UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

|

[ x ]

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended: December 31, 2013 OR

|

|

|

[ ]

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Commission file number: 0-14731

|

|

“COAL KEEPS YOUR LIGHTS ON”

|

“COAL KEEPS YOUR LIGHTS ON”

|

|

HALLADOR ENERGY COMPANY

(www.halladorenergy.com)

|

||||||

|

COLORADO

(State of incorporation)

|

84-1014610

(IRS Employer Identification No.)

|

|||||

|

1660 Lincoln Street, Suite 2700, Denver, Colorado

(Address of principal executive offices)

|

80264-2701

(Zip Code)

|

|||||

|

Issuer's telephone number: 303.839.5504

|

||||||

Securities registered pursuant to Section 12(b) of the Exchange Act: NONE

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, $.01 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "larger accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

o Large accelerated filer

|

o Accelerated filer

|

|

o Non-accelerated filer (do not check if a small reporting company)

|

þ Smaller reporting company

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes o No þ

The aggregate market value of the common stock held by non-affiliates (public float) on June 30, 2013 was $74 million based on the closing price reported that date by the NASDAQ of $8.05 per share.

As of March 6, 2014 we had 28.7 million shares outstanding.

Portions of our information statement to be filed with the SEC in connection with our annual stockholders’ meeting to be held on Thursday, April 24, 2014 are incorporated by reference into Part III of this Form 10-K.

1

ITEM 1. BUSINESS.

See Item 7- MDA for a discussion of our business.

Regulatory Matters

Safety and Environmental Regulations

Our operations, like operations of other coal companies, are subject to extensive regulation, primarily by federal and state authorities, on matters such as: air quality standards; reclamation and restoration activities involving our mining properties; mine permits and other licensing requirements; water pollution; employee health and safety; management of materials generated by mining operations; storage of petroleum products; protection of wetlands and endangered plant and wildlife protection. Many of these regulations require registration, permitting, compliance, monitoring and self-reporting and may impose civil and criminal penalties for non-compliance.

Additionally, the electric generation industry is subject to extensive regulation regarding the environmental impact of its power generation activities, which could affect demand for our coal over time. The possibility exists that new legislation or regulations may be adopted or that the enforcement of existing laws could become more stringent, causing coal to become a less attractive fuel source and reducing the percentage of electricity generated from coal. Future legislation or regulation or more stringent enforcement of existing laws may have a significant impact on our mining operations or our customers’ ability to use coal.

While it is not possible to accurately quantify the expenditures we incur to maintain compliance with all applicable federal and state laws, those costs have been and are expected to continue to be significant. Federal and state mining laws and regulations require us to obtain surety bonds or post letters of credit from our banks to guarantee performance or payment of certain long-term obligations, including mine closure and reclamation costs.

Federal, state and local authorities regulate the U.S. coal mining industry with respect to matters such as employee health and safety, permitting and licensing requirements, air quality standards, water pollution, plant and wildlife protection, the reclamation and restoration of mining properties after mining has been completed, the discharge of materials into the environment, surface subsidence from underground mining and the effects of mining on groundwater quality and availability. In addition, the industry is affected by significant legislation mandating certain benefits for current and retired coal miners. Numerous federal, state and local governmental permits and approvals are required for mining operations. We believe that we have obtained all permits currently required to conduct our present mining operations.

We endeavor to conduct our mining operations in compliance with all applicable federal, state and local laws and regulations. However, because of extensive and comprehensive regulatory requirements, violations during mining operations occur from time to time in the industry. None of our violations to date or the monetary penalties assessed have been material.

Mine Safety and Health

We are subject to health and safety standards both at the federal and state level. The regulations are comprehensive and affect numerous aspects of mining operations, including training of mine personnel, mining procedures, blasting, the equipment used in mining operations and other matters.

Mine Safety and Health Administration (MSHA) is the entity responsible for monitoring compliance with the federal mine health and safety standards. MSHA has various enforcement tools that it can use, including the issuance of monetary penalties and orders of withdrawal from a mine or part of a mine. Some, but not all, of the costs of complying with existing regulations and implementing new safety and health regulations may be passed on to customers.

2

MSHA has taken a number of actions to identify mines with safety issues, and has engaged in a number of targeted enforcement, awareness, outreach and rulemaking activities to reduce the number of mining fatalities, accidents and illnesses. There has also been an industry-wide increase in the monetary penalties assessed for citations of a similar nature.

Black Lung

Under the Black Lung Benefits Revenue Act of 1977 and the Black Lung Benefits Reform Act of 1977, as amended in 1981, each U.S. coal mine operator must pay federal black lung benefits and medical expenses to claimants who are current and former employees and last worked for the operator after July 1, 1973. Coal mine operators must also make payments to a trust fund for the payment of benefits and medical expenses to claimants who last worked in the coal industry prior to July 1, 1973. Historically, less than 7% of the miners currently seeking federal black lung benefits are awarded these benefits. The trust fund is funded by an excise tax on U.S. production of up to $1.10 per ton for deep-mined coal and up to $0.55 per ton for surface-mined coal, neither amount to exceed 4.4% of the gross sales price.

Environmental Laws and Regulations

We are subject to various federal, state and local environmental laws and regulations. These laws and regulations place substantial requirements on our coal mining operations, and require regular inspection and monitoring of our mines and other facilities to ensure compliance. We are also affected by various other federal, state and local environmental laws and regulations that our customers are subject to.

Surface Mining Control and Reclamation Act. In the U.S., the Surface Mining Control and Reclamation Act of 1977 (SMCRA), which is administered by the Office of Surface Mining Reclamation and Enforcement (OSM), established mining, environmental protection and reclamation standards for all aspects of U.S. surface mining and many aspects of deep mining. Mine operators must obtain SMCRA permits and permit renewals for mining operations from the OSM. Where state regulatory agencies have adopted federal mining programs under SMCRA, the state becomes the regulatory authority.

The Carlisle mine began commercial production in February 2007 and is operating in compliance with all local, state, and federal regulations. We have no old mine properties to reclaim, other than the Howesville mine, which was operated for only eight months before it was closed in June 2006 due to safety concerns. During 2007, we finished Phase I of the reclamation of the Howesville mine. We expect the final phase to be completed by the end of 2015.

Numerous governmental permits or approvals are required for mining operations. When we apply for these permits and approvals, we may be required to prepare and present to federal, state or local authorities data pertaining to the effect or impact that any proposed production or processing of coal may have upon the environment. The authorization, permitting and implementation requirements imposed by any of these authorities may be costly and time consuming and may delay commencement or continuation of mining operations. Regulations also provide that a mining permit or modification can be delayed, refused or revoked if an officer, director or a shareholder with a 10% or greater interest in the entity is affiliated with another entity that has outstanding permit violations. Thus, past or ongoing violations of federal and state mining laws could provide a basis to revoke existing permits and to deny the issuance of additional permits.

In order to obtain mining permits and approvals from state regulatory authorities, mine operators must submit a reclamation plan for restoring, upon the completion of mining operations, the mined property to its prior condition, productive use or other permitted condition. Typically, we submit the necessary permit applications several months before we plan to begin mining a new area. Some of our required permits are becoming increasingly more difficult and expensive to obtain, and the application review processes are taking longer to complete and becoming increasingly subject to challenge. Under some circumstances, substantial fines and penalties, including revocation or suspension of mining permits, may be imposed under the laws described above. Monetary sanctions and, in severe circumstances, criminal sanctions may be imposed for failure to comply with these laws. Compliance with these laws has increased the cost of coal mining for domestic coal producers.

3

After a permit application is prepared and submitted to the regulatory agency, it goes through a completeness and technical review. Public notice of the proposed permit is given for a comment period before a permit can be issued. Regulatory authorities have considerable discretion in the timing of the permit issuance and the public has the right to comment on and otherwise engage in the permitting process, including public hearings and through intervention in the courts. Before a SMCRA permit is issued, a mine operator must submit a bond or other form of financial security to guarantee the performance of reclamation obligations.

