UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number File No. 811-04415

COLLEGE RETIREMENT EQUITIES FUND

(Exact Name of Registrant as specified in charter)

730 Third Avenue, New York, New York 10017-3206

(Address of Principal Executive Offices) (Zip code)

Rachael M. Zufall, Esq.

College Retirement Equities Fund

8500 Andrew Carnegie Blvd.

Charlotte, North Carolina 28262-8500

(Name and address of agent for service)

Registrant’s telephone number, including area code: 704-595-1000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Item 1. Reports to Stockholders.

|

Annual Report ■ December 31, 2021

College Retirement

The annual report contains the audited financial statements.

|

| Account name | Class R1 | Class R2 | Class R3 |

| Stock Account | QCSTRX | QCSTPX | QCSTIX |

| Global Equities Account | QCGLRX | QCGLPX | QCGLIX |

| Growth Account | QCGRRX | QCGRPX | QCGRIX |

| Equity Index Account | QCEQRX | QCEQPX | QCEQIX |

| Bond Market Account | QCBMRX | QCBMPX | QCBMIX |

| Inflation-Linked Bond Account | QCILRX | QCILPX | QCILIX |

| Social Choice Account | QCSCRX | QCSCPX | QCSCIX |

| Money Market Account | QCMMRX | QCMMPX | QCMMIX |

As permitted by regulations adopted by the Securities and Exchange Commission (“SEC”), paper copies of the CREF Accounts’ (the “Accounts”) annual and semiannual reports will not be sent to you by mail, unless you specifically request paper copies of the reports. Instead, they will be made available on Teachers Insurance and Annuity Association of America’s (“TIAA”) website, TIAA.org, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive reports and other communications from the Accounts electronically anytime by either (1) updating your account settings at TIAA.org/eDelivery, if you hold your Account units through a TIAA-affiliated financial intermediary, account or retirement plan (each, a “TIAA Account”), or (2) contacting your financial intermediary (such as a broker-dealer or bank) through which you hold Account units.

If you invest in the Accounts through a TIAA Account, you may elect to receive all future reports in paper free of charge by updating your account settings at TIAA.org/eDelivery or by calling 877-518-9161 during regular business hours. If you invest through another financial intermediary, you can contact your financial intermediary to request that you receive paper copies of your reports. Your election to receive reports in paper will apply to all funds held through your financial intermediary or, if you invest through a TIAA Account, to all funds held with the Accounts and any other investment companies within the same group of related investment companies.

Contents

| Summary portfolios of investments | 43 |

| Audited financial statements | |

| Statements of assets and liabilities | 80 |

| Statements of operations | 82 |

| Statements of changes in net assets | 84 |

| Financial highlights | 90 |

| Notes to financial statements | 100 |

| Report of independent registered public accounting firm | 119 |

| Trustees and officers | 121 |

| Additional information about index providers | 127 |

| How to reach us | Inside back cover |

This annual report contains information about the CREF variable annuity accounts and describes their results for the twelve months ended December 31, 2021. The report contains four main sections:

| • | A letter to participants from Colbert G. Narcisse, President and Chief Executive Officer of CREF. | |

| • | The account performance section compares each account’s investment returns with those of its benchmark index. | |

| • | The summary portfolios of investments list the industries and types of securities in which each account had investments as of December 31, 2021. | |

| • | The financial statements provide detailed information about the operations and financial condition of each account. |

The views and opinions expressed in this report are through the end of the period, as stated on the cover of this report. They are subject to change at any time based on a variety of factors. As such, they are not guarantees of future performance or investment results and should not be taken as investment advice. To see the risks of investing in any account, please read the latest prospectus.

As always, you should carefully consider the investment objectives, risks, charges and expenses of any account before investing. For a prospectus that contains this and other important information, please visit our website at TIAA.org, or call 877-518-9161. We urge you to read the prospectus carefully before investing.

Proposals for action at the 2022 meeting of CREF participants

We anticipate that the next meeting of CREF participants will be held in July 2022; however, the exact date, time and location of such meeting have yet to be determined. Proposals submitted by or on behalf of participants pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 for inclusion in the proxy materials for the 2022 participant meeting must be received by the CREF Corporate Secretary no later than March 18, 2022. The submission of a proposal does not assure its inclusion in CREF’s proxy statement or presentation at the meeting. Unless CREF is notified by April 27, 2022 of other matters that may be properly brought before the 2022 participant meeting by or on behalf of participants, the persons named in the proxy will have the discretion to vote on those matters as they see fit.

| College Retirement Equities Fund ■ 2021 Annual Report | 3 |

Domestic and international developed stock markets produced solid gains in 2021 despite the ongoing global challenge of the COVID-19 pandemic. The U.S. economy grew strongly at the start of the period, but the pace of expansion decelerated in the summer months. Economies in the 19-nation euro area struggled at the beginning of the year but returned to growth as the period progressed. Most central banks around the world left accommodative monetary policies in place but monitored rising inflation. The U.S. Federal Reserve kept the federal funds target rate unchanged at 0.00%–0.25%. The European Central Bank also maintained its near-zero benchmark rates, while the Bank of England increased its benchmark rate from 0.10% to 0.25% in December 2021.

| • | The five CREF accounts with significant exposure to the U.S. stock market all recorded double-digit gains ranging from 12.4% for the Social Choice Account to 25.3% for the Equity Index Account. | |

| • | Fixed-income markets generally declined, and the Bond Market Account returned –1.4%. However, the Inflation-Linked Bond Account gained 5.1% due to the rise in inflation. | |

| • | Two accounts outperformed their benchmarks, while the other six underperformed. All account returns are for Class R1. |

CREF performance review

Six of the eight CREF accounts produced positive results for the period. Overall, stocks outperformed bonds, and U.S. equities outpaced foreign stocks.

The Stock Account—the largest CREF account in terms of net assets—advanced 18.7% but trailed its composite benchmark. The Equity Index Account gained 25.3% but underperformed the Russell 3000® Index, primarily due to expenses. The Growth Account returned 20.2%, trailing the Russell 1000® Growth Index. The Global Equities Account gained 15.4%, lagging the MSCI All Country World Index (ACWI). The Social Choice Account, which excludes certain stocks and bonds due to environmental, social and governance criteria, outpaced its composite benchmark with a return of 12.4%.

Turning to fixed-income accounts, the Bond Market Account returned –1.4%, outperforming the Bloomberg U.S. Aggregate Bond Index. The Inflation-Linked Bond Account gained 5.1% but fell short of the Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 1–10 Year Index. The Money Market Account, which returned 0.0%, slightly underperformed the iMoneyNet Money Fund Averages™—All Government. For more information regarding the performance of the CREF accounts, please see the commentaries starting on page 11.

| 4 | 2021 Annual Report ■ College Retirement Equities Fund |

|

| Colbert G. Narcisse |

Stocks advanced while bonds lost ground

For the twelve-month period, the domestic stock market, as measured by the Russell 3000 Index, rose 25.7%. Foreign equities, as represented by the MSCI EAFE Index, returned 11.3%. U.S. investment-grade fixed-rate bonds, as measured by the Bloomberg U.S. Aggregate Bond Index, returned –1.5%. Yields on all but the shortest maturity U.S. Treasury securities rose, generally sending bond prices lower (bond yields move in the opposite direction of prices).

