UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2020

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For transition period from to

Commission file number 0-5734

AGILYSYS, INC.

(Exact name of registrant as specified in its charter)

|

Ohio |

34-0907152 |

|

State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

|

|

|

|

1000 Windward Concourse, Suite 250, Alpharetta, Georgia |

30005 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area code: (770) 810-7800

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

|

Common Shares, without par value |

AGYS |

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☑ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

||

|

Emerging growth company |

☐ |

|||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☑ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of Common Shares held by non-affiliates as of May 20, 2020 was $375,276,893.

As of May 20, 2020, 23,400,816 shares of the registrant's common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement to be used in connection with its 2020 Annual Meeting of Shareholders are incorporated by reference into Part III of this Form 10-K.

Annual Report on Form 10-K

Year Ended March 31, 2020

Table of Contents

|

|

|

Page |

|

|

4 |

|

|

|

|

|

|

ITEM 1. |

4 |

|

|

ITEM 1A. |

11 |

|

|

ITEM 1B. |

17 |

|

|

ITEM 2. |

17 |

|

|

ITEM 3. |

17 |

|

|

ITEM 4. |

18 |

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

ITEM 5. |

19 |

|

|

ITEM 6. |

21 |

|

|

ITEM 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

22 |

|

ITEM 7A. |

36 |

|

|

ITEM 8. |

37 |

|

|

ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

65 |

|

ITEM 9A. |

65 |

|

|

ITEM 9B. |

65 |

|

|

|

|

|

|

|

66 |

|

|

|

|

|

|

ITEM 10. |

66 |

|

|

ITEM 11. |

66 |

|

|

ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

66 |

|

ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

66 |

|

ITEM 14. |

66 |

|

|

|

|

|

|

|

67 |

|

|

|

|

|

|

ITEM 15. |

67 |

|

|

|

|

|

|

|

69 |

|

2

This Annual Report and other publicly available documents, including the documents incorporated herein and therein by reference, contain, and our officers and representatives may from time to time make, "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements related to our current expectations, the performance of our business, our financial results, our liquidity and capital resources and other non-historical statements. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict, and in many cases, are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, our ability to manage the direct and indirect impact of the novel coronavirus (“COVID-19”) pandemic on our business, operations, and customer demand for our products and services, our ability to achieve operational efficiencies and meet customer demand for products and services as well as the other risks identified in the risk factors set forth in Item 1A of this Annual Report. Any forward-looking statement made by us in this Annual Report is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement made in this Annual Report or any other forward-looking statement that may be made from time to time, whether written or oral, whether as a result of new information, future events, or otherwise.

3

Overview

Agilysys has been a leader in hospitality software for more than 40 years, delivering innovative guest-centric technology solutions for casinos, hotels, resorts, cruise ships, managed foodservice providers, sports and entertainment, and healthcare. Agilysys offers the most comprehensive solutions in the industry, including point-of-sale (POS), property management (PMS), inventory and procurement, payment solutions, and related hospitality applications, to manage the entire guest journey. Agilysys is known for its leadership in hospitality, its broad product offerings and its customer-centric service. Some of the largest hospitality companies around the world use Agilysys solutions to help improve guest loyalty, drive revenue growth, increase operational efficiencies and support social distancing.

The Company has just one reportable segment serving the global hospitality industry. Agilysys operates across North America, Europe, Asia-Pacific, and India with headquarters located in Alpharetta, GA.

Our principal executive offices and corporate services are located at 1000 Windward Concourse, Suite 250, Alpharetta, Georgia, 30005.

Reference herein to any particular year or quarter refers to periods within our fiscal year ended March 31. For example, fiscal 2020 refers to the fiscal year ended March 31, 2020.

History and Significant Events

Organized in 1963 as Pioneer-Standard Electronics, Inc., an Ohio corporation, we began operations as a distributor of electronic components and, later, enterprise computer solutions. Exiting the former business in fiscal 2003 with the sale of our Industrial Electronic Division, we used the proceeds to reduce debt and fund growth of our enterprise solutions business. This included acquiring businesses focused on higher-margin and more specialized solutions for the hospitality and retail industries. At the same time, we changed our name to Agilysys, Inc.

In fiscal 2004, we acquired Inter-American Data, Inc., which allowed us to become the leading developer and provider of technology solutions for hotel property management and inventory management in the casino and resort industries.

In fiscal 2007, we exited the enterprise computer distribution business. We used the proceeds from that sale to return cash to shareholders and fund a number of acquisitions that broadened our solutions and capabilities portfolios. We acquired InfoGenesis, Inc., Visual One Systems Corp. and Eatec Corporation in fiscal 2008, significantly expanding our specialized offerings to the hospitality industry through enterprise-class POS, PMS and inventory and procurement software solutions tailored for a variety of applications in cruise, golf, spa, gaming, lodging, resort and catering. These offerings feature highly intuitive, secure and robust solutions, easily scalable across multiple departments or property locations.

In fiscal 2012, we sold our IT solutions business and restructured our business model to focus on higher-margin, profitable growth opportunities in the hospitality and retail sectors. We also reduced our real-estate footprint and lowered overhead costs by relocating corporate services from Solon, Ohio to Alpharetta, Georgia, thus moving our senior management team closer to our remaining operating units.

In fiscal 2014, we sold our retail solutions and services business to Kyrus Solutions, Inc. (Kyrus), an affiliate of Clearlake Capital Group, L.P. Following completion of the transaction, our business focused exclusively on hospitality solutions and the growth opportunities in the hospitality market.

In fiscal 2018, we opened a software development center in Chennai, India, to supplement our product development efforts.

Today, we are focused on providing state-of-the-art, end-to-end solutions that enhance guest experiences and allow our customers to promote their brands. We help our customers win the guest recruitment battle and, in turn, grow revenue, reduce costs and increase efficiency. This is accomplished by developing and deploying innovative solutions that increase data speed and accuracy, integrate with other enterprise systems and create a common infrastructure for managing guest data thereby enabling more effective management, intelligent upselling, reduced shrinkage, improved brand recognition and better control of the guest relationship.

Our strategy is to increase the proportion of revenue we derive from ongoing support and maintenance agreements, subscription services, cloud applications and professional services.

4

Products, Support and Professional Services

We are a leading developer and marketer of software enabled solutions and services to the hospitality industry, including software solutions fully integrated with third party hardware and operating systems; support, maintenance and subscription services; and, professional services. Areas of specialization are point of sale, property management, and a broad range of solutions that support the ecosystem of these core solutions.

