CONFIDENTIAL TREATMENT REQUESTED FOR PORTIONS OF THIS DOCUMENT. PORTIONS FOR WHICH CONFIDENTIAL TREATMENT IS REQUESTED HAVE BEEN MARKED WITH THREE ASTERISKS [***] AND A FOOTNOTE INDICATING “CONFIDENTIAL TREATMENT REQUESTED”. MATERIAL OMITTED HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

Exhibit 10.11

COTEAU LIGNITE SALES AGREEMENT

dated as of January 1, 1990

by and between

THE COTEAU PROPERTIES COMPANY

and

DAKOTA COAL COMPANY

CONTENTS

1

Exhibits

EXHIBIT A

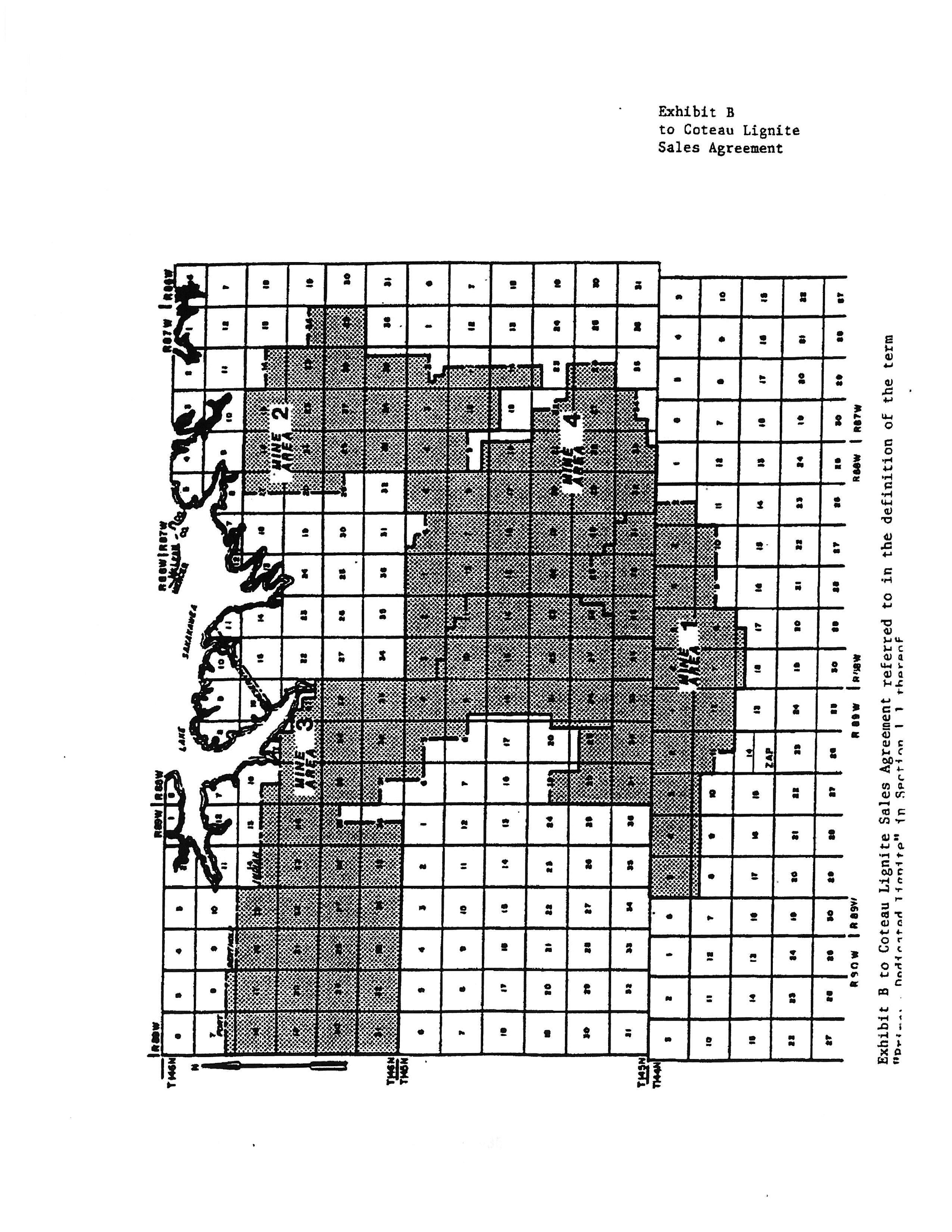

EXHIBIT B

EXHIBIT C

EXHIBIT D

EXHIBIT E

EXHIBIT F

EXHIBIT G

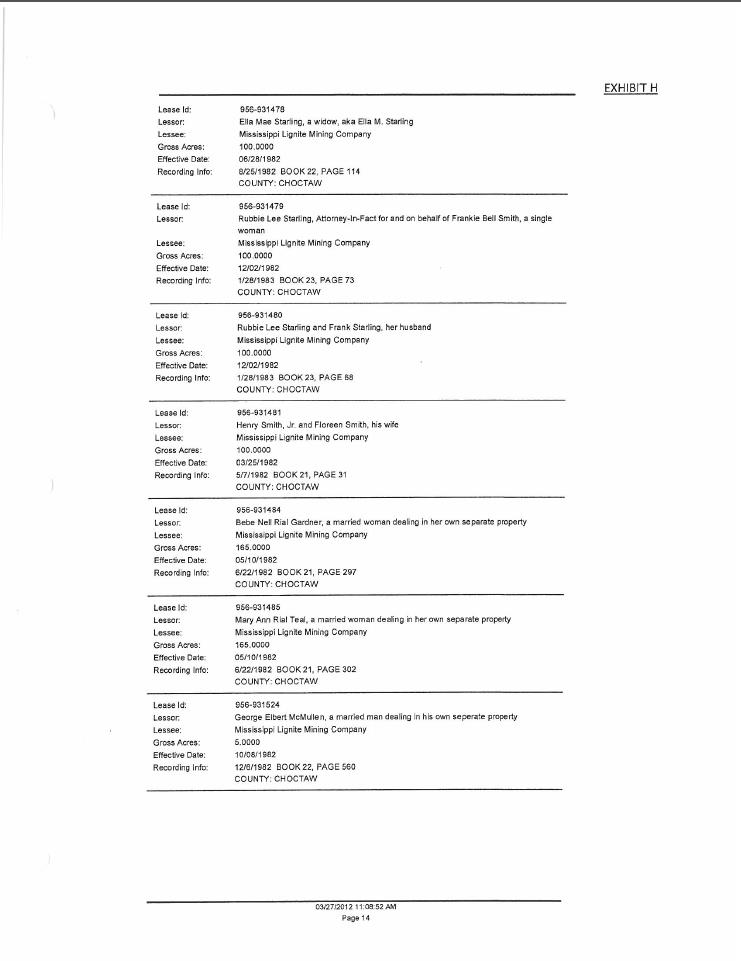

EXHIBIT H

2

COTEAU LIGNITE SALES AGREEMENT

THIS COTEAU LIGNITE SALES AGREEMENT (Agreement) dated as of January 1, 1990, is by and between THE COTEAU PROPERTIES COMPANY, an Ohio corporation authorized to do business in the State of North Dakota (Coteau) and DAKOTA COAL COMPANY, a North Dakota corporation (Dakota).

W I T N E S S E T H :

WHEREAS, Coteau is a party to the Restatement of Coal Sales Agreement dated as of June 1, 1979, as subsequently amended (the Coal Sales Agreement), by and between Coteau and ANG Coal Gasification Company (ANG);

WHEREAS, as of November 1, 1988, ANG assigned, and Dakota assumed, all of ANG's rights, interests and obligations pursuant to and under the Coal Sales Agreement;

WHEREAS, Dakota has entered into an agreement entitled “Coal Sales Agreement” dated as of November 1, 1988 with Basin Electric Power Cooperative (Basin Electric) pursuant to which Dakota is selling lignite to Basin Electric for use by Basin Electric in its Antelope Valley Station, which consists of two 450 MW generating units and is located near Beulah, North Dakota;

WHEREAS, Dakota has also entered into the Coal Supply Agreement dated as of November 1, 1988 with Dakota Gasification Company (DGC) pursuant to which Dakota is selling lignite to DGC for use by DGC in its Great Plains Coal Gasification Plant, the first phase of which consists of a Lurgi lignite gasification facility with the capability of producing approximately 160 MMSCF of pipeline quality synthetic natural gas per day and is located on a site adjacent to Basin Electric's Antelope Valley Station;

WHEREAS, Dakota may enter into another agreement with Basin Electric or an Affiliate (as hereinafter defined) of Basin Electric pursuant to which Dakota will supply to Basin Electric all of the lignite to be used by Basin Electric in any expansion of the electrical generating capability at the Antelope Valley Station;

WHEREAS, Dakota may enter into another agreement with DGC or an Affiliate of DGC pursuant to which Dakota will supply to DGC all of the lignite used by DGC in any expansion of the Great Plains Coal Gasification Plant;

WHEREAS, Dakota intends to enter into another agreement with Basin Electric or an Affiliate of Basin Electric pursuant to which Dakota will supply to Basin Electric or an Affiliate of Basin Electric the portion of the lignite used at Basin Electric's Leland Olds Station, which consists of a 215 MW generating unit and a 440 MW generating unit and is located near Stanton, North Dakota, which is not supplied by the Glenharold Mine;

WHEREAS, Dakota hopes to enter into agreements with other third parties pursuant to which Dakota will provide all or a portion of the lignite used by said third parties' facilities; and

WHEREAS, in light of the foregoing, the Coal Sales Agreement is being terminated by Coteau and Dakota simultaneously in connection with the execution and delivery of this Agreement, and Coteau and Dakota desire that this Agreement supersede and replace the Coal Sales Agreement.

1

NOW, THEREFORE, Coteau and Dakota agree as follows:

ARTICLE I

DEFINITIONS

DEFINITIONS

Section 1.1 Definitions. As used in this Agreement, the following terms shall have the following meanings:

Additional Dedicated Lignite shall mean those lignite reserves in the areas outside of the Primary Dedicated Lignite which, pursuant to Section 3.3 hereof, are made part of the Dedicated Lignite pursuant to this Agreement by being hereafter (a) acquired or held by Dakota or an Affiliate of Dakota, which then are acquired by, or transferred or subleased to Coteau or (b) acquired by Coteau at the direction of Dakota.

Affiliate shall mean any other person who, directly or indirectly, through ownership of securities, contract or otherwise, controls, is controlled by or is under common control with another person.

Agreed Profit shall have the meanings ascribed to the term in Sections 5.4, 5.5 and 5.7 hereof.

ANG shall mean ANG Coal Gasification Company, a Delaware corporation authorized to do business in the State of North Dakota and a second tier wholly owned subsidiary of Basin Electric.

