UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2017 OR

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-3473

| “COAL KEEPS YOUR LIGHTS ON” |  |

“COAL KEEPS YOUR LIGHTS ON” |

HALLADOR ENERGY COMPANY

(www.halladorenergy.com)

|

Colorado (State of incorporation) |

84-1014610 (IRS Employer Identification No.) | |

|

1660 Lincoln Street, Suite 2700, Denver, Colorado (Address of principal executive offices) |

80264-2701 (Zip Code) |

Issuer's telephone number: 303.839.5504

| Securities registered pursuant to Section 12(b) of the Exchange Act: | Name of each Exchange on which registered | |

| Common Stock, par value $.01 per share | Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "larger accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| ¨ Large accelerated filer | þ Accelerated filer |

| ¨ Non-accelerated filer (do not check if a small reporting company) | ¨ Smaller reporting company |

| ¨ Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

The aggregate market value of the common stock held by non-affiliates (public float) on June 30, 2017 was $124.5 million based on the closing price reported that date by the NASDAQ of $7.77 per share.

As of March 9, 2018, we had 29,955,713 shares outstanding.

Portions of our Proxy Statement to be filed with the SEC in connection with our annual stockholders’ meeting are incorporated by reference into Part III of this Form 10-K. Our Annual Meeting of Shareholders will be held on May 23, 2018 in New York City, NY.

FORWARD-LOOKING STATEMENTS

Certain statements and information in this Annual Report on Form 10-K may constitute “forward-looking statements.” These statements are based on our beliefs as well as assumptions made by, and information currently available to us. When used in this document, the words “anticipate,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “may,” “project,” “will,” and similar expressions identify forward-looking statements. Without limiting the foregoing, all statements relating to our outlook, anticipated capital expenditures, future cash flows and borrowings and sources of funding are forward-looking statements. These statements reflect our current views with respect to future events and are subject to numerous assumptions that we believe are reasonable, but are open to a wide range of uncertainties and business risks, and actual results may differ materially from those discussed in these statements. Among the factors that could cause actual results to differ from those in the forward-looking statements are:

| · | changes in competition in coal markets and our ability to respond to such changes; |

| · | changes in coal prices, which could affect our operating results and cash flows; |

| · | risks associated with the expansion of our operations and properties; |

| · | legislation, regulations, and court decisions and interpretations thereof, including those relating to the environment, mining, miner health and safety and health care; |

| · | deregulation of the electric utility industry or the effects of any adverse change in the coal industry, electric utility industry, or general economic conditions; |

| · | dependence on significant customer contracts, including renewing customer contracts upon expiration of existing contracts; |

| · | changing global economic conditions or in industries in which our customers operate; |

| · | liquidity constraints, including those resulting from any future unavailability of financing; |

| · | customer bankruptcies, cancellations or breaches to existing contracts, or other failures to perform; |

| · | customer delays, failure to take coal under contracts or defaults in making payments; |

| · | adjustments made in price, volume or terms to existing coal supply agreements; |

| · | fluctuations in coal demand, prices and availability; |

| · | our productivity levels and margins earned on our coal sales; |

| · | changes in raw material costs; |

| · | changes in the availability of skilled labor; |

| · | our ability to maintain satisfactory relations with our employees; |

| · | increases in labor costs, adverse changes in work rules, or cash payments or projections associated with post-mine reclamation and workers’ compensation claims; |

| · | increases in transportation costs and risk of transportation delays or interruptions; |

| · | operational interruptions due to geologic, permitting, labor, weather-related or other factors; |

| · | risks associated with major mine-related accidents, such as mine fires, or interruptions; |

| · | results of litigation, including claims not yet asserted; |

| · | difficulty maintaining our surety bonds for mine reclamation; |

| · | the coal industry’s share of electricity generation, including as a result of environmental concerns related to coal mining and combustion and the cost and perceived benefits of other sources of electricity, such as natural gas, nuclear energy and renewable fuels; |

| · | uncertainties in estimating and replacing our coal reserves; |

| · | a loss or reduction of benefits from certain tax deductions and credits; |

| · | difficulty obtaining commercial property insurance; |

| · | difficulty in making accurate assumptions and projections regarding future revenue and costs associated with equity investments in companies we do not control; and |

| · | other factors, including those discussed in “Item 1A. Risk Factors.” |

| 2 |

If one or more of these or other risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results may differ materially from those described in any forward-looking statement. When considering forward-looking statements, you should also keep in mind the risk factors described in “Item 1A. Risk Factors” below. The risk factors could also cause our actual results to differ materially from those contained in any forward-looking statement. We disclaim any obligation to update the above list or to announce publicly the result of any revisions to any of the forward-looking statements to reflect future events or developments.

You should consider the information above when reading any forward-looking statements contained in this Annual Report on Form 10-K; other reports filed by us with the U.S. Securities and Exchange Commission (“SEC”); our press releases; our website http://www.halladorenergy.com and written or oral statements made by us or any of our officers or other authorized persons acting on our behalf.

ITEM 1. BUSINESS.

See Item 7- MDA for a discussion of our business.

Regulation and Laws

The coal mining industry is subject to extensive regulation by federal, state and local authorities on matters such as:

| · | employee health and safety; |

| · | mine permits and other licensing requirements; |

| · | air quality standards; |

| · | water quality standards; |

| · | storage of petroleum products and substances that are regarded as hazardous under applicable laws or that, if spilled, could reach waterways or wetlands; |

| · | plant and wildlife protection; |

| · | reclamation and restoration of mining properties after mining is completed; |

| · | discharge of materials; |

| · | storage and handling of explosives; |

| · | wetlands protection; |

| · | surface subsidence from underground mining; and |

| · | the effects, if any, that mining has on groundwater quality and availability. |

In addition, the utility industry is subject to extensive regulation regarding the environmental impact of its power generation activities, which has adversely affected demand for coal. It is possible that new legislation or regulations may be adopted, or that existing laws or regulations may be interpreted differently or more stringently enforced, any of which could have a significant impact on our mining operations or our customers’ ability to use coal. For more information, please see risk factors described in “Item 1A. Risk Factors” below.

We are committed to conducting mining operations in compliance with applicable federal, state and local laws and regulations. However, because of the extensive and detailed nature of these regulatory requirements, particularly the regulatory system of the Mine Safety and Health Administration (“MSHA”) where citations can be issued without regard to fault, and many of the standards include subjective elements, it is not reasonable to expect any coal mining company to be free of citations. When we receive a citation, we attempt to remediate any identified condition immediately. While we have not quantified all the costs of compliance with applicable federal and state laws and associated regulations, those costs have been and are expected to continue to be significant. Compliance with these laws and regulations has substantially increased the cost of coal mining for domestic coal producers.

Capital expenditures for environmental matters have not been material in recent years. We have accrued for the present value of the estimated cost of asset retirement obligations and mine closings, including the cost of treating mine water discharge, when necessary. The accruals for asset retirement obligations and mine closing costs are based upon permit requirements and the costs and timing of asset retirement obligations and mine closing procedures. Although management believes it has made adequate provisions for all expected reclamation and other costs associated with mine closures, future operating results would be adversely affected if these accruals were insufficient.

| 3 |

Mining Permits and Approvals

Numerous governmental permits or approvals are required for mining operations. Applications for permits require extensive engineering and data analysis and presentation and must address a variety of environmental, health and safety matters associated with a proposed mining operation. These matters include the manner and sequencing of coal extraction, the storage, use and disposal of waste and other substances and impacts on the environment, the construction of water containment areas, and reclamation of the area after coal extraction. Meeting all requirements imposed by any of these authorities may be costly and time-consuming, and may delay or prevent commencement or continuation of mining operations.

