|

Delaware

|

|

16-1268674

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(IRS Employer Identification No.)

|

|

Title of each class:

|

|

Name of each exchange on which registered:

|

|

Common Stock, par value $0.01 per share

|

|

The NASDAQ Stock Market LLC

|

|

Large accelerated filer ☒

|

Accelerated filer ☐

|

Non-accelerated filer ☐

|

Smaller reporting company ☐

|

Emerging growth Company ☐

|

|

PART I

|

|

|

|

|

|

|

|

ITEM 1

|

4

|

|

|

ITEM 1A

|

16

|

|

|

ITEM 1B

|

24

|

|

|

ITEM 2

|

25

|

|

|

ITEM 3

|

26

|

|

|

ITEM 4

|

26

|

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

|

ITEM 5

|

26

|

|

|

ITEM 6

|

28

|

|

|

ITEM 7

|

30

|

|

|

ITEM 7A

|

47

|

|

|

ITEM 8

|

49

|

|

|

|

49

|

|

|

|

50

|

|

|

51

|

||

|

52

|

||

|

53

|

||

|

|

54

|

|

|

|

56 | |

|

ITEM 9

|

105

|

|

|

ITEM 9A

|

106

|

|

|

ITEM 9B

|

109

|

|

|

|

|

|

|

PART III

|

|

|

|

|

|

|

|

ITEM 10

|

109

|

|

|

ITEM 11

|

109

|

|

|

ITEM 12

|

109

|

|

|

ITEM 13

|

109

|

|

|

ITEM 14

|

109

|

|

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

|

ITEM 15

|

110

|

|

|

ITEM 16

|

112

|

|

|

|

|

|

|

|

113

|

|

County

|

State

|

Deposits

in Thousands

|

Market Share

|

Market

Rank

|

Number of

Branches*

|

Number of ATMs*

|

|||||||||||||||

|

Chenango

|

NY

|

$

|

836,819

|

94.51

|

%

|

1

|

11

|

12

|

|||||||||||||

|

Fulton

|

NY

|

507,651

|

64.84

|

%

|

1

|

5

|

6

|

||||||||||||||

|

Schoharie

|

NY

|

219,139

|

47.47

|

%

|

1

|

4

|

4

|

||||||||||||||

|

Hamilton

|

NY

|

45,801

|

43.48

|

%

|

2

|

1

|

1

|

||||||||||||||

|

Cortland

|

NY

|

291,036

|

40.84

|

%

|

1

|

5

|

7

|

||||||||||||||

|

Montgomery

|

NY

|

266,070

|

35.71

|

%

|

2

|

5

|

4

|

||||||||||||||

|

Delaware

|

NY

|

368,041

|

35.70

|

%

|

1

|

5

|

5

|

||||||||||||||

|

Otsego

|

NY

|

380,455

|

34.31

|

%

|

1

|

8

|

11

|

||||||||||||||

|

Essex

|

NY

|

208,694

|

28.47

|

%

|

2

|

3

|

5

|

||||||||||||||

|

Madison

|

NY

|

231,978

|

25.34

|

%

|

2

|

4

|

8

|

||||||||||||||

|

Susquehanna

|

PA

|

178,324

|

20.11

|

%

|

2

|

5

|

7

|

||||||||||||||

|

Broome

|

NY

|

391,519

|

14.15

|

%

|

2

|

7

|

9

|

||||||||||||||

|

Oneida

|

NY

|

498,371

|

14.00

|

%

|

4

|

7

|

9

|

||||||||||||||

|

St. Lawrence

|

NY

|

165,322

|

13.72

|

%

|

4

|

4

|

5

|

||||||||||||||

|

Pike

|

PA

|

83,699

|

11.66

|

%

|

5

|

2

|

2

|

||||||||||||||

|

Oswego

|

NY

|

144,549

|

10.91

|

%

|

4

|

4

|

6

|

||||||||||||||

|

Wayne

|

PA

|

124,450

|

9.54

|

%

|

4

|

3

|

4

|

||||||||||||||

|

Herkimer

|

NY

|

56,982

|

8.45

|

%

|

4

|

2

|

1

|

||||||||||||||

|

Tioga

|

NY

|

35,521

|

7.90

|

%

|

5

|

1

|

1

|

||||||||||||||

|

Clinton

|

NY

|

106,166

|

7.64

|

%

|

5

|

3

|

3

|

||||||||||||||

|

Lackawanna

|

PA

|

416,818

|

6.98

|

%

|

6

|

12

|

17

|

||||||||||||||

|

Schenectady

|

NY

|

177,724

|

6.41

|

%

|

5

|

2

|

2

|

||||||||||||||

|

Franklin

|

NY

|

34,042

|

6.33

|

%

|

4

|

1

|

1

|

||||||||||||||

|

Onondaga

|

NY

|

487,142

|

4.74

|

%

|

6

|

11

|

13

|

||||||||||||||

|

Warren

|

NY

|

78,519

|

4.14

|

%

|

5

|

2

|

3

|

||||||||||||||

|

Saratoga

|

NY

|

174,077

|

3.68

|

%

|

8

|

4

|

4

|

||||||||||||||

|

Monroe

|

PA

|

73,469

|

2.70

|

%

|

8

|

4

|

4

|

||||||||||||||

|

Berkshire

|

MA

|

117,200

|

2.63

|

%

|

7

|

6

|

6

|

||||||||||||||

|

Chittenden

|

VT

|

102,142

|

2.31

|

%

|

7

|

3

|

3

|

||||||||||||||

|

Greene

|

NY

|

37,089

|

2.30

|

%

|

5

|

2

|

2

|

||||||||||||||

|

Cheshire

|

NH

|

32,815

|

2.06

|

%

|

7

|

1

|

-

|

||||||||||||||

|

Luzerne

|

PA

|

97,177

|

1.56

|

%

|

13

|

4

|

6

|

||||||||||||||

|

Albany

|

NY

|

265,509

|

1.37

|

%

|

9

|

4

|

5

|

||||||||||||||

|

Rensselaer

|

NY

|

27,233

|

1.29

|

%

|

10

|

1

|

1

|

||||||||||||||

|

Hillsborough

|

NH

|

90,806

|

0.78

|

%

|

12

|

2

|

2

|

||||||||||||||

|

Rutland

|

VT

|

4,813

|

0.49

|

%

|

10

|

1

|

1

|

||||||||||||||

|

Cumberland

|

ME

|

17,176

|

0.18

|

%

|

16

|

1

|

-

|

||||||||||||||

|

Rockingham

|

NH

|

8,765

|

0.11

|

%

|

23

|

1

|

2

|

||||||||||||||

|

|

|

$

|

7,383,103

|

151

|

182

|

||||||||||||||||

| ● |

4.5% CET1 to risk-weighted assets;

|

| ● |

6.0% Tier 1 capital (CET1 plus Additional Tier 1 capital) to risk-weighted assets;

|

| ● |

8.0% Total capital (Tier 1 capital plus Tier 2 capital) to risk-weighted assets; and

|

| ● |

4.0% Tier 1 capital to average consolidated assets as reported on consolidated financial statements (known as the “leverage ratio”).

