UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-22418

ITRON, INC.

(Exact name of registrant as specified in its charter)

Washington | 91-1011792 | |

(State of Incorporation) | (I.R.S. Employer Identification Number) | |

2111 N Molter Road, Liberty Lake, Washington 99019

(509) 924-9900

(Address and telephone number of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common stock, no par value | NASDAQ Global Select Market | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | x | Accelerated filer | ¨ | ||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2015 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of common stock held by non-affiliates of the registrant (based on the closing price for the common stock on the NASDAQ Global Select Market) was $1,309,640,099.

As of May 31, 2016 there were outstanding 38,243,435 shares of the registrant’s common stock, no par value, which is the only class of common stock of the registrant.

DOCUMENTS INCORPORATED BY REFERENCE: None

Itron, Inc.

Table of Contents

Page | |||

PART I | |||

ITEM 1: | |||

ITEM 1A: | |||

ITEM 1B: | |||

ITEM 2: | |||

ITEM 3: | |||

ITEM 4: | |||

PART II | |||

ITEM 5: | |||

ITEM 6: | |||

ITEM 7: | |||

ITEM 7A: | |||

ITEM 8: | |||

ITEM 9: | |||

ITEM 9A: | |||

ITEM 9B: | |||

PART III | |||

ITEM 10: | |||

ITEM 11: | |||

ITEM 12: | |||

ITEM 13: | |||

ITEM 14: | |||

PART IV | |||

ITEM 15: | |||

SCHEDULE II: | |||

In this Annual Report on Form 10-K, the terms “we,” “us,” “our,” “Itron,” and the “Company” refer to Itron, Inc.

Certain Forward-Looking Statements

This document contains forward-looking statements concerning our operations, financial performance, revenues, earnings growth, liquidity, and other items. This document reflects our current plans and expectations and is based on information currently available as of the date of this Annual Report on Form 10-K. When we use the words “expect,” “intend,” “anticipate,” “believe,” “plan,” “project,” “estimate,” “future,” “objective,” “may,” “will,” “will continue,” and similar expressions, they are intended to identify forward-looking statements. Forward-looking statements rely on a number of assumptions and estimates. These assumptions and estimates could be inaccurate and cause our actual results to vary materially from expected results. Risks and uncertainties include 1) the rate and timing of customer demand for our products, 2) rescheduling or cancellations of current customer orders and commitments, 3) changes in estimated liabilities for product warranties, litigation, and costs to deliver and implement network solutions, 4) our dependence on customers’ acceptance of new products and their performance, 5) competition, 6) changes in domestic and international laws and regulations, 7) changes in foreign currency exchange rates and interest rates, 8) international business risks, 9) our own and our customers’ or suppliers’ access to and cost of capital, 10) future business combinations, 11) implementation of restructuring projects, and 12) other factors. You should not solely rely on these forward-looking statements as they are only valid as of the date of this Annual Report on Form 10-K. We do not have any obligation to publicly update or revise any forward-looking statement in this document. For a more complete description of these and other risks, refer to Item 1A: “Risk Factors” included in this Annual Report on Form 10-K.

PART I

ITEM 1: BUSINESS

Available Information

Documents we provide to the Securities and Exchange Commission (SEC) are available free of charge under the Investors section of our website at www.itron.com as soon as practicable after they are filed with or furnished to the SEC. In addition, these documents are available at the SEC’s website (http://www.sec.gov) and at the SEC’s Headquarters at 100 F Street, NE, Washington, DC 20549, or by calling 1-800-SEC-0330.

General

Itron is among the leading technology and services companies dedicated to the resourceful use of electricity, natural gas, and water. We provide comprehensive solutions that measure, manage, and analyze energy and water use. Our broad product portfolio helps utilities responsibly and efficiently manage resources.

With increasing populations and resource consumption, there continues to be growing demand for electricity, natural gas, and water. This demand comes at a time when utilities are challenged by cost constraints, regulatory requirements, and environmental concerns. Our solution is to provide utilities with the knowledge they need to optimize their resources and to better understand and serve their customers - knowledge that gives their customers control over their energy and water needs and allows for better management and conservation of valuable resources.

We were incorporated in 1977 with a focus on meter reading technology. In 2004, we entered the electricity meter manufacturing business with the acquisition of Schlumberger Electricity Metering. In 2007, we expanded our presence in global meter manufacturing and systems with the acquisition of Actaris Metering Systems SA.

The following is a discussion of our major products, our markets, and our operating segments. Refer to Item 8: “Financial Statements and Supplementary Data” included in this Annual Report on Form 10-K for specific segment results.

Our Business

We offer solutions that enable electric and natural gas utilities to build smart grids to manage assets, secure revenue, lower operational costs, improve customer service, and enable demand response. Our solutions include standard meters and next-generation advanced and smart metering products, metering systems, and services, which ultimately empower and benefit consumers.

1

We supply comprehensive solutions to address the unique challenges facing the water industry, including increasing demand and resource scarcity. We offer a complete product portfolio, including standard meters and advanced and smart metering products, metering systems, and services, for applications in the residential and commercial industrial markets for water and heat.

We offer a portfolio of services to our customers from standalone services to end-to-end solutions. These include licensing meter data management and analytics software, managed services, software-as-a-service (hosted software), technical support services, licensing hardware technology, and consulting services.

We classify metering systems into three categories: standard metering systems, advanced metering systems, and smart metering systems. These categories are described in more detail below:

Standard Metering Systems

Standard metering systems employ a standard meter, which measures electricity, natural gas, water, or thermal energy by mechanical, electromechanical, or electronic means, with no built-in remote-reading communication capability. Standard meters require manual reading, which is typically performed by a utility representative or meter reading service provider. Worldwide, we produce standard residential, commercial and industrial (C&I), and transmission and distribution (T&D) electricity, natural gas, water, and heat meters.

Advanced Metering Systems

Advanced metering systems use a meter with a one-way communication module embedded in or attached to the meter to collect and store meter data, which is transmitted to handheld computers, mobile units, and/or fixed networks. This allows utilities to collect meter data for billing systems and analyze the data for more efficient resource management and operations. Worldwide, we produce electricity, natural gas, and water advanced metering systems and related technology. Communication technologies can vary by region and country and include telephone, radio frequency (RF), cellular, power line carrier (PLC), and Ethernet devices.

Smart Metering Systems

Smart metering systems employ meters, which have two-way communication capability to collect and transmit meter data to support various applications beyond monthly billings. Our smart metering solutions have substantially more features and functions than our advanced metering systems. Smart meters can collect and store interval data, remotely connect and disconnect service to the meter, send data, receive commands, and interface with other devices, such as in-home displays, smart thermostats and appliances, home area networks, and advanced control systems. Smart meters can also include adaptive communication technology (ACT). ACT enables dynamic selection of the optimal communications path, utilizing RF or PLC, based on network operating conditions, data attributes and application requirements.

