UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31 , 20211-3579

| State of incorporation: | I.R.S. Employer Identification No. | |||||||||||||

| Address: | ||||||||||||||||||||

| Telephone Number: | ||||||||||||||||||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files) Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| þ | Accelerated filer | o | Non-accelerated filer | o | |||||||||||||

| Smaller reporting company | Emerging growth company | ||||||||||||||||

If an emerging growth company, indicate by check mark whether the registrant has elected not to use the extended transition period for complying with new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☑ No ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No þ

As of June 30, 2021, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant was $2 billion based on the closing sale price as reported on the New York Stock Exchange. At January 31, 2022, there were 174,855,086 outstanding shares of common stock, $1 par value.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's proxy statement to be filed within 120 days after our fiscal year end in connection with the Annual Meeting of Stockholders to be held May 2, 2022, are incorporated by reference in Part III of this Form 10-K.

1

PITNEY BOWES INC.

TABLE OF CONTENTS

| Page Number | ||||||||

| PART I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| PART IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

2

PART I

Forward-Looking Statements

This Annual Report on Form 10-K (Annual Report) contains statements that are forward-looking. We believe that these forward-looking statements are reasonable based on our current expectations and assumptions. However, we caution readers that any forward-looking statement within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 are subject to risks and uncertainties and actual results could differ materially. Words such as "estimate," "target," "project," "plan," "believe," "expect," "anticipate," "intend" and similar expressions may identify such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Forward-looking statements in this Annual Report speak only as of the date hereof, and forward-looking statements in documents attached that are incorporated by reference speak only as of the date of those documents.

Although we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in our forward-looking statements. Our future financial condition, results of operations and forward-looking statements are subject to change and to inherent risks and uncertainties, as disclosed or incorporated by reference in our filings with the Securities and Exchange Commission (the SEC). In particular, we continue to navigate the impacts of the COVID-19 pandemic (COVID-19) and the effect that its unpredictability is having on our, and our client's business, financial performance and results of operations. Other factors which could cause future financial performance to differ materially from the expectations, and which may also be exacerbated by COVID-19 or a negative change in the economy, include, without limitation:

•declining physical mail volumes

•changes in postal regulations or the operations and financial health of posts in the U.S. or other major markets, or changes to the broader postal or shipping markets

•the loss of, or significant changes to, our contractual relationships with the United States Postal Service (USPS) or USPS' performance under those contracts

•our ability to continue to grow and manage unexpected fluctuations in volumes, gain additional economies of scale and improve profitability within our Global Ecommerce segment

•changes in labor and transportation availability and costs

•global supply chain issues adversely impacting our third-party suppliers' ability to provide us products and services

•declines in demand for our ecommerce services resulting from supply chain delays or interruptions affecting our retail clients, or changes in retail consumer behavior or spending patterns

•competitive factors, including pricing pressures, technological developments and the introduction of new products and services by competitors

•the loss of some of our larger clients in our Global Ecommerce and Presort Services segments

•the impacts of inflation and rising prices on our costs and expenses, and to our clients and retail consumers

•expenses and potential impacts resulting from a breach of security, including cyber-attacks or other comparable events

•the potential impacts on our cost of debt due to potential interest rate increases

•our success at managing customer credit risk

•capital market disruptions or credit rating downgrades that adversely impact our ability to access capital markets at reasonable costs

•our success in developing and marketing new products and services and obtaining regulatory approvals, if required

•the continued availability and security of key information technology systems and the cost to comply with information security requirements and privacy laws

•changes in international trade policies, including the imposition or expansion of trade tariffs

•changes in tax laws, rulings or regulations

•our success at managing relationships and costs with outsource providers of certain functions and operations

•changes in banking regulations or the loss of our Industrial Bank charter

•changes in foreign currency exchange rates

•increased environmental and climate change requirements or other developments in these areas

•intellectual property infringement claims

•the use of the postal system for transmitting harmful biological agents, illegal substances or other terrorist attacks

•impact of acts of nature on the services and solutions we offer

Further information about factors that could materially affect us, including our results of operations and financial condition, is contained in Item 1A. "Risk Factors" in this Annual Report.

3

ITEM 1. BUSINESS

General

Pitney Bowes Inc. (we, us, our, or the company) is a global shipping and mailing company that provides technology, logistics, and financial services to small and medium sized businesses, large enterprises, including more than 90 percent of the Fortune 500, retailers and government clients around the world. These clients rely on us to remove the complexity and increase the efficiency in their sending of mail and parcels. For additional information, visit www.pitneybowes.com.

Business Segments

Global Ecommerce

Domestic parcel services offers retailers a cost-effective parcel delivery and returns network for end consumers. We operate numerous domestic parcel sortation centers connected by a nationwide transportation network, enabling us to pick up parcels from retailer distribution centers and move them through our physical network. We also offer fulfillment services, providing pick, pack and ship services for clients through four fulfillment centers co-located within four of our larger parcel sortation centers to facilitate same-day entry into our parcel delivery network.

Cross-border solutions manages all aspects of the international shopping and shipping experience. Our proprietary technology enables global tracking and logistics services; calculates duty, tax and shipping costs at checkout; enables multi-currency pricing, payment processing and fraud management; ensures compliance with product restrictions and produces all documentation requirements to meet export complexities and customs clearance. Our proprietary technology is utilized by direct merchants and major online marketplaces facilitating millions of parcels to be shipped worldwide.

Digital delivery services enables clients to reduce transportation and logistics costs, select the best carrier based on need and cost, improve delivery times and track packages in real-time. Powered by our shipping APIs, clients can purchase postage, print shipping labels and access shipping and tracking services from multiple carriers that can be easily integrated into any web application such as online shopping carts or ecommerce sites and provide guaranteed delivery times and flexible payment options.

Presort Services

We are a workshare partner of the USPS and national outsource provider of mail sortation services that allow clients to qualify large volumes of First-Class Mail, Marketing Mail and Marketing Mail Flats and Bound Printed Matter for postal workshare discounts. Our network of operating centers throughout the United States and fully-customized proprietary technology provides clients with end-to-end solutions from pick up to delivery into the postal system network, expedited mail delivery and optimal postage savings.

Sending Technology Solutions

We provide clients with physical and digital mailing and shipping technology solutions and other applications to help simplify and save on the sending, tracking and receiving of letters, parcels and flats. We also offer supplies and maintenance services for these offerings. Our cloud enabled infrastructure provides software-as-a-service (SaaS) offerings delivered online and via connected or mobile devices. Our latest offerings are designed on an open platform architecture that have the capabilities to leverage partnerships with carriers, developers and other innovative companies to deliver value to our clients. We offer financing alternatives that enable clients to finance equipment and product purchases.

Through our wholly owned subsidiary, The Pitney Bowes Bank (the Bank), we offer our clients in the United States a revolving credit solution that enables clients to make meter rental payments and purchase postage, services and supplies and an interest-bearing deposit solution to clients who prefer to prepay postage. Additionally, we offer financing alternatives that enable clients to finance or lease other manufacturers’ equipment and provide working capital.

We provide revolving credit solutions to clients in Canada and the U.K. that enable them to make meter rental payments and purchase postage, services and supplies.

We establish credit approval limits and procedures based on the credit quality of the client and the type of product or service provided. We closely monitor the portfolio by analyzing industry sectors and delinquency trends by product line, industry and client to ensure reserve levels and credit policies reflect current trends. Management continuously monitors credit lines and collection resources and revises credit policies as necessary.

