U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| S | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

| £ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission File Number: 001-32473

FEIHE INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| Utah | 90-0208758 |

| (State or other jurisdiction of Incorporation or organization) |

(I.R.S. Employer Identification No.) |

Star City International Building, 10 Jiuxianqiao Road, C-16th Floor

Chaoyang District, Beijing, China 100016

(Address of principal executive offices)

Registrant’s telephone number, including area code: 86(10) 6431-9357

Securities registered under Section 12(b) of the Exchange Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock | New York Stock Exchange, Inc. |

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. £ Yes S No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. £ Yes S No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. S Yes £ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). S Yes £ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. S

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of ”accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer £ | Accelerated filer S | Non-accelerated filer £ | Smaller Reporting Company £ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). £ Yes S No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing sale price of the registrant’s common stock on June 30, 2012 as reported on the NYSE, was approximately $78,765,000.

As of March 15, 2013, there were 19,784,291 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information is incorporated by reference to the Proxy Statement for the registrant’s 2012 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Form 10-K.

TABLE OF CONTENTS

In this Annual Report on Form 10-K, references to “dollars” and “$” are to United States dollars and, unless the context otherwise requires, references to “Feihe International,” “we,” “us” and “our” refer to Feihe International, Inc. and its consolidated subsidiaries.

Overview

We are a leading producer and distributor of milk powder, soybean milk powder, and related dairy products in the People’s Republic of China, or the PRC. Using proprietary processing techniques, we make products that are specially formulated for particular ages, dietary needs and health concerns. We have over 200 company-owned milk collection stations, five production and distribution facilities with an aggregate milk powder processing capacity of approximately 2,020 tons per day, and an extensive distribution network that reaches over 100,000 retail outlets throughout China.

Corporate History and Structure

We were incorporated in the State of Utah on December 31, 1985, originally under the corporate name of Gaslight, Inc. We were inactive until March 30, 1988, when we changed our corporate name to Lazarus Industries, Inc. and engaged in the business of manufacturing and marketing medical devices. We discontinued this business in 1991 and became a non-operating public company shell. Effective May 7, 2003, we acquired 100% of the issued and outstanding capital stock of American Flying Crane Corporation, or AFC, a Delaware corporation that operates a dairy business in China through various subsidiaries. In connection with that acquisition, we changed our name to American Dairy, Inc. In October 2010, we changed our name to Feihe International, Inc.

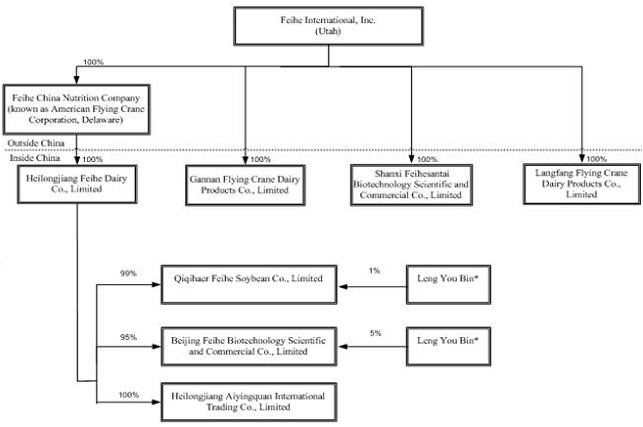

Today, we own various subsidiaries in the PRC that operate our business, including:

| • | Heilongjiang Feihe Dairy Co., Limited, or Feihe Dairy, which produces, packages and distributes milk powder and other dairy products; | |

| • | Gannan Flying Crane Dairy Products Co., Limited, or Gannan Feihe, which produces milk products; | |

| • | Shanxi Feihesantai Biotechnology Scientific and Commercial Co., Limited, or Shanxi Feihe, which produces walnut and soybean products; | |

| • | Heilongjiang Aiyingquan International Trading Co., Limited, or Aiyingquan, which markets and distributes water and cheese, specifically marketed for consumption by children; | |

| • | Qiqihaer Feihe Soybean Co., Limited, or Feihe Soybean, which manufactures and distributes soybean products; and | |

| • | Beijing Feihe Biotechnology Scientific and Commercial Co., Limited, or Beijing Feihe, which markets and distributes dairy products. |

In May 2012, we successfully deregistered our PRC subsidiaries Heilongjiang Flying Crane Trading Co., Limited, or Feihe Trading, which distributed milk and soybean related products, and Baiquan Feihe Dairy Co., Limited, or Baiquan Dairy, which produced milk products. In November 2012, we sold the land use rights and fixed assets, and then ceased the operations, of Langfang Flying Crane Dairy Products Co., Limited, or Langfang Feihe, which packaged and distributed finished products.

| 1 |

The following chart reflects the current corporate structure of the Feihe International entities as at December 31, 2012:

* Indicates a nominee shareholder who, pursuant to a former requirement under the PRC Company Law that certain PRC companies have at least two shareholders, holds its equity interest for the benefit of the majority shareholder.

“Going Private” Transaction

In October 2012, we received a preliminary, non-binding proposal from Mr. Leng You-Bin, our Chairman and Chief Executive Officer, and an affiliate of Morgan Stanley Private Equity Asia, or MSPEA, the private equity arm of Morgan Stanley, to acquire all of the outstanding shares of our common stock not currently owned by Mr. Leng You-Bin (and possibly other rollover shareholders) in a going private transaction for $7.40 per share of common stock in cash, subject to certain conditions. Our Board of Directors has formed a special committee of independent directors to consider the proposal, which retained a financial advisor and legal counsel to assist it in this process. Upon the unanimous recommendation of the special committee and unanimous approval of our Board of Directors, on March 3, 2013, we entered into an Agreement and Plan of Merger, or the Merger Agreement, which would effectuate the going private proposal, with Diamond Infant Formula Holding Limited, or Holdco, Platinum Infant Formula Holding Limited, and a wholly owned subsidiary of Holdco, or Parent, and Infant Formula Merger Sub Holding Inc., a wholly owned subsidiary of Parent, or the Merger Sub. Pursuant to the terms and subject to the conditions of the Merger Agreement, Merger Sub would merge with and into us, and we would survive as a wholly-owned subsidiary of Parent and a wholly-owned indirect subsidiary of Holdco. In connection with and at the effective time of the merger, each share of our common stock that is outstanding immediately prior to the effective time of the merger would be cancelled in consideration for the right to receive $7.40 in cash without interest, except for those shares beneficially owned by (i) Mr. Leng You-Bin, Mr. Liu Sheng-Hui, and Mr. Liu Hua, who we refer to collectively as the “Rollover Holders,” and (ii) Holdco, Parent, Merger Sub, us or any subsidiary immediately prior to the effective time of the merger, which shares would be cancelled for no consideration at the effective time of the merger, subject to applicable dissenters rights. If the merger closes pursuant to the Merger Agreement, we would cease to be listed on the New York Stock Exchange, or the NYSE, or a public reporting company in the U.S. The Merger Agreement is subject to closing conditions, including certain shareholder approvals, and there can be no assurance that this or any other transaction will be approved or consummated.