Keeping long-term goals in mind

As we begin a third year living with the COVID-19 pandemic, it’s clear that we still haven’t reached the point of a full recovery. But the resiliency demonstrated by people and economies in the face of these challenges has been truly remarkable.

The U.S. economy has steadily expanded since the latter half of 2020, and global stock markets have prospered. But there were moments when continued growth appeared far from certain, and investors experienced periods of higher volatility along the way. Certainly, no one can predict the direction of financial markets in the future. But those unknowns, along with the inevitable periods of higher volatility, should not distract investors from their long-term investment goals. We believe a well-balanced and diversified portfolio of different asset classes can be a prudent strategy to help investors manage through the market’s ups and downs. Of course, diversification does not guarantee against market losses, and past performance cannot guarantee future results.

If you have questions or concerns about your investments, we recommend that you speak with your financial advisor or call a TIAA financial consultant. To learn more, visit us at TIAA.org or call 800-842-2252. We would be pleased to assist you.

/s/ Colbert G. Narcisse

Colbert G. Narcisse

President and Chief Executive Officer of CREF

| College Retirement Equities Fund ■ 2021 Annual Report | 5 |

Information for CREF participants

Portfolio holdings

Securities and Exchange Commission (SEC) rules allow investment companies to list the top holdings of each account in their annual and semiannual reports instead of providing complete portfolio listings. CREF also files complete portfolio listings with the SEC, and they are available to the public.

You can obtain a complete list of the CREF accounts’ holdings (Schedules of Investments) as of the most recently completed fiscal quarter in the following ways:

| • | By visiting our website at TIAA.org; or | |

| • | By calling us at 800-842-2252 to request a copy, which will be provided free of charge. |

You can also obtain a complete list of the CREF accounts’ portfolio holdings as of the most recently completed fiscal quarter, and for prior quarter-ends, from our SEC Form N-CSR and Form N-PORT or Form N-MFP (for money market products only) filings. Form N-CSR filings are as of December 31 or June 30; Form N-PORT or Form N-MFP filings are as of March 31 or September 30. Copies of these forms are available:

| • | Through the Electronic Data Gathering and Retrieval System (EDGAR) on the SEC’s website at sec.gov; or | |

| • | From the SEC’s Office of Investor Education and Advocacy. | |

| Call 202-551-8090 for more information. |

Proxy voting

CREF’s ownership of stock gives it the right to vote on proxy issues of companies in which it invests. A description of our proxy voting policies and procedures can be found on our website at TIAA.org or on the SEC’s website at sec.gov. You can also call us at 800-842-2252 to request a free copy. A report of how the accounts voted during the most recently completed twelve-month period ended June 30 can be found on our website or on Form N-PX at sec.gov.

Contacting TIAA

There are three easy ways to contact us: by email, using the Contact Us link under Get Help at the top of our home page; by mail at TIAA, 730 Third Avenue, New York, NY 10017-3206; or by phone at 800-842-2252.

Account management

The CREF Accounts are managed by the portfolio management teams of TIAA-CREF Investment Management, LLC. The members of these teams are responsible for the day-to-day investment management of the accounts.

| 6 | 2021 Annual Report ■ College Retirement Equities Fund |

Information for CREF participants

CREF Rules of the Fund

From time to time, CREF updates its Rules of the Fund with the New York State Department of Financial Services. Current copies of the updated Rules of the Fund can be found on the TIAA.org website at the following location: https://www.tiaa.org/public/about-tiaa/corporate-governance-leadership/document-library.

| College Retirement Equities Fund ■ 2021 Annual Report | 7 |

About the accounts’ benchmarks

CREF Stock Account

The Account’s composite benchmark is a weighted average of two unmanaged indexes: the Russell 3000® Index, which measures the performance of the broad U.S. stock market, and the MSCI All Country World (ACWI) ex USA Investable Market Index (IMI), which measures the performance of small-, mid- and large-cap stocks in 47 developed- and emerging-markets nations throughout the world, excluding the United States.

The Morningstar Aggressive Target Risk Index is a broad-based securities market index for the Stock Account and has a 95% global equity market exposure and a multi-asset class exposure that is similar to the Stock Account.

CREF Global Equities Account

The Account’s benchmark is the MSCI All Country World Index (ACWI), which measures the performance of large- and mid-capitalization stocks in 23 developed-markets countries and 25 emerging-markets countries.

CREF Growth Account

The Account’s benchmark is the Russell 1000® Growth Index, a subset of the Russell 1000 Index, which measures the performance of the stocks of the 1,000 largest companies in the Russell 3000 Index, based on market capitalization. The Russell 1000 Growth Index measures the performance of those stocks of the Russell 1000 Index with higher relative forecasted growth rates and price/book ratios.

CREF Equity Index Account

The Account’s benchmark is the Russell 3000 Index, which measures the performance of the stocks of the 3,000 largest publicly traded U.S. companies, based on market capitalization. The index measures the performance of about 98% of the total market capitalization of the publicly traded U.S. equity market.

CREF Bond Market Account

The Account’s benchmark is the Bloomberg U.S. Aggregate Bond Index, which measures the performance of the domestic investment-grade fixed-rate bond market, including government and corporate securities, agency mortgage pass-through securities, asset-backed securities and commercial mortgage-backed securities.

| 8 | 2021 Annual Report ■ College Retirement Equities Fund |

About the accounts’ benchmarks

CREF Inflation-Linked Bond Account

The Account’s benchmark is the Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1–10 Year Index, which measures the performance of fixed-income securities with maturities between 1 and 10 years that are adjusted for inflation, as measured by the Consumer Price Index for All Urban Consumers (CPI-U).

CREF Social Choice Account

The Account’s composite benchmark is a weighted average of three unmanaged indexes: the Russell 3000® Index, which measures the performance of the broad U.S. stock market; the Bloomberg U.S. Aggregate Bond Index, which measures the performance of the domestic investment-grade fixed-rate bond market; and the MSCI EAFE+Canada Index, which measures stock performance in 22 developed-markets nations, excluding the United States.

