UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04570

| Name of Registrant: | Vanguard New York Tax-Free Funds |

| Address of Registrant: | P.O. Box 2600 Valley Forge, PA 19482 |

| Name and address of agent for service: | Anne E. Robinson, Esquire P.O. Box 876 Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: November 30

Date of reporting period: December 1, 2018—November 30, 2019

Item 1: Reports to Shareholders

|

Annual Report | November 30, 2019

Vanguard New York Tax-Exempt Funds

|

|

Vanguard New York Municipal Money Market Fund Vanguard New York Long-Term Tax-Exempt Fund

See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports.

|

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com.

You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.

| Contents | |

| A Note From Our Chairman | 1 |

| Your Fund’s Performance at a Glance | 2 |

| Advisor’s Report | 3 |

| About Your Fund’s Expenses | 7 |

| New York Municipal Money Market Fund | 9 |

| New York Long-Term Tax-Exempt Fund | 29 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

A Note From Our Chairman

Tim Buckley

Chairman and Chief Executive Officer

Dear Shareholder,

Recent volatility in financial markets—affecting stocks, bonds, and commodities—has been a good reminder of the wise old adage, “Never keep all your eggs in one basket.” Maintaining balance and diversification in your investment portfolio can help to both limit risk and set you up for long-term success.

It’s understandable why some investors might become complacent after a long market run-up like the one that lifted stock prices, especially U.S. stock prices, in the years following the global financial crisis. But failing to rebalance regularly can leave a portfolio with a much different mix of assets than intended and, often, more risk than intended.

Balance across and diversification within asset classes are powerful tools for managing risk and achieving your investment goals. A portfolio’s allocation will determine a large portion of its long-term return and also the majority of its volatility risk. A well-diversified portfolio is less vulnerable to significant swings in the performance of any one segment of the asset classes in which it invests.

Balance and diversification will never eliminate the risk of loss, nor will they guarantee positive returns in a declining market. But they may reduce the chance that you’ll suffer disproportionate losses in one particular high-flying asset class or sector when it comes back to earth. And exposure to all key market components should give you at least some participation in the sectors that are performing best at any given time.

Vanguard is committed to helping you achieve balance and diversification in your portfolios to help meet your investment goals. We thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

Chairman and Chief Executive Officer

December 17, 2019

| 1 |

Your Fund’s Performance at a Glance

· For the 12 months ended November 30, 2019, Vanguard New York Long-Term Tax-Exempt Fund returned 9.37% for Investor Shares and 9.46% for Admiral Shares. These results exceeded those of the fund’s benchmark, the Bloomberg Barclays NY Municipal Bond Index, which returned 8.09%.

· Vanguard New York Municipal Money Market Fund returned 1.39%.

· Global monetary policy shifted markedly during the fiscal year. Faced with slowing global growth and intensifying trade disputes, many central banks turned more accommodative. The U.S. Federal Reserve, after raising its target for short-term interest rates four times in 2018, cut rates three times this calendar year and ended its balance sheet tapering. Bonds, including municipal issues, saw their yields fall and prices rise.

· The Long-Term Fund’s average duration (a measure of the price sensitivity of the fund’s holdings to movements in interest rates) was longer than that of its benchmark. That stance accounted for much of the fund’s relative outperformance

· The advisor continued to favor intermediate- and long-term bonds, which boosted performance. A tilt toward lower-quality investment-grade bonds compared with the benchmark index also proved beneficial as recession fears went unrealized.

Market Barometer

| Average Annual Total Returns | ||||||

| Periods Ended November 30, 2019 | ||||||

| One Year | Three Years | Five Years | ||||

| Stocks | ||||||

| Russell 1000 Index (Large-caps) | 16.10% | 14.67% | 10.80% | |||

| Russell 2000 Index (Small-caps) | 7.51 | 8.57 | 8.22 | |||

| Russell 3000 Index (Broad U.S. market) | 15.49 | 14.22 | 10.61 | |||

| FTSE All-World ex US Index (International) | 11.50 | 9.39 | 4.20 | |||

| Bonds | ||||||

| Bloomberg Barclays U.S. Aggregate Bond Index (Broad taxable market) | 10.79% | 4.10% | 3.08% | |||

| Bloomberg Barclays Municipal Bond Index (Broad tax-exempt market) | 8.49 | 5.02 | 3.57 | |||

| FTSE Three-Month U.S. Treasury Bill Index | 2.31 | 1.61 | 1.01 | |||

| CPI | ||||||

| Consumer Price Index | 2.05% | 2.14% | 1.72% | |||

| 2 |

Advisor’s Report

For the 12 months ended November 30, 2019, Vanguard New York Long-Term Tax-Exempt Fund returned 9.37% for Investor Shares and 9.46% for Admiral Shares. Those results exceeded the 8.09% return of the fund’s benchmark, the Bloomberg Barclays NY Municipal Bond Index.

Municipal bond yields declined across the board; prices increased most at the long end. For both Investor and Admiral Shares, the capital return was 6.14%. Return from income was 3.23% for Investor Shares and 3.32% for Admiral Shares. The Long-Term Fund’s 30-day SEC yield fell 124 basis points to 1.82% for Investor Shares and 122 basis points to 1.90% for Admiral Shares. (A basis point is one-hundredth of a percentage point.)

Vanguard New York Municipal Money Market Fund returned 1.39%. The fund’s 7-day SEC yield fell 57 basis points to 1.01%.

Please note that the funds are permitted to invest in securities that can generate income distributions subject to the alternative minimum tax (AMT). At the end of the fiscal period, only the Money Market Fund owned such securities.

The investment environment

The financial markets were driven largely by shifts in the outlook for global growth and monetary policy during the period.

Further signs of a global slowdown and tepid inflation at the start of 2019 led to a pivot in monetary policy across much of the world as major central banks took a more accommodative stance. In the United States, the labor market remained robust even as the pace of job creation eased a little. The unemployment rate continued to trend lower, falling to 3.5% by the end of the period, which helped keep consumers spending.

Gross domestic product, the broadest measure of economic activity, expanded at an annual rate of about 3% after adjusting for inflation in the first quarter of 2019. The pace of its growth has slowed since then,

Yields of Tax-Exempt Municipal Securities

(National Averages, AAA-Rated General Obligation Issues)

| November 30, | November 30, | |

| Maturity | 2018 | 2019 |

| 2 years | 1.98% | 1.10% |

| 5 years | 2.16 | 1.17 |

| 10 years | 2.55 | 1.50 |

| 30 years | 3.27 | 2.13 |

| Source: Vanguard. |

| 3 |

however, amid fading effects from tax cuts, weaker business confidence, and trade disputes. Inflation has remained tame.

After raising rates in December, the Federal Reserve began to reverse gears with an announcement in March that it would end its balance sheet tapering. It went on to lower the federal funds rate in August, September, and October. Those cuts, the first in more than a decade, were justified by policymakers as “insurance” meant to cushion the effects of trade policies and prolong an economic expansion already in its 11th year.

In this environment, Treasury yields fell across the maturity spectrum. Although munis are affected less by international developments, they largely followed suit. The average yield of 2-year AAA-rated general obligation issues slipped 88 basis points to 1.10% over the period; the average yield of similarly rated 10-year issues dropped 105 basis points to 1.50%.

Demand for muni bonds was strong through much of the period. That demand supported prices, as did supply in recent months. The 2017 tax reform legislation eliminated municipal issuers’ ability to advance-refund their outstanding debt prior to the call date with another tax-exempt debt issuance. However, with rates falling, municipalities have been pre-refunding tax-exempt securities by issuing taxable securities—thereby shrinking the supply of longer-dated tax-exempt munis.

Credit quality in the municipal market remained solid overall as the strong economy boosted revenue collections.

New York State’s credit fundamentals remain healthy. For the fiscal year ended March 31, 2019, the general fund posted a deficit, but its overall position remains satisfactory. A drop in revenues in fiscal 2019 was largely the result of the 2017 federal tax reform and higher-than-expected revenues the prior fiscal year. The state’s fiscal 2020 budget was balanced and adopted on time. In its November 2019 mid-year update, the state’s Division of Budget reported that the general fund remained balanced, based on operating results for the first half of the state’s fiscal year. However, New York is facing increasing budget gaps in the years ahead, which are primarily driven by increasing Medicaid-related costs.

Governor Andrew Cuomo is expected to submit his fiscal 2021 budget to the state legislature by February 1, 2020. Vanguard expects his administration to propose a balanced budget that keeps spending growth to the targeted limit of 2% that has been in place for almost a decade.

New York City’s financial position also remains good. Its general fund posted another small surplus in the fiscal year ended June 30, 2019. The Mayor’s Office of Management and Budget reported in its November 2019 update that revenues were trending slightly higher than expected. The budget remains balanced and reserves

| 4 |

are expected to remain in line with those of prior years, at about 10% of expenditures.

Credit ratings for the state’s general obligation bonds remained at AA and stable in the assessment of the major ratings agencies. For New York City’s general obligation bonds, Moody’s Investors Service upgraded the rating to Aa1 from Aa2 in March 2019. Standard & Poor’s and Fitch Ratings kept their ratings of the city’s bonds unchanged at AA/stable. We expect the ratings for both the state and the city to remain stable over the next 12 to 18 months.

Management of the funds

The Long-Term Fund’s average duration— a measure, expressed in years, of a portfolio’s sensitivity to changes in interest rates—was longer than that of its benchmark, boosting the fund’s relative performance.

We maintained a tilt toward longer-term maturities, which helped as yields fell. For the 12 months, the average return for municipal bonds with a 3-year maturity was 4.15%, compared with 8.75% for 10-year bonds and 10.50% for 20-year bonds, as measured by the Bloomberg Barclays Municipal Bond Index.

