UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

Filed by Registrant ☑

Filed by Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☑

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

|

NBT Bancorp Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☑

|

No fee required.

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, schedule or registration statement no.:

|

|

|

(3)

|

Filing party:

|

|

|

(4)

|

Date filed:

|

|

NBT Bancorp Inc.

52 South Broad Street

Norwich, New York 13815

NOTICE OF 2018 ANNUAL MEETING OF SHAREHOLDERS

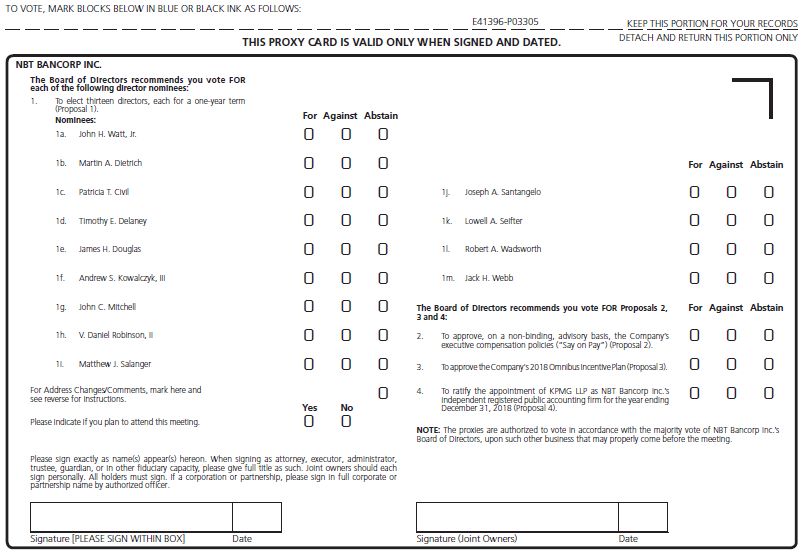

NBT Bancorp Inc. (“NBT”) will hold an annual meeting of shareholders at the DoubleTree by Hilton Hotel, 225 Water Street, Binghamton, New York 13901 on May 22, 2018 at 10:00 a.m. local time for the following purposes:

| 1. |

To elect thirteen directors each for a one-year term (Proposal 1);

|

| 2. |

To approve, on a non-binding, advisory basis, the compensation paid to the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis, compensation tables and other related tables and narrative discussion (“Say on Pay”) (Proposal 2);

|

| 3. |

To approve the NBT 2018 Omnibus Incentive Plan (Proposal 3);

|

| 4. |

To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2018 (Proposal 4); and

|

| 5. |

To transact such other business as may properly come before the NBT annual meeting.

|

We have fixed the close of business on March 29, 2018 as the record date for determining those shareholders of NBT entitled to vote at the NBT annual meeting and any adjournments or postponements of the meeting. Only holders of record of NBT common stock at the close of business on that date are entitled to notice of and to vote at the NBT annual meeting.

By Order of the Board of Directors of

NBT Bancorp Inc.

/s/ Martin A. Dietrich

Martin A. Dietrich

Chairman of the Board

Norwich, New York

April 6, 2018

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED REGARDLESS OF THE NUMBER YOU OWN. EVEN IF YOU PLAN TO BE PRESENT, YOU ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD PROMPTLY IN THE ENVELOPE PROVIDED OR VOTE VIA THE TOLL-FREE TELEPHONE NUMBER OR VIA THE INTERNET ADDRESS LISTED ON THE PROXY CARD. YOU MAY REVOKE ANY PROXY GIVEN IN WRITING OR IN PERSON AT ANY TIME PRIOR TO THE VOTE AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on May 22, 2018: This Proxy Statement, along with our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 and our 2017 Annual Report are available free of charge on our website at www.nbtbancorp.com/bncp/proxy.html.

NBT Bancorp Inc.

52 South Broad Street

Norwich, New York 13815

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

May 22, 2018

This proxy statement and accompanying proxy card are being sent to the shareholders of NBT Bancorp Inc. (“NBT” or the “Company”) in connection with the solicitation of proxies on behalf of the Board of Directors to be used at the 2018 annual meeting of shareholders. This proxy statement, together with the enclosed proxy card, is being mailed to shareholders on or about April 6, 2018.

When and Where the NBT Annual Meeting Will Be Held

We will hold our annual meeting of shareholders at the DoubleTree by Hilton Hotel, 225 Water Street, Binghamton, New York 13901 on May 22, 2018 at 10:00 a.m. local time.

What Will Be Voted on at the NBT Annual Meeting

At our annual meeting, our shareholders will be asked to consider and vote upon the following proposals:

| · |

To elect thirteen directors each for a one-year term (Proposal 1);

|

| · |

To approve, on a non-binding, advisory basis, the compensation paid to the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis, compensation tables and other related tables and narrative discussion (“Say on Pay”) (Proposal 2);

|

| · |

To approve the NBT 2018 Omnibus Incentive Plan (Proposal 3);

|

| · |

To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2018 (Proposal 4); and

|

| · |

To transact such other business as may properly come before the NBT annual meeting.

|

We may take action on the above matters at our annual meeting on May 22, 2018, or on any later date to which the annual meeting is postponed or adjourned.

We are unaware of other matters to be voted on at our annual meeting. If other matters do properly come before our annual meeting, including consideration of a motion to adjourn the annual meeting to another time and/or place for the purpose of soliciting additional proxies, we intend that the persons named in this proxy will vote the shares represented by the proxies on such matters as determined by a majority of our Board.

Shareholders Entitled to Vote

We have set March 29, 2018, as the record date to determine which of our shareholders will be entitled to vote at our annual meeting. Only those shareholders who held their shares of record as of the close of business on that date will be entitled to receive notice of and to vote at our annual meeting. As of March 29, 2018, there were 43,615,653 outstanding shares of our common stock held by holders of record. Each of our shareholders on the record date is entitled to one vote per share.

Quorum Requirement

The presence, in person or by proxy, of at least a majority of the total number of issued and outstanding shares of common stock entitled to vote at the annual meeting is necessary to constitute a quorum at the annual meeting. Abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum for the transaction of business.

Vote Required to Approve the Proposals

Assuming the presence of a quorum at the annual meeting, the voting requirements for the matters presented are as follows:

| · |

For a nominee to be elected as a director, more votes must be cast FOR the nominee than AGAINST (Proposal 1).

|

| · |

The affirmative vote of a majority of the shares of common stock represented at our annual meeting, either in person or by proxy, and entitled to vote thereon is required to approve the Say on Pay Proposal, to approve and adopt the NBT Bancorp Inc. 2018 Omnibus Incentive Plan and to ratify the appointment of our independent registered public accounting firm.

|

Our Board urges our shareholders to complete, date and sign the accompanying proxy card and return it promptly in the enclosed postage-paid envelope or vote via the Internet or by telephone.

Effect of Abstentions and Broker Non-Votes

For the purpose of the Say on Pay Proposal, approval of the 2018 Omnibus Plan and the ratification of the appointment of our independent registered public accounting firm, abstentions will have the effect of a vote against the proposal. Broker non-votes are proxies received from brokers or other nominees holding shares on behalf of their clients who have not been given specific voting instructions from their clients with respect to non-routine matters. Brokers who hold their customers’ shares in “street name” may, under the applicable rules of the exchange and other self-regulatory organizations of which the brokers are members, sign and submit proxies for such shares and may vote such shares on “routine” matters. Proposals 1, 2 and 3 are considered “non-routine” and Proposal 4 is considered “routine” under the applicable rules. Broker non-votes will not be counted as a vote cast or entitled to vote on any matter presented at the annual meeting and will therefore have no effect on the outcome of the voting on any matter presented at the annual meeting.

