SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(MARK ONE)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the fiscal year ended September 30, 2015

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 0-14665

DAILY JOURNAL CORPORATION

(Exact name of registrant as specified in its charter)

|

South Carolina (State or other jurisdiction of incorporation or organization) |

95-4133299 (IRS Employer Identification No.) |

|

915 East First Street |

|

|

Los Angeles, California (Address of principal executive offices) |

90012 (Zip Code) |

Registrant's telephone number, including area code: (213) 229-5300

Securities registered pursuant to Section 12(b) of the Act: Common Stock, The NASDAQ Stock Market.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated ☐ Accelerated filer ☒ Non-accelerated filer ☐ Smaller reporting company ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes No ☒

As of March 31, 2015, the aggregate market value of Daily Journal Corporation's voting stock held by non-affiliates was approximately $198,239,000.

As of November 30, 2015 there were outstanding 1,380,746 shares of Common Stock of Daily Journal Corporation.

Disclosure Regarding Forward-Looking Statements

This Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Certain statements contained in this document, including but not limited to those in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, are “forward-looking” statements that involve risks and uncertainties that may cause actual future events or results to differ materially from those described in the forward-looking statements. Words such as “expects,” “intends,” “anticipates,” “should,” “believes,” “will,” “plans,” “estimates,” “may,” variations of such words and similar expressions are intended to identify such forward-looking statements. We disclaim any intention or obligation to revise any forward-looking statements whether as a result of new information, future developments, or otherwise. There are many factors that could cause actual results to differ materially from those contained in the forward-looking statements. These factors include, among others: risks associated with software development and implementation efforts; Journal Technologies’ reliance on professional services engagements with justice agencies, including California courts, for a substantial portion of its revenues; material changes in the costs of postage and paper; possible changes in the law, particularly changes limiting or eliminating the requirements for public notice advertising; possible loss of the adjudicated status of the Company’s newspapers and their legal authority to publish public notice advertising; a further decline in public notice advertising revenues because of fewer foreclosures; a further decline in subscriber and commercial advertising revenues; possible security breaches of the Company’s software or websites; the Company’s reliance on its president and chief executive officer; changes in accounting guidance; material weaknesses in the Company’s internal control over financial reporting; and declines in the market prices of the securities owned by the Company. In addition, such statements could be affected by general industry and market conditions, general economic conditions (particularly in California) and other factors. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Important factors that could cause actual results to differ materially from those in the forward-looking statements are discussed in this Form 10-K, including in conjunction with the forward-looking statements themselves, and in other documents filed by the Company with the Securities and Exchange Commission.

PART I

Item 1. Business

The Company publishes newspapers and web sites covering California and Arizona and produces several specialized information services. It also serves as a newspaper representative specializing in public notice advertising. We often refer to this as “The Traditional Business”.

Journal Technologies, Inc. (“Journal Technologies”), a wholly owned subsidiary of the Company, supplies case management software systems and related products to courts and other justice agencies, including administrative law organizations, county governments and bar associations. These organizations use the Journal Technologies family of products to help manage cases and information electronically, to interface with other critical justice partners and to extend electronic services to the public, including a website to pay traffic citations online, and bar members. These products are licensed to more than 500 organizations in 41 states and internationally. Journal Technologies is the result of the October 1, 2014 merger of the Company’s three technology-related subsidiaries, which were previously separate companies: Sustain Technologies, Inc. (“Sustain”), a wholly owned subsidiary since 2008; New Dawn Technologies, Inc. (“New Dawn”), acquired in December 2012; and ISD Technologies, Inc. (“ISD”), acquired in September 2013.

Essentially all of the Company’s operations are based in California, Arizona and Utah. Financial information of the Company, including information about each of the Company’s reportable segments, is set forth in Item 8 (“Financial Statements and Supplementary Data”).

Products and Services

The Traditional Business

Newspapers and related online publications. The Company publishes 10 newspapers of general circulation. Each newspaper, in addition to news of interest to the general public, has a particular area of in-depth focus with regard to its news coverage, thereby attracting readers interested in obtaining information about that area through a newspaper format. Effective October 1, 2015, the Company has discontinued the publication of the California Lawyer magazine and the California Directory of Attorneys. The Company also discontinued publication of the San Diego Commerce on September 19, 2015 and concurrently replaced it through a small acquisition of The Daily Transcript, which serves the San Diego market. These changes are not expected to materially impact the Company’s financial results.

The publications are based in the following cities:

|

Newspaper publications |

Base of publication | |

|

Los Angeles Daily Journal |

Los Angeles, California | |

|

Daily Commerce |

Los Angeles, California | |

|

San Francisco Daily Journal |

San Francisco, California | |

|

The Daily Recorder |

Sacramento, California | |

|

The Inter-City Express |

Oakland, California | |

|

San Jose Post-Record |

San Jose, California | |

|

Orange County Reporter |

Santa Ana, California | |

|

The Daily Transcript |

San Diego, California | |

|

Business Journal |

Riverside, California | |

|

The Record Reporter |

Phoenix, Arizona |

The Daily Journals. The Los Angeles Daily Journal and the San Francisco Daily Journal are each published every weekday except certain holidays and were established in 1888 and 1893, respectively. In addition to covering state and local news of general interest, these newspapers focus particular coverage on law and its impact on society. (The Los Angeles Daily Journal and the San Francisco Daily Journal are referred to collectively herein as ''The Daily Journals''.) Generally The Daily Journals seek to be of special utility to lawyers and judges and to gain wide multiple readership of newspapers sent to law firm subscribers.

The Daily Journals contain much material and render many services in a common endeavor. The Los Angeles Daily Journal is the largest newspaper published by the Company, both in terms of revenues and circulation. At September 30, 2015, the Los Angeles Daily Journal had approximately 5,300 paid subscribers and the San Francisco Daily Journal had approximately 2,700 paid subscribers as compared with total paid subscriptions for both of The Daily Journals of 8,200 at September 30, 2014. The Daily Journals carry commercial advertising (display and classified) and public notice advertising required or permitted by law to be published in a newspaper of general circulation. The main source of commercial advertising revenue has been local advertisers, law firms and businesses in or wishing to reach the legal professional community. The gross revenues generated directly by The Daily Journals are attributable approximately 64% to subscriptions and 36% to the sale of advertising and other revenues. Revenues from The Daily Journals constituted approximately 18% of the Company's total fiscal 2015 revenues, 19% in 2014, 23% in 2013, 28% in 2012 and 27% in 2011.

It is the policy of The Daily Journals (1) to take no editorial position on the legal and political controversies of the day but instead to publish well-written editorial views of others on many sides of a controversy and (2) to try to report on factual events with technical competence and with objectivity and accuracy. It is believed that this policy suits a professional readership of exceptional intelligence and education, which is the target readership for the newspapers. Moreover, The Daily Journals believe that they bear a duty to their readership, particularly judges and justices, as a self-imposed public trust, regardless, within reason, of short-term income penalties. The Company believes that this policy of The Daily Journals is in the long-term interest of the Company’s shareholders.

The Daily Journals contain the Daily Appellate Report which provides the full text and case summaries of all opinions certified for publication by the California Supreme Court, the California Courts of Appeal, the U.S. Supreme Court, the U.S. Court of Appeals for the Ninth Circuit, the U.S. Bankruptcy Appellate Panel for the Ninth Circuit, the State Bar Court and selected opinions of the U.S. District Courts in California and the Federal Circuit Court of Appeals. The Daily Journals also include a monthly court directory in booklet form. This directory includes a comprehensive list of sitting judges in all California courts as well as courtroom assignments, phone numbers and courthouse addresses, plus ''Judicial Transitions'' which lists judicial appointments, elevations, confirmations, resignations, retirements and deaths.