|

| ● |

the Truth-In-Lending Act, governing disclosures of credit terms to consumer borrowers;

|

| ● |

the Equal Credit Opportunity Act (“ECOA”), prohibiting discrimination in connection with the extension of credit;

|

| ● |

the Home Mortgage Disclosure Act (“HMDA”), requiring home mortgage lenders, including the Bank, to make available to the public expanded information regarding the pricing

of home mortgage loans, including the “rate spread” between the annual percentage rate and the average prime offer rate for mortgage loans of a comparable type;

|

| ● |

the Fair Credit Reporting Act (“FCRA”), governing the provision of consumer information to credit reporting agencies and the use of consumer information; and

|

| ● |

the Fair Debt Collection Practices Act, governing the manner in which consumer debts may be collected by collection agencies.

|

| ● |

the ability to develop, maintain and build upon long-term customer relationships based on top quality service, high ethical standards and safe, sound assets;

|

| ● |

the ability to expand the Company’s market position;

|

| ● |

the scope, relevance and pricing of products and services offered to meet customer needs and demands;

|

| ● |

the rate at which the Company introduces new products, services and technologies relative to its competitors;

|

| ● |

customer satisfaction with the Company’s level of service;

|

| ● |

industry and general economic trends; and

|

| ● |

the ability to attract and retain talented employees.

|

| ● |

increased Volcker Rule requirements and restrictions;

|

| ● |

increased capital, leverage, liquidity and risk management standards;

|

| ● |

examinations by the CFPB for compliance with federal consumer financial protection laws and regulations; and

|

| ● |

limits on interchange fees on debit cards.

|

| ● |

investors may have less confidence in the equity markets in general and in financial services industry stocks in particular, which could place downward pressure on the

Company’s stock price and resulting market valuation;

|

| ● |

consumer and business confidence levels could be lowered and cause declines in credit usage and adverse changes in payment patterns, causing increases in delinquencies and

default rates;

|

| ● |

the Company’s ability to assess the creditworthiness of its customers may be impaired if the models and approaches the Company uses to select, manage and underwrite its

customers become less predictive of future behaviors;

|

| ● |

the Company could suffer decreases in demand for loans or other financial products and services or decreased deposits or other investments in accounts with the Company;

|

| ● |

demand for and income received from the Company's fee-based services could decline;

|

| ● |

customers of the Company's trust and benefit plan administration business may liquidate investments, which together with lower asset values, may reduce the level of assets

under management and administration and thereby decrease the Company's investment management and administration revenues;

|

| ● |

competition in the financial services industry could intensify as a result of the increasing consolidation of financial services companies in connection with current market

conditions or otherwise; and;

|

| ● |

the value of loans and other assets or collateral securing loans may decrease.

|

| ● |

our ability to realize anticipated cost savings;

|

| ● |

the difficulty of integrating operations and personnel and the potential loss of key employees;

|

| ● |

the potential disruption of our or the acquired company’s ongoing business in such a way that could result in decreased revenues or the inability of our management to

maximize our financial and strategic position;

|

| ● |

the inability to maintain uniform standards, controls, procedures and policies; and

|

| ● |

the impairment of relationships with the acquired company’s employees and customers as a result of changes in ownership and management.

|

| ● |

the political climate and whether the proposed policies of the current Presidential administration in the U.S. that have affected market prices for financial institution

stocks are successfully implemented;

|

| ● |

changes in securities analysts’ recommendations or expectations of financial performance;

|

| ● |

volatility of stock market prices and volumes;

|

| ● |

incorrect information or speculation;

|

| ● |

changes in industry valuations;

|

| ● |

variations in operating results from general expectations;

|

| ● |

actions taken against the Company by various regulatory agencies;

|

| ● |

changes in authoritative accounting guidance;

|

| ● |

changes in general domestic economic conditions such as inflation rates, tax rates, unemployment rates, labor and healthcare cost trend rates, recessions and changing

government policies, laws and regulations; and

|

| ● |

severe weather, natural disasters, acts of war or terrorism and other external events.

