csl-20210914P5YP5YP2Y11111P1YP1Yus-gaap:OtherAssetsus-gaap:OtherAssetsus-gaap:OtherLiabilitiesCurrentus-gaap:OtherLiabilitiesCurrentus-gaap:LiabilitiesNoncurrentAbstractus-gaap:LiabilitiesNoncurrentAbstract0000790051falsetrueiso4217:USD00007900512020-01-012020-12-3100007900512019-01-012019-12-3100007900512018-01-012018-12-31iso4217:USDxbrli:sharesxbrli:shares00007900512020-12-3100007900512019-12-3100007900512018-12-3100007900512017-12-310000790051us-gaap:CommonStockMember2017-12-310000790051us-gaap:AdditionalPaidInCapitalMember2017-12-310000790051us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310000790051us-gaap:RetainedEarningsMember2017-12-310000790051us-gaap:TreasuryStockMember2017-12-310000790051us-gaap:AccumulatedOtherComprehensiveIncomeMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310000790051srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2017-12-310000790051srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310000790051us-gaap:RetainedEarningsMember2018-01-012018-12-310000790051us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310000790051us-gaap:CommonStockMember2018-01-012018-12-310000790051us-gaap:TreasuryStockMember2018-01-012018-12-310000790051us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310000790051us-gaap:CommonStockMember2018-12-310000790051us-gaap:AdditionalPaidInCapitalMember2018-12-310000790051us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310000790051us-gaap:RetainedEarningsMember2018-12-310000790051us-gaap:TreasuryStockMember2018-12-310000790051us-gaap:RetainedEarningsMember2019-01-012019-12-310000790051us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000790051us-gaap:CommonStockMember2019-01-012019-12-310000790051us-gaap:TreasuryStockMember2019-01-012019-12-310000790051us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310000790051us-gaap:CommonStockMember2019-12-310000790051us-gaap:AdditionalPaidInCapitalMember2019-12-310000790051us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000790051us-gaap:RetainedEarningsMember2019-12-310000790051us-gaap:TreasuryStockMember2019-12-310000790051us-gaap:RetainedEarningsMember2020-01-012020-12-310000790051us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000790051us-gaap:CommonStockMember2020-01-012020-12-310000790051us-gaap:TreasuryStockMember2020-01-012020-12-310000790051us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000790051us-gaap:CommonStockMember2020-12-310000790051us-gaap:AdditionalPaidInCapitalMember2020-12-310000790051us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000790051us-gaap:RetainedEarningsMember2020-12-310000790051us-gaap:TreasuryStockMember2020-12-310000790051srt:MinimumMember2020-01-012020-12-310000790051srt:MaximumMember2020-01-012020-12-310000790051srt:WeightedAverageMember2020-01-012020-12-310000790051csl:ConstructionMaterialsMemberus-gaap:OperatingSegmentsMember2018-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:OperatingSegmentsMember2018-12-310000790051csl:FluidTechnologiesMemberus-gaap:OperatingSegmentsMember2018-12-310000790051us-gaap:CorporateNonSegmentMember2018-12-310000790051csl:ConstructionMaterialsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310000790051csl:FluidTechnologiesMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310000790051us-gaap:CorporateNonSegmentMember2019-01-012019-12-310000790051csl:ConstructionMaterialsMemberus-gaap:OperatingSegmentsMember2019-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:OperatingSegmentsMember2019-12-310000790051csl:FluidTechnologiesMemberus-gaap:OperatingSegmentsMember2019-12-310000790051us-gaap:CorporateNonSegmentMember2019-12-310000790051csl:ConstructionMaterialsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310000790051csl:FluidTechnologiesMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310000790051us-gaap:CorporateNonSegmentMember2020-01-012020-12-310000790051csl:ConstructionMaterialsMemberus-gaap:OperatingSegmentsMember2020-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:OperatingSegmentsMember2020-12-310000790051csl:FluidTechnologiesMemberus-gaap:OperatingSegmentsMember2020-12-310000790051us-gaap:CorporateNonSegmentMember2020-12-310000790051us-gaap:BuildingMembersrt:MinimumMember2020-01-012020-12-310000790051us-gaap:BuildingMembersrt:MaximumMember2020-01-012020-12-310000790051us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2020-01-012020-12-310000790051us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2020-01-012020-12-310000790051srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2020-01-012020-12-310000790051us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2020-01-012020-12-31csl:reporting_unitcsl:segment0000790051us-gaap:OperatingSegmentsMember2020-01-012020-12-310000790051us-gaap:OperatingSegmentsMember2020-12-310000790051us-gaap:OperatingSegmentsMember2019-01-012019-12-310000790051us-gaap:OperatingSegmentsMember2019-12-310000790051csl:ConstructionMaterialsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310000790051csl:FluidTechnologiesMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310000790051us-gaap:OperatingSegmentsMember2018-01-012018-12-310000790051us-gaap:OperatingSegmentsMember2018-12-310000790051us-gaap:CorporateNonSegmentMember2018-01-012018-12-310000790051country:US2020-12-310000790051country:US2019-12-310000790051srt:EuropeMember2020-12-310000790051srt:EuropeMember2019-12-310000790051srt:AsiaMember2020-12-310000790051srt:AsiaMember2019-12-310000790051country:MX2020-12-310000790051country:MX2019-12-310000790051country:GB2020-12-310000790051country:GB2019-12-310000790051csl:OtherCountriesMember2020-12-310000790051csl:OtherCountriesMember2019-12-310000790051country:UScsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembercountry:US2020-01-012020-12-310000790051csl:FluidTechnologiesMembercountry:US2020-01-012020-12-310000790051country:US2020-01-012020-12-310000790051srt:EuropeMembercsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembersrt:EuropeMember2020-01-012020-12-310000790051srt:EuropeMembercsl:FluidTechnologiesMember2020-01-012020-12-310000790051srt:EuropeMember2020-01-012020-12-310000790051srt:AsiaMembercsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembersrt:AsiaMember2020-01-012020-12-310000790051srt:AsiaMembercsl:FluidTechnologiesMember2020-01-012020-12-310000790051srt:AsiaMember2020-01-012020-12-310000790051country:CAcsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembercountry:CA2020-01-012020-12-310000790051csl:FluidTechnologiesMembercountry:CA2020-01-012020-12-310000790051country:CA2020-01-012020-12-310000790051country:MXcsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembercountry:MX2020-01-012020-12-310000790051csl:FluidTechnologiesMembercountry:MX2020-01-012020-12-310000790051country:MX2020-01-012020-12-310000790051csl:MiddleEastandAfricaMembercsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembercsl:MiddleEastandAfricaMember2020-01-012020-12-310000790051csl:MiddleEastandAfricaMembercsl:FluidTechnologiesMember2020-01-012020-12-310000790051csl:MiddleEastandAfricaMember2020-01-012020-12-310000790051csl:OtherCountriesMembercsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembercsl:OtherCountriesMember2020-01-012020-12-310000790051csl:OtherCountriesMembercsl:FluidTechnologiesMember2020-01-012020-12-310000790051csl:OtherCountriesMember2020-01-012020-12-310000790051csl:InternationalMembercsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembercsl:InternationalMember2020-01-012020-12-310000790051csl:FluidTechnologiesMembercsl:InternationalMember2020-01-012020-12-310000790051csl:InternationalMember2020-01-012020-12-310000790051csl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMember2020-01-012020-12-310000790051csl:FluidTechnologiesMember2020-01-012020-12-310000790051country:UScsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembercountry:US2019-01-012019-12-310000790051csl:FluidTechnologiesMembercountry:US2019-01-012019-12-310000790051country:US2019-01-012019-12-310000790051srt:EuropeMembercsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembersrt:EuropeMember2019-01-012019-12-310000790051srt:EuropeMembercsl:FluidTechnologiesMember2019-01-012019-12-310000790051srt:EuropeMember2019-01-012019-12-310000790051srt:AsiaMembercsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembersrt:AsiaMember2019-01-012019-12-310000790051srt:AsiaMembercsl:FluidTechnologiesMember2019-01-012019-12-310000790051srt:AsiaMember2019-01-012019-12-310000790051country:CAcsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembercountry:CA2019-01-012019-12-310000790051csl:FluidTechnologiesMembercountry:CA2019-01-012019-12-310000790051country:CA2019-01-012019-12-310000790051country:MXcsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembercountry:MX2019-01-012019-12-310000790051csl:FluidTechnologiesMembercountry:MX2019-01-012019-12-310000790051country:MX2019-01-012019-12-310000790051csl:MiddleEastandAfricaMembercsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembercsl:MiddleEastandAfricaMember2019-01-012019-12-310000790051csl:MiddleEastandAfricaMembercsl:FluidTechnologiesMember2019-01-012019-12-310000790051csl:MiddleEastandAfricaMember2019-01-012019-12-310000790051csl:OtherCountriesMembercsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembercsl:OtherCountriesMember2019-01-012019-12-310000790051csl:OtherCountriesMembercsl:FluidTechnologiesMember2019-01-012019-12-310000790051csl:OtherCountriesMember2019-01-012019-12-310000790051csl:InternationalMembercsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembercsl:InternationalMember2019-01-012019-12-310000790051csl:FluidTechnologiesMembercsl:InternationalMember