UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-1A

File No. 033-00442

File No. 811-04413

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | /X/ | |||

|

|

| ||

| Pre-Effective Amendment No. |

|

| / / |

| Post-Effective Amendment No. | 90 |

| /X/ |

|

|

| ||

|

| and/or | ||

|

|

| ||

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | /X/ | |||

|

|

| ||

| Amendment No. | 90 |

|

|

| ||||

(Check appropriate box or boxes) | ||||

|

|

| ||

DELAWARE GROUP EQUITY FUNDS IV | ||||

(Exact Name of Registrant as Specified in Charter) | ||||

|

|

| ||

100 Independence, 610 Market Street, Philadelphia, PA | 19106-2354 | |||

(Address of Principal Executive Offices) | (Zip Code) | |||

|

|

| ||

Registrant’s Telephone Number, including Area Code: | (800) 523-1918 | |||

|

|

| ||

David F. Connor, Esq., 100 Independence, 610 Market Street, Philadelphia, PA 19106-2354 | ||||

(Name and Address of Agent for Service) | ||||

|

|

| ||

Please send copies of all communications to: Jonathan M. Kopcsik, Esq. Taylor Brody, Esq. Stradley, Ronon, Stevens & Young, LLP 2005 Market Street, Suite 2600, Philadelphia, PA 19103-7018 (215) 564-8099 (215) 564-8071 | ||||

Approximate Date of Proposed Public Offering: | January 19, 2023 | |||

|

|

| ||

It is proposed that this filing will become effective (check appropriate box): | ||||

| ||||

/X/ | immediately upon filing pursuant to paragraph (b) | |||

/ / | on (date) pursuant to paragraph (b) | |||

/ / | 60 days after filing pursuant to paragraph (a)(1) | |||

/ / | on (date) pursuant to paragraph (a)(1) | |||

/ / | 75 days after filing pursuant to paragraph (a)(2) | |||

/ / | on (date) pursuant to paragraph (a)(2) of Rule 485. | |||

|

|

| ||

If appropriate, check the following box: | ||||

| ||||

/ / | this post-effective amendment designates a new effective date for a previously filed post-effective amendment. | |||

The Registrant is filing this Post-Effective Amendment (the “Amendment”) for the purpose of adding a new C class and a new R class of shares to the Registrant’s Delaware Opportunity Fund (the “Fund”). The prospectuses and statements of additional information relating to the other series of the Registrant are not amended or superseded hereby.

--- C O N T E N T S ---

This Post-Effective Amendment No. 89 to Registration File No. 033-00442 includes the following:

| 1. | Facing Page |

| 2. | Contents Page |

| 3. | Part A – Prospectus |

| 4. | Part B – Statement of Additional Information |

| 5. | Part C – Other Information |

| 6. | Signatures |

| 7. | Exhibits |

Delaware Group® Equity Funds IV

Nasdaq ticker symbols | ||

| Class C | Class R |

Delaware Opportunity Fund | ||

The US Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Prospectus.

Any representation to the contrary is a criminal offense.

Get shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Table of contents

Fund summary | 1 |

Delaware Opportunity Fund | 1 |

How we manage the Fund | 6 |

Our principal investment strategies | 6 |

The securities in which the Fund typically invests | 6 |

The risks of investing in the Fund | 7 |

Disclosure of portfolio holdings information | 9 |

Who manages the Fund | 10 |

Investment manager | 10 |

Sub-advisors | 10 |

Portfolio managers | 10 |

Manager of managers structure | 11 |

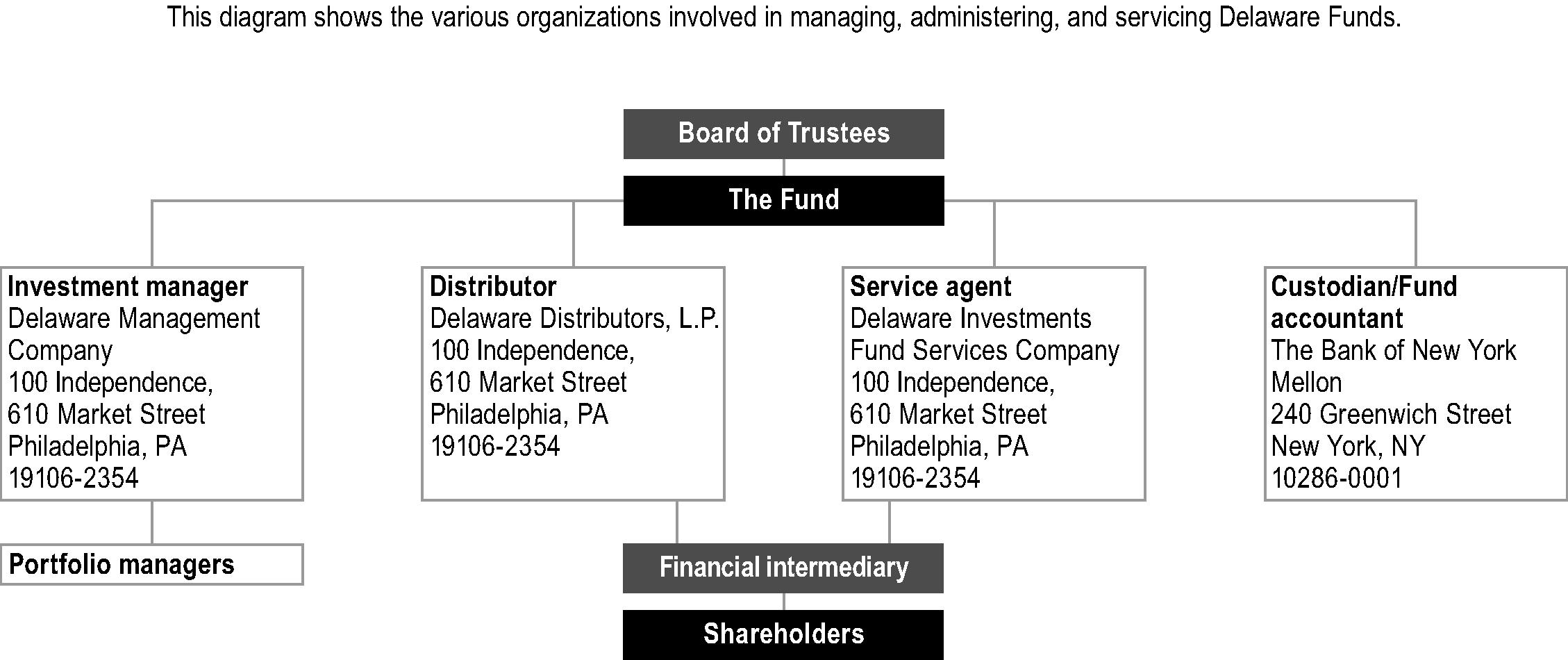

Who’s who | 12 |

About your account | 13 |

Investing in the Fund | 13 |

Choosing a share class | 13 |

Dealer compensation | 14 |

Payments to intermediaries | 14 |

Waivers of contingent deferred sales charges | 15 |

How to buy shares | 16 |

Calculating share price | 16 |

Fair valuation | 17 |

Retirement plans | 17 |

Document delivery | 17 |

Inactive accounts | 17 |

How to redeem shares | 18 |

Low balance accounts | 19 |

Investor services | 19 |

Frequent trading of Fund shares (market timing and disruptive trading) | 20 |

Dividends, distributions, and taxes | 22 |

Certain management considerations | 24 |

Financial highlights | 25 |

Additional information | 33 |

Fund summary

Delaware Opportunity Fund

Delaware Opportunity Fund seeks long-term capital growth.