A modest overweight to muni bonds on the lower rungs of the investment-grade credit ladder was intended principally to capture the additional yield they produce, especially as credit spreads versus Treasuries were fairly tight. For the 12 months, lower-rung New York munis performed better than their higher-quality counterparts as credit spreads compressed. As measured by the Bloomberg Barclays NY Municipal Bond Index, BBB-rated New York munis returned 8.78%, compared with 7.78% and 8.30% for, respectively, their AA-rated and AAA-rated counterparts.

Outlook

Global growth is set to keep softening, owing in part to trade tensions and policy uncertainty. The U.S. economy may slow to a pace of around 1% in 2020 after adjusting for inflation, below its normal trend growth of around 2%.

Other major economies are likely to see a deceleration as well. China, the world’s second-largest economy, is likely to grow at around 5.8% in 2020—but that figure could be markedly lower without further stimulus. In the euro area, growth may stay below trend, at about 1%, given recent indications that manufacturing weakness is spilling over into supply chains and the services sector.

These conditions—along with modest wage gains and structural factors such as technology advancements and globalization—are unlikely to fuel a surge in consumer prices.

We expect to see periods of turbulence in the global economy in the year ahead. Based on that outlook and the fact that rates are low and credit spreads are tight, we are starting the new fiscal year with

| 5 |

plenty of dry powder on hand, so that we can take advantage of price dislocations as they arise.

Whatever the markets may bring, our experienced team of portfolio managers, traders, and credit analysts will continue to navigate this large, fragmented market to seek attractive investment opportunities that will add to fund performance.

Paul M. Malloy, CFA, Principal,

Head of Municipal Bond Group

Adam M. Ferguson, CFA,

Portfolio Manager

John P. Grimes, CFA,

Portfolio Manager

Vanguard Fixed Income Group

December 16, 2019

| 6 |

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

· Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

· Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

| 7 |

Six Months Ended November 30, 2019

| Beginning | Ending | Expenses | |

| Account Value | Account Value | Paid During | |

| 5/31/2019 | 11/30/2019 | Period | |

| Based on Actual Fund Return | |||

| New York Municipal Money Market Fund | $1,000.00 | $1,006.30 | $0.80 |

| New York Long-Term Tax-Exempt Fund | |||

| Investor Shares | $1,000.00 | $1,023.02 | $0.86 |

| Admiral™ Shares | 1,000.00 | 1,023.43 | 0.46 |

| Based on Hypothetical 5% Yearly Return | |||

| New York Municipal Money Market Fund | $1,000.00 | $1,024.27 | $0.81 |

| New York Long-Term Tax-Exempt Fund | |||

| Investor Shares | $1,000.00 | $1,024.22 | $0.86 |

| Admiral Shares | 1,000.00 | 1,024.62 | 0.46 |

The calculations are based on expenses incurred in the most recent six-month period. The funds’ annualized six-month expense ratios for that period are: for the New York Municipal Money Market Fund, 0.16%; and for the New York Long-Term Tax-Exempt Fund, 0.17% for Investor Shares and 0.09% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (183/365).

| 8 |

New York Municipal Money Market Fund

Distribution by Issuer

As of November 30, 2019

| Tax-Exempt Securities | 100.0 | % |

9

New York Municipal Money Market Fund

Financial Statements

Statement of Net Assets

As of November 30, 2019

The fund publishes its holdings on a monthly basis on Vanguard’s website and files them with the Securities and Exchange Commission (SEC) on Form N-MFP. The fund’s Form N-MFP filings may be viewed via a link on the “Portfolio Holdings” page at www.vanguard.com or on the SEC’s website at www.sec.gov.

| Face | Market | ||||||

| Maturity | Amount | Value• | |||||

| Coupon | Date | ($000) | ($000) | ||||

| Tax-Exempt Municipal Bonds (99.1%) | |||||||

| New York (99.1%) | |||||||

| Albany NY Industrial Development Agency Civic Facility Revenue (CHF Holland Suites LLC Project) VRDO | 1.120% | 12/6/19 | LOC | 7,515 | 7,515 | ||

| Amityville NY Union Free School District TAN | 2.000% | 6/19/20 | 11,000 | 11,037 | |||

| 1 | Battery Park City NY Authority Revenue PUT | 1.120% | 12/6/19 | 40,000 | 40,000 | ||

| 2 | Battery Park City NY Authority Revenue TOB VRDO | 1.130% | 12/6/19 | LOC | 25,500 | 25,500 | |

| Bayport-Blue Point NY Union Free School District BAN | 2.250% | 7/17/20 | 8,200 | 8,245 | |||

| 2 | BlackRock MuniYield New York Quality Fund, Inc. VRDP VRDO | 1.220% | 12/6/19 | LOC | 130,000 | 130,000 | |

| Brighton NY Central School District BAN | 2.000% | 6/30/20 | 12,000 | 12,043 | |||

| Carmel NY BAN | 1.750% | 10/2/20 | 12,360 | 12,399 | |||

| Clarkstown NY Central School District BAN | 2.250% | 7/24/20 | 15,994 | 16,085 | |||

| Columbia County NY Capital Resource Corp. Civic Facility Revenue (Columbia Memorial Hospital Project) VRDO | 1.170% | 12/6/19 | LOC | 2,000 | 2,000 | ||

| Columbia County NY Industrial Development Agency Civic Facility Revenue (Columbia Memorial Hospital Project) VRDO | 1.170% | 12/6/19 | LOC | 3,260 | 3,260 | ||

| Connetquot NY Central School District of Islip TAN | 1.750% | 6/25/20 | 10,000 | 10,027 | |||

| Corning NY City School District BAN | 2.250% | 6/18/20 | 9,995 | 10,038 | |||

| Croton-Harmon NY Union Free School District BAN | 2.500% | 6/12/20 | 8,275 | 8,320 | |||

| Delaware Valley NY Industrial Development Authority Revenue (Delaware Valley Hospital) VRDO | 1.170% | 12/6/19 | LOC | 2,000 | 2,000 | ||

| East Hampton NY Union Free School District TAN | 1.750% | 6/25/20 | 14,000 | 14,034 | |||

| East Meadow NY Union Free School District BAN | 3.000% | 2/28/20 | 10,000 | 10,028 | |||

| East Meadow NY Union Free School District BAN | 2.250% | 6/19/20 | 8,500 | 8,537 | |||

| 2 | Erie County NY Industrial Development Agency School Facility Revenue (Buffalo City School District Project) TOB VRDO | 1.120% | 12/6/19 | 6,665 | 6,665 | ||

| Franklin County NY Civic Development Corp. Revenue VRDO | 1.170% | 12/6/19 | LOC | 4,700 | 4,700 | ||

10

New York Municipal Money Market Fund

| Face | Market | ||||||

| Maturity | Amount | Value• | |||||

| Coupon | Date | ($000) | ($000) | ||||

| Geneva NY Industrial Development Agency Civic Facility Revenue (Colleges of the Seneca Project) VRDO | 1.130% | 12/6/19 | LOC | 14,795 | 14,795 | ||

| Goshen NY Central School District BAN | 3.000% | 12/6/19 | 20,087 | 20,089 | |||

| Half Hollow Hills NY Central School District TAN | 2.000% | 6/25/20 | 10,000 | 10,043 | |||

| Hauppauge NY Union Free School District TAN | 1.750% | 6/26/20 | 26,000 | 26,063 | |||

| Huntington NY Union Free School District TAN | 2.000% | 6/25/20 | 18,000 | 18,078 | |||

| Irondequoit NY BAN | 3.000% | 4/17/20 | 11,250 | 11,304 | |||

| Jamesville-Dewitt NY Central School District GO | 2.000% | 6/26/20 | 12,100 | 12,142 | |||

| Jefferson County NY BAN | 1.750% | 10/30/20 | 9,000 | 9,041 | |||

| Lancaster NY Central School District BAN | 2.500% | 6/12/20 | 22,400 | 22,521 | |||

| Liverpool NY Central School District BAN | 2.250% | 6/26/20 | 9,100 | 9,141 | |||

| Mechanicville NY School District BAN | 2.500% | 6/19/20 | 23,095 | 23,224 | |||

| Metropolitan Transportation Authority NY Revenue VRDO | 1.080% | 12/6/19 | LOC | 8,700 | 8,700 | ||

| Metropolitan Transportation Authority NY Revenue VRDO | 1.090% | 12/6/19 | LOC | 6,005 | 6,004 | ||

| Monroe County NY Industrial Development Agency Civic Facility Revenue (Nazareth College) VRDO | 1.160% | 12/6/19 | LOC | 6,630 | 6,630 | ||

| 2 | Monroe County NY Industrial Development Corp. Revenue (University of Rochester) TOB VRDO | 1.130% | 12/6/19 | 4,350 | 4,350 | ||

| 2 | Nassau County NY GO TOB VRDO | 1.130% | 12/6/19 | LOC | 6,000 | 6,000 | |

| Nassau NY Health Care Corp. VRDO | 1.080% | 12/6/19 | LOC | 10,000 | 10,000 | ||

| New Rochelle NY BAN | 3.000% | 2/26/20 | 15,531 | 15,574 | |||

| New Rochelle NY City School District BAN | 2.000% | 6/26/20 | 45,000 | 45,159 | |||

| 2 | New York City Housing Development Corp. Revenue TOB VRDO | 1.130% | 12/6/19 | 7,500 | 7,500 | ||