The permitting process for certain mining operations can extend over several years and can be subject to administrative and judicial challenge, including by the public. Some required mining permits are becoming increasingly difficult to obtain in a timely manner, or at all. We cannot assure you that we will not experience difficulty or delays in obtaining mining permits in the future or that a current permit will not be revoked.

We are required to post bonds to secure performance under our permits. Under some circumstances, substantial fines and penalties, including revocation of mining permits, may be imposed under the laws and regulations described above. Monetary sanctions and, in severe circumstances, criminal sanctions may be imposed for failure to comply with these laws and regulations. Regulations also provide that a mining permit can be refused or revoked if the permit applicant or permittee owns or controls, directly or indirectly through other entities, mining operations that have outstanding environmental violations. Although like other coal companies, we have been cited for violations in the ordinary course of our business, we have never had a permit suspended or revoked because of any violation, and the penalties assessed for these violations have not been material.

Mine Health and Safety Laws

Stringent safety and health standards have been imposed by federal legislation since the Federal Coal Mine Health and Safety Act of 1969 (“CMHSA”) was adopted. The Federal Mine Safety and Health Act of 1977 (“FMSHA”), and regulations adopted pursuant thereto, significantly expanded the enforcement of health and safety standards of the CMHSA, and imposed extensive and detailed safety and health standards on numerous aspects of mining operations, including training of mine personnel, mining procedures, blasting, the equipment used in mining operations, and numerous other matters. MSHA monitors and rigorously enforces compliance with these federal laws and regulations. In addition, the states where we operate have state programs for mine safety and health regulation and enforcement. Federal and state safety and health regulations affecting the coal mining industry are perhaps the most comprehensive and rigorous system in the U.S. for protection of employee safety and have a significant effect on our operating costs. Although many of the requirements primarily impact underground mining, our competitors in all of the areas in which we operate are subject to the same laws and regulations.

The FMSHA has been construed as authorizing MSHA to issue citations and orders pursuant to the legal doctrine of strict liability, or liability without fault, and FMSHA requires imposition of a civil penalty for each cited violation. Negligence and gravity assessments, and other factors can result in the issuance of various types of orders, including orders requiring withdrawal from the mine or the affected area, and some orders can also result in the imposition of civil penalties. The FMSHA also contains criminal liability provisions. For example, criminal liability may be imposed upon corporate operators who knowingly and willfully authorize, order or carry out violations of the FMSHA, or its mandatory health and safety standards.

The Federal Mine Improvement and New Emergency Response Act of 2006 (“MINER Act”) significantly amended the FMSHA, imposing more extensive and stringent compliance standards, increasing criminal penalties and establishing a maximum civil penalty for non-compliance, and expanding the scope of federal oversight, inspection, and enforcement activities. Following the passage of the MINER Act, MSHA has issued new or more stringent rules and policies on a variety of topics, including:

| · | sealing off abandoned areas of underground coal mines; |

| · | mine safety equipment, training, and emergency reporting requirements; |

| · | substantially increased civil penalties for regulatory violations; |

| · | training and availability of mine rescue teams; |

| · | underground “refuge alternatives” capable of sustaining trapped miners in the event of an emergency; |

| · | flame-resistant conveyor belts, fire prevention and detection, and use of air from the belt entry; and |

| · | post-accident two-way communications and electronic tracking systems. |

| 4 |

MSHA continues to interpret and implement various provisions of the MINER Act, along with introducing new proposed regulations and standards.

In 2014, MSHA began implementation of a finalized new regulation titled “Lowering Miner’s Exposure to Respirable Coal Mine Dust, Including Continuous Personal Dust Monitors.” The final rule implements a reduction in the allowable respirable coal mine dust exposure limits, requires the use of sampling data taken from a single sample rather than an average of samples, and increases oversight by MSHA regarding coal mine dust and ventilation issues at each mine, including the approval process for ventilation plans at each mine, all of which increase mining costs. The second phase of the rule began in February 2016 and requires additional sampling for designated and other occupations using the new continuous personal dust monitor technology, which provides real-time dust exposure information to the miner. Phase three of the rule began in August 2016 and resulted in lowering the current respirable dust level of 2.0 milligrams per cubic meter to 1.5 milligrams per cubic meter of air. Compliance with these rules can result in increased costs on our operations, including, but not limited to, the purchasing of new equipment and the hiring of additional personnel to assist with monitoring, reporting, and recordkeeping obligations.

Additionally, in July 2014, MSHA proposed a rule addressing the “criteria and procedures for assessment of civil penalties.” Public commenters have expressed concern that the proposed rule exceeds MSHA’s rulemaking authority and would result in substantially increased civil penalties for regulatory violations cited by MSHA. MSHA last revised the process for proposing civil penalties in 2006 and, as discussed above, civil penalties increased significantly. The notice-and-comment period for this proposed rule has closed, and it is uncertain when MSHA will present a final rule addressing these civil penalties.

In January 2015, MSHA published a final rule requiring mine operators to install proximity detection systems on continuous mining machines, over a staggered time frame ranging from November 2015 through March 2018. The proximity detection systems initiate a warning or shutdown the continuous mining machine depending on the proximity of the machine to a miner. MSHA subsequently proposed a rule requiring mine operators to also install proximity detection systems on other types of underground mobile mining equipment. The comment period for this proposed rule closed on April 10, 2017, and it is uncertain when MSHA will promulgate a final rule addressing the issue of proximity detection systems on underground mobile mining equipment, other than continuous mining machines.

In June 2016, MSHA published a request for information on Exposure of Underground Miners to Diesel Exhaust. Following a comment period that closed in November 2016, MSHA received requests for MSHA and the National Institute for Occupational Safety and Health to hold a Diesel Exhaust Partnership to address the issues covered by MSHA's request for information. The comment period for the request for information was reopened and closed in January 2018. It is uncertain whether MSHA will present a proposed rule pertaining to exposure of underground miners to diesel exhaust, after completing its evaluation of the comments received.

Subsequent to passage of the MINER Act, Illinois, Kentucky, Pennsylvania and West Virginia have enacted legislation addressing issues such as mine safety and accident reporting, increased civil and criminal penalties, and increased inspections and oversight. Additionally, state administrative agencies can promulgate administrative rules and regulations affecting our operations. Other states may pass similar legislation or administrative regulations in the future.

Some of the costs of complying with existing regulations and implementing new safety and health regulations may be passed on to our customers. Although we have not quantified the full impact, implementing and complying with these new state and federal safety laws and regulations have had, and are expected to continue to have, an adverse impact on our results of operations and financial position.

Black Lung Benefits Act

The Black Lung Benefits Act of 1977 and the Black Lung Benefits Reform Act of 1977, as amended in 1981 (“BLBA”) requires businesses that conduct current mining operations to make payments of black lung benefits to current and former coal miners with black lung disease and to some survivors of a miner who dies from this disease. The BLBA levies a tax on production of $1.10 per ton for underground-mined coal and $0.55 per ton for surface-mined coal, but not to exceed 4.4% of the applicable sales price, in order to compensate miners who are totally disabled due to black lung disease and some survivors of miners who died from this disease, and who were last employed as miners prior to 1970 or subsequently where no responsible coal mine operator has been identified for claims. In addition, the BLBA provides that some claims for which coal operators had previously been responsible are or will become obligations of the government trust funded by the tax. The Revenue Act of 1987 extended the termination date of this tax from January 1, 1996, to the earlier of January 1, 2014, or the date on which the government trust becomes solvent. We are also liable under state statutes for black lung claims. Congress and state legislatures regularly consider various items of black lung legislation, which, if enacted, could adversely affect our business, results of operations and financial position.

| 5 |

The revised BLBA regulations took effect in January 2001, relaxing the stringent award criteria established under previous regulations and thus potentially allowing new federal claims to be awarded and allowing previously denied claimants to re-file under the revised criteria. These regulations may also increase black lung related medical costs by broadening the scope of conditions for which medical costs are reimbursable and increase legal costs by shifting more of the burden of proof to the employer.

