UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file Number _811-04471_

Value Line Aggressive Income Trust

(Exact name of registrant as specified in charter)

7 Times Square,21st Floor, New York, N.Y. 10036-6524

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 212-907-1900

Date of fiscal year end: January 31, 2012

Date of reporting period: July 31, 2011

Item I. Reports to Stockholders.

A copy of the Semi -Annual Report to Stockholders for the period ended 7/31/11 is included with this Form.

|

INVESTMENT ADVISER

|

EULAV Asset Management

|

S E M I – A N N U A L R E P O R T

|

|||||

|

7 Times Square 21st Floor

|

J u l y 3 1 , 2 0 1 1

|

||||||

|

New York, NY 10036-6524

|

|||||||

|

DISTRIBUTOR

|

EULAV Securities LLC

|

||||||

|

7 Times Square 21st Floor

|

|||||||

|

New York, NY 10036-6524

|

|||||||

|

CUSTODIAN BANK

|

State Street Bank and Trust Co.

|

||||||

|

225 Franklin Street

|

|||||||

|

Boston, MA 02110

|

|||||||

|

SHAREHOLDER

|

State Street Bank and Trust Co.

|

||||||

|

SERVICING AGENT

|

c/o BFDS

|

||||||

|

P.O. Box 219729

|

|||||||

|

Kansas City, MO 64121-9729

|

|||||||

|

INDEPENDENT

|

PricewaterhouseCoopers LLP

|

||||||

|

REGISTERED PUBLIC

|

300 Madison Avenue

|

Value Line

Aggressive

Income Trust

|

|||||

|

ACCOUNTING FIRM

|

New York, NY 10017

|

||||||

|

LEGAL COUNSEL

|

Peter D. Lowenstein, Esq.

|

||||||

|

496 Valley Road

|

|||||||

|

Cos Cob, CT 06807-0272

|

|||||||

|

DIRECTORS

|

Mitchell E. Appel

|

||||||

|

Joyce E. Heinzerling

|

|||||||

|

Francis C. Oakley

|

|||||||

|

David H. Porter

|

|||||||

|

Paul Craig Roberts

|

|||||||

|

Nancy-Beth Sheerr

|

|||||||

|

Daniel S. Vandivort

|

|||||||

|

OFFICERS

|

Mitchell E. Appel

|

||||||

|

President

|

|||||||

|

Michael J. Wagner

|

|||||||

|

Chief Compliance Officer

|

|||||||

|

Emily D. Washington

|

|||||||

|

Treasurer and Secretary

|

|||||||

|

|||||||

|

This unaudited report is issued for information to shareholders. It is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of the Trust (obtainable from the Distributor).

|

|||||||

|

#00081727

|

|||||||

Value Line Aggressive Income Trust

|

To Our Value Line Aggressive

|

|

To Our Shareholders (unaudited):

|

Enclosed is your semi-annual report for the period ended July 31, 2011. We encourage you to carefully review this report, which includes economic observations, your Trust’s performance data and highlights, schedule of investments, and financial statements. For the six months ended July 31, 2011, the total return of the Value Line Aggressive Income Trust was 2.74%, versus the 3.90% of the Barclays Capital U.S. Corporate High Yield Index(1), a proxy for the overall high-yield market.

In the beginning of 2011, high-yield securities performed reasonably well due to prospects for continued economic growth, solid corporate profits, and a lower than expected default rate of 2.3%. An unexpectedly slower growth environment took hold as the nation’s Gross Domestic Product (GDP) fell to the 1% level following growth of 2% to 4% in 2010. We expect this subpar growth to continue for the course of the year, placing some pressure on the high yield market. After all, high yield has enjoyed strong gains in both 2009 and 2010, so some retrenchment would not be surprising. However, because the Trust emphasizes higher quality credits, B to BB+ and is underweight the lowest rated issues (CCC), the Trust performance should hold up well. The underweight in CCC issues had caused the Trust to underperform its index benchmark during the last six-month period, but we believe this should not be the case in the weaker environment.

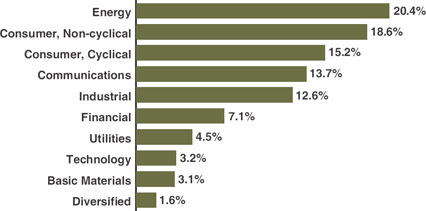

We continue to focus our investments in the more liquid and stronger credits available in the high-yield sector. We have an underweight in those cyclical industries which are especially sensitive to an economic slowdown, and we have maintained our overweight in energy because we still like the strong earnings growth potential of this sector.

Preserving capital in a difficult market environment, while allowing for an attractive dividend yield, remains our goal. We thank you for your continued investment with us.

|

Sincerely,

|

||

|

/s/ Mitchell Appel

|

||

|

Mitchell Appel, President

|

||

|

/s/ Jeff Geffen

|

||

|

Jeff Geffen, Portfolio Manager

|

|

(1)

|

The Barclays Capital U.S. Corporate High Yield Index is representative of the broad based fixed-income market. It includes non-investment grade corporate bonds. The returns for the Index do not reflect charges, expenses, or taxes, and it is not possible to directly invest in this unmanaged Index.

|

2

|

Value Line Aggressive Income Trust

|

|

Income Trust Shareholders

|

|

Economic Highlights (unaudited)

|

The first half of 2011 saw the broad US stock market rising on the heels of strengthening corporate profits. The S&P 500 returned 6% for the first six months of the year despite significant global economic concerns. Several members of the European Union continued to face a serious debt crisis including Greece, Portugal, Ireland, and Spain. Further, the nuclear disaster in Japan and the geopolitical upheaval in commodity markets added to investor concerns. At home, disappointing job growth in the United States kept the national unemployment rate firmly above 9% for the second quarter.

By mid-year there was mounting evidence that the US recovery had slowed to a crawl. Consumer spending, which accounts for roughly 70% of economic activity, declined in June for the first time in 2 years. First quarter GDP was up by only 0.4%, and second quarter GDP growth was only modestly better at 1.3%. Employment growth in July lagged June numbers, and it was reported that the level of new factory orders decreased. By August, only 58% of the population was working, the lowest level in nearly 3 decades. Housing prices remained almost uniformly weak.

Much of the summer was consumed by the drama of the U.S. debt ceiling negotiations, resulting in an 11th hour deal that appears to satisfy few constituents. It surely did not satisfy Standard & Poor’s who felt that the $2.1 trillion deficit reduction over 10 years was insufficient to solve the country’s debt problem. The rating agency proceeded to downgrade U.S. Treasury debt from AAA to AA+. This downgrade did not affect short-term Treasuries. Within a few days the rating agency imposed the same rating cut on the long-term debt of several U.S. Agencies including Fannie Mae and Freddie Mac. The other major rating agencies, Moody’s and Fitch, maintained AAA ratings for U.S. Treasury debt as well as for the U.S. Agencies. Investor confidence plunged on the heels of the debt ceiling debacle and the US Treasury debt downgrade. Returns for the S&P 500 turned negative in August giving up its returns for the year.