Seasonality

A larger percentage of our revenue is earned in the fourth quarter relative to the other quarters, driven primarily by higher shipping volumes during the holiday season.

4

Sales and Services

We market our products, solutions and services through a direct and inside sales force, global and regional partner channels, direct mailings and digital channels. We provide call-center, online and on-site support services for our products and solutions. Support services are primarily provided under maintenance contracts.

Competition

Our businesses face competition from large, multinational companies and smaller, more narrowly focused regional and local firms. We compete on the basis of technology and innovation, breadth of product offerings, our ability to design and tailor targeted solutions to meet client needs, performance, service and support, price, quality and brand.

We must continue to invest in our current technologies, products and solutions, and in the development of new technologies, products and solutions in order to maintain and improve our competitive position. We frequently encounter new competitors as the markets in which we participate evolve and newer businesses enter our existing markets.

A summary of the competitive environment for each of our segments is as follows:

Global Ecommerce

The domestic parcel services and cross-border solutions market includes competitors of various sizes, including companies with greater financial resources than us. Some of these competitors specialize in point solutions or freight forwarding services, are full-service ecommerce business process outsourcers and online marketplaces with international logistic support, or major global delivery services companies. We also face competition from companies that can offer both domestic and cross-border solutions in a single package which creates pricing leverage. The principal competitive factors include speed of delivery, price, ease of integration and use, innovative services, reliability, functionality and scalability. We compete based on the accuracy, reliability and scalability of our platform and logistics services, our ability to provide clients and their customers a one-stop full-service ecommerce experience and the ability to provide a more customized shipping solution than some of the larger competitors in the industry.

Our digital delivery services business competes with technology providers who help make shipping easier and more cost-effective. These technology providers range from large, established companies to smaller companies offering negotiated carrier rates. The principal competitive factors include technology stability and reliability, innovation, access to preferred shipping rates and ease of integration with existing systems.

Presort Services

We face competition from regional and local presort providers, cooperatives of multiple local presort providers, consolidators and service bureaus that offer presort solutions as part of a larger bundle of outsourcing services. We also face competition from large mailers that have sufficient volumes and the capability to sort their own mailings in-house and could use excess capacity to offer presort services to others. The principal competitive factors include price, innovative service, delivery speed, tracking and reporting, industry expertise and economies of scale. Our competitive advantages include our extensive network of presort facilities capable of processing significant volumes and our innovative proprietary technology that provides clients with reliable, secure and precise services and maximum postage discounts.

Sending Technology Solutions

We face competition from other mail equipment and solutions providers and those that offer online shipping and mailing products and services solutions. Additionally, the growth of alternative communication methods as compared to physical mail continue to grow, which creates competition to mail and also to our offerings that enable clients to use the mail efficiently. We differentiate ourselves from our competitors through our breadth of physical and digital offerings, including cloud enabled SaaS and open platform architecture offerings; pricing; available financing and payment offerings; product reliability; support services; and our extensive knowledge of the shipping and mailing industry.

Our financing operations face competition, in varying degrees, from large, diversified financial institutions, including leasing companies, commercial finance companies and commercial banks, as well as small, specialized firms. We believe our competitive advantage that differentiates us from our competitors is the breadth of our financing and payment solutions and our ability to seamlessly integrate these solutions into our clients' shipping and mailing operations.

Also see Item 1A. Risk Factors for further details regarding the competition our businesses face.

5

Research, Development and Intellectual Property

We invest in research and development activities to develop new products and solutions, enhance the effectiveness and functionality of existing products and solutions and deliver high value technology and differentiated services in high value segments of the market.

Third-Party Suppliers

Our Sending Technology Solutions (SendTech Solutions) segment depends on third-party suppliers and outsource providers for a variety of services and product components and the hosting of our SaaS offerings. Our Global Ecommerce and Presort Services segments rely on third party suppliers to help equip our facilities, provide warehouse support and assist with our logistical operations. All of our businesses and corporate functions depend on third-party providers for a variety of data analytics, sales, reporting and other functions. In certain instances, we rely on single-sourced or limited-sourced suppliers and outsourcing vendors around the world because doing so is advantageous due to quality, price or lack of alternative sources. We have risk mitigation programs to monitor conditions affecting our suppliers' ability to fulfill expected commitments. We believe that our available sources for services, components, supplies, logistics and manufacturing are adequate.

Regulatory Matters

We are subject to the regulations of postal authorities worldwide related to product specifications of our postage meters. Our Presort Services segment is also subject to regulations of the USPS. The Bank is chartered as an Industrial Bank under the laws of the State of Utah. The Bank and certain company affiliates that provide services to the Bank are subject to the regulations of the Utah Department of Financial Institutions and the Federal Deposit Insurance Corporation. We are also subject to transportation regulations for various parts of our business, customs and trade regulations worldwide related to our cross-border shipping services and regulations concerning data privacy and security for our businesses that use, process and store certain personal, confidential or proprietary data.

Climate Change

Although climate change has had no material impact on our operations to date, the risk of increasingly severe climate events or the risk that those events happen more frequently could affect one or more of our facilities and our ability to conduct daily operations in the future. Increasing regulatory restrictions in response to climate change could also materially affect our costs, especially with respect to transportation.

Human Capital

We have approximately 11,500 employees, with approximately 80% located in the United States. We also rely on a contingent hourly workforce to supplement our full-time workforce to meet fluctuating demand. We seek to create a high-performance culture that will drive and sustain enhanced value for all our stakeholders. To attract, retain and engage the talent needed, we strive to maintain a diverse, inclusive and safe workplace, with equitable opportunities for growth and development, supported by competitive compensation, benefits and health and wellness programs, and by programs that build connections between our employees and their communities.

Diversity and Inclusion

We believe that maintaining a diverse workforce and an inclusive environment for our workforce is important to our success. We celebrate a rich mix of countries, cultures, ages, races, ethnicities, gender identities, sexual orientation, abilities and perspectives that showcase our humanity, differentiate us as individuals and enhance our businesses.

Employee Engagement and Development

We emphasize employee development and training and provide professional development initiatives, training, experiential learning and inclusion networks to our employees to enable them to advance their skills and achieve career goals. We also believe employee engagement is important to the company's success and conduct a survey annually that has driven participation rates with scores reflecting high levels of employee engagement.

Health, Safety and Wellness

We are committed to the health, safety and wellness of our employees. We provide our employees and their families with access to a variety of flexible and convenient health and wellness programs.

In response to COVID-19, we implemented significant changes that we determined were in the best interest of our employees, and the communities in which we operate, and which comply with local and federal government regulations. As the pandemic conditions change, we adapt our approach to keep our employees safe, including allowing them to work remotely when they do not need to be in any of our facilities and adapting our requirements around social distancing or the use of personal protective equipment. We have also

6

taken steps to encourage-but not require-our employees to get vaccinated. We continuously monitor the rate of infection of our employees both overall and in specific facilities.