The Patient Protection and Affordable Care Act enacted in 2010, includes significant changes to the federal black lung program, retroactive to 2005, including an automatic survivor benefit paid upon the death of a miner with an awarded black lung claim and establishes a rebuttable presumption with regard to pneumoconiosis among miners with 15 or more years of coal mine employment that are totally disabled by a respiratory condition. These changes could have a material impact on our costs expended in association with the federal black lung program.

Workers’ Compensation

We provide income replacement and medical treatment for work-related traumatic injury claims as required by applicable state laws. Workers’ compensation laws also compensate survivors of workers who suffer employment-related deaths. States in which we operate consider changes in workers’ compensation laws from time to time.

Surface Mining Control and Reclamation Act

The Federal Surface Mining Control and Reclamation Act of 1977 (“SMCRA”) and similar state statutes establish operational, reclamation and closure standards for all aspects of surface mining as well as many aspects of deep mining. Although we have minimal surface mining activity and no mountaintop removal mining activity, SMCRA nevertheless requires that comprehensive environmental protection and reclamation standards be met during the course of and upon completion of our mining activities.

SMCRA and similar state statutes require, among other things, that mined property be restored in accordance with specified standards and approved reclamation plans. SMCRA requires us to restore the surface to approximate the original contours as contemporaneously as practicable with the completion of surface mining operations. Federal law and some states impose on mine operators the responsibility for replacing certain water supplies damaged by mining operations and repairing or compensating for damage to certain structures occurring on the surface as a result of mine subsidence, a consequence of longwall mining and possibly other mining operations. We believe we are in compliance in all material respects with applicable regulations relating to reclamation.

In addition, the Abandoned Mine Lands Program, which is part of SMCRA, imposes a tax on all current mining operations, the proceeds of which are used to restore mines closed before 1977. The tax for surface-mined and underground-mined coal is $0.28 per ton and $0.12 per ton, respectively. We have accrued the estimated costs of reclamation and mine closing, including the cost of treating mine water discharge when necessary. In addition, states from time to time have increased and may continue to increase their fees and taxes to fund reclamation or orphaned mine sites and acid mine drainage control on a statewide basis.

Under SMCRA, responsibility for unabated violations, unpaid civil penalties and unpaid reclamation fees of independent contract mine operators and other third parties can be imputed to other companies that are deemed, according to the regulations, to have “owned” or “controlled” the third-party violator. Sanctions against the “owner” or “controller” are quite severe and can include being blocked from receiving new permits and having any permits revoked that were issued after the time of the violations or after the time civil penalties or reclamation fees became due. We are not aware of any currently pending or asserted claims against us relating to the “ownership” or “control” theories discussed above. However, we cannot assure you that such claims will not be asserted in the future.

The U.S. Office of Surface Mining Reclamation (“OSM”) published in November 2009 an Advance Notice of Proposed Rulemaking, announcing its intent to revise the Stream Buffer Zone (“SBZ”) rule published in December 2008. The SBZ rule prohibits mining disturbances within 100 feet of streams if there would be a negative effect on water quality. Environmental groups brought lawsuits challenging the rule, and in a March 2010 settlement, the OSM agreed to rewrite the SBZ rule. In January 2013, the environmental groups reopened the litigation against OSM for failure to abide by the terms of the settlement. Oral arguments were heard on January 31, 2014. OSM published a notice on December 22, 2014, to vacate the 2008 SBZ rule to comply with an order issued by the U.S. District Court for the District of Columbia. OSM reimplemented the 1983 SBZ rule.

| 6 |

OSM issued its final Stream Protection Rule ("SPR") in December 2016 to replace the vacated SBZ rule. The rule would have generally prohibited the approval of permits issued pursuant to SMCRA where the proposed operations would result in "material damage to the hydrologic balance outside the permit area." Pursuant to the rule, permittees would have also been required to restore any perennial or intermittent streams that a permittee mined through. Finally, the rule would have also imposed additional baseline data collection, surface/groundwater monitoring, and bonding and financial assurance requirements. However, in February 2017, both the U.S. House of Representatives and the Senate passed resolutions disapproving the SPR under the Congressional Review Act ("CRA"). President Trump signed the resolution on February 16, 2017, and, pursuant to the CRA, the SPR "shall have no force or effect" and OSM cannot promulgate a substantially similar rule absent future legislation. Whether Congress will enact future legislation to require a new SPR rule remains uncertain.

Following the spill of coal combustion residues (“CCRs”) in the Tennessee Valley Authority impoundment in Kingston, Tennessee, in December 2009, the EPA issued proposed rules on CCRs in 2010. This final rule was published on December 19, 2014. The EPA's final rule does not address the placement of CCRs in minefills or non-minefill uses of CCRs at coal mine sites. OSM has announced their intention to release a proposed rule to regulate placement and use of CCRs at coal mine sites, but, to date, no further action has been taken. These actions by OSM, potentially could result in additional delays and costs associated with obtaining permits, prohibitions or restrictions relating to mining activities, and additional enforcement actions.

Bonding Requirements

Federal and state laws require bonds to secure our obligations to reclaim lands used for mining, and to satisfy other miscellaneous obligations. These bonds are typically renewable on a yearly basis. It has become increasingly difficult for us and for our competitors to secure new surety bonds without posting collateral. In addition, surety bond costs have increased while the market terms of surety bonds have generally become less favorable to us. It is possible that surety bond issuers may refuse to renew bonds or may demand additional collateral upon those renewals. Our failure to maintain or inability to acquire, surety bonds that are required by state and federal laws would have a material adverse effect on our ability to produce coal, which could affect our profitability and cash flow.

Air Emissions

The CAA and similar state and local laws and regulations regulate emissions into the air and affect coal mining operations. The CAA directly impacts our coal mining and processing operations by imposing permitting requirements and, in some cases, requirements to install certain emissions control equipment, achieve certain emissions standards, or implement certain work practices on sources that emit various air pollutants. The CAA also indirectly affects coal mining operations by extensively regulating the air emissions of coal-fired electric power generating plants and other coal-burning facilities. There have been a series of federal rulemakings focused on emissions from coal-fired electric generating facilities. Installation of additional emissions control technology and any additional measures required under applicable state and federal laws and regulations related to air emissions will make it costlier to operate coal-fired power plants and possibly other facilities that consume coal and, depending on the requirements of individual state implementation plans (“SIPs”), could make coal a less attractive fuel alternative in the planning and building of power plants in the future. A significant reduction in coal’s share of power generating capacity could have a material adverse effect on our business, financial condition and results of operations. Since 2010, utilities have formally announced the retirement or conversion of over 600 coal-fired electric generating units through 2030.

