UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

Commission File Number: 1-14795

AMERICAN SAFETY INSURANCE HOLDINGS, LTD.

(Exact name of registrant as specified in its charter)

| Bermuda | Not Applicable | |

| (State of or other jurisdiction incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 31 Queen Street 2nd Floor Hamilton, Bermuda |

HM 11 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number: (441) 296-8560

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 par value | New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of registrant’s voting common stock held by non-affiliates based upon the closing sales price as reported by the New York Stock Exchange as of June 30, 2012, was $169,554,394.

The number of shares of registrant’s common stock outstanding on March 1, 2013, was 9,894,885.

Documents Incorporated by Reference

None.

[The Remainder of this Page Intentionally Left Blank]

ii

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment’) to the Annual Report on Form 10-K of American Safety Insurance Holdings, Ltd. (the “Registrant” or the “Company’) for the year ended December 31, 2012 filed on March 15, 2013 (the “Original Filing”) is being filed for the purpose of including the performance graph required by Part II, Item 5 and the information required by Part III of Form 10-K that previously had been incorporated by reference.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issurer Purchases of Equity Securities.

Performance Graph

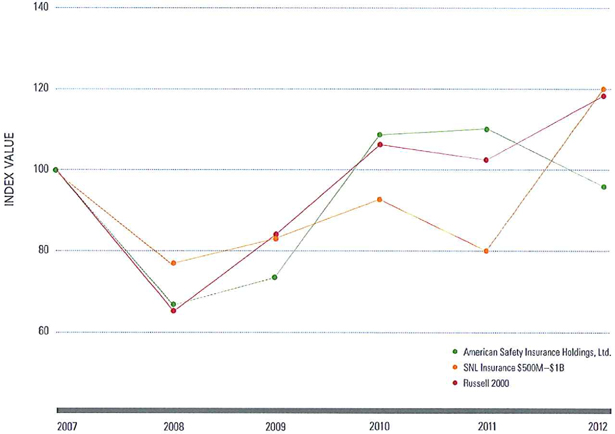

TOTAL RETURN PERFORMANCE

| YEAR ENDED DECEMBER 31, INDEX |

2007 | 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||||

| American Safety Insurance Holdings, Ltd. |

100.00 | 67.23 | 73.54 | 108.80 | 110.69 | 96.28 | ||||||||||||||||||

| SNL Insurance $500M-$ 1B |

100.00 | 78.22 | 83.25 | 92.29 | 80.66 | 120.67 | ||||||||||||||||||

| Russell 2000 |

100.00 | 66.21 | 84.20 | 106.82 | 102.36 | 119.09 | ||||||||||||||||||

The performance graph above compares the total shareholder return on the Company’s common shares with the Russell 2000 index and a peer group index of $500 million - $1 billion asset-sized insurance companies, assuming an investment of $100 on December 31, 2007. The comparison in the performance graph is based on historical data and is not intended to forecast the future performance of the Company’s common shares.

© 2013 SNL Financial LC, Charlottesville, VA

1

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance. |

DIRECTORS

Class I Directors

David V. Brueggen, age 66, has served as a Director of the Company since 1986 and as Chairman of the Board of Directors since 2004. Prior to his retirement in December 2008, Mr. Brueggen was Senior Vice President of finance of Anson Industries, Inc., in Melrose Park, Illinois, which is engaged in drywall, acoustical and foam insulation contracting. Mr. Brueggen was employed by Anson Industries, Inc. since 1982. Previously, he was with an international public accounting firm for 10 years.

Stephen R. Crim, age 49, has served as a Director of the Company since 2002. Mr. Crim became President and Chief Executive Officer of the Company in 2003 and became President of the Company’s insurance and reinsurance operations in 2002. Prior to becoming President and Chief Executive Officer, Mr. Crim was responsible for all of the Company’s underwriting functions since joining the Company in 1990. Previously, Mr. Crim was employed in the underwriting departments of Aetna Casualty and Surety Co. and The Hartford Insurance Co. between 1986 and 1990.

Lawrence I. Geneen, age 69, has served as a Director of the Company since 2003. He is President and Owner of an insurance risk management and strategic consulting firm in Scarsdale, New York. From 1999 to 2001, he was Executive Vice President and Chief Operating Officer of the American Management Association in New York, New York, which is engaged in management training and publishing. From 1997 to 1999, Mr. Geneen was a Managing Director of Marsh & McLennan, Inc. in New York, where he was responsible for global sales and client management leadership in its insurance brokerage business. From 1992 to 1997 he was a Managing Principal and Shareholder of Johnson and Higgins, and from 1974 to 1992 he was employed in a number of executive sales positions and management positions in its insurance brokerage business. Mr. Geneen also currently serves on the Board of Hartville Industries, a privately held pet insurance company.

Class II Directors

Cody W. Birdwell, age 60, has served as a Director of the Company since 1986. Mr. Birdwell has been President of Houston Sunbelt Communities, L.C. in Houston, Texas which is engaged in subdivision and mobile home community development and sales, since 1993.

Steven L. Groot, age 63, has served as a Director of the Company since 2006. Prior to his retirement in 2002, Mr. Groot served in various positions at Allstate Insurance Company in Northbrook, Illinois from 1970 to 2002, most recently as President of Direct Distribution and e-Commerce and as a member of Allstate’s Board of Directors.

Class III Directors

Harris R. Chorney, age 61, has served as a Director of the Company since January 2009. Mr. Chorney is the Founding Principal of Holder & Wilcox, LLC, a retained executive search firm focusing on the human capital needs of the insurance industry that was founded in 2001. From 2000 to 2001, Mr. Chorney served as a Managing Director at KPMG Consulting, and from 1983 to 2000 was an Assurance Partner at KPMG LLP, serving as Partner-in-Charge of KPMG’s U.S. insurance practice. Mr. Chorney was also a member of KPMG’s International Insurance and U.S. Financial Services Leadership Committees from 1993 to 2000.

2

Thomas W. Mueller, age 58, has served as a Director of the Company since 1986. Mr. Mueller has been Vice President of Cardinal Industrial Insulation Co., Inc. in Louisville, Kentucky, which is engaged in industrial insulation and asbestos and sound abatement, since 1975

EXECUTIVE OFFICERS

The following summarizes the business experience over the last five years of the Company’s Executive Officers, other than Mr. Crim, whose business experience is described above under ‘DIRECTORS.’

Joseph D. Scollo, Jr., age 49, has served as Executive Vice President and Chief Operating Officer of the Company since January 2006. Mr. Scollo served as Executive Vice President of the Company since January 2003 and as Senior Vice President—Operations from 1998 until January 2003. Previously, Mr. Scollo served as Senior Vice President—Operations of United Coastal Insurance Company in New Britain, Connecticut from 1989 until 1998. Mr. Scollo has over 24 years of experience in the insurance industry.

Mark W. Haushill, age 51, has served as Chief Financial Officer and Treasurer since September 2009. Prior to joining ASI, he served as Senior Vice President and Chief Financial Officer at Argo Group International from December 2000 to September 2009. Prior to Argo Group, Mr. Haushill served in the management of the Treasury Operations both at USAA and Titan Holdings, Inc. and in the audit practice at KPMG. Mr. Haushill has over 24 years of experience in property and casualty insurance. Mr. Haushill is a certified public accountant.

Ambuj Jain, age 52, has served as the Company’s Senior Vice President of U.S. Operations since 2008. He oversees underwriting and marketing for the U.S. product lines. Mr. Jain served as Vice President of Planning Operations Support from 2004 to 2008. Prior to joining ASI, he served as a Consultant to the Company’s Board and Executive Management from 1999 to 2004. Mr. Jain holds a Bachelor of Commerce degree from Allahabad University, a Master of Commerce degree from the University of Delhi, an MBA and a Ph.D. from SUNY at Buffalo.

Nicholas J. Pascall, age 40, has served as Chief Underwriting Officer of American Safety Reinsurance Ltd. since August 2008. Previously, Mr. Pascall was the head of casualty underwriting with Catlin Bermuda from 2003 to 2008, a class underwriter with Catlin Underwriting Agencies London from 1999 until 2002, an underwriter with CNA Re Chicago from 1998 to 1999 and an underwriter with CNA Re London from 1992 to 1998. Mr. Pascall has over 20 years of experience in the reinsurance industry.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s Executive Officers and Directors and persons who beneficially own 10% or more of the registered class of the Company’s equity securities to file with the SEC initial reports of ownership and reports of changes in beneficial ownership of common stock and other equity securities of the Company. SEC regulations require that Executive Directors, Officers and persons who beneficially own 10% or more of a registered class of equity securities furnish the Company with copies of all Section 16(a) reports they file. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company, all Directors, Executive Officers and person who beneficially own 10% or more of a registered class of equity securities complied with all Section 16(a) filing requirements during the fiscal year ended December 31, 2012, except that each of the Named Executive Officers (“NEOs”) made one late filing.