Voting Your Shares

Our Board is soliciting proxies from our shareholders. This will give you an opportunity to vote at our annual meeting without having to attend. When you deliver a valid proxy, the shares represented by that proxy will be voted by a named agent in accordance with your instructions.

If you are a shareholder and vote by proxy but make no specification on your proxy card that you have otherwise properly executed, the named persons will vote the shares represented by your proxy:

| · |

FOR electing thirteen persons nominated by our Board as directors (Proposal 1);

|

| · |

FOR approving on a non-binding, advisory basis, the compensation of the Company’s named executive officers (Proposal 2);

|

| · |

FOR approving the 2018 Omnibus Incentive Plan (Proposal 3); and

|

| · |

FOR ratifying the appointment of KPMG LLP as our independent registered public accounting firm (Proposal 4).

|

If any other matters are properly brought before the annual meeting, the persons named in the proxy will vote the shares represented by such proxy or such matters as determined by a majority of the board of directors.

If you are a shareholder whose shares are registered in your name, you may vote your shares by using one of the following four methods:

Via the Internet. If you hold NBT common stock in your own name and not through a broker or other nominee, you can vote your shares of NBT common stock electronically via the Internet at www.proxyvote.com. Internet voting is available 24 hours a day until 11:59 p.m. local time on May 21, 2018. Internet voting procedures are designed to authenticate shareholders by using the individual control number on your proxy card. If you vote via the Internet, you do not need to return your proxy card.

Mail. To grant your proxy by mail, please complete your proxy card and sign, date and return it in the enclosed envelope. To be valid, a returned proxy card must be signed and dated.

Telephone. If you hold NBT common stock in your own name and not through a broker or other nominee, you can vote your shares of NBT common stock by telephone by dialing the toll-free telephone number 1-800-690-6903. Telephone voting is available 24 hours a day until 11:59 p.m. local time on May 21, 2018. Telephone voting procedures are designed to authenticate shareholders by using the individual control number on your proxy card. If you vote by telephone, you do not need to return your proxy card.

2

In person. If you attend the annual meeting in person, you may vote your shares by completing a ballot at the meeting. Attendance at the annual meeting will not by itself be sufficient to vote your shares; you still must complete and submit a ballot at the annual meeting.

If your shares are registered in the name of a bank or brokerage firm you will receive instructions from your holder of record that must be followed in order for the record holder to vote the shares per your instructions. Many banks and brokerage firms have a process for their beneficial holders to provide instructions over the telephone or via the Internet. If you hold shares through a bank or brokerage firm and wish to be able to vote in person at the meeting, you must obtain a legal proxy from your broker, bank or other holder of record and present it to the inspector of elections with your ballot.

Changing Your Vote

Any NBT shareholder of record giving a proxy may revoke the proxy in one or more of the following ways:

| · |

Delivering a written notice of revocation to the Corporate Secretary of NBT bearing a later date than the proxy;

|

| · |

Submitting a later-dated proxy by mail, telephone or via the Internet; or

|

| · |

Appearing in person and submitting a later-dated proxy or voting at the annual meeting.

|

Attendance at the annual meeting will not by itself constitute a revocation of a proxy; to revoke your proxy, you must complete and submit a ballot at the annual meeting or submit a later-dated proxy.

You should send any written notice of revocation or subsequent proxy to NBT Bancorp Inc., 52 South Broad Street, Norwich, New York 13815, Attention: F. Sheldon Prentice, Esq., Executive Vice President, General Counsel and Corporate Secretary, or hand deliver the notice of revocation or subsequent proxy to the Corporate Secretary at or before the taking of the vote at the annual meeting. Any later-dated proxy submitted by telephone or via the Internet must be submitted prior to 11:59 p.m. on May 21, 2018.

If you hold shares through a bank or brokerage firm, you must contact that firm to revoke any prior voting instructions. You may also vote in person at the annual meeting if you obtain a legal proxy as described above.

Solicitation of Proxies and Costs

We will bear our own costs of soliciting of proxies. We will reimburse brokerage houses, fiduciaries, nominees and others for their out-of-pocket expenses in forwarding proxy materials to owners of shares of our common stock held in their names. In addition to the solicitation of proxies by use of the mail, we may solicit proxies from our shareholders by directors, officers and employees acting on our behalf in person or by telephone, facsimile or other appropriate means of communications. We will not pay any additional compensation, except for reimbursement of reasonable out-of-pocket expenses, to our directors, officers and employees in connection with the solicitation. We have also engaged D.F. King & Co. to solicit proxies for an estimated fee of $8,500, plus reasonable expenses. You may direct any questions or requests for assistance regarding this proxy statement to F. Sheldon Prentice, Corporate Secretary, by telephone at (607) 337-6530 or by email at sprentice@nbtbci.com or to D.F. King & Co., our proxy solicitor, by telephone at (800) 755-7250.

Annual Report

A copy of our 2017 Annual Report accompanies this Proxy Statement. NBT is required to file an annual report on Form 10-K for its 2017 fiscal year with the Securities and Exchange Commission. Shareholders may obtain, free of charge, a copy of the Form 10-K by writing to: NBT Bancorp Inc., 52 South Broad Street, Norwich, New York 13815, Attention: Chief Financial Officer, Michael J. Chewens. Our annual report on Form 10-K is available on our website www.nbtbancorp.com.

REGARDLESS OF THE NUMBER OF SHARES YOU OWN, YOUR VOTE IS IMPORTANT TO US. PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE OR VOTE BY TELEPHONE OR VIA THE INTERNET USING THE TELEPHONE NUMBER OR THE INTERNET ADDRESS ON YOUR PROXY CARD.

3

|

PROPOSAL 1

|

ELECTION OF DIRECTORS

|

The Company elects all directors annually. Therefore, all thirteen directors are standing for election at the 2018 annual meeting.

The persons named in the enclosed proxy intend to vote the shares of our common stock represented by each proxy properly executed and returned to us FOR the election of the aforementioned nominees as directors, but if the nominees should be unable to serve, they will vote such proxies for those substitute nominees as our Board shall designate to replace those nominees who are unable to serve. Our Board currently believes that each nominee will stand for election and will serve if elected as a director. Assuming the presence of a quorum at the annual meeting, in order for each of the thirteen director nominees to be elected, more votes must be cast FOR the director nominee than AGAINST (Proposal 1). A director who fails to receive more votes FOR his or her election than AGAINST will tender his or her resignation to the Board of Directors for consideration, and our Nominating and Corporate Governance Committee will recommend to the Board of Directors whether to accept or reject the resignation, or whether other action should be taken. The Board of Directors will consider the recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of election results.

Information as to Nominees

Information regarding the nominees continuing in office is provided below. Each biography contains information regarding each person’s business experience, director positions held currently or at any time during the last five years, information regarding involvement in certain legal or administrative proceedings, if applicable, and the experience, qualifications, attributes or skills that caused the Nominating and Corporate Governance Committee and the Board of Directors to determine that such person should serve as a director at the time of filing of this proxy statement. Unless otherwise stated, each individual has held his or her current occupation for the last five years. The age indicated in each director’s biography is as of December 31, 2017. There are no family relationships among the directors or executives. All nominees are currently members of the board of directors of NBT Bank, N.A. (“NBT Bank”).

