UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☑ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

____________________________________________________

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

To be held on August 21, 2023

____________________________________________________

Please join us for the Agilysys, Inc. 2023 Annual Meeting of Stockholders to be held on Monday, August 21, 2023, at 4:00 p.m., Eastern time. The 2023 Annual Meeting be held as a “virtual meeting” via live webcast. You will be able to attend the meeting virtually and to vote and submit questions during the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/AGYS2023 and entering the 16-digit control number provided in these proxy materials.

The purposes of the Annual Meeting are:

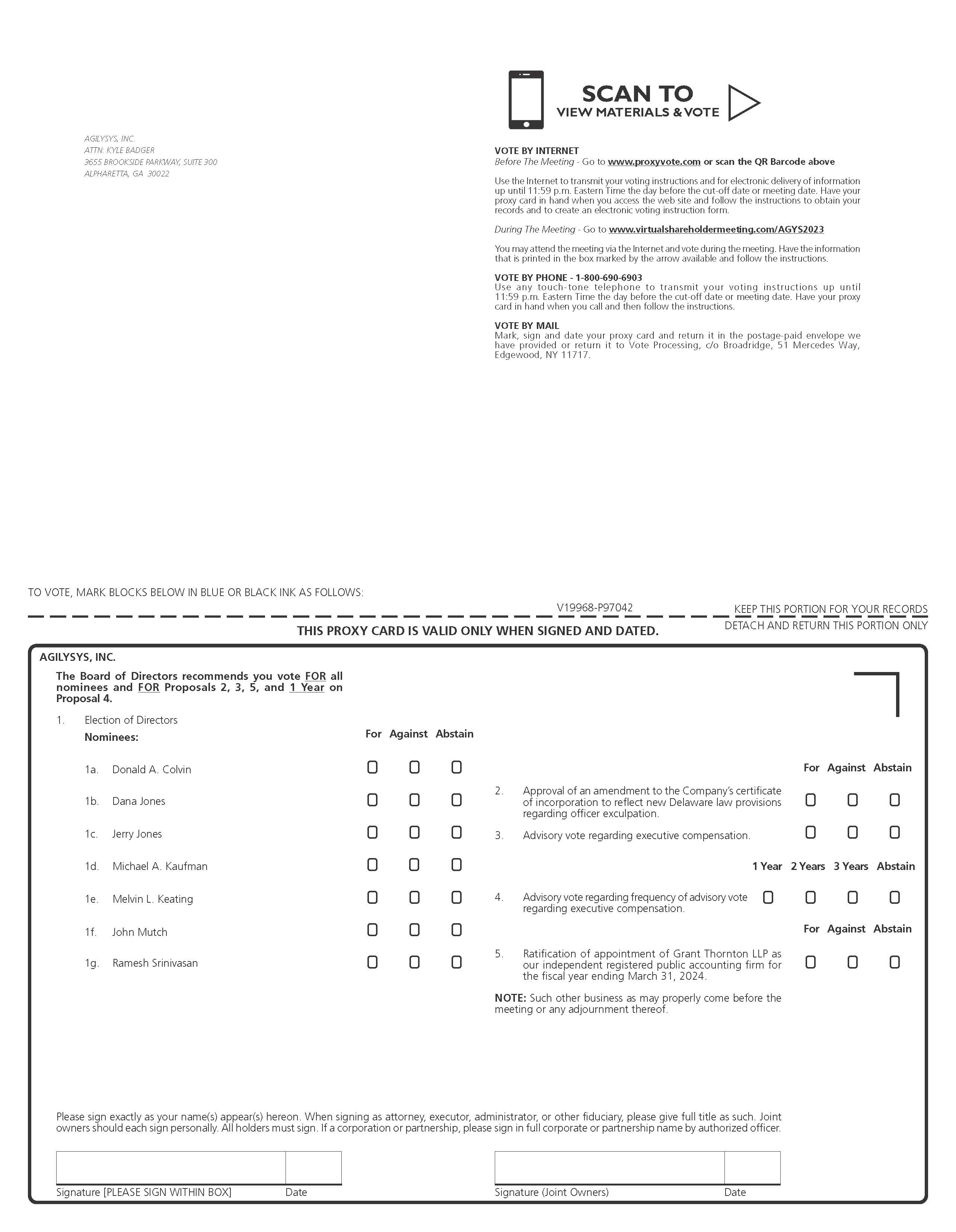

Stockholders of record at the close of business on June 23, 2023, are entitled to vote at the Annual Meeting. It is important to vote your shares at the Annual Meeting, regardless of whether you plan to attend virtually. In addition to voting by mail, you may vote by telephone or internet. Please refer to your enclosed proxy card and the Proxy Statement for information regarding how to vote by telephone or internet. If you choose to vote by mail, please sign, date, and promptly return your proxy card in the enclosed envelope.

By Order of the Board of Directors,

Michael A. Kaufman

Chairman of the Board of Directors

July 12, 2023

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be held on August 21, 2023.

The Proxy Statement and our Annual Report on Form 10-K for the

fiscal year ended March 31, 2023, are available at www.agilysys.com.

____________________________________________________

PROXY STATEMENT

2023 ANNUAL MEETING OF STOCKHOLDERS

August 21, 2023

____________________________________________________

ANNUAL MEETING INFORMATION

General Information

This Proxy Statement and the enclosed proxy card are being provided in connection with the solicitation by the board of directors of Agilysys, Inc., a Delaware corporation (“Agilysys,” the “Company,” “we,” “our,” or “us”), to be used at the Annual Meeting of Stockholders to be held at 4:00 p.m., Eastern time, on August 21, 2023, and any adjournments or postponements of the Annual Meeting. The Annual Meeting will be held as a “virtual meeting” via live webcast. There will be no physical meeting location. To participate in the Annual Meeting, visit www.virtualshareholdermeeting.com/AGYS2023 and enter the 16-digit control number included on your proxy card, or on the instructions that accompanied your proxy materials. You may begin to log into the meeting platform beginning at 3:45 p.m., Eastern time, on August 21, 2023. The meeting will begin promptly at 4:00 p.m., Eastern time, on August 21, 2023.

Our principal executive office is located at 3655 Brookside Parkway, Suite 300, Alpharetta, Georgia 30022. The purposes of the Annual Meeting are stated in the accompanying Notice. This Proxy Statement, the enclosed proxy card, and our Annual Report on Form 10-K for the fiscal year ended March 31, 2023 (“2023 Annual Report”), are first being mailed to stockholders and made available electronically on our website at www.agilysys.com beginning on or about July 12, 2023.

Record Date, Voting Shares, and Quorum

Stockholders of record of our common shares and Series A Convertible Preferred Stock at the close of business on June 23, 2023, the “Record Date,” are entitled to notice of and to vote their shares at the Annual Meeting, or any adjournment or postponement of the Annual Meeting. On the Record Date, there were 25,373,122 common shares and 1,735,457 shares of Series A Convertible Preferred Stock outstanding and entitled to vote. Each common share and each share of Series A Convertible Preferred Stock is entitled to one vote. The presence at the Annual Meeting, virtually or by proxy, of the holders of a majority of the total combined shares outstanding at the close of business on the Record Date will constitute a quorum for the transaction of business at the Annual Meeting. We will include abstentions and broker non-votes in the number of shares present at the Annual Meeting for purposes of determining a quorum. A broker non-vote occurs when a nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares. Our common shares are listed on the NASDAQ Global Select Market under the symbol AGYS. References within this Proxy Statement to our common shares refer to our common shares, without par value, and references within this Proxy Statement to our shares refer to both our common shares and shares of Series A Convertible Preferred Stock, which are the only classes of securities entitled to vote at the Annual Meeting.