The table below describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Class | C | R |

Maximum sales charge (load) imposed on purchases as a percentage of offering price | ||

Maximum contingent deferred sales charge (load) as a percentage of original purchase price or redemption price, whichever is lower |

Class | C | R | |

Management fees | |||

Distribution and service (12b-1) fees | |||

Other expenses | |||

Total annual fund operating expenses | |||

Fee waivers and expense reimbursements | ( | ( | |

Total annual fund operating expenses after fee waivers and expense reimbursements | |||

1 | |||

2 | |||

3 | |||

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. In addition, the example shows expenses for Class C shares, assuming those shares were not redeemed at the end of those periods. The example also assumes that your investment has a 5% return each year and reflects the Manager’s expense waivers and reimbursements for the 2-year contractual period and the total operating expenses without waivers for years 3 through 10. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Class | (if not | C | R |

1 year | $ | $ | $ |

3 years | $ | $ | $ |

5 years | $ | $ | $ |

10 years | $ | $ | $ |

1

Fund summary

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was

The Fund uses a “bottom-up” approach to selecting investments. The Fund uses fundamental research to search for companies that have one or more of the following: a strong balance sheet; experienced management; and stocks that are attractively priced. The Fund attempts to stay broadly diversified, but it may emphasize certain industry sectors based upon economic and market conditions.

The Fund may sell a stock if it becomes fully valued, its fundamentals have deteriorated, or alternative investments become more attractive. The Fund may also sell a stock if it grows into a large, well-established company, although it may also continue to hold such a stock irrespective of its size.

The Manager may permit its affiliate, Macquarie Investment Management Global Limited (MIMGL), to execute Fund security trades on behalf of the Manager. The Manager may also seek quantitative support from MIMGL.

Market risk — The risk that all or a majority of the securities in a certain market — such as the stock or bond market — will decline in value because of factors such as adverse political or economic conditions, future expectations, investor confidence, or heavy institutional selling.

Company size risk — The risk that investments in small- and/or medium-sized companies may be more volatile than those of larger companies because of limited financial resources or dependence on narrow product lines.

Exchange-traded fund risk — The risks of investing in an exchange-traded fund (ETF) typically reflect the risks of the types of instruments in which the ETF invests. Because ETFs are investment companies, a fund will bear its proportionate share of the fees and expenses of an investment in an ETF. As a result, a fund’s expenses may be higher and performance may be lower.

Real estate industry risk — This risk includes, among others: possible declines in the value of real estate; risks related to general and local economic conditions; possible lack of availability of mortgage funds; overbuilding; extended vacancies of properties; increases in competition, property taxes, and operating expenses; changes in zoning laws; costs resulting from the cleanup of, and liability to third parties resulting from, environmental problems; casualty for condemnation losses; uninsured damages from floods, earthquakes, or other natural disasters; limitations on and variations in rents; and changes in interest rates.

Liquidity risk — The possibility that investments cannot be readily sold within seven calendar days at approximately the price at which a fund has valued them.

IBOR risk — The risk that changes related to the use of the London Interbank Offered Rate (LIBOR) or similar interbank offered rates (“IBORs,” such as the Euro Overnight Index Average (EONIA)) could have adverse impacts on financial instruments that reference LIBOR or a similar rate. While some instruments may contemplate a scenario where LIBOR or a similar rate is no longer available by providing for an alternative rate setting methodology, not all instruments have such fallback provisions and the effectiveness of replacement rates is uncertain. The abandonment of LIBOR and similar rates could affect the value and liquidity of instruments that reference such rates, especially those that do not have fallback provisions. The use of alternative reference rate products may impact investment strategy performance.

2

Active management and selection risk — The risk that the securities selected by a fund’s management will underperform the markets, the relevant indices, or the securities selected by other funds with similar investment objectives and investment strategies. The securities and sectors selected may vary from the securities and sectors included in the relevant index.

None of the entities noted in this document is an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia) and the obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (Macquarie Bank). Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these entities. In addition, if this document relates to an investment (a) each investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group company guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

Class C and Class R shares had not commenced operations as of the date of this Prospectus and therefore performance of the Class C and Class R shares is not included below. The performance of the Class C and Class R shares will appear in a future version of this Prospectus after Class C and Class R shares have annual returns for one complete calendar year.

The returns shown for periods ending on or prior to October 4, 2019 reflect the performance and expenses of the Predecessor Fund. The Predecessor Fund was reorganized into the Fund after the close of business on October 4, 2019. The returns shown for periods after October 4, 2019 reflect the performance and expenses of the Fund.

You may obtain the Fund’s most recently available month-end performance by calling

Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

Year Total Return | - | - | - |

As of

Class C and Class R shares had not commenced operations as of the date of this Prospectus and are therefore not included below.

3

Fund summary

1 year | 5 years | 10 years or lifetime | |

Class A return before taxes | |||

Class A return after taxes on distributions | |||

Class A return after taxes on distributions and sale of Fund shares | |||

Institutional Class return before taxes (lifetime: | |||

Class R6 return before taxes (lifetime: | |||

Russell Midcap® Value Index |

Who manages the Fund?

Investment manager

Delaware Management Company, a series of Macquarie Investment Management Business Trust (a Delaware statutory trust)

Portfolio managers | Title with Delaware Management Company | Start date on the Fund |

Kelley M. Carabasi, CFA | Co-Chief Investment Officer – US Small-Mid Cap Value Equity | October 2019 |

Kent P. Madden, CFA | Co-Chief Investment Officer – US Small-Mid Cap Value Equity | October 2019 |

Steven G. Catricks, CFA | Senior Portfolio Manager | October 2019 |

Michael Foley, CFA | Senior Portfolio Manager | October 2019 |

Sub-advisor

Macquarie Investment Management Global Limited (MIMGL)

Purchase and redemption of Fund shares

You may purchase or redeem shares of the Fund on any day that the New York Stock Exchange (NYSE) is open for business (Business Day). Shares may be purchased or redeemed: through your financial intermediary; through the Fund’s website at delawarefunds.com/account-access; by calling 800 523-1918; by regular mail (c/o Delaware Funds by Macquarie®, P.O. Box 9876, Providence, RI 02940-8076); by overnight courier service (c/o Delaware Funds by Macquarie Service Center, 4400 Computer Drive, Westborough, MA 01581-1722); or by wire.

For Class C shares, the minimum initial investment is generally $1,000 and subsequent investments can be made for as little as $100. The minimum initial investment for IRAs, Uniform Gifts/Transfers to Minors Act accounts, direct deposit purchase plans, and automatic investment plans is $250 and through Coverdell Education Savings Accounts is $500, and subsequent investments in these accounts can be made for as little as $25. For Class R shares (except those shares purchased through an automatic investment plan), there is no minimum initial purchase requirement, but certain eligibility requirements must be met. The eligibility requirements are described in this Prospectus under “Choosing a share class” and on the Fund’s website. We may reduce or waive the minimums or eligibility requirements in certain cases.

Tax information

The Fund’s distributions generally are taxable to you as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an IRA, in which case your distributions may be taxed as ordinary income when withdrawn from the tax-advantaged account.

4

Payments to broker/dealers and other financial intermediaries

If you purchase shares of the Fund through a broker/dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

5

How we manage the Fund

Our principal investment strategies

Delaware Opportunity Fund

The Fund invests primarily in mid-size companies that the Manager believes offer attractive valuation and quality characteristics. The Fund invests primarily in US companies but may also invest in foreign companies that are listed in the US. Companies with attractive valuations are those that have a lower valuation than the company's historical average valuation and a lower valuation than the company's competitors. Companies with quality characteristics will make shareholder friendly use of its cash flow, which would include, but is not limited to: dividend payments or increases, share repurchases, and repayment of debt. The Fund also may invest in exchange-traded funds (ETFs) to gain exposure to such securities and up to 20% of its net assets in real estate investment trusts (REITs). The Fund may continue to hold stocks of mid-size companies that grow into larger companies and may also invest opportunistically in stocks of larger companies.