Basic Agreement shall mean the Basic Agreement dated March 6, 1973, between North American Coal and Michigan Wisconsin Pipe Line Company. Pursuant to an Assignment Agreement dated July 1, 1975, Michigan Wisconsin Pipe Line Company assigned all of its rights and obligations under said Basic Agreement to American Natural Gas Production Company. Pursuant to an Assignment Agreement dated November 2, 1977, American Natural Gas Production Company assigned all of its rights and obligations under said Basic Agreement to WCDC. The Basic Agreement was subsequently restated pursuant to the Restatement of Basic Agreement dated as of June 1, 1979. Subsequently, the Restatement of Basic Agreement was terminated and replaced by the Coal Reserve Agreement. Pursuant to the Coal Reserve Agreement, WCDC transferred its obligations under the Restatement of Basic Agreement to ANG.

Basin Electric shall mean Basin Electric Power Cooperative, a North Dakota electric cooperative corporation.

Business Day shall mean any day other than a Saturday, Sunday or day on which banks in North Dakota or New York City are required or authorized to be closed.

Coal Reserve Agreement shall mean the Coal Reserve Agreement made and entered into as of March 2, 1987, by and among Coteau, Dakota (as successor in interest to ANG), North American Coal, The Missouri Valley Properties Company and WCDC.

Coal Sales Agreement shall mean the Restatement of Coal Sales Agreement dated as of June 1, 1979, and as subsequently amended, by and between Coteau and Dakota (as successor in interest to ANG).

Cost of Production shall have the meaning ascribed to the term in Section 5.2 hereof.

Coteau shall mean The Coteau Properties Company, an Ohio corporation authorized to do business in the State of North Dakota and a wholly owned subsidiary of North American Coal.

Coteau's Mine shall mean all mining areas developed by Coteau in the Dedicated Lignite.

Dakota shall mean Dakota Coal Company, a North Dakota corporation and a wholly owned subsidiary of Basin Electric.

2

Dakota's Other Plants shall mean all additional generating units installed by Basin Electric which increase the original generating capacity of the Antelope Valley Station and all additional gasifiers as well as the incremental increased capacity achieved by replacing one or more of the existing gasifiers with a replacement gasifier having a capacity greater than the gasifier being replaced at or near the Great Plains Coal Gasification Plant.

Dakota's Plants shall mean collectively Dakota's Primary Plants, Dakota's Secondary Plant, Dakota's Other Plants and Other Plants.

Dakota's Primary Plants shall mean collectively the Antelope Valley Station, consisting of two 450 MW generating units named Units 1 and 2 and located near Beulah, North Dakota, which is controlled and operated by Basin Electric, and the Great Plains Coal Gasification Plant, the first phase of which consists of a Lurgi lignite gasification facility with the capability of producing approximately 160 MMSCF of pipeline quality synthetic natural gas per day and is located on a site adjacent to the Antelope Valley Station, which is owned and operated by DGC.

Dakota's Requirements shall mean (a) all of the coal requirements of Dakota's Primary Plants and Dakota's Other Plants, (b) except as otherwise provided by Section 2.1 hereof, the portion of the coal used at Dakota's Secondary Plant which is not supplied by the Glenharold Mine and (c) the portion of the coal requirements of Other Plants which Dakota desires Coteau to supply.

Dakota's Secondary Plant shall mean the Leland Olds Station, consisting of a 215 MW generating unit and a 440 MW generating unit, owned by Basin Electric and located near Stanton, North Dakota.

Dedicated Lignite shall mean collectively the Primary Dedicated Lignite and the Additional Dedicated Lignite.

Development Period shall mean, with respect to the development of any mining area of Coteau's Mine for Dakota's Plants, the period from the date of Dakota's written approval of the Mining Plan with respect to such mining area until such date that Dakota shall designate.

DGC shall mean Dakota Gasification Company, a North Dakota corporation and a wholly owned subsidiary of Basin Electric.

Emergency Expenditures shall mean expenditures for Coteau’s Mine which, in the reasonable judgment of Coteau, are necessary as a result of explosion, fire, flood or other emergency and the delay of which, in order to secure Dakota’s prior approval, would either jeopardize life or substantial property of Dakota or Coteau, or result in a material interruption of Couteau’s Mine production.

Escrowed Stock shall mean the one hundred (100) shares of common stock, without par value, issued and outstanding of Coteau.

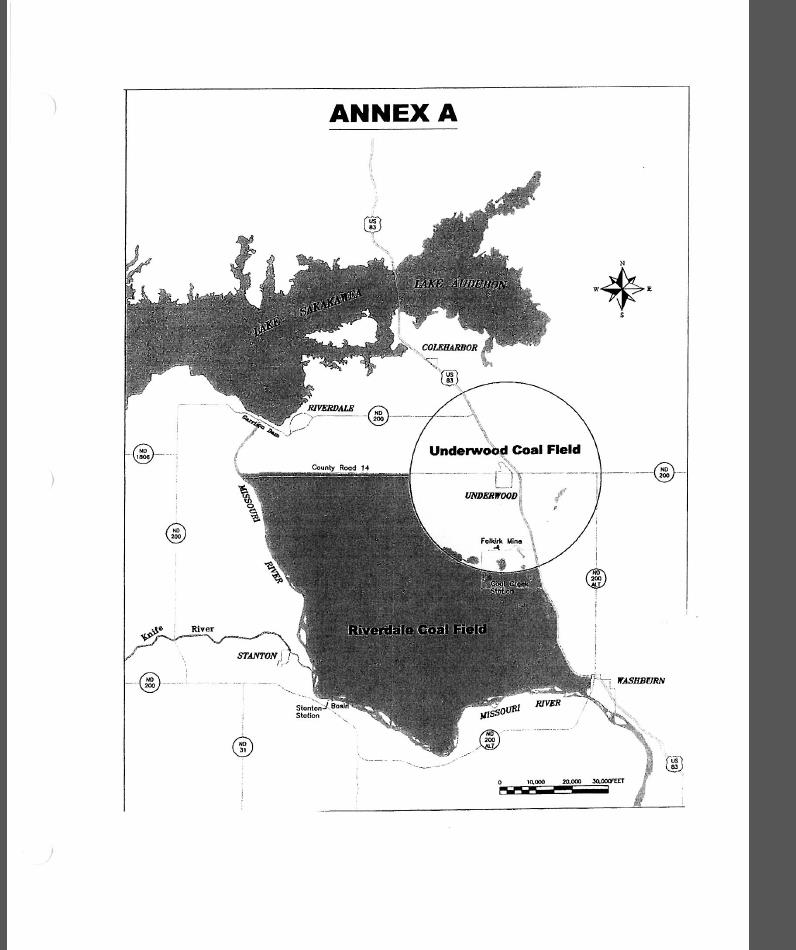

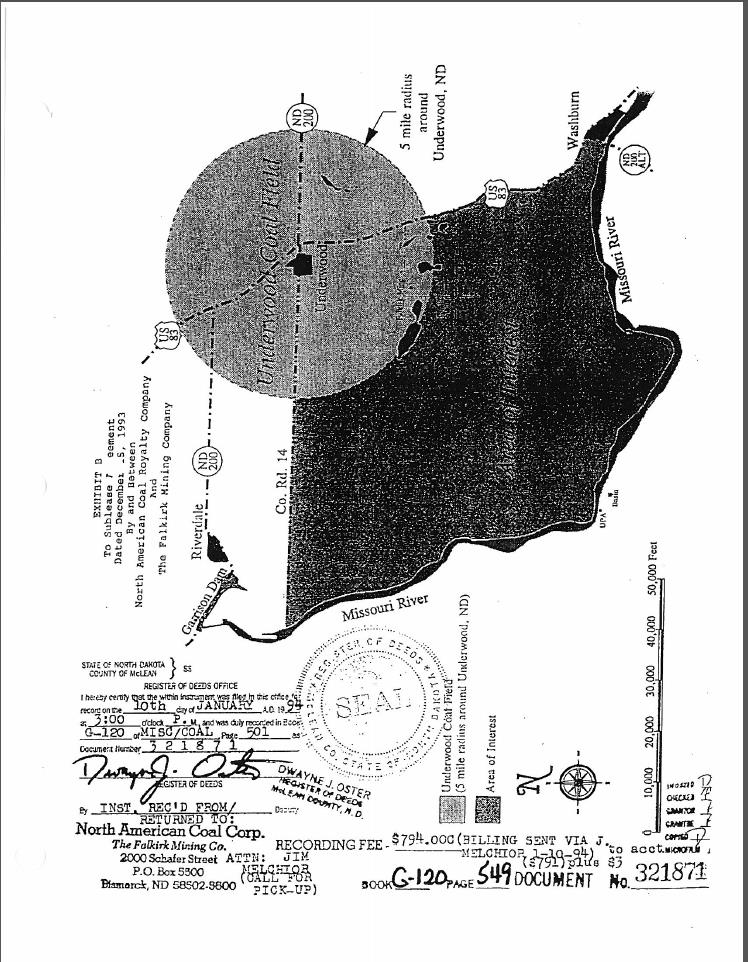

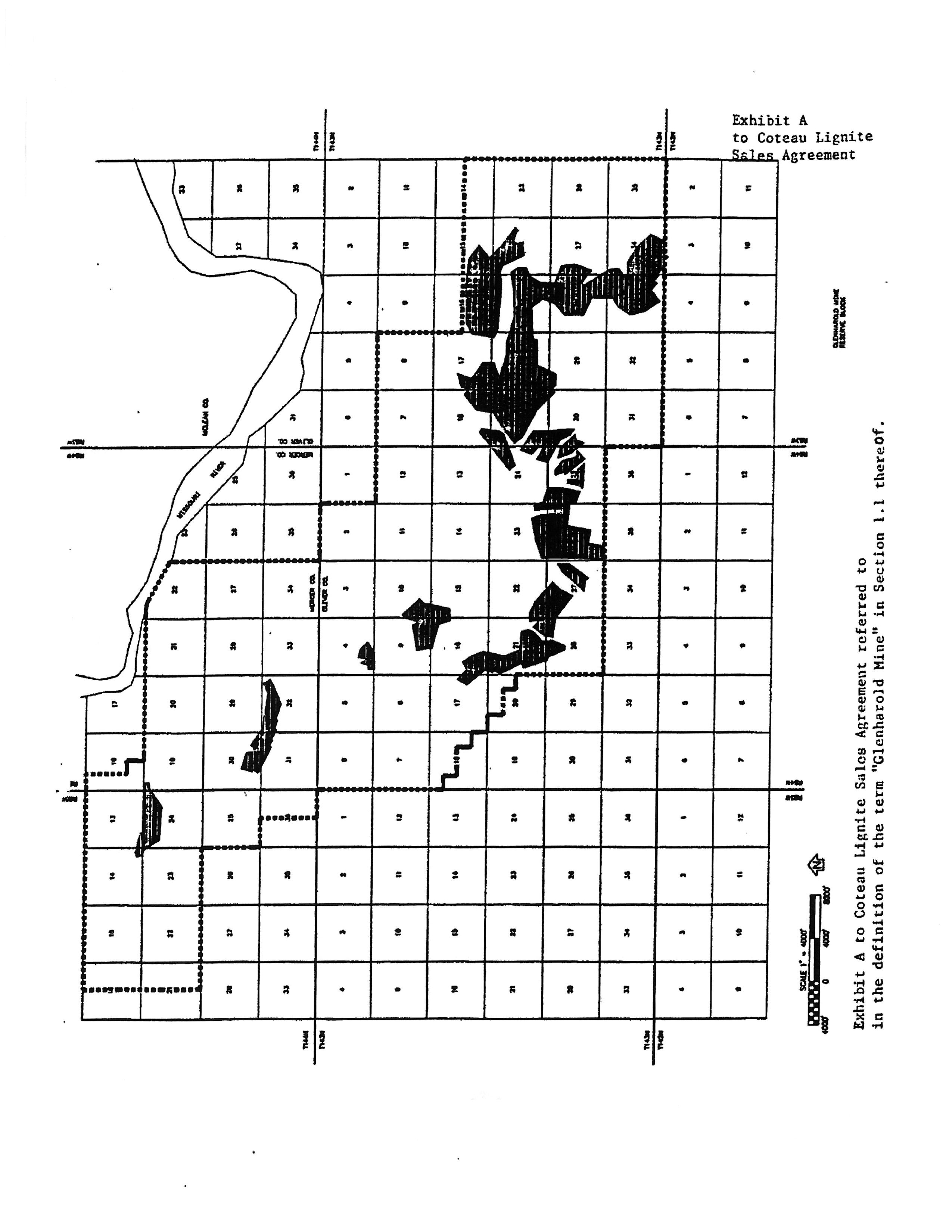

Glenharold Mine shall mean the lignite reserves delineated in Exhibit A hereto which by this reference is made a part hereof.