The Daily Journals are distributed by mail and hand delivery, with subscribers in the Los Angeles and San Francisco areas usually receiving copies the same day. Certain subscribers in Los Angeles, San Francisco, Santa Clara, Alameda, Orange, San Diego, Riverside and San Bernardino counties receive copies by hand delivery. The regular yearly subscription rate for each of The Daily Journals is $788.

Much of the information contained in The Daily Journals is available to subscribers online at www.dailyjournal.com.

Daily Commerce. Published since 1917, the Daily Commerce, based in Los Angeles, in addition to covering news of general interest, devotes substantial coverage to items designed to serve real estate investors and brokers, particularly those interested in Southern California distressed properties. The nature of the news coverage enhances the effectiveness of public notice advertising in distributing information about foreclosures to potential buyers at foreclosures. The features of the paper include default listings and probate estate sales. The Daily Commerce carries both public notice and commercial advertising and is published in the afternoon each business day.

The Daily Recorder. The Daily Recorder, based in Sacramento, began operations in 1911. It is published each business day. In addition to general news items, it focuses on the Sacramento legal and real estate communities and on California state government and activities ancillary to it. Among the regular features of The Daily Recorder is news about government leaders and lobbyists, as well as the Daily Appellate Report for those who request it. Advertising in The Daily Recorder consists of both commercial and public notice advertising.

The Inter-City Express. The Inter-City Express (the ''Express'') has been published since 1909. It covers general news of local interest and focuses its coverage on news about the real estate and legal communities in the Oakland/San Francisco area. The Express carries both commercial and public notice advertising. It is published each business day.

San Jose Post-Record. The San Jose Post-Record (the ''Post-Record'') has been published since 1910. In addition to general news of local interest, the Post-Record, which is published each business day, focuses on legal and real estate news and carries commercial and public notice advertising.

Orange County Reporter. The Orange County Reporter (''Orange Reporter'') has been an adjudicated newspaper of general circulation since 1922. In addition to general news of local interest, the Orange Reporter reports local and state legal, business and real estate news, and carries primarily public notice advertising. The Orange Reporter is published three days a week.

The Daily Transcript. The Daily Transcript (San Diego) is published five days a week and carries general news of local interest and public notice advertising and has been an adjudicated newspaper of general circulation since 1909. The Daily Transcript also serves legal and real estate professionals in San Diego County.

Business Journal. The Business Journal, established in 1991, publishes news of general interest and provides coverage of the business and professional communities in Riverside County. It also carries public notice advertising and is published each business day.

The Record Reporter (Arizona). The Record Reporter has been in existence since 1914. In addition to general news of local interest, The Record Reporter, which is published three days a week, focuses on legal news and public record information and carries primarily public notice advertising.

Information Services. The specialized information services offered by the Company have grown out of its newspaper operations or have evolved in response to a desire for such services primarily from its newspaper subscribers.

The Company has several court rules services. One is Court Rules, a multi-volume, loose-leaf set. Court Rules reproduces court rules for certain state and federal courts in California. The Court Rules appear in two versions, one of which covers Northern California courts (nine volumes) and one of which covers Southern California courts (eight volumes). The Company updates Court Rules on a monthly basis. In addition, the Company publishes a single volume of rules known as Local Rules for major counties of California. Six versions are published for Southern California, each a single bound volume for the rules of: (1) Los Angeles County; (2) Orange County; (3) San Diego County; (4) San Bernardino County; (5) Riverside County; and (6) Ventura, Santa Barbara and San Luis Obispo counties. Also, the Company publishes single-volume rules for the Federal District Court in the Central District of California and California Probate Rules. In Northern California, three versions of the Local Rules appear in loose-leaf books for Santa Clara/San Mateo, Alameda/Contra Costa and San Francisco counties. The single volumes are normally updated or replaced whenever there are substantial rule changes.

The Judicial Profiles services contain information concerning nearly all active and retired judges in California. Most of the profiles have previously appeared in The Daily Journals as part of a regular feature. The Judicial Profiles include biographical data and financial disclosure statements on judges and information supplied by each judge regarding the judge's policies and views on various trial and appellate procedures and the manner in which appearances are conducted in his or her courtroom. Subscribers may purchase either the ten-volume set for Southern California or the eight-volume set for Northern California.

The Company also provides online foreclosure information to about 40 customers. This service primarily provides distressed property information, some of which also appears in some of the Company's newspapers, as well as expanded features. Consolidation of both newspapers and online products more effectively utilizes the costs of gathering such information.

Advertising and Newspaper Representative. The Company's publications carry commercial advertising, and most also contain public notice advertising. Commercial advertising consists of display and classified advertising and constituted about 8% of the Company’s total revenues in fiscal 2015, 9% in 2014, 11% in 2013, 15% in 2012 and 14% in 2011. Classified advertising has continued to decline primarily due to the continued downturn in the employment advertising marketplace and competition from online employment web sites.

Public notice advertising consists of many different types of legal notices required by law to be published in an adjudicated newspaper of general circulation, including notices of death, fictitious business names, trustee sale notices and notices of governmental hearings. The major types of public notice advertisers are real estate-related businesses and trustees, governmental agencies, attorneys and businesses or individuals filing fictitious business name statements. Many government agencies use the Company’s Internet-based advertising system to produce and send their notices to the Company. A fictitious business name web site enables individuals to send their statements to the Company for filing and publication and another web site enables attorneys and individuals to send probate, civil, corporate, public sale and other types of public notices to the Company. California Newspaper Service Bureau (“CNSB”), a division of the Company, is a statewide newspaper representative (commission-earning selling agent) specializing since 1934 in public notice advertising. CNSB places public notices and other forms of advertising with adjudicated newspapers of general circulation, most of which are not owned by the Company.

Public notice advertising revenues and related advertising and other service fees, including trustee sales legal advertising revenues, constituted about 22% of the Company's total revenues in fiscal 2015, 24% in 2014, 35% in 2013, 56% in 2012 and 58% in 2011. Most of these revenues were generated by (i) notices published in the Company’s newspapers, (ii) commissions and similar fees received from other publications in which the advertising was placed and (iii) service fees generated when filing notices with government agencies.

Trustee sales legal advertising revenues alone represented about 6% of the Company’s total revenues in fiscal 2015, 7% in 2014, 17% in 2013, 56% in 2012 and 58% in 2011. For several years, these revenues were driven by the large number of foreclosures in California and Arizona, for which public notice advertising is required by law, but the number of foreclosures has continued to decline. In addition, in many states, including California and Arizona, legislatures have considered various proposals which would result in the elimination or reduction of the amount of public notice advertising required by statute. There is a risk that such laws could change in a manner that would have a significant adverse impact on the Company's public notice advertising revenues.

Other revenues are attributable to service fees from users of an online foreclosure/fictitious business name database, fees from attorneys taking continuing legal education “courses” published in the Company’s publications and other miscellaneous fees.

Journal Technologies

Journal Technologies provides case management software and related services to courts and other justice agencies. Its operations constituted about 57% of the Company’s total revenues in fiscal 2015, 53% in 2014, 37% in 2013, 9% in 2012 and 9% in 2011 (with the 2011-2012 numbers reflecting Sustain only). Journal Technologies earns revenue from license and maintenance fees paid by customers to use its software products; consulting fees paid by customers for installation, implementation and training services; and fees generated by the use of secure websites through which the general public can pay traffic citations. Journal Technologies has the following main products:

eCourt®, eProsecutor, eDefender and eProbation — browser-based case processing systems that can be used by courts and other justice agencies for all case types because its screens, data elements, business rules, work queues, searches and alerts are highly configurable. Journal Technologies also supports its prior generation Justice Edition software, which is a Windows-based system that also provides for customizable configurability.