The Morningstar Moderate Target Risk Index is a broad-based securities market index for the Social Choice Account. The index has a multi-asset class exposure (60% global equity, 40% global fixed income) that is similar to the Social Choice Account.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses. For additional details about the benchmark indexes, please read the accounts’ latest prospectus.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE® ,” “Russell® ” and “FTSE Russell® ” are trademarks of the relevant LSE Group companies and are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. This report is not approved, reviewed or produced by MSCI. EAFE stands for Europe, Australasia, Far East.

| College Retirement Equities Fund ■ 2021 Annual Report | 9 |

Important information about expenses

All participants in the CREF Accounts incur ongoing costs, including management fees and other account expenses.

The expense examples that appear in this report are intended to help you understand your ongoing costs only (in U.S. dollars) and do not reflect transactional costs. The examples are designed to help you compare these ongoing costs with the ongoing costs of investing in other variable annuity accounts and mutual funds. Participants in the CREF Accounts do not incur a sales charge for purchases or other distributions.

The examples are based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (July 1, 2021–December 31, 2021).

Actual expenses

The first section in each table uses the Account’s actual expenses and its actual rate of return. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the six-month period.

Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses paid during period” to estimate the expenses you paid during the six-month period.

Hypothetical example for comparison purposes

The second section in the table shows hypothetical account values and expenses based on the Account’s actual expense ratio for each Class for the six-month period and an assumed 5%-per-year rate of return before expenses. This was not the Account’s actual return.

This hypothetical example cannot be used to estimate the actual expenses you paid for the period, but rather allows you to compare the ongoing costs of investing in the Account with the costs of other accounts. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other variable annuity accounts and mutual funds.

| 10 | 2021 Annual Report ■ College Retirement Equities Fund |

Performance for the twelve months ended December 31, 2021

The CREF Stock Account returned 18.67% for the year, compared with the 19.90% return of its composite benchmark, a weighted average of the Russell 3000® Index and the MSCI All Country World (ACWI) ex USA Investable Market Index (IMI). (All returns for the Account are for Class R1.)

The U.S. economy grew at a solid pace during the period, despite ongoing supply-chain bottlenecks and the impact of new COVID-19 variants. The unemployment rate fell from 6.3% in January 2021 to 3.9% in December. Core inflation, which includes all items except food and energy, rose 5.5% over the twelve months ended December 31, 2021. The Federal Reserve held the federal funds target rate unchanged at 0.00%–0.25%. In November, however, the Fed began reducing the pace of its bond-buying program and indicated it would continue tapering into 2022. Crude oil prices rose sharply over the twelve months.

The broad U.S. stock market, as measured by the Russell 3000 Index, advanced 25.66% for the period. Large-cap stocks surpassed smaller shares, while mid- and small-cap value equities had the best performance overall. (Returns by investment style and capitalization size are based on the Russell indexes.)

Account trailed its composite benchmark

The Account’s management team typically uses a combination of three different investment strategies—active management, quantitative management and indexing—which, in turn, invest in both domestic and foreign stocks.

For the twelve-month period, the Account trailed its composite benchmark. In the United States, the Account’s quantitative small-cap and active large-cap value strategies outperformed but were offset by underperformance from the active large-cap growth and core strategies. Among foreign investments, the Account’s actively managed global strategies made a solid contribution, while emerging markets detracted.

The Account’s returns may sometimes diverge from the returns of its benchmark more than would be expected. This divergence may be the result of the Account’s fair value pricing adjustments or of the timing of foreign currency valuations. Many foreign exchanges close for trading before the Account’s accumulation unit value (AUV) is calculated (see the current CREF prospectus for more details on AUV calculations). In the intervening hours, the values of foreign securities can change, and these changes are not reflected immediately in the returns of the Account’s benchmark. These changes are, however, taken into account to value the Account’s portfolio holdings at the time the Account’s AUV is calculated; these are known as fair value pricing adjustments.

| College Retirement Equities Fund ■ 2021 Annual Report | 11 |

CREF Stock Account

Performance as of December 31, 2021

| Stock Account | Total return | Average annual total return | Estimated annual operating expenses | |||||||||||||||||

| Inception date | 1 year | 5 years | 10 years | * | ||||||||||||||||

| Class R1 | 7/31/1952 | 18.67 | % | 14.50 | % | 12.94 | % | 0.445 | % | |||||||||||

| Class R2 | 4/24/2015 | 18.86 | 14.72 | 13.10 | † | 0.290 | ||||||||||||||

| Class R3 | 4/24/2015 | 18.92 | 14.79 | 13.15 | † | 0.240 | ||||||||||||||

| CREF Stock Account Composite Index§ | — | 19.90 | 15.44 | 13.64 | — | |||||||||||||||

| Broad market index | ||||||||||||||||||||

| Morningstar Aggressive Target Risk Index | — | 17.30 | 13.38 | 11.93 | — | |||||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Refer to the Financial highlights later in this report for the Account’s expense ratios as of the end of the reporting period. | |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. | |

| § | As of the close of business on December 31, 2021, the CREF Stock Account Composite Benchmark consisted of: 65.0% Russell 3000® Index and 35.0% MSCI ACWI ex USA IMI. The Account’s benchmark, the components that make up the composite benchmark and the method of calculating the composite benchmark’s performance may vary over time. |

| 12 | 2021 Annual Report ■ College Retirement Equities Fund |

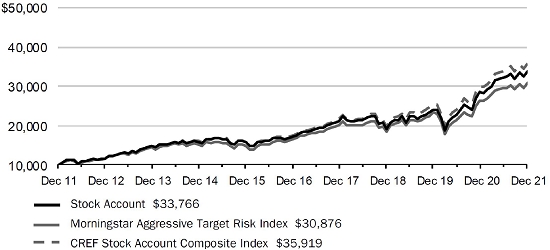

CREF Stock Account

$10,000 over 10 years (Class R1)

Ending amounts are as of December 31, 2021. For the purpose of comparison, the graph also shows the change in the values of the Account’s composite benchmark and a broad market index during the same period. The performance of other classes varies due to differences in expense charges.

Expense example

Six months ended December 31, 2021

| Stock Account | Beginning account value (7/1/21 | ) | Ending account value (12/31/21 | ) | Expenses paid during period (7/1/21–12/31/21 | * ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $ | 1,000.00 | $ | 1,047.00 | $ | 2.06 | ||||||

| Class R2 | 1,000.00 | 1,047.77 | 1.29 | |||||||||

| Class R3 | 1,000.00 | 1,048.03 | 1.03 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,023.19 | 2.04 | |||||||||

| Class R2 | 1,000.00 | 1,023.95 | 1.28 | |||||||||

| Class R3 | 1,000.00 | 1,024.20 | 1.02 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2021. The Account’s annualized six-month expense ratios for that period were 0.40% for Class R1, 0.25% for Class R2 and 0.20% for Class R3. |

For more information about this expense example, please see page 10.