| 2 |

Discontinued Operations

In October 2011, we sold our prior subsidiaries Heilongjiang Feihe Kedong Feedlots Co., Limited and Heilongjiang Feihe Gannan Feedlots Co., Limited, which we refer to collectively as the “Dairy Farms.” As a result, they are accounted for as discontinued operations. The total purchase price to us was approximately $133.1 million. This aggregate purchase price included approximately $18 million in cash. The remaining purchase price is to be satisfied by the purchaser’s delivery to us, in six quarterly installments, of raw milk with an aggregate value of approximately $115.1 million from the Dairy Farms, or the Supply Obligations. Concurrently, we entered into a raw milk exclusive supply agreement with the Dairy Farms and the purchaser, pursuant to which the Dairy Farms must satisfy the Supply Obligations by supplying to us raw milk valued at approximately $19.2 million during each quarter for a period of 18 months following September 30, 2011. During this period, the Dairy Farms have agreed to supply raw milk to us exclusively until the quarterly quota amounts are delivered and for so long as we require additional supply. In the event the raw milk production of the Dairy Farms is insufficient to fulfill such quarterly amounts, the shortfall will be immediately payable to us in cash by the Dairy Farms. The quality of the milk must meet governmental and our standards, and we have the right to return any milk which does not meet such standards. In addition, we entered into an asset mortgage agreement with the Dairy Farms, pursuant to which the Dairy Farms granted us a primary security interest in certain properties and assets belonging to the Dairy Farms to secure their obligations to us.

On December 31, 2012, we entered into a supplemental agreement to rearrange the repayment schedule, pursuant to which the purchaser has agreed to repay RMB200 million (approximately $32.1 million) in April 2013 and that a residual amount of the purchase price would be paid by raw milk during the three quarters ending December 31, 2013. If the total value of raw milk supplied to us is less than the residual amount of the purchase price, the purchaser has agreed to pay the shortfall to us in cash.

Principal Products

Our products fall into five main product categories: milk powder, soybean powder, rice cereal, packed milk and walnut and other products.

Milk Powder

Milk powder is our primary product and is divided into several sub-categories. We produce milk powder for infants and young children formulated for zero to six months, six months to one year, one to three years and three to six years of age. We also produce milk powder for expectant mothers, for students and for the middle-aged and elderly populations. In addition, we occasionally purchase semi-finished milk powder, which we refer to as “raw milk powder,” from third parties, which we then process and distribute to beverage manufacturers and other wholesalers for use in their blended drink products.

Soybean Powder

Soybean powder is an auxiliary product to our milk powders and represents a low fat, high calcium alternative to milk powder, particularly for seniors.

Rice Cereal

Rice cereal is an auxiliary product to our milk powders and represents a low fat, high calcium alternative to milk powder, particularly for young children, teenagers, and seniors. We purchase semi-finished rice cereal from third parties, process it, and then distribute it to wholesalers and retailers.

Packed Milk

Packed milk is a new product in 2012. We process the raw milk and add in different flavors. We then individually package and sell the product to primary schools and middle schools for the consumption of their students.

Walnut and Other Products

We produce other auxiliary products that we market in conjunction with our infant milk powder, as well as to health-conscious adults. Walnut products include walnut powder and walnut oil. Other products include cream, skim milk powder, full milk powder, butter, cheese and other related milk powder products and water and cheese marketed specifically for children.

| 3 |

Product Sales

The following tables reflect the sales of our principal products during the fiscal years ended December 31, 2012, 2011 and 2010:

| 2012 | 2011 | 2012 over 2011 | ||||||||||||||||||||||||||||||||||

| Product name | Quantity (Kg’000) | Amount ($’000) | % of Sales | Quantity (Kg’000) | Amount ($’000) | % of Sales | Quantity (Kg’000) | Amount ($’000) | % of Change (Amount) | |||||||||||||||||||||||||||

| Milk powder | 21,309 | 248,359 | 92.7 | 20,577 | 217,506 | 74.3 | 732 | 30,853 | 14.2 | |||||||||||||||||||||||||||

| Raw milk powder | 1,688 | 6,165 | 2.3 | 16,079 | 62,749 | 21.4 | (14,391 | ) | (56,584 | ) | (90.2 | ) | ||||||||||||||||||||||||

| Soybean powder | 1,290 | 3,445 | 1.3 | 3,641 | 6,760 | 2.3 | (2,351 | ) | (3,315 | ) | (49.0 | ) | ||||||||||||||||||||||||

| Rice cereal | 476 | 3,137 | 1.2 | 559 | 3,613 | 1.2 | (83 | ) | (476 | ) | (13.2 | ) | ||||||||||||||||||||||||

| Walnut products | 10 | 60 | 0.1 | 117 | 800 | 0.3 | (107 | ) | (740 | ) | (92.5 | ) | ||||||||||||||||||||||||

| Packed milk | 2,536 | 3,893 | 1.4 | — | — | — | 2,536 | 3,893 | — | |||||||||||||||||||||||||||

| Other | 370 | 2,792 | 1.0 | 341 | 1,507 | 0.5 | 29 | 1,285 | 85.3 | |||||||||||||||||||||||||||

| Total | 27,679 | 267,851 | 100 | 41,314 | 292,935 | 100 | (13,635 | ) | (25,084 | ) | (8.6 | ) | ||||||||||||||||||||||||

| 2011 | 2010 | 2011 over 2010 | ||||||||||||||||||||||||||||||||||

| Product name | Quantity (Kg’000) | Amount ($’000) | % of Sales | Quantity (Kg’000) | Amount ($’000) | % of Sales | Quantity (Kg’000) | Amount ($’000) | % of Change (Amount) | |||||||||||||||||||||||||||

| Milk powder | 20,577 | 217,506 | 74.3 | 22,690 | 180,217 | 70.2 | (2,113 | ) | 37,289 | 20.7 | ||||||||||||||||||||||||||

| Raw milk powder | 16,079 | 62,749 | 21.4 | 15,691 | 57,752 | 22.5 | 388 | 4,997 | 8.7 | |||||||||||||||||||||||||||

| Soybean powder | 3,641 | 6,760 | 2.3 | 4,917 | 10,812 | 4.2 | (1,276 | ) | (4,052 | ) | (37.5 | ) | ||||||||||||||||||||||||

| Rice cereal | 559 | 3,613 | 1.2 | 633 | 4,040 | 1.6 | (74 | ) | (427 | ) | (10.6 | ) | ||||||||||||||||||||||||

| Walnut products | 117 | 800 | 0.3 | 263 | 1,511 | 0.6 | (146 | ) | (711 | ) | (47.1 | ) | ||||||||||||||||||||||||

| Other | 341 | 1,507 | 0.5 | 242 | 2,282 | 0.9 | 99 | (775 | ) | (34.0 | ) | |||||||||||||||||||||||||

| Total | 41,314 | 292,935 | 100 | 44,436 | 256,614 | 100 | (3,122 | ) | 36,321 | 14.2 | ||||||||||||||||||||||||||

Sources of Milk

We source our fresh milk from numerous small dairy farmers that have provided us access to over 200,000 cows that provide milk to our over 200 company-owned milk collection stations. On average, each cow provides four tons of milk per year, which farmers deliver to our milk collection stations. In addition, we have steady milk supply arrangements with our former Dairy Farms described under “– Discontinued Operations” and we purchase raw milk from 4 dairy farms in Kedong and Gannan which in total control over 32,200 cows.