The SMCRA Abandoned Mine Land Fund requires a fee on all coal produced in the U.S. The proceeds are used to rehabilitate lands mined and left unreclaimed prior to August 3, 1977 and to pay health care benefit costs of orphan beneficiaries of the Combined Fund created by the Coal Industry Retiree Health Benefit Act of 1992. The fee amount can change periodically. Pursuant to the Tax Relief and Health Care Act of 2006, from October 1, 2007 to September 30, 2012, the fee was $0.315 and $0.135 per ton of surface-mined and underground-mined coal, respectively. From October 1, 2012 through September 30, 2021, the fee is $0.28 and $0.12 per ton of surface-mined and underground-mined coal, respectively. We also pay $0.03 per ton to the Indiana Department of Reclamation.

The OSM has been in the process of developing a “stream protection rule,” which could result in changes to mining operations under the SMCRA program. The OSM has projected that it will issue a proposed stream protection rule in 2014. Other rulemaking proceedings have been proposed or are being considered by the OSM. Notably, the Proposed Rule for Cost Recovery for Permit Processing, Administration and Enforcement was published in March 2013. Additionally, the OSM is working on a Coal Combustion Residues rulemaking for minefill operations. The agency has projected it may publish a proposed rule by May 2014. These OSM rulemakings and others could have a direct impact on our operations.

Clean Air Act. The Clean Air Act, enacted in 1970, and comparable state laws that regulate air emissions affect our U.S. coal mining operations both directly and indirectly.

Direct impacts on coal mining and processing operations may occur through the Clean Air Act permitting requirements and/or emission control requirements relating to particulate matter (PM), sulfur dioxide and ozone. It is possible that modifications to the national ambient air quality standards (NAAQS) could directly impact our mining operations in a manner that includes, but is not limited to, requiring changes in vehicle emissions standards or resulting in newly designated non-attainment areas. Furthermore, the U.S. Environmental Protection Agency (EPA) in 2009 adopted revised rules to add more stringent PM emissions limits for coal preparation and processing plants constructed or modified after April 28, 2008. Since 2011, the EPA has required underground coal mines to report on their greenhouse gas emissions.

The Clean Air Act indirectly, but more significantly, affects the U.S. coal industry by extensively regulating the air emissions of sulfur dioxide, nitrogen oxides, mercury, PM and other substances emitted by coal-fueled electricity generating plants. The air emissions programs that may affect our operations, directly or indirectly, include, but are not limited to, the Acid Rain Program, interstate transport rules, New Source Performance Standards (NSPS), Maximum Achievable Control Technology (MACT) emissions limits for Hazardous Air Pollutants, the Regional Haze program and New Source Review. In addition, in recent years the U.S. EPA has adopted more stringent NAAQS for PM, nitrogen oxide and sulfur dioxide. The EPA is expected to propose a more stringent ozone standard from the current standard. The Sierra Club and others requested the U.S. District Court for the Northern District of California on January 21, 2014 to order the EPA to propose a new ozone NAAQS by December 1, 2014 and issue a final rule by October 1, 2015. The actual final rule date remains unknown at this time. More stringent standards may trigger additional control technology for mining equipment, or result in additional challenges to permitting and expansion efforts. Many of these air emissions programs and regulations have resulted in litigation which has not been completely resolved.

4

In December 2009, the EPA published its finding that atmospheric concentrations of greenhouse gases endanger public health and welfare within the meaning of the Clean Air Act, and that emissions of greenhouse gases from new motor vehicles and motor vehicle engines are contributing to air pollution that are endangering public health and welfare within the meaning of the Clean Air Act. In May 2010, the EPA published final greenhouse gas emission standards for new motor vehicles pursuant to the Clean Air Act. Both the endangerment finding and motor vehicle standards have been the subject of litigation. Because the Clean Air Act specifies that the prevention of significant deterioration (PSD) program applies once emissions of regulated pollutants exceed either 100 or 250 tons per year (depending on the type of source), millions of sources previously unregulated under the Clean Air Act could be subject to greenhouse gas reduction measures. The EPA published a rule in June 2010 to limit the number of greenhouse gas sources that would be subject to the PSD program. In the so-called “tailoring rule,” the EPA limited the regulation of greenhouse gases from certain stationary sources to those that emit more than 75,000 tons of greenhouse gases per year (for sources that would be subject to PSD permitting regardless of greenhouse gas emissions due to other emissions) or 100,000 tons of greenhouse gases per year (for sources not subject to PSD permitting for any other air emissions), measured by “carbon dioxide equivalent.”

In a decision issued on June 26, 2012, the U.S. Court of Appeals for the District of Columbia (D.C. Circuit) affirmed the EPA's endangerment finding, its motor vehicle greenhouse gas rule and the tailoring rule. In a decision issued on December 20, 2012, the same court denied petitions to reconsider that decision. Petitions for review to the U.S. Supreme Court (Supreme Court) were filed, and on October 15, 2013, the Supreme Court accepted six petitions for review, but only a single question is being considered: “Whether the EPA permissibly determined that its regulation of greenhouse gas emissions from new motor vehicles triggered permitting requirements under the Clean Air Act for stationary sources that emit greenhouse gases.” A decision in the case will likely come by June 2014. This review will not affect the D.C. Circuit decision upholding the EPA’s 2009 “endangerment finding” with respect to greenhouse gas emissions from new motor vehicles. However, the decision could have a significant impact on EPA rules, proposed rules and rules under development that may affect the demand for coal, including the proposed NSPS for carbon dioxide emissions from new fossil fuel-fired electric utility generating units and the performance standards under development for carbon dioxide emissions from existing power plants.

Proposed NSPS for Fossil Fuel-Fired Electricity Utility Generating Units. On April 13, 2012, the EPA published for comment proposed NSPS for emissions of carbon dioxide from new fossil fuel-fired electric utility generating units. If those standards are adopted as proposed, it is unlikely, with a few possible exceptions, that any new coal-fired electric utility generating units could be constructed in the U.S. as CCS technologies are not yet commercially viable.

In light of over 2 million comments on its April 13, 2012 proposal and ongoing developments in the industry, the EPA subsequently indicated its intention to issue a new proposal. On June 25, 2013, the U.S. President directed the EPA to issue that new proposal by September 30, 2013 and to finalize it in a timely manner. On September 20, 2013, the EPA revoked its April 13, 2012 proposal and issued a new proposed NSPS for emissions of carbon dioxide from new fossil fuel-fired electric utility generating units, using section 111(b) of the Clean Air Act. On January 8, 2014, the re-proposal was published in the Federal Register, with the comment deadline stated as March 10, 2014.

The EPA has not yet proposed rules for modified sources under section 111(b) of the Clean Air Act or existing sources under section 111(d) of the Clean Air Act. However, the U.S. President directed the EPA, in the June 25, 2013 statement referred to above, to issue such standards, regulations or guidelines, as appropriate, addressing carbon pollution from existing, modified and reconstructed power plants. The President also requested that the EPA: (a) issue a proposal addressing such matters by June 1, 2014; (b) finalize it by June 1, 2015; and (c) include, in the guidelines addressing existing power plants, a requirement that states submit to the EPA implementation plans required under Section 111(d) of the Clean Air Act by June 30, 2016. We believe that any final rules issued by the EPA in this area will be challenged.