Board Nominees for 2018

John H. Watt Jr., 59, serves as the President and Chief Executive Officer (“CEO”) of the Company effective December 19, 2016. Prior to that, Mr. Watt was an Executive Vice President and joined the Company’s executive management team in 2015. He joined the Company and NBT Bank in 2014. Mr. Watt provided executive leadership for key functions, including commercial and consumer lending, credit administration and marketing. Mr. Watt became a director of NBT and NBT Bank in December 2016. Mr. Watt also serves on the NBT Financial Services, Inc. Board which is an affiliate board of the Company. Mr. Watt has over thirty years of experience in the financial services industry. Prior to joining the Company, he was executive vice president of commercial banking, investment management and bank operations at Alliance Bank, N.A. He was also a member of the board of directors for Alliance Bank and Alliance Financial Corporation, which merged with the Company in 2013. Previously, he was employed by JP Morgan Chase and its predecessors. Mr. Watt has served on numerous community-oriented boards in upstate New York, most recently on the finance committee of the Foundation of The Episcopal Diocese of Central New York, the finance committee of the Allyn Foundation and as President of the board of On Point for College in Syracuse, NY. He is a graduate of Rutgers University with a bachelor’s degree in political science and earned his Juris Doctor from The National Law Center at George Washington University. Mr. Watt’s past experience and current leadership as President and CEO of NBT and NBT Bank provides him with thorough knowledge of the Company’s opportunities, challenges and operations.

Martin A. Dietrich, 62, served as the President and Chief Executive Officer of the Company and NBT Bank from January 2004 to December 19, 2016. Prior to that, Mr. Dietrich was President and Chief Operating Officer of NBT Bank from September 1999 to December 2003. He is currently a director of Preferred Mutual Insurance Company, New York Bankers Association, and Norwich Building Tomorrow Foundation Inc. Mr. Dietrich has been a director of NBT Bank since 2003, and NBT since 2005. Mr. Dietrich became Chairman of NBT and NBT Bank Boards in May 2016. Mr. Dietrich also serves on the NBT Financial Services, Inc. Board which is an affiliate board of the Company. Mr. Dietrich’s past leadership as President and Chief Executive Officer of NBT and NBT Bank provides him with thorough knowledge of the Company’s opportunities, challenges and operations.

4

Patricia T. Civil, 68, served as the Managing Partner of PricewaterhouseCoopers LLP in Syracuse, NY from 1992 until her retirement in 2002. Ms. Civil has been a director of NBT and NBT Bank since 2003. Ms. Civil served as director for Anaran Inc. from December 2007 until its sale to a private equity firm in 2014 and for SRC Inc. from 2006 to 2015. She is currently a director of New York Central Mutual Fire Insurance Company. As a Certified Public Accountant specializing in banking and financial services, Ms. Civil provides the Board with extensive experience in corporate finance and accounting and serves as the Chair of the Audit and Risk Management Committee. In addition to her accounting background, Ms. Civil’s service as the Managing Partner of the Syracuse, NY office of her accounting firm brings strong executive experience to the Board, and her recent service on the board of another public company provides the Board with additional corporate governance expertise.

Timothy E. Delaney, 55, is the President of the Wesson Group LLC. Mr. Delaney is Founder and former President of The Delaney Group, Inc. and is a former Executive Vice President of its successor company, Tetra Tech Construction, Inc. and President of Tetra Tech Canada Construction. Together, these companies make up the North American Renewable Construction division of Tetra Tech, Inc. (NASDAQ: TTEK), a public company, and they are principally engaged in energy related heavy civil engineering and construction since 1982. Mr. Delaney has been a director of NBT since January 2011 and has been a director of NBT Bank since 2006. Mr. Delaney’s experience as a business owner in NBT’s market area and experience as an NBT Bank director provides the Board with insight into the needs of NBT’s customers, executive management and insight into NBT’s challenges, opportunities and operations.

James H. Douglas, 66, is the former Governor of Vermont, a position he held for four, two-year terms, starting in 2002 and ending in 2010. Mr. Douglas has been a director of NBT and NBT Bank since January 2011. Mr. Douglas also serves on the NBT Financial Services, Inc. Board which is an affiliate board of the Company. Mr. Douglas served the people of Vermont for more than 35 years, having been elected to the Vermont House of Representatives after graduating from Middlebury College in 1972. Mr. Douglas was elected Secretary of State in 1980, a position he held until 1992. He was then elected as State Treasurer in 1994, a position he held until his election as Governor. Outside of government, Mr. Douglas is an executive in residence at Middlebury College and has been active in numerous community organizations. In addition, he is a director for National Life Group and National Life Insurance Company, as well as a director for Union Mutual of Vermont. Mr. Douglas’ experience in state politics provides the Board with insight into one of NBT’s newer market areas. Mr. Douglas also brings executive management and governance experience from his previous positions to the Board. Further, the skills he developed as State Treasurer provide the Board with additional finance experience.

Andrew S. Kowalczyk III, 60, is an attorney and partner at Kowalczyk & Deery, LLP in Utica, New York. His practice focuses on banking, business law and real estate. He was admitted to the New York State Bar in 1983. Mr. Kowalczyk is a graduate of St. Lawrence University and Albany Law School. He is a member of the Oneida County Bar Association, the New York State Bar Association and the American Bar Association. He served on the NBT Bank Advisory Board from 2006 through 2010. He was appointed to NBT Bank’s board in October 2010 and NBT’s board in May 2016. Mr. Kowalczyk brings leadership experience, legal technical expertise and Utica area market knowledge.

John C. Mitchell, 67, was formerly President and Chief Executive Officer of I.L. Richer Co., an agricultural business, from 1979 to 2008. He is currently a director of Preferred Mutual Insurance Company, Delaware Otsego Corporation and has been a director of NBT Bank and NBT since 1993 and 1994, respectively. Mr. Mitchell’s over twenty years of service on NBT’s Board provides him with a seasoned view of NBT’s operations and challenges. He has a strong corporate governance background due to his service on other corporate boards, the Nominating and Corporate Governance Committee and his role as Chairman of the Compensation and Benefits Committee.

V. Daniel Robinson II, 61, has served on the Board of Directors of New York Central Mutual Fire Insurance Company since 1986 and was appointed as President and Chief Executive Officer in 2002. He also serves as President, Chief Executive Officer and a board member of automobile insurer A. Central Insurance Company, a subsidiary of New York Central Mutual Fire Insurance Company since 1999. He serves as director and president of A.F. Stager Independent Adjustors, since 1991 and 2018, respectively. He is a member of the Excellus BlueCross BlueShield Board of Directors and the Utica College Advisory board since 2014 and 2006, respectively. He has served on the Board of A. O. Fox Hospital, an affiliate association with Bassett Health Care Network, from 2012 through July 2016 and continues his board membership with Basset Health Care Network. Mr. Robinson earned his bachelor’s degree in marketing from St. Bonaventure University. He was appointed to NBT Bank’s board in March 2008 and NBT’s board in May 2016. Mr. Robinson also serves on the NBT Financial Services, Inc. Board which is an affiliate board of the Company.

5

Matthew J. Salanger, 62, was the longest-serving President and Chief Executive Officer of United Health Services, Inc. (“UHS”) having held the position from 2007-2017. He also served as President and Chief Executive Officer for UHS Hospitals, including UHS Binghamton General Hospital and UHS Wilson Medical Center from 1994-2017. Upon his retirement as President and Chief Executive Officer, Mr. Salanger continues to provide guidance to UHS in a Senior Strategic Advisor role and as a member of the UHS Board and Executive Committee. Mr. Salanger is a Fellow of the American College of Healthcare Executives, is a member of the Binghamton University Council, and recently completed his appointment by New York State Governor Paterson on the State’s Board of Examiners of Nursing Home Administrators. He earned his bachelor of arts degree at the University at Albany/SUNY and his master’s degree in hospital and health administration at Xavier University. He was appointed to NBT Bank’s board in January 2011 and NBT’s board in May 2016. Mr. Salanger brings executive leadership experience, board experience and knowledge of our Binghamton area market.

Joseph A. Santangelo, 65, is President and Chief Executive Officer of Arkell Hall Foundation Inc. Mr. Santangelo has been a director of NBT Bank and NBT since 1991 and 2000, respectively. Mr. Santangelo’s service on the Nominating and Corporate Governance Committee and past experience on the Compensation and Benefits Committee provides the Board with strong corporate governance and executive compensation experience. In addition, his seventeen plus years of service on the Board along with his considerable experience in operating one of the largest private foundations in the upstate NY region provides him with a seasoned view of NBT’s operations and the challenges facing NBT.