2019-01-012019-12-310000790051csl:InternationalMember2019-01-012019-12-310000790051csl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMember2019-01-012019-12-310000790051csl:FluidTechnologiesMember2019-01-012019-12-310000790051country:UScsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembercountry:US2018-01-012018-12-310000790051csl:FluidTechnologiesMembercountry:US2018-01-012018-12-310000790051country:US2018-01-012018-12-310000790051srt:EuropeMembercsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembersrt:EuropeMember2018-01-012018-12-310000790051srt:EuropeMembercsl:FluidTechnologiesMember2018-01-012018-12-310000790051srt:EuropeMember2018-01-012018-12-310000790051srt:AsiaMembercsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembersrt:AsiaMember2018-01-012018-12-310000790051srt:AsiaMembercsl:FluidTechnologiesMember2018-01-012018-12-310000790051srt:AsiaMember2018-01-012018-12-310000790051country:CAcsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembercountry:CA2018-01-012018-12-310000790051csl:FluidTechnologiesMembercountry:CA2018-01-012018-12-310000790051country:CA2018-01-012018-12-310000790051country:MXcsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembercountry:MX2018-01-012018-12-310000790051csl:FluidTechnologiesMembercountry:MX2018-01-012018-12-310000790051country:MX2018-01-012018-12-310000790051csl:MiddleEastandAfricaMembercsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembercsl:MiddleEastandAfricaMember2018-01-012018-12-310000790051csl:MiddleEastandAfricaMembercsl:FluidTechnologiesMember2018-01-012018-12-310000790051csl:MiddleEastandAfricaMember2018-01-012018-12-310000790051csl:OtherCountriesMembercsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembercsl:OtherCountriesMember2018-01-012018-12-310000790051csl:OtherCountriesMembercsl:FluidTechnologiesMember2018-01-012018-12-310000790051csl:OtherCountriesMember2018-01-012018-12-310000790051csl:InternationalMembercsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembercsl:InternationalMember2018-01-012018-12-310000790051csl:FluidTechnologiesMembercsl:InternationalMember2018-01-012018-12-310000790051csl:InternationalMember2018-01-012018-12-310000790051csl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMember2018-01-012018-12-310000790051csl:FluidTechnologiesMember2018-01-012018-12-31xbrli:pure0000790051csl:BeaconRoofingSupplyIncMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310000790051csl:BeaconRoofingSupplyIncMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2019-01-012019-12-310000790051csl:BeaconRoofingSupplyIncMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2018-01-012018-12-310000790051us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercsl:ABCSupplyCo.Member2020-01-012020-12-310000790051us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercsl:ABCSupplyCo.Member2019-01-012019-12-310000790051us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercsl:ABCSupplyCo.Member2018-01-012018-12-31csl:item0000790051us-gaap:CustomerConcentrationRiskMemberus-gaap:OtherCustomerMemberus-gaap:SalesRevenueNetMember2019-01-012019-12-310000790051us-gaap:CustomerConcentrationRiskMemberus-gaap:OtherCustomerMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310000790051us-gaap:CustomerConcentrationRiskMemberus-gaap:OtherCustomerMemberus-gaap:SalesRevenueNetMember2018-01-012018-12-310000790051csl:MotionTechAutomationLLCMember2020-07-220000790051csl:MotionTechAutomationLLCMember2020-07-222020-07-220000790051csl:MotionTechAutomationLLCMember2020-07-222020-12-310000790051csl:MotionTechAutomationLLCMember2020-01-012020-12-310000790051us-gaap:TechnologyBasedIntangibleAssetsMembercsl:MotionTechAutomationLLCMember2020-07-220000790051us-gaap:TechnologyBasedIntangibleAssetsMembercsl:MotionTechAutomationLLCMember2020-07-222020-07-220000790051us-gaap:CustomerRelationshipsMembercsl:MotionTechAutomationLLCMember2020-07-220000790051us-gaap:CustomerRelationshipsMembercsl:MotionTechAutomationLLCMember2020-07-222020-07-220000790051us-gaap:TradeNamesMembercsl:MotionTechAutomationLLCMember2020-07-220000790051us-gaap:TradeNamesMembercsl:MotionTechAutomationLLCMember2020-07-222020-07-220000790051csl:MotionTechAutomationLLCMembercsl:ConstructionMaterialsMember2020-07-220000790051csl:FluidTechnologiesMembercsl:MotionTechAutomationLLCMember2020-07-220000790051csl:InterconnectTechnologiesMembercsl:MotionTechAutomationLLCMember2020-07-220000790051csl:ProvidienLLCMember2020-11-202020-11-200000790051csl:ProvidienLLCMember2019-11-200000790051csl:ProvidienLLCMember2019-11-202019-12-310000790051csl:ProvidienLLCMember2020-01-012020-12-310000790051csl:ProvidienLLCMember2019-11-202019-11-200000790051us-gaap:ScenarioAdjustmentMembercsl:ProvidienLLCMember2019-11-202020-11-200000790051csl:ProvidienLLCMember2020-11-200000790051us-gaap:ScenarioAdjustmentMembercsl:ProvidienLLCMember2020-11-200000790051csl:ProvidienLLCMember2020-12-310000790051us-gaap:CustomerRelationshipsMembercsl:ProvidienLLCMember2020-11-200000790051us-gaap:CustomerRelationshipsMembercsl:ProvidienLLCMember2019-11-202019-11-200000790051us-gaap:TechnologyBasedIntangibleAssetsMembercsl:ProvidienLLCMember2020-11-200000790051us-gaap:TechnologyBasedIntangibleAssetsMembercsl:ProvidienLLCMember2019-11-202019-11-200000790051us-gaap:TradeNamesMembercsl:ProvidienLLCMember2020-11-200000790051us-gaap:TradeNamesMembercsl:ProvidienLLCMember2019-11-202019-11-200000790051csl:PetersenAluminumCorporationMember2019-01-110000790051csl:PetersenAluminumCorporationMember2019-01-112019-01-110000790051csl:PetersenAluminumCorporationMember2019-01-112019-12-310000790051csl:PetersenAluminumCorporationMember2020-01-012020-12-310000790051csl:PetersenAluminumCorporationMember2020-01-112020-01-110000790051csl:PetersenAluminumCorporationMember2020-01-110000790051csl:PetersenAluminumCorporationMemberus-gaap:ScenarioAdjustmentMember2020-01-110000790051csl:PetersenAluminumCorporationMemberus-gaap:CustomerRelationshipsMember2019-01-110000790051csl:PetersenAluminumCorporationMemberus-gaap:CustomerRelationshipsMember2019-01-112019-01-110000790051us-gaap:TradeNamesMembercsl:PetersenAluminumCorporationMember2019-01-110000790051us-gaap:TradeNamesMembercsl:PetersenAluminumCorporationMember2019-01-112019-01-110000790051us-gaap:TechnologyBasedIntangibleAssetsMembercsl:PetersenAluminumCorporationMember2019-01-110000790051us-gaap:TechnologyBasedIntangibleAssetsMembercsl:PetersenAluminumCorporationMember2019-01-112019-01-110000790051us-gaap:OtherNoncurrentAssetsMembercsl:PetersenAluminumCorporationMember2019-01-110000790051csl:MicroConnexCorporationMember2019-04-010000790051csl:MicroConnexCorporationMember2019-04-012019-04-010000790051csl:InterconnectTechnologiesMembercsl:MicroConnexCorporationMember2019-04-012019-12-310000790051csl:InterconnectTechnologiesMembercsl:MicroConnexCorporationMember2019-04-010000790051csl:InterconnectTechnologiesMembercsl:MicroConnexCorporationMemberus-gaap:CustomerRelationshipsMember2019-04-012019-04-010000790051us-gaap:TradeNamesMembercsl:InterconnectTechnologiesMembercsl:MicroConnexCorporationMember2019-04-012019-04-010000790051us-gaap:TechnologyBasedIntangibleAssetsMembercsl:InterconnectTechnologiesMembercsl:MicroConnexCorporationMember2019-04-012019-04-010000790051csl:AccellaHoldingsLLCMember2017-11-300000790051us-gaap:SubsequentEventMembercsl:BrakeAndFrictionMember2021-05-312021-05-310000790051us-gaap:SubsequentEventMembercsl:BrakeAndFrictionMember2021-05-210000790051csl:FoodServiceProductsMember2018-03-202018-03-200000790051csl:BrakeAndFrictionMember2020-01-012020-12-310000790051csl:DisposalGroupNameOtherMember2020-01-012020-12-310000790051csl:BrakeAndFrictionMember2019-01-012019-12-310000790051csl:DisposalGroupNameOtherMember2019-01-012019-12-310000790051csl:BrakeAndFrictionMember2018-01-012018-12-310000790051csl:FoodServiceProductsMember2018-01-012018-12-310000790051csl:ProductsTransferredataPointinTimeorOverTimeMember2020-01-012020-12-310000790051us-gaap:TransferredAtPointInTimeMembercsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:TransferredAtPointInTimeMember2020-01-012020-12-310000790051csl:FluidTechnologiesMemberus-gaap:TransferredAtPointInTimeMember2020-01-012020-12-310000790051us-gaap:TransferredAtPointInTimeMember2020-01-012020-12-310000790051csl:ConstructionMaterialsMemberus-gaap:TransferredOverTimeMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:TransferredOverTimeMember2020-01-012020-12-310000790051csl:FluidTechnologiesMemberus-gaap:TransferredOverTimeMember2020-01-012020-12-310000790051us-gaap:TransferredOverTimeMember2020-01-012020-12-310000790051us-gaap:TransferredAtPointInTimeMembercsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:TransferredAtPointInTimeMember2019-01-012019-12-310000790051csl:FluidTechnologiesMemberus-gaap:TransferredAtPointInTimeMember2019-01-012019-12-310000790051us-gaap:TransferredAtPointInTimeMember2019-01-012019-12-310000790051csl:ConstructionMaterialsMemberus-gaap:TransferredOverTimeMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:TransferredOverTimeMember2019-01-012019-12-310000790051csl:FluidTechnologiesMemberus-gaap:TransferredOverTimeMember2019-01-012019-12-310000790051us-gaap:TransferredOverTimeMember2019-01-012019-12-310000790051us-gaap:TransferredAtPointInTimeMembercsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:TransferredAtPointInTimeMember2018-01-012018-12-310000790051csl:FluidTechnologiesMemberus-gaap:TransferredAtPointInTimeMember2018-01-012018-12-310000790051us-gaap:TransferredAtPointInTimeMember2018-01-012018-12-310000790051csl:ConstructionMaterialsMemberus-gaap:TransferredOverTimeMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:TransferredOverTimeMember2018-01-012018-12-310000790051csl:FluidTechnologiesMemberus-gaap:TransferredOverTimeMember2018-01-012018-12-310000790051us-gaap:TransferredOverTimeMember2018-01-012018-12-3100007900512021-01-012020-12-3100007900512022-01-012020-12-3100007900512023-01-012020-12-3100007900512024-01-012020-12-3100007900512025-01-012020-12-3100007900512026-01-012020-12-310000790051csl:RevenuesByEndMarketMember2020-01-012020-12-310000790051csl:GeneralConstructionMembercsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembercsl:GeneralConstructionMember2020-01-012020-12-310000790051csl:FluidTechnologiesMembercsl:GeneralConstructionMember2020-01-012020-12-310000790051csl:GeneralConstructionMember2020-01-012020-12-310000790051csl:ConstructionMaterialsMembercsl:AerospaceManufacturingOperationsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembercsl:AerospaceManufacturingOperationsMember2020-01-012020-12-310000790051csl:FluidTechnologiesMembercsl:AerospaceManufacturingOperationsMember2020-01-012020-12-310000790051csl:AerospaceManufacturingOperationsMember2020-01-012020-12-310000790051csl:MedicalBusinessMembercsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembercsl:MedicalBusinessMember2020-01-012020-12-310000790051csl:FluidTechnologiesMembercsl:MedicalBusinessMember2020-01-012020-12-310000790051csl:MedicalBusinessMember2020-01-012020-12-310000790051csl:TransportationMembercsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:TransportationMembercsl:InterconnectTechnologiesMember2020-01-012020-12-310000790051csl:TransportationMembercsl:FluidTechnologiesMember2020-01-012020-12-310000790051csl:TransportationMember2020-01-012020-12-310000790051csl:ConstructionMaterialsMembercsl:HeavyEquipmentMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembercsl:HeavyEquipmentMember2020-01-012020-12-310000790051csl:FluidTechnologiesMembercsl:HeavyEquipmentMember2020-01-012020-12-310000790051csl:HeavyEquipmentMember2020-01-012020-12-310000790051csl:GeneralIndustrialandOtherMembercsl:ConstructionMaterialsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembercsl:GeneralIndustrialandOtherMember2020-01-012020-12-310000790051csl:GeneralIndustrialandOtherMembercsl:FluidTechnologiesMember2020-01-012020-12-310000790051csl:GeneralIndustrialandOtherMember2020-01-012020-12-310000790051csl:GeneralConstructionMembercsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembercsl:GeneralConstructionMember2019-01-012019-12-310000790051csl:FluidTechnologiesMembercsl:GeneralConstructionMember2019-01-012019-12-310000790051csl:GeneralConstructionMember2019-01-012019-12-310000790051csl:ConstructionMaterialsMembercsl:AerospaceManufacturingOperationsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembercsl:AerospaceManufacturingOperationsMember2019-01-012019-12-310000790051csl:FluidTechnologiesMembercsl:AerospaceManufacturingOperationsMember2019-01-012019-12-310000790051csl:AerospaceManufacturingOperationsMember2019-01-012019-12-310000790051csl:MedicalBusinessMembercsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembercsl:MedicalBusinessMember2019-01-012019-12-310000790051csl:FluidTechnologiesMembercsl:MedicalBusinessMember2019-01-012019-12-310000790051csl:MedicalBusinessMember2019-01-012019-12-310000790051csl:TransportationMembercsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:TransportationMembercsl:InterconnectTechnologiesMember2019-01-012019-12-310000790051csl:TransportationMembercsl:FluidTechnologiesMember2019-01-012019-12-310000790051csl:TransportationMember2019-01-012019-12-310000790051csl:ConstructionMaterialsMembercsl:HeavyEquipmentMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembercsl:HeavyEquipmentMember2019-01-012019-12-310000790051csl:FluidTechnologiesMembercsl:HeavyEquipmentMember2019-01-012019-12-310000790051csl:HeavyEquipmentMember2019-01-012019-12-310000790051csl:GeneralIndustrialandOtherMembercsl:ConstructionMaterialsMember2019-01-012019-12-310000790051csl:InterconnectTechnologiesMembercsl:GeneralIndustrialandOtherMember2019-01-012019-12-310000790051csl:GeneralIndustrialandOtherMembercsl:FluidTechnologiesMember2019-01-012019-12-310000790051csl:GeneralIndustrialandOtherMember2019-01-012019-12-310000790051csl:GeneralConstructionMembercsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembercsl:GeneralConstructionMember2018-01-012018-12-310000790051csl:FluidTechnologiesMembercsl:GeneralConstructionMember2018-01-012018-12-310000790051csl:GeneralConstructionMember2018-01-012018-12-310000790051csl:ConstructionMaterialsMembercsl:AerospaceManufacturingOperationsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembercsl:AerospaceManufacturingOperationsMember2018-01-012018-12-310000790051csl:FluidTechnologiesMembercsl:AerospaceManufacturingOperationsMember2018-01-012018-12-310000790051csl:AerospaceManufacturingOperationsMember2018-01-012018-12-310000790051csl:MedicalBusinessMembercsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembercsl:MedicalBusinessMember2018-01-012018-12-310000790051csl:FluidTechnologiesMembercsl:MedicalBusinessMember2018-01-012018-12-310000790051csl:MedicalBusinessMember2018-01-012018-12-310000790051csl:TransportationMembercsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:TransportationMembercsl:InterconnectTechnologiesMember2018-01-012018-12-310000790051csl:TransportationMembercsl:FluidTechnologiesMember2018-01-012018-12-310000790051csl:TransportationMember2018-01-012018-12-310000790051csl:ConstructionMaterialsMembercsl:HeavyEquipmentMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembercsl:HeavyEquipmentMember2018-01-012018-12-310000790051csl:FluidTechnologiesMembercsl:HeavyEquipmentMember2018-01-012018-12-310000790051csl:HeavyEquipmentMember2018-01-012018-12-310000790051csl:GeneralIndustrialandOtherMembercsl:ConstructionMaterialsMember2018-01-012018-12-310000790051csl:InterconnectTechnologiesMembercsl:GeneralIndustrialandOtherMember2018-01-012018-12-310000790051csl:GeneralIndustrialandOtherMembercsl:FluidTechnologiesMember2018-01-012018-12-310000790051csl:GeneralIndustrialandOtherMember2018-01-012018-12-310000790051csl:ExecutiveIncentiveProgramMember2020-12-310000790051csl:EmployeeStockOptionAnnualEquityGrantMember2020-01-012020-12-310000790051csl:RestrictedStockAwardMember2020-01-012020-12-310000790051csl:PerformanceShareAwardMember2020-01-012020-12-310000790051us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310000790051us-gaap:EmployeeStockOptionMember2020-01-012020-12-310000790051us-gaap:EmployeeStockOptionMember2019-01-012019-12-310000790051us-gaap:EmployeeStockOptionMember2018-01-012018-12-310000790051csl:RestrictedStockAwardMember2019-01-012019-12-310000790051csl:RestrictedStockAwardMember2018-01-012018-12-310000790051csl:PerformanceShareAwardMember2019-01-012019-12-310000790051csl:PerformanceShareAwardMember2018-01-012018-12-310000790051us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310000790051us-gaap:RestrictedStockUnitsRSUMember2018-01-012018-12-310000790051us-gaap:StockAppreciationRightsSARSMember2020-01-012020-12-310000790051us-gaap:StockAppreciationRightsSARSMember2019-01-012019-12-310000790051us-gaap:StockAppreciationRightsSARSMember2018-01-012018-12-310000790051csl:Q22018StockOptionandStockAppreciationRightGrantMember2020-01-012020-12-310000790051csl:Q22018StockOptionandStockAppreciationRightGrantMember2019-01-012019-12-310000790051us-gaap:EmployeeStockOptionMember2020-12-310000790051csl:EmployeeStockOptionAnnualEquityGrantMember2019-01-012019-12-310000790051csl:EmployeeStockOptionOnetimeGrantMember2018-01-012018-12-310000790051us-gaap:EmployeeStockOptionMember2019-12-310000790051csl:RestrictedStockAwardMember2020-12-310000790051csl:RestrictedStockAwardMember2019-12-310000790051csl:PerformanceShareAwardMember2020-12-310000790051csl:PerformanceShareAwardMember2019-12-310000790051us-gaap:RestrictedStockUnitsRSUMembersrt:DirectorMember2020-05-062020-05-060000790051us-gaap:RestrictedStockUnitsRSUMember2020-12-310000790051us-gaap:RestrictedStockUnitsRSUMember2019-12-310000790051us-gaap:RestrictedStockUnitsRSUMember2018-12-310000790051us-gaap:StockAppreciationRightsSARSMember2020-12-310000790051us-gaap:StockAppreciationRightsSARSMember2019-12-310000790051us-gaap:DeferredCompensationShareBasedPaymentsMember2020-01-012020-12-310000790051us-gaap:DeferredCompensationShareBasedPaymentsMember2019-01-012019-12-3100007900512019-01-012019-03-310000790051csl:InterconnectTechnologiesMembersrt:MinimumMember2020-07-012020-09-300000790051csl:InterconnectTechnologiesMembersrt:MaximumMember2020-07-012020-09-300000790051csl:InterconnectTechnologiesMembercsl:FacilityCleanupAndEmployeeTerminationBenefitCostsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMember2020-12-310000790051csl:InterconnectTechnologiesMemberus-gaap:OneTimeTerminationBenefitsMember2020-12-310000790051csl:InterconnectTechnologiesMembercsl:EmployeeSeveranceAndBenefitArrangementsMember2020-01-012020-12-310000790051csl:InterconnectTechnologiesMembercsl:EmployeeSeveranceAndBenefitArrangementsMember2020-12-310000790051csl:EmployeeSeveranceAndBenefitArrangementsMember2020-01-012020-12-310000790051csl:EmployeeSeveranceAndBenefitArrangementsMember2019-01-012019-12-310000790051csl:EmployeeSeveranceAndBenefitArrangementsMember2018-01-012018-12-310000790051csl:FacilityCleanupCostsMember2020-01-012020-12-310000790051csl:FacilityCleanupCostsMember2019-01-012019-12-310000790051csl:FacilityCleanupCostsMember2018-01-012018-12-310000790051csl:NoncashAcceleratedDepreciationMember2020-01-012020-12-310000790051csl:NoncashAcceleratedDepreciationMember2019-01-012019-12-310000790051csl:NoncashAcceleratedDepreciationMember2018-01-012018-12-310000790051us-gaap:EmployeeRelocationMember2020-01-012020-12-310000790051us-gaap:EmployeeRelocationMember2019-01-012019-12-310000790051us-gaap:EmployeeRelocationMember2018-01-012018-12-310000790051us-gaap:OtherRestructuringMember2020-01-012020-12-310000790051us-gaap:OtherRestructuringMember2019-01-012019-12-310000790051us-gaap:OtherRestructuringMember2018-01-012018-12-310000790051us-gaap:CostOfSalesMember2020-01-012020-12-310000790051us-gaap:CostOfSalesMember2019-01-012019-12-310000790051us-gaap:CostOfSalesMember2018-01-012018-12-310000790051us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310000790051us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-01-012019-12-310000790051us-gaap:SellingGeneralAndAdministrativeExpensesMember2018-01-012018-12-310000790051us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-12-310000790051us-gaap:ResearchAndDevelopmentExpenseMember2019-01-012019-12-310000790051us-gaap:ResearchAndDevelopmentExpenseMember2018-01-012018-12-310000790051us-gaap:OtherIncomeMember2020-01-012020-12-310000790051us-gaap:OtherIncomeMember2019-01-012019-12-310000790051us-gaap:OtherIncomeMember2018-01-012018-12-310000790051us-gaap:OtherNoncurrentAssetsMember2020-12-310000790051us-gaap:OtherNoncurrentAssetsMember2019-12-310000790051us-gaap:OtherNoncurrentLiabilitiesMember2020-12-310000790051us-gaap:OtherNoncurrentLiabilitiesMember2019-12-310000790051srt:MinimumMember2020-12-310000790051srt:MaximumMember2020-12-310000790051us-gaap:LandMember2020-12-310000790051us-gaap:LandMember2019-12-310000790051csl:BuildingAndLeaseholdImprovementsMember2020-12-310000790051csl:BuildingAndLeaseholdImprovementsMember2019-12-310000790051us-gaap:MachineryAndEquipmentMember2020-12-310000790051us-gaap:MachineryAndEquipmentMember2019-12-310000790051us-gaap:ConstructionInProgressMember2020-12-310000790051us-gaap:ConstructionInProgressMember2019-12-310000790051csl:ConstructionMaterialsMember2018-12-310000790051csl:InterconnectTechnologiesMember2018-12-310000790051csl:FluidTechnologyMember2018-12-310000790051csl:FluidTechnologyMember2019-01-012019-12-310000790051csl:ConstructionMaterialsMember2019-12-310000790051csl:InterconnectTechnologiesMember2019-12-310000790051csl:FluidTechnologyMember2019-12-310000790051csl:FluidTechnologyMember2020-01-012020-12-310000790051csl:ConstructionMaterialsMember2020-12-310000790051csl:FluidTechnologyMember2020-12-31csl:business0000790051csl:AdditionalAcquisitionsMember2020-01-012020-12-310000790051csl:AdditionalAcquisitionsMember2019-01-012019-12-310000790051us-gaap:CustomerRelationshipsMember2020-12-310000790051us-gaap:CustomerRelationshipsMember2019-12-310000790051csl:PatentsAndIntellectualPropertyMember2020-12-310000790051csl:PatentsAndIntellectualPropertyMember2019-12-310000790051us-gaap:OtherIntangibleAssetsMember2020-12-310000790051us-gaap:OtherIntangibleAssetsMember2019-12-310000790051us-gaap:TradeNamesMember2020-12-310000790051us-gaap:TradeNamesMember2019-12-310000790051us-gaap:CustomerRelationshipsMember2020-01-012020-12-310000790051csl:PatentsAndIntellectualPropertyMember2020-01-012020-12-310000790051us-gaap:OtherIntangibleAssetsMember2020-01-012020-12-3100007900512017-01-012017-03-310000790051csl:A275SeniorNotesDue2030Member2020-02-280000790051csl:A275SeniorNotesDue2030Member2020-12-310000790051csl:A275SeniorNotesDue2030Member2019-12-310000790051csl:A275SeniorNotesDue2030Memberus-gaap:FairValueInputsLevel2Member2020-12-310000790051csl:A275SeniorNotesDue2030Memberus-gaap:FairValueInputsLevel2Member2019-12-310000790051csl:SeniorNotesPayable3.75PercentDue2027Member2017-11-160000790051csl:SeniorNotesPayable3.75PercentDue2027Member2020-12-310000790051csl:SeniorNotesPayable3.75PercentDue2027Member2019-12-310000790051csl:SeniorNotesPayable3.75PercentDue2027Memberus-gaap:FairValueInputsLevel2Member2020-12-310000790051csl:SeniorNotesPayable3.75PercentDue2027Memberus-gaap:FairValueInputsLevel2Member2019-12-310000790051csl:SeniorNotesPayable3.5PercentDue2024Member2017-11-160000790051csl:SeniorNotesPayable3.5PercentDue2024Member2020-12-310000790051csl:SeniorNotesPayable3.5PercentDue2024Member2019-12-310000790051csl:SeniorNotesPayable3.5PercentDue2024Memberus-gaap:FairValueInputsLevel2Member2020-12-310000790051csl:SeniorNotesPayable3.5PercentDue2024Memberus-gaap:FairValueInputsLevel2Member2019-12-310000790051csl:SeniorNotesPayable3.75PercentDue2022Member2012-11-200000790051csl:SeniorNotesPayable3.75PercentDue2022Member2020-12-310000790051csl:SeniorNotesPayable3.75PercentDue2022Member2019-12-310000790051csl:SeniorNotesPayable3.75PercentDue2022Memberus-gaap:FairValueInputsLevel2Member2020-12-310000790051csl:SeniorNotesPayable3.75PercentDue2022Memberus-gaap:FairValueInputsLevel2Member2019-12-310000790051csl:SeniorNotesPayable5.125PercentDue2020Member2010-12-090000790051csl:SeniorNotesPayable5.125PercentDue2020Member2020-12-310000790051csl:SeniorNotesPayable5.125PercentDue2020Member2019-12-310000790051csl:SeniorNotesPayable5.125PercentDue2020Memberus-gaap:FairValueInputsLevel2Member2020-12-310000790051csl:SeniorNotesPayable5.125PercentDue2020Memberus-gaap:FairValueInputsLevel2Member2019-12-310000790051csl:A275SeniorNotesDue2030Member2020-02-282020-02-280000790051csl:SeniorNotesPayable3.75PercentDue2027Member2017-11-162017-11-160000790051csl:SeniorNotesPayable3.5PercentDue2024Member2017-11-162017-11-160000790051csl:SeniorNotesPayable3.75PercentDue2022Member2012-11-202012-11-200000790051csl:SeniorNotesPayable5.125PercentDue2020Member2010-12-092010-12-090000790051us-gaap:UnsecuredDebtMember2020-03-292020-03-290000790051csl:SeniorNotesPayable5.125PercentDue2020Member2020-03-292020-03-290000790051csl:SeniorNotesPayable5.125PercentDue2020Member2020-01-012020-12-310000790051us-gaap:RevolvingCreditFacilityMembercsl:FourthAmendedAndRestatedCreditAgreementMember2020-03-310000790051us-gaap:RevolvingCreditFacilityMembercsl:FourthAmendedAndRestatedCreditAgreementMember2020-02-050000790051csl:FourthAmendedAndRestatedCreditAgreementMemberus-gaap:LetterOfCreditMember2020-02-050000790051us-gaap:RevolvingCreditFacilityMember2020-12-310000790051us-gaap:RevolvingCreditFacilityMember2020-01-012020-12-310000790051us-gaap:RevolvingCreditFacilityMember2019-01-012019-12-310000790051us-gaap:RevolvingCreditFacilityMember2018-01-012018-12-310000790051us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2020-12-310000790051us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310000790051us-gaap:PensionPlansDefinedBenefitMember2020-12-310000790051us-gaap:PensionPlansDefinedBenefitMember2019-12-310000790051us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310000790051us-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310000790051us-gaap:PensionPlansDefinedBenefitMember2018-12-310000790051us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2020-01-012020-12-310000790051us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2019-01-012019-12-310000790051us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2020-12-310000790051us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2019-12-310000790051us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Member2020-12-310000790051us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel1Member2020-12-310000790051us-gaap:FairValueInputsLevel1Memberus-gaap:CashMember2020-12-310000790051us-gaap:FairValueInputsLevel1Memberus-gaap:CashMember2019-12-310000790051us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000790051us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000790051us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000790051us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000790051us-gaap:FairValueInputsLevel1Member2020-12-310000790051us-gaap:FairValueInputsLevel1Member2019-12-310000790051us-gaap:CashAndCashEquivalentsMember2020-12-310000790051us-gaap:CashAndCashEquivalentsMember2019-12-310000790051us-gaap:ShortTermInvestmentsMember2020-12-310000790051us-gaap:ShortTermInvestmentsMember2019-12-310000790051us-gaap:AccountingStandardsUpdate201602Member2019-01-012019-12-310000790051us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310000790051us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310000790051us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2020-12-310000790051us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2019-12-310000790051us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMembersrt:MaximumMember2020-01-012020-12-310000790051us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMembersrt:MaximumMember2020-01-012020-12-310000790051us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-310000790051us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310000790051us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-12-310000790051us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-12-310000790051us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-12-310000790051us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-01-012019-12-310000790051us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310000790051us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310000790051us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310000790051us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-12-310000790051us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-12-310000790051us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310000790051us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310000790051us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310000790051us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-3100007900512021-09-142021-09-140000790051us-gaap:CommonStockMember2021-09-142021-09-140000790051us-gaap:PreferredStockMember2021-09-142021-09-14