| New York City NY Capital Resources Corp. Revenue (Loan Enhanced Assistance Program) VRDO | 1.090% | 12/6/19 | LOC | 20,705 | 20,705 | ||

| New York City NY Capital Resources Corp. Revenue (Loan Enhanced Assistance Program) VRDO | 1.100% | 12/6/19 | LOC | 3,080 | 3,080 | ||

| New York City NY Capital Resources Corp. Revenue (Loan Enhanced Assistance Program) VRDO | 1.100% | 12/6/19 | LOC | 4,885 | 4,885 | ||

| New York City NY GO | 5.000% | 8/1/20 | 8,115 | 8,323 | |||

| 1,2 | New York City NY GO TOB PUT | 1.220% | 1/16/20 | 4,860 | 4,860 | ||

| 1,2 | New York City NY GO TOB PUT | 1.220% | 1/23/20 | 2,450 | 2,450 | ||

| 2 | New York City NY GO TOB VRDO | 1.200% | 12/2/19 | LOC | 43,275 | 43,275 | |

| 2 | New York City NY GO TOB VRDO | 1.130% | 12/6/19 | LOC | 17,125 | 17,125 | |

| 2 | New York City NY GO TOB VRDO | 1.130% | 12/6/19 | 9,330 | 9,330 | ||

| New York City NY GO VRDO | 1.080% | 12/6/19 | LOC | 4,590 | 4,590 | ||

| New York City NY GO VRDO | 1.080% | 12/6/19 | LOC | 1,000 | 1,000 | ||

| New York City NY GO VRDO | 1.080% | 12/6/19 | LOC | 4,290 | 4,290 | ||

| New York City NY GO VRDO | 1.180% | 12/6/19 | LOC | 2,400 | 2,400 |

11

New York Municipal Money Market Fund

| Face | Market | ||||||

| Maturity | Amount | Value• | |||||

| Coupon | Date | ($000) | ($000) | ||||

| New York City NY Housing Development Corp. Multi-Family Housing Revenue (201 Pearl Street) VRDO | 1.100% | 12/6/19 | LOC | 5,895 | 5,895 | ||

| New York City NY Housing Development Corp. Multi-Family Housing Revenue PUT | 1.300% | 5/1/20 | 16,670 | 16,670 | |||

| 2 | New York City NY Housing Development Corp. Multi-Family Housing Revenue TOB VRDO | 1.130% | 12/6/19 | 7,500 | 7,500 | ||

| 2 | New York City NY Housing Development Corp. Multi-Family Housing Revenue TOB VRDO | 1.130% | 12/6/19 | 7,500 | 7,500 | ||

| 2 | New York City NY Housing Development Corp. Multi-Family Housing Revenue TOB VRDO | 1.130% | 12/6/19 | 14,455 | 14,455 | ||

| 2 | New York City NY Housing Development Corp. Multi-Family Housing Revenue TOB VRDO | 1.130% | 12/6/19 | 3,800 | 3,800 | ||

| 2 | New York City NY Housing Development Corp. Multi-Family Housing Revenue TOB VRDO | 1.140% | 12/6/19 | LOC | 19,000 | 19,000 | |

| 2 | New York City NY Housing Development Corp. Multi-Family Housing Revenue TOB VRDO | 1.150% | 12/6/19 | 6,665 | 6,665 | ||

| New York City NY Housing Development Corp. Multi-Family Mortgage Revenue (1405 Fifth Avenue Apartments) VRDO | 1.120% | 12/6/19 | LOC | 1,000 | 1,000 | ||

| New York City NY Housing Development Corp. Multi-Family Mortgage Revenue (550 East 170th Street Apartments) VRDO | 1.150% | 12/6/19 | LOC | 2,815 | 2,815 | ||

| New York City NY Housing Development Corp. Multi-Family Mortgage Revenue (941 Hoe Avenue Apartments) VRDO | 1.120% | 12/6/19 | LOC | 6,660 | 6,660 | ||

| New York City NY Housing Development Corp. Multi-Family Mortgage Revenue (Aldus Street Apartments) VRDO | 1.120% | 12/6/19 | LOC | 8,100 | 8,100 | ||

| New York City NY Housing Development Corp. Multi-Family Mortgage Revenue (Bruckner by the Bridge) VRDO | 1.090% | 12/6/19 | LOC | 6,860 | 6,860 | ||

| New York City NY Housing Development Corp. Multi-Family Mortgage Revenue (Villa Avenue Apartments) VRDO | 1.120% | 12/6/19 | LOC | 5,990 | 5,990 | ||

| New York City NY Housing Development Corp. Multi-Family Mortgage Revenue (West 26th Street Development) VRDO | 1.070% | 12/6/19 | LOC | 17,200 | 17,200 | ||

| New York City NY Housing Development Corp. Multi-Family Mortgage Revenue (West 26th Street Development) VRDO | 1.110% | 12/6/19 | LOC | 15,400 | 15,400 | ||

| New York City NY Housing Development Corp. Multi-Family Rental Housing Revenue (Atlantic Court Apartments) VRDO | 1.080% | 12/6/19 | LOC | 22,500 | 22,500 | ||

| New York City NY Housing Development Corp. Multi-Family Rental Housing Revenue (Ocean Gate Development) VRDO | 1.110% | 12/6/19 | LOC | 8,445 | 8,445 |

12

New York Municipal Money Market Fund

| Face | Market | ||||||

| Maturity | Amount | Value• | |||||

| Coupon | Date | ($000) | ($000) | ||||

| New York City NY Housing Development Corp. Multi-Family Rental Housing Revenue (Rivereast Apartments) VRDO | 1.140% | 12/6/19 | LOC | 24,525 | 24,525 | ||

| New York City NY Housing Development Corp. Multi-Family Rental Housing Revenue (Royal Charter Properties) VRDO | 1.040% | 12/6/19 | LOC | 14,255 | 14,255 | ||

| New York City NY Housing Development Corp. Revenue (Courtlandt Avenue Apartments) VRDO | 1.130% | 12/6/19 | LOC | 2,000 | 2,000 | ||

| New York City NY Housing Development Corp. Revenue (Ninety Second Realty LLC) VRDO | 1.080% | 12/6/19 | LOC | 8,000 | 8,000 | ||

| New York City NY Housing Development Corp. Revenue (Ogden Avenue Apartments) VRDO | 1.080% | 12/6/19 | LOC | 2,500 | 2,500 | ||

| New York City NY Housing Development Corp. Sustainable Neighborhood Revenue | 1.375% | 5/1/20 | 8,000 | 8,000 | |||

| New York City NY Housing Development Corp. Sustainable Neighborhood Revenue VRDO | 1.070% | 12/6/19 | 44,400 | 44,400 | |||

| New York City NY Housing Finance Agency Revenue (211 North End Avenue) VRDO | 1.120% | 12/6/19 | LOC | 14,700 | 14,700 | ||

| New York City NY Housing Finance Agency Revenue (900 Eighth Avenue) VRDO | 1.100% | 12/6/19 | LOC | 22,100 | 22,100 | ||

| New York City NY Housing Finance Agency Revenue (Capitol Green Apartments) VRDO | 1.070% | 12/6/19 | LOC | 10,900 | 10,900 | ||

| New York City NY Housing Finance Agency Revenue (Grace Towers) VRDO | 1.080% | 12/6/19 | LOC | 4,000 | 4,000 | ||

| New York City NY Housing Finance Agency Revenue (Prospect Plaza) VRDO | 1.130% | 12/6/19 | LOC | 2,650 | 2,650 | ||

| New York City NY Housing Finance Agency Revenue (West 25th Street) VRDO | 1.080% | 12/6/19 | LOC | 16,700 | 16,700 | ||

| New York City NY Industrial Development Agency Civic Facility Revenue (New York Congregational Nursing Center Project) VRDO | 1.170% | 12/6/19 | LOC | 1,645 | 1,645 | ||

| 1,2 | New York City NY Municipal Water Finance Authority Water & Sewer System Revenue PUT TOB | 1.130% | 12/6/19 | LOC | 60,000 | 60,000 | |

| 2 | New York City NY Municipal Water Finance Authority Water & Sewer System Revenue TOB VRDO | 1.200% | 12/2/19 | LOC | 3,000 | 3,000 | |

| 2 | New York City NY Municipal Water Finance Authority Water & Sewer System Revenue TOB VRDO | 1.200% | 12/2/19 | LOC | 7,500 | 7,500 | |

| 2 | New York City NY Municipal Water Finance Authority Water & Sewer System Revenue TOB VRDO | 1.130% | 12/6/19 | 3,000 | 3,000 | ||

| 2 | New York City NY Municipal Water Finance Authority Water & Sewer System Revenue TOB VRDO | 1.220% | 1/16/20 | 5,115 | 5,115 | ||

| New York City NY Municipal Water Finance Authority Water & Sewer System Revenue VRDO | 1.130% | 12/2/19 | 5,600 | 5,600 |