All of our offices and facilities are open for employees. There are some employees who have been working full-time in our offices and operating centers due to the nature of their work; some have chosen to come in regularly and others are predominantly working from home, coming into our office for purposeful activities. Over the course of the pandemic, we have been developing and will continue to adapt our workplace strategy to reflect the current changes in how people work. As we develop and adjust these approaches, we focus on doing so with an emphasis on maintaining a high level of performance while ensuring an inclusive and safe work environment. This approach provides a consistent framework for recognizing the evolving ways in which we work to deliver value to our stakeholders – warehouse employees who are onsite every day, service technicians, salespeople and drivers travelling to client sites, and office workers working in an array of flexible models. We continue to encourage our employees to get vaccinated, social distance where appropriate, provide and encourage the use of personal protective equipment and monitor the health of our employees. We expect to continue to implement safety measures as necessary and take further actions as government authorities require or recommend, or as we determine to be in the best interests of our employees, customers, partners and suppliers.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments thereto filed with, or furnished to, the SEC, are available, free of charge, through the Investor Relations section of our website at www.investorrelations.pitneybowes.com or from the SEC's website at www.sec.gov, as soon as reasonably practicable after these reports are electronically filed with, or furnished to, the SEC. The other information found on our website is not part of this or any other report we file with or furnish to the SEC.

Information About Our Executive Officers

| Name | Age | Title | Executive Officer Since | |||||||||||||||||

| Marc B. Lautenbach | 60 | President and Chief Executive Officer | 2012 | |||||||||||||||||

| Johnna G. Torsone | 71 | Executive Vice President and Chief Human Resources Officer | 1993 | |||||||||||||||||

| Daniel J. Goldstein | 60 | Executive Vice President and Chief Legal Officer and Corporate Secretary | 2010 | |||||||||||||||||

| Christoph Stehmann | 59 | Executive Vice President, International Sending Technology Solutions | 2016 | |||||||||||||||||

| Jason C. Dies | 52 | Executive Vice President and President, Sending Technology Solutions | 2017 | |||||||||||||||||

| Gregg Zegras | 54 | Executive Vice President and President, Global Ecommerce | 2020 | |||||||||||||||||

| Ana Maria Chadwick | 50 | Executive Vice President and Chief Financial Officer | 2021 | |||||||||||||||||

| James Fairweather | 50 | Executive Vice President, Chief Innovation Officer | 2021 | |||||||||||||||||

There are no family relationships among the above officers. The above officers have served in various executive positions with the company for at least the past five years except as follows:

Mr. Dies was appointed Executive Vice President and President, Sending Technology Solutions in October 2017. He joined the company in 2015 as President, Document Messaging Technologies (DMT). Prior to joining the company, Mr. Dies was employed at IBM where he held several leadership positions in North America, Europe, and Asia across diverse business units.

Mr. Zegras was appointed Executive Vice President and President, Global Ecommerce in July 2020. He joined the company in 2013 as President, Imagitas. Prior to joining the company, Mr. Zegras held several executive leadership positions, including at NBC Universal, Sharecare and Hearst Entertainment.

Ms. Chadwick joined the company as Executive Vice President and Chief Financial Officer on January 29, 2021. Prior to joining the company, Ms. Chadwick was employed at GE Capital as President and CEO of GE Capital Global Legacy Solutions. Ms. Chadwick spent over 20 years at GE Capital, where she held several executive positions, including Controller of GE Capital Americas and CFO at GE Capital Energy Financial Services.

Mr. Fairweather was appointed Executive Vice President and Chief Innovation Officer in May 2021. Prior to this, he was Senior Vice President and Chief Technology Officer, Commerce Services. He has been a leader in the company's strategic digital transformation and technology initiatives across Design, SaaS, Data Science and Analytics, API Management, Security and Mobility.

7

ITEM 1A. RISK FACTORS

Our operations face certain risks that should be considered in evaluating our business. We manage and mitigate these risks on a proactive basis, using an enterprise risk management program. Nevertheless, the following risk factors, some of which may be beyond our control, could materially affect our business, financial condition, results of operations, brand and reputation, and may cause future results to be materially different than our current expectations. These risk factors are not intended to be all inclusive.

COVID-19 Pandemic Risks

Our business, financial condition and results of operations have been, and will continue to be, affected by the unpredictability, duration, and severity of the ongoing COVID-19 pandemic.

The ongoing COVID-19 pandemic has impacted, and is expected to continue to impact, our business, operations, and financial performance. Given the unpredictability, duration, and, at times, the severity of resurgences of the pandemic, its ultimate effect on our business, operations and financial performance remains uncertain. There are many factors, not within our control, which could affect the pandemic's ultimate impact on our businesses and our ability to execute our business strategies and initiatives in the expected time frame. These include, but are not limited to: the response of governments, businesses and individuals to the pandemic; its impact on the labor force, the global economy and economic activity (including inflation), and the spending habits of consumers and businesses; disruptions in global supply chains; and significant volatility and disruption of financial markets. In addition to having the effect of potentially heightening many of our other risk factors in this section, the COVID-19 pandemic has, and may continue to, adversely affect the following to the detriment of our business, including:

•Our ability to sell products and provide services to our clients, fulfill orders, and install equipment on a timely basis and market to prospective new clients due to social distancing rules and heightened security policies.

•The acceleration of the decline of physical mail volumes in the geographies in which we operate, which adversely affects both our Presort Services and SendTech Solutions segments. We cannot yet assess the extent to which these declines in mail volumes, and resulting impact to our business, are permanent or temporary.

•The financial health of posts around the world, especially that of the USPS, given the adverse effects associated with the declines in physical mail volumes. If these financial difficulties are not resolved, or if any resolution requires posts to operate differently, price in a manner that hurts their competitiveness or further reduces postal volume or causes them to change their contractual relationships with their partners or vendors, these changes could have a material adverse effect on our business.

•Costs and reduced labor productivity associated with extended safety protocols, higher levels of employees out sick, hiring and training temporary labor, redirecting volumes to other facilities, and complying with government mandates.

•Global Ecommerce’s costs, including those relating to postage, transportation, and warehouse space, resulting from sudden and significant increases or decreases in volumes, due to unexpected short-term shifts in consumer spending patterns or short-term interruptions or delays in our retail client’s supply chains.

•Our ability to timely obtain parts, supplies, or finished goods from our vendors in order to meet our sales obligations or equip our facilities.

•The frequency of long-distance airplane flights, resulting in higher costs and at times, reduced demand for our Global Ecommerce cross-border offerings.

•Delinquencies in collections and bankruptcies in our clients, which could affect our cash flow. Client requests for potential payment deferrals or other contract modifications could also reduce the profitability or ongoing cash flow from some of our current customers.

•Third-party service providers ability to satisfy their performance obligations to us, which in turn affects our ability to satisfy our service commitments to our clients.

•Our earnings or cash flows, which could result in additional credit rating downgrades, higher costs of borrowing, or limit our access to additional debt.

8

Mailing and Shipping Industry Risks

Further significant deterioration in the financial condition of the USPS, or the national posts in our other major markets, could affect the ability of those posts to provide services to us or our clients, which could adversely affect client demand for our offerings and thus our financial performance.

We are dependent on financially viable national posts in the geographic markets where we operate, particularly in the United States. A significant portion of our revenue depends upon the ability of these posts, especially the USPS, to provide competitive mail and package delivery services to our clients and the quality of the services they provide. Their ability to provide high quality service at affordable rates in turn depends upon their ongoing financial strength. If the posts are unable to continue to provide these services into the future, our financial performance will be adversely affected.

Our ability to compete in the package shipping market in the United States depends upon certain contractual relationships we have with the USPS and the successful performance of those services.