We present revenue and costs of goods sold in three categories:

|

|

• |

Products (hardware and software) |

|

|

• |

Support, maintenance and subscription services |

|

|

• |

Professional services |

Total revenue for these three specific areas is as follows:

|

|

|

Year ended March 31, |

|

|||||||||

|

(In thousands) |

|

2020 |

|

|

2019 |

|

|

2018 |

|

|||

|

Products |

|

$ |

44,230 |

|

|

$ |

39,003 |

|

|

$ |

33,699 |

|

|

Support, maintenance and subscription services |

|

|

83,680 |

|

|

|

75,496 |

|

|

|

69,068 |

|

|

Professional services |

|

|

32,847 |

|

|

|

26,343 |

|

|

|

24,593 |

|

|

Total |

|

$ |

160,757 |

|

|

$ |

140,842 |

|

|

$ |

127,360 |

|

Products: Products revenue is comprised of revenue from the sale of software along with third party hardware and operating systems. Software sales include up front revenue for licensing our solutions on a perpetual basis. Software sales are driven by our solutions' ability to help customers meet the demands of their guests and improve operating efficiencies. Our software revenue is also driven by the ability of our customers to configure our solutions for their specific needs and the robust catalog of integrations we offer to third party solutions. Our software solutions require varying form factors of third party hardware and operating systems to operate, such as staff facing terminals, kiosk solutions, mobile tablets or servers. Third party hardware and operating system revenue is typically driven by new customer wins and existing customer hardware refresh purchases.

Support, Maintenance and Subscription Services: Technical software support, software maintenance and software subscription services are a significant portion of our consolidated revenue and typically generate higher profit margins than products revenue. Growth has been driven by a strategic focus on developing and promoting these offerings while market demand for maintenance services and updates that enhance reliability, as well as the desire for flexibility in purchasing options, continue to reinforce this trend. Our commitment to exceptional service has enabled us to become a trusted partner with customers who wish to optimize the level of service they provide to their guests and maximize commerce opportunities both on premise and in the cloud.

Professional Services: We have industry-leading expertise in designing, implementing, integrating and installing customized solutions into both traditional and newly created platforms. For existing enterprises, we seamlessly integrate new systems and for start-ups and fast-growing customers, we become a partner that can manage large-scale rollouts and tight construction schedules. Our extensive experience ranges from staging equipment to phased rollouts as well as training staff to provide operational expertise to help achieve maximum effectiveness and efficiencies in a manner that saves our customers time and money.

Our portfolio of hospitality software solutions:

The hospitality industry has long been focused on operating end-to-end businesses, but the technology vendors that service the industry have been focused on product-centric solutions that make use of a high number of software modules and operating silos. To resolve this disconnect and more effectively align with the business operations of our customers, we have evolved our approach to be focused on delivering integrated “platform-centric” solutions for Lodging and Food & Beverage functions, including the applications necessary to support this ecosystem.

Our technology platform is aimed at transitioning our product and services offerings to better address the needs of hospitality operators as they focus on building better connections with guests before, during and post-visit. We offer an end-to-end solution that helps our customers improve the guest experience, increase top-line performance and reduce operating costs, which leads to opportunities for higher profitability. Our integrated yet modular products allow hospitality operators to recruit and retain customers into their facilities, increase their wallet share from each guest and improve the overall experience throughout the entire guest journey - from the initial customer touch point through post-visit interactions.

5

With our omni-channel suite of software products, we are uniquely positioned to offer solutions that allow our customers to adhere to social distancing guidelines and offer contactless solutions at every point of the guest journey for our hospitality operators while maximizing operational efficiency.

Point of Sale (POS) Solutions:

Agilysys POS solution suite allows our customers to provide their guests with an omni-channel experience within their property. Guests are empowered to create their own experiences through ordering from a mobile device or walking up to a self-service kiosk, but also providing for a more traditional experience with staff by interacting with a cashier or bar, or having a server come to them. Irrespective of the channel of interaction for the guest, our POS suite provides a single integrated enterprise grade back office management system with robust reporting capabilities. This allows our customers to manage menus, price changes, purchasing trends, inventory management and sales reporting from a single integrated source providing for increased efficiency as well as providing a richer guest profile.

Agilysys InfoGenesis® POS is an award-winning point of sale solution that combines a fast, intuitive and highly customizable terminal application with powerful, flexible reporting and configuration capabilities in the back office management portal. The system is easy to set up, and its scalable architecture enables customers to add workstations without having to build out expensive infrastructure. The system's detailed and high-quality reporting capabilities provide insight into sales data and guest purchasing trends. Engineered for all regions of the world, the InfoGensis POS solution suite offers a multinational set of features, including language, currency and fiscal technology, coupled with a robust enterprise management capability enabling the largest global customers to run their business efficiently. With a modern integration platform of APIs, the solution is also capable of integrating with a variety of ancillary applications allowing our customers to keep their entire technology estate. InfoGenesis POS is available as a cloud-based or on-premise solution.

Agilysys InfoGenesis Flex is a mobility solution that offers full point of sale functionality on a Windows tablet in 6, 8, or 10" form factors. It provides a sleek, modern alternative to traditional point of sale installations and can be used as a slim fixed terminal or as a convertible mobile POS simply by removing the tablet from its base.

Agilysys InfoGenesis KDS is a digital kitchen management solution that integrates with InfoGenesis, rGuest Buy® Kiosk and rGuest Buy OnDemand to deliver staff and customer originated orders to the kitchen for preparation. Custom attributes such as guest phone number, name, guest location or packaging instructions can be provided on each incoming order so the order can be fulfilled promptly to guests. Guests can optionally be notified of order completion via an order status monitor (OSM) or via text message.

rGuest Buy Kiosk is an enterprise-class self-service, customer-facing point of sale solution for the hospitality industry. It is ideal for food & beverage venues such as buffets, grab 'n go, corporate cafeterias and food courts. Its flexibility supports a variety of operational workflows, such as "order and pay", "order only", "pay at cashier" and “self check-out,” and integrates with a variety of property management, casino management and loyalty systems. rGuest Buy Kiosk is currently deployed at more than 270 customer sites across the country, including corporate cafeterias at a top five U.S. bank, a top 40 U.S. law firm, one of the nation's largest technology manufacturers, and at a national financial services firm.

rGuest Buy Kiosk’s intuitive guest-facing order and pay experiences transfer the control and convenience to the end user. The self-service components reduce on-site labor needed to manage venue operations, while improving guest throughput, check size, order accuracy, guest experience and satisfaction. The platform-driven and cloud-based solution allows for easy deployments and management at scale resulting in a lowered overall cost of ownership.

6

rGuest Buy OnDemand provides a visual, interactive food and beverage ordering experience to any mobile device - phone, tablet, laptop - with a browser-based self-service experience. Using a simple, intuitive interface, guests can easily order and reorder from anywhere across the property, driving order velocity and volume.

rGuest Buy OnDemand allows our customers to immediately offer an online ordering platform that is natively integrated with their physical location operations. Menus and price updates can be done in one place and automatically updated across all channels – online web store, digital menus and app ordering as well as POS terminals. Orders placed online are routed automatically to the appropriate kitchen for preparation. Orders placed from all channels are automatically available on the POS terminal at the physical location.