In addition to the greenhouse gas (“GHG”) issues discussed below, the air emissions programs that may affect our operations, directly or indirectly, include, but are not limited to, the following:

| · | The EPA’s Acid Rain Program, provided in Title IV of the CAA, regulates emissions of sulfur dioxide from electric generating facilities. Sulfur dioxide is a by-product of coal combustion. Affected facilities purchase or are otherwise allocated sulfur dioxide emissions allowances, which must be surrendered annually in an amount equal to a facility’s sulfur dioxide emissions in that year. Affected facilities may sell or trade excess allowances to other facilities that require additional allowances to offset their sulfur dioxide emissions. In addition to purchasing or trading for additional sulfur dioxide allowances, affected power facilities can satisfy the requirements of the EPA’s Acid Rain Program by switching to lower-sulfur fuels, installing pollution control devices such as flue gas desulfurization systems, or “scrubbers,” or by reducing electricity generating levels. These requirements would not be supplanted by a replacement rule for the Clean Air Interstate Rule (“CAIR”), discussed below. |

| 7 |

| · | The CAIR calls for power plants in 28 states and Washington, D.C. to reduce emission levels of sulfur dioxide and nitrogen oxide pursuant to a cap-and-trade program similar to the system in effect for acid rain. In June 2011, the EPA finalized the Cross-State Air Pollution Rule (“CSAPR”), a replacement rule for CAIR, which would have required 28 states in the Midwest and eastern seaboard to reduce power plant emissions that cross state lines and contribute to ozone and/or fine particle pollution in other states. Under CSAPR, the first phase of the nitrogen oxide and sulfur dioxide emissions reductions would have commenced in 2012 with further reductions effective in 2014. However, in August 2012, the D.C. Circuit Court of Appeals vacated CSAPR, finding the EPA exceeded its statutory authority under the CAA and striking down the EPA’s decision to require federal implementation plans (“FIPs”), rather than SIPs, to implement mandated reductions. In its ruling, the D.C. Circuit Court of Appeals ordered the EPA to continue administering CAIR but proceed expeditiously to promulgate a replacement rule for CAIR. The U.S. Supreme Court granted the EPA’s certiorari petition appealing the D.C. Circuit Court of Appeals’ decision and heard oral arguments on December 10, 2013. In April 2014, the U.S. Supreme Court reversed and remanded the D.C. Circuit Court of Appeals’ decision, concluding that the EPA’s approach is lawful. CSAPR has been reinstated and the EPA began implementation of Phase 1 requirements in January 2015. In September 2016, the EPA finalized the CSAPR Update to respond to the remand by the D.C. Circuit Court of Appeals. Implementation of Phase 2 began in 2017. Further litigation is expected against the CSAPR Update in the D.C. Circuit Court of Appeals. The impacts of CSAPR Update are unknown at the present time due to the implementation of Mercury and Air Toxic Standards ("MATS"), discussed below, and the significant number of coal retirements that have resulted and that potentially will result from MATS. |

| · | In February 2012, the EPA adopted the MATS, which regulates the emission of mercury and other metals, fine particulates, and acid gases such as hydrogen chloride from coal and oil-fired power plants. In March 2013, the EPA finalized a reconsideration of the MATS rule as it pertains to new power plants, principally adjusting emissions limits to levels attainable by existing control technologies. Appeals were filed, and oral arguments were heard by the D.C. Circuit Court of Appeals in December 2013. On April 15, 2014, the D.C. Circuit Court of Appeals upheld MATS. On June 29, 2015, the Supreme Court remanded the final rule back to the D.C. Circuit holding that the agency must consider cost before deciding whether regulation is necessary and appropriate. On December 1, 2015, the EPA issued, for comment, the proposed Supplemental Finding. In April 2016, the EPA issued a final supplemental finding upholding the rule and concluding that a cost analysis supports the MATS rule. In April 2017, the D.C Circuit Court of Appeals granted EPA's request to cancel oral arguments and ordered the case held in abeyance for an EPA review of the supplemental finding. Many electric generators have already announced retirements due to the MATS rule. Although various issues surrounding the MATS rule remain subject to litigation in the D.C. Circuit, the MATS will force generators to make capital investments to retrofit power plants and could lead to additional premature retirements of older coal-fired generating units. The announced and possible additional retirements are likely to reduce the demand for coal. Apart from MATS, several states have enacted or proposed regulations requiring reductions in mercury emissions from coal-fired power plants, and federal legislation to reduce mercury emissions from power plants has been proposed. Regulation of mercury emissions by the EPA, states, or Congress may decrease the future demand for coal. We continue to evaluate the possible scenarios associated with CSAPR and MATS and the effects they may have on our business and our results of operations, financial condition or cash flows. |

| · | In January 2013, the EPA issued final Maximum Achievable Control Technology (“MACT”) standards for several classes of boilers and process heaters, including large coal-fired boilers and process heaters (“Boiler MACT”), which require owners of industrial, commercial, and institutional boilers to comply with standards for air pollutants, including mercury and other metals, fine particulates, and acid gases such as hydrogen chloride. Businesses and environmental groups have filed legal challenges to Boiler MACT in the D.C. Circuit Court of Appeals and petitioned the EPA to reconsider the rule. On December 1, 2014, the EPA announced a reconsideration of the standard and will accept public comment on five issues for its standards on area sources, will review three issues related to its major-source boiler standards, and four issues relating to commercial and solid waste incinerator units. Before reconsideration, the EPA estimated the rule would affect 1,700 existing major source facilities with an estimated 14,316 boilers and process heaters. While some owners would make capital expenditures to retrofit boilers and process heaters, a number of boilers and process heaters could be prematurely retired. Retirements are likely to reduce the demand for coal. In August 2016, the D.C. Circuit Court of Appeals vacated a portion of the rule while remanding portions back to the EPA. In December 2016, the D.C. Circuit Court of Appeals agreed to the EPA request to remand the rule back to the EPA without vacatur. The impact of the regulations will depend on the EPA's reconsideration and the outcome of subsequent legal challenges. The impact of the regulations will depend on the EPA’s reconsideration and the outcome of subsequent legal challenges. |

| 8 |

| · | The EPA is required by the CAA to periodically re-evaluate the available health effects information to determine whether the national ambient air quality standards (“NAAQS”) should be revised. Pursuant to this process, the EPA has adopted more stringent NAAQS for fine particulate matter (“PM”), ozone, nitrogen oxide and sulfur dioxide. As a result, some states will be required to amend their existing SIPs to attain and maintain compliance with the new air quality standards and other states will be required to develop new SIPs for areas that were previously in “attainment” but do not attain the new standards. In addition, under the revised ozone NAAQS, significant additional emissions control expenditures may be required at coal-fired power plants. Initial non-attainment determinations related to the revised sulfur dioxide standard became effective in October 2013. In addition, in January 2013, the EPA updated the NAAQS for fine particulate matter emitted by a wide variety of sources including power plants, industrial facilities, and gasoline and diesel engines, tightening the annual PM 2.5 standard to 12 micrograms per cubic meter. The revised standard became effective in March 2013. In November 2013, the EPA proposed a rule to clarify PM 2.5 implementation requirements to the states for current 1997 and 2006 non-attainment areas. In July 2016, the EPA issued a final rule for states to use in creating their plans to address the particulate matter. On October 26, 2015, the EPA published a final rule that reduced the ozone NAAQS from 75 to 70 ppb. Murray Energy filed a challenge to the final rule in the D.C. Circuit. Since that time, other industry and state petitioners have filed challenges as have several environmental groups. Attainment dates for the new standards range between 2013 and 2030, depending on the severity of the non-attainment. In April 2017, the D.C. Court of Appeals granted EPA's request to cancel oral arguments and ordered the case held in abeyance for an EPA review of the 2015 Rule. In July 2009, the D.C. Circuit Court of Appeals vacated part of a rule implementing the ozone NAAQS and remanded certain other aspects of the rule to the EPA for further consideration. In June 2013, the EPA proposed a rule for implementing the 2008 ozone NAAQS. Under a consent decree published in the Federal Register in January 2017, the EPA has agreed to review the NAAQS for nitrogen oxides with a final decision due by 2018 and review the NAAQS for sulfur oxide with a final decision due by 2019. In July 2017, the EPA proposed to retain the current NAAQS for nitrogen oxides. The comment period for the proposal closed in September 2017. New standards may impose additional emissions control requirements on new and expanded coal-fired power plants and industrial boilers. Because coal mining operations and coal-fired electric generating facilities emit particulate matter and sulfur dioxide, our mining operations and our customers could be affected when the new standards are implemented by the applicable states, and developments might indirectly reduce the demand for coal. |