13

New York Municipal Money Market Fund

| Face | Market | ||||||

| Maturity | Amount | Value• | |||||

| Coupon | Date | ($000) | ($000) | ||||

| New York City NY Municipal Water Finance Authority Water & Sewer System Revenue VRDO | 1.150% | 12/2/19 | 2,600 | 2,600 | |||

| New York City NY Municipal Water Finance Authority Water & Sewer System Revenue VRDO | 1.160% | 12/2/19 | 12,005 | 12,005 | |||

| New York City NY Municipal Water Finance Authority Water & Sewer System Revenue VRDO | 1.160% | 12/2/19 | 8,000 | 8,000 | |||

| New York City NY Municipal Water Finance Authority Water & Sewer System Revenue VRDO | 1.160% | 12/2/19 | 3,610 | 3,610 | |||

| New York City NY Municipal Water Finance Authority Water & Sewer System Revenue VRDO | 1.160% | 12/2/19 | 43,515 | 43,515 | |||

| New York City NY Municipal Water Finance Authority Water & Sewer System Revenue VRDO | 1.080% | 12/6/19 | 20,405 | 20,405 | |||

| New York City NY Municipal Water Finance Authority Water & Sewer System Revenue VRDO | 1.090% | 12/6/19 | 52,625 | 52,625 | |||

| New York City NY Municipal Water Finance Authority Water & Sewer System Revenue VRDO | 1.100% | 12/6/19 | 29,700 | 29,700 | |||

| New York City NY Municipal Water Finance Authority Water & Sewer System Revenue VRDO | 1.100% | 12/6/19 | 25,850 | 25,850 | |||

| 2 | New York City NY Sales Tax Asset Receivable Corp. Revenue TOB VRDO | 1.130% | 12/6/19 | 3,335 | 3,335 | ||

| 2 | New York City NY Sales Tax Asset Receivable Corp. Revenue TOB VRDO | 1.130% | 12/6/19 | 5,250 | 5,250 | ||

| 2 | New York City NY Transitional Finance Authority Building Aid Revenue TOB VRDO | 1.120% | 12/6/19 | 5,915 | 5,915 | ||

| 2 | New York City NY Transitional Finance Authority Building Aid Revenue TOB VRDO | 1.120% | 12/6/19 | 680 | 680 | ||

| 2 | New York City NY Transitional Finance Authority Building Aid Revenue TOB VRDO | 1.120% | 12/6/19 | 16,275 | 16,275 | ||

| New York City NY Transitional Finance Authority Future Tax Revenue | 5.000% | 2/1/20 | 2,425 | 2,440 | |||

| 2 | New York City NY Transitional Finance Authority Future Tax Revenue TOB VRDO | 1.120% | 12/6/19 | 13,500 | 13,500 | ||

| 2 | New York City NY Transitional Finance Authority Future Tax Revenue TOB VRDO | 1.130% | 12/6/19 | 2,890 | 2,890 | ||

| 2 | New York City NY Transitional Finance Authority Future Tax Revenue TOB VRDO | 1.130% | 12/6/19 | 7,500 | 7,500 | ||

| 2 | New York City NY Transitional Finance Authority Future Tax Revenue TOB VRDO | 1.130% | 12/6/19 | LOC | 11,800 | 11,800 | |

| 2 | New York City NY Transitional Finance Authority Future Tax Revenue TOB VRDO | 1.130% | 12/6/19 | 1,500 | 1,500 | ||

| New York City NY Transitional Finance Authority Future Tax Revenue VRDO | 1.130% | 12/2/19 | 3,555 | 3,555 | |||

| New York City NY Transitional Finance Authority Future Tax Revenue VRDO | 1.130% | 12/2/19 | 24,340 | 24,340 |

14

New York Municipal Money Market Fund

| Face | Market | ||||||

| Maturity | Amount | Value• | |||||

| Coupon | Date | ($000) | ($000) | ||||

| New York City NY Transitional Finance Authority Future Tax Revenue VRDO | 1.160% | 12/2/19 | 9,600 | 9,600 | |||

| New York City NY Transitional Finance Authority Future Tax Revenue VRDO | 1.160% | 12/2/19 | 10,210 | 10,210 | |||

| New York City NY Transitional Finance Authority Future Tax Revenue VRDO | 1.180% | 12/2/19 | 850 | 850 | |||

| New York City NY Transitional Finance Authority Future Tax Revenue VRDO | 1.060% | 12/6/19 | 13,545 | 13,545 | |||

| New York City NY Transitional Finance Authority Future Tax Revenue VRDO | 1.080% | 12/6/19 | LOC | 5,775 | 5,775 | ||

| 2 | New York City NY Transitional Finance Authority Future Tax Secured Revenue TOB VRDO | 1.120% | 12/6/19 | 8,760 | 8,760 | ||

| 2 | New York City NY Transitional Finance Authority Future Tax Secured Revenue TOB VRDO | 1.130% | 12/6/19 | 18,100 | 18,100 | ||

| 1,2 | New York City NY Transitional Finance Authority Future Tax Secured Revenue TOB VRDO | 1.130% | 12/6/19 | 3,000 | 3,000 | ||

| 2 | New York City NY Transitional Finance Authority Future Tax Secured Revenue TOB VRDO | 1.130% | 12/6/19 | 6,000 | 6,000 | ||

| New York City NY Transitional Finance Authority Recovery Revenue VRDO | 1.070% | 12/6/19 | 9,725 | 9,725 | |||

| New York City NY Transitional Finance Authority Revenue VRDO | 1.080% | 12/6/19 | 12,100 | 12,100 | |||

| 1 | New York City NY Trust for Cultural Resources Revenue (American Museum of Natural History) PUT, SIFMA Municipal Swap Index Yield + 0.000% | 1.100% | 4/8/20 | 6,000 | 6,000 | ||

| 1 | New York City NY Trust for Cultural Resources Revenue (American Museum of Natural History) PUT, SIFMA Municipal Swap Index Yield + 0.000% | 0.010% | 7/6/20 | 10,500 | 10,500 | ||

| New York City NY Trust for Cultural Resources Revenue (The Metropolitan Museum of Art) VRDO | 1.050% | 12/6/19 | 12,590 | 12,590 | |||

| New York City NY Trust for Cultural Resources Revenue (The Metropolitan Museum of Art) VRDO | 1.050% | 12/6/19 | 20,200 | 20,200 | |||

| 2 | New York City NY Trust for Cultural Resources Revenue (Wildlife Conservation Society) TOB VRDO | 1.130% | 12/6/19 | 5,335 | 5,335 | ||

| 2 | New York City Transitional Finance Authority Building Aid Revenue TOB VRDO | 1.120% | 12/6/19 | 4,000 | 4,000 | ||

| 2 | New York Liberty Development Corp. Revenue (7 World Trade Center Project) TOB VRDO | 1.250% | 12/6/19 | 8,000 | 8,000 | ||

| New York Liberty Development Corp. Revenue (Greenwich LLC) VRDO | 1.100% | 12/6/19 | LOC | 10,100 | 10,100 | ||

| 2 | New York Metropolitan Transportation Authority Revenue (Dedicated Tax Fund) TOB VRDO | 1.130% | 12/6/19 | 5,350 | 5,350 |

15

New York Municipal Money Market Fund

| Face | Market | ||||||

| Maturity | Amount | Value• | |||||

| Coupon | Date | ($000) | ($000) | ||||

| 2 | New York Metropolitan Transportation Authority Revenue (Dedicated Tax Fund) TOB VRDO | 1.130% | 12/6/19 | 3,330 | 3,330 | ||

| New York Metropolitan Transportation Authority Revenue (Dedicated Tax Fund) VRDO | 1.080% | 12/6/19 | LOC | 45,525 | 45,525 | ||

| 2 | New York Metropolitan Transportation Authority Revenue TOB VRDO | 1.120% | 12/6/19 | 11,000 | 11,000 | ||

| 2 | New York Metropolitan Transportation Authority Revenue TOB VRDO | 1.130% | 12/6/19 | LOC | 35,000 | 35,000 | |

| New York Metropolitan Transportation Authority Revenue VRDO | 1.120% | 12/2/19 | LOC | 10,400 | 10,400 | ||

| New York Metropolitan Transportation Authority Revenue VRDO | 1.160% | 12/2/19 | LOC | 9,800 | 9,800 | ||

| New York Metropolitan Transportation Authority Revenue VRDO | 1.080% | 12/6/19 | LOC | 9,275 | 9,275 | ||

| New York Metropolitan Transportation Authority Revenue VRDO | 1.080% | 12/6/19 | LOC | 18,385 | 18,385 | ||

| New York Metropolitan Transportation Authority Revenue VRDO | 1.120% | 12/6/19 | LOC | 7,340 | 7,340 | ||

| 2 | New York NY GO TOB VRDO | 1.130% | 12/6/19 | LOC | 13,000 | 13,000 | |

| 2 | New York NY GO TOB VRDO | 1.130% | 12/6/19 | LOC | 5,000 | 5,000 | |

| 2 | New York NY GO TOB VRDO | 1.130% | 12/6/19 | 6,665 | 6,665 | ||

| New York State Dormitory Authority Revenue | 6.000% | 7/1/20 | (4) | 1,830 | 1,880 | ||

| New York State Dormitory Authority Revenue (City University System) VRDO | 1.050% | 12/6/19 | LOC | 23,160 | 23,160 | ||

| New York State Dormitory Authority Revenue (Columbia University) CP | 1.320% | 3/4/20 | 8,000 | 8,000 | |||

| New York State Dormitory Authority Revenue (Cornell University) VRDO | 1.090% | 12/2/19 | 10,875 | 10,875 | |||

| 2 | New York State Dormitory Authority Revenue (Memorial Sloan-Kettering Cancer Center) TOB VRDO | 1.120% | 12/6/19 | 7,860 | 7,860 | ||

| 2 | New York State Dormitory Authority Revenue (Memorial Sloan-Kettering Cancer Center) TOB VRDO | 1.120% | 12/6/19 | 3,330 | 3,330 | ||

| New York State Dormitory Authority Revenue (Mental Health Services Facilities Improvement) VRDO | 1.100% | 12/6/19 | LOC | 30,080 | 30,080 | ||

| New York State Dormitory Authority Revenue (Mental Health Services Facilities Improvement) VRDO | 1.100% | 12/6/19 | LOC | 5,050 | 5,050 | ||

| 1,2 | New York State Dormitory Authority Revenue (New York University) TOB PUT | 1.160% | 12/2/19 | 4,400 | 4,400 | ||

| New York State Dormitory Authority Revenue (Personal Income Tax) | 5.000% | 2/15/20 | 1,000 | 1,007 | |||

| New York State Dormitory Authority Revenue (Personal Income Tax) | 5.000% | 3/15/20 | 7,350 | 7,433 | |||

| 2 | New York State Dormitory Authority Revenue (Personal Income Tax) TOB VRDO | 1.130% | 12/6/19 | 7,500 | 7,500 | ||

| 2 | New York State Dormitory Authority Revenue (Personal Income Tax) TOB VRDO | 1.130% | 12/6/19 | 5,000 | 5,000 | ||

| 2 | New York State Dormitory Authority Revenue (Personal Income Tax) TOB VRDO | 1.130% | 12/6/19 | 4,000 | 4,000 |