The USPS is our primary provider for the “last mile” component of our parcel delivery services in the United States. This represents a significant component of our cost in offering these services. If we are unable to receive competitive pricing from the USPS or take advantage of lower cost USPS options, our ability to compete with private carriers and to achieve profitable revenue growth will be adversely affected. The quality of service we provide to our clients also depends upon the quality of delivery services received from the USPS. As the ecommerce market continues to evolve, and as the USPS implements changes to its network, if the USPS’ service performance is materially worse than that of the private carriers, we may lose clients to competition and our financial performance will be adversely affected.

We are subject to postal regulations and processes, which could adversely affect our financial performance.

A significant portion of our business is subject to regulation and oversight by the USPS and posts in other major markets. These postal authorities have the power to regulate some of our current products and services. They also must approve many of our new or future product and service offerings before we can bring them to market. If our new or future product and service offerings are not approved, there are significant conditions to approval, regulations on our existing products or services are changed or, we fall out of compliance with those regulations, our financial performance could be adversely affected.

If we are not able to respond to the continuing decline in the volume of physical mail delivered via traditional postal services, our financial performance could be adversely affected.

Traditional mail volumes continue to decline and impact our current and future financial results, primarily within our SendTech Solutions and Presort Services segments. An accelerated or sudden decline could result from changes in communication behavior or available communication technologies, reductions to the Universal Service Obligation (USO) under which the USPS and other national posts are required to deliver to every address in a country with similar pricing and frequency, pandemics, and legislation or regulations that mandate electronic substitution for communication by mail, prohibit certain types of mailings, increase the difficulty of using information or materials in the mail, or impose higher taxes or fees on postal services. If we are not successful at meeting the continuing challenges faced in our mailing business, or if physical mail volumes were to experience an accelerated or sudden decline, our financial performance could be adversely affected.

Significant changes to the laws regulating the USPS or other posts, or changes in their operating models could have an adverse effect on our financial performance.

As a significant portion of our revenue and earnings is dependent on postal operations, changes in the laws and regulations that affect how posts operate could have an adverse effect on our financial performance. As posts consider new strategies for their operations in an era of declining mail volumes and increasing package volumes, if we are unable to work with posts to support those strategies, our financial performance could be adversely affected.

Business Operational Risks

We face intense competition in the industries in which we operate.

The markets for our products and services in each of our segments are highly competitive. In our Global Ecommerce segment, we face competition in our shipping business from full-service ecommerce business process outsourcers, online marketplaces, freight forwarders, and major global delivery services companies, including those that can offer both domestic and cross-border solutions in a single package. Our digital delivery business competes with technology providers ranging from large, established companies to

9

smaller companies offering negotiated carrier rates. If we cannot compete against these competitors with, among other things, speed of delivery, price, reliability, functionality and scalability of our platform and logistic services and ease of integration and use, we may lose clients, incur additional costs and suffer from reduced margins, and the financial results of the segment may be adversely affected. Our Presort Services segment faces competition from regional and local presort providers, cooperatives of multiple local presort providers, consolidators and service bureaus that offer presort solutions as part of a larger bundle of outsourcing services and large volume mailers that have sufficient volumes and the capability to presort their own mailings in-house and could use excess capacity to offer presort services to others. If we are not able to effectively compete on price, innovative service, delivery speed, tracking and reporting, we may lose clients and the financial results of the segment may be adversely affected. Our Sending Technology Solutions segment faces competition from other mail equipment and solutions providers, companies that offer products and services as alternative means of message communications and those that offer online shipping and mailing products and services solutions. In addition, our financing operations face competition, in varying degrees, from large, diversified financial institutions, including leasing companies, commercial finance companies and commercial banks, as well as small, specialized firms. If we are not able to differentiate ourselves from our competitors or effectively compete with them, the financial results of the segment may be adversely affected.

The evolution of our businesses to more digital and shipping-related services has resulted in a decline in our overall profit margins. If we cannot increase our volumes while at the same time reduce our costs, our overall profitability could be adversely affected.

As our businesses shift to more digital and shipping-related services, the relative revenue contribution from our shipping-related offerings now exceeds that of the revenue from our mailing-related offerings. We expect the revenue contribution from shipping services to continue to grow; however, profit margins on these services are lower than those for our mailing-related offerings. Accordingly, if we cannot gain additional economies of scale through increasing volumes, lowering our cost per piece and in turn, improve margins and profitability, our short and long-term financial performance will be adversely affected.

Seasonality of the Global Ecommerce segment, unexpected declines in consumer demand or the performance of our retail customers, or unexpected spikes in the costs of labor or transportation, especially during the fourth quarter, could adversely affect our overall performance.

Our Global Ecommerce segment derives the majority of its revenue from its retail clients. The retail industry is subject to cyclical trends in consumer sentiment and spending habits that are affected by many factors, including prevailing economic conditions, recession or fears of recession, inflation, unemployment levels, pandemics (as continues to be the case with the COVID-19 pandemic) or geopolitical events. Our retail clients are also dependent on third party suppliers to provide them with either raw materials or finished goods to meet the product demands of their clients. Moreover, Global Ecommerce’s annual financial results are also highly dependent on its performance during the peak holiday season in the fourth quarter. If consumer sentiment or spending habits deteriorate or change such that the demand for our clients’ online products is negatively impacted, or if our clients encounter supply chain challenges, we could incur unexpected costs and revenue declines, and if these factors impact our fourth quarter, as occurred in 2021 due to the COVID-19 pandemic, the impact on the segment's financial results could be more severe.

The loss of any of our largest clients in our Global Ecommerce segment could adversely affect the financial performance of that segment.

The Global Ecommerce segment receives a large portion of its revenue from a relatively small number of clients and business partners. The loss of any of these larger clients or business partners, or a substantial reduction in their use of our products or services, could have a material adverse effect on the revenue and profitability of the segment. There can be no assurance that our larger clients and business partners will continue to utilize our products or services at current levels, or that we would be able to replace any of these clients or business partners with others who can generate revenue at current levels.

If we fail to effectively manage our third-party suppliers, or if their ability to perform were negatively impacted, our business, financial performance and reputation could be adversely affected.

Our SendTech Solutions segment relies on third-party suppliers for services and components for our mailing equipment, spare parts, supplies and services and for the hosting of our SaaS offerings. We also rely on third party suppliers to help us equip our Presort and Ecommerce facilities and to provide us with services related to some of our operations. In certain instances, we rely on single-sourced or limited-sourced suppliers around the world because of advantages in quality, price or lack of alternative sources. If our suppliers are not able to provide these services, components or equipment to us in a timely manner, or if the supply chain constraints we are currently experiencing due to the COVID-19 pandemic were to worsen, the quality of the goods or services received were to deteriorate, our relationship with certain suppliers were to be terminated, or if the costs of using these third parties were to increase

10

and we were not able to find alternate suppliers, we could lose clients, incur significant disruptions in manufacturing and operations and increased costs, including higher freight and re-engineering costs.

Fluctuations in transportation costs or disruptions to transportation services in our Global Ecommerce or Presort Services segments could adversely affect client satisfaction or our financial performance.