The Fund uses a “bottom-up” approach to selecting investments. The Fund uses fundamental research to search for companies that the Manager believes have one or more of the following: a strong balance sheet; experienced management; and stocks that are attractively priced. The Fund attempts to stay broadly diversified, but it may emphasize certain industry sectors based upon economic and market conditions.

The Fund may sell a stock if it becomes fully valued, its fundamentals have deteriorated or alternative investments become more attractive. The Fund may also sell a stock if it grows into a large, well-established company, although it may also continue to hold such a stock irrespective of its size.

The Fund considers medium-sized companies to be those companies whose market capitalizations fall within the range represented in the Russell Midcap® Value Index (Index) at the time of the Fund's investment. As of May 6, 2022, the smallest company included in the Index had a market capitalization of $2.9 billion and the largest company included in the Index had a market capitalization of $46.5 billion. The market capitalization range for the Russell Midcap Value Index will change on a periodic basis. A company's market capitalization is determined based on its current market capitalization. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

The Manager may permit its affiliate, Macquarie Investment Management Global Limited (MIMGL), to execute Fund security trades on behalf of the Manager. The Manager may also seek quantitative support from MIMGL.

The Statement of Additional Information also describes non-principal investment strategies that the Fund may use, including investing in other types of investments that are not described in this Prospectus.

The securities in which the Fund typically invest

Please see the Fund's SAI for additional information about certain of the securities described below as well as other securities in which the Fund may invest.

|

Common or ordinary stocks |

Common or ordinary stocks are securities that represent shares of ownership in a corporation. Stockholders may participate in a corporation's profits through its distributions of dividends to stockholders, proportionate to the number of shares they own.

How the Fund use them: The portfolio managers will generally invest the Fund's assets in common or ordinary stocks, some of which may be dividend-paying stocks.

|

Foreign securities |

Foreign securities are securities of issuers which are classified by index providers, or by the investment manager applying internally consistent guidelines, as being assigned to countries outside the United States. Investments in foreign securities include investments in American depositary receipts (ADRs), European depositary receipts (EDRs), and global depositary receipts (GDRs). ADRs are receipts issued by a depositary (usually a US bank) and EDRs and GDRs are receipts issued by a depositary outside of the US (usually a non-US bank or trust company or a foreign branch of a US bank). Depositary receipts represent an ownership interest in an underlying security that is held by the depositary. Generally, the underlying security represented by an ADR is issued by a foreign issuer and the underlying security represented by an EDR or GDR may be issued by a foreign or US issuer. Sponsored depositary receipts are issued jointly by the issuer of the underlying security and the depositary, and unsponsored depositary receipts are issued by the depositary without the participation of the issuer of the underlying security. Generally, the holder of the depositary receipt is entitled to all payments of interest, dividends, or capital gains that are made on the underlying security.

How the Fund use them: The Fund may invest in securities of foreign companies traded in the United States.

6

|

Investment company securities |

Any investments in investment company securities, including exchange-traded funds (ETFs), will be limited by the Investment Company Act of 1940, as amended (the “1940 Act”), and any rules thereunder, and would involve a payment of the pro rata portion of their expenses, including advisory fees, of such other investment companies. Under the current 1940 Act limitations, without an exemption a fund generally may not: (i) own more than 3% of the voting stock of another investment company; (ii) invest more than 5% of a fund's total assets in the shares of any one investment company; or (iii) invest more than 10% of a fund's total assets in shares of other investment companies, unless any rules, regulations or no-action or exemptive relief under the 1940 Act permit a fund's investments to exceed such limits. These percentage limitations also apply to a fund's investment in an unregistered investment company.

How the Fund use them: The Fund may invest in investment company securities, which include securities of exchange-traded funds.

|

Real estate investment trusts (REITs) |

REITs are pooled investment vehicles that invest primarily in income-producing real estate or real estate-related loans or interests. REITs are generally classified as equity REITs, mortgage REITs, or a combination of equity and mortgage REITs. Equity REITs invest the majority of their assets directly in real property and derive income primarily from the collection of rents. Equity REITs can also realize capital gains by selling properties that have appreciated in value. Mortgage REITs invest the majority of their assets in real estate mortgages and derive income from the collection of interest payments.

How the Fund use them: The Fund may invest in REITs.

Other non-principal investment strategies

|

Borrowing from banks |

The Fund may borrow money from banks as a temporary measure for extraordinary or emergency purposes or to facilitate redemptions. A Fund will be required to pay interest to the lending banks on the amount borrowed. As a result, borrowing money could result in a Fund being unable to meet its investment objective. The Fund will not borrow money in excess of one-third of the value of its total assets.

|

Purchasing securities on a when-issued or delayed-delivery basis |

The Fund may buy or sell securities on a when-issued or delayed-delivery basis (i.e., paying for securities before delivery or taking delivery at a later date).

|

Temporary defensive positions |

In response to unfavorable market conditions, a Fund may make temporary investments in cash or cash equivalents or other high-quality, short-term instruments. These investments may not be consistent with a Fund's investment objective. To the extent that a Fund holds such instruments, it may be unable to achieve its investment objective.

|

Illiquid investments |

Illiquid investments are any investment that a fund reasonably expects cannot be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment.

How the Fund use them: The Fund may invest up to 15% of its net assets in illiquid investments.

|

Restricted securities |

Restricted securities are privately placed securities whose resale is restricted under US securities laws.

How the Fund use them: The Fund may invest in privately placed securities, including those that are eligible for resale only among certain institutional buyers without registration, which are commonly known as “Rule 144A Securities.” Restricted securities that are determined to be illiquid may not exceed a Fund's limit on investments in illiquid investments.

The risks of investing in the Fund

Investing in any mutual fund involves risk, including the risk that you may receive little or no return on your investment, and the risk that you may lose part or all of the money you invest. Before you invest in the Fund, you should carefully evaluate the risks. Because of the nature of the Fund, you should consider your investment to be a long-term investment that typically provides the best results when held for a number of years. The information below describes the principal risks you assume when investing in the Fund. Please see the SAI for a further discussion of these risks and other risks not discussed here.

7

How we manage the Fund

Delaware Opportunity Fund

|

Market risk |

Market risk is the risk that all or a majority of the securities in a certain market — such as the stock or bond market — will decline in value because of factors such as adverse political or economic conditions, future expectations, investor confidence, or heavy institutional selling.

How the Fund strives to manage it: The Manager maintains a long-term investment approach and focuses on securities that the Manager believes can appreciate over an extended period of time regardless of interim market fluctuations. Generally, the Manager does not try to predict overall stock market movements. Although the Fund may hold securities for any amount of time, the Manager generally does not trade for short-term purposes.

|

Company size risk |

Company size risk is the risk that investments in small- and/or medium-sized companies typically exhibit higher volatility than investments in larger, more established companies. Company size risk also comes from lower liquidity typically associated with small company stocks, which means the price may be affected by poorly executed trades, even if the underlying business of the company is unchanged.

How the Fund strives to manage it: The Fund may invest in small- and medium-sized companies. The Manager believes medium-sized companies, in general, are more stable than smaller companies and involve less risk due to their larger size, greater experience, and more extensive financial resources. Nonetheless, medium-sized companies have many of the same risks as small companies and are considered to be riskier, in general, than large-sized companies. To address this risk, the Manager seeks a well-diversified portfolio, selects stocks carefully, and monitors them frequently.

|

Exchange-traded funds risk |

The risks of investing in securities of an ETF typically reflect the risks of the instruments in which the underlying ETF invests.