Index shall mean the average Producer Price Index- All Commodities on the base 1982 = 100, published by the Bureau of Labor Statistics of the U.S. Department of Labor, for the twelve (12) months of said calendar year. The base for calculating changes in the Index in Subsections 5.5(a), 5.5(b) and 5.5(c) hereof shall be the Producer Price Index - All Commodities for July, 1988.

Loans and Leases shall have the meaning ascribed to the term in Section 10.1 hereof.

3

Mining Plan shall mean the mining plan furnished to and approved by Dakota in accordance with Section 4.1 hereof and updated pursuant to such Section.

North American Coal shall mean The North American Coal Corporation, a Delaware corporation authorized to do business in the State of North Dakota (formerly Nortex Mining Company).

Option Agreement shall mean the Option and Put Agreement dated as of January 1, 1990, by and among Dakota, North American Coal and the State of North Dakota doing business as the Bank of North Dakota.

Other Plants shall mean any other facility owned by a third party for which Dakota shall contract to provide lignite.

Party shall mean either Coteau or Dakota as indicated by the context.

Parties shall mean Coteau and Dakota.

Premature Termination Mine Closing Costs shall have the meaning ascribed to the term in Section 14.2 hereof.

Primary Dedicated Lignite shall mean those lignite reserves within the areas of interest described in Exhibit B hereto which by this reference is made a part hereof which areas may be changed from time to time pursuant to Section 3.3 hereof.

Primary Truck Dump shall mean the facility presently located at Couteau’s Mine where mine-run lignite is dumped and subsequently crushed before delivery to the Secondary Crusher Building.

Production Payment shall have the meaning ascribed to the term in Section 5.7 hereof.

Secondary Crusher Building shall mean the building constructed by Coteau to house the secondary crusher and to accommodate the transfer of lignite from the Primary Truck Dump to Dakota’s Primary Plants.

Sub-Quality Lignite shall mean lignite with an average calorific content of less than six thousand two hundred (6,200) BTUs per pound on an as-received basis.

Such average computations shall be based upon the analyses of representative samples taken in accordance with the provisions of Subsection 5.5(d) and Section 9.1 hereof.

Ton shall mean a net ton of two thousand (2,000) pounds.

WCDC shall mean ANR Western Coal Development Company, a Delaware corporation.

ARTICLE II

SALE OF LIGNITE

Section 2.1 General. Dakota agrees to purchase and accept and Coteau agrees to sell and deliver lignite pursuant to the terms and conditions of this Agreement. Dakota shall purchase from Coteau all of Dakota’s Requirements pursuant to this Agreement; provided, however, that lignite purchased by Dakota from an Affiliate of Basin Electric from lignite reserves located in the Glenharold Mine for use at Dakota’s Secondary Plant shall be exempt from this requirement; and further provided that, if federal, state or local laws prohibit or, in the reasonable opinion of Basin Electric or an Affiliate of Basin Electric, render uneconomical the use of North Dakota lignite at Dakota’s Secondary Plant, Dakota shall have the right to purchase and use, outside of the scope of this Agreement, alternative fuels or sub-bituminous or bituminous coal at Dakota’s Secondary Plant.

4

Section 2.2 Tonnages. On a time schedule agreed to by the Parties, Dakota shall designate in writing to Coteau Dakota’s Requirements for the following calendar year, including the monthly tonnage requirements from Coteau’s Mine for each of Dakota’s Plants. Dakota shall promptly advise Coteau in writing of any material revisions and modifications to the annual designation of Dakota’s Requirements.

As necessary, Dakota shall consult with Coteau as to projected increases and decreases in Dakota’s Requirements on a long-range basis. If Dakota desires to increase the annual lignite deliveries for any calendar year by more than ten percent (10%) of the preceding year’s lignite requirements, Dakota shall provide Coteau with a written estimated schedule of Dakota’s Requirements on an annual basis for the succeeding five (5) calendar years, including the estimated deliveries from Coteau's Mine for each of Dakota’s Plants. The lignite quantities set forth in such schedule shall be within the limits of Coteau’s productive capability, provided that when any increase in estimated lignite requirements occurs which necessitates the acquisition by Coteau of additional equipment, Coteau shall not be obligated to supply such increased requirements until such time as it is able to acquire and install such additional equipment and do all other things necessary to supply such increased requirements.

Section 2.3 Rate. Scheduled deliveries shall be in approximately equal weekly amounts in each calendar year during the entire term of this Agreement, subject, however, to the right of Dakota to increase or decrease such weekly amounts pursuant to Section 2.2 hereof. The scheduling of such shipments of lignite shall be made by mutual agreement of the Parties. To the extent practicable, Coteau shall coordinate the vacation schedule at Coteau's Mine so as to accommodate the requirements of Dakota's Plants for lignite and other services provided hereunder.

Section 2.4 Point(s) of Delivery. Delivery of lignite shall be made at Dakota's Primary Plants or to such other point(s) designated in writing by Dakota to Coteau. Any transportation beyond said point(s) of delivery shall be arranged by and at the cost of Dakota.

ARTICLE III

DESCRIPTION OF LIGNITE

Section 3.1 Lignite Quality.

The lignite to be sold and delivered hereunder shall be from Coteau's Mine and shall be mine-run lignite. Coteau shall make all reasonable efforts to avoid shipping extraneous impurities and, upon request of and reasonable written notice from Dakota, shall install lignite cleaning facilities specified by Dakota. Coteau shall not mine lignite from any area estimated by Coteau and Dakota to contain Sub-Quality Lignite unless Dakota shall have given its prior written consent.

Section 3.2 Sub-Quality Lignite.

Dakota shall have the right to reject Sub-Quality Lignite, provided that Dakota shall not have the right to reject Sub-Quality Lignite mined with its consent from an area estimated to contain Sub-Quality Lignite pursuant to Section 3.1 hereof. If Coteau delivers Sub-Quality Lignite without receiving Dakota's prior written consent pursuant to Section 3.1 hereof, Dakota shall have the right, on notice to Coteau confirmed in writing, to suspend deliveries of lignite until Coteau establishes that it will meet specifications. Any Sub-Quality Lignite so rejected and not utilized or sold by Dakota shall be excluded from the tonnages upon which Coteau's Agreed Profit is based.

Section 3.3 Dedicated Lignite.

The lignite to be sold and delivered hereunder shall be from the Dedicated Lignite. At the written direction of Dakota from time to time the geographic boundaries of the Dedicated Lignite may be modified to reflect the addition of Additional Dedicated Lignite to the Dedicated Lignite. At the written direction of Dakota from time to time the geographic boundaries of Primary Dedicated Lignite may be modified to reflect additions to the Primary Dedicated Lignite. With the mutual written approval of Coteau and Dakota, the geographic boundaries of the Dedicated Lignite may be modified from time to time to reflect deletions from the Dedicated Lignite. With the mutual written approval of Coteau and Dakota, the

5

geographic boundaries of the Primary Dedicated Lignite also may be modified from time to time to reflect deletions from the Primary Dedicated Lignite.

ARTICLE IV

MINING PLAN, FINANCIAL PROTECTION TO DAKOTA

Section 4.1 Mining Plan.

From time to time at Dakota's request, Coteau shall provide to Dakota in writing a Mining Plan to furnish Dakota's Requirements from the Dedicated Lignite. The Mining Plan shall be in accordance with sound engineering and design practices and applicable laws, rules and regulations and shall include production schedules, manpower and equipment requirements, estimated costs per Ton, time schedules for mine development, estimated dates of initial production and full production, method of operation, including method of operation of any lignite handling facilities, reclamation and permitting schedules, capital expenditure and operating cost requirements, mine design, mine projection maps, mine progression and reserve studies and such other data as may be reasonably requested by Dakota. The Mining Plan shall be in such detail and format as may be reasonably requested by Dakota. Within seventy-five (75) days after receipt by Dakota of such Mining Plan, Dakota shall give Coteau written notice of Dakota's approval or disapproval of the Mining Plan. If Dakota does not give such notice within such seventy-five (75) days, Dakota shall be deemed to have approved such Mining Plan. If Dakota disapproves the Mining Plan or any portion(s) thereof, Dakota shall state in detail in its notice of disapproval the reason(s) for such disapproval and Coteau and Dakota shall meet promptly and attempt in good faith to settle their differences with respect to the Mining Plan. If Coteau and Dakota are unable to resolve their differences within thirty (30) days after Coteau's receipt from Dakota of such notice of disapproval, Dakota may reasonably direct Coteau, subject to Section 16.4 hereof, as to the revisions to be made in the Mining Plan and Coteau shall make such revisions. The Mining Plan shall be reviewed and revised or expanded annually (or as necessary) with the written approval of Dakota. Such revisions shall be based upon the then current projections developed by Coteau and requirements of applicable law, rules and regulations and shall be subject to approval by Dakota as provided above. No material modification of or deviation from the Mining Plan shall be made without the written approval of Dakota, which approval shall not be unreasonably withheld. It is recognized by the Parties that, subject to the duties imposed upon Coteau pursuant to Section 16.4 hereof, Coteau may make minor modifications of or deviations from the Mining Plan without Dakota's approval. Coteau shall consult with and keep Dakota informed of the progress of the design, development and operation of Coteau's Mine and shall, upon Dakota's request, furnish to Dakota copies of all major and significant drawings and documents relating to such design, development and operation.

Section 4.2 Budgets and Cash Flow Projections.