Lowell A. Seifter, 65, is Senior Vice President and General Counsel of St. Joseph’s Hospital Health Center in Syracuse, New York. He was a founding member of Green & Seifter Attorneys, PLLC, now known as Bousquet Holstein Attorneys, PLLC, where he practiced law from 1977 until 2011. From 2002 until 2006, Mr. Seifter was a member of the board of directors of Bridge Street Financial, Inc. and its banking subsidiary, Oswego County National Bank. From 2006 until the merger with NBT, Mr. Seifter served on the Board of Directors of Alliance Financial Corporation and its subsidiary Alliance Bank where he was Chairman of the Compensation Committee and member of the Governance, Business Development and Risk Committees. Mr. Seifter received a B.S. degree from Syracuse University, a Juris Doctor degree from Syracuse University College of Law and is a non-practicing certified public accountant. Mr. Seifter brings technical expertise, leadership experience, industry knowledge and an understanding of the Syracuse market area.

Robert A. Wadsworth, 68, was the Chief Executive Officer of Preferred Mutual Insurance Company from 1997 until his retirement in 2008. Mr. Wadsworth is currently the Chairman and a director of the board of Preferred Mutual Insurance Company. He is also a director of Preferred Services Corp., Preferred of New York Inc., and has been a director of NBT Bank and NBT since 2001 and 2006, respectively. Mr. Wadsworth’s service as the Chief Executive Officer of a corporation based in one of NBT’s communities brings to the Board strong executive experience and an understanding of the business and consumer needs of a community that NBT serves. His service on the boards of several insurance and financial services corporations provides the Board with additional insight into the financial services industry.

Jack H. Webb, 65, was the Chairman and Chief Executive Officer of Alliance Financial Corporation from January 2002 until March 2013 when the company merged with NBT at which time Mr. Webb became Executive Vice President of Strategic Support for NBT until May 2015. In March 2013, Mr. Webb also became a director of NBT and NBT Bank. Prior to the merger, he was also the President and Chief Executive Officer of Alliance Bank. He joined Alliance Financial Corporation in May 2000 after a 26-year career with Chase Manhattan Bank. He serves on the advisory board of CNY Lifetime Healthcare. Mr. Webb graduated from the Rochester Business Institute. His day to day leadership of Alliance Financial Corporation and Alliance Bank provides him with thorough knowledge of the financial services industry as well as NBT’s Syracuse market. Mr. Webb also serves on the NBT Financial Services, Inc. Board which is an affiliate board of the Company.

The Board of Directors unanimously recommends that shareholders vote “FOR” the election of all of its director nominees.

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information, as of February 28, 2018 with respect to the beneficial ownership of the Company’s Common Stock by: (1) each director and nominee; (2) each executive officer named in the Summary Compensation Table; and (3) all executive officers and directors as a group. Except as otherwise indicated, each of the stockholders named below effectively exercises sole, or shared with spouse, voting and investment power with respect to the outstanding shares of Common Stock beneficially owned.

|

Directors, Nominees for Director

and Named Executive Officers

|

Number of

Shares Owned

|

Options Exercisable

Within 60 Days (1)

|

Total Beneficial

Ownership of

NBT Bancorp

Common Stock

|

Percent of

Shares

Outstanding

|

||||||||||||

|

Patricia T. Civil

|

24,298

|

3,630

|

27,928

|

*

|

||||||||||||

|

Timothy E. Delaney (2)

|

43,639

|

-

|

43,639

|

*

|

||||||||||||

|

Martin A. Dietrich (3)

|

125,669

|

-

|

125,669

|

*

|

||||||||||||

|

James H. Douglas

|

6,924

|

-

|

6,924

|

*

|

||||||||||||

|

Andrew S. Kowalczyk III

|

3,910

|

-

|

3,910

|

*

|

||||||||||||

|

John C. Mitchell

|

32,781

|

-

|

32,781

|

*

|

||||||||||||

|

V. Daniel Robinson II (4)

|

597,749

|

-

|

597,749

|

1.37

|

%

|

|||||||||||

|

Matthew J. Salanger

|

18,756

|

-

|

18,756

|

*

|

||||||||||||

|

Joseph A. Santangelo (5)

|

88,493

|

-

|

88,493

|

*

|

||||||||||||

|

Lowell A. Seifter

|

44,391

|

-

|

44,391

|

*

|

||||||||||||

|

Robert A. Wadsworth

|

14,826

|

-

|

14,826

|

*

|

||||||||||||

|

Jack H. Webb

|

55,557

|

-

|

55,557

|

*

|

||||||||||||

|

John H. Watt Jr.

|

43,029

|

-

|

43,029

|

*

|

||||||||||||

|

Michael J. Chewens

|

51,351

|

-

|

51,351

|

*

|

||||||||||||

|

Timothy L. Brenner

|

51,249

|

-

|

51,249

|

*

|

||||||||||||

|

Sarah A. Halliday

|

2,296

|

-

|

2,296

|

*

|

||||||||||||

|

Joseph R. Stagliano

|

64,501

|

5,500

|

70,001

|

*

|

||||||||||||

|

Directors and Executive Officers as a Group (21 persons)

|

1,400,754

|

9,130

|

1,409,884

|

3.23

|

%

|

|||||||||||

|

(*)

|

Less than one percent.

|

|

(1)

|

Shares under option from the 2008 Omnibus Incentive Plan, which are exercisable within 60 days of February 28, 2018.

|

|

(2)

|

Includes 12,020 shares held by a trust for which Mr. Delaney has voting discretion.

|

|

(3)

|

Includes 7,429 shares held by a trust for which Mr. Dietrich has voting discretion.

|

|

(4)

|

Includes 587,558 shares held by NYCM of which Mr. Robinson is President and CEO.

|

|

(5)

|

Includes 71,689 shares held by Arkell Hall Foundation Inc. of which Mr. Santangelo is President and CEO and shares investment and voting powers with that foundation’s Board of Trustees.

|

7

BENEFICIAL OWNERSHIP OF PRINCIPAL HOLDERS OF VOTING SECURITIES OF NBT

The following table sets forth information as of February 28, 2018, except as indicated below, with respect to the beneficial ownership of common stock by any person or group as defined in Section 13(d)(3) of the Exchange Act who is known to the Company to be the beneficial owner of more than five percent of the common stock. As of February 28, 2018, the Company had 43,593,370 outstanding shares of common stock.

|

Name and Addresses of Beneficial Owners

|

Number of Shares;

Nature of Beneficial Ownership (1)

|

Percent of

Common

Stock Owned

|

||||||

|

BlackRock, Inc.

|

5,609,927

|

(2)

|

12.87

|

%

|

||||

|

40 East 52nd Street

|

||||||||

|

New York, NY 10022

|

||||||||

|

The Vanguard Group, Inc.

|

4,172,489

|

(3)

|

9.57

|

%

|

||||

|

100 Vanguard Blvd.

|

||||||||

|

Malvern, PA 19355

|

||||||||

|

(1)

|

Based on information in the most recent Schedule 13D or 13G filed with the Securities and Exchange Commission pursuant to the Exchange Act with respect to holdings of the Company’s common stock as of December 31, 2017. In accordance with Rule 13d-3 under the Exchange Act, a person is deemed to be the beneficial owner, for purposes of this table, of any shares of Company common stock if such person has or shares voting power and/or investment power with respect to the security, or has the right to acquire beneficial ownership at any time within 60 days from February 28, 2018. As used herein, “voting power” includes the power to vote or direct the voting of shares and “investment power” includes the power to dispose or direct the disposition of shares.

|

|

(2)

|

BlackRock, Inc. reported that it has sole dispositive power over 5,609,927 shares (12.88% of outstanding shares) and sole voting power over 5,505,557 shares (12.64% of outstanding shares) of Company common stock as of December 31, 2017.

|

|

(3)

|

The Vanguard Group, Inc. reported that it has sole dispositive and voting power over 4,123,404 shares and shared dispositive and voting power over 49,085 shares of NBT common stock as of December 31, 2017, or an aggregate of 9.58% of Company shares outstanding as of such date.

|

CORPORATE GOVERNANCE

The business and affairs of the Company are managed under the direction of the Board of Directors. Members of the Board are kept informed of the Company’s business through discussions with the Company’s executive officers, by reviewing materials provided to them and by participating in meetings and strategic planning sessions of the Board and its committees. The Board has adopted corporate governance practices and policies which the Board and senior management believe promote sound and effective corporate governance.