Bookings and Backlog of Orders

Bookings for a reported period represent customer contracts and purchase orders received during the period for hardware, software, and services that have met certain conditions, such as regulatory and/or contractual approval. Total backlog represents committed but undelivered contracts and purchase orders at period-end. Twelve-month backlog represents the portion of total backlog that we estimate will be recognized as revenue over the next 12 months. Backlog is not a complete measure of our future revenues as we also receive significant book-and-ship orders. Bookings and backlog may fluctuate significantly due to the timing of large project awards. In addition, annual or multi-year contracts are subject to rescheduling and cancellation by customers due to the long-term nature of the contracts. Beginning total backlog, plus bookings, minus revenues, will not equal ending total backlog due to miscellaneous contract adjustments, foreign currency fluctuations, and other factors.

Year Ended | Annual Bookings | Total Backlog | 12-Month Backlog | |||||||||

(in millions) | ||||||||||||

December 31, 2015 | $ | 1,981 | $ | 1,575 | $ | 836 | ||||||

December 31, 2014 | 2,385 | 1,516 | 737 | |||||||||

December 31, 2013 | 1,946 | 1,079 | 524 | |||||||||

Information on bookings by our operating segments is as follows:

Year Ended | Total Bookings | Electricity | Gas | Water | ||||||||||||

(in millions) | ||||||||||||||||

December 31, 2015 | $ | 1,981 | $ | 958 | $ | 577 | $ | 446 | ||||||||

December 31, 2014 | 2,385 | 1,074 | 753 | 558 | ||||||||||||

December 31, 2013 | 1,946 | 786 | 552 | 608 | ||||||||||||

2

Our Operating Segments

We operate under the Itron brand worldwide and manage and report under three operating segments, Electricity, Gas, and Water. Our Water operating segment includes both our global water and heat solutions. This structure allows each segment to develop its own go-to-market strategy, prioritize its marketing and product development requirements, and focus on its strategic investments. Our sales, marketing, and delivery functions are managed under each segment. Our product development and manufacturing operations are managed on a worldwide basis to promote a global perspective in our operations and processes and yet still maintain alignment with the segments.

Sales and Distribution

We use a combination of direct and indirect sales channels in our operating segments. A direct sales force is utilized for large electric, natural gas, and water utilities, with which we have long-established relationships. For smaller utilities, we typically use an indirect sales force that consists of distributors, sales representatives, partners, and meter manufacturer representatives.

No single customer represented more than 10% of total revenues for the years ended December 31, 2015, 2014, and 2013. Our 10 largest customers in each of the years ended December 31, 2015, 2014, and 2013, accounted for approximately 22%, 19%, and 21% of total revenues, respectively.

Raw Materials

Our products require a wide variety of components and materials, which are subject to price and supply fluctuations. We enter into standard purchase orders in the ordinary course of business, which can can include purchase orders for specific quantities based on market prices, as well as open-ended agreements that provide for estimated quantities over an extended shipment period, typically up to one year at an established unit cost. Although we have multiple sources of supply for most of our material requirements, certain components and raw materials are supplied by sole-source vendors, and our ability to perform certain contracts depends on the availability of these materials. Refer to Item 1A: “Risk Factors”, included in this Annual Report on Form 10-K, for further discussion related to supply risks.

Partners

In connection with delivering products and systems to our customers, we may partner with third party vendors to provide hardware, software, or services, e.g., meter installation and communication network equipment and infrastructure. Our ability to perform on our contractual obligations with our customers is dependent on these partners meeting their obligations to us.

Product Development

Our product development is focused on both improving existing technology and developing innovative new technology for electricity, natural gas, water and heat meters, sensing and control devices, data collection software, communication technologies, data warehousing, and software applications. We invested approximately $162 million, $176 million, and $175 million in product development in 2015, 2014 and 2013, which represented approximately 9% of total revenues for each year.

Workforce

As of December 31, 2015, we had approximately 7,900 people in our workforce, including 6,900 permanent and temporary employees. We have not experienced significant work stoppages and consider our employee relations to be good.

Competition

We provide a broad portfolio of products, solutions, software, and services to electric, gas, and water utility customers globally. Consequently, we operate within a large and complex competitive landscape. Some of our competitors have diversified product portfolios and participate in multiple geographic markets, while others focus on specific regional markets and/or certain types of products, including some low-cost suppliers based in China and India. Our competitors in China have an increasing presence in other markets around the world, however, this does not represent a major market share in any one of our global operating regions. Our competitors range from small to large established companies. Our primary competitors for each operating segment are discussed below.

We believe that our competitive advantage is based on our in-depth knowledge of the utility industries, our capacity to innovate, our ability to provide complete end-to-end integrated solutions (including metering, network communications, data collection systems, meter data management software, and other metering software applications), our established customer relationships, and our track record of delivering reliable, accurate, and long-lived products and services. Refer to Item 1A: “Risk Factors” included in this Annual Report on Form 10-K for a discussion of the competitive pressures we face.

3

Electricity

We are among the leading global suppliers of electricity metering solutions, including standard meters and advanced and smart metering systems. Within the electricity business line, our primary global competitors include Aclara (Sun Capital Partners), Elster (Honeywell International Inc.), Landis+Gyr (Toshiba), and Silver Spring Networks. On a regional basis, other major competitors include OSAKI Group, Sagemcom Energy & Telecom (SAS), Sensus (The Resolute Fund, L.P.), Trilliant Networks, and ZIV (Avantha Group).

Gas

We are among the leading global suppliers of gas metering solutions, including standard meters and advanced and smart metering systems. Our primary global competitor is Elster. On a regional basis, other major competitors include Aclara, Apator, Landis+Gyr, LAO Industria, and Sensus.

Water

We are among the leading global suppliers of standard and advanced water meters and communication modules. Our primary global competitors include Apator, Diehl Metering (Diehl Stiftung & Co. KG), Elster, Sensus, and Zenner Performance (Zenner International GmbH & Co. KG). On a regional basis, other major competitors include Badger Meter, LAO Industria, and Neptune Technologies (Roper Industries).

Strategic Alliances

We pursue strategic alliances with other companies in areas where collaboration can produce product advancement and acceleration of entry into new markets. The objectives and goals of a strategic alliance can include one or more of the following: technology exchange, product development, joint sales and marketing, or access to new geographic markets. Refer to Item 1A: “Risk Factors” included in this Annual Report on Form 10-K for a discussion of risks associated with strategic alliances.

Intellectual Property

Our patents and patent applications cover a range of technologies, which relate to standard metering, advanced metering systems and technology, smart metering systems and technology, meter data management software, and knowledge application solutions. We also rely on a combination of copyrights, patents, and trade secrets to protect our products and technologies.

Disputes over the ownership, registration, and enforcement of intellectual property rights arise in the ordinary course of our business. While we believe patents and trademarks are important to our operations and, in aggregate, constitute valuable assets, no single patent or trademark, or group of patents or trademarks, is critical to the success of our business. We license some of our technology to other companies, some of which are our competitors.

Environmental Regulations

In the ordinary course of our business we use metals, solvents, and similar materials that are stored on-site. We believe we are in compliance with environmental laws, rules, and regulations applicable to the operation of our business.