|

|

County

|

Branches

|

ATMs

|

County

|

Branches

|

ATMs

|

||||||||||||

|

New York

|

Pennsylvania

|

||||||||||||||||

|

Albany

|

4

|

5

|

Lackawanna

|

12

|

17

|

||||||||||||

|

Broome

|

7

|

9

|

Luzerne

|

4

|

6

|

||||||||||||

|

Chenango

|

11

|

12

|

Monroe

|

4

|

4

|

||||||||||||

|

Clinton

|

3

|

3

|

Pike

|

2

|

2

|

||||||||||||

|

Cortland

|

5

|

7

|

Susquehanna

|

5

|

7

|

||||||||||||

|

Delaware

|

5

|

5

|

Wayne

|

3

|

4

|

||||||||||||

|

Essex

|

3

|

5

|

|

||||||||||||||

|

Franklin

|

1

|

1

|

New Hampshire

|

||||||||||||||

|

Fulton

|

5

|

6

|

Cheshire

|

1

|

-

|

||||||||||||

|

Greene

|

2

|

2

|

Hillsborough

|

2

|

2

|

||||||||||||

|

Hamilton

|

1

|

1

|

Rockingham

|

1

|

2

|

||||||||||||

|

Herkimer

|

2

|

1

|

|

||||||||||||||

|

Madison

|

4

|

8

|

Vermont

|

||||||||||||||

|

Montgomery

|

5

|

4

|

Chittenden

|

3

|

3

|

||||||||||||

|

Oneida

|

7

|

9

|

Rutland

|

1

|

1

|

||||||||||||

|

Onondaga

|

11

|

13

|

|

||||||||||||||

|

Oswego

|

4

|

6

|

Massachusetts

|

||||||||||||||

|

Otsego

|

8

|

11

|

Berkshire

|

6

|

6

|

||||||||||||

|

Rensselaer

|

1

|

1

|

|

||||||||||||||

|

St. Lawrence

|

4

|

5

|

Maine

|

||||||||||||||

|

Saratoga

|

4

|

4

|

Cumberland

|

1

|

-

|

||||||||||||

|

Schenectady

|

2

|

2

|

|

||||||||||||||

|

Schoharie

|

4

|

4

|

|

||||||||||||||

|

Tioga

|

1

|

1

|

|

||||||||||||||

|

Warren

|

2

|

3

|

|

||||||||||||||

|

|

|

||||||||||||||||

|

|

Total

|

151

|

182

|

||||||||||||||

|

|

Period Ending

|

|||||||||||||||||||||||

|

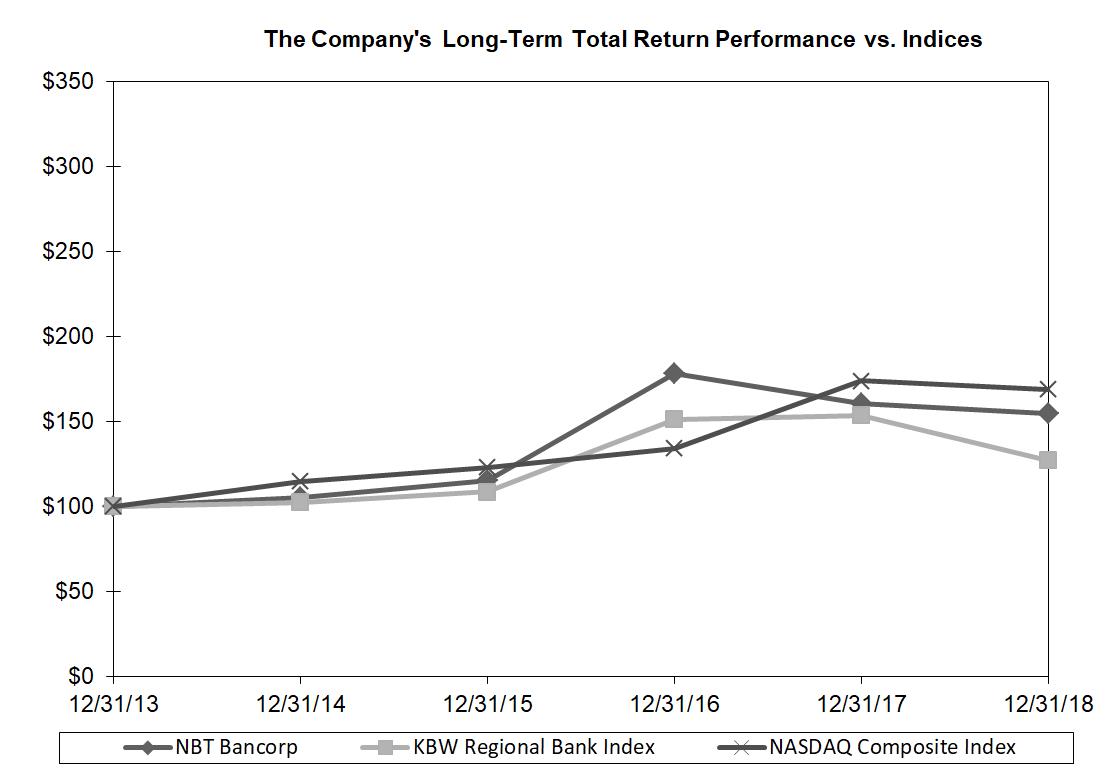

Index

|

12/31/13

|

12/31/14

|

12/31/15

|

12/31/16

|

12/31/17

|

12/31/18

|

||||||||||||||||||

|

NBT Bancorp

|

$

|

100.00

|

$

|

105.07

|

$

|

115.29

|

$

|

178.26

|

$

|

160.59

|

$

|

154.95

|

||||||||||||

|

KBW Regional Bank Index

|

$

|

100.00

|

$

|

102.43

|

$

|

108.56

|

$

|

151.40

|

$

|

153.77

|

$

|

126.88

|

||||||||||||

|

NASDAQ Composite Index

|

$

|

100.00

|

$

|

114.83

|

$

|

122.99

|

$

|

134.02

|

$

|

173.86

|

$

|

168.98

|

||||||||||||

|

|

Year ended December 31,

|

|||||||||||||||||||

|

(In thousands, except per share data)

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Interest, fee and dividend income

|

$

|

344,255

|

$

|

309,407

|

$

|

286,947

|

$

|

273,224

|

$

|

275,081

|

||||||||||

|

Interest expense

|

38,626

|

25,914

|

22,506

|

20,616

|

23,203

|

|||||||||||||||

|

Net interest income

|

305,629

|

283,493

|

264,441

|

252,608

|

251,878

|

|||||||||||||||

|

Provision for loan losses

|

28,828

|

30,988

|

25,431

|

18,285

|

19,539

|

|||||||||||||||

|

Noninterest income excluding net securities (losses) gains

|

131,103

|

119,437

|

116,357

|

115,394

|

125,935

|

|||||||||||||||

|

Net securities (losses) gains

|

(6,341

|

)

|

1,867

|

(644

|

)

|

3,087

|

92

|

|||||||||||||

|

Noninterest expense

|

264,561

|

245,648

|

235,922

|

236,176

|

246,063

|

|||||||||||||||

|

Income before income taxes

|

137,002

|

128,161

|

118,801

|

116,628

|

112,303

|

|||||||||||||||

|

Net income

|

112,566

|

82,151

|

78,409

|

76,425

|

75,074

|

|||||||||||||||

|

Per common share

|

||||||||||||||||||||

|

Basic earnings

|

$

|

2.58

|

$

|

1.89

|

$

|

1.81

|

$

|

1.74

|

$

|

1.71

|

||||||||||

|

Diluted earnings

|

2.56

|

1.87

|

1.80

|

1.72

|

1.69

|

|||||||||||||||

|

Cash dividends paid

|

0.99

|

0.92

|

0.90

|

0.87

|

0.84

|

|||||||||||||||

|

Book value at year-end

|

23.31

|

22.01

|

21.11

|

20.31

|

19.69

|

|||||||||||||||

|

Tangible book value at year-end (1)