The bond market rallied as stocks took a dive. Yields fell and prices rose across fixed income markets as investors looked for safer havens. Despite the rating downgrade, investor demand for Treasuries soared, and by early September, 10-year Treasury note yields had fallen to an all-time low of 1.90%. This downward pressure on Treasury yields came largely from an employment report showing no new jobs being added in August. This disappointing jobs report kept the unemployment report unchanged at 9.1%.

3

|

Value Line Aggressive Income Trust

|

| TRUST EXPENSES (unaudited): |

Example

As a shareholder of the Trust, you incur ongoing costs, including management fees, distribution and service (12b-1) fees, and other Trust expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Trust and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (February 1, 2011 through July 31, 2011).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Trust’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Trust’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Trust and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs would have been higher.

|

Expenses

|

||||||||||||

|

Beginning

|

Ending

|

paid during

|

||||||||||

|

account value

|

account value

|

period 2/1/11

|

||||||||||

|

2/1/11

|

7/31/11

|

thru 7/31/11*

|

||||||||||

|

Actual

|

$ | 1,000.00 | $ | 1,027.36 | $ | 5.98 | ||||||

|

Hypothetical (5% return before expenses)

|

$ | 1,000.00 | $ | 1,018.89 | $ | 5.96 | ||||||

|

*

|

Expenses are equal to the Trust’s annualized expense ratio of 1.19% multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. This expense ratio may differ from the expense ratio shown in the Financial Highlights.

|

4

|

Value Line Aggressive Income Trust

|

|

Portfolio Highlights at July 31, 2011 (unaudited)

|

|

Ten Largest Holdings

|

|

|

||||||||||||

|

Principal

|

Percentage of

|

|||||||||||

|

Issue

|

Amount

|

Value

|

Net Assets

|

|||||||||

|

Ford Motor Co., Global Landmark Securities, Senior Notes, 7.45%, 7/16/31

|

$ | 500,000 | $ | 569,909 | 1.7 | % | ||||||

|

EchoStar DBS Corp., Senior Notes, 6.63%, 10/1/14

|

500,000 | 533,125 | 1.6 | % | ||||||||

|

Briggs & Stratton Corp., 6.88%, 12/15/20

|

500,000 | 530,000 | 1.6 | % | ||||||||

|

Leucadia National Corp., Senior Notes, 7.13%, 3/15/17

|

500,000 | 520,625 | 1.6 | % | ||||||||

|

Ball Corp., 5.75%, 5/15/21

|

500,000 | 505,000 | 1.5 | % | ||||||||

|

Gulfmark Offshore, Inc., Guaranteed Notes, 7.75%, 7/15/14

|

500,000 | 504,375 | 1.5 | % | ||||||||

|

Boyd Gaming Corp., Senior Subordinated Notes, 6.75%, 4/15/14

|

500,000 | 498,125 | 1.5 | % | ||||||||

|

American Tower Corp., Senior Notes, 7.00%, 10/15/17

|

400,000 | 471,584 | 1.4 | % | ||||||||

|

Community Health Systems, Inc., Senior Notes, 8.88%, 7/15/15

|

450,000 | 465,187 | 1.4 | % | ||||||||

|

Peabody Energy Corp., Senior Notes, 7.38%, 11/1/16

|

400,000 | 453,000 | 1.4 | % | ||||||||

| Asset Allocation — Percentage of Total Net Assets | ||||||||||||

|

Sector Weightings — Percentage of Total Investment Securities

|

5

Value Line Aggressive Income Trust

| Schedule of Investments (unaudited) |

|

Principal

Amount

|

Value

|

||||||

|

CORPORATE BONDS & NOTES (89.1%)

|

|||||||

|

BASIC MATERIALS (2.6%)

|

|||||||

|

$

|

200,000

|

AK Steel Corp., 7.63%, 5/15/20

|

$

|

204,500

|

|||

|

250,000

|

FMG Resources Pty Ltd., Senior Notes, 7.00%, 11/1/15 (1)

|

259,063

|

|||||

|

400,000

|

United States Steel Corp., Senior Notes, 6.05%, 6/1/17

|

401,000

|

|||||

|

864,563

|

|||||||

|

COMMUNICATIONS (12.5%)

|

|||||||

|

250,000

|

Alcatel-Lucent USA, Inc., Senior Notes, 6.45%, 3/15/29

|

225,625

|

|||||

|

400,000

|

American Tower Corp., Senior Notes, 7.00%, 10/15/17

|

471,584

|

|||||

|

250,000

|

Cablevision Systems Corp., 7.75%, 4/15/18

|

266,875

|

|||||

|

300,000

|

Crown Castle International Corp., Senior Notes, 9.00%, 1/15/15

|

328,500

|

|||||

|

500,000

|

EchoStar DBS Corp., Senior Notes, 6.63%, 10/1/14

|

533,125

|

|||||

|

300,000

|

Intelsat Luxembourg SA, 11.25%, 2/4/17

|

321,000

|

|||||

|

350,000

|

MetroPCS Wireless, Inc., 6.63%, 11/15/20

|

350,875

|

|||||

|

250,000

|

Nielsen Finance LLC / Nielsen Finance Co., 7.75%, 10/15/18 (1)

|

265,000

|

|||||

|

400,000

|

Qwest Corp., Senior Notes, 8.88%, 3/15/12

|

418,000

|

|||||

|

350,000

|

Sprint Capital Corp., 8.75%, 3/15/32

|

378,875

|

|||||

|

200,000

|

Wind Acquisition Finance SA, 11.75%, 7/15/17 (1)

|

221,750

|

|||||

|

350,000

|

Windstream Corp., Senior Notes, 8.13%, 8/1/13

|

380,625

|

|||||

|

4,161,834

|

|||||||

|

CONSUMER, CYCLICAL (14.3%)

|

|||||||

|

300,000

|

ArvinMeritor, Inc., Senior Notes, 8.13%, 9/15/15

|

311,250

|

|||||

|

500,000

|

Boyd Gaming Corp., Senior Subordinated Notes, 6.75%, 4/15/14

|

498,125

|

|||||

|

250,000

|

Cooper Tire & Rubber Co., Senior Notes, 7.63%, 3/15/27

|

242,188

|

|||||

|

Principal

Amount

|

Value

|

||||||

|

$

|

300,000

|

Dana Holding Corp., Senior Notes, 6.50%, 2/15/19

|

$

|

303,750

|

|||

|

500,000

|

Ford Motor Co., Global Landmark Securities, Senior Notes, 7.45%, 7/16/31

|

569,909

|

|||||

|

350,000

|

Goodyear Tire & Rubber Co. (The), 8.25%, 8/15/20

|

384,125

|

|||||

|

300,000

|

Hanesbrands, Inc., 6.38%, 12/15/20

|

298,500

|

|||||

|

350,000

|

Lear Corp., 7.88%, 3/15/18

|

377,563

|

|||||

|

115,000

|

Lennar Corp., Senior Notes, 6.50%, 4/15/16

|

115,000

|

|||||

|

200,000

|

Macy’s Retail Holdings, Inc., 8.13%, 8/15/35

|

218,249

|

|||||

|

300,000

|

MGM Resorts International, Senior Notes, 7.50%, 6/1/16

|

292,500

|

|||||

|

300,000

|

PEP Boys-Manny, Moe & Jack, Senior Subordinated Notes, 7.50%, 12/15/14

|

307,125

|

|||||

|

300,000

|

Royal Caribbean Cruises Ltd., Senior Notes, 7.50%, 10/15/27

|

303,000

|

|||||

|

294,624

|

United Air Lines, Inc., 12.75%, 7/15/12

|

316,721

|

|||||

|

200,000

|

Wynn Las Vegas Ltd., 7.75%, 8/15/20

|

221,000

|

|||||

|

4,759,005

|

|||||||

|

CONSUMER, NON-CYCLICAL (16.0%)