JustWare® — a family of case management software products for use by courts and other justice agencies. JustWare® provides a standardized case management system that includes business rules to automate tasks, document and report generation, digital signatures and shortcuts to speed data input. Journal Technologies also licenses its JusticeWeb® public access software, which allows the public to view certain case information, provides a means to create permission-based access for sensitive data, allows pro se litigants and attorneys to e-file documents and includes a way for case participants to make payments online.

ICMS™ — a court case management system, which was acquired as part of the acquisition of the ISD assets. Journal Technologies also licenses CASE™ — an automated probation case management system, including juvenile hall detention management features.

eFile™ — a browser-based interface that allows attorneys and the general public to electronically file documents with the court from a personal computer using the Internet at any time.

ePayIt™ — a service for the online payment of traffic citations. Users can pay traffic citations using the Internet at any time with a credit card, and can obtain traffic school and other information.

Almost all of Journal Technologies’ customers are government agencies, and most new software installation and licensing projects are subject to competitive bidding procedures. Accordingly, the ability of Journal Technologies to get new customers is highly unpredictable. In addition, budget constraints, especially during stressful economic times, could force governmental agencies to defer or forgo consulting services or even to stop paying their annual software maintenance fees. As a technology-based company, Journal Technologies’ success depends on the continued improvement of its products, which is why the costs to update and upgrade them consistently constitute such a significant portion of the Company’s expenses.

The Company’s revenues from Journal Technologies’ foreign customers were $278,000 in fiscal 2015, $332,000 in fiscal 2014, and $301,000 in fiscal 2013. All of the Company’s other revenues in those years were attributable to the United States.

Materials and Postage

After personnel costs (included in “Salaries and employee benefits” and in “Outside services” in the accompanying consolidated statements of comprehensive income (loss)), postage and paper costs are typically the Company's next two largest expenses. Paper and postage accounted for approximately 6% of our traditional publishing segment's operating costs in fiscal 2015, 7% in 2014, 7% in 2013, 6% in 2012 and 6% in 2011. Paper prices may fluctuate substantially in the future, and periodic postal rate increases could significantly impact income from operations. Further, we may not be able to pass on such increases to our customers.

An adequate supply of newsprint and other paper is important to the Company's operations. The Company currently does not have a contract with any paper supplier. The Company has always been able to obtain sufficient newsprint for its operations, although in the past, shortages of newsprint have sometimes resulted in higher prices. The price of paper remained unchanged during fiscal 2015. We anticipate the price of paper will remain unchanged at least through June 2016.

We use the U.S. Postal Service for distribution of a majority of our newspapers. During the past several years, the Company has instituted changes in an attempt to mitigate higher postage costs. These changes have included contracting for hand delivery in selected sections of the San Francisco Bay area and in Santa Clara, Alameda, San Diego, Riverside, San Bernardino, Orange and Los Angeles counties, delivering pre-sorted newspapers to the post office on pallets, which facilitates delivery and improves service, and implementing a method of bundling newspapers which reduces the per piece charges. In addition, the Company has an ink jet labeler which eliminates paper labels and enables the Company to receive bar code discounts from the postal service on some of its newspapers.

Postal rates are dependent on the operating efficiency of the U.S. Postal Service and on legislative mandates imposed upon the U.S. Postal Service. During the past several years, the U.S. Postal Service has increased postal rates. There were decreases in the Company’s postage costs during fiscal 2015 primarily due to fewer subscribers.

Marketing

The Company actively promotes its individual newspapers and its multiple newspaper network as well as its other publications. The Company's staff includes a number of employees whose primary responsibilities include attracting new subscribers and advertisers. The specialization of each publication creates both target subscribers and target advertisers. Subscribers are likely to be attracted because of the nature of the information carried by the particular publication, and likely advertisers are those interested in reaching such consumer groups. In marketing products, the Company also focuses on its ancillary products which can be of service to subscribers, such as its specialized information services.

The Company receives, on a non-exclusive basis, public notice advertising from a number of agencies. Such agencies ordinarily receive a commission of 15% to 25% on their sales of advertising in Company publications. Commercial advertising agencies also place advertising in Company publications and receive commissions for advertising sales.

Journal Technologies’ staff includes employees who provide marketing and consulting services which may also result in additional consulting projects and the licensing of products. Most of Journal Technologies’ new projects come from existing customers or from a competitive bidding process.

Competition

Competition for readers and advertisers is very intense, both by established publications and by new entries into the market. The Daily Journals face aggressive competition, including amazingly low prices for multiple copy subscriptions, from law-oriented newspapers in Los Angeles and San Francisco. All of the Company's business publications and products face strong competition from other publications and service companies. Readers of specialized newspapers focus on the amount and quality of general and specialized news, amount and type of advertising, timely delivery and price. The Company designs its newspapers to fill niches in the news marketplace that are not covered as well by major metropolitan dailies. The in-depth news coverage which the Company's newspapers provide along with general news coverage attracts readers who, for personal or professional reasons, desire to keep abreast of topics to which a major newspaper cannot devote significant news space. Other newspapers do provide some of the same subject coverage as does the Company, but the Company believes its coverage, particularly that of The Daily Journals, is more complete and therefore attracts more readers. The Company believes that The Daily Journals are the most important newspapers serving California lawyers on a daily basis.

The Company's court rules publications face competition in both the Southern California and Northern California markets from online court rules services and the courts themselves. Subscriptions to the multi-volume Court Rules and Local Rules volumes continued to decline during fiscal 2015. The Company's Judicial Profile services have direct competition and also indirect competition, because some of the same information is available through other sources, including the courts.

The steady decline in recent years in the number of subscriptions to The Daily Journals and the Company’s court rule publications is likely to continue and will certainly impact the Company’s future revenues. The pricing of the Company's products is reviewed every year. Subscription price increases have in recent years exceeded inflation, as have advertising rate increases.

In attracting commercial advertisers, the Company competes with other newspapers and magazines, television, radio and other media, including electronic and online systems for employment-related classified advertising. Factors which may affect competition for advertisers are the cost for such advertising compared with other media, and the size and characteristics of the readership of the Company's publications.

Internet sites devoted to recruitment have become significant competitors of our newspapers and web sites for classified advertising. In addition, there has been a steady consolidation of companies serving the legal marketplace, resulting in an ever-smaller group of companies placing display advertising. Consequently, retaining advertising revenues remains a challenge.

The Company competes with anywhere from one serious competitor to many competing newspapers for public notice advertising revenue in all of its markets. Large metropolitan general interest newspapers normally do not carry a significant amount of legal advertising, although recently they too have solicited certain types of public notice advertising. CNSB, the Company’s commission-earning selling agent, faces competition from a number of companies based in California, some of which specialize in placing certain types of notices.

There is significant competition among a limited number of companies to provide services and software to the courts and other justice agencies, and some of these companies are much larger and have greater access to capital and other resources than Journal Technologies. Others provide services for a limited number of customers. As part of the competitive bidding process, many customers will express a preference for, or even require, larger vendors.