Raw Milk Processing

We believe that, through purchasing raw milk locally and employing minimal processing techniques, we are able to preserve the fresh taste of milk. The industry standard for the time it takes for raw milk to be converted to milk powder is approximately 48 hours. Many large regional dairies, we believe, process raw milk that may be three to four days old. Milk processed by conventional farms for sale to regional dairies is typically stored at the farm for a minimum of two days, commonly spends a full day in transit to the dairy facility, and is processed the following day.

However, our standard is to process the raw milk within 6-24 hours after milking, depending upon the time of day the raw milk is delivered to us. Within this time, the milk is chilled, transported, separated, sterilized and spray-dried. The raw milk is first received from milk collection centers or from the Dairy Farms. Fully enclosed, stainless-steel vacuum milking machines are used to receive the raw milk. Once received, the raw milk will no longer have any contact with air and is immediately processed with refrigeration equipment that cools the raw milk within four seconds to approximately zero to four degrees Celsius. The raw milk is then stored in air-tight tanks in preparation for advanced processes, which include milk fat separation, sterilization and spray-drying.

| 4 |

The milk used in our products is not homogenized. During homogenization, pressurized milk is forced through openings smaller than the size of the fat globules present in milk, breaking them into smaller particles. Thus treated, the milk fat remains suspended and does not separate out in the form of cream. We believe that this process adversely affects the taste and feel of milk. In addition, our milk is pasteurized at the lowest temperatures allowed by law to avoid imparting a cooked flavor to the milk. When the milk is clarified and the butterfat removed to yield cream and skim milk, a process of cold separation is used, rather than the more commonly employed hot separation, which we believe adversely affects the flavor of the milk.

Dairy Product Processing

Our products are made in small batches using minimal processing techniques to maintain freshness and allow maximum flavor and nutrition retention. They are made with wholesome ingredients and no chemicals or additives are employed. Our dairy products arrive to consumers in our marketing area sooner after production than most other dairy products because they are produced locally. To assure product quality, the beginning of each production run is sampled for flavor, aroma, texture and appearance. In addition, inspectors routinely sample for bacteria and butterfat content in our products, and check the sanitary conditions in our facilities.

Quality Assurance

We are committed to delivering high-quality dairy products. We apply a 25-step quality control process that involves approximately 130 points of testing from the feed for the dairy cows, throughout our manufacturing process, and extending to semi-finished products, which we purchase from third parties for further processing, and finished products.

The production facilities we have constructed comply with pharmaceutical good manufacturing practice, or GMP, standards, a higher level of quality control than required for consumer goods manufacturing facilities. Since 2000, our production facilities have obtained ISO 9002 and HACCP quality assurance certifications, as well as quality certifications from the PRC regulatory authorities. Our processing equipment is manufactured by well-known European manufacturing companies. We use whole-sealing and mechanized vacuum milk-pressing devices with freezing equipment for each milk station, which allows us to reduce the temperature of raw milk to zero to four degrees Celsius within seconds for storage. Our equipment also eliminates external air contact from the time milk is collected through the time that it is fully processed. We employ automated processes and scientific parameters throughout the manufacturing process that are designed to ensure that all products meet our quality requirements. We have in-house laboratories that utilize proprietary in-line sampling techniques to ensure the quality and safety of the entire production process, from raw materials to semi-finished products to finished products. We believe that our rigorous testing and inspection procedures have been critical in ensuring that our products are free from melamine and other contaminants, are premium quality products and are safe and healthy for customers.

Production and Packaging Facilities

Currently we own and operate five production and packaging facilities. The production facilities we have constructed comply with pharmaceutical GMP standards, a higher level of quality control than required for consumer goods manufacturing facilities. Since 2000, our production facilities have obtained ISO 9002 and HACCP quality assurance certifications, as well as quality certifications from the PRC regulatory authorities. In March 2011, we successfully renewed our manufacturing licenses with Heilongjiang and Hebei Bureau of Quality and Technical Supervision and the licenses’ term of validity was 3 years. The renewal permit was granted pursuant to regulatory measures introduced in 2010 by China’s General Administration of Quality Supervision, Inspection and Quarantine, or AQSIQ, which in 2011 revoked the licenses of approximately 40% of China’s dairy facilities. We believe that our design standards help us assure our product quality. We believe that we are one of the few PRC milk producers that have processing areas that meet a 300,000 cleanliness purification standard, which means that there are less than 300,000 dust particles per cubic centimeter of air. In a standard room, dust particles can reach over two million dust particles per cubic centimeter of air. Continuing our commitment to quality, we have also added testing equipment and other quality control procedures to our processing equipment manufactured by known European and American manufacturing companies.

Feihe Dairy

Located in Kedong, Heilongjiang Province, China, the Feihe Dairy premises are approximately 88,221 square meters. The plant is approximately 12 years old, although it was completely remodeled in 2005. Feihe Dairy principally produces infant milk formula and has a processing capacity of 550 tons per day of raw milk. In addition, Feihe Dairy serves as a packaging facility and packages approximately 22,000 tons of products per year.

| 5 |

Gannan Feihe

Located in Gannan, Heilongjiang Province, China, the Gannan Feihe premises are approximately 300,000 square meters. The original plant is approximately 7 years old and commenced milk powder production in 2008. In 2011, we completed an expansion of the plant, which we refer to as “Phase II”. Gannan Feihe principally produces infant milk formula and has a processing capacity of approximately 1,000 tons per day of raw milk, including the 700 tons per day added by Phase II. In November 2012, Langfang Feihe transferred its packaging facility to Gannan Feihe, which packages approximately 50,000 tons of products per year.

Shanxi Feihe

Located in Licheng, Shanxi Province, China, the Shanxi Feihe premises are approximately 40,000 square meters. The plant is approximately 9 years old. Shanxi Feihe principally produces soybean powder, walnut powder and walnut oil and has a production capacity of approximately 5,000 tons per year of soybean powder and walnut powder combined, and 1,000 tons per year of walnut oil.

Qiqihaer Feihe

Located in Qiqihaer, Heilongjiang Province, China, the Qiqihaer Feihe, a branch of Feihe Dairy, premises are approximately 90,000 square meters. The plant is approximately 8 years old. Qiqihaer Feihe principally produces infant milk formula and adult milk formula and has a processing capacity of approximately 270 tons per day of raw milk. Qiqihaer Feihe also produces butter and has a production capacity of approximately 15 tons per day.

Longjiang Feihe

Located in Longjiang, Heilongjiang Province, China, the Longjiang Feihe, a branch of Gannan Feihe, premises are approximately 29,690 square meters. The plant is approximately 22 years old. In 2011, we started an expansion of plant with a processing capacity of approximately 900 tons per day of raw milk. This facility is currently under construction, which we expect to be completed in July 2013. Longjiang Feihe has a processing capacity of approximately 200 tons per day of raw milk.

In May 2012, we closed the business of Baiquan Dairy, which produced milk products, and Feihe Trading, which distributed milk and soybean related products. In November 2012, we sold the land use rights and fixed assets, and then ceased the operations, of Langfang Feihe, which packaged and distributed finished products.