Coteau shall furnish to Dakota, on a time schedule agreed to by the Parties, the following budgets and cash flow for activities pursuant to this Agreement during the following calendar year:

(a) An annual capital budget containing estimates of all commitments in excess of $10,000. Such annual capital budget shall be revised quarterly and submitted to Dakota no later than forty-five (45) days prior to the end of each calendar quarter. Within forty-five (45) days after Dakota’s receipt of the foregoing annual capital budget and within thirty (30) days after Dakota’s receipt of the foregoing revised quarterly budgets, Dakota shall give Coteau written notice of Dakota’s approval or disapproval of such capital budgets. If Dakota shall fail to give such notice within such forty-five (45) day or thirty (30) day period, as the case may be, Dakota shall be deemed to have approved such budgets. Dakota’s approval of such capital budgets may be limited to the immediately following calendar quarter. Upon the approval of any capital budget or portion thereof by Dakota, such budget or portion thereof shall be deemed part of the Mining Plan.

6

(b) An operating budget containing estimates of all operating and production costs. Such operating budget may be modified pursuant to the change order procedure described in Section 4.4 hereof. The annual operating budget shall be presented on a month-by-month basis. Within forty-five (45) days after Dakota’s receipt of the foregoing annual operating budget, Dakota shall give Coteau written notice of Dakota’s approval or disapproval of such operating budget. If Dakota shall fail to give such notice within such forty-five (45) day period, Dakota shall be deemed to have approved such budget. Upon the approval of any operating budget or portion thereof by Dakota, such budget or portion thereof shall be deemed part of the Mining Plan.

(c) A cash flow statement for all capital expenditures and operating and production costs presented on a month-by-month basis for the following four (4) calendar years. Such cash flow statement shall be revised monthly by Coteau and submitted to Dakota.

Such budgets and cash flow statement, as described in this Section 4.2, shall be in such form and detail acceptable to Dakota.

Section 4.3 Financial Protection to Dakota.

Coteau shall not make any expenditures unless they are generally reflected in a budget, or portion thereof, approved by Dakota as aforesaid; nor shall Coteau make any single expenditure (except for expenditures made to maintain inventory levels as approved by Dakota from time to time) for materials, supplies, equipment, facilities or services in excess of $10,000, or enter into any contracts, agreements or commitments involving more than $10,000, unless such item has been specifically identified in a budget, or portion thereof, approved by Dakota or unless Dakota has otherwise approved thereof.

Any expenditures made by Coteau for capital items which are not made in accordance with the immediately preceding paragraph shall be deemed to have been made for the account of Coteau and shall not be recoverable from Dakota under any of the other provisions of this Agreement. Coteau shall have the right in its sole discretion to dispose of any capital items which are deemed to have been made for the account of Coteau.

Notwithstanding anything to the contrary contained in this Agreement, Coteau shall have the right during any calendar year to make Emergency Expenditures without advance approval by Dakota, provided that Coteau shall subsequently and promptly give Dakota written notice thereof.

If, at any time while an operating budget as approved by Dakota is in effect and Dakota, in good faith, believes that Coteau is not in compliance with any of the provisions of such operating budget, Dakota shall have the right to give Coteau notice of such noncompliance. Such notice shall be in writing and identified as a "Notice of Noncompliance Pursuant to Section 4.3 of the Coteau Lignite Sales Agreement dated as of January 1, 1990", shall cite the provision(s) of the operating budget as to which Dakota believes Coteau is not in compliance, shall state in detail the reasons why Dakota so believes Coteau is not in compliance and shall include all other pertinent information.

No later than fifteen (15) Business Days after Couteau’s receipt of such notice of noncompliance, Coteau shall either (a) give Dakota written notice that Coteau denies that such noncompliance has occurred or is occurring or (b) correct such noncompliance; provided, however, that if Coteau within five (5) Business Days after Coteau's receipt of such notice of noncompliance from Dakota gives Dakota notice confirmed in writing that Coteau needs more than fifteen (15) Business Days in order to correct the noncompliance(s) cited in such notice, together with reasons therefor, Dakota shall give Coteau such reasonable extension as may be necessary in order to make such correction(s).

If Coteau gives Dakota notice denying such noncompliance, Coteau and Dakota shall meet promptly and attempt in good faith to settle their differences. Any matter agreed upon by Coteau and Dakota with respect to such operating budget which requires implementation shall be implemented promptly. If

7

Coteau and Dakota are unable to resolve their differences within thirty (30) days after Dakota’s receipt of notice from Coteau denying such noncompliance, either Party may submit the matter to arbitration as provided in Section 16.2 hereof. If arbitration is sought, Coteau shall not be deemed to be in noncompliance and shall not be required to correct any noncompliance until the matter shall have been determined finally in accordance with the aforesaid arbitration provisions.

If the noncompliance is not corrected or resolved by Coteau and Dakota as aforesaid and (x) arbitration is not so sought, or (y) Coteau subsequently is found in arbitration proceedings to be in noncompliance, then all costs incurred by Coteau following the expiration of five (5) Business Days after Coteau's receipt of notice of noncompliance from Dakota, including costs incurred during the period prior to the completion of any arbitration proceeding, and which costs result directly from such noncompliance with the operating budget as specified in said notice of noncompliance from Dakota, shall be disallowed up to an amount equal to the Agreed Profit due to Coteau for lignite produced during the period of disallowance and computed in accordance with Section 5.4 hereof. Subject to the provisions of Section 16.4 hereof, such disallowance shall be Dakota’s exclusive remedy for such noncompliance.

Section 4.4 Change Orders.

Coteau shall develop a change order procedure acceptable to Dakota. Change orders consistent with such procedures shall be submitted by Coteau to Dakota for Dakota’s approval for (a) any change in the annual operating budget, as approved by Dakota, resulting from changes requested in writing by Dakota in the lignite quantities or design criteria contained in the annual operating budget, (b) any factor which results in a change in the current delivery schedule for lignite and (c) any predicted or actual increase in the annual operating budget, as approved by Dakota.

Section 4.5 Meetings.

Coteau and Dakota shall meet periodically to review the progress of the design, development and operation of Coteau's Mine. Coteau and Dakota anticipate these meetings will be held quarterly. Prior to such meetings, Coteau shall submit to Dakota in a format acceptable to Dakota, such reports, schedules and operating and financial data as may be reasonably requested by Dakota.

Section 4.6 Reports.

Coteau and Dakota shall cooperate to establish, maintain and use a cost and schedule control system with respect to the development of Coteau's Mine adequate for (a) the preparation of a project schedule which shall facilitate the planning of the development of Coteau's Mine and demonstrate production date impact resulting from schedule slippages, if any, in the development of Coteau's Mine, and (b) a cost control system and a physical progress data reporting system which (i) provide actual cost and scheduling status reports to Dakota for the immediately preceding calendar month by the fifteenth (15th) Business Day of every month in which development of Coteau's Mine is in progress, (ii) report the actual progress of the development of Coteau's Mine relative to the Mining Plan and such other schedules as Dakota shall designate and (iii) provide adequate audit trail information. Such control system may include the preparation by Coteau, as requested by Dakota, of the following documents in a format acceptable to Dakota:

1) Budget Status Report

2) Projected Expenditures Report (actual/projected)

3) Cost and Comparison to Estimate Report

4) Physical Progress Report

5) Permit Status Report

6) Project Status Report (written detail, all areas)

7) Project Development Schedule (bar chart or time-oriented activity diagram);

or such other documents as requested by Dakota. Coteau shall notify Dakota in writing of any proposed changes in the cost and schedule control system previously approved by Dakota.

Section 4.7 Procurement Policies.

All materials, supplies, equipment, facilities and services, and all contracts, agreements and commitments therefor or in connection therewith required to construct, develop and operate Coteau's Mine shall be

8

acquired, entered into or made only pursuant to formal procurement policies adopted by Coteau and acceptable to Dakota. Coteau shall notify Dakota in writing of any proposed material changes to formal procurement policies previously approved by Dakota.

Section 4.8 Payment of Dividends.

Coteau shall have the right to pay dividends on the Escrowed Stock only from earned surplus.

Section 4.9 Accounting Practices.

Coteau shall maintain accurate books and records in accordance with generally accepted accounting principles and as necessary to support such detailed cost analyses, classifications and allocations as may be requested from time to time by Dakota.

Couteau’s accounting systems, policies and procedures shall conform to Dakota’s specifications, which shall be in accordance with generally accepted accounting principles, and shall be subject to Dakota’s approval. Coteau shall notify Dakota in writing of any proposed material changes to Couteau’s accounting systems, policies and procedures previously approved by Dakota. Couteau’s accounting system shall provide for cost classifications (chart of accounts) as requested by Dakota. Coteau shall develop a cash management system acceptable to Dakota which shall include the maintenance of separate cash accounts to the extent requested by Dakota.

Couteau’s accounting operations with respect to matters related to this Agreement shall be at such location as Dakota shall approve; provided, however, that Coteau shall have the right under this Agreement to conduct such other accounting operations and maintain such other accounting records and systems as Coteau deems necessary to be consistent with the accounting system of Affiliates of Coteau, the cost of which shall be included in the Cost of Production defined in Section 5.2 hereof.

Section 4.10 Other Policies and Practices.

Coteau shall develop formal written policies with respect to executive compensation plans, which policies shall be subject to approval of Dakota. Such approval shall not be withheld if such policies are consistent with those of North American Coal.

Expenditures by Coteau for memberships in national trade associations and state trade associations which are included in the Cost of Production shall be limited to one and two, respectively, unless expenditures for additional memberships are approved by Dakota. Coteau shall keep Dakota apprised of the activities of the trade associations of which Coteau is a member and shall use its influence as a member to support the causes of Dakota.

Coteau shall develop formal written policies with respect to matters such as travel and entertainment, overtime, labor reporting, attendance at seminars, meetings and schools, use of company aircraft and vehicles, mine-related cost allocation methods and equipment replacement policies, all of which policies shall be subject to approval by Dakota.

Coteau shall develop formal written policies with respect to employee insurance, ·relocation expense, vacation and retirement benefits, all of which policies shall be subject to approval by Dakota. Such approval shall not be withheld if such policies are consistent with those of North American Coal and generally consistent with those of the lignite mining industry.

Coteau shall develop formal written policies with respect to donations to charitable and civic organizations and corporate sponsorships, which policies shall be subject to approval by Dakota. Expenditures by Coteau for donations and sponsorships which are included in the Cost of Production shall be limited to not more than $10,000 per year, unless a higher amount is approved in writing by Dakota. Coteau shall provide Dakota a listing of estimated planned expenditures for donations and sponsorships for the following calendar year by December 1.

9

Coteau shall notify Dakota in writing of any proposed material changes to such policies previously approved by Dakota.

Section 4.11 Employment Contracts.

Coteau shall consult with Dakota and consider the advice and counsel provided by Dakota before entering into any employment contracts or any contracts for the employment of consultants in its mining business other than contracts for professional services such as accounting services, architectural services and legal services which normally are performed by independent contractors.

ARTICLE V

PRICING

Section 5.1 Determination of Price.

Subject to the right of Dakota to determine the price during the Development Period pursuant to Section 5.3 hereof and to adjustment as provided in Sections 5.5 and 5.7 hereof, Dakota shall pay for the lignite sold and delivered hereunder a price which annually equals the Cost of Production, as defined in Section 5.2 hereof, plus the Agreed Profit as determined pursuant to Sections5.4, 5.5 and 5.7 hereof.