3

CORPORATE GOVERNANCE

Audit Committee of the Board of Directors

The Board of Directors has established an audit committee composed of independent directors that reviews the scope of the Company’s audit, pre-approves the services and fees of its independent accounting firm, recommends to the Shareholders the engagement of the independent registered public accounting firm, and reviews such firm’s reports. The audit committee operates pursuant to a written charter, a copy of which is available on our website, www.asih.bm, in the “Committee Charting” subsection, under “Corporate Overview” in the “Investor Relations” section. The current members of the audit committee are Messrs. Brueggen, Chorney (chairman) and Groot. The Board of Directors has determined that each member of the audit committee is financially literate and independent as defined in the listing standards of the New York Stock Exchange. The Board of Directors has also determined that each of Messrs. Brueggen, Chorney and Groot is qualified as an “audit committee financial expert” within the meaning of the SEC regulations, and therefore, meets the requirement under the New York Stock Exchange listing standards that at least one member of the audit committee have accounting or related financial management expertise.

The Company’s independent registered public accounting firm reports directly to the audit committee, which controls its engagement. The audit committee pre-approves the provision of all audit and non-audit related services by the Company’s independent registered public accounting firm and meets with management and the accounting firm at each audit committee meeting in separate executive sessions, if deemed necessary, to review the Company’s financial statements and significant findings based on the auditor’s review processes. The audit committee has also established a procedure for the confidential and anonymous reporting of concerns regarding questionable accounting or auditing matters. The audit committee held five meetings during 2012. The audit committee is responsible for reviewing the financial reports and other financial information provided by the Company to any governmental or other regulatory body and monitoring any public distribution or other uses thereof, reviewing the annual independent audit of the Company’s financial statements, reviewing the Company’s systems of internal accounting and financial controls and reviewing and monitoring the internal audit process and internal audit results. However, the audit committee is not responsible for planning or conducting the audit or for determining whether the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Nor is the audit committee responsible for ensuring that the Company complies with all laws and regulations and its Code of Business Conduct and Ethics.

Code of Business Conduct and Ethics

The Board of Directors has approved a Code of Business Conduct and Ethics in accordance with rules of the SEC and the New York Stock Exchange listing standards applicable to all Directors, Officers and Employees, including the Principal Executive Officers, Principal Financial Officers, Principal and Senior Accounting Officers or Controller, or persons performing similar functions. The Code of Business Conduct and Ethics is intended to provide guidance to Directors and Management to assure compliance with law and promote ethical behavior. The Company’s Code of Business Conduct and Ethics is available on our website, www.asih.bm, in the “Governance Documents” subsection, under “Corporate Overview” in the “Investor Relations” section. Shareholders may request a printed copy of the Code of Business Conduct and Ethics, free of charge, upon written request to the Secretary of the Company, Boyle Building, 2nd Floor, 31 Queen Street, Hamilton, Bermuda HM 11.

4

Corporate Governance Guidelines

The Company is committed to having sound corporate governance practices, and the Board of Directors has adopted Corporate Governance Guidelines that provide a framework for the governance of the Company. The Board of Directors reviews these guidelines periodically and monitors developments in the area of corporate governance. Our Corporate Governance Guidelines are available on our website, www.asih.bm, in the “Governance Documents” subsection, under “Corporate Overview” in the “Investor Relations” section. Shareholders may request a printed copy without charge upon written request to the Secretary of the Company, Boyle Building, 2nd Floor, 31 Queen Street, Hamilton, Bermuda HM 11.

Diversity

The Board firmly believes that it is necessary in order for the Board to function appropriately for each of its members to possess a number of qualities and skills. The Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”) seeks candidates for the Board who have a broad diversity of experience, profession, skill, education and background. The Board believes that the backgrounds and experiences of the members of the Board, considered as a group, should provide a significant composite mix of experience, particularly management experience, knowledge, industry expertise and abilities in order for the Board to best fill its responsibilities. The Nominating Committee also considers the evolving needs of the Board for particular expertise and searches for candidates to fill any current or anticipated future particular expertise or experience needs of the Board. In addition, the Nominating Committee considers areas of judgment, background, stature, potential conflicts of interest, integrity, ethics, and commitment to maximizing shareholder value, as well as focusing on areas of diversity such as gender, race, national origin, education and differences in viewpoints and skills. The Nominating Committee does not have a formal policy with respect to diversity but believes strongly that the Board members must represent diverse points of view. Potential nominees are not discriminated against on the basis of race, gender, national origin, sexual orientation, disability or any other basis proscribed by law. In the context of nomination of members of the Board for re-election, the individual’s performance as a Board member and contributions to the Board are also considered.

Director Qualifications

The Board of Directors is responsible for oversight of the Company’s business, subject to the Board’s fiduciary duties to the Company’s stockholders. This responsibility requires that the Board consist of skilled individuals with varied backgrounds, qualities and experience. The Board believes that there are both basic qualifications for service on the Board that apply to all Directors and special qualifications that need to be represented on the Board but need not be possessed by each of the members. The Board and the Nominating Committee consider the qualifications of members of the Board and nominees for Board positions individually and in light of the composition of the Board and perceived needs of the Company.

In assessing Board members and candidates for the Board, the Nominating Committee considers, among other attributes, the person’s judgment, integrity, experience, background, industry knowledge and ability and commitment to devote the time necessary in order to fulfill his or her Board responsibilities. As noted above in Diversity, the Nominating Committee does not have a specific diversity policy but believes that a variety of points of view is beneficial to the proper functioning of the Board and the satisfaction of its responsibilities. Because the Company is a specialized excess and surplus insurance carrier and reinsurer, the Board believes that it is particularly important that specific industry experience in the insurance, construction and environmental industries be represented on the Board. In addition, both general and industry specific finance and accounting expertise is valuable.

5

Below is a chart that summarizes the specific qualifications of each non-employee member of the Board of Directors, including the nominees for election at the 2013 Annual Meeting of Stockholders. An “X” in the chart indicates that person’s specific qualification or expertise upon which his or her Board service is based. The fact that a particular qualification is not marked does not mean that the person does not have that particular qualification or skill, just that the particular qualification or skill is not the area for which the Board relies on that person.

| Cody W. Birdwell |

David V. Brueggen |

Harris R. Chorney |

Lawrence I. Geneen |

Steven L. Groot* |

Thomas W. Mueller* | |||||||

| High level of industry specific accounting and finance expertise |

X | X | X | |||||||||

| Audit Committee financial expert |

X | X | X | |||||||||

| Extensive knowledge of the insurance industry |

X | X | X | |||||||||

| Extensive environmental construction industry knowledge and experience |

X | X | X | |||||||||

| Broad general business experience |

X | X | X | X | X | X |

| * | Candidate for reelection at 2013 Annual Meeting of Stockholders |

Board Leadership Structure

The Company has separated the roles of Chief Executive Officer and Chairman of the Board in recognition of the distinct differences between the two functions. The Chief Executive Officer is responsible for setting the strategic direction of the Company, acting as the face of the Company to the investment community, and for the day to day leadership and performance of the Company. In contrast, the Chairman of the Board provides guidance to the Chief Executive Officer, sets the agenda for Board meetings and presides over meetings of the Board and the Shareholders. Mr. Brueggen, the Chairman of the Board, is not an employee of the Company and is “independent”, so the Board has not appointed a “lead” or “presiding” Director.

Board’s Role in Risk Oversight

The Board takes an active role, both as a whole and at the committee level, in overseeing management of the Company’s risks. The Board or appropriate committee of the Board receives regular reports from members of senior management on areas of material risk to the Company, including, without limitation, operational, financial, legal and regulatory, strategic, credit, catastrophe, liquidity, investment and reputational risks. The Compensation Committee is responsible for overseeing management of risks associated with the Company’s compensation plans and arrangements. The Audit Committee is responsible for oversight of financial risk management while the Finance Committee oversees management of investment risks. The Nominating and Corporate Governance Committee oversees management of risks related to Director independence, conflicts of interest and corporate governance. The Board as a whole is responsible for oversight of the Company’s enterprise risk management program and, while Committees are primarily responsible for overseeing the management of certain risks, the entire Board is regularly informed about such risk oversight through Committee reports.