Because ETFs are listed on an exchange, ETFs may be subject to trading halts and may trade at a discount or premium to their NAV. In addition, ETFs are investment companies, and a fund will bear its proportionate share of the fees and expenses of an investment in an ETF. As a result, a fund's expenses may be higher and performance may be lower.

The in-kind redemption and purchase mechanism of ETFs used by market makers seeking to arbitrage away any differences in the market value as compared with net asset value generally keeps premium or discounts to a minimal level.

How the Fund strives to manage it: The Fund's total investments in ETF's will not exceed 5% of net assets in any one ETF and 10% in all positions in investment companies, including ETF's, in the aggregate, unless the Fund's investments are permitted to exceed those limits by any rules, regulations or no-action or exemptive relief under the 1940 Act.

|

Real estate industry risk |

Real estate industry risk includes, among others: possible declines in the value of real estate; risks related to general and local economic conditions; possible lack of availability of mortgage funds; overbuilding; extended vacancies of properties; increases in competition, property taxes, and operating expenses; changes in zoning laws; costs resulting from the cleanup of, and liability to third parties resulting from, environmental problems; casualty for condemnation losses; uninsured damages from floods, earthquakes, or other natural disasters; limitations on and variations in rents; and changes in interest rates. REITs are subject to substantial cash flow dependency, defaults by borrowers, self-liquidation, and the risk of failing to qualify for tax-free pass-through of income under the Internal Revenue Code of 1986, as amended (Internal Revenue Code), or other similar statutes in non-US countries and/or to maintain exemptions from the Investment Company Act of 1940, as amended.

How the Fund strives to manage it: The Manager may invest a substantial portion of the Fund's assets in REITs, which generally offer high income potential relative to other categories of stocks. The Manager carefully selects REITs based on the Manager's assessment of the quality of their management and their ability to generate substantial cash flow, which the Manager believes can help to shield the Fund from some of the risks involved with real estate investing.

|

Liquidity risk |

Liquidity risk is the possibility that investments cannot be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. Illiquid investments may trade at a discount from comparable, more liquid investments, and may be subject to wide fluctuations in market value. A fund also may not be able to dispose of illiquid investments at a favorable time or price during periods of infrequent trading of an illiquid investment.

How the Fund strives to manage it: The Fund limits exposure to illiquid investments to no more than 15% of its net assets.

8

|

IBOR risk |

The risk that changes related to the use of the London Interbank Offered Rate (LIBOR) or similar interbank offered rates (“IBORs,” such as the Euro Overnight Index Average (EONIA)) could have adverse impacts on financial instruments that reference such rates. While some instruments may contemplate a scenario where LIBOR or a similar rate is no longer available by providing for an alternative rate setting methodology, not all instruments have such fallback provisions and the effectiveness of replacement rates is uncertain. The abandonment of LIBOR and similar rates could affect the value and liquidity of instruments that reference such rates, especially those that do not have fallback provisions. The use of alternative reference rate products may impact investment strategy performance.

How the Fund strives to manage it: Due to uncertainty regarding the future use of LIBOR or similar rates (such as the EONIA), the impact of the abandonment of such rates on the Fund or the financial instruments in which the Fund invests cannot yet be determined. However, the Fund tries to address such risk by monitoring the economic, political and regulatory climate in jurisdictions relevant to the Fund and the financial instruments in which the Fund invests in order to minimize any potential impact on the Fund. In addition, the Fund typically invests in a number of different securities in a variety of sectors in order to minimize the impact to the Fund of any legislative or regulatory development affecting particular countries, issuers, or market sectors.

|

Natural disaster and epidemic risk |

Natural disaster and epidemic risk is the risk that the value of a fund's investments may be negatively affected by natural disasters, epidemics, or similar events. Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis, and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and can be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of a fund's investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries. These disruptions could prevent a fund from executing advantageous investment decisions in a timely manner and could negatively impact the fund's ability to achieve its investment objective.

How the Fund strives to manage it: The Fund maintains a long-term investment approach and focuses on securities that the portfolio managers believe can appreciate over an extended period of time regardless of interim market fluctuations. Generally, the portfolio managers do not try to predict overall market movements, but the portfolio managers do note trends in the economy, industries, and financial markets. Although the Fund may hold securities for any amount of time, it generally does not trade for short-term purposes.

Disclosure of portfolio holdings information

A description of the Fund's policies and procedures with respect to the disclosure of their portfolio securities is available in the SAI.

9

Who manages the Fund

Investment manager

The Manager, located at 100 Independence, 610 Market Street, Philadelphia, PA 19106-2354, is the Fund's investment manager. Together, the Manager and the other subsidiaries of Macquarie Management Holdings, Inc. (MMHI) manage, as of September 30, 2022, $192.2 billion in assets, including mutual funds, separate accounts, and other investment vehicles. The Manager and its predecessors have been managing Delaware Funds since 1938. The Manager is a series of Macquarie Investment Management Business Trust (a Delaware statutory trust), which is a subsidiary of MMHI. MMHI is a wholly owned subsidiary of Macquarie Group Limited. The Manager makes investment decisions for the Fund, manages the Fund's business affairs, and provides daily administrative services.For its services to the Fund, the Manager was paid an aggregate fee, net of fee waivers (if applicable), during the last fiscal year as follows:

|

|

As a percentage of average daily net assets |

||

|

Delaware Opportunity Fund

|

0.74% |

||

A discussion of the basis for the Board's approval of the Fund's investment advisory contract is available in the Fund's annual report to shareholders for the period ended September 30, 2022.

Sub-advisor

Macquarie Investment Management Global Limited

Macquarie Investment Management Global Limited (MIMGL), located at 50 Martin Place, Sydney, Australia. MIMGL is an affiliate of the Manager and a part of MIM. Although the Manager has principal responsibility for the Manager's portion of the Fund, the Manager may permit MIMGL to execute Fund security trades on behalf of the Manager.

A discussion of the basis for the Board's approval of the sub-advisory contract is available in the Fund's annual report to shareholders for the period ended September 30, 2022.

Portfolio managers

Delaware Opportunity Fund

Kelley M. Carabasi and Kent P. Madden have primary responsibility for making day-to-day investment decisions for the Fund. Ms. Carabasi and Mr. Madden regularly consult with Steven G. Catricks and Michael Foley.

Kelley M. Carabasi, CFA Co-Chief Investment Officer — US Small-Mid Cap Value Equity

Kelley M. Carabasi, CFA, is a Co-Chief Investment Officer for the US Small-Mid Cap Value Equity team, a role she assumed in January 2022. She assumed portfolio management responsibilities in July 2012. She joined the team in July 2005 as an equity analyst.

Kent P. Madden, CFA Co-Chief Investment Officer — US Small-Mid Cap Value Equity

Kent P. Madden, CFA, is a Co-Chief Investment Officer for the US Small-Mid Cap Value Equity team, a role he assumed in January 2022. He assumed portfolio management responsibilities in July 2012. He joined the team in December 2004 as an equity analyst and was promoted to senior equity analyst in October 2010.

Steven G. Catricks, CFA Senior Portfolio Manager

Steven G. Catricks, CFA, is a Senior Portfolio Manager for the US Small-Mid Cap Value Equity team. He assumed portfolio management responsibilities in July 2012. He joined the team in October 2010 as a senior equity analyst.

Michael Foley, CFA Senior Portfolio Manager

Michael Foley, CFA, is a Senior Portfolio Manager for the US Small-Mid Cap Value Equity team. He assumed portfolio management responsibilities in July 2019. He joined the team in February 2015 as a senior equity analyst.