|

16.66

|

15.54

|

14.61

|

13.79

|

13.22

|

|||||||||||||||

|

Average diluted common shares outstanding

|

44,020

|

43,905

|

43,622

|

44,389

|

44,395

|

|||||||||||||||

|

Securities available for sale, at fair value

|

$

|

998,496

|

$

|

1,255,925

|

$

|

1,338,290

|

$

|

1,174,544

|

$

|

1,013,171

|

||||||||||

|

Securities held to maturity, at amortized cost

|

783,599

|

484,073

|

527,948

|

471,031

|

454,361

|

|||||||||||||||

|

Loans

|

6,887,709

|

6,583,639

|

6,196,978

|

5,882,642

|

5,591,959

|

|||||||||||||||

|

Allowance for loan losses

|

72,505

|

69,500

|

65,200

|

63,018

|

66,359

|

|||||||||||||||

|

Assets

|

9,556,363

|

9,136,812

|

8,867,268

|

8,262,646

|

7,807,340

|

|||||||||||||||

|

Deposits

|

7,368,211

|

7,170,636

|

6,973,688

|

6,604,843

|

6,299,605

|

|||||||||||||||

|

Borrowings

|

1,046,616

|

909,188

|

886,986

|

674,124

|

548,943

|

|||||||||||||||

|

Stockholders’ equity

|

1,017,909

|

958,177

|

913,316

|

882,004

|

864,181

|

|||||||||||||||

|

Key ratios

|

||||||||||||||||||||

|

Return on average assets

|

1.20

|

%

|

0.91

|

%

|

0.92

|

%

|

0.96

|

%

|

0.97

|

%

|

||||||||||

|

Return on average equity

|

11.49

|

%

|

8.71

|

%

|

8.74

|

%

|

8.70

|

%

|

8.84

|

%

|

||||||||||

|

Average equity to average assets

|

10.47

|

%

|

10.45

|

%

|

10.49

|

%

|

10.98

|

%

|

10.95

|

%

|

||||||||||

|

Net interest margin

|

3.58

|

%

|

3.47

|

%

|

3.43

|

%

|

3.50

|

%

|

3.61

|

%

|

||||||||||

|

Dividend payout ratio

|

38.67

|

%

|

49.20

|

%

|

50.00

|

%

|

49.92

|

%

|

49.16

|

%

|

||||||||||

|

Tier 1 leverage

|

9.52

|

%

|

9.14

|

%

|

9.11

|

%

|

9.44

|

%

|

9.39

|

%

|

||||||||||

|

Common equity tier 1 capital ratio

|

10.49

|

%

|

10.06

|

%

|

9.98

|

%

|

10.20

|

%

|

N/A

|

|||||||||||

|

Tier 1 risk-based capital

|

11.79

|

%

|

11.42

|

%

|

11.42

|

%

|

11.73

|

%

|

12.32

|

%

|

||||||||||

|

Total risk-based capital

|

12.78

|

%

|

12.42

|

%

|

12.39

|

%

|

12.74

|

%

|

13.50

|

%

|

||||||||||

| (1) |

Tangible book value calculation (non-GAAP):

|

|

|

Year ended December 31,

|

|||||||||||||||||||

|

(In thousands, except per share data)

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Stockholders' equity

|

$

|

1,017,909

|

$

|

958,177

|

$

|

913,316

|

$

|

882,004

|

$

|

864,181

|

||||||||||

|

Intangibles

|

290,368

|

281,463

|

281,254

|

283,222

|

283,951

|

|||||||||||||||

|

Tangible equity

|

727,541

|

676,714

|

632,062

|

598,782

|

580,230

|

|||||||||||||||

|

Diluted common shares outstanding

|

43,673

|

43,543

|

43,258

|

43,431

|

43,896

|

|||||||||||||||

|

Tangible book value

|

$

|

16.66

|

$

|

15.54

|

$

|

14.61

|

$

|

13.79

|

$

|

13.22

|

||||||||||

|

|

2018

|

2017

|

||||||||||||||||||||||||||||||

|

(In thousands, except per share data)

|

Fourth

|

Third

|

Second

|

First

|

Fourth

|

Third

|

Second

|

First

|

||||||||||||||||||||||||

|

Interest, fee and dividend income

|

$

|

90,524

|

$

|

88,204

|

$

|

84,767

|

$

|

80,760

|

$

|

80,230

|

$

|

78,847

|

$

|

75,894

|

$

|

74,436

|

||||||||||||||||

|

Interest expense

|

11,649

|

10,677

|

9,026

|

7,274

|

6,779

|

6,917

|

6,273

|

5,945

|

||||||||||||||||||||||||

|

Net interest income

|

78,875

|

77,527

|

75,741

|

73,486

|

73,451

|

71,930

|

69,621

|

68,491

|

||||||||||||||||||||||||

|

Provision for loan losses

|

6,528

|

6,026

|

8,778

|

7,496

|

8,153

|

7,889

|

7,567

|

7,379

|

||||||||||||||||||||||||

|

Noninterest income excluding net securities (losses) gains

|

32,862

|

32,969

|

34,067

|

31,205

|

29,603

|

30,782

|

30,302

|

28,750

|

||||||||||||||||||||||||

|

Net securities (losses) gains

|

(6,916

|

)

|

412

|

91

|

72

|

1,869

|

(4

|

)

|

2

|

-

|

||||||||||||||||||||||

|

Noninterest expense

|

68,904

|

66,497

|

64,888

|

64,272

|

63,444

|

60,601

|

60,321

|

61,282

|

||||||||||||||||||||||||

|

Net income

|

28,652

|

29,807

|

28,121

|

25,986

|

17,637

|

22,876

|

21,359

|

20,279

|

||||||||||||||||||||||||

|

Basic earnings per share

|

$

|

0.66

|

$

|

0.68

|

$

|

0.64

|

$

|

0.60

|

$

|

0.40

|

$

|

0.52

|

$

|

0.49

|

$

|

0.47

|

||||||||||||||||

|

Diluted earnings per share

|

$

|

0.65

|

$

|

0.68

|

$

|

0.64

|

$

|

0.59

|

$

|

0.40

|

$

|

0.52

|

$

|

0.49

|

$

|

0.46

|

||||||||||||||||

|

Annualized net interest margin

|

3.61

|

%

|

3.57

|

%

|

3.57

|

%

|

3.57

|

%

|

3.52

|

%

|

3.47

|

%

|

3.44

|

%

|

3.46

|

%

|

||||||||||||||||

|

Annualized return on average assets

|

1.20

|

%

|

1.25

|

%

|

1.21

|

%

|

1.15

|

%

|

0.77

|

%

|

1.00

|

%

|

0.95

|

%

|

0.92

|

%

|

||||||||||||||||

|

Annualized return on average equity

|

11.34

|

%

|

11.96

|

%

|

11.64

|

%

|

10.99

|

%

|

7.27

|

%

|

9.55

|

%

|

9.11

|

%

|

8.94

|

%

|

||||||||||||||||

|

Weighted average diluted common shares outstanding

|

44,060

|

44,051

|

44,017

|

43,975

|

43,958

|

43,915

|

43,901

|

43,883

|

||||||||||||||||||||||||

| ● |

diluted earnings per share up 37% from prior year

|

| ● |

earnings in excess of $100 million for the first time in the 163 year history of the Company

|

| ● |

loan growth for the year ended December 31, 2018 of 4.6%

|

| ● |

average demand deposits for the year ended December 31, 2018 up 4.7% over 2017

|

| ● |

FTE net interest margin of 3.58% for year ended December 31, 2018 up 11 bps from 2017

|

| ● |

full cycle deposit beta of 6.9% through the quarter ended December 31, 20181

|

| ● |

continued strong economic conditions may lead to further increases in interest rates. This would result in principal and interest payments on currently outstanding loans

and investments being reinvested at higher rates. In addition, rising market rates would likely increase deposit and borrowing costs from current low levels. This could potentially offset, or more than offset, the benefits of higher

rates on our earning assets. The magnitude and timing of interest rate increases, if any, along with the shape of the yield curve, will impact net interest income in 2019.

|

| ● |

slower economic growth could reduce demand for credit, slowing loan growth.

|

| ● |

the Company's continued focus on long-term strategies including growth in the New England markets, diversification of revenue, improving operating efficiencies and

investing in technology.

|

| ● |

the Company’s 2019 outlook is subject to factors in addition to those identified above and those risks and uncertainties that could impact the Company’s future results

are explained in ITEM 1A. RISK FACTORS.