|

|||||||

|

350,000

|

Alere, Inc., Senior Notes, 9.00%, 5/15/16

|

364,438

|

|||||

|

250,000

|

Avis Budget Car Rental LLC / Avis Budget Finance, Inc., Senior Notes, 7.75%, 5/15/16

|

256,250

|

|||||

|

400,000

|

Bausch & Lomb, Inc., Senior Notes, 9.88%, 11/1/15

|

423,000

|

|||||

|

300,000

|

Chiquita Brands International, Inc., Senior Notes, 7.50%, 11/1/14

|

303,000

|

|||||

|

450,000

|

Community Health Systems, Inc., Senior Notes, 8.88%, 7/15/15

|

465,187

|

|||||

|

400,000

|

Constellation Brands, Inc., Senior Notes, 7.25%, 5/15/17

|

438,000

|

|||||

|

300,000

|

Dean Foods Co., Senior Notes, 7.00%, 6/1/16

|

297,000

|

|||||

|

300,000

|

Deluxe Corp., 7.00%, 3/15/19 (1)

|

298,500

|

|||||

See Notes to Financial Statements.

6

Value Line Aggressive Income Trust

| July 31, 2011 |

|

Principal

Amount

|

Value

|

||||||

|

$

|

250,000

|

HCA, Inc., Senior Notes, 6.50%, 2/15/16

|

$

|

255,625

|

|||

|

400,000

|

Hertz Corp. (The), 7.38%, 1/15/21 (1)

|

409,000

|

|||||

|

300,000

|

Humana, Inc., Senior Notes, 6.45%, 6/1/16

|

347,364

|

|||||

|

200,000

|

Jarden Corp., 6.13%, 11/15/22

|

201,500

|

|||||

|

250,000

|

R.R. Donnelley & Sons Co., Senior Notes, 7.25%, 5/15/18

|

257,500

|

|||||

|

300,000

|

Reynolds Group Holdings Ltd., 8.50%, 5/15/18 (1)

|

288,000

|

|||||

|

350,000

|

Tyson Foods, Inc., Senior Notes, 6.60%, 4/1/16

|

389,812

|

|||||

|

250,000

|

Valeant Pharmaceuticals International, 6.75%, 8/15/21 (1)

|

236,250

|

|||||

|

100,000

|

Warner Chilcott Co. LLC, 7.75%, 9/15/18 (1)

|

101,000

|

|||||

|

5,331,426

|

|||||||

|

DIVERSIFIED (1.6%)

|

|||||||

|

500,000

|

Leucadia National Corp., Senior Notes, 7.13%, 3/15/17

|

520,625

|

|||||

|

ENERGY (17.2%)

|

|||||||

|

200,000

|

Arch Coal, Inc., 7.25%, 10/1/20

|

209,250

|

|||||

|

166,000

|

Arch Western Finance LLC, Guaranteed Senior Notes, 6.75%, 7/1/13

|

167,037

|

|||||

|

400,000

|

Bill Barrett Corp., Senior Notes, 9.88%, 7/15/16

|

452,000

|

|||||

|

400,000

|

Cie Generale de Geophysique-Veritas, 7.75%, 5/15/17

|

414,000

|

|||||

|

350,000

|

Cimarex Energy Co., Senior Notes, 7.13%, 5/1/17

|

368,375

|

|||||

|

400,000

|

Complete Production Services, Inc., Senior Notes, 8.00%, 12/15/16

|

420,000

|

|||||

|

260,000

|

Covanta Holding Corp., Senior Notes, 7.25%, 12/1/20

|

282,169

|

|||||

|

350,000

|

Forest Oil Corp., 8.50%, 2/15/14

|

380,625

|

|||||

|

300,000

|

Frontier Oil Corp., 8.50%, 9/15/16

|

321,750

|

|||||

|

250,000

|

Linn Energy LLC, 7.75%, 2/1/21 (1)

|

266,250

|

|||||

|

300,000

|

McMoRan Exploration Co., Senior Notes, 11.88%, 11/15/14

|

323,250

|

|||||

|

Principal

Amount

|

Value

|

||||||

|

$

|

400,000

|

Newfield Exploration Co., Senior Notes, 6.63%, 9/1/14

|

$

|

406,000

|

|||

|

400,000

|

Peabody Energy Corp., Senior Notes, 7.38%, 11/1/16

|

453,000

|

|||||

|

300,000

|

PetroHawk Energy Corp., Senior Notes, 7.88%, 6/1/15

|

324,750

|

|||||

|

400,000

|

Plains Exploration & Production Co., 6.63%, 5/1/21

|

418,000

|

|||||

|

250,000

|

SandRidge Energy, Inc., 8.00%, 6/1/18 (1)

|

265,000

|

|||||

|

250,000

|

SM Energy Co., Senior Notes, 6.63%, 2/15/19 (1)

|

257,500

|

|||||

|

5,728,956

|

|||||||

|

FINANCIAL (6.0%)

|

|||||||

|

400,000

|

Ally Financial, Inc., 8.00%, 3/15/20

|

428,500

|

|||||

|

400,000

|

CIT Group, Inc., 7.00%, 5/1/16

|

401,000

|

|||||

|

135,000

|

Citigroup Capital III, 7.63%, 12/1/36

|

144,638

|

|||||

|

300,000

|

Ford Motor Credit Co. LLC, Senior Notes, 8.00%, 12/15/16

|

343,599

|

|||||

|

250,000

|

Icahn Enterprises LP, 8.00%, 1/15/18

|

258,125

|

|||||

|

250,000

|

LBG Capital No.1 PLC, 7.88%, 11/1/20 (1)

|

230,313

|

|||||

|

200,000

|

SLM Corp., Senior Notes, 5.63%, 8/1/33

|

175,503

|

|||||

|

1,981,678

|

|||||||

|

INDUSTRIAL (11.7%)

|

|||||||

|

350,000

|

Alliant Techsystems, Inc., Senior Subordinated Notes, 6.75%, 4/1/16

|

359,625

|

|||||

|

200,000

|

Anixter, Inc., 5.95%, 3/1/15

|

203,750

|

|||||

|

500,000

|

Ball Corp., 5.75%, 5/15/21

|

505,000

|

|||||

|

200,000

|

BE Aerospace, Inc., Senior Notes, 8.50%, 7/1/18

|

220,750

|

|||||

|

500,000

|

Briggs & Stratton Corp., 6.88%, 12/15/20

|

530,000

|

|||||

|

200,000

|

Crown Americas LLC/Crown Americas Capital Corp. III, Senior Notes, 6.25%, 2/1/21 (1)

|

204,500

|

|||||

|

400,000

|

General Cable Corp., Senior Notes, 7.13%, 4/1/17

|

412,000

|

|||||

See Notes to Financial Statements.