The SAI provides additional information about each portfolio manager's compensation, other accounts managed by each portfolio manager, and each portfolio manager's ownership of Fund shares.

10

Manager of managers structure

The Fund and the Manager have received an exemptive order from the US Securities and Exchange Commission (SEC) to operate under a manager of managers structure that permits the Manager, with the approval of the Fund's Board, to appoint and replace both affiliated and unaffiliated sub-advisors, and to enter into and make material amendments to the related sub-advisory contracts on behalf of the Fund without shareholder approval (Manager of Managers Structure). Under the Manager of Managers Structure, the Manager has ultimate responsibility, subject to oversight by the Board, for overseeing the Fund's sub-advisors and recommending to the Board their hiring, termination, or replacement.

The Manager of Managers Structure enables the Fund to operate with greater efficiency and without incurring the expense and delays associated with obtaining shareholder approvals for matters relating to sub-advisors or sub-advisory agreements. The Manager of Managers Structure does not permit an increase in the overall management and advisory fees payable by the Fund without shareholder approval. Shareholders will be notified of the hiring of any new sub-advisor within 90 days of the hiring.

The Fund and the Manager also have an exemptive order from the SEC that allows the approval of a new sub-advisor to be taken at a Board of Trustees meeting held via any means of communication that allows the Trustees to hear each other simultaneously during the meeting. If a new unaffiliated sub-adviser is hired for the Fund, shareholders will receive information about the new sub-advisor within 90 days of the change.

11

Who manages the Fund

Who's who

Board of trustees: A mutual fund is governed by a board of trustees, which has oversight responsibility for the management of the fund's business affairs. Trustees establish procedures and oversee and review the performance of the fund's service providers.

Investment manager and sub-advisor: An investment manager is a company responsible for selecting portfolio investments consistent with the objective and policies stated in the mutual fund's prospectus. A sub-advisor is a company generally responsible for certain delegated tasks, such as executing trades or providing quantitative support. The sub-advisor is selected and supervised by the investment manager. A written contract between a mutual fund and its investment manager specifies the services the investment manager performs and the fee the manager is entitled to receive.

Portfolio managers: Portfolio managers make investment decisions for individual portfolios.

Distributor: Most mutual funds continuously offer new shares to the public through distributors that are regulated as broker/dealers and are subject to the Financial Industry Regulatory Authority (FINRA) rules governing mutual fund sales practices.

Service agent: Mutual fund companies employ service agents (sometimes called transfer agents) to maintain records of shareholder accounts, calculate and disburse dividends and capital gains, and prepare and mail shareholder statements and tax information, among other functions. Many service agents also provide administrative services to a fund and oversight of other fund service providers.

Custodian/Fund accountant: Mutual funds are legally required to protect their portfolio securities, and most funds place them with a qualified bank custodian that segregates fund securities from other bank assets. The fund accountant provides services such as calculating a fund's net asset value (NAV) and providing financial reporting information for the fund.

Financial intermediary: Financial professionals provide advice to their clients. They are associated with securities broker/dealers who have entered into selling and/or service arrangements with the distributor. Selling broker/dealers and financial professionals are compensated for their services generally through sales commissions, and through 12b-1 fees and/or service fees deducted from a fund's assets.

Shareholders: Mutual fund shareholders have specific voting rights on matters such as material changes in the terms of a fund's management contract and changes to fundamental investment policies.

12

About your account

Investing in the Fund

You can choose from a number of share classes for the Fund. Because each share class has a different combination of sales charges, fees, and other features, you should consult your financial intermediary or your financial professional (hereinafter collectively referred to as the “financial intermediary”) to determine which share class best suits your investment goals and time frame. It is the responsibility of your financial intermediary to assist you in determining the most appropriate share class and to communicate such determination to us.

Information about existing sales charges and sales charge reductions and waivers is available in this Prospectus below and free of charge on the Delaware Funds website at delawarefunds.com. Additional information on sales charges can be found in the SAI, which is available upon request.

Please also see the “Broker-defined sales charge waiver policies” section in this Prospectus for information provided to the Fund by certain financial intermediaries on sales charge discounts and waivers that may be available to you through your financial intermediary. Shareholders purchasing Fund shares through a financial intermediary may also be eligible for sales charge discounts or waivers which may differ from those disclosed elsewhere in this Prospectus or SAI. The availability of certain initial or deferred sales charge waivers and discounts may depend on the particular financial intermediary or type of account through which you purchase or hold Fund shares. It is the responsibility of the financial intermediary to implement any of its proprietary sales charge discounts or waivers listed in “Broker-defined sales charge waiver policies” or otherwise offered by the financial intermediary. Accordingly, you should consult with your financial intermediary to determine whether you qualify for any sales charge discounts or waivers.

Choosing a share class

Each share class may be eligible for purchase through programs sponsored by financial intermediaries that require the purchase of a specific class of shares.

For Class C and Class R shares, the Fund has adopted a 12b-1 plan that allows the Fund to pay distribution fees for the sale and distribution of its shares. Because these fees are paid out of a Fund's assets on an ongoing basis, over time these fees will increase the cost of your investment and may cost you more than paying other types of sales charges.

|

Class C |

Calculation of contingent deferred sales charges—Class C

CDSCs are charged as a percentage of the dollar amount subject to the CDSC. The charge will be assessed on an amount equal to the lesser of the NAV at the time the shares being redeemed were purchased or the NAV of those shares at the time of redemption. No CDSC will be imposed on increases in NAV above the initial purchase price, nor will a CDSC be assessed on redemptions of shares acquired through reinvestment of dividends or capital gains distributions. For purposes of this formula, the “NAV at the time of purchase” will be the NAV at purchase of Class C shares of the Fund, even if those shares are later exchanged for shares of another Delaware Fund. In the event of an exchange of the shares, the “NAV of such shares at the time of redemption” will be the NAV of the shares that were acquired in the exchange.

13

About your account

|

Class R |

The Fund reserves the right to modify or waive the above policies at any time without prior notice to shareholders.

Dealer compensation

The financial intermediary who sells you shares of the Fund may be eligible to receive the following amounts as compensation for your investment in the Fund. These amounts are paid by the Distributor to the securities dealer with whom your financial advisor is associated.

|

Commission (%) |

Class C1 |

Class R2 |

||||

|

Investment less than $50,000

|

1.00% |

— |

||||

|

$50,000 but less than $100,000

|

— |

— |

||||

|

$100,000 but less than $250,000

|

— |

— |

||||

|

$250,000 but less than $500,000

|

— |

— |

||||

|

$500,000 but less than $1 million

|

— |

— |

||||

|

$1 million but less than $5 million

|

— |

— |

||||

|

$5 million but less than $25 million

|

— |

— |

||||

|

$25 million or more

|

— |

— |

||||

|

12b-1 fee to dealer

|

1.00% |

0.50% |

||||

1 On sales of Class C shares, the Distributor may pay your securities dealer an upfront commission of 1.00%. The upfront commission includes an advance of the first year's 12b-1 service fee of up to 0.25%. During the first 12 months, the Distributor retains the full 1.00% 12b-1 fee to partially offset the upfront commission and the prepaid 0.25% service fee advanced at the time of purchase. Starting in the 13th month, your securities dealer may be eligible to receive the full 1.00% 12b-1 fee applicable to Class C shares. Alternatively, certain intermediaries may not be eligible to receive the upfront commission of 1.00%, but may receive the 12b-1 fee for sales of Class C shares from the date of purchase. After approximately eight years, Class C shares are eligible to automatically convert to Class A shares and dealers may then be eligible to receive the 12b-1 fee applicable to Class A shares.