| · | The EPA’s regional haze program is designed to protect and improve visibility at and around national parks, national wilderness areas, and international parks. Under the program, states are required to develop SIPs to improve visibility. Typically, these plans call for reductions in sulfur dioxide and nitrogen oxide emissions from coal-fueled electric plants. In recent cases, the EPA has decided to negate the SIPs and impose stringent requirements through FIPs. The regional haze program, including particularly the EPA’s FIPs, and any future regulations may restrict the construction of new coal-fired power plants whose operation may impair visibility at and around federally protected areas and may require some existing coal-fired power plants to install additional control measures designed to limit haze-causing emissions. These requirements could limit the demand for coal in some locations. |

| · | The EPA’s new source review (“NSR”) program under the CAA in certain circumstances requires existing coal-fired power plants, when modifications to those plants significantly increase emissions, to install more stringent air emissions control equipment. The Department of Justice, on behalf of the EPA, has filed lawsuits against a number of coal-fired electric generating facilities alleging violations of the NSR program. The EPA has alleged that certain modifications have been made to these facilities without first obtaining certain permits issued under the program. Several of these lawsuits have settled, but others remain pending. Depending on the ultimate resolution of these cases, demand for coal could be affected. |

| 9 |

Carbon Dioxide Emissions

Combustion of fossil fuels, such as the coal we produce, results in the emission of carbon dioxide, which is considered a GHG. Combustion of fuel for mining equipment used in coal production also emits GHGs. Future regulation of GHG emissions in the U.S. could occur pursuant to future U.S. treaty commitments, new domestic legislation or regulation by the EPA. Congress has considered various proposals to reduce GHG emissions, and it is possible federal legislation could be adopted in the future. Internationally, the Kyoto Protocol set binding emission targets for developed countries that ratified it (the U.S. did not ratify, and Canada officially withdrew from its Kyoto commitment in 2012) to reduce their global GHG emissions. The Kyoto Protocol was nominally extended past its expiration date of December 2012, with a requirement for a new legal construct to be put into place by 2015. The United Nations Framework Convention on Climate Change met in Paris, France in December 2015 and agreed to an international climate agreement (Paris Agreement). Although this agreement does not create any binding obligations for nations to limit their GHG emissions, it does include pledges to voluntarily limit or reduce future emissions. These commitments could further reduce demand and prices for our coal. In June of 2017, President Trump announced that the U.S. would withdraw from the Paris Agreement, which has a four-year exit process. Future participation in the Paris Agreement by the U.S. remains uncertain. However, many states, regions and governmental bodies have adopted GHG initiatives and have or are considering the imposition of fees or taxes based on the emission of GHGs by certain facilities, including coal-fired electric generating facilities. Depending on the particular regulatory program that may be enacted, at either the federal or state level, the demand for coal could be negatively impacted, which would have an adverse effect on our operations.

Even in the absence of new federal legislation, the EPA has begun to regulate GHG emissions under the CAA based on the U.S. Supreme Court’s 2007 decision in Massachusetts v. Environmental Protection Agency that the EPA has authority to regulate GHG emissions. In 2009, the EPA issued a final rule, known as the “Endangerment Finding”,” declaring that GHG emissions, including carbon dioxide and methane, endanger public health and welfare and that six GHGs, including carbon dioxide and methane, emitted by motor vehicles endanger both the public health and welfare.

In May 2010, the EPA issued its final “tailoring rule” for GHG emissions, a policy aimed at shielding small emission sources from CAA permitting requirements. The EPA’s rule phases in various GHG-related permitting requirements beginning in January 2011. Beginning July 1, 2011, the EPA requires facilities that must already obtain NSR permits (new or modified stationary sources) for other pollutants to include GHGs in their permits for new construction projects that emit at least 100,000 tons per year of GHGs and existing facilities that increase their emissions by at least 75,000 tons per year. These permits require that the permittee adopt the Best Available Control Technology (“BACT”). In June 2012, the D.C. Circuit Court of Appeals upheld these permitting regulations. In June 2014, the U.S. Supreme Court invalidated the EPA’s position that power plants and other sources can be subject to permitting requirements based on their GHG emissions alone. For CO2 BACT to apply, CAA permitting must be triggered by another regulated pollutant (e.g., SO2).

As a result of revisions to its preconstruction permitting rules that became fully effective in 2011, the EPA now requires new sources, including coal-fired power plants, to undergo control technology reviews for GHGs (predominantly carbon dioxide) as a condition of permit issuance. These reviews may impose limits on GHG emissions, or otherwise be used to compel consideration of alternative fuels and generation systems, as well as increase litigation risk for and so discourage development of coal-fired power plants. The EPA has also issued final rules requiring the monitoring and reporting of greenhouse gas emissions from certain sources.

In March 2012, the EPA proposed New Source Performance Standards (“NSPS”) for carbon dioxide emissions from new fossil fuel-fired power plants. The proposal requires new coal units to meet a carbon dioxide emissions standard of 1,000 lbs. CO2/MWh, which is equivalent to the carbon dioxide emitted by a natural gas combined cycle unit. In January 2014, the EPA formally published its re-proposed NSPS for carbon dioxide emissions from new power plants. The re-proposed rule requires an emissions standard of 1,100 lbs. CO2/MWh for new coal-fired power plants. To meet such a standard, new coal plants would be required to install carbon capture and storage (“CCS”) technology. In August 2015, the EPA released final rules requiring newly constructed coal-fired steam electric generating units (“EGUs”) to emit no more than 1,400 lbs CO2/MWh (gross) and be constructed with CCS to capture 16% of CO2 produced by an electric generating unit burning bituminous coal. At the same time, the EPA finalized GHG emissions regulations for modified and existing power plants. The rule for modified sources required reducing GHG emissions from any modified or reconstructed source and could limit the ability of generators to upgrade coal-fired power plants thereby reducing the demand for coal. In April 2017, the EPA published notice in the federal register that the agency has initiated a review of the NSPS for new and modified fossil fuel-fired power plants and that, following the review, the EPA will initiate reconsideration proceedings to suspend, revise or rescind this NSPS. Challenges to the NSPS have been filed in U.S. Court of Appeal for the D.C. Circuit and oral arguments were set for April 2017; however, in April 2017, the U.S Court of Appeal for the D.C. Circuit ordered the NSPS case held in abeyance for an EPA review of the rule. It is likely than any repeal or revisions to the NSPS will be subject to legal challenges as well. Future implementation of the NSPS is uncertain at this time.