16

New York Municipal Money Market Fund

| Face | Market | ||||||

| Maturity | Amount | Value• | |||||

| Coupon | Date | ($000) | ($000) | ||||

| 2 | New York State Dormitory Authority Revenue (Personal Income Tax) TOB VRDO | 1.130% | 12/6/19 | 14,675 | 14,675 | ||

| 2 | New York State Dormitory Authority Revenue (Personal Income Tax) TOB VRDO | 1.130% | 12/6/19 | 6,250 | 6,250 | ||

| New York State Dormitory Authority Revenue (Personal Income Tax) VRDO | 1.100% | 12/6/19 | 5,000 | 5,000 | |||

| 1,2 | New York State Dormitory Authority Revenue (Rockefeller University) TOB VRDO | 1.130% | 12/6/19 | 1,600 | 1,600 | ||

| New York State Dormitory Authority Revenue (Rockefeller University) VRDO | 1.100% | 12/6/19 | 14,900 | 14,900 | |||

| New York State Dormitory Authority Revenue (Royal Charter Properties) VRDO | 1.040% | 12/6/19 | LOC | 13,925 | 13,925 | ||

| New York State Dormitory Authority Revenue (University of Rochester) VRDO | 1.180% | 12/2/19 | LOC | 1,300 | 1,300 | ||

| 2 | New York State Dormitory Authority Revenue TOB VRDO | 1.120% | 12/6/19 | 7,500 | 7,500 | ||

| 2 | New York State Dormitory Authority Sales Tax Revenue TOB VRDO | 1.120% | 12/6/19 | 7,845 | 7,845 | ||

| 2 | New York State Dormitory Authority Sales Tax Revenue TOB VRDO | 1.120% | 12/6/19 | 12,100 | 12,100 | ||

| 2 | New York State Dormitory Authority Sales Tax Revenue TOB VRDO | 1.120% | 12/6/19 | 11,250 | 11,250 | ||

| 2 | New York State Dormitory Authority Sales Tax Revenue TOB VRDO | 1.130% | 12/6/19 | 11,200 | 11,200 | ||

| 2 | New York State Dormitory Authority Sales Tax Revenue TOB VRDO | 1.130% | 12/6/19 | 3,365 | 3,365 | ||

| 2 | New York State Dormitory Authority Sales Tax Revenue TOB VRDO | 1.130% | 12/6/19 | 17,370 | 17,370 | ||

| 2 | New York State Dormitory Authority Sales Tax Revenue TOB VRDO | 1.130% | 12/6/19 | 7,500 | 7,500 | ||

| 2 | New York State Dormitory Authority Sales Tax Revenue TOB VRDO | 1.130% | 12/6/19 | 16,265 | 16,265 | ||

| 2 | New York State Dormitory Authority TOB VRDO | 1.120% | 12/6/19 | 6,185 | 6,185 | ||

| 2 | New York State Dormitory Authority TOB VRDO | 1.130% | 12/6/19 | 7,000 | 7,000 | ||

| New York State Energy Research & Development Authority Facilities Revenue (Consolidated Edison Co. of New York Inc.) VRDO | 1.130% | 12/6/19 | LOC | 4,600 | 4,600 | ||

| New York State Housing Finance Agency Housing Revenue (100 Maiden Lane) VRDO | 1.030% | 12/6/19 | LOC | 9,800 | 9,800 | ||

| New York State Housing Finance Agency Housing Revenue (20 River Terrace Housing) VRDO | 1.100% | 12/6/19 | LOC | 3,300 | 3,300 | ||

| New York State Housing Finance Agency Housing Revenue (600 W 42nd Street) VRDO | 1.070% | 12/6/19 | LOC | 11,200 | 11,200 | ||

| New York State Housing Finance Agency Housing Revenue (600 W 42nd Street) VRDO | 1.110% | 12/6/19 | LOC | 6,500 | 6,500 | ||

| New York State Housing Finance Agency Housing Revenue (8 East 102nd Street) VRDO | 1.110% | 12/6/19 | LOC | 10,000 | 10,000 |

17

New York Municipal Money Market Fund

| Face | Market | ||||||

| Maturity | Amount | Value• | |||||

| Coupon | Date | ($000) | ($000) | ||||

| New York State Housing Finance Agency Housing Revenue (Dock Street Rental LLC) VRDO | 1.080% | 12/6/19 | LOC | 3,100 | 3,100 | ||

| New York State Housing Finance Agency Housing Revenue (Dock Street) VRDO | 1.080% | 12/6/19 | LOC | 17,155 | 17,155 | ||

| New York State Housing Finance Agency Housing Revenue (West 17th Street) VRDO | 1.080% | 12/6/19 | LOC | 19,800 | 19,800 | ||

| New York State Housing Finance Agency Housing Revenue (West 23rd Street) VRDO | 1.150% | 12/6/19 | LOC | 2,350 | 2,350 | ||

| New York State Housing Finance Agency Revenue (250 West 50th Street Project) VRDO | 1.080% | 12/6/19 | LOC | 42,700 | 42,700 | ||

| New York State Housing Finance Agency Revenue (Overlook Apartments) VRDO | 1.120% | 12/6/19 | LOC | 4,500 | 4,500 | ||

| New York State Housing Finance Agency Revenue (Sea Park West LP) VRDO | 1.070% | 12/6/19 | LOC | 14,100 | 14,100 | ||

| New York State Housing Finance Agency Revenue (Tower 31) VRDO | 1.130% | 12/6/19 | LOC | 63,000 | 63,000 | ||

| New York State Housing Finance Agency Revenue (Union Square South Housing) VRDO | 1.080% | 12/6/19 | LOC | 1,500 | 1,500 | ||

| 2 | New York State Housing Finance Agency TOB VRDO | 1.120% | 12/6/19 | 6,665 | 6,665 | ||

| New York State Local Government Assistance Corp. Revenue VRDO | 1.100% | 12/6/19 | 1,725 | 1,725 | |||

| New York State Local Government Assistance Corp. Revenue VRDO | 1.100% | 12/6/19 | 20,750 | 20,750 | |||

| New York State Local Government Assistance Corp. Revenue VRDO | 1.100% | 12/6/19 | 67,100 | 67,100 | |||

| 2 | New York State Mortgage Agency Homeowner Mortgage Revenue TOB VRDO | 1.120% | 12/6/19 | 3,365 | 3,365 | ||

| New York State Mortgage Agency Homeowner Mortgage Revenue VRDO | 1.220% | 12/2/19 | 10,880 | 10,880 | |||

| New York State Mortgage Agency Homeowner Mortgage Revenue VRDO | 1.230% | 12/2/19 | 7,800 | 7,800 | |||

| New York State Mortgage Agency Homeowner Mortgage Revenue VRDO | 1.080% | 12/6/19 | 2,500 | 2,500 | |||

| New York State Mortgage Agency Homeowner Mortgage Revenue VRDO | 1.100% | 12/6/19 | 47,060 | 47,060 | |||

| New York State Mortgage Agency Homeowner Mortgage Revenue VRDO | 1.150% | 12/6/19 | 15,000 | 15,000 | |||

| New York State Mortgage Agency Homeowner Mortgage Revenue VRDO | 1.180% | 12/6/19 | 5,425 | 5,425 | |||

| New York State Power Authority Revenue CP | 1.390% | 12/3/19 | 23,429 | 23,429 | |||

| New York State Power Authority Revenue CP | 1.390% | 12/3/19 | 4,000 | 4,000 | |||

| New York State Power Authority Revenue CP | 1.400% | 12/4/19 | 33,100 | 33,100 | |||

| New York State Power Authority Revenue CP | 1.420% | 12/4/19 | 37,416 | 37,416 | |||

| New York State Power Authority Revenue CP | 1.150% | 1/22/20 | 21,479 | 21,479 | |||

| 2 | New York State Power Authority Revenue TOB VRDO | 1.120% | 12/6/19 | (13)(1) | 6,835 | 6,835 | |

| 2 | New York State Thruway Authority Revenue (Highway & Bridge Trust Fund) TOB VRDO | 1.120% | 12/6/19 | 5,170 | 5,170 | ||

| 2 | New York State Thruway Authority Revenue (Highway & Bridge Trust Fund) TOB VRDO | 1.120% | 12/6/19 | 4,800 | 4,800 |