EXPLANATORY NOTE

Carlisle Companies Incorporated (the "Company") is filing this exhibit to update the financial information and certain related disclosures included in its Annual Report on Form 10-K for the year ended December 31, 2020 (the "2020 Form 10-K") to reflect the presentation of Carlisle Brake & Friction ("CBF") as discontinued operations. This update is consistent with the presentation of continuing and discontinued operations included in the Company's Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2021, filed with the United States Securities and Exchange Commission ("SEC") on July 27, 2021 (the “Q2 2021 Form 10-Q”).

As previously disclosed in the Company's Q2 2021 Form 10-Q, on May 25, 2021, the Company announced the signing of a definitive agreement to sell CBF to certain direct and indirect wholly-owned subsidiaries of BRWS Parent LLC, a portfolio company of One Rock Capital Partners (“CentroMotion”), for gross proceeds of (i) $250 million cash at closing, subject to certain adjustments, and (ii) the right to receive up to an additional $125 million based on CBF's achievement of certain performance targets. As disclosed in the Company's Current Report on Form 8-K filed with the SEC on August 2, 2021, the Company completed the sale of CBF to CentroMotion. Accordingly, the Company has reported the results of CBF as discontinued operations in the Consolidated Statements of Income and Comprehensive Income and presented the assets and liabilities of CBF as held for sale in the Consolidated Balance Sheets for all periods presented.

This exhibit updates the information in the following items as initially filed in order to reflect the presentation of discontinued operations:

•Part I. Item 1 Business

•Part I. Item 2 Properties

•Part II. Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations

•Part II. Item 8 Financial Statements and Supplementary Data

No items in the 2020 Form 10-K other than those identified above are being updated by this exhibit. Information in the 2020 Form 10-K is generally stated as of December 31, 2020, and this exhibit does not reflect any subsequent information or events other than the discontinued operations presentation noted above. Without limiting the foregoing, this exhibit does not purport to update Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in the 2020 Form 10-K for any information, uncertainties, transactions, risks, events or trends occurring, or known to management, other than the events described above. More current information is contained in the Company’s Q2 2021 Form 10-Q and other filings with the SEC. This exhibit should be read in conjunction with the 2020 Form 10-K, the Q2 2021 Form 10-Q and the other documents the Company has filed with the SEC subsequent to February 11, 2021 (the “Other Documents”). The Q2 2021 Form 10-Q and the Other Documents contain information regarding events, developments and updates to certain expectations of the Company that have occurred since the filing of the 2020 Form 10-K.

Carlisle Companies Incorporated

PART I

Item 1. Business.

Overview

Carlisle Companies Incorporated (“Carlisle”, the “Company”, “we”, “us” or “our”) is a diversified, global manufacturer of highly engineered products. Our Company website is www.carlisle.com, through which we make available, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and all amendments to those reports, as soon as reasonably practicable after these reports are electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). All references to "Notes" refer to our Notes to Consolidated Financial Statements in this Annual Report on Form 10-K.

Business Strategy

We strive to be the market leader of highly engineered products in the various markets we serve. Under Vision 2025, our key pillars include: dedication to driving above market growth, utilizing the Carlisle Operating System (“COS”) consistently to drive efficiencies and operating leverage, building scale with synergistic acquisitions, continuing to invest in and develop exceptional talent, accommodating continued organic growth through capital expenditures, and returning capital to shareholders through share repurchases and dividends.

We utilize COS, an operating structure and strategy deployment system based on lean enterprise and six sigma principles, to drive improving operational performance. COS is a continuous improvement process that defines the way we do business. Waste is eliminated and efficiencies are improved enterprise wide, allowing us to increase overall profitability. Improvements are not limited to production areas, as COS is also driving improvements in new product innovation, engineering, supply chain management, warranty and product rationalization. COS has created a culture of continuous improvement across all aspects of our business operations.

While the coronavirus pandemic ("COVID-19") has affected our near-term results, we believe our proactive approach to cost reductions and continuous improvement initiatives will allow us to accelerate through the recovery by: further improving the efficiency of our businesses through COS, continuing to make the investments necessary to deliver a world-class Carlisle Experience, which delivers the right product, at the right place, at the right time, and ensuring we maintain discipline and rigor in our capital allocation process. Taken together, we believe these actions will drive us to achieve our goals outlined in Vision 2025. See Description of Business by Segment below for a more detailed discussion of our Vision 2025 strategy.

As noted above, a significant part of our strategy is to build scale with synergistic acquisitions. Synergies considered in making an acquisition include consolidation opportunities (e.g., footprint, back office, technology, systems), supply chain savings and cross-sell opportunities. We acquired two businesses during 2020, which add to our existing Carlisle Construction Materials (“CCM”), Carlisle Interconnect Technologies (“CIT”) and Carlisle Fluid Technologies ("CFT") segments. For more details regarding acquisitions of the Company’s businesses during the past three years, refer to Note 3.

We also pursue the sale of a business when it is determined it no longer fits within the Company’s long-term goals or strategy. Accordingly, on August 2, 2021, we completed the sale of our Carlisle Brake & Friction ("CBF") segment to certain direct and indirect wholly-owned subsidiaries of BRWS Parent LLC, a portfolio company of One Rock Capital Partners (“CentroMotion”), for gross proceeds of (i) $250 million cash at closing, subject to certain adjustments, and (ii) the right to receive up to an additional $125 million based on CBF's achievement of certain performance targets. Refer to Note 4 for further discussion of our discontinued operations. Additionally, on March 20, 2018, we completed the sale of our Carlisle FoodService Products ("CFS") segment to The Jordan Company for $758.0 million.

Description of Business by Segment

Carlisle Construction Materials (“CCM”)

Products, Markets and Locations

The CCM segment has evolved from a supplier of the first single-ply ethylene propylene diene monomer (“EPDM”) roofing membranes in the early 1960s to today, where we deliver innovative, easy-to-install and energy-efficient solutions through the Carlisle Experience for customers who are creating the sustainable building of the future. CCM manufactures a complete range of building envelope products for commercial, industrial and residential buildings, including single-ply roofing, rigid foam insulations, spray polyurethane foam technologies, architectural

metal, heating, ventilation and air conditioning ("HVAC") hardware and sealants, below-grade waterproofing, and air and vapor barrier systems focused on the weatherproofing and thermal performance of the building envelope. CCM is a leading North American and European building products manufacturer offering a complete set of solutions and systems to aid in the design of efficient building envelope construction projects, backed by industry-leading warranties and a focus on green principles.

EPDM, thermoplastic polyolefin (“TPO”) and polyvinyl chloride (“PVC”) membrane and polyisocyanurate insulation are sold together in warranted systems or separately in non-warranted systems to the new construction, re-roofing and maintenance, general construction and industrial markets. These products are primarily sold under the SynTec, Versico, Weatherbond and Hunter Panels brands in the United States of America (“U.S.” or “United States”) and throughout the world, and EPDM membrane under the Resitrix and Hertalan brands primarily in Europe. The segment sells its expanded polystyrene for a variety of end markets, predominantly roofing and waterproofing through its Insulfoam brand.

CCM operates manufacturing facilities located throughout the United States, its primary market, and in Germany, the Netherlands, United Kingdom ("U.K.") and Romania. The majority of CCM’s products are sold through a network of authorized sales representatives and distributors in the United States.

Key Raw Materials

Key raw materials for this segment include methylene diphenyl diisocyanate (“MDI”), polyol, EPDM polymer, TPO polymer, carbon black and coated steel. These raw materials generally have at least two vendor sources to better assure adequate supply. The vendor typically has multiple processing facilities for key raw materials that are single sourced.

Seasonality

Revenues and earnings for CCM have historically been higher in the second and third quarters due to increased construction activity during those periods from favorable weather conditions.

Market Factors

CCM serves a large and diverse customer base; however, in 2020 CCM's two largest customers represented 32.1% of this segment’s revenues and 24.2% of the Company’s consolidated revenues. The loss of either of these customers could have a material adverse effect on this segment’s revenues and operating income and the Company's consolidated revenues and operating income.