6

| Item 11. | Executive Compensation. |

Compensation Discussion and Analysis

Compensation Committee. As described above, in “Corporate Governance,” the Company has a Compensation Committee (the “Committee”) that currently consists of Messrs. Brueggen, Geneen (Chairman) and Mueller. The Committee operates pursuant to a written charter reviewed annually by the Committee and that is available on our website, www.asih.bm. The Board of Directors has determined that the members of the Committee are “non-employee Directors” (within the meaning of Rule 16b-3 of the Securities Exchange Act of 1934, as amended), “outside directors” (within the meaning of Section 162(m) of the Internal Revenue Code) and “independent directors” (within the standards set forth by the New York Stock Exchange). In addition, no Committee member is a current or former employee of the Company or any of its subsidiaries. Generally, the Committee is responsible for reviewing and recommending to the Board of Directors matters regarding Executive compensation. The Committee generally meets quarterly, and on an as-needed basis.

General Philosophy. We compensate our senior management through a combination of base salary, bonus and equity compensation that we design to be competitive and to align our management’s incentives with the long-term interests of our Shareholders. The purpose of our compensation program generally is to develop and implement a fair, consistent and competitive program, which will attract, motivate and retain highly qualified talent. The Committee views the compensation program as a management tool that, through the setting of goals and objectives, encourages management to achieve or exceed the Company’s business objectives. In making compensation decisions, we establish target overall cash compensation and then allocate that compensation between base salary and bonus. We then determine what level, if any, of equity compensation is appropriate. At the senior management level, we design incentive compensation as an aid to retention of key employees and to reward company-wide performance by tying awards to the achievement of goals and objectives that relate to (i) our performance in such areas as growth and return on equity, (ii) individual performance and (iii) business unit performance, as discussed below under “- Annual Cash Bonuses” and “- Equity Compensation.” The compensation for each of our NEOs consists of a base salary, an annual bonus opportunity, restricted stock awards and other benefits and perquisites.

Our management incentive plans are designed to be self-funding and provide participant target incentive awards that increase or decrease based on individual and Company performance results. Incentive compensation will become a larger portion of an Executive’s total direct compensation as he or she assumes significant responsibilities and has a significant impact on the financial or operational success of the Company.

Committee Process. The Committee designs, evaluates and approves our Executive compensation plans, policies and programs. The Committee annually reviews and evaluates the goals and objectives relevant to the compensation of our NEOs and annually evaluates the performance of our Chief Executive Officer in light of those goals and objectives. In addition, the Committee reviews and approves compensation levels and compensation awards for our other NEOs recommended by the Chief Executive Officer, who reviews individual and corporate performance for the other NEOs and makes recommendations to the Committee. These recommendations are generally approved. In all cases, however, the Committee is an active participant in establishing the goals for bonuses.

7

The Committee also administers our equity-based compensation plan, although it has delegated to our Chief Executive Officer the authority to make limited awards to newly-hired Executives and other key employees as necessary or appropriate to attract and retain highly qualified individuals to the Company. The Committee is authorized to retain experts, consultants and other advisors to aid in the discharge of its duties. The Committee reports regularly to the Board of Directors on matters relating to the Committee’s responsibilities, and it is common for all of our non-employee Directors to attend Committee meetings. The Committee follows regulatory and legislative developments and considers corporate governance best practices in performing its duties.

At our 2012 Annual Meeting of Shareholders we asked our shareholders to approve, on a non-binding basis, our Executive compensation as disclosed in the proxy statement for that meeting. The shareholders approved our Executive compensation by a vote of 6,122,116 (98.02%) to 123,381 (1.84%), with 8,100 abstaining. While we were pleased with this vote of confidence, the Committee remains committed to continuous improvement in our compensation system.

Targeted Overall Compensation for 2012. The goal of our compensation programs is to fairly compensate our Executives in a manner to be competitive and to align our Executives’ incentives with the short term operational and financial success of the Company and the long-term interests of our stockholders. Our compensation programs are designed to support management’s goal of hiring, retaining and rewarding qualified Executives who embrace the Company’s mission of providing innovative insurance solutions for specialty risks in underserved markets and who are committed to providing continuing value to our stockholders. All of our compensation programs are strategy-focused, competitive and, where appropriate, may include supplemental and perquisite programs.

Base compensation generally is established at a level competitive with a defined peer group. Total direct compensation will be targeted at up to the 75th percentile when performance goals are achieved. In 2009, the Committee retained Lockton Benefits Group (“Lockton”) to perform certain consulting and advisory services with respect to the Company’s compensation practices. The peer data was prepared by Lockton Companies, LLC and included information with respect to the following companies:

| • American Physicians Capital, Inc. |

• Hallmark Financial Services, Inc. | |

| • American Physicians Service Group, Inc. |

• Meadowbrook Insurance Group, Inc. | |

| • Amerisafe Inc. |

• Mercer Insurance Group, Inc. | |

| • Amtrust Financial Services, Inc. |

• National Interstate Corp. | |

| • Baldwin & Lyons Inc. |

• NYMagic, Inc. | |

| • Donegal Group, Inc. |

• PMA Capital Corp. | |

| • Eastern Insurance Holdings |

• Seabright Insurance Holdings, Inc. | |

| • Employers Holdings |

• Specialty Underwriters Alliance, Inc. | |

| • First Mercury Financial Corp. |

• Tower Group, Inc. | |

| • FPIC Insurance Group, Inc. |

• United America Indemnity, Ltd. | |

8

While the Company is not aware of any company that is identical in structure, size, lines of business and U.S. and Bermuda operations, each of the companies included in the peer group is a small to mid-cap sized specialty insurer or reinsurer that has characteristics that Lockton and the Committee believe qualify them to be appropriate points of comparison. The goal of our compensation program is to fairly compensate our Executives in a manner to be competitive with comparable employers and to align our Executive’s incentives with the short-term operational and financial success of the Company and the long-term interests of the Company and its Shareholders.

Where appropriate, Executives will be selected to participate in the Company’s supplemental or perquisite programs, depending upon comparable data, retention value of the Executive and cost to the Company.

Our Chief Executive Officer, Chief Financial Officer and the three other most highly compensated Executive Officers of the Company who received a combined salary and bonus in excess of $100,000 during 2012 (our “NEOs”) are Stephen R. Crim, our President and Chief Executive Officer, Mark W. Haushill, our Chief Financial Officer, Joseph D. Scollo, Jr., our Executive Vice President and Chief Operating Officer, Ambuj K. Jain, our Senior Vice President, and Nicholas J. Pascall, Vice President and Chief Underwriting Officer of our Bermuda reinsurance subsidiary.

With respect to Stephen R. Crim, our President and Chief Executive Officer, we considered Mr. Crim’s responsibilities and his contributions to the Company’s operating results during his tenure in establishing his targeted overall compensation for 2012. The results of the 2009 advisory work by Lockton Companies, LLC noted above were taken into account in setting compensation levels for 2012. The Committee did not perform a formal survey of those peer or similar company levels, nor did the Committee retain a separate compensation consultant to advise us with respect to compensation levels for 2012. Rather we subjectively assessed the appropriate areas of compensation levels. We followed a similar process when establishing targeted compensation for our other NEOs. The Chief Executive Officer reviews the other NEO’s performance and makes compensation recommendations to the Committee, which are reviewed by the Committee in light of the overall compensation and Company performance.

For 2012, the Company’s bonus plans relative to its NEOs were governed by the 2012 Executive Long-Term Incentive Plan (the “LTIP”). See “2012 Executive Long-Term Incentive Plan,” below. The LTIP includes Messrs. Crim, Scollo, Haushill, Jain, and Pascall. The Company’s bonus plans as they relate to each NEO have both corporate and personal performance goals established on an annual basis. Pursuant to the LTIP, bonuses for NEO’s Crim, Haushill, Scollo and Jain are based 50% on the achievement of the corporate goals and 50% on the achievement of the particular NEO’s personal goals. For Mr. Pascall, the bonus is based 40% on the achievement of the corporate goals and 60% on the achievement of his personal goals. The Board of Directors sets the corporate goals based on the budget. Mr. Crim, the CEO, works directly with the Committee and the other NEOs to formulate and approve applicable group goals and their respective personal goals at the beginning of the year and the Committee formulates and approves Mr. Crim’s personal goals. At the end of the year, Mr. Crim assesses the achievement of the group and personal goals with respect to the other NEOs and the Committee assesses the achievement of these goals with respect to Mr. Crim.