The table below summarizes key information regarding the production and packaging facilities material to our ongoing operations.

| Facility | Province/ Region | Products | Processing/ Production | Packaging Capacity (tons/year) | |||||

| Feihe Dairy | Heilongjiang | Infant milk formula | 550 (tons/day) | 22,000 | |||||

| Gannan Feihe | Heilongjiang | Infant milk formula | 1,000 (tons/day) | 50,000 | |||||

| Shanxi Feihe | Shanxi | Walnut powder & Soybean powder; | 5,000 (tons/year) | N/A | |||||

| Walnut oil | 1,000 (tons/year) | ||||||||

| Qiqihaer Feihe | Heilongjiang | Infant milk formula; Adult milk powder; | 270 (tons/day) | N/A | |||||

| Butter | 15 (tons/day) | ||||||||

| Longjiang Feihe | Heilongjiang | Infant milk formula; Adult milk powder | 200 (tons/day) | N/A |

Sources of Walnut and Soybeans

We order walnuts and soybeans from local farmers for delivery to Feihe Dairy. We then distribute these raw materials to our facilities as necessary.

| 6 |

Product Distribution

Currently, our products are sold in stores nationwide throughout China, except in Hong Kong SAR, Macau SAR and Taiwan. Prior to distribution, we route our products to Feihe Dairy and Gannan Feihe for final packaging. Feihe Dairy then distributes our finished products primarily in northeastern China, including Heilongjiang, Jilin and Liaoning Provinces. We have a distribution team based in our corporate headquarters that coordinates with a network of over 600 dealers or representatives in key provinces across China. The dealers, in turn, each typically hire one or two secondary agents who assist in the distribution process, including inventory management, product sales, customer service and payments. Dealer agents display and sell our products in specially designated areas in stores. In 2010, we established a system to monitor distributor inventory levels and cross-territory selling activity.

Generally, we deliver our products only after receipt of payment from the dealer. We typically enter into new agreements with our dealers each year that specify sales targets and territories, among other provisions. We seek to expand the number of key provinces served by our dealer network as part of our growth strategy and ultimately to establish a distribution system based upon local production at local dairies. We currently distribute our products through an extensive distribution network that reaches over 100,000 retail outlets throughout China.

Customers

No single customer equaled or exceeded 10% of our sales during the years ended December 31, 2012, 2011 or 2010.

Intellectual Property

We rely principally on trade secrets and confidentiality agreements to protect our proprietary product formulations and production processes. We have obtained trademark registrations for the use of our trade name “Feihe,” as well as our “Xingfeifan,” “Feifan,” “Super Feifan,” “Feihui,” “Feirui,” “Feiyue,” and “Beidiqi” Chinese brands and our “Firmus,” “Astrobaby” and “Babyrich” English brand names, which have been registered with the PRC Trademark Bureau of the State Administration for Industry and Commerce with respect to our milk products. We have obtained trademark registrations for the use of our trade name “Feihe” and “Firmus,” which have been registered with the United States Patent and Trademark Office. We believe our trademarks are important to the establishment of consumer recognition of our products. However, due to uncertainties in PRC trademark law, the protection afforded by our trademarks may be less than we currently expect and may, in fact, be insufficient. In the event any of our trademarks are challenged or infringed, we may not have the financial resources to defend against the challenge or infringement and such defense could in any event be unsuccessful. Moreover, any events or conditions that negatively impact our trademark could have a material adverse effect on our business, operations and finances.

Research and Development

As of March 15, 2013, we had seven technicians engaged in research and development activities. These technicians monitor quality control at our production facilities to ensure that the processing, packaging and distribution of our milk products result in high quality premium milk products that are safe and healthy for customers. These technicians also pursue methods and techniques to improve the taste and quality of our milk products and to evaluate new milk products for further production based upon changes in consumer tastes, trends and the introduction of competitive products by other milk producers.

During the fiscal years ended December 31, 2012, 2011 and 2010, we incurred approximately $141,000, $171,000 and $169,000, respectively, on research and development, representing amounts paid in compensation to our technicians described above.

Growth Strategy

We believe the market for dairy products in China, particularly the market for high quality infant milk formula and other dairy products, is growing. Our growth strategy involves increasing market share during this growth phase. To implement this strategy, we plan to:

| • | Strengthen distribution logistics in strategic PRC markets. We plan to focus on improving sales at existing sales points, leveraging our extensive distribution network to generate revenues in a cost-effective manner. Our distribution network has grown in first-tier markets in the PRC, including Beijing, Shanghai, Guangzhou, Shenzhen and other major second and third-tier cities in the Pearl River Delta. Our extensive distribution network, which reaches many provincial capital and sub-provincial cities, has special channels into first-tier markets that we plan to expand. We believe that improving our distribution logistics in our network is an important driver of our gross margins. |

| 7 |

| • |

Strengthen our premium quality brand awareness. We believe that our products enjoy a reputation for high quality among those familiar with them, and our products routinely pass government and internal quality inspections. We have increased our advertising expenses and plan to continue advertising on influential provincial stations in China, in order to market our products as premium and super-premium products. We believe many consumers in China tend to regard higher prices as indicative of higher quality and higher nutritional value, and as a result consumers with higher disposable incomes are increasingly inclined to purchase higher priced products, particularly in the areas of infant formula and nutritional products. In addition, we believe that opportunistic product marketing and distribution, such as with our recent packed milk sales activities in primary and middle schools, will reinforce our brand and reputation. | |

| • | Align sourcing, production and distribution by region. We believe that we can increase our efficiency and decrease our costs if our products are produced from local sources and sold in local markets. We plan to select strategic locations for our company-owned collection stations and production facilities that will enhance this efficiency. | |

| • | Maintaining quality through world-class production processes. We believe we can maintain our production of high quality dairy products by continuing to source high quality milk through exclusive contracts with the Dairy Farms and other dairy farmers, expanding our company-owned collection stations and production facilities, and continuing to employ comprehensive testing and quality control measures. |

Competition

The dairy industry in China is highly competitive. We face significant competition from large multinational producers, such as Dumex, Mead Johnson, Abbott and Wyeth, and large national milk companies, such as Yili, Beingmate, Synutra and Yashili, particularly in more affluent major urban areas. Many of our competitors have greater resources and sell more products than we do. We believe that our competitive position has improved following the melamine crisis in 2008, which did not involve any of our products. We also believe our competitive position has improved in light of AQSIQ revoking the license in 2012 of approximately 40% of China’s dairy facilities, although we believe many such facilities had significantly smaller operations than we do. Our products are positioned as premium products and, accordingly, are generally priced higher than many similar competitive products. We believe that the principal competitive factors in marketing our products are quality, taste, freshness, price and product recognition. While we believe that we compete favorably in terms of quality, taste and freshness, our products are more expensive and less well known than certain other established brands. Our premium products may also be considered in competition with non-premium quality dairy products for discretionary food dollars.

Government Regulation

We are regulated under national, provincial and local laws in China. The following information summarizes aspects of those regulations that apply to us and is qualified in its entirety by reference to all particular statutory or regulatory provisions. Regulations at the national, provincial and local levels in China are subject to change. To date, compliance with governmental regulations has not had a material impact on our level of capital expenditures, earnings or competitive position, but, because of the evolving nature of such regulations, we are unable to predict the impact such regulations may have in the foreseeable future.