Section 5.2 Cost of Production.

For the purposes of this Agreement, except as otherwise expressly stated, "Cost of Production" shall mean all the costs actually incurred by Coteau in the design, development, construction and operation of Coteau's Mine and the mining, processing and delivery of lignite under this Agreement. Such costs shall be determined and allocated on an accrual basis in accordance with generally accepted accounting principles (except as otherwise expressly stated herein), consistently applied and shall include but not be limited to the following:

a) | All production, transportation and maintenance costs including without limitation the following types of costs: |

i) | Labor costs, which include wages and the costs of all related payroll taxes, benefits and fringes, including welfare plans; group insurance, vacations and other comparable benefits of employees, wherever located, whose labor cost is properly charged directly to Coteau's Mine, |

ii) | Materials and supplies, |

iii) | Tools, |

iv) | Machinery and equipment not capitalized or leased, |

v) | With respect to the particular lignite mined, an appropriate allocation of the cost of acquiring interests in lignite reserves and surface lands, whether in fee, by lease or otherwise, prepaid royalties recoverable on mining and other expenses of having kept such interests in effect (not including costs paid by Dakota or its Affiliates pursuant to paragraph 5 of the Coal Reserve Agreement) and current tonnage royalty actually paid, if any, |

vi) | Rental of machinery and equipment, |

vii) | Power costs, |

viii) | Reasonable and necessary services by third parties other than Affiliates of Coteau, |

ix) | Insurance including Worker’s Compensation either in the state fund or self insurance, whichever in the best judgment of Coteau is more advantageous, · |

10

x) | Taxes, but not including income taxes or alternative minimum income taxes imposed by any governmental unit, |

xi) | Cost of reclamation as required by law or at such higher level of reclamation as shall be agreed upon between the Parties, |

xii) | Costs incurred by Coteau in connection with or as a result of the enactment, modification, interpretation, repeal or enforcement of all applicable federal, state and local governmental laws, rules and regulations, |

xiii) | Development costs, which shall be amortized ratably after the end of the Development Period as provided in Section 5.3 hereof, |

xiv) | Amounts payable to WCDC pursuant to paragraph 7 of the Coal Reserve Agreement, and |

xv) | Amounts payable to WCDC pursuant to paragraph 8 of the Coal Reserve Agreement. |

There shall be credited to costs under this Subsection 5.2(a): (y) any investment tax credit or other tax credits based upon new investment taken by Coteau and any net receipts by Coteau from rental of, or other net income derived by Coteau from, property including surface lands overlying the Dedicated Lignite, and (z) all amounts disallowed in accordance with the last paragraph of Section 4.3 hereof. There shall be credited to costs under this Subsection 5.2(a) any gains, and so charged any losses, on the disposal of any property owned by Coteau related to Couteau’s Mine or the Dedicated Lignite.

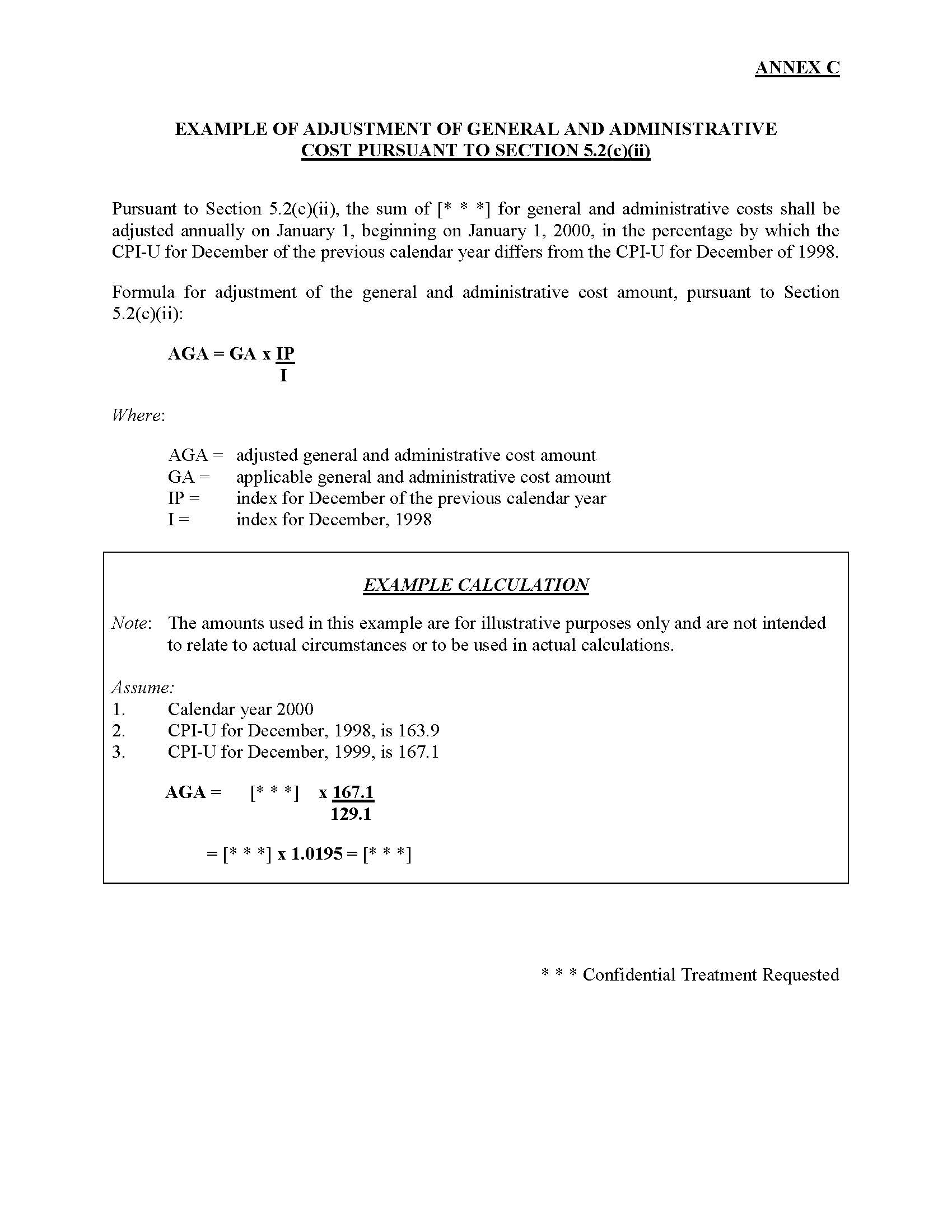

b) | General and administrative costs of Coteau's Mine including services rendered by Affiliates of Coteau. |

If any of the foregoing items in Subsections 5.2(a) and 5.2(b) hereof include costs incurred by an Affiliate of Coteau and charged to Coteau, they shall be included only at the cost to such Affiliate without addition for any loading, inter-company profit or service charge and shall be allocated to Coteau on the basis of time spent or (in the case of buildings) space used.

c) | Depreciation and amortization on personal property owned by Coteau the rates of which, reflecting salvage, shall be determined by Coteau and Dakota from time to time, and which shall not, except by mutual consent of the Parties, exceed the maximum deduction allowable under applicable federal income tax laws and regulations. Transactions involving capital assets between Coteau and any of its Affiliates shall be reflected in Coteau’s accounts at the higher of the cost of the assets involved, less accrued depreciation, as shown by the accounts of the transferring company or the fair market value of the assets involved. |

d) Loan and Lease Expense. Interest on indebtedness and loan and lease commitment fees to the extent not previously paid by Dakota during the Development Period currently due and payable, and amortization of other expenses incurred in connection with Coteau obtaining loans or leases (to the extent not otherwise provided for under Subsection 5.2(c) hereof), accrued by Coteau with respect to such loans and leases, less interest or dividends received by Coteau on its investments.

e) Protective Provisions. If Coteau files consolidated tax returns with an Affiliate or Affiliates of Coteau, it shall collect from such Affiliate or Affiliates any net tax benefit derived by any such Affiliate from such consolidation attributable to Coteau. If Coteau has any surplus cash, it shall invest it in income producing securities or, if requested by Dakota, use such excess to repay indebtedness of Coteau.

Notwithstanding the foregoing, "Cost of Production" shall specifically exclude fines and penalties imposed by any governmental agency, administration, commission or body, with the exception of (i) a fine or penalty imposed by a governmental agency, administration, commission or body regulating the mining of

11

lignite or the reclamation of mined lignite lands or (ii) a fine or penalty imposed by any governmental agency, administration, commission or body on activities or conduct specifically directed or otherwise approved by Dakota or one of its Affiliates.

Section 5.3 Price During Development Period.

Dakota shall determine the price to be paid during each Development Period for the lignite sold and delivered hereunder from the relevant portion of Coteau's Mine, which price shall not be less per Ton of lignite than the prior calendar year's Cost of Production per Ton of lignite and which shall be deemed to include the Agreed Profit with respect to lignite delivered from such portion of Coteau's Mine. During each Development Period, the excess of the Cost of Production over the price (less Agreed Profit) paid for such lignite shall be capitalized, for purposes of determining subsequent price. The amount so capitalized shall be recovered by inclusion in the Cost of Production pro rata commencing at the end of each Development Period over a period, designated by Dakota, which shall not be longer than the estimated life of the particular mining area.

Section 5.4 Computation of Agreed Profit.

a) | For lignite sold and delivered hereunder in any calendar year for use at Dakota's Primary Plants, the Agreed Profit, expressed in July 1, 1988 dollars, shall be [* * *] per Ton for all Tons of lignite up to and including ten million (10,000,000) Tons and shall be [* * *] per Ton for all Tons of lignite which exceed ten million (10,000,000) Tons, which such amounts of Agreed Profit shall be subject to adjustment as provided in Subsection 5.5(a) hereof. |

For the first one hundred seventy-six million six hundred one thousand nine hundred forty-nine (176,601,949) Tons of lignite sold and delivered from the Dedicated Lignite for use at Dakota's Primary Plants following the date of this Agreement, the Agreed Profit per Ton, after adjustment pursuant to Subsection 5.5(a) hereof, shall be reduced by an amount equal to [* * *] adjusted in the manner as provided in paragraph 7 of the Coal Reserve Agreement. An example of the aforesaid calculation is attached hereto as Exhibit C and made a part hereof.