| College Retirement Equities Fund ■ 2021 Annual Report | 13 |

CREF Stock Account

Actual expenses

| Net expense ratio for the one-year period ended 12/31/2021 | |

| Class R1 | 0.43% |

| Class R2 | 0.28% |

| Class R3 | 0.23% |

| Account profile | |

| as of 12/31/2021 | |

| Net assets | $139.17 billion |

| Portfolio turnover rate | 50% |

| Number of holdings | 10,094 |

| Weighted median market capitalization | $86.16 billion |

| Price/earnings ratio (weighted 12-month trailing average)† | 24.0 |

| † | Price/earnings ratio is the price of a stock divided by its earnings per share for the past twelve-month period. |

| Portfolio composition | |

| Sector | % of net assets as of 12/31/2021 |

| Information technology | 23.1 |

| Financials | 13.8 |

| Consumer discretionary | 12.8 |

| Health care | 11.4 |

| Industrials | 10.6 |

| Communication services | 7.8 |

| Consumer staples | 6.1 |

| Materials | 4.8 |

| Energy | 3.2 |

| Real estate | 3.0 |

| Utilities | 2.3 |

| Short-term investments, other assets & liabilities, net | 1.1 |

| Total | 100.0 |

| Holdings by company size | |

| Market capitalization | % of equity investments as of 12/31/2021 |

| More than $50 billion | 60.5 |

| More than $15 billion–$50 billion | 19.4 |

| More than $2 billion–$15 billion | 16.5 |

| $2 billion or less | 3.6 |

| Total | 100.0 |

| Holdings by country | |

| % of portfolio investments as of 12/31/2021 | |

| United States | 63.7 |

| Japan | 4.9 |

| United Kingdom | 3.4 |

| China | 3.1 |

| France | 2.5 |

| Canada | 2.4 |

| Germany | 2.0 |

| Switzerland | 1.8 |

| 73 other nations | 14.4 |

| Short-term investments | 1.8 |

| Total | 100.0 |

| 14 | 2021 Annual Report ■ College Retirement Equities Fund |

Performance for the twelve months ended December 31, 2021

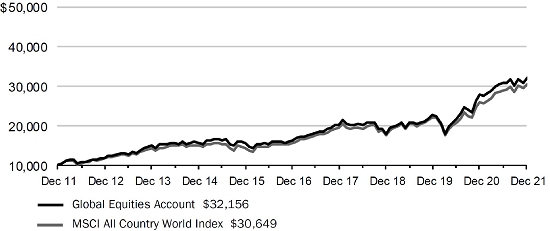

The CREF Global Equities Account returned 15.42% for the year, compared with the 18.54% return of its benchmark, the MSCI All Country World Index (ACWI). (All returns for the Account are for Class R1.)

International developed-markets stocks posted double-digit gains for the period, while emerging-markets equities declined. China’s economy grew at a rapid year-over-year pace in the first quarter, though expansion decelerated as the year progressed. Economies in the 19-nation euro area grew at a moderate pace during the period. Central banks around the world maintained accommodative monetary policies but grew increasingly cautious about rising inflation. The U.S. Federal Reserve maintained the federal funds target rate at 0.00%–0.25% throughout the period, and the European Central Bank left its benchmark rates unchanged at near-zero levels. The Bank of England increased its benchmark interest rate from 0.10% to 0.25% in December 2021.

Thirty-seven of the 48 countries represented in the MSCI ACWI posted gains in U.S.-dollar terms for the twelve-month period. In local-currency terms, the returns of most countries were higher than—or the same as—their U.S.-dollar returns.

Account trailed its benchmark

The account underperformed its benchmark for the twelve-month period. An out-of-benchmark investment in British e-commerce company THG detracted most as the stock declined amid a wave of selling caused by a lack of investor confidence. Next was an overweight position in Chinese internet data services provider GDS Holdings, which was hurt by the bearish trend in Chinese technology stocks, and an underweight in U.S. gaming semiconductor maker NVIDIA, which performed well.

Other positions helped offset these detractors, including overweights in Dutch financial firm ING Groep, which reported strong earnings, as well as U.S. stocks Freeport-McMoRan, a mining company, and Broadcom, a semiconductor manufacturer.

The Account’s returns may sometimes diverge from the returns of its benchmark more than would be expected. This divergence may be the result of the Account’s fair value pricing adjustments or of the timing of foreign currency valuations. Many foreign exchanges close for trading before the Account’s accumulation unit value (AUV) is calculated (see the current CREF prospectus for more details on AUV calculations). In the intervening hours, the values of foreign securities can change, and these changes are not reflected immediately in the returns of the Account’s benchmark. These changes are, however, taken into account to value the Account’s portfolio holdings at the time the Account’s AUV is calculated; these are known as fair value pricing adjustments.

| College Retirement Equities Fund ■ 2021 Annual Report | 15 |

CREF Global Equities Account

Performance as of December 31, 2021

| Global Equities Account | Total return | Average annual total return | Estimated annual operating expenses | |||||||||||||||||

| Inception date | 1 year | 5 years | 10 years | * | ||||||||||||||||

| Class R1 | 5/1/1992 | 15.42 | % | 14.49 | % | 12.39 | % | 0.420 | % | |||||||||||

| Class R2 | 4/24/2015 | 15.59 | 14.71 | 12.55 | † | 0.265 | ||||||||||||||

| Class R3 | 4/24/2015 | 15.65 | 14.78 | 12.60 | † | 0.215 | ||||||||||||||

| MSCI All Country World Index | — | 18.54 | 14.40 | 11.85 | — | |||||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Refer to the Financial highlights later in this report for the Account’s expense ratios as of the end of the reporting period. | |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

$10,000 over 10 years (Class R1)

Ending amounts are as of December 31, 2021. For the purpose of comparison, the graph also shows the change in the value of the Account’s benchmark during the same period. The performance of other classes varies due to differences in expense charges.

| 16 | 2021 Annual Report ■ College Retirement Equities Fund |

CREF Global Equities Account

Expense example

Six months ended December 31, 2021

| Global Equities Account | Beginning account value (7/1/21) | Ending account value (12/31/21) | Expenses paid during period (7/1/21–12/31/21 | * ) | ||||||||

| Actual return | ||||||||||||

| Class R1 | $ | 1,000.00 | $ | 1,041.42 | $ | 1.96 | ||||||

| Class R2 | 1,000.00 | 1,042.18 | 1.18 | |||||||||

| Class R3 | 1,000.00 | 1,042.44 | 0.93 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,023.29 | 1.94 | |||||||||

| Class R2 | 1,000.00 | 1,024.05 | 1.17 | |||||||||

| Class R3 | 1,000.00 | 1,024.30 | 0.92 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2021. The Account’s annualized six-month expense ratios for that period were 0.38% for Class R1, 0.23% for Class R2 and 0.18% for Class R3. |

For more information about this expense example, please see page 10.