As a producer and distributor of nutritional products, and particularly dairy-based food products in China, we are subject to the regulations of China’s Agricultural Ministry and Ministry of Health. This regulatory scheme governs the manufacture (including composition and ingredients), labeling, packaging and safety of food. Specific PRC laws and regulations we face include:

| • | the PRC Product Quality Law; | |

| • | the PRC Food Hygiene Law; |

| 8 |

| • | the Access Conditions for Dairy Products Processing Industry; | |

| • | the Implementation Rules on the Administration and Supervision of Quality and Safety in Food Producing and Processing Enterprises; | |

| • | the Regulation on the Administration of Production Licenses for Industrial Products; | |

| • | the General Measure on Food Quality Safety Market Access Examination; | |

| • | the General Standards for the Labeling of Prepackaged Foods; | |

| • | the Implementation Measures on Examination of Dairy Product Production Permits; | |

| • | the Standardization Law; | |

| • | the Raw Milk Collection Standard; | |

| • | the Whole Milk Powder, Skimmed Milk Powder, Sweetened Whole Milk Powder and Flavored Milk Powder Standards; and | |

| • | the General Technical Requirements for Infant Formula Powder and Supplementary Cereal for Infants and Children. |

We and our products are also subject to provincial and local regulations through such measures as the licensing of dairy manufacturing facilities, enforcement of standards for our products, inspection of our facilities and regulation of our trade practices in connection with the sale of dairy products.

In March 2008, the PRC National Development and Reform Commission, or the NDRC, promulgated the Access Conditions for Dairy Products Processing Industry, or the Access Conditions. The Access Conditions set forth the conditions an entity must satisfy in order to engage, or continue to engage, in the dairy products processing business in China, including technique and equipment, product quality, energy and water consumption, sanitation and environmental protection, as well as production safety. Any new or continuing dairy products processing projects or enterprises will be required to meet all the conditions and requirements set forth in the Access Conditions. For projects or enterprises that already commenced operations before the promulgation of the Access Conditions, improvements or rectification actions may need to be taken in order to have such projects or enterprises meet the conditions within two years of the effective date of the Access Conditions on April 1, 2010.

The Access Conditions also set forth requirements relating to the location, processing capacity and raw milk source for any new or continuing dairy products processing project or enterprise. Any new or continuing dairy processing projects or enterprises that fail to meet the requirements will not be able to procure land, license, permits, loan facilities and electricity necessary for the processing of dairy products, and those projects or enterprises already in operation before the promulgation of the Access Conditions will be deregistered and ordered to shut down if they fail to meet the conditions within a two-year rectification period.

In May 2008, the NDRC issued the Dairy Industry Policies, or the Policies. According to the PRC government, the Policies are the first set of comprehensive government policies on the dairy industry in China, covering a broad range of matters such as industry planning, closure of inefficient capacity, milk supply, quality control and product safety, environmental protection and promotion of milk consumption. Moreover, the Policies provide conditions that new entrants to the dairy industry must meet in addition to the conditions set forth in the Access Conditions.

As a result of the melamine crisis, PRC governmental authorities have conducted several dairy industry inspections. In addition to the initial 22 companies implicated in the melamine crisis, these subsequent government inspections have identified other companies with unacceptable contaminants in dairy products. The melamine crisis did not involve any of our products, and we have passed all of these government inspections. In addition, we have worked with the PRC government and attended several emergency meetings to discuss ways to improve the dairy and overall food industry in China.

| 9 |

In 2010, AQSIQ announced a nationwide renewal inspection for all infant formula manufacturing facilities in China. AQSIQ has announced that approximately 40% of China’s dairy facilities had their licenses revoked in 2012. In March 2011, we successfully renewed our manufacturing license and the licenses’ term of validity was 3 years.

Environmental Matters

Our manufacturing facilities are subject to various pollution control regulations with respect to noise, water and air pollution and the disposal of waste and hazardous materials. We are also subject to periodic inspections by local environmental protection authorities. Our operating subsidiaries have received certifications from the relevant PRC government agencies in charge of environmental protection indicating that their business operations are in material compliance with the relevant PRC environmental laws and regulations. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

Employees

As of March 15, 2013, we had approximately 1,932 employees on our payroll. We had 7 group administrators, approximately 535 employees were in marketing and sales, approximately 70 employees provided marketing support, approximately 159 employees were performing administrative functions, including financing, auditing and human resources, approximately 1,161 employees were in production, storage and distribution and 7 employees were in research and development functions. Our employees are not represented by a labor union or covered by a collective bargaining agreement. We have not experienced any work stoppages. We believe that our relations with our employees are good.

Financial Information about Segments and Geographic Areas

Until October 31, 2011, we had two reportable segments: dairy products and dairy farms. The dairy products segment produces and sells dairy products, such as wholesale and retail milk powders as well as soybean powder, rice cereal, walnut powder and walnut oil. In October 2011, we sold the Dairy Farms we previously operated. As of December 31, 2012, we only operate our dairy products segment. See “-Discontinued Operations.” As we primarily generate our revenues from customers in the PRC, no geographical segments are presented.

Available Information

Our website is http://ady.feihe.com. We provide free access to various reports that we file with, or furnish to, the U.S. Securities and Exchange Commission, or the SEC, through our website, as soon as reasonably practicable after they have been filed or furnished. These reports include, but are not limited to, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports. Also available on our website are printable versions of our Code of Business Conduct and Ethics and charters of our Audit Committee, Compensation Committee, Nominating/Corporate Governance Committee and other committees of our board of directors. Information on our website does not constitute part of and is not incorporated by reference into this Annual Report on Form 10-K or any other report we file or furnish with the SEC. Our SEC reports can also be accessed through the SEC’s website at www.sec.gov and may be read or copied at the SEC’s Public Reference Room located at 100 F Street, NE, Washington, D.C., 20549. Information regarding the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

FORWARD-LOOKING STATEMENTS

The statements included in this report that are not purely historical are forward-looking statements within the meaning of Section 21E of the Exchange Act, and Section 27A of the Securities Act of 1933, as amended, or the Securities Act. These statements include, but are not limited to, statements about our plans, objectives, expectations, strategies, intentions or other characterizations of future events or circumstances and are generally identified by the words “may,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “could,” “would,” and similar expressions. Because these forward-looking statements are subject to a number of risks and uncertainties, our actual results could differ materially from those expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed under the heading “Risk Factors” and in other documents we file from time to time with the Securities and Exchange Commission. All forward-looking statements included in this report are based on information available to us on the date hereof. Our business and the associated risks may have changed since the date this report was originally filed with the SEC. We assume no obligation to update any such forward-looking statements.

| 10 |

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this report before purchasing our common stock. If any of the following events were to occur, our business, financial condition or results of operations could be materially and adversely affected. In these circumstances, the market price of our common stock could decline, and you could lose some or all of your investment. Additional risks and uncertainties not currently known to us or that we currently believe to be immaterial could also materially and adversely affect our business, financial condition, operating results and/or cash flow.

Any negative public perception regarding our products or industry, or any ill effects or product liability claims, could harm our reputation, damage our brand, result in costly and damaging recalls, and expose us to government investigations and sanctions, which would materially and adversely affect our results of operations.