5

Cross State Air Pollution Rule (CSAPR). On July 6, 2011, the EPA finalized the CSAPR, which requires 28 states from Texas eastward (not including the New England states or Delaware) to significantly improve air quality by reducing power plant emissions that cross state lines and contribute to ozone and/or fine particle pollution in other states. Under the CSAPR, the first phase of the nitrogen oxide and sulfur dioxide emissions reductions was to commence in 2012 with further reductions effective in 2014. In October 2011, the EPA proposed amendments to the CSAPR to increase emission budgets in ten states, including Texas, and ease limits on market-based compliance options. While the CSAPR had an initial compliance deadline of January 1, 2012, the rule was challenged and on December 30, 2011, the D.C. Circuit stayed the rule and advised that the EPA is expected to continue administering the Clean Air Interstate Rule (CAIR) until the pending challenges are resolved. The court vacated the CSAPR on August 21, 2012, in a 2 to 1 decision, concluding that the rule was beyond the EPA's statutory authority. On October 5, 2012, the EPA petitioned for en banc review of that decision by the entire D.C. Circuit, which denied the EPA's petition on January 24, 2013. On March 29, 2013, the Solicitor General's Office, on behalf of the EPA, and, separately, certain non-governmental organizations, filed petitions for writs of certiorari with the Supreme Court seeking Supreme Court review of the D.C. Circuit's decision. The Supreme Court granted these petitions on June 24, 2013, held oral arguments on December 10, 2013 and will likely issue a decision by June 2014.

Mercury and Air Toxic Standards (MATS). On December 16, 2011, the EPA issued MATS, which imposes MACT emission limits on hazardous air emissions from new and existing coal-fueled electric generating plants. The rule also revised NSPS for nitrogen oxides, sulfur dioxides and particulate matter for new and modified coal-fueled electricity generating plants. The MACT rule provides three years for compliance and a possible fourth year as a state permitting agency may deem necessary. On March 28, 2013, the EPA issued reconsidered MACT standards for new plants that are less stringent in some aspects than the standards issued in December 2011. On June 24, 2013, certain environmental organizations and industry groups filed an appeal of these regulations in the D.C. Circuit, and oral arguments were held on December 10, 2013. The rule could result in the retirement of certain older coal plants.

Clean Water Act. The Clean Water Act of 1972 directly impacts U.S. coal mining operations by requiring effluent limitations and treatment standards for wastewater discharge from mines through the National Pollutant Discharge Elimination System (NPDES). Regular monitoring, reporting and performance standards are requirements of NPDES permits that govern the discharge of water from mine-related point sources into receiving waters.

The U.S. Army Corps of Engineers (Corps) regulates certain activities affecting navigable waters and waters of the U.S., including wetlands. Section 404 of the Clean Water Act requires mining companies to obtain Corps permits to place material in streams for the purpose of creating slurry ponds, water impoundments, refuse areas, valley fills or other mining activities.

States are empowered to develop and apply “in stream” water quality standards. These standards are subject to change and must be approved by the EPA. Discharges must either meet state water quality standards or be authorized through available regulatory processes such as alternate standards or variances. “In stream” standards vary from state to state. Additionally, through the Clean Water Act section 401 certification program, states have approval authority over federal permits or licenses that might result in a discharge to their waters. States consider whether the activity will comply with their water quality standards and other applicable requirements in deciding whether or not to certify the activity.

In September 2013, a draft rule identifying waters protected by the Clean Water Act was sent to the Office of Management and Budget. This draft rule may be formally proposed by the EPA in early 2014, but we believe the final rule will not likely be issued until 2015. Litigation is likely from various stakeholders. If CWA authority is eventually expanded, it may impact our operations in some areas by way of additional requirements.

6

National Environmental Policy Act (NEPA). NEPA, signed into law in 1970, requires federal agencies to review the environmental impacts of their decisions and issue either an environmental assessment or an environmental impact statement. We must provide information to agencies when we propose actions that will be under the authority of the federal government. The NEPA process involves public participation and can involve lengthy timeframes.

Resource Conservation and Recovery Act (RCRA). RCRA, which was enacted in 1976, affects U.S. coal mining operations by establishing “cradle to grave” requirements for the treatment, storage and disposal of hazardous wastes. Typically, the only hazardous wastes generated at a mine site are those from products used in vehicles and for machinery maintenance. Coal mine wastes, such as overburden and coal cleaning wastes, are not considered hazardous wastes under RCRA.

Subtitle C of RCRA exempted fossil fuel combustion wastes from hazardous waste regulation until the EPA completed a report to Congress and made a determination on whether the wastes should be regulated as hazardous. A recent federal district court decision in the District of Columbia requires the EPA to soon submit to the court a proposed deadline for completing the agency’s CCR rulemaking process. This EPA initiative is separate from the OSM CCR rulemaking mentioned above.

Comprehensive Environmental Response, Compensation and Liability Act (CERCLA). Although typically not applied to the coal mining sector, CERCLA, which was enacted in 1980, nonetheless may affect U.S. coal mining operations by creating liability for investigation and remediation in response to releases of hazardous substances into the environment and for damages to natural resources. Under CERCLA, joint and several liabilities may be imposed on waste generators, site owners or operators and others, regardless of fault.

Toxic Release Inventory. Arising out of the passage of the Emergency Planning and Community Right-to-Know Act in 1986 and the Pollution Prevention Act passed in 1990, the EPA's Toxic Release Inventory program requires companies to report the use, manufacture or processing of listed toxic materials that exceed established thresholds, including chemicals used in equipment maintenance, reclamation, water treatment and ash received for mine placement from power generation customers.

Endangered Species Act (ESA). The ESA of 1973 and counterpart state legislation is intended to protect species whose populations allow for categorization as either endangered or threatened. Changes in listings or requirements under these regulations could have a material adverse effect on our our costs or our ability to mine some of our properties in accordance with our current mining plans.

Use of Explosives. Our surface mining operations are subject to numerous regulations relating to blasting activities. Pursuant to these regulations, we incur costs to design and implement blast schedules and to conduct pre-blast surveys and blast monitoring. The storage of explosives is subject to strict federal regulatory requirements. The U.S. Bureau of Alcohol, Tobacco and Firearms (ATF) regulates the use of explosive blasting materials. In addition to ATF regulation, the Department of Homeland Security (DHS) is expected to finalize an ammonium nitrate security program rule in 2014. While such new regulations may result in additional costs related to our surface mining operations, such costs are not expected to have a material adverse effect on our results of operations, financial condition or cash flows.

Global Climate

In the U.S., Congress has considered legislation addressing global climate issues and greenhouse gas emissions, but to date nothing has been enacted. While it is possible that the U.S. will adopt legislation in the future, the timing and specific requirements of any such legislation are uncertain. In the absence of new U.S. federal legislation, the EPA is undertaking steps to regulate greenhouse gas emissions pursuant to the Clean Air Act. In response to the 2007 U.S. Supreme Court ruling in Massachusetts v. EPA, the EPA has commenced several rulemaking projects as described under “Regulatory Matters-U.S. - Clean Air Act.”

7

A number of states in the U.S. have adopted programs to regulate greenhouse gas emissions. For example, 10 northeastern states (Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island and Vermont) entered into the Regional Greenhouse Gas Initiative (RGGI) in 2005, which is a mandatory cap-and-trade program to cap regional carbon dioxide emissions from power plants. In 2011, New Jersey announced its withdrawal from RGGI effective January 1, 2012. Six midwestern states (Illinois, Iowa, Kansas, Michigan, Minnesota and Wisconsin) and one Canadian province have entered into the Midwestern Regional Greenhouse Gas Reduction Accord (MGGRA) to establish voluntary regional greenhouse gas reduction targets and develop a voluntary multi-sector cap-and-trade system to help meet the targets. It has been reported that, while the MGGRA has not been formally suspended, the participating states are no longer pursuing it. Seven western states (Arizona, California, Montana, New Mexico, Oregon, Utah and Washington) and four Canadian provinces entered into the Western Climate Initiative (WCI) in 2008 to establish a voluntary regional greenhouse gas reduction goal and develop market-based strategies to achieve emissions reductions. However, in November 2011, the WCI announced that six states had withdrawn from the WCI, leaving California and four Canadian provinces as the remaining members. Of those five jurisdictions, only California and Quebec have adopted greenhouse gas cap-and-trade regulations to date and both programs have begun operating. Many of the states and provinces that left WCI, RGGI and MGGRA, along with many that continue to participate, have joined the new North America 2050 initiative, which seeks to reduce greenhouse gas emissions and create economic opportunities in ways not limited to cap-and-trade programs.

