Notice of the 2023

Annual Meeting and

Proxy Statement

Dear Fellow Stockholder:

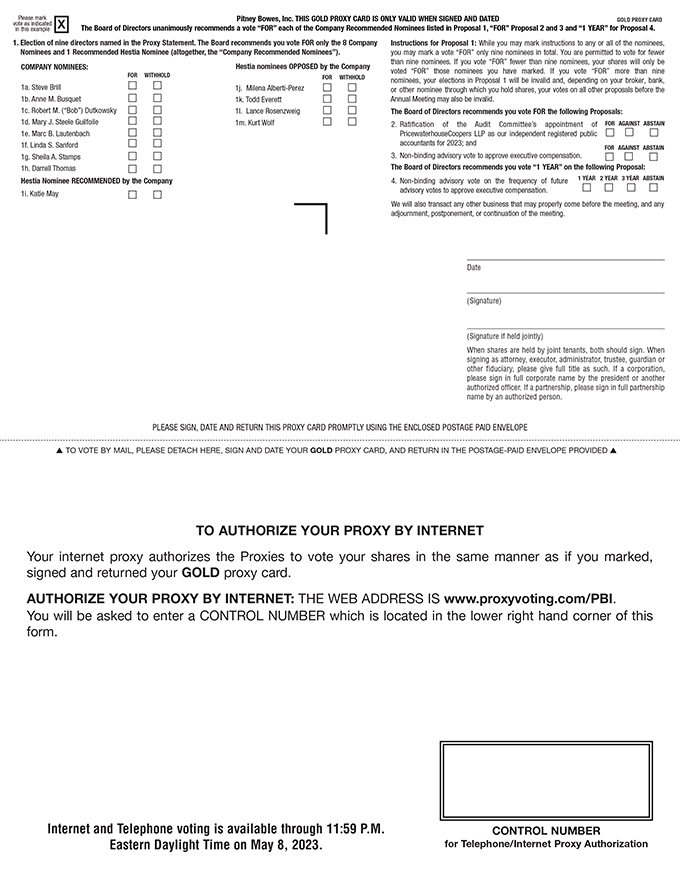

We cordially invite you to attend our 2023 annual meeting of stockholders (including any adjournments, postponements or continuations thereof, the “Annual Meeting”) scheduled to be held on May 9, 2023 at 9:00 a.m. Eastern Time in a virtual meeting format, via a live webcast.

The Annual Meeting will once again be conducted in a virtual format, which will provide stockholders the ability to participate irrespective of location. Included with this letter are the Notice of Meeting, a proxy statement detailing the business to be conducted at the Annual Meeting (the “Proxy Statement”) and a GOLD proxy card.

In 2022, Pitney Bowes made significant continued progress in its transformation. We grew equipment sales in SendTech, successfully reconfigured our Global Ecommerce network, added many new, key customer relationships across our businesses and grew revenue in Presort. In the domestic parcel component of Global Ecommerce, we saw positive momentum at the end of the year, driven by improved service levels, higher volumes and increased per parcel gross margin contribution. We believe that this progress positions us well for the future.

Additionally, we continued to see improvements in our client satisfaction scores as well as strength in our employee engagement scores at levels that we believe are consistent with high-performance companies. Throughout the year, we received multiple awards reflecting our quality as an employer, including being named by Forbes to its annual lists of America’s Best Large Employers, Best Employers for Women, Best Employers for Diversity, and earning a score of 100 on the Human Rights Campaign Foundation’s 2022 Corporate Equity Index, recognizing Pitney Bowes as a best place to work for LGBTQ+ equality. These are important achievements as we continue to seek the best talent throughout our industry.

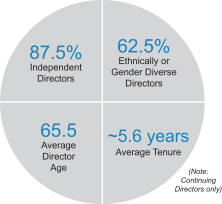

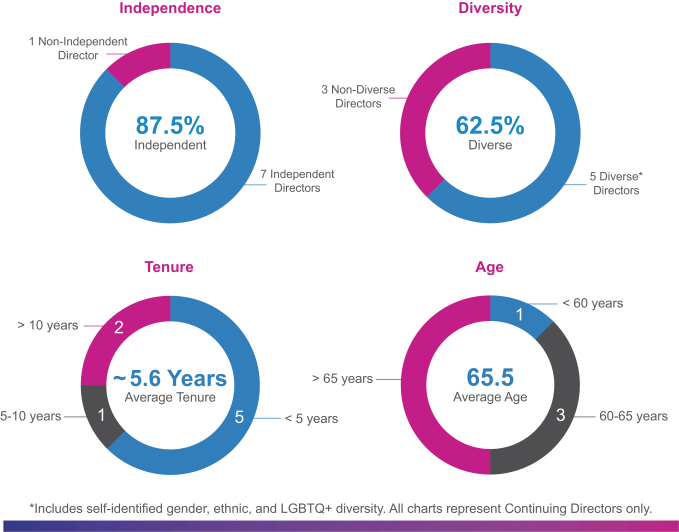

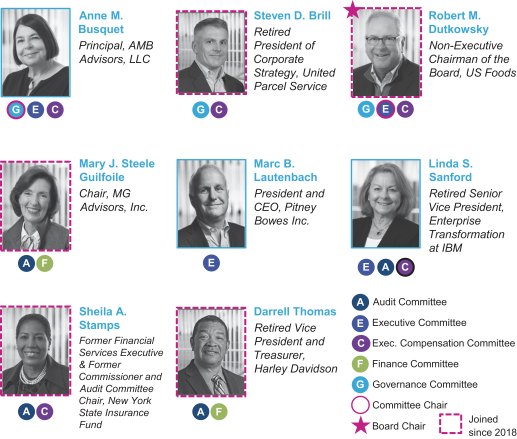

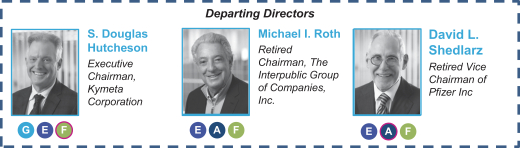

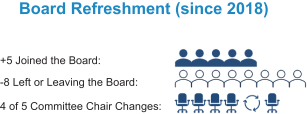

We have also announced the recent appointments of Darrell Thomas, former Treasurer and interim CFO at Harley-Davidson, and Steven D. Brill, a former UPS senior executive, as independent directors of the Board and that directors Michael I. Roth, S. Douglas Hutcheson, and David L. Shedlarz will not stand for re-election at the Company’s 2023 Annual Meeting. We are excited to welcome Darrell and Steve to our Board – who possess deep leadership experience and expertise – and we are immensely grateful for Michael, Doug, and David for their leadership, service, and many contributions over the years.

Your vote is especially important this year because Hestia Capital Partners, LP (together with its affiliates and associates, “Hestia”) has notified us that it intends to nominate five candidates for election at the Annual Meeting. OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” OUR BOARD’S RECOMMENDED NOMINEES (INCLUDING ALL EIGHT COMPANY NOMINEES AND THE ONE RECOMMENDED HESTIA NOMINEE, KATIE MAY) BY USING THE ENCLOSED GOLD PROXY CARD AND DISREGARD ANY MATERIALS, AND DO NOT SIGN, RETURN OR VOTE ON ANY WHITE PROXY CARD, SENT TO YOU BY OR ON BEHALF OF HESTIA.

On behalf of everyone at Pitney Bowes, we are grateful for your continued trust and support. Thank you for being a Pitney Bowes stockholder.

Bob Dutkowsky

Non-Executive Chair of the Board

Stamford, Connecticut

March 14, 2023