18

New York Municipal Money Market Fund

| Face | Market | ||||||

| Maturity | Amount | Value• | |||||

| Coupon | Date | ($000) | ($000) | ||||

| 2 | New York State Thruway Authority Revenue TOB VRDO | 1.130% | 12/6/19 | LOC | 8,155 | 8,155 | |

| 2 | New York State Urban Development Corp. Revenue (Personal Income Tax) TOB VRDO | 1.120% | 12/6/19 | 1,760 | 1,760 | ||

| 2 | New York State Urban Development Corp. Revenue (Personal Income Tax) TOB VRDO | 1.130% | 12/6/19 | 5,850 | 5,850 | ||

| 2 | New York State Urban Development Corp. Revenue (Personal Income Tax) TOB VRDO | 1.130% | 12/6/19 | 10,300 | 10,300 | ||

| 2 | New York State Urban Development Corp.Revenue (Personal Income Tax) TOB VRDO | 1.130% | 12/6/19 | 3,750 | 3,750 | ||

| New York State Urban Development Corp. Revenue (Service Contract) VRDO | 1.090% | 12/6/19 | 9,650 | 9,650 | |||

| New York State Urban Development Corp. Revenue (Service Contract) VRDO | 1.090% | 12/6/19 | 27,550 | 27,550 | |||

| New York State Urban Development Corp. Revenue (Service Contract) VRDO | 1.100% | 12/6/19 | LOC | 30,470 | 30,470 | ||

| New York State Urban Development Corp.Revenue (Service Contract) VRDO | 1.100% | 12/6/19 | LOC | 9,215 | 9,215 | ||

| 2 | New York State Urban Development Corp. Revenue TOB VRDO | 1.130% | 12/6/19 | 9,000 | 9,000 | ||

| 2 | New York State Urban Development Corp. Revenue TOB VRDO | 1.150% | 12/6/19 | 1,440 | 1,440 | ||

| New York State Urban Development Corp. Revenue VRDO | 1.100% | 12/6/19 | 1,145 | 1,145 | |||

| 2 | New York State Urban Development Corp. TOB VRDO | 1.120% | 12/6/19 | 6,890 | 6,890 | ||

| 2 | New York State Urban Development Corp.TOB VRDO | 1.130% | 12/6/19 | 3,750 | 3,750 | ||

| Niagara NY Area Development Corp. Revenue (Niagara Falls Memorial Medical Center) VRDO | 1.160% | 12/6/19 | LOC | 4,515 | 4,515 | ||

| 2 | Nuveen New York AMT-Free Quality Municipal Income Fund VRDP VRDO | 1.140% | 12/6/19 | LOC | 46,200 | 46,200 | |

| 2 | Nuveen New York AMT-Free Quality Municipal Income Fund VRDP VRDO | 1.140% | 12/6/19 | LOC | 22,000 | 22,000 | |

| 2 | Nuveen New York AMT-Free Quality Municipal Income Fund VRDP VRDO | 1.140% | 12/6/19 | LOC | 20,000 | 20,000 | |

| 2 | Nuveen New York AMT-Free Quality Municipal Income Fund VRDP VRDO | 1.140% | 12/6/19 | LOC | 48,700 | 48,700 | |

| 2 | Nuveen New York Quality Municipal Fund VRDP VRDO | 1.210% | 12/6/19 | LOC | 34,800 | 34,800 | |

| Oceanside NY Union Free School District GO | 2.000% | 6/25/20 | 9,250 | 9,283 | |||

| Onondaga County NY Industrial Development Agency Civic Facility Revenue (Syracuse Home Association Project) VRDO | 1.170% | 12/6/19 | LOC | 4,130 | 4,130 | ||

| Port Authority of New York & New Jersey Revenue CP | 1.290% | 12/4/19 | 11,780 | 11,780 | |||

| Port Authority of New York & New Jersey Revenue CP | 1.300% | 12/11/19 | 7,010 | 7,010 | |||

| Port Authority of New York & New Jersey Revenue CP | 1.300% | 12/18/19 | 11,370 | 11,370 | |||

| Port Authority of New York & New Jersey Revenue CP | 1.250% | 1/2/20 | 2,025 | 2,025 |

19

New York Municipal Money Market Fund

| Face | Market | ||||||

| Maturity | Amount | Value• | |||||

| Coupon | Date | ($000) | ($000) | ||||

| Port Authority of New York & New Jersey Revenue CP | 1.340% | 1/2/20 | 6,865 | 6,865 | |||

| Port Authority of New York & New Jersey Revenue CP | 1.350% | 1/29/20 | 4,115 | 4,115 | |||

| Port Authority of New York & New Jersey Revenue CP | 1.250% | 2/6/20 | 11,025 | 11,025 | |||

| Port Authority of New York & New Jersey Revenue CP | 1.180% | 2/12/20 | 12,915 | 12,915 | |||

| Port Authority of New York & New Jersey Revenue CP | 1.170% | 2/20/20 | 11,060 | 11,060 | |||

| Port Authority of New York & New Jersey Revenue CP | 1.150% | 3/4/20 | 9,070 | 9,070 | |||

| Port Authority of New York & New Jersey Revenue CP | 1.190% | 3/5/20 | 20,285 | 20,285 | |||

| Port Authority of New York & New Jersey Revenue CP | 1.180% | 3/19/20 | 12,160 | 12,160 | |||

| 2 | Port Authority of New York & New Jersey Revenue TOB VRDO | 1.120% | 12/6/19 | 3,000 | 3,000 | ||

| 2 | Port Authority of New York & New Jersey Revenue TOB VRDO | 1.130% | 12/6/19 | 8,500 | 8,500 | ||

| 2 | Port Authority of New York & New Jersey Revenue TOB VRDO | 1.170% | 12/6/19 | 2,260 | 2,260 | ||

| 2 | Port Authority of New York & New Jersey Revenue TOB VRDO | 1.180% | 12/6/19 | 6,500 | 6,500 | ||

| 2 | Port Authority of New York & New Jersey TOB VRDO | 1.170% | 12/6/19 | 2,790 | 2,790 | ||

| 2 | Regional Transportation Authority IL TOB VRDO | 1.130% | 12/6/19 | 7,500 | 7,500 | ||

| Scarsdale NY Union Free School District BAN | 2.250% | 6/26/20 | 10,287 | 10,335 | |||

| Sewanhaka NY Central High School District of Elmont TAN | 2.000% | 6/22/20 | 7,500 | 7,523 | |||

| Smithtown NY Central School District TAN | 1.750% | 6/26/20 | 43,000 | 43,099 | |||

| South Country NY Central School District of Brookhaven TAN | 1.750% | 6/25/20 | 20,000 | 20,045 | |||

| South Huntington NY Union Free School District TAN | 1.750% | 6/25/20 | 26,000 | 26,076 | |||

| Triborough Bridge & Tunnel Authority New York Revenue (MTA Bridges and Tunnels) VRDO | 1.120% | 12/2/19 | LOC | 16,710 | 16,710 | ||

| 2 | Triborough Bridge & Tunnel Authority New York Revenue TOB VRDO | 1.120% | 12/6/19 | 9,780 | 9,780 | ||

| 2 | Triborough Bridge & Tunnel Authority New York Revenue TOB VRDO | 1.120% | 12/6/19 | 14,000 | 14,000 | ||

| 2 | Triborough Bridge & Tunnel Authority New York Revenue TOB VRDO | 1.130% | 12/6/19 | 3,750 | 3,750 | ||

| 2 | Triborough Bridge & Tunnel Authority New York Revenue TOB VRDO | 1.130% | 12/6/19 | 4,195 | 4,195 | ||

| Triborough Bridge & Tunnel Authority New York Revenue VRDO | 1.160% | 12/2/19 | LOC | 3,460 | 3,460 | ||

| Triborough Bridge & Tunnel Authority New York Revenue VRDO | 1.100% | 12/6/19 | LOC | 2,410 | 2,410 | ||

| Ulster County NY BAN | 1.750% | 11/19/20 | 29,431 | 29,591 | |||

| 2 | Utility Debt Securitization Authority New York Revenue TOB VRDO | 1.120% | 12/6/19 | 6,750 | 6,750 | ||

| 2 | Utility Debt Securitization Authority New York Revenue TOB VRDO | 1.120% | 12/6/19 | 5,250 | 5,250 |

20

New York Municipal Money Market Fund

| Face | Market | ||||||

| Maturity | Amount | Value• | |||||

| Coupon | Date | ($000) | ($000) | ||||

| 2 | Utility Debt Securitization Authority New York Revenue TOB VRDO | 1.130% | 12/6/19 | 1,000 | 1,000 | ||

| Vestal NY BAN | 2.500% | 5/8/20 | 10,211 | 10,245 | |||

| Webster NY Central School District BAN | 2.250% | 6/26/20 | 10,000 | 10,047 | |||

| West Babylon NY Union Free School District TAN | 1.750% | 6/25/20 | 15,000 | 15,034 | |||

| West Islip NY Union Free School District BAN | 2.250% | 6/22/20 | 9,500 | 9,548 | |||

| West Islip NY Union Free School District BAN | 2.250% | 7/22/20 | 18,700 | 18,806 | |||

| Westbury NY Union Free School District GO | 2.500% | 4/29/20 | 9,500 | 9,531 | |||

| Westhampton Beach NY BAN | 1.750% | 10/23/20 | 10,800 | 10,850 | |||

| Total Tax-Exempt Municipal Bonds (Cost $3,423,626) | 3,423,626 | ||||||

| Amount | |

| ($000) | |

| Other Assets and Liabilities (0.9%) | |

| Other Assets | |

| Investment in Vanguard | 159 |

| Receivables for Investment Securities Sold | 18,021 |

| Receivables for Accrued Income | 8,283 |

| Receivables for Capital Shares Issued | 5,600 |

| Other Assets | 5,494 |

| Total Other Assets | 37,557 |

| Liabilities | |

| Payables for Investment Securities Purchased | (3,610) |

| Payables for Capital Shares Redeemed | (3,496) |

| Payables for Distributions | (193) |

| Payables to Vanguard | (258) |

| Total Liabilities | (7,557) |

| Net Assets (100%) | |

| Applicable to 3,453,387,868 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | 3,453,626 |

| Net Asset Value Per Share | $1.00 |

|

|

| At November 30, 2019, net assets consisted of: |

| Amount | |

| ($000) | |

| Paid-in Capital | 3,453,618 |

| Total Distributable Earnings (Loss) | 8 |

| Net Assets | 3,453,626 |

| • | See Note A in Notes to Financial Statements. |

| 1 | Adjustable-rate security; rate shown is effective rate at period end. Certain adjustable-rate securities are not based on a published reference rate and spread but are determined by the issuer or agent based on current market conditions. |

| 2 | Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2019, the aggregate value of these securities was $1,082,675,000, representing 31.3% of net assets. |

| A key to abbreviations and other references follows the Statement of Net Assets. |

See accompanying Notes, which are an integral part of the Financial Statements.