In the U.S., several states have enacted legislation establishing greenhouse gas emissions reduction goals or requirements. In addition, several states have enacted legislation or have in effect regulations requiring electricity suppliers to use renewable energy sources to generate a certain percentage of power or that provide financial incentives to electricity suppliers for using renewable energy sources.

In 2013, the U.S. and a number of international development banks, including the World Bank, the European Investment Bank and the European Bank for Reconstruction and Development, announced that they would no longer provide financing for the development of new coal-fueled power plants or would do so only in narrowly defined circumstances. Other international development banks, such as the Asian Development Bank, have indicated that they will continue to provide such financing.

The Kyoto Protocol, adopted in December 1997 by the signatories to the 1992 United Nations Framework Convention on Climate Change, established a binding set of emission targets for developed nations. The U.S. signed the Kyoto Protocol but it was not ratified by the U.S. Senate. Australia ratified the Kyoto Protocol in December 2007 and became a full member in March 2008. There are continuing discussions to develop a treaty to replace the Kyoto Protocol after its expiration in 2012, including at the Cancun meetings in late 2010, the Durban meeting in late 2011 and the Doha meeting in late 2012. At the Doha meeting, an amendment to the Kyoto Protocol was adopted, which includes new commitments for certain parties in a second commitment period, from 2013 to 2020.

Enactment of laws or passage of regulations regarding emissions from the combustion of coal by the U.S., some of its states or other countries, or other actions to limit such emissions, could result in electricity generators switching from coal to other fuel sources. Further, policies limiting available financing for the development of new coal-fueled power plants could adversely impact the global demand for coal in the future. The potential financial impact on us of future laws, regulations or other policies will depend upon the degree to which any such laws or regulations force electricity generators to diminish their reliance on coal as a fuel source. That, in turn, will depend on a number of factors, including the specific requirements imposed by any such laws, regulations or other policies, the time periods over which those laws, regulations or other policies would be phased in, the state of commercial development and deployment of CCS technologies and the alternative markets for coal. In view of the significant uncertainty surrounding each of these factors, it is not possible for us to reasonably predict the impact that any such laws, regulations or other policies may have on our results of operations, financial condition or cash flows.

8

Suppliers

The main types of goods we purchase are mining equipment and replacement parts, steel-related (including roof control) products, belting products, lubricants, electricity, fuel and tires. Although we have many long, well-established relationships with our key suppliers, we do not believe that we are dependent on any of our individual suppliers other than for purchases of electricity. The supplier base providing mining materials has been relatively consistent in recent years. Purchases of certain underground mining equipment are concentrated with one principle supplier; however, supplier competition continues to develop.

Illinois Basin (ILB)

The coal industry underwent a significant transformation in the early 1990s, as greater environmental accountability was established in the electric utility industry. Through the U.S. Clean Air Act, acceptable baseline levels were established for the release of sulfur dioxide in power plant emissions. In order to comply with the new law, most utilities switched fuel consumption to low-sulfur coal, thereby stripping the ILB of over 50 million tons of annual coal demand. This strategy continued until mid 2000 when a shortage of low-sulfur coal drove up prices. This price increase combined with the assurance from the U.S. government that the utility industry would be able to recoup their costs to install scrubbers caused utilities to begin investing in scrubbers on a large scale. With scrubbers, the ILB has reopened as a significant fuel source for utilities and has enabled them to burn lower cost, high sulfur coal.

The ILB consists of coal mining operations covering more than 50,000 square miles in Illinois, Indiana and western Kentucky. The ILB is centrally located between four of the largest regions that consume coal as fuel for electricity generation (East North Central, West South Central, West North Central and East South Central). The region also has access to sufficient rail and water transportation routes that service coal-fired power plants in these regions as well as other significant coal consuming regions of the South Atlantic and Middle Atlantic.

U. S. Coal Industry

According to the EIA, coal is expected to remain the largest energy source of electric power generation in the United States for the foreseeable future.

The major coal production basins in the U.S. include Central Appalachia (CAPP), Northern Appalachia (NAPP), Illinois Basin (ILB), Powder River Basin (PRB) and the Western Bituminous region (WB). CAPP includes eastern Kentucky, Tennessee, Virginia and southern West Virginia. NAPP includes Maryland, Ohio, Pennsylvania and northern West Virginia. The ILB includes Illinois, Indiana and western Kentucky. The PRB is located in northeastern Wyoming and southeastern Montana. The WB includes western Colorado, eastern Utah and southern Wyoming.

Coal type varies by basin. Heat value and sulfur content are important quality characteristics and determine the end use for each coal type.

Coal in the U.S. is mined through surface and underground mining methods. The primary underground mining techniques are longwall mining and continuous (room-and-pillar) mining. The geological conditions dictate which technique to use. The Carlisle mine uses the continuous technique. In continuous mining, rooms are cut into the coal bed leaving a series of pillars, or columns of coal, to help support the mine roof and control the flow of air. Continuous mining equipment cuts the coal from the mining face. Generally, openings are driven 20’ wide and the pillars are rectangular in shape measuring 40’x 40’. As mining advances, a grid-like pattern of entries and pillars is formed. Roof bolts are used to secure the roof of the mine. Battery cars move the coal to the conveyor belt for transport to the surface. The pillars can constitute up to 50% of the total coal in a seam.

The United States coal industry is highly competitive, with numerous producers selling into all markets that use coal. We compete against large producers and hundreds of small producers. Peabody Energy Corporation (NYSE:BTU) and Alliance (NASDAQ:ARLP) are the two largest operators in the ILB producing slightly less than half the ILB’s coal production.

9

There are some that believe natural gas (natgas) will overtake coal as the most economic way to produce electricity in the U.S. In the event the government places a price tag on carbon emissions, natgas would gain another advantage over coal since electricity from coal produces more carbon. The potential exists for natgas producers and utilities to develop a new relationship that has not been possible historically.

Employees

Our coal operations currently employ about 370 people. We use a consulting geologist when evaluating new coal mine projects. We also use a consultant to sell our coal, find new buyers and help in contract negotiations. All of our mines are non-union. Other than the 370 Sunrise Coal employees in Indiana, our Chairman, CFO, controller, land person and two part time administrative staff work in the Denver office.

Other

We have no significant patents, trademarks, licenses, franchises or concessions.

Our Denver office is located at 1660 Lincoln Street, Suite 2700, Denver, Colorado 80264, phone 303.839.5504 and Sunrise Coal's corporate office is located at 1183 Canvasback Drive, Terre Haute, Indiana 47802, phone 812.299.2800. Terre Haute is approximately 70 miles west of Indianapolis. Our website is www.halladorenergy.com and Sunrise Coal’s is www.sunrisecoal.com.

ITEM 1A. RISK FACTORS.

Smaller reporting companies are not required to provide the information required by this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Smaller reporting companies are not required to provide the information required by this item; however, there were none.

ITEM 2. PROPERTIES.

See Item 7 MDA for a discussion of our mines.

Coal Reserve Estimates

“Reserves” are defined by the SEC Industry Guide 7 (Guide 7) as that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. “Recoverable” reserves mean coal that is economically recoverable using existing equipment and methods under federal and state laws currently in effect. “Proven (measured) reserves” are defined by Guide 7 as reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. “Probable reserves” are defined by Guide 7 as reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

Our reserve estimates were prepared by Samuel Elder and Jacob Gennicks, two of our mining engineers. Mr. Elder is a licensed Professional Engineer in the State of Indiana and has over 25 years experience estimating coal reserves. Mr. Gennicks is a licensed Professional Engineer in the State of Indiana and Illinois and has five years experience estimating coal reserves.