This segment faces competition from numerous competitors that produce roofing, insulation and waterproofing products for commercial and residential applications. The level of competition within this market varies by product line and region. As one of four major manufacturers in the single-ply industry, CCM competes through innovative products, long-term warranties and customer service. CCM offers separately priced extended warranty contracts on certain of its products ranging from five to 40 years, the most significant being those offered on its installed single-ply roofing systems primarily in the United States, subject to certain exclusions, that covers leaks in the roofing system attributable to a problem with the particular product or the installation of the product. The building owner must have the roofing system installed by an independent authorized roofing contractor trained by CCM to install its roofing systems in order to qualify for the warranty.

Vision 2025 Strategy

Our strategy under Vision 2025 for the CCM segment is to:

•Improve upon its above average margin profile;

•Capture significant aftermarket opportunities as buildings in the U.S. approach “re-roofing” vintage;

•Further expand our presence in niche high-growth and high-margin opportunities including spray foam insulation and architectural metals; and

•Expand internationally, especially into Europe, where there is a market to displace traditional asphalt roofing with EPDM and other single-ply roofing.

Key growth initiatives:

•Capture market share based on value created for labor and energy efficiency;

•Leverage the Carlisle Experience to create the preferred choice through operational excellence;

•Continued development of proprietary, differentiated products;

•Utilize training to drive a culture of continuous learning that creates brand loyalty; and

•Focus mergers and acquisitions on synergistic building envelope opportunities.

Carlisle Interconnect Technologies (“CIT”)

Products, Markets and Locations

The CIT segment designs and manufactures high-performance wire and cable, including optical fiber, for the commercial aerospace, military and defense electronics, medical device, industrial, and test and measurement markets. CIT's product portfolio also includes sensors, connectors, contacts, cable assemblies, complex harnesses, racks, trays and installation kits, in addition to engineering and certification services. Offering both turnkey and custom solutions, CIT is also known as a single-source global provider for innovative medical device solutions and electromechanical technology. Leveraging our global presence, CIT continues to deliver a growing line of advanced solutions for emerging applications worldwide.

The aerospace and defense electronics products are primarily sold under the Carlisle, Thermax and Tri-Star brand names, with the medical products primarily sold under the Carlisle, LHi Technology and Providien brand names. This segment primarily operates manufacturing facilities in the United States, China and Mexico, with the United States, Europe and China being the primary target regions for sales. Sales are made by direct sales personnel and independent sales representatives.

Key Raw Materials

Key raw materials for this segment include gold, copper conductors that are plated with tin, nickel or silver, polyimide tapes, polytetrafluoroethylene (“PTFE”) tapes, PTFE fine powder resin, thermoplastic resins, stainless steel, beryllium copper rod, machined metals, plastic parts, and various marking and identification materials. These raw materials are typically sourced worldwide and generally have at least two supplier sources to better assure adequate supply, except when prohibited by customer contracts, which represented less than 10% of purchases in 2020.

Market Factors

Backlog orders were $279.6 million and $306.8 million as of December 31, 2020 and 2019, respectively. Of the $279.6 million in backlog orders as of December 31, 2020, $27.9 million are not reasonably expected to be filled in 2021.

The CIT segment faces competition from numerous competitors within each of the markets it serves. While product specifications, certifications and life cycles vary by market, the CIT segment primarily positions itself to gain design specification for customer platforms or products with long life cycles and high barriers to entry, such as in the aerospace and medical markets. These markets generally have high standards for product certification as deemed by the Federal Aviation Administration (“FAA”) and European Union Aviation Safety Agency ("EASA"), and Food and Drug Administration (“FDA”), respectively. The CIT segment competes primarily on the basis of its product performance and its ability to meet its customers’ highly specific design, engineering and delivery needs on a timely basis.

Vision 2025 Strategy

Our strategy under Vision 2025 for the CIT segment is to focus on highly regulated industries that have the characteristics of high-performance, mission-critical products designed to operate in harsh environments with significant barriers to entry and attractive margins. The primary industries currently include commercial aerospace, defense, industrial and medical devices.

Our strategy under Vision 2025 for the CIT segment is to:

•Increase its status as the wire and cable supplier of choice by meeting increased electrification needs of aircraft;

•Broaden its breadth of product and geographic reach within aerospace and medical through both new product development and mergers and acquisitions;

•Capitalize on increased investment on medical equipment and technology; and

•Leverage core technologies to diversify into attractive, adjacent markets.

Key growth initiatives:

•Increase content per aircraft across all product groups;

•Build out and convert medical original equipment manufacturers ("OEM") project pipeline;

•Establish new OEM relationships and drive new product development in precision sensors;

•Increase market share on defense electronics and space programs;

•Ensure organization alignment is market focused to drive accelerated organic growth;

•Focus merger and acquisition efforts on commercial aerospace, medical technologies, and test and measurement end markets; and

•Leverage vertically integrated capabilities to support the medical device OEM strategy of consolidating supply chains across strategic end markets.

Carlisle Fluid Technologies (“CFT”)

Products, Markets and Locations

The CFT segment designs, manufactures and sells highly engineered liquid, powder, sealants and adhesives finishing equipment and integrated system solutions for spraying, pumping, mixing, metering and curing a variety of coatings used primarily in the automotive manufacture, general industrial, protective coating, wood, specialty and automotive refinish markets. The CFT segment manufactures and sells products that are sold under the brand names of Binks®, DeVilbiss®, Ransburg®, BGK® and MS Powder®. The segment operates manufacturing facilities primarily in the United States, the U.K., Switzerland and Sweden, and assembly and distribution facilities in China, Japan and South Korea, with approximately 55% of its revenues outside the United States. The majority of sales into CFT's industries are made through a worldwide network of distributors, integrators and some direct to end-user sales. These business relationships are managed primarily through direct sales personnel worldwide.

Key Raw Materials

Key raw materials for this segment include carbon and various grades of stainless steel, brass, aluminum, copper, machined metals, carbide, machined plastic parts and PTFE. These raw materials are typically sourced worldwide and have at least two vendor sources to better assure adequate supply.

Seasonality

Approximately 18% of CFT’s annual revenues are for the development, and in some cases assembly, of large fluid handling or other application systems projects. Timing of these system sales can result in revenues that are higher in certain quarters versus other quarters within the same calendar year, particularly the fourth quarter.

Market Factors

The CFT segment competes against both regional and international manufacturers. Major competitive factors include innovative designs, the ability to provide customers with lower cost of ownership, dependable performance and high quality at a competitive price. CFT’s products' ability to spray, mix or deliver a wide range of coatings, applied uniformly in exact increments, is critical to the overall appearance of the applied coatings and functionality. The segment’s installed base of global customers is supported by a worldwide distribution network with the ability to deliver critical spare parts and other services. Brands that are well recognized and respected internationally, combined with a diverse base of customers, applications and industries served, positions the CFT segment to continue designing patented, innovative equipment and solutions for customers across the globe.

Vision 2025 Strategy

Our strategy under Vision 2025 for the CFT segment is to focus on key end markets of automotive and automotive refinish, transportation and general industrial.

In the automotive and automotive refinish markets CFT is focused on:

•Growing sales of core spray guns in automotive OEM and automotive refinishing markets by capitalizing on strong brand recognition and solid customer advocacy among key automotive OEMs; and

•Further expanding in mixing, metering and dispensing viscous liquids or powder coating equipment through our energy efficient pumps, leveraging those pumps to support core spray gun sales and expanding in adjacent markets.

In the transportation and general industrial markets CFT is focused on:

•Leveraging the CFT brand and distribution in Asia;

•Scaling the powder business outside of Europe;

•Expanding pump sales in the attractive reciprocating pumps market;

•Further penetrating the fast-set applications market, including spray foam insulation;

•Launching innovative new products; and

•Continuing to expand into sealants and adhesives.

Key growth initiatives:

•Expand global distribution network by developing partners in growing regions and markets;

•Expand product portfolio by launching new products in adjacent markets and filling gaps in existing product portfolio;

•Increase market share by driving deep customer relationships and operational excellence; and

•Focus merger and acquisition efforts on targets that deliver precision fluid management solutions.

Intellectual Property

We own or hold the right to use a variety of patents, trademarks, licenses, inventions, trade secrets and other intellectual property rights. We have adopted a variety of measures and programs to ensure the continued validity and enforceability of our various intellectual property rights.

Research and Development

Research and development activities include the development of new product lines, the modification of existing product lines to comply with regulatory changes, and the research of cost efficiencies through raw material substitution and process improvements. Our research and development expenses were $45.4 million, $52.2 million and $45.5 million, representing 1.1%, 1.2% and 1.1% of revenues in 2020, 2019 and 2018, respectively.

Compliance with Government Regulations

We are subject to various government regulations, including environmental regulations. To date, our costs of complying with these regulations have not had a material effect on our capital expenditures, earnings or competitive position or that of any business segment. We do not expect to incur any material capital expenditures for environmental control facilities for the current fiscal year or any other subsequent period.

Human Capital Resources

Investing in Our People

As of December 31, 2020, we employed approximately 12,000 people, excluding approximately 1,000 contractors.

Talent acquisition and retention are critical drivers to delivering the goals of Vision 2025. A trained, diverse and inspired workforce is integral to delivering value to our stakeholders. We begin with a recruiting process that reaches a wide array of potential employees and includes the engagement of specialized, diverse recruiting firms such as The Standard Diversity Network, Jobs4Women.net, Asian American Jobsite, African American Jobsite and many others.