We sell products for human consumption, which involves risks such as product contamination, spoilage and tampering. In 2008, sales in China of substandard milk formula contaminated with a substance known as melamine caused the death of six infants as well as illness of nearly 300,000 others. In 2010, 2011 and 2012, new incidents of substandard milk formula contaminated with melamine and hydrolyzed leather protein also occurred in China. Although our products were not involved in these incidents, AQSIQ found that the products of at least 22 Chinese milk and formula producers were contaminated by melamine, a substance not approved for use in food, which caused significant negative publicity for the entire dairy industry in China. Furthermore, in 2010 there were widely publicized claims that certain Chinese infant formula products were linked to precocious puberty in female infants. While governmental authorities concluded these claims were false, the operations of the companies involved were adversely effected. The mere publication of information asserting that our milk powder, infant formula or other products contain melamine or other contaminants or have harmful health effects could have a material adverse effect on us, regardless of whether these reports are scientifically supported or concern our products or the raw materials used in our products. In addition, if the consumption of any of our products causes injury, illness or death, we may face product liability claims, product recalls, temporary or permanent suspensions of operations, government investigations or sanctions, any of which could be extremely expensive and damaging to our business.

Prior to and after the 2008 melamine crisis, there were also widely publicized occurrences of counterfeit, substandard milk products in China. For example, in April 2004, such sales of counterfeit and substandard infant formula in Anhui Province, China caused the deaths of 13 infants and harmed many others. Counterfeiting or imitation of our products may occur in the future, and we may not be able to detect it and deal with it effectively. Any occurrence of counterfeiting or imitation could negatively impact our corporate brand and image or consumers’ perception of our products or similar nutritional products generally, particularly if the counterfeit or imitation products cause injury or death to consumers.

Our products may not achieve market acceptance.

We are currently selling our products principally in northern, central, and eastern China. Achieving market acceptance for our products, particularly in new markets, will require substantial marketing efforts and the expenditure of significant funds. There is substantial risk that any new markets may not accept or be as receptive to our products. In addition, we market our products as premium and super-premium products and have adopted a corresponding pricing model, which may not be accepted in new or existing markets. Market acceptance of our current and proposed products will depend, in large part, upon our ability to inform potential customers that the distinctive characteristics of our products make them superior to competitive products and justify their pricing. Our current and proposed products may not be accepted by consumers or able to compete effectively against other premium or non-premium dairy products. Lack of market acceptance would limit our revenues.

| 11 |

Our planned growth may require more raw milk than is available and could diminish the quality of our dairy products.

Our business requires a supply of raw milk. Our growth will be limited if the supply of raw milk is insufficient to meet demand. Moreover, as we attempt to implement our growth strategy, it may become difficult to maintain current levels of quality control. Inadequate quality control could harm our reputation and the demand for our products, which would also limit our growth. A significant amount of the raw milk used in our products is supplied to us by numerous local farms under output contracts. We believe that our farmers can increase their production of raw milk. We further believe, however, that this supply may not be sufficient to meet increased demand for our products associated with our proposed marketing efforts and that such increase may compromise quality. Though we believe that additional raw milk is available locally, if needed, we may not be able to enter into arrangements with the producers of such milk on terms acceptable to us, if at all. Our efforts to source milk through the Dairy Farms are new, may involve unforeseen difficulties, and may not supply the quantity of raw milk we need to maintain and expand our levels of production. An inadequate supply of raw milk, coupled with concern over quality control, could increase costs for raw milk or decrease the sales price for our products, which could limit our ability to grow, cause our earnings to decline and make our business unable to become profitable.

We may not consummate the transactions contemplated by the Merger Agreement or may suffer adverse effects in our efforts to close the transactions it contemplates.

On March 3, 2013, we entered into the Merger Agreement to effectuate a going private proposal. Pursuant to the terms and subject to the conditions of the Merger Agreement, Merger Sub would merge with and into us, and we would survive as a wholly-owned subsidiary of Parent and a wholly-owned indirect subsidiary of Holdco. In connection with and at the effective time of the merger, each share of our common stock that is outstanding immediately prior to the effective time of the merger would be cancelled in consideration for the right to receive $7.40 in cash without interest, except for those shares beneficially owned by the Rollover Shareholders, Holdco, Parent, Merger Sub, us or any subsidiary immediately prior to the effective time of the merger, which shares would be cancelled for no consideration at the effective time of the merger, subject to applicable dissenters rights. The Merger Agreement contains several closing conditions, including certain shareholder approvals and other covenants that may be difficult to perform, and confers certain termination rights. There can be no assurance that this or any other transaction will be approved or consummated on a timely basis, or at all.

In addition, our efforts to close the transactions contemplated by the Merger Agreement may have any number of adverse effects on us, whether or not the transactions close, including:

| • | our announcement or the pendency of the merger may adversely impact our business relationships, operating results and business generally; | |

| • | our management’s attention may be diverted from our ongoing business operations; | |

| • | we may incur substantial amounts of costs, fees, expenses and charges related to the merger and the actual terms of the financing that will be obtained for the merger; and | |

| • | we may face heightened risks of litigation, regulatory proceedings or enforcement matters that may be instituted against us and others relating to the merger. |

The recent global economic and financial market crisis could significantly impact our financial condition.

Current global economic conditions could have a negative effect on our business and results of operations. Economic activity in China, the United States, Europe and much of the world has undergone significant economic downturns following the housing crisis in the real estate and credit markets in both the United States and Europe, as well as natural disasters and related concerns in Asia. Market disruptions have included extreme volatility in securities prices, as well as severely diminished liquidity and credit availability. The economic crisis may adversely affect us in a variety of ways. Access to lines of credit or the capital markets may be severely restricted, which may preclude us from raising funds required for operations and to fund continued expansion. It may be more difficult for us to complete strategic transactions with third parties. The financial and credit market turmoil could also negatively impact our suppliers and customers, which could decrease our ability to source, produce and distribute our products and could decrease demand for our products. While it is not possible to predict with certainty the duration or severity of the current disruption in financial and credit markets, if economic conditions worsen, it is possible these factors could significantly impact our financial condition.

Our results of operations may be affected by fluctuations in availability and price of raw materials.

The raw materials we use are subject to price fluctuations due to various factors beyond our control, including, among other pertinent factors:

| 12 |

| • | increasing market demand; | |

| • | inflation; | |

| • | severe climatic and environmental conditions; | |

| • | seasonal factors, with dairy cows generally producing more milk in temperate weather as opposed to cold or hot weather and extended unseasonably cold or hot weather potentially leading to lower than expected production; | |

| • | commodity price fluctuations; | |

| • | currency fluctuations; and | |

| • | changes in governmental and agricultural regulations and programs. |

For example, our external raw milk unit purchase cost increased by approximately 6% in 2012 due to various factors, including, we believe, general economic conditions, such as inflation and fuel prices, and rising production costs due to various other factors, including increased competition abroad and currency appreciation. We also expect that our raw material prices will continue to fluctuate and be affected by all of these factors in the future. Changes to our raw materials prices may result in increases in production and packaging costs, and we may be unable to raise the prices of our products to offset such increases in the short term or at all. As a result, our results of operations may be materially and adversely affected.

| 13 |

We are subject to public company reporting and other requirements for which we will incur substantial costs and our accounting and other management systems and resources may not be adequately prepared.