Property Management Systems (PMS):

Agilysys offers the most comprehensive suite of property management applications to serve the needs of our integrated resort and hospitality customers. Our platforms enable our customers to provide a seamless experience to their guests while driving operational efficiencies throughout the value chain. Our PMS suite of applications consists of the core property management system, a commission free booking engine, self-service check in and check out solutions, spa, golf, retail, accounting, sales and catering, service request optimization and condo management applications.

Agilysys Lodging Management System® (LMS™) is an on-premise or hosted, web and mobile-enabled, PMS solution targeting the operator with large, complex operations. It runs 24/7 to automate every aspect of hotel operations in properties from 100 to over 7,000 rooms, and has interfaces to a wide array of industry applications including but not limited to all core casino management systems and leading global distribution systems. Its foundation expands to incorporate modules for activities scheduling, attraction ticketing and more.

Agilysys Visual One® PMS is installed in hotels and resorts ranging from 50-1,500 rooms. It is a complete hospitality solution expanding beyond traditional PMS solutions enabling the resort to run its end-to-end operations, including front desk, housekeeping, sales & catering, maintenance, accounting, condo owner management, golf, retail POS, and activities. Visual One provides an integrated solution with interfaces to leading global distribution systems, casino management systems, hospitality automation and our other products.

rGuest® Stay PMS is the company’s cloud-based property management system that optimizes operational efficiency, increases revenue and enhances guest service. rGuest Stay is currently generally available for select-service hotels and chains, as well as for limited-service casino hotels. The guest-centric PMS leverages the rGuest standards-based platform on an open architecture with public APIs to enable richly integrated applications delivered from Agilysys, its partners and customers. rGuest Stay offers powerful capabilities for multi-property operations, allowing managers to view guest profiles, history and reservations, as well as room availability and operational reports, seamlessly across multiple properties.

Focused on improving revenue and streamlining operations, rGuest Stay is designed to enable hotels to gather and analyze guest information across properties that can be used to create loyalty-generating offers and increase guest wallet share. In addition, running natively in a browser on both desktop and tablet devices, it delivers real-time operating metrics so that hotels can more accurately forecast demand and scale guest services accordingly.

Virtual Check-in and Check-out Solutions

Today’s hotels cater to guests with high expectations when it comes to technological efficiency. An emerging trend in the hotel industry that has accelerated in the COVID-19 environment, where social distancing is now the norm, is the ability for guests to check themselves in or out of their room without interacting with the front desk. To that end, we offer software modules that enable this approach and are fully integrated with our core PMS solutions.

7

rGuest Express Kiosk simplifies check-in and check-out, optimizes staff productivity and enhances the guest experience by enabling a seamless self-service option for guests to use in the hotel lobby at a kiosk. More properties are turning to kiosks to reduce overhead and offer more self-service options. With rGuest Express Kiosk, it’s easy to elevate service levels without adding front-line staff. rGuest Express Kiosk provides ID verification to allow for hotels to enforce security standards efficiently and to allow the guest to bypass the front desk and observe social distancing guidelines.

rGuest Express Mobile simplifies check-in and check-out even further and at the same time allows operators to offer mobile keys, concurrent dining reservations or room upsells, all on a personal mobile device such as a smart phone or tablet. Properties are turning to mobility at an ever-increasing pace to improve efficiency. With rGuest Express Mobile, it’s easy to reduce wait times and empower guests by putting the power of choice in the palm of their hand. rGuest Express Mobile allows for digital ID verification before securely delivering the digital room key to the guest phone allowing operators to maintain security standards while allowing the guest to bypass the front desk.

Point of Sale and Property Management Ecosystem Offerings:

The following solutions integrate with and are complementary to our point of sale or property management systems, or both. These solutions, for the most part, can stand alone and do not require POS or PMS to be functional. However, we lead with our core POS and PMS solutions discussed above and focus on selling these complimentary ecosystem solutions into our customer base.

rGuest® Pay payment processing solution is our innovative payment gateway. rGuest Pay protects guests’ financial data and reduces risk by leveraging point-to-point encryption (P2PE) and tokenization with every credit card transaction. rGuest Pay Gateway leverages one of the first payment gateways in the world to receive official PCI-P2PE validation, allowing us to offer PCI cost and scope reduction that other providers cannot. These security benefits are built on top of a full-featured, enterprise-grade gateway that offers broad support for U.S., Canadian, European and certain Asian countries’ credit card processors and a wide variety of payment device options for every use-case, including countertop, pay-at-table, EMV, mobile tablet, and signature capture scenarios.

rGuest Pay offers contactless payment options on all markets as well as supporting various wallet payment options like Apple Pay®, Google Pay®, AliPay®, and WeChat®.

rGuest Spa software covers all aspects of running a spa, from scheduling guests for services to managing staff schedules. With this guest-centric technology, spas have more time to focus on creating personalized experiences in places of quiet tranquility. rGuest Spa is a single solution that connects effortlessly to our other software solutions. The solution includes real-time integration, simplifies the appointment booking process, enhances the guest experience, and maximizes the value of the spa as a revenue center.

Integrated with our booking engine, rGuest Book, customers can book both their hotel room and their spa appointments from a single place giving operators additional opportunities to upsell and cross sell various amenities that they can offer.

rGuest Golf is a guest centric golf management software that offers golf property managers complete pro shop management with tee time scheduling, member profile/billing, tournament management and Web and e-mail access bundled into one solution. Customers are given the option of using our robust built in retail POS module or they may choose to leverage the power of InfoGenesis. Staff can easily schedule and personalize reservations for guests which then appear on itineraries, confirmations, and folios. Resort operations with multiple amenities can integrate with rGuest Book and allow patrons to book both their resort reservation and their golf tee time simultaneously.

8

rGuest Book is a commission-free, easy-to-use reservation system that’s designed to move guests effortlessly through the booking process of hotel rooms, spa appointments and golf tee times. The solution allows booking of one or more rooms and is seamlessly connected with our core PMS solutions to provide a flawless experience for guests and hotel operators. rGuest Book is the only booking engine in the market that seamlessly integrates with the core primary gaming system and allows for casino operators to enable their patrons to self-book their entitlements resulting in increased guest satisfaction and reduced operational expenses. The solution also allows operators to capture increased revenue through add-ons and upsells of premium rooms.

rGuest Service is our new integrated service optimization platform that allows our customers to provide an integrated hospitality experience for their guests while driving greater operational efficiency by connecting departments across the hotel - front desk, house-keeping, concierge, maintenance, bell desk, food runners, wait staff, etc. The rGuest service platform provides a unified communication and messaging service for guest and staff interaction as well as internal staff interaction. Apart from providing the functionality for managing back of house operations like house-keeping, engineering and maintenance, the rGuest service platform proactively tracks events and exceptions that take place in the hotel or resort and drive targeted action to ensure high level of guest satisfaction at all times.