Actual expenses

| Net expense ratio for the one-year period ended 12/31/2021 | |

| Class R1 | 0.41% |

| Class R2 | 0.26% |

| Class R3 | 0.20% |

| College Retirement Equities Fund ■ 2021 Annual Report | 17 |

CREF Global Equities Account

| Account profile | |

| as of 12/31/2021 | |

| Net assets | $28.74 billion |

| Portfolio turnover rate | 46% |

| Number of holdings | 2,568 |

| Weighted median market capitalization | $131.63 billion |

| Price/earnings ratio (weighted 12-month trailing average)† | 23.5 |

| † | Price/earnings ratio is the price of a stock divided by its earnings per share for the past twelve-month period. |

| Portfolio composition | |

| Sector | % of net assets as of 12/31/2021 |

| Information technology | 24.1 |

| Financials | 12.8 |

| Consumer discretionary | 12.4 |

| Health care | 11.2 |

| Industrials | 10.4 |

| Consumer staples | 7.5 |

| Communication services | 7.4 |

| Materials | 5.4 |

| Energy | 3.1 |

| Utilities | 2.1 |

| Real estate | 2.1 |

| Short-term investments, other assets & liabilities, net | 1.5 |

| Total | 100.0 |

| Holdings by company size | |

| Market capitalization | % of equity investments as of 12/31/2021 |

| More than $50 billion | 72.4 |

| More than $15 billion–$50 billion | 18.9 |

| More than $2 billion–$15 billion | 8.2 |

| $2 billion or less | 0.5 |

| Total | 100.0 |

| Holdings by country | |

| % of portfolio investments as of 12/31/2021 | |

| United States | 60.0 |

| Japan | 5.5 |

| United Kingdom | 4.4 |

| China | 3.7 |

| France | 3.5 |

| Netherlands | 2.2 |

| Switzerland | 2.1 |

| Germany | 2.1 |

| 46 other nations | 14.6 |

| Short-term investments | 1.9 |

| Total | 100.0 |

| 18 | 2021 Annual Report ■ College Retirement Equities Fund |

Performance for the twelve months ended December 31, 2021

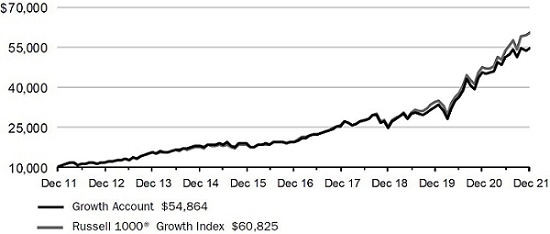

The CREF Growth Account returned 20.19% for the year, compared with the 27.60% return of its benchmark, the Russell 1000® Growth Index. (All returns for the Account are for Class R1.)

The U.S. economy grew at a solid pace during the period, despite ongoing supply-chain bottlenecks and the impact of new COVID-19 variants. The unemployment rate fell from 6.3% in January 2021 to 3.9% in December. Core inflation, which includes all items except food and energy, rose 5.5% over the twelve months ended December 31, 2021. The Federal Reserve held the federal funds target rate unchanged at 0.00%–0.25%. In November, however, the Fed began reducing the pace of its bond-buying program, which was designed to support the economy and credit markets, and indicated it would continue tapering into 2022. Crude oil prices rose sharply over the twelve months.

The broad U.S. stock market, as measured by the Russell 3000® Index, advanced 25.66% for the period. Large-cap stocks surpassed smaller shares, while mid- and small-cap value equities had the best performance overall. (Returns by investment style and capitalization size are based on the Russell indexes.)

Account posted a double-digit gain but lagged its benchmark

All eleven industry sectors in the Russell 1000 Growth Index generated significant gains for the twelve months. Energy (up 53.9%) was the best-performing sector, driven by the steep increase in oil prices. Information technology (up 33.3%)—the benchmark’s largest sector—contributed more than one-half of the index’s return. The next-largest contributors were communication services (up 31.4%) and consumer discretionary (up 18.4%). Together, these four sectors represented nearly three-quarters of the benchmark’s total market capitalization on December 31, 2021. Utilities (up 13.4%) and industrials (up 16.2%) were the worst-performing sectors.

The Account underperformed its benchmark for the year as certain stock selections did not perform as anticipated. The largest detractors were an underweight position in Apple, which reported strong growth in iPhone and iPad sales, and an overweight position in PayPal Holdings, which issued a lower-than-expected 2022 sales forecast. The next-largest detractor was an overweight position in cloud-communications firm Twilio.

On the positive side, an overweight position in software provider Intuit was the top contributor to relative performance. Intuit benefited from record levels of small business creation in the United States, which fueled demand for its products. The next-largest contributors were overweight positions in retailer Costco Wholesale and semiconductor supplier Marvell Technology.

| College Retirement Equities Fund ■ 2021 Annual Report | 19 |

CREF Growth Account

Performance as of December 31, 2021

| Growth Account | Total return | Average annual total return | Estimated annual | |||||||||||||||||

| Inception date | 1 year | 5 years | 10 years | operating expenses | * | |||||||||||||||

| Class R1 | 4/29/1994 | 20.19 | % | 23.17 | % | 18.56 | % | 0.390 | % | |||||||||||

| Class R2 | 4/24/2015 | 20.37 | 23.40 | 18.73 | † | 0.235 | ||||||||||||||

| Class R3 | 4/24/2015 | 20.43 | 23.47 | 18.78 | † | 0.185 | ||||||||||||||

| Russell 1000® Growth Index | — | 27.60 | 25.32 | 19.79 | — | |||||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Refer to the Financial highlights later in this report for the Account’s expense ratios as of the end of the reporting period. |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

$10,000 over 10 years (Class R1)

Ending amounts are as of December 31, 2021. For the purpose of comparison, the graph also shows the change in the value of the Account’s benchmark during the same period. The performance of other classes varies due to differences in expense charges.

| 20 | 2021 Annual Report ■ College Retirement Equities Fund |

CREF Growth Account

Expense example

Six months ended December 31, 2021

| Growth Account | Beginning account value (7/1/21 | ) | Ending account value (12/31/21 | ) | Expenses paid during period (7/1/21–12/31/21 | * ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $ | 1,000.00 | $ | 1,064.00 | $ | 1.82 | ||||||

| Class R2 | 1,000.00 | 1,064.78 | 1.09 | |||||||||

| Class R3 | 1,000.00 | 1,065.05 | 0.83 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,023.44 | 1.79 | |||||||||

| Class R2 | 1,000.00 | 1,024.15 | 1.07 | |||||||||

| Class R3 | 1,000.00 | 1,024.40 | 0.82 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2021. The Account’s annualized six-month expense ratios for that period were 0.35% for Class R1, 0.21% for Class R2 and 0.16% for Class R3. |

For more information about this expense example, please see page 10.