7

Value Line Aggressive Income Trust

| Schedule of Investments (unaudited) |

|

Principal

Amount

|

Value

|

||||||

|

$

|

500,000

|

Gulfmark Offshore, Inc., Guaranteed Notes, 7.75%, 7/15/14

|

$

|

504,375

|

|||

|

200,000

|

Masco Corp., Senior Notes, 7.13%, 3/15/20

|

205,963

|

|||||

|

400,000

|

Terex Corp., Senior Subordinated Notes, 8.00%, 11/15/17

|

407,500

|

|||||

|

400,000

|

USG Corp., Senior Notes, 6.30%, 11/15/16

|

344,000

|

|||||

|

3,897,463

|

|||||||

|

TECHNOLOGY (3.1%)

|

|||||||

|

250,000

|

Advanced Micro Devices, Inc., Senior Notes, 8.13%, 12/15/17

|

265,625

|

|||||

|

81,000

|

Broadridge Financial Solutions, Inc., Senior Notes, 6.13%, 6/1/17

|

92,861

|

|||||

|

350,000

|

First Data Corp., Senior Notes, 9.88%, 9/24/15

|

355,250

|

|||||

|

300,000

|

Seagate Technology HDD Holdings, 6.80%, 10/1/16

|

318,000

|

|||||

|

1,031,736

|

|||||||

|

UTILITIES (4.1%)

|

|||||||

|

350,000

|

AES Corp. (The), Senior Notes, 8.00%, 10/15/17

|

378,000

|

|||||

|

300,000

|

Calpine Corp., Senior Notes, 7.88%, 1/15/23 (1)

|

315,000

|

|||||

|

300,000

|

NRG Energy, Inc., 8.50%, 6/15/19

|

312,000

|

|||||

|

350,000

|

RRI Energy, Inc., Senior Notes, 7.63%, 6/15/14

|

364,000

|

|||||

|

1,369,000

|

|||||||

|

TOTAL CORPORATE BONDS & NOTES

(Cost $27,917,449) (89.1%) |

29,646,286

|

||||||

| CONVERTIBLE CORPORATE BONDS & NOTES (5.7%) | |||||||

|

BASIC MATERIALS (0.4%)

|

|||||||

|

100,000

|

Steel Dynamics, Inc., 5.13%, 6/15/14

|

117,875

|

|||||

|

COMMUNICATIONS (0.7%)

|

|||||||

|

250,000

|

Leap Wireless International, Inc., 4.50%, 7/15/14

|

237,500

|

|||||

|

Principal

Amount

|

Value

|

||||||

| CONSUMER, NON-CYCLICAL (1.8%) | |||||||

|

$

|

250,000

|

Charles River Laboratories International, Inc., Senior Notes, 2.25%, 6/15/13

|

$

|

260,313

|

|||

|

250,000

|

LifePoint Hospitals, Inc., Senior Subordinated Debentures, 3.50%, 5/15/14

|

262,187

|

|||||

|

89,000

|

Omnicare, Inc., 3.25%, 12/15/35

|

85,329

|

|||||

|

607,829

|

|||||||

|

ENERGY (2.4%)

|

|||||||

|

150,000

|

Chesapeake Energy Corp., 2.50%, 5/15/37

|

165,375

|

|||||

|

300,000

|

Global Industries Ltd., Senior Debentures, 2.75%, 8/1/27

|

215,625

|

|||||

|

150,000

|

Helix Energy Solutions Group, Inc., 3.25%, 12/15/25

|

151,125

|

|||||

|

250,000

|

SESI LLC, Guaranteed Senior Notes, 1.50%, 12/15/26 (2)

|

260,937

|

|||||

|

793,062

|

|||||||

|

INDUSTRIAL (0.4%)

|

|||||||

|

150,000

|

Suntech Power Holdings Co., Ltd., Senior Notes, 3.00%, 3/15/13

|

123,000

|

|||||

|

TOTAL CONVERTIBLE CORPORATE BONDS & NOTES

(Cost $1,696,401) (5.7%) |

1,879,266

|

||||||

|

Shares

|

Value

|

||||||

| CONVERTIBLE PREFERRED STOCKS (0.7%) | |||||||

|

CONSUMER, CYCLICAL (0.3%)

|

|||||||

|

2,000

|

General Motors Co., Convertible Fixed, Series B, 4.75%

|

92,420

|

|||||

|

FINANCIAL (0.4%)

|

|||||||

|

2,000

|

Hartford Financial Services Group, Inc. (The), 7.25%

|

47,600

|

|||||

|

100

|

Bank of America Corp., Series L, 7.25%

|

97,473

|

|||||

|

145,073

|

|||||||

|

TOTAL CONVERTIBLE PREFERRED STOCKS

(Cost $253,981) (0.7%) |

237,493

|

||||||

See Notes to Financial Statements.

8

Value Line Aggressive Income Trust

| July 31, 2011 |

|

Shares

|

Value

|

||||||

|

COMMON STOCKS (0.5%)

|

|||||||

|

FINANCIALS (0.2%)

|

|||||||

|

3,000

|

Hospitality Properties Trust

|

$

|

75,750

|

||||

|

UTILITIES (0.3%)

|

|||||||

|

2,000

|

FirstEnergy Corp.

|

89,300

|

|||||

|

TOTAL COMMON STOCKS

(Cost $141,751) (0.5%) |

165,050

|

||||||

| PREFERRED STOCKS (0.2%) | |||||||

|

FINANCIALS (0.2%)

|

|||||||

|

3,000

|

Health Care REIT, Inc., Series F, 7.63%

|

75,960

|

|||||

|

TOTAL PREFERRED STOCKS

(Cost $75,000) (0.2%) |

75,960

|

||||||

|

TOTAL INVESTMENT SECURITIES (96.2%)

(Cost $30,084,582) |

32,004,055

|

||||||

|

CASH AND OTHER ASSETS IN EXCESS OF LIABILITIES (3.8%)

|

1,275,658

|

||||||

|

NET ASSETS (100%)

|

$

|

33,279,713

|

|||||

|

NET ASSET VALUE OFFERING AND REDEMPTION PRICE, PER OUTSTANDING SHARE

($33,279,713 ÷ 6,733,764 shares outstanding) |

$

|

4.94

|

|||||

|

(1)

|

Pursuant to Rule 144A under the Securities Act of 1933, this security can only be sold to qualified institutional investors.

|

|

(2)

|

Step Bond - The rate shown is as of July 31, 2011 and will reset at a future date.

|

| REIT | Real Estate Investment Trust. |

See Notes to Financial Statements.