Many customers desire Internet-based solutions to centralize operations, facilitate electronic filing and other interfaces with other justice partners and the public, and publish certain information from case management systems. Journal Technologies’ product lines provide versions of these services, but there are many uncertainties in the process of courts and other agencies migrating to newer Internet-based systems, including whether Journal Technologies’ versions of case management systems will find general acceptance and whether the update, upgrade and modification of such systems can be done in a cost effective manner. The Company competes on a variety of factors, including price, technological capabilities and services to accommodate the individual requirements of each customer.

Employees

The Company has approximately 320 full-time employees and contractors and about 30 part-time employees and contractors as of September 30, 2015. This includes about 150 full-time employees and contractors and 20 part-time employees and contractors of Journal Technologies. The Company is not a party to any collective bargaining agreements. Certain benefits, including medical insurance, are provided to all full-time employees. Management considers its employee relations to be good.

The Company relies heavily on Gerald Salzman, who serves as president, chief executive officer, chief financial officer, treasurer and assistant secretary. If Mr. Salzman’s services were no longer available to the Company, it is unlikely that the Company could find a single replacement to perform all of the duties now handled by him, and it could have a significant adverse effect on the Company’s business. The Company does not carry key man life insurance, nor has it entered into an employment agreement with Mr. Salzman.

Working Capital

Traditionally, the Company has generated sufficient cash flow from operations to cover all its needs without significant borrowing. To a considerable extent, the Company benefits from the fact that subscriptions and some licenses, maintenance and consulting fees are paid in advance. In addition, the aggregate market value of the securities owned by the Company has increased significantly in recent years (although fiscal 2015 was an exception), providing the Company with even more working capital, subject, of course, to the normal risks associated with owning stocks and bonds. In December 2012, the Company borrowed $14 million from its investment margin account to purchase all of the outstanding stock of New Dawn, and in September 2013, it borrowed another $15.5 million to acquire substantially all of the operating assets and liabilities of ISD, in each case pledging its marketable securities to obtain favorable financing.

The Company believes it has sufficient cash and marketable securities for the foreseeable future. If the Company’s overall cash needs exceed cash flow from operations and its current working capital, the Company may still have the ability to borrow against its marketable securities on favorable terms as it did for the New Dawn and ISD acquisitions, or it may attempt to secure additional financing which may or may not be available on acceptable terms.

The Company extends unsecured credit to most of its advertising customers. The Company maintains a reserve account for estimated losses resulting from the inability of these customers to make required payments, but if the financial conditions of these customers were to deteriorate or the Company’s judgments about their abilities to pay are incorrect, additional allowances might be required, and the Company’s cash flows and results of operations could be materially affected.

Inflation

The effects of inflation are not significantly any more or less adverse on the Company's businesses than they are on other publishing and software companies. The Company has experienced the effects of inflation primarily through increases in costs of personnel, newsprint, postage and services. These costs have generally been offset by periodic price increases for advertising and subscription rates, but with frequent exceptions during several years when the Company has experienced substantial increases in postage and newsprint expenses and additional costs related to acquisitions.

Access to Our Information

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). These filings are not available on our website, www.dailyjournal.com, which is generally dedicated to the content of our publications. We will, however, provide these filings in electronic or paper format free of charge upon request addressed to our Secretary at our principal executive offices. Our SEC filings are also available to the public over the Internet at the SEC’s website at www.sec.gov. The public may also read and copy any document we file at the SEC’s public reference room located at 100 F Street N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room.

Item 1A. Risk Factors

The foregoing business discussion and the other information included in this Form 10-K should be read in conjunction with the following risks, trends and uncertainties, any of which, either individually or in the aggregate, could materially and adversely affect our business, operating results or financial condition.

Risks Associated with The Traditional Business

A continuing reduction in the number of residential foreclosures in California and Arizona will result in fewer trustee sale notices being published in the Company’s newspapers.

For several years, the revenues of The Traditional Business were driven by the large number of foreclosures in California and Arizona, for which public notice advertising is required by law. The number of foreclosures continued to decline in 2015 and is expected to continue to decline in 2016. Along with improvements in the economy, the California Homeowner’s Bill of Rights imposed new requirements effective January 1, 2013 that have contributed to the slowdown in foreclosures. We expect this trend to continue, and it will significantly impact the earnings of The Traditional Business because it will be impractical for the Company to offset the revenue loss with expense reductions.

Changes in the legal requirement to publish public notice advertising or in the legal ability of our newspapers to publish those notices would have a significant adverse impact on The Traditional Business.

From time to time, the legislatures in California and Arizona (and elsewhere) have considered various proposals that would result in the elimination or reduction of the amount of public notice advertising in printed newspapers required by statute. These proposals typically focus on the availability of alternative means of providing public notices, such as via the Internet. Some proposals also question the need for public notices at all. Should any of these proposals become law, particularly in California, they would materially affect the revenues of The Traditional Business.

In addition, if the adjudication, which is what gives publishers the legal ability to publish public notice advertising, of one or more of the Company’s newspapers was challenged and revoked, those newspapers would no longer be eligible to publish public notice advertising, and it could materially affect the revenues of The Traditional Business.

The Traditional Business faces strong competition in each of its markets.

Competition for readers and advertisers is very intense, both from established publications and from new entrants into the market. The Daily Journals face aggressive competition, including amazingly low prices for multiple copy subscriptions from law-oriented newspapers in Los Angeles and San Francisco. The Company’s court rules publications face competition in both Northern and Southern California from online court rules services and the courts themselves. The steady decline in recent years in the number of subscriptions to The Daily Journals and the court rule publications is likely to continue and will certainly impact The Traditional Business’ future revenues.

The Traditional Business also competes with anywhere from one serious competitor to many competing newspapers for public notice advertising in all of its markets. As the amount of this advertising has decreased due to the reduction in the number of foreclosures discussed above, the competition to publish the remaining public notices has intensified and may result in a further decline in The Traditional Business’ public notice advertising revenues.

The Traditional Business continues to experience challenges in maintaining its commercial advertising and circulation revenues, particularly due to the growth of Internet sites.

Internet sites devoted to recruitment have become significant competitors of our newspapers and web sites for classified advertising. In addition, there has been a steady consolidation of companies serving the legal marketplace, resulting in an ever-smaller group of companies placing display advertising. Furthermore, newspapers like ours have been struggling to compete for display advertising generally, given the many other forums (including Internet sites) that compete for advertising dollars. These trends are expected to continue and will adversely affect The Traditional Business.

Circulation revenues have continued to decline as more and more information has become available from the internet. Law firm mergers have also reduced the number of firms that purchase multiple subscriptions of our newspapers. It is not practical to assume that we will be able to offset the decline in subscriptions with increases in the subscription rate, and we expect that our circulation revenues will continue to decline.

The Traditional Business is exposed to risks associated with fluctuations in postage and paper costs.

After personnel costs, postage and paper costs are typically the Company’s next two largest expenses. An adequate supply of newsprint and other paper is important to the operations of The Traditional Business. The Company currently does not have a contract with any paper supplier, and in the past, shortages of newsprint have sometimes resulted in higher prices. The price of paper has remained unchanged since fiscal year 2013, and we expect it to remain unchanged at least through June 2016.

The Traditional Business uses the U.S. Postal Service for distribution of a majority of its newspapers and magazine. Postal rates are dependent on the operating efficiency of the U.S. Postal Service and on legislative mandates imposed upon the U.S. Postal Service. During the past several years, postal rates have increased. Postal rates and fees may increase more in the future. Further, we may not be able to pass on increases in paper and postage costs to our customers.

Risks Associated with Journal Technologies

The success of Journal Technologies depends in large part on the technological update and upgrade of its software products.