We also partner with universities in the U.S. and outside the U.S., recruiting for functional talent in management, sales, finance, information technology and other functions from the communities in which we work. In addition, we engage certain of these universities in collaborative research and development, and training efforts. Each business segment works with high schools and trade schools in their respective locations to educate young people about and attract them to manufacturing careers.

We offer several training programs for current employees intended to develop talent, including:

•The Carlisle Leadership Summit is intended to identify and prepare high-performing employees for senior leadership roles.

•The Carlisle Leadership Program, developed in association with the Kelley School of Business, is a program for senior manager or director level employees who are leading teams and demonstrating future potential for senior leadership roles. This program develops business and leadership skills in both applied and classroom environments.

•The Carlisle Leadership Foundation is a program designed for skilled functional or technical individual contributors who have recently advanced, or are expected to advance, to their first leadership roles. This program helps these employees to define their own leadership skills to enable their future success.

•The Carlisle Management Development Program was established with several university MBA programs and is a one-year post-MBA rotational program designed to give an expedited experience for participants within business segments across functional areas.

Diversity, Equity & Inclusion

Carlisle has pledged to take action to cultivate a workplace where diverse perspectives and experiences are welcomed and respected. In May 2018, Carlisle joined the CEO Action for Diversity & Inclusion™, a growing coalition of more than 900 CEOs of major corporations pledging to advance diversity and inclusion in the workplace. By signing on to this commitment, Carlisle is pledging to take action to cultivate a workplace where diverse perspectives and experiences are welcomed and respected. CEO Action for Diversity & Inclusion™ is cultivating a new type of ecosystem centered around collaboration and sharing.

Carlisle’s commitment to diversity and inclusion in the workforce includes a policy of non-discriminatory treatment and respect of human rights for all current and prospective employees. Discrimination on the basis of an individual’s race, religion, creed, color, sex, sexual orientation, age, marital status, disability, national origin or veteran’s status is not permitted by Carlisle and is illegal in many jurisdictions. Carlisle respects the human rights of all employees and strives to treat them with dignity consistent with standards and practices recognized by the international community. Carlisle is committed to respecting all human rights, as articulated in the Universal Declaration of Human Rights, the International Covenant on Civil and Political Rights, the International Covenant on Economic, Social and Cultural Rights, and the International Labor Organization’s Declaration on Fundamental Principles and Rights at Work.

In addition to policies for fair treatment, Carlisle also works to address unconscious bias in the workplace. Unconscious bias training is a key component of Carlisle’s leadership development programs. This training helps inform leaders of biases and provides a forum for them to explore how Carlisle can strengthen our culture of inclusion by addressing and breaking down biases. This has contributed to an effort to gain equal diversity representation throughout Carlisle.

Over a year ago, we began a significant initiative to ensure women and men are compensated fairly at Carlisle. As of the end of 2020, we achieved gender pay equity across the U.S. for executives, senior officers and management. In 2021, we will expand this initiative across the Company. This means compensating employees the same when they perform the same job duties, while accounting for other factors, such as their experience level, job performance and tenure with the company. In 2020, we raised Carlisle's minimum starting wage to $15 per hour for our entire U.S. workforce.

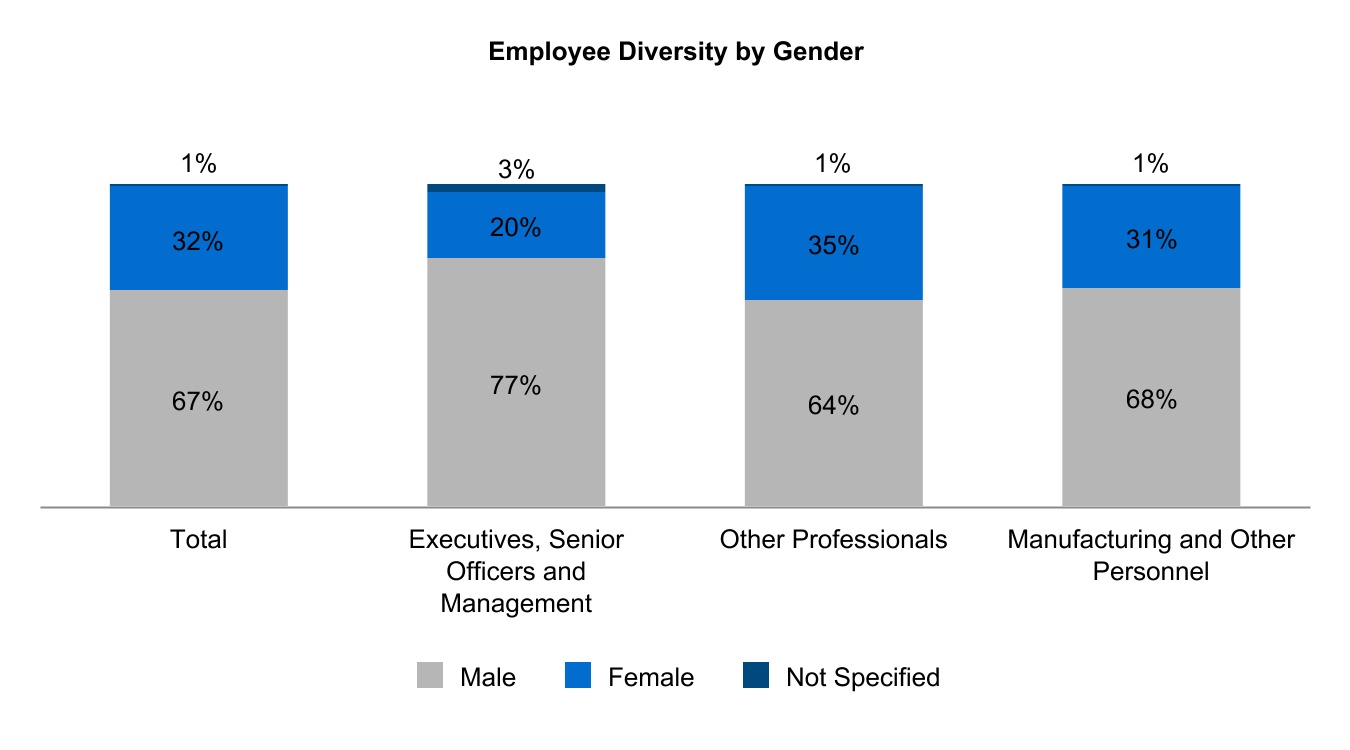

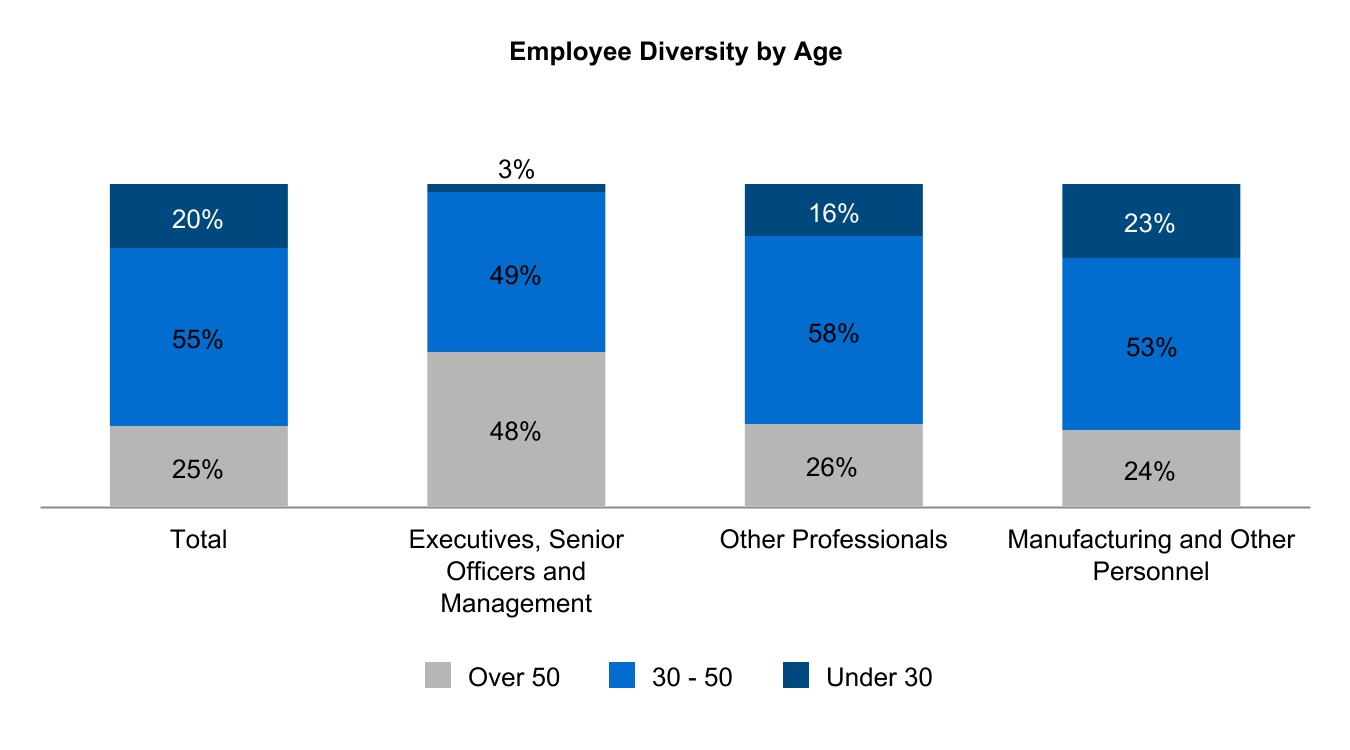

Below is a summary of our global employees diversity as of December 31, 2020 by gender and age:

Health and Safety

Carlisle is continuously striving to provide safer, healthier work environments. From the onset of COVID-19, Carlisle formed an internal task force to monitor and implement at all locations all of the health and safety guidelines and requirements of national and local authorities to protect our workforce, including, but not limited to, providing a period of full pay for employees required to follow stay-at-home orders and implementing remote work plans for eligible employees. Our task force met weekly with division management to ensure health and safety compliance in the workplace.

