Exhibit 13

National Bancshares Corporation

Annual Report to Security Holders

for the year ended

December 31, 2012

(See Attached)

TABLE OF CONTENTS

| 3 | Message to Shareholders | |||

| 5 | Financial Highlights | |||

| 6 | Selected Financial Data | |||

| 8 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||

| 27 | Consolidated Balance Sheets | |||

| 28 | Consolidated Statements of Income | |||

| 29 | Consolidated Statements of Comprehensive Income | |||

| 30 | Consolidated Statements of Changes in Shareholders’ Equity | |||

| 31 | Consolidated Statements of Cash Flows | |||

| 32 | Notes to Consolidated Financial Statements December 31, 2012, 2011 and 2010 | |||

| 62 | Report of Independent Registered Public Accounting Firm | |||

| 64 | Report of Management on the Corporation’s Internal Control Over Financial Reporting | |||

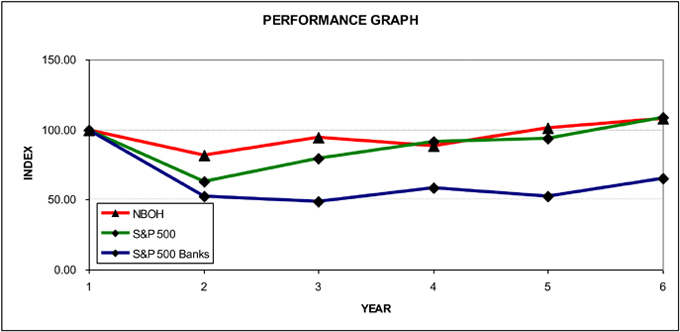

| 65 | Comparison of Five-Year Cumulative Total Return of National Bancshares Corporation, S&P 500 Stock Index, and S&P 500 Bank Index | |||

| 66 | Price Range of Common Stock | |||

| 66 | Shareholder Information | |||

| 67 | Officers | |||

| 68 | Directors | |||

| 68 | First National Bank Offices | |||

1

(This page left intentionally blank)

2

Dear Shareholders;

I am pleased to present our 2012 Annual Report. This report will show 2012 was a year of growth and outstanding performance by National Bancshares Corporation.

Our Bank’s Directors and staff continue to focus on providing our communities with a first class banking experience. We pride ourselves on being able to provide solutions for the financial challenges facing our customers. Whether a growing business needs a new facility, a farmer wants to upgrade his equipment or a family is looking for an attractive interest rate on a checking account, First National Bank can deliver.

Agriculture and small business continue to perform well and provide a strong foundation for our local economy. The Agribusiness and Community Banking Group focuses on agriculture lending, small business lending and cash management services. The Business Banking Group focuses on lending and cash management services for larger businesses and corporations. Total loans increased $51.8 million or 23.9% from $217.1 million as of December 31, 2011 to $268.9 million as of December 31, 2012. The loan-to-asset ratio increased from 53% as of year end 2011 to 61% as of year end 2012.

Net income rose to $2.8 million in 2012, compared to $2.6 million in 2011. Basic and diluted earnings per share increased from $1.18 in 2011 to $1.27 in 2012. Earnings in 2012 were positively impacted by increases in net interest income and mortgage banking activities and lower noninterest expense.

Total assets increased to $440.8 million as of December 31, 2012 from $406.1 million as of December 31, 2011. Total deposits increased from $340.7 million as of year end 2011 to $367.1 million as of year end 2012. Shareholders’ equity increased 6.0% to $45.3 million at the end of 2012, compared to $42.7 million at the end of 2011.

We expect continued growth in loans and deposits in 2013 as we focus on serving our customers and building new banking relationships. I am excited about the opportunities we have to share the First National Bank experience with our current and future customers.

On behalf of the Board of Directors and our staff, I would like to thank you for your continued confidence in National Bancshares Corporation and First National Bank.

Mark R. Witmer

President and CEO

3

CHARITABLE GIVING COMMITTEE

In 2012, the Charitable Giving Committee of the Board of Directors approved gifts to the following organizations.

| Every Woman’s House | Orrville-Dalton YMCA | |

| Fairlawn Chamber of Commerce | Orrville Public Library | |

| First National Bank Scholarship | Orrville Salvation Army | |

| (Wayne County Community Foundation) |

Orrville United Way, Inc. | |

| Heartland Education Community, Inc. | Paint Township Area Fireworks | |

| HOPE Fund | Smithville Community Historical Society | |

| Hospice of Wayne County | Stark County Development Board | |

| Kidron Community Historical Society | STEPS (FKA Wayne County Alcoholism Services) | |

| Main Street Orrville | United Way of Wayne and Holmes Counties | |

| Main Street Wooster, Inc. | United Way of Western Stark County | |

| Massillon Boys and Girls Club | Village Network (FKA Boy’s Village) | |

| Massillon Chamber of Commerce | Wayne County Capital Campaign | |

| Newspapers in Education | Wayne Development Council | |

| Ohio Funding for Independent Colleges | Wayne/Holmes Soap Box Derby | |

| Orr Views | Wee Care Center, Inc. | |

| Orrville Area Boys and Girls Club | Wooster Chamber of Commerce | |

| Orrville Booster Club/Turf Fund | ||

| Orrville Chamber of Commerce |

4

FINANCIAL HIGHLIGHTS

These financial highlights are excerpts of and are not a substitute for National Bancshares Corporation’s consolidated financial statements, including notes, and other detailed financial information we provide elsewhere in this document. You should read the entire document, including the consolidated financial statements and notes to the consolidated financial statements.

Financial Position

(Dollar amounts in thousands, except per share data)

| Percentage | ||||||||||||

| 2012 | 2011 | Change | ||||||||||

| At December 31, |

||||||||||||

| Total assets |

$ | 440,834 | $ | 406,086 | 8.6 | % | ||||||

| Deposits |

367,069 | 340,664 | 7.7 | % | ||||||||

| Loans, net |

265,539 | 213,952 | 24.1 | % | ||||||||

| Securities |

121,650 | 150,175 | (19.0 | )% | ||||||||

| Shareholders’ equity |

45,321 | 42,745 | 6.0 | % | ||||||||

| Book value per share |

20.42 | 19.31 | 5.7 | % | ||||||||

| Year ended December 31, |

||||||||||||

| Net interest income |

$ | 14,227 | $ | 13,363 | 6.5 | % | ||||||

| Income before income taxes |

3,362 | 3,056 | 19.8 | % | ||||||||

| Net income |

2,811 | 2,612 | 7.6 | % | ||||||||

| Cash dividends declared |

711 | 706 | 0.7 | % | ||||||||

| Net income per share |

1.27 | 1.18 | 7.6 | % | ||||||||

| Cash dividends per share |

0.32 | 0.32 | 0.0 | % | ||||||||

National Bancshares Corporation is the holding company for First National Bank, a federally chartered national bank formed in Ohio in 1881. First National Bank has fourteen offices in Orrville, Massillon, Wooster, Apple Creek, Dalton, Fairlawn, Kidron, Lodi, Mt. Eaton, Seville and Smithville. Additional information is available at www.discoverfirstnational.com.

5

SELECTED FINANCIAL DATA

(Dollar amounts in thousands, except per share data)

| As of or for the years ended December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| Income statement data: |