Journal Technologies’ success depends on the continued improvement of its products, and the costs to update and upgrade those products consistently represent a large portion of Journal Technologies’ expenses. There are many uncertainties in the process of courts and other justice agencies migrating to newer case management systems, including whether Journal Technologies’ versions of these systems will find general acceptance and whether the modification of such systems can be done in a cost effective manner. The costs to update and upgrade Journal Technologies’ products are expensed as incurred and will impact earnings at least through the foreseeable future.

Journal Technologies faces significant competition from other case management software vendors.

There is significant competition among a limited number of companies to provide services and software to courts and other justice agencies, and some of these companies are much larger and have greater access to capital and other resources than Journal Technologies. Normally, the vendor is selected through a bidding process, and often the customers will express a preference for, or even require, larger vendors. An inability to successfully compete in this difficult market could materially affect the earnings of Journal Technologies.

The customers of Journal Technologies are public sector entities, which create special issues and risks.

Substantially all of the customers of Journal Technologies are courts, justice agencies, and other government entities. Accordingly, we face special risks associated with governmental budget constraints, especially during stressful economic times, which could force government entities to defer or forego consulting services or even stop paying their annual software license and maintenance fees. In addition, we encounter risks related to a longer and more complicated sales cycle than exists for commercial customers; political issues related to resource allocation, administration turnover and preferences for internal case management solutions or for a particular vendor; complicated bidding procedures; and fluctuations in the demand for information technology products and services.

Journal Technologies generally recognizes revenues for software installations only upon completion of the applicable services and customer acceptance of the software system.

In most cases, the fees paid to Journal Technologies for installation services and software licenses are at risk until the customer has indicated its satisfaction with the installed system and it has “gone live”. Also, we utilize the completed contract method of accounting because the customer’s acceptance is typically unpredictable and reliable estimates of the progress towards completion cannot be made. Accordingly, we do not recognize revenues for installation services or licenses or for most other consulting services until after the services have been performed, and there are significant risks associated with our ability to complete our services to the satisfaction of our customers and to fulfill the requirements that entitle us to be paid. An inability to realize payment for services performed could materially affect the earnings of Journal Technologies.

Risks Associated with Our Holdings of Marketable Securities

A large portion of the Company’s assets is held in publicly traded securities, and the prices of those securities may decline.

As of September 30, 2015, the Company held marketable securities worth approximately $166,041,000, with an unrealized gain for financial statement purposes of $111,498,000. While this portfolio has enabled the Company to borrow on very favorable terms for the New Dawn and ISD acquisitions and to better compete for case management software opportunities that are usually limited to “large” firms, it is unusual for a public company to invest a significant amount of its available cash in the marketable securities of other public companies. The value of these securities could decline, which would adversely affect shareholders’ equity.

Also, as of September 30, 2015, the Company’s holdings of marketable securities were concentrated in just seven companies and included two based in foreign currencies. Accordingly, a significant decline in the market value and unfavorable changes in the foreign exchange rates of one or more of the Company’s holdings may not be offset by hypothetically better performance of other holdings. This concentration of risk may result in a more pronounced effect on shareholders’ equity.

In certain circumstances, the Company may be required to recognize losses in a particular security for financial statement purposes even though the Company has not actually sold the security.

Even if the Company’s marketable securities as a whole perform extraordinarily well, for accounting reasons, an “other than temporary impairment” in a particular security may result in the need to recognize a loss with respect to that security in the Company’s income statement in a particular period. This has happened this fiscal year and in the other two previous fiscal years prior to last year, and it may happen again in the future with respect to the same securities or other securities owned by the Company. This requirement to recognize a loss could have a material effect on the Company’s earnings in a particular period. Also, at times, the Company may hold marketable securities denominated in currencies other than the United States Dollar. When it does, the Company may be at risk for significant fluctuations in the applicable foreign currency exchange rates, which would affect the profitability of such marketable securities.

General Corporate Risks

The Company relies heavily on the services of Gerald Salzman.

Gerald Salzman, 76, serves as the Company’s president, chief executive officer, chief financial officer, treasurer and assistant secretary. He is also the president, chief executive officer, chief financial officer and secretary of Journal Technologies. If Mr. Salzman’s services were no longer available to the Company, it is unlikely that the Company could find a single replacement to perform all of the duties now handled by him, and it could have a significant adverse effect on the Company’s business. The Company does not carry key man life insurance, nor has it entered into an employment agreement with Mr. Salzman.

Changes in accounting guidance could have a significant effect on the Company’s reported financial results.

Preparing consolidated financial statements requires the Company’s management to make estimates and assumptions that affect the reported amount of assets, liabilities, revenues and expenses. These estimates and assumptions are affected by management’s application of accounting policies and the prevailing accounting guidance. The Company considers fair value measurement and disclosures, revenue recognition, accounting for software costs, accounting for business combinations, testing for goodwill and intangible impairments and income taxes to be critical accounting policies and estimates. A change in the accounting guidance with respect to one or more of these areas could materially affect the Company’s reported financial results.

We cannot be sure that customer information and systems are fully protected against security breaches.

Journal Technologies’ software processes and stores customer information in the conduct of its business, including in some cases by utilizing a cloud-based system supplied by a third-party vendor. Despite our efforts to maintain up-to-date security controls, it is possible that our system could be improperly used to access or misappropriate customer systems or information, including personally identifiable or other confidential information. A material security breach of this nature could harm our reputation, cause us to lose current and potential customers, require us to allocate more resources to information security, or subject us or our customers to liability, resulting in increased costs, loss of revenue, or both. The Traditional Business also operates certain websites that process and, in certain cases, store customer information. A minor security breach was discovered on a website operated by The Traditional Business in early fiscal 2015, and although it was remediated, there can be no assurance that there will not be more material breaches in the future. Also, our insurance may not cover all of the costs that we may incur as a result of a material security breach.

The Company has identified certain material weaknesses in its internal control over financial reporting.

The Company has identified certain material weaknesses in its internal control over financial reporting. The Company’s internal control over financial reporting has been designed to provide management and the Board of Directors with reasonable assurance regarding the preparation and fair presentation of the Company’s consolidated financial statements. As a small company, we have eight experienced employees in the accounting department and three in the IT department. Accordingly, we are not able to segregate duties to the extent we could if we had more people, and we have not sufficiently designed and documented controls that support an effective assessment of our internal controls relating to the prevention of fraud and possible management override of controls. Further, the Company does not have sufficient technical expertise in assessing and applying accounting standards to complex and/or non-routine transactions, reviewing the quarterly and annual tax analysis and provision, and assessing the adequacy of disclosures in the quarterly and annual consolidated financial statements.

We believe that our overall internal control environment is sufficient for a company of our size. However, the existence of material weaknesses means that there is a reasonable possibility that a material misstatement of our financial statements will not be prevented or detected on a timely basis. This may result in legal, operational, financial and regulatory issues. For more information regarding the material weaknesses, the mitigating controls used by the Company and certain remedial steps being taken or considered, please see Part II. Item 9A Controls and Procedures.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The Company owns office and printing facilities in Los Angeles and office space in Logan, Utah and leases space for its other offices under operating leases which expire at various dates through 2020.

The main Los Angeles property is comprised of a two-story, 34,000 square foot building constructed in 1990, which is fully occupied by the Company. Approximately 75% of the building is devoted to office space and the remainder to printing and production equipment and facilities. In 2003, the Company finished building an adjacent 37,000 square foot building and parking facilities on properties it acquired in 1996 and 1998. This building provides additional office, production and storage space. The Company and Journal Technologies occupy this building’s first floor and will complete the build-out of the second floor as needed.