Agilysys’ Eatec® solution provides core purchasing, inventory, recipe, forecasting, production and sales analysis functions and is unique in offering catering, restaurant, buffet management and nutrition modules in a single web-enabled solution. Agilysys’ Eatec Mobile is an optional app that can be downloaded from Google Play and Apple app stores and provides users with access to Eatec application from any Android® and iOS® device. Users can provide inventory receiving and transfer operations seamlessly from any mobile device even when they are offline using Eatec’s innovative store and forward capabilities.

Agilysys Stratton Warren System (SWS) integrates with all leading financial and POS software products. The software manages the entire procurement process via e-commerce, from business development to the management of enterprise-wide backend systems and daily operations. Agilysys SWS Direct is an add-on module for SWS that provides a convenient, efficient and intuitive shopping cart experience to SWS users. SWS Direct streamlines operations, provides enhanced bidding and request for pricing services, and offers supplier registration tools and self-service maintenance capabilities.

Agilysys DataMagine™ document management solution is a U.S.-patented imaging module and archiving solution that allows users to securely capture and retrieve documents and system-generated information. DataMagine integrates with other Agilysys products, adding functionality and providing seamless workflows that cross functional areas. DataMagine helps drive the Go Green initiative at a number of our customer sites by enabling a completely paperless experience through all facets of the customers operations - from signature capture at the front desk to automated routing of PO’s and requisition orders for approvals. DataMagine provides robust indexing and archiving features to allows easy contextual based document retrieval.

rGuest® Seat solution is a guest-centric reservation and wait list management solution that helps operators to book any location. The solution allows operators to manage restaurant, cabana and auditorium reservations. With an innovative doll house view approach, patrons have the ability to select and book a specific seat in a restaurant or a specific cabana on a pool deck online. With built in price yielding capabilities, rGuest Seat allows operators to maximize revenue opportunities for various locations. Using the built-in guest management system, operators can build guest profiles and provide a superior experience while driving repeat guests.

9

rGuest Analyze is a cloud-based data analytic platform focused on the needs of the hospitality industry. It is a full business intelligence solution that collects data from Agilysys point of sale and property management solutions and helps food & beverage and property operators gain critical insight into business operations and performance. Out-of-the-box analysis helps hospitality operators manage costs, minimize loss due to fraud, boost item sales, increase server productivity, occupancy, room revenue, and other profit enhancing capabilities.

Representative Agilysys clients include:

|

7 Cedars Casino |

Drive Shack |

Pinnacle Entertainment |

|

AVI Foodsystems, Inc. |

Dickies Arena |

Prairie Band Casino & Resort |

|

Banner Health |

Drury Hotels |

Rosewood Castiglion Del Bosco |

|

Boyd Gaming Corporation |

Ellis Island Hotel, Casino and Brewery |

Resorts World Bimini |

|

Caesars Entertainment |

Golden Nugget Lake Charles |

Rosen Hotels & Resorts |

|

Cal Dining at UC Berkeley |

Grand Central Hotel in Belfast |

Royal Caribbean International |

|

Camelback Lodge & Waterpark |

Grand Sierra Resort and Casino |

Royal Lahaina Resort |

|

Carnival UK |

Hialeah Park |

Seaport District – NYC |

|

Cartoon Network Hotel |

Hilton Worldwide |

Spooky Nook Sports |

|

Casino del Sol Resort |

Intercontinental Hotel Group |

Stations Casino |

|

Catholic Charities |

Kiawah |

The Venetian Resort Hotel Casino |

|

Chukchansi Gold Resort & Casino |

Kimpton Hotels |

The Kessler Collection |

|

Compass Group North America |

Longwood University |

Treehouse - London |

|

Comanche Nation of Oklahoma |

Maryland Live! Casino |

Vail Resorts |

|

Copper Mountain |

MGM |

Valley View Casino & Hotel |

|

Costa Pacifica |

Oxford Casino |

Vanderbilt University |

|

The Cosmopolitan of Las Vegas |

Palm Garden Hotel |

Wendover Resorts |

|

Crystal Springs Resort |

Pinehurst Resort |

Yale University |

Industry and Markets

We are a technology software solutions company exclusively focused on the hospitality industry for more than 4 decades. Our solutions are mission critical to core hospitality operations. Our software solutions are required to run the operations of the hospitality business and designed to drive substantial customer benefits through increased revenue, improved operational efficiency, enhanced guest experience and improved employee morale. In addition, many of our solutions enable social distancing capabilities for our customers. Our innovative software solutions described above have been purpose-built to serve the unique needs of the following hospitality sectors: casinos, hotels, resorts, cruise ships, managed foodservice providers, sports and entertainment, and healthcare. We operate across North America, Europe, Asia-Pacific and India with headquarters located in Alpharetta, GA.

The sectors we serve are going through unprecedented and uncertain times with the COVID-19 pandemic. While the near-term outlook is hard to predict with closures and travel restrictions, these market sectors will recover. The long-term outlook remains strong and we expect the momentum from the last three years to eventually pick back up with a focus on social distancing and mobile applications. Prior to COVID-19, we estimated our total addressable market to be approximately $4.8 billion in annual recurring revenue opportunity. While the size of the opportunity might face pressure in an economic downturn, we feel it is still in the billions of dollars and we are only a fraction of that size. We continue to feel good about our opportunity to win market share given our relative competitive strength in the industry.

Customers

Our customers include large, medium-sized and boutique hospitality providers, both owned and franchised, as well as divisions or departments of large corporations in the hospitality industry. We concentrate on serving the needs of customers in a range of customer-focused settings where brand differentiation is important and guest recruitment is intense. Our customer base is highly fragmented.

10

Occasionally, the timing of large one-time orders, such as those associated with significant remarketed product sales around large customer refresh cycles or significant volume rollouts, creates variability in our quarterly results.

Competition

Our solutions face a highly competitive market. Competition exists with respect to developing and maintaining relationships with customers, pricing for products and solutions, and customer support and service.

We compete with other full-service providers that sell and service bundled POS and PMS solutions comprised of hardware, software, support and services. These companies, some of which are much larger than we are, include Oracle Corp., NCR, Constellation Software, Inc., Amadeus IT Group and Infor. We also compete with smaller software companies like POSitouch, Northwind and Appetize Technologies. In addition, we compete with PMS systems that are designed and maintained in-house by large hotel chains.

Environmental Matters

We believe we are compliant in all material respects with all applicable environmental laws. Presently, we do not anticipate that such compliance will have a material effect on capital expenditures, earnings or competitive position with respect to any of our operations.

Employees

As of March 31, 2020, we had 1,275 employees. We are not a party to any collective bargaining agreements, have had no strikes or work stoppages and consider our employee relations to be good.

Access to Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports are available free of charge through our corporate website, http://www.agilysys.com, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (SEC). The information posted on our website is not incorporated into this Annual Report. Reports, proxy and information statements, and other information regarding issuers that file electronically, are maintained on the SEC website, http://www.sec.gov.