10

Standards set forth by the USGS were used to place areas of the mine reserves into the Proven (measured) and Probable (indicated) categories. Under these standards, coal within 1,320' of a data point is considered to be proven, and coal within 1,320' to 3,960' is placed in the Probable category. All reserves are stated as a final salable product.

For the exploration process core samples are bagged and boxed and delivered to an independent lab for analysis. For the production process samples are taken just before the coal is placed in the rail car by the customer and delivered to an independent lab for analysis.

Prior to acquiring coal leases, we have our title abstractors or contract title abstractors conduct a preliminary title search on the property. This information provides a strong indication of the coal owner, with whom we will enter into a lease. The next step is to execute a lease with the owner, giving us control of the property. Prior to mining the coal, we verify the lessor is the coal owner with a title opinion. Prior to purchasing coal properties we follow a similar process.

ADDITIONAL DISCLOSURES FOR THE CARLISLE MINE

|

1.

|

The Carlisle mine currently has road frontage on State Highway 58, and is adjacent to the CSX railroad. The Carlisle mine has a double 100 car loop facility. Substantially all of our coal is shipped by rail.

|

|

2.

|

Currently only the Indiana V seam is planned to be mined, and all of the controlled tonnage is leased to Sunrise. Most leases have unlimited terms once mining has begun, and yearly payments or earned royalties are kept current. Mineable coal thickness used is greater than four feet. The current Carlisle mine plan is broken into four areas– North Main – South Main – West Main – 2 South Main. It is believed that all additional property that would be required to access all lease areas can be obtained but, if some properties cannot be leased, some modification of the current mine plan would be required. All coal should be mined within the terms of the leases. Leasing programs are continuing by our staff.

|

|

3.

|

The Carlisle mine has a dual-use slope for the main coal conveyor and the moving of supplies and personnel. There are two 8' diameter shafts, known as the “main fans”, at the base of the slope for mine ventilation. Two additional air shafts (8’ and 10.5’ diameter), known as the “north fans”, were completed about three miles north of the original air shaft in 2009 to facilitate the mine expansion. The slope (9° or 15% grade) is 18' wide with concrete and steel arch construction. A 16’ hoist is about four miles north of the main slope. The hoist is currently facilitating two production units by efficiently moving personnel and materials into the north main and north main addition areas of the reserve. Two additional 8’ diameter airshafts, the “north portal fans”, were completed in 2013 at the North Portal facility to more effectively ventilate the north units, and facilitate more efficient use of the main set and north set of air shafts to units elsewhere in the mine. All underground mining equipment is powered with electricity and underground compliant diesel.

|

|

4.

|

The new slurry impoundment construction has been completed in 2013 as planned. The impoundment is currently being utilized as fine refuse disposal, with a final estimated storage capacity of 36 million clean tons.

|

|

5.

|

Current production capabilities are projected to be in the range of 3 to 3.3 million tons per year giving the mine a reserve life of about 15 years. The mine plan is basic room-and-pillar using a synchronized continuous miner section with no retreat mining. Plans are for pillars to be centered on a 60'x80' pattern with 18' entries for our mains, and pillars on 60'x60' centers with 20' entries in the rooms.

|

|

6.

|

The Carlisle mine has been in production since February 2007. The North Main, Sub Main #1, and the South Main have been developed with four units currently in production.

|

7. The Carlisle mine has two wash plants capable of 950 tons/hour of raw feed.

11

The Ace-in-the-Hole mine is a multi-seam open pit strip mine. The majority of the seams are sold raw, but some of the seams will be washed prior to sales depending on quality. To convert the tons sold raw the in-place tonnage is taken times a pit recovery of 94% based on seam thickness. To convert the tons sold washed the in-place tonnage is taken times a pit recovery based on seam thickness then reduced by the projected plant recovery of 72%.

Mine and Wash Plant Recovery

|

Mine recovery

|

Wash plant recovery

|

||||

|

Carlisle

|

53%

|

69-72%

|

|||

|

Bulldog

|

45%

|

77%

|

|||

|

Russellville

|

54%

|

77%

|

|

Inaccuracies in our estimates of our coal reserves could result in decreased profitability from lower than expected revenues or higher than expected costs.

|

Our future performance depends on, among other things, the accuracy of our estimates of our proven and probable coal reserves. We base our estimates of reserves on engineering, economic and geological data assembled, analyzed and reviewed by internal engineers. We update our estimates of the quantity and quality of proven and probable coal reserves annually to reflect the production of coal from the reserves, updated geological models and mining recovery data, the tonnage contained in new lease areas acquired and estimated costs of production and sales prices. There are numerous factors and assumptions inherent in estimating the quantities and qualities of, and costs to mine, coal reserves, including many factors beyond our control, including the following:

|

•

|

quality of the coal;

|

|

|

•

|

geological and mining conditions, which may not be fully identified by available exploration data and/or may differ from our experiences in areas where we currently mine;

|

|

|

•

|

the percentage of coal ultimately recoverable;

|

|

|

•

|

the assumed effects of regulation, including the issuance of required permits, taxes, including severance and excise taxes and royalties, and other payments to governmental agencies;

|

|

|

•

|

assumptions concerning the timing for the development of the reserves; and

|

|

|

•

|

assumptions concerning equipment and productivity, future coal prices, operating costs, including for critical supplies such as fuel, tires and explosives, capital expenditures and development and reclamation costs.

|

As a result, estimates of the quantities and qualities of economically recoverable coal attributable to any particular group of properties, classifications of reserves based on risk of recovery, estimated cost of production, and estimates of future net cash flows expected from these properties as prepared by different engineers, or by the same engineers at different times, may vary materially due to changes in the above factors and assumptions. Actual production recovered from identified reserve areas and properties, and revenues and expenditures associated with our mining operations, may vary materially from estimates.

12

ITEM 3. LEGAL PROCEEDINGS. None

ITEM 4. MINE SAFETY DISCLOSURES

See Exhibit 95 to this Form 10-K for a listing of our mine safety violations.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Stock Price Information

Our common stock is traded on the NASDAQ Capital Market under the symbol HNRG. 64% of our stock is held by our officers, directors and their affiliates. The following table sets forth the high and low closing sales price for the periods indicated:

|

High

|

Low

|

||||

|

2014

|

|||||

|

January 1 through March 5, 2014

|

$8.29

|

$7.63

|

|||

|

2013

|

|||||

|

Fourth quarter

|

8.55

|

6.58

|

|||

|

Third quarter

|

8.41

|

6.82

|

|||

|

Second quarter

|

8.37

|

6.46

|

|||

|

First quarter

|

8.35

|

6.90

|

|||

|

2012

|

|||||

|

Fourth quarter

|

10.11

|

8.03

|

|||

|

Third quarter

|

8.51

|

7.25

|

|||

|

Second quarter

|

9.01

|

6.56

|

|||

|

First quarter

|

10.83

|

8.70

|

Regular and Special Cash Dividends

On April 5, 2013 our Board of Directors approved the adoption of a regular quarterly dividend policy. During 2013 we paid three regular quarterly dividends of $.04 each on May 15, August 15 and November 15.

During 2012 we paid three special dividends; April for $.14 per share, August for $.50 and December for $.16 for a total of $.80 per share.

At March 5, 2014, we had 236 shareholders of record of our common stock; this number does not include the shareholders holding stock in "street name.” We estimate we have over 1,800 street name holders.

Equity Compensation Plan Information

Restricted Stock Units

At December 31, 2013 we had 164,000 Restricted Stock Units (RSUs) outstanding and 840,000 available for future issuance. The outstanding RSUs have a value of $9 million based on our current stock price of $8.21. On February 1, 2014 we granted 920,000 RSUs to key employees of which 720,000 vest equally over four years and 200,000 vest equally over two years; our stock price on grant date was $7.66 per share. In April 2012, we granted 143,000 RSUs with cliff vesting over three years; our stock closed at $9 on grant date. We expect 310,000 RSUs to vest/lapse during 2014 under our current vesting schedule.