Actual expenses

| Net expense ratio for the one-year period ended 12/31/2021 | ||||

| Class R1 | 0.38 | % | ||

| Class R2 | 0.23 | % | ||

| Class R3 | 0.18 | % | ||

| College Retirement Equities Fund ■ 2021 Annual Report | 21 |

CREF Growth Account

| Account profile | ||

| as of 12/31/2021 | ||

| Net assets | $39.84 billion | |

| Portfolio turnover rate | 67% | |

| Number of holdings | 121 | |

| Weighted median market capitalization | $250.82 billion | |

| Price/earnings ratio (weighted 12-month trailing average)† | 46.5 |

| † | Price/earnings ratio is the price of a stock divided by its earnings per share for the past twelve-month period. |

| Portfolio composition | ||

| Sector | % of net assets as of 12/31/2021 | |

| Information technology | 41.9 | |

| Consumer discretionary | 19.3 | |

| Communication services | 13.6 | |

| Health care | 10.2 | |

| Industrials | 5.5 | |

| Consumer staples | 4.0 | |

| Financials | 3.5 | |

| Materials | 1.2 | |

| Short-term investments, other assets & liabilities, net | 0.8 | |

| Total | 100.0 |

| Holdings by company size | ||

| Market capitalization | % of equity investments as of 12/31/2021 | |

| More than $50 billion | 84.2 | |

| More than $15 billion–$50 billion | 14.5 | |

| More than $2 billion–$15 billion | 1.2 | |

| $2 billion or less | 0.1 | |

| Total | 100.0 |

| 22 | 2021 Annual Report ■ College Retirement Equities Fund |

Performance for the twelve months ended December 31, 2021

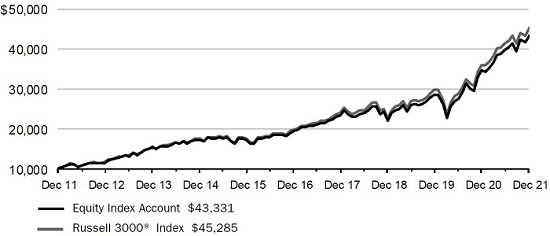

The CREF Equity Index Account returned 25.26% for the year, compared with the 25.66% return of its benchmark, the Russell 3000® Index. (All returns for the Account are for Class R1.)

For the twelve-month period, the Account’s return underperformed that of its benchmark index due to the effect of expenses. The Account’s return includes a deduction for expenses, while the benchmark’s does not. The Account had a risk profile similar to that of its benchmark.

The U.S. economy grew at a solid pace during the period, despite ongoing supply-chain bottlenecks and the impact of new COVID-19 variants. The unemployment rate fell from 6.3% in January 2021 to 3.9% in December. Core inflation, which includes all items except food and energy, rose 5.5% over the twelve months ended December 31, 2021. The Federal Reserve held the federal funds target rate unchanged at 0.00%–0.25%. In November, however, the Fed began reducing the pace of its bond-buying program, which was designed to support the economy and credit markets, and indicated it would continue tapering into 2022. Crude oil prices rose sharply over the twelve months.

The broad U.S. stock market, as measured by the Russell 3000 Index, advanced 25.66% for the period. Large-cap stocks surpassed smaller shares, while mid- and small-cap value equities had the best performance overall. (Returns by investment style and capitalization size are based on the Russell indexes.)

All benchmark sectors posted double-digit gains

All eleven industry sectors in the Russell 3000 Index delivered substantial gains for the twelve months. Energy (up 56.1%) produced the strongest return, helped by rising oil prices. Information technology (up 29.9%)—the benchmark’s largest sector—was the top contributor to the index’s return. The next-largest contributors were financials (up 34.8%) and consumer discretionary (up 22.4%). Together, these four sectors represented over one-half of the benchmark’s total market capitalization on December 31, 2021. The worst performer was utilities (up 17.1%), a defensive sector that tends to lag when the economy is strong, followed by communication services (up 17.9%).

For the twelve-month period, four of the five largest stocks in the Russell 3000 Index generated impressive gains that surpassed the overall return of the benchmark. Alphabet (the parent company of Google) performed best amid robust growth in spending on digital advertising. Next came Microsoft, which benefited from strong demand for its cloud-computing services. Electric car maker Tesla and Apple also outperformed, while Amazon.com advanced modestly but trailed the benchmark. Amazon was hurt by rising labor and shipping costs.

| College Retirement Equities Fund ■ 2021 Annual Report | 23 |

CREF Equity Index Account

Performance as of December 31, 2021

| Equity Index Account | Total return | Average annual total return | Estimated annual | |||||||||||||||||

| Inception date | 1 year | 5 years | 10 years | operating expenses | * | |||||||||||||||

| Class R1 | 4/29/1994 | 25.26 | % | 17.45 | % | 15.79 | % | 0.375 | % | |||||||||||

| Class R2 | 4/24/2015 | 25.45 | 17.68 | 15.96 | † | 0.220 | ||||||||||||||

| Class R3 | 4/24/2015 | 25.52 | 17.75 | 16.01 | † | 0.170 | ||||||||||||||

| Russell 3000® Index | — | 25.66 | 17.97 | 16.30 | — | |||||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Refer to the Financial highlights later in this report for the Account’s expense ratios as of the end of the reporting period. |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

$10,000 over 10 years (Class R1)

Ending amounts are as of December 31, 2021. For the purpose of comparison, the graph also shows the change in the value of the Account’s benchmark during the same period. The performance of other classes varies due to differences in expense charges.

| 24 | 2021 Annual Report ■ College Retirement Equities Fund |

CREF Equity Index Account

Expense example

Six months ended December 31, 2021

| Equity Index Account | Beginning account value (7/1/21 | ) | Ending account value (12/31/21 | ) | Expenses paid during period (7/1/21–12/31/21 | * ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $ | 1,000.00 | $ | 1,089.97 | $ | 1.79 | ||||||

| Class R2 | 1,000.00 | 1,090.76 | 1.00 | |||||||||

| Class R3 | 1,000.00 | 1,091.04 | 0.74 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,023.49 | 1.73 | |||||||||

| Class R2 | 1,000.00 | 1,024.25 | 0.97 | |||||||||

| Class R3 | 1,000.00 | 1,024.50 | 0.71 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2021. The Account’s annualized six-month expense ratios for that period were 0.34% for Class R1, 0.19% for Class R2 and 0.14% for Class R3. |

For more information about this expense example, please see page 10.