||||||||||||||||||||

| Interest income |

$ | 15,989 | $ | 15,413 | $ | 15,501 | $ | 16,465 | $ | 17,071 | ||||||||||

| Interest expense |

1,762 | 2,050 | 3,219 | 4,237 | 5,785 | |||||||||||||||

| Net interest income |

14,227 | 13,363 | 12,282 | 12,228 | 11,286 | |||||||||||||||

| Provision for loan losses |

1,374 | 600 | 2,229 | 1,829 | 482 | |||||||||||||||

| Net interest income after provision for loan losses |

12,853 | 12,763 | 10,053 | 10,399 | 10,804 | |||||||||||||||

| Noninterest income |

2,897 | 3,032 | 3,190 | 2,972 | 2,333 | |||||||||||||||

| Noninterest expense |

12,388 | 12,739 | 11,847 | 11,364 | 10,173 | |||||||||||||||

| Income before income taxes |

3,362 | 3,056 | 1,396 | 2,007 | 2,964 | |||||||||||||||

| Income taxes |

551 | 444 | 71 | 398 | 770 | |||||||||||||||

| Net income |

2,811 | 2,612 | 1,325 | 1,609 | 2,194 | |||||||||||||||

| Balance sheet data: |

||||||||||||||||||||

| Cash and due from banks |

$ | 27,624 | $ | 15,213 | $ | 12,837 | $ | 8,124 | $ | 11,001 | ||||||||||

| Securities |

121,650 | 150,175 | 138,033 | 130,241 | 127,248 | |||||||||||||||

| Loans, net |

265,539 | 213,952 | 190,685 | 194,071 | 179,831 | |||||||||||||||

| Deposits |

367,069 | 340,664 | 309,134 | 291,373 | 263,642 | |||||||||||||||

| Borrowings |

23,633 | 18,168 | 23,471 | 36,720 | 34,285 | |||||||||||||||

| Shareholders’ equity |

45,321 | 42,745 | 38,981 | 38,903 | 36,881 | |||||||||||||||

| Total assets |

440,834 | 406,086 | 374,096 | 370,228 | 338,002 | |||||||||||||||

| Share and per share data: |

||||||||||||||||||||

| Net income |

$ | 1.27 | $ | 1.18 | $ | 0.60 | $ | 0.73 | $ | 1.00 | ||||||||||

| Cash dividends |

0.32 | 0.32 | 0.32 | 0.32 | 0.64 | |||||||||||||||

| Book value at period end |

20.42 | 19.31 | 17.67 | 17.64 | 16.75 | |||||||||||||||

| Weighted average number of shares outstanding |

2,219,965 | 2,211,508 | 2,205,973 | 2,202,457 | 2,203,218 | |||||||||||||||

| Performance ratios: |

||||||||||||||||||||

| Return on average equity |

6.39 | % | 6.39 | % | 3.34 | % | 4.21 | % | 6.20 | % | ||||||||||

| Return on average assets |

0.65 | % | 0.66 | % | 0.35 | % | 0.46 | % | 0.70 | % | ||||||||||

| Dividend payout percentage |

25.29 | % | 27.03 | % | 53.28 | % | 43.82 | % | 64.00 | % | ||||||||||

| Efficiency ratio (1) |

72.34 | % | 77.70 | % | 76.56 | % | 74.76 | % | 74.70 | % | ||||||||||

| Full-time equivalent staff |

113 | 115 | 113 | 101 | 108 | |||||||||||||||

| Average total assets to full-time equivalent staff |

$ | 3,857 | $ | 3,463 | $ | 3,370 | $ | 3,491 | $ | 2,916 | ||||||||||

| Asset quality ratios: |

||||||||||||||||||||

| Allowance for loan losses to ending total loans |

1.26 | % | 1.46 | % | 1.34 | % | 1.48 | % | 0.95 | % | ||||||||||

| Net loan charge-offs to average loans |

0.48 | % | 0.01 | % | 1.30 | % | 0.35 | % | 0.41 | % | ||||||||||

| Capital ratios: |

||||||||||||||||||||

| Average equity to average assets |

10.09 | % | 10.26 | % | 10.40 | % | 10.84 | % | 11.24 | % | ||||||||||

| Leverage ratio (2) |

7.59 | % | 7.78 | % | 7.46 | % | 7.40 | % | 7.78 | % | ||||||||||

| Total risk-based capital ratio (2) |

12.53 | % | 13.85 | % | 13.59 | % | 12.46 | % | 12.60 | % | ||||||||||

| (1) | The efficiency ratio is calculated by dividing noninterest expenses by the sum of net interest income and noninterest income. |

| (2) | First National Bank ratios computed in accordance with regulatory guidelines. |

6

SELECTED FINANCIAL DATA

The following table shows quarterly results of operations for 2012 and 2011.

| Income | Basic and | |||||||||||||||||||||||

| Interest | Net interest | Provision for | (loss) before | diluted earnings | ||||||||||||||||||||

| income | income | loan losses | income taxes | Net income | per share | |||||||||||||||||||

| (Dollar amounts in thousands, except per share data) | ||||||||||||||||||||||||

| 2012 |

||||||||||||||||||||||||

| First quarter |

$ | 3,850 | $ | 3,397 | $ | 149 | $ | 838 | $ | 700 | $ | 0.32 | ||||||||||||

| Second quarter |

3,954 | 3,483 | 981 | 258 | 317 | 0.14 | ||||||||||||||||||

| Third quarter |

4,108 | 3,669 | 209 | 1,081 | 857 | 0.39 | ||||||||||||||||||

| Fourth quarter |

4,077 | 3,678 | 35 | 1,185 | 937 | 0.42 | ||||||||||||||||||

| 2011 |

||||||||||||||||||||||||

| First quarter |

$ | 3,675 | $ | 3,097 | $ | 147 | $ | 536 | $ | 487 | $ | 0.22 | ||||||||||||

| Second quarter |

3,892 | 3,370 | 150 | 693 | 589 | 0.27 | ||||||||||||||||||

| Third quarter |

3,920 | 3,439 | 150 | 950 | 762 | 0.34 | ||||||||||||||||||

| Fourth quarter |

3,926 | 3,457 | 153 | 877 | 774 | 0.35 | ||||||||||||||||||

7

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

This section of the annual report is intended to assist the reader in evaluating the performance of National Bancshares Corporation for the years ended December 31, 2012, 2011 and 2010. This information should be read in conjunction with the consolidated financial statements and accompanying notes to the financial statements.

Forward Looking Statement

The Private Securities Litigation Reform Act of 1995 contains safe harbor provisions regarding forward-looking statements. Forward-looking statements can be identified by terminology such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “should,” “will,” “plans,” “potential” and similar words. Forward-looking statements are also statements that are not statements of historical fact. Forward-looking statements necessarily involve risks and uncertainties. They are merely predictive or statements of probabilities, involving known and unknown risks, uncertainties and other factors. If one or more of these risks or uncertainties occurs or if the underlying assumptions prove incorrect, actual results in 2012 and beyond could differ materially from those expressed in or implied by the forward-looking statements.

Forward-looking statements are based upon a variety of estimates and assumptions. The estimates and assumptions involve judgments about a number of things, including future economic, competitive, and financial market conditions and future business decisions. These matters are inherently subject to significant business, economic, and competitive uncertainties, all of which are difficult to predict and many of which are beyond National Bancshares Corporation’s control. Although we believe the estimates and assumptions are reasonable, actual results could vary materially from those shown. Inclusion of forward-looking information does not constitute a representation by National Bancshares Corporation or any other person that the indicated results will be achieved. You are cautioned not to place undue reliance on forward-looking information.

Management Strategy

The Corporation is a community-oriented financial institution offering a variety of financial services to meet the needs of the communities it serves. The Corporation attracts deposits from the general public and uses such deposits, together with borrowings and other funds, primarily to originate commercial and commercial real estate loans, single-family and multi-family residential mortgage loans, home equity loans and lines of credit and consumer loans.

During 2012, the Corporation operated under a strategic plan which is updated, modified and adopted annually by the Board of Directors. The plan calls for achieving an above peer return on equity, achieving a loan to asset ratio of 60%, reducing the net overhead ratio to 2.3%, maintaining cash-type deposits above 70%, achieving a net interest margin of at least 3.50%, maintaining a risk based capital ratio of at least 12% and holding the classification ratio at 20% or less.

Historically, the Corporation’s low loans-to-assets ratio has been detrimental to the net interest margin and return on equity. In 2010, the Board and Management established a goal of changing the Corporation’s asset mix by increasing the loan to asset ratio to 60%. The Bank formed a new Agribusiness and Community Banking Group in 2010 to focus on agriculture lending and cash management services. Business bankers and mortgage originators were added and office managers underwent increased consumer loan training. The Bank added a new senior credit officer and two credit analysts to its underwriting staff. These additions have increased the credit administration staff to five and the result is improved credit underwriting and loan monitoring. These initiatives have been successful and are the primary reason total loans increased $75.4 million, or 38.9% over the past two years. On December 31, 2012, the loan-to-asset ratio was 61.0%.

The net overhead ratio is calculated by netting total non-interest expense (excluding gains/losses) and total non-interest income and dividing by the period’s average total assets. A lower ratio indicates a higher degree of efficiency. The net overhead ratio for 2012 was 2.18%, compared to 2.52% and 2.44% in 2011 and 2010. Reducing the net overhead ratio was accomplished as the Bank was able to grow assets without significantly adding to expenses.

The Corporation benefits from a cash-type deposit ratio of 83.4%. The goal of maintaining cash type deposits above 70% will be challenging but can be accomplished through the increased productivity of the Corporation’s retail office system which generates core funding cash-type deposits. The Corporation benefits from its strong core deposit base which is much higher than peer and its strong core deposit base significantly enhances value and makes it possible for assets to be supported by stable and relatively low cost funding. While the Corporation enjoys low cost of funds, this cost advantage comes at the price of increased overhead expenses discussed above which is a result of the relatively small size of many of its offices.