In November 2015, the Company purchased a 30,700 square foot office building constructed in 1998 on about 3.6 acres in Logan, Utah that had been previously leased for Journal Technologies.

The Company leases approximately 6,200 square feet of office space (expiring in October 2019) in San Francisco. Journal Technologies leases about 7,100 square feet of office space (expiring in March 2017) in Corona, California. In addition, the Company rents facilities in each of the remaining cities where its staff is located on a month-to-month basis or pursuant to leases generally of no longer than three years’ duration. The Company believes that it has adequate office space.

See Note 4 of Notes to Consolidated Financial Statements for information concerning rents payable under leases.

Item 3. Legal Proceedings

From time to time, the Company is subject to litigation arising in the normal course of its business. While it is not possible to predict the results of such litigation, management does not believe the ultimate outcome of these types of matters will have a material adverse effect on the Company’s financial position or results of operations or cash flows.

Item 4. Mine Safety Disclosures

Not applicable.

Part II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The following table sets forth the sales prices of the Company’s common stock for the periods indicated. Quotations are as reported by the NASDAQ Capital Market.

|

High |

Low |

|||||||

|

Fiscal 2015 |

||||||||

|

Quarter ended December 31, 2014 |

$ | 280.51 | $ | 173.97 | ||||

|

Quarter ended March 31, 2015 |

253.25 | 168.90 | ||||||

|

Quarter ended June 30, 2015 |

222.50 | 183.61 | ||||||

|

Quarter ended September 30, 2015 |

224.17 | 183.67 | ||||||

|

Fiscal 2014 |

||||||||

|

Quarter ended December 31, 2013 |

$ | 191.85 | $ | 134.06 | ||||

|

Quarter ended March 31, 2014 |

194.87 | 154.12 | ||||||

|

Quarter ended June 30, 2014 |

219.68 | 161.17 | ||||||

|

Quarter ended September 30, 2014 |

210.00 | 168.07 | ||||||

As of December 2, 2015, there were approximately 540 holders of record of the Company’s common stock, and the last trade was at $212.54 per share.

The Company did not declare or pay any dividends during fiscal 2015, 2014 or 2013. A determination by the Company whether or not to pay dividends in the future will depend on numerous factors, including the Company’s earnings, cash flow, financial condition, capital requirements, future prospects, acquisition opportunities, and other relevant factors. The Board of Directors does not expect that the Company will pay any dividends or other distributions to shareholders in the foreseeable future.

The Company does not have any equity compensation plans, and it did not sell any securities, whether or not registered under the Securities Act of 1933, during the past three fiscal years.

From time to time, the Company has repurchased shares of its common stock and may continue to do so. The Company maintains a common stock repurchase program that was implemented in 1987 in combination with the Company’s Management Incentive Plan. See Note 2 of Notes to Consolidated Financial Statements for more information. The Company’s stock repurchase program remains in effect, but the Company did not repurchase any shares during fiscal 2015 or 2014.

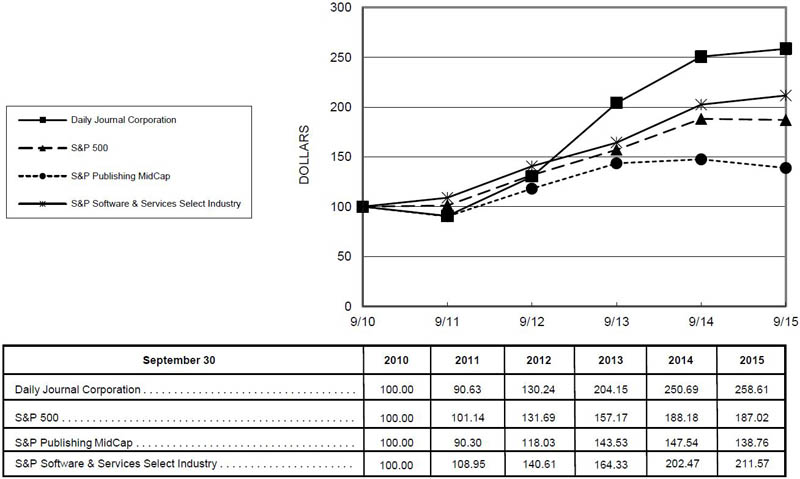

The following graph shows a five-year comparison of cumulative total return on the Company’s common stock, Standard & Poor’s 500 Composite Index, Standard & Poor’s Publishing MidCap Index and Standard & Poor’s Software & Services Select Industry Index, assuming $100 was invested on September 30, 2010, and all dividends were reinvested. The Company has not declared a dividend in any of the fiscal years shown.

Daily Journal Corporation

Total Cumulative Shareholder Return for Five Years Ended September 30, 2015

|

Item 6. Selected Financial Data

The following sets forth selected financial data for the Company as of, and for each of the five years ended September 30, 2015. Such data should be read in conjunction with, and is qualified in its entirety by reference to, the Company’s consolidated financial statements and the notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” each included herein.

|

Fiscal Year Ended September 30 |

||||||||||||||||||||

|

2015 |

2014 |

2013 |

2012 |

2011 |

||||||||||||||||

|

(Dollar amounts in thousands, except share and per share amounts) |

||||||||||||||||||||

|

Consolidated Statement of Comprehensive Income (Loss): |

||||||||||||||||||||

|

Revenues |

||||||||||||||||||||

|

Advertising, net |

$ | 10,502 | $ | 11,435 | $ | 14,472 | $ | 19,221 | $ | 21,337 | ||||||||||

|

Circulation |

5,915 | 6,038 | 6,346 | 6,530 | 6,767 | |||||||||||||||

|

Advertising service fees and other |

2,703 | 2,800 | 3,012 | 3,205 | 3,428 | |||||||||||||||

|

Licensing and maintenance fees |

13,984 | 12,987 | 9,942 | 2,205 | 2,167 | |||||||||||||||

|

Consulting fees |

4,704 | 4,002 | 3,406 | 713 | 814 | |||||||||||||||

|

Other public service fees |

6,170 | 6,161 | 498 | --- | --- | |||||||||||||||

| 43,978 | 43,423 | 37,676 | 31,874 | 34,513 | ||||||||||||||||

|

Costs and expenses |

||||||||||||||||||||

|

Salaries and employee benefits |

26,010 | 25,262 | 19,236 | 13,592 | 13,473 | |||||||||||||||

|

Outside services |

3,524 | 3,212 | 3,086 | 2,956 | 3,168 | |||||||||||||||

|

Postage and delivery costs |

1,318 | 1,281 | 1,328 | 1,375 | 1,437 | |||||||||||||||

|

Newsprint and printing expenses |

1,225 | 1,221 | 1,307 | 1,321 | 1,382 | |||||||||||||||

|

Depreciation and amortization |

5,531 | 5,516 | 2,441 | 503 | 535 | |||||||||||||||

|

Other general and administrative expenses |

9,882 | 9,121 | 6,489 | 3,445 | 3,716 | |||||||||||||||

| 47,490 | 45,613 | 33,887 | 23,192 | 23,711 | ||||||||||||||||

|

(Loss) income from operations |

(3,512 | ) | (2,190 | ) | 3,789 | 8,682 | 10,802 | |||||||||||||

|

Other income and expenses |

||||||||||||||||||||

|

Dividends and interest income |

3,829 | 3,001 | 2,541 | 1,967 | 1,233 | |||||||||||||||

|

Other income |

65 | 97 | 54 | --- | --- | |||||||||||||||

|

Interest expenses on margin loans |

(224 | ) | (230 | ) | (97 | ) | --- | --- | ||||||||||||

|

Interest and penalty (expense) expense reversal accrued for uncertain and unrecognized tax benefits |