21

New York Municipal Money Market Fund

Key to Abbreviations

ARS—Auction Rate Security.

BAN—Bond Anticipation Note.

CMT—Constant Maturing Treasury Rate.

COP—Certificate of Participation.

CP—Commercial Paper.

FR—Floating Rate.

GAN—Grant Anticipation Note.

GO—General Obligation Bond.

LIBOR—London Interbank Offered Rate.

PILOT—Payments in Lieu of Taxes.

PUT—Put Option Obligation.

RAN—Revenue Anticipation Note.

SIFMA—Securities Industry and Financial Markets Association.

SOFR—Secured Overnight Financing Rate.

TAN—Tax Anticipation Note.

TOB—Tender Option Bond.

TRAN—Tax Revenue Anticipation Note.

VRDO—Variable Rate Demand Obligation.

VRDP—Variable Rate Demand Preferred.

(ETM)—Escrowed to Maturity.

(Prere.)—Prerefunded.

Scheduled principal and interest payments are guaranteed by:

(1) MBIA (Municipal Bond Investors Assurance).

(2) AMBAC (Ambac Assurance Corporation).

(3) FGIC (Financial Guaranty Insurance Company).

(4) AGM (Assured Guaranty Municipal Corporation).

(5) BIGI (Bond Investors Guaranty Insurance).

(6) Connie Lee Inc.

(7) FHA (Federal Housing Authority).

(8) CapMAC (Capital Markets Assurance Corporation).

(9) American Capital Access Financial Guaranty Corporation.

(10) XL Capital Assurance Inc.

(11) CIFG (CDC IXIS Financial Guaranty).

(12) AGC (Assured Guaranty Corporation).

(13) BHAC (Berkshire Hathaway Assurance Corporation).

(14) NPFG (National Public Finance Guarantee Corporation).

(15) BAM (Build America Mutual Assurance Company).

(16) MAC (Municipal Assurance Corporation).

(17) RAA (Radian Asset Assurance Inc.).

(18) SBLF (Michigan School Bond Loan Fund).

(19) TPSF (Texas Permanent School Fund).

The insurance does not guarantee the market value of the municipal bonds.

LOC—Scheduled principal and interest payments are guaranteed by bank letter of credit.

22

New York Municipal Money Market Fund

Statement of Operations

| Year Ended | |

| November 30, 2019 | |

| ($000) | |

| Investment Income | |

| Income | |

| Interest | 52,244 |

| Total Income | 52,244 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 944 |

| Management and Administrative | 3,965 |

| Marketing and Distribution | 479 |

| Custodian Fees | 19 |

| Auditing Fees | 28 |

| Shareholders’ Reports | 16 |

| Trustees’ Fees and Expenses | 1 |

| Total Expenses | 5,452 |

| Expenses Paid Indirectly | (17) |

| Net Expenses | 5,435 |

| Net Investment Income | 46,809 |

| Realized Net Gain (Loss) on Investment Securities Sold | 46 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 46,855 |

See accompanying Notes, which are an integral part of the Financial Statements.

23

New York Municipal Money Market Fund

Statement of Changes in Net Assets

| Year Ended November 30, | ||

| 2019 | 2018 | |

| ($000) | ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 46,809 | 35,653 |

| Realized Net Gain (Loss) | 46 | (1) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 46,855 | 35,652 |

| Distributions | ||

| Net Investment Income | (46,812) | (35,651) |

| Realized Capital Gain | — | — |

| Total Distributions | (46,812) | (35,651) |

| Capital Share Transactions (at $1.00 per share) | ||

| Issued | 2,104,177 | 2,342,201 |

| Issued in Lieu of Cash Distributions | 43,491 | 33,556 |

| Redeemed | (1,908,137) | (1,585,680) |

| Net Increase (Decrease) from Capital Share Transactions | 239,531 | 790,077 |

| Total Increase (Decrease) | 239,574 | 790,078 |

| Net Assets | ||

| Beginning of Period | 3,214,052 | 2,423,974 |

| End of Period | 3,453,626 | 3,214,052 |

See accompanying Notes, which are an integral part of the Financial Statements.

24

New York Municipal Money Market Fund

Financial Highlights

| For a Share Outstanding | Year Ended November 30, | ||||

| Throughout Each Period | 2019 | 2018 | 2017 | 2016 | 2015 |

| Net Asset Value, Beginning of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Investment Operations | |||||

| Net Investment Income | .0141 | .0121 | .0071 | .003 | .0001 |

| Net Realized and Unrealized Gain (Loss) on Investments | — | — | — | — | — |

| Total from Investment Operations | .014 | .012 | .007 | .003 | .0001 |

| Distributions | |||||

| Dividends from Net Investment Income | (.014) | (.012) | (.007) | (.003) | (.0001) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (.014) | (.012) | (.007) | (.003) | (.0001) |

| Net Asset Value, End of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total Return2 | 1.39% | 1.24% | 0.67% | 0.26% | 0.01% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $3,454 | $3,214 | $2,424 | $2,059 | $2,190 |

| Ratio of Total Expenses to Average Net Assets | 0.16% | 0.16% | 0.16% | 0.13%3 | 0.06%3 |

| Ratio of Net Investment Income to Average Net Assets | 1.38% | 1.24% | 0.67% | 0.25% | 0.01% |

| 1 | Calculated based on average shares outstanding. |

| 2 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 3 | The ratio of total expenses to average net assets before an expense reduction was 0.16% for 2016 and 0.16% for 2015. Vanguard and the board of trustees have agreed to temporarily limit certain net operating expenses in excess of the fund’s daily yield in order to maintain a zero or positive yield for the fund. The fund is not obligated to repay this amount to Vanguard. |

See accompanying Notes, which are an integral part of the Financial Statements.

25

New York Municipal Money Market Fund

Notes to Financial Statements

Vanguard New York Municipal Money Market Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in debt instruments of municipal issuers whose ability to meet their obligations may be affected by economic and political developments in the state.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Securities are valued at amortized cost, which approximates market value.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (November 30, 2016–2019), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

3. Distributions: Distributions from net investment income are declared daily and paid on the first business day of the following month. Annual distributions from realized capital gains, if any, are recorded on the ex-dividend date. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes.

4. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $4.3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

The fund had no borrowings outstanding at November 30, 2019, or at any time during the period then ended.

5. Other: Interest income is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

26

New York Municipal Money Market Fund

B. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees, and are generally settled twice a month.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At November 30, 2019, the fund had contributed to Vanguard capital in the amount of $159,000, representing less than 0.01% of the fund’s net assets and 0.06% of Vanguard’s capital received pursuant to the FSA. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

C. The fund’s custodian bank has agreed to reduce its fees when the fund maintains cash on deposit in the non-interest-bearing custody account. For the year ended November 30, 2019, custodian fee offset arrangements reduced the fund’s expenses by $17,000 (an annual rate of less than 0.01% of average net assets).

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments valued with significant unobservable inputs are noted on the Statement of Net Assets.

At November 30, 2019, 100% of the market value of the fund’s investments was determined using amortized cost, in accordance with rules under the Investment Company Act of 1940. Amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, securities valued at amortized cost are considered to be valued using Level 2 inputs.

E. Permanent differences between book-basis and tax-basis components of net assets, if any, are reclassified among capital accounts in the financial statements to reflect their tax character. These reclassifications have no effect on net assets or net asset value per share.

27

New York Municipal Money Market Fund

Temporary differences between book-basis and tax-basis components of total distributable earnings (loss) arise when certain items of income, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. The differences are primarily related to payables for distributions. As of period end, the tax-basis components of total distributable earnings (loss) are detailed in the table as follows:

| Amount | |

| ($000) | |

| Undistributed Ordinary Income | — |

| Undistributed Tax-Exempt Income | 193 |

| Undistributed Long-Term Gains | — |

| Capital Loss Carryforwards (Non-expiring)* | — |

| Net Unrealized Gains (Losses) | — |

| * | The fund used capital loss carryforwards of $7,000 to offset taxable capital gains realized during the year ended November 30, 2019. |

As of November 30, 2019, gross unrealized appreciation and depreciation for investments based on cost for U.S. federal income tax purposes were as follows:

| Amount | |

| ($000) | |

| Tax Cost | 3,423,626 |

| Gross Unrealized Appreciation | — |

| Gross Unrealized Depreciation | — |

| Net Unrealized Appreciation (Depreciation) | — |

F. The fund purchased securities from and sold securities to other Vanguard funds or accounts managed by Vanguard or its affiliates, in accordance with procedures adopted by the board of trustees in compliance with Rule 17a-7 of the Investment Company Act of 1940. For the year ended November 30, 2019, such purchases and sales were $289,560,000 and $391,930,000 respectively.