Risks Relating to Our Business

COVID-19 has adversely impacted our business and may further impact our business, financial results and liquidity for an unknown period of time.

The global spread and unprecedented impact of COVID-19 is complex and rapidly evolving and has resulted in disruption to our business, the hospitality industry and the global economy. The COVID-19 pandemic has led government and other authorities around the world to impose measures intended to control its spread, including restrictions on freedom of movement, gatherings of large numbers of people, and business operations such as travel bans, border closings, business closures, quarantines, shelter-in-place orders, and social distancing measures. As a result, the COVID-19 pandemic and its consequences have significantly reduced demand for gaming, hotels, resorts, cruises, corporate foodservice, restaurants, university cafeterias, and stadia and have had a material detrimental impact on global commercial activity across these hospitality industries that we serve, and in some cases, has caused the closure of our customers’ businesses. Business closures have resulted in our inability to complete certain implementations and negatively impacted our ability to recognize revenue. We have also taken impairments on certain of our rGuest solutions based upon the impacts of COVID-19 on our business.

The extent to which COVID-19 continues to adversely impact our business, operations, and financial results significantly depends on the effect upon the demand for our customers’ hospitality services, which may be affected by, among other things, the duration and scope of COVID-19 (including whether and to what extent a resurgence of the virus could occur after the pandemic initially subsides); the negative impact it has on global regional economies and economic activity, including its impact on unemployment rates and consumer confidence and discretionary spending; its short and longer-term impact on the demand for hospitality businesses; the ability of our customers to successfully navigate the impacts of COVID-19; actions governments, businesses and individuals take in response to the pandemic; and how quickly economies, travel activity, businesses, universities and demand for lodging, destination resorts, cruises and stadia events recovers after the pandemic subsides. To the extent that our hospitality customers’ businesses continue to be impacted, it may have the following effects on our business:

|

|

• |

Effect on Revenue and Liquidity: If our hospitality customers continue to have a material decline in their revenues, they could be unable to continue to pay for our services, and potentially even go out of business. If our customers are unable or unwilling to continue to pay for our services on a timely basis or at all, our revenue and liquidity would be adversely affected. |

11

|

|

financing or drawing on existing credit facilities, resulting in them having diminished capital to spend on new technology purchases. Finally, customers or prospective customers may delay, terminate or not go forward with projects in development, for which we may have sold or software. |

Additionally, in response to COVID-19, we have taken steps to reduce operating costs and improve efficiency, including furloughing approximately 24% of our employees in the United States, APAC and EMEA. Such steps, and further changes we may make in the future to reduce our costs, may negatively impact our ability to attract and retain employees, including furloughed employees potentially not returning to work with us when the COVID-19 public health emergency subsidies. If this were to occur, we may experience operational challenges that result in a negative impact on our customer services and ultimately, loss of market share, which could limit our ability to grow and expand our business.

Our business is impacted by changes in macroeconomic and/or global conditions.

We conduct our business internationally, changes in global, national, or regional economies, governmental policies (including in areas such as trade, travel, immigration, healthcare, and related issues), geopolitical conditions (such as political unrest and armed conflicts), natural disasters, or outbreaks of disease (such as COVID-19 pandemic) may impact our business. Any general weakening of, and related declining corporate confidence in, the global economy or the curtailment in corporate spending could cause current or potential customers to reduce or eliminate their information technology budgets and spending, which could cause customers to delay, decrease or cancel purchases of our products and services; cause customers not to pay us; or to delay payment for previously purchased products and services.

For example, our business is impacted by decreases in travel and leisure activities resulting from weak economic conditions, increases in energy prices and changes in currency values, political instability, heightened travel security measures, travel advisories, disruptions in air travel, and concerns over disease, violence, war, or terrorism. As discussed above under “COVID-19 has adversely impacted our business and may further impact our business, financial results and liquidity for an unknown period of time,” our performance has been affected by these conditions associated with COVID-19 and could be materially affected going forward if these conditions worsen or continue for an extended period or in other circumstances that we are unable to foresee or mitigate. Even after COVID-19 subsides, our business, markets, growth prospects and business model could be materially impacted or altered as a result of adverse changes in travel and leisure activities.

Similarly, increases in energy prices can result in higher ingredient and food costs for our customers with restaurant operations, which may adversely affect demand for our customers’ restaurant businesses, and in turn, our business, financial results and liquidity.

Our business may be adversely impacted by international trade disputes.

We depend on third-party manufacturers and suppliers located outside of the United States, including in China, in connection with the supply of certain of our hardware products and related components. Accordingly, our business is subject to risks associated with international supply. For example, the Trump Administration has called for substantial changes to U.S. foreign trade policy, including imposing greater restrictions on international trade and significant increases in tariffs on goods imported into the United States from China and other countries. Increased tariffs, including on goods imported from China, or the institution of additional protectionist trade measures could adversely affect our supply costs, and in turn, our business, financial results and liquidity.

Our future success will depend on our ability to develop new products, product upgrades and services that achieve market acceptance.

Our business is characterized by rapid and continual changes in technology and evolving industry standards. We believe that in order to remain competitive in the future we will need to continue to develop new products, product upgrades and services, requiring the investment of significant financial resources. If we fail to accurately anticipate our customer's needs and technological trends, or are otherwise unable to complete the development of a product or product upgrade on a timely basis, we will be unable to introduce new products or product upgrades into the market that are demanded by our customers and prospective customers on a timely basis, if at all, and our business and operating results would be materially and adversely affected.

The development process for most new products and product upgrades is complicated, involves a significant commitment of time and resources and is subject to a number of risks and challenges including:

|

|

• |

Managing the length of the development cycle for new products and product enhancements; |

|

|

• |

Adapting to emerging and evolving industry standards and to technological developments by our competitors and customers; and |

|

|

• |

Extending the operation of our products and services to new and evolving platforms, operating systems and hardware products, such as mobile devices. |

Our product development activities are costly and recovering our investment in product development may take a significant amount of time, if it occurs at all. We anticipate continuing to make significant investments in software research and development and related product opportunities because we believe it is necessary to compete successfully. We cannot estimate with any certainty when we will, if ever, receive significant revenues from these investments.

12

If we are not successful in managing these risks and challenges, or if our new products, product upgrades, and services are not technologically competitive or do not achieve market acceptance, our business and operating results could be adversely affected.

If we fail to meet our customers' performance expectations, our reputation may be harmed, and we may be exposed to legal liability.

Our ability to attract and retain customers depends to a large extent on our relationships with our customers and our reputation for high quality services and solutions. As a result, if a customer is not satisfied with our products and services, our reputation may be damaged. Moreover, if we fail to meet our customers' performance expectations or if customers experience service disruptions, breaches or other quality issues, we may lose customers and be subject to legal liability, particularly if such failure, service disruptions or breaches adversely impact our customers' businesses.