How to Vote

If you are the record holder of shares, you or your duly authorized agent may vote by completing and returning the enclosed proxy card in the envelope provided. You may also vote by telephone or internet. Telephone and internet voting information is provided on your proxy card. A control number, located on the proxy card, is designed to verify your identity, allow you to vote your shares, and confirm that your voting instructions have been properly recorded. Please note the deadlines for voting by telephone, internet, and proxy card as set forth on the proxy card. If you vote by telephone or internet, you need not return your proxy card. You may also attend the virtual Annual Meeting and vote by completing a ballot online during the meeting through the virtual stockholder meeting platform at www.virtualshareholdermeeting.com/AGYS2023; however, we encourage you to vote your shares in advance of the Annual Meeting even if you plan on attending virtually. If your common shares are held by a bank, broker or any other nominee, you must follow the voting instructions provided to you by the bank, broker, or nominee. Although most banks and brokers offer voting by mail, telephone, and internet, availability and specific procedures will depend on their voting arrangements. If you hold your shares in street name and wish to vote at the virtual meeting, please obtain instructions on how to vote electronically at the meeting from your broker, bank or other nominee.

1

Unless revoked, shares represented by a properly signed and returned proxy card (or other valid form of proxy), or as instructed via telephone or internet, received in time for voting will be voted as instructed. If your proxy card is signed and returned with no instructions given, the persons designated as proxy holders on the proxy card will vote as follows:

The Company knows of no other matters scheduled to come before the Annual Meeting. If any other business is properly brought before the Annual Meeting, your proxy gives discretionary authority to the proxy holders with respect to such business, and the proxy holders intend to vote the proxy as recommended by our board of directors with regard to any such business, or, if no such recommendation is given, the proxy holders will vote in their own discretion.

Revocability of Proxies

You may revoke or change your vote at any time before the final vote on the matter is taken at the Annual Meeting by submitting to our Secretary a notice of revocation or by timely delivery of a valid, later-dated, duly executed proxy by mail, telephone, or internet. You may also revoke or change your vote by attending the virtual Annual Meeting and voting electronically. If your shares are held by a bank, broker, or other nominee, you must contact the bank, broker, or nominee and follow their instructions for revoking or changing your vote.

Vote Required, Abstentions, and Broker Non-Votes

If a quorum is present at the Annual Meeting, the nominees named herein for election as directors in proposal 1 will be elected if they receive a greater number of votes “for” their election than votes “against” their election. Abstentions and broker non-votes will have no effect on the election of directors.

Proposal 2 (approval of amendment to the Company’s certificate of incorporation to reflect new Delaware law provisions regarding officer exculpation) must be approved by the affirmative vote of the holders of two-thirds of the voting power of the issued and outstanding capital stock of the Company entitled to vote.

For each of proposal 3 (advisory vote on named executive officer compensation), proposal 4 (advisory vote on frequency of stockholder advisory votes on named executive officer compensation), and proposal 5 (ratification of independent registered public accounting firm), if a quorum is present at the Annual Meeting, the affirmative vote of the holders of shares representing a majority of the shares present virtually or represented by proxy and entitled to vote will be required to approve each proposal.

The effect of an abstention is the same as a vote against each of proposals 2, 3, 4, and 5. If you hold your shares in street name and do not give your broker or nominee instruction as to how to vote your shares with respect to proposals 2 and 3, your broker or nominee will not have discretionary authority to vote your shares on proposals 2, 3 or 4. These broker non-votes will have the effect of a vote against proposal 2, but will have no effect on proposals 3 or 4.

Proposal 5 is considered a “routine proposal” on which your broker or nominee will have discretionary authority to vote your shares if you do not give voting instructions, and accordingly we do not expect any broker non-votes to result from proposal 5.

No Cumulative Voting

Under our certificate of incorporation, our stockholders do not have cumulative voting rights in the election of directors.

Proxy Solicitation

The cost of solicitation of proxies, including the cost of preparing, assembling, and mailing the Notice, Proxy Statement, and proxy card, will be borne by the Company. In addition to solicitation by mail, arrangements may be made with brokerage houses and other

2

custodians, nominees, and fiduciaries to send proxy materials to their principals, and we may reimburse them for their expenses in so doing. Our officers, directors, and employees may, without additional compensation, personally or by other appropriate means request the return of proxies.

Attending the Virtual Annual Meeting

All holders of our common shares at the close of business on the Record Date, or their duly appointed proxies, are authorized to attend the virtual Annual Meeting. To participate in the Annual Meeting, visit www.virtualshareholdermeeting.com/AGYS2023 and enter the 16-digit control number included on your proxy card, or on the instructions that accompanied your proxy materials. You may begin to log into the meeting platform beginning at 3:45 p.m., Eastern time, on August 21, 2023. The meeting will begin promptly at 4:00 p.m., Eastern time, on August 21, 2023.

The virtual meeting platform is fully supported across browsers (Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most updated version of applicable software and plug-ins. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the meeting. Participants should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the meeting.

If you wish to submit a question, during the meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/AGYS2023 and follow the instructions in the virtual meeting platform for submitting a question. Questions pertinent to meeting matters will be answered during the meeting, subject to time constraints.

If you encounter any technical difficulties with the virtual meeting platform on the meeting day either during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting platform log in page.

Voting Results

Preliminary voting results will be announced at the Annual Meeting. Within four business days following the Annual Meeting, final results, or preliminary results if final results are unknown, will be announced on a Form 8-K filed with the Securities and Exchange Commission (“SEC”). If preliminary results are announced, final results will be announced on a Form 8-K filed with the SEC within four business days after the final results are known.

Company Information

Our 2023 Annual Report is being mailed with this Proxy Statement. These documents also are available electronically on our website at www.agilysys.com, under Investor Relations. Our 2023 Annual Report and the other information available on or through our website is not incorporated into this Proxy Statement and is not to be considered proxy solicitation material. If you wish to have additional copies of our 2023 Annual Report, we will mail copies to you without charge. Requests may be sent to our corporate headquarters at: Agilysys, Inc., Attn: Investor Relations, 3655 Brookside Parkway, Suite 300, Alpharetta, Georgia 30022, or you may request copies through our website, under Investor Relations. These documents have been filed with the SEC and may be accessed from the SEC’s website at www.sec.gov. If you have any questions about the Annual Meeting or these proxy materials, please contact Investor Relations by telephone at 770-810-7941, or by email at investorrelations@agilysys.com, or through our website under Investor Relations.

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Corporate Governance Guidelines (the “Guidelines”) adopted by our board of directors are intended to provide a sound framework to assist the board of directors in fulfilling its responsibilities to stockholders. Under the Guidelines, the board of directors exercises its role in overseeing the Company by electing qualified and competent officers and by monitoring the performance of the Company. The Guidelines state that the board of directors and its committees exercise oversight of executive officer compensation and director compensation, succession planning, director nominations, corporate governance, financial accounting and reporting, internal controls, strategic and operational issues, and compliance with laws and regulations. The Guidelines also state the board of directors’ policy regarding eligibility for the board of directors, including director independence and qualifications for director candidates, events that require resignation from the board of directors, service on other public company boards of directors, and stock ownership guidelines. The Nominating and Corporate Governance Committee annually reviews the Guidelines and makes recommendations for changes to the board of directors. The Guidelines are available on our website at www.agilysys.com, under Investor Relations.

3

Code of Business Conduct

The Code of Business Conduct adopted by our board of directors applies to all directors, officers, and employees of the Company, as well as certain third parties, and incorporates additional ethics standards applicable to our Chief Executive Officer, Chief Financial Officer, and other senior financial officers of the Company, and any person performing a similar function. The Code of Business Conduct is reviewed annually by the Audit Committee, and recommendations for change are submitted to the board of directors for approval. The Code of Business Conduct is available on our website at www.agilysys.com, under Investor Relations. The Company has in place a reporting hotline and website available for use by all employees and third parties, as described in the Code of Business Conduct. Any employee or third-party can anonymously report potential violations of the Code of Business Conduct through the hotline or website, both of which are managed by an independent third party. Reported violations are promptly reported to and investigated by the Company. Reported violations are addressed by the Company and, if related to accounting, internal accounting controls, or auditing matters, the Audit Committee. In addition, we intend to post on our website all disclosures that are required by law or NASDAQ listing standards concerning any amendments to, or waivers from, any provision of the Code of Business Conduct.