G. Management has determined that no events or transactions occurred subsequent to November 30, 2019, that would require recognition or disclosure in these financial statements.

28

New York Long-Term Tax-Exempt Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

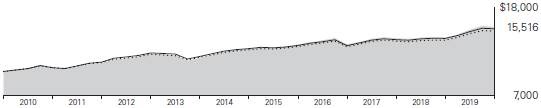

Cumulative Performance: November 30, 2009, Through November 30, 2019

Initial Investment of $10,000

| Average Annual Total Returns | |||||

| Periods Ended November 30, 2019 | |||||

| Final Value | |||||

| One | Five | Ten | of a $10,000 | ||

| Year | Years | Years | Investment | ||

|

New York Long-Term Tax-Exempt Fund Investor Shares | 9.37% | 3.91% | 4.49% | $15,516 |

|

Bloomberg Barclays NY Municipal Bond Index | 8.09 | 3.41 | 4.14 | 15,003 |

|

Bloomberg Barclays Municipal Bond Index | 8.49 | 3.57 | 4.34 | 15,300 |

| Final Value | |||||

| One | Five | Ten | of a $50,000 | ||

| Year | Years | Years | Investment | ||

| New York Long-Term Tax-Exempt Fund Admiral Shares | 9.46% | 4.00% | 4.58% | $78,234 | |

| Bloomberg Barclays NY Municipal Bond Index | 8.09 | 3.41 | 4.14 | 75,016 | |

| Bloomberg Barclays Municipal Bond Index | 8.49 | 3.57 | 4.34 | 76,500 | |

See Financial Highlights for dividend and capital gains information.

29

New York Long-Term Tax-Exempt Fund

Distribution by Stated Maturity

As of November 30, 2019

| Under 1 Year | 3.8% |

| 1 - 3 Years | 3.2 |

| 3 - 5 Years | 2.8 |

| 5 - 10 Years | 11.3 |

| 10 - 20 Years | 44.4 |

| 20 - 30 Years | 30.3 |

| Over 30 Years | 4.2 |

30

New York Long-Term Tax-Exempt Fund

Financial Statements

Statement of Net Assets

As of November 30, 2019

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| Face | Market | ||||||

| Maturity | Amount | Value· | |||||

| Coupon | Date | ($000) | ($000) | ||||

| Tax-Exempt Municipal Bonds (99.4%) | |||||||

| New York (99.0%) | |||||||

| Albany NY Capital Resource Corp. Revenue (St. Peter’s Hospital) | 6.000% | 11/15/20 | (Prere.) | 325 | 340 | ||

| Albany NY Capital Resource Corp. Revenue (St. Peter’s Hospital) | 6.125% | 11/15/20 | (Prere.) | 150 | 157 | ||

| Amherst NY Development Corp. Revenue (Daemen College Project) | 5.000% | 10/1/43 | 975 | 1,097 | |||

| Amherst NY Development Corp. Revenue (Daemen College Project) | 5.000% | 10/1/48 | 800 | 897 | |||

| Amherst NY Development Corp. Student Housing Facility Revenue | 5.000% | 10/1/20 | (Prere.) | 2,500 | 2,582 | ||

| Amherst NY Development Corp. Student Housing Facility Revenue | 5.000% | 10/1/20 | (Prere.) | 3,800 | 3,925 | ||

| Battery Park City NY Authority Revenue | 4.000% | 11/1/44 | 2,500 | 2,877 | |||

| Brooklyn NY Local Development Corp. PILOT Revenue (Barclays Center Project) | 6.250% | 1/15/20 | (Prere.) | 5,475 | 5,508 | ||

| Brooklyn NY Local Development Corp. PILOT Revenue (Barclays Center Project) | 6.375% | 1/15/20 | (Prere.) | 19,390 | 19,510 | ||

| Brooklyn NY Local Development Corp. PILOT Revenue (Barclays Center Project) | 0.000% | 7/15/31 | 10,890 | 7,712 | |||

| Brooklyn NY Local Development Corp. PILOT Revenue (Barclays Center Project) | 0.000% | 7/15/32 | 1,745 | 1,182 | |||

| Brooklyn NY Local Development Corp. PILOT Revenue (Barclays Center Project) | 0.000% | 7/15/33 | 2,210 | 1,441 | |||

| Brooklyn NY Local Development Corp. PILOT Revenue (Barclays Center Project) | 0.000% | 7/15/35 | 1,750 | 1,052 | |||

| Brooklyn NY Local Development Corp. PILOT Revenue (Barclays Center Project) | 0.000% | 7/15/45 | 3,050 | 1,197 | |||

| Brooklyn NY Local Development Corp. PILOT Revenue (Barclays Center Project) | 0.000% | 7/15/46 | 455 | 171 | |||

| Brooklyn NY Local Development Corp. PILOT Revenue (Brooklyn Events Center) | 5.000% | 7/15/22 | 1,250 | 1,358 | |||

| Brooklyn NY Local Development Corp. PILOT Revenue (Brooklyn Events Center) | 5.000% | 7/15/24 | 1,800 | 2,054 | |||

| Brooklyn NY Local Development Corp. PILOT Revenue (Brooklyn Events Center) | 5.000% | 7/15/25 | 1,655 | 1,930 | |||

| Brooklyn NY Local Development Corp. PILOT Revenue (Brooklyn Events Center) | 5.000% | 7/15/26 | 3,000 | 3,547 | |||

| Brooklyn NY Local Development Corp. PILOT Revenue (Brooklyn Events Center) | 5.000% | 7/15/30 | 5,990 | 7,019 | |||

31

New York Long-Term Tax-Exempt Fund

| Face | Market | ||||||

| Maturity | Amount | Value· | |||||

| Coupon | Date | ($000) | ($000) | ||||

| Brooklyn NY Local Development Corp. PILOT Revenue (Brooklyn Events Center) | 5.000% | 7/15/42 | 3,290 | 3,738 | |||

| Buffalo & Erie County NY Industrial Land Development Corp. Revenue | 5.000% | 11/15/24 | 1,395 | 1,575 | |||

| Buffalo & Erie County NY Industrial Land Development Corp. Revenue | 5.000% | 7/1/25 | 2,015 | 2,386 | |||

| Buffalo & Erie County NY Industrial Land Development Corp. Revenue | 5.000% | 11/15/25 | 1,590 | 1,830 | |||

| Buffalo & Erie County NY Industrial Land Development Corp. Revenue | 5.000% | 11/15/37 | 5,515 | 6,169 | |||

| Buffalo & Erie County NY Industrial Land Development Corp. Revenue | 5.000% | 7/1/40 | 5,270 | 6,017 | |||

| Buffalo & Erie County NY Industrial Land Development Corp. Revenue (Catholic Health System Obligated Group) | 5.000% | 7/1/30 | 1,155 | 1,348 | |||

| Buffalo & Erie County NY Industrial Land Development Corp. Revenue (Catholic Health System Obligated Group) | 5.250% | 7/1/35 | 2,200 | 2,568 | |||

| Buffalo & Fort Erie NY Public Bridge Authority Revenue | 5.000% | 1/1/47 | 3,000 | 3,499 | |||

| Buffalo NY Municipal Water Finance Authority Revenue | 5.000% | 7/1/24 | 500 | 586 | |||

| Buffalo NY Municipal Water Finance Authority Revenue | 5.000% | 7/1/25 | 510 | 614 | |||

| Buffalo NY Municipal Water Finance Authority Revenue | 5.000% | 7/1/26 | 1,000 | 1,199 | |||

| Buffalo NY Municipal Water Finance Authority Revenue | 5.000% | 7/1/28 | 2,010 | 2,384 | |||

| Buffalo NY Municipal Water Finance Authority Revenue | 5.000% | 7/1/29 | 500 | 590 | |||

| Buffalo NY Municipal Water Finance Authority Revenue | 3.000% | 7/1/35 | (4) | 400 | 409 | ||

| Buffalo NY Municipal Water Finance Authority Revenue | 3.000% | 7/1/36 | (4) | 400 | 408 | ||

| Buffalo NY Municipal Water Finance Authority Revenue | 3.000% | 7/1/37 | (4) | 465 | 474 | ||

| Build NYC NY Resource Corp. Revenue (Children’s Aid Society) | 5.000% | 7/1/25 | 100 | 120 | |||

| Build NYC NY Resource Corp. Revenue (Children’s Aid Society) | 5.000% | 7/1/26 | 85 | 104 | |||

| Build NYC NY Resource Corp. Revenue (Children’s Aid Society) | 5.000% | 7/1/27 | 75 | 94 | |||

| Build NYC NY Resource Corp. Revenue (Children’s Aid Society) | 5.000% | 7/1/35 | 130 | 164 | |||

| Build NYC NY Resource Corp. Revenue (Children’s Aid Society) | 4.000% | 7/1/36 | 130 | 149 | |||

| Build NYC NY Resource Corp. Revenue (Children’s Aid Society) | 4.000% | 7/1/37 | 165 | 188 | |||

| Build NYC NY Resource Corp. Revenue (Children’s Aid Society) | 4.000% | 7/1/38 | 150 | 170 | |||

| Build NYC NY Resource Corp. Revenue (Children’s Aid Society) | 3.000% | 7/1/39 | 550 | 554 | |||

| Build NYC NY Resource Corp. Revenue (Children’s Aid Society) | 4.000% | 7/1/44 | 975 | 1,092 |

32

New York Long-Term Tax-Exempt Fund

| Face | Market | ||||||

| Maturity | Amount | Value· | |||||

| Coupon | Date | ($000) | ($000) | ||||