Through COS, we have launched “The Path to Zero,” an initiative to drive our incident rate to zero. At Carlisle, safety is everyone’s responsibility. This includes our own employees, as well as contractors, suppliers, customers and others. Carlisle is committed to adhere to safety policies, procedures, and training to incorporate safety into all aspects of business operations. All safety incidents are investigated to reduce safety risks and share lessons learned. Carlisle measures and reviews safety performance and strives for continuous improvement along the Path to Zero.

Labor Matters

Employees represented by unions, local work councils or collective bargaining agreements as of December 31, 2020, are listed below, with the number of employees represented and the expiration date of the applicable agreements:

| | | | | | | | | | | | | | | | | | | | | | | |

| Location | | Number of Agreements | | Number of Employees Represented | | Expiration Date | |

| CIT - China | | 2 | | 3,572 | | December 2022 | |

| CIT - Mexico | | 1 | | 1,179 | | N/A | |

CBF - Italy(1) | | 3 | | 307 | | December 2019 December 2020 December 2023 | (2) |

| CCM - Germany | | 2 | | 153 | | March 2021 | |

| CCM - Netherlands | | 1 | | 130 | | September 2021 | |

CBF - United Kingdom(1) | | 1 | | 100 | | N/A | |

| CIT - Switzerland | | 1 | | 86 | | N/A | |

| CCM - Romania | | 1 | | 59 | | June 2021 | |

| CFT - Germany | | 5 | | 26 | | N/A | |

(1)On August 2, 2021, the Company completed the sale of CBF to CentroMotion.

(2)The agreements between CBF and its employees that expired in December 2020 and 2019 are currently in negotiation for renewal.

Item 2. Properties.

The number, location and size of the Company’s principal properties as of December 31, 2020, by segment follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Number of Facilities | | Square Footage (in millions) |

| | North America | | Europe | | Asia | | Other | | Total | | Owned | | Leased |

| Continuing Operations: | | | | | | | | | | | | | | |

| Carlisle Construction Materials | | 44 | | | 11 | | | — | | | — | | | 55 | | | 5.1 | | | 1.5 | |

| Carlisle Interconnect Technologies | | 18 | | | 2 | | | 4 | | | — | | | 24 | | | 0.6 | | | 1.1 | |

| Carlisle Fluid Technologies | | 8 | | | 3 | | | 2 | | | 1 | | | 14 | | | 0.5 | | | 0.2 | |

| Discontinued Operations: | | | | | | | | | | | | | | |

Carlisle Brake & Friction(1) | | 4 | | | 2 | | | 4 | | | — | | | 10 | | | 1.0 | | | 0.2 | |

| Totals | | 74 | | | 18 | | | 10 | | | 1 | | | 103 | | | 7.2 | | | 3.0 | |

(1)On August 2, 2021, the Company completed the sale of these properties in connection with its sale of CBF to CentroMotion.

The Company considers its principal properties, as well as the related machinery and equipment, to be generally well maintained, and suitable and adequate for its intended purposes.

PART II

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Carlisle Companies Incorporated (“Carlisle”, the “Company”, “we”, “us” or “our”) is a diversified manufacturer of highly engineered products. Carlisle is committed to generating superior shareholder returns by combining a unique management style of decentralization, entrepreneurial spirit, active mergers and acquisitions, and a balanced and disciplined approach to capital deployment, all with a culture of continuous improvement as embodied in the Carlisle Operating System ("COS"). Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is designed to provide a reader of our financial statements with a narrative from the perspective of Company management. All references to “Notes” refer to our Notes to Consolidated Financial Statements in this Annual Report on Form 10-K.

Executive Overview

2020 demonstrated yet again the strong earnings power of Carlisle's business model and our proven ability to deliver sustainable earnings even in significant downturns. Carlisle Construction Materials ("CCM") once again drove the majority of positives in Carlisle's results, supported by strong re-roofing trends, continued price discipline and management of raw material costs. CCM also made significant strides in integrating and improving our newer platforms of architectural metals and polyurethanes. CCM's sustainable cash generating abilities, combined with the Carlisle Experience, provide us with the financial and strategic flexibility that supports our conviction in achieving Vision 2025.

Our other business platforms made important improvements despite being impacted significantly in a challenging year. Carlisle Interconnect Technologies ("CIT") delivered results in line with our expectations in a year of record declines in the aerospace industry by focusing on delivering new products to increase our content per plane, rightsizing its manufacturing footprint, further integrating its medical platform, and continuing to invest in our test and measurement and sensors product lines. Carlisle Fluid Technologies ("CFT") exceeded expectations, leveraging a strong focus on execution while introducing exciting, innovative new products.

We remain balanced in our capital deployment approach. We are increasing our capital expenditures in 2021 to drive future growth. We continue to manage an active merger and acquisition pipeline focused on synergistic businesses that complement our high-margin product lines. Finally, we will remain active in returning capital to shareholders. Notably, we raised our dividend in 2020 for the 44th consecutive year and returned $495 million to shareholders in the form of share repurchases and dividends.

Vision 2025 gave us clear direction and consistency of mission during 2020 and will continue to guide our efforts as we accelerate into the expected economic recovery in 2021.

Summary Financial Results

| | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share amounts) | | 2020 | | 2019 | | 2018 |

| Revenues | | $ | 3,969.9 | | | $ | 4,484.6 | | | $ | 4,105.7 | |

| | | | | | |

| Operating income | | $ | 487.8 | | | $ | 634.1 | | | $ | 510.0 | |

| Operating margin percentage | | 12.3 | % | | 14.1 | % | | 12.4 | % |

| Income from continuing operations | | $ | 325.7 | | | $ | 457.8 | | | $ | 358.3 | |

(Loss) income from discontinued operations | | $ | (5.6) | | | $ | 15.0 | | | $ | 252.8 | |

Diluted earnings per share attributable to common shares: | | | | | | |

Income from continuing operations | | $ | 5.90 | | | $ | 7.93 | | | $ | 5.87 | |

(Loss) income from discontinued operations | | $ | (0.10) | | | $ | 0.26 | | | $ | 4.15 | |

| | | | | | |

Items affecting comparability:(1) | | | | | | |

Impact to operating income | | $ | 37.6 | | | $ | 20.9 | | | $ | 12.8 | |

Impact to income from continuing operations | | $ | 19.8 | | | $ | 0.8 | | | $ | (2.0) | |

Impact to diluted EPS from continuing operations | | $ | 0.36 | | | $ | 0.02 | | | $ | (0.04) | |

(1)Items affecting comparability primarily include exit and disposal and facility rationalization charges, costs of and related to acquisitions, idle capacity and labor costs, net of subsidies, asset impairments, litigation settlement costs, insurance settlements, (gains) losses from and costs related to divestitures, losses on debt extinguishment and non-comparable tax items. The tax effect is based on the rate of the jurisdiction where the expense is deductible. Refer to Items Affecting Comparability in this MD&A for further discussion.

2020 Compared with 2019

Revenues decreased in 2020 primarily reflecting lower volumes in all of our segments, which have continued to be impacted by the global economic slowdown due to the coronavirus pandemic ("COVID-19"). Contributions from acquisitions, primarily Providien, LLC ("Providien"), partially offset the decrease in volume.

The decrease in operating income in 2020 primarily reflected lower volumes as well as lower production levels increasing per unit costs and wage inflation. The decrease in operating income was partially offset by raw material savings, particularly in our CCM segment, lower incentive compensation and travel costs, and savings from COS.

Diluted earnings per share from continuing operations decreased primarily from the above operating income performance ($1.94 per share) and higher interest expense ($0.14 per share), partially offset by reduced average shares outstanding ($0.26 per share) resulting from our share repurchase program.

We generated $696.7 million in operating cash flows during 2020 and utilized cash on hand and cash provided by operations to return capital to shareholders through dividends and share repurchases, and fund capital expenditures.

2019 Compared with 2018

Revenues increased primarily reflecting contributions from the acquisition of Petersen Aluminum Corporation ("Petersen") in the CCM segment, higher volumes and continued price leadership, partially offset by unfavorable foreign currency exchange rates.

The increase in operating income primarily reflected the above revenue performance and benefits from raw material savings and contributions from COS, partially offset by wage inflation. Refer to Segment Results of Operations within this MD&A for further information related to segment operating income results.

Diluted earnings per share from continuing operations primarily benefited from the above operating income performance ($1.55 per share), reduced average shares outstanding ($0.42 per share) resulting from our share repurchase program, and a lower effective tax rate ($0.03 per share).

We generated $703.1 million in operating cash flows during 2019 and utilized cash on hand and cash provided by operations to fund acquisitions, fund capital projects and return capital to shareholders.

Consolidated Results of Operations

Revenues

2020 Compared with 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | 2020 | | 2019 | | Change | | % | | Acquisition

Effect | | Price / Volume

Effect | | Exchange

Rate Effect |

| Revenues | | $ | 3,969.9 | | | $ | 4,484.6 | | | $ | (514.7) | | | (11.5) | % | | 2.2 | % | | (13.8) | % | | 0.1 | % |