|

|

|

2018

|

2017

|

2016

|

|||||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

Average

Balance

|

Interest

|

Yield/

Rate

|

Average

Balance

|

Interest

|

Yield/

Rate

|

Average

Balance

|

Interest

|

Yield/

Rate

|

|||||||||||||||||||||||||||

|

Assets:

|

||||||||||||||||||||||||||||||||||||

|

Short-term interest bearing accounts

|

$

|

3,377

|

$

|

183

|

5.42

|

%

|

$

|

9,636

|

$

|

179

|

1.86

|

%

|

$

|

16,301

|

$

|

95

|

0.58

|

%

|

||||||||||||||||||

|

Securities available for sale (1)(3)

|

1,210,013

|

27,081

|

2.24

|

%

|

1,350,995

|

28,969

|

2.14

|

%

|

1,237,930

|

24,450

|

1.98

|

%

|

||||||||||||||||||||||||

|

Securities held to maturity (1)

|

567,117

|

14,657

|

2.58

|

%

|

507,583

|

13,490

|

2.66

|

%

|

487,837

|

12,255

|

2.51

|

%

|

||||||||||||||||||||||||

|

Federal Reserve Bank and FHLB stock

|

48,214

|

3,083

|

6.39

|

%

|

46,673

|

2,634

|

5.64

|

%

|

38,867

|

1,973

|

5.08

|

%

|

||||||||||||||||||||||||

|

Loans (2)

|

6,765,748

|

301,258

|

4.45

|

%

|

6,359,447

|

267,934

|

4.21

|

%

|

6,035,513

|

251,723

|

4.17

|

%

|

||||||||||||||||||||||||

|

Total interest earning assets

|

$

|

8,594,469

|

$

|

346,262

|

4.03

|

%

|

$

|

8,274,334

|

$

|

313,206

|

3.79

|

%

|

$

|

7,816,448

|

$

|

290,496

|

3.72

|

%

|

||||||||||||||||||

|

Other assets (3)

|

764,670

|

752,258

|

740,506

|

|||||||||||||||||||||||||||||||||

|

Total assets

|

$

|

9,359,139

|

$

|

9,026,592

|

$

|

8,556,954

|

||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||

|

Liabilities and Stockholders' Equity:

|

||||||||||||||||||||||||||||||||||||

|

Money market deposit accounts

|

$

|

1,706,823

|

$

|

8,314

|

0.49

|

%

|

$

|

1,697,386

|

$

|

3,864

|

0.23

|

%

|

$

|

1,668,555

|

$

|

3,599

|

0.22

|

%

|

||||||||||||||||||

|

NOW deposit accounts

|

1,191,008

|

1,894

|

0.16

|

%

|

1,153,361

|

1,051

|

0.09

|

%

|

1,077,581

|

546

|

0.05

|

%

|

||||||||||||||||||||||||

|

Savings deposits

|

1,266,970

|

725

|

0.06

|

%

|

1,214,480

|

683

|

0.06

|

%

|

1,135,182

|

652

|

0.06

|

%

|

||||||||||||||||||||||||

|

Time deposits

|

866,388

|

11,211

|

1.29

|

%

|

817,370

|

8,877

|

1.09

|

%

|

905,126

|

9,569

|

1.06

|

%

|

||||||||||||||||||||||||

|

Total interest bearing deposits

|

$

|

5,031,189

|

$

|

22,144

|

0.44

|

%

|

$

|

4,882,597

|

$

|

14,475

|

0.30

|

%

|

$

|

4,786,444

|

$

|

14,366

|

0.30

|

%

|

||||||||||||||||||

|

Short-term borrowings

|

727,635

|

10,552

|

1.45

|

%

|

690,036

|

5,996

|

0.87

|

%

|

497,654

|

2,309

|

0.46

|

%

|

||||||||||||||||||||||||

|

Long-term debt

|

80,195

|

1,790

|

2.23

|

%

|

93,389

|

2,299

|

2.46

|

%

|

118,860

|

3,204

|

2.70

|

%

|

||||||||||||||||||||||||

|

Junior subordinated debt

|

101,196

|

4,140

|

4.09

|

%

|

101,196

|

3,144

|

3.11

|

%

|

101,196

|

2,627

|

2.60

|

%

|

||||||||||||||||||||||||

|

Total interest bearing liabilities

|

$

|

5,940,215

|

$

|

38,626

|

0.65

|

%

|

$

|

5,767,218

|

$

|

25,914

|

0.45

|

%

|

$

|

5,504,154

|

$

|

22,506

|

0.41

|

%

|

||||||||||||||||||

|

Demand deposits

|

2,321,264

|

2,217,785

|

2,045,465

|

|||||||||||||||||||||||||||||||||

|

Other liabilities

|

117,655

|

97,913

|

110,105

|

|||||||||||||||||||||||||||||||||

|

Stockholders' equity

|

980,005

|

943,676

|

897,230

|

|||||||||||||||||||||||||||||||||

|

Total liabilities and stockholders' equity

|

$

|

9,359,139

|

$

|

9,026,592

|

$

|

8,556,954

|

||||||||||||||||||||||||||||||

|

Net interest income (FTE)

|

$

|

307,636

|

$

|

287,292

|

$

|

267,990

|

||||||||||||||||||||||||||||||

|

Interest rate spread

|

3.38

|

%

|

3.34

|

%

|

3.31

|

%

|

||||||||||||||||||||||||||||||

|

Net interest margin (FTE)

|

3.58

|

%

|

3.47

|

%

|

3.43

|

%

|

||||||||||||||||||||||||||||||

|

Taxable equivalent adjustment

|

$

|

2,007

|

$

|

3,799

|

$

|

3,549

|

||||||||||||||||||||||||||||||

|

Net interest income

|

$

|

305,629

|

$

|

283,493

|

$

|

264,441

|

||||||||||||||||||||||||||||||

|

|

Increase (Decrease)

2018 over 2017

|

Increase (Decrease)

2017 over 2016

|

||||||||||||||||||||||

|

(In thousands)

|

Volume

|

Rate

|

Total

|

Volume

|

Rate

|

Total

|

||||||||||||||||||

|

Short-term interest-bearing accounts

|

$

|

(173

|

)

|

$

|

177

|

$

|

4

|

$

|

(52

|

)

|

$

|

136

|

$

|

84

|

||||||||||

|

Securities available for sale

|

(3,115

|

)

|

1,227

|

(1,888

|

)

|

2,331

|

2,188

|

4,519

|

||||||||||||||||

|

Securities held to maturity

|

1,547

|

(380

|

)

|

1,167

|

508

|

727

|

1,235

|

|||||||||||||||||

|

Federal Reserve Bank and FHLB stock

|

89

|

360

|

449

|

425

|

236

|

661

|

||||||||||||||||||

|

Loans

|

17,632

|

15,692

|

33,324

|

13,627

|

2,584

|

16,211

|

||||||||||||||||||

|

Total FTE interest income

|

$

|

15,980

|

$

|

17,076

|

$

|

33,056

|

$

|

16,839

|

$

|

5,871

|

$

|

22,710

|

||||||||||||

|

Money market deposit accounts

|

22

|

4,428

|

4,450

|

63

|

202

|

265

|

||||||||||||||||||

|

NOW deposit accounts

|

35

|

808

|

843

|

41

|

464

|

505

|

||||||||||||||||||

|

Savings deposits

|

30

|

12

|

42

|

45

|

(14

|

)