2 On sales of Class R shares, the Distributor does not pay your securities dealer an upfront commission. Your securities dealer may be eligible to receive a 12b-1 fee of up to 0.50% from the date of purchase.

Payments to intermediaries

The Distributor and its affiliates may pay additional compensation at their own expense and not as an expense of a Fund to certain affiliated or unaffiliated brokers, dealers, or other financial intermediaries (Financial Intermediaries) in connection with the sale or retention of Fund shares and/or shareholder servicing, including providing the Fund with “shelf space” or a higher profile with the Financial Intermediaries' consultants, salespersons, and customers (distribution assistance). For example, the Distributor or its affiliates may pay additional compensation to Financial Intermediaries for various purposes, including, but not limited to, promoting the sale of Fund shares, maintaining share balances and/or for subaccounting, administrative, or shareholder processing services, marketing, educational support, data, and ticket charges. Such payments are in addition to any distribution fees, service fees, subaccounting fees, and/or transfer agency fees that may be payable by a Fund. The additional payments may be based on factors, including level of sales (based on gross or net sales or some specified minimum sales or some other similar criteria related to sales of a Fund and/or some or all other Delaware Funds), amount of assets invested by the Financial Intermediary's customers (which could include current or aged assets of a Fund and/or some or all other Delaware Funds), a Fund's advisory fees, some other agreed-upon amount, or other measures as determined from time to time by the Distributor.

14

The level of payments made to a qualifying Financial Intermediary in any given year may vary. To the extent permitted by SEC and FINRA rules and other applicable laws and regulations, the Distributor may pay, or allow its affiliates to pay, other promotional incentives or payments to Financial Intermediaries.

Sub-transfer agent/recordkeeping payments may be made to third parties (including affiliates of the Manager) that provide sub-transfer agent, recordkeeping, and/or shareholder services with respect to certain shareholder accounts (including omnibus accounts), or to the shareholder account directly to offset the costs of these services, in lieu of the transfer agent providing such services. For Class R6 shares, the Distributor and its affiliates will generally not pay additional compensation to Financial Intermediaries in connection with the sale or retention of Fund shares and/or shareholder servicing (including sub-transfer agent/recordkeeping payments).

If a mutual fund sponsor or distributor makes greater payments for distribution assistance to your Financial Intermediary with respect to distribution of shares of that particular mutual fund than sponsors or distributors of other mutual funds make to your Financial Intermediary with respect to the distribution of the shares of their mutual funds, your Financial Intermediary and its salespersons may have a financial incentive to favor sales of shares of the mutual fund making the higher payments over shares of other mutual funds or over other investment options. In addition, depending on the arrangements in place at any particular time, a Financial Intermediary may also have a financial incentive for recommending a particular share class over other share classes. You should consult with your Financial Intermediary and review carefully any disclosure provided by such Financial Intermediary as to compensation it receives in connection with investment products it recommends or sells to you. A significant purpose of these payments is to increase sales of a Fund's shares. The Manager or its affiliates may benefit from the Distributor's or its affiliates' payment of compensation to Financial Intermediaries through increased fees resulting from additional assets acquired through the sale of Fund shares through Financial Intermediaries. In certain instances, the payments could be significant and may cause a conflict of interest for your Financial Intermediary. Any such payments will not change the NAV or the price of a Fund's shares.

Waivers of contingent deferred sales charges

Certain sales charges may be based on historical cost. Therefore, you should maintain any records that substantiate these costs because the Fund, their transfer agent, and financial intermediaries may not maintain this information. Please note that you or your financial intermediary will have to notify us at the time of redemption that the trade qualifies for such waiver. Class R shares do not have a CDSC so they are not included in the list below. Please also see the “Shareholder fees” table in the Fund summary and “Choosing a share class” for more information about applicable CDSCs. Your financial intermediary may offer waivers for certain account types or programs that may be different than what is noted below. See the "Broker-defined sales charge waiver policies" section or contact your financial intermediary for information on program availability.

CDSCs for Class C shares may be waived under the following circumstances, except as noted otherwise:

15

About your account

1 Qualified plans that are fully redeemed at the direction of the plan's fiduciary may be subject to any applicable CDSC, unless the redemption is due to the termination of the plan.

Certain existing investors or programs sponsored by certain intermediaries that were eligible for waivers of CDSCs may continue to be eligible for those waivers of CDSCs.

How to buy shares

|

Through your financial intermediary |

Your financial intermediary (if applicable) can handle all the details of purchasing shares, including opening an account. Your financial intermediary may charge you a separate fee for this service.

|

Through the Delaware Funds by Macquarie® Service Center |

By mail

Complete an investment slip and mail it with your check, made payable to the fund and class of shares you wish to purchase, to Delaware Funds by Macquarie at P.O. Box 9876, Providence, RI 02940-8076 for investments by regular mail or Delaware Funds by Macquarie Service Center at 4400 Computer Drive, Westborough, MA 01581-1722 for investments by overnight courier service. If you are making an initial purchase by mail, you must include a completed investment application (or an appropriate retirement plan application if you are opening a retirement account) with your check. Purchase orders will not be accepted at any other address.

Please note that purchase orders submitted by mail will not be considered received until such purchase orders arrive at Delaware Funds by Macquarie Service Center at 4400 Computer Drive, Westborough, MA 01581-1722 and are determined to be in good order. For a purchase request to be in “good order,” you must provide the name of the Delaware Fund in which you are investing, your account registration/number (if you are an existing shareholder), and the total number of shares or dollar amount of the shares to be purchased, along with meeting any requirements set forth in applicable forms, this Prospectus, or the SAI. The Fund does not consider the US Postal Service or other independent delivery services to be their agent. Therefore, deposits in the mail or with such services or receipt at the Fund's post office box, of purchase orders, do not constitute receipt by the Fund or their agent. Please note that the Fund reserve the right to reject any purchase.

By wire

Ask your bank to wire the amount you want to invest to The Bank of New York Mellon, ABA #011001234, bank account #000073-6910. Include your account number, the name of the fund, registered account name, and class of shares in which you want to invest. If you are making an initial purchase by wire, you must first call the Delaware Funds by Macquarie Service Center at 800 523-1918 so we can assign you an account number.

By exchange

You may exchange all or part of your investment in one or more Delaware Funds for shares of other Delaware Funds. Please keep in mind, however, that under most circumstances you may exchange between like classes of shares only. To open an account by exchange, call the Delaware Funds by Macquarie Service Center at 800 523-1918.

|

Through automated shareholder services |

You may purchase or exchange shares through our automated telephone service (for Class C and Class R shares only), or through our website, delawarefunds.com (for Class C and Class R shares only). For more information about how to sign up for these services, call our Delaware Funds by Macquarie Service Center at 800 523-1918.

Calculating share price

The price you pay for shares will depend on when we receive your purchase order. If your order is received by an authorized agent or us before the close of regular trading on the NYSE (normally 4:00pm Eastern time), you will pay that day's closing Fund share price, which is based on the Fund's NAV. If the NYSE has an unscheduled early close, we will continue to accept your order until that day's scheduled close of the NYSE and you will pay that day's closing Fund share price. If your order is received after the scheduled close of regular trading on the NYSE, you will pay the next Business Day's closing Fund share price. We reserve the right to reject any purchase order.