Director Independence

Based on a review of the responses of the directors to questions regarding employment and compensation history, affiliations and family and other relationships and on individual discussions with directors, the full Board has determined that all directors, excluding Messrs. Dietrich, Watt and Webb, meet the standards of independence set forth by the NASDAQ Stock Market. In making this determination, the Board considered transactions and relationships between each director or his or her immediate family and the Company and its subsidiaries, including those reported under “Compensation Committee Interlocks and Insider Participation” and “Certain Relationships and Related Party Transactions” found on page 42. Mr. Dietrich is not independent because he was formerly the President and Chief Executive Officer of the Company until his retirement in 2016. Mr. Watt is not independent because he is the current President and Chief Executive Officer of the Company. Mr. Webb is not independent because he was formerly the Executive Vice President of Strategic Support for the Company until his retirement in 2015.

The independent members of the Board meet at least twice annually in an executive session where non-independent directors and management are excused. Lead independent director John Mitchell, who serves as chairman of the Compensation and Benefits Committee, currently chairs these executive sessions.

8

Code of Ethics

The Company has adopted a Code of Business Conduct and Ethics that applies to all employees, as well as each member of the Company’s Board of Directors. The Code of Business Conduct and Ethics is available at the Company’s website at www.nbtbancorp. com/bncp/corporategov.html .

Board Policy Regarding Communications with the Board

The Board of Directors maintains a process for shareholders to communicate with the Board of Directors. Shareholders wishing to communicate with the Board of Directors should send any communication to Corporate Secretary, NBT Bancorp Inc., 52 South Broad Street, Norwich, New York 13815. Any such communication must state the name of the shareholder and the number of shares beneficially owned by the shareholder making the communication. The Corporate Secretary will forward such communication to the full Board of Directors or to any individual director or directors to whom the communication is directed unless the communication is unduly hostile, threatening, illegal or similarly inappropriate. At each Board meeting, a member of management presents a summary of all communications received since the last meeting, if applicable, that were not forwarded and makes those communications available on request.

The Board’s Role in Risk Oversight

The Board of Directors, together with the Audit and Risk Management Committee, the Nominating and Corporate Governance Committee, and the Compensation and Benefits Committee coordinate with each other to provide enterprise-wide oversight of our management and handling of risk. These committees report regularly to the full Board of Directors on risk-related matters and provide the Board of Directors with insight about our management of strategic, credit, interest rate, liquidity, compliance, operational and reputational risks. In addition, at meetings of the Board of Directors and its committees, directors receive regular updates and reports from management regarding risk management practices, including credit quality, financial reporting, technology, internal controls, compliance, legal matters, and asset liability and liquidity management, among others. Furthermore, current risk management issues are discussed regularly with the Board of Directors and its committees.

Board Leadership Structure

The Board of Directors does not have a policy on whether the same person may serve as both the chief executive officer and chairman of the board or, if the roles are separate, whether the chairman should be selected from the non-employee directors. The Board believes that it should have the flexibility to make these determinations at any given point in time in the way that it believes best to provide appropriate leadership for the Company at that time. Currently, Mr. Watt serves as the Chief Executive Officer of the Company, while Mr. Dietrich, serves as the Chairman of the Board of Directors. The Board of Directors believes that this leadership structure best serves the Company at this time because it allows Mr. Watt to focus on the Company’s operations and strategy, while Mr. Dietrich, among other things, can provide leadership for the Board of Directors, set the agenda for meetings, and enable other directors to raise issues and concerns for Board consideration without immediately involving the Chief Executive Officer or other management. The Board of Directors believes it currently benefits from having a director, who is also a former executive officer of the Company, as its Chairman. Mr. Mitchell serves as the lead independent director providing an independent point of contact for the Board of Directors.

Director Attendance at Board Meetings and Annual Meetings

During 2017, the Board held nine meetings. Each incumbent director attended at least 75% of the aggregate of: (i) the total number of meetings of the Board held during the period that the individual served; and (ii) the total number of meetings held by all committees of the Board on which the director served during the period that the individual served. In addition, directors are expected to attend our annual meeting of shareholders. Twelve of our thirteen directors were in attendance at the 2017 annual meeting, and we expect that all directors will be present at the 2018 annual meeting.

Committees of the Board of Directors

Our Board has a number of standing committees, including a Nominating and Corporate Governance Committee, Audit and Risk Management Committee and Compensation and Benefits Committee. The Board has determined that all of the directors who serve on these committees are independent for purposes of NASDAQ Rule 5605 and that the members of the Audit and Risk Management Committee are also “independent” for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934 (the “Exchange Act”). A table showing the members of each of these committees follows:

9

|

Director

|

Nominating and Corporate

Governance

|

Audit and Risk Management

|

Compensation and Benefits

|

|

Patricia T. Civil

|

P

|

Chair

|

P

|

|

Timothy E. Delaney

|

P

|

P

|

|

|

James H. Douglas

|

Chair

|

P

|

|

|

Andrew S. Kowalczyk III

|

P

|

P

|

|

|

John C. Mitchell

|

P

|

Chair

|

|

|

V. Daniel Robinson II

|

P

|

||

|

Matthew J. Salanger

|

P

|

P

|

|

|

Joseph A. Santangelo

|

P

|

||

|

Lowell A. Seifter

|

P

|

P

|

|

|

Robert A. Wadsworth

|

P

|

P

|

A description of each of these committees follows:

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for determining the qualification of and nominating persons for election to the Board of Directors, including (if applicable) shareholder nominations that comply with the notice procedures set forth by SEC rules and the Company’s Bylaws. The Committee also formulates our corporate governance guidelines and functions to insure successful development of management at the senior level and succession planning, as applicable. The Board of Directors has adopted a written charter for the Nominating and Corporate Governance Committee, a copy of which is available on the Company’s website at www.nbtbancorp.com/bncp/corporategov.html. This Committee met three times during 2017.

During the past several years, the Nominating and Corporate Governance Committee has engaged in a process to evaluate our corporate governance processes against current trends. To further this endeavor, changes were made to align our corporate governance process with current trends including having our board elected annually, adopting a majority vote standard for directors in uncontested election with a director resignation policy, prohibiting the pledging of Company shares and determining not to adopt a new poison pill following the expiration of the Company’s former poison pill in October 2014. In 2016, the Company made changes to NBT Bank’s board of directors so that the same directors serve on both the Company and Bank boards, in order to improve continuity, efficiency and agility.

The Board of Directors believes that it should be comprised of directors who possess the highest personal and professional ethics, integrity, and values, and who shall have demonstrated exceptional ability and judgment and who shall be most effective in representing the long-term interests of the shareholders. While the Board of Directors and Nominating and Corporate Governance Committee have no formal policy on board diversity, diversity is considered by the Nominating and Corporate Governance Committee in determining the qualification of and nominating persons for election to the Board of Directors.

