Associated Banc-Corp

Investor Presentation

FIRST QUARTER

2018

Exhibit 99.1

DISCLAIMER

Important note regarding forward-looking statements:

Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities

Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations,

products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may

be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,” “intend,” “outlook” or similar

expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and

uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause

actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s

most recent Form 10-K and subsequent SEC filings. Such factors are incorporated herein by reference.

Non-GAAP Measures

This presentation includes certain non-GAAP financial measures. These non-GAAP measures are provided in addition to, and not as

substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP

measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in

the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in

isolation from, or as a substitute for, related GAAP measures. Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures can be found at the end of this presentation.

Trademarks:

All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective

owners.

1

Community,

Consumer, and

Business

33%

Corporate and

Commercial

Specialty

60%

RMSS2

7%

2017 Net Income

by Business Segment

WI

63%

151

MN

7%

20 IL

30%

42

2017 Deposits (%)

And Branches

OUR FRANCHISE

2

$33 billion of assets1 $23 billion of loans1

Over $1 billion of revenue1 $25 billion of deposits1

February 1, 2018

1 – Pro forma combined results of ASB and BKMU as of and for the year ended December 31, 2017

2 – Risk Management and Shared Services

3 – Affinity debit cards as a percentage of active personal checking accounts, as of December 31, 2017

− Largest bank headquartered in Wisconsin

− Approximately 5,000 employees, servicing over 1 million

customer accounts in 8 states and over 110 communities1

− 40%+ of active personal checking accounts are affinity related3

24%

7%

9%

2%

Affinity Programs3

Manufacturing

& Wholesale

Trade

25%

ATTRACTIVE MIDWEST MARKETS

2.8% 3.0% 3.1%

3.4% 3.5%

4.1%

4.7% 4.7% 4.8%

IA WI MN IN MO U.S. MI OH IL

Midwest

~35%

All other

regions

~65%

U.S.

Manufacturing

Jobs

1 – U.S. Census Bureau, Annual Estimates of the Resident Population, June 30, 2016 - July 31, 2017

2 – U.S. Bureau of Labor Statistics, Manufacturing Industry Employees, seasonally adjusted, December 2017 (preliminary)

3 – U.S. Bureau of Labor Statistics, Unemployment Rates by State, seasonally adjusted, December 2017 (preliminary)

4 – U.S. Bureau of Labor Statistics, Unemployment Rates, Midwest Information Office, seasonally adjusted, November 2017 (preliminary)

Midwest holds ~20% of the U.S. population1 and

nearly 35% of all U.S. manufacturing jobs2

3

Large Population Base With a Manufacturing and Wholesale Trade-Centric Economy

Several Midwestern states have unemployment rates3 well

below the national average:

Dark green bars denote ASB branch states

Commercial and Business Lending

ASB Loan Composition by Industry

Madison, WI……………………

Rochester, MN…………………

Wausau, WI……………………

Minneapolis – St. Paul, MN…..

Green Bay, WI…………………

2.1%

2.2%

2.4%

2.4%

2.6%

Supporting Strong Employment Base and Healthy Consumer Credit

Select ASB Metro Market

Unemployment Rates4

2018 OUTLOOK

Balance Sheet

Management

▪ Pro forma mid-single digit

annual average loan growth on

the combined Associated and

Bank Mutual portfolio

▪ Maintain Loan to Deposit ratio

under 100%

▪ Stable to modestly improving

year over year NIM trend

Fee

Businesses

▪ Improving year over year fee-

based revenues

▪ Approximately $360M - $370M

full year noninterest income

Expense

Management

▪ Approximately $820M (including

$40M of restructuring costs)

▪ Continued improvement to our

efficiency ratio

▪ Lower effective tax rate

(20%-22%)

Capital &

Credit

Management

▪ Continue to follow stated

corporate priorities for capital

deployment

▪ Provision expected to adjust with

changes to risk grade, other

indications of credit quality, and

loan volume

Our outlook reflects a stable to improving economy and the expected beneficial impact of corporate

tax reform. We may adjust our outlook if, and when, we have more clarity on any one, or more, of

these factors.

4

Wisconsin

31%

Illinois

26%

Minnesota

10%

Other

Midwest

13%

Texas

4%

Other

16%

$1.6 $1.5 $1.5 $1.4 $1.3

$4.6 $4.9 $5.5

$6.2 $7.1

1

$3.7 $4.0

$4.2

$4.7

$5.0

$5.8

$6.5

$7.0

$7.4

$7.3 $15.7

$16.8

$18.3

$19.7

$20.6

2013 2014 2015 2016 2017

Commercial & Business Commercial Real Estate

Residential Mortgage Home Equity & Other consumer

LOAN GROWTH TRENDS

($ in billions)

5%

Average Annual Loans

6%

8%

12%

1 – Approximately $5 billion of the total residential mortgage portfolio was comprised of adjustable-rate loans at year-end 2017

2 – The Wisconsin #1 Mortgage Lender designation is based on information gathered from the Home Mortgage Disclosure Act

data compiled annually by the FFIEC. The results of the data were obtained through RATA Comply, November 2017.