16

We determine the NAV per share for each class of a Delaware Fund at the close of regular trading on the NYSE on each Business Day (normally 4:00pm Eastern time). A Fund does not calculate its NAV on days the NYSE is closed for trading. If the NYSE has an unscheduled early close, a Fund's closing share price would still be determined as of that day's regularly scheduled close of the NYSE. The NAV per share for each class of a fund is calculated by subtracting the liabilities of each class from its total assets and dividing the resulting number by the number of shares outstanding for that class. We generally price securities and other assets for which market quotations are readily available at their market value. The value of foreign securities may change on days when a shareholder will not be able to purchase or redeem fund shares because foreign markets are open at times and on days when US markets are not. We price fixed income securities on the basis of valuations provided to us by an independent pricing service that uses methods approved by the Board. For all other securities, we use methods approved by the Board that are designed to price securities at their fair market values.

Fair valuation

When the Fund use fair value pricing, they may take into account any factors they deem appropriate. The Fund may determine fair value based upon developments related to a specific security, current valuations of foreign stock indices (as reflected in US futures markets), and/or US sector or broad stock market indices. In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. The prices of securities used by the Fund to calculate its NAV may differ from quoted or published prices for the same securities. Fair value pricing may involve subjective judgments and it is possible that the fair value determined for a security could be materially different than the value that could be realized upon the sale of that security.

The Fund anticipate using fair value pricing for securities primarily traded on US exchanges only under very limited circumstances, such as the early closing of the exchange on which a security is traded or suspension of trading in the security. The Fund may use fair value pricing more frequently for securities traded primarily in non-US markets because, among other things, most foreign markets close well before the Fund value its securities, normally at 4:00pm Eastern time or the close of the NYSE. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim. To account for this, the Fund may frequently value many foreign equity securities using fair value prices based on third-party vendor modeling tools to the extent available.

The Board has designated the Manager as the valuation designee, and delegated responsibility for valuing the Fund's assets to the Manager and its Pricing Committee, which operates under the policies and procedures approved by the Board and is subject to the Board's oversight. The Manager, as the valuation designee, is responsible for periodically assessing any material risks associated with the determination of the fair value of the Fund's investments; establishing and applying fair value methodologies; testing the appropriateness of fair value methodologies; and overseeing and evaluating third-party pricing vendors and services. The Manager has a Pricing Committee to assist with its designated responsibilities as valuation designee.

Retirement plans

In addition to being an appropriate investment for your IRA, Roth IRA, and Coverdell Education Savings Account, the Fund may be suitable for group retirement plans. You may establish your IRA account even if you are already a participant in an employer-sponsored retirement plan. For more information on how the Fund can play an important role in your retirement planning or for details about group plans, please consult your financial intermediary, or call the Delaware Funds by Macquarie® Service Center at 800 523-1918.

Document delivery

To reduce fund expenses, we try to identify related shareholders in a household and send only one copy of a fund's financial reports and prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call the Delaware Funds by Macquarie Service Center at 800 523-1918. At any time you may view current prospectuses and financial reports on our website.

Inactive accounts

Please note that your account may be required to transfer to the appropriate state if no activity occurs in the account within the time period specified by state law.

17

About your account

How to redeem shares

Under normal circumstances, the Fund typically meets redemption requests through its holdings of cash or cash equivalents, the sale of portfolio assets, and/or its ability to redeem in kind (when applicable). During stressed market conditions, the Fund may use lines of credit to meet redemption requests.

Availability of these services may be limited by your financial intermediary and by the way your account is registered with Delaware Funds.

When you send us a completed request in good order to redeem or exchange shares and the request is received by an authorized agent or us before the close of regular trading on the NYSE (normally 4:00pm ET), you will receive the NAV next determined after we receive your request. If we receive your request after the close of regular trading on the NYSE, you will receive the NAV next determined on the next Business Day. If the NYSE has an unscheduled early close, we will continue to accept your order until that day's scheduled close of the NYSE and you will receive that day's closing Fund share price. We will deduct any applicable CDSCs. You may also have to pay taxes on the proceeds from your sale of shares. If you purchased your shares by check, those shares are subject to a 15-day hold to ensure your check has cleared. Redemption requests for shares still subject to the hold may be rejected with instructions to resubmit at the conclusion of the holding period.

If you are required to pay a CDSC when you redeem your shares, the amount subject to the fee will be based on the shares' NAV when you purchased them or their NAV when you redeem them, whichever is less. This arrangement ensures that you will not pay a CDSC on any increase in the value of your shares. You also will not pay the charge on any shares acquired by reinvesting dividends or capital gains. If you exchange shares of one fund for shares of another, you do not pay a CDSC at the time of the exchange. If you later redeem those shares, the purchase price for purposes of the CDSC formula will be the price you paid for the original shares, not the exchange price. The redemption price for purposes of this formula will be the NAV of the shares you are actually redeeming.

If you hold your shares in certificates, you must submit the certificates with your request to sell the shares. We recommend that you send your certificates by certified mail.

Redemption proceeds will be distributed promptly, but not later than seven days after receipt of a redemption request (except as noted above). For direct transactions, redemption proceeds are typically paid the next Business Day after receipt of the redemption request. Redemptions submitted by financial intermediaries typically settle between one and three Business Days after receipt, depending on the settlement cycle requested by the financial intermediary. Settlement could be extended as a result of various factors, including but not limited to redemption amount or other market conditions. Please see the SAI for additional information.

|

Through your financial intermediary |

Your financial intermediary (if applicable) can handle all the details of redeeming your shares (selling them back to a Fund). Your financial intermediary may charge you a separate fee for this service.

|

Through the Delaware Funds by Macquarie® Service Center |

By mail

You may redeem your shares by mail by writing to: Delaware Funds by Macquarie at P.O. Box 9876, Providence, RI 02940-8076 for redemption requests by regular mail or Delaware Funds by Macquarie Service Center at 4400 Computer Drive, Westborough, MA 01581-1722 for redemption requests by overnight courier service. Redemption requests will not be accepted at any other address. All owners of the account must sign the request. For redemptions of more than $100,000, you must include a medallion signature guarantee for each owner. Medallion signature guarantees are also required when redemption proceeds are going to an address other than the address of record on the account. Please contact the Delaware Funds by Macquarie Service Center at 800 523-1918 for more information about the medallion signature guarantee requirements.

Please note that redemption orders submitted by mail will not be considered received until such redemption orders arrive at Delaware Funds by Macquarie Service Center at 4400 Computer Drive, Westborough, MA 01581-1722 and are determined to be in good order. For a redemption request to be in “good order,” you must provide the name of the Delaware Fund whose shares you are redeeming, your account number, account registration, and the total number of shares or dollar amount of the transaction. Redemption requests must be signed by the record owner(s) exactly as the shares are registered, along with meeting any requirements set forth in applicable forms, this Prospectus, or the SAI. The Fund does not consider the US Postal Service or other independent delivery services to be their agent. Therefore, redemption requests placed in the mail or with such services or receipt at the Fund's post office box, of redemption requests, do not constitute receipt by the Fund or the transfer agent.

By telephone

You may redeem up to $100,000 of your shares by telephone. You may have the proceeds sent to you in the following ways:

18

Bank information must be on file before you request a wire or ACH redemption. Your bank may charge a fee for these services.

|

Through automated shareholder services |

You may redeem shares through our automated telephone service or through our website, delawarefunds.com. For more information about how to sign up for these services, call our Delaware Funds by Macquarie Service Center at 800 523-1918.

|

Redemptions-in-kind |

The Fund has reserved the right to pay for redemptions with portfolio securities under certain conditions. Subsequent sale by an investor receiving a distribution in kind could result in the payment of brokerage commissions and taxable gains (if such investment was held in a taxable account). Investors bear market risks until securities are sold for cash. See the SAI for more information on redemptions-in-kind.