When considering candidates for the Board of Directors, the Nominating and Corporate Governance Committee takes into account the candidate’s qualifications, experience and independence from management. In addition, in accordance with the Company’s Bylaws:

| · |

Every director must be a citizen of the United States;

|

| · |

Each director must own $1,000 aggregate book value of the Company’s common stock (see ownership guidelines for continuing directors on page 26); and

|

| · |

No person shall serve as a director beyond the Company’s annual meeting following the date upon which he or she shall have attained the age of 72 years.

|

10

When seeking candidates for director, the Nominating and Corporate Governance Committee may solicit suggestions from incumbent directors, management or others. The Committee also has the authority to retain any search firm to assist in the identification of director candidates. The Committee will review the qualifications and experience of each candidate. If the Committee believes a candidate would be a valuable addition to the Board, it will recommend to the full Board that candidate’s election.

The Company’s Bylaws also permit shareholders eligible to vote at the annual meeting to nominate director candidates, but only if such nominations are made pursuant to timely notice in writing to the CEO of NBT. To be timely, notice must be delivered to, or mailed to and received at, the principal executive offices of NBT at least 150 days prior to the one-year anniversary of the date immediately preceding the prior year’s annual meeting of shareholders. The Nominating and Corporate Governance Committee will consider candidates for director suggested by shareholders applying the criteria for candidates described above and considering the additional information required by Article III, Section 4 of the Company’s Bylaws, which must be set forth in a shareholder’s notice of nomination. Article III, Section 4 of the Company’s Bylaws requires that the notice include: (a) as to each person whom the shareholder proposes to nominate for election as a director, (i) the name and address of such person and (ii) the principal occupation or employment of such person; and (b) as to the shareholder giving notice (i) the name and address of such shareholder, (ii) the number of shares of the Company that will be voted for the proposed nominee by such shareholder (including shares to be voted by proxy) and (iii) the number of shares of the Company which are beneficially owned by such shareholder.

Audit and Risk Management Committee

The Audit and Risk Management Committee represents our Board in fulfilling its statutory and fiduciary responsibilities for independent audits of NBT’s consolidated financial statements, including monitoring accounting and financial reporting practices and financial information distributed to shareholders and the general public. The Audit and Risk Management Committee is also responsible for overseeing the Company’s compliance with legal and regulatory requirements and the performance of the Company’s Risk Management Division. Directors on our Audit and Risk Management Committee meet the expanded independence requirements of audit committee members. In addition, our Board of Directors has determined that Ms. Civil and Mr. Seifter are “audit committee financial experts” as that term is defined in Item 407(d)(5) of Regulation S-K.

This Committee met five times in 2017. Responsibilities and duties of this Committee are discussed more fully in the Audit and Risk Management Committee Report on page 44 and in the Audit and Risk Management Committee’s charter, which is available on the Company’s website at www.nbtbancorp.com/bncp/corporategov.html.

Compensation and Benefits Committee

All of the Company’s Compensation and Benefits Committee members are independent directors, as determined by the Board, and as such term is defined in the NASDAQ Marketplace Rules as they apply to the Company.

The Committee is responsible for the development, oversight and administration of the Company’s compensation program. The Committee works closely with the Company’s CEO and Executive Vice President of Human Resources to implement our compensation program. In addition, the Committee typically engages in executive sessions without Company management present.

The Committee regularly reviews our compensation practices and policies and recommends to the Board of Directors the compensation and benefits for the CEO, directors and executive management team, including the named executive officers. In making compensation recommendations to the Board of Directors for the named executive officers, the Committee relies substantially on the recommendations of the CEO and, in the case of the CEO’s compensation, upon the recommendation of the Chairman of the Board. The Committee generally determines the compensation for the named executive officers at its December meeting preceding the commencement of the fiscal year in which the compensation will be paid or earned, or in its January meeting of such fiscal year.

The CEO’s compensation reflects the Committee’s evaluation of his performance measured against the following criteria: (i) implementation of the Company’s short and long-term strategies; (ii) financial and operating performance; (iii) management development; (iv) customer service; and (v) leadership in positioning the Company to meet the significant operational and regulatory challenges of the evolving financial services industry. The Committee may use its discretion to deviate from or modify compensation policies and recommendations, but does so rarely, and typically, only in unusual circumstances.

11

The Committee also administers the Company’s Defined Benefit Pension Plan (“Pension Plan”), 401(k) & Employee Stock Ownership Plan (the “401(k) Plan & ESOP”), the directors’ and officers’ stock plans as well as the 2008 Omnibus Incentive Plan (the “Omnibus Plan”) and any future equity plans. Pursuant to the terms of the Company’s Omnibus Plan, the Committee may delegate its authority to grant awards to nonexecutive officers under such plan to a member of the Board and the Committee has granted such authority, within certain defined limits, to Mr. Watt. A charter that reflects these responsibilities and delegated authority, which the Committee and the Board periodically review and revise, governs the Committee. A copy of the charter is available on the Company’s website at www.nbtbancorp.com/bncp/corporategov.html. The Committee met six times in 2017.

Policy on Recovery of Awards

Incentive Compensation Clawback Policy

In the event of a restatement of incorrect financial results, the Company’s Compensation and Benefits Committee (the “Committee”) will review all cash and equity incentive awards made under the Company’s Omnibus Plan that were paid or awarded to executive officers (within the meaning of Rule 3b-7 of the Exchange Act) for performance periods beginning on and after January 1, 2015, which occur during the restatement period. If any such awards would have been lower had the level of achievement of applicable financial performance goals been calculated based on such restated financial results, the Committee will, if it determines appropriate in its sole discretion, to the extent permitted by governing law, require the reimbursement of the incremental portion of the awards in excess of the awards that would have been paid based on the restated financial results.

Furthermore, if the Company is required to prepare an accounting restatement due to the material noncompliance of the Company as a result of misconduct with regard to any financial reporting requirement under applicable securities laws, the individuals subject to the automatic forfeiture provisions under Section 304 of the Sarbanes-Oxley Act of 2002 and any other employee who knowingly engaged in the misconduct, was grossly negligent in engaging in the misconduct, knowingly failed to prevent the misconduct or was grossly negligent in failing to prevent the misconduct, shall reimburse the Company the amount of any payment in settlement of an award earned or accrued during the 12-month period following the first public issuance or filing with the SEC (whichever first occurred) of the financial document that contained such material noncompliance.

Equity Compensation Clawback Policy

The Committee may specify in an award that a grantee’s rights, payments, and benefits with respect to the award shall be subject to reduction, cancellation, forfeiture, or recoupment upon the occurrence of certain specified events, in addition to any otherwise applicable vesting or performance conditions of the award. Such events may include, but shall not be limited to, termination of employment for cause, termination of the grantee’s provision of services to the Company, violation of material Company policies, breach of noncompetition, confidentiality, or other restrictive covenants that may apply to the grantee, or other conduct by the grantee that is detrimental to the business or reputation of the Company. These provisions will generally be limited to a three year look-back from the occurrence of the event that gives rise to the forfeiture.