9

Value Line Aggressive Income Trust

| Statement of Assets and Liabilities at July 31, 2011 (unaudited) |

||||

|

Assets:

|

||||

|

Investment securities, at value

(Cost - $30,084,582) |

$ | 32,004,055 | ||

|

Cash

|

1,081,685 | |||

|

Interest and dividends receivable

|

549,599 | |||

|

Prepaid expenses

|

8,794 | |||

|

Receivable for trust shares sold

|

5,245 | |||

|

Total Assets

|

33,649,378 | |||

|

Liabilities:

|

||||

|

Payable for securities purchased

|

226,294 | |||

|

Payable for trust shares redeemed

|

81,340 | |||

|

Dividends payable to shareholders

|

36,589 | |||

|

Accrued expenses:

|

||||

|

Advisory fee

|

14,755 | |||

|

Service and distribution plan fees

|

4,035 | |||

|

Other

|

6,652 | |||

|

Total Liabilities

|

369,665 | |||

|

Net Assets

|

$ | 33,279,713 | ||

|

Net assets consist of:

|

||||

|

Shares of beneficial interest, at $0.01 par value (authorized unlimited, outstanding 6,733,764 shares)

|

$ | 67,338 | ||

|

Additional paid-in capital

|

33,449,993 | |||

|

Distributions in excess of net investment income

|

(38,747 | ) | ||

|

Accumulated net realized loss on investments

|

(2,118,344 | ) | ||

|

Net unrealized appreciation of investments

|

1,919,473 | |||

|

Net Assets

|

$ | 33,279,713 | ||

|

Net Asset Value, Offering and Redemption Price per Outstanding Share ($33,279,713 ÷ 6,733,764 shares outstanding)

|

$ | 4.94 | ||

|

Statement of Operations

for the Six Months Ended July 31, 2011 (unaudited) |

||||

|

Investment Income:

|

||||

|

Interest

|

$ | 1,174,235 | ||

|

Dividends

|

18,412 | |||

|

Total Income

|

1,192,647 | |||

|

Expenses:

|

||||

|

Advisory fee

|

125,577 | |||

|

Service and distribution plan fees

|

41,859 | |||

|

Printing and postage

|

17,732 | |||

|

Transfer agent fees

|

17,098 | |||

|

Custodian fees

|

14,055 | |||

|

Registration and filing fees

|

13,903 | |||

|

Auditing and legal fees

|

11,930 | |||

|

Trustees’ fees and expenses

|

3,062 | |||

|

Insurance

|

2,213 | |||

|

Other

|

3,614 | |||

|

|

||||

|

Total Expenses Before Fees Waived and Custody Credits

|

251,043 | |||

|

Less: Advisory Fees Waived

|

(33,487 | ) | ||

|

Less: Service and Distribution Plan Fees Waived

|

(16,744 | ) | ||

|

Less: Custody Credits

|

(65 | ) | ||

|

Net Expenses

|

200,747 | |||

|

Net Investment Income

|

991,900 | |||

|

Net Realized and Unrealized Gain/(Loss) on Investments:

|

||||

|

Net Realized Gain

|

734,799 | |||

|

Change in Net Unrealized Appreciation/(Depreciation)

|

(807,677 | ) | ||

|

Net Realized Gain and Change in Net Unrealized Appreciation/(Depreciation) on Investments

|

(72,878 | ) | ||

|

Net Increase in Net Assets from Operations

|

$ | 919,022 | ||

See Notes to Financial Statements.

10

Value Line Aggressive Income Trust

| Statement of Changes in Net Assets for the Six Months Ended July 31, 2011 (unaudited) and for the Year Ended January 31, 2011 |

||||||||

|

Six Months Ended

|

||||||||

|

July 31, 2011

|

Year Ended

|

|||||||

|

(unaudited)

|

January 31, 2011

|

|||||||

|

Operations:

|

||||||||

|

Net investment income

|

$ | 991,900 | $ | 2,210,230 | ||||

|

Net realized gain on investments

|

734,799 | 1,419,052 | ||||||

|

Change in net unrealized appreciation/(depreciation)

|

(807,677 | ) | 387,736 | |||||

|

Net increase in net assets from operations

|

919,022 | 4,017,018 | ||||||

|

Distributions to Shareholders:

|

||||||||

|

Net investment income

|

(991,900 | ) | (2,207,166 | ) | ||||

|

Trust Share Transactions:

|

||||||||

|

Proceeds from sale of shares

|

901,112 | 2,439,245 | ||||||

|

Proceeds from reinvestment of dividends to shareholders

|

763,921 | 1,743,738 | ||||||

|

Cost of shares redeemed *

|

(3,197,475 | ) | (8,894,522 | ) | ||||

|

Net decrease in net assets from Trust share transactions

|

(1,532,442 | ) | (4,711,539 | ) | ||||

|

Total Decrease in Net Assets

|

(1,605,320 | ) | (2,901,687 | ) | ||||

|

Net Assets:

|

||||||||

|

Beginning of period

|

34,885,033 | 37,786,720 | ||||||

|

End of period

|

$ | 33,279,713 | $ | 34,885,033 | ||||

|

Distributions in excess of net investment income, at end of period

|

$ | (38,747 | ) | $ | (38,747 | ) | ||

| * |

Net of redemption fees (see Note 1K and Note 2).

|

See Notes to Financial Statements.

11

Value Line Aggressive Income Trust

| Notes to Financial Statements (unaudited) |

1. Significant Accounting Policies

Value Line Aggressive Income Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The primary investment objective of the Trust is to maximize current income through investment in a diversified portfolio of high-yield fixed-income securities. As a secondary investment objective, the Trust will seek capital appreciation, but only when consistent with its primary objective. Lower rated or unrated (i.e., high-yield) securities are more likely to react to developments affecting market risk (general market liquidity) and credit risk (issuers’ inability to meet principal and interest payments on their obligations) than are more highly rated securities, which react primarily to movements in the general level of interest rates. The ability of issuers of debt securities held by the Trust to meet their obligations may be affected by economic developments in a specific industry.

The following significant accounting policies are in conformity with generally accepted accounting principles for investment companies. Such policies are consistently followed by the Trust in the preparation of its financial statements. Generally accepted accounting principles require management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results may differ from those estimates.

(A) Security Valuation: The Trustees have determined that the value of bonds and other fixed income corporate securities be calculated on the valuation date by reference to valuations obtained from an independent pricing service that determines valuations for normal institutional-size trading units of debt securities, without exclusive reliance upon quoted prices. This service takes into account appropriate factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data in determining valuations. Securities, other than bonds and other fixed income securities, not priced in this manner are valued at the midpoint between the latest available and representative bid and asked prices or, when stock valuations are used, at the latest quoted sale price as of the regular close of business of the New York Stock Exchange on the valuation date. Other assets and securities for which market valuations are not readily available are valued at their fair value as the Trustees may determine. In addition, the Trust may use the fair value of a security when the closing price on the primary exchange where the security is traded no longer reflects the value of a security due to factors affecting one or more relevant securities markets or the specific issuer. Short term instruments with maturities of 60 days or less, at the date of purchase, are valued at amortized cost which approximates market value.