Low balance accounts

For Class C shares, if you redeem shares and your account balance falls below the required account minimum of $1,000 ($250 for IRAs, Roth IRAs, Uniform Gifts to Minors Act and Uniform Transfers to Minors Act accounts, or accounts with automatic investment plans, and $500 for Coverdell Education Savings Accounts) for three or more consecutive months, you will have until the end of the current calendar quarter to raise the balance to the minimum.

For Class R shares, if you redeem shares and your account balance falls below $500, your shares may be redeemed after 60 days' written notice to you.

If your account is not at the minimum for low balance purposes by the required time, you may be charged a $9 fee for that quarter and each quarter after that until your account reaches the minimum balance, or it may be redeemed after 60 days' written notice to you. Any CDSC that would otherwise be applicable will not apply to such a redemption.

Certain accounts held in omnibus, advisory, or asset-allocation programs or programs offered by certain intermediaries may be opened below the minimum stated account balance and may maintain balances that are below the minimum stated account balance without incurring a service fee or being subject to involuntary redemption.

If the applicable account falls below the minimum due to market fluctuation, a Fund still reserves the right to liquidate the account.

Investor services

To help make investing with us as easy as possible, and to help you build your investments, we offer the investor services described below. Information about the investor services we offer is available free of charge on the Delaware Funds website at delawarefunds.com, including hyperlinks to relevant information in fund offering documents. Availability of these services may be limited by the way your account is registered with Delaware Funds.

|

Online account access |

Online account access is a password-protected area of the Delaware Funds website that gives you access to your account information and allows you to perform transactions in a secure Internet environment.

|

Electronic delivery |

With Delaware Funds eDelivery, you can receive your fund documents electronically instead of via US mail. When you sign up for eDelivery, you can access your account statements, shareholder reports, and other fund materials online, in a secure Internet environment at any time.

|

Automatic investment plan |

The automatic investment plan allows you to make regular monthly or quarterly investments directly from your bank account.

|

Direct deposit |

With direct deposit, you can make additional investments through payroll deductions, recurring government or private payments such as Social Security, or direct transfers from your bank account.

19

About your account

|

Systematic exchange option |

With the systematic exchange option, you can arrange automatic monthly exchanges between your shares in one or more Delaware Funds. These exchanges are subject to the same rules as regular exchanges (see below) and require a minimum monthly exchange of $100 per fund.

|

Dividend reinvestment plan |

Through the dividend reinvestment plan, you can have your distributions reinvested in your account or the same share class in another Delaware Fund. The shares that you purchase through the dividend reinvestment plan are not subject to a front-end sales charge or to a CDSC. Under most circumstances, you may reinvest dividends only into like classes of shares.

|

Exchange of shares |

You may generally exchange all or part of your shares for shares of the same class of another Delaware Fund without paying a front-end sales charge or a CDSC at the time of the exchange. However, if you exchange shares from a fund that does not have a sales charge, you will pay any applicable sales charge on your new shares. You do not pay sales charges on shares that you acquired through the reinvestment of dividends. You may have to pay taxes on your exchange. When you exchange shares, you are purchasing shares in another fund, so you should be sure to get a copy of the fund's prospectus and read it carefully before buying shares through an exchange. We may refuse the purchase side of any exchange request if, in the Manager's judgment, a fund would be unable to invest effectively in accordance with its investment objective and policies or would otherwise potentially be adversely affected. Please note that depending on the financial intermediary holding your account, this policy may be unavailable or differ from those described in this Prospectus.

|

On demand service |

The on demand service allows you or your financial advisor to transfer money between your Fund account and your predesignated bank account by telephone request. There is a minimum transfer of $25 and a maximum transfer of $100,000. Macquarie Asset Management does not charge a fee for this service; however, your bank may assess one.

|

Direct deposit service |

Through the direct deposit service, you can have $25 or more in dividends and distributions deposited directly into your bank account. Macquarie Asset Management does not charge a fee for this service; however, your bank may assess one. This service is not available for retirement plans.

|

Systematic withdrawal plan |

You can arrange a regular monthly or quarterly payment from your account made to you or someone you designate. If the value of your account is $5,000 or more, you can make withdrawals of at least $25 monthly, or $75 quarterly. You may also have your withdrawals deposited directly to your bank account through the direct deposit service.

The CDSC for Class C shares redeemed via a systematic withdrawal plan will be waived if the annual amount withdrawn in each year is less than 12% of the account balance on the date that the plan is established. If the annual amount withdrawn in any year exceeds 12% of the account balance on the date that the systematic withdrawal plan is established, all redemptions under the plan will be subject to the CDSC, including an assessment for previously redeemed amounts under the plan.

|

Right to discontinue offering shares and/or to merge or liquidate a share class |

To the extent authorized by law, the Fund reserves the right to discontinue offering shares at any time and/or to merge or liquidate a share class, such as in response to shareholder redemptions of substantially or all shares in a class. For any blocked accounts involving a liquidating fund, a shareholder's account may be moved into Delaware Investments Ultrashort Fund if no instruction is given upon receipt of a fund's pending liquidation.

Frequent trading of Fund shares (market timing and disruptive trading)

The Fund discourages purchases by market timers and purchase orders (including the purchase side of exchange orders) by shareholders identified as market timers may be rejected. The Board has adopted policies and procedures designed to detect, deter, and prevent trading activity detrimental to the Fund and their shareholders, such as market timing and disruptive trading. The Fund will consider anyone who follows a pattern of market timing in any Delaware Fund or the Optimum Fund Trust to be a market timer and may consider anyone who has followed a similar pattern of market timing at an unaffiliated fund family to be a market timer.

20

Market timing of a fund occurs when investors make consecutive, rapid, short-term “round trips” — that is, purchases into a fund followed quickly by redemptions out of that fund. A short-term round trip is considered any redemption of fund shares within 20 Business Days of a purchase of that fund's shares. If you make a second such short-term round trip in a fund within 90 rolling calendar days of a previous short-term round trip in that fund, you may be considered a market timer. In determining whether market timing has occurred, the Fund considers short-term round trips to include rapid purchases and sales of Fund shares through the exchange privilege. The Fund reserves the right to consider other trading patterns to be market timing.

Your ability to use the Fund's exchange privilege may be limited if you are identified as a market timer. If you are identified as a market timer, the Fund will execute the redemption side of your exchange order but may refuse the purchase side of your exchange order. The Fund reserves the right to restrict or reject, without prior notice, any purchase order or exchange order for any reason, including any purchase order or exchange order accepted by any shareholder's financial intermediary or in any omnibus-type account. Transactions placed in violation of the Fund's market timing policy are not necessarily deemed accepted by the Fund and may be rejected by a Fund on the next Business Day following receipt by a Fund.

Redemptions will continue to be permitted in accordance with the Fund's then-current prospectus. A redemption of shares under these circumstances could be costly to a shareholder if, for example, the shares have declined in value, the shareholder recently paid a front-end sales charge, the shares are subject to a CDSC, or the sale results in adverse tax consequences. To avoid this risk, a shareholder should carefully monitor the purchases, sales, and exchanges of Fund shares and avoid frequent trading in Fund shares.

The Fund reserves the right to modify this policy at any time without notice, including modifications to a Fund's monitoring procedures and the procedures to close accounts to new purchases. Although the implementation of this policy involves certain judgments that are inherently subjective and may be selectively applied, the Fund seeks to make judgments and applications that are consistent with the interests of the Fund's shareholders. While the Fund will take actions designed to detect and prevent market timing, there can be no assurance that such trading activity will be completely eliminated. Moreover, a Fund's market timing policy does not require the Fund to take action in response to frequent trading activity. If a Fund elects not to take any action in response to frequent trading, such frequent trading activity could continue.

Risks of market timing