In addition to our reliance on the USPS, our Global Ecommerce and Presort Services segments rely upon independent third-party transportation service providers to transport a significant portion of our parcel and mail volumes. Some of our providers may also be our competitors. The use of these providers is subject to risks, including our ability to negotiate acceptable terms, increased competition during peak periods, capacity issues, performance problems, extreme weather, natural or man-made disasters, pandemics, increased fuel costs, labor shortages or disputes and other unforeseen difficulties. Any disruption to the timely supply of these services for any reason, any dramatic increase in the cost of these services or any deterioration of the performance of these services (each of which we experienced, at times, during the COVID-19 pandemic), could adversely affect client satisfaction or our financial performance. Given our continued reliance upon these providers, any future unforeseen disruptions affecting these providers could similarly adversely affect client satisfaction and our financial performance.

Our business depends on the our ability to attract, retain and maintain good relationships with, employees at a reasonable cost to meet the needs of our business and to consistently deliver highly differentiated, competitive offerings.

The rapid growth of the ecommerce industry has resulted in intense competition for employees in the shipping, transportation and logistics industry, including drivers and warehouse employees. The COVID-19 pandemic has accelerated this industry growth resulting in our Global Ecommerce segment experiencing a higher demand, and increased competition, for labor, especially in our warehouses. This increased demand and competition for workers has also impacted our Presort Services segment. We supplement our Global Ecommerce and Presort Services workforce with contingent hourly workers from staffing agencies on an as-needed basis. Due to increased demand and competition, concern over exposure to COVID-19 and other factors, at times during the COVID-19 pandemic, we experienced labor shortages, increased costs and reduced productivity. If we experience similar labor shortages again, do not effectively manage our use of such contingent workers, or if our staffing agencies chose to terminate their relationship with us and we cannot find alternative providers, it could result in increased costs and adversely affect our operations. Moreover, given the nature of our Global Ecommerce and Presort Services employee base, if we cannot continue to maintain good relationships with those employees resulting in employee dissatisfaction and turnover, our operating costs could significantly increase, and our operational flexibility could be significantly reduced.

There is also significant competition for the talent needed to develop our other products and services. Increased competition for employees has resulted in higher wages and costs of other benefits necessary to attract and retain employees with the right skill sets. Additional labor costs which may also impact our business include those triggered by regulatory actions; increased health care and workers’ compensation insurance expenses; and, those costs associated with the COVID-19 pandemic, which in our Global Ecommerce and Presort Services segments, continues to include costs resulting from reduced productively (staggering shifts, breaks to enhance social distancing and higher levels of employees out sick), costs for extended safety protocols in our warehouses and incremental costs required to hire temporary labor.

Our inability to obtain and protect our intellectual property and defend against claims of infringement by others may negatively impact our financial performance.

Our businesses are not materially dependent on any one patent or license or group of related patents and licenses; however, our business success depends in part upon protecting our intellectual property rights, including proprietary technology developed or obtained through acquisitions. We rely on copyrights, patents, trademarks and trade secrets and other intellectual property laws to establish and protect our proprietary rights. If we are unable to protect our intellectual property rights, our competitive position may suffer, which could adversely affect our revenue and profitability. The continued evolution of patent law and the nature of our innovation work may affect the number of patents we are able to receive for our development efforts. As we continue to transition our business to more software and service-based offerings, patent protection of these innovations will be more difficult to obtain. In addition, from time to time, third parties may claim that we, our clients, or our suppliers, have infringed their intellectual property rights. These claims, if successful, may require us to redesign affected products, enter into costly settlement or license agreements, pay damage awards, or face a temporary or permanent injunction prohibiting us from marketing or selling certain products.

11

If we fail to comply with government contracting regulations, our financial performance, brand name and reputation could suffer.

We have a significant number of contracts with governmental entities. Government contracts are subject to extensive and complex procurement laws and regulations, along with regular audits and investigations by government agencies. If one or more government agencies discovers contractual noncompliance by us or one of our subcontractors in the course of an audit or investigation, we may be subject to various civil or criminal penalties and administrative sanctions, which could include the termination of the contract, reimbursement of payments received, fines and debarment from doing business with one or more governments. Any of these events could not only affect our financial performance, but also adversely affect our brand and reputation.

We may not fully realize the anticipated benefits of strategic acquisitions and divestitures which may harm our financial performance.

We may make strategic acquisitions or divest certain businesses. These actions may involve significant risks and uncertainties, which could have an adverse effect on our financial performance, including:

•difficulties in achieving anticipated benefits or synergies;

•difficulties in integrating newly acquired businesses and operations, including combining product and service offerings and entering new markets, or reducing fixed costs previously associated with divested businesses;

•the loss of key employees or clients of businesses acquired or divested;

•significant charges for employee severance and other restructuring costs, legal, accounting and financial advisory fees; and

•possible goodwill and asset impairment charges as divestitures and changes in our business model may adversely affect the recoverability of certain long- lived assets and valuation of our operating segments.

Our capital investments to develop new products and offerings or expand our current operations may not yield the anticipated benefits.

We are making significant capital investments in new products, services, and facilities. If we are not successful in these new product or service introductions at the levels anticipated when making the investments, there may be an adverse effect on our financial performance.

Cybersecurity and Technology Risks

Our financial performance and our reputation could be adversely affected, and we could be subject to legal liability or regulatory enforcement actions, if we or our suppliers are unable to protect against, or effectively respond to, cyberattacks or other cyber incidents.

We depend on the security of our and our suppliers' information technology systems to support numerous business processes and activities, to service our clients, and to enable consumer transactions and postal services. There are numerous cybersecurity risks to these systems, including individual and group criminal hackers, industrial espionage, denial of service attacks, ransomware and malware attacks, attacks on the software supply chain, and employee errors and/or malfeasance. These cyber threats are constantly evolving, thereby increasing the difficulty of preventing, detecting, and successfully defending against them. Successful breaches could, among other things, disrupt our operations or result in the unauthorized disclosure, theft and misuse of company, client, consumer and employee sensitive and confidential information, all of which could adversely affect our financial performance. Cybersecurity breaches could result in financial liability to other parties, governmental investigations, regulatory enforcement actions and penalties, and our brand and reputation could be damaged. Although we maintain insurance coverage relating to cybersecurity incidents, we may incur costs or financial losses that are either not insured against or not fully covered through our insurance.

We have security systems, procedures, and business continuity plans in place-and require our suppliers to have them as well. These security systems, procedures, and business continuity plans are designed to ensure the continuous and uninterrupted performance of our information technology systems, protect against unauthorized access to information or disruption to our services, and minimize the impact of and the time to detect, respond, and recover from a breach should one occur. Despite the protections we have in place, we have suffered cyber-events in the past. In response to these attacks, we implemented a variety of measures to further enhance our cybersecurity protections and minimize the impact of any future attack. None of these systems are fool proof and like all companies, intrusions will occur, and have occurred, from time to time. Our goal is to prevent meaningful incursions and minimize the overall impact of those that occur.

12

Failure to comply with data privacy and protection laws and regulations could subject us to legal liability and adversely affect our reputation and our financial performance.

Our businesses use, process, and store proprietary information and personal, sensitive, or confidential data relating to our business, clients, and employees. Privacy laws and similar regulations in many jurisdictions where we do business require that we take significant steps to safeguard that information, and these laws and regulations continue to evolve. The scope of the laws that may be applicable to us is often uncertain and may be conflicting. In addition, new laws may add a broad array of requirements on how we handle or use information and increase our compliance obligations. For example, the European Union greatly increased the jurisdictional reach of European Law by enacting the General Data Protection Regulation (GDPR), which, among other things, enhanced an individual’s rights with respect to their information and ongoing litigation in the European Union continues to create uncertainty in how to demonstrate compliance. In the United States, several states have enacted different laws regarding personal information and privacy that impose significant new requirements on consumer personal information. Other countries or states may enact laws or regulations in the future that have similar or additional requirements. Although we continually monitor and assess the impact of these laws and regulations, their interpretation and enforcement are uncertain, subject to change, and may require substantial costs to monitor and implement. Failure to comply with data privacy and protection laws and regulations could also result in government enforcement actions (which could include substantial civil and/or criminal penalties) and private litigation, which could adversely affect our reputation and financial performance.