Director Independence

NASDAQ listing standards provide that at least a majority of the members of the board of directors must be independent, meaning free of any material relationship with the Company, other than his or her relationship as a director. The Guidelines state that the board of directors should consist of a substantial majority of independent directors. A director is not independent if he or she fails to satisfy the standards for director independence under NASDAQ listing standards, the rules of the SEC, and any other applicable laws, rules, and regulations. During the board of directors’ annual review of director independence, the board of directors considers transactions, relationships, and arrangements, if any, between each director or a director’s immediate family members and the Company or its management. In May 2023, the board of directors performed its annual director independence review and, as a result, determined that each of Donald Colvin, Dana Jones, Jerry Jones, Michael A. Kaufman, Melvin Keating, and John Mutch qualify as independent directors. Ramesh Srinivasan is not independent because of his service as President and CEO of the Company.

Director Attendance

The board of directors held five meetings during fiscal year 2023, and no director attended less than 75% of the aggregate of the total number of board of director meetings and meetings held by committees of the board of directors on which the director served. Independent directors meet regularly in executive session at board of director and committee meetings, and executive sessions are chaired by the chairman of the board or by the appropriate committee chairman. It is the board of directors’ policy that all its members attend the Annual Meeting of Stockholders absent exceptional cause. All the directors attended the 2022 Annual Meeting of Stockholders.

Stockholder Communication with Directors

Stockholders and others who wish to communicate with the board of directors as a whole, or with any individual director, may do so by sending a written communication to such director(s) in care of our Secretary at our Alpharetta, Georgia office address, and our Secretary will forward the communication to the specified director(s).

Committees of the Board

During fiscal year 2023, the board of directors had three standing committees: Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Mr. Srinivasan is not a member of any committee. At the end of the fiscal year, the members and chairperson of each committee were as follows:

Director |

Audit |

Compensation |

Nominating and Corporate Governance |

Donald Colvin* |

Chair |

|

|

Dana Jones* |

X |

Chair |

|

Jerry Jones |

|

X |

X |

Michael A. Kaufman |

|

X |

Chair |

Melvin Keating |

|

X |

X |

John Mutch* |

X |

|

X |

*Qualifies as an Audit Committee Financial Expert.

As of July 12, 2023, the committee membership set forth above remained the same.

4

Committee Charters. The board of directors has adopted a charter for each committee, and each committee with a charter is responsible for the annual review of its respective charter. Charters for each committee are available on our website at www.agilysys.com, under Investor Relations.

Audit Committee. The Audit Committee held eight meetings during fiscal year 2023. The Audit Committee reviews, with our independent registered public accounting firm, the proposed scope of our annual audits and audit results, as well as interim reviews of quarterly reports; reviews the adequacy of internal financial controls; reviews internal audit functions; is directly responsible for the appointment, determination of compensation, retention, and general oversight of our independent registered public accounting firm; reviews related person transactions; oversees the Company’s implementation of its Code of Business Conduct; and reviews any concerns identified by either the internal or external auditors. The board of directors determined that all Audit Committee members are financially literate and independent under NASDAQ listing standards for audit committee members. The board of directors also determined that each of Ms. Jones and Messrs. Colvin and Mutch qualify as an “audit committee financial expert” under SEC rules.

Compensation Committee. The Compensation Committee held four meetings during fiscal year 2023. The purpose of the Compensation Committee is to enhance stockholder value by ensuring that pay available to the board of directors, Chief Executive Officer, and other executive officers enables us to attract and retain high-quality leadership and is consistent with our executive pay philosophy. As part of its responsibility, the Compensation Committee oversees our pay plans and policies; annually reviews and determines all pay, including base salary, annual cash incentive, long-term equity incentive, and retirement and perquisite plans; administers our incentive programs, including establishing performance goals, determining the extent to which performance goals are achieved, and determining awards; administers our equity pay plans, including making grants to our executive officers; and regularly evaluates the effectiveness of the overall executive pay program and evaluates our incentive plans to determine if the plans’ measures or goals encourage inappropriate risk-taking by our executives. A more complete description of the Compensation Committee’s functions is found in the Compensation Committee Charter. The board of directors determined that all Compensation Committee members are independent under NASDAQ listing standards for compensation committee members. Our Finance, Legal and Human Resources Departments support the Compensation Committee in its work and, in some cases, as a result of delegation of authority by the Compensation Committee, fulfill various functions in administering our pay programs. In addition, the Compensation Committee has the authority to engage the services of outside consultants and advisers to assist it. The Committee engages compensation consultants to perform current market assessments when it believes that such an assessment would inform its decision making with respect to executive compensation. The Compensation Committee engaged FW Cook as a compensation consultant to provide competitive analysis regarding CEO employment contracts and advice regarding a CEO equity award, and carefully considered such analysis and advice, along with other factors, in connection with negotiating Mr. Srinivasan’s amended employment agreement in fiscal year 2023. The Compensation Committee did not engage FW Cook or any other compensation consultant to advise it in connection with setting compensation for the other Named Executive Officers in fiscal year 2023.

Our Chief Executive Officer, Chief Financial Officer and General Counsel attend Compensation Committee meetings when executive compensation, Company performance, and individual performance are discussed and evaluated by Compensation Committee members, and they provide their thoughts and recommendations on executive pay issues during these meetings and provide updates on financial performance, industry status, and other factors that may impact executive compensation. Decisions regarding the Chief Executive Officer’s compensation were based solely on the Compensation Committee’s deliberations, while compensation decisions regarding other executive officers took into consideration recommendations from the Chief Executive Officer. Only Compensation Committee members make decisions on executive officer compensation and approve all outcomes.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee (“Nominating Committee”) held three meetings during fiscal year 2023. The board of directors determined that all Nominating Committee members are independent under NASDAQ listing standards. The Nominating Committee assists the board of directors in finding and nominating qualified people for election to the board; reviewing stockholder-recommended nominees; assessing and evaluating the board of directors’ effectiveness; and establishing, implementing, and overseeing our governance programs and policies. The Nominating Committee is responsible for reviewing the qualifications of, and recommending to the board of directors, individuals to be nominated for membership on the board of directors. The board of directors has adopted Guidelines for Qualifications and Nomination of Director Candidates (“Nominating Guidelines”), and the Nominating Committee considers nominees using the criteria set forth in the Nominating Guidelines. At a minimum, a director nominee must:

Be of proven integrity with a record of substantial achievement;

5

The Nominating Committee considers the foregoing factors, among others, in identifying nominees; however, there is no policy requiring the Nominating Committee to consider the impact of any one factor by itself. Although the Nominating Committee does not have a specific diversity policy, diversity is one of several factors considered in our corporate governance guidelines. The Nominating Committee also will consider the board of directors’ current and anticipated needs in terms of number, specific qualities, expertise, skills, experience, and background. In addition, the Corporate Governance Guidelines state that the board of directors should have a balanced membership, with diverse representation of relevant areas of experience, expertise, and backgrounds. The Nominating Committee seeks nominees that collectively will build a capable, responsive, and effective board of directors, prepared to address strategic, oversight, and governance challenges. The Nominating Committee believes that the backgrounds and qualifications of the directors as a group should provide a significant mix of experience, knowledge, and abilities that will enable the board of directors to fulfill its responsibilities.

The Nominating Committee will consider stockholder-recommended nominees for membership on the board of directors. For a stockholder to properly nominate a candidate for election as a director at a meeting of the stockholders, the stockholder must be a stockholder of record at the time the notice of the nomination is given and at the time of the meeting, be entitled to vote at the meeting in the election of directors, and have given timely written notice of the nomination to the Secretary. To be timely, notice must be received by the Secretary, in the case of an annual meeting, not less than 90 days nor more than 120 days prior to the anniversary of the previous year’s annual meeting; provided, however, that if the date of the annual meeting is advanced more than 30 days prior to or delayed by more than 30 days after the anniversary of the preceding year’s annual meeting, notice must be delivered not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th calendar day following the day on which public disclosure of the date of such annual meeting is first made. In the case of a special meeting, timely notice must be received by the Secretary not later than the close of business on the 10th day after the date of such meeting is first publicly disclosed. A stockholder’s notice must set forth, as to each candidate:

The Nominating Committee may request additional information from such nominee to assist in its evaluation. The Nominating Committee will evaluate any stockholder-recommended nominees in the same way it evaluates nominees recommended by other sources, as described above.