We incur significant legal, accounting, insurance and other expenses as a result of being a public company. For example, laws and regulations affecting public companies, including the provisions of the Sarbanes-Oxley Act of 2002, or SOX, and rules related to corporate governance and other matters subsequently adopted by the SEC and the NYSE result in substantial costs to us, including legal and accounting costs, and may divert our management’s attention from other matters that are important to our business.

We have historically identified material weaknesses in our internal control over financial reporting. If we fail to remediate the material weaknesses or maintain an effective system of internal control over financial reporting, we may be unable to accurately report our financial results or prevent fraud, and investor confidence and the market price of our shares may be adversely affected.

We and our independent registered public accounting firm, in connection with the audit of internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act for the fiscal year ended December 31, 2012, have identified the following material weaknesses in our internal control over financial reporting: There was insufficient accounting personnel with appropriate knowledge of accounting principles generally accepted in the United States of America, or U.S. GAAP. We identified the same material weakness as of December 31, 2011 and similar material weaknesses in prior years. A "material weakness" is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company's annual or interim financial statements will not be prevented or detected on a timely basis. We have taken measures and plan to continue to take measures to remedy this material weakness. However, the implementation of these measures may not fully address the material weakness in our internal control over financial reporting. Our failure to address any control deficiency could result in inaccuracies in our financial statements and could also impair our ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis. Moreover, effective internal control over financial reporting is important to prevent fraud. As a result, our business, financial condition, results of operations and prospects, as well as the trading price of our shares, may be materially and adversely affected.

We significantly depend on our management team.

Each of our executive officers is responsible for an important aspect of our operations. In addition, we rely on management and senior personnel to ensure that our sourcing, production, sales, distribution and other business functions are effective. Losing the services of our executive officers or key personnel could be detrimental to our operations. We do not have key-man life insurance for any of our executive officers or other employees.

Investors may not be able to enforce judgments entered by United States courts against certain of our officers and directors.

We are incorporated in the State of Utah. However, a majority of our directors and executive officers, and certain of our principal shareholders, live outside of the U.S., principally in China. In addition, substantially all of our assets are located outside of the U.S. As a result, you may not be able to effect service of process upon those persons within the U.S. or enforce against those persons judgments obtained in U.S. courts.

We face substantial competition in connection with the marketing and sale of our products.

Our products compete with other premium quality dairy brands as well as less expensive, non-premium brands. Our products face competition from non-premium producers distributing in our marketing area and other producers packaging their products in our marketing area. Many of our competitors are well established, have greater financial, marketing, personnel and other resources, have more established distribution channels into major markets, and have products that have gained wide customer acceptance in the marketplace. Our largest competitors are multi-national dairy companies owned by the government of China. The greater financial resources of such competitors will permit them to procure retail store shelf space and to implement extensive marketing and promotional programs, both generally and in direct response to advertising efforts by us. The dairy industry in China is also characterized by the frequent introduction of new products, accompanied by substantial promotional campaigns, such as large discounts to distributors. In addition, distributors in China often engage in cross-territory selling activities, which involve their diversion of products into different geographic regions, which can disrupt the price of our products and adversely impact our revenues. We may be unable to compete successfully with our competitors in some or all of our markets, and our competitors may develop products which have superior qualities or gain wider market acceptance than ours.

| 14 |

We may incur costs related to expansion into new plants and ventures, which may not prove to be profitable. Moreover, any delays in our expansion plans could adversely impact our results of operations and jeopardize our business.

Our expansion strategy has historically involved, and may in the future involve acquisitions and construction of milk production facilities. Our cost estimates and projected completion dates for construction of new production facilities may change significantly as the projects progress. In addition, projects could entail significant construction risks, including shortages of materials or skilled labor, unforeseen environmental or engineering problems, weather interferences, unanticipated cost increases or budgetary constraints, any of which could have a material adverse effect on the projects and could delay their scheduled openings. A delay in scheduled openings of production facilities could delay our receipt of sales revenues from such facilities, which, when coupled with the increased costs and expenses of our expansion, could prevent us from becoming profitable.

Our plans to finance, develop, and expand our production facilities could be subject to the many risks inherent in the rapid expansion of a high growth business enterprise, including unanticipated design, construction, regulatory and operating problems, and the significant risks commonly associated with implementing a marketing strategy in changing and expanding markets. These projects may not become operational within their estimated time frames and budgets as projected at the time we enter into a particular agreement, or at all. In addition, we may develop projects as joint ventures in an effort to reduce our financial commitment to individual projects. The significant expenditures required to expand our production plants may not ultimately prove to be profitable.

When our future expansion projects become operational, we will be required to add and train personnel, expand our management information systems and control expenses. If we do not successfully address our increased management needs or are otherwise unable to manage our growth effectively, our operating results could be materially and adversely affected.

We face the potential risk of product liability associated with food products.

We face the risk of liability in connection with the sale and consumption of dairy products and other products should the consumption of such products cause injury, illness or death. Such risks may be particularly great in a company undergoing rapid and significant growth. The successful assertion of product liability claims against us could result in potentially significant monetary damages, divert management resources and require us to make significant payments and incur substantial legal expenses. We do not currently maintain product liability insurance. Any insurance that we may obtain in the future may be insufficient to cover potential claims or the level of insurance coverage needed may be unavailable at a reasonable cost. Even if a product liability claim is not successfully pursued to judgment by a claimant, we may still incur substantial legal expenses defending against such a claim and our brand image and reputation would suffer. Finally, serious product quality concerns could result in governmental action against us, which, among other things, could result in mandatory recalls of our products, the suspension of production or distribution of our products, loss of certain licenses, or other governmental penalties, including possible criminal liability.

Doing business in China involves various political and economic risks.

We conduct substantially all of our operations and generate most of our revenue in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. China’s economy differs from the economies of most developed countries in many respects, including:

| • | the higher level of government involvement and regulation; | |

| • | the early stage of development of the market-oriented sector of the economy; | |

| • | the rapid growth rate; | |

| • | the higher level of control over foreign exchange; and | |

| • | government control over the allocation of many resources. |

As China’s economy has been transitioning from a planned economy to a more market-oriented economy, the government of China has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall economy of China, they may also have a negative effect on us.

Although the government of China has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways. Any adverse change in the economic conditions or government conditions or government policies in China could have a material adverse effect on the overall economic growth and the level of consumer spending in China, which in turn could lead to a reduction in demand for our products and consequently have a material adverse effect on our business and prospects.

| 15 |

Extensive regulation of the food processing and distribution industry in China could increase our expenses and make us unable to become profitable.

We are subject to extensive regulation by China’s Agricultural Ministry, Ministry of Health and by other provincial and local authorities in jurisdictions in which our products are processed or sold, regarding the processing, packaging, storage, distribution and labeling of our products. For instance, in June 2009, regulatory requirements became effective in China requiring new package labeling for dairy products, which we believe impacted our sales cycles during the three months ended June 30, 2009. Additional labeling requirements became effective in June 2010 for all dairy products. Such requirements may have rapid implementation dates, require significant planning or expense, and have an adverse impact on our sales, inventory levels, or packing and distribution.