The goals are intended to reflect the attainment of targets that are primarily designed to further the objectives of the Company’s strategic plan, which is updated each year. For 2012, the Board based 100% of the corporate component of the bonus plans on profitability, measured by the achievement of a return on equity target of 7.5% (the “2012 Annual Objective”).

9

Mr. Pascall, who has specific business unit oversight with respect to the Company’s Bermuda operations, focused primarily on achieving the 2012 Annual Objective by pursuing achievement of targeted gross written premium of $64.7 million and a 91.1% combined ratio for the assumed reinsurance division. Mr. Haushill, as CFO, primarily focused on achieving the 2012 Annual Objective through developing and implementing a talent management process for the financial organization and developing a strategy for capital deployment and acquisition. Mr. Jain, as the Company’s Senior Vice President, focused primarily on achieving the 2012 Annual Objective by pursuing achievement of targeted gross written premium of $229.7 million, $(6.03) million of pre-tax earnings excluding investment income and a combined ratio for the U.S. business of 103.4%.

For the year ended December 31, 2012, the Company achieved a return on equity of 1.6%. As the return on equity goal was not achieved for 2012, none of the NEOs received a cash bonus with respect to 2012.

Base Salaries. The base salaries for 2012 for Messrs. Crim, Scollo and Haushill were identical to their respective salaries for 2011 as based on Company performance no raises were granted in 2012. In the case of each of Messrs. Jain and Pascall, base salaries were established by considering his respective performance and contribution to the Company and his respective business responsibilities. These amounts reflect levels that we concluded were appropriate based on our general experience and considering compensation levels at our peer companies. Our base salaries are intended to be competitive with base salaries paid by other similar insurance companies to Executives with similar qualifications, experience and responsibilities, although we do not follow a formal practice in this regard. The Committee periodically discusses salary recommendations with the Chief Executive Officer with regard to other Executive Officers. These salary recommendations generally are based on an evaluation of the individual’s performance in the position held, the Company’s operating results, and the individual’s contribution to the Company’s operating results.

The compensation of our Chief Executive Officer, Stephen R. Crim, Executive Vice President and Chief Operating Officer, Joseph D. Scollo, Jr. and Chief Financial Officer, Mark W. Haushill, are governed in part by employment agreements, the material terms of which are more specifically described below under “—Employment Agreements.” These employment agreements provide for a minimum base salary of $408,233 for Mr. Crim, $345,000 for Mr. Scollo and $335,000 for Mr. Haushill, subject to annual review and adjustment. Compensation, including base salary and bonus opportunity for each of Messrs. Jain and Pascall was based on a determination by the Chief Executive Officer, discussed with and approved by the Committee. The base salaries for Messrs. Crim, Scollo, Haushill, Jain and Pascall in 2012 were $440,000, $410,016, $351,157, $275,316, and $400,000, respectively.

2012 Awards under 2007 Plan. In 2007, the Committee retained Lockton to review the Company’s compensation programs. Based on the results of this review, the Compensation Committee adopted, and shareholders approved, the 2007 Plan. This plan is administered by our Human Resources Department, with input from the Chief Executive Officer and the Committee. In January 2012, the Committee adopted the 2012 Executive Long-Term Incentive Plan (the “LTIP”) covering NEOs Crim, Haushill, Scollo and Jain. The LTIP is implemented through awards under the 2007 Plan.

The LTIP is designed to compensate and retain those Executives and key employees that contribute the most to driving revenue and profitability. Each of our NEO’s is included in the LTIP and is eligible to receive restricted stock grants and annual performance-based cash bonus awards. Restricted stock awards are designed as an aid in retention of personnel and are not directly tied to performance. The annual restricted stock awards under the LTIP vest 25% on each of the first and second anniversaries of the award, with the final 50% vesting on the third anniversary of the award.

10

The targeted incentive payouts for 2012 generally applicable to NEOs are based on meeting established targets, expressed as a percentage of the NEO’s base salary and include a 40% cash bonus for each of NEO Crim, Scollo, Haushill and Jain under the LTIP, and a 35% cash bonus for Mr. Pascall. The LTIP also includes a 40% restricted stock grant for Messrs. Crim and Scollo; a 30% restricted stock grant for Messrs. Haushill and Jain; and a 20% restricted stock grant for Mr. Pascall. The targets are established each year. The Committee reserves the right to modify the bonus payout based on extraordinary circumstances and/or exceptional performance.

The cash bonus portion of the LTIP is designed to reward short term performance, and is distributed based on a combination of achieving annual financial targets and established qualitative goals. For 2012, our financial target was based 100% on profitability, as measured by return on equity. In addition to the financial target, a portion of the bonus is based upon achievement of other personal and qualitative goals established annually. Under the 2012 LTIP, Messrs. Crim, Scollo, Haushill and Jain receive 50% of their cash bonus based on the corporate financial target and 50% of their cash bonus based on meeting certain personal and qualitative goals. Mr. Pascall receives 40% of his cash bonus based on the corporate financial target and 60% of his cash bonus based on meeting certain personal and qualitative goals. For the year ended December 31, 2012, the Company achieved a return on equity of 1.6%. As the return on equity goal was not achieved for 2012, none of the NEOs received a cash bonus with respect to 2012.

Under the LTIP, to reward NEOs for achieving optimal results, leverage ratios apply to the cash bonus amounts for exceeding or missing financial targets. The following leverage ratios apply to the cash bonus portion under the LTIP:

| ROE |

% ACHIEVED OF TARGET | LEVERAGE RATIO | ||||||

| 9.0% |

120 | % | 150 | % | ||||

| 8.5% |

110 | % | 125 | % | ||||

| 7.5% |

100 | % | 100 | % | ||||

| 6.4% |

70 | % | 70 | % | ||||

| 5% or lower |

0 | % | 0 | % | ||||

The following table provides an overview of the total incentive compensation under the 2012 LTIP, consisting of cash bonus and restricted stock awards, which participants may receive depending on the level of achievement of established targets. For example, if 100% of the target is achieved, NEOs Crim and Scollo would receive a cash bonus of 40% of salary and a restricted stock award equal to 40% of salary. Messrs. Haushill and Jain would receive a cash bonus of 40% of salary and a restricted stock award equal to 30% of salary. Mr. Pascall would receive a cash bonus of 35% of salary and a restricted stock award of 20% of salary. As a result, at 100% of target Messrs. Crim and Scollo would receive total incentive compensation under the 2012 LTIP of 80% of salary, Messrs. Haushill and Jain would receive total incentive compensation of 70% of salary and Mr. Pascall would receive total incentive compensation under the 2012 LTIP of 55% of salary.

11

| NEO RECIPIENT |

TARGET BONUS |

BONUS AT 110% OF TARGET |

BONUS AT 120% OF TARGET |

BONUS AT 70% OF TARGET |

||||||||||||

| Crim Scollo |

80 | % | 90 | % | 100.0 | % | 68.0 | % | ||||||||

| Haushill Jain |

70 | % | 80 | % | 90.0 | % | 58.0 | % | ||||||||

| Pascall |

55 | % | 63.75 | % | 72.5 | % | 44.5 | % | ||||||||

Note that the information in the table above represents the total incentive compensation, including cash and restricted stock, and is expressed as a percentage of the NEO’s base salary.

Production Underwriters Long-Term Incentive Plan. The Compensation Committee adopted the Underwriters LTIP in order to more closely tie incentives for production underwriters to the long term profitability of the participating underwriter’s respective product line. The Underwriters LTIP also is implemented through awards under the 2007 Plan. Restricted Stock Awards are designed as an aid in retention of underwriting personnel and are not directly tied to performance. Restricted stock awards vest 25% on each of the first and second anniversaries of the award, with the final 50% vesting on the third anniversary of the award.

Participants in the Underwriters LTIP also are eligible to receive a cash bonus equal to a share of the underwriting profits, as defined in the Underwriters LTIP, of their respective product line. An amount equal to 6% of the 2012 underwriting profits of the applicable product line is placed in a pool. The percentage of the bonus pool that is distributed is determined by meeting certain levels of return on equity levels by the Company, as follows:

| 2012 COMPANY ROE |

% OF POOL DISTRIBUTED | |||

| 7% or higher |

100 | % | ||

| 6.4% |

70 | % | ||

The percentage of the pool to be distributed is adjusted on a pro-rata basis if the return on equity results fall between the indicated levels.