6

Board Leadership

The board of directors determined that having an independent director serve as chairman of the board is in the best interest of stockholders at this time. The structure ensures a greater role for our independent directors in the oversight of the Company and the active participation in setting agendas and establishing priorities and procedures for the board of directors. Pursuant to the board of directors’ Corporate Governance Guidelines, it is our policy that the positions of chairman of the board and chief executive officer be held by different individuals, except as otherwise determined by the board of directors. Mr. Kaufman has served as Chairman of the Board since 2015.

Risk Oversight

Management is responsible for the day-to-day management of risks facing the Company. The board of directors, as a whole and through its committees, particularly the Audit Committee, is actively involved in the oversight of such risks. The board of directors’ role in risk oversight includes regular reports at board of director and Audit Committee meetings from members of senior management on areas of material risk to the Company, including strategic, financial, operational, and legal and regulatory compliance risks. Management regularly identifies and updates, among other items, the population of possible risks for the Company, assigns risk ratings, prioritizes the risks, assesses likelihood of risk occurrence, develops risk mitigation plans for prioritized risks, and assigns roles and responsibilities to implement mitigation plans. Risks are ranked by evaluating each risk’s likelihood of occurrence and magnitude.

The board of directors’ Compensation Committee, in consultation with management, evaluates our incentive plans to determine if the plans’ measures or goals encourage inappropriate risk-taking by our employees. As part of its evaluation, the Compensation Committee determined that the performance measures and goals were tied to our business, financial, and strategic objectives. As such, the incentive plans are believed not to encourage risk-taking outside of the range of risks contemplated by the Company’s business plan.

Given the nature of our business, management is highly focused on identifying and managing a broad range of cybersecurity risks. These risks include those relating to our internal systems, as well as to our products and services for customers. The full board of directors has primary responsibility for oversight of the Company’s cybersecurity risks. The Audit Committee is also responsible for reviewing the Company’s information and cybersecurity risks and the steps that management has taken to protect against threats to the Company’s information systems and security, including results of periodic security assessments performed in conjunction with ongoing monitoring.

To more effectively prevent, detect and respond to information security threats, the Company maintains a cybersecurity risk management program, which is supervised by a dedicated Chief Information Security Officer whose team is responsible for leading enterprise-wide cybersecurity strategy, policies, standards, architecture and processes. The board of directors receives regular reports from the Chief Information Security Officer and the Chief Information Officer on, among other things, the Company’s cybersecurity risks and threats, the status of projects to strengthen the Company’s information security systems and assessments of the Company’s security program.

In March of 2023, the board of directors formed the Cybersecurity Risk Subcommittee of the Audit Committee consisting of two independent directors to assist the Audit Committee in its oversight of cybersecurity risks. The Cybersecurity Risk Subcommittee did not meet in fiscal year 2023.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee during fiscal year 2023 (Ms. Jones and Messrs. Jones, Kaufman, and Keating) is or has been an officer or employee of the Company or has had any relationship with the Company required to be disclosed as a related person transaction, and none of our executive officers served on the compensation committee (or other committee serving an equivalent function) or board of any company that employed any member of our Compensation Committee or our board of directors during fiscal year 2023.

Policy on Hedging of Shares

We do not have any practices or policies regarding hedging or offsetting any decrease in the market value of the Company’s equity securities.

7

DIRECTOR COMPENSATION

During fiscal year 2023, the board of directors approved compensation for non-employee directors consisting of the following:

We also reimburse our directors for reasonable out-of-pocket expenses incurred for attendance at board of directors and committee meetings.

The fiscal year 2023 equity award for each director consisted of 2,322 restricted shares, based on the closing price of the Company’s common stock of $43.06 on the date the grant was approved by the board of directors, and was granted under the 2020 Equity Incentive Plan. The restricted shares vested on March 31, 2023, and provided for pro-rata vesting upon retirement prior to March 31, 2023.

Our directors are subject to share ownership guidelines that require ownership of common stock with a market value of three times the director’s respective annual cash retainer within two years of service and six times the director’s respective annual cash retainer within four years of service. We pay no additional fees for board of director or committee meeting attendance.

Director Compensation for Fiscal Year 2023

Director (1) |

Fees Earned or Paid in Cash ($)(2) |

Stock Awards ($)(3) |

Total ($) |

Donald Colvin |

65,000 |

100,000 |

165,000 |

Dana Jones |

67,292 |

100,000 |

167,292 |

Jerry Jones |

60,000 |

100,000 |

160,000 |

Michael A. Kaufman |

102,500 |

100,000 |

202,500 |

Melvin Keating |

65,208 |

100,000 |

165,208 |

John Mutch |

60,000 |

100,000 |

160,000 |

8

PROPOSAL 1

ELECTION OF DIRECTORS |

Our board of directors currently consists of seven members whose term expires at this Annual Meeting. In each case, subject to their earlier death, resignation, removal or retirement, the directors remain in office until their respective successors are duly elected and qualified, notwithstanding the expiration of the otherwise applicable term.

Nominees for Director

Upon the recommendation of the Nominating and Corporate Governance Committee, comprised of independent directors, the board of directors has nominated each of Donald Colvin, Dana Jones, Jerry Jones, Michael A. Kaufman, Melvin Keating, John Mutch and Ramesh Srinivasan for election to the board of directors for a term of one year, to serve until the annual meeting of stockholders in 2024 and until their successors have been duly elected and qualified, subject to their earlier death, resignation, retirement or removal. Information concerning the nominees for election at this Annual Meeting is set forth below.

Unless the stockholder specifies otherwise as to any of these nominees, the shares represented by a validly executed proxy will be voted “FOR” the election of each of Ms. Jones and Messrs. Colvin, Jones, Kaufman, Keating, Mutch and Srinivasan for a one-year term. Each nominee has indicated his or her willingness to serve as a director, if elected.

A biography for each director nominee follows and, if applicable, arrangements under which a director was appointed to the board of directors or information regarding any involvement in certain legal or administrative proceedings is provided. Additional information about the experiences, qualifications, attributes, or skills of each director and director nominee in support of his or her service on the board of directors is also provided.

DIRECTOR NOMINEES

Donald Colvin |

Age 70 |

Director since 2015 |

Mr. Colvin is a director of Viavi Solutions Inc. (Nasdaq: VIAV), a global provider of network test, monitoring and assurance solutions, and a director and chairman of the board of Maxeon Solar (Nasdaq: MAXN). He was formerly a director of UTAC Holdings, Ltd., a private Singapore technology company, and a director of Applied Micro Circuits Corporation from 2007 to 2011. Mr. Colvin previously served as Chief Financial Officer of Caesars Entertainment Corporation from November 2012 to January 2015. Caesars Entertainment Group filed for bankruptcy protection in January 2015. Before that, he was Executive Vice President and Chief Financial Officer of ON Semiconductor Corp. from April 2003 to October 2012. Prior to joining ON Semiconductor, he held a number of financial leadership positions, including Vice President of Finance and Chief Financial Officer of Atmel Corporation, Chief Financial Officer of European Silicon Structures as well as several financial roles at Motorola Inc.

Mr. Colvin earned his B.A. in Economics, with honors, and an M.B.A. from the University of Strathclyde in Scotland. Mr. Colvin’s qualifications and extensive experience include financial management, capital structure, financial strategy, significant public company leadership and board experience, and experience in the hospitality industry which the Company serves.

Dana Jones |

Age 48 |

Director since 2019 |

Dana Jones has served as the Chief Executive Officer and President of RealPage, Inc. a provider of software and data analytics for the real estate industry, since August 2021. She also serves as a current member of RealPage’s Board of Directors and has over two decades of experience leading and growing global enterprise software businesses.

Prior to RealPage, Ms. Jones was the Chief Executive Officer of Sparta Systems, the market leader in digital enterprise quality management software for the life sciences space, from March 2018 until March 2021 when Sparta was acquired by Honeywell. She also served as a director of RealPage, Inc. (formerly Nasdaq: RP), from October 2019 to April 2021 when the company was acquired by Thoma Bravo. Prior to joining Sparta Systems in April 2018, Dana served as Chief Executive Officer of Active Network, the leader in activity and event management software, during 2016 and 2017. Before joining Active Network, Ms. Jones was Chief Marketing Officer and Senior Vice President of Products for Sabre Airline Solutions, a global provider of software to the airline industry, from 2012 to 2017. Prior to Sabre, Ms. Jones co-founded Noesis Energy and served as Executive Vice President of Product, Sales, Marketing, and Operations.