Other applicable laws and regulations governing our products may include nutritional labeling, product standardization requirements and serving size requirements. Our processing facilities and products are subject to periodic inspection by national, provincial and local authorities. For instance, in 2010, AQSIQ announced a nationwide renewal inspection for all infant manufacturing facilities. In March 2011, we successfully renewed our manufacturing license and the licenses’ term of validity was 3 years, although in 2011 approximately 40% of PRC dairy facilities did not. We may fall out of substantial compliance with current laws and regulations or may be unable to comply with any future laws and regulations. To the extent that new regulations are adopted, we will be required, possibly at considerable expense, to adjust our activities in order to comply with such regulations. Our failure to comply with applicable laws and regulations could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as potential criminal sanctions, which could have a material adverse effect on our business, operations and finances.

Regulations affecting acquisitions of PRC companies by foreign entities may make it more difficult for us to complete acquisitions and grow our business.

In 2005, the PRC State Administration of Foreign Exchange, or SAFE, issued a public notice, known as “Circular 75,” concerning the application of foreign exchange regulations to mergers and acquisitions involving foreign investment in China. Among other things, the public notice provides that if an offshore company controlled by PRC residents intends to acquire a PRC company, such acquisition will be subject to strict examination by the relevant foreign exchange authorities. Under Circular 75, if an acquisition of a PRC company by an offshore company controlled by PRC residents occurred prior to the issuance of Circular 75, certain PRC residents were required to submit a registration form to the local SAFE branch to register their ownership interests in the offshore company before March 31, 2006. Such PRC residents must also amend the registration form if there is a material event affecting the offshore company, such as, among other things, a change of the company’s share capital, a transfer of shares, or if the company is involved in a merger, an acquisition or a spin-off transaction or uses its assets in China to guarantee offshore obligations. In the past, we have acquired a number of assets from, or equity interests in, PRC companies.

There is still significant uncertainty in China regarding the interpretation and implementation of Circular 75. Nevertheless, we have requested that our shareholders who are PRC residents make the necessary applications, filings and amendments that required under Circular 75 and related regulations. However, all of our PRC-resident shareholders may not comply with such requirements. We also cannot predict how these regulations will affect our future acquisition strategy and business operations. For example, if we decide to acquire additional PRC companies, we or the owners of such companies may not be able to complete the filings and registrations, if any, required by the SAFE notices. Failure to complete Circular 75 registrations may limit the ability of our PRC subsidiaries to issue dividends to us, limit our ability to inject additional capital into our subsidiaries, restrict our ability to implement our acquisition strategy and adversely affect our business and prospects.

| 16 |

In addition, in September 2006 six PRC regulatory authorities, including the PRC Ministry of Commerce and the PRC Securities Regulatory Commission, jointly promulgated a rule entitled “Provisions regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors,” or the M&A Rules. The M&A Rules establish additional procedures and requirements that could make merger and acquisition activities by foreign investors more time-consuming and complex, including, in some circumstances, advance notice to the Ministry of Commerce of any change-of-control transaction in which a foreign investor takes control of a PRC domestic enterprise. Compliance with the M&A Rules, and any related approval processes, including obtaining approval from the Ministry of Commerce, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

Furthermore, in August 2008, SAFE issued a notice, known as “Circular 142,” regulating the conversion by a foreign-invested company of foreign currency into PRC currency, the Reminbi or RMB, by restricting the uses for the converted RMB. Circular 142 requires that the registered capital of a foreign-invested company denominated in RMB but converted from a foreign currency may only be used pursuant to the purposes set forth in the foreign-invested company’s business scope as approved by the applicable governmental authority. Such registered capital may not be used for equity investments within the PRC. In addition, SAFE strengthened its oversight of the flow and use of the registered capital of a foreign-invested company that was denominated in RMB but converted from foreign currency. Violations of Circular 142 may result in severe penalties, including significant fines. As a result, Circular 142 may significantly limit our ability to invest in or acquire other PRC companies using the RMB-denominated capital of our PRC subsidiaries.

The PRC government’s recent measures to curb inflation rates could adversely affect future results of operations.

China has faced rising inflation in recent years. The government of China undertook various measures to alleviate the effects of inflation, especially with respect to key commodities. In January 2008, the PRC National Development and Reform Commission announced national price controls on various products, including milk. Similarly, the government of China may conclude that the prices of infant formula or other of our products are too high and may institute price controls that would limit our ability to set prices for our products as we might wish. The government of China has also encouraged local governments to institute price controls on similar products. Such price controls could adversely affect our future results of operations and, accordingly, the price of our common stock.

Our independent registered public accounting firm, like others operating in China, is not permitted to be subject to inspection by the Pubic Company Accounting Oversight Board and, as such, you may be deprived of any benefits of such inspection.

Our independent registered public accounting firm that issues the audit report included in this Annual Report on Form 10-K, as auditors of companies that are traded publicly in the United States and a firm registered with the Public Company Accounting Oversight Board (United States), or the PCAOB, is required by the laws of the United States to undergo regular inspections by the PCAOB to assess its compliance with the laws of the United States and professional standards.

However, our operations are mainly located in the PRC, a jurisdiction where the PCAOB is currently unable to conduct inspections without the approval of relevant PRC authorities. Our independent registered public accounting firm, like others operating in China (and Hong Kong, to the extent their audit clients have operations in China), is currently not subject to inspection conducted by the PCAOB.

Inspections of other firms that the PCAOB has conducted outside China have identified deficiencies in those firms’ audit procedures and quality control procedures. Certain deficiencies revealed in the inspection process can be addressed to improve future audit quality. The inability of the PCAOB to conduct full inspections of auditors operating in China makes it difficult to evaluate our auditor’s audit procedures and quality control procedures. As a result, our investors may be deprived of the benefits of any PCAOB inspections.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially all of our revenues in Renminbi. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior SAFE approval by complying with certain procedural requirements. However, approval from or registration with appropriate government authorities is required where Renminbi is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may also, at its discretion, restrict access to foreign currencies for current account transactions in the future. If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders.

| 17 |

Fluctuation in the value of the Renminbi against the U.S. dollar may have a material adverse effect on your investment.

The value of the Renminbi against the U.S. dollar and other currencies is affected by, among other things, changes in China’s political and economic conditions and China’s foreign exchange policies. The conversion of the Renminbi into foreign currencies, including the U.S. dollar, has been based on exchange rates set by the People’s Bank of China. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the Renminbi solely to the U.S. dollar. Under this revised policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. Following the removal of the U.S. dollar peg, the Renminbi appreciated approximately 21.5% against the U.S. dollar over the following three years. Since July 2008, however, the Renminbi has traded within a narrow range against the U.S. dollar. As a consequence, the Renminbi has fluctuated significantly since July 2008 against other freely traded currencies, in tandem with the U.S. dollar. On June 20, 2010, the People’s Bank of China announced that the PRC government will further reform the Renminbi exchange rate regime and enhance the Renminbi exchange rate flexibility.

| 18 |

Significant revaluation of the Renminbi may have a material adverse effect on your investment. If we decide to convert our Renminbi into U.S. dollars for the purpose of making payments for dividends on our common shares or for other business purposes, appreciation of the U.S. dollar against the Renminbi would have a negative effect on the U.S. dollar amount available to us.

Under the EIT Law, we may be classified as a “resident enterprise” of China, which would likely result in unfavorable tax consequences to us and our non-PRC shareholders.