4

EXECUTIVE OFFICERS

Set forth below are the names, ages, and titles of our executive officers as of June 29, 2016.

Name | Age | Position | ||

Philip C. Mezey | 56 | President and Chief Executive Officer | ||

W. Mark Schmitz | 64 | Executive Vice President and Chief Financial Officer | ||

Thomas L. Deitrich | 49 | Executive Vice President and Chief Operating Officer | ||

Michel C. Cadieux | 59 | Senior Vice President, Human Resources | ||

Shannon M. Votava | 56 | Senior Vice President, General Counsel and Corporate Secretary | ||

Philip C. Mezey is President and Chief Executive Officer and a member of our Board of Directors. Mr. Mezey was appointed to his current position and to the Board of Directors in January 2013. Mr. Mezey joined Itron in March 2003, and in 2007 Mr. Mezey became Senior Vice President and Chief Operating Officer, Itron North America. Mr. Mezey served as President and Chief Operating Officer, Energy from March 2011 through December 2012.

W. Mark Schmitz is Executive Vice President and Chief Financial Officer. Mr. Schmitz was appointed to this role in September 2014. Prior to joining Itron, Mr. Schmitz was Chief Financial Officer of Alghanim Industries from 2009 to 2013. Mr. Schmitz served as the Executive Vice President and Chief Financial Officer of The Goodyear Tire and Rubber Company from 2007 to 2008 and as Vice President and Chief Financial Officer of Tyco International Limited's Fire and Security Segment from 2003 to 2007.

Thomas L. Deitrich is Executive Vice President and Chief Operating Officer. Mr. Deitrich joined Itron in October 2015. From 2012 to September 2015, Mr. Deitrich was Senior Vice President and General Manager for Digital Networking at Freescale Semiconductor, Inc. (Freescale), and he served as the Senior Vice President and General Manager of Freescale's RF, Analog, Sensor, and Cellular Products Group from 2009 to 2012. Mr. Deitrich had other roles of increasing responsibility at Freescale from 2006 to 2009. Prior to Freescale, Mr. Deitrich worked for Flextronics, Sony-Ericsson/Ericsson, and GE.

Michel C. Cadieux is Senior Vice President, Human Resources and has been so since joining Itron in February 2014. From 2008 to 2012, Mr. Cadieux was Senior Vice President of Human Resources and Security at Freescale Semiconductor, Inc.

Shannon M. Votava is Senior Vice President, General Counsel and Corporate Secretary. Ms. Votava was promoted to this role in March 2016. Ms. Votava joined Itron in May 2010 as Assistant General Counsel and was promoted to Vice President and General Counsel in January 2012. She assumed the responsibilities of Corporate Secretary in January 2013. Before joining Itron, Ms. Votava served as Associate General Counsel, Commercial at Cooper Industries plc from October 2008 to April 2010, and as General Counsel for Honeywell's Electronic Materials business from 2003 to 2008.

5

ITEM 1A: RISK FACTORS

We are dependent on the utility industry, which has experienced volatility in capital spending.

We derive the majority of our revenues from sales of products and services to utilities. Purchases of our products may be deferred as a result of many factors, including economic downturns, slowdowns in new residential and commercial construction, customers’ access to capital upon acceptable terms, the timing and availability of government subsidies or other incentives, utility specific financial circumstances, mergers and acquisitions, regulatory decisions, weather conditions, and fluctuating interest rates. We have experienced, and may in the future experience, variability in operating results on an annual and a quarterly basis as a result of these factors.

Utility industry sales cycles can be lengthy and unpredictable.

The utility industry is subject to substantial government regulation. Regulations have often influenced the frequency of meter replacements. Sales cycles for standalone meter products have typically been based on annual or biennial bid-based agreements. Utilities place purchase orders against these agreements as their inventories decline, which can create fluctuations in our sales volumes.

Sales cycles for advanced and smart metering systems are generally long and unpredictable due to several factors, including budgeting, purchasing, and regulatory approval processes that can take several years to complete. Our utility customers typically issue requests for quotes and proposals, establish evaluation processes, review different technical options with vendors, analyze performance and cost/benefit justifications, and perform a regulatory review, in addition to applying the normal budget approval process. Today, governments around the world are implementing new laws and regulations to promote increased energy efficiency, slow or reverse growth in the consumption of scarce resources, reduce carbon dioxide emissions, and protect the environment. Many of the legislative and regulatory initiatives encourage utilities to develop a smart grid infrastructure, and some of these initiatives provide for government subsidies, grants, or other incentives to utilities and other participants in their industry to promote transition to smart grid technologies. If government regulations regarding the smart grid and smart metering are delayed, revised to permit lower or different investment levels in metering infrastructure, or terminated altogether, this could have a material adverse effect on our results of operation, cash flow, and financial condition.

Our quarterly results may fluctuate substantially due to several factors.

We have experienced variability in quarterly results, including losses, and believe our quarterly results will continue to fluctuate as a result of many factors, including those risks and events included throughout this section. Additional factors that may cause our results to vary include:

• | a higher proportion of products sold with fewer features and functionality, resulting in lower revenues and gross margins; |

• | a shift in sales channel mix, which could impact the revenue received and commissions paid; |

• | a decrease in sales volumes, which could result in lower gross margins as driven by lower absorption of manufacturing costs; |

• | a change in accounting standards or practices that may impact us to a greater degree than other companies due to our product mix, which would impact revenue recognition, or our borrowing structure; |

• | a change in existing taxation rules or practices due to our specific operating structure that may not be comparable to other companies; and |

• | a shortfall in sales without a proportional decrease in expenses. |

We face product-failure exposure.

Our products are complex and may contain defects or experience failures due to any number of issues in design, materials, deployment, and/or use. If any of our products contain a defect, a compatibility or interoperability issue, or other types of errors, we may have to devote significant time and resources to identify and correct the issue. We provide product warranties for varying lengths of time and establish allowances in anticipation of warranty expenses. In addition, we record contingent liabilities for additional product-failure related costs. These warranty and related product-failure allowances may be inadequate due to product defects, and unanticipated component failures, as well as higher than anticipated material, labor, and other costs we may incur to replace projected product failures. A product recall or a significant number of product returns could be expensive; damage our reputation and relationships with utilities, meter and communication vendors, and other third-party vendors; result in the loss of business to competitors; or result in litigation against us. We may incur additional warranty expenses in the future with respect to new or established products, which could materially and adversely affect our operations and financial position.

6

Our customer contracts are complex and contain provisions that could cause us to incur penalties, be liable for damages, and/or incur unanticipated expenses with respect to the functionality, deployment, operation, and availability of our products and services.