(B) Fair Value Measurements: The Trust follows fair valuation accounting standards (FASB ASC 820-10) which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| ● | Level 1 — Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Trust has the ability to access at the measurement date; |

| ● | Level 2 — Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active; |

| ● | Level 3 — Inputs that are unobservable. |

Transfers between investment levels may occur as the markets fluctuate and/or the availability of data used in an investment’s valuation changes. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

12

Value Line Aggressive Income Trust

| July 31, 2011 |

The following table summarizes the inputs used to value the Trust’s investments in securities as of July 31, 2011:

|

Investments in Securities:

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Assets

|

||||||||||||||||

|

Corporate Bonds & Notes

|

$ | 0 | $ | 29,646,286 | $ | 0 | $ | 29,646,286 | ||||||||

|

Convertible Corporate Bonds & Notes

|

0 | 1,879,266 | 0 | 1,879,266 | ||||||||||||

|

Common Stocks

|

165,050 | 0 | 0 | 165,050 | ||||||||||||

|

Preferred Stocks

|

75,960 | 0 | 0 | 75,960 | ||||||||||||

|

Convertible Preferred Stocks

|

237,493 | 0 | 0 | 237,493 | ||||||||||||

|

Total Investments in Securities

|

$ | 478,503 | $ | 31,525,552 | $ | 0 | $ | 32,004,055 | ||||||||

The Trust follows the updated provisions surrounding fair value measurements and disclosures on transfers in and out of all levels of the fair value hierarchy on a gross basis and the reasons for the transfers as well as to disclosures about the valuation techniques and inputs used to measure fair value for investments that fall in either Level 2 or Level 3 fair value hierarchy.

For the six months ended July 31, 2011, there was no significant transfer activity between Level 1 and Level 2.

For the six months ended July 31, 2011, there were no Level 3 investments. The Schedule of Investments includes a breakdown of the Schedule’s investments by category.

(C) Repurchase Agreements: In connection with transactions in repurchase agreements, the Trust’s custodian takes possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, it is the Trust’s policy to mark-to-market the collateral on a daily basis to ensure the adequacy of the collateral. In the event of default of the obligation to repurchase, the Trust has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings.

(D) Distributions: It is the policy of the Trust to distribute all of its net investment income to shareholders. Dividends from net investment income will be declared daily and paid monthly. Net realized capital gains, if any, are distributed to shareholders annually or more frequently if necessary to comply with the Internal Revenue Code. Income dividends and capital gains distributions are automatically reinvested in additional shares of the Trust unless the shareholder has requested otherwise. Income earned by the Trust on weekends, holidays and other days on which the Trust is closed for business is declared as a dividend on the next day on which the Trust is open for business.

(E) Federal Income Taxes: It is the Trust’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies, including the distribution requirements of the Tax Reform Act of 1986, and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

(F) Foreign Currency Translation: The books and records of the Trust are maintained in U.S. dollars. Assets and liabilities which are denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. The Trust does not isolate changes in the value of investments caused by foreign exchange rate differences from the changes due to other circumstances.

Income and expenses are translated to U.S. dollars based upon the rates of exchange on the respective dates of such transactions.

13

|

Value Line Aggressive Income Trust

|

|

Notes to Financial Statements (unaudited)

|

Net realized foreign exchange gains or losses arise from currency fluctuations realized between the trade and settlement dates on securities transactions, the differences between the U.S. dollar amounts of dividends, interest, and foreign withholding taxes recorded by the Trust, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investments, at the end of the fiscal period, resulting from changes in the exchange rates. The effect of the change in foreign exchange rates on the value of investments is included in realized gain/loss on investments and change in net unrealized appreciation/ (depreciation) on investments.

(G) Representations and Indemnifications: In the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

(H) Security Transactions: Securities transactions are recorded on a trade date basis. Realized gains and losses from security transactions are recorded on the identified-cost basis. Interest income, adjusted for amortization of discount and premium, is earned from settlement date and recognized on the accrual basis. Dividend income is recorded on the ex-dividend date.

(I) Accounting for Real Estate Investment Trusts: The Trust owns shares of Real Estate Investment Trusts (“REITs”) which report information on the source of their distributions annually. Distributions received from REITs during the year which represent a return of capital are recorded as a reduction of cost and distributions which represent a capital gain dividend are recorded as a realized long-term capital gain on investments.

(J) Foreign Taxes: The Trust may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Trust will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

(K) Redemption Fees: The Trust charges a 2% redemption fee on shares held for less than 120 days. Such fees are retained by the Trust and accounted for as paid in capital.

(L) Subsequent Events: Management has evaluated all subsequent transactions and events through the date on which these financial statements were issued, and except as already included in the notes to these financial statements, has determined that no additional items require disclosure.

2. Trust Share Transactions and Distributions to Shareholders

Transactions in shares of beneficial interest in the Trust were as follows:

|

Six Months Ended

|

||||||||

|

July 31, 2011

|

Year Ended

|

|||||||

|

(unaudited)

|

January 31, 2011

|

|||||||

|

Shares sold

|

181,873 | 510,978 | ||||||

|

Shares issued to shareholders in reinvestment of dividends and distributions

|

154,119 | 364,174 | ||||||

|

Shares redeemed

|

(643,941 | ) | (1,867,909 | ) | ||||

|

Net (decrease)

|

(307,949 | ) | (992,757 | ) | ||||

|

Dividends per share from net investment income

|

$ | 0.1441 | $ | 0.2960 | ||||

Redemption fees of $607 and $5,016 were retained by the Trust for the six months ended July 31, 2011 and the year ended January 31, 2011, respectively.

14

Value Line Aggressive Income Trust

| July 31, 2011 |

3. Purchases and Sales of Securities

Purchases and sales of investment securities, excluding short-term securities, were as follows:

|

Six Months Ended

|

||||

|

July 31, 2011

|

||||

|

(unaudited)

|

||||

|

Purchases:

|

||||

|

Investment Securities

|

$ | 10,632,862 | ||

|

Sales:

|

||||

|

Investment Securities

|

$ | 10,205,978 | ||

4. Income Taxes

At July 31, 2011, information on the tax components of capital is as follows:

|

Cost of investments for tax purposes

|

$ | 30,084,582 | ||

|

Gross tax unrealized appreciation

|

$ | 2,061,888 | ||

|

Gross tax unrealized depreciation

|

(142,415 | ) | ||

|

Net tax unrealized appreciation on investments

|

$ | 1,919,473 |

5. Investment Advisory Fee, Service and Distribution Fees and Transactions With Affiliates

An advisory fee of $125,577 was paid or payable to EULAV Asset Management (the “Adviser”) for the six months ended July 31, 2011. This was computed at an annual rate of 0.75% on the first $100 million of the Trust’s average daily net assets during the period, and 0.50% on the average daily net assets in excess thereof prior to any fee waivers. The Adviser provides research, investment programs, supervision of the investment portfolio and pays costs of administrative services and office space. The Adviser also provides persons, satisfactory to the Trust’s Trustees, to act as officers of the Trust and pays their salaries. Effective June 1, 2007 and 2008, the Adviser contractually agreed to reduce the Trust’s advisory fee by 0.40% for one year periods.

Effective June 1, 2009, the Adviser contractually agreed to waive 0.30% of the advisory fee for a one year period. Effective June 1, 2010 through May 31, 2012, the Adviser contractually agreed to waive 0.20% of the advisory fee for a one year period. The fees waived amounted to $33,487 for the six months ended July 31, 2011. The Adviser has no right to recoup previously waived amounts.

