of these facilities are provided on an unsecured, short-term basis and are reviewed periodically for renewal. There was $17.9 million outstanding on these facilities at April 30, 2016, at an average interest rate of 6.01% and there was $18.1 million outstanding on these facilities at January 31, 2016, at a weighted average interest rate of 5.26%.

At April 30, 2016, we had also issued standby letters of credit of $32.0 million. These letters of credit typically act as a guarantee of payment to certain third parties in accordance with specified terms and conditions. The issuance of these letters of credit reduces the Company's borrowing availability under certain of the above-mentioned credit facilities.

Certain of our credit facilities contain limitations on the amounts of annual dividends and repurchases of common stock and require compliance with other obligations, warranties and covenants. The financial ratio covenants within these credit facilities include a maximum debt to capitalization ratio and a minimum interest coverage ratio. At April 30, 2016, we were in compliance with all such financial covenants. In light of these financial covenants, the Company’s maximum borrowing availability on its credit facilities was restricted to $863.6 million, of which $17.9 million was outstanding at April 30, 2016.

Accounts receivable purchase agreements

We have uncommitted accounts receivable purchase agreements under which certain accounts receivable may be sold, without recourse, to third-party financial institutions. Under these programs, we may sell certain accounts receivable in exchange for cash less a discount, as defined in the agreements. Available capacity under these programs, which we use as a source of working capital funding, is dependent on the level of accounts receivable eligible to be sold into these programs and the financial institutions' willingness to purchase such receivables. In addition, certain of these agreements also require that we continue to service, administer and collect the sold accounts receivable. At April 30, 2016 and January 31, 2016, the Company had a total of $430.6 million and $554.2 million, respectively, of accounts receivable sold to and held by financial institutions under these agreements. During the three months ended April 30, 2016 and 2015, discount fees recorded under these facilities were $1.2 million and $1.0 million, respectively. These discount fees are included as a component of "other (income) expense, net" in our Consolidated Statement of Income.

RETURN ON INVESTED CAPITAL

As discussed previously, one of our key financial objectives is to earn a return on invested capital ("ROIC") above our weighted average cost of capital. Our ROIC is calculated based on the trailing twelve months non-GAAP operating income (as previously defined), on an after-tax basis, divided by the average total debt and non-GAAP shareholders’ equity balances, less cash, for the prior five quarters. Management believes that providing this additional information is useful to investors because it provides a meaningful comparison of our performance between periods. The following table presents a detailed calculation of our ROIC:

|

| | | | | | | |

Twelve months ended April 30: | 2016 | | 2015 |

(in millions) | | | |

ROIC (A/B) | 14% | | 11% |

| | | |

Non-GAAP Net Operating Profit After Tax ("NOPAT") (A): | | | |

Non-GAAP Operating Income | $ | 326.4 |

| | $ | 307.0 |

|

Non-GAAP Effective Tax Rate | 28.1 | % | | 31.2 | % |

Non-GAAP NOPAT (Non-GAAP operating income x (1 - non-GAAP effective tax rate)) | $ | 234.8 |

| | $ | 211.4 |

|

| | | |

Average Invested Capital (B): | | | |

Short-term debt (5-qtr average) | $ | 17.5 |

| | $ | 34.9 |

|

Long-term debt (5-qtr average) | 349.8 |

| | 351.9 |

|

Non-GAAP Shareholders' Equity (5-qtr average) | 1,976.2 |

| | 2,075.2 |

|

Total average capital | 2,343.5 |

| | 2,462.0 |

|

Less: Cash (5-qtr average) | (654.3 | ) | | (583.0 | ) |

Average invested capital less average cash | $ | 1,689.2 |

| | $ | 1,879.0 |

|

(A/B) ROIC is calcluated as Non-GAAP Net Operating Profit After Tax divided by Average Invested Capital (less average cash)

RECENT ACCOUNTING PRONOUNCEMENTS

See Note 1 of Notes to Consolidated Financial Statements for the discussion on recent accounting pronouncements.

ITEM 3. Quantitative and Qualitative Disclosures About Market Risk.

For a description of the Company’s market risks, see “Part II, Item 7A. Qualitative and Quantitative Disclosures About Market Risk” in our Annual Report on Form 10-K for the fiscal year ended January 31, 2016. No material changes have occurred in our market risks since January 31, 2016.

ITEM 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

The Company maintains disclosure controls and procedures designed to ensure that information required to be disclosed in reports filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is recorded, processed, summarized and reported within the specified time period. Tech Data’s management, with the participation of the Company’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), has evaluated the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act), as of April 30, 2016. Based on that evaluation, the Company’s CEO and CFO concluded that the Company’s disclosure controls and procedures were effective as of April 30, 2016.

Changes in Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) identified in connection with management’s evaluation during our first quarter of fiscal 2017 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

PART II

ITEM 1. Legal Proceedings.