In addition to the risk of unanticipated warranty or recall expenses, our customer contracts may contain provisions that could cause us to incur penalties, be liable for damages, including liquidated damages, or incur other expenses if we experience difficulties with respect to the functionality, deployment, operation, and availability of our products and services. Some of these contracts contain long-term commitments to a set schedule of delivery or performance. If we failed in our initial estimated schedule or we fail in our management of the project, this may cause delays in completion. In the event of late deliveries, late or improper installations or operations, failure to meet product or performance specifications or other product defects, or interruptions or delays in our managed service offerings, our customer contracts may expose us to penalties, liquidated damages, and other liabilities. In the event we were to incur contractual penalties, such as liquidated damages or other related costs that exceed our expectations, our business, financial condition, and operating results could be materially and adversely affected. Further, we could be required to recognize a current-period expense related to a specific component of a customer contract at the time we determine the products and/or services to be delivered under that component would result in a loss due to expected revenues estimated to be less than expected costs. Depending on the amounts of the associated revenues (if any) and the costs, this charge could be material to our results of operations in the period it is recognized.

We depend on our ability to develop new competitive products.

Our future success will depend, in part, on our ability to continue to design and manufacture new competitive products and to enhance and sustain our existing products, keep pace with technological advances and changing customer requirements, gain international market acceptance, and manage other factors in the markets in which we sell our products. Product development will require continued investment in order to maintain our competitive position, and the periods in which we incur significant product development costs may drive variability in our quarterly results. We may not have the necessary capital, or access to capital at acceptable terms, to make these investments. We have made, and expect to continue to make, substantial investments in technology development. However, we may experience unforeseen problems in the development or performance of our technologies or products. In addition, we may not meet our product development schedules. New products often require certifications or regulatory approvals before the products can be used and we cannot be certain that our new products will be approved in a timely manner. Finally, we may not achieve market acceptance of our new products and services.

We face increasing competition.

We face competitive pressures from a variety of companies in each of the markets we serve. Some of our present and potential future competitors have, or may have, substantially greater financial, marketing, technical, or manufacturing resources and, in some cases, have greater name recognition, customer relationships, and experience. Some competitors may enter markets we serve and sell products at lower prices in order to gain or grow market share. Our competitors may be able to respond more quickly to new or emerging technologies and changes in customer requirements. They may also be able to devote greater resources to the development, promotion, and sale of their products and services than we can. Some competitors have made, and others may make, strategic acquisitions or establish cooperative relationships among themselves or with third parties that enhance their ability to address the needs of our prospective customers. It is possible that new competitors or alliances among current and new competitors may emerge and rapidly gain significant market share. Other companies may also drive technological innovation and develop products that are equal in quality and performance or superior to our products, which could put pressure on our market position, reduce our overall sales, and require us to invest additional funds in new technology development. In addition, there is a risk that low-cost providers will expand their presence in our markets, improve their quality, or form alliances or cooperative relationships with our competitors, thereby contributing to future price erosion. Some of our products and services may become commoditized, and we may have to adjust the prices of some of our products to stay competitive. Further, some utilities may purchase meters separately from the communication devices. The specifications for the meters would require interchangeability, which could lead to further commoditization of the meter, driving prices lower and reducing margins. Should we fail to compete successfully with current or future competitors, we could experience material adverse effects on our business, financial condition, results of operations, and cash flows.

7

Our acquisitions of and investments in third parties have risks.

We may complete additional acquisitions or make investments in the future, both within and outside of the United States. In order to finance future acquisitions, we may need to raise additional funds through public or private financings, and there are no assurances that such financing would be available at acceptable terms. Acquisitions and investments involve numerous risks such as the diversion of senior management’s attention; unsuccessful integration of the acquired entity’s personnel, operations, technologies, and products; incurrence of significant expenses to meet an acquiree's customer contractual commitments; lack of market acceptance of new services and technologies; or difficulties in operating businesses in international legal jurisdictions. Failure to properly or adequately address these issues could result in the diversion of management’s attention and resources and materially and adversely impact our ability to manage our business. In addition, acquisitions and investments in third parties may involve the assumption of obligations, significant write-offs, or other charges associated with the acquisition. Impairment of an investment, goodwill, or an intangible asset may result if these risks were to materialize. For investments in entities that are not wholly owned by Itron, such as joint ventures, a loss of control as defined by U.S. generally accepted accounting principles (GAAP) could result in a significant change in accounting treatment and a change in the carrying value of the entity. There can be no assurances that an acquired business will perform as expected, accomplish our strategic objectives, or generate significant revenues, profits, or cash flows.

We may face adverse publicity, consumer or political opposition, or liability associated with our products.

The safety and security of the power grid and natural gas and water supply systems, the accuracy and protection of the data collected by meters and transmitted via the smart grid, concerns about the safety and perceived health risks of using radio frequency communications, and privacy concerns of monitoring home appliance energy usage have been the focus of recent adverse publicity. Negative publicity and consumer opposition may cause utilities or their regulators to delay or modify planned smart grid initiatives. Smart grid projects may be, or may be perceived as, unsuccessful.

We may be subject to claims that there are adverse health effects from the radio frequencies utilized in connection with our products. If these claims prevail, our customers could suspend implementation or purchase substitute products, which could cause a loss of sales.

Changes in tax laws, valuation allowances, and unanticipated tax liabilities could adversely affect our effective income tax rate and profitability.

We are subject to income tax in the United States and numerous foreign jurisdictions. Significant judgment is required in evaluating our tax positions and determining our provision for income taxes. During the ordinary course of business, there are many transactions and calculations for which the ultimate tax determination is uncertain. We establish reserves for tax-related uncertainties based on estimates of whether, and the extent to which, additional taxes will be due. These reserves may be established when we believe that certain positions might be challenged despite our belief that our tax return positions are fully supportable. We adjust these reserves in light of changing facts and circumstances. The provision for income taxes includes the impact of reserve positions and changes to reserves that are considered appropriate, as well as valuation allowances when we determine it is more likely than not that a deferred tax asset cannot be realized. In addition, future changes in tax laws in the jurisdictions in which we operate could have a material impact on our effective income tax rate and profitability. We regularly assess all of these matters to determine the adequacy of our tax provision, which is subject to significant judgment.

Disruption and turmoil in global credit and financial markets, which may be exacerbated by the inability of certain countries to continue to service their sovereign debt obligations, and the possible negative implications of such events for the global economy, may negatively impact our business, liquidity, operating results, and financial condition.

The current economic conditions, including volatility in the availability of credit and foreign exchange rates and extended economic slowdowns, have contributed to the instability in some global credit and financial markets. Additionally, at-risk financial institutions in certain countries may, without forewarning, seize a portion of depositors' account balances. The seized funds would be used to recapitalize the at-risk financial institution and would no longer be available for the depositors' use. If such seizure were to occur at financial institutions where we have funds on deposit, it could have a significant impact on our overall liquidity. While the ultimate outcome of these events cannot be predicted, it is possible that such events may have a negative impact on the global economy and our business, liquidity, operating results, and financial condition.

We are subject to international business uncertainties, obstacles to the repatriation of earnings, and foreign currency fluctuations.