| 10 |

In August 2015, the EPA issued its final Clean Power Plan ("CPP") rules that establish carbon pollution standards for power plants, called CO2 emission performance rates. Judicial challenges led the U.S. Supreme Court to grant a stay in February 2016 of the implementation of the CPP before the United States Court of Appeals for the District of Columbia ("Circuit Court") even issued a decision. By its terms, this stay will remain in effect throughout the pendency of the appeals process including at the Circuit Court and the Supreme Court through any certiorari petition that may be granted. The Supreme Court's stay applies only to EPA's regulations for CO2 emissions from existing power plants and will not affect EPA's standards for new power plants. It is not yet clear how either the Circuit Court or the Supreme Court will rule on the legality of the CPP. Additionally, in October 2017 the EPA proposed to repeal the CPP, although the final outcome of this action and the pending litigation regarding the CPP is uncertain at this time. In connection with this proposed repeal, the EPA issued an Advance Notice of Proposed Rulemaking ("ANPRM") in December 2017 regarding emission guidelines to limit GHG emissions from existing electricity utility generating units. The ANPRM seeks comment regarding what the EPA should include in a potential new, existing-source regulation under the Clean Air Act of GHG emissions from electric utility generating units that it may propose. If the effort to repeal the rules is unsuccessful and the rules were upheld at the conclusion of this appellate process and were implemented in their current form, or if the ANPRM results in a different proposal to control GHG emissions from electric utility generating units, demand for coal would likely be further decreased, potentially significantly, and our business would be adversely impacted.

Collectively, these requirements have led to premature retirements and could lead to additional premature retirements of coal-fired generating units and reduce the demand for coal. Congress has rejected legislation to restrict carbon dioxide emissions from existing power plants, and it is unclear whether the EPA has the legal authority to regulate carbon dioxide emissions for existing and modified power plants as proposed in the NSPS and CPP. Substantial limitations on GHG emissions could adversely affect demand for the coal we produce.

There have been numerous protests of and challenges to the permitting of new coal-fired power plants by environmental organizations and state regulators for concerns related to GHG emissions. For instance, various state regulatory authorities have rejected the construction of new coal-fueled power plants based on the uncertainty surrounding the potential costs associated with GHG emissions from these plants under future laws limiting the emissions of carbon dioxide. In addition, several permits issued to new coal-fueled power plants without limits on GHG emissions have been appealed to the EPA’s Environmental Appeals Board. In addition, over thirty states have currently adopted “renewable energy standards” or “renewable portfolio standards,” which encourage or require electric utilities to obtain a certain percentage of their electric generation portfolio from renewable resources by a certain date. These standards generally range from 10% to 30%, over time periods that generally extend from the present until between 2020 and 2030. Other states may adopt similar requirements, and federal legislation is a possibility in this area. To the extent these requirements affect our current and prospective customers, they may reduce the demand for coal-fired power, and may affect long-term demand for our coal. Finally, a federal appeals court allowed a lawsuit pursuing federal common law claim to proceed against certain utilities on the basis that they may have created a public nuisance due to their emissions of carbon dioxide, while a second federal appeals court dismissed a similar case on procedural grounds. The U.S. Supreme Court overturned that decision in June 2011, holding that federal common law provides no basis for public nuisance claims against utilities due to their carbon dioxide emissions. The Supreme Court did not, however, decide whether similar claims can be brought under state common law. As a result, despite this favorable ruling, tort-type liabilities remain a concern.

In addition, environmental advocacy groups have filed a variety of judicial challenges claiming that the environmental analyses conducted by federal agencies before granting permits and other approvals necessary for certain coal activities do not satisfy the requirements of the National Environmental Policy Act (“NEPA”). These groups assert that the environmental analyses in question do not adequately consider the climate change impacts of these particular projects. In December 2014, the Council on Environmental Quality (“CEQ”) released updated draft guidance discussing how federal agencies should consider the effects of GHG emissions and climate change in their NEPA evaluations. The guidance encourages agencies to provide a more detailed discussion of the direct, indirect, and cumulative impacts of a proposed action’s reasonably foreseeable emissions and effects. This guidance could create additional delays and costs in the NEPA review process or in our operations, or even an inability to obtain necessary federal approvals for our future operations, including due to the increased risk of legal challenges from environmental groups seeking additional analysis of climate impacts. In April 2017, CEQ withdrew its final 2016 guidance on how federal agencies should incorporate climate change and GHG considerations into NEPA reviews of federal actions.

Many states and regions have adopted GHG initiatives, and certain governmental bodies have or are considering the imposition of fees or taxes based on the emission of GHG by certain facilities, including coal-fired electric generating facilities. For example, in 2005, ten Northeastern states entered into the Regional Greenhouse Gas Initiative agreement (“RGGI”), calling for the implementation of a cap and trade program aimed at reducing carbon dioxide emissions from power plants in the participating states. The members of RGGI have established in statutes and/or regulations a carbon dioxide trading program. Auctions for carbon dioxide allowances under the program began in September 2008. Though New Jersey withdrew from RGGI in 2011, since its inception, several additional northeastern states and Canadian provinces have joined as participants or observers. New Jersey has announced its intention to rejoin RGGI following the change in state government administrations.

| 11 |

Following the RGGI model, five Western states launched the Western Regional Climate Action Initiative to identify, evaluate, and implement collective and cooperative methods of reducing GHG in the region to 15% below 2005 levels by 2020. These states were joined by two additional states and four Canadian provinces and became collectively known as the Western Climate Initiative Partners. However, in November 2011, six states withdrew, leaving California and the four Canadian provinces as members. At a January 2012 stakeholder meeting, this group confirmed a commitment and timetable to create the largest carbon market in North America and provide a model to guide future efforts to establish national approaches in both Canada and the U.S. to reduce GHG emissions. It is likely that these regional efforts will continue.

It is possible that future international, federal and state initiatives to control GHG emissions could result in increased costs associated with coal production and consumption, such as costs to install additional controls to reduce carbon dioxide emissions or costs to purchase emissions reduction credits to comply with future emissions trading programs. Such increased costs for coal consumption could result in some customers switching to alternative sources of fuel, or otherwise adversely affect our operations and demand for our products, which could have a material adverse effect on our business, financial condition, and results of operations.

Water Discharge

The Federal Clean Water Act (“CWA”) and similar state and local laws and regulations affect coal mining operations by imposing restrictions on effluent discharge into waters and the discharge of dredged or fill material into the waters of the U.S. Regular monitoring, as well as compliance with reporting requirements and performance standards, is a precondition for the issuance and renewal of permits governing the discharge of pollutants into water. Section 404 of the CWA imposes permitting and mitigation requirements associated with the dredging and filling of wetlands and streams. The CWA and equivalent state legislation, where such equivalent state legislation exists, affect coal mining operations that impact wetlands and streams. Although permitting requirements have been tightened in recent years, we believe we have obtained all necessary permits required under CWA Section 404 as it has traditionally been interpreted by the responsible agencies. However, mitigation requirements under existing and possible future “fill” permits may vary considerably. For that reason, the setting of post-mine asset retirement obligation accruals for such mitigation projects is difficult to ascertain with certainty and may increase in the future. Although more stringent permitting requirements may be imposed in the future, we are not able to accurately predict the impact, if any, of such permitting requirements.