8

The Corporation’s net interest margin for 2012 was 3.69%. Maintaining a net interest margin of at least 3.50% in a falling rate environment, will be accomplished through loan growth which will result in the reduction of securities as a percentage of assets. The banking business starts with loans. Loans are supported by deposits and capital is needed to support the volume of loans and deposits. Without loans there is no need for deposits and certainly there is no need for capital. The Corporation has historically relied too heavily on income from its securities portfolio and that was a reasonable plan when the term structure of interest rates accommodated such a business plan. Unfortunately that reliance is misplaced in a nearly zero interest rate environment. In this low rate environment one way to increase yield with securities is by extending the duration of the securities portfolio which is exactly the wrong action to take since longer duration securities will decline in value significantly should interest rates rise. Securities are of course needed for liquidity and income but the overreliance on securities as a source of interest income is inappropriate.

A Strong capital ratio is critical to the subsidiary Bank’s safety and soundness. A bank must have a risk-based capital ratio over 10% to be considered well capitalized by its regulators. The Corporation’s Board of Directors has established a goal of maintaining a risk-based capital ratio of 12% to protect the financial stability of the organization. The risk-based capital ratio was 12.53% as of December 31, 2012.

The classification ratio is calculated using total adversely classified assets (excluding special mention loans) divided by Tier 1 capital plus allowance for loan losses. The classification ratio was 17.7%, 21.1% and 32.0% as of December 31, 2012, 2011 and 2010. Prior to 2009, the classification ratio was consistently less than 20%. As the economy improves and the current number of classified loans is reduced through monitoring and working with borrowers, the classification ratio is expected to improve.

In 2012, loans, net of allowance for loan losses increased $51.6 million from year-end 2011. The Bank has been taking advantage of the opportunity to lend to businesses in search of a bank that will be responsive to their credit needs as other banks have tightened lending requirements. Loans secured by farmland and agricultural production loans increased $19.9 million, or 130.1% during 2012. One-to-four family real estate loans increased $13.1 million, or 23.3% during the year ended December 31, 2012. Commercial and commercial real estate loans increased $10.9 million, or 12.8% during 2012.

The securities portfolio is a significant source of income. However income from securities will decline unless interest rates rise significantly, as cash flow from maturing securities and cash flow from mortgage backed securities is reinvested at lower interest rates. Changing market conditions could affect the profitability of the portfolio, as well as the level of interest rate risk exposure. The Bank invests in securities it believes offer good relative value at the time of purchase, and it will reposition its securities portfolio as needed. In making its decisions to sell or purchase securities, the Bank considers credit ratings, call features, maturity dates, relative yields, current market factors, interest rate risk and other relevant factors. The Bank’s loan growth in 2012 has enabled management to invest most of the proceeds from the maturities and repayment of securities in loans.

The average yield of the securities portfolio was 2.94% as of December 31, 2012. The portfolio duration was 2.1 years and based on current interest rates and payment assumptions, cash flows of $21.6 million are projected over the next twelve months. The yield on securities is expected to decline in 2013 as cash flows are reinvested in the current low interest rate environment. The Bank will continue to monitor market conditions and invest in securities with good relative value.

Platinum Checking, a high-interest checking account for clients with balances above $10 thousand accounted for $73.5 million or 20.0% of total deposits at December 31, 2012. Bonus Checking, an account that pays bonus interest to clients that use the Bank’s Visa debit card, receive their account statement online, and make at least one electronic direct deposit accounted for $25.4 million of deposits at December 31, 2012. In 2012 these two accounts grew 13.6% and 12.6% respectively. In March 2010, the Corporation introduced “Bonus Savings”, a high-yield savings account that is available to customers that have a Bonus Checking account. Bonus Savings accounted for $12.5 million as of December 31, 2012 an increase of $8.5 million since year end 2010. In 2012 total deposits grew $26.4 million or 7.8%.

Office of the Comptroller of the Currency (“OCC”) regulations require banks to maintain certain minimum levels of regulatory capital. Additionally, the regulations establish a framework for the classification of banks into five categories: well-capitalized, adequately capitalized, undercapitalized, significantly undercapitalized and critically undercapitalized. Generally, an institution is considered well-capitalized if it has a core (Tier 1) capital ratio of at least 5.0% (based on adjusted total assets); a core (Tier 1) risk-based capital ratio of a least 6.0%; and a total risk-based capital ratio of at least 10.0%. At December 31, 2012 the Bank is categorized as well capitalized under the regulatory framework for prompt corrective action and capital ratios were well above regulatory minimums.

9

The Corporation is not aware of any market or institutional trends, events or uncertainties that are expected to have a material effect on liquidity, capital resources or operations. The Corporation is not aware of any current recommendations by its regulators which would have a material effect if implemented. The Corporation has not engaged in sub-prime lending activities and does not plan to engage in those activities in the future.

Financial Condition

Total assets increased 8.6% to $440.8 million as of December 31, 2012, from $406.1 million at December 31, 2011. Securities available for sale totaled $121.7 million as of December 31, 2012, compared to $150.2 million at December 31, 2011. Loans, net of allowance for loan losses increased $51.6 million to $265.5 million as of December 31, 2012, compared to $214.0 million at December 31, 2011. Deposits increased 7.7% to $367.1 million as of December 31, 2012, compared to $340.7 million at December 31, 2011. Shareholders’ equity increased 6.0% to $45.3 million at the end of 2012, from $42.7 million at the end of 2011. Accumulated other comprehensive income increased to $3.9 million as of December 31, 2012, compared to $3.6 million as of December 31, 2011. The change in accumulated other comprehensive income was a result of an increase in unrealized gains on securities available for sale.

Loans

Total loans increased by $51.6 million or 23.7% from year-end 2012 to year-end 2011. The Bank continues to focus its efforts on attracting commercial loan business. Average loans, net of allowance for loan losses increased from $200.8 million in 2011 to $238.6 million in 2012.

First National Bank’s loan policy limits the balances of loans of certain loan categories as follows: up to 60% of total loans for commercial loans, up to 40% of total loans for consumer loans, up to 60% of total loans for residential real estate loans and up to 200% of total capital for commercial real estate loans. The loan to deposit ratio will not exceed 90%.

10

| Loan portfolio composition at December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| (Dollar amounts in thousands) | ||||||||||||||||||||

| Commercial real estate: |

||||||||||||||||||||

| Commercial real estate |

$ | 59,484 | $ | 55,520 | $ | 58,047 | $ | 54,787 | $ | 43,972 | ||||||||||

| Secured by farmland |

23,161 | 11,609 | 0 | 0 | 0 | |||||||||||||||

| Construction and land development |

8,682 | 4,822 | 9,942 | 11,797 | 11,725 | |||||||||||||||

| Commercial: |

||||||||||||||||||||

| Commercial and industrial |

37,138 | 30,165 | 26,158 | 30,621 | 27,241 | |||||||||||||||

| Agricultural production |

12,107 | 3,721 | 0 | 0 | 0 | |||||||||||||||

| Residential real estate: |

||||||||||||||||||||

| One-to-four family |

69,364 | 56,261 | 47,204 | 50,390 | 54,924 | |||||||||||||||

| Multifamily |

18,660 | 17,041 | 14,397 | 10,353 | 4,062 | |||||||||||||||

| Construction and land development |

959 | 683 | 301 | 598 | 1,121 | |||||||||||||||

| Home equity |

31,218 | 30,086 | 27,766 | 26,526 | 24,442 | |||||||||||||||

| Consumer: |

||||||||||||||||||||

| Auto: |

||||||||||||||||||||

| Direct |

5,436 | 3,866 | 2,474 | 3,171 | 3,171 | |||||||||||||||

| Indirect |

1,087 | 2,740 | 6,401 | 8,605 | 10,923 | |||||||||||||||

| Other |

1,780 | 980 | 989 | 567 | 260 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans |

269,076 | 217,494 | 193,679 | 197,415 | 181,841 | |||||||||||||||

| Less: |

||||||||||||||||||||

| Unearned and deferred income |

(137 | ) | (379 | ) | (409 | ) | (438 | ) | (292 | ) | ||||||||||

| Allowance for loan losses |

(3,400 | ) | (3,163 | ) | (2,585 | ) | (2,906 | ) | (1,718 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loans |

$ | 265,539 | $ | 213,952 | $ | 190,685 | $ | 194,071 | $ | 179,831 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loans as a percent of total assets |

60.24 | % | 52.69 | % | 50.97 | % | 52.42 | % | 53.20 | % | ||||||||||

Ranked by North American Industry Classification System – or NAICS – codes, the industries most represented by First National Bank’s commercial borrowers include lessors of non-residential buildings, lessors of residential buildings and dwellings and dairy cattle farming, in that order, accounting for 10.9%, 8.9%, and 6.2% of the total loans at year-end 2012, respectively.