13

During 2013 and 2012, there were 315,500 and 297,500 RSUs that vested, respectively. On the vesting dates the shares had a value of $2.3 million for 2013 and $2.4 million for 2012. Under our RSU Plan participants are allowed to relinquish shares to pay for their required minimum statutory income taxes.

Stock-based compensation expense for 2013 was $2.2 million and for 2012 was $2.7 million. For 2014, based on existing RSUs outstanding, stock-based compensation expense will be $2.7 million.

On February 1, 2014, our Board of Directors authorized to increase the available shares for issuance under the 2008 Restricted Stock Unit Plan by 1,500,000 shares to be used for future compensation. The total number of RSUs authorized under the plan since inception is 3,850,000.

Stock Options

On October 31, 2012 we paid our CEO $1.5 million in exchange for him relinquishing his 200,000 stock options with a $2.30 strike price. The stock was selling for $9.50 on the transaction date. We no longer have any stock options outstanding.

Stock Bonus Plan

Our stock bonus plan was authorized in late 2009 with 250,000 shares. Currently, we have about 86,000 shares left in such plan.

ITEM 6. SELECTED FINANCIAL DATA.

Smaller reporting companies are not required to provide the information required by this item.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Our consolidated financial statements should be read in conjunction with this discussion.

Overview

The largest portion of our business is devoted to coal mining in the state of Indiana through Sunrise Coal, LLC (a wholly-owned subsidiary) serving the electric power generation industry. We also own a 45% equity interest in Savoy Energy, L.P., a private oil and gas exploration company with operations in Michigan and a 50% interest in Sunrise Energy, LLC, a private gas exploration company with operations in Indiana. We account for our investments in Savoy and Sunrise Energy using the equity method.

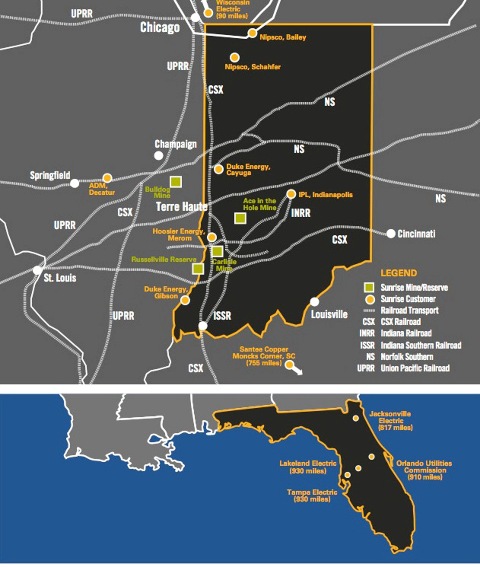

Our largest contributor to revenue and earnings is the Carlisle underground coal mine located in western Indiana, about 30 miles south of Terre Haute. Over 81% of our coal sales are to customers with large scrubbed coal-fired power plants in the state of Indiana. Our mines and coal reserves are strategically located in close proximity to our primary customers, which reduces transportation costs and thus provides us with a competitive advantage with respect to those customers; our closest customer’s plant is 13 miles away and the farthest Indiana customer is 100 miles away. We have access to our primary customers directly through either the CSX Corporation (NYSE: CSX) or through the Indiana Rail Road, majority owned by the CSX. During 2013 about 12% of our sales were to customers in Central Florida almost 1,000 miles away.

We see an increasing demand for coal produced in the Illinois Basin (ILB) in the future. Demand for coal produced in the ILB is expected to grow at a rate faster than overall U.S. coal demand due to ILB coal having higher heating content than Powder River Basin (PRB) and lower cost structure than Central Appalachia (CAAP) coal. Many utilities are scrubbing to meet emission requirements beyond just sulfur compliance, even utilities that burn exclusively PRB. Once scrubbed, those utilities are usually capable of burning ILB coal. It is this trend of new scrubber installations coupled with rising CAAP cost structure that is leading to increased switching from CAAP coal to ILB coal. Some fuel switching will also occur from PRB to ILB in newly scrubbed utilities located near ILB coal supply.

14

Our customers have made or announced plans to make significant investments in pollution control equipment at their plants. Due to these large investments none of these plants are scheduled for retirement; thus we expect to be supplying these plants for many years. It is not economical for the smaller, older, less efficient power plants to install scrubbers and other pollution control devices; accordingly, those type plants most likely will be retired in the coming years.

Our Coal Contracts

We have close relationships with our customers: Duke Energy Corporation (NYSE:DUK), Hoosier Energy, an electric cooperative, and Indianapolis Power & Light Company, a wholly-owned subsidiary of The AES Corporation (NYSE:AES). During 2013 and 2012 we sold 400,600 tons and 185,000 tons, respectively to an Orlando utility through an arrangement we have with an affiliate of JP Morgan. We believe these Florida sales are an indication of the trend of ILB coal replacing CAAP coal that has traditionally supplied the southeast markets. During 2013 we sold about one million tons each to two customers, about 500,000 tons to the third customer and about 400,000 tons to the fourth customer.

The table below illustrates the status of our current coal contracts:

|

Year

|

Contracted Tons

|

Average Price/Ton

|

|||

|

2014

|

3,504,000*

|

$42.72

|

|||

|

2015

|

1,650,000

|

41.99

|

|||

|

2016

|

689,000

|

40.93 **

|

.

|

||

|

Total

|

5,843,000

|

_________________________

*Includes about 150,000 tons from our new Ace-in-the-Hole surface mine.

**During 2013, to accommodate one of our major customers, we entered into three separate agreements that allowed them to defer 338,000 tons originally to be delivered in 2013 to sometime in 2016. Under the agreements they agreed to pay us an average of $5.36/ton over the life of the deferral periods and we recognize the revenue accordingly as required by US GAAP. Therefore, we recognized $251,000 in the fourth quarter of 2013 and will recognize $781,000 during each of the years 2014 and 2015; otherwise our average price/ton in 2016 would be $43.57.

We expect to continue selling a significant portion of our coal under supply agreements with terms of one year or longer. Typically, customers enter into coal supply agreements to secure reliable sources of coal at predictable prices while we seek stable sources of revenue to support the investments required to open, expand and maintain or improve productivity at the mines needed to supply these contracts. The terms of coal supply agreements result from competitive bidding and extensive negotiations with customers.

Current Projects

All of our underground coal reserves are high sulfur (4.5 - 6#) with a BTU content in the 11,500 range. As discussed below, the Ace surface mine is low sulfur (1.5#) with a BTU content of 11,400. We have no met coal reserves, only steam (thermal) coal reserves. We do not use outside contractors. Below is a discussion of our current projects preceded by a table of our coal reserves.

15

Reserve Table - Controlled Tons (in millions):

|

Year-End Reserves

|

||||||||||||||

|

Annual Capacity

|

2013

|

2012

|

||||||||||||

|

Proven

|

Probable

|

Total

|

Proven

|

Probable

|

Total

|

|||||||||

|

Carlisle (assigned)

|

3.4

|

33.5

|

8.6

|

42.1

|

34.2

|

9.3

|

43.5

|

|||||||

|

Ace-in-the-Hole (assigned)

|

0.5

|

3.1

|

3.1

|

3.1

|

3.1

|

|||||||||

|

Bulldog (unassigned)

|

19.6

|

16.2

|

35.8

|

19.5

|

16.1

|

35.6

|

||||||||

|

War Eagle (unassigned)

|

27.7

|

15.4

|

43.1

|

15.5

|

13.9

|

29.4

|

||||||||

|

Total

|

3.9

|

83.9

|

40.2

|

124.1

|

72.3

|

39.3

|

111.6

|

|||||||

|

Assigned

|

45.2

|

46.6

|

||||||||||||

|

Unassigned

|

78.9

|

65.0

|

||||||||||||

|

|

124.1

|

111.6

|

||||||||||||

Active Reserve (assigned) - Carlisle Mine (underground)

Our coal reserves at December 31, 2013 assigned to the Carlisle Mine were 42.1 million tons compared to beginning of year reserves of 43.5 million tons. Primarily through the execution of new leases, our reserve additions of 2.5 million tons replaced 80% of our 2013 production of 3.1 million tons. We reduced our reserves by 810,000 tons due to revised mining plans. The mine is located near the town of Carlisle, Indiana in Sullivan County and became operational in January 2007. The coal is accessed with a slope to a depth of 340'. The coal is mined in the Indiana Coal V seam which is highly volatile bituminous coal and is the most economically significant coal in Indiana. The Indiana V seam has been extensively mined by underground and surface methods in the general area. The coal thickness in the project area is 4' to 7'.