b) | For lignite sold and delivered hereunder for use at Dakota's Other Plants, the Agreed Profit, expressed in July 1, 1988 dollars, shall be [* * *] per Ton, which such amount shall be subject to adjustment as provided in Subsection 5.5(b) hereof, until the quantity of lignite sold and delivered to Dakota's Secondary Plant, Dakota's Other Plants and Other Plants equals the total quantity of economically recoverable lignite reserves contained within the Additional Dedicated Lignite then owned, leased or subleased by Coteau pursuant to this Agreement. Once the aggregate lignite deliveries to Dakota's Secondary Plant, Dakota's Other Plants and Other Plants equal such quantity, the Agreed Profit for all lignite delivered to Dakota for use at Dakota's Other Plants shall be at the rate(s) specified in Subsection 5.4(a) hereof and the adjustment of such Agreed Profit shall be as provided in Subsection 5.5(a) hereof. |

c) | For lignite sold and delivered hereunder in any calendar year for use at Dakota's Secondary Plant and at Other Plants, the Agreed Profit, expressed in July 1, 1988 dollars, shall be [* * *] per Ton for all Tons up to and including one million two hundred fifty thousand (1,250,000) Tons, [* * *] per Ton for all Tons in excess of one million two hundred fifty thousand (1,250,000) and less than two million five hundred thousand (2,500,000) Tons, and [* * *] per Ton for all Tons including and in excess of two million five hundred thousand (2,500,000) Tons, which such amounts of Agreed Profit shall be subject to adjustment as provided in Subsection 5.5(c) hereof, until the quantity of lignite sold and delivered to Dakota's Secondary Plant, Dakota's Other Plants and Other Plants equals the total quantity of economically recoverable lignite reserves contained within the Additional Dedicated Lignite then owned, leased or subleased by Coteau pursuant to this Agreement. Once the aggregate lignite deliveries to Dakota's Secondary Plant, Dakota's Other Plants and Other Plants equal such total quantity, the Agreed Profit for all lignite delivered to Dakota for use at Dakota's Secondary Plant and at Other Plants shall be at the rate(s) specified in Subsection 5.4(a) hereof and the adjustment of such Agreed Profit shall be as provided in Subsection 5.5(a) hereof. |

* * * Confidential Treatment Requested

12

Section 5.5 Modification of Agreed Profit.

a) | The Agreed Profit per Ton for each Ton of lignite sold and delivered hereunder for use at Dakota's Primary Plants shall be adjusted for each calendar year, as of December 31 of such calendar year, by one hundred percent (100%) of the percentage difference between the Index for the year under consideration and the base Index figure. An example of the aforesaid calculation is attached hereto as Exhibit D and made a part hereof. |

b) | Subject to Subsection 5.4(b) hereof, the Agreed Profit per Ton for each Ton of lignite sold and delivered hereunder for use at Dakota's Other Plants shall be adjusted for each calendar year, as of December 31 of such calendar year, by: |

i) Seventy-five percent (75%) of the first four percent (4%) of the change in the Index for the year under consideration relative to the previous year's Index and

ii) | A prorated percentage of that portion of the percentage change in the Index for the year under consideration relative to the previous year's Index which is greater than four percent (4%) but less than eight percent (8%), which proration shall be made linearly, with the prorated percentage being seventy-five percent (75%) for a four and one one-hundredth percent (4.01%) increase or decrease in the Index and with the prorated percentage being one hundred percent (100%) for the eight percent (8%) change in the Index and |

iii) | One hundred percent (100%) of that portion of the percentage increase or decrease in the Index relative to the previous year's Index which is equal to or greater than eight percent (8%). |

Examples of the aforesaid calculation are attached hereto as Exhibit E and made a part hereof.

c) | Subject to Subsection 5.4(c) hereof, the Agreed Profit per Ton for each Ton of lignite sold and delivered hereunder for use at Dakota's Secondary Plant and Other Plants shall be adjusted for each calendar year, as of December 31 of such calendar year, by seventy-five percent (75%) of the percentage difference between the Index for the year under consideration and the base Index figure. An example of the aforesaid calculation is attached hereto as Exhibit F and made a part hereof. |

d) | The Agreed Profit for all Sub-Quality Lignite that is sold and delivered hereunder shall be reduced by multiplying the applicable Agreed Profit by a fraction, the numerator of which shall be the actual BTU content of said Sub-Quality Lignite and the denominator of which shall be six thousand seven hundred fifty (6,750) BTUs per pound. The Agreed Profit rate to which such reductions shall be made shall be the average Agreed Profit rate, before said adjustment, paid by Dakota to Coteau during the month in which the Sub-Quality Lignite is severed by Coteau and sold and delivered to Dakota hereunder. An example of the aforesaid calculation is attached hereto as Exhibit G and made a part hereof. Specific mining areas in which Sub-Quality Lignite is available shall be determined by Coteau and agreed to by Dakota prior to the delivery of such lignite. The actual quantities of Sub-Quality Lignite taken from these specific areas to which the adjustment in this Subsection 5.5(d) shall apply shall be determined by pit survey, and the BTU rating shall be determined from pit samples, utilizing procedures mutually agreed to by Coteau and Dakota. |

Section 5.6 Further Modifications.

13

If at any time during the term of this Agreement it is reasonably believed by either Party that the Producer Price Index - All Commodities or any index substituted therefor in accordance with the following provisions reflects the true change in

purchasing power of the United States dollar, then upon the written request of either Party a substituted index or method whereby such change in purchasing power of the United States dollar can be determined shall be substituted by mutual agreement. In the event that the Producer Price Index - All Commodities or any substituted index is changed in the future to use some

base other than the base of 1982 = 100, then, for the purposes hereof, the Producer Price Index - All Commodities or any substitute index, as the case may be, shall be adjusted so as to be in correct relationship to the base of 1982 = 100, or some other alternative base which is mutually agreeable to Coteau and Dakota. In the event publication of the Producer Price Index - All Commodities or any substituted index is no longer made by any federal agency, the index to be used as aforesaid shall be that index agreed to by the Parties which, after necessary adjustment, if any, provides the most reasonable substitute for said index.

Section 5.7 Post-Expiration/Termination Payments.

a) | In the event that, following an expiration of this Agreement pursuant to Section 14.1 hereof, Dakota exercises its right, pursuant to the Option Agreement, to cause the transfer of the Escrowed Stock to Dakota, or in the event that, following a premature termination of this Agreement pursuant to Subsection 14.2(a) hereof, North American Coal exercises its put option under the Option Agreement, Dakota shall then pay to North American Coal or its designee as part of the purchase price for the Escrowed Stock a production payment (Production Payment) in the following amounts under the following circumstances: |

i) | Until such time as Dakota shall have paid Agreed Profit as calculated pursuant to Subsection 5.4(a) hereof as adjusted pursuant to Subsection 5.5(a) hereof and/or Production Payments pursuant to the terms of this Agreement for three hundred ninety million (390,000,000) Tons of coal and/or lignite sold and delivered following the date of this Agreement, a Production Payment equal to the Agreed Profit as calculated pursuant to Subsection 5.4(a) hereof as adjusted pursuant to Subsection 5.7(b) hereof for x) coal and/or lignite sold and delivered to Dakota's Primary Plants, regardless of the source of such coal and/or lignite, and/or y) lignite sold and delivered to Dakota's Plants from Primary Dedicated Lignite; |

ii) | After the conditions of Subsection 5.7(a)(i) hereof have been satisfied and Dakota shall have paid the specified Agreed Profit and/or Production Payments for three hundred ninety million (390,000,000) Tons, a Production Payment, expressed in January 1, 1990 dollars, equal to [* * *] per Ton for all Tons mined from the Primary Dedicated Lignite and sold to Dakota's Plants, until such time as Dakota shall have paid Agreed Profit pursuant to Subsection 5.4(a) hereof as adjusted pursuant to Subsection 5.5(a) and/or Production Payments pursuant to Subsection 5.7(a)(i) hereof and this Subsection 5.7(a)(ii) as adjusted pursuant to Subsection 5.7(b) hereof for all Tons in excess of three hundred ninety million (390,000,000) Tons of coal and/or lignite but less than four hundred forty million (440,000,000) Tons of coal and/or lignite; and |

iii) | Thereafter, a Production Payment, expressed in January 1, 1990 dollars, equal to [* * *] per Ton for all Tons mined from the Primary Dedicated Lignite and sold and delivered to Dakota's Plants, until such time as Dakota shall have paid Agreed Profit pursuant to Subsection 5.4(a) hereof as adjusted pursuant to Subsection 5.5(a) hereof and/or Production Payments pursuant to Subsection 5.7(a)(i) and Subsection 5.7(a)(ii) hereof and this Subsection 5.7(a)(iii) as adjusted pursuant to Subsection 5.7(b) hereof for all |

* * * Confidential Treatment Requested

14

Tons in excess of four hundred forty million (440,000,000) but less than five hundred fifty million (550,000,000) Tons of coal and/or lignite;

at which point Dakota’s obligation to pay the Production Payment shall cease.

b) | The Production Payment per Ton of lignite referenced in Subsection 5.7(a)(i) hereof shall be adjusted for each calendar year, as of December 31 of such calendar year, by one hundred percent (100%) of the percentage difference between the Index for the year under consideration and the Index as of July 1, 1988. The Production Payment per Ton of lignite referenced in Subsections 5.7(a)(ii) and 5.7(a)(iii) hereof shall be adjusted for each calendar year, as of December 31 of such calendar year, by one hundred percent (100%) of the percentage difference between the Index for the year under consideration and the Index as of January 1, 1990. |

c) | There shall be included in and counted toward the tonnage figures in Subsection 5.7(a) hereof all Tons of lignite sold by Coteau to third parties as provided in Section 13.1 hereof. |

d) | In the event Dakota or North American Coal exercises its right, pursuant to the Option Agreement, to cause the transfer of the Escrowed Stock to Dakota, (i) the obligations of Dakota under this Section 5.7 shall survive any termination or expiration of this Agreement, (ii) Dakota shall not, and shall cause Coteau to not, dissolve or liquidate and (iii) Dakota shall not, and shall cause Coteau to not, merge or consolidate with, or sell all or substantially all of its assets to, any third party unless such third party shall have agreed in writing to be bound by the terms of this Section 5.7 and shall be financially capable of performing Dakota’s obligation under this Section 5.7 and shall otherwise be solvent. |

Section 5.8 Mine Closing Costs.

Dakota recognizes that mine closing costs will be incurred by Coteau from time to time. Dakota shall reimburse Coteau for all such mine closing costs. Such costs when determined shall be included within budgets and operating plans submitted to Dakota for its approval and shall be paid as part of the Cost of Production or otherwise be reimbursed to Coteau by Dakota as incurred, which obligation of Dakota shall survive any termination or expiration of this Agreement.

ARTICLE VI

AUDITS AND FINANCIAL REPORTS

AUDITS AND FINANCIAL REPORTS

Section 6.1 Audits.

Coteau shall annually have an audit of its accounts performed by a firm of independent certified public accountants and shall provide Dakota with a copy of such audit. Dakota shall have the right at any time on reasonable notice in writing to Coteau to examine by its certified public accountants (which may include representatives of Basin Electric or its Affiliate) the records and books of account of Coteau and any Affiliate of Coteau, relating to the items and allocations of cost and production entering into the computation of the Cost of Production. Payment or payments under Article VII of this Agreement shall not be deemed a waiver of any rights of Dakota to have the price hereunder corrected.

Section 6.2 Financial Reports.

On or before the twentieth (20th) day of each month, Coteau shall furnish to Dakota financial statements reflecting Coteau's financial position as of the end of the preceding calendar month and the results of operations of Coteau for the period then ending and a detailed statement of the Cost of Production for the preceding calendar month at Coteau's Mine, including the quantity of lignite delivered and the aggregate man-hours by classification and shifts required for its production. Coteau shall furnish to Dakota detailed

15

cost analyses and other financial reports with respect to Coteau as Dakota may reasonably request. Said statements, analyses and reports shall be in such form and detail as may reasonably be requested by Dakota.