If we or our suppliers encounter unforeseen interruptions or difficulties in the operation of our cloud-based applications, our business could be disrupted, our reputation and relationships may be harmed, and our financial performance could be adversely affected.

Our business relies upon the continuous and uninterrupted performance of our and our suppliers' cloud-based applications and systems to support numerous business processes, to service our clients and to support their transactions with their customers and postal services. Our applications and systems, and those of our partners, may be subject to interruptions due to technological errors, system capacity constraints, software errors or defects, human errors, computer or communications failures, power loss, adverse acts of nature and other unexpected events. We have business continuity and disaster recovery plans in place to protect our business operations in case of such events and we also require our suppliers to have the same. Nonetheless, there can be no guarantee that these plans will function as designed. If we are unable to limit interruptions or successfully correct them in a timely manner or at all, it could result in lost revenue, loss of critical data, significant expenditures of capital, a delay or loss in market acceptance of our services and damage to our reputation, brand and relationships, any of which could have an adverse effect on our business and our financial performance.

Macroeconomic and General Regulatory Risks

Future credit rating downgrades or capital market disruptions could adversely affect our ability to maintain adequate liquidity to provide competitive financing services to our clients and to fund various discretionary priorities.

We provide competitive finance offerings to our clients and fund discretionary priorities, such as business investments, strategic acquisitions, dividend payments and share repurchases through a combination of cash generated from operations, deposits held at the Bank and access to capital markets. Our ability to access U.S. capital markets and the associated cost of borrowing is dependent upon our credit ratings and is subject to capital market volatility. Given our current credit rating, we may experience reduced financial or strategic flexibility and higher costs when we do access the U.S. capital markets. We maintain a $500 million revolving credit facility that requires we maintain certain financial and nonfinancial covenants.

A significant decline in cash flows, noncompliance with any of the covenants under the revolving credit facility, further credit rating downgrades, material capital market disruptions, significant withdrawals by depositors at the Bank, adverse changes to our industrial loan charter or an increase in our credit default swap spread could impact our ability to maintain adequate liquidity to provide competitive finance offerings to our clients, refinance maturing debt and fund other financing activities, which in turn, could adversely affect our financial performance.

Our Global Ecommerce segment is exposed to increased foreign exchange rate fluctuations.

The sales generated from many of our clients’ internationally focused websites running on our cross-border platform are exposed to foreign exchange rate fluctuations. Currently, our platforms are located in the U.S. and the U.K. and a majority of consumers making purchases through these platforms are in a limited number of foreign countries. A strengthening of the U.S. Dollar or British Pound relative to currencies in the countries where we do the most business impacts our ability to compete internationally as the cost of similar international products improves relative to the cost of U.S. and U.K. retailers' products. A strong U.S. Dollar or British Pound would likely result in a decrease in international sales volumes, which would adversely affect the segment's revenue and profitability.

13

Our operations and financial performance may be negatively affected by changes in trade policies, tariffs and regulations.

Our Global Ecommerce segment is subject to significant trade regulations, taxes, and duties throughout the world. Any changes to these regulations could potentially impose increased documentation and delivery requirements, delay delivery times and subject us to increased costs and additional liabilities, which could adversely affect our financial performance. Within the last four years, the United States increased tariffs for certain goods, which triggered other nations to also increase tariffs on certain of their goods. For our Global Ecommerce segment, tariff increases, or even an environment of uncertainty surrounding trade issues, could reduce demand and adversely affect its financial performance. For our SendTech Solutions segment, increased tariffs resulted in additional costs on certain components used in some of our products.

If we do not keep pace with evolving expectations and regulators in the areas of Environmental, Social and Governance (ESG) and address the potential impact of climate change on our costs and operations, our reputation and results of operations may be adversely affected.

The set of topics incorporated within the term ESG in general, and climate change in particular, cover a range of issues that pose potential risks to our operations. From an environmental perspective, the impact of climate change and a potential increase in extreme weather events may pose risk to the operation of our sortation facilities and the ability to transport mail and packages. The increased focus on alternative energy sources and the need to reduce our carbon footprint over time, could result in higher investments in capital spending and increased operational costs. There are also a series of laws related to product stewardship and waste disposal to which we need to comply. From a “social” perspective, a failure to meet employee expectations around safety and diversity, equity and inclusion could impact our ability to recruit new employees and retain talent. Finally, from a “governance” perspective, if we do not maintain a good governance processes in general or do not satisfy investor stakeholder expectations on ESG, our reputation and attractiveness to portions of the investment community could be adversely affected.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We lease numerous facilities worldwide, including our corporate headquarters located in Stamford, Connecticut, fulfillment centers, parcel operations and mail sortation facilities, service locations, data centers and call centers.

Our Global Ecommerce segment leases four fulfillment centers that comprise the majority of our fulfillment operations. Our Global Ecommerce and Presort Services segments conduct parcel operations and mail sortation operations through a network of over 50 operating centers throughout the United States. Our SendTech Solutions segment leases a manufacturing and distribution facility in Indianapolis. This facility is significant as it stores a majority of the SendTech Solutions products, supplies and inventories.

Should any facility be unable to function as intended for an extended period of time, our ability to service our clients and operating results could be impacted.

We conduct most of our research and development activities in facilities located in Noida and Pune, India and Shelton, Connecticut. Management believes that our facilities are in good operating condition, materially utilized and adequate for our current business needs.

ITEM 3. LEGAL PROCEEDINGS

See Note 16 Commitments and Contingencies for additional information.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

14

PART II

ITEM 5. MARKET FOR THE COMPANY'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is principally traded on the New York Stock Exchange (NYSE) under the symbol "PBI". At January 31, 2022, we had 12,812 common stockholders of record.

Share Repurchases

We periodically repurchase shares of our common stock to manage the dilution created by shares issued under employee stock plans and for other purposes. During 2021 and 2020, we did not repurchase any additional shares of our common stock and in 2019, we repurchased 18.6 million shares of our common stock at an aggregate price of $105 million. At December 31, 2021, we have authorization from our Board of Directors to repurchase up to of $16 million of our common stock.

