Table of Contents

As filed with the Securities and Exchange Commission on October 30, 2008

Registration No. 333-152446/811-04420

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-6

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| PRE-EFFECTIVE AMENDMENT NO. 2 |

x |

| POST-EFFECTIVE AMENDMENT NO. |

¨ |

and/or

REGISTRATION STATEMENT

UNDER

THE INVESTMENT COMPANY ACT OF 1940

| Amendment No. 81 |

x |

(Check appropriate box or boxes)

WRL SERIES LIFE ACCOUNT

(Exact Name of Registrant)

WESTERN RESERVE LIFE ASSURANCE CO. OF OHIO

(Name of Depositor)

570 Carillon Parkway

St. Petersburg, FL 33716

(Address of Depositor's Principal Executive Offices) (Zip Code)

Depositor’s Telephone Number, including Area Code:

(727) 299-1800

Arthur D. Woods, Esq.

Vice President and Senior Counsel

Western Reserve Life Assurance Co. of Ohio

570 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

Mary Jane Wilson-Bilik, Esq.

Sutherland Asbill & Brennan LLP

1275 Pennsylvania Avenue, N.W.

Washington, D.C. 20004-2415

Approximate Date of Proposed Public Offering:

As soon as practicable after effectiveness of this registration statement.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Title of securities being registered:

Units of interest in a separate account under individual flexible premium variable life policies.

Table of Contents

PART A

INFORMATION REQUIRED IN A PROSPECTUS

Table of Contents

P R O S P E C T U S

{DATE}, 2008

WRL XCELERATOR FOCUSSM

WRL XCELERATOR EXEC SM

issued through

WRL Series Life Account

by

Western Reserve Life Assurance Co. of Ohio

Administrative Office:

570 Carillon Parkway

St. Petersburg, Florida 33716

1-800-851-9777; (727) 299-1800

Direct all payments made by check, and all correspondence

and notices to the Mailing Address:

4333 Edgewood Road, N.E.

Cedar Rapids, Iowa 52499

Each An Individual Flexible Premium Variable Life Insurance Policy

This prospectus describes the WRL Xcelerator FocusSM and WRL Xcelerator Exec, SM each a flexible premium variable life insurance policy (each a “Policy”, collectively the “Policies”). You can allocate your Policy’s cash value to the fixed account (which credits a specified guaranteed interest rate) and/or to the WRL Series Life Account, which invests through its subaccounts in portfolios of the Transamerica Series Trust (formerly, AEGON/Transamerica Series Trust) – Initial Class, the Fidelity Variable Insurance Products Funds – Service Class 2 (“Fidelity VIP Fund”), the ProFunds, and the Access One Trust (Access Trust”) (collectively, the “funds”). Please refer to the next page of this prospectus for the list of portfolios that may be available to you under your Policy.

If you already own a life insurance policy, it may not be to your advantage to buy additional insurance or to replace your policy with either Policy described in this prospectus. And it may not be to your advantage to borrow money to purchase a Policy or to take withdrawals from another policy you own to make premium payments under a Policy.

Prospectuses for the portfolios of the funds must accompany this prospectus. Certain portfolios may not be available in all states. Please read these documents before investing and save them for future reference.

An investment in a Policy is not a bank deposit. Each Policy is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon

the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Table of Contents

PORTFOLIOS AVAILABLE UNDER YOUR POLICY

PORTFOLIOS AVAILABLE UNDER YOUR POLICY

TRANSAMERICA SERIES TRUST:*

PROFUNDS:***

| • | FIDELITY FUNDS: |

| • | Fidelity Index 500 Portfolio |

| • | ACCESS ONE TRUST:*** |

| • | Access VP High Yield Fund |

| * | Effective May 1, 2008, several Series Trust portfolios were renamed. For a complete list of both the former and new names of each portfolio, please refer to “The Portfolios” section in this prospectus. |

| ** | This portfolio no longer accepts new investments from current or prospective investors. If you surrender your Policy’s cash value from this portfolio, you may not reinvest in this portfolio. |

| *** | The ProFunds and Access Trust portfolios permit frequent transfers. Investors in the ProFunds and/or Access Trust portfolios bear the additional costs and investment risks of frequent transfers. See “Disruptive Trading and Market Timing” in this prospectus. |

| + |

Formerly, ProFund VP OTC. |

Table of Contents

| Fee Tables (For Policies Applied For On or After October 30, 2008) |

2 | |

| Fee Tables (For Policies Applied For Before October 30, 2008 and Issued Before January 1, 2009) |

13 | |

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 25 | ||

| 26 | ||

| 26 | ||

| 26 | ||

| 27 | ||

| 27 | ||

| 28 | ||

| 28 | ||

| 28 | ||

| 28 | ||

| 28 | ||

| 28 | ||

| 29 | ||

| 29 | ||

| 30 | ||

| Western Reserve, the Separate Account, the Fixed Account and the Portfolios |

30 | |

| 30 | ||

| 30 | ||

| 31 | ||

| 39 | ||

| 40 | ||

| 40 | ||

| 40 | ||

| 41 | ||

| 41 | ||

| 44 | ||

| 45 | ||

| 46 | ||

| 47 | ||

| 47 | ||

| 48 | ||

| 48 | ||

| 48 | ||

| 49 | ||

| 49 | ||

| 50 | ||

| 50 | ||

| 51 | ||

| 51 | ||

| 51 | ||

| 52 | ||

| 53 | ||

| 54 | ||

| 54 | ||

| 55 | ||

| 55 | ||

| 55 | ||

| 55 | ||

| 56 | ||

| 56 | ||

| 57 | ||

| 57 |

i

Table of Contents

| 58 | ||

| 58 | ||

| 58 | ||

| 59 | ||

| 62 | ||

| 62 | ||

| 62 | ||

| 63 | ||

| 64 | ||

| 64 | ||

| 64 | ||

| 65 | ||

| 65 | ||

| 65 | ||

| 66 | ||

| 66 | ||

| 66 | ||

| 67 | ||

| 70 | ||

| 70 | ||

| 70 | ||

| 71 | ||

| 71 | ||

| 71 | ||

| 73 | ||

| 73 | ||

| 73 | ||

| 73 | ||

| 74 | ||

| 74 | ||

| 74 | ||

| 75 | ||

| 75 | ||

| 75 | ||

| 76 | ||

| 76 | ||

| 76 | ||

| 77 | ||

| 77 | ||

| 77 | ||

| 78 | ||

| 80 | ||

| 80 | ||

| 81 | ||

| 81 | ||

| 82 | ||

| 82 | ||

| 82 | ||

| 82 | ||

| 83 | ||

| Disability Waiver of Monthly Deductions Rider (For Focus and Exec Policies) |

83 | |

| Disability Waiver of Premium Rider (For Focus and Exec Policies) |

84 | |

| Primary Insured Rider Plus (“PIR”) (For Focus Policies Only) |

85 | |

| Living Benefit Rider (an Accelerated Death Benefit) (For Focus and Exec Policies) |

86 | |

| 86 | ||

| 88 | ||

| 88 | ||

| 90 | ||

| 90 | ||

| Table of Contents of the Statement of Additional Information |

90 |

ii

Table of Contents

| 91 | ||

| 96 | ||

| 110 | ||

| 119 | ||

| 121 | ||

| Appendix B — Monthly Per Unit Charges (Rate Per Thousand) |

123 | |

| 133 | ||

| 135 | ||

| 141 | ||

| 141 | ||

| 141 |

iii

Table of Contents

WRL Xcelerator FocusSM and Xcelerator ExecSM

Please refer to the section entitled “Policy Benefits/Risks Summary” beginning on page 24 of this prospectus for a description of the benefits and risks of the WRL Xcelerator Focus and WRL Xcelerator Exec Policies.

Fee Tables

The following tables describe the fees and expenses that you will pay when buying, owning and surrendering the Policy. Please Note: We have included two versions of each table, some of which are product specific. Section A includes the fee tables for Policies applied for on/or after October 30, 2008 (or subsequent state approval), regardless of issue date, based on the Commissioners 2001 Standard Ordinary Tobacco and Non-Tobacco Mortality Tables (“2001 C.S.O. Tables”); Section B includes the fee tables for Policies applied for before October 30, 2008 and issued before January 1, 2009, based on the Commissioners 1980 Standard Ordinary Mortality Tables (“1980 C.S.O. Tables”). If the amount of a charge depends on the personal characteristics of the insured or the owner, then the fee table lists the minimum and maximum charges we assess under the Policy, and the fees and charges of a representative insured with the characteristics set forth in the table. These charges may not be representative of the charges you will pay.

The first table describes the fees and expenses that you will pay when buying the Focus Policy, paying premiums, making cash withdrawals from the Policy, surrendering the Policy, or transferring Policy cash value among the subaccounts and the fixed account.

1

Table of Contents

Fee Tables for Policies Applied For On Or After October 30, 2008

(Based on the 2001 C.S.O. Tables)

2

Table of Contents

FOR POLICIES APPLIED FOR ON/OR AFTER OCTOBER 30, 2008

| Transaction Fees for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Premium Expense Charge | Upon payment of each premium | 3% of premium payments | 0% of premium payments in first year, 3% thereafter | |||

| Cash Withdrawal Charge2 | Upon withdrawal | 2.0% of the amount withdrawn, not to exceed $25 | 2.0% of the amount withdrawn, not to exceed $25 | |||

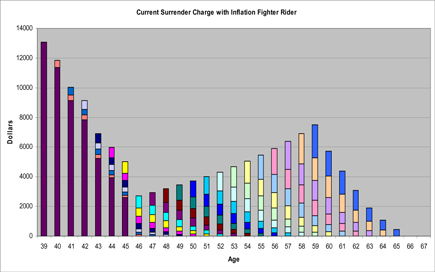

| Surrender Charge3 | Upon full surrender of the Policy during the first 8 Policy years or during the first 8 years from the date of any increase in the specified amount (whether requested or an increase generated by the Inflation Fighter Rider) | |||||

| Maximum Charge4 |

$40.93 per $1,000 of specified amount during the first Policy year | $40.93 per $1,000 of specified amount during the first Policy year | ||||

| Minimum Charge5 |

$7.63 per $1,000 of specified amount during the first Policy year | $7.63 per $1,000 of specified amount during the first Policy year | ||||

| Initial charge for a male insured, issue age 39, in the preferred-elite non-tobacco use class |

$16.35 per $1,000 of specified amount during the first Policy year | $16.35 per $1,000 of specified amount during the first Policy year | ||||

| Transfer Charge6 | Upon transfer | $25 for each transfer in excess of 12 per Policy year | $25 for each transfer in excess of 12 per Policy year | |||

| Decrease Charge | Deducted when specified amount is decreased during the first 8 Policy years or during the 8 Policy years following any increase in specified amount | Equal to the surrender charge (as of the date of the decrease) applicable to that portion of the layer of the specified amount that is decreased | Equal to the surrender charge (as of the date of the decrease) applicable to that portion of the layer of the specified amount that is decreased | |||

| Living Benefit Rider (an Accelerated Death Benefit)7 | When rider is exercised | Discount Factor | Discount Factor | |||

| 1 |

The Company reserves the right at any time to change the current charge, but never to a level that exceeds the guaranteed charge. |

| 2 |

When we incur the expense of expedited delivery of your partial withdrawal or complete surrender payment, we currently assess the following additional charges: $20 for overnight delivery ($30 for Saturday delivery); and $25 for wire service. You can obtain further information about these charges by contacting our administrative office. |

| 3 |

The surrender charge will vary based on the issue age, gender and underwriting class of the insured on the Policy date and at the time of any increase in the specified amount. Each increase in specified amount will have its own 8 year surrender charge period starting on the date of the increase and surrender charges that are based upon the insured’s age, gender and underwriting class at the time of the increase. (Note: only the increase in specified amount is subject to the additional 8 year surrender charge period). The surrender charge for each increase in specified amount (“layer”) is calculated as the surrender charge per $1,000 of specified amount in that layer multiplied by the number of thousands of dollars of specified amount in the layer, multiplied by the surrender charge factor. The surrender charge factor for the Policy and each layer will be 1.00 at issue and will decrease until it reaches zero at the end of the 8th Policy year after the Policy date (or date of any specified amount increase). The surrender charge shown in the table is rounded up. The charges shown in the table may not be representative of the charges you will pay. More detailed information about the surrender charges applicable to you is available from your registered representative. |

| 4 |

This maximum surrender charge is based on an insured with the following characteristics: male, issue age 85, in the standard tobacco use underwriting class. This maximum charge may also apply to insureds with other characteristics. |

| 5 |

This minimum surrender charge is based on an insured with the following characteristics: female, issue age 0, in the juvenile underwriting class. This minimum charge may also apply to insureds with other characteristics. |

| 6 |

The first 12 transfers per Policy year are free. |

| 7 |

We reduce the single sum benefit by a discount factor to compensate us for lost income due to the early payment of the death benefit. The discount rate is equal to the current yield on 90-day U.S. Treasury bills or the Policy loan rate, whichever is greater. Please see footnote 17 for a description of the loan rate. For a complete description of the Living Benefit Rider, please refer to the section entitled “Living Benefit Rider (an Accelerated Death Benefit)” in this prospectus. |

3

Table of Contents

FOR POLICIES APPLIED FOR ON/OR AFTER OCTOBER 30, 2008

The table below describes the fees and expenses that you will pay periodically during the time that you own the Focus Policy, not including portfolio fees and expenses.

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Monthly Policy Charge |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 100 | $10.00 per month during the first Policy year and, $12.00 thereafter through age 99, $0 starting with age 100 | $10.00 per month through age 99; $0 per month starting at age 100 | |||

| Cost of Insurance8 (without Extra Ratings)9 |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 100 | |||||

| Maximum Charge10 |

$30.40 per $1,000 of net amount at risk per month11 | $28.88 per $1,000 of net amount at risk per month11 | ||||

| Minimum Charge |

$0.02 per $1,000 of net amount at risk per month11,12 | $0.01 per $1,000 of net amount at risk per month11,13 | ||||

| Initial Charge for male insured, issue age 39, in the preferred elite non-tobacco use class, band 2 |

$0.12 per $1,000 of net amount at risk per month 11 | $0.01 per $1,000 of net amount at risk per month 11 | ||||

| 8 |

Cost of insurance charges are based on the insured’s issue age, gender, underwriting class, specified amount, Policy duration, Policy year, and the net amount at risk. Cost of insurance rates generally will increase each year with the age of the insured. Cost of insurance rates are generally lower for each higher band of specified amount. For example, band 3 (specified amounts $1,000,000.00 and higher) generally has lower cost of insurance rates than those of band 2 (specified amounts of $500,000- $999,999). The cost of insurance rates shown in the table may not be representative of the charges you will pay. Your Policy’s schedule page will indicate the guaranteed cost of insurance charges applicable to your Policy. You can obtain more detailed information concerning your cost of insurance charges by contacting your registered representative. |

| 9 |

We may place an insured in a sub-standard underwriting class with extra ratings that reflect higher mortality risks and that result in higher cost of insurance rates. If the insured possesses additional mortality risks, we may add a surcharge to the cost of insurance rates up to a total charge of $83.33 per $1,000 of net amount at risk. |

| 10 |

This maximum charge is based on an insured with the following characteristics: male, age 35 at issue, standard tobacco class, with an initial face amount of between $500,000 and $999,999 (Band 2) and in the 65th Policy year. This maximum charge may also apply to insureds with other characteristics. |

| 11 |

The net amount at risk equals the death benefit on a Monthiversary, minus the cash value on such Monthiversary. |

| 12 |

The minimum charge is based on an insured with the following characteristics: female, age 5 at issue, juvenile class, and in the first Policy year. This minimum may also apply to insureds with other characteristics. |

| 13 |

This minimum charge is based on an insured with the following characteristics: female, age 26 at issue, preferred elite non-tobacco class, with an initial face amount of $1,000,000 or higher (Band 3) and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

4

Table of Contents

FOR POLICIES APPLIED FOR ON/OR AFTER OCTOBER 30, 2008

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Monthly Per Unit Charge14 |

Monthly, for up to 20 years on and after the Policy date, and on any increase in specified amount (whether requested or generated by the Inflation Fighter Rider) | |||||

|

Maximum Charge15 |

$ 2.96 per $1,000 of specified amount per month |

$2.23 per $1,000 of specified amount per month | ||||

| Minimum Charge16 |

$0.15 per $1,000 of specified amount per month | $0.09 per $1,000 of specified amount per month | ||||

| Initial Charge for a male insured, issue age 39, band 2 |

$0.33 per $1,000 of specified amount per month | $0.22 per $1,000 of specified amount per month | ||||

| Mortality and Expense Risk Charge | Daily | Annual rate of 0.75% for Policy years 1 – 15, and 0.30% for Policy years 16+, of average daily net assets of each subaccount in which you are invested | Annual rate of 0.75% for Policy years 1 – 15, and 0.00% for Policy years 16+, of average daily net assets of each subaccount in which you are invested | |||

| Loan Interest Spread17 | On Policy anniversary or earlier, as applicable18 | 1.0% (effective annual rate) | 0.75% (effective annual rate) | |||

| 14 |

We deduct the monthly per unit charge on each Monthiversary as part of the monthly deductions for a maximum of 20 years from the Policy date based on the insured’s age and specified amount band on the Policy date. We also assess a new monthly per unit charge for 20 years following any increase in specified amount (including specified amount increases generated by the Inflation Fighter Rider) that are based on the insured’s attained age and specified amount band for the total specified amount on the date of the increase. Currently, we plan to deduct this charge for the first 8 Policy years and during the first 8 Policy years from the date of any increase in specified amount. We will notify you if we extend the period during which we will assess the monthly per unit charge. We also deduct this charge for any Primary Insured Rider Plus or Other Insured Rider attached to the Policy, at a lower rate than applies to the Policy. Note: If you make a transfer out of any of the limited number of designated subaccounts to which your premium must be allocated during the first Policy year (under a Focus Policy), or modify the allocation percentages during the first Policy year, then we may increase your monthly per unit charge and keep these higher charges in effect for the life of the Policy. The amount of such increase will depend upon each insured’s issue age, and the specified amount. |

| 15 |

This maximum charge is based on an insured with the following characteristics: male, age 85 at issue, with an initial specified amount between $500,000 and $999,999 (Band 2) and in the first Policy year. This maximum charge may also apply to insureds with other characteristics. |

| 16 |

This minimum charge is based on an insured with the following characteristics: female, age 5 at issue, juvenile class, with an initial specified amount of $1,000,000 or higher (Band 3) and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

| 17 |

The Loan Interest Spread is the difference between the amount of interest we charge you for a loan (currently, an effective annual rate of 2.75%, guaranteed not to exceed 3.0%) and the amount of interest we credit to your loan account (an effective annual rate of 2.0% guaranteed). After the 10th Policy year, we will charge preferred loan interest rates on a portion of the loan that are lower. After attained age 100 all loans will be considered preferred loans. The maximum loan interest spread on preferred loans is 0.25%, and the current spread is 0.0%. |

| 18 |

While a Policy loan is outstanding, loan interest is payable in arrears on each Policy anniversary, or, if earlier, on the date of loan repayment, Policy lapse, surrender, Policy termination, or the insured’s death. |

5

Table of Contents

FOR POLICIES APPLIED FOR ON/OR AFTER OCTOBER 30, 2008

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Optional Rider Charges:19 |

||||||

| Accidental Death Benefit Rider |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 70 | |||||

| Maximum Charge20 |

$0.18 per $1,000 of rider face amount per month | $0.18 per $1,000 of rider face amount per month | ||||

| Minimum Charge21 |

$0.10 per $1,000 of rider face amount per month | $0.10 per $1,000 of rider face amount per month | ||||

| Initial Charge for a male insured, issue age 3 9 |

$0.10 per $1,000 of rider face amount per month | $0.10 per $1,000 of rider face amount per month | ||||

| Disability Waiver of Monthly Deductions Rider22 | Monthly, on the Policy date and on each Monthiversary until the insured reaches age 60 | |||||

| Maximum Charge23 |

$0.39 per $1,000 of the Policy’s net amount at risk per month11 | $0.39 per $1,000 of the Policy’s net amount at risk per month11 | ||||

| Minimum Charge24 |

$0.03 per $1,000 of the Policy’s net amount at risk per month11 | $0.03 per $1,000 of the Policy’s net amount at risk per month11 | ||||

| Initial Charge for a male insured, issue age 39 |

$0.06 per $1,000 of base Policy net amount at risk per month11 | $0.06 per $1,000 of base Policy net amount at risk per month11 | ||||

| 19 |

Optional Rider Cost of insurance charges are based on each insured’s issue age, gender, underwriting class, Policy year and rider face amount. The cost of insurance rates shown in the table may not be representative of the charges you will pay. Your Policy’s schedule page will indicate the guaranteed cost of insurance charges applicable to your Policy. You can obtain more detailed information concerning your cost of insurance charges by contacting your registered representative. |

| 20 |

This maximum charge is based on an insured with the following characteristics: male, age 50 at issue and in the 20th Policy year. This maximum charge may also apply to insureds with other characteristics. |

| 21 |

This minimum charge is based on an insured with the following characteristics: male, age 45 at issue and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

| 22 |

Disability Waiver of Monthly Deductions Rider charges are based on the primary insured’s issue age, gender and net amount at risk. The charges shown are for the Focus Policy only (i.e., without riders and other benefits). The addition of riders and other benefits would increase these charges. This charge does not vary once it is added to the Policy. The cost of insurance rates shown in the table may not be representative of the charges you will pay. Your Policy’s schedule page will indicate the guaranteed cost of insurance charges applicable to your Policy. You can obtain more detailed information concerning your cost of insurance charges by contacting your registered representative. |

| 23 |

This maximum charge is based on an insured with the following characteristics: female, age 55 at issue. This maximum charge may also apply to insureds with other characteristics. |

| 24 |

This minimum charge is based on an insured with the following characteristics: male, age 25 at issue. This minimum charge may also apply to insureds with other characteristics. |

6

Table of Contents

FOR POLICIES APPLIED FOR ON/OR AFTER OCTOBER 30, 2008

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Disability Waiver of Premium Rider25 | Monthly, on the Policy date and on each Monthiversary until the insured reaches age 60 | |||||

| Maximum Charge26 |

$ 1.61 per $10 monthly rider benefit | $1.61 per $10 monthly rider benefit | ||||

| Minimum Charge27 |

$0.27 per $10 monthly rider benefit | $0.27 per $10 monthly rider benefit | ||||

| Initial Charge for a male insured, issue age 3 9 |

$0.58 per $10 monthly rider benefit | $0.58 per $10 monthly rider benefit | ||||

| Children’s Insurance Rider28 |

Monthly, on the Policy date and on each Monthiversary until the youngest child reaches age 25 | $0.60 per $1,000 of rider face amount per month | $0.60 per $1,000 of rider face amount per month | |||

| Other Insured Rider29 | Monthly, on the Policy date and on each Monthiversary until the insured reaches age 100 | |||||

| (without Extra Ratings)9 | ||||||

| Cost of Insurance: |

||||||

| Maximum Charge30 |

$30.40 per $1,000 of rider face amount per month | $29.80 per $1,000 of rider face amount per month | ||||

| Minimum Charge |

$0.02 per $1,000 of rider face amount per month31 | $0.01 per $1,000 of rider face amount per month32 | ||||

| Initial Charge for a female insured, issue age 35, preferred elite |

$0.08 per $1,000 of rider face amount per month | $0.01 per $1,000 of rider face amount per month | ||||

| 25 |

The charge for this rider is based on the primary insured’s issue age, gender and amount of monthly rider benefit. |

| 26 |

This maximum charge is based on an insured with the following characteristics: female, age 55 at issue. This maximum charge may also apply to insureds with other characteristics. |

| 27 |

This minimum charge is based on an insured with the following characteristics: male, age 15 at issue. This minimum charge may also apply to insureds with other characteristics. |

| 28 |

The charge for this rider is based on the rider face amount and does not vary. |

| 29 |

Rider cost of insurance charges and monthly per unit charges are based on each insured’s issue age, gender, underwriting class, Policy year, and the rider face amount. Cost of insurance rates and monthly per unit charges generally will increase each year with the age of the insured. The cost of insurance rates and monthly per unit charges shown in the table may not be representative of the charges you will pay. The rider will indicate the maximum guaranteed rider charges applicable to your Policy. You can obtain more information about these riders by contacting your registered representative. |

| 30 |

This maximum charge is based on an insured with the following characteristics: male, age 75 at issue standard tobacco underwriting class and in the 25th Policy year. This maximum charge may also apply to insureds with other characteristics. |

| 31 |

This minimum charge is based on an insured with the following characteristics: female, age 5 at issue, juvenile class and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

| 32 |

This minimum charge is based on an insured with the following characteristics: female, issue age 26, preferred elite non-tobacco class and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

7

Table of Contents

FOR POLICIES APPLIED FOR ON/OR AFTER OCTOBER 30, 2008

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Other Insured Rider (continued) |

||||||

| Monthly Per Unit Charge |

||||||

| Maximum Charge33 |

$0.57 per $1,000 of rider face amount34 | $0.57 per $1,000 of rider face amount35 | ||||

| Minimum Charge36 |

$0.03 per $1,000 of rider face amount34 | $0.03 per $1,000 of rider face amount35 | ||||

| Initial Charge for a female insured, issue age 35, preferred elite |

$0.05 per $1,000 of rider face amount34 | $0.05 per $1,000 of rider face amount35 | ||||

| Primary Insured Rider Plus29 (without Extra Ratings)9 |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 100 | |||||

|

Cost of Insurance |

||||||

| Maximum Charge30 |

$30.40 per $1,000 of rider face amount per month | $29.80 per $1,000 of rider face amount per month | ||||

| Minimum Charge |

$0.02 per $1,000 of rider face amount per month31 | $0.01 per $1,000 of rider face amount per month32 | ||||

| Initial charge for a male insured, issue age 39, in the preferred elite non-tobacco use class |

$0.12 per $1,000 of rider face amount per month | $0.01 per $1,000 of rider face amount per month | ||||

| 33 |

This maximum charge is based on an insured with the following characteristic: issue age 85. |

| 34 |

We deduct the monthly per unit charge on each Monthiversary and guarantee that the duration of the charge will be no more than 20 Policy years from the issue date of the rider and from the date of any increase of face amount for the rider. |

| 35 |

We currently deduct the monthly per unit charge on each Monthiversary during the first 8 Policy years from the issue date of the rider and from the date of any increase of face amount for the rider. |

| 36 |

This minimum charge is based on an insured with the following characteristics: issue age 0. This minimum charge may also apply to insureds with other characteristics. |

8

Table of Contents

FOR POLICIES APPLIED FOR ON/OR AFTER OCTOBER 30, 2008

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Primary Insured Rider Plus (continued) |

||||||

| Monthly Per Unit Charge |

||||||

| Maximum Charge33 |

$0.14 per $1,000 of rider face amount34 | $0.14 per $1,000 of rider face amount35 | ||||

| Minimum Charge36 |

$0.01 per $1,000 of rider face amount34 | $0.01 per $1,000 of rider face amount35 | ||||

| Initial Charge for a male insured, issue age 39 |

$0.02 per $1,000 of rider face amount34 | $0.02 per $1,000 of rider face amount35 | ||||

| Inflation Fighter Rider37 |

After rider generates annual increases to Policy specified amount | See listings in tables above for:

Cost of insurance Monthly per unit charge Surrender charge |

See listings in tables above for:

Cost of insurance Monthly per unit charge Surrender charge | |||

| 37 |

Scheduled annual increases in specified amount generated by this rider will create a new layer of cost of insurance charges, monthly per unit charges and surrender charges under the Policy. Each new layer of cost of insurance charge and monthly per unit charge resulting from the scheduled annual increase in specified amount will be set based on the insured’s issue age and duration from issue. |

The table below describes the fees and expenses that you will pay when buying the Exec Policy, paying premiums, or transferring Policy cash value among the subaccounts and the fixed account.

| Transaction Fees for the WRL XCELERATOR EXEC POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Premium Expense Charge |

Upon payment of each premium | 3% of premium payments | 0% of premium payments in first year, 3% thereafter | |||

| Transfer Charge2 |

Upon transfer | $25 for each transfer in excess of 12 per Policy year | $25 for each transfer in excess of 12 per Policy year | |||

| 1 |

The Company reserves the right at any time to change the current charge, but never to a level that exceeds the guaranteed charge. |

| 2 |

The first 12 transfers per Policy year are free. |

9

Table of Contents

FOR POLICIES APPLIED FOR ON/OR AFTER OCTOBER 30, 2008

| Transaction Fees for the WRL XCELERATOR EXEC POLICY | ||||||

| Charge (Cont.) |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Living Benefit Rider (an Accelerated Death Benefit)3 | When rider is exercised | Discount Factor | Discount Factor | |||

The table below describes the fees and expenses that you will pay periodically during the time you own the Exec Policy, not including portfolio fees and expenses.

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR EXEC POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Monthly Policy Charge | Monthly, on the Policy date and on each Monthiversary until the insured reaches age 100 | $10.00 per month during the first Policy year and, $12.00 thereafter through age 99, $0 starting with age 100 | $10.00 per month through age 99; $ 0 starting at age 100. | |||

| Cost of Insurance4 |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 100 | |||||

| (without Extra Ratings) 5 |

||||||

| Maximum Charge6 |

$29.19 per $1,000 of net amount at risk per month7 | $29.19 per $1,000 of net amount at risk per month7 | ||||

| Minimum Charge |

$0.04 per $1,000 of net amount at risk per month7,8 | $0.01 per $1,000 of net amount at risk per month7,9 | ||||

| 3 |

We reduce the single sum benefit by a discount factor to compensate us for lost income due to the early payment of the death benefit. The discount rate is equal to the current yield on 90-day U.S. Treasury bills or the Policy loan rate, whichever is greater. Please see footnote 13 for a description of the loan rate. For a complete description of the Living Benefit Rider, please refer to the section entitled “Living Benefit Rider (an Accelerated Death Benefit)” in this prospectus. |

| 4 |

Cost of insurance charges are based on the insured’s issue age, gender, underwriting class, specified amount, Policy year, and the net amount at risk. Cost of insurance rates generally will increase each year with the age of the insured. Cost of insurance rates are generally lower for each higher band of specified amount. For example, band 3 (specified amounts of $500,000--$999,999) generally has lower cost of insurance rates than those of band 2 (specified amounts of $250,000--$499,999). For Exec Policies, the current cost of insurance rates for the first Policy year are fixed at issue and we guarantee not to change them. The cost of insurance rates shown in the table may not be representative of the charges you will pay. Your Policy’s schedule page will indicate the guaranteed cost of insurance charges applicable to your Policy. You can obtain more detailed information concerning your cost of insurance charges by contacting your registered representative. |

| 5 |

We may place an insured in a sub-standard underwriting class with extra ratings that reflect higher mortality risks and that result in higher cost of insurance rates. If the insured possesses additional mortality risks, we may add a surcharge to the cost of insurance rates up to a total charge of $83.33 monthly per $1,000 of net amount at risk. |

| 6 |

This maximum charge is based on an insured with the following characteristics: male, age 25 at issue, standard tobacco class, and in the 75th Policy year. This maximum charge may also apply to insureds with other characteristics. |

| 7 |

The net amount at risk equals the death benefit on a Monthiversary, minus the cash value on such Monthiversary. |

| 8 |

This minimum charge is based on an insured with the following characteristics: female, age 18 at issue, and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

| 9 |

This minimum charge is based on an insured with the following characteristics: female, age 27 at issue, select non-tobacco class, and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

10

Table of Contents

FOR POLICIES APPLIED FOR ON/OR AFTER OCTOBER 30, 2008

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR EXEC POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Cost of Insurance (without Extra Ratings) continued |

||||||

|

Initial Charge for a male insured, issue age 46, in the standard non-tobacco use class |

$0.25 per $1,000 of net amount at risk per month7 | $0.04 per $1,000 of net amount at risk per month7 | ||||

| Monthly Per Unit Charge10 |

Monthly, on and after the Policy date, and on any increase in specified amount until the insured reaches age 100 | |||||

| Maximum Charge11 |

$6.34 per $1,000 of specified amount per month | $6.34 per $1,000 of specified amount per month | ||||

| Minimum Charge12 |

$0.10 per $1,000 of specified amount per month | $0.10 per $1,000 of specified amount per month | ||||

| Initial Charge for a male insured, issue age 46, in the standard non-tobacco class, band 2 |

$0.24 per $1,000 of specified amount per month | $0.24 per $1,000 of specified amount per month | ||||

| Mortality and Expense Risk Charge | Daily | Annual rate of 0.75% for Policy years 1 – 15, and 0.30% for Policy years 16+, of daily net assets of each subaccount in which you are invested | Annual rate of 0.75% for Policy years 1 – 15, and 0.00% for Policy years 16+, of daily net assets of each subaccount in which you are invested | |||

| Loan Interest Spread13 | On Policy anniversary or earlier, as applicable14 | 1.0% (effective annual rate) | 0.75% (effective annual rate) | |||

| 10 |

Currently, we plan to deduct this charge for the first 8 Policy years and during the first 8 Policy years from the date of any increase in specified amount. We will notify you if we extend the period during which we will assess the monthly per unit charge. We guarantee this charge will not be assessed beyond the Policy anniversary when the insured attains age 100. We deduct the monthly per unit charge on each Monthiversary as part of the monthly deductions from the Policy date based on the insured’s age and specified amount band on the Policy date. We also assess a new monthly per unit charge for 8 years following any increase in specified amount that are based on the insured’s attained age and specified amount band for a total specified amount on the date of the increase. |

| 11 |

This maximum charge is based on an insured with the following characteristics: male, age 80 at issue, with an initial specified amount less than $250,000 (Band 1) and in the second Policy year. This maximum charge may also apply to insureds with other characteristics. |

| 12 |

This minimum charge is based on an insured with the following characteristics: male, age 18 at issue, standard non-tobacco class, with an initial specified amount of $1,000,000 or higher (Band 4) and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

| 13 |

The Loan Interest Spread is the difference between the amount of interest we charge you for a loan (currently, an effective annual rate of 2.75%, guaranteed not to exceed 3.0%) and the amount of interest we credit to your loan account (an effective annual rate of 2.0% guaranteed). After the 10th Policy year, we will charge preferred loan interest rates that are lower on a portion of the loan. After attained age 100 all loans will be considered preferred loans. The maximum loan interest spread on preferred loans is 0.25%, and the current spread is 0.0%. |

| 14 |

While a Policy loan is outstanding, loan interest is payable in arrears on each Policy anniversary, or, if earlier, on the date of loan repayment, Policy lapse, surrender, Policy termination, or the insured’s death. |

11

Table of Contents

FOR POLICIES APPLIED FOR ON OR AFTER OCTOBER 30, 2008

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR EXEC POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Optional Rider Charges:15 |

||||||

| Disability Waiver of Monthly Deductions Rider16 |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 60 | |||||

| Maximum Charge17 |

$0.39 per $1,000 of the Policy’s net amount at risk per month7 | $0.39 per $1,000 of the Policy’s net amount at risk per month7 | ||||

| Minimum Charge18 |

$0.03 per $1,000 of the Policy’s net amount at risk per month7 | $0.03 per $1,000 of the Policy’s net amount at risk per month7 | ||||

| Initial Charge for a male insured, issue age 46 |

$0.09 per $1,000 of base Policy net amount at risk per month7 | $0.09 per $1,000 of base Policy net amount at risk per month7 | ||||

| Disability Waiver of Premium Rider19 |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 60 | |||||

| Maximum Charge20 |

$1.61 per $10 monthly rider benefit | $1.61 per $10 monthly rider benefit | ||||

| Minimum Charge21 |

$0.28 per $10 monthly rider benefit | $0.28 per $10 monthly rider benefit | ||||

| Initial Charge for a male insured, issue age 46 |

$0.89 per $10 monthly rider benefit | $0.89 per $10 monthly rider benefit | ||||

| 15 |

Optional Rider Cost of insurance charges are based on each insured’s issue age, gender, underwriting class, Policy year and rider face amount. The cost of insurance rates shown in the table may not be representative of the charges you will pay. Your Policy’s schedule page will indicate the guaranteed cost of insurance charges applicable to your Policy. You can obtain more detailed information concerning your cost of insurance charges by contacting your registered representative. |

| 16 |

Disability Waiver of Monthly Deductions Rider charges are based on the primary insured’s issue age, gender and net amount at risk. The charges shown are for the Exec Policy only (i.e., without riders and other benefits). The addition of riders and other benefits would increase these charges. This charge does not vary once it is added to the Exec Policy. The cost of insurance rates shown in the table may not be representative of the charges you will pay. Your Policy’s schedule page will indicate the guaranteed cost of insurance charges applicable to your Policy. You can obtain more detailed information concerning your cost of insurance charges by contacting your registered representative. This rider is only available on fully underwritten policies. |

| 17 |

This maximum charge is based on an insured with the following characteristics: female, age 55 at issue. This maximum charge may also apply to insureds with other characteristics. |

| 18 |

This minimum charge is based on an insured with the following characteristics: male, age 25 at issue. This minimum charge may also apply to insureds with other characteristics. |

| 19 |

The charge for this rider is based on the primary insured’s issue age, gender and amount of monthly rider benefit. This rider is only available on fully underwritten policies |

| 20 |

This maximum charge is based on an insured with the following characteristics: female, age 55 at issue. This maximum charge may also apply to insureds with other characteristics. |

| 21 |

This minimum charge is based on an insured with the following characteristics: male, age 18 at issue. The minimum charge may also apply to insureds with other characteristics. |

12

Table of Contents

Fee Tables for Policies Applied for Before October 30, 2008 and Issued

Before January 1, 2009

(Based on the 1980 C.S.O. Tables)

13

Table of Contents

FOR POLICIES APPLIED FOR BEFORE OCTOBER 30, 2008 AND ISSUED BEFORE JANUARY 1, 2009

| Transaction Fees for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Premium Expense Charge: |

Upon payment of each premium | 3% of premium payments | 0% of premium payments in first year, 3% thereafter | |||

| Cash Withdrawal Charge2 |

Upon withdrawal | 2.0% of the amount withdrawn, not to exceed $25 | 2.0% of the amount withdrawn, not to exceed $25 | |||

| Surrender Charge3

|

Upon full surrender of the Policy during the first 8 Policy years or during the first 8 years from the date of any increase in the specified amount (whether requested or an increase generated by the Inflation Fighter Rider) | |||||

| Maximum Charge4 |

$74.10 per $1,000 of specified amount during the first Policy year | $74.10 per $1,000 of specified amount during the first Policy year | ||||

| Minimum Charge5 |

$13.82 per $1,000 of specified amount during the first Policy year |

$13.82 per $1,000 of specified amount during the first Policy year | ||||

| Initial charge for a male insured, issue age 35, in the preferred-elite non-tobacco use class |

$25.61 per $1,000 of specified amount during the first Policy year |

$25.61 per $1,000 of specified amount during the first Policy year | ||||

| Transfer Charge6 |

Upon transfer | $25 for each transfer in excess of 12 per Policy year | $25 for each transfer in excess of 12 per Policy year | |||

| Decrease Charge |

Deducted when specified amount is decreased during the first 8 Policy years or during the 8 Policy years following any increase in specified amount | Equal to the surrender charge (as of the date of the decrease) applicable to that portion of the layer of the specified amount that is decreased | Equal to the surrender charge (as of the date of the decrease) applicable to that portion of the layer of the specified amount that is decreased | |||

| Living Benefit Rider (an Accelerated Death Benefit)7 | When rider is exercised | Discount Factor | Discount Factor | |||

| 1 |

The Company reserves the right at any time to change the current charge, but never to a level that exceeds the guaranteed charge. |

| 2 |

When we incur the expense of expedited delivery of your partial withdrawal or complete surrender payment, we currently assess the following additional charges: $20 for overnight delivery ($30 for Saturday delivery); and $25 for wire service. You can obtain further information about these charges by contacting our administrative office. |

| 3 |

The surrender charge will vary based on the issue age, gender and underwriting class of the insured on the Policy date and at the time of any increase in the specified amount. Each increase in specified amount will have its own 8 year surrender charge period starting on the date of the increase and surrender charges that are based upon the insured’s age, gender and underwriting class at the time of the increase. (Note: only the increase in specified amount is subject to the additional 8 year surrender charge period). The surrender charge for each increase in specified amount (“layer”) is calculated as the surrender charge per $1,000 of specified amount in that layer multiplied by the number of thousands of dollars of specified amount in the layer, multiplied by the surrender charge factor. The surrender charge factor for the Policy and each layer will be 1.00 at issue and will decrease until it reaches zero at the end of the 8th Policy year after the Policy date (or date of any specified amount increase). The surrender charge shown in the table is rounded up. The charges shown in the table may not be representative of the charges you will pay. More detailed information about the surrender charges applicable to you is available from your registered representative. |

| 4 |

This maximum surrender charge is based on an insured with the following characteristics: male, issue age 85, in the standard tobacco use underwriting class. This maximum charge may also apply to insureds with other characteristics. |

| 5 |

This minimum surrender charge is based on an insured with the following characteristics: female, issue age 4, in the juvenile underwriting class. This minimum charge may also apply to insureds with other characteristics. |

| 6 |

The first 12 transfers per Policy year are free. |

| 7 |

We reduce the single sum benefit by a discount factor to compensate us for lost income due to the early payment of the death benefit. The discount rate is equal to the current yield on 90-day U.S. Treasury bills or the Policy loan rate, whichever is greater. Please see footnote 17 for a description of the loan rate. For a complete description of the Living Benefit Rider, please refer to the section entitled “Living Benefit Rider (an Accelerated Death Benefit)” in this prospectus. |

14

Table of Contents

FOR POLICIES APPLIED FOR BEFORE OCTOBER 30, 2008 AND ISSUED BEFORE JANUARY 1, 2009

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Monthly Policy Charge |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 100 | $8.00 per month during the first Policy year; thereafter, $15.00 per month up to age 99; and $0 per month starting at age 100. | $8.00 per month up to age 99; and $0 starting at age 100. | |||

| Cost of Insurance8 (without Extra Ratings)9 |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 100 | |||||

| Maximum Charge10 |

$83.33 per $1,000 of net amount at risk per month11 | $45.35 per $1,000 of net amount at risk per month11 | ||||

| Minimum Charge |

$0.06 per $1,000 of net amount at risk per month11, 12 | $0.01 per $1,000 of net amount at risk per month11, 13 | ||||

| Initial Charge for male insured, issue age 39, in the preferred elite non-tobacco use class, band 2 |

$0.18 per $1,000 of net amount at risk per month11 | $0.02 per $1,000 of net amount at risk per month11 | ||||

| * |

Cost of insurance charges are based on the insured’s issue age, gender, underwriting class, specified amount, Policy duration, Policy year, and the net amount at risk. Cost of insurance rates generally will increase each year with the age of the insured. Cost of insurance rates are generally lower for each higher band of specified amount. For example, band 3 (specified amount of $1,000,000 or more) generally has lower cost of insurance rates than those of band 2 (specified amounts of $500,000—$999,999). The cost of insurance rates shown in the table may not be representative of the charges that you will pay. Your Policy’s schedule page will indicate the guaranteed cost of insurance charges applicable to your Policy. You can obtain more detailed information concerning your cost of insurance charges by contacting your registered representative. |

| 9 |

We may place an insured in a sub-standard underwriting class with extra ratings that reflect higher mortality risks and that result in higher cost of insurance rates. If the insured possesses additional mortality risks, we may add a surcharge to the cost of insurance rates up to a total charge of $83.33 monthly per $1,000 of net amount at risk. |

| 10 |

This maximum charge is based on an insured with the following characteristics: male, age 25 at issue, standard tobacco class, with an initial face amount of $500,000—$999,999 (Band 2) and in the 75th Policy year. This maximum charge may also apply to insureds with other characteristics. |

| 11 |

The net amount at risk equals the death benefit on a Monthiversary, minus the cash value on such Monthiversary. |

| 12 |

The minimum charge is based on an insured with the following characteristics: female, age 10 at issue, juvenile class, and in the first Policy year. This minimum may also apply to insureds with other characteristics. |

| 13 |

This minimum charge is based on an insured with the following characteristics: female, age 26 at issue, preferred elite non-tobacco class, with an initial face amount of $1,000,000 or higher (Band 3) and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

15

Table of Contents

FOR POLICIES APPLIED FOR BEFORE OCTOBER 30, 2008 AND ISSUED BEFORE JANUARY 1, 2009

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Monthly Per Unit Charge14 |

Monthly, for up to 20 years on and after the Policy date, and on any increase in specified amount (whether requested or generated by the Inflation Fighter Rider) | |||||

|

Maximum Charge15 |

$2.29 per $1,000 of specified amount per month |

$1.83 per $1,000 of specified amount per month | ||||

|

Minimum Charge16 |

$0.12 per $1,000 of specified amount per month |

$0.08 per $1,000 of specified amount per month | ||||

|

Initial Charge for an insured, issue age 39, band 2 |

$0.28 per $1,000 of specified amount per month |

$0.17 per $1,000 of specified amount per month | ||||

|

Mortality and Expense Risk Charge |

Daily |

Annual rate of 0.75% for Policy years 1 – 15, and 0.30% for Policy years 16+, of average daily net assets of each subaccount in which you are invested |

Annual rate of 0.75% for Policy years 1 – 15, and 0.00% for Policy years 16+, of average daily net assets of each subaccount in which you are invested | |||

|

Loan Interest Spread17 |

On Policy anniversary or earlier, as applicable18 |

1.0% (effective annual rate) |

0.75% (effective annual rate) | |||

| 14 |

We deduct the monthly per unit charge on each Monthiversary as part of the monthly deductions for a maximum of 20 years from the Policy date based on the insured’s age and specified amount band on the Policy date. We also assess a new monthly per unit charge for 20 years following any increase in specified amount (including specified amount increases generated by the Inflation Fighter Rider) that are based on the insured’s attained age and specified amount band for the total specified amount on the date of the increase. Currently, we plan to deduct this charge for the first 8 Policy years and during the first 8 Policy years from the date of any increase in specified amount. We will notify you if we extend the period during which we will assess the monthly per unit charge. We also deduct this charge for any Primary Insured Rider Plus or Other Insured Rider attached to the Policy, at a lower rate than applies to the Policy. Note: If you make a transfer out of any of the limited number of designated subaccounts to which your premium must be allocated during the first Policy year (under a Focus Policy), or modify the allocation percentages during the first Policy year, then we may increase your monthly per unit charge and keep these higher charges in effect for the life of the Policy. The amount of such increase will depend upon each insured’s issue age, and the specified amount. |

| 15 |

This maximum charge is based on an insured with the following characteristics: male, age 85 at issue, with an initial specified amount of $500,000—$999,999 (Band 2). This maximum charge may also apply to insureds with other characteristics. |

| 16 |

This minimum charge is based on an insured with the following characteristics: female, age 5 at issue, juvenile class, with an initial specified amount of $1,000,000 or higher (Band 3) . This minimum charge may also apply to insureds with other characteristics. |

| 17 |

The Loan Interest Spread is the difference between the amount of interest we charge you for a loan (currently, an effective annual rate of 2.75%, guaranteed not to exceed 3.0%) and the amount of interest we credit to your loan account (an effective annual rate of 2.0% guaranteed). After the 10th Policy year, we will charge preferred loan interest rates on a portion of the loan that are lower. After attained age 100 all loans will be considered preferred loans. The maximum loan interest spread on preferred loans is 0.25%, and the current spread is 0.0%. |

| 18 |

While a Policy loan is outstanding, loan interest is payable in arrears on each Policy anniversary, or, if earlier, on the date of loan repayment, Policy lapse, surrender, Policy termination, or the insured’s death. |

16

Table of Contents

FOR POLICIES APPLIED FOR BEFORE OCTOBER 30, 2008 AND ISSUED BEFORE JANUARY 1, 2009

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Optional Rider Charges:19 |

||||||

|

Accidental Death Benefit Rider |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 70 |

|||||

|

Maximum Charge20 |

$0.18 per $1,000 of rider face amount per month |

$0.18 per $1,000 of rider face amount per month | ||||

|

Minimum Charge21 |

$0.10 per $1,000 of rider face amount per month |

$0.10 per $1,000 of rider face amount per month | ||||

|

Initial Charge for a male insured, issue age 39 |

$0.10 per $1,000 of rider face amount per month |

$0.10 per $1,000 of rider face amount per month | ||||

|

Disability Waiver of Monthly Deductions Rider22 |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 60 |

|||||

|

Maximum Charge23 |

$0.39 per $1,000 of the Policy’s net amount at risk per month |

$0.39 per $1,000 of the Policy’s net amount at risk per month | ||||

|

Minimum Charge24 |

$0.03 per $1,000 of the Policy’s net amount at risk per month |

$0.03 per $1,000 of the Policy’s net amount at risk per month | ||||

|

Initial Charge for a male insured, issue age 39 |

$0.06 per $1,000 of base Policy net amount at risk per month |

$0.06 per $1,000 of base Policy net amount at risk per month1 | ||||

| 19 |

Optional Rider Cost of insurance charges are based on each insured’s issue age, gender, underwriting class, Policy year and rider face amount. The cost of insurance rates shown in the table may not be representative of the charges you will pay. Your Policy’s schedule page will indicate the guaranteed cost of insurance charges applicable to your Policy. You can obtain more detailed information concerning your cost of insurance charges by contacting your registered representative. |

| 20 |

This maximum charge is based on an insured with the following characteristics: male, age 50 at issue and in the 20th Policy year. This maximum charge may also apply to insureds with other characteristics. |

| 21 |

This minimum charge is based on an insured with the following characteristics: male, age 45 at issue and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

| 22 |

Disability Waiver of Monthly Deductions Rider charges are based on the primary insured’s issue age, gender and net amount at risk. The charges shown are for the Focus Policy only (i.e., without riders and other benefits). The addition of other riders and benefits would increase these charges. This charge does not vary once it is added to the Policy. The cost of insurance rates shown in the table may not be representative of the charges you will pay. Your Policy’s schedule page will indicate the guaranteed cost of insurance charges applicable to your Policy. You can obtain more detailed information concerning your cost of insurance charges by contacting your registered representative. |

| 23 |

This maximum charge is based on an insured with the following characteristics: female, age 55 at issue. This maximum charge may also apply to insureds with other characteristics. |

| 24 |

This minimum charge is based on an insured with the following characteristics: male, age 25 at issue. This minimum charge may also apply to insureds with other characteristics. |

17

Table of Contents

FOR POLICIES APPLIED FOR BEFORE OCTOBER 30, 2008 AND ISSUED BEFORE JANUARY 1, 2009

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Disability Waiver of Premium Rider25 |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 60 | |||||

|

Maximum Charge26 |

$1.61 per $10 monthly rider benefit |

$1.61 per $10 monthly rider benefit | ||||

|

Minimum Charge27 |

$0.27 per $10 monthly rider benefit |

$0.27 per $10 monthly rider benefit | ||||

|

Initial Charge for a male insured, issue age 39 |

$0.58 per $10 monthly rider benefit |

$0.58 per $10 monthly rider benefit | ||||

|

Children’s Insurance Rider28 |

Monthly, on the Policy date and on each Monthiversary until the youngest child reaches age 25 |

$0.60 per $1,000 of rider face amount per month |

$0.60 per $1,000 of rider face amount per month | |||

|

Other Insured Rider29

(without Extra Ratings)9 |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 100 |

|||||

|

Cost of Insurance |

||||||

|

Maximum Charge30 |

$83.33 per $1,000 of rider face amount per month |

$42.68 per $1,000 of rider face amount per month | ||||

|

Minimum Charge |

$0.06 per $1,000 of rider face amount per month31 |

$0.01 per $1,000 of rider face amount per month32 | ||||

|

Initial Charge for a female insured, issue age 35, in the preferred elite non-tobacco user class |

$0.13 per $1,000 of rider face amount per month |

$0.01 per $1,000 of rider face amount per month | ||||

| 25 |

The charge for this rider is based on the primary insured’s issue age, gender and amount of monthly rider benefit. |

| 26 |

This maximum charge is based on an insured with the following characteristics: female, age 55 at issue. This maximum charge may also apply to insureds with other characteristics. |

| 27 |

This minimum charge is based on an insured with the following characteristics: male, age 15 at issue. This minimum charge may also apply to insureds with other characteristics. |

| 28 |

The charge for this rider is based on the rider face amount and does not vary. |

| 29 |

Rider cost of insurance charges and monthly per unit charges are based on each insured’s issue age, gender, underwriting class, Policy year, and the rider face amount. Cost of insurance rates and monthly per unit charges generally will increase each year with the age of the insured. The cost of insurance rates and monthly per unit charges shown in the table may not be representative of the charges you will pay. The rider will indicate the maximum guaranteed rider charges applicable to your Policy. You can obtain more information about these riders by contacting your registered representative. |

| 30 |

This maximum charge is based on an insured with the following characteristics: male, age 25 at issue standard tobacco underwriting class and in the 75th Policy year. This maximum charge may also apply to insureds with other characteristics. |

| 31 |

This minimum charge is based on an insured with the following characteristics: female, age 10 at issue, juvenile class and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

| 32 |

This minimum charge is based on an insured with the following characteristics: female, issue age 26, preferred elite non-tobacco class and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

18

Table of Contents

FOR POLICIES APPLIED FOR BEFORE OCTOBER 30, 2008 AND ISSUED BEFORE JANUARY 1, 2009

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Other Insured Rider (continued) |

||||||

|

Monthly Per Unit Charge |

||||||

|

Maximum Charge33 |

$0.57 per $1,000 of rider face amount34 |

$0.57 per $1,000 of rider face amount35 | ||||

|

Minimum Charge36 |

$0.03 per $1,000 of rider face amount34 |

$0.03 per $1,000 of rider face amount35 | ||||

|

Initial Charge for a female insured, issue age 35 |

$0.05 per $1,000 of rider face amount34 |

$0.05 per $1,000 of rider face amount35 | ||||

|

Primary Insured Rider Plus29 (without Extra Ratings) 9 |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 100 | |||||

|

Cost of Insurance |

||||||

|

Maximum Charge30 |

$83.33 per $1,000 of rider face amount per month |

$42.68 per $1,000 of rider face amount per month | ||||

|

Minimum Charge |

$0.06 per $1,000 of rider face amount per month31 |

$0.01 per $1,000 of rider face amount per month32 | ||||

|

Initial charge for a male insured, issue age 39, in the preferred elite non-tobacco use class |

$0.14 per $1,000 of rider face amount per month |

$0.02 per $1,000 of rider face amount per month | ||||

| 33 |

This maximum charge is based on an insured with the following characteristic: issue age 85. |

| 34 |

We deduct the monthly per unit charge on each Monthiversary and guarantee that the duration of the charge will be no more than 20 Policy years from the issue date of the rider and from the date of any increase of face amount for the rider. |

| 35 |

We currently deduct the monthly per unit charge on each Monthiversary during the first 8 Policy years from the issue date of the rider and from the date of any increase of face amount for the rider. |

| 36 |

This minimum charge is based on an insured with the following characteristics: issue age 0. This minimum charge may also apply to insureds with other characteristics. |

19

Table of Contents

FOR POLICIES APPLIED FOR BEFORE OCTOBER 30, 2008 AND ISSUED BEFORE JANUARY 1, 2009

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR FOCUS POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Primary Insured Rider Plus (continued) |

||||||

|

Monthly Per Unit Charge |

||||||

|

Maximum Charge33 |

$0.14 per $1,000 of rider face amount34 |

$0.14 per $1,000 of rider face amount35 | ||||

|

Minimum Charge36 |

$0.01 per $1,000 of rider face amount34 |

$0.01 per $1,000 of rider face amount35 | ||||

|

Initial Charge for a male insured, issue age 39 |

$0.02 per $1,000 of rider face amount34 |

$0.02 per $1,000 of rider face amount35 | ||||

|

Inflation Fighter Rider37 |

After rider generates annual increases to Policy specified amount |

See listings in tables above for: |

See listings in tables above for: | |||

| Cost of insurance | Cost of insurance | |||||

|

Monthly per unit charge |

Monthly per unit charge | |||||

|

Surrender charge |

Surrender charge | |||||

| 37 |

Scheduled annual increases in specified amount generated by this rider will create a new layer of cost of insurance charges, monthly per unit charges and surrender charges under the Policy. Each new layer of cost of insurance charge and monthly per unit charge resulting from the scheduled annual increase in specified amount will be set based on the insured’s issue age and duration from issue. |

The table below describes the fees and expenses that you will pay when buying an Exec Policy, paying premiums or transfer Policy cash value among the subaccounts or the fixed account:

| Transaction Fees for the WRL XCELERATOR EXEC POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Premium Expense Charge | Upon payment of each premium | 3% of premium payments | 0% of premium payments in first year, 3% thereafter | |||

| Transfer Charge2 | Upon transfer | $25 for each transfer in excess of 12 per Policy year | $25 for each transfer in excess of 12 per Policy year | |||

| Living Benefit Rider (an Accelerated Death Benefit)3 | When rider is exercised | Discount Factor | Discount Factor | |||

The Company reserves the right at any time to change the current charge but never to exceed the guaranteed charge.

| 2 |

The first 12 transfers per Policy year are free. |

| 3 |

We reduce the single sum benefit by a discount factor to compensate us for lost income due to the early payment of the death benefit. The discount rate is equal to the current yield on 90-Day U.S. Treasury bills or the Policy loan rate, whichever is greater. Please see footnote 13 for a description of the loan rate. For a complete description of the Living Benefit Rider, please refer to the section entitled “Living Benefit Rider (an Accelerated Death Benefit)” in this prospectus. |

20

Table of Contents

FOR POLICIES APPLIED FOR BEFORE OCTOBER 30, 2008 AND ISSUED BEFORE JANUARY 1, 2009

The table below describes the fees and expenses that you will pay periodically during the time you own the Exec Policy, not including portfolio fees and expenses.

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR EXEC POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Monthly Policy Charge |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 100 | $8.00 per month during the first Policy year; thereafter, $15.00 per month up to age 99; and $0 per month starting at age 100. | $8.00 per month up to age 99; and $0 starting at age 100. | |||

|

Cost of Insurance4

(without Extra Ratings) 5 |

Monthly, on the Policy date and on each Monthiversary until the insured reaches age 100 |

|||||

|

Maximum Charge6 |

$83.33 per $1,000 of net amount at risk per month7 |

$42.05 per $1,000 of net amount at risk per month7 | ||||

|

Minimum Charge |

$0.08 per $1,000 of net amount at risk per month7,8 |

$0.01 per $1,000 of net amount at risk per month7,9 | ||||

| 4 |

Cost of insurance charges are based on the insured’s issue age, gender, underwriting class, specified amount, Policy year, and the net amount at risk. Cost of insurance rates generally will increase each year with the age of the insured. Cost of insurance rates are generally lower for each higher band of specified amount. For example, band 3 (specified amounts of $500,000–$999,999) generally has lower cost of insurance rates than those of band 2 (specified amounts of $250,000–$499,999). The cost of insurance rates shown in the table may not be representative of the charges you will pay. Your Policy’s schedule page will indicate the guaranteed cost of insurance charges applicable to your Policy. You can obtain more detailed information concerning your cost of insurance charges by contacting your registered representative. |

| 5 |

We may place an insured in a sub-standard underwriting class with extra ratings that reflect higher mortality risks and that result in higher cost of insurance rates. If the insured possesses additional mortality risks, we may add a surcharge to the cost of insurance rates up to a total charge of $83.33 monthly per $1,000 of net amount at risk. |

| 6 |

This maximum charge is based on an insured with the following characteristics: male, age 25 at issue, expedited simplified issue tobacco class, and in the 75th Policy year. This maximum charge may also apply to insureds with other characteristics. |

| 7 |

The net amount at risk equals the death benefit on a Monthiversary, minus the cash value on such Monthiversary. |

| 8 |

This minimum charge is based on an insured with the following characteristics: female, age 18 at issue, and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

| 9 |

This minimum charge is based on an insured with the following characteristics: female, age 27 at issue, select non-tobacco class, and in the first Policy year. This minimum charge may also apply to insureds with other characteristics. |

21

Table of Contents

FOR POLICIES APPLIED FOR BEFORE OCTOBER 30, 2008 AND ISSUED BEFORE JANUARY 1, 2009

| Periodic Charges Other Than Portfolio Operating Expenses for the WRL XCELERATOR EXEC POLICY | ||||||

| Charge |

When Charge is Deducted |

Amount Deducted | ||||

| Guaranteed Charge |

Current Charge1 | |||||

| Cost of Insurance (without Extra Ratings) continued |

||||||

| Initial Charge for a male insured, issue age 46, in the standard non-tobacco use class |

$0.43 per $1,000 of net amount at risk per month7 | $0.04 per $1,000 of net amount at risk per month7 | ||||

| Monthly Per Unit Charge10 | Monthly, on and after the Policy date, and on any increase in specified amount until the insured reaches age 100 | |||||

| Maximum Charge11 |

$6.34 per $1,000 of specified amount per month | $6.34 per $1,000 of specified amount per month | ||||

| Minimum Charge12 |

$0.10 per $1,000 of specified amount per month | $0.10 per $1,000 of specified amount per month | ||||

| Initial Charge for a male insured, issue age 46 in the standard non-tobacco class, band 2 |

$0.24 per $1,000 of specified amount per month | $0.24 per $1,000 of specified amount per month | ||||

| Mortality and Expense Risk Charge | Daily | Annual rate of 0.75% for Policy years 1 – 15, and 0.30% for Policy years 16+, of daily net assets of each subaccount in which you are invested | Annual rate of 0.75% for Policy years 1 – 15, and 0.00% for Policy years 16+, of daily net assets of each subaccount in which you are invested | |||