Director Compensation

A directors’ compensation analysis including a peer comparison was completed in 2017. The goal of the study was to evaluate our director compensation against our peer group to ensure the Company’s compensation practices for our directors is consistent with banks our size and within our similar markets. The analysis revealed that both director cash and equity retainers as well as meeting fees were below peer median. In addition, committee chair fees were also below peer median. The peer group used in the director compensation analysis was consistent with the methodology outlined on page 20. The last time the Company increased director’s fees and retainers was in 2011. Based on the analysis the following recommendations to director compensation were made:

| · |

Increase member cash retainer from $25,000 to $40,000

|

| · |

Increase board chairman and member equity retainer from $21,000 to $25,000

|

| · |

Increase per meeting fee from $1,000 to $1,250

|

| · |

Increase Audit and Risk Committee Chairman retainer from $10,000 to $15,000

|

| · |

Increase all other committee chairmen retainer from $5,000 to $10,000

|

| · |

Increase per committee meeting fees from $800 to $1,000

|

12

Set forth below is the fee schedule for non-executive directors as of December 31, 2017:

|

Cash

|

Restricted Stock Units

|

|||||||

| Annual Retainer Fees | ||||||||

|

Chair:

|

||||||||

|

NBT Bancorp Inc. Board

|

$

|

50,000

|

$

|

12,500

|

||||

|

NBT Bank, N.A. Board

|

$

|

50,000

|

$

|

12,500

|

||||

|

Audit and Risk Management Committee

|

$

|

15,000

|

$

|

-

|

||||

|

All Other Committees

|

$

|

10,000

|

$

|

-

|

||||

|

Affiliate Board

|

$

|

2,500

|

$

|

-

|

||||

|

Member:

|

||||||||

|

NBT Bancorp Inc. Board

|

$

|

20,000

|

$

|

12,500

|

||||

|

NBT Bank, N.A. Board

|

$

|

20,000

|

$

|

12,500

|

||||

|

Fee per Board Meeting

|

$

|

1,250

|

$

|

-

|

||||

|

Fee per Committee Meeting

|

$

|

1,000

|

$

|

-

|

||||

The restricted stock unit awards in 2017 were issued pursuant to the Omnibus Plan. The restricted stock units awarded to the non-employee directors vest one-third annually beginning on the first anniversary of the grant date.

Director Compensation Table

|

Name

|

Fees Earned or

Paid in Cash

($) (1)

|

Restricted

Stock Awards

($) (1) (2) (3)

|

Change in Pension

Value and Nonqualified

Deferred Compensation

Earnings

($) (4)

|

All Other

Compensation

($) (5)

|

Total

($)

|

|||||||||||||||

|

Patricia T. Civil

|

83,350

|

23,781

|

854

|

2,232

|

110,217

|

|||||||||||||||

|

Timothy E. Delaney

|

64,750

|

23,781

|

12,025

|

614

|

101,170

|

|||||||||||||||

|

Martin A. Dietrich

|

151,000

|

29,775

|

-

|

563,166

|

743,941

|

|||||||||||||||

|

James H. Douglas

|

76,600

|

23,781

|

-

|

-

|

100,381

|

|||||||||||||||

|

Andrew S. Kowalczyk III

|

67,832

|

30,284

|

255

|

-

|

98,371

|

|||||||||||||||

|

John C. Mitchell

|

77,550

|

23,781

|

-

|

5,437

|

106,768

|

|||||||||||||||

|

Michael M. Murphy (6)

|

8,850

|

-

|

-

|

1,956

|

10,806

|

|||||||||||||||

|

V. Daniel Robinson II

|

66,082

|

30,284

|

-

|

-

|

96,366

|

|||||||||||||||

|

Matthew J. Salanger

|

68,832

|

30,284

|

-

|

-

|

99,116

|

|||||||||||||||

|

Joseph A. Santangelo

|

79,150

|

23,781

|

2,246

|

5,337

|

110,514

|

|||||||||||||||

|

Lowell A. Seifter

|

69,900

|

23,781

|

39,069

|

10,536

|

143,286

|

|||||||||||||||

|

Robert A. Wadsworth

|

65,150

|

23,781

|

13,873

|

1,181

|

103,985

|

|||||||||||||||

|

Jack H. Webb

|

70,300

|

23,781

|

-

|

-

|

94,081

|

|||||||||||||||

|

(1)

|

Includes all fees earned during the fiscal year whether such fees were paid currently or deferred.

|

|

(2)

|

The amounts reflect the aggregate grant date fair value of awards computed in accordance with FASB ASC Topic 718. The director restricted stock unit awards granted for fiscal year ending December 31, 2017, were issued as of May 23, 2017, and the per share fair market value was $34.87. Upon appointment to the Company’s board, Messrs. Kowalczyk, Robinson and Salanger each received a pro-rata restricted stock unit award granted on January 3, 2017, and the per share fair market value was $40.14. Mr. Dietrich received a pro-rata restricted stock unit award granted on February 3, 2017, and the per share fair market value was $38.67. Assumptions used in the calculation of these amounts are materially consistent with those that are included in footnote 14 to the Company’s audited consolidated financial statements contained in its Annual Report on Form 10-K.

|

13

|

(3)

|

The aggregate number of outstanding awards as of December 31, 2017, is as follows (Ms. Civil has 1,500 unexercisable options related to reloads as of such date):

|

|

Name

|

Unvested Stock Units

|

Options Exercisable

|

||||||

|

Patricia T. Civil

|

1,471

|

2,130

|

||||||

|

Timothy E. Delaney

|

1,471

|

-

|

||||||

|

Martin A. Dietrich

|

837

|

-

|

||||||

|

James H. Douglas

|

1,471

|

-

|

||||||

|

Andrew S. Kowalczyk III

|

844

|

-

|

||||||

|

John C. Mitchell

|

1,471

|

-

|

||||||

|

V. Daniel Robinson II

|

844

|

-

|

||||||

|

Matthew J. Salanger

|

844

|

-

|

||||||

|

Joseph A. Santangelo

|

1,471

|

-

|

||||||

|

Lowell A. Seifter

|

1,471

|

-

|

||||||

|

Robert A. Wadsworth

|

1,471

|

1,625

|

||||||

|

Jack H. Webb

|

1,471

|

-

|

||||||

|

(4)

|

Figures in the change in pension value and nonqualified deferred compensation earnings represent earnings for the fiscal year ending December 31, 2017, on deferred directors’ fees under a nonqualified deferred compensation plan.

|

|

(5)

|

All other compensation includes: cash dividends received on restricted stock and deferred stock granted pursuant to the Non-Employee Directors’ Restricted and Deferred Stock Plan and the Omnibus Plan for all non-employee directors totaling $13,075; health and/or dental/vision insurance offered through the Company for three active Directors as part of legacy director benefit plans no longer offered, the Company’s associated premium costs totaled $4,469. Mr. Seifter’s compensation includes dividends paid through the Alliance Financial Corporation Deferred Compensation Plan. Mr. Dietrich’s other compensation includes amounts earned as an employee of NBT Bancorp Inc. prior to retirement as follows: $175,385 in salary, $327,732 of equity compensation representing the grant date fair value of the awards granted, $42,075 for the fair value of the vehicle transferred to him upon retirement, $6,138 of matching contributions to the 401(k) Plan and ESOP, $8,835 in health and life insurance premiums and $3,001 for the value of split dollar life insurance premiums paid.

|

|

(6)

|

Mr. Murphy retired as a director upon the expiration of his term at the 2017 annual meeting.

|

Named Executive Officers of NBT Bancorp Inc.

The following table sets forth certain information for the Named Executive Officers (“NEOs”) of NBT Bancorp Inc.

|

Name

|

Age at December 31, 2017

|

Positions Held with NBT and NBT Bank

|

|

John H. Watt Jr.

|

59

|

President and Chief Executive Officer

|

|

Michael J. Chewens

|

56

|

Senior Executive Vice President and Chief Financial Officer

|

|

Timothy L. Brenner

|

61

|

Executive Vice President and President of Wealth Management

|

|

Joseph R. Stagliano

|

49

|

Executive Vice President, Operations and Retail Banking

|

|

Sarah A. Halliday

|

47

|

Executive Vice President and President of Commercial Banking

|

Biographical information regarding the NEOs is set forth below. Information regarding Mr. Watt can be found under the section Board Nominees for 2018 found on page 4.