Stock Performance Graph

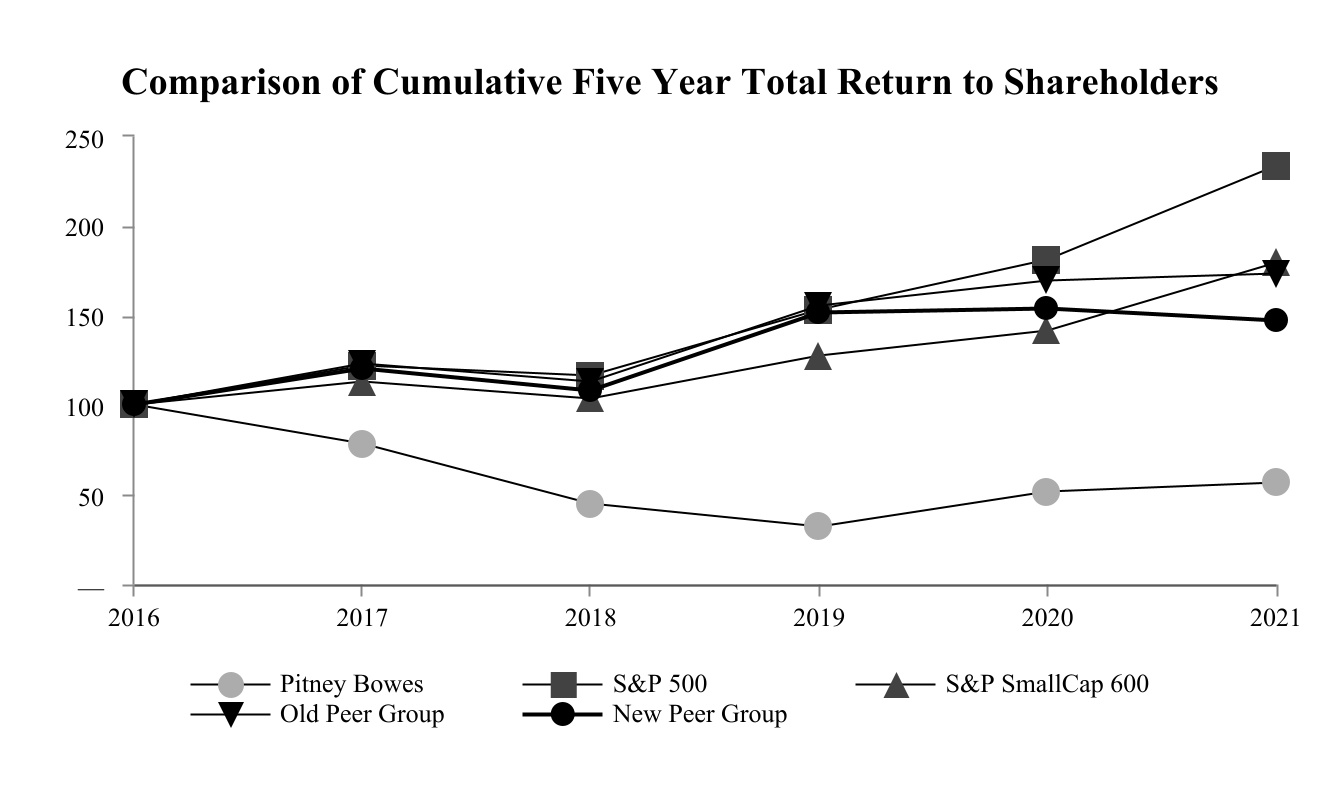

We revised our peer group from last year to exclude companies that were no longer publicly listed on an exchange and to include additional companies to align with our changing business offerings.

Our new peer group is comprised of: ACCO Brands Corporation, Alliance Data Systems Corporation, Avery Dennison Corporation, Cimpress plc, Deluxe Corporation, Diebold Nixdorf, Incorporated, Etsy, Inc., Fidelity National Information Services, Inc., Fiserv, Inc., Hub Group, Inc., NCR Corporation, Overstock.com, Inc., Rockwell Automation, Inc., Ryder System, Inc., Schneider National, Inc., The Western Union Company, W.W. Grainger, Inc. and Xerox Holdings Corporation.

The old peer group was comprised of: ACCO Brands Corporation, Alliance Data Systems Corporation, Deluxe Corporation, Diebold Nixdorf, Incorporated, Echo Global Logistics, Inc., Fidelity National Information Services, Inc., Fiserv, Inc., Hub Group, Inc., NCR Corporation, R.R. Donnelley & Sons Company, Rockwell Automation, Inc., Stamps.com Inc., The Western Union Company and Xerox Holdings Corporation.

The accompanying graph shows the annual change in the value of a $100 investment in Pitney Bowes Inc., the Standard and Poor's (S&P) 500 Composite Index, the S&P SmallCap 600 Composite Index, the old peer group and our new peer group over a five-year period assuming the reinvestment of dividends. On a total return basis, a $100 investment on December 31, 2016 in Pitney Bowes Inc., the S&P 500 Composite Index, the S&P SmallCap 600 Composite Index, the old peer group and our new peer group would have been worth $57, $233, $180, $173 and $147 respectively, on December 31, 2021.

All information is based upon data independently provided to us by Standard & Poor's Corporation and is derived from their official total return calculation. Total return for the S&P 500 and S&P SmallCap 600 Composite Indexes and our peer group is based on market capitalization, weighted for each year. The stock price performance is not necessarily indicative of future stock price performance.

15

ITEM 6. [RESERVED]

16

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The following discussion of our financial condition and operating results should be read in conjunction with our risk factors, consolidated financial statements and related notes. This discussion includes forward-looking statements based on management's current expectations, estimates and projections and involves risks and uncertainties. Actual results may differ significantly from those currently expressed. A detailed discussion of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements is outlined under "Forward-Looking Statements" and "Item 1A. Risk Factors" in this Form 10-K. All table amounts are presented in thousands of dollars.

Throughout this discussion, we refer to revenue growth on a constant currency basis. Constant currency measures exclude the impact of changes in currency exchange rates from the prior period under comparison. We believe that excluding the impacts of currency exchange rates provides investors a better understanding of the underlying revenue performance. Constant currency change is calculated by converting the current period non-U.S. dollar denominated revenue using the prior year’s exchange rate. Where constant currency measures are not provided, the actual change and constant currency change are the same.

Management measures segment profitability and performance using segment earnings before interest and taxes (EBIT). Segment EBIT is calculated by deducting from segment revenue the related costs and expenses attributable to the segment. Segment EBIT excludes interest, taxes, general corporate expenses, restructuring charges, asset and goodwill impairment charges and other items not allocated to a business segment. Management believes that it provides investors a useful measure of operating performance and underlying trends of the business. Segment EBIT may not be indicative of our overall consolidated performance and therefore, should be read in conjunction with our consolidated results of operations.

A discussion of our financial condition and results of operations for the year ended December 31, 2019, can be found under Item 7 “Management's Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the SEC on February 19, 2021.

Overview

Financial Results Summary - Year Ended December 31:

| Revenue | |||||||||||||||||||||||

| Years Ended December 31, | |||||||||||||||||||||||

| 2021 | 2020 | Actual % change | Constant Currency % Change | ||||||||||||||||||||

| Business services | $ | 2,334,674 | $ | 2,191,306 | 7 | % | 6 | % | |||||||||||||||

| Support services | 460,888 | 473,292 | (3) | % | (3) | % | |||||||||||||||||

| Financing | 294,418 | 341,034 | (14) | % | (15) | % | |||||||||||||||||

| Equipment sales | 350,138 | 314,882 | 11 | % | 10 | % | |||||||||||||||||

| Supplies | 159,438 | 159,282 | — | % | (1) | % | |||||||||||||||||

| Rentals | 74,005 | 74,279 | — | % | (1) | % | |||||||||||||||||

| Total revenue | $ | 3,673,561 | $ | 3,554,075 | 3 | % | 3 | % | |||||||||||||||

| Revenue | |||||||||||||||||||||||

| Years Ended December 31, | |||||||||||||||||||||||

| 2021 | 2020 | Actual % change | Constant currency % change | ||||||||||||||||||||