Ms. Jones also serves on the board of directors of Zapata Computing, a leading enterprise software company for NISQ-based quantum applications.

9

Ms. Jones graduated Summa Cum Laude and holds a BSE in industrial and operations engineering from the University of Michigan. Ms. Jones is an accomplished software executive with decades of experience leading and growing cloud-based global enterprise software businesses.

Jerry Jones |

Age 67 |

Director since 2012 |

Mr. Jones is the Executive Vice President, Chief Ethics and Legal Officer of LiveRamp Holdings, Inc. (NYSE: RAMP), a software-as-a-service (SaaS) company that provides the identity platform for powering exceptional experiences. His responsibilities include oversight of its legal, privacy and security teams and various strategic initiatives, including the strategy and execution of mergers and alliances, as well as serving as a director of most wholly owned subsidiary companies. Prior to joining LiveRamp, which is the successor entity to Acxiom Corp., in September 2018, Mr. Jones was the Chief Ethics and Legal Officer at Acxiom since 1999, where he oversaw all legal and data ethics matters. Prior to joining Acxiom, Mr. Jones was a partner with the Rose Law Firm in Little Rock, Arkansas, where he specialized in problem solving and business litigation for 19 years, representing a broad range of business interests.

Mr. Jones is a 1980 graduate of the University of Arkansas School of Law and holds a bachelor’s degree in public administration from the University of Arkansas. As the Chief Ethics and Legal Officer of a SaaS company, Mr. Jones has extensive experience with legal, privacy, and cybersecurity matters. He has also led the strategy and execution of mergers and alliances and international expansion efforts.

Michael A. Kaufman |

Age 51 |

Director since 2014 |

Mr. Kaufman is the Chief Executive Officer of MAK Capital, an investment advisory firm based in New York, New York, which he founded in 2002. He is director and Chairman of the Board of Agilysys, Inc., and serves as a director for Skyline Champion, Yatra Online, Inc., Trailhead Biosystems and Metal Recovery Holdings, LLC.

Mr. Kaufman holds a B.A. in Economics from the University of Chicago, where he also received his M.B.A.. He also earned a law degree from Yale University. As Chief Executive Officer of MAK Capital, a significant stockholder of the Company, Mr. Kaufman is especially qualified to represent the interests of the Company’s stockholders as a director and chairman of the board. Additionally, Mr. Kaufman’s qualifications and experience include capital markets, investment strategy, and financial management.

Melvin Keating |

Age 76 |

Director since 2015 |

Mr. Keating has been a consultant, providing investment advice and other services to private and public companies and private equity firms since 2008. Mr. Keating also serves as a director of MagnaChip Semiconductor Corporation (NYSE: MX), a specialist in OLED panel technology and a designer/manufacturer of analog and mixed signal semiconductor platform solutions (since August 2016). Previously he was a director of Vitamin Shoppe Inc., a retailer of nutritional supplements, from April 2018 until it was taken private in December 2019, and Red Lion Hotels Corporation from July 2010 until June 2017, serving as Chairman of the Board from May 2013 to 2015. During the past five years, Mr. Keating also served on the boards of directors of the following public companies: SPS Commerce, Inc., a provider of cloud-based supply chain management solutions (from March 2018 to May 2019), and Harte Hanks Inc. a global marketing services firm (2017 until July 2020).

Mr. Keating holds a B.A. from Rutgers University as well as both an M.S. in Accounting and an M.B.A. in Finance from The Wharton School of the University of Pennsylvania. Mr. Keating has substantial experience leading public companies in the technology and hospitality industries and is qualified in global operations, financial management and strategy, and capital markets.

John Mutch |

Age 66 |

Director since 2009 |

Mr. Mutch has served as managing partner of MV Advisors LLC (“MV Advisors”), a strategic block investment firm that provides focused investment and strategic guidance to small and mid-cap technology companies, since founding the firm in December 2005. From December 2008 to January 2014, Mr. Mutch served as President, CEO and Chairman of the Board of Directors of BeyondTrust Software, a privately-held security software company. Mr. Mutch has served as Chairman of the board of directors of Aviat Networks, Inc. (Nasdaq: AVNW), a global provider of microwave networking solutions, since February 2015, and has served on the board of directors since January 2015. Previously, Mr. Mutch served on the board of directors of Maxwell Technologies, Inc. (formerly Nasdaq: MXWL), a manufacturer of energy storage and power delivery solutions for automotive, heavy transportation, renewable energy, backup power, wireless communications and industrial and consumer electronics applications, from April 2017 to May 2019, YuMe, Inc. (NYSE: YUME), a provider of digital video brand advertising solutions, from July 2017 to February 2018, at which time the company was acquired by RhythmOne PLC (LON: RTHM), a technology-enabled digital media company, and Mr. Mutch continued serving as a director on the RhythmOne PLC board of directors until January 2019.

10

Mr. Mutch holds a B.S. in Economics from Cornell University and an M.B.A. from the University of Chicago. As a former chief executive officer and board member of many technology companies, Mr. Mutch has extensive experience in the technology industry, restructuring, financial management and strategy, capital markets, sales management, and marketing.

Ramesh Srinivasan |

Age 63 |

Director since 2017 |

Mr. Srinivasan has been President and Chief Executive Officer of the Company since January 3, 2017. He previously served as CEO of Ooyala, a Silicon Valley based provider of a suite of technology offerings in the online video space, from January 2016 to November 2016. From March 2015 to November 2015, he was President and CEO of Innotrac Corp., an ecommerce fulfillment provider which merged with eBay Enterprise to form Radial Inc. in 2015. Prior to that, Mr. Srinivasan served as President and CEO of Bally Technologies Inc. (NYSE: BYI) from December 2012 to May 2014, and President and COO from April 2011 to December 2012; he started as Executive Vice President of Bally Systems in March 2005. Mr. Srinivasan was with Manhattan Associates from 1998 to 2005, where his last position was Executive Vice-President of Warehouse Management Systems.

Mr. Srinivasan holds a Post-Graduate Diploma in Management (MBA equivalent) from the Indian Institute of Management, Bangalore, India, and a degree in Engineering from the Indian Institute of Technology (Banaras Hindu University), Varanasi, India. Mr. Srinivasan has nearly three decades of hands-on enterprise software development, execution and senior technology management leadership and strategy expertise and accomplishments, including experience and expertise in driving performance at high growth technology companies and helping them scale their business profitably.

Board Diversity Matrix

The NASDAQ diversity matrix is set forth below as required under the listing requirements of NASDAQ.

To see our Board Diversity Matrix as of June 30, 2022, please see the proxy statement filed with the SEC on July 19, 2022.

Board Diversity Matrix (As of June 12, 2023) |

||||

Total Number of Directors |

7 |

|||

|

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

Directors |

1 |

5 |

|

1 |

Number of Directors who identify in Any of the Categories Below: |

||||

African American or Black |

|

|

|

|

Alaskan Native or Native American |

|

|

|

|

Asian |

|

1 |

|

|

Hispanic or Latin |

|

|

|

|

Native Hawaiian or Pacific Islander |

|

|

|

|

White |

1 |

4 |

|

|

Two or More Races or Ethnicities |

|

|

|

|

LGBTQ+ |

— |

|||

Did Not Disclose Demographic Background |

1 |

|||

One of our directors also identifies as being of U.K. origin.

Vote Required

Each of the nominees for election as directors will be elected if the number of votes cast “for” such nominee’s election exceeds the number of votes cast “against” such nominee’s election. Abstentions and broker non-votes will have no effect on the election of directors.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES. PROXY CARDS RECEIVED BY THE COMPANY WILL BE VOTED “FOR” THE ELECTION OF EACH OF THE NOMINEES UNLESS THE STOCKHOLDER SPECIFIES OTHERWISE ON THE PROXY CARD.