(96 | ) | (537 | ) | --- | 100 | (36 | ) | ||||||||||||

|

Gains on sales of capital assets |

4 | --- | 1 | 7 | 1 | |||||||||||||||

|

Other-than temporary impairment losses on investment |

(376 | ) | --- | (1,719 | ) | (2,855 | ) | --- | ||||||||||||

|

Income (loss) before taxes |

(310 | ) | 141 | 4,569 | 7,901 | 12,000 | ||||||||||||||

|

Benefit from (provision for) income taxes |

1,120 | 490 | (790 | ) | (2,360 | ) | (4,160 | ) | ||||||||||||

|

Net income |

$ | 810 | $ | 631 | $ | 3,779 | $ | 5,541 | $ | 7,840 | ||||||||||

|

Weighted average number of common shares outstanding – basic and diluted |

1,380,746 | 1,380,746 | 1,380,746 | 1,380,746 | 1,380,746 | |||||||||||||||

|

Basic and diluted net income per share |

$ | 0.59 | $ | 0.46 | $ | 2.74 | $ | 4.01 | $ | 5.68 | ||||||||||

| Comprehensive | ||||||||||||||||||||

|

Net income |

$ | 810 | $ | 631 | $ | 3,779 | $ | 5,541 | $ | 7,840 | ||||||||||

|

Net change in unrealized appreciation of investments (net of taxes) |

(8,811 | ) | 22,393 | 21,292 | 15,085 | (3,627 | ) | |||||||||||||

|

Reclassification adjustment of other-than-temporary impairment losses recognized in net income |

230 | --- | 1,051 | 1,720 | --- | |||||||||||||||

|

Net change in comprehensive income (loss) |

$ | (7,771 | ) | $ | 23,024 | $ | 26,122 | $ | 22,346 | $ | 4,213 | |||||||||

|

September 30 |

||||||||||||||||||||

|

2015 |

2014 |

2013 |

2012 |

2011 |

||||||||||||||||

|

Consolidated Balance Sheet Data: |

||||||||||||||||||||

|

Total assets |

$ | 228,196 | $ | 243,877 | $ | 203,063 | $ | 120,964 | $ | 90,816 | ||||||||||

|

Shareholders’ equity |

128,600 | 136,371 | 113,347 | 87,225 | 64,879 | |||||||||||||||

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations

The Company continues to operate as two different businesses: (1) The Traditional Business, being the business of newspaper publishing and related services that the Company had before 1999 when it purchased a majority interest in Sustain, and (2) Journal Technologies, Inc. (“Journal Technologies”), a wholly-owned subsidiary, which includes as of October 1, 2014, the combined operations of Sustain Technologies, Inc. (“Sustain”), a wholly-owned subsidiary since 2008; New Dawn Technologies, Inc. (“New Dawn”), acquired in December 2012; and ISD Technologies, Inc. (“ISD”), acquired in September 2013. Journal Technologies supplies case management software systems and related products to courts, prosecutor and public defender offices, probation departments and other justice agencies, including administrative law organizations, city and county governments and bar associations. These organizations use the Journal Technologies family of products to help manage cases and information electronically, to interface with other critical justice partners and to extend electronic services to bar members and the public, including a website to pay traffic citations online. These products are licensed to more than 500 organizations in 41 states and internationally.

Fiscal 2015 compared to fiscal 2014

Overall Results

During fiscal 2015, consolidated pretax loss was $310,000 as compared to a profit of $141,000 in the prior year. The Traditional Business segment’s pretax income decreased by $2,037,000 (65%) to $1,082,000 from $3,119,000, primarily resulting from decreases in trustee sale notice and related service fee revenues of $881,000, commercial advertising revenues of $237,000 and circulation revenues of $123,000, and increased expenses of $884,000 primarily for increased personnel costs and legal, accounting and tax fees. Journal Technologies’ business segment pretax loss decreased by $1,156,000 (20%) to $4,690,000 from $5,846,000 primarily resulting from increased licensing and maintenance fees and consulting fees of $1,699,000 (10%), partially offset by increased personnel costs of $524,000. The Company’s non-operating income, net of expenses, increased by $430,000 (15%) to $3,298,000 primarily because of additional dividends and interest income from the Company’s marketable securities. There were pretax other than temporary impairment losses on investments of $376,000 in fiscal 2015 and none in fiscal 2014.

Additional detail about each of the Company’s reportable segments, and its corporate income and expenses, is set forth below:

Overall Financial Results (000)

For the twelve months ended September 30

|

Reportable Segments |

||||||||||||||||||||||||||||||||

|

Traditional Business |

Journal Technologies |

Corporate income and expenses |

Total |

|||||||||||||||||||||||||||||

|

2015 |

2014 |

2015 |

2014 |

2015 |

2014 |

2015 |

2014 |

|||||||||||||||||||||||||

|

Revenues |

||||||||||||||||||||||||||||||||

|

Advertising |

$ | 10,502 | $ | 11,435 | $ | --- | $ | --- | $ | --- | $ | --- | $ | 10,502 | $ | 11,435 | ||||||||||||||||

|

Circulation |

5,915 | 6,038 | --- | --- | --- | --- | 5,915 | 6,038 | ||||||||||||||||||||||||

|

Advertising service fees and other |

2,703 | 2,800 | --- | --- | --- | --- | 2,703 | 2,800 | ||||||||||||||||||||||||

|

Licensing and maintenance fees |

--- | --- | 13,984 | 12,987 | --- | --- | 13,984 | 12,987 | ||||||||||||||||||||||||

|

Consulting fees |

--- | --- | 4,704 | 4,002 | --- | --- | 4,704 | 4,002 | ||||||||||||||||||||||||

|

Other public service fees |

--- | --- | 6,170 | 6,161 | --- | --- | 6,170 | 6,161 | ||||||||||||||||||||||||

|

Total revenues |

19,120 | 20,273 | 24,858 | 23,150 | --- | --- | 43,978 | 43,423 | ||||||||||||||||||||||||

|

Expenses |

||||||||||||||||||||||||||||||||

|

Salaries and employee benefits |

9,750 | 9,526 | 16,260 | 15,736 | --- | --- | 26,010 | 25,262 | ||||||||||||||||||||||||

|

Amortization of intangible assets |

12 | --- | 4,895 | 4,866 | --- | --- | 4,907 | 4,866 | ||||||||||||||||||||||||

|

Others |

8,276 | 7,628 | 8,297 | 7,857 | --- | --- | 16,573 | 15,485 | ||||||||||||||||||||||||

|

Total operating expenses |

18,038 | 17,154 | 29,452 | 28,459 | --- | --- | 47,490 | 45,613 | ||||||||||||||||||||||||

|

Income (loss) from operations |

1,082 | 3,119 | (4,594 | ) | (5,309 | ) | --- | --- | (3,512 | ) | (2,190 | ) | ||||||||||||||||||||

|

Other income (net), primarily dividends and interest income |

--- | --- | --- | --- | 3,674 | 2,868 | 3,674 | 2,868 | ||||||||||||||||||||||||

|

Other-than-temporary impairment Losses on investments |

--- | --- | --- | --- | (376 | ) | --- | (376 | ) | --- | ||||||||||||||||||||||

|

Interest and penalty expenses accrued for uncertain and unrecognized tax benefits |

--- | --- | (96 | ) | (537 | ) | --- | --- | (96 | ) | (537 | ) | ||||||||||||||||||||

|

Pretax income (loss) |

$ | 1,082 | $ | 3,119 | $ | (4,690 | ) | $ | (5,846 | ) | $ | 3,298 | $ | 2,868 | $ | (310 | ) | $ | 141 | |||||||||||||

At September 30, 2015, the aggregate fair market value of the Company’s marketable securities was $166,041,000. These securities had approximately $111,498,000 of unrealized gains before taxes of $43,278,000 and generated approximately $3,829,000 in dividends and interest income during the year, which lowers the Company’s effective income tax rate because of the dividends received deduction.