In addition, many of our projects are critical to the operations of our customers' businesses. While our contracts typically include provisions designed to limit our exposure to legal claims relating to our products and services, these provisions may not adequately protect us or may not be enforceable in all cases. The general liability insurance coverage that we maintain, including coverage for errors and omissions, is subject to important exclusions and limitations. We cannot be certain that this coverage will continue to be available on reasonable terms or will be available in sufficient amounts to cover one or more large claims, or that the insurer will not disclaim coverage as to any future claim. A successful assertion of one or more large claims against us that exceeds our available insurance coverage or changes in our insurance policies, including premium increases or the imposition of large deductible or co-insurance requirements, could adversely affect our profitability.

We face extensive competition in the markets in which we operate, and our failure to compete effectively could result in price reductions and/or decreased demand for our products and services.

Several companies offer products and services similar to ours. The rapid rate of technological change in the hospitality market makes it likely we will face competition from new products designed by companies not currently competing with us. We believe our competitive ability depends on our product offerings, our experience in the hospitality industry, our product development and systems integration capability, and our customer service organization. There is no assurance, however, that we will be able to compete effectively in the hospitality technology market in the future.

We compete for customers based on several factors, including price. The competitive markets in which we operate may oblige us to reduce our prices in order to contend with the pricing models of our competitors. If our competitors discount certain products or services, we may have to lower prices on certain products or services in order to attract or retain customers. Any such price modifications would likely reduce margins and could have adverse effects. In addition, if we fail to reduce our prices in order to contend with the pricing models of our competitors, we may not be able to retain customers or grow our business, which could adversely affect our revenues and liquidity.

We are subject to laws and regulations governing the protection of personally identifiable information; we are also subject to cyber-attacks. A failure to comply with applicable privacy or data protection laws or the occurrence of a cyber-attack could harm our reputation and have a material adverse effect on our business.

We collect, process, transmit, and/or store (on our systems and those of third-party providers) customer transactional data, as well as their and our customers’ and employees’ personally identifiable information and/or other data and information. Personally identifiable information is increasingly subject to legislation and regulations in numerous jurisdictions with regard to privacy and data security such as such as the California Consumer Privacy Act and the European Union’s General Data Protection Regulation. Moreover, what constitutes personally identifiable information and what other data and/or information is subject to the privacy laws varies by jurisdiction and continues to evolve, and the laws that do reference data privacy continue to be interpreted by the courts and their applicability and reach are therefore uncertain. Our failure and/or the failure of our customers, vendors, and service providers to comply with applicable privacy and data protection laws and regulations could damage our reputation, discourage current and/or potential customers from using our products and services, and result in fines, governmental investigations and/or enforcement actions, complaints by private individuals, and/or the payment of penalties to consumers.

13

We have established practices and procedures intended to protect our systems and information against cyber-attacks. However, there can be no assurance that such measures will prevent all cyber-attacks from impacting our systems and information. Our systems, and those of our third-party providers, have and could in the future become subject to cyber-attacks, including using computer viruses, credential harvesting, dedicated denial of services attacks, malware, social engineering, and other means for obtaining unauthorized access to, or disrupting the operation of, our systems and those of our third-party providers. Any operational disruptions, unauthorized access, or misappropriation of information (including personally identifiable information or personal data) could harm our relationship with our customers and could have a material adverse effect on our business, financial condition, reputation, and results of operations.

Actual or perceived security vulnerabilities in our software products may result in reduced sales or liabilities.

Our software may be used in connection with processing sensitive data (e.g., credit card numbers). It may be possible for the data to be compromised if our customer does not maintain appropriate security procedures. In those instances, the customer may attempt to seek damages from us. While we believe that all of our current software complies with applicable industry security requirements and that we take appropriate security measures to reduce the possibility of breach through our support and other systems, we cannot assure that our customers' systems will not be breached, or that all unauthorized access can be prevented. If a customer, or other person, seeks redress from us as a result of a security breach, our business could be adversely affected.

We have incurred losses in each of the last several years, and we may continue to incur losses in the future.

We have incurred operating losses in each of the last several years, including the year ended March 31, 2020, and we may continue to incur losses in the future as we continue to invest in our products. Our lack of profitability limits the resources available to us to invest in developing new products, product upgrades and services and otherwise in improving business operations.

We may incur goodwill and intangible asset impairment charges that adversely affect our operating results.

As of March 31, 2020, we had $19.6 million and $8.4 million of goodwill and intangible assets (including capitalized software development costs), net, respectively, on our Consolidated Balance Sheet. We review our goodwill and intangible assets for impairment on at least an annual basis. As of March 31, 2020, we determined the net realizable value of intangible assets consisting of capitalized software development costs for certain solutions within our rGuest suite of products no longer exceeded their carrying value, and as a result, recorded non-cash impairment charges of $22.0 million. The impact of the COVID-19 pandemic on the hospitality industry resulted in significantly lower sales and cash flow projections for the related rGuest solutions after evaluating the Company’s strategy for market development and continued costs to support the software. As a result, we recorded impairment charges to reduce the net realizable value of the related assets to zero. Our future operating results and the market price of our common stock could be materially adversely affected if we are required to write down the carrying value of goodwill or other intangible assets in the future.

If we fail to attract, retain and motivate key employees, our business may be harmed.

Our success depends on the skill, experience and dedication of our employees. There can be no assurance that we will be able to successfully attract, retain and motivate the personnel that we need. If we are unable to attract, retain and motivate sufficiently experienced and capable personnel, especially in product development, customer services and support, operations, sales and management, our business and financial results may suffer. For example, if we are unable to attract and retain a sufficient number of skilled technical personnel, our ability to develop high quality products and provide high quality customer service may be impaired. Experienced and capable personnel in the technology industry remain in high demand, and there is continual competition for their talents. Although we believe our compensation, benefits and other employment amenities are competitive in the markets in which we compete for talent, we may have difficulty attracting sufficiently experienced and capable personnel or retaining and motivating talented employees, and in such events our business may suffer.

Additionally, in response to COVID-19, we furloughed approximately 24% of our employees to reduce operating costs and improve efficiency. If this action negatively impacts our ability to attract employees or if employees do not resume their employment at the end of the furlough, we may experience operational challenges that result in a negative impact on our customer services and ultimately, loss of market share, which could limit our ability to grow and expand our business. See “COVID-19 has adversely impacted our business and may further impact our business, financial results and liquidity for an unknown period of time” above for additional information regarding this risk.

Our international operations have many associated risks.

We continue to strategically manage our presence in international markets, and these efforts require significant management attention and financial resources. We may not be able to successfully penetrate international markets, or, if we do, there can be no assurance that we will grow our business in these markets at the same rate as in North America. Because of these inherent complexities and

14

challenges, lack of success in international markets could adversely affect our business, results of operations, cash flow, and financial condition.