11

PROPOSAL 2

APPROVAL OF AN AMENDMENT TO THE COMPANY’S CERTIFICATE OF INCORPORATION |

Background

The State of Delaware, which is the Company’s state of incorporation, recently amended Section 102(b)(7) of the Delaware General Corporation Law (“DGCL”) to enable Delaware companies to limit or eliminate the monetary liability of certain senior officers in limited circumstances (referred to as “exculpation”). Section 102(b)(7) of the DGCL previously permitted Delaware corporations to exculpate only directors, but not officers, and the Company’s Certificate of Incorporation currently aligns with the previous Section 102(b)(7) in providing for the exculpation of directors but not officers. The Company is asking its stockholders to approve an amendment to the Certificate of Incorporation to add a provision exculpating officers of the Company from personal liability for monetary damages associated with claims of breach of the duty of care, as now permitted under the DGCL (the “Exculpation Amendment”).

Amended Section 102(b)(7) of the DGCL provides that only certain officers may be entitled to exculpation, namely: (i) the corporation’s president, chief executive officer, chief operating officer, chief financial officer, chief legal officer, controller, treasurer or chief accounting officer; (ii) an individual identified in the corporation’s public filings with the SEC as one of the most highly compensated executive officers of the corporation (i.e., the named executive officers); and (iii) an individual who, by written agreement with the corporation, has consented to be identified as an officer for purposes of accepting service of process (collectively, the “covered officers”).

The Exculpation Amendment would permit the exculpation of the covered officers for personal liability for monetary damages in connection with direct claims brought by stockholders for breach of fiduciary duty of care, including class actions. The Exculpation Amendment would not limit the liability of the covered officers for:

For clarity, the Exculpation Amendment specifically sets forth those circumstances in which covered officers, as well as directors of the Company, will not be entitled to exculpation, consistent with the provisions of the DGCL.

Proposed Exculpation Amendment

The Board is asking our stockholders to approve the Exculpation Amendment. The full text of the proposed amendment is set forth below and in Appendix A. In Appendix A, additions are marked with bold, underlined text and deletions are indicated by struck-out text.

If the Exculpation Amendment is adopted, the heading of Article VII and the text of Article VII, Section 1 of the Certificate of Incorporation will be amended to read in its entirety as follows:

“ARTICLE VII – LIMITATION OF DIRECTOR AND OFFICER LIABILITY

Section 1. To the fullest extent permitted by the DGCL as the same exists or as may hereafter be amended from time to time, a director or officer of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or officer, provided that this provision shall not eliminate or limit the liability of (a) a director or officer for any breach of the director's or officer’s duty of loyalty to the Corporation or its stockholders, (b) a director or officer for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (c) a director under Section 174 of the DGCL, (d) a director or officer for any transaction from which the director or officer derived an improper personal benefit, or (e) an officer in any action by or in the right of the Corporation. If the DGCL is amended to authorize corporate action further eliminating or limiting the personal liability of directors or officers, then the liability of a director or officer of the Corporation shall be eliminated or limited to the fullest extent permitted by the DGCL, as so amended.”

12

Reasons for the Exculpation Amendment

The Board believes that there is a need for officers to have appropriate protections from personal liability, both to allow the Company to continue to attract and retain the most qualified officers and to prevent costly and protracted litigation that distracts our senior officers from important operational and strategic matters.

We believe that an exculpation provision that is updated to align with amended Section 102(b)(7) strikes the appropriate balance between stockholders’ interest in accountability from our senior officers and their interest in the Company being able to attract and retain quality officers. In the absence of appropriate protection from personal liability, qualified officers might be deterred from serving due to exposure to personal liability and the risk of incurring substantial expense in defending lawsuits, regardless of merit.

Furthermore, exculpation has been available to directors of Delaware companies for a long time, and now that Delaware law permits officer exculpation, the Company expects public companies, including our peers, to adopt exculpation clauses that limit the personal liability of officers in their certificates of incorporation. Failure to adopt the amendment could impact our ability to recruit and retain experienced and qualified officers, who may conclude that the potential exposure to liabilities, costs of defense and other risks of proceedings exceeds the benefits of serving as an officer of the Company.

In addition, officers frequently must make decisions in response to time-sensitive opportunities and challenges, which can create substantial risk of investigations, claims, actions, suits or proceedings seeking to impose liability on the basis of hindsight, especially in the current litigious environment, and regardless of merit. Adopting the Exculpation Amendment could empower our officers to exercise their business judgment in furtherance of the interests of the stockholders. On the other hand, even under the Exculpation Amendment, our officers would not be protected from liability for breaches of the duty of loyalty, acts or omissions not in good faith or those that involve intentional misconduct or a knowing violation of law, or any transactions in which an officer derived an improper personal benefit.

In light of the narrow class and type of claims for which officers would be exculpated, the limited number of officers to whom the protections would apply, and the benefits that the Board believes would accrue to the Company and its stockholders in the form of an enhanced ability to attract and retain quality officers, our Board has determined that the Exculpation Amendment is in the best interests of the Company and its stockholders, and has unanimously approved the Exculpation Amendment.

Effect of the Proposed Amendment

Other than the replacement of the existing Article VII, Section 1 by the proposed Article VII, Section 1, the remainder of the Certificate of Incorporation will remain unchanged. If the Exculpation Amendment is approved by the stockholders, the amendment will become effective upon filing of the Certificate of Amendment to Certificate of Incorporation with the Delaware Secretary of State, which the Company anticipates filing promptly following the Annual Meeting.

Vote Required

The affirmative vote of the holders of two-thirds of the voting power of the issued and outstanding shares of our capital stock will be required to approve the Exculpation Amendment to the Certificate of Incorporation of the Company. Abstentions and broker non-votes will have the same effect as a vote against this proposal.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE EXCULPATION AMENDMENT. PROXY CARDS RECEIVED BY THE COMPANY WILL BE VOTED “FOR” PROPOSAL 2 UNLESS THE STOCKHOLDER SPECIFIES OTHERWISE ON THE PROXY CARD.

13

BENEFICIAL OWNERSHIP OF COMMON SHARES

The following table shows the number of common shares beneficially owned as of June 14, 2023, by (i) each current director; (ii) our Named Executive Officers; (iii) all directors and executive officers as a group; and (iv) each person who is known by us to beneficially own more than 5% of our common shares. Percent of common shares are calculated based on 27,092,456 shares of common stock, consisting of 25,356,999 shares of common stock outstanding on June 14, 2023, and 1,735,457 shares of common stock into which 1,735,457 shares of Series A Convertible Preferred Stock outstanding on June 14, 2023, were convertible.

Name |

Common Shares |

Common Shares Subject to Exercisable Options |

Restricted Common Shares |

Total Common Shares Beneficially Owned (1) |

Percent of Class |

Series A Convertible Preferred Shares (2) |

Percent of Class |

Directors and Nominees |

|||||||

Donald Colvin |

33,189 |

— |

1,435 |

34,624 |

* |

— |

* |

Dana Jones |

14,263 |

— |

1,435 |

15,698 |

* |

— |

* |

Jerry Jones |

58,129 |

— |

1,435 |

59,564 |

* |

— |

* |

Michael A. Kaufman (3) |

4,142,136 |

— |

1,435 |

4,143,571 |

15.3 |

1,735,457 |

100 |

Melvin Keating |

41,908 |

— |

1,435 |

43,343 |

* |

— |

* |

John Mutch |

35,923 |

— |

1,435 |

37,358 |

* |

— |

* |

Named Executive Officers |

|||||||

Ramesh Srinivasan |

691,751 |

600,000 |

67,856 |

1,359,607 |

5.0 |

— |

* |

William David ("Dave") Wood |

45,150 |

2,528 |

12,832 |

60,510 |

* |

— |

* |

Kyle Badger |

110,277 |

75,248 |

4,112 |

189,637 |

* |

— |

* |

Prabuddha Biswas |

63,503 |

— |

3,550 |

67,053 |

* |

— |

* |

Don DeMarinis |

14,406 |

— |

3,672 |

18,078 |

* |

— |

* |

All current directors and |

5,343,590 |

911,935 |

136,582 |

6,392,107 |

23.6 |

1,735,457 |

100 |

Other Beneficial Owners |

|||||||

MAK Capital One LLC et al |

3,952,064 (3) |

|

|

|

14.6 |

— |

* |

BlackRock, Inc. |

3,237,416 (4) |

|

|

|

11.9 |

— |

* |

The Vanguard Group, Inc. |

1,650,177 (5) |

|

|

|

6.1 |

— |

* |

* Less than 1%.