A substantial portion of our revenues is derived from operations conducted outside the United States. International sales and operations may be subjected to risks such as the imposition of government controls, government expropriation of facilities, lack

8

of a well-established system of laws and enforcement of those laws, access to a legal system free of undue influence or corruption, political instability, terrorist activities, restrictions on the import or export of critical technology, currency exchange rate fluctuations, and adverse tax burdens. Lack of availability of qualified third-party financing, generally longer receivable collection periods than those commonly practiced in the United States, trade restrictions, changes in tariffs, labor disruptions, difficulties in staffing and managing international operations, difficulties in imposing and enforcing operational and financial controls at international locations, potential insolvency of international distributors, preference for local vendors, burdens of complying with different permitting standards and a wide variety of foreign laws, and obstacles to the repatriation of earnings and cash all present additional risk to our international operations. Fluctuations in the value of international currencies may impact our operating results due to the translation to the U.S. dollar as well as our ability to compete in international markets. International expansion and market acceptance depend on our ability to modify our technology to take into account such factors as the applicable regulatory and business environment, labor costs, and other economic conditions. In addition, the laws of certain countries do not protect our products or technologies in the same manner as the laws of the United States. Further, foreign regulations or restrictions, e.g., opposition from unions or works councils, could delay, limit, or disallow significant operating decisions made by our management, e.g., decisions to exit certain businesses, close certain manufacturing locations, or other restructuring actions. There can be no assurance that these factors will not have a material adverse effect on our future international sales and, consequently, on our business, financial condition, and results of operations.

We depend on certain key vendors and components.

Certain of our products, subassemblies, and system components are procured from limited sources. Our reliance on such limited sources involves certain risks, including the possibility of shortages and reduced control over delivery schedules, quality, costs, and our vendors’ access to capital upon acceptable terms. Any adverse change in the supply, or price, of these components could adversely affect our business, financial condition, and results of operations. In addition, we depend on a small number of contract manufacturing vendors for a large portion of our low-volume manufacturing business and all of our repair services for our domestic handheld meter reading units. Should any of these vendors become unable to perform up to their responsibilities, our operations could be materially disrupted.

We may engage in future restructuring activities and incur additional charges in our efforts to improve profitability. We also may not achieve the anticipated savings and benefits from current or any future restructuring projects.

In recent years, we have implemented multiple restructuring projects to adjust our cost structure, and we may engage in similar restructuring activities in the future. These restructuring activities reduce our available employee talent, assets, and other resources, which could slow product development, impact ability to respond to customers, increase quality issues, temporarily reduce manufacturing efficiencies, and limit our ability to increase production quickly. In addition, delays in implementing restructuring projects, unexpected costs, or failure to meet targeted improvements could reduce the overall savings anticipated from the restructuring project.

Business interruptions could adversely affect our business.

Our worldwide operations could be subject to hurricanes, tornadoes, earthquakes, floods, fires, extreme weather conditions, medical epidemics or pandemics, or other natural or man-made disasters or business interruptions. The occurrence of any of these business disruptions could seriously harm our business, financial condition, and results of operations.

Our key manufacturing facilities are concentrated, and, in the event of a significant interruption in production at any of our manufacturing facilities, considerable expense, time, and effort could be required to establish alternative production lines to meet contractual obligations, which would have a material adverse effect on our business, financial condition, and results of operations.

We may encounter strikes or other labor disruptions that could adversely affect our financial condition and results of operations.

We have significant operations throughout the world. In a number of countries outside the U.S., our employees are covered by collective bargaining agreements. As the result of various corporate or operational actions, which our management has undertaken or may be made in the future, we could encounter labor disruptions. These disruptions may be subject to local media coverage, which could damage our reputation. Additionally, the disruptions could delay our ability to meet customer orders and could adversely affect our results of operations. Any labor disruptions could also have an impact on our other employees. Employee morale and productivity could suffer, and we may lose valued employees whom we wish to retain.

9

Asset impairment could result in significant changes that would adversely impact our future operating results.

We have significant intangible assets, long-lived assets, goodwill, and deferred tax assets that are susceptible to valuation adjustments as a result of changes in various factors or conditions.

We assess impairment of amortizable intangible and long-lived assets whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Factors that could trigger an impairment of such assets include the following:

• | underperformance relative to projected future operating results; |

• | changes in the manner or use of the acquired assets or the strategy for our overall business; |

• | negative industry or economic trends; |

• | decline in our stock price for a sustained period or decline in our market capitalization below net book value; and |

• | changes in our organization or management reporting structure, which could result in additional reporting units, requiring greater aggregation or disaggregation in our analysis by reporting unit and potentially alternative methods/assumptions of estimating fair values. |

We assess the potential impairment of goodwill each year as of October 1. We also assess the potential impairment of goodwill whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Adverse changes in economic conditions or our operations could affect the assumptions we use to calculate the fair value, which in turn could result in an impairment charge in future periods that would impact our results of operations and financial position in that period.

The realization of our deferred tax assets is supported in part by projections of future taxable income. We record valuation allowances to reduce deferred tax assets to the extent we believe it is more likely than not that a portion of such assets will not be realized. In making such determinations, we consider all available positive and negative evidence, including scheduled reversals of deferred tax liabilities, projected future taxable income, tax planning strategies, and our ability to carry back losses to prior years. We are required to make assumptions and judgments about potential outcomes that lie outside management’s control. Our most sensitive and critical factors are the projection, source, and character of future taxable income. Realization is not assured, and the amount of deferred tax assets considered realizable could be reduced in the near term if estimates of future taxable income during the carryforward periods are reduced or current tax planning strategies are not implemented.

We are subject to a variety of litigation that could adversely affect our results of operations, financial condition, and cash flows.

From time to time, we are involved in litigation that arises from our business. Litigation may, for example, relate to alleged infringements of intellectual property rights of others. Non-practicing entities may also make infringement claims in order to reach a settlement with us. In addition, these entities may bring claims against our customers, which, in some instances, could result in an indemnification of the customer. Litigation may also relate to, among other things, product failure or product liability claims, contractual disputes, employment matters, or securities litigation. Litigation can be expensive to defend and can divert the attention of management and other personnel for long periods of time, regardless of the ultimate outcome. We may be required to pay damage awards or settlements or become subject to equitable remedies that could adversely affect our financial condition and results of operations. While we currently maintain insurance coverage, such insurance may not provide adequate coverage against potential claims.

We may face losses associated with alleged unauthorized use of third party intellectual property.

We may be subject to claims or inquiries regarding alleged unauthorized use of a third party’s intellectual property. An adverse outcome in any intellectual property litigation or negotiation could subject us to significant liabilities to third parties, require us to license technology or other intellectual property rights from others, require us to comply with injunctions to cease marketing or the use of certain products or brands, or require us to redesign, re-engineer, or rebrand certain products or packaging, any of which could affect our business, financial condition, and results of operations. If we are required to seek licenses under patents or other intellectual property rights of others, we may not be able to acquire these licenses at acceptable terms, if at all. In addition, the cost of responding to an intellectual property infringement claim, in terms of legal fees, expenses, and the diversion of management resources, whether or not the claim is valid, could have a material adverse effect on our business, financial condition, and results of operations.