|

31

|

|||||||||||||||||

|

Time deposits

|

557

|

1,777

|

2,334

|

(948

|

)

|

256

|

(692

|

)

|

||||||||||||||||

|

Short-term borrowings

|

343

|

4,213

|

4,556

|

1,132

|

2,555

|

3,687

|

||||||||||||||||||

|

Long-term debt

|

(307

|

)

|

(202

|

)

|

(509

|

)

|

(644

|

)

|

(261

|

)

|

(905

|

)

|

||||||||||||

|

Junior subordinated debt

|

-

|

996

|

996

|

-

|

517

|

517

|

||||||||||||||||||

|

Total FTE interest expense

|

$

|

680

|

$

|

12,032

|

$

|

12,712

|

$

|

(311

|

)

|

$

|

3,719

|

$

|

3,408

|

|||||||||||

|

Change in FTE net interest income

|

$

|

15,300

|

$

|

5,044

|

$

|

20,344

|

$

|

17,150

|

$

|

2,152

|

$

|

19,302

|

||||||||||||

|

|

December 31,

|

|||||||||||||||||||

|

(In thousands)

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Commercial

|

$

|

1,291,568

|

$

|

1,258,212

|

$

|

1,242,701

|

$

|

1,159,089

|

$

|

1,144,761

|

||||||||||

|

Commercial Real Estate

|

1,930,742

|

1,769,620

|

1,543,301

|

1,430,618

|

1,334,984

|

|||||||||||||||

|

Residential Real Estate

|

1,380,836

|

1,320,370

|

1,262,041

|

1,196,780

|

1,112,530

|

|||||||||||||||

|

Dealer Finance

|

1,216,144

|

1,227,870

|

1,169,129

|

1,173,729

|

1,104,869

|

|||||||||||||||

|

Specialty Lending

|

524,928

|

438,866

|

361,152

|

287,096

|

256,542

|

|||||||||||||||

|

Home Equity

|

474,566

|

498,179

|

507,784

|

528,442

|

569,595

|

|||||||||||||||

|

Other Consumer

|

68,925

|

70,522

|

110,870

|

106,888

|

68,678

|

|||||||||||||||

|

Total loans

|

$

|

6,887,709

|

$

|

6,583,639

|

$

|

6,196,978

|

$

|

5,882,642

|

$

|

5,591,959

|

||||||||||

|

|

Remaining maturity at December 31, 2018

|

|||||||||||||||

|

(In thousands)

|

Within One Year

|

After One

Year But

Within Five

Years

|

After Five Years

|

Total

|

||||||||||||

|

Floating/adjustable rate:

|

||||||||||||||||

|

Commercial and Commercial Real Estate

|

$

|

464,923

|

$

|

490,180

|

$

|

1,418,506

|

$

|

2,373,609

|

||||||||

|

Fixed rate:

|

||||||||||||||||

|

Commercial and Commercial Real Estate

|

89,736

|

448,861

|

310,104

|

848,701

|

||||||||||||

|

Total

|

$

|

554,659

|

$

|

939,041

|

$

|

1,728,610

|

$

|

3,222,310

|

||||||||

|

|

As of December 31,

|

|||||||||||||||||||||||

|

|

2018

|

2017

|

2016

|

|||||||||||||||||||||

|

(In thousands)

|

Amortized

Cost

|

Fair

Value

|

Amortized

Cost

|

Fair

Value

|

Amortized

Cost

|

Fair

Value

|

||||||||||||||||||

|

AFS securities:

|

||||||||||||||||||||||||

|

Federal agency

|

$

|

84,982

|

$

|

84,299

|

$

|

109,862

|

$

|

108,899

|

$

|

175,135

|

$

|

174,408

|

||||||||||||

|

State & municipal

|

30,136

|

29,915

|

42,171

|

41,956

|

47,053

|

46,726

|

||||||||||||||||||

|

Mortgage-backed

|

522,415

|

512,295

|

556,755

|

554,927

|

528,769

|

529,844

|

||||||||||||||||||

|

Collateralized mortgage obligations

|

380,093

|

371,987

|

546,754

|

535,994

|

574,253

|

566,573

|

||||||||||||||||||

|

Equity securities

|

-

|

-

|

10,623

|

14,149

|

15,849

|

20,739

|

||||||||||||||||||

|

Total AFS securities

|

$

|

1,017,626

|

$

|

998,496

|

$

|

1,266,165

|

$

|

1,255,925

|

$

|

1,341,059

|

$

|

1,338,290

|

||||||||||||

|

|

||||||||||||||||||||||||

|

HTM securities:

|

||||||||||||||||||||||||

|

Federal agency

|

$

|

19,995

|

$

|

20,047

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||||

|

Mortgage-backed

|

179,848

|

178,190

|

96,775

|

96,107

|

97,201

|

96,112

|

||||||||||||||||||

|

Collateralized mortgage obligations

|

340,623

|

338,590

|

186,327

|

183,974

|

225,213

|

224,765

|

||||||||||||||||||

|

State & municipal

|

243,133

|

241,848

|

200,971

|

201,790

|

205,534

|

204,173

|

||||||||||||||||||

|

Total HTM securities

|

$

|

783,599

|

$

|

778,675

|

$

|

484,073

|

$

|

481,871

|

$

|

527,948

|

$

|

525,050

|

||||||||||||

|

(Dollars in thousands)

|

Amortized cost

|

Estimated fair value

|

Weighted Average Yield

|

|||||||||

|

AFS debt securities:

|

||||||||||||

|

Within one year

|

$

|

44,262

|

$

|

44,218

|

1.54

|

%

|

||||||

|

From one to five years

|

84,391

|

83,441

|

2.59

|

%

|

||||||||

|

From five to ten years

|

163,400

|

160,898

|

2.73

|

%

|

||||||||

|

After ten years

|

725,573

|

709,939

|

2.74

|

%

|

||||||||

|

Total AFS debt securities

|

$

|

1,017,626

|

$

|

998,496

|

||||||||

|

HTM debt securities:

|

||||||||||||

|

Within one year

|

$

|

85,778

|

$

|

85,778

|

2.11

|

%

|

||||||

|

From one to five years

|

62,441

|

62,558

|

3.14

|

%

|

||||||||

|

From five to ten years

|

213,184

|

210,480

|

2.34

|

%

|

||||||||

|

After ten years

|

422,196

|

419,859

|

3.12

|

%

|

||||||||

|

Total HTM debt securities

|

$

|

783,599

|

$

|

778,675

|

||||||||

|

(In thousands)

|

December 31,2018

|

|||

|

Within three months

|

$

|

36,943

|

||

|

After three but within twelve months

|

64,334

|

|||

|

After one but within three years

|

33,322

|

|||

|

Over three years

|

11,524

|

|||

|

Total

|

$

|

146,123

|

||

|

|

Years ended December 31,

|

|||||||||||

|

(In thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Insurance and other financial services revenue