14

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act requires the Company’s directors and certain of its executive officers and persons who beneficially own more than 10% of the Company’s common shares to file reports of and changes in ownership with the SEC. Based solely on the Company’s review of copies of SEC filings it has received or filed, the Company believes that each of its directors, executive officers, and beneficial owners of more than 10% of the shares satisfied the Section 16(a) filing requirements during fiscal year 2023.

EXECUTIVE OFFICERS

The following are biographies for each of our current, non-director executive officers. The biography for Mr. Srinivasan, our President and Chief Executive Officer, and a director, is provided above.

Name |

Age |

Current Position |

Previous Positions |

William David (“Dave”) Wood III |

45 |

Senior Vice President and Chief Financial Officer since June 2020 |

Vice President – Corporate Strategy & Investor Relations from June 2019 to May 2020. Vice President – Finance from June 2017 to June 2019. Senior Director, Financial Planning & Analysis from June 2016 to June 2017. Director, Financial Planning & Analysis from August 2013 to June 2016. |

Kyle Badger |

55 |

Senior Vice President, General Counsel and Secretary since October 2011 |

Executive Vice President, General Counsel and Secretary at Richardson Electronics, Ltd. from July 2007 until October 2011. |

Prakash Bhat |

60 |

Senior Vice President and Managing Director, India, since May 2023 |

Vice President and Managing Director, India, from March 2017 to May 2023. Vice President, India Operations, at Radial Omnichannel Technologies India from November 2015 until March 2017. |

Don DeMarinis |

59 |

Senior Vice President, Sales - Americas & EMEA, since January 2021 |

Senior Vice President Sales, Americas from January 2018 to December 2020. Chief Commercial Officer, Global, at QikServe Limited, from April 2017 until January 2018. Executive Vice President/Chief Revenue Officer, Gusto, from June 2016 until April 2017. Vice President, Sports, Leisure & Entertainment Business Unit, Oracle/MICROS, January 2011 until June 2016. |

Jeba Kingsley |

50 |

Senior Vice President, Professional Services since May 2023 |

Vice President, Professional Services from December 2018 to May 2023. Vice President, Global Services, at Scientific Games, from November 2014 until November 2017. |

Rohith Kori |

43 |

Senior Vice President, Corporate and Product Strategy, since May 2023 |

Vice President, Corporate and Product Strategy, from June 2020 to May 2023. Senior Director, Corporate and Product Strategy from May 2019 to May 2020. Senior Director Client Services from May 2017 to May 2019. |

Sridhar Laveti |

55 |

Senior Vice President of Established, Emerging Products and Customer support since June 2020

|

Vice President, Business Transformation from May 2017 until September 2017. Senior Vice President, Gaming Systems, at Bally Technologies from December 2014 until September 2017. |

15

Name |

Age |

Current Position |

Previous Positions |

Terrie O’Hanlon |

61 |

Senior Vice President, Chief Marketing Officer, since May 2023 |

Vice President, Chief Marketing Officer, from March 2022 to May 2023. Chief Marketing Officer at GreyOrange from March 2019 until March 2022. Chief Marketing Officer at DefenseStorm from September 2017 until March 2019. |

Chris Robertson |

52 |

Vice President, Corporate Controller and Treasurer, since June 2019 |

Corporate Controller and Treasurer from June 2017 until June 2019. Corporate Controller from February 2017 until June 2017. Managing Director at Grant Thornton LLP from 2010 until January 2017. |

Frank Pitsikalis |

55 |

Senior Vice President, Strategy, since May 2023 |

Vice President, Strategy, from January 2022 to May 2023. Founder and Chief Executive Officer at ResortSuite from September 2000 until January 2022. |

Sethuram Shivashankar |

53 |

Senior Vice President, Chief Technology Officer and Chief Information Officer, since July 2023 |

Senior Vice President, Chief Information Officer from March 2022 until July 2023. Senior Vice President, Gaming Systems at Scientific Games from October 2018 until April 2021. Senior Vice President, Technology at Scientific Games from October 2017 until October 2018. |

16

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (the “CD&A”) describes our executive compensation philosophy and programs for our Named Executive Officers during fiscal year 2023, being the year beginning April 1, 2022, and continuing through March 31, 2023. Compensation arrangements with our Named Executive Officers are governed by the Compensation Committee of our board of directors.

Our Named Executive Officers in fiscal year 2023 consisted of our Chief Executive Officer (CEO), our Chief Financial Officer (CFO), and our three other most highly compensated officers during fiscal year 2023, as listed below:

Mr. Biswas retired from the Company on June 30, 2023, in fiscal year 2024.

Compensation Focus for Fiscal Year 2023

In determining compensation for our Named Executive Officers in fiscal year 2023, the Committee was primarily focused on:

The compensation arrangements with our Named Executive Officers for fiscal year 2023 were similar to the compensation arrangements for Named Executive Officers in prior years. Our CEO’s compensation includes base salary and an annual incentive based on company financial performance that is settled in shares of common stock. The compensation for our other Named Executive Officers includes base salary, annual cash incentives based on company financial performance, and long-term equity incentives.

After considering the results of our recent votes on Named Executive Officer compensation, which confirmed the Company’s general philosophy and objectives relative to our executive compensation program, the Compensation Committee continued to link executive pay to performance and maintained annual incentive opportunities for the Named Executive Officers at the same level as fiscal year 2022. Annual incentive performance targets for fiscal year 2023 were focused on improvements over fiscal year 2022 results. The annual incentive for our CEO, while based on the same company financial measures as the annual incentives for the other Named Executive Officers, was settled in shares of common stock to further align the CEO with stockholder interests and to emphasize long term value creation.

Long-term equity incentives for the Named Executive Officer other than the CEO fiscal year 2023 consisted of grants of shares of restricted stock that vest over three years.

During the fourth quarter of fiscal year 2023 we entered into an amended and restated employment agreement with Mr. Srinivasan, our CEO. As with prior employment agreements with Mr. Srinivasan, the amended employment agreement has a three-year initial term and included a long-term equity grant, a significant portion of which is conditioned on the Company’s stock price performance to align the CEO with stockholder interests and to emphasize stockholder value creation over the three-year term.

Compensation Philosophy, Objectives, and Structure

Our Compensation Committee adopted its pay philosophy, objectives, and structure for Named Executive Officers to achieve financial and business goals and create long-term stockholder value.

Compensation Philosophy and Objectives. For fiscal year 2023, our Compensation Committee’s pay philosophy was to emphasize performance-based compensation tied to annual goals in the form of annual cash incentives and long-term performance-based

17

compensation in the form of long-term equity incentives. The Compensation Committee’s objective was to establish an overall compensation package to:

Compensation Structure. Our compensation structure is comprised of:

Base Salary — Base salary provides fixed pay levels aimed to attract and retain executive talent. Variations in salary levels among Named Executive Officers are based on each executive’s roles and responsibilities, experience, functional expertise, relation to benchmark pay levels, individual performance, and changes in salaries in the overall general market and for all employees of the Company. Salaries are reviewed annually by our Compensation Committee, and changes in salary are based on these factors and input from our CEO, other than for himself. None of the factors are weighted according to any specific formula. Salaries for new executive officers are generally based on the Compensation Committee’s discretion and judgment but may be based on any of the above-mentioned relevant factors.

Annual Incentives — Annual incentives provide variable pay for achievement of the Company’s financial goals, with target incentives set as a percentage of salary, and are designed to reward achievement of goals with an annual cash payment. At the end of each fiscal year, the Compensation Committee considers the aggregate compensation of each Named Executive Officer and may adjust the annual incentive payment otherwise earned if the aggregate compensation is deemed deficient or excessive in the opinion and discretion of the Compensation Committee. Annual incentives are paid in cash except for our CEO, and his annual incentives are settled in shares of common stock.