The Trust has a Service and Distribution Plan (the “Plan”), adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, which compensates EULAV Securities LLC (the “Distributor”) for advertising, marketing and distributing the Trust’s shares and for servicing the Trust’s shareholders at an annual rate of 0.25% of the Trust’s average daily net assets. Fees amounting to $41,859 before fee waivers were accrued under the Plan for the six months ended July 31, 2011. Effective June 1, 2007 through May 31, 2012, the Distributor contractually agreed to reduce the 12b-1 fee by 0.10% for one year periods. The fees waived amounted to $16,744 for the six months ended July 31, 2011. The Distributor has no right to recoup previously waived amounts.

For the six months ended July 31, 2011, the Trust’s expenses were reduced by $65 under a custody credit arrangement with the custodian.

Direct expenses of the Trust are charged to the Trust while common expenses of the Value Line Funds are allocated proportionately based upon the Funds’ respective net assets. The Trust bears all other costs and expenses.

Certain officers and a Trustee of the Adviser are also officers and a Trustee of the Trust. At July 31, 2011, the officers and Trustee as a group owned 1,050 shares of beneficial interest in the Trust, representing less than 1% of the outstanding shares.

15

Value Line Aggressive Income Trust

| Financial Highlights |

|

Selected data for a share of beneficial interest outstanding throughout each period:

|

||||||||||||||||||||||||

|

Six Months Ended

|

||||||||||||||||||||||||

|

July 31, 2011

|

Years Ended January 31, | |||||||||||||||||||||||

|

(unaudited)

|

2011

|

2010

|

2009

|

2008

|

2007

|

|||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 4.95 | $ | 4.70 | $ | 3.89 | $ | 4.83 | $ | 5.06 | $ | 5.01 | ||||||||||||

|

Income from investment operations:

|

||||||||||||||||||||||||

|

Net investment income

|

0.14 | 0.30 | 0.28 | 0.32 | 0.34 | 0.32 | ||||||||||||||||||

|

Net gains or (losses) on securities (both realized and unrealized)

|

(0.01 | ) | 0.25 | 0.81 | (0.95 | ) | (0.23 | ) | 0.05 | |||||||||||||||

|

Total from investment operations

|

0.13 | 0.55 | 1.09 | (0.63 | ) | 0.11 | 0.37 | |||||||||||||||||

|

Redemption fees

|

0.00 | (3) | 0.00 | (3) | 0.00 | (3) | 0.00 | (3) | 0.00 | (3) | 0.00 | (3) | ||||||||||||

|

Less distributions:

|

||||||||||||||||||||||||

|

Dividends from net investment income

|

(0.14 | ) | (0.30 | ) | (0.28 | ) | (0.31 | ) | (0.34 | ) | (0.32 | ) | ||||||||||||

|

Net asset value, end of period

|

$ | 4.94 | $ | 4.95 | $ | 4.70 | $ | 3.89 | $ | 4.83 | $ | 5.06 | ||||||||||||

|

Total return

|

2.74 | %(4) | 12.01 | % | 28.92 | % | (13.42 | )% | 2.14 | % | 7.80 | % | ||||||||||||

|

Ratios/Supplemental Data:

|

||||||||||||||||||||||||

|

Net assets, end of period (in thousands)

|

$ | 33,280 | $ | 34,885 | $ | 37,787 | $ | 25,924 | $ | 32,459 | $ | 37,340 | ||||||||||||

|

Ratio of expenses to average net

assets(1) |

1.48 | %(5) | 1.48 | %(6) | 1.56 | % | 1.50 | % | 1.28 | % | 1.50 | % | ||||||||||||

|

Ratio of expenses to average net

assets(2) |

1.19 | %(5) | 1.13 | %(7) | 1.13 | % | 0.98 | % | 0.77 | % | 1.04 | % | ||||||||||||

|

Ratio of net investment income to average net assets

|

5.86 | %(5) | 6.20 | % | 6.51 | % | 7.17 | % | 6.76 | % | 6.54 | % | ||||||||||||

|

Portfolio turnover rate

|

32 | %(4) | 42 | % | 51 | % | 39 | % | 30 | % | 31 | % | ||||||||||||

|

(1)

|

Ratio reflects expenses grossed up for custody credit arrangement, the waiver of a portion of the advisory fee by the Adviser, and a portion of the service and distribution plan fees by the Distributor. The ratio of expenses to average net assets, net of custody credits, but exclusive of the fee waivers would have been 1.48% for the year ended January 31, 2009, 1.27% for the year ended January 31, 2008, 1.49% for the year ended January 31, 2007 and would have been unchanged for the other periods shown.

|

|

(2)

|

Ratio reflects expenses net of the custody credit arrangement, the waiver of a portion of the advisory fee by the Adviser, and a portion of the service and distribution plan fees by the Distributor.

|

|

(3)

|

Amount is less than $.01 per share.

|

|

(4)

|

Not annualized.

|

|

(5)

|

Annualized.

|

|

(6)

|

Ratio reflects expenses grossed up for the reimbursement by Value Line, Inc. of certain expenses incurred by the Trust.

|

|

(7)

|

Ratio reflects expenses net of the reimbursement by Value Line, Inc. of certain expenses incurred by the Trust.

|

See Notes to Financial Statements.

16

|

Value Line Aggressive Income Trust

|

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Trust’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Trust voted these proxies for the 12-month period ended June 30 is available through the Trust’s website at http://www.vlfunds.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-243-2729.

17

|

Value Line Aggressive Income Trust

|

|

Management of the Trust

|

MANAGEMENT INFORMATION

The business and affairs of the Trust are managed by the Trust’s officers under the direction of the Board of Trustees. The following table sets forth information on each Trustee and Officer of the Trust. Each Trustee serves as a director or trustee of each of the 14 Value Line Funds. Each Trustee serves until his or her successor is elected and qualified.

|

Name, Address, and YOB

|

Position

|

Length of

Time Served

|

Principal Occupation

During the Past 5 Years

|

Other

Directorships

Held by Trustee

|

||||

|

Interested Trustee*

|

||||||||

|

Mitchell E. Appel

YOB: 1970

|

Trustee

|

Since 2010

|

President of each of the Value Line Funds since June 2008; President of the Adviser and Distributor since February 2009; Chief Financial Officer of Value Line, Inc. (“Value Line”) from April 2008 to December 2010 and from September 2005 to November 2007; Director of Value Line February 2010 to December 2010 and Treasurer from June 2005 to September 2005; Chief Financial Officer of XTF Asset Management from November 2007 to April 2008.

|

None

|

||||

|

Non-Interested Trustees

|

||||||||

|

Joyce E. Heinzerling

500 East 77th Street

New York, NY 10162

YOB: 1956

|

Trustee

|

Since 2008

|

President, Meridian Fund Advisers LLC. (consultants) since April 2009; General Counsel, Archery Capital LLC (private investment fund) until April 2009.

|

Burnham Investors Trust, since 2004 (4 funds).

|

||||

|

Francis C. Oakley

54 Scott Hill Road

Williamstown, MA 01267

YOB: 1931

|

Trustee

|

Since 2000

|

Professor of History, Williams College, (1961-2002). Professor Emeritus since 2002; President Emeritus since 1994 and President, (1985-1994); Chairman (1993-1997) and Interim President (2002-2003) of the American Council of Learned Societies. Trustee since 1997 and Chairman of the Board since 2005, National Humanities Center.