ACTICLE VII

BILLING AND ADJUSTMENTS

Section 7.1 Billing.

The monthly invoice for lignite sold and delivered hereunder in a calendar month shall be issued by Coteau no earlier than the sixth (6th) day of the next calendar month. Any such invoice received by Dakota after 12:00 Noon, Bismarck time, on any Business Day shall be deemed to have been received by Dakota on the following Business Day. Dakota shall pay such invoice within ten (10) days after its receipt thereof. If such tenth (10th) day is not a Business Day, Dakota shall pay such invoice no later than the next following Business Day.

Section 7.2 Adjustments.

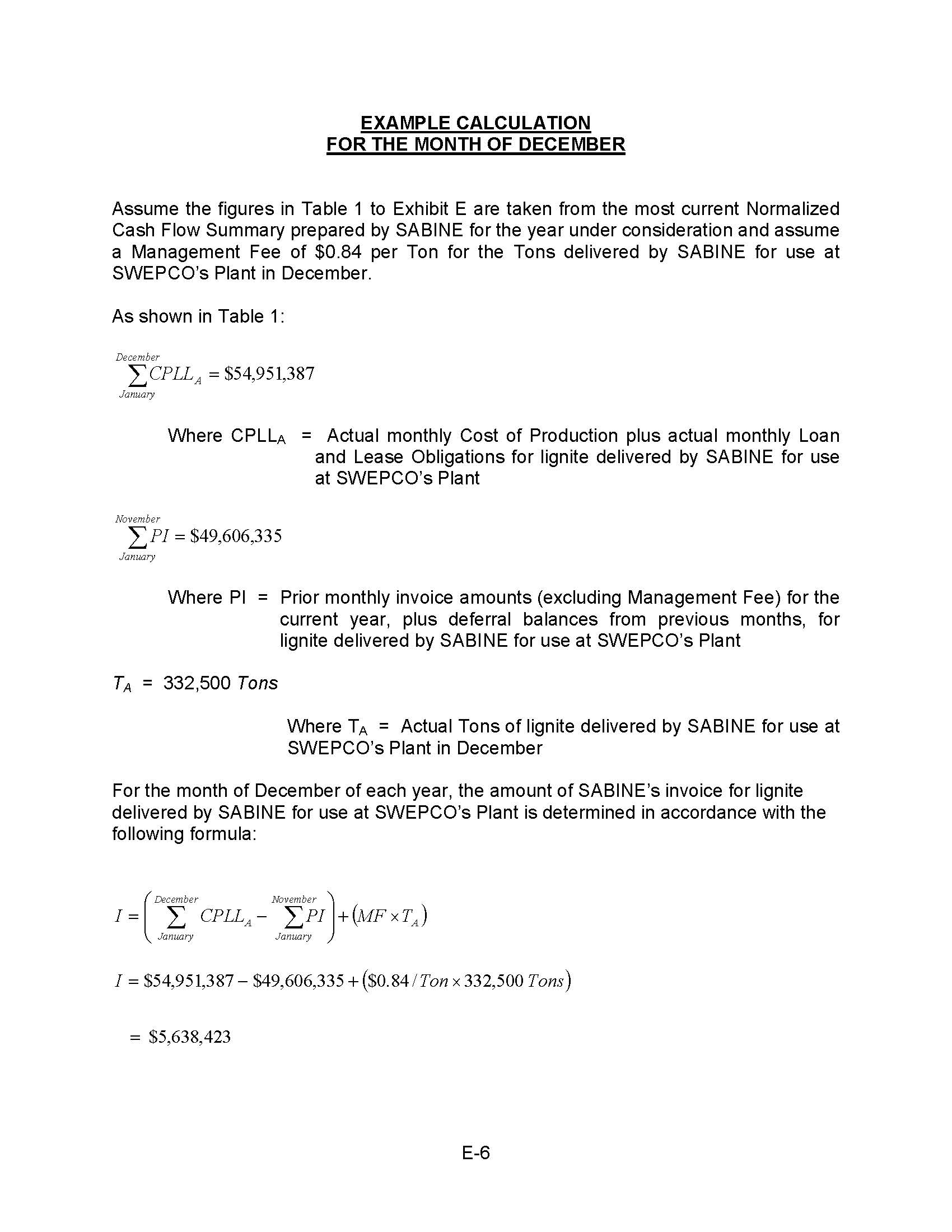

After the end of each Development Period, the monthly billing of lignite sold and delivered from Coteau's Mine to which such Development Period related in each calendar month shall be based upon the estimated Cost of Production applicable to Coteau's Mine during such month, plus the Agreed Profit on lignite mined from Coteau's Mine for such month. Any differences between the estimated Cost of Production, upon which the billing is based, and actual Cost of Production for each calendar month shall be included as an adjustment to the monthly billing of lignite in each subsequent calendar month. Billings for lignite sold and delivered from Coteau's Mine for each calendar month shall be based upon the Agreed Profit for the previous calendar year as recomputed pursuant.to Section 5.5 hereof. As soon as possible after the expiration of each calendar year, the Agreed Profit shall be recomputed on an annual basis for such calendar year and additional payment or refund shall be made accordingly. An example of such recomputation is attached hereto as Exhibit H and made a part hereof.

ARTICLE VIII

RATE OF SHIPMENT, PERFORMANCE

Section 8.1 Rate of Shipment.

If by reason of failure to receive shipping instructions or releases from Dakota under this Agreement, Coteau does not ship the required amount for any particular month, Coteau shall have the option, but shall not be required, to waive the actual delivery of the undelivered tonnage for such month, but any such waiver shall not relieve Dakota from liability to respond in damages for the failure to perform its obligations; provided, however, that Dakota shall not incur any liability to respond in damages if the failure to perform its obligations pursuant to this Agreement is due to an event described in Section 11.2 hereof. If Coteau fails to make deliveries required of it hereunder, Dakota shall have the option, but shall not be required, to waive the actual delivery of the undelivered tonnage, but such waiver shall not relieve Coteau from the liability to respond in damages for the failure to perform its obligations.

Section 8.2 Performance.

Notwithstanding anything to the contrary contained in this Agreement, Coteau shall not incur any liability to respond in damages for failure to perform its obligations pursuant to this Agreement if such failure is due to an event described in Section 11.1 hereof or if such failure is due to control exercised by Dakota in accordance with this Agreement or results from the failure of Dakota to perform its obligations in accordance herewith.

16

ARTICLE IX

SAMPLING AND ANALYSIS, WEIGHTS

Section 9.1 Sampling and Analysis.

Except for the analyses of pit samples of Sub-Quality Lignite pursuant to Subsection 5.5(d) hereof, the quality of the lignite sold and delivered hereunder from Coteau's Mine shall be determined by analyses of samples taken from at least five thousand (5,000) Tons of lignite at a point or points mutually agreed upon by Coteau and Dakota. Sampling and analysis shall be performed by methods which meet the standards of the American Society of Testing Materials, or by such other methods as may be mutually agreed upon by Coteau and Dakota. Each sample shall be divided into two (2) parts and put into suitable air-tight containers. One (1) part shall be submitted to Dakota for analysis and the second part shall be properly sealed and labeled and retained by Dakota for thirty (30) days, to be analyzed if a dispute arises with respect to the results of the analyses of Dakota. Coteau shall be given copies of all analyses made by Dakota and Coteau shall have the right to have a representative present at any and all times to observe the sampling and analyses performed by Dakota.

If any dispute arises with respect to the results of the analyses of Dakota, an analysis of the second part shall be made by an independent commercial testing laboratory mutually chosen by Coteau and Dakota and the analysis of the independent commercial testing laboratory shall be controlling. The cost of the analysis made by such commercial laboratory shall be paid by Coteau and shall be included in the Cost of Production. If any dispute arises with respect to the methods of sampling or analyses performed or being performed by Dakota, Coteau shall so advise Dakota. Coteau and Dakota shall meet promptly and shall, within thirty (30) days of notice of such dispute, mutually agree upon modifications or changes in such method(s) to resolve such dispute.

Section 9.2 Weights.

The weight of the lignite sold and delivered hereunder for use at Dakota's Plants shall be determined by Coteau on scales located on the conveyors between the Primary Truck Dump and the Secondary Crusher Building at Dakota's Primary Plants or at such other location(s) mutually agreed to by the Parties; provided, however, that when Coteau's scales are inoperable, the weight of lignite sold and delivered hereunder for use at Dakota's Primary Plants and Dakota's Other Plants shall be determined by Basin Electric's and/or DGC's scales at Dakota's Primary Plants. Dakota shall be given a record of all weight determinations made by Coteau and shall have the right to have a representative present at any and all times to observe the weighing of lignite sold and delivered hereunder. If Dakota at any time questions the accuracy of the weights, Dakota shall so advise Coteau and Coteau shall permit Dakota's representatives to test and check such scales. If such tests show that any scale is inaccurate, it shall be adjusted by mutual agreement of Coteau and Dakota to an accurate condition.

The weight of lignite redelivered by Dakota to Dakota's Secondary Plant and to Other Plants shall be determined from rail car or truck weight receipts acquired from the transportation contractor(s), or by some other method mutually agreeable to the Parties. The weight of the lignite utilized by Dakota's Primary Plants and Dakota's Other Plants shall be determined by subtracting the weight of the lignite ultimately delivered to Dakota's Secondary Plant and to Other Plants from the total lignite measured on Coteau's scales at the location(s) specified in this Section 9.2. For the weight of all lignite redelivered by Dakota to Dakota's Secondary Plant and Other Plants, Coteau shall be given a record of all weight determinations made by Dakota, and Coteau shall have the right to have a representative present at any or all times to observe the weighing of lignite delivered hereunder. If Coteau should at any time question the accuracy of the weights, Coteau shall so advise Dakota and Dakota shall permit Coteau's representatives to test and check such scales. If such tests show that any scale is inaccurate, it shall be adjusted by mutual agreement of Coteau and Dakota to an accurate condition.

If it is determined that any scale or any other method used to weigh lignite is inaccurate, the quantities of lignite delivered hereunder during the period when such inaccuracy existed shall be adjusted pursuant to procedures agreed to by the Parties.

17

ARTICLE X

LOAN AND LEASE OBLIGATIONS

Section 10.1 Loan and Lease Obligations.