Long-Term Incentives — Long-term incentives are variable, equity incentives designed to drive improvements in performance that build wealth and create long-term stockholder value by tying the value of earned incentives to the long-term performance of our common shares. For Named Executive Officers other than the CEO, target long-term incentives are also set as a percentage of salary.

Compensation Key Considerations

Annual Goal Setting. Annual goals for our Named Executive Officers may be tied to our financial, strategic, and operational goals and may include business specific financial targets relating to our goals. For fiscal year 2023, the Compensation Committee linked annual incentive goals to financial targets emphasizing both growth and profitability. Annual incentives were based on revenue growth, but payment was conditioned upon the achievement of a minimum adjusted EBITDA as a percentage of revenue.

Variable Pay at Risk. Our compensation philosophy drives the provision of greater at-risk pay to our Named Executive Officers, and variable pay at risk comprised between 52% and 66% of target annual compensation for the Named Executive Officers other than Mr. Srinivasan and 91% of fiscal year 2023 compensation at target for Mr. Srinivasan. Our Named Executive Officers have significant opportunities for long-term, equity-based incentive compensation, as our philosophy is to tie a significant portion of compensation to the long-term performance of our common shares. Thus, significant emphasis is placed on long-term stockholder value creation, thereby we believe minimizing excessive risk taking by our executives.

Compensation Consultants and Competitive Market Assessments. The Compensation Committee engaged FW Cook as a compensation consultant to provide competitive analysis regarding CEO employment contracts and advice regarding a CEO equity award, and carefully considered such analysis and advice, along with other factors, in connection with negotiating Mr. Srinivasan’s amended employment agreement in the fourth quarter of fiscal year 2023. Following such review and consideration, the Committee and Mr. Srinivasan agreed to maintain his base salary and annual target incentive at the levels agreed to in his prior employment agreement, which was effective for fiscal years 2020 to 2023. The Committee also granted him a long-term equity incentive consisting of restricted stock units (“RSUs”), as further described below under Fiscal Year 2023 Compensation – Long-Term Incentives. The Compensation Committee did not engage FW Cook or any other compensation consultant for any other matters related to setting compensation for fiscal year 2023.

18

Fiscal Year 2023 Compensation

Base Salary.

For fiscal year 2023, base salary comprised between 34% and 48% of total target compensation for the Named Executive Officers other than Mr. Srinivasan. Excluding the long-term equity grant made to him in connection with his amended employment agreement, Mr. Srinivasan’s base salary comprised 50% of his total target compensation for fiscal year 2023. Base salaries for the Named Executive Officers did not change from fiscal year 2022. The Compensation Committee and Mr. Srinivasan, with respect to the Named Executive Officers other than himself, believed that the base salaries of the Named Executive Officers remained aligned with the Committee’s philosophies and goals. Mr. Srinivasan’s base salary has remained unchanged since he joined the Company in fiscal year 2017, except for fiscal year 2021 when Mr. Srinivasan voluntarily agreed to accept no base salary for the first nine months of the fiscal year.

Annual Incentives.

Annual Incentive Targets. The Compensation Committee set fiscal year 2023 annual incentive goals at the beginning of the fiscal year. As previously discussed, the Committee linked the annual incentive goals of the Named Executive Officers to revenue and Adjusted EBITDA. All the Named Executive Officers were subject to the same annual incentive structure:

Component |

Weighting (%) |

Threshold |

Target |

Maximum |

|||

Amount |

Payout (% of target incentive) |

Amount |

Payout (% of target incentive) |

Amount |

Payout (% of target incentive) |

||

Revenue |

100 |

$180M |

50 |

$195M |

100 |

$210M |

150 |

Achievement would be scaled between the threshold level and the target level and between the target level and the maximum level. Payouts were capped at 150% of target incentives. If the Adjusted EBITDA condition was not achieved, then the annual incentives would not be earned.

For fiscal year 2023, the Committee continued to believe that revenue growth was most accretive to stockholder value. The Committee imposed the Adjusted EBITDA condition in order to encourage disciplined management of Company expenses and profitable growth.

The annual revenue target represented at 20% increase over fiscal year 2022 revenue, which the Compensation Committee believed involved performance that was reasonably difficult.

Annual Incentive Results. Total revenue increased $35.5 million, or 21.9%, in fiscal 2023 compared to fiscal 2022 to a record $198.1 million, compared to $162.6 in fiscal year 2022 and $137.2 million in fiscal year 2021. Total Adjusted EBITDA increased $3 million, or 11%, in fiscal year 2023 compared to fiscal year 2022 to $30.3 million compared to $27.3 million in fiscal year 2022. As a result, Adjusted EBITDA was 15.3% of revenue in fiscal year 2023 compared to 16.8% of revenue in fiscal year 2022. Although the attained revenue was above the $195 million target and well above the $180 million threshold level for annual incentive achievement, Adjusted EBITDA as a percentage of revenue failed to meet the 15.5% threshold for annual incentive payments.

Notwithstanding the failure to achieve the threshold Adjusted EBITDA percentage, the Committee believed the Company had exceeded expectations with respect to growing revenue and had achieved an acceptable level of Adjusted EBITDA since the Company had a compelling need to make additional cost investments in fiscal year 2023 to address future revenue growth opportunities. Accordingly, the Committee used its discretion to certify 60% achievement of annual incentive targets, which was the amount the Committee believed was both reasonable and would not significantly impact the Company’s profitability goals.

Component |

Result |

Target |

Revenue |

$198.1M |

$195.0M |

Adjusted EBITDA |

15.3% |

15.5% |

19

CEO Annual Incentive. Mr. Srinivasan was eligible for an annual incentive for fiscal year 2023 based on the Company financial performance metrics described above, with any such earned incentive to be settled in shares of common stock. Pursuant to both his prior employment agreement and his amended employment agreement, Mr. Srinivasan’s target annual incentive for fiscal year 2023 was set at 100% of his base salary, or $600,000, with a maximum potential incentive of $900,000 (150% of his base salary), payable upon achievement of 150% of the annual incentive goals, and a threshold potential incentive of $300,000 (50% of his target annual incentive), payable upon achievement of 50% of the annual incentive goals.

Based on the fiscal year 2023 results discussed above, Mr. Srinivasan was awarded 60%, or $360,000, of his annual incentive target. Accordingly, the Compensation Committee granted Mr. Srinivasan 5,168 shares of common stock, being the number of shares having an approximate value of $360,000 based on the closing price of the Company’s common stock on May 24, 2023, the date that the Committee made its determination.

Annual Incentives for the Other Named Executive Officers. Fiscal year 2023 target annual incentives for the other Named Executive Officers other than Mr. DeMarinis, were set as 50% of the executive’s base salary. Mr. DeMarinis’ annual incentive was set as 60% of his base salary, and he was also eligible for annual sales-related incentives of $150,000 at target due to his role as head of our Americas and EMEA Sales teams.

Annual incentives comprised 21% to 41% of total fiscal year 2023 target compensation for these Named Executive Officers.

Officer |

Target Annual Incentive as % of Base Salary |

Target Annual Incentives ($) |

Target Annual Incentive as % of FY23 Total Target Compensation |

Dave Wood |

50% |

137,500 |

21% |

Kyle Badger |

50% |

140,000 |

23% |

Prabuddha Biswas |

50% |

135,000 |

24% |

Don DeMarinis |

120% |

300,000 |

41% |

Additional detail about target and maximum incentives are disclosed in the Grants of Plan-Based Awards for Fiscal Year 2023 table below.

Based on the fiscal year 2023 results discussed above, each of the Named Executive Officers were awarded 60% of their target annual incentives subject to the annual incentive plan described above. Mr. DeMarinis earned an additional $136,176 of his target $150,000 sales incentives (90.7%) based on the net gross profit of eligible sales.

Officer |

Annual Incentive Plan Target ($) |

Achievement (%) |

Annual Incentive Plan Payout ($) |

Annual Sales Incentive Payout ($) |

Total Annual Incentives Payouts ($) |

Dave Wood |

137,500 |

60% |