After December 31 and before March 15 of each subsequent calendar year until the end of the vesting period (outlined below), the 2012 underwriting profit will be recalculated based on updated gross ultimate accident year loss and LAE incurred (including IBNR as established by the Company). Any change in the underwriting profit from the updated calculation will adjust the bonus pool and the bonus pool account for each participant. The adjustment to each applicable participant will be in the same ratio as the original distribution.

To the extent that there is a downward adjustment to the business unit bonus pool as a result of lower underwriting profit for that unit, any current or future potential payouts applicable to the original 2012 bonus pool is adjusted to reflect lower underwriting profit offset to the extent of previously overpaid amounts. Concurrently, if the business unit bonus pool is increased as a result of improved underwriting profit, such increased amount will be added to the bonus pool account.

In order to reward performance over the long-term, the payout of the bonus pool account (as adjusted from time to time) is subject to a vesting schedule. Vesting will occur on December 31 of each calendar year starting on December 31, 2012 as set out below. Vested amounts will be paid by March 15 of the subsequent calendar year in which vesting occurs. The vesting period for the payout of the bonus pool is four years, with 50% of the bonus payable in year 1, 20% payable in each of years 2 and 3, with the balance of 10% payable in year 4.

12

Annual Cash Bonuses. For 2012, each NEO was eligible for an annual cash bonus under the LTIP. Cash bonus awards to our NEOs under the 2012 LTIP were based on the achievement of goals and objectives established by the Committee which relate to (i) our profitability measured by return on equity, (ii) individual performance, and (iii) in Mr. Jain’s and Mr. Pascall’s case, group performance. As management responsibility increases, the bonus potential increases and goals and objectives are more heavily weighted toward overall Company performance. The goals and objectives were established by the Committee in January 2012 and consisted of a target for profitability measured by pre-tax income and return on equity. The Committee established goals and objectives for 2013 in January 2013. These goals and objectives for 2013 are similar to those established for 2012, with components for return on equity and pre-tax earnings.

For the year ended December 31, 2012, no NEO received a cash bonus because the goals were not achieved.

Equity Compensation. The Committee believes strongly that equity-based awards are an integral part of total compensation for employees with significant responsibility for our long-term results. As part of our compensation program, in 2012 each NEO was eligible for a restricted stock award pursuant to the LTIP.

All equity awards granted under the LTIP and Underwriters LTIP are issued under the Company’s 2007 Plan approved by our Shareholders in June 2007. The 2007 Plan is intended to further the interests of the Company and its Shareholders by attracting, retaining and motivating officers, employees, consultants and advisors to participate in the long-term development of the Company through stock ownership. The 2007 Plan defines the incentive arrangements for eligible participants and authorizes the granting of incentive stock options, nonqualified options, restricted stock awards and other forms of equity compensation, which may be made subject to the discretion of the Committee and, for annual awards, are generally made in conjunction with the achievement of the goals and objectives detailed in the LTIP and Underwriters LTIP as discussed above. The Committee is authorized to determine the terms and conditions of all option grants, subject to the limitations set forth in the 2007 Plan. In accordance with the terms of the 2007 Plan, for options, the option exercise price per share will not be less than the fair market value of the common shares on the date of grant, the term of any options granted may be no longer than ten years and there may or may not be a vesting period before any recipient may exercise any of those options. The rights of recipients receiving stock options generally vest equally over three years, beginning with the first anniversary date of grant, although options granted may cliff vest on the third anniversary of the grant date. All options expire ten years from the date of grant, unless sooner exercised. However, in some instances, particularly with initial option grants to new key employees, the options vest 100% on the fifth anniversary of the grant date. Generally, the vesting of options issued under the 2007 Plan is accelerated in the event of a change in control of the Company.

With the exception of significant promotions and new hires, we generally make these types of awards at a meeting of the Committee each year following the availability of the financial results for the prior year and prior to March 15. The 2012 grant awards were determined at the Committee’s meeting on March 5, 2013, with a grant date of March 14, 2013. This timing was selected because it enabled the Committee to consider the Company’s prior year performance, the performance of the potential recipients and our expectations for future years. The Committee’s meeting schedule is determined several months in advance, and the proximity of any awards to earnings announcements or other market events is coincidental. During the year ended December 31, 2012, a total of 96,330 shares of restricted stock, valued at $1,779,605 were granted under the 2007 Plan.

13

Pursuant to their employment agreements, each of Messrs. Crim, Scollo and Haushill is eligible to participate in all Company equity plans. Under the LTIP, all NEOs are eligible to receive awards under the 2007 Plan. In 2012 pursuant to the LTIP, Messrs. Crim, Scollo, Haushill, Jain and Pascall were granted Restricted Stock Awards valued at $176,009, $164,003, $105,339, $82,603, $79,994, respectively, under the 2007 Plan. Each of these awards vests 25% on the first anniversary of the award, 25% on the second anniversary of the award and 50% on the third anniversary.

Severance Benefits. We believe that companies should provide reasonable severance benefits to certain of their employees. With respect to senior management, these severance benefits should reflect the fact that it may be difficult for employees to find comparable employment within a short period of time. They should also disentangle the Company from the former employee as soon as possible. We do not have a general severance plan in place but severance benefits for certain of our NEOs are detailed in their respective employment agreements, as detailed in the section entitled “Potential Payments Upon Termination or Change In Control.”

Retirement Plans. The Company offers its employees a “safe harbor 401(k) plan” (the “401(k) Plan”). All employees are eligible to participate in the 401(k) Plan. Participants in the 401(k) Plan may elect to defer up to 92% of their compensation each year in lieu of receiving such amount in cash. However, a participant’s total deferral each year is subject to dollar limitations that are set by law. For 2012 the limit was $17,000. This limit may be increased for cost of living changes. In addition, participants over age 50 may elect to defer additional amounts, referred to as catch-up contributions, of up to $5,500 in 2012. In order to maintain the safe harbor status of the 401(k) Plan, the Company contributes the total amount of each participant’s salary deferrals each Plan Year and makes a safe harbor matching contribution equal to 100% of the participant’s salary deferrals that do not exceed 3% of the participant’s compensation and 50% of the amount between 3% and 5% of the compensation. A participant is always 100% vested in amounts attributable to his or her salary deferrals and in the contributions.

Change in Control. The 2007 Plan generally provides for the immediate vesting of all options in the event of a change in control of the Company. However, the Company has no change in control program in place and none of the current employment agreements with NEOs provide for any separate benefits in connection with a change in control, although severance benefits are enhanced in the event of a termination after or in connection with a change in control, as discussed in the section entitled “Potential Payments Upon Termination or Change In Control.”

Perquisites and Other Benefits. The Committee annually reviews the perquisites that senior management receives. The primary perquisites for senior management are the payment of a monthly car allowance and the payment of annual insurance premiums. Mr. Pascall receives a housing allowance as is typical in the Bermuda market. The Committee believes that these perquisites are modest and appropriate.

Senior management also participates in the Company’s other benefit plans on the same terms as other employees. These plans include medical and dental insurance and life insurance.

The value of perquisites and other benefits received by our NEOs for 2012 are shown in the Summary Compensation Table under the heading of “All Other Compensation.”

Stock Ownership Guidelines. The Company does not have established stock ownership guidelines for any of its Officers. The Company believes that its awards under the LTIP sufficiently align the interests of its Officers with those of its shareholders.

14

Employment Agreements. Stephen R. Crim is employed by the Company as its Chief Executive Officer pursuant to an employment agreement dated August 1, 2007, as amended and restated August 9, 2011 (the “Crim Agreement”). The Crim Agreement provides for an initial term of three years, with automatic one year extensions unless either party gives notice of non-renewal at least 120 days prior to the expiration of the initial or then current renewal term. The Crim Agreement provides for a base salary, which may be increased pursuant to a merit increase at each annual performance evaluation. In addition, Mr. Crim is eligible to receive an annual cash bonus, in an amount to be determined by the Board of Directors, pursuant to the LTIP. Mr. Crim also is eligible to participate in all Company equity plans, including the 2007 Plan. The Crim Agreement provides for a monthly automobile allowance of $1,000, up to $25,000 per year in reimbursement of the premium cost of a universal life insurance policy or other mutually agreeable similar instrument on Mr. Crim’s life and reimbursement of the premium cost of a supplemental long-term disability policy.

Joseph D. Scollo, Jr. is employed by the Company as its Executive Vice President and Chief Operating Officer pursuant to an employment agreement dated August 1, 2007, as amended and restated August 9, 2011 (the “Scollo Agreement”). With the exception of salary levels, the Scollo Agreement is substantially identical to the Crim Agreement.