It will be necessary for Coteau to obtain loans and/or leases for the construction and equipping of Coteau's Mine, which shall be indebtedness or lease obligations of Coteau not guaranteed by North American Coal. If Dakota so requests, Coteau shall use its best efforts to obtain long-term loans and/or long-term leases (such loans and leases and such continued or additional loans or leases as may be necessitated by replacement of or addition to Coteau's · equipment, or by the expiration of any lease of equipment to Coteau prior to the expiration of this Agreement being referred to herein collectively as the "Loans and Leases'') in amounts sufficient for the following purposes: developing, equipping and operating of Coteau's Mine, including, without limitation, (a) developing roadways, (b) constructing tipples and cleaning plants, (c) acquiring machinery and (d) maintaining working capital for operating Coteau's Mine; provided, however, that (i) the Loans and Leases and the amounts thereof must be approved by Dakota in its sole discretion and shall be made if directed by Dakota and (ii) if such Loans and Leases are not available to Coteau, or Dakota does not request that Coteau obtain the same or does not approve the same, Dakota shall assume the responsibility for obtaining the Loans and Leases for such amounts and on such terms as it shall reasonably determine to be necessary to meet the foregoing purposes. If Dakota has such responsibility, Dakota itself shall (w) provide the Loans and Leases, (x) arrange for Loans or Leases by Coteau from third persons, (y) direct Coteau to borrow or lease from third persons or (z) combine Dakota's Loans or Leases with those of third persons. If the Loans and Leases shall be arranged with third persons, Dakota shall have the right subsequently to discharge the Loans or Leases and substitute itself as lender or lessor for the balance of the term of such Loans or Leases. Any Loan or Lease provided, arranged for or directed by Dakota in the exercise of its rights under this Section 10.1 shall not be less favorable to Coteau than a Loan or Lease for the same term which could be obtained by Coteau directly. Dakota shall have the right to cause part or all of its obligations under this Section 10.1 with respect to Coteau's Mine to be performed by an Affiliate, but such performance by an Affiliate shall not relieve Dakota of its responsibility for arranging subsequent Loans and Leases for Coteau's Mine.

Section 10.2 Negative Pledge.

Coteau shall not incur any long-term debt or pledge or encumber any assets owned by it in fee or any leasehold interests which it may hold except in connection with financing which has been approved by Dakota or an Affiliate of Dakota.

ARTICLE XI

FORCE MAJEURE

Section 11.1 Force Majeure/Coteau.

In the event of strikes, labor disputes, fires, accidents at Coteau's Mine, failure of equipment, inability of Coteau to obtain necessary equipment by reason of a general short supply thereof, failure of transportation or shortage of transportation equipment, federal, state or local laws or regulations or other contingencies, whether of a like or different nature, beyond the control of Coteau and not due to its negligence, any of which contingencies prevents or interferes with the production or shipment of lignite hereunder, the shipments contracted for may, at the election of Coteau, be suspended or partially suspended as the case may require for the duration of the contingency.

Section 11.2 Force Majeure/Dakota.

In the event of strikes, labor disputes, fires, accidents at Dakota's Plants, failure of equipment, the inability to obtain necessary equipment for Dakota's Plants by reason of a general short supply thereof, failure of transportation or shortage of transportation equipment, federal, state or local laws or regulations or other contingencies, whether of a like or different nature, beyond control of Dakota and not due to its negligence, any of which contingencies prevents or interferes with the taking of delivery of the lignite purchased hereunder at Dakota's Plants to which, under instructions of Dakota, such lignite is then currently being delivered, or which prevents or interferes with the processing of such lignite or the

18

subsequent transportation of the product to be produced at Dakota’s Plants, or in the event that the product to be produced at Dakota’s Plants cannot be sold on an economic basis, then shipments contracted for shall, at the election of Dakota, be suspended or partially suspended as the case may require for the duration of such contingency.

Section 11.3 Idle Mine Expenses.

Notwithstanding the suspensions of delivery of lignite provided for in Sections11.1 and 11.2 hereof, if Coteau's Mine is substantially idle during a calendar month pursuant to such Sections, or if Dakota takes no deliveries in any calendar month, Dakota shall pay to Coteau as part of the Cost of Production or otherwise reimburse Coteau for the actual out-of-pocket idle mine expenses and depreciation for such month.

Section 11.4 Resumption After Interruption.

Interruptions in tendering delivery or acceptance of shipments and deliveries referred to in this Article XI shall not invalidate the remainder of this Agreement, but upon removal of the cause of such interruptions, delivery shall be resumed at the rate specified herein. In the event of such interruptions, the Party immediately affected by such contingency shall, if possible, give reasonable advance notice confirmed in writing to the other Party of the extent and probable duration thereof, with sufficient detail to enable the other Party to verify the same.

ARTICLE XII

LIGNITE FEE LAND AND LEASE ACQUISITION AND MAINTENANCE

Section 12.1 Leases.

Coteau shall proceed as directed by Dakota to acquire leases or the fee title to lignite reserves within the Dedicated Lignite. Coteau shall drill said areas to the extent that Dakota determines is necessary to establish the estimated quantity and the estimated quality of lignite therein and shall provide Dakota with access to all cores and access to and copies of all logs and other records of such drilling. In its acquisition and drilling program, Coteau shall follow any guidelines stated in writing by Dakota as to terms and conditions as well as the maximum amount it may pay for fee interests or in lease rentals or in tonnage royalties and amounts to be spent for drilling, and shall keep Dakota currently advised as to the progress of such acquisition and drilling programs. Upon the request of Dakota, Coteau shall provide, at the expense of Dakota, good and sufficient evidence of the right, title and interest of Coteau in and to leases and fee title to lignite reserves within the Dedicated Lignite. As to any parcel of land, whether mineral or surface or both, which by reason of its location is within the Dedicated Lignite, if Coteau notifies Dakota of the availability of such parcel for acquisition and Dakota does not request that it be acquired, North American Coal shall be free to acquire the same for its own account in accordance with the Coal Reserve Agreement and it shall not thereafter be considered a part or portion of the Dedicated Lignite.

Section 12.2 Recoverable Tons.

At the time Additional Dedicated Lignite is acquired by Coteau or assigned, transferred or subleased by Dakota to Coteau, Dakota and Coteau shall mutually agree as to the total quantity of economically recoverable Tons of lignite contained in such lignite reserves. If Coteau and Dakota cannot agree on the quantity of economically recoverable Tons of lignite contained within such reserves, Coteau and Dakota shall jointly select a qualified independent consultant to make a final and binding determination of such quantity.

Section 12.3 Protection of Reserves.

Coteau, utilizing lease maintenance and payment procedures approved by Dakota in writing, agrees to make all payments due under those leases acquired by or assigned or transferred to Coteau in the Dedicated Lignite in a timely manner, not to permit any default under said leases to occur, not to surrender said leases in whole or in part without the written consent of Dakota and not to encumber, assign or sublease said leases, except in connection with financing pursuant to Section 10.1 hereof.

Section 12.4 Remedy for Failure to Protect.

19

If Coteau, without the written consent of Dakota, causes or permits any such lease covering lignite with a calorific content of six thousand two hundred (6,200) BTUs per pound or more, on an as-received basis, to be surrendered, terminated or cancelled prior to the expiration of its term or encumbers, assigns or subleases any such lease, (a) Coteau shall (i) at its sole expense, remove the encumbrance(s), (ii) reinstate such lease or (iii) acquire and make available a substitute lease or leases within the Dedicated Lignite which, to the reasonable satisfaction of Dakota, covers lignite of no less total BTU content than the lignite covered by any such lease which was surrendered, terminated, cancelled, assigned or subleased, or (b) Coteau may, at its sole discretion, deliver to Dakota substitute lignite of no less total BTU content than the lignite covered by any such lease which was surrendered, terminated, cancelled, assigned or subleased at a per-Ton cost each month equal to the average of the Cost of Production, as defined in Section 5.2 hereof, for the twelve (12) month period preceding such month in which the substitute lignite is delivered to Dakota plus the applicable Agreed Profit. For the purposes of Subsections 12.4(a)(iii) and 12.4(b) hereof, only lignite with a calorific content of six thousand two hundred (6,200) or more BTUs per pound, on an as-received basis, shall be considered. For the activities described in Subsections 12.4(a)(ii) and 12.4(a)(iii) hereof, Coteau shall pay the acquisition costs (as hereinafter defined), drilling costs, engineering and testing costs, any increase in the annual advance engineering and testing costs and any increase in the annual advance royalty or rental payments and/or the production royalty rates. For the purposes of this Section 12.4 and Article XII hereof, the term 11 acquisition costs11 shall mean the salaries, associated overhead costs and related expenses of employees engaged in the reinstatement of any lease(s) or in the acquisition of a substitute lease(s), bonus or advance royalty for a lease(s), brokerage fees, legal and other expenses in establishing and reviewing titles, closing expenses and all drilling, exploratory, analytical and engineering costs directly related to such acquisition work. It is understood and agreed that in the event of a default by Coteau of its obligations under Section 12.3 hereof, Dakota's sole exclusive remedy shall be the enforcement of the obligations of Coteau set forth in this Section 12.4.

ARTICLE XIII

LIMITATION OF COTEAU'S ACTIVITIES

Section 13.1 Sales to Others.

Coteau shall engage in no business other than the ownership and operation of

Coteau's Mine, the sale of the products thereof and the rental of property which is owned as an incident to its mining business. Coteau shall not sell outside of this Agreement any lignite extracted from the Dedicated Lignite which would make Coteau unable to give first priority to the performance of its obligations under this Agreement, including any extensions thereof. Coteau shall notify Dakota in writing annually of the amount of lignite to be extracted from the Dedicated Lignite, if any, which it proposes to sell outside this Agreement in advance of such sale, and Dakota shall be entitled to prohibit such sale if, in the reasonable judgment of Dakota, such sale would impair Coteau's ability to perform its obligations under this Agreement including any extensions thereof. In addition to the foregoing restrictions, such sales outside this Agreement shall not without written consent of Dakota exceed two million (2,000,000) Tons per calendar year during the first ten (10) calendar years of this Agreement.

Any sale of lignite by Coteau to third parties shall be from lignite reserves within the Dedicated Lignite. All Tons of lignite sold by Coteau to third parties shall be treated as if such Tons were sold and delivered to Dakota's Primary Plants for purposes of Section 5.7 hereof. In consideration of Dakota providing the financing that has enabled and will enable Coteau to acquire equipment which Coteau has used and will use to produce and sell lignite under this Agreement and to third parties, Coteau shall pay to Dakota for each Ton of lignite sold by Coteau during the term of this Agreement to third parties a fee equal to [* * *] per Ton, which fee shall be adjusted as provided in Subsection 5.5(a) hereof. In addition, Coteau shall include in the cost of lignite sold to third parties a cost per Ton not less than the then current Cost of Production per Ton. For all Tons of lignite sold to third parties, Coteau also shall reimburse Dakota or its Affiliate a proportionate amount of the costs that Dakota or such Affiliate has incurred, and for which Dakota has not been reimbursed by Coteau, of providing financing for Coteau's Mine or for which Dakota

* * * Confidential Treatment Requested

20

or its Affiliates anticipate Dakota or its Affiliates will incur during the period of time that said lignite is being sold to said third parties and would not otherwise be reimbursed by Coteau.

Section 13.2 Other Activities.

Notwithstanding the provisions of Section 13.1 hereof, it is contemplated that Coteau may provide other services to Dakota such as solid waste disposal, disposal of excess lignite fines, snow removal as well as such other services, in each instance as may be mutually agreed upon by Coteau and Dakota. It is further contemplated that Coteau shall provide said services to Dakota at a price agreed to by the Parties.

ARTICLE XIV

TERM, PREMATURE TERMINATION AND EXPIRATION OPTIONS

Section 14.1 Term.