Actual expenses

| Net expense ratio for the one-year period ended 12/31/2021 | ||||

| Class R1 | 0.36 | % | ||

| Class R2 | 0.21 | % | ||

| Class R3 | 0.16 | % | ||

| College Retirement Equities Fund ■ 2021 Annual Report | 25 |

CREF Equity Index Account

| Account profile | ||

| as of 12/31/2021 | ||

| Net assets | $25.68 billion | |

| Portfolio turnover rate | 4% | |

| Number of holdings | 2,814 | |

| Weighted median market capitalization | $139.18 billion | |

| Price/earnings ratio (weighted 12-month trailing average)† | 28.5 |

| † | Price/earnings ratio is the price of a stock divided by its earnings per share for the past twelve-month period. |

| Portfolio composition | ||

| Sector | % of net assets as of 12/31/2021 | |

| Information technology | 28.2 | |

| Health care | 13.3 | |

| Consumer discretionary | 12.3 | |

| Financials | 11.2 | |

| Communication services | 9.2 | |

| Industrials | 8.9 | |

| Consumer staples | 5.4 | |

| Real estate | 3.6 | |

| Energy | 2.7 | |

| Utilities | 2.4 | |

| Materials | 2.4 | |

| Short-term investments, other assets & liabilities, net | 0.4 | |

| Total | 100.0 |

Holdings by company size

| Market capitalization | % of equity investments as of 12/31/2021 | |

| More than $50 billion | 68.4 | |

| More than $15 billion–$50 billion | 17.7 | |

| More than $2 billion–$15 billion | 12.0 | |

| $2 billion or less | 1.9 | |

| Total | 100.0 |

| 26 | 2021 Annual Report ■ College Retirement Equities Fund |

Performance for the twelve months ended December 31, 2021

The CREF Bond Market Account returned –1.43% for the year, compared with the –1.54% return of its benchmark, the Bloomberg U.S. Aggregate Bond Index. (All returns for the Account are for Class R1.)

The U.S. economy grew at a solid pace during the period, despite ongoing supply-chain bottlenecks and the impact of new COVID-19 variants. The unemployment rate fell from 6.3% in January 2021 to 3.9% in December. Core inflation, which includes all items except food and energy, rose 5.5% over the twelve months ended December 31, 2021, while crude oil prices increased sharply.

Central banks around the world maintained accommodative monetary policies but grew increasingly cautious about rising inflation. The Federal Reserve maintained the federal funds target rate throughout the period at 0.00%–0.25%, and the European Central Bank left its benchmark rates unchanged at near-zero levels. The Bank of England increased its benchmark rate from 0.10% to 0.25% in December. Yields on U.S. Treasury securities rose for all but one- to three-month maturities, with intermediate-term bond yields having the largest increases (bond yields move in the opposite direction of prices).

Account outperformed its benchmark

Most sectors in the Bloomberg U.S. Aggregate Bond Index declined for the twelve month period due to the general rise in bond yields. The U.S. Treasuries sector, the largest in the index with a weight of 37.8%, returned –2.3%. Mortgage-backed securities (MBS), the second-largest sector accounting for 26.5% of the index’s total market capitalization on December 31, 2021, returned –1.0%. Corporate bonds—the benchmark’s third-largest sector at 26.4%—returned –1.0%, while asset-backed securities and commercial mortgage-backed securities (CMBS) returned –0.3% and –1.2%, respectively.

The Account outperformed its benchmark for the year, with asset allocation as the largest driver of the Account’s returns versus its benchmark. An overweight to corporate bonds (including high-yield and emerging-markets corporates) and underweights to MBS and Treasuries proved beneficial as risk appetites returned during the year. Positions in out-of-index municipal bonds, asset-backed securities and CMBS also aided the Account’s performance. Overall, shorter-than-benchmark duration helped as rates generally rose.

By contrast, these positive effects were offset by positioning along the yield curve, where the Account was underweight the longer-maturity segments of the curve.

| College Retirement Equities Fund ■ 2021 Annual Report | 27 |

CREF Bond Market Account

Performance as of December 31, 2021

| Bond Market Account | Average annual | Estimated | ||||||||||||||||

| Total return | total return | annual | ||||||||||||||||

| Inception | operating | |||||||||||||||||

| date | 1 year | 5 years | 10 years | expenses | * | |||||||||||||

| Class R1 | 3/1/1990 | –1.43 | % | 3.59 | % | 2.98 | % | 0.415 | % | |||||||||

| Class R2 | 4/24/2015 | –1.28 | 3.79 | 3.13 | † | 0.260 | ||||||||||||

| Class R3 | 4/24/2015 | –1.23 | 3.85 | 3.18 | † | 0.210 | ||||||||||||

| Bloomberg U.S. Aggregate Bond Index | — | –1.54 | 3.57 | 2.90 | — | |||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance and 30-day SEC yield information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Refer to the Financial highlights later in this report for the Account’s expense ratios as of the end of the reporting period. |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

$10,000 over 10 years (Class R1)

Ending amounts are as of December 31, 2021. For the purpose of comparison, the graph also shows the change in the value of the Account’s benchmark during the same period. The performance of other classes varies due to differences in expense charges.

| 28 | 2021 Annual Report ■ College Retirement Equities Fund |

CREF Bond Market Account

Expense example

Six months ended December 31, 2021

| Bond Market Account | Beginning account value (7/1/21 | ) | Ending account value (12/31/21 | ) | Expenses paid during period (7/1/21-12/31/21 | * ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $ | 1,000.00 | $ | 997.78 | $ | 1.96 | ||||||

| Class R2 | 1,000.00 | 998.51 | 1.21 | |||||||||

| Class R3 | 1,000.00 | 998.76 | 0.96 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,023.24 | 1.99 | |||||||||

| Class R2 | 1,000.00 | 1,024.00 | 1.22 | |||||||||

| Class R3 | 1,000.00 | 1,024.25 | 0.97 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2021. The Account’s annualized six-month expense ratios for that period were 0.39% for Class R1, 0.24% for Class R2 and 0.19% for Class R3. |

For more information about this expense example, please see page 10.

Actual expenses

| Net expense ratio for the one-year period ended 12/31/2021 | |||

| Class R1 | 0.41% | ||

| Class R2 | 0.26% | ||

| Class R3 | 0.21% | ||

| College Retirement Equities Fund ■ 2021 Annual Report | 29 |

CREF Bond Market Account

Account profile

| as of 12/31/2021 | ||

| Net assets | $13.62 billion | |

| Portfolio turnover rate | 207% | |

| Portfolio turnover rate, excluding mortgage dollar-roll transactions | 49% | |

| Number of issues | 2,140 | |

| Option-adjusted duration‡ | 6.33 years | |

| Average maturity§ | 8.38 years |

| ‡ | Option-adjusted duration estimates how much the value of a bond portfolio would be affected by a change in prevailing interest rates, taking into account the options embedded in the individual securities. The longer a portfolio’s duration, the more sensitive it is to changes in interest rates. |

| § | Average maturity is a simple average of the maturities of all the bonds in an account’s portfolio. The maturity of a bond is the amount of time until the bond’s principal becomes due or payable. |