| Global Ecommerce | $ | 1,702,580 | $ | 1,618,897 | 5 | % | 4 | % | |||||||||||||||

| Presort Services | 573,480 | 521,212 | 10 | % | 10 | % | |||||||||||||||||

| SendTech Solutions | 1,397,501 | 1,413,966 | (1) | % | (2) | % | |||||||||||||||||

| Total | $ | 3,673,561 | $ | 3,554,075 | 3 | % | 3 | % | |||||||||||||||

17

| EBIT | |||||||||||||||||

| Years Ended December 31, | |||||||||||||||||

| 2021 | 2020 | % change | |||||||||||||||

| Global Ecommerce | $ | (98,673) | $ | (82,894) | (19) | % | |||||||||||

| Presort Services | 79,721 | 55,799 | 43 | % | |||||||||||||

| SendTech Solutions | 429,415 | 442,648 | (3) | % | |||||||||||||

| Total Segment EBIT | $ | 410,463 | $ | 415,553 | (1) | % | |||||||||||

Revenue increased 3% in 2021 compared to 2020. Business services revenue, which primarily includes revenue from Presort Services and Global Ecommerce, increased 7% (6% at constant currency) compared to the prior year. Presort Services revenue increased 10% primarily due to higher mail volumes, pricing actions and investments made in the network and technology to enable a higher level of five-digit sortation services. Global Ecommerce revenue increased 5% (4% at constant currency) primarily due to higher cross-border volumes. SendTech Solutions revenue declined 1% (2% at constant currency) primarily due to lower financing revenue and support services revenue, partially offset by higher equipment sales. Financing revenue declined 14% (15% at constant currency) primarily due to lower lease extensions and lower fee income and prior year gains from the sales of investment securities. Support services revenue declined 3% driven by a declining meter population and a shift to cloud-enabled products. Equipment sales increased 11% (10% at constant currency) primarily due to the effect of COVID-19 on prior year equipment sales.

Segment EBIT in 2021 decreased 1% compared to 2020. Global Ecommerce EBIT declined 19% primarily due to a $14 million unfavorable vendor price adjustment driven by lower domestic parcel delivery volumes, SendTech Solutions EBIT decreased 3% primarily driven by a decline in revenue. and Presort Services EBIT increased 43% primarily due to higher revenue and improved productivity from investments made in the network and technology. Refer to Results of Operations section for further information.

Outlook

We continue to invest in market opportunities and new solutions and services across all our businesses, optimizing our operations and implementing cost savings initiatives to drive long-term value. During 2021, we invested significantly in our facilities, network and technologies to expand operations, improve productivity and gain economies of scale. Going forward, we will focus our investments on gaining further network efficiencies and economies of scale within our Global Ecommerce and Presort Services operations and in market opportunities and new solutions and services across all our businesses. Our portfolio continues to shift to higher growth, lower margin, markets. As we continue to invest in Global Ecommerce with a view to, and ahead of, our expectations for long term growth, it is possible that near term margins will be under pressure. However, we expect margins to improve as we build scale and realize the full benefits of our investments and optimizations.

The impacts of COVID-19 on our businesses and financial results remain uncertain. Supply chain issues continue to pose challenges for us and our clients' ability to meet their customers' demand. These supply chain issues could continue to impact our customers' behavior as well as that of end consumers, which could impact our shipping and delivery volumes. The duration and severity of these supply chain issues is unknown and unpredictable. There are some unique factors not within our control that could affect our business; however, we believe we can navigate the current conditions and will continue to take proactive steps to manage our operations and mitigate related financial impacts.

On a consolidated basis, we expect revenue growth in the low to mid-single digit range in 2022 compared to 2021. Within Global Ecommerce, we anticipate revenue growth in 2022 and margin and profit improvements from pricing initiatives and productivity improvements from the benefits of the investments we made in our facilities and network. However, we also expect continued growth of the market's need for transportation services and labor to generate increased costs. Within Presort Services, we expect revenue growth in 2022 and margin and profit improvements as productivity initiatives, increased automation and facilities consolidation and optimization will more than offset expected higher labor and transportation costs. Within SendTech Solutions, we expect overall revenue to decline, growth in our cloud-enabled shipping solutions and margins to remain strong.

18

RESULTS OF OPERATIONS

REVENUE AND SEGMENT EBIT

Global Ecommerce

Global Ecommerce includes the revenue and related expenses from domestic parcel services, cross-border solutions and digital delivery services.

| Revenue | Cost of Revenue | Gross Margin | |||||||||||||||||||||||||||||||||||||||||||||

| Years Ended December 31, | Years Ended December 31, | Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | Actual % change | Constant Currency % change | 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||||||||||||||||||||

| Business services | $ | 1,702,580 | $ | 1,618,897 | 5 | % | 4 | % | $ | 1,577,628 | $ | 1,480,612 | 7.3 | % | 8.5 | % | |||||||||||||||||||||||||||||||

| Segment EBIT | |||||||||||||||||||||||||||||||||||||||||||||||

| Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | Actual % change | |||||||||||||||||||||||||||||||||||||||||||||

| Segment EBIT | $ | (98,673) | $ | (82,894) | (19) | % | |||||||||||||||||||||||||||||||||||||||||

Global Ecommerce revenue increased 5% as reported (4% at constant currency) in 2021 compared to 2020 due to revenue growth of 7% from higher cross-border volumes, partially offset by revenue decline of 2% from lower domestic parcel delivery volumes.

Total gross margin declined $13 million and gross margin percentage declined to 7.3% from 8.5% primarily due to a $14 million unfavorable vendor price adjustment driven by lower domestic parcel delivery volumes and higher transportation, postal and labor costs, partially offset by the impact of higher revenue.

Segment EBIT for 2021 was a loss of $99 million compared to a loss of $83 million in the prior year. The increase in EBIT loss was driven by the decline in gross margin and $2 million in higher operating expenses.

Presort Services

Presort Services includes revenue and related expenses from sortation services to qualify large volumes of First Class Mail, Marketing Mail, Marketing Mail Flats and Bound Printed Matter for postal worksharing discounts.

| Revenue | Cost of Revenue | Gross Margin | |||||||||||||||||||||||||||||||||||||||||||||

| Years Ended December 31, | Years Ended December 31, | Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | Actual % change | Constant Currency % change | 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||||||||||||||||||||

| Business services | $ | 573,480 | $ | 521,212 | 10 | % | 10 | % | $ | 431,382 | $ | 402,599 | 24.8 | % | 22.8 | % | |||||||||||||||||||||||||||||||

| Segment EBIT | |||||||||||||||||||||||||||||||||||||||||||||||

| Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | Actual % change | |||||||||||||||||||||||||||||||||||||||||||||

| Segment EBIT | $ | 79,721 | $ | 55,799 | 43 | % | |||||||||||||||||||||||||||||||||||||||||

Presort Services revenue increased 10% in 2021 compared to 2020. The processing of Marketing Mail, First Class Mail and Marketing Mail Flats and Bound Printed Matter contributed revenue growth of 5%, 4% and 1%, respectively, primarily due to the impact of increased mail volumes, improvements in five-digit sortation, pricing actions and benefits from the impacts of COVID-19 that adversely affected mail volumes in 2020.

Gross margin increased $23 million and gross margin percentage increased to 24.8% from 22.8% primarily due to the increase in revenue and improved productivity, partially offset by increased labor and transportation costs of $16 million and $6 million, respectively, due to increased competition and demand for these resources.