Approximately 59.5% of the conventional mortgage loans secured by one-to-four family and multifamily real estate are long term fixed interest rate loans. Approximately 40.5% of the portfolio of conventional mortgage loans secured by one-to-four family and multifamily real estate at year-end 2012 consisted of adjustable rate loans. First National Bank’s fixed-rate conventional mortgage loans are originated with loan documentation that permits their sale in the secondary market. The Bank’s policy is to classify all thirty year fixed-rate mortgage loans as “Held for Sale” or “Held for Portfolio” at the time the loans are originated within various scenarios and classifications set by the Bank. The classification is based upon several factors such as the Bank’s interest rate risk position, the loan’s interest rate and term, the Bank’s liquidity position, the interest rate environment and general economic conditions.

Allowance for Loan Losses

As explained in Note 1 of the consolidated financial statements, the allowance for loan losses is a valuation allowance for probable incurred credit losses, increased by the provision for loan losses and recoveries, and decreased by charge-offs. The allowance for loan losses is the sum of components recognized and measured either: (1) according to Accounting Standards Codification (ASC) 450-10-05, “Accounting for Contingencies,” for pools of homogenous loans, or (2) according to ASC 310-10-35, “Accounting by Creditors for Impairment of a Loan,” for loans the Bank considers impaired based upon individual loan review. Management determines the necessary allowance balance using the Bank’s loan loss experience, the nature and volume of the portfolio, information about specific borrower situations and estimated collateral values, economic conditions, and other factors. Loan losses are charged against the allowance when management believes the uncollectibility of a loan balance is confirmed.

Loans Analyzed Individually

Determining the loan loss allowance begins with the Bank’s assessment of credit risk for loans analyzed individually. Individual loans are assigned credit-risk grades based on the Bank’s assessment of conditions affecting a borrower’s ability to satisfy its contractual obligation under the loan agreement. The assessment process includes reviewing a borrower’s current financial information, historical payment experience, credit documentation, public information, current economic trends and other information specific to each borrower. Loans reviewed individually are reviewed at

11

least annually or more frequently if management becomes aware of information affecting a borrower’s ability to fulfill its obligation. All loans over $250 thousand or to borrower’s whose aggregate total borrowing exceeds $250 thousand are reviewed individually, except for first and second mortgage loans on a borrower’s personal residence. Loans or borrowers with balances under $250 thousand may also be reviewed individually if considered necessary by the board and management. A borrower’s risk rating may be downgraded at any point during the year if the creditworthiness of a borrower deteriorates. In addition, risk ratings are reviewed annually by a qualified independent third party. The independent third party reviews all aggregate loan relationships of $300 thousand or greater along with a sampling of loan relationships under $300 thousand. Loans analyzed individually are ranked as follows:

Loans Graded 1, 2, 3 and 4 are loans that are considered satisfactory, with lower than average risk and low probability of serious financial deterioration on the borrower’s part.

Loans Graded 5 (“Watch”) are performing according to the terms of the loan agreement but that nevertheless require enhanced management supervision because of factors such as an unusual payment history or a deterioration in the borrower’s financial condition.

Loans Graded 6 (“Special Mention”) have more than average risk, with identified potential weaknesses that deserve management’s close attention. Left uncorrected, the potential weaknesses may result in deterioration of the repayment prospects for the loan or of the institution’s credit position at some future date. In the case of a commercial borrower, for example, potential weaknesses could include adverse trends in the borrower’s operations or adverse economic or market conditions that could affect the borrower in the future.

Loans Graded 7 (“Substandard”) are inadequately protected by the current financial condition and paying capacity of the borrower or by the collateral securing the loan. Substandard loans have a well-defined weakness or weaknesses jeopardizing collection of the debt in full, with a distinct possibility of loss if the weakness or weaknesses are not corrected. Loans may be classified substandard even if payments are not 90 days or more past due. Loans 90 days or more past due are classified as substandard or lower unless the loan is adequately collateralized and in the process of collection.

Loans Graded 8 (“Doubtful”) have all the weaknesses inherent in those classified as substandard, with the added characteristic that the weaknesses make collection or liquidation in full, on the basis of currently existing facts, condition and values, highly questionable and improbable. The possibility of loss is extremely high, but because of factors that could work to the borrower’s advantage classification of the “doubtful” loan as “loss” is deferred.

Loans Graded 9 (“Loss”) are those considered uncollectible or portions of loans that are considered uncollectable. Loans in this category are charged-off by management.

If it is probable that the Bank will be unable to collect all principal and interest due on a commercial or non-homogenous loan then that loan is considered impaired. The measure of impairment is based on the present value of expected future cash flows discounted at the loan’s effective interest rate or the value of collateral less estimated costs to sell for collateral dependent loans, compared to the recorded investment in the loan (including accrued interest, net deferred loans fees or costs, and unamortized premium or discount). The Bank considers commercial or non-homogenous loans graded doubtful or loss to be impaired. Some loans graded substandard are considered impaired. Special mention and watch loans are not considered to be impaired. Impairment is evaluated in total for smaller-balance loans of similar type and purpose – such as residential mortgage and consumer, – and on an individual loan basis for other loans (other loans consists of loans to non-profit organizations and loans collateralized with cash). If a loan is impaired, a portion of the loan loss allowance is allocated so that the loan is reported net, at the present value of estimated future cash flows using the loan’s existing rate or at the fair value of collateral if repayment is expected solely from the collateral. Increases in the allowance for loan losses are made by expensing a provision for loan losses. No specific provision for loan losses expense would result if an individually reviewed loan is graded higher than “watch”, but such loans are included in the pools of loans analyzed under ASC 450-10-05. Loans classified “special mention” or “substandard”, and smaller-balance loans classified “doubtful” are assigned a provision based upon a historical migration analysis performed on classified loans. The migration analysis identifies the percentage of classified loans by category that has historically been ultimately charged-off. The migration percentages are reviewed and adjusted by management to reflect various factors such as the growth and change in mix of the loan portfolio and the regulator’s guidelines. Loans ranked “loss” are charged off in their entirety because at that point the unconfirmed loss that the loan loss allowance is intended to approximate is considered to be confirmed.

12

As of December 31, 2012, 2011 and 2010 classified assets were as follows:

| Classified assets at December 31, | ||||||||||||||||||||||||

| 2012 | 2011 | 2010 | ||||||||||||||||||||||

| Percent of | Percent of | Percent of | ||||||||||||||||||||||

| Amount | total loans | Amount | total loans | Amount | total loans | |||||||||||||||||||

| (Dollar amounts in thousands) | ||||||||||||||||||||||||

| Classified loans: |

||||||||||||||||||||||||

| Special mention |

$ | 3,028 | 1.1 | % | $ | 4,887 | 2.3 | % | $ | 2,667 | 1.4 | % | ||||||||||||

| Substandard |

5,689 | 2.1 | % | 7,242 | 3.3 | % | 9,878 | 5.1 | % | |||||||||||||||

| Doubtful |

0 | 0.0 | % | 0 | 0.0 | % | 0 | 0.0 | % | |||||||||||||||

| Loss |

0 | 0.0 | % | 0 | 0.0 | % | 0 | 0.0 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total classified loans |

8,717 | 3.2 | % | 12,129 | 5.6 | % | 12,545 | 6.5 | % | |||||||||||||||

| Other real estate owned |

860 | 0.3 | % | 18 | 0.0 | % | 58 | 0.0 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total classified assets |

$ | 9,577 | 3.5 | % | $ | 12,147 | 5.6 | % | $ | 12,603 | 6.5 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Total classified loans decreased from $12.1 million at December 31, 2011 to $8.7 million at December 31, 2012. The Bank’s classification ratio was 17.7% and 21.1% as of December 31, 2012 and December 31, 2011. The classification ratio is calculated using total adversely classified assets (excluding special mention loans) divided by Tier 1 capital plus allowance for loan losses.

Pools of Loans Analyzed under ASC 450

The total loan loss allowance is derived both from analysis of individual impaired loans under ASC 310-10-35 and analysis of aggregated pools of loans under ASC 450. Smaller balance loans (such as automobile or home equity loans, for example), groups of loans (such as residential mortgage loans), and less severely classified loans reviewed individually may be analyzed on an aggregated or pooled basis under ASC 450.