|

$

|

24,345

|

$

|

23,532

|

$

|

24,396

|

||||||

|

Service charges on deposit accounts

|

17,224

|

16,750

|

16,729

|

|||||||||

|

ATM and debit card fees

|

22,699

|

21,372

|

19,448

|

|||||||||

|

Retirement plan administration fees

|

26,992

|

20,213

|

16,063

|

|||||||||

|

Trust

|

19,524

|

19,586

|

18,565

|

|||||||||

|

Bank owned life insurance income

|

5,091

|

5,175

|

5,195

|

|||||||||

|

Net securities (losses) gains

|

(6,341

|

)

|

1,867

|

(644

|

)

|

|||||||

|

Gain on the sale of equity investment

|

-

|

818

|

-

|

|||||||||

|

Other

|

15,228

|

11,991

|

15,961

|

|||||||||

|

Total noninterest income

|

$

|

124,762

|

$

|

121,304

|

$

|

115,713

|

||||||

|

|

Years ended December 31,

|

|||||||||||

|

(In thousands)

|

2018

|

2017

|

2016

|

|||||||||

|

Salaries and employee benefits

|

$

|

151,685

|

$

|

135,222

|

$

|

132,060

|

||||||

|

Occupancy

|

22,318

|

21,808

|

20,940

|

|||||||||

|

Data processing and communications

|

17,652

|

17,068

|

16,495

|

|||||||||

|

Professional fees and outside services

|

14,376

|

13,499

|

13,617

|

|||||||||

|

Equipment

|

17,037

|

15,225

|

14,295

|

|||||||||

|

Office supplies and postage

|

6,204

|

6,284

|

6,168

|

|||||||||

|

FDIC expenses

|

4,651

|

4,767

|

5,111

|

|||||||||

|

Advertising

|

2,782

|

2,744

|

2,556

|

|||||||||

|

Amortization of intangible assets

|

4,042

|

3,960

|

3,928

|

|||||||||

|

Loan collection and other real estate owned, net

|

4,217

|

4,763

|

3,458

|

|||||||||

|

Other

|

19,597

|

20,308

|

17,294

|

|||||||||

|

Total noninterest expense

|

$

|

264,561

|

$

|

245,648

|

$

|

235,922

|

||||||

|

|

As of December 31,

|

|||||||||||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

%

|

2017

|

%

|

2016

|

%

|

2015

|

%

|

2014

|

%

|

||||||||||||||||||||||||||||||

|

Nonaccrual loans:

|

||||||||||||||||||||||||||||||||||||||||

|

Commercial, Agricultural and Real Estate loans

|

$

|

11,804

|

46

|

%

|

$

|

12,485

|

48

|

%

|

$

|

19,351

|

54

|

%

|

$

|

14,655

|

43

|

%

|

$

|

18,226

|

45

|

%

|

||||||||||||||||||||

|

Residential Real Estate

|

6,526

|

26

|

%

|

5,919

|

23

|

%

|

8,027

|

23

|

%

|

8,625

|

26

|

%

|

10,867

|

26

|

%

|

|||||||||||||||||||||||||

|

Consumer

|

4,068

|

16

|

%

|

4,324

|

17

|

%

|

4,653

|

13

|

%

|

6,009

|

18

|

%

|

8,086

|

20

|

%

|

|||||||||||||||||||||||||

|

Troubled debt restructured loans

|

3,089

|

12

|

%

|

2,980

|

12

|

%

|

3,681

|

10

|

%

|

4,455

|

13

|

%

|

3,895

|

9

|

%

|

|||||||||||||||||||||||||

|

Total nonaccrual loans

|

$

|

25,487

|

100

|

%

|

$

|

25,708

|

100

|

%

|

$

|

35,712

|

100

|

%

|

$

|

33,744

|

100

|

%

|

$

|

41,074

|

100

|

%

|

||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||

|

Loans 90 days or more past due and still accruing:

|

||||||||||||||||||||||||||||||||||||||||

|

Commercial, Agricultural and Real Estate loans

|

$

|

588

|

12

|

%

|

$

|

-

|

-

|

|

$

|

-

|

-

|

|

$

|

-

|

-

|

|

$

|

84

|

2

|

%

|

||||||||||||||||||||

|

Residential Real Estate

|

1,182

|

23

|

%

|

1,402

|

26

|

%

|

1,733

|

36

|

%

|

1,022

|

28

|

%

|

1,927

|

39

|

%

|

|||||||||||||||||||||||||

|

Consumer

|

3,315

|

65

|

%

|

4,008

|

74

|

%

|

3,077

|

64

|

%

|

2,640

|

72

|

%

|

2,930

|

59

|

%

|

|||||||||||||||||||||||||

|

Total loans 90 days or more past due and still accruing

|

$

|

5,085

|

100

|

%

|

$

|

5,410

|

100

|

%

|

$

|

4,810

|

100

|

%

|

$

|

3,662

|

100

|

%

|

$

|

4,941

|

100

|

%

|

||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||

|

Total nonperforming loans

|

$

|

30,572

|

$

|

31,118

|

$

|

40,522

|

$

|

37,406

|

$

|

46,015

|

||||||||||||||||||||||||||||||

|

Other real estate owned

|

2,441

|

4,529

|

5,581

|

4,666

|

3,964

|

|||||||||||||||||||||||||||||||||||

|

Total nonperforming assets

|

$

|

33,013

|

$

|

35,647

|

$

|

46,103

|

$

|

42,072

|

$

|

49,979

|

||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||

|

Total nonperforming loans to total loans

|

0.44

|

%

|

0.47

|

%

|

0.65

|

%

|

0.64

|

%

|

0.82

|

%

|

||||||||||||||||||||||||||||||

|

Total nonperforming assets to total assets

|

0.35

|

%

|

0.39

|

%

|

0.52

|

%

|

0.51

|

%

|

0.64

|

%

|

||||||||||||||||||||||||||||||

|

Total allowance for loan losses to nonperforming loans

|

237.16

|

%

|

223.34

|

%

|

160.90

|

%

|

168.47

|

%

|

144.21

|

%

|

||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Balance at January 1

|

$

|

69,500

|

$

|

65,200

|

$

|

63,018

|

$

|

66,359

|

$

|

69,434

|

||||||||||

|

Loans charged-off

|

||||||||||||||||||||

|

Commercial and Agricultural

|

3,463

|

4,169

|

4,592

|

5,718

|

9,414

|

|||||||||||||||

|

Residential Real Estate

|

913

|

1,846

|

1,343

|

2,229

|

1,417

|

|||||||||||||||

|

Consumer*

|

29,752

|

27,072

|

23,364

|

18,140

|

16,642

|

|||||||||||||||

|

Total loans charged-off

|

$

|

34,128

|

$

|

33,087

|

$

|

29,299

|

$

|

26,087

|

$

|

27,473

|

||||||||||

|

Recoveries

|

||||||||||||||||||||

|

Commercial and Agricultural

|

$

|

1,178

|

$

|

1,077

|

$

|

1,887

|

$

|

1,014

|

$

|

1,774

|

||||||||||

|

Residential Real Estate

|

306

|

180

|

293

|

320

|

285

|

|||||||||||||||

|

Consumer*

|

6,821

|

5,142

|

3,870

|

3,127

|

2,800

|

|||||||||||||||

|

Total recoveries

|

$

|

8,305

|

$

|

6,399

|

$

|

6,050

|

$

|

4,461

|

$

|

4,859

|

||||||||||

|

Net loans charged-off

|

$

|

25,823

|

$

|

26,688

|

$

|

23,249

|

$

|

21,626

|

$

|

22,614

|

||||||||||

|

|

||||||||||||||||||||

|

Provision for loan losses

|

$

|

28,828

|

$

|

30,988

|

$

|

25,431

|

$

|

18,285

|

$

|

19,539

|

||||||||||

|

Balance at December 31

|

$

|

72,505

|

$

|

69,500

|

$

|

65,200

|

$

|

63,018

|

$

|

66,359

|

||||||||||

|

Allowance for loan losses to loans outstanding at end of year

|

1.05

|

%

|

1.06

|

%

|

1.05

|

%

|

1.07

|

%

|

1.19

|

%

|

||||||||||

|

Net charge-offs to average loans outstanding

|

0.38

|

%

|

0.42

|

%

|

0.39

|

%

|

0.38

|

%

|

0.41

|

%

|

||||||||||

|

|

December 31,

|

|||||||||||||||||||||||||||||||||||||||

|

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

Allowance

|

Category

Percent of

Loans

|

Allowance

|

Category

Percent of

Loans

|

Allowance

|

Category

Percent of

Loans

|

Allowance

|

Category

Percent of

Loans

|

Allowance

|

Category

Percent of

of Loans

|

||||||||||||||||||||||||||||||

|

Commercial and Agricultural

|

$

|

32,759

|

47

|

%

|

$

|

27,606

|

46

|

%

|

$

|

25,444

|

45

|

%

|

$

|

25,545

|

44

|

%

|

$

|

32,433

|

44

|

%

|

||||||||||||||||||||

|

Residential Real Estate

|

2,568

|

20

|

%

|

5,064

|

20

|

%

|

6,381

|

20

|

%

|

7,960

|

20

|

%

|

7,130

|

20

|

%

|

|||||||||||||||||||||||||

|

Consumer

|

37,178

|

33

|

%

|

36,830

|

34

|

%

|

33,375

|

35

|

%

|

29,253

|

36

|

%

|

26,720

|

36

|

%

|

|||||||||||||||||||||||||

|

Unallocated

|

-

|

-

|

-

|

-

|

-

|

-

|

260

|

-

|

76

|

-

|

||||||||||||||||||||||||||||||

|

Total

|

$

|

72,505

|

100

|

%

|

$

|

69,500

|

100

|

%

|

$

|

65,200

|

100

|

%

|

$

|

63,018

|

100

|

%

|

$

|

66,359

|

100

|

%

|

||||||||||||||||||||

|

|

Payments Due by Period

|

|||||||||||||||||||||||||||

|

(In thousands)

|

2019

|

2020

|

2021

|

2022

|

2023

|

Thereafter

|

Total

|

|||||||||||||||||||||

|

Long-term debt obligations

|

$

|

20,000

|

$

|

25,000

|

$

|

25,039

|

$

|

-

|

$

|

-

|

$

|

3,685

|

$

|

73,724

|

||||||||||||||

|

Junior subordinated debt

|

-

|

-

|

-

|

-

|

-

|

101,196

|

101,196

|

|||||||||||||||||||||

|

Operating lease obligations

|

6,890

|

6,467

|

5,613

|

4,773

|

3,972

|

13,869

|

41,584

|

|||||||||||||||||||||

|

Capital lease obligations

|

188

|

149

|

78

|

8

|

-

|

-

|

423

|

|||||||||||||||||||||

|

IT/Software obligations

|

7,870

|

2,748

|

1,588

|

1,507

|

1,474

|

-

|

15,187

|

|||||||||||||||||||||

|

Data processing commitments

|

12,191

|

12,191

|

1,178

|

295

|

-

|

-

|

25,855

|

|||||||||||||||||||||

|

Total contractual obligations

|

$

|

47,139

|

$

|

46,555

|

$

|

33,496

|

$

|

6,583

|

$

|

5,446

|

$

|

118,750

|

$

|

257,969

|

||||||||||||||

|

(In thousands)

|

December 31, 2018

|

|||

|

Within one year

|

$

|

33,150

|

||

|

After one but within three years

|

4,696

|

|||

|

After three but within five years

|

1,701

|

|||

|

After five years

|

1,647

|

|||

|

Total

|

$

|

41,194

|

||

|

Change in interest rates

(In basis points)

|

Percent change in net interest income

|

|||

|

+200

|

(1.18

|

%)

|

||

|

-100

|

(2.87

|

%)

|

||

|

Change in interest rates

(In basis points)

|

Percent change in net portfolio value

|

|||

|

+200

|

(9.63

|

%)

|

||

|

-100

|

(8.81

|

%)

|

||

|

|

As of December 31,

|

|||||||

|

2018

|

2017

|

|||||||

|

(In thousands except share and per share data)

|

||||||||

|

Assets

|

||||||||

|

Cash and due from banks

|

$

|

175,550

|

$

|

156,852

|

||||

|

Short-term interest bearing accounts

|

5,405

|

2,812

|

||||||

|

Equity securities, at fair value

|

23,053

|

-

|

||||||

|

Securities available for sale, at fair value

|

998,496

|

1,255,925

|

||||||

|

Securities held to maturity (fair value $778,675 and $481,871, respectively)

|

783,599

|

484,073

|

||||||

|

Trading securities

|

-

|

11,467

|

||||||

|

Federal Reserve and Federal Home Loan Bank stock

|

53,229

|

46,706

|

||||||

|

Loans held for sale

|

6,943

|

1,134

|

||||||

|

Loans

|

6,887,709

|

6,583,639

|

||||||

|

Less allowance for loan losses

|

72,505

|

69,500

|

||||||

|

Net loans

|

$

|

6,815,204

|

$

|

6,514,139

|

||||

|

Premises and equipment, net

|

78,970

|

81,305

|

||||||

|

Goodwill

|

274,769

|

268,043

|

||||||

|

Intangible assets, net

|

15,599

|

13,420

|

||||||

|

Bank owned life insurance

|

177,479

|

172,388

|

||||||

|

Other assets

|

148,067

|

128,548

|

||||||

|

Total assets

|

$

|

9,556,363

|

$

|

9,136,812

|

||||

|

Liabilities

|

||||||||

|

Demand (noninterest bearing)

|

$

|

2,361,099

|

$

|

2,286,892

|

||||

|

Savings, NOW and money market

|

4,076,434

|

4,076,978

|

||||||

|

Time

|

930,678

|

806,766

|

||||||

|

Total deposits

|

$

|

7,368,211

|

$

|

7,170,636

|

||||

|

Short-term borrowings

|

871,696

|

719,123

|

||||||

|