We have international offices in the United Kingdom, China, Malaysia, the Philippines, Singapore, and India. We have committed resources to maintaining and further expanding, where appropriate, our sales offices and sales and support channels in key international markets. However, our efforts may not be successful. International sales are subject to many risks and difficulties, including those arising from the following: building and maintaining a competitive presence in new markets; staffing and managing foreign operations; complying with a variety of foreign laws; producing localized versions of our products; developing integrations between our products and other locally-used products; import and export restrictions and tariffs, enforcing contracts and collecting accounts receivable; unexpected changes in regulatory requirements; reduced protection for intellectual property rights in some countries; potential adverse tax treatment; language and cultural barriers; currency fluctuations; and political and economic instability abroad.

Natural disasters or other catastrophic events affecting our principal facilities could cripple our business.

Natural disasters or other catastrophic events, particularly those affecting employees in our Alpharetta headquarters or India research and development center, may cause damage or disruption to our operations, and thus could have a negative effect on us. Most of our administrative functions are concentrated in our Alpharetta headquarters and most of our software development activity is concentrated in our India research and development center. Although we maintain crisis management and disaster response plans, a natural disaster, fire, power shortage, pandemic, act of terrorism or other catastrophic event occurring in either geographic location that prevents or substantially impairs our employees’ ability to work could make it difficult or impossible for us to deliver our products and services to customers.

We may not be able to enforce or protect our intellectual property rights.

We rely on a combination of copyright, patent, trademark and trade secret laws and restrictions on disclosure to protect our intellectual property rights. We cannot be certain that the steps we have taken will prevent unauthorized use of our technology. Any failure to protect our intellectual property rights would diminish or eliminate the competitive advantages that we derive from our proprietary technology.

We may be subject to claims of infringement of third-party intellectual property rights.

Third parties may assert claims that our software or technology infringe, misappropriate, or otherwise violate their intellectual property or other proprietary rights. Such claims may be made by our competitors seeking to obtain a competitive advantage or by other parties. The risk of claims may increase as the number of software products that we offer and competitors in our market increase and overlaps occur. Any such claims, regardless of merit, that result in litigation could result in substantial expenses, divert the attention of management, cause significant delays in introducing new or enhanced services or technology, materially disrupt the conduct of our business, and have a material adverse effect on our business, financial condition, and results of operations.

While we do not believe that our products and services infringe any patents or other intellectual property rights, from time to time, we receive claims that we have infringed the intellectual property rights of others. For example, on April 6, 2012, Ameranth, Inc. filed a complaint against us in the U.S. District Court for the Southern District of California, alleging that certain of our products infringe patents owned by Ameranth directed to configuring and transmitting hospitality menus (e.g., restaurant menus) for display on electronic devices, and synchronizing the menu content between the devices. This lawsuit remains pending.

If we fail to maintain our data centers and other systems, the demand for our subscription services and our ability to operate our business efficiently could diminish, which could have a material adverse effect on our business.

We currently utilize data center hosting facilities, some of which are managed by third-parties, to provide cloud-based products and hosting services to our customers and to support our internal business operations. If these data center facilities fail or encounter any damage, it could result in interruptions in services to our customers or disruption of our business operations. This could result in unanticipated downtime for our customers, and in turn, our reputation and business could be adversely affected. Similarly any significant disruption or deficiency in the operation of our internal systems could have a material adverse effect on our ability to fulfill and invoice customer orders, apply cash receipts, place purchase orders with suppliers, and make cash disbursements, which may have a material adverse effect on our business, financial condition, or results of operations.

If we fail to maintain an effective system of internal controls, we may not be able to detect fraud, which could have a material adverse impact on our business.

While we believe our internal control over financial reporting is effective, a controls system cannot provide absolute assurance that the objectives of the controls system are met, and no evaluation of controls can provide absolute assurance that control issues and instances of fraud, if any, within our company have been detected.

15

We have encountered risks associated with maintaining large cash balances.

While we have attempted to invest our cash balances in investments we considered to be relatively safe, we nevertheless confront credit and liquidity risks. Bank failures could result in reduced liquidity or the actual loss of money held in deposit accounts in excess of federally insured amounts, if any.

If we acquire new businesses, we may not be able to successfully integrate them or attain the anticipated benefits.

As part of our operating history and growth strategy, we have acquired other businesses. In the future, we may continue to seek acquisitions. We can provide no assurance that we will be able to identify and acquire targeted businesses or obtain financing for such acquisitions on satisfactory terms. The process of integrating acquired businesses into our operations may result in unforeseen difficulties and may require a disproportionate amount of resources and management attention. If integration of our acquired businesses is not successful, we may not realize the potential benefits of an acquisition or suffer other adverse effects.

We may have exposure to greater than anticipated tax liabilities.

Some of our products and services may be subject to sales taxes in states where we have not collected and remitted such taxes from our customers. We have reserves for certain state sales tax contingencies based on the likelihood of obligation. These contingencies are included in “Other non-current liabilities” in our Consolidated Balance Sheets. We believe we have appropriately accrued for these contingencies. In the event that actual results differ from these reserves, we may need to make adjustments, which could materially impact our financial condition and results of operations.

We are subject to litigation, which may be costly.

As a company that does business with many customers, employees and suppliers, we are subject to litigation. The results of such litigation are difficult to predict, and we may incur significant legal expenses if any such claim were filed. While we generally take steps to reduce the likelihood that disputes will result in litigation, litigation is very commonplace and could have an adverse impact on our business.

Our dependence on certain strategic partners makes us vulnerable to the extent we rely on them.

We rely on a concentrated number of vendors for the majority of our hardware and for certain software and related services needs. We do not have long term agreements with many of these vendors. If we can no longer obtain these hardware, software or services needs from our major suppliers due to mergers, acquisitions or consolidation within the marketplace, material changes in their partner programs, their refusal to continue to supply to us on reasonable terms or at all, and we cannot find suitable replacement suppliers, it may have a material adverse impact on our future operating results and gross margins.

Risks Relating to the Industries We Serve

Our business depends to a significant degree on the hospitality industry and a weakening could adversely affect our business and results of operations.

Because our customer base is concentrated in the hospitality industry, our business is largely dependent on the health of that industry. Our sales are dependent in large part on the health of the hospitality industry, which in turn is dependent on the domestic and international economy. Instabilities or downturns in the hospitality industry, such as those resulting from the impact of COVID-19, as discussed above, could disproportionately impact our revenue, as customers may exit the industry or delay, cancel or reduce planned expenditures for our products. For additional information regarding the potential impact of COVID-19 on our business, see “COVID-19 has adversely impacted our business and may further impact our business, financial results and liquidity for an unknown period of time” above for additional information.

Consolidation in the gaming and other hospitality industries could adversely affect our business.