Under ASC 450, loans are segmented into groups of loans having similar risk characteristics based on purpose, loan type, and collateral, for example residential mortgage loans, home equity loans, and consumer loans. Losses inherent in pools of loans are estimated using average historical losses over a period of years for loans of those types, but with adjustments to account for changes in loan policies, changes in underwriting or loan recovery practices, changes in prevailing economic conditions, changes in the nature or volume of the loan portfolio, and changes in other internal and external factors. Loans secured by real estate – particularly residential mortgage loans – generally have less credit risk than other types of loans.

Changes in the Allowance for Loan Losses and Classified Assets

An effective loan review function is vital to the establishment of an appropriate loan loss allowance. Loan officers and the Bank’s credit analysts are responsible for the assignment of risk ratings for loans reviewed individually. Each quarter, a committee consisting of the Bank’s Chief Financial Officer and Senior Credit Officer evaluates the loan loss allowance and reports the results of its evaluation to senior management and the Bank’s Board of Directors. The Bank may adjust its loan loss allowance methodology as well, making adjustments in its estimates and assumptions as necessary to account for variances of estimated loan losses from actual loan loss experience. The Bank’s determination about classification of its assets and the amount of its allowances is subject to review by the Office of the Comptroller of the Currency (OCC), which may order the establishment of additional loss allowances.

The allowance for loan losses increased from $3,163,000 as of December 31, 2011 to $3,400,000 at December 31, 2012. The allowance for loans losses to total loans decreased from 1.46% at year-end 2011 to 1.26% at December 31, 2012. Net charge-offs increased from $22,000 in 2011 to $1,137,000 in 2012. The provision for loan losses for 2012 was $1,374,000, compared to $600,000 in 2011. The increase in the allowance for loan losses in 2012 was primarily related to the increase in loan balances outstanding.

Total nonperforming loans decreased from $4.0 million as of December 31, 2011 to $1.2 million at December 31, 2012. Non-performing loans consist of loans placed on non-accrual status and loans past due 90 or more days and still accruing interest. Loans past due between 30 and 89 days still accruing decreased to $339 thousand at December 31, 2012 from $634 thousand as of December 31, 2011. In 2012, total classified loans decreased from $12.1 million to $8.7 million. Management believes the allowance for loan losses is adequate as of December 31, 2012.

13

Loan review and monitoring is integral to effective credit administration and risk management. In order to minimize the credit risk inherent in the lending process, management and the Board of Directors has adopted a more formal and systematic approach with credit administration and loan review. As part of this systematic approach, a qualified independent third party was engaged to perform loan reviews in 2012, 2011 and 2010. Management intends to continue this practice on an annual basis.

Loans deemed uncollectible are charged against the allowance for loan losses. After a loan is charged off, the Bank continues its efforts to recover the loss. Recoveries of previously charged-off amounts are credited to the allowance for loan losses. The charge-offs in 2012 relate primarily to two commercial real estate loans totaling $763 thousand. The charge-offs in 2010 relate primarily to two commercial loans totaling $1.7 million. The Bank recorded a $400 thousand partial charge-off of a $1.6 million commercial real estate loan in 2009. The Bank recorded a $676 thousand partial charge-off of a $1.7 million commercial real estate loan in 2008. Transactions in the allowance for loan losses are summarized in following table:

| Year ended December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| (Dollar amounts in thousands) | ||||||||||||||||||||

| Balance, beginning of period |

$ | 3,163 | $ | 2,585 | $ | 2,906 | $ | 1,718 | $ | 2,028 | ||||||||||

| Loans charged off: |

||||||||||||||||||||

| Commercial real estate: |

||||||||||||||||||||

| Commercial real estate |

481 | 0 | 340 | 0 | 688 | |||||||||||||||

| Construction land development |

44 | 0 | 272 | 400 | 0 | |||||||||||||||

| Commercial: |

||||||||||||||||||||

| Commercial and industrial |

282 | 0 | 1,797 | 0 | 42 | |||||||||||||||

| Residential real estate: |

||||||||||||||||||||

| One-to-four family |

250 | 28 | 82 | 38 | 16 | |||||||||||||||

| Multifamily |

0 | 0 | 0 | 0 | 0 | |||||||||||||||

| Construction and land development |

0 | 0 | 0 | 0 | 0 | |||||||||||||||

| Home equity |

91 | 26 | 45 | 25 | 9 | |||||||||||||||

| Consumer |

41 | 17 | 40 | 195 | 69 | |||||||||||||||

| Credit cards |

0 | 0 | 0 | 1 | 21 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans charged off |

1,189 | 71 | 2,576 | 659 | 845 | |||||||||||||||

| Recoveries of loans previously charged off: |

||||||||||||||||||||

| Commercial real estate: |

||||||||||||||||||||

| Commercial real estate |

0 | 0 | 0 | 0 | 5 | |||||||||||||||

| Construction land development |

1 | 1 | 0 | 0 | 0 | |||||||||||||||

| Commercial: |

||||||||||||||||||||

| Commercial and industrial |

10 | 25 | 0 | 1 | 20 | |||||||||||||||

| Real estate construction: |

||||||||||||||||||||

| One-to-four family |

5 | 0 | 0 | 0 | 14 | |||||||||||||||

| Multifamily |

0 | 0 | 0 | 0 | 0 | |||||||||||||||

| Construction land development |

0 | 0 | 0 | 0 | 0 | |||||||||||||||

| Home equity |

9 | 1 | 2 | 2 | 2 | |||||||||||||||

| Consumer |

27 | 22 | 24 | 15 | 11 | |||||||||||||||

| Credit cards |

0 | 0 | 0 | 0 | 1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total recoveries |

52 | 49 | 26 | 18 | 53 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loans charged off |

(1,137 | ) | (22 | ) | (2,550 | ) | (641 | ) | (792 | ) | ||||||||||

| Provision charged to operations |

1,374 | 600 | 2,229 | 1,829 | 482 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance, end of period |

$ | 3,400 | $ | 3,163 | $ | 2,585 | $ | 2,906 | $ | 1,718 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loans outstanding: |

||||||||||||||||||||

| Average |

$ | 241,980 | $ | 203,669 | $ | 195,730 | $ | 184,965 | $ | 192,472 | ||||||||||

| End of period |

268,939 | 217,115 | 193,270 | 196,977 | 181,549 | |||||||||||||||

| Ratio of allowance for loan losses to total loans outstanding at end of period |

1.26 | % | 1.46 | % | 1.34 | % | 1.48 | % | 0.95 | % | ||||||||||

| Net charge offs to average loans |

0.47 | % | 0.01 | % | 1.30 | % | 0.35 | % | 0.41 | % | ||||||||||

14

The allowance for loan losses is allocated among loan categories as shown in the following table. Although the Bank considers inherent losses in individual loans and categories of similar loans when it establishes the loan loss allowance, the allowance is a general reserve available to absorb all credit losses in the portfolio. No part of the allowance is segregated for or dedicated to any particular asset or group of assets.

| Allocation of the allowance for loan losses at December 31, | ||||||||||||||||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||||||||||||||||||||||

| Amount | Percent(1) | Amount | Percent(1) | Amount | Percent(1) | Amount | Percent(1) | Amount | Percent(1) | |||||||||||||||||||||||||||||||

| (Dollar amounts in thousands) | ||||||||||||||||||||||||||||||||||||||||

| Commercial real estate: |

||||||||||||||||||||||||||||||||||||||||

| Commercial real estate |

$ | 1,267 | 22 | % | $ | 1,185 | 26 | % | $ | 1,019 | 30 | % | $ | 1,142 | 28 | % | $ | 501 | 24 | % | ||||||||||||||||||||

| Secured by farmland |

345 | 9 | % | 146 | 5 | % | 0 | 0 | % | 0 | 0 | % | 0 | 0 | % | |||||||||||||||||||||||||

| Construction and land development |

181 | 3 | % | 149 | 2 | % | 248 | 5 | % | 424 | 6 | % | 42 | 6 | % | |||||||||||||||||||||||||

| Commercial: |

||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial |

744 | 14 | % | 801 | 14 | % | 460 | 14 | % | 929 | 16 | % | 579 | 15 | % | |||||||||||||||||||||||||

| Agricultural production |

182 | 4 | % | 55 | 2 | % | 0 | 0 | % | 0 | 0 | % | 0 | 0 | % | |||||||||||||||||||||||||

| Residential real estate: |

||||||||||||||||||||||||||||||||||||||||

| One-to-four family |

292 | 26 | % | 487 | 26 | % | 510 | 24 | % | 163 | 26 | % | 283 | 30 | % | |||||||||||||||||||||||||

| Multifamily |

282 | 7 | % | 225 | 8 | % | 164 | 8 | % | 29 | 5 | % | 41 | 2 | % | |||||||||||||||||||||||||

| Construction and land development |

10 | 0 | % | 9 | 0 | % | 1 | 0 | % | 2 | 0 | % | 4 | 1 | % | |||||||||||||||||||||||||

| Home equity |

65 | 12 | % | 66 | 14 | % | 100 | 14 | % | 73 | 13 | % | 74 | 14 | % | |||||||||||||||||||||||||

| Consumer: |

||||||||||||||||||||||||||||||||||||||||

| Auto: |

||||||||||||||||||||||||||||||||||||||||

| Direct |

17 | 2 | % | 21 | 2 | % | 13 | 1 | % | 37 | 2 | % | 43 | 2 | % | |||||||||||||||||||||||||

| Indirect |

3 | 0 | % | 14 | 1 | % | 35 | 3 | % | 100 | 4 | % | 147 | 6 | % | |||||||||||||||||||||||||

| Other |

12 | 1 | % | 5 | 0 | % | 5 | 1 | % | 7 | 0 | % | 4 | 0 | % | |||||||||||||||||||||||||

| Unallocated |

0 | 0 | % | 0 | 0 | % | 30 | 0 | % | 0 | 0 | % | 0 | 0 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