The mine has several advantages as listed below:

|

•

|

SO2 - Historically, Carlisle has guaranteed a 6# SO2 product; however, with the addition of the Ace-in-the-Hole Mine we can blend lower sulfur coal with Carlisle coal and guarantee a mid-sulfur product which should command a higher price and increase our customer base. Few mines in the ILB have the ability to offer their customers various ranges of SO2. Carlisle has supplied coal to 11 different power plants.

|

|

•

|

Chlorine - Our reserves have lower chlorine (<0.10%) than average ILB reserves of 0.22%. Much of the ILB’s new production is located in Illinois and possesses chlorine content in excess of .30%. The relatively low chlorine content of our reserves is attractive to buyers given their desire to limit the corrosive effects of chlorine in their power plants.

|

|

•

|

Transportation - Carlisle has a double 100 rail car loop facility and a four-hour certified batch load-out facility connected to the CSX railroad. The Indiana Rail Road (INRD) also has limited running rights on the CSX to our mine. Dual rail access gives us a freight advantage to more customers. Long term, the CSX anticipates our coal being shipped to southeast markets via their railroad. We sell our coal FOB the mine and substantially all of our coal is transported by rail. However, on occasion we have shipped to three power plants via truck.

|

16

New Mine (assigned) - Ace-in-the-Hole Mine (Ace) (surface)

In November 2012 we purchased for $6 million permitted fee coal reserves, coal leases and surface properties near Clay City, Indiana in Clay County. The Ace mine is 42 road miles northeast of the Carlisle Mine. We control 3.1 million tons of proven coal reserves of which we own 1.2 million tons in fee. We mine two primary seams of low sulfur coal which make up 2.9 million of the 3.1 million tons controlled. Both of the primary seams are low sulfur (2# SO2). Mine development began in late December 2012 and we began shipping coal in late August 2013. We truck low sulfur coal from Ace to Carlisle to blend with Carlisle’s high sulfur coal. Many utilities in the southeastern U.S. have scrubbers with lower sulfur limits (4# SO2) which cannot accept the higher sulfur contents of the ILB (6# SO2). Blending Carlisle coal to a lower sulfur specification enables us to market Carlisle coal to more customers. We currently have a contract at Carlisle which requires us to blend coal from Ace to meet sulfur specifications. We also expect to ship low sulfur coal from Ace direct to unscrubbed customers that require low sulfur (2# SO2). We expect the maximum capacity of Ace to be 500,000 tons annually. Ace currently has 30% of its capacity contracted for 2014. We have invested $22 million in minerals, land, equipment and development as of December 31, 2013.

During the last half of 2013 we sold 10,000 high sulfur and 26,000 low sulfur tons from Ace. Ace transitioned to the production stage in October.

New Reserve (unassigned) - Bulldog Mine (underground)

We have leased roughly 19,300 acres in Vermillion County, Illinois near the village of Allerton. Based on our reserve estimates we currently control 35.8 million tons of coal reserves. A considerable amount of our leased acres has yet to receive any exploratory drilling, thus we anticipate our controlled reserves to grow as we continue drilling in 2014. The permitting process was started in the summer of 2011, and we filed the formal

permit with the state of Illinois and the appropriate Federal regulators during June 2012. We currently expect to receive an approved mining permit in the fourth quarter of 2014.

Full-scale mine development will not commence until we have a sales commitment. We estimate the costs to develop this mine to be $150 million at full capacity of three million tons annually.

New Reserve (unassigned) – War Eagle Mine (underground)

We have leased roughly 11,000 acres in Lawrence County, Illinois near the village of Russellville. Based on our reserve estimates we currently control 43.1 million tons of coal reserves. This reserve is located about 20 miles southwest of the Carlisle Mine. Our initial testing indicates that this reserve’s minability and coal quality is very similar to the Carlisle reserve.

We anticipate filing for a mining permit in late 2014. Full-scale mine development will not commence until we have a sales commitment. We estimate the costs to develop this mine to be $150 million at full capacity of 3.3 million tons annually.

Unassigned reserves represent coal reserves that would require new mineshafts, mining equipment, and plant facilities before operations could begin on the property. The primary reason for this distinction is to inform investors which coal reserves will require substantial capital expenditures before production can begin.

17

Below is a map that shows our mines, reserves and customer (past and present) locations.

18

On May 31, 2013 we purchased for $2.8 million a multi-commodity truck/barge terminal. Over 17 acres of secured area is available. The terminal is at mile point 743.8 on the Indiana bank of the Ohio River near the William Natcher Bridge between Rockport and Grandview, Indiana. Currently the dock will handle third party commodities. In the long term, we plan to ship coal through the dock. The terminal is in close proximity to the NS railroad, the CSX railroad and American Electric Power's Rockport generating power plant. We do not expect revenue from this asset until 2015. G&A expenses for this property were about $500,000 during 2013.

Liquidity and Capital Resources

Our capex budget for 2014 is about $15 million. At Carlisle we expect to spend $12 million for maintenance capex and $2.5 million for expansion capex. At Ace we estimate maintenance capex to be about $500,000. Cash from operations should fund these expenditures. In addition we have about $110 million available under our bank line.

We have no material off-balance sheet arrangements.

Capital Expenditures (capex)

For 2013 our capex was about $31.4 million allocated as follows (in 000’s):

|

Carlisle - maintenance capex

|

$ | 14,602 | ||

|

Carlisle - expansion/improvements

|

2,973 | |||

|

Carlisle - land and minerals

|

346 | |||

|

Ace - mine development

|

4,013 | |||

|

Ace - surface equipment

|

5,858 | |||

|

Other projects

|

3,685 | |||

|

Items accrued for but not paid

|

(85 | ) | ||

|

Capex per the Cash Flow Statement

|

$ | 31,392 |

19

Results of Operations

Quarterly coal sales and cost data (in 000’s):