The U.S. Army Corps of Engineers (“Corps of Engineers”) maintains two permitting programs under CWA Section 404 for the discharge of dredged or fill material: one for “individual” permits and a more streamlined program for “general” permits. In June 2010, the Corps of Engineers suspended the use of “general” permits under Nationwide Permit 21 (“NWP 21”) in the Appalachian states. In February 2012, the Corps of Engineers reissued the final 2012 NWP 21. The Center for Biological Diversity later filed a notice of intent to sue the Corps of Engineers based on allegations the 2012 NWP 21 program violated the Endangered Species Act (“ESA”). The Corps of Engineers and National Marine Fisheries Service (“NMFS”) have completed their programmatic ESA Section 7 consultation process on the Corps of Engineers’ 2012 NWP 21 package, and NMFS has issued a revised biological opinion finding that the NWP 21 program does not jeopardize the continued existence of threatened and endangered species and will not result in the destruction or adverse modification of designated critical habitat. However, the opinion contains 12 additional protective measures the Corps of Engineers will implement in certain districts to “enhance the protection of listed species and critical habitat.” While these measures will not affect previously verified permit activities where construction has not yet been completed, several Corps of Engineers districts with mining operations will be impacted by the additional protective measures going forward. These measures include additional reporting and notification requirements, potential imposition of new regional conditions and additional actions concerning cumulative effects analyses and mitigation. Our coal mining operations typically require Section 404 permits to authorize activities such as the creation of slurry ponds and stream impoundments. The CWA authorizes the EPA to review Section 404 permits issued by the Corps of Engineers, and in 2009, the EPA began reviewing Section 404 permits issued by the Corps of Engineers for coal mining in Appalachia. Currently, significant uncertainty exists regarding the obtaining of permits under the CWA for coal mining operations in Appalachia due to various initiatives launched by the EPA regarding these permits.

| 12 |

The EPA also has statutory “veto” power over a Section 404 permit if the EPA determines, after notice and an opportunity for a public hearing, that the permit will have an “unacceptable adverse effect.” In January 2011, the EPA exercised its veto power to withdraw or restrict the use of a previously issued permit for Spruce No. 1 Surface Mine in West Virginia, which is one of the largest surface mining operations ever authorized in Appalachia. This action was the first time that such power was exercised with regard to a previously permitted coal mining project. A challenge to the EPA’s exercise of this authority was made in the U.S. District Court for the District of Columbia, and in March 2012, that court ruled that the EPA lacked the statutory authority to invalidate an already issued Section 404 permit retroactively. In April 2013, the D.C. Circuit Court of Appeals reversed this decision and authorized the EPA to retroactively veto portions of a Section 404 permit. The U.S. Supreme Court denied a request to review this decision. Any future use of the EPA’s Section 404 “veto” power could create uncertainly with regard to our continued use of current permits, as well as impose additional time and cost burdens on future operations, potentially adversely affecting our coal revenue. In addition, the EPA initiated a preemptive veto prior to the filing of any actual permit application for a copper and gold mine based on fictitious mine scenario. The implications of this decision could allow the EPA to bypass the state permitting process and engage in watershed and land use planning.

Total Maximum Daily Load (“TMDL”) regulations under the CWA establish a process to calculate the maximum amount of a pollutant that an impaired water body can receive and still meet state water quality standards and to allocate pollutant loads among the point and non-point pollutant sources discharging into that water body. Likewise, when water quality in a receiving stream is better than required, states are required to conduct an antidegradation review before approving discharge permits. The adoption of new TMDL-related allocations or any changes to antidegradation policies for streams near our coal mines could require more costly water treatment and could adversely affect our coal production.

Considerable legal uncertainty exists surrounding the standard for what constitutes jurisdictional waters and wetlands subject to the protections and requirements of the Clean Water Act. A 2015 rulemaking by EPA to revise the standard was stayed nationwide by the U.S. Court of Appeals for the Sixth Circuit and stayed for certain primarily western states by a United States District Court in North Dakota. In January 2018, the Supreme Court determined that the circuit courts do not have jurisdiction to hear challenges to the 2015 rule, removing the basis for the Sixth Circuit to continue its nationwide stay. Additionally, EPA has promulgated a final rule that extends the applicability date of the 2015 rule for another two years in order to allow EPA to undertake a rulemaking on the question of what constitutes a water of the United States. In the meantime, judicial challenges to the 2015 rulemaking are likely to continue to work their way through the courts along with challenges to the recent rulemaking that extends the applicability date of the 2015 rule. For now, EPA and the Corps of Engineers will continue to apply the existing standard for what constitutes a water of the United States as determined by the Supreme Court in the Rapanos case and post-Rapanos guidance. Should the 2015 rule take effect, or should a different rule expanding the definition of what constitutes a water of the United States be promulgated as a result of EPA and the Corps of Engineers' rulemaking process, we could face increased costs and delays due to additional permitting and regulatory requirements and possible challenges to permitting decisions.

Hazardous Substances and Wastes

The Federal Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), otherwise known as the “Superfund” law, and analogous state laws, impose liability, without regard to fault or the legality of the original conduct on certain classes of persons that are considered to have contributed to the release of a “hazardous substance” into the environment. These persons include the owner or operator of the site where the release occurred and companies that disposed or arranged for the disposal of the hazardous substances found at the site. Persons who are or were responsible for the release of hazardous substances may be subject to joint and several liabilities under CERCLA for the costs of cleaning up releases of hazardous substances and natural resource damages. Some products used in coal mining operations generate waste containing hazardous substances. We are currently unaware of any material liability associated with the release or disposal of hazardous substances from our past or present mine sites.

The Federal Resource Conservation and Recovery Act (“RCRA”) and corresponding state laws regulating hazardous waste affect coal mining operations by imposing requirements for the generation, transportation, treatment, storage, disposal, and cleanup of hazardous wastes. Many mining wastes are excluded from the regulatory definition of hazardous wastes, and coal mining operations covered by SMCRA permits are by statute exempted from RCRA permitting. RCRA also allows the EPA to require corrective action at sites where there is a release of hazardous substances. In addition, each state has its own laws regarding the proper management and disposal of waste material. While these laws impose ongoing compliance obligations, such costs are not believed to have a material impact on our operations.

| 13 |

In June 2010, the EPA released a proposed rule to regulate the disposal of certain coal combustion by-products (“CCB”). The proposed rule set forth two very different options for regulating CCB under RCRA. The first option called for regulation of CCB as a hazardous waste under Subtitle C, which creates a comprehensive program of federally enforceable requirements for waste management and disposal. The second option utilized Subtitle D, which would give the EPA authority to set performance standards for waste management facilities and would be enforced primarily through citizen suits. The proposal leaves intact the Bevill exemption for beneficial uses of CCB. In April 2012, several environmental organizations filed suit against the EPA to compel the EPA to take action on the proposed rule. Several companies and industry groups intervened. A consent decree was entered on January 29, 2014.

The EPA finalized the CCB rule on December 19, 2014, setting nationwide solid, nonhazardous waste standards for CCB disposal. On April 17, 2015, the EPA finalized regulations under the solid waste provisions (“Subtitle D”) of RCRA and not the hazardous waste provisions (“Subtitle C”) which became effective on October 19, 2015. EPA affirms in the preamble to the final rule that “this rule does not apply to CCR placed in active or abandoned underground or surface mines.” Instead, “the U.S. Department of Interior (“DOI”) and EPA will address the management of CCR in mine fills in a separate regulatory action(s).” While classification of CCB as a hazardous waste would have led to more stringent restrictions and higher costs, this regulation may still increase our customers’ operating costs and potentially reduce their ability to purchase coal.