$ | 3,400 | 100 | % | $ | 3,163 | 100 | % | $ | 2,585 | 100 | % | $ | 2,906 | 100 | % | $ | 1,718 | 100 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| (1) | - Percent of loans in each category to total loans. |

15

Management reviews nonperforming assets on a regular basis and assesses the requirement for specific reserves on those assets. Any loan past due 90 days or more and any loan on nonaccrual is considered to be a nonperforming asset. Any loan 90 days or more past due that is not both adequately collateralized and in a positive cash-flow position and any loan to a borrower experiencing serious financial deterioration may be placed on nonaccrual by the Senior Credit Officer with the concurrence of senior management. Interest received on nonaccrual loans – also referred to as nonperforming loans – is recorded as a reduction of principal. The table to follow summarizes nonperforming loans and other nonperforming assets by category.

| Problem assets at December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| (Dollar amounts in thousands) | ||||||||||||||||||||

| Nonaccrual loans |

$ | 733 | $ | 3,836 | $ | 4,373 | $ | 4,716 | $ | 1,752 | ||||||||||

| Past due 90 days or more and still accruing |

463 | 177 | 487 | 458 | 261 | |||||||||||||||

| Restructured loans and leases(1) |

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming loans |

1,196 | 4,013 | 4,860 | 5,174 | 2,013 | |||||||||||||||

| Other real estate owned |

860 | 18 | 58 | 104 | 354 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming assets |

$ | 2,056 | $ | 4,031 | $ | 4,918 | $ | 5,278 | $ | 2,367 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loans outstanding, net |

$ | 265,539 | $ | 213,952 | $ | 190,685 | $ | 194,071 | $ | 179,831 | ||||||||||

| Nonperforming loans to total net loans |

0.45 | % | 1.88 | % | 2.55 | % | 2.67 | % | 1.12 | % | ||||||||||

| Nonperforming assets to total assets |

0.47 | % | 0.99 | % | 1.31 | % | 1.43 | % | 0.70 | % | ||||||||||

| Allowance for loan losses to total loans |

1.26 | % | 1.46 | % | 1.34 | % | 1.48 | % | 0.95 | % | ||||||||||

| Allowance for loan losses to nonperforming loans |

284.28 | % | 78.82 | % | 53.19 | % | 56.17 | % | 85.35 | % | ||||||||||

| (1) | All restructured loans and leases as of the dates shown were on nonaccrual status and are included as nonaccrual loans and leases in this table. |

16

Securities

Total securities decreased $28.5 million or 19% at December 31, 2012 when compared to December 31, 2011. Securities are primarily comprised of mortgage-backed securities, municipal securities and securities issued by corporations. The Bank actively purchases bonds issued by local municipalities, school systems and other public entities when opportunities arise. Securities are classified either as held to maturity or as available for sale. The Bank does not hold any securities for trading purposes. If management has the intent and the Bank has the ability at the time of purchase to hold a security until maturity, the security is classified as held to maturity and it is reflected on the balance sheet at amortized cost. Securities to be held for indefinite periods and not intended to be held to maturity or on a long-term basis are classified as available for sale, and they are reflected on the balance sheet at their fair value. Management generally believes that all securities should be classified as available for sale but makes that determination at the time of purchase. In order to more effectively manage securities and to be in a better position to react to market conditions, at December 31, 2012, all securities were classified as available for sale. At year-end 2012 and 2011 there was no single issuer of securities where the total book value of such securities exceeded 10% of shareholders’ equity except for U.S. government and agency obligations.

The following table shows the amortized cost and estimated fair values of the corporation’s securities portfolio at the date indicated.

| Gross | Gross | |||||||||||||||

| Amortized | unrealized | unrealized | Fair | |||||||||||||

| cost | gains | losses | value | |||||||||||||

| (Dollar amounts in thousands) | ||||||||||||||||

| December 31, 2012 |

||||||||||||||||

| Available for sale: |

||||||||||||||||

| U.S. Government and federal agency |

$ | 1,794 | $ | 8 | $ | 0 | $ | 1,802 | ||||||||

| State and municipal |

50,946 | 4,241 | (8 | ) | 55,179 | |||||||||||

| Mortgage-backed: residential |

62,903 | 1,755 | (20 | ) | 64,638 | |||||||||||

| Equity securities |

23 | 8 | 0 | 31 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total securities |

$ | 115,666 | $ | 6,012 | $ | (28 | ) | $ | 121,650 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| December 31, 2011 |

||||||||||||||||

| Available for sale: |

||||||||||||||||

| U.S. Government and federal agency |

$ | 2,430 | $ | 16 | $ | 0 | $ | 2,446 | ||||||||

| State and municipal |

53,841 | 3,592 | (10 | ) | 57,423 | |||||||||||

| Mortgage-backed: residential |

88,362 | 2,060 | (136 | ) | 90,286 | |||||||||||

| Equity securities |

23 | 0 | (3 | ) | 20 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total securities |

$ | 144,656 | $ | 5,668 | $ | (149 | ) | $ | 150,175 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| December 31, 2010 |

||||||||||||||||

| Available for sale: |

||||||||||||||||

| U.S. Government and federal agency |

$ | 2,954 | $ | 21 | $ | 0 | $ | 2,975 | ||||||||

| State and municipal |

44,656 | 833 | (484 | ) | 45,005 | |||||||||||

| Corporate bonds and notes |

1,487 | 29 | 0 | 1,516 | ||||||||||||

| Mortgage-backed: residential |

86,001 | 2,766 | (240 | ) | 88,527 | |||||||||||

| Equity securities |

23 | 0 | (13 | ) | 10 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total securities |

$ | 135,121 | $ | 3,649 | $ | (737 | ) | $ | 138,033 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

17

The contractual maturity of securities available for sale at December 31, 2012 is shown below.

| One year or less |

More than one to five years |

More than five to ten years |

More than ten years |

Total securities | ||||||||||||||||||||

| Amortized Cost | Amortized Cost | Amortized Cost | Amortized Cost | Amortized Cost | Fair | |||||||||||||||||||

| Average yield | Average yield | Average yield | Average yield | Average yield | value | |||||||||||||||||||

| (Dollar amounts in thousands) | ||||||||||||||||||||||||

| U.S. Government and |

$ | 0 | $ | 1,179 | $ | 615 | $ | 0 | $ | 1,794 | $ | 1,802 | ||||||||||||

| federal agency |

0 | % | 1.38 | % | 4.54 | % | 0 | % | 2.46 | % | ||||||||||||||

| State and municipal |

1,340 | 3,495 | 20,393 | 25,718 | 50,946 | 55,179 | ||||||||||||||||||

| 1.66 | % | 3.63 | % | 3.56 | % | 3.30 | % | 3.38 | % | |||||||||||||||

| Mortgage-backed: |

||||||||||||||||||||||||

| residential |

164 | 3,171 | 52,779 | 6,789 | 62,903 | 64,638 | ||||||||||||||||||

| 1.12 | % | 2.31 | % | 2.58 | % | 2.87 | % | 2.59 | % | |||||||||||||||

| Total |

$ | 1,504 | $ | 7,845 | $ | 73,787 | $ | 32,507 | $ | 115,643 | $ | 121,619 | ||||||||||||

| 1.60 | % | 2.76 | % | 2.87 | % | 3.21 | % | 2.94 | % | |||||||||||||||

Restricted Equity Securities

As of December 31, 2012, the Bank held 24,855 shares of $100 par value Federal Home Loan Bank of Cincinnati (FHLB) stock, which are restricted-equity securities. FHLB stock represents an equity interest in the FHLB, but it does not have a readily determinable fair value. The stock can be sold at its par value only, and only to the FHLB or to another member institution. Member institutions are required to maintain a minimum stock investment in the FHLB, based on total assets, total mortgages, and total mortgage-backed securities.