Consolidated revenues were $43,978,000 and $43,423,000 for fiscal 2015 and 2014, respectively. This increase of $555,000 (1%) was primarily from additional Journal Technologies licensing and maintenance and consulting revenues of $1,699,000, partially offset by the reduction in The Traditional Business’s trustee sale notice and related service fee revenues of $881,000, commercial advertising revenues of $237,000 and circulation revenues of $123,000. The Company’s revenues derived from Journal Technologies’ operations constituted about 57% and 53% of the Company’s total revenues for fiscal 2015 and 2014, respectively.

Consolidated operating costs and expenses increased by $1,877,000 (4%) to $47,490,000 from $45,613,000, primarily resulting from additional expenses for Journal Technologies. Total personnel costs increased by $748,000 (3%) to $26,010,000 from $25,262,000 including additional personnel costs for Journal Technologies of $524,000. Other general and administrative expenses increased by $761 (8%) to $9,882 from $9,121 mainly because of increased travel for installation services and selling expenses.

There was net income per share of $0.59 for fiscal 2015 as compared with $0.46 per share in the prior year.

The Traditional Business

The Traditional Business segment advertising revenues, which declined by $933,000 (8%) to $10,502,000 from $11,435,000, are very much dependent on the number of California and Arizona foreclosures for which public notice advertising is required by law. The number of foreclosure notices published by the Company decreased by 21% during fiscal 2015 as compared to the prior year and accounted for almost all of the decline in revenues. Because this slowing is expected to continue, there will be fewer foreclosure notice advertisements and declining revenues in fiscal 2016, and the Company’s print-based earnings will also likely decline significantly because it will be impractical for the Company to offset all revenue loss by expense reduction. The Company's smaller newspapers, those other than the Los Angeles and San Francisco Daily Journals ("The Daily Journals"), accounted for about 92% of the total public notice advertising revenues in fiscal 2015. Public notice advertising revenues and related advertising and other service fees constituted about 22% and 24% of the Company's total revenues for fiscal 2015 and 2014, respectively. Because of this concentration, the Company’s revenues would be significantly affected if California (and to a lesser extent Arizona) eliminated the legal requirement to publish public notices in adjudicated newspapers of general circulation, as has been proposed from time to time. Also, if the adjudication of one or more of the Company’s newspapers was challenged and revoked, those newspapers would no longer be eligible to publish public notice advertising, and it could have a material adverse effect on the Company’s revenues. Commercial advertising revenues decreased by $237,000 (6%) to $3,611,000 from $3,848,000 because of the continuing challenges in the commercial advertising business.

The Daily Journals accounted for about 87% of the Company's total circulation revenues, which declined by $123,000 (2%) to $5,915,000 from $6,038,000. The court rule and judicial profile services generated about 10% of the total circulation revenues, with the other newspapers and services accounting for the balance. Advertising service fees and other are Traditional Business segment revenues, which include primarily (i) agency commissions received from outside newspapers in which the advertising is placed and (ii) fees generated when filing notices with government agencies.

The Traditional Business segment operating expenses increased by $884,000 (5%) to $18,038,000 from $17,154,000 primarily due to increased personnel costs of $224,000 and additional legal, accounting and tax fees of $387,000.

Journal Technologies

Journal Technologies’ revenues increased by $1,708,000 (7%) to $24,858,000 from $23,150,000 in the prior year. Licensing and maintenance fees increased by $997,000 (8%) to $13,984,000 from $12,987,000. Consulting fees increased by $702,000 (18%) to $4,704,000 from $4,002,000. In most cases, revenues from new installation projects will only be recognized, if at all, upon completion and acceptance of the services by the various customers. Deferred revenues on installation contracts primarily represent the fair value of advances from customers of Journal Technologies for software licenses and installation services. After a customer’s acceptance of the completed project, the advances are generally no longer at risk of refund and are therefore considered earned. Deferred revenues on license and maintenance contracts represent prepayments of annual license and maintenance fees and are recognized ratably over the maintenance period.

Journal Technologies’ operating expenses, which included the amortization of intangible assets of $4,895,000 and $4,866,000 in fiscal 2015 and 2014, respectively, increased by $993,000 (3%) to $29,452,000 from $28,459,000 primarily due to increased personnel costs of $524,000 and travel expenses of $576,000. Identifiable intangible assets, including customer relationships and developed technology, are being amortized on a straight-line basis over five years due to the short life cycle of technology that customer relationships depend on and over 15 years for tax purposes. Goodwill, which is not amortized for financial statement purposes, is amortized over a 15-year period for tax purposes. Goodwill represents the expected synergies in expanding the Company’s software business. Goodwill is evaluated for impairment annually, or whenever events or changes in circumstances indicate that the value may not be recoverable. Considered factors for potential goodwill impairment evaluation include the current year’s business profitability before intangible amortization, fluctuations of revenues, changes in the market place, the status of installation contracts and new business, among other things. The Company is continuing to update and upgrade its software products. These costs are expensed as incurred and will impact earnings at least through the foreseeable future.

Taxes

The Company recorded an income tax benefit of $1,120,000 on pretax loss of $310,000 in fiscal 2015. The effective tax rate was lower than the statutory rate primarily due to the dividends received deduction, the domestic production activity deduction and a discrete benefit of approximately $400,000 related to the California Enterprise Zone hiring credits which resulted from the Company’s filing amended California tax returns for fiscal 2010 through fiscal 2013. A benefit of this tax credit was recognized in the fiscal 2014 amended tax return. On pretax income of $141,000 for fiscal 2014, the Company recorded a tax benefit of $490,000. The Company’s effective tax rate was 361% and -348% for fiscal 2015 and 2014, respectively.

At September 30, 2015, the Company had an accrued liability of approximately $2,991,000 for uncertain and unrecognized tax benefits relating to an acquisition in fiscal 2013, after a reduction of $253,000 resulting from the recognition of deferred revenues and from the amortization of goodwill for tax purposes. The Company does not anticipate a significant increase or decrease in this liability in the next twelve months. If recognized, it is expected that these unrecognized tax benefits would not have a significant impact on the Company’s effective tax rate. At September 30, 2014, the Company evaluated a tax position taken on its prior year tax return and determined that the position did not meet the more likely than not criteria because that position taken was in contrary to the one accounted for in purchase accounting. The Company thus accrued a liability of approximately $3,244,000 for uncertain and unrecognized tax benefits at September 30, 2014. There was no such an accrual in fiscal 2013.

During fiscal 2015, 2014 and 2013, interest expense of approximately $96,000, $537,000 and $0, respectively, was recorded as “interest and penalty expense accrued for uncertain and unrecognized tax benefits” in the consolidated statements of comprehensive income (loss). The Company files federal income tax returns in the United States and with various state jurisdictions and is no longer subject to examinations for fiscal years before fiscal 2012 with regard to federal income taxes and fiscal 2011 for state income taxes.

Fiscal 2014 compared to fiscal 2013