Customers that we serve may seek to achieve economies of scale and other synergies by combining with or acquiring other companies. The hospitality industry has experienced recent consolidations, including the hotel and gaming sectors of the industry. Although recent consolidations in the hospitality industry have not materially adversely affected our business, there is no assurance that future consolidations will not have such affect. For example, if one of our current customers merges or consolidates with a company that relies on another provider's products or services, it could decide to reduce or cease its purchases of products or services from us, which could have an adverse effect our business.

16

Insolvencies in the hospitality industry could adversely affect our business.

Customers that we serve may be or become insolvent. Most of our customers have been significantly affected by the COVID-19 pandemic. Loss of revenue and other operating challenges may cause some of our customers to declare bankruptcy or cause their lenders to declare a default, accelerate the related debt, or foreclose on their property. Customers in bankruptcy may not have sufficient assets to pay us unpaid fees or reimbursements we are owed under their agreements with us. If a significant number of customers file for bankruptcy or otherwise fail to pay amounts owed to us, our revenues and liquidity could be adversely affected.

Risks Relating to Our Stock

Our stock has been volatile and we expect that it will continue to be volatile.

Our stock price has been volatile, and we expect it will continue to be volatile. For example, during the year ended March 31, 2020, the trading price of our common stock ranged from a high close of $36.85 to a low close of $13.00. The market price for our common stock could be subject to wide fluctuations in response to many risk factors listed in this section, and others beyond our control. Factors affecting the trading price of our common stock may include:

|

|

• |

uncertainties the COVID-19 pandemic has caused for the global economy; |

|

|

• |

economic news or other events generally causing volatility in the trading markets; |

|

|

• |

our operating results failing to meet the expectation of securities analysts or investors in a particular period or failure of securities analysts to publish reports about us or our business; |

|

|

• |

announcements by us or our competitors of acquisitions, new offerings or improvements, significant contracts, commercial relationships or capital commitments; |

|

|

• |

our ability to market new and enhanced solutions on a timely basis; |

|

|

• |

any major change in our board or management; general economic and political conditions such as recessions, interest rates, fuel prices, international currency fluctuations and acts of war or terrorism. |

On May 11, 2020, we entered into an agreement to sell $35 million of preferred stock with a 5.25% cumulative dividend and convertible into common stock at a conversion price of $20.1676 per share. Until converted, the preferred stock may impede stock price increases above the conversion price.

Additionally, our ownership base has been and may continue to be concentrated in a few shareholders, which could increase the volatility of our common share price over time.

Item 1B. Unresolved Staff Comments.

None.

Our corporate headquarters are located in Alpharetta, Georgia where we lease approximately 33,000 square feet of office space. In addition, we lease approximately 33,000 square feet of office space in Las Vegas, Nevada, 12,000 square feet of office space in Bellevue, Washington, 12,000 square feet of office space in Santa Barbara, California, and 6,000 square feet of warehouse space in Roswell, Georgia. Internationally, we lease approximately 104,000 square feet of office space in Chennai, India and lease several other smaller office locations throughout Europe and Asia. Our major leases contain renewal options for periods of up to 10 years. We believe that our current facilities and office space are sufficient to meet our needs and do not anticipate any difficulty securing additional space as needed.

We are involved in legal actions that arise in the ordinary course of business. It is the opinion of management that the resolution of any current pending litigation will not have a material adverse effect on our financial position or results of operations.

On April 6, 2012, Ameranth, Inc. filed a complaint against us in the U.S. District Court for the Southern District of California alleging that certain of our products infringe patents owned by Ameranth directed to configuring and transmitting hospitality menus (e.g., restaurant menus) for display on electronic devices, and synchronizing the menu content between devices. The case against us was consolidated with similar cases brought by Ameranth against more than 30 other defendants. Most of the patents at issue in the case were invalidated by the U.S. Court of Appeals for the Federal Circuit in 2016. Cases against us and our co-defendants remained pending in the District Court with respect to one surviving Ameranth patent. In September 2018, the District Court found that patent invalid, and granted summary judgment in favor of the movant co-defendants. In early 2019, Ameranth appealed the District Court's summary judgment ruling to the U.S. Court of Appeals for the Federal Circuit. In November 2019, the U.S. Court of Appeals for the

17

Federal Circuit affirmed the lower court’s summary judgement with respect to all claims except for two, which were not asserted against Agilysys. Shortly thereafter, Ameranth moved for a rehearing en banc, which was denied in February 2020. Finally, Ameranth filed for writ of certiorari to the United States Supreme Court. The Supreme Court has not yet responded to the writ.

We were not a party to the appeal, and it is currently unclear what impact the summary judgment ruling or writ of certiorari may have on our case. Ameranth seeks monetary damages, injunctive relief, costs and attorneys’ fees from us. At this time, we are not able to predict the outcome of the remaining claims in the lawsuit, or any possible monetary exposure associated with the lawsuit. However, we dispute the allegations of wrongdoing and are vigorously defending ourselves in this matter.

Item 4. Mine Safety Disclosures.

Not applicable.

18

Item 5. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common shares, without par value, are traded on the NASDAQ Stock Market LLC under the symbol “AGYS”. As of May 20, 2020, there were 1,551 registered holders of our common shares, without par value.

Dividends

We did not pay dividends in fiscal 2020 or 2019 on our common stock and are unlikely to do so in the foreseeable future. The current policy of the Board of Directors is to retain any available earnings for use in the operations of our business.

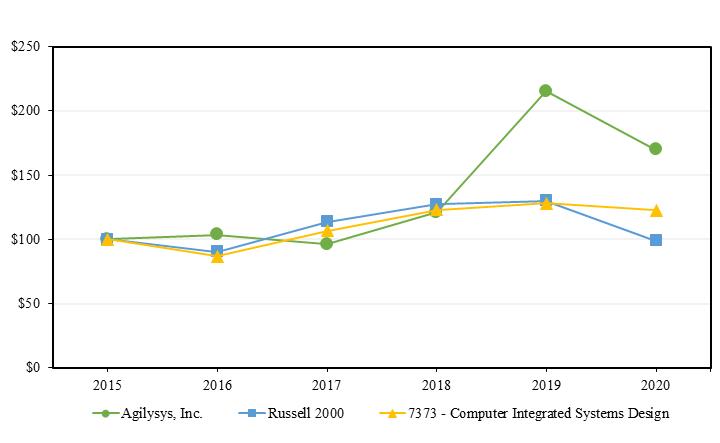

Shareholder Return Performance Presentation

The following chart compares the value of $100 invested in our common shares, including reinvestment of dividends, with a similar investment in the Russell 2000 Index (the “Russell 2000”) and with the companies listed in the SIC Code 7373-Computer Integrated Systems Design for the period March 31, 2015 through March 31, 2020. The stock price performance in this graph is not necessarily indicative of the future performance of our common shares.

19

Comparison of 5 Year Cumulative Total Return

INDEXED RETURNS

|

|

|

|

|

|

|

Fiscal Years Ended March 31, |

|

|||||||||||||||||

|

|