As of December 31, 2012, the Bank held 14,714 shares of Federal Reserve Bank stock, with a carrying value of $736 thousand, which are restricted equity securities. The capital stock represents an equity interest in the Federal Reserve Bank, but does not have a readily determinable fair value. Member institutions are required to hold 6% of capital and surplus in Federal Reserve Bank stock at all times.

Total Liabilities

Total liabilities increased by $32.2 million or 8.9% from 2011 to 2012. This increase is primarily a result of a $26.4 million increase in deposits and a $8.5 million increase in repurchase agreements, partially offset by a decrease of $3.0 million in Federal Home Loan Bank advances.

Deposits

Deposits increased during 2012 by $26.4 million or 7.8%. The increase is primarily attributed to a growth in interest-bearing demand deposits of $9.4 million or 6.1% and noninterest-bearing demand deposits of $8.2 million or 11.6%. Much of the increase in this category is attributed to the Bank’s success in marketing our “Platinum Checking” and “Bonus Checking” accounts. Savings accounts increased by $6.3 million or 11.2% from the end of 2011 to the end of 2012. Time deposits increased by $2.5 million or 4.2%.

| Maturity of time deposits of $100,000 or more at December 31, 2012 |

||||||||

| (Dollar amounts in thousands) | ||||||||

| Amount | Percent of Total | |||||||

| Time remaining to maturity: |

||||||||

| Three months or less |

$ | 2,936 | 16 | % | ||||

| Over three through 12 months |

8,187 | 43 | % | |||||

| Over one year through 3 years |

6,417 | 34 | % | |||||

| Over 3 years |

1,410 | 7 | % | |||||

|

|

|

|

|

|||||

| $ | 18,950 | 100 | % | |||||

|

|

|

|

|

|||||

Liquidity and Capital Resources

A Bank’s liquidity risk is the risk associated with having to satisfy current and future financial obligations in a timely manner. Both short- and long-term liquidity needs are addressed by maturities and sales of unpledged securities, loan repayments and maturities, sales of loans that are not pledged as security for FHLB borrowings, and transactions in cash and cash equivalents, such as federal funds purchased. The use of these resources, combined with access to credit, provide funds for satisfying depositor and borrower needs. Management considers the Bank to have satisfactory liquidity, with the ability to satisfy the demands of customers and the local economy. Liquidity may be adversely affected by unexpected deposit outflows, which can be caused by higher interest rates paid by competitors. Management continually monitors projected liquidity needs and establishes a desirable level based in part on the Bank’s commitment to make loans as well as management’s assessment of the Bank’s ability to generate funds.

18

The most liquid assets are cash and cash equivalents, which at year-end 2012 consisted of $27.6 million in cash and due from banks. At year-end 2011 cash and cash equivalents consisted of $15.2 million in cash and due from banks. Federal funds sold are overnight investments with correspondent banks, an investment and liquidity tool used to maximize earning assets. Securities classified as available for sale that are not pledged are another source of liquidity. We consider the Bank’s loans-to-deposits ratio to assess liquidity, seeking to cap the ratio of loans to deposits at 90%. The ratio of total loans to deposits at year-end 2012 was 73.3%. At the end of 2012 the fair value of securities available for sale was approximately $121.7 million, while the fair value of securities pledged was approximately $66.5 million, representing securities pledged to secure public deposits and repurchase agreements.

The Corporation’s operating activities, as described in the Consolidated Statements of Cash Flows in the attached consolidated financial statements, include net cash provided of $7.4 million in 2012, $6.3 million in 2011 and $5.1 million in 2010, generated principally from net income in those years. The Bank reported $17.0 and $17.6 million in originations and proceeds from sales of mortgage loans held for sale as operating activities in 2012.

The Corporation’s investing activities, as described in the Consolidated Statements of Cash Flows in the attached consolidated financial statements, consist primarily of loan originations and repayments, along with securities purchases, sales and maturities. In 2012, net cash used in investing activities was $26.1 million. Proceeds from the maturities and repayments securities, offset by purchases of securities provided $27.3 million. The increase in loans over the year utilized $53.8 million of cash. In 2011, net cash used in investing activities was $29.4 million. The purchase of securities, offset by maturities, repayments and sales accounted for the use of $10.6 million. Proceeds from the maturities and repayments of time deposits with other financial institutions provided $5.5 million.

The Corporation’s financing activities, as described in the Consolidated Statements of Cash Flows in the attached consolidated financial statements, include the solicitation and repayment of customer deposits, borrowings and repayments, treasury stock activity, and the payment of dividends. In 2012, net cash provided by financing activities was $31.2 million. The increase in deposits over the year provided $26.4 million of cash. The increase in short-term borrowings over the year provided $8.5 million of cash. At December 31, 2012, the Bank had $5.0 million of borrowings outstanding with FHLB, maturing in the year 2014. This amount represents a $3.0 million decrease from the $8.0 million that was owed at the end of 2011. Net cash provided by financing activities was $25.5 million in 2011. The increase in deposits during 2011 provided $31.5 million of cash. The maturity of FHLB borrowings used $12.0 million of cash during the year.

First National Bank has approximately $14.0 million available in short-term funding arrangements with its correspondent banks and the FHLB as of December 31, 2012. Additional information concerning FHLB borrowings and bank obligations under repurchase agreements is contained in Notes 9 and 10 of the consolidated financial statements of National Bancshares Corporation. The outstanding balances and related information about short-term borrowings, which consists almost entirely of securities sold under agreements to repurchase are summarized as follows:

| Year ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| (Dollar amounts in thousands) | ||||||||||||

| Balance at year-end |

$ | 18,633 | $ | 10,168 | $ | 7,747 | ||||||

| Average balance outstanding |

11,604 | 9,071 | 8,032 | |||||||||

| Maximum month-end balance |

18,633 | 11,114 | 12,083 | |||||||||

| Weighted-average rate at year-end |

0.15 | % | 0.15 | % | 0.15 | % | ||||||

| Average rate during the year |

0.15 | % | 0.15 | % | 0.15 | % | ||||||

The Bank is subject to federal regulations imposing minimum capital requirements. Total risk-based capital, tier I risk-based capital, and tier I leverage capital ratios are monitored to assure compliance with regulatory capital requirements. At December 31, 2012, the Bank exceeded minimum risk-based and leverage capital ratio requirements. The Bank’s ratio of total capital to risk-based assets was 12.53% on December 31, 2012. The minimum required ratio to be considered adequately capitalized is 8%. Additional information concerning capital ratios at year-end 2012 and 2011 is contained in Note 15 of the consolidated financial statements.

19

Contractual Obligations

As discussed in the notes to National Bancshares Corporation’s consolidated financial statements, obligations exist to make payments under contracts, including borrowings. At December 31, 2012, the aggregate contractual obligations are outlined below:

| Payment due by period | ||||||||||||||||||||

| (Dollar amounts in thousands) | ||||||||||||||||||||

| One year | More than one | More than three | More than | |||||||||||||||||

| Total | or less | to three years | to five years | five years | ||||||||||||||||

| Time deposits |

$ | 62,174 | $ | 34,180 | $ | 23,343 | $ | 4,651 | $ | 0 | ||||||||||

| Deposits without a stated maturity |

304,895 | 304,895 | 0 | 0 | 0 | |||||||||||||||

| Long-term obligations |

5,000 | 0 | 5,000 | 0 | 0 | |||||||||||||||

| Information system contract obligations |

2,108 | 1,027 | 1,081 | 0 | 0 | |||||||||||||||

| Operating lease obligations |

145 | 51 | 94 | 0 | 0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | 374,322 | $ | 340,153 | $ | 29,518 | $ | 4,651 | $ | 0 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Off-Balance Sheet and Contingent Liabilities

Financial instruments, such as loan commitments, credit lines, and letters of credit are issued to satisfy customers’ financing needs. Ordinarily having fixed expiration dates, these commitments are agreements to provide credit or to support the credit of others, as long as conditions established in the contracts are satisfied. Off-balance-sheet risk in the form of potential credit loss exists up to the face amount of these instruments, although we do not expect losses. Since these commitments are viewed as loans, the same credit policies used for loans are used to evaluate making the commitments. These funding commitments by expiration period were as follows at year-end 2012:

| Expiration of funding commitments | ||||||||||||

| One year | More than | |||||||||||

| or less | one year | Total | ||||||||||

| (Dollar amounts in thousands) | ||||||||||||

| Unused loan commitments |

$ | 28,255 | $ | 33,337 | $ | 61,592 | ||||||

| Commitment to make loans |

6,996 | 0 | 6,996 | |||||||||

| Overdraft protection |

12,264 | 0 | 12,264 | |||||||||

| Letters of credit |

288 | 0 | 288 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 47,803 | $ | 33,337 | $ | 81,140 | |||||||

|

|

|

|

|

|

|

|||||||

Of the unused loan commitments, $1,992 are fixed-rate commitments, $66,884 are variable-rate commitments and $12,264 are related to automatic overdraft protection for checking accounts. Rates on unused fixed-rate loan commitments range from 3.75% to 7.5%. The funding commitments shown in the table above do not necessarily represent future cash requirements since experience demonstrates that a large percentage of funding commitments expire unused or partially used.