3 – Based on outstandings as of December 31, 2017

5

2013

– 2017

CAGR

-5%

Commercial & Business

Core manufacturing-centric portfolio is

complemented with specialty national businesses

Commercial Real Estate

Well diversified by geography, property type, and

borrower

Consumer

Recognized as Wisconsin’s #1 mortgage lender

for the 9th straight year2

Upper Midwest Focused Portfolio3

Chart excludes Bank

Mutual and $0.4 billion

Other consumer

portfolio

Growth Across the Portfolio

Checking and Savings Deposits

Represented nearly 50% of our year-end deposit

base

2017 Annual Average Deposits by Segment

Loan to Deposit Ratio

DEPOSIT GROWTH TRENDS

($ in billions)

Growing Low Cost Deposits Average Annual Deposits

6%

6%

$1.8 $1.6 $1.6 $1.6 $2.0

$1.2 $1.2 $1.3 $1.4 $1.5

$7.3 $7.6

$9.2 $9.1 $9.1

$2.8 $3.0

$3.2 $3.8

$4.3 $4.2

$4.2

$4.5

$5.1

$5.0

$17.4 $17.6

$19.9

$21.0

$21.9

2013 2014 2015 2016 2017

Noninterest-bearing Demand Interest-bearing Demand

Money Market Savings

Time Deposits 6

11%

92%

94%

89%

92% 91%

2013

– 2017

CAGR

4%

2%

1 – Risk Management and Shared Services (“RMSS”) is primarily comprised of network deposits and institutional funding

Corporate and

Commercial

Specialty

32%

RMSS1

15%

Community,

Consumer, and

Business

53%

Money

Market

39%

Noninterest-

bearing

demand

24%

Interest-

bearing

demand

20%

Savings

7%

Time

Deposit

10%

Customers continue to seek more efficient ways to bank. Digital capabilities are key to meeting their

rising expectations. Associated is actively enhancing its multichannel approach and expects to deploy

new and enhanced consumer mobile solutions in early 2018.

SHIFT TO DIGITAL CHANNELS

7

We Have an App for That Adopting a Multichannel Approach

Online

Banking

Branch

ATM

Chat,

Email,

Text

Snap

Deposit

Call

Center

Associated Mobile Banking

Snap mobile deposits and online bill pay

capabilities

Associated Bank HSA PLUS

Real-time transaction updates, balances,

and expense tracking

Associated Retire

Mobile contribution and allocation

updates and balance and portfolio

updates

Enhanced Mobile & Online Upgrades

Associated Bank Mobile & Online Banking Platform

Q1 2018

Bank Mutual Mobile & Online Banking Conversion

Mid 2018

Commercial Deposit Platform

Late 2018

8

INCREASING DISTRIBUTION EFFICIENCY

LESS BRANCH CENTRIC; MORE MOBILE AND ENHANCED 24/7 ACCESS

Deposits

~63%

from 2007

Branches

~30%

from 2007

Average Deposits

per Branch

~130%

from 2007

ATM transactions

represent nearly 30% of all

deposit and withdrawal1 activity

ATM deposit transactions

~4.5x

from 2012

Over 90% of our Corporate Banking customers’

deposit activity1 is executed via lockbox or remote deposit

In 2017, 55%

of all deposit and

withdrawal activity1

occurred

outside our branches

Nearly 60% of consumer

checking customers log in to

online banking2

Mobile deposits

~21%

from 2016

1 – Excludes ACH and wire transfer activity, for the year ended December 31, 2017

2 – Logged in during last 90 days, for the period ended December 31, 2017

650

700

750

800

850

2011 2012 2013 2014 2015 2016 2017

FOCUSED ON CUSTOMER EXPERIENCE

9

ROBUST

AFFINITY

PROGRAMS

OUTSTANDING

CUSTOMER

SERVICE

CHALLENGER

PHILOSOPHY

MULTI-CHANNEL

INITIATIVES

Customer Approach

J.D. Power U.S. Retail Banking Satisfaction Study2

1 – J.D. Power 2017 Certified Contact Center ProgramSM recognition is based on successful completion of an audit and exceeding a customer satisfaction benchmark

through a survey of recent servicing interactions. For more information, visit www.jdpower.com/ccc

2 – J.D. Power U.S. Retail Banking Satisfaction Study

Contact Center Recognition1

71.1%

70.3% 70.0%

67.0%

66.0% 69.3% 68.5% 68.2%

65.5%

64.5%

2013 2014 2015 2016 2017

Federal Reserve Fully tax-equivalent

Efficiency Ratio1

Enhanced

Automation

Operational

Efficiencies

Branch

Consolidations

Branch Staffing

Initiatives

OVERALL EXPENSE EFFICIENCY

Efficiency Drivers

1 – The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the

sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent efficiency ratio, which is a non-GAAP

financial measure, is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully

tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. Refer to the appendix for a reconciliation of the Federal

Reserve efficiency ratio to the fully tax-equivalent efficiency ratio.