|

None

|

||||

|

David H. Porter

5 Birch Run Drive

Saratoga Springs, NY 12866

YOB: 1935

|

Trustee

|

Since 1997

|

Professor, Skidmore College since 2008; Visiting Professor of Classics, Williams College, (1999-2008); President Emeritus, Skidmore College since 1999 and President, (1987-1998).

|

None

|

18

|

Value Line Aggressive Income Trust

|

|

Management of the Trust

|

|

Name, Address, and YOB

|

Position

|

Length of

Time Served

|

Principal Occupation

During the Past 5 Years

|

Other

Directorships

Held by Trustee

|

||||

|

Paul Craig Roberts

169 Pompano St.

Panama City Beach, FL

32413

YOB: 1939

|

Trustee

|

Since 1986

|

Chairman, Institute for Political Economy.

|

None

|

||||

|

Nancy-Beth Sheerr

1409 Beaumont Drive

Gladwyne, PA 19035

YOB: 1949

|

Trustee

|

Since 1996

|

Senior Financial Advisor, Veritable L.P. (Investment Adviser).

|

None

|

||||

|

Daniel S. Vandivort

59 Indian Head Road

Riverside, CT 06878

YOB: 1954

|

Trustee (Lead Independent Trustee since 2010)

|

Since 2008

|

President, Chief Investment Officer, Weiss, Peck and Greer/Robeco Investment Management (2005-2007); Managing Director, Weiss, Peck and Greer, (1995-2005).

|

None

|

||||

|

Officers

|

||||||||

|

Mitchell E. Appel

YOB: 1970

|

President

|

Since 2008

|

President of each of the Value Line Funds since June 2008; President of the Adviser and Distributor since February 2009; Chief Financial Officer of Value Line, Inc. (“Value Line”) from April 2008 to December 2010 and from September 2005 to November 2007; Director of Value Line February 2010 to December 2010 and Treasurer from June 2005 to September 2005; Chief Financial Officer of XTF Asset Management from November 2007 to April 2008.

|

|||||

|

Michael J. Wagner

YOB: 1950

|

Chief Compliance Officer

|

Since 2009

|

Chief Compliance Officer of Value Line Funds since June 2009; President of Northern Lights Compliance Services, LLC (formerly Fund Compliance Services, LLC (2006 – present)) and Senior Vice President (2004-2006) and President and Chief Operations Officer (2003-2006) of Gemini Fund Services, LLC; Director of Constellation Trust Company until 2008.

|

|||||

|

Emily D. Washington

YOB: 1979

|

Treasurer and Secretary

|

Since 2008

|

Treasurer and Chief Financial Officer (Principal Financial and Accounting Officer) of each of the Value Line Funds since August 2008 and Secretary since 2010; Associate Director of Mutual Fund Accounting at Value Line until August 2008.

|

|||||

|

*

|

Mr. Appel is an “interested person” as defined in the Investment Company Act of 1940 by virtue of his position with the Adviser and Distributor.

|

Unless otherwise indicated, the address for each of the above officers is c/o Value Line Funds, 7 Times Square, New York, NY 10036.

|

The Trust’s Statement of Additional Information (SAI) includes additional information about the Trust’s Trustees and is available, without charge, upon request by calling 1-800-243-2729 or on the Trust’s website, www.vlfunds.com.

|

19

Value Line Aggressive Income Trust

|

The Value Line Family of Funds

|

1950 — The Value Line Fund seeks long-term growth of capital. Current income is a secondary objective.

1952 — Value Line Income and Growth Fund’s primary investment objective is income, as high and dependable as is consistent with reasonable risk. Capital growth to increase total return is a secondary objective.

1956 — Value Line Premier Growth Fund seeks long-term growth of capital. No consideration is given to current income in the choice of investments.

1972 — Value Line Larger Companies Fund’s sole investment objective is to realize capital growth.

1979 — Value Line U.S. Government Money Market Fund, a money market fund, seeks to secure as high a level of current income as is consistent with maintaining liquidity and preserving capital. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

1981 — Value Line U.S. Government Securities Fund seeks maximum income without undue risk to capital. Under normal conditions, at least 80% of the value of its net assets will be invested in securities issued or guaranteed by the U.S. Government and its agencies and instrumentalities.

1983 — Value Line Centurion Fund* seeks long-term growth of capital.

1984 — The Value Line Tax Exempt Fund seeks to provide investors with the maximum income exempt from federal income taxes while avoiding undue risk to principal. The fund may be subject to state and local taxes and the Alternative Minimum Tax (if applicable).

1985 — Value Line Convertible Fund seeks high current income together with capital appreciation primarily from convertible securities ranked 1, 2 or 3 for the year-ahead performance by the Value Line Convertible Ranking System.

1986 — Value Line Aggressive Income Trust seeks to maximize current income.

1987 — Value Line New York Tax Exempt Trust seeks to provide New York taxpayers with the maximum income exempt from New York State, New York City and federal income taxes while avoiding undue risk to principal. The Trust may be subject to state and local taxes and the Alternative Minimum Tax (if applicable).

1987 — Value Line Strategic Asset Management Trust* seeks to achieve a high total investment return consistent with reasonable risk.

1993 — Value Line Emerging Opportunities Fund invests in US common stocks of small capitalization companies, with its primary objective being long-term growth of capital.

1993 — Value Line Asset Allocation Fund seeks high total investment return, consistent with reasonable risk. The Fund invests in stocks, bonds and money market instruments utilizing quantitative modeling to determine the asset mix.

|

*

|

Only available through the purchase of Guardian Investor, a tax deferred variable annuity, or ValuePlus, a variable life insurance policy.

|

For more complete information about any of the Value Line Funds, including charges and expenses, send for a prospectus from EULAV Securities LLC, 7 Times Square, New York, New York 10036-6524 or call 1-800-243-2729, 9am–5pm CST, Monday–Friday, or visit us at www.vlfunds.com. Read the prospectus carefully before you invest or send money.

20

Item 11. Controls and Procedures.

|

(a)

|

The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in rule 30a-2(c) under the Act (17 CFR 270.30a-2(c) ) based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report, are appropriately designed to ensure that material information relating to the registrant is made known to such officers and are operating effectively.

|

|

(b)

|

The registrant’s principal executive officer and principal financial officer have determined that there have been no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including corrective actions with regard to significant deficiencies and material weaknesses.

|

Item 12. Exhibits.

|

(a)

|

(1) Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2) attached hereto as Exhibit 99.CERT.

|

(2) Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 attached hereto as Exhibit 99.906.CERT.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| By: | /s/ Mitchell E.Appel | |

|

Mitchell E.Appel, President

|

||

| Date: | October 5, 2011 | |

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

||

| By: | /s/ Mitchell E.Appel | |

|

Mitchell E. Appell, President, Principal Executive Officer

|

||

| By: | /s/ Emily D. Washington | |

|

Emily D. Washington, Treasurer, Principal Financial Officer

|

||

| Date: | October 5, 2011 | |