The Bank sells some of the loans it originates, particularly conventional fixed-rate residential mortgage loans. The loans are sold without recourse. The Bank has retained mortgage-servicing rights on approximately $22.6 million of residential mortgage loans sold.

Shareholders’ Equity

The $2.6 million or 6.0% increase in shareholders’ equity from year-end 2011 to year-end 2012 was caused by an increase in retained earnings of $2.1 million, and a $306 thousand increase in accumulated other comprehensive income, which resulted from an increase in the fair value of securities available for sale. Accumulated other comprehensive income represents the unrealized appreciation or depreciation (net of taxes) in the fair value of securities available for sale. Interest rate volatility, economic and interest rate conditions could cause material fluctuations in accumulated other comprehensive income. The dividend payout ratio for 2012 was 25.29% versus 27.03% in 2011.

National Bancshares Corporation is dependent on the Bank for earnings and funds necessary to pay dividends, and the payment of dividends, by the Bank to National Bancshares Corporation, is subject to bank regulatory restrictions. According to the National Bank Act and Office of the Comptroller of the Currency (OCC) Rule 5.64, a national bank may never pay a cash dividend without advance OCC approval if the amount of the dividend exceeds retained net income for the year and for the two preceding years (after any required transfers to surplus). The Bank could, without prior approval, pay dividends to the holding company of approximately $6.3 million as of December 31, 2012.

20

Interest Rate Sensitivity

Asset-liability management is the active management of a bank’s balance sheet to maintain a mix of loans and deposits consistent with its goals for long-term growth and risk management. Banks, in the normal course of business, assume financial risk by making loans at interest rates that differ from rates paid on deposits. Deposits often have shorter maturities than loans and adjust to current market rates faster than loans. The result is a balance sheet mismatch between assets (loans) and liabilities (deposits).

The function of asset-liability management is to measure and control three levels of financial risk: interest rate risk (the pricing difference between loans and deposits), credit risk (the probability of default), and liquidity risk (occurring when loans and deposits have different maturities).

A primary objective in asset-liability management is managing net interest margin, that is, the net difference between interest earning assets (loans) and interest paying liabilities (deposits) to produce consistent growth in the loan portfolio and shareholder earnings, regardless of short-term movement in interest rates. The dollar difference between assets (loans) maturing or repricing and liabilities (deposits) is known as the rate sensitivity gap (or maturity gap). Banks attempt to manage this asset-liability gap by pricing some of their loans at variable interest rates.

A more precise measure of interest rate risk is duration, which measures the impact of changes in interest rates on the expected maturities of both assets and liabilities. In essence, duration takes the gap report data and converts that information into present-value worth of deposits and loans, which is more meaningful in estimating maturities and the probability that either assets or liabilities will reprice during the period under review.

Interest rate risk is the result of such risks as repricing risk, option risk and basis risk. Repricing risk is caused by the differences in the maturity, or repricing, of assets and liabilities. Most residential mortgage and consumer loans give consumers the right to prepay with little or no prepayment penalty, and because of competitive pressures, it may not be advisable to enforce prepayment penalties on commercial loans. Fixed-rate conventional mortgage loans are originated with loan documentation that permits such loans to be sold in the secondary market. The Bank’s policy is to classify these loans as “Held for Sale” or “Held in Portfolio” at the time the loans are originated based on such factors as the Bank’s liquidity position, interest rate environment and general economic conditions.

Option risk is the risk that a change in prevailing interest rates will lead to an adverse impact on earnings or capital caused by changes in the timing of cash flows from investments, loans and deposits. Cash flows may be received earlier than expected as a result of the exercise of the option to prepay or withdraw early embedded in the financial contracts. The option a borrower has to prepay a loan is similar to the option a depositor has to make an early withdrawal from a deposit account. This form of embedded option gives the customer the opportunity to benefit when interest rates change in their favor and ordinarily occurs at the Bank’s expense in the form of higher interest expense or lower interest income. Residential mortgage loans tend to have higher option risk because of the borrower’s option to prepay the loan, primarily through refinancing when rates decline, and higher interest rate risk because of the longer term associated with residential mortgage loans. Option risk in the form of prepayments also affects the value of mortgage-backed securities.

Basis risk is the risk that changes in interest rates will cause interest-bearing deposit liabilities to reprice at a different rate than interest-bearing assets, creating an asset-liability mismatch. If for example, a bank lends at a rate which changes as the prime rate changes and finances the loan with deposits not tied to the prime rate as an index; it faces basis risk due to the possibility that the prime rate-deposit rate spread might change.

Economic Value of Equity

The economic value of equity, (EVE), is the difference between the net present value of the assets and the net present value of liabilities. EVE can be thought of as the liquidation value of the Bank on the date the calculation is made. Calculating EVE involves using a discount rate to calculate the net present value of assets and liabilities after making assumptions about the duration of assets and liabilities. As interest rates change, the discount rate changes and the change in interest rates effects the duration of assets and liabilities. If interest rates fall, for example, the duration of loans shortens since borrowers tend to prepay. Conversely the duration of loans increases if interest rates rise since borrowers are inclined to hold on to the favorable rate they were able to obtain in the lower interest rate environment.

The Board of Directors has established revised limits on a decline in the economic value of equity (EVE) and earnings at risk (EAR) given changes in interest rates. These limits are that EVE shall not decline by more than 10%, 20%, 30% and 35% given a 1%, 2%, 3% and 4% increase or decrease in interest rates respectively and that EAR shall not be greater than 5%, 10%, 15% or 20% given a 1%, 2%, 3% or 4% increase or decrease in interest rates respectively. The following illustrates our equity at risk in the economic value of equity model.

21

December 31, 2012

| Basis Point Change in Rates |

+400 bp | +300 bp | +200 bp | +100 bp | -100 bp | -200 bp | -300 bp | -400 bp | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Increase (decrease) in EVE |

(15.4 | )% | (10.9 | )% | (5.1 | )% | (1.0 | )% | (4.8 | )% | nm | nm | nm |

December 31, 2011

| Basis Point Change in Rates |

+400 bp | +300 bp | +200 bp | +100 bp | -100 bp | -200 bp | -300 bp | -400 bp | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Increase (decrease) in EVE |

(18.7 | )% | (13.3 | )% | (6.3 | )% | (1.1 | )% | (8.2 | )% | nm | nm | nm |

nm – not meaningful

The Bank is in compliance with the interest rate risk policy limits related to EVE as of December 31, 2012 and 2011.

Earnings at Risk

Earnings at risk, is the amount by which net interest income will be affected given a change in interest rates. The interest income and interest expense for each category of earning assets and interest bearing liabilities is recalculated after making up and down assumptions about the change in interest rates. Changes in prepayment speeds and repricing speeds are also taken into account when computing earnings at risk given a change in interest rates.

The following illustrates the effect on earnings or EAR given rate increases of 100 to 400 basis points and decreases in interest rates of 100 to 400 basis points.

December 31, 2012

| Basis Point Change in Rates |

+ 400 bp | +300 bp | +200 bp | +100 bp | -100 bp | -200 bp | -300 bp | -400 bp | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Increase (decrease) in Earnings |

(1.0 | )% | (1.0 | )% | (0.3 | )% | (0.0 | )% | (1.0 | )% | nm | nm | nm |

December 31, 2011

| Basis Point Change in Rates |

+400 bp | +300 bp | +200 bp | +100 bp | -100 bp | -200 bp | -300 bp | -400 bp | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Increase (decrease) in Earnings |

(1.1 | )% | (1.0 | )% | (0.4 | )% | (0.1 | )% | (0.4 | )% | nm | nm | nm |

nm – not meaningful