If our products infringe the intellectual property rights of others, we may be required to indemnify our customers for any damages they suffer. We generally indemnify our customers with respect to infringement by our products of the proprietary rights of third parties. Third parties may assert infringement claims against our customers. These claims may require us to initiate or defend protracted and costly litigation on behalf of our customers, regardless of the merits of these claims. If any of these claims succeed,

10

we may be forced to pay damages on behalf of our customers or may be required to obtain licenses for the products they use. If we cannot obtain all necessary licenses on commercially reasonable terms, our customers may be forced to stop using our products.

We are affected by the availability and regulation of radio spectrum and interference with the radio spectrum that we use.

A significant number of our products use radio spectrum, which are subject to regulation by the Federal Communications Commission (FCC) in the United States. The FCC may adopt changes to the rules for our licensed and unlicensed frequency bands that are incompatible with our business. In the past, the FCC has adopted changes to the requirements for equipment using radio spectrum, and it is possible that the FCC or the U.S. Congress will adopt additional changes.

Although radio licenses are generally required for radio stations, Part 15 of the FCC’s rules permits certain low-power radio devices (Part 15 devices) to operate on an unlicensed basis. Part 15 devices are designed for use on frequencies used by others. These other users may include licensed users, which have priority over Part 15 users. Part 15 devices cannot cause harmful interference to licensed users and must be designed to accept interference from licensed radio devices. In the United States, our advanced and smart metering systems are typically Part 15 devices that transmit information to (and receive information from, if applicable) handheld, mobile, or fixed network systems pursuant to these rules.

We depend upon sufficient radio spectrum to be allocated by the FCC for our intended uses. As to the licensed frequencies, there is some risk that there may be insufficient available frequencies in some markets to sustain our planned operations. The unlicensed frequencies are available for a wide variety of uses and may not be entitled to protection from interference by other users who operate in accordance with FCC rules. The unlicensed frequencies are also often the subject of proposals to the FCC requesting a change in the rules under which such frequencies may be used. If the unlicensed frequencies become crowded to unacceptable levels, restrictive, or subject to changed rules governing their use, our business could be materially adversely affected.

We have committed, and will continue to commit, significant resources to the development of products that use particular radio frequencies. Action by the FCC could require modifications to our products. The inability to modify our products to meet such requirements, the possible delays in completing such modifications, and the cost of such modifications all could have a material adverse effect on our future business, financial condition, and results of operations.

Outside of the United States, certain of our products require the use of RF and are subject to regulations in those jurisdictions where we have deployed such equipment. In some jurisdictions, radio station licensees are generally required to operate a radio transmitter and such licenses may be granted for a fixed term and must be periodically renewed. In other jurisdictions, the rules permit certain low power devices to operate on an unlicensed basis. Our advanced and smart metering systems typically transmit to (and receive information from, if applicable) handheld, mobile, or fixed network reading devices in license-exempt bands pursuant to rules regulating such use. In Europe, we generally use the 169 megahertz (MHz), 433 MHz, and 868 MHz bands. In the rest of the world, we primarily use the 433 MHz and 2.4000-2.4835 gigahertz (GHz) bands, as well as other local license-exempt bands. To the extent we introduce new products designed for use in the United States or another country into a new market, such products may require significant modification or redesign in order to meet frequency requirements and other regulatory specifications. In some countries, limitations on frequency availability or the cost of making necessary modifications may preclude us from selling our products in those countries. In addition, new consumer products may create interference with the performance of our products, which could lead to claims against us.

We may be unable to adequately protect our intellectual property.

While we believe that our patents and other intellectual property have significant value, it is uncertain that this intellectual property or any intellectual property acquired or developed by us in the future will provide meaningful competitive advantages. There can be no assurance that our patents or pending applications will not be challenged, invalidated, or circumvented by competitors or that rights granted thereunder will provide meaningful proprietary protection. Moreover, competitors may infringe our patents or successfully avoid them through design innovation. To combat infringement or unauthorized use of our intellectual property, we may need to commence litigation, which can be expensive and time-consuming. In addition, in an infringement proceeding a court may decide that a patent or other intellectual property right of ours is not valid or is unenforceable, or may refuse to stop the other party from using the technology or other intellectual property right at issue on the grounds that it is non-infringing or the legal requirements for an injunction have not been met. Policing unauthorized use of our intellectual property is difficult and expensive, and we cannot provide assurance that we will be able to prevent misappropriation of our proprietary rights, particularly in countries that do not protect such rights in the same manner as in the United States.

11

We have pension benefit obligations, which could have a material impact on our earnings, liabilities, and shareholders' equity and could have significant adverse impacts in future periods.

We sponsor both funded and unfunded defined benefit pension plans for our international employees, primarily in Germany, France, Italy, Indonesia, Brazil, and Spain. Our general funding policy for these qualified pension plans is to contribute amounts sufficient to satisfy regulatory funding standards of the respective countries for each plan.

The determination of pension plan expense, benefit obligation, and future contributions depends heavily on market factors such as the discount rate and the actual return on plan assets. We estimate pension plan expense, benefit obligation, and future contributions to these plans using assumptions with respect to these and other items. Changes to those assumptions could have a significant effect on future contributions as well as on our annual pension costs and/or result in a significant change to shareholders' equity.

A number of key personnel are critical to the success of our business.

Our success depends in large part on the efforts of our highly qualified technical and management personnel and highly skilled individuals in all disciplines. The loss of one or more of these employees and the inability to attract and retain qualified replacements could have a material adverse effect on our business.

If we are unable to protect our information technology infrastructure and network against data corruption, cyber-based attacks or network security breaches, we could be exposed to customer liability and reputational risk.

We rely on various information technology systems to capture, process, store, and report data and interact with customers, vendors, and employees. Despite security steps we have taken to secure all information and transactions, our information technology systems, and those of our third-party providers, may be subject to cyber attacks. Any data breaches could result in misappropriation of data or disruption of operations. In addition, hardware and operating system software and applications that we procure from third parties may contain defects in design or manufacture that could interfere with the operation of the systems. Misuse of internal applications; theft of intellectual property, trade secrets, or other corporate assets; and inappropriate disclosure of confidential information could stem from such incidents.

In addition, we have designed products and services that connect to and are part of the “Internet of Things.” While we attempt to provide adequate security measures to safeguard our products from cyber attacks, the potential for an attack remains. A successful attack may result in inappropriate access to information or an inability for our products to function properly.

Any such operational disruption and/or misappropriation of information could result in lost sales, negative publicity, or business delays and could have a material adverse effect on our business.

We may not realize the expected benefits from strategic alliances.

We have several strategic alliances with large and complex organizations and other companies with which we work to offer complementary products and services. There can be no assurance we will realize the expected benefits from these strategic alliances. If successful, these relationships may be mutually beneficial and result in shared growth. However, alliances carry an element of risk because, in most cases, we must both compete and collaborate with the same company from one market to the next. Should our strategic partnerships fail to perform, we could experience delays in product development or experience other operational difficulties.

We rely on information technology systems.

Our industry requires the continued operation of sophisticated information technology systems and network infrastructures, which may be subject to disruptions arising from events that are beyond our control. We are dependent on information technology systems, including, but not limited to, networks, applications, and outsourced services. We continually enhance and implement new systems and processes throughout our global operations.