|

2013

|

||||||||||||||||||||

|

1st

|

2nd

|

3rd

|

4th

|

Full Year

|

||||||||||||||||

|

Tons sold

|

840 | 774 | 817 | 757 | 3,188 | |||||||||||||||

|

Coal sales

|

$ | 33,995 | $ | 34,149 | $ | 34,985 | $ | 34,307 | $ | 137,436 | ||||||||||

|

Average price/ton

|

40.47 | 44.12 | 42.82 | 45.32 | 43.11 | |||||||||||||||

|

Wash plant recovery

|

74.0 | % | 70.9 | % | 68.0 | % | 63.2 | % | 69.0 | % | ||||||||||

|

Operating costs

|

$ | 23,290 | $ | 22,262 | $ | 23,407 | $ | 23,934 | $ | 92,893 | ||||||||||

|

Average cost/ton

|

27.73 | 28.76 | 28.65 | 31.62 | 29.14 | |||||||||||||||

|

Margin

|

10,705 | 11,887 | 11,578 | 10,373 | 44,543 | |||||||||||||||

|

Margin/ton

|

12.74 | 15.36 | 14.17 | 13.70 | 13.97 | |||||||||||||||

|

Capex

|

8,604 | 6,174 | 8,780 | 7,834 | 31,392 | |||||||||||||||

|

2012

|

||||||||||||||||||||

|

1st

|

2nd

|

3rd

|

4th

|

Full Year

|

||||||||||||||||

|

Tons sold

|

701 | 743 | 810 | 752 | 3,006 | |||||||||||||||

|

Coal sales

|

$ | 29,620 | $ | 32,487 | $ | 36,152 | $ | 33,111 | $ | 131,370 | ||||||||||

|

Average price/ton

|

42.25 | 43.72 | 44.63 | 44.03 | 43.70 | |||||||||||||||

|

Wash plant recovery

|

73.1 | % | 71.2 | % | 71.1 | % | 71.7 | % | 71.8 | % | ||||||||||

|

Operating costs

|

$ | 18,433 | $ | 18,816 | $ | 20,745 | $ | 21,745 | $ | 79,739 | ||||||||||

|

Average cost/ton

|

26.29 | 25.32 | 25.61 | 28.91 | 26.53 | |||||||||||||||

|

Margin

|

11,187 | 13,671 | 15,407 | 11,366 | 51,631 | |||||||||||||||

|

Margin/ton

|

15.96 | 18.40 | 19.02 | 15.12 | 17.17 | |||||||||||||||

|

Capex

|

2,372 | 1,857 | 4,993 | 16,987 | 26,209 | |||||||||||||||

|

Year

|

Tons

|

Average Sales Price/ton

|

Average Cost/ton

|

Margin/

ton

|

Margin

(in millions)

|

||||||||||||||||

|

2012

|

3,006,000 | $ | 43.70 | $ | 26.53 | $ | 17.17 | $ | 51.6 | ||||||||||||

|

2013

|

3,188,000 | 43.11 | 29.14 | 13.97 | 44.5 | ||||||||||||||||

| 2014* | 3,504,000 | 42.72 | 28.50 | 14.22 | 49.8 | ||||||||||||||||

____________________________

*Sales are contracted for 2014. Average cost per ton is an estimate.

During much of 2013 we experienced difficult mining conditions and lower recoveries at Carlisle. In the fourth quarter of 2013 we experienced our highest cost of production ever due to extremely low recovery. Additionally, several production days were lost due to weather and operational issues at Carlisle. We estimate 2014 costs will be lower than 2013 due to improving recovery. We are making significant investments to our wash plant in an effort to improve recovery. The wash plant recovery for January 2014 was 68.6%. We are focused on reducing our costs to the projected $28.50/ton set forth in the table above. January 2014 costs per ton were less than the projected $28.50.

Capex in the fourth quarter of 2012 includes $9 million for the purchase of the Ace surface mine and another $4 million for land at Bulldog and Carlisle.

20

Other Analyses of Results of Operations

Savoy’s activity is discussed below.

The increase in equity income from Sunrise Energy was due to higher natgas prices.

The increase in DD&A was due to additions to plant and equipment.

Quarterly EPS

|

2013

|

||||||||||||||

|

1st

|

2nd

|

3rd

|

4th

|

|||||||||||

|

Basic

|

$.19

|

$.29

|

$.17

|

$.16

|

||||||||||

|

Diluted

|

.19

|

|

.28

|

.17

|

.16

|

|||||||||

|

2012

|

||||||||||||||

|

1st

|

2nd

|

3rd

|

4th

|

|||||||||||

|

Basic

|

$.22

|

$.23

|

$.22

|

$.18

|

||||||||||

|

Diluted

|

.21

|

|

.23

|

.22

|

.17

|

|||||||||

MSHA Reimbursements

Some of our coal contracts allow us to pass on certain costs incurred resulting from changes in costs to comply with mandates issued by MSHA or other government agencies. We do not recognize any revenue until customers have notified us that they accept the charges.

We submitted our incurred costs for 2010 in September 2011 for $4.2 million. One of the customers agreed with our analysis and paid $2.3 million in February 2012 and the other agreed with our analysis in May 2012. Accordingly, $2.3 million was recorded in the first quarter and the other $1.9 million was recorded in the second quarter of 2012.

We submitted our incurred costs for 2011 in October 2012 for $3.7 million. $2.1 million in reimbursements were recorded in the first quarter 2013 and $1.6 million were recorded in the fourth quarter. Based on past experience we expect to collect the 2012 costs in 2014 and the 2013 costs in 2015.

Income Taxes

During 2013 our effective tax rate was 25%. For 2014, we are projecting an effective tax rate of 25% or slightly less. Based on our projections, we are forecasting a total federal and state tax obligation in excess of existing prepayments of $4.6 million, resulting in additional outlays of cash for income taxes. In addition, we expect the tax consequences between income tax and financial reporting purposes to result in a reduction to the deferred tax liability with a corresponding deferred tax benefit.

45% Ownership in Savoy

Savoy operates almost exclusively in Michigan. They have an interest in the Trenton-Black River Play in southern Michigan. They hold 144,000 gross acres (about 72,000 net) in this area. During 2013 Savoy drilled 30 gross wells in this play of which 10 were dry, 17 were successful, and three are still being evaluated. During 2014 Savoy plans on drilling 20 or more additional wells in the play. Drilling locations in this play are identified based on the evaluation of extensive 3-D seismic shoots. Savoy operates their own wells and their working interest averages between 30 and 60% and their net revenue interest averages between 25 and 48%. Savoy’s net daily oil production currently averages about 1,100 barrels. Savoy has an interest in about 96 gross wells (37 net).

21

Late last year Savoy engaged Energy Spectrum Advisors Inc. (ESA) to market its Trenton-Black River (TBR) operated oil properties located in southeast Michigan. ESA has offices in Dallas and Houston. More information will be posted to the ESA website in early March 2014.

The reserve quantity and value information set forth in the tables below, do not agree to the Brock Engineering Report (see Note 6 to the financial statements) as such report only includes the TBR properties. The other properties are not significant, but have been included in the tables below. The TBR properties comprise about 95% of the PV10 amounts.

We are looking forward to the opportunity to potentially effect a monetization of our Savoy investment.

The table below provides detail for Savoy’s operations for the last two years; such unaudited amounts are to the 100%, in other words not shown proportionate to our 45% interest (financial statement data in thousands):

|

2013

|

2012

|

|||||||

|

Revenue:

|

||||||||

|

Oil

|

$

|

32,057

|

$

|

25,830

|

||||

|

NGLs (natural gas liquids)

|

900

|

926

|

||||||

|

Natgas

|

709

|

368

|

||||||

|

Contract drilling

|

5,409

|

4,555

|

||||||

|

Other

|

3,173

|

373

|

||||||

|

Total revenue

|

42,248

|

32,052

|

||||||

|

Costs and expenses:

|

||||||||

|

LOE (lease operating expenses)

|

3,262

|

2,659

|

||||||

|

Severance tax

|

2,476

|

2,015

|

||||||

|

Contract drilling costs

|

3,520

|

3,161

|

||||||

|

DD&A (depreciation, depletion & amortization)

|

5,802

|

6,387

|

||||||

|

G&G (geological and geophysical costs)

|

5,084

|

3,208

|

||||||

|

Dry hole costs

|

3,066

|

3,244

|

||||||

|

Impairment of unproved properties

|

3,999

|

3,778

|

||||||

|

Other exploration costs

|

451

|

340

|

||||||

|

G&A (general & administrative)

|

1,662

|

1,287

|

||||||

|

Stock option expense

|

1,448

|

|||||||

|

Total expenses

|

29,322

|

27,527

|

||||||

|

Net income

|

$

|

12,926

|

$

|

4,525

|

|

The information below is not in thousands:

|

||||||||

|

Oil production – barrels

|

337,950

|

295,000

|

||||||