Mark W. Haushill is employed by the Company as its Chief Financial Officer pursuant to an employment agreement effective as of September 8, 2009, as amended and restated August 9, 2011 (the “Haushill Agreement”). With the exception of salary levels, the Haushill Agreement is substantially identical to the Crim Agreement.

Under their respective employment agreements, each of Messrs. Crim, Scollo and Haushill (the “Executives”) have agreed not to reveal, divulge, or disclose any confidential information and will not use or make use of any confidential information during the employment period plus the longer period of 12 months from termination or the end of each applicable severance period (the “Restricted Period”). Additionally, the Executives have each further agreed not to transmit or disclose any trade secret or make use of any such trade secret for the benefit of himself or for any other person without the prior written consent of the Company at any time throughout the terms of the employment agreements and after termination of the employment agreements. The Executives have also agreed not to solicit or induce any protected employees to terminate their employment relationship with the Company or to enter into employment with any other person during the Restricted Period. Each of the Executives has each agreed not to solicit, divert, take away or attempt to solicit, divert or take away any of the Company’s protected customers with whom they may have had contact on the Company’s behalf during the 12 months immediately preceding the termination without the Company’s prior written consent. The Executives will not seek or obtain a competitive position in the restricted territory with a competitor during the Restricted Period without the prior written consent of the Company.

Each of the respective employment agreements also provides for certain termination provisions for Messrs. Crim, Scollo and Haushill, which are discussed further in the section entitled “Potential Payments Upon Termination or Change In Control.”

15

Executive Compensation

The following table sets forth information regarding the annual compensation paid our NEOs for services rendered to the Company during the years ended December 31, 2010, 2011 and 2012:

SUMMARY COMPENSATION TABLE

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) |

Stock Awards ($)(1) |

Option Awards ($)(2) |

All Other Compensation ($)(3) |

Total ($) |

|||||||||||||||||||||

| Stephen R. Crim |

2012 | 440,000 | — | 175,989 | — | 55,750 | 671,739 | |||||||||||||||||||||

| CEO/President |

2011 | 440,000 | — | 1,301,009 | — | 55,809 | 1,796,818 | |||||||||||||||||||||

| 2010 | 435,000 | 184,800 | 173,795 | — | 55,141 | 848,736 | ||||||||||||||||||||||

| Joseph D. Scollo, Jr. |

2012 | 410,016 | — | 164,000 | — | 52,308 | 626,324 | |||||||||||||||||||||

| COO/Exec. VP |

2011 | 407,516 | — | 1,289,003 | — | 55,384 | 1,751,903 | |||||||||||||||||||||

| 2010 | 397,009 | 168,007 | 158,811 | — | 42,166 | 765,993 | ||||||||||||||||||||||

| Mark W. Haushill |

2012 | 351,157 | — | 105,352 | — | 21,348 | 477,857 | |||||||||||||||||||||

| CFO |

2011 | 348,600 | — | 1,042,839 | — | 22,197 | 1,413,636 | |||||||||||||||||||||

| 2010 | 339,447 | 153,418 | 101,842 | — | 16,880 | 611,587 | ||||||||||||||||||||||

| Ambuj Jain |

2012 | 275,316 | — | 82,603 | — | 11,034 | 368,953 | |||||||||||||||||||||

| Senior VP |

2011 | 272,038 | — | 551,353 | — | 76,688 | 900,079 | |||||||||||||||||||||

| 2010 | 256,655 | 104,882 | 78,664 | — | 9,800 | 450,001 | ||||||||||||||||||||||

| Nicholas J. Pascall(4) |

2012 | 400,000 | — | 80,006 | — | 205,153 | 685,159 | |||||||||||||||||||||

| VP |

2011 | 381,326 | 37,522 | 314,994 | — | 201,246 | 935,088 | |||||||||||||||||||||

| 2010 | 365,068 | 95,093 | — | — | 203,298 | 663,459 | ||||||||||||||||||||||

| (1) | The 2011 awards include special restricted stock awards for Messrs. Crim, Scollo, Haushill, Jain and Pascall valued at $1,125,000, $937,500, $1,125,000, $468,750 and $187,500, respectively, under the 2007 plan. Mr. Pascall received an additional award on August 3, 2011, valued $47,500. |

| (2) | “Option Awards” dollar amount is calculated by using the fair market value of the option on the dates of grant as described in Note 14 to the Consolidated Financial Statements in the Company’s Annual Report to Shareholders as of December 31, 2010, 2011 and 2012 respectively. |

| (3) | “All Other Compensation” includes amounts paid for car allowances, the Company’s contribution to each individual’s 401(k) plan (in the case of Mr. Pascall, his pension plan), amounts expended for annual insurance premiums and other perquisites, amounts for spouses’ air travel, taxes in connection with the Employee Stock Purchase Plan (in case of Mr. Pascall, the employee portion of Bermuda employment taxes and social insurance paid by the Company) and, in the case of Mr. Pascall, a housing allowance. The specific components are shown in the All Other Compensation table. |

| (4) | Mr. Pascall became head of our Bermuda reinsurance operation as of September 30, 2011. |

16

ALL OTHER COMPENSATION TABLE

| Named Executive Officer |

Year | Car Allowance ($) |

401(k) Contributions ($) |

Payments for Annual Insurance Premiums ($) |

Spousal Air Travel ($) |

Housing Allowance ($) |

Misc. ($) |

|||||||||||||||||||||

| Stephen R. Crim |

2012 | 12,000 | 17,600 | 25,000 | 1,129 | — | 21 | |||||||||||||||||||||

| Joseph D. Scollo, Jr. |

2012 | 9,000 | 16,401 | 25,634 | 1,252 | — | 21 | |||||||||||||||||||||

| Mark W. Haushill |

2012 | 6,000 | 14,046 | — | 1,281 | — | 21 | |||||||||||||||||||||

| Ambuj Jain |

2012 | — | 11,013 | — | — | — | 21 | |||||||||||||||||||||

| Nicholas J. Pascall |

2012 | — | 40,000 | (1) | 15,153 | — | 150,000 | — | ||||||||||||||||||||

| (1) | Amount paid by the Company into a pension fund on behalf of Mr. Pascall. |

17

Grants of Plan-Based Awards

The following table sets forth information with respect to the stock options granted to the NEOs during the years ended December 31, 2010, 2011 and 2012:

GRANTS OF PLAN BASED AWARDS

| All | All | |||||||||||||||||||||||||||||||||||||||||||

| Other | Other | Grant | ||||||||||||||||||||||||||||||||||||||||||

| Stock | Option | Date | ||||||||||||||||||||||||||||||||||||||||||

| Awards: | Awards: | Exercise | Fair | |||||||||||||||||||||||||||||||||||||||||

| Number | Number | or | Value of | |||||||||||||||||||||||||||||||||||||||||

| Estimate Future Payouts | Estimated Future Payouts | of | of | Base | Stock | |||||||||||||||||||||||||||||||||||||||

| Under Non-Equity Incentive | Under Equity Incentive | Shares | Securities | Price of | And | |||||||||||||||||||||||||||||||||||||||

| Plan Awards | Plan Awards | of Stock | Underlying | Option | Option | |||||||||||||||||||||||||||||||||||||||

| Grant | Threshold | Target | Maximum | Threshold | Target | Maximum | or Units | Options | Awards | Awards | ||||||||||||||||||||||||||||||||||

| Name |

Date | ($) | ($) | ($) | (#) | (#) | (#) | (#) | (#) | ($/Sh) | ($) | |||||||||||||||||||||||||||||||||

| Stephen R. Crim |

3/5/2010 | 86,999 | 173,999 | 260,999 | 4,021 | 8,042 | 16,083 | 35,738 | 16,083 | 14.64 | 9.14 | |||||||||||||||||||||||||||||||||

| 3/14/2011 | — | — | — | — | — | — | 8,908 | — | 19.51 | — | ||||||||||||||||||||||||||||||||||

| 7/29/2011 | — | — | — | — | — | — | 60,000 | — | 18.75 | — | ||||||||||||||||||||||||||||||||||

| 3/14/2012 | — | — | — | — | — | — | 9,514 | — | 18.50 | — | ||||||||||||||||||||||||||||||||||

| Joseph D. Scollo, Jr. |

3/5/2010 | 79,401 | 158,803 | 238,205 | 3,714 | 7,428 | 14,857 | 23,975 | 14,857 | 14.64 | 9.14 | |||||||||||||||||||||||||||||||||