We offer managed services and software utilizing several data center facilities located worldwide. Any damage to, or failure of, these systems could result in interruptions in the services we provide to our utility customers. As we continue to add capacity to our existing and future data centers, we may move or transfer data. Despite precautions taken during this process, any delayed or unsuccessful data transfers may impair the delivery of our services to our utility customers. We also sell vending and pre-payment systems with security features that, if compromised, may lead to claims against us.

12

We are completing a phased upgrade of our primary enterprise resource planning (ERP) systems to allow for greater depth and breadth of functionality worldwide. System conversions are expensive and time consuming undertakings that impact all areas of the Company. While successful implementations of each phase will provide many benefits to us, an unsuccessful or delayed implementation of any particular phase may cost us significant time and resources.

The failure of these systems to operate effectively, problems with transitioning to upgraded or replacement systems, or a breach in security of these systems due to computer viruses, hacking, acts of terrorism, and other causes could materially and adversely affect our business, financial condition, and results of operations by harming our ability to accurately forecast sales demand, manage our supply chain and production facilities, achieve accuracy in the conversion of electronic data and records, and report financial and management information on a timely and accurate basis. In addition, due to the systemic internal control features within ERP systems, we may experience difficulties that could affect our internal control over financial reporting.

Changes in environmental regulations, violations of such regulations, or future environmental liabilities could cause us to incur significant costs and could adversely affect our operations.

Our business and our facilities are subject to numerous laws, regulations, and ordinances governing, among other things, the storage, discharge, handling, emission, generation, manufacture, disposal, remediation of, and exposure to toxic or other hazardous substances, and certain waste products. Many of these environmental laws and regulations subject current or previous owners or operators of land to liability for the costs of investigation, removal, or remediation of hazardous materials. In addition, these laws and regulations typically impose liability regardless of whether the owner or operator knew of, or was responsible for, the presence of any hazardous materials and regardless of whether the actions that led to the presence were conducted in compliance with the law. In the ordinary course of our business, we use metals, solvents, and similar materials, which are stored on-site. The waste created by the use of these materials is transported off-site on a regular basis by unaffiliated waste haulers. Many environmental laws and regulations require generators of waste to take remedial actions at, or in relation to, the off-site disposal location even if the disposal was conducted in compliance with the law. The requirements of these laws and regulations are complex, change frequently, and could become more stringent in the future. Failure to comply with current or future environmental regulations could result in the imposition of substantial fines, suspension of production, alteration of our production processes, cessation of operations, or other actions, which could materially and adversely affect our business, financial condition, and results of operations. There can be no assurance that a claim, investigation, or liability will not arise with respect to these activities, or that the cost of complying with governmental regulations in the future will not have a material adverse effect on us.

Our credit facility limits our ability and the ability of many of our subsidiaries to take certain actions.

Our credit facility places restrictions on our ability, and the ability of many of our subsidiaries, dependent on meeting specified financial ratios, to, among other things:

• incur more debt; | • pay dividends, make distributions, and repurchase capital stock; | |

• make certain investments; | • create liens; | |

• enter into transactions with affiliates; | • enter into sale lease-back transactions; | |

• merge or consolidate; | • transfer or sell assets. | |

Our credit facility contains other customary covenants, including the requirement to meet specified financial ratios and provide periodic financial reporting. Our ability to borrow under our credit facility will depend on the satisfaction of these covenants. Events beyond our control can affect our ability to meet those covenants. Our failure to comply with obligations under our borrowing arrangements may result in declaration of an event of default. An event of default, if not cured or waived, may permit acceleration of required payments against such indebtedness. We cannot be certain we will be able to remedy any such defaults. If our required payments are accelerated, we cannot be certain that we will have sufficient funds available to pay the indebtedness or that we will have the ability to raise sufficient capital to replace the indebtedness on terms favorable to us or at all. In addition, in the case of an event of default under our secured indebtedness such as our credit facility, the lenders may be permitted to foreclose on our assets securing that indebtedness.

Our credit facility is sensitive to interest rate fluctuations that could impact our financial position and results of operations.

13

Our ability to service our indebtedness is dependent on our ability to generate cash, which is influenced by many factors beyond our control.

Our ability to make payments on or refinance our indebtedness, fund planned capital expenditures, and continue research and development will depend on our ability to generate cash in the future. This is dependent on the degree to which we succeed in executing our business plans, which is influenced, in part, by general economic, financial, competitive, legislative, regulatory, counterparty, and other risks that are beyond our control. We may need to refinance all or a portion of our indebtedness on or before maturity. We cannot provide assurance that we will be able to refinance any of our indebtedness on commercially reasonable terms or at all.

We are exposed to counterparty default risks with our financial institutions and insurance providers.

If one or more of the depository institutions in which we maintain significant cash balances were to fail, our ability to access these funds might be temporarily or permanently limited, and we could face material liquidity problems and financial losses.

The lenders of our credit facility consist of several participating financial institutions. Our revolving line of credit allows us to provide letters of credit in support of our obligations for customer contracts and provides additional liquidity. If our lenders are not able to honor their line of credit commitments due to the loss of a participating financial institution or other circumstance, we would need to seek alternative financing, which may not be under acceptable terms, and therefore could adversely impact our ability to successfully bid on future sales contracts and adversely impact our liquidity and ability to fund some of our internal initiatives or future acquisitions.

Our international sales and operations are subject to complex laws relating to foreign corrupt practices and anti-bribery laws, among many others, and a violation of, or change in, these laws could adversely affect our operations.

The Foreign Corrupt Practices Act in the United States requires United States companies to comply with an extensive legal framework to prevent bribery of foreign officials. The laws are complex and require that we closely monitor local practices of our overseas offices. The United States Department of Justice has recently heightened enforcement of these laws. In addition, other countries continue to implement similar laws that may have extra-territorial effect. In the United Kingdom, where we have operations, the U.K. Bribery Act imposes significant oversight obligations on us and could impact our operations outside of the United Kingdom. The costs for complying with these and similar laws may be significant and could require significant management time and focus. Any violation of these or similar laws, intentional or unintentional, could have a material adverse effect on our business, financial condition, or results of operations.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results, prevent fraud, or maintain investor confidence. Failure to maintain effective internal controls over financial reporting resulted in a material weakness during 2015.

Effective internal controls are necessary for us to provide reliable and accurate financial reports and effectively prevent fraud. We have devoted significant resources and time to comply with the internal control over financial reporting requirements of the Sarbanes-Oxley Act. In addition, Section 404 under the Sarbanes-Oxley Act requires that our auditors attest to the design and operating effectiveness of our controls over financial reporting. Our compliance with the annual internal control report requirement for each fiscal year will depend on the effectiveness of our financial reporting, data systems, and controls across our operating subsidiaries. Furthermore, an important part of our growth strategy has been, and will likely continue to be, the acquisition of complementary businesses, and we expect these systems and controls to become increasingly complex to the extent that we integrate acquisitions and our business grows. Likewise, the complexity of our transactions, systems, and controls may become more difficult to manage. We cannot be certain that these measures will ensure that we design, implement, and maintain adequate controls over our financial processes and reporting in the future, especially for acquisition targets that may not have been required to be in compliance with Section 404 of the Sarbanes-Oxley Act at the date of acquisition.

Failure to implement new controls or enhancements to controls, failure to remediate the material weakness, difficulties encountered in control implementation or operation, or difficulties in the assimilation of acquired businesses into our control system could result in additional errors, material misstatements, or delays in our financial reporting obligations. Inadequate internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our stock and our access to capital.

The material weakness over financial reporting related to revenue recognition is disclosed in Item 9A. Remediating our material weakness and ensuring that we maintain effective internal control over financial reporting will require substantial management

14

time and attention. We have also incurred significant costs, including legal, accounting and other professional fees in connection with assessing the impacts of misstatements and revising our previously issued financial statements.

Our failure to prepare and timely file our periodic reports with the SEC limits our access to the public markets to raise debt or equity capital.

We did not file our 2015 Annual Report on Form 10-K or our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 (our “First Quarter 2016 Form 10-Q”) within the time frame required by SEC rules. Because of our failure to have timely filed those periodic reports with the SEC, we are currently ineligible to use SEC Form S-3, which is a short-form registration statement, to register our securities for public offer and sale, until we have timely filed all periodic reports under the Securities Exchange Act of 1934, as amended, for a period of twelve months and any portion of a month from the due date of the last untimely report. Our inability to use Form S-3 limits our ability to access the public capital markets rapidly, including in reaction to changing business needs or market conditions. While we may currently register an offering of our securities on Form S-1, doing so would likely increase transaction costs and adversely impact our ability to raise capital or complete any related transaction, such as an acquisition, in a timely manner.

We are subject to regulatory compliance.

We are subject to various governmental regulations in all of the jurisdictions in which we conduct business. Failure to comply with current or future regulations could result in the imposition of substantial fines, suspension of production, alteration of our production processes, cessation of operations, or other actions, which could materially and adversely affect our business, financial condition, and results of operations.

Regulations related to “conflict minerals” may force us to incur additional expenses, may result in damage to our business reputation, and may adversely impact our ability to conduct our business.

In August 2012, under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the SEC adopted requirements for companies that use certain minerals and derivative metals (referred to as “conflict minerals,” regardless of their actual country of origin) in their products. Some of these metals are commonly used in electronic equipment and devices, including our products. These requirements require companies to investigate, disclose and report whether or not such metals originated from the Democratic Republic of Congo or adjoining countries and required due diligence efforts. There may be increased costs associated with complying with these disclosure requirements, including for diligence to determine the sources of conflict minerals used in our products and other potential changes to products, processes or sources of supply as a consequence of such verification activities. Further interpretation and implementation of these rules could adversely affect the sourcing, supply, and pricing of materials used in our products.

ITEM 1B: UNRESOLVED STAFF COMMENTS

None.

15

ITEM 2: PROPERTIES

We own our headquarters facility, which is located in Liberty Lake, Washington.

Our Gas and Water manufacturing facilities are located throughout the world, while our Electricity manufacturing facilities are located primarily in Europe, Middle East, and Africa (EMEA) and North America. The following table lists our major manufacturing facilities by the location and product line.

Product Line | ||||

Region | Electricity | Gas | Water | Multiple Product Lines |

North America | Oconee, SC (O) | Owenton, KY (O) | None | Waseca, MN - G,W (L) |

EMEA | Chasseneuil, France (O) Godollo, Hungary (O) | Argenteuil, France (L) Reims, France (O) Karlsruhe, Germany (O) Stretford, England (O) | Massy, France (L) Macon, France (O) Haguenau, France (O) Oldenburg, Germany (O) Asti, Italy (O) | None |

Asia/Pacific | None | Wujiang, China (L) | Suzhou, China (L) Dehradun, India (L) | Bekasi, Indonesia - E,W (O) |

Latin America | None | Buenos Aires, Argentina (O) | Americana, Brazil (O) | None |

(O) - Manufacturing facility is owned

(L) - Manufacturing facility is leased

E - Electricity manufacturing facility, G - Gas manufacturing facility, W - Water manufacturing facility

Our principal properties are in good condition, and we believe our current facilities are sufficient to support our operations. Our major manufacturing facilities are owned, while smaller factories are typically leased.

In addition to our manufacturing facilities, we have numerous sales offices, product development facilities, and distribution centers, which are located throughout the world.

ITEM 3: LEGAL PROCEEDINGS

Please refer to Item 8: “Financial Statements and Supplementary Data, Note 13: Commitments and Contingencies” included in this Annual Report on Form 10-K. Except as described therein, there were no material pending legal proceedings, as defined by Item 103 of Regulation S-K, at December 31, 2015.

ITEM 4: MINE SAFETY DISCLOSURES

Not applicable.

16

PART II

ITEM 5: MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information for Common Stock

Our common stock is traded on the NASDAQ Global Select Market. The following table reflects the range of high and low common stock sales prices for the four quarters of 2015 and 2014 as reported by the NASDAQ Global Select Market.

2015 | 2014 | ||||||||||||||

High | Low | High | Low | ||||||||||||

First Quarter | $ | 41.86 | $ | 35.05 | $ | 43.14 | $ | 33.64 | |||||||

Second Quarter | $ | 37.81 | $ | 34.44 | $ | 41.21 | $ | 33.68 | |||||||

Third Quarter | $ | 33.91 | $ | 28.30 | $ | 42.88 | $ | 35.77 | |||||||

Fourth Quarter | $ | 37.53 | $ | 31.75 | $ | 43.35 | $ | 36.42 | |||||||

Performance Graph

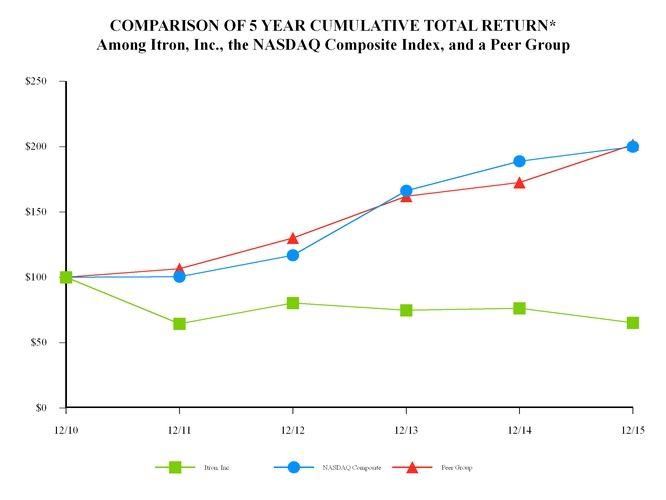

The following graph compares the five-year cumulative total return to shareholders on our common stock with the five-year cumulative total return of our peer group of companies used for the year ended December 31, 2015 and the NASDAQ Composite Index.

* $100 invested on 12/31/10 in stock or index, including investment of dividends.

Fiscal years ending December 31.

17