10

~240

213

2.92%

2.41%

2013 2014 2015 2016 2017

Branches (period end)

Noninterest Expense /

Average Assets

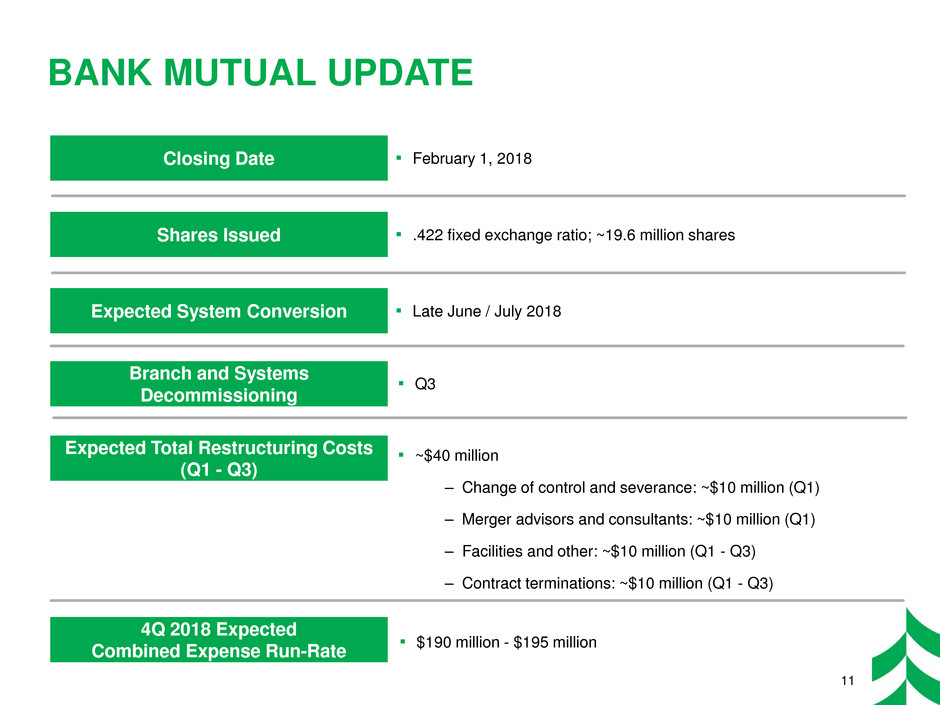

BANK MUTUAL UPDATE

Closing Date

11

Expected System Conversion

Branch and Systems

Decommissioning

Expected Total Restructuring Costs

(Q1 - Q3)

▪ February 1, 2018

▪ Late June / July 2018

▪ Q3

▪ ~$40 million

– Change of control and severance: ~$10 million (Q1)

– Merger advisors and consultants: ~$10 million (Q1)

– Facilities and other: ~$10 million (Q1 - Q3)

– Contract terminations: ~$10 million (Q1 - Q3)

Shares Issued ▪ .422 fixed exchange ratio; ~19.6 million shares

4Q 2018 Expected

Combined Expense Run-Rate ▪ $190 million - $195 million

NONINTEREST EXPENSE OUTLOOK

($ in millions)

12

2017 Associated noninterest expense $709M

2017 Bank Mutual noninterest expense + 70

Whitnell incremental noninterest expense + ~5

One-time Tax Act compensation actions - ~$2

2018 noninterest expense baseline = ~$782M

+ ~1.0% baseline expense growth + ~8

+ $15 minimum wage impact + ~2

– Q3 Bank Mutual cost saves (mid-quarter) at 22.5% - ~4

– Q4 Bank Mutual cost saves (full quarter) at 45% - ~8

2018 pro forma total noninterest expense baseline, before restructuring costs = ~$780M

+ Estimated Bank Mutual restructuring costs + ~40

2018 pro forma total noninterest expense, including restructuring costs = ~$820M

Commercial

& Business

Lending

35%

CRE

Investor

16%

Construction

7%

Residential

Mortgage

36%

Home Equity

& Other

Consumer

6%

Commercial

& Business

Lending

33%

CRE Investor

18%

Construction

7%

Residential

Mortgage

35%

Home Equity

& Other

Consumer

7%

Money

Market

38%

Noninterest-

bearing

demand

23%

Interest-

bearing

demand

20%

Savings

7%

Time

Deposit

12%

Money

Market

39%

Noninterest-

bearing

demand

24%

Interest-

bearing

demand

20%

Savings

7%

Time

Deposit

10%

Money

Market

27%

Noninterest-

bearing

demand

16%

Interest-

bearing

demand

13%

Savings

13% Time Deposit

31%

Commercial

& Business

Lending

17%

CRE Investor

43%

Construction

8%

Residential

Mortgage

23%

Home Equity

& Other

Consumer

9%

PRO FORMA LOANS & DEPOSITS

Note: Total Loans and Total Deposits are as of December 31, 2017; Yield on Loans and Cost of Deposits are for the full year 2017

1 – Cost of deposits includes interest-bearing deposits only

Lo

an

s

D

ep

os

its

Associated

Bank Mutual

Pro Forma

Associated

Bank Mutual

Pro Forma

13

Total Loans = $20.8bn

Yield on Loans = 3.66%

Total Loans = $2.0bn

Yield on Loans = 4.01%

Total Loans = $22.8bn

Yield on Loans = 3.69%

Total Deposits = $22.8bn

Cost of Deposits1 = 0.56%

Total Deposits = $1.9bn

Cost of Deposits1 = 0.44%

Total Deposits = $24.7bn

Cost of Deposits1 = 0.55%

NET INTEREST MARGIN OUTLOOK

14

4Q 2017 Run-Rate 2.79%

+ Expected benefit of 3 Fed rate increases + 3-6 bps

+ Expected benefit of Bank Mutual's higher loan yields + 3 bps

Pro forma run-rate before tax adjustments 2.85%-2.88%

– Fully tax-equivalent adjustments on municipal securities and loans - 3-4 bps

Net 2018 projected net interest margin range '= 2.82%-2.85%

$138 $154 $155 $149 $155

$234 $236

$250 $261 $294

$358 $366

$370 $402

$459

$729

$756 $774

$812

$908

2013 2014 2015 2016 2017

Investment and Other Retail Commercial

REPRICING DYNAMICS OF EARNING ASSETS

($ in millions)

15

Interest Income

Commercial

Residential Mortgage

Investments and Other

2.59% 2.59%

2.45%

2.34%

2.42%

3.76%

3.49%

3.29% 3.32%

3.76%

3.58%

3.47%

3.29%

3.17%

3.23%

2013 2014 2015 2016 2017

Average Yield

91%

8%

% Repricing1

in next 12mo.

1 – Repricing, resetting, or maturing balances as a percentage of year-end 2017 balances

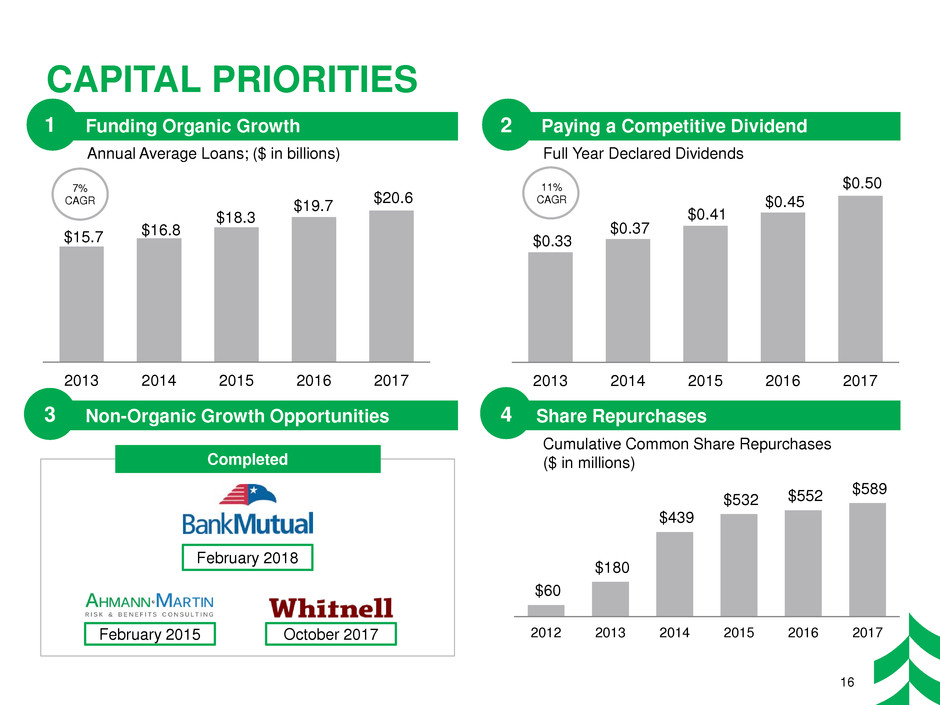

Funding Organic Growth Paying a Competitive Dividend

Non-Organic Growth Opportunities Share Repurchases

$15.7 $16.8

$18.3

$19.7 $20.6

2013 2014 2015 2016 2017

CAPITAL PRIORITIES

16

$0.33

$0.37

$0.41

$0.45

$0.50

2013 2014 2015 2016 2017

11%

CAGR

7%

CAGR

Annual Average Loans; ($ in billions) Full Year Declared Dividends

February 2015

$60

$180

$439

$532 $552

$589

2012 2013 2014 2015 2016 2017

Cumulative Common Share Repurchases

($ in millions)

February 2018

October 2017

Completed

1 2

3 4

$1.42 $1.26

$0.10

2016 2017

Per Share Data Dividends

Shareholder Gain Return on Average Common Equity

Return on average tangible equity2

$0.12

$0.15

Q1 2017 Q1 2018

EXPANDING BOTTOM LINE

17

As of December 31, 2017

Growing Shareholder Wealth

+25%

YoY

10.1% 10.9%

Return on average common equity

$100.0

$140.0

$180.0

$220.0

2012 2013 2014 2015 2016 2017

Associated Banc-Corp

S&P 500 Index

S&P 400 Regional Banks Sub-Industry Index

Expenses related to the Tax Act

GAAP Earnings per share

$1.521

1 – Earnings per share, excluding expenses related to the Tax Act is a non-GAAP financial measure. Refer to the appendix for a reconciliation of non-GAAP measures.

2 – Return on average tangible equity is a non-GAAP financial measure. Refer to the appendix for a reconciliation of non-GAAP measures.

6.6% 7.3%

2016 2017

45%

114%

Three Years Five Years

LINE OF BUSINESS PROFILES

12.4% 12.9%

Corporate and

Commercial

Specialty

Community,

Consumer, and

Business

Return on Average

Allocated Capital

BALANCED BUSINESS SEGMENTS

19

Community, Consumer,

and Business

Corporate and

Commercial Specialty

$409

$628

Corporate and

Commercial

Specialty

Community,

Consumer, and

Business

Net Interest Income and

Noninterest Income

$ millions

$17.8

$21.2

Corporate and

Commercial

Specialty

Community,

Consumer, and

Business

Average Loans and

Deposits

$ billions

Corporate Banking

Commercial Real Estate

Consumer and Business Banking

Community Markets

Private Client and Institutional Services

For the year ended December 31, 2017

Corporate

Lending

Specialized

Lending

Verticals

Commercial

Deposits

and Treasury

Management

Capital

Markets

CORPORATE BANKING

CORPORATE AND COMMERCIAL SPECIALTY SEGMENT

20

Creative, relationship-oriented teams build loyal,

long-lasting client relationships

Corporate Lending serves large and complex

customers, including Specialized Industries

Commercial Deposits and Treasury Management

and Capital Markets provide solutions focused on

customer needs and supported by high-touch, in-

market service

2017 Highlights

Grew net income after tax by 7.9% from 2016

Increased agented transactions resulting in 14.7%

growth of Syndication Fees

Enhanced Treasury Management product offering

with PEP+ and rolled out relationship management

and profitability tools across Commercial Banking

groups

$12.0 billion in average loans and

deposits

10 offices across 6 states

~270 colleagues

Commercial and Business Lending1

Loan Composition by Industry

1 – Total commercial and business lending loan outstandings as of December 31, 2017

Overview Business Units

Manufacturing &

Wholesale Trade

25%

Power & Utilities

14%

Real Estate

12%

Oil & Gas

8%

Finance &

Insurance

12%

Health Care and

Soc. Assist.

5% Retail Trade

4%

Profsnl, Scientific,

and Tech Svs

4%

Rental and leasing

Services

3%

Construction

3%

Other

10%

$5.7 billion in average loans and

deposits

11 offices across 8 states

~110 colleagues

COMMERCIAL REAL ESTATE

CORPORATE AND COMMERCIAL SPECIALTY SEGMENT

21

Local experienced teams create custom real estate

financing solutions

Term, acquisition, construction and interim-bridge

financing

Deposit and cash management solutions

Specialized financial services including loan

syndications and interest rate risk management

2017 Highlights

Closed ~ $2 billion of new loan commitments

Average deposits grew over 20% from 2016

Year over year core fee income grew 9%

Commercial Real Estate1

Loan Composition by Property Type

1 – Total commercial real estate lending loan outstandings as of December 31, 2017

Overview

CRE Lending

Real Estate

Investment

Trusts

CRE

Syndications

CRE

Tax Credits

Business Units

Multi-Family

30%

Retail

22%

Office / Mixed

Use

20%

Industrial

10%

1-4 Family

Construction

9% Hotel / Motel 5%

Other

4%

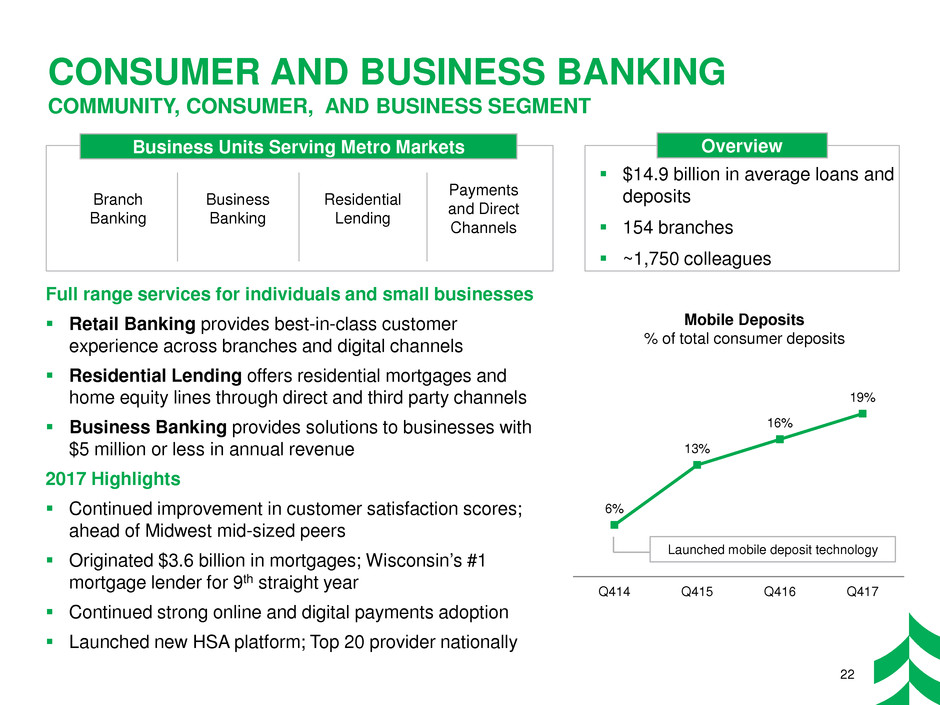

6%

13%

16%

19%

Q414 Q415 Q416 Q417

$14.9 billion in average loans and

deposits

154 branches

~1,750 colleagues

Full range services for individuals and small businesses

Retail Banking provides best-in-class customer

experience across branches and digital channels

Residential Lending offers residential mortgages and

home equity lines through direct and third party channels

Business Banking provides solutions to businesses with

$5 million or less in annual revenue

2017 Highlights

Continued improvement in customer satisfaction scores;

ahead of Midwest mid-sized peers

Originated $3.6 billion in mortgages; Wisconsin’s #1

mortgage lender for 9th straight year

Continued strong online and digital payments adoption

Launched new HSA platform; Top 20 provider nationally

CONSUMER AND BUSINESS BANKING

COMMUNITY, CONSUMER, AND BUSINESS SEGMENT

22

Launched mobile deposit technology

Overview

Mobile Deposits

% of total consumer deposits

Branch

Banking

Business

Banking

Residential

Lending

Payments

and Direct

Channels

Business Units Serving Metro Markets

COMMUNITY MARKETS

COMMUNITY, CONSUMER, AND BUSINESS SEGMENT

23

Localized approach ensures the customer experience is

at the forefront of decisions and actions

Virtual community banks with our full suite of financial and

risk management solutions in midsize markets

Community market presidents are positioned as active

community partners and financial leaders

Strategy is intended to build on our strong deposit market

share in select midsize markets

Increased residential loan officers for optimized

geographical coverage

2017 Highlights

Best-in-class retail banking satisfaction scores

Growing Private Banking prominence

Improving residential mortgage production

Continuing deposit growth

$3.8 billion in average loans and

deposits

59 branches

~410 colleagues

Rochester

La Crosse

Peoria

Southern Illinois

Northern Wisconsin

Branch

Banking

Commercial &

Business

Banking

Residential

Lending

Private

Banking

Business Units Serving Midsize Markets

Rockford

Eau Claire

Central Wisconsin

Overview

Brokerage

and

Annuity

$20

Insurance

$81

Other1

$2

Trust and Asset

Management

$50

$7.4

$8.0 $7.7

$8.3

$10.6

2013 2014 2015 2016 2017

Assets Under Management

“AUM”2

PRIVATE CLIENT AND INSTITUTIONAL SERVICES

COMMUNITY, CONSUMER, AND BUSINESS SEGMENT

24

Market-based teams are comprised of specialists

Private Client Services offers a suite of services

tailored to the unique needs of high-net-worth and

ultra-high-net-worth clients

Institutional Services works with businesses and

other entities to provide strategic, customized

employee benefits, retirement plan services,

business insurance and HR solutions

2017 Fee Revenues2

$2.5 billion in average loans and

deposits

$10.6 billion AUM

~710 colleagues

2017 Highlights

AUM grew 28% from 2016

Acquired Whitnell & Co ($1B AUM)

to provide asset management and

family office services to the

ultra-high-net-worth segment

Net income after tax grew 33% from 2016

Business Units

Private Banking Personal Trust Asset Management

Retirement Plan

Services

Associated Benefits

and Risk Consulting

Associated

Investment Services

Overview

1 – Primarily other nondeposit fee income

2 – Balances as of or for the year ended December 31, 2017

APPENDIX

$185 $177 $158 $128 $132

$20

$147 $77

$178

$275

$209

2013 2014 2015 2016 2017

1.7% 1.5% 1.5% 1.4% 1.3%

5.6% 5.7%

4.5%

2013 2014 2015 2016 2017

ALLL / Total Loans

Oil and Gas ALLL / Oil and Gas Loans

CREDIT QUALITY

($ IN MILLIONS; AT OR FOR THE YEAR ENDED)

Potential Problem Loans Nonaccrual Loans

26

$39

$15

$30

$6 $14

$59

$25

$65

$39

2013 2014 2015 2016 2017

$235 $190 $178

$276

$137

$124

$75

$40

$302

$351

$177

2013 2014 2015 2016 2017

Net Charge Offs (Recoveries) Allowance to Total Loans / Oil and Gas Loans

Oil and Gas Oil and Gas

Oil and Gas

C&BL by Geography

$7.2 billion

CRE by Geography

$4.8 billion

Multi-Family

30%

Retail5

22%

Office / Mixed

Use

20%

Industrial

10%

1-4 Family

Construction

9%

Hotel / Motel

5%

Other

4%

Wisconsin

29%

Illinois

19% Minnesota

9%

Other

Midwest2

24%

Texas

5%

Other

14%

C&BL by Industry

$7.2 billion

Oil and Gas Lending4

$600 million

CRE by Property Type

$4.8 billion

Manufacturing &

Wholesale Trade

25%

Power &

Utilities

14%

Real Estate

12%

Oil & Gas

8%

Finance &

Insurance

12%

Health Care and

Soc. Assist.

5% 1 – Excludes $0.4 billion Other consumer portfolio

2 – Other Midwest includes Missouri, Indiana, Ohio, Michigan and Iowa

3 – Principally reflects the oil and gas portfolio

4 – Based on outstanding commitments of $935 million

5 – Our largest tenant exposure is less than 5%, spread over six loans, to a national investment grade grocer

South Texas

& Eagle Ford

17%

East Texas

North

Louisiana

Arkansas

16%

Permian

16%

Rockies

16%

Marcellus

Utica

Appalachia

9%

Mid-

Continent

(primarily OK

& KS)

9%

Other

(Onshore

Lower 48)

6%

Gulf Shallow

4%

Gulf Coast

4%

Bakken

3%

Wisconsin

28%

Illinois

15%

Minnesota

7%

Other

Midwest2

10%

Texas3

9%

Other

31%

LOANS STRATIFICATION OUTSTANDINGS AS OF DECEMBER 31, 2017

27

Total Loans1

Wisconsin

31%

Illinois

26%

Minnesota

10%

Other

Midwest2

13%

Texas

4%

Other

16%

OIL AND GAS UPDATE

$446 $413 $450 $446

$483

$75

$78 $37 $39

$40

$147

$134 $114 $92

$77

$668

$625 $601 $577 $600

4Q 2016 1Q 2017 2Q 2017 3Q 2017 4Q 2017

Pass Potential Problem Loans Nonaccrual

Period End Loans by Credit Quality Oil and Gas Allowance

$38 $42

$33 $30 $27

5.7%

6.7%

5.4% 5.2%

4.5%

4Q 2016 1Q 2017 2Q 2017 3Q 2017 4Q 2017

($ in millions) ($ in millions)

28

Total O&G Portfolio

As of December 31, 2017

# of credits $ of commitments $ of outstandings % of total loans

56 $935 million $600 million 3%

22

39%

$453 million

48%

$258 million

43%

1%

New Business Since

January 1, 2016

Oil and Gas Allowance

Oil and Gas Allowance / Oil and Gas Loans

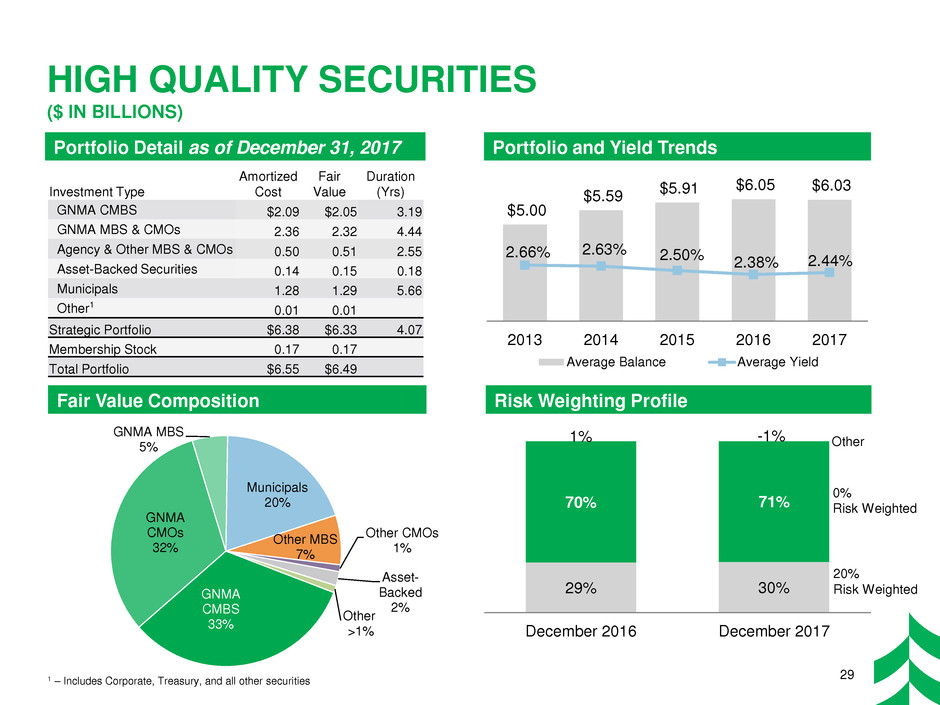

Fair Value Composition Risk Weighting Profile

$5.00

$5.59 $5.91

$6.05 $6.03

2.66% 2.63% 2.50% 2.38% 2.44%

1.00%

2.00%

3.00%

4.00%

5.00%

2013 2014 2015 2016 2017

Average Balance Average Yield

29% 30%

70% 71%

1% -1%

December 2016 December 2017

HIGH QUALITY SECURITIES

($ IN BILLIONS)

Investment Type

Amortized

Cost

Fair

Value

Duration

(Yrs)

GNMA CMBS $2.09 $2.05 3.19

GNMA MBS & CMOs 2.36 2.32 4.44

Agency & Other MBS & CMOs 0.50 0.51 2.55

Asset-Backed Securities 0.14 0.15 0.18

Municipals 1.28 1.29 5.66

Other1 0.01 0.01

Strategic Portfolio $6.38 $6.33 4.07

Membership Stock 0.17 0.17

Total Portfolio $6.55 $6.49

GNMA

CMBS

33%

GNMA

CMOs

32%

GNMA MBS

5%

Municipals

20%

Other MBS

7%

Other CMOs

1%

Asset-

Backed

2%

Other

>1%

Portfolio Detail as of December 31, 2017 Portfolio and Yield Trends

0%

Risk Weighted

Other

20%

Risk Weighted

1 – Includes Corporate, Treasury, and all other securities 29

TAX ACT IMPACTS

2017 Tax Act expenses

30

~$0.10 per share

Corporate Effective Tax Rate Outlook

Expected 20-22% Effective Rate

1. Required partial write-off of deferred

tax assets ~$12 million

2. Required acceleration of low income

housing tax credit amortization ~$1 million

3. Previously disclosed compensation

actions ~$1 million

4. Other accelerated write-offs ~$1 million

Total 2017 Tax Act related expenses ~$15 million

Lower federal statutory rate

Smaller net benefits from municipal,

BOLI, and tax credit investments

Newly disallowed FDIC insurance

premiums, executive compensation,

meals and entertainment, parking

and commuting reimbursements,

and other disallowed items

Lower federal benefit on state taxes

Efficiency Ratio 2013 2014 2015 2016 2017

Federal Reserve efficiency ratio 71.14% 70.28% 69.96% 66.95% 65.97%

Fully tax-equivalent adjustment (1.45)% (1.36)% (1.41)% (1.29)% (1.28)%

Other intangible amortization (0.42)% (0.39)% (0.31)% (0.20)% (0.18)%

Fully tax-equivalent efficiency ratio 69.27% 68.53% 68.24% 65.46% 64.51%

The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by

the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent efficiency ratio, which is a

non-GAAP financial measure, is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization,

divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. Management

believes the fully tax-equivalent efficiency ratio, which adjusts net interest income for the tax-favored status of certain loans and investment securities, to be

the preferred industry measurement as it enhances the comparability of net interest income arising from taxable and tax-exempt sources.

RECONCILIATION AND DEFINITIONS OF

NON-GAAP ITEMS

31

Earnings per share, excluding expenses related to the Tax Act

FY 2017 per

share data

GAAP earnings per share $1.42

Required partial write-off of deferred tax asset 0.08

Required acceleration of low income housing tax credit amortization <0.01

Previously disclosed compensation actions <0.01

Other accelerated write-offs <0.01

Total expenses related to the Tax Act 0.10

Earnings per share, excluding expenses related to the Tax Act $1.52

Given the passage of the Tax Cuts and Jobs Act of 2017, the Company believes the above required and reported impacts of the Tax Cuts and

Jobs Act of 2017 are generally of a non-recurring nature and notably impacted the fourth quarter 2017 results. Management believes this

measure is meaningful because it reflects adjustments commonly made by management, investors, regulators, and analysts to evaluate the

adequacy of earnings per common share. Associated believes earnings per common share, excluding expenses related to the Tax Act

provides a greater understanding of ongoing operations and enhances comparability of results with prior periods. All items are tax effected.

Average Tangible Common Equity

($ in millions) 2016 2017

Average common equity $2,889 $3,013

Average goodwill and other intangible assets, net (988) (988)

Average tangible common equity $1,900 $2,025