| 3/14/2011 | — | — | — | — | — | — | 8,140 | — | 19.51 | — | ||||||||||||||||||||||||||||||||||

| 7/29/2011 | — | — | — | — | — | — | 60,000 | — | 18.75 | — | ||||||||||||||||||||||||||||||||||

| 3/14/2012 | — | — | — | — | — | — | 8,865 | — | 18.50 | — | ||||||||||||||||||||||||||||||||||

| Mark W. Haushill |

3/5/2010 | 67,889 | 135,778 | 203,668 | 762 | 1,525 | 3,051 | 7,394 | 3,051 | 14.64 | 9.14 | |||||||||||||||||||||||||||||||||

| 3/14/2011 | — | — | — | — | — | — | 5,220 | — | 19.51 | — | ||||||||||||||||||||||||||||||||||

| 7/29/2011 | — | — | — | — | — | — | 50,000 | — | 18.75 | — | ||||||||||||||||||||||||||||||||||

| 3/14/2012 | — | — | — | — | — | — | 5,694 | — | 18.50 | — | ||||||||||||||||||||||||||||||||||

| Ambuj Jain |

3/5/2010 | — | — | — | — | — | — | 8,709 | 6,565 | 14.64 | 9.14 | |||||||||||||||||||||||||||||||||

| 3/14/2011 | — | — | — | — | — | — | 4,032 | — | 19.51 | — | ||||||||||||||||||||||||||||||||||

| 7/29/2011 | — | — | — | — | — | — | 25,000 | — | 18.75 | — | ||||||||||||||||||||||||||||||||||

| 3/14/2012 | — | — | — | — | — | — | 4,465 | — | 18.50 | — | ||||||||||||||||||||||||||||||||||

| Nicholas J. Pascall |

3/5/2010 | — | — | — | — | — | — | 3,658 | 9,766 | 14.64 | 9.14 | |||||||||||||||||||||||||||||||||

| 7/29/2011 | — | — | — | — | — | — | 10,000 | — | 18.75 | — | ||||||||||||||||||||||||||||||||||

| 8/3/2011 | — | — | — | — | — | — | 2,500 | — | 19.00 | — | ||||||||||||||||||||||||||||||||||

| 3/14/2012 | — | — | — | — | — | — | 4,324 | — | 18.50 | — | ||||||||||||||||||||||||||||||||||

18

Outstanding Equity Awards at Fiscal Year End

The following table sets forth the outstanding option and stock awards held by the NEOs as of December 31, 2012:

| Option Awards | Stock Awards | |||||||||||||||||||||||||||

| Equity | ||||||||||||||||||||||||||||

| Incentive | ||||||||||||||||||||||||||||

| Plan | ||||||||||||||||||||||||||||

| Awards: | Market | |||||||||||||||||||||||||||

| Number | Number | Number | Number | Value Of | ||||||||||||||||||||||||

| Of | Of | Of | Of Shares | Shares Or | ||||||||||||||||||||||||

| Securities | Securities | Securities | Or Units | Units Of | ||||||||||||||||||||||||

| Underlying | Underlying | Underlying | Of Stock | Stock | ||||||||||||||||||||||||

| Unexercised | Unexercised | Unexercised | That Have | That Have | ||||||||||||||||||||||||

| Options | Options | Unearned | Option | Option | Not | Not | ||||||||||||||||||||||

| (#) | (#) | Options | Exercise | Expiration | Vested | Vested | ||||||||||||||||||||||

| Name |

Exercisable | Unexercisable | (#) | Price | Date | (#) | ($)(3) | |||||||||||||||||||||

| Stephen R. Crim |

12,000 | — | — | 6.75 | 1/30/2013 | — | — | |||||||||||||||||||||

| CEO/President |

95,000 | — | — | 8.57 | 6/19/2013 | — | — | |||||||||||||||||||||

| 18,000 | — | — | 13.67 | 1/21/2014 | — | — | ||||||||||||||||||||||

| 10,000 | — | — | 16.40 | 3/15/2016 | — | — | ||||||||||||||||||||||

| 10,000 | — | — | 19.05 | 3/15/2017 | — | — | ||||||||||||||||||||||

| 10,000 | — | — | 17.95 | 3/4/2018 | — | — | ||||||||||||||||||||||

| 8,455 | — | — | 17.95 | 3/4/2018 | — | — | ||||||||||||||||||||||

| 26,439 | — | — | 9.10 | 3/11/2019 | — | — | ||||||||||||||||||||||

| 10,722 | 5,361 | (1) | — | 14.64 | 3/5/2020 | 32,869 | 621,881 | |||||||||||||||||||||

| — | — | — | — | 3/14/2021 | 6,681 | 126,405 | ||||||||||||||||||||||

| — | — | — | — | 7/29/2021 | 60,000 | 1,135,200 | ||||||||||||||||||||||

| — | — | — | — | 3/14/2022 | 9,514 | 180,005 | ||||||||||||||||||||||

| Joseph D. Scollo, Jr. |

50,000 | — | — | 8.57 | 6/19/2013 | — | — | |||||||||||||||||||||

| COO/Executive VP |

12,000 | — | — | 13.67 | 1/21/2014 | — | — | |||||||||||||||||||||

| 7,500 | — | — | 16.40 | 3/15/2016 | — | — | ||||||||||||||||||||||

| 7,500 | — | — | 19.05 | 3/15/2017 | — | — | ||||||||||||||||||||||

| 7,500 | — | — | 17.95 | 3/4/2018 | — | — | ||||||||||||||||||||||

| 6,946 | — | — | 17.95 | 3/4/2018 | — | — | ||||||||||||||||||||||

| 23,712 | — | — | 9.10 | 3/11/2019 | — | — | ||||||||||||||||||||||

| 9,905 | 4,952 | (1) | — | 14.64 | 3/5/2020 | 21,988 | 416,013 | |||||||||||||||||||||

| — | — | — | — | 3/14/2021 | 6,105 | 115,507 | ||||||||||||||||||||||

| — | — | — | — | 7/29/2021 | 60,000 | 1,135,200 | ||||||||||||||||||||||

| — | — | — | — | 3/14/2022 | 8,865 | 167,726 | ||||||||||||||||||||||

| Mark W. Haushill |

— | 20,000 | (2) | — | 16.07 | 9/8/2019 | — | — | ||||||||||||||||||||

| CFO |

2,034 | 1,017 | (1) | — | 14.64 | 3/5/2020 | 6,822 | 129,072 | ||||||||||||||||||||

| — | — | — | — | 3/14/2021 | 3,915 | 74,072 | ||||||||||||||||||||||

| — | — | — | — | 7/29/2021 | 50,000 | 946,000 | ||||||||||||||||||||||

| — | — | — | — | 3/14/2022 | 5,694 | 107,730 | ||||||||||||||||||||||

| Ambuj Jain |

10,000 | — | — | 13.77 | 7/14/2014 | — | — | |||||||||||||||||||||

| Senior VP |

4,000 | — | — | 16.40 | 3/15/2016 | — | — | |||||||||||||||||||||

| 4,000 | — | — | 19.05 | 3/4/2018 | — | — | ||||||||||||||||||||||

| 4,000 | — | — | 17.95 | 3/4/2018 | — | — | ||||||||||||||||||||||

| 10,342 | — | — | 9.10 | 3/11/2019 | — | — | ||||||||||||||||||||||

| 4,377 | 2,188 | (1) | — | 14.64 | 3/5/2020 | 7,480 | 141,522 | |||||||||||||||||||||

| — | — | — | — | 3/14/2021 | 3,024 | 57,214 | ||||||||||||||||||||||

| — | — | — | — | 7/29/2021 | 25,000 | 473,000 | ||||||||||||||||||||||

| — | — | — | — | 3/14/2022 | 4,465 | 84,478 | ||||||||||||||||||||||

| Nicholas J. Pascall(4) |

4,196 | — | — | 9.10 | 3/11/2019 | — | — | |||||||||||||||||||||

| Vice President |

6,511 | 3,255 | (1) | — | 14.64 | 3/5/2020 | 1,829 | 34,605 | ||||||||||||||||||||

| — | — | — | — | 8/3/2021 | 10,000 | 189,200 | ||||||||||||||||||||||

| — | — | — | — | 7/29/2021 | 1,875 | 35,475 | ||||||||||||||||||||||

| — | — | — | — | 3/14/2022 | 4,324 | 81,810 | ||||||||||||||||||||||

| (1) | The options have a three-year vesting schedule, pursuant to which the shares underlying the options shall vest in one-third increments on each of the first three anniversaries from the date of grant. |

| (2) | The options cliff vest on the fifth anniversary from the date of grant. |

| (3) | Closing price on December 31, 2012, was $18.92. |

| (4) | Mr. Pascall became head of our Bermuda reinsurance operation on September 30, 2011. |