14

Michael J. Chewens, has been Senior Executive Vice President and Chief Financial Officer of NBT and NBT Bank since January 2002. Mr. Chewens was Executive Vice President and Chief Financial Officer of same from 1999 to 2001. He joined NBT’s Executive Management Team in 1995 as Senior Vice President and head of the Risk Management Division. Mr. Chewens began his career at NBT Bank in 1994, after gaining ten years of experience in accounting and auditing with KPMG. He was also Corporate Secretary of NBT and NBT Bank from December 2000 to April 2010. Mr. Chewens also serves on the NBT Financial Services, Inc. Board which is an affiliate board of the Company. Mr. Chewens has over thirty years of experience in accounting and finance. Mr. Chewens graduated from the State University of New York at Oswego with a bachelor’s degree in accounting. He earned an MBA from Syracuse University. Mr. Chewens is a certified public accountant and is a member of the American Institute of Certified Public Accountants and the New York State Society of Certified Public Accountants. Mr. Chewens is also an adjunct professor for the Martin J. Whitman School of Management at Syracuse University.

Timothy L. Brenner, has been Executive Vice President for NBT and President of Wealth Management for NBT Bank since March 2012. He is responsible for developing the company’s wealth management strategies and overseeing the trust, investment and retirement services lines of business, which includes NBT’s 401(k) plan recordkeeping firm, EPIC Advisors, Inc. In 2016, his role was expanded to include oversight of all non-bank lines of business, including NBT Insurance Agency, LLC. Mr. Brenner has over thirty years of experience in the financial services industry. Mr. Brenner also serves on the NBT Financial Services, Inc. Board which is an affiliate board of the Company. Prior to joining NBT, Mr. Brenner was employed at M&T Bank as Senior Vice President of the M&T Investment Group. In this role, he managed the multi-state Institutional Services Division. Previously, Brenner led M&T’s Private Client Services Division. He was also President of the MTB Funds and M&T Life Insurance Company. Prior to that, he was a partner at Vivacqua and Company, an independent financial services and insurance agency. Mr. Brenner earned his bachelor’s degree from Kalamazoo College in Kalamazoo, MI, and his master’s degree in education from John Carroll University in Cleveland, OH.

Joseph R. Stagliano, has been Executive Vice President, Operations and Retail Banking for NBT since January 2016. Since his appointment in 2016, the Consumer Lending and Marketing divisions were also added to his responsibilities. He was promoted to Chief Information Officer and joined NBT’s Executive Management Team in 2006. Mr. Stagliano joined NBT in 1999 and has held a number of leadership positions in Operations, including Director of Information Technology. Mr. Stagliano has over twenty-five years of experience in the financial services industry. Prior to joining the Company, Mr. Stagliano was employed by MetLife and advanced to leadership roles in customer service and call center management during his tenure there. Mr. Stagliano holds a Bachelor’s Degree in business and public management from SUNY Polytechnic Institute, formerly the State University of New York Institute of Technology in Utica. His community activities include serving as a member of the board of education for the Norwich City School District.

Sarah A. Halliday, has been Executive Vice President and President of Commercial Banking with responsibility for NBT’s Commercial Banking Division since she joined the Company in January 2017. She has more than twenty-five years of experience in banking and commercial lending. Prior to joining the Company, she was employed at M&T Bank as Capital Region Market President. Prior to joining M&T in 2005, Ms. Halliday worked for the New York Business Development Corporation for 11 years as Vice President and Loan Officer. She started her career with Fleet Bank. Ms. Halliday earned her Bachelor of Arts degree from Colgate University, graduating with honors in Economics. She is involved in several community and professional organizations, including the Capital Region Sponsor a Scholar, Junior Achievement of Northeastern New York, the foundation for the St. Anne Institute and Rensselaer Polytechnic Institute’s Athletic Council.

Section 16(a) Beneficial Ownership Reporting Compliance

Our directors and executive officers must, under Section 16(a) of the Exchange Act, file certain reports of their initial ownership of our common stock and of changes in beneficial ownership of our securities. Based solely on a review of reports submitted to NBT, or written representations from reporting persons that all reportable transactions were reported, the Company believes that during the fiscal year ended December 31, 2017 all Section 16(a) filing requirements applicable to NBT’s officers and directors were complied with on a timely basis with the exception of two transactions reported each in a late filing for Mr. Kowalczyk and Mr. Webb.

15

COMPENSATION DISCUSSION AND ANLYSIS

This section discusses the Company’s executive compensation philosophy, guidelines and programs, and the material factors affecting the Company’s decisions regarding the compensation of its named executive officers (“NEOs”). This information is presented to give our shareholders a clear and comprehensive picture of the Company’s executive compensation program, and its individual components. It also describes the process followed by the Compensation and Benefits Committee (the “Committee”) for making compensation decisions, as well as its rationale for specific decisions related to 2017. The NEOs for 2017 are:

| · |

John H. Watt Jr., President and Chief Executive Officer (“CEO”)

|

| · |

Michael J. Chewens, Senior Executive Vice President and Chief Financial Officer (“CFO”)

|

| · |

Timothy L. Brenner, Executive Vice President and President of Wealth Management

|

| · |

Joseph R. Stagliano, Executive Vice President, Operations and Retail Banking

|

| · |

Sarah A. Halliday, Executive Vice President and President of Commercial Banking

|

Executive Summary

The Company has a strong pay for performance culture. Our executive compensation programs are designed to reward the NEOs for making decisions that lead to consistent financial performance and value creation for our shareholders. In 2017, the Company achieved record earnings. As a result, the NEO’s achieved 100% of their targeted opportunity under the annual Executive Incentive Compensation Plan (“EICP”) and 125.0% of their targeted opportunity in performance-vesting stock awards in the first year of the performance period.

2017 Business Highlights

We achieved our highest level of net income and diluted earnings per share in the Company’s 161 year history. The following highlights improved performance from 2016:

| · |

Diluted earnings per share was $1.97* increasing 9.4%.

|

| · |

Net income was up 10.4%* from 2016.

|

| · |

Net interest margin expanded by 4 basis points to 3.47%.

|

| · |

Loan growth continued to be strong, increasing 6.2%.

|

| · |

Average demand deposits grew 8.4%.

|

* These results for 2017 exclude the $4.4 million one-time noncash charge related to the enactment of the Tax Cuts and Jobs Act (“Tax Reform”) as the Committee’s assessment of 2017 incentive compensation relative to Company performance did not include the impact of Tax Reform.

Below is a summary of key financial metrics. Refer to “Pay for Performance” on page 20 for a summary of our pay for performance analysis.

|

Performance Metric

|

2017

|

|||

|

Net Income ($ Millions)

|

$

|

86.6

|

||

|

Diluted earnings per share (“EPS”) (1)

|

$

|

1.97

|

||

|

Return on Average Assets (“ROAA”) (1)

|

0.96

|

%

|

||

|

Return on Average Tangible Equity (“ROATE”) (1)

|

13.48

|

%

|

||

|

Loan Growth

|

6.2

|

%

|

||

|

Demand Deposit Growth

|

8.4

|

%

|

||

|

NonPerforming Assets (“NPA”) to Total Assets

|

0.39

|

%

|

||

(1) Non-GAAP measures adjust GAAP measures to exclude the $4.4 million charge related to Tax Reform and also for ROATE the effects of acquisition related intangible amortization expense on equity.

16

Say-on-Pay Results

We continue to be focused on aligning our compensation plans with our business objectives, performance, shareholder interests, and the practices of our peers. We considered the 95.5% non-binding advisory basis approval of the executive compensation of our NEOs by our shareholders at the annual meeting on May 23, 2017 and also have considered feedback from shareholders and commentary received from proxy advisory groups and independent compensation consultants to evaluate our compensation practices. We considered the 95.5% approval rating of the executive compensation of our NEOs as strong endorsement of our compensation programs.

Compensation Governance

The Company instituted and maintained policies and practices that promote strong compensation governance:

| · |

Link a significant portion of compensation to performance through the use of short-term (cash) and long-term (equity) compensation to encourage both proactivity and long-term sustainability.

|

| · |

Employ a variety of performance metrics to deter excessive risk-taking by eliminating any incentive focus on a single performance goal.

|

| · |