On November 3, 2015, EPA published the final rule Effluent Limitations Guidelines and Standards (“ELG”), revising the regulations for the Steam Electric Power Generating category which became effective on January 4, 2016. The rule sets the first federal limits on the levels of toxic metals in wastewater that can be discharged from power plants, based on technology improvements in the steam electric power industry over the last three decades. The combined effect of the CCR and ELG regulations has forced power generating companies to close existing ash ponds and will likely force the closure of certain older existing coal-burning power plants that cannot comply with the new standards. These regulations add costs to the operation of coal-burning power plants on top of other regulations like the 2014 regulations issued under Section 316(b) of the CWA that affects the cooling water intake structures at power plants in order to reduce fish impingement and entrainment. Individually and collectively, these regulations could, in turn, impact the market for our products. In April 2017, EPA granted petitions for reconsideration and an administrative stay of all future compliance deadlines for the ELG rule. In August 2017, EPA granted petitions for reconsideration of the CCR rule.

Endangered Species Act

The federal Endangered Species Act (“ESA”) and counterpart state legislation protect species threatened with possible extinction. The U.S. Fish and Wildlife Service (the “USFWS”) works closely with the OSM and state regulatory agencies to ensure that species subject to the ESA are protected from mining-related impacts. If the USFWS were to designate species indigenous to the areas in which we operate as threatened or endangered, we could be subject to additional regulatory and permitting requirements.

Other Environmental, Health and Safety Regulations

In addition to the laws and regulations described above, we are subject to regulations regarding underground and above ground storage tanks in which we may store petroleum or other substances. Some monitoring equipment that we use is subject to licensing under the Federal Atomic Energy Act. Water supply wells located on our properties are subject to federal, state, and local regulation. In addition, our use of explosives is subject to the Federal Safe Explosives Act. We are also required to comply with the Federal Safe Drinking Water Act, the Toxic Substance Control Act, and the Emergency Planning and Community Right-to-Know Act. The costs of compliance with these regulations should not have a material adverse effect on our business, financial condition or results of operations.

Suppliers

The main types of goods we purchase are mining equipment and replacement parts, steel-related (including roof control) products, belting products, lubricants, electricity, fuel, and tires. Although we have many long, well-established relationships with our key suppliers, we do not believe that we are dependent on any of our individual suppliers other than for purchases of electricity. The supplier base providing mining materials has been relatively consistent in recent years. Purchases of certain underground mining equipment are concentrated with one principle supplier; however, supplier competition continues to develop.

| 14 |

Illinois Basin (ILB)

The coal industry underwent a significant transformation in the early 1990s, as greater environmental accountability was established in the electric utility industry. Through the U.S. Clean Air Act, acceptable baseline levels were established for the release of sulfur dioxide in power plant emissions. In order to comply with the new law, most utilities switched fuel consumption to low-sulfur coal, thereby stripping the ILB of over 50 million tons of annual coal demand. This strategy continued until mid-2000 when a shortage of low-sulfur coal drove up prices. This price increase combined with the assurance from the U.S. government that the utility industry would be able to recoup their costs to install scrubbers caused utilities to begin investing in scrubbers on a large scale. With scrubbers, the ILB has re-opened as a significant fuel source for utilities and has enabled them to burn lower cost high sulfur coal.

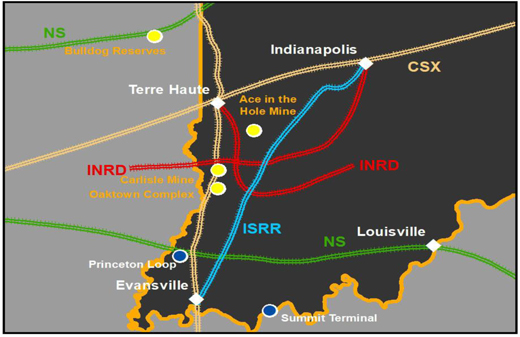

The ILB consists of coal mining operations covering more than 50,000 square miles in Illinois, Indiana and western Kentucky. The ILB is centrally located between four of the largest regions that consume coal as fuel for electricity generation (East North Central, West South Central, West North Central and East South Central). The region also has access to sufficient rail and water transportation routes that service coal-fired power plants in these regions as well as other significant coal consuming regions of the South Atlantic and Middle Atlantic.

U. S. Coal Industry

The major coal production basins in the U.S. include Central Appalachia (CAPP), Northern Appalachia (NAPP), Illinois Basin (ILB), Powder River Basin (PRB) and the Western Bituminous region (WB). CAPP includes eastern Kentucky, Tennessee, Virginia and southern West Virginia. NAPP includes Maryland, Ohio, Pennsylvania and northern West Virginia. The ILB includes Illinois, Indiana and western Kentucky. The PRB is located in northeastern Wyoming and southeastern Montana. The WB includes western Colorado, eastern Utah and southern Wyoming.

Coal type varies by basin. Heat value and sulfur content are important quality characteristics and determine the end use for each coal type.

Coal in the U.S. is mined through surface and underground mining methods. The primary underground mining techniques are longwall mining and continuous (room-and-pillar) mining. The geological conditions dictate which technique to use. Our mines use the continuous technique. In continuous mining, rooms are cut into the coal bed leaving a series of pillars, or columns of coal, to help support the mine roof and control the flow of air. Continuous mining equipment cuts the coal from the mining face. Generally, openings are driven 20’ wide, and the pillars are rectangular in shape measuring 40’x 40’. As mining advances, a grid-like pattern of entries and pillars is formed. Roof bolts are used to secure the roof of the mine. Battery cars move the coal to the conveyor belt for transport to the surface. The pillars can constitute up to 50% of the total coal in a seam.

The United States coal industry is highly competitive, with numerous producers selling into all markets that use coal. We compete against large producers such as Peabody Energy Corporation (NYSE: BTU) and Alliance (Nasdaq: ARLP) and small producers.

Employees

We have 742 employees, of which 736 are Sunrise Coal employees.

Other

We have no significant patents, trademarks, licenses, franchises or concessions.

Our Denver office is located at 1660 Lincoln Street, Suite 2700, Denver, Colorado 80264, phone 303.839.5504 and Sunrise Coal's corporate office is located at 1183 East Canvasback Drive, Terre Haute, Indiana 47802, phone 812.299.2800. Terre Haute is approximately 70 miles west of Indianapolis. Our website is www.halladorenergy.com.

| 15 |

ITEM 1A. RISK FACTORS.

Risks Related to our Business

Global economic conditions or economic conditions in any of the industries in which our customers operate as well as sustained uncertainty in financial markets may have material adverse impacts on our business and financial condition that we currently cannot predict.

Weakness in global economic conditions or economic conditions in any of the industries we serve or in the financial markets could materially adversely affect our business and financial condition. For example:

| · | the demand for electricity in the U.S. may decline if economic conditions deteriorate, which may negatively impact the revenue, margins, and profitability of our business; |

| · | any inability of our customers to raise capital could adversely affect their ability to honor their obligations to us; and |

| · | our future ability to access the capital markets may be restricted as a result of future economic conditions, which could materially impact our ability to grow our business, including the development of our coal reserves. |

A substantial or extended decline in coal prices could negatively impact our results of operations.

Our results of operations are primarily dependent upon the prices we receive for our coal, as well as our ability to improve productivity and control costs. The prices we receive for our production depends upon factors beyond our control, including:

| · | the supply of and demand for domestic and foreign coal; |

| · | weather conditions and patterns; |

| · | the proximity to and capacity of transportation facilities; |

| · | competition from other coal suppliers; |

| · | domestic and foreign governmental regulations and taxes; |

| · | the price and availability of alternative fuels; |

| · | the effect of worldwide energy consumption, including the impact of technological advances on energy consumption; and |

| · | prevailing economic conditions. |

Any adverse change in these factors could result in weaker demand and lower prices for our products. A substantial or extended decline in coal prices could materially and adversely affect us by decreasing our revenue to the extent we are not protected by the terms of existing coal supply agreements.