19

Option Exercises and Stock Vested

The following table sets forth the options exercised and stock vested by the NEOs during the year ended December 31, 2012:

OPTION EXERCISES AND STOCK VESTED

| OPTION AWARDS | STOCK AWARDS | |||||||||||||||

| Name |

Number of Shares Acquired on Exercise (#) |

Value Realized on Exercise ($) |

Number of Shares Acquired on Vesting (#) |

Value Realized on Vesting ($) |

||||||||||||

| Stephen R. Crim |

— | — | 1,435 | $ | 26,935 | |||||||||||

| CEO/President |

— | — | 4,616 | $ | 84,334 | |||||||||||

| — | — | 2,227 | $ | 41,200 | ||||||||||||

| Joseph D. Scollo, Jr. |

11,000 | $ | 129,855 | 994 | $ | 18,657 | ||||||||||

| COO/Exec. VP |

— | — | 3,105 | $ | 56,728 | |||||||||||

| — | — | 2,035 | $ | 37,648 | ||||||||||||

| Mark W. Haushill |

— | — | 286 | $ | 5,368 | |||||||||||

| CFO |

— | — | 1,305 | $ | 24,143 | |||||||||||

| Ambuj Jain |

— | — | 615 | $ | 11,544 | |||||||||||

| Senior VP |

— | — | 1,896 | $ | 34,640 | |||||||||||

| — | — | 1,008 | $ | 18,648 | ||||||||||||

| Nicholas J. Pascall(1) |

— | — | 915 | $ | 17,175 | |||||||||||

| VP |

— | — | 1,923 | $ | 35,133 | |||||||||||

| — | — | 625 | $ | 10,844 | ||||||||||||

| (1) | Mr. Pascall became head of our Bermuda reinsurance operation on September 30, 2011. |

20

Pension Benefits

The Company does not have or provide any supplemental Executive retirement plan or similar plan that provides for specified retirement payments or benefits with the exception of Mr. Pascall.

The Company makes an annual contribution to Mr. Pascall pension equal to 10% of his annual salary.

Nonqualified Deferred Compensation

The Company does not have or provide any defined contribution or other plan that provides for the deferral of compensation on a basis that is not tax-qualified.

Potential Payments Upon Termination or Change In Control

Because of their employment agreements, Messrs. Crim, Scollo and Haushill are eligible for certain benefits in the event of termination of their employment as more specifically discussed below. Each of Mr. Jain and Mr. Pascall is party to a Change in Control Agreement, dated April 1, 2008 and November 1, 2012, respectively. Mr. Jain’s agreement provides for the payment of 12 months of salary, 100% of his bonus opportunity and 12 months of COBRA coverage, and acceleration of unvested equity awards if he is terminated other than for cause in connection with or within 24 months after a Change in Control. Mr. Pascall’s agreement provides for the payment of 12 months of salary, payment of premium for National Insurance coverage, 100% of his bonus opportunity and acceleration of his unvested equity awards if he is terminated other than for cause in connection with or within 24 months after a Change in Control. The amount of potential payments to each such NEO is dependent upon the nature of the termination as discussed below. The amounts of potential payments as referenced in the table assume that such triggering event was effective as of December 31, 2012. The actual amounts to be paid out upon termination or change in control can only be determined at the time of such event.

For purposes of this discussion, “Executive” refers to each of Messrs. Crim, Scollo and Haushill and:

(1) “Cause” means (i) the continued failure of Executive to perform substantially Executive’s duties with the Company (other than any such failure resulting from incapacity due to physical or mental illness, and specifically excluding any failure by Executive, after reasonable efforts, to meet performance expectations), after a written demand for substantial performance is delivered to Executive by the Board which specifically identifies in detail the manner in which the Board believes that Executive has not substantially performed Executive’s duties, (ii) any act of fraud, misappropriation, embezzlement or similar dishonest or wrongful act by Executive, (iii) Executive’s abuse of alcohol or any substance which materially interferes with Executive’s ability to perform services on behalf of the Company, (iv) Executive’s conviction for, or plea of guilty or nolo contendere to, a felony, (v) Executive’s acceptance of employment with an employer other than the Company or any affiliate or subsidiary of the Company, or (vi) Executive’s conviction for any crime of moral turpitude.

(2) “Good Reason” means (i) a reduction by the Company in Executive’s base salary or benefits as in effect on the Effective Date or as the same may be increased from time to time, unless a similar reduction is made in salary or benefits of substantially all Senior Executives of the Company (or any of its affiliates and any of their respective subsidiaries with respect to which the Company exerts control over compensation policies); (ii) the Company’s requiring Executive, without his consent, to be based at any office or location other than in the greater metropolitan area of the city in which his office is located at the Effective Date; or (iii) the Company’s changing the reporting structure so that Executive no longer reports directly to the Board.

21

(3) “Poor Performance” means the failure of Executive to meet reasonable and achievable performance expectations (other than any such failure resulting from incapacity due to physical or mental illness); provided, however, that termination for Poor Performance will not be effective unless at least 30 days prior to such termination Executive has received written notice from the Board which specifically identifies the manner in which the Board believes that Executive has not met performance expectations and Executive has failed after receipt of such notice to resume the diligent performance of his duties to the satisfaction of the Board.

Prior to or More than 24 Months after Change in Control.

Termination by Company other than for Poor Performance, Cause or Disability; Termination by Executive for Good Reason; or Expiration of Executive’s Employment Period:

If the Company terminates any of the Executive’s employment other than for Poor Performance, Cause or Disability or any of the Executives terminates his employment for Good Reason within 90 days after the event or occurrence of the event causing the Good Reason or the Executive’s employment period expires, such Executive shall be entitled to:

| • | the sum of the base salary through the date of termination and any accrued vacation pay to the extent not yet paid to be paid in a lump sum within 30 days after the date of termination (the “Accrued Obligations”). |

| • | an amount equal to the longer of 18 months base salary or the remaining term of the employment period from the date of termination, to be paid in equal semi-monthly or other installments as are customary under the Company’s payroll practices (the “Normal Severance Period”). |

| • | COBRA continuation coverage during the Normal Severance Period. |

| • | a cash sum in an amount equal to 100% of his bonus opportunity (prorated through the date of termination) adjusted according to his year-to-date performance at the date of termination to be paid in a lump sum within 30 days after the date of termination. |

| • | vesting as of the date of termination of all grants of restricted stock, restricted stock units and similar stock-based awards. |

| • | vesting as of the date of termination of all options, stock appreciation rights and similar stock-based awards that would have become vested within the 24 month period following the date of termination had the Executive remained employed. |

| • | exercisability of all options that are vested but unexercised through the earlier of the original expiration date, the 90th day following the end of the Normal Severance Period, or 10 years from the date of grant. |

22

Termination by the Company for Poor Performance:

If the Company terminates any of the Executive’s employment for Poor Performance, such Executive shall be entitled to:

| • | payment of the Accrued Obligations to be paid in a lump sum within 30 days after the date of termination. |

| • | an amount equal to 12 months base salary, to be paid in equal semi-monthly or other installments as are customary under the Company’s payroll practices (the “Poor Performance Severance Period”). |

| • | COBRA continuation coverage during the Poor Performance Severance Period. |

| • | vesting as of the date of termination of all grants of restricted stock, restricted stock units and similar stock-based awards that would have become vested within the 12 month period following the date of termination had the Executive remained employed. |

| • | subject to specific approval of the Committee, vesting as of the date of termination all options, stock appreciation rights and similar stock-based awards that would have become vested within the 12 month period following the date of termination had the Executive remained employed. |

| • | vesting as of the date of termination of all options that are vested but unexercised which will remain exercisable through the earlier of the original expiration date; the 90th day following the end of the Poor Performance Severance Period; or 10 years from the date of grant. |

Within 24 Months After or In Connection with Change in Control:

Termination by Executive for Good Reason; Termination by Company other than for Cause or Disability:

If a change in control occurs, and within 24 months following such change in control (or if Executive can show that termination by the Executive or the Company in anticipation of a change in control) the Company terminates any of the Executive’s employment other than for Cause or Disability or any of the Executives terminates his employment for Good Reason, such Executive shall be entitled to: