paceth_8k-ex1001.htm

EXHIBIT 10.1

SECOND AMENDED AND RESTATED

ASSET MANAGEMENT AGREEMENT

by and between

PACIFIC ETHANOL, INC.,

and

PACIFIC ETHANOL HOLDING CO. LLC,

PACIFIC ETHANOL MADERA LLC,

PACIFIC ETHANOL COLUMBIA, LLC,

PACIFIC ETHANOL STOCKTON, LLC and

PACIFIC ETHANOL MAGIC VALLEY, LLC

Dated as of June 30, 2011

TABLE OF CONTENTS

|

Article I

|

|

DEFINITIONS

|

1

|

|

1.1

|

|

Definitions

|

1

|

|

1.2

|

|

Interpretation

|

8

|

|

Article II

|

|

APPOINTMENT

|

9

|

|

Article III

|

|

RESPONSIBILITIES OF MANAGER

|

9

|

|

3.1

|

|

Scope of Asset Management Services

|

9

|

|

3.2

|

|

Scope of Asset Preservation Services

|

11

|

|

3.3

|

|

Scope of O&M Services

|

12

|

|

3.4

|

|

Subcontracts

|

12

|

|

3.5

|

|

Standards for Performance of the Asset Management Services

|

13

|

|

3.6

|

|

Standards for Performance of the Asset Preservation Services and the O&M Services

|

13

|

|

3.7

|

|

Personnel Standards.

|

13

|

|

3.8

|

|

Training

|

13

|

|

3.9

|

|

Additional Obligations of Manager

|

13

|

|

3.10

|

|

Licenses and Permits

|

14

|

|

3.11

|

|

Records and Reports; Other Material Information

|

14

|

|

3.12

|

|

No Liens or Encumbrances

|

14

|

|

3.13

|

|

Emergency Action

|

14

|

|

3.14

|

|

Scope; Manager Authority

|

14

|

|

3.15

|

|

Retention of Control by Owners

|

15

|

|

3.16

|

|

Limitations on Performance

|

15

|

|

3.17

|

|

Deficiency of Funds

|

15

|

|

Article IV

|

|

ITEMS TO BE FURNISHED BY OWNERS

|

15

|

|

4.1

|

|

General

|

15

|

|

4.2

|

|

Information

|

15

|

|

4.3

|

|

Corn, Fuel and Other Materials

|

15

|

|

4.4

|

|

Cold Shutdown or Start Up of a Facility

|

15

|

|

Article V

|

|

DEVELOPMENT PROJECTS; FACILITY SERVICES

|

16

|

|

5.1

|

|

Development Projects

|

16

|

|

Article VI

|

|

REPORTING AND PERSONNEL

|

16

|

|

6.1

|

|

Accounts and Reports

|

16

|

|

6.2

|

|

Budget

|

17

|

|

6.3

|

|

Manager Representative

|

17

|

|

Article VII

|

|

LIMITATIONS ON AUTHORITY

|

18

|

|

Article VIII

|

|

COMPENSATION

|

19

|

|

8.1

|

|

Asset Management Fee

|

19

|

|

8.2

|

|

Sale Incentive Fee

|

19

|

|

8.3

|

|

Lien Waivers

|

20

|

|

8.4

|

|

Netting

|

20

|

|

8.5

|

|

Intentionally Left Blank

|

20

|

|

Article IX

|

|

TERM

|

20

|

|

9.1

|

|

Term

|

20

|

|

9.2

|

|

Owner Defaults and Manager Remedies

|

21

|

|

9.3

|

|

Manager Defaults and Owner Remedies

|

21

|

|

9.4

|

|

Termination for Convenience

|

22

|

|

9.5

|

|

Facility Condition at End of Term; Successor Manager.

|

22

|

|

9.6

|

|

Termination Payment; Manager Payment.

|

23

|

|

Article X

|

|

INSURANCE

|

23

|

|

10.1

|

|

Manager Insurance

|

23

|

|

10.2

|

|

Owners Insurance

|

25

|

|

10.3

|

|

Manager Insurance Premiums and Deductibles

|

25

|

|

10.4

|

|

Subcontractor Insurance

|

25

|

|

Article XI

|

|

INDEMNIFICATION

|

25

|

|

11.1

|

|

Owners’ Indemnity

|

25

|

|

11.2

|

|

Manager’s Indemnity

|

25

|

|

Article XII

|

|

LIABILITIES OF THE PARTIES

|

26

|

|

12.1

|

|

Maximum Liability of Manager

|

26

|

|

12.2

|

|

No Consequential or Punitive Damages

|

26

|

|

Article XIII

|

|

CONFIDENTIALITY

|

26

|

|

13.1

|

|

Owner’s Confidential Information

|

26

|

|

13.2

|

|

Manager’s Confidential Information

|

27

|

|

Article XIV

|

|

TITLE, DOCUMENTS AND DATA

|

27

|

|

14.1

|

|

Materials and Equipment

|

27

|

|

14.2

|

|

Documents

|

27

|

|

Article XV

|

|

FORCE MAJEURE

|

28

|

|

15.1

|

|

Events Constituting Force Majeure

|

28

|

|

15.2

|

|

Effect

|

28

|

|

15.3

|

|

Limitations

|

28

|

|

Article XVI

|

|

MISCELLANEOUS PROVISIONS

|

29

|

|

16.1

|

|

Assignment

|

29

|

|

16.2

|

|

Sale of Facilities

|

29

|

|

16.3

|

|

Cooperation in Financing

|

29

|

|

16.4

|

|

Access

|

29

|

|

16.5

|

|

Not for Benefit of Third Parties

|

30

|

|

16.6

|

|

Amendments

|

30

|

|

16.7

|

|

Survival

|

30

|

|

16.8

|

|

No Waiver

|

30

|

|

16.9

|

|

Notices

|

30

|

|

16.10

|

|

Representations and Warranties.

|

31

|

|

16.11

|

|

Counterparts and Execution

|

32

|

|

16.12

|

|

Governing Law

|

32

|

|

16.13

|

|

Entire Agreement

|

32

|

|

16.14

|

|

Severability

|

33

|

|

16.15

|

|

Successors and Assigns

|

33

|

|

16.16

|

|

Owner Agent

|

33

|

|

16.17

|

|

Independent Contractor

|

33

|

|

16.18

|

|

Captions; Appendices

|

33

|

| 16.19 |

|

No Novation |

33 |

| 16.20 |

|

Several Liability |

33 |

|

Appendix A-1

|

Scope of Asset Management Services and Asset Preservation Services

|

|

Appendix A-2

|

Scope of O&M Services

|

|

Appendix B

|

Personnel Listing

|

|

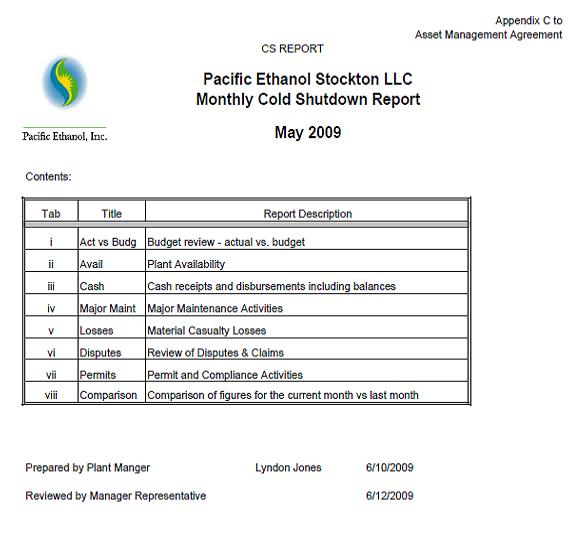

Appendix C

|

Form of Report (Cold Shutdown)

|

|

Appendix D

|

Form of Report (Operating)

|

|

Exhibit I

|

Example Performance Bonus Calculation

|

|

Exhibit II

|

Example Sale Incentive Fee Calculation

|

|

Exhibit III

|

Example EBITDA Calculation

|

This SECOND AMENDED AND RESTATED ASSET MANAGEMENT AGREEMENT (this “Agreement”) is made and entered into as of June 30, 2011 by and between Pacific Ethanol Holding Co. LLC, a Delaware limited liability company (“Pacific Holding”), Pacific Ethanol Madera LLC, a Delaware limited liability company (“Madera”), Pacific Ethanol Columbia, LLC, a Delaware limited liability company (“Boardman”), Pacific Ethanol Stockton, LLC, a Delaware limited liability company (“Stockton”), and Pacific Ethanol Magic Valley, LLC, a Delaware limited liability company (“Burley” and, together with Madera, Boardman and Stockton, an “Owner” and collectively “Owners”), Pacific Holding as Owner Agent (“Owner Agent”) and Pacific Ethanol, Inc., a Delaware corporation (“Manager”). Owners and Manager are each individually referred to herein as a “Party” and collectively are referred to herein as the “Parties”.

RECITALS

WHEREAS, the Parties hereto were previously party to that certain Amended and Restated Asset Management Agreement, dated as of October 15, 2010 (the “Prior Agreement”) pursuant to which Manager provided various services to the Owners;

WHEREAS, Owners have entered into the Credit Agreement (as defined below) to provide funds for the working capital requirements of Owners and for other purposes permitted under the Credit Agreement;

WHEREAS, as a condition precedent to the obligation of the lenders party to the Credit Agreement to make loans or other extensions of credit to Owners, Owners are required to engage Manager to provide certain management services to Owners; and

WHEREAS, Manager desires to provide such management services.

WHEREAS, the parties to the Prior Agreement desire to amend and restate the Prior Agreement in its entirety upon the terms and conditions set forth herein.

NOW, THEREFORE, for good and adequate consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto, intending to be legally bound, do hereby agree as follows:

ARTICLE I

DEFINITIONS

1.1 Definitions. Capitalized terms used in this Agreement but not defined herein shall have the meanings assigned thereto in the Credit Agreement. The following terms shall have the meanings set forth below when used in this Agreement:

“Act of Insolvency” means, with respect to any Person, any of the following: (a) commencement by such Person of a voluntary proceeding under any jurisdiction’s bankruptcy, insolvency or reorganization law; (b) the filing of an involuntary proceeding against such Person under any jurisdiction’s bankruptcy, insolvency or reorganization law which is not vacated within 60 days after such filing; (c) the admission by such Person of the material allegations of any petition filed against it in any proceeding under any jurisdiction’s bankruptcy, insolvency or reorganization law; (d) the adjudication of such Person as bankrupt or insolvent or the winding up or dissolution of such Person; (e) the making by such Person of a general assignment for the benefit of its creditors (assignments for a solvent financing excluded); (f) the appointment of a receiver or an administrator for all or a substantial portion of such Person’s assets, which receiver or administrator, if appointed without the consent of such Person, is not discharged within 60 days after its appointment; or (g) the occurrence of any event analogous to any of the foregoing with respect to such Person occurring in any jurisdiction.

“Affiliate” of a specified Person means any corporation, partnership, sole proprietorship or other Person which directly or indirectly through one or more intermediaries controls, is controlled by or is under common control with the Person specified. The term “control” means the ownership, either direct or indirect, of twenty-five percent (25%) or more of the voting securities (or comparable equity interests) or other ownership interests of a Person, or the possession, either direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or any other means whatsoever.

“Agreement” means this Second Amended and Restated Asset Management Agreement, including all appendices hereto, as the same may be modified, supplemented or amended from time to time in accordance with the provisions hereof.

“Asset Management Fee” has the meaning assigned to such term in Section 8.1.

“Asset Management Services” has the meaning assigned to such term in Section 3.1.

“Asset Preservation Services” has the meaning assigned to such term in Section 3.2.

“Asset Sale Proceeds” in respect of a Facility means the cash proceeds received from the sale of such Facility net of reasonable attorney’s fees, investment banking fees, accounting fees and other fees and all taxes applied or estimated (as determined in good faith by Owner of such Facility) required to be paid or that become due within the following 12 months as a result of such sale and any amounts escrowed or deferred (provided that when released such escrowed or deferred amounts shall be Asset Sale Proceeds when received).

“Availability of Funds” means, with respect to any obligation that constitutes a Manager Expense, an Operating Disbursement or a Direct Reimbursement Expense, that sufficient funds have been provided by Owners and are available to Manager to pay such obligation. For sake of clarity, with respect to costs for Manager’s obligations constituting Manager Expenses, Availability of Funds means that the Asset Management Fee has been paid, without regard to the actual costs necessary to be incurred by Manager to fulfill such obligations.

“Boardman Corn Supply Agreement” means the Amended and Restated Corn Procurement and Handling Agreement between Pacific AG. Products, LLC and Boardman dated as of June 30, 2011, and any other agreement relating to the procurement of corn for the Boardman Facility.

“Boardman Ethanol Sales and Marketing Agreement” means the Amended and Restated Ethanol Marketing Agreement between Boardman and Kinergy Marketing, LLC, dated as of June 30, 2011, and any other agreement relating to the sale of ethanol from the Boardman Facility.

“Boardman Facility” means the Facility owned by Boardman.

“Boardman Facility Agreements” means this Agreement, the Boardman Corn Supply Agreement, the Technology Licensing Agreement to which Boardman is a party, the Boardman Ethanol Sales and Marketing Agreement, the Boardman WDG Sales and Marketing Agreement, and such other or additional material agreements entered into by Boardman with respect to the operation and maintenance of the Boardman Facility.

“Boardman WDG Sales and Marketing Agreement” means the Amended and Restated Distillers Grains Marketing Agreement between Boardman and Pacific Ag Products, LLC, dated as of June 30, 2011, and any other agreement relating to the sale of distillers grains from the Boardman Facility.

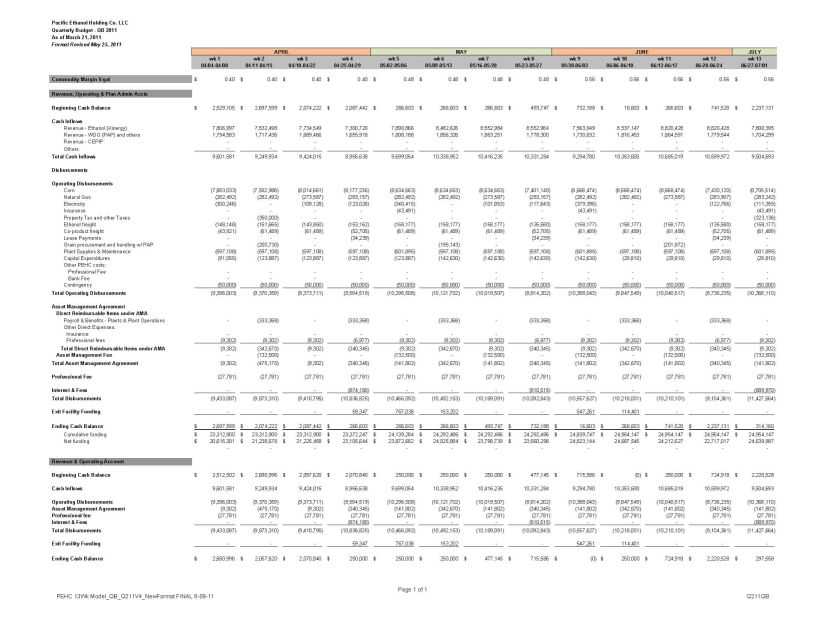

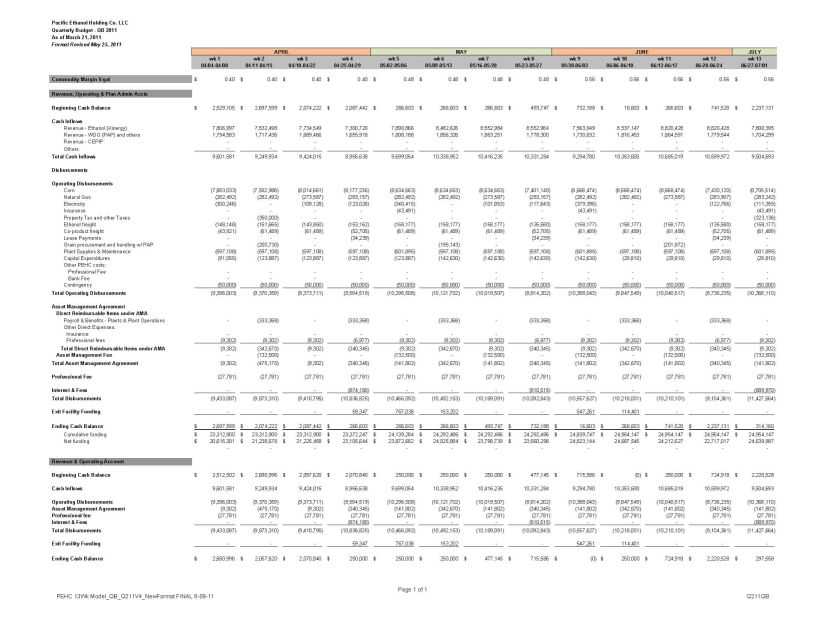

“Budget” means the Budget attached hereto as Appendix E, as amended or modified from time to time in accordance with Section 6.2.

“Burley Corn Supply Agreement” means the Amended and Restated Corn Procurement and Handling Agreement between Pacific AG. Products, LLC and Burley dated as of June 30, 2011, and any other agreement relating to the procurement of corn for the Burley Facility.

“Burley Ethanol Sales and Marketing Agreement” means the Amended and Restated Ethanol Marketing Agreement between Burley and Kinergy Marketing, LLC, dated as of June 30, 2011, and any other agreement relating to the sale of ethanol from the Burley Facility.

“Burley Facility” means the Facility owned by Burley.

“Burley Facility Agreements” means this Agreement, the Burley Corn Supply Agreement, the Technology Licensing Agreement to which Burley is a party, the Burley Ethanol Sales and Marketing Agreement, the Burley WDG Sales and Marketing Agreement, and such other or additional material agreements entered into by Burley with respect to the operation and maintenance of the Burley Facility.

“Burley WDG Sales and Marketing Agreement” means the Amended and Restated Distillers Grains Marketing Agreement between Burley and Pacific Ag Products, LLC, dated as of June 30, 2011, and any other agreement relating to the sale of distillers grains from the Burley Facility.

“Business Day” means any day other than a Saturday, Sunday or a day on which commercial banks in Sacramento, California or New York, New York are required or authorized to be closed.

“Consistent with Past Practices” means consistent with those practices previously utilized by the Manager with respect to a Facility pursuant to the Prior Agreement.

“Consumables” means all items consumed, or needing regular, periodic replacement or replenishment by Manager in the performance of services pursuant to this Agreement, including, but not limited to, chemicals, hand tools, catalysts, lubricants, rags, oils, filter media, ammonia, additives, anti-corrosion devices, gases (CO2, O2, halon, etc.), and other expendable materials.

“Credit Agreement” means the Credit Agreement, dated June 25, 2010, among Owners, Owner Agent, each of the Lenders from time to time party thereto, WestLB AG, New York Branch, as Administrative Agent and Collateral Agent, and Amarillo National Bank, as accounts bank, as the same may be amended, restated, modified or otherwise supplemented from time to time.

“Direct Reimbursement Expenses” means those expenses included in the line items of the Budget under the category “Asset Management Agreement-Direct Reimbursement.”

“EBITDA” means, with respect to an Owner, the earnings of such Owner before interest, taxes, depreciation and amortization, reorganization adjustments, financing charges and fees, current month lower cost or market inventory adjustment, and other lender related expenses calculated in accordance with Exhibit III.

“EBITDA per Gallon of Operating Capacity” of a Facility means the quotient obtained by dividing EBITDA by Operating Capacity.

“Effective Date” has the meaning assigned to such term in Section 9.1.

“Environmental Law” means any statute, law, regulation, ordinance, rule, judgment, order, decree, legally binding directive or requirement, or any similar form of decision of or determination by, or any interpretation or administration of any of the foregoing by a Governmental Authority, relating to the environment, health or safety as affected by the environment or any Hazardous Material as now or hereinafter in effect.

“Extension Notice” has the meaning assigned to such term in Section 9.1.

“Facility” means an ethanol production facility owned by an Owner including (a) all equipment associated with the operation of such facility and forming part thereof, (b) the storage space for corn, ethanol and wet distillers grains, (c) administrative offices and building structures housing facility equipment, (d) site improvements such as roads, railroad spur lines, barge docks and fencing, and (e) the Loading/Unloading Facilities and (f) piping, structures and equipment for the delivery of ethanol and wet distillers grains and for water, fuel, sewer, waste water discharge and other Consumables required for facility operation and maintenance.

“Facility Agreements” means the Boardman Facility Agreements, the Burley Facility Agreements, the Madera Facility Agreements and the Stockton Facility Agreements.

“Facility Manuals” means Facility equipment manuals, system descriptions, system operating instructions, equipment maintenance instructions and pertinent design documentation as developed by the construction contractor of the Facility and/or Plant Designer.

“Facilities Records” has the meaning assigned to such term in Section 3.11.1.

“Force Majeure Event” has the meaning assigned to such term in Section 15.1.

“Governmental Authority” means any United States federal, state, municipal, local, territorial, or other governmental department, commission, board, bureau, agency, regulatory authority, instrumentality, judicial or administrative body.

“Hazardous Materials” means (a) any petroleum or petroleum products, radioactive materials, asbestos in any form that is or could become friable, urea formaldehyde foam insulation, and transformers or other equipment that contain dielectric fluid containing polychlorinated biphenyls; (b) any chemicals, materials or substances which are now or hereafter become defined as or included in the definition of “hazardous substances,” “hazardous wastes,” “hazardous materials,” “extremely hazardous wastes,” “restricted hazardous wastes,” “toxic substances,” “toxic pollutants,” “pollution,” “pollutants,” “regulated substances,” or works of similar import, under the Environmental Laws, including but not limited to the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (42 U.S.C. § 9601 et seq.); the Hazardous Material Transportation Act, as amended (49 U.S.C. §1801 et seq.); the Resource Conservation and Recovery Act, as amended (42 U.S.C. § 6901 et seq.); the Toxic Substances Control Act, as amended (42 U.S.C. § 7401 et seq.); the Clean Air Act, as amended (42 U.S.C. § 7401 et seq.); the Federal Water Pollution Control Act, as amended (33 U.S.C. § 1251 et seq.); or in the regulations promulgated pursuant to said laws; (c) any Material of Environmental Concern as defined in the Credit Agreement; and (d) any other chemical, material, substance or waste declared to be hazardous, toxic, or polluting material by any Governmental Authority, exposure to which is now or hereafter prohibited, limited or regulated by any Governmental Authority.

“Law” means any law, statute, act, legislation, bill, enactment, policy, treaty, international agreement, ordinance, judgment, injunction, award, decree, rule, regulation, interpretation, determination, requirement, writ or order of any Governmental Authority.

“Liabilities” has the meaning assigned to such term in Section 11.1.

“Loading/Unloading Facilities” means the rail spurs, barge and/or truck docks located at a Facility, and all loading and unloading equipment and facilities with respect thereto located at such Facility, including, but not limited to, all conveyors, lifts and elevators used in connection with movement of materials and products (including grain and grain products) in and out of the Storage Silos and other locations at a Facility.

“Madera Corn Supply Agreement” means any agreement relating to the procurement of corn for the Madera Facility.

“Madera Ethanol Sales and Marketing Agreement” means any agreement relating to the sale of ethanol from the Madera Facility.

“Madera Facility” means the Facility owned by Madera.

“Madera Facility Agreements” means this Agreement, the Madera Corn Supply Agreement, the Technology Licensing Agreement to which Madera is a party, the Madera Ethanol Sales and Marketing Agreement, the Madera WDG Sales and Marketing Agreement, and such other or additional material agreements entered into by Madera with respect to the operation and maintenance of the Madera Facility.

“Madera WDG Sales and Marketing Agreement” means any agreement relating to the sale of distillers grains from the Madera Facility.

“Magic Valley Air Permit” means a final, non-appealable air quality permit required to operate the Magic Valley Facility at not less than nameplate capacity.

“Magic Valley Facility” means the Facility owned by Burley.

“Manager” has the meaning assigned to such term in the Preamble.

“Manager Account” means a depositary account designated by Manager, from time to time, which account shall be under the sole dominion and control of Manager and located in a banking institution designated by Manager.

“Manager Expenses” means the expenses incurred by Manager in performing the Services that are to be for the account of Manager, as specified in the Manager Expense portion of the Budget.

“Manager Indemnified Person” has the meaning assigned to such term in Section 11.2.

“Manager Information” has the meaning assigned to such term in Section 13.2.

“Manager Proprietary Property” has the meaning assigned to such term in Section 9.5(a).

“NewCo” means New PE Holdco LLC, a Delaware limited liability company and the owner on the date hereof, directly or indirectly, of all the equity interests in Owner Agent and each Owner.

“Operating Capacity” means 57,142,857 un-denatured gallons annually in the case of each of the Magic Valley and the Stockton Facilities and 38,095,238 un-denatured gallons annually in the case of each of the Boardman and Madera Facilities, plus, in each case, the actual gallons of denaturant used annually with regard to any Facility not in Cold Shutdown.

“Operating Disbursements” means those expenses included in the line items of the Budget under the category “Operating Disbursements”.

“O&M Services” has the meaning assigned to such term in Section 3.3.

“Owner Agent” has the meaning assigned to such term in the Preamble

“Owners” has the meaning assigned to such term in the Preamble.

“Owner Indemnified Person” has the meaning assigned to such term in Section 11.1.

“Party” has the meaning assigned to such term in the Preamble.

“Permits” means all permits, authorizations, registrations, consents, approvals, waivers, exceptions, variances, orders, judgments, written interpretations, decrees, licenses, exemptions, publications, filings, notices to and declarations of or with, or required by, any Governmental Authority, or required by any Law, and shall include all environmental and operating permits and licenses that are required for the full use, occupancy, zoning and operation of each Facility.

“Person” means any individual, partnership, corporation, association, business, trust, government or political subdivision thereof, governmental agency or other entity.

“Plant Designer” means Delta-T Corporation.

“Prior Agreement” has the meaning assigned to such term in the Recitals.

“Prudent Ethanol Practices” means those reasonable practices, methods and acts that (i) are commonly used in the regions where the Facilities are located to manage and maintain ethanol production, distribution, equipment and associated facilities of the size and type that comprise the Facilities safely, reliably, and efficiently and in compliance with applicable Laws, manufacturers’ warranties and manufacturers’ and licensor’s recommendations and guidelines, and (ii) in the exercise of reasonable judgment, skill, diligence, foresight and care are expected of an ethanol plant manager, in order to efficiently accomplish the desired result consistent with safety standards, applicable Laws, manufacturers’ warranties and manufacturers’ recommendations, in each case taking into account whether a Facility is in operation or is in Cold Shutdown. Prudent Ethanol Practices does not necessarily mean one particular practice, method, equipment specifications or standard in all cases, but is instead intended to encompass a broad range of acceptable practices, methods, equipment specifications and standards.

“Sale Price per Gallon” in respect of a Facility (or the equity interests in Owner of such Facility) means the quotient obtained by dividing (i) the excess of (x) Asset Sale Proceeds in respect of such Facility (or such equity interests) over (y) the pro rata portion of the Loans allocated (on the basis of relative Operating Capacities) to such Facility by (ii) the Operating Capacity of such Facility.

“Services” means, collectively, the Asset Management Services, the Asset Preservation Services and the O&M Services and any other services provided by or on behalf of the Manager with respect to the Facilities in accordance with this Agreement.

“Sponsor Support Agreement” means that certain Amended and Restated Sponsor Support Agreement, dated as of October 22, 2008, among Owner Agent, Manager and WestLB AG, New York Branch, as Administrative Agent.

“Stockton Completion Obligation” means those actions required to be taken to cause the Stockton Facility to achieve Final Completion (as defined in the Pre-Petition Credit Agreement) including receipt of all Permits.

“Stockton Corn Supply Agreement” means the Amended and Restated Corn Procurement and Handling Agreement between Pacific AG. Products, LLC and Stockton dated as of June 30, 2011, and any other agreement relating to the procurement of corn for the Stockton Facility.

“Stockton Ethanol Sales and Marketing Agreement” means the Amended and Restated Ethanol Marketing Agreement between Stockton and Kinergy Marketing, LLC, dated as of June 30, 2011, and any other agreement relating to the sale of ethanol from the Stockton Facility.

“Stockton Facility” means the Facility owned by Stockton.

“Stockton Facility Agreements” means this Agreement, the Stockton Corn Supply Agreement, the Technology Licensing Agreement to which Stockton is a party, the Stockton Ethanol Sales and Marketing Agreement, the Stockton WDG Sales and Marketing Agreement, and such other or additional material agreements entered into by Stockton with respect to the operation and maintenance of the Stockton Facility.

“Stockton WDG Sales and Marketing Agreement” means the Amended and Restated Distillers Grains Marketing Agreement between Stockton and Pacific Ag Products, LLC, dated as of June 30, 2011, and any other agreement relating to the sale of distillers grains from the Stockton Facility.

“Storage Silos” means Owners’ grain storage silos located at a Facility.

“Supplemental Termination Payment” means the product obtained by multiplying (i) the difference between (x) sixty (60) and (y) the number of days notice (fewer than sixty (60)) that Manager is given pursuant to clause (y) of Section 9.4 by (ii) the quotient of (x) the Asset Management Fee with respect to the relevant Facility divided by (y) 30.

“Technology Licensing Agreement” means (i) each License for Technology between an Owner of a Facility (other than Madera) and Plant Designer, each dated as of September 6, 2006 and (ii) the License for Technology between Madera and Plant Designer, dated as of September 1, 2005 in each case, as such agreement may from time to time be amended.

“Termination Payment” has the meaning assigned to such term in Section 9.6.1.

1.2 Interpretation. The following interpretations and rules of construction shall apply to this Agreement:

(a) titles and headings are for convenience only and will not be deemed part of this Agreement for purposes of interpretation;

(b) unless otherwise stated, references in this Agreement to “Sections,” “Appendices” or “Articles” refer, respectively, to Sections, Appendices or Articles of this Agreement;

(c) “including” means “including, but not limited to”, and “include” or “includes” means “include, without limitation” or “includes, without limitation”;

(d) “hereunder”, “herein”, “hereto” and “hereof”, when used in this Agreement, refer to this Agreement as a whole and not to a particular Section or clause of this Agreement;

(e) in the case of defined terms, the singular includes the plural and vice versa;

(f) unless otherwise indicated, all accounting terms not specifically defined shall be construed in accordance with generally accepted accounting practices in the United States;

(g) unless otherwise indicated, each reference to a particular Law is a reference to such Law as it may be amended, modified, extended, restated or supplemented from time to time, as well as to any successor Law thereto;

(h) unless otherwise indicated, references to agreements shall be deemed to include all subsequent amendments, supplements and other modifications thereto; and

(i) unless otherwise indicated, each reference to any Person shall include such Person’s successors and permitted assigns.

ARTICLE II

APPOINTMENT

Owners hereby appoint and retain Manager to provide the Services from the Effective Date on the terms and conditions set forth in this Agreement. Manager hereby accepts such appointment and agrees to perform the Services in accordance with the terms and conditions set forth in this Agreement.

ARTICLE III

RESPONSIBILITIES OF MANAGER

3.1 Scope of Asset Management Services. With respect to each Facility, commencing on the Effective Date, subject to the terms of this Agreement and the Availability of Funds, Manager shall perform, or cause to be performed, the following services with respect to such Facility (collectively, the “Asset Management Services”):

3.1.1 Administration of Financing Documents. Subject to the terms of this Agreement and the direction of Owner Agent, Manager shall administer the Owners’ compliance with all covenants and obligations set forth in the Financing Documents, including monitoring compliance with the Financing Documents and advising Owners as to their compliance obligations thereunder and providing Owner Agent with Manager’s analysis and recommendations regarding the application of the Financing Documents. In furtherance of the foregoing, Appendix A-1 sets forth various time and certification requirements regarding Manager’s furnishing to Owner of various reports, budgets and other submissions for review by Owner prior to the submission of same to the Administrative Agent. For convenience, Appendix A-1 also sets forth the time and requirements for reports called for by this Agreement and the Facility Agreements. Manager shall not take any action that would reasonably be expected to cause any Owner to contravene such Owner’s obligations under the Financing Documents. Manager shall be authorized to deal directly with the Administrative Agent and the Collateral Agent on behalf of Owners with respect to routine matters and to receive notifications from the Administrative Agent and the Collateral Agent pursuant to the Financing Documents. Manager shall reasonably cooperate with the Administrative Agent, the Collateral Agent and the Consultants. The parties to this Agreement hereby agree that the terms of this Agreement shall not vary or amend the obligations of any Owner under any Financing Document to which such Owner is a party or subject Manager to any obligations under the Financing Documents.

3.1.2 Billing and Collection of Revenues. Manager shall implement and maintain billing and collection procedures in respect of all accounts receivable and other amounts due Owners.

3.1.3 Bank Accounts and Disbursement of Funds. Manager shall establish and/or maintain on behalf of and in the name of the applicable Owner one or more bank accounts as may be required by the applicable Owner or the Financing Documents. Subject to availability of adequate funds in such accounts, Manager shall withdraw from such accounts such funds as may be necessary to pay such Owner’s Operating Disbursements and Direct Reimbursement Expenses in accordance with the Budget.

3.1.4 Accounting and Documentation. Manager shall provide full bookkeeping, accounting (including tax accounting), and record keeping services to Owners as required from time to time by Owners and the Financing Documents.

3.1.5 Insurance. Manager shall implement Owners’ insurance programs, including procuring and maintaining any and all insurance required to be maintained by Owners under the Financing Documents. Manager also shall be responsible for administering all claims, arranging for all payments, and making all collections on behalf of Owners under insurance policies covering Owners.

3.1.6 Licenses and Permits. Manager shall monitor and use commercially reasonable efforts to assist each Owner with its respective obligations to maintain compliance with any required permits, licenses and governmental approvals required and obtained by or for an Owner in connection with the ownership or operation of its Facility. Manager shall, upon request by any Owner, prepare or cause the preparation of any application, filing or notice related thereto, shall cause such materials to be submitted to, and shall represent Owner in contacts with, the appropriate governmental agency, and shall perform all ministerial or administrative acts necessary for timely issuance and the continued effectiveness thereof. Copies of all permits, licenses and governmental approvals obtained by or for an Owner pursuant hereto shall be maintained by Manager at its offices and at the respective Facility sites.

3.1.7 Public Relations. Manager shall coordinate all public and community relations matters of Owners with respect to the Facilities as directed by Owner Agent. Notwithstanding the foregoing, the Manager shall not issue (nor have any obligation to issue) any press release regarding an Owner or a Facility without the prior written consent of such Owner.

3.1.8 Reports and Budgets. Manager shall prepare and distribute, or cause to be prepared and distributed, all financial or other reports, budgets (including the Budget), estimates, tax returns and other information required to be prepared and distributed by Owners pursuant to the Financing Documents.

3.1.9 Dispute Resolution. Subject to the directions of Owner Agent, Manager shall manage any litigation, arbitration, or other proceedings involving any Facility (except any litigation, arbitration, or other proceedings involving Manager). Manager shall obtain Owner Agent’s written approval prior to commencing any litigation, arbitration or other proceeding on behalf of an Owner and Manager shall periodically advise Owner Agent on the status of each litigation, arbitration and other proceeding involving any Facility. In addition, notwithstanding the foregoing, except as otherwise authorized by Owner Agent, Manager shall not settle any claim brought by or against an Owner without the prior written approval of Owner Agent.

3.1.10 Materials. Manager shall provide all materials necessary for the performance of the Asset Management Services and shall provide appropriate office space for its personnel performing the Asset Management Services.

3.1.11 Sale of Facilities. Manager shall use commercially reasonable efforts to assist Owners with the sale of the Facilities.

3.1.12 Offices. Manager shall maintain the principal office of each Owner and arrange for the provision of cleaning, security and other necessary services with respect to each such office and to each Facility.

3.1.13 Consultation. Manager shall consult with Owner Agent on all aspects of the preservation, operation and maintenance of each Facility, at such places and times as Owner Agent may reasonably request.

3.1.14 Other. Manager shall use commercially reasonable efforts to provide any other assistance or services reasonably requested by Owners that are consistent with the foregoing services and necessary for, or materially beneficial to, the management or administration of the Facilities including the services set forth in Appendix A-1.

3.2 Scope of Asset Preservation Services. With respect to each Facility that is in Cold Shutdown, subject to the terms of this Agreement and the Availability of Funds, Manager shall perform, or cause to be performed, the following services with respect to such Facility (collectively, the “Asset Preservation Services”):

3.2.1 Layup Services. Manager will take all commercially reasonable steps to ensure that site security measures, equipment preservation and general site maintenance is conducted in order to support a cost effective return of each Facility to operational status once schedules therefor are established by Owners and communicated to Manager. Manager shall:

(a) be in complete charge of, and have care and custody over, each Facility;

(b) perform, or cause to be performed on behalf of Owners, all maintenance of each Facility Consistent with Past Practice; and

(c) perform periodic inspections Consistent with Past Practice.

3.2.2 Waste Management. Subject to Environmental Laws and any permits maintained with respect to each Facility by its Owner or Manager, Manager shall be responsible for the onsite management of all wastes generated by or used in the preservation of each Facility.

3.2.3 Other. Manager shall use commercially reasonable efforts to provide any other assistance or services reasonably requested by Owners that are consistent with the foregoing services, Consistent with Past Practices and necessary for, or materially beneficial to, the preservation of the Facilities including the services set forth in Appendix A-1.

3.3 Scope of O&M Services. With respect to each Facility that is not in Cold Shutdown, commencing on the Effective Date and subject to the terms of this Agreement, the Availability of Funds and Consistent with Past Practices, Manager shall perform, or cause to be performed, the following services (collectively, the “O&M Services”):

3.3.1 Operations and Maintenance. Manager shall operate and maintain each such Facility. Manager shall:

(a) perform, or cause to be performed on behalf of such Facility, all operations and maintenance of such Facility;

(b) supply, or cause to be supplied, all goods and materials, including spare parts, required to operate and maintain such Facility;

(c) maintain, control and store such Facility’s equipment and spare parts inventory;

(d) perform periodic inspections; and

(e) coordinate compliance by Owner with the applicable Facility Agreements.

3.3.2 Waste Management. Subject to Environmental Laws and any permits maintained with respect to such Facility by Owner of such Facility or Manager, Manager shall be responsible for the onsite management of all wastes generated by or used in the operation or maintenance of such Facility.

3.3.3 Other. Manager shall use commercially reasonable efforts to provide any other assistance or services reasonably requested by Owner of such Facility, that are consistent with the foregoing services and necessary for, or materially beneficial to, the operations and maintenance of such Facility, respectively, including the services set forth in Appendix A-2.

3.4 Subcontracts. Manager shall not enter into any subcontract for the services described herein without the prior written consent of Owner Agent; provided that Manager shall be permitted to subcontract certain of the Services relating to the maintenance and operation of the Facilities to Affiliates of Manager (other than Owners) Consistent with Past Practices (it being understood that Manager shall remain primarily liable for any services performed by any subcontractor).

3.5 Standards for Performance of the Asset Management Services. Manager shall perform the Asset Management Services in a prudent, businesslike and efficient manner in accordance with (i) all applicable Laws (including Environmental Laws) and Permits, (ii) the applicable terms and conditions of the Financing Documents and (iii) this Agreement.

3.6 Standards for Performance of the Asset Preservation Services and the O&M Services. Subject to Availability of Funds and Consistent with Past Practices, Manager shall perform the Asset Preservation Services and the O&M Services in accordance with (i) the Facility Manuals, (ii) all applicable Laws (including Environmental Laws) and Permits, (iii) Prudent Ethanol Practices, (iv) the applicable Facility Agreements and (v) this Agreement. Manager shall obtain and maintain in effect all licenses and permits required to allow Manager to do business or perform its services hereunder in the jurisdictions where such services are to be performed except where the failure to do so shall not adversely affect Manager’s ability to perform its obligations under this Agreement.

3.7 Personnel Standards.

3.7.1 Manager shall provide and make available as necessary, in accordance with the requirements of this Agreement, all labor and professional, supervisory and managerial personnel as are required to perform its services hereunder in accordance with the terms hereof. Such personnel shall be qualified and experienced in the duties to which they are assigned and shall be the employees of Manager or its Affiliates, and their working hours, rates of compensation and all other matters relating to their employment shall be determined solely by Manager. Manager shall retain sole authority, control and responsibility with respect to its employment policy in connection with the performance of its obligations hereunder. A preliminary listing of personnel that Manager anticipates will be necessary to operate, preserve and/or maintain each Facility in its current state of operation or Cold Shutdown as applicable as such state may change from time to time, including function, the number of such positions and the date by which such personnel should be hired, is set forth in Appendix B, it being understood that such listing is non-binding and shall be revised from time to time (but not less frequently than quarterly, if changes have occurred) by Manager in consultation with Owner Agent.

3.7.2 Upon the written request of Owner Agent, Manager shall remove from each site and each Facility workforce, any employee or subcontractor.

3.8 Training. Manager shall maintain regular training procedures approved by Owner Agent in the exercise of its reasonable judgment and discretion. Such procedures shall be adequate to keep Manager’s personnel informed and knowledgeable regarding the operation and maintenance of each Facility.

3.9 Additional Obligations of Manager. Anything contained herein to the contrary notwithstanding and without regard to Availability of Funds, Manager shall (i) take all actions as may be necessary to cause the Stockton Facility to satisfy the Stockton Completion Obligation and (ii) perform its obligations under Section 2.01(b) of the Sponsor Support Agreement to cause the Magic Valley Facility to obtain the Magic Valley Air Permit. This Section 3.9 shall not be deemed to make Manager a party to the Facility Agreements (other than this Agreement) or to impose any obligations on Manager under the Facility Agreements (other than this Agreement).

3.10 Licenses and Permits. Manager has reviewed and shall continue to review all Laws and regulations containing or establishing compliance requirements in connection with the operation and maintenance of each Facility and applicable to Manager in connection with its obligations under this Agreement, and assist Owners in securing and complying with, as appropriate, all Permits necessary for the operation and maintenance of each Facility (and renewals or replacements of the same), including those relating to Facility operation, waste water and sewer use and treatment, chemical and other waste including Hazardous Materials; provided, however, that all such permits, licenses and approvals relating to Hazardous Materials shall be in the name of Owners except for any individual licenses or permits required under Section 3.6. Manager shall also initiate and maintain precautions and procedures necessary to comply with applicable provisions of all such Laws (including Environmental Laws), including those related to prevention of injury to persons or damage to property at each Facility.

3.11 Records and Reports; Other Material Information

3.11.1 Records and Reports. Manager shall prepare and maintain logs, records and reports documenting the operation and maintenance of each Facility including all information and reports required by applicable Laws or beneficial for proper operation and maintenance of each Facility in accordance with Prudent Ethanol Practices. Manager shall also prepare reports and data related to the maintenance of Hazardous Materials onsite at each Facility in a manner complying with applicable Environmental Laws, and shall maintain current revisions of the drawings, specifications, lists, clarifications and other materials provided to Manager by Owners, construction contractors and/or Plant Designer. Appendix A-1 details timing and certification requirements relating to certain of such reports. Copies of all such reports that may be submitted to any Governmental Authority by Manager shall be transmitted to Owner Agent. All such reports and other documents specified in this Section 3.11.1 are referred to as the “Facilities Records”.

3.11.2 Other Material Information. Manager shall promptly submit to Owner Agent any material information that it or any of its Affiliates may have concerning new or significant developments relating to any Facility and, upon Owner Agent’s reasonable request, shall promptly submit any other information that it or any of its Affiliates may have concerning any Facility or the services performed by Manager hereunder.

3.12 No Liens or Encumbrances. Manager shall keep and maintain each Facility free and clear of all liens and encumbrances resulting from the action of Manager or work done at the request of or by Manager.

3.13 Emergency Action. In the event of an emergency affecting the safety or protection of Persons or endangering a Facility or property located at a Facility, Manager shall promptly notify Owner Agent and, take prompt action to attempt to prevent any damage, injury or loss resulting from such emergency.

3.14 Scope; Manager Authority. On at least 60 days prior written notice, Owner Agent may revoke or rescind all or any material part of the authority granted to Manager or materially reduce or materially restrict the scope of the Services.

3.15 Retention of Control by Owners. Notwithstanding anything in this Agreement to the contrary, Owners and Manager expressly acknowledge and agree that: (a) this Agreement does not convey ownership or control over the Facilities from Owners to the Manager; and (b) Owners retain ultimate decision-making authority with respect to the Facilities, including ultimate decision-making authority relating to the operation of, and sale of products produced by, the Facilities.

3.16 Limitations on Performance. Notwithstanding anything herein to the contrary, none of the following shall result in a breach of Manager’s obligations under this Agreement to the extent caused by: (i) lack of Availability of Funds, (ii) Force Majeure Events or (iii) any failure by Owners to perform their respective obligations under this Agreement.

3.17 Deficiency of Funds. If funds shall not be sufficient to make applicable disbursements for Operating Disbursements or Direct Reimbursement Expenses, Manager shall promptly notify Owner Agent and Owner Agent shall promptly provide the required funds, subject to the terms of this Agreement. Manager, in its sole discretion, may elect (but shall not be obligated), to advance any such funds for the account of Owners, and Owner Agent shall promptly reimburse Manager for any such advances properly made by Manager in accordance with the terms of this Agreement. Manager shall use commercially reasonable efforts to keep Owner Agent advised as to projected cash deficits so as to permit the orderly funding thereof by Owner Agent.

ARTICLE IV

ITEMS TO BE FURNISHED BY OWNERS

4.1 General. Owners shall furnish to Manager, at Owners’ expense, the information, services, materials and other items described in this Article IV. All such items shall be made available at such times and in such manner as may be reasonably required for the expeditious and orderly performance of the Services by Manager.

4.2 Information. Owners shall provide copies of the Facility Agreements and the Facility Manuals to Manager as well as technical, operational and other Facility information reasonably available to Owners or in Owners’ possession and necessary for the performance of the Services. Subject to the standards of performance set forth in Article III, Manager shall be entitled to rely upon such information in the performance of the Services.

4.3 Corn, Fuel and Other Materials. During the period in which Manager is required to provide O&M Services to a Facility, Owner of such Facility shall be responsible for furnishing and delivering to such Facility: (a) corn, (b) water, (c) natural gas, (d) electricity, (e) denaturant, and (f) any other materials necessary for the operation of such Facility, in each case, in sufficient quantities to produce ethanol and wet distillers grains in accordance with the applicable Facility Agreements.

4.4 Cold Shutdown or Start Up of a Facility. From time to time, upon not less than sixty (60) days notice to Manager, Owner Agent or Owner of a Facility may elect to recommence operations of such Facility that is then in Cold Shutdown or to place such Facility in Cold Shutdown. Within ten (10) days of receipt of any such notice, Manager shall provide Owner’s Agent and Owner of such Facility with a budget for any costs to be incurred with such recommencing operation or Cold Shutdown. Upon agreement of Manager, Owner Agent and Owner of such Facility with respect to such budget, and the concurrence therewith by the Administrative Agent, Manager shall recommence operations or place such Facility in Cold Shutdown, as applicable.

ARTICLE V

DEVELOPMENT PROJECTS; FACILITY SERVICES

5.1 Development Projects. If, during the term of this Agreement, Manager intends to develop or pursue any business opportunity that involves or promotes any Facility assets, properties located adjacent to the Facilities or products produced at the Facilities, then Manager shall notify Owners of such opportunity, including providing reasonable detail thereof (following Owners’ execution of a reasonable and customary confidentiality and non-intervention agreement, if required by Manager), and Manager agrees to negotiate, in good faith, Owners participating in such business opportunity on terms mutually acceptable to the parties. Notwithstanding the foregoing, Manager (i) shall not be under any obligation to include any Owner in any transaction regarding any such opportunities and Owners shall have no right to participate in any such transaction, (ii) shall be free to pursue and engage in such opportunity with any or no party as Manager shall in its sole and absolute discretion deem appropriate, (iii) shall be free to negotiate concurrently with third parties regarding such opportunity and (iv) may cease discussions with Owners regarding any such opportunity at any time and in Manager’s sole discretion.

ARTICLE VI

REPORTING AND PERSONNEL

6.1 Accounts and Reports. Manager shall furnish or cause to be furnished to Owner Agent (i) the reports required to be delivered to the Administrative Agent pursuant to the Financing Documents and (ii) the following reports and information:

6.1.1 CS Reports. (a) With respect to each Facility that is in Cold Shutdown, as soon as available and in any event within 25 days following the end of each calendar month, Manager shall submit to Owner Agent a summary report in the form attached hereto as Appendix C, which report shall include, with respect to each Facility, a numerical and narrative assessment in respect of such month of (i) the Facility’s compliance with each category in the Budget, (ii) plant availability, (iii) cash receipts and disbursements including balances in the Accounts, (iv) major maintenance activity, (v) material casualty losses (whether or not covered by insurance), (vi) disputes with any contractor, materialman, supplier or other Person and any related claims against any Owner, (vii) compliance with governmental permits, and (viii) a comparison of figures to corresponding figures provided in the prior month.

(b) With respect to each Facility that is in Cold Shutdown, as soon as practicable and in any event within 25 days following the end of each calendar quarter, Manager shall submit to Owner Agent a summary report containing the information required to be provided pursuant to Section 6.1.1(a) for the quarter then ended.

6.1.2 Operating Reports. With respect to each Facility that is not in Cold Shutdown, as soon as available and in any event within 25 days following the end of each calendar month, Manager shall submit to Owner Agent a summary report in the form attached hereto as Appendix D, which report shall include, with respect to each such Facility, a numerical and narrative assessment in respect of such month of (i) each such Facility’s compliance with each category in the Budget, (ii) ethanol and WDG production and delivery, (iii) corn deliveries and use, (iv) plant availability, (v) cash receipts and disbursements including balances in the Accounts, (vi) major maintenance activity, (vii) material casualty losses (whether or not covered by insurance), (viii) disputes with any contractor, materialman, supplier or other Person and any related claims against the Owner of each such Facility, (ix) compliance with governmental permits, and (x) a comparison of figures to corresponding figures provided in the prior month.

6.1.3 Manager Report. As soon as available and in any event within ten (10) days after the filing thereof, Manager shall submit to Owner Agent and the Administrative Agent copies of all reports filed by Manager or any Affiliate with the Securities and Exchange Commission, any communications or information provided by Manager to its shareholders, and the monthly financial statements of Kinergy Marketing LLC as provided to its working capital lenders. Each report shall be certified as complete and correct by an Authorized Officer of Manager.

6.1.4 Other Information. Any other information concerning the Services, Owners or the Facilities or reasonably requested by Owner Agent regarding any Facility or the Services.

6.2 Budget. The Budget sets forth the budgeted amounts for all Operating Disbursements and Direct Reimbursement Expenses and for the Asset Management Fee. Manager shall submit a revised Budget each quarter and each year in conjunction with the quarterly and annual budgets provided to the Lenders pursuant to the Credit Agreement. If accepted by the Owners and the Lenders, each such quarterly budget shall serve as the Budget hereunder. Manager shall promptly notify Owner Agent of any actual or anticipated variance from the amounts budgeted for Operating Disbursements and Direct Reimbursement Expenses, the reasons therefor and Manager’s recommendations with respect thereto. Each Owner shall be responsible for (but shall not be obligated to fund) all Operating Disbursements and Direct Reimbursement Expenses in respect of its Facility; provided that any failure by an Owner to provide such funding shall relieve Manager of any obligation hereunder for which there is no Availability of Funds. Each Owner agrees to pay Manager the Asset Management Fee in respect of its Facility; provided that, except as expressly set forth herein, any such failure to fund shall relieve Manager of its obligations hereunder. Manager agrees that the amount of the Asset Management Fee is fixed and that any increase or decrease in the Manager Expenses shall be solely for the account of the Manager and shall not result in any increase or decrease in the amount of the Asset Management Fee.

6.3 Manager Representative. Manager has appointed a representative (a “Manager Representative”) authorized and empowered to act for and on behalf of Manager on all matters concerning this Agreement and the Services with respect to a Facility. The appointment of any Manager Representative shall be subject to the reasonable approval of Owner Agent. Such appointment shall remain in full force and effect until such Manager Representative is replaced by Manager with the reasonable approval of Owner Agent. At any time, a Manager Representative may act through or be represented by one or more individuals appointed by Manager.

ARTICLE VII

LIMITATIONS ON AUTHORITY

Notwithstanding any provision in this Agreement to the contrary, unless otherwise approved in writing in advance by Owner Agent, Manager shall not (and shall not permit any of its agents or representatives to):

(a) sell, lease, pledge, mortgage, encumber, convey, or make any license, exchange or other transfer or disposition of any property or assets of an Owner (other than products produced by an Owner for sale in the ordinary course of business), including any property or assets purchased by Manager hereunder;

(b) make, enter into, execute, amend, terminate, modify or supplement any contract or agreement (including any labor or collective bargaining agreement) on behalf of or in the name of an Owner;

(c) make any expenditure or acquire any equipment, materials, assets or other items, except in substantial conformity with the Budget, or consent or agree to do any of the foregoing; provided, that in the event of an emergency affecting the safety or protection of Persons or endangering a Facility or property located at a Facility, Manager, without approval from Owner Agent, shall be authorized to take all reasonable actions to prevent damage, injury or loss;

(d) settle, compromise, assign, pledge, transfer, release or consent to the compromise, assignment, pledge, transfer or release of, any claim, suit, debt, demand or judgment against or due by, Owners, or initiate, submit or respond to any such claim, dispute or controversy or arbitration or judicial process, or stipulate in respect thereof to a judgment, or consent to the same; or

(e) INTENTIONALLY LEFT BLANK

(f) describe itself as an employee, agent or representative of any Owner;

(g) make any warranty or representation relating to or on behalf of any Owner;

(h) engage in any other transaction on behalf of Owners not permitted under this Agreement; or

(i) commit to or enter into any agreement or arrangement with respect to any of the foregoing.

ARTICLE VIII

COMPENSATION

8.1 Asset Management Fee. As compensation to Manager for the performance of the Services in respect of a Facility, Owner of such Facility shall pay Manager a monthly management fee equal to (i) $75,000 for each calendar month during which a Facility is not in Cold Shutdown, and (ii) $40,000 for each calendar month during which a Facility is in Cold Shutdown (the “Asset Management Fee”), payable in advance in equal semi-monthly installments on the 1st and 11th Business Days of each month by deposit into the Manager Account (and pro rated for partial calendar months) commencing on the Effective Date and continuing for the term of this Agreement with respect to such Facility.

In addition to the foregoing compensation, during any six-month period (measured on September 30 and March 31 of each year commencing March 31, 2011) in which any Facility shall have an annualized EBITDA Per Gallon of Operating Capacity of $.20 or greater, Owner of such Facility shall pay to Manager a performance bonus equal to the product of 3% of the amount by which annualized EBITDA Per Gallon of Operating Capacity at such Facility for such six-month period exceeds $.20 multiplied by the number of gallons of ethanol produced at such Facility during such period; provided that (i) no performance bonus shall be paid at any time when a Default or an Event of Default under the Credit Agreement as a result of Borrower’s failure to pay any amounts then due and owing shall exist and be continuing; (ii) such performance bonus shall be capped at $2.2 million for each six-month period; and (iii) such performance bonus shall be reduced by 25% if all Facilities then operating do not operate at a minimum average yield (in the aggregate across all operating Facilities) of 2.70 gallons of denatured ethanol per bushel of corn during such six-month period.

An example of this computation is set forth in Exhibit I.

8.2 Sale Incentive Fee. Upon the sale of all or substantially all the assets of a Facility or all of the equity interests in an Owner of a Facility, in each case to a third party (for sake of clarity, a sale to Manager or any Affiliate of Manager shall not be considered a sale to a third party for this purpose), Manager shall receive an Incentive Fee with respect to such sale, as set forth below:

|

|

|

|

| |

|

|

|

Tier I

|

$.60 or less

|

0

|

| |

|

|

|

Tier II

|

Above $.60 up to and including $.70

|

The excess of Sale Price Per Gallon over $.60, to and including the lesser of the Sale Price Per Gallon and $.70, multiplied by the Operating Capacity of the Facility (in gallons), multiplied by 0.5%; plus

|

| |

|

|

|

Tier III

|

Above $.70 up to and including $.80

|

If the Sale Price Per Gallon exceeds $.70, the excess of the Sale Price Per Gallon over $.70, to and including the lesser of the Sale Price Per Gallon and $.80, multiplied by the Operating Capacity of the Facility (in gallons), multiplied by 1.0%; plus

|

| |

|

|

|

Tier IV

|

Above $.80

|

If the Sale Price Per Gallon exceeds $.80, the excess of the Sale Price Per Gallon over $.80, multiplied by the Operating Capacity of the Facility (in gallons), multiplied by 1.5%.

|

An example of this computation is set forth in Exhibit II.

8.3 Lien Waivers. In connection with any payment of the Asset Management Fee, Manager shall provide such releases or waivers of mechanics or other liens as any Owner may require.

8.4 Netting. If the Parties each owe an amount to the other for obligations incurred under this Agreement, the undisputed portion(s) of such amounts shall be aggregated, and the Parties shall satisfy their payment obligations through netting, in which case the Party owing the greater aggregate undisputed amount shall pay to the other Party the difference between the undisputed amounts owed.

8.5 INTENTIONALLY LEFT BLANK

ARTICLE IX

TERM

9.1 Term. This Agreement shall be effective as of June 30, 2011 (the “Effective Date”) and, unless earlier terminated in accordance with its terms, shall continue in effect until and including June 30, 2012; provided, that either Owner Agent or Manager may extend this Agreement for additional one year periods, in each case by written notice to the other (an “Extension Notice”) delivered not less than ninety (90) days prior to the end of the original or renewal term, provided further that this Agreement shall nonetheless terminate if the recipient of any such Extension Notice rejects such extension in a written notice delivered to the party that issued such Extension Notice not more than fifteen (15) days after receipt of the Extension Notice. Notwithstanding anything to the contrary contained herein, the obligations set forth in Section 3.9 hereof shall survive the termination or expiration of this Agreement; provided, that (i) following the termination of this Agreement with respect to the Magic Valley Facility by Burley pursuant to Section 9.4, the total liability of Manager with respect to such obligations relating to the Magic Valley Facility hereunder and under Section 2.01(b) of the Sponsor Support Agreement shall not exceed the reasonable cost of performing such obligations as estimated by the Independent Engineer plus fifteen percent (15%) of such estimate and (ii) such obligations relating to the Stockton Facility shall survive only to the extent that Stockton pays to Manager any amounts required to perform such obligations constituting Operating Disbursements or Direct Reimbursement Expenses.

9.2 Owner Defaults and Manager Remedies. Upon the occurrence of any of the following events, Manager may exercise such rights and remedies as may be available to it at law or in equity, including the right to terminate this Agreement with respect to any Facility or Facilities, by written notice to the Owners:

(a) the failure by an Owner to pay the Asset Management Fee required to be paid to Manager hereunder when due, and such failure continues for ten (10) days after receipt of written notice from Manager of such failure, with respect to the first such failure and within five (5) days after receipt of written notice from Manager of such failure with respect to any subsequent such failure;

(b) the failure by an Owner to make any other payment, deposit or transfer required to be paid to Manager hereunder when due and such failure continues for fifteen (15) days after receipt of written notice from Manager of such failure;

(c) the failure of any statement, representation or warranty made by such Owner in this Agreement to have been correct in any material respect when made if such failure could reasonably be expected to have a material adverse effect on such Owner’s ability to perform its obligations under this Agreement; or

(d) the failure of such Owner to perform any of its material obligations under this Agreement (other than with respect to the payment of money) and such failure continues for thirty (30) days after receipt of written notice from Manager of such failure; provided, that such thirty (30) day period shall be extended for up to an aggregate of ninety (90) days so long as such Owner is diligently attempting to cure such failure.

9.3 Manager Defaults and Owner Remedies. Upon the occurrence of any of the following events, each Owner may exercise such rights and remedies as may be available to it at law or in equity, including the right to terminate this Agreement with respect to such Owner’s Facility or the right of the Owners to terminate this Agreement with respect to all Facilities, by written notice to the Manager, provided, that no such notice shall be required for a termination pursuant to clause (c) of this Section 9.3:

(a) the failure by Manager to make any payment, deposit or transfer required hereunder when due and such failure continues for fifteen (15) days after receipt of written notice from such Owner of such failure;

(b) the failure of any statement, representation or warranty made by Manager in this Agreement to have been correct in any material respect when made if such failure could reasonably be expected to have a material adverse effect on Manager’s ability to perform its obligations under this Agreement;

(c) the occurrence of an Act of Insolvency with respect to Manager; or

(d) the failure of Manager to perform any of its material obligations under this Agreement and such failure continues for thirty (30) days after receipt of written notice from such Owner of such failure; provided, that such thirty (30) day period shall be extended for up to an aggregate of ninety (90) days so long as Manager is diligently attempting to cure such failure.

9.4 Termination for Convenience. Each Owner may terminate this Agreement with respect to its Facility for any reason upon (x) sixty (60) days prior written notice to Manager or (y) less than sixty (60) days prior written notice to Manager if such Owner shall pay the Supplemental Termination Payment. Manager may terminate this Agreement with respect to the Facilities for any reason upon sixty (60) days prior written notice to Owner Agent.

9.5 Facility Condition at End of Term; Successor Manager.

(a) Upon expiration or termination of this Agreement with respect to a Facility, Manager shall remove its personnel from such Facility. Manager shall leave such Facility in as good condition as at the date hereof subject to (i) normal wear and tear, (ii) if a Facility has suffered damages covered by insurance, the availability to Manager of the proceeds of such insurance and (iii) changes in condition resulting from Force Majeure Events; provided that Manager is otherwise in compliance with its obligations under this Agreement. All special tools, improvements, inventory of supplies, spare parts, safety equipment (in each case as obtained by or provided by Manager and paid for by Owners during the term of this Agreement), Facilities Records, and any other items furnished under this Agreement will be left at the Facility and will remain the property of Owner without additional charge. Owners shall also have the right, in their sole discretion, to directly assume and become liable for any contracts or obligations that Manager may have undertaken with third parties principally in connection with the Services. Manager shall execute all documents and take all other reasonable steps requested by Owner that may be required to assign to and vest in Owner all rights and obligations, benefits, interests and title in connection with such contracts or obligations. Notwithstanding the foregoing, Manager, at all times, shall be deemed the owner of and shall be permitted to retain or remove all trademarks, logos, trade names and similar proprietary rights of Manager and its Affiliates (“Manager Proprietary Property”) and shall disable all connections to Manager’s ERP System servicing the Facilities (provided that Manager shall provide hard copies of financial, operational and other information relating principally to the Facilities as reasonably requested by Owners).

(b) Upon expiration or termination of this Agreement with respect to a Facility, Manager shall, at the request and expense of Owner of such Facility, assist such Owner in arranging for the future performance of the Services by such Owner or the successor to Manager (the “Successor Manager”), provided that Manager shall provide such assistance at no charge to such Owner if the Agreement is terminated pursuant to Section 9.3. Manager shall provide such Owner and the Successor Manager full access to such Facility and to all relevant information, data and records relating thereto reasonably required for taking over the performance of Services for such Facility.

(c) Promptly after expiration or termination of this Agreement with respect to a Facility, Manager shall deliver to Owner of such Facility or (if so required by such Owner by notice to Manager) to the Successor Manager all property in its possession or under its control owned by such Owner or leased or licensed to such Owner.

(d) The parties agree that Manager has granted each Owner and Owner’s Agent a license to use the name “Pacific Ethanol”. Upon expiration or termination of this Agreement, each Owner and Owner Agent as promptly as practicable shall cease using the name Pacific Ethanol and shall change its name to delete any reference to Pacific Ethanol, it being understood that Owner and Owner’s Agent may use existing letterhead and similar supplies for a period not to exceed 30 days.

9.6 Termination Payment; Manager Payment.

9.6.1 Termination Payment. Promptly after the date of any termination, Manager shall be paid on a pro rata basis (i) the Asset Management Fee earned through the date of termination but not paid (the “Termination Payment”), (ii) if such termination is pursuant clause (y) of Section 9.4 the Supplemental Termination Payment and (iii) all other payments that it is entitled to under this Agreement for the period through the date of termination. Except for the Termination Payment, the Supplemental Termination Payment, if applicable, and such other payments, Owners shall not be liable for any costs incident to termination.

9.6.2 Manager Payment. Subject to Article XII, in the event of a termination of this Agreement by an Owner under Section 9.3, such Owner shall be entitled to recover from Manager any damages, costs, fines or penalties such Owner suffers or incurs as a result of any such termination, including the reasonable costs of mobilizing and training a successor Manager, and such Owner hereby releases Manager from any liability in excess thereof. In calculating such reasonable costs, any savings achieved due to the retention by the successor Manager of any or part of the Facility workforce shall be taken into account.

ARTICLE X

INSURANCE

10.1 Manager Insurance. Without limiting any of the other obligations or liabilities of Manager under this Agreement, Manager shall at all times carry and maintain or cause to be carried and maintained, the minimum insurance coverage set forth in this Section 10.1:

(a) Manager shall maintain (i) Workers’ Compensation insurance in compliance with the workers’ compensation laws of the jurisdictions in which each Facility is located as extended by the Broad Form All States Endorsements, the United States Longshoreman’s and Harbor Workers’ Coverage Endorsements on an if-any-exposure basis and the Voluntary Compensation Coverage Endorsement, and (ii) Employer’s Liability (including Occupational Disease) coverage with limits of not less than $1,000,000, which shall cover all of Manager’s employees engaged in providing services hereunder.

(b) Manager shall maintain automobile liability insurance for owned (if any), non-owned and hired vehicles with combined single limits for bodily injury/property damage not less than $1,000,000 per occurrence and containing appropriate no-fault insurance provisions wherever applicable.

(c) Manager will maintain commercial general liability insurance with a limit for bodily injury/property damage of not less than $1,000,000 per occurrence and $2,000,000 in the annual aggregate. Such coverage shall include premises/operations, explosion, collapse and underground property damage, broad form contractual, independent contractors, products/completed operations (including Manager errors and omissions), broad form property damage, sudden and accidental pollution, personal injury and incidental professional liability (if not covered under product/completed operations and if commercially available).

(d) Manager shall maintain or cause to be maintained umbrella liability insurance providing coverage limits in excess of those set forth in Section (a), (b) and (c) above. The limits of this umbrella coverage shall not be less than $10,000,000 per occurrence and in the annual aggregate.