Portfolio composition

| Sector | % of net assets as of 12/31/2021 | |

| Corporate bonds | 33.4 | |

| Mortgage-backed securities | 23.5 | |

| Foreign government & corporate bonds denominated in U.S. dollars | 15.8 | |

| U.S. Treasury securities | 7.6 | |

| Commercial mortgage-backed securities | 7.3 | |

| Asset-backed securities | 6.9 | |

| Municipal bonds | 3.0 | |

| Bank loan obligations | 0.7 | |

| U.S. agency securities | 0.4 | |

| Preferred stock | 0.1 | |

| Short-term investments, other assets & liabilities, net | 1.3 | |

| Total | 100.0 |

Holdings by maturity

| % of fixed-income investments (excluding short-term investments) as of 12/31/2021 | ||

| Less than 1 year | 3.6 | |

| 1–3 years | 12.4 | |

| 3–5 years | 20.7 | |

| 5–10 years | 44.0 | |

| Over 10 years | 19.3 | |

| Total | 100.0 |

Holdings by credit quality

| % of fixed-income investments (excluding short-term investments) as of 12/31/2021 | |||

| U.S. Treasury & U.S. agency securities* | 28.3 | ||

| Aaa/AAA | 9.9 | ||

| Aa/AA | 9.1 | ||

| A/A | 18.1 | ||

| Baa/BBB | 29.2 | ||

| Ba/BB | 3.0 | ||

| B/B | 1.2 | ||

| Non-rated | 1.2 | ||

| Total | 100.0 | ||

| * | These securities are guaranteed by the full faith and credit of the U.S. government. |

Credit quality ratings are based on the Bloomberg methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

| 30 | 2021 Annual Report ■ College Retirement Equities Fund |

CREF Inflation-Linked Bond Account

Performance for the twelve months ended December 31, 2021

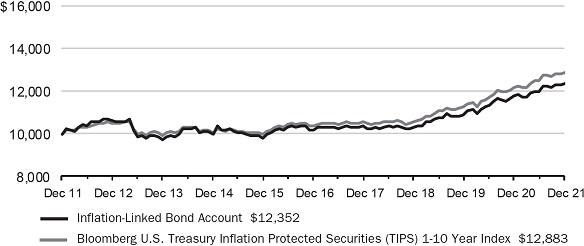

The CREF Inflation-Linked Bond Account returned 5.06% for the year, compared with the 5.69% return of its benchmark, the Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1–10 Year Index. (All returns for the Account are for Class R1.)

The U.S. economy grew at a solid pace during the period, despite ongoing supply-chain bottlenecks and the impact of new COVID-19 variants. The unemployment rate fell from 6.3% in January 2021 to 3.9% in December. Core inflation, which includes all items except food and energy, rose 5.5% over the twelve months ended December 31, 2021, while crude oil prices increased sharply.

Central banks around the world maintained accommodative monetary policies but grew increasingly cautious about rising inflation. The Federal Reserve maintained the federal funds target rate throughout the period at 0.00%–0.25%, and the European Central Bank left its benchmark rates unchanged at near-zero levels. The Bank of England increased its benchmark rate from 0.10% to 0.25% in December. Yields on U.S. Treasury securities rose for all but one- to three-month maturities, with intermediate-term bond yields having the largest increases (bond yields move in the opposite direction of prices).

TIPS surpassed the broader U.S. bond market

For the twelve months, the TIPS 1–10 Year Index outperformed the –1.54% return of the broad domestic investment-grade fixed-rate bond market, as measured by the Bloomberg U.S. Aggregate Bond Index.

Yields on intermediate- and longer-maturity high-quality bonds rose during the period as tight labor markets, surging consumer demand and supply-chain bottlenecks led to higher interest rates, a sharp increase in inflation and a shift in Fed monetary policy. As a result, bond performance overall was generally negative. However, these developments were favorable for TIPS, which posted gains for the period.

The Account trailed its benchmark for the period. The Account’s return includes a deduction for expenses, while the benchmark’s return does not. Since the Account’s portfolio resembled the composition of its benchmark, the above discussion of the benchmark’s performance also applies to the Account’s performance.

During the period, the Account’s portfolio managers kept the Account’s duration—a measure of its sensitivity to interest-rate changes—close to that of the TIPS 1–10 Year Index. This strategy helped the Account’s risk and reward characteristics to more closely resemble those of its benchmark.

| College Retirement Equities Fund ■ 2021 Annual Report | 31 |

CREF Inflation-Linked Bond Account

Performance as of December 31, 2021

| Inflation-Linked Bond Account | Average annual | Estimated | ||||||||||||||||

| Total return | total return | annual | ||||||||||||||||

| Inception | operating | |||||||||||||||||

| date | 1 year | 5 years | 10 years | expenses | * | |||||||||||||

| Class R1 | 5/1/1997 | 5.06 | % | 3.93 | % | 2.13 | % | 0.385 | % | |||||||||

| Class R2 | 4/24/2015 | 5.22 | 4.13 | 2.28 | † | 0.230 | ||||||||||||

| Class R3 | 4/24/2015 | 5.28 | 4.19 | 2.33 | † | 0.180 | ||||||||||||

| Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) 1–10 Year Index | — | 5.69 | 4.46 | 2.57 | — | |||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance and 30-day SEC yield information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Refer to the Financial highlights later in this report for the Account’s expense ratios as of the end of the reporting period. |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

$10,000 over 10 years (Class R1)

Ending amounts are as of December 31, 2021. For the purpose of comparison, the graph also shows the change in the value of the Account’s benchmark during

| 32 | 2021 Annual Report ■ College Retirement Equities Fund |

CREF Inflation-Linked Bond Account

the same period. The performance of other classes varies due to differences in expense charges.

Expense example

Six months ended December 31, 2021

| Inflation-Linked Bond Account | Beginning account value (7/1/21 | ) | Ending account value (12/31/21 | ) | Expenses paid during period (7/1/21-12/31/21 | * ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $ | 1,000.00 | $ | 1,029.63 | $ | 1.79 | ||||||

| Class R2 | 1,000.00 | 1,030.38 | 1.07 | |||||||||

| Class R3 | 1,000.00 | 1,030.64 | 0.82 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,023.44 | 1.79 | |||||||||

| Class R2 | 1,000.00 | 1,024.15 | 1.07 | |||||||||

| Class R3 | 1,000.00 | 1,024.40 | 0.82 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2021. The Account’s annualized six-month expense ratios for that period were 0.35% for Class R1, 0.21% for Class R2 and 0.16% for Class R3. |

For more information about this expense example, please see page 10.

Actual expenses

| Net expense ratio for the one-year period ended 12/31/2021 | |

| Class R1 | 0.37% |

| Class R2 | 0.22% |

| Class R3 | 0.17% |

| College Retirement Equities Fund ■ 2021 Annual Report | 33 |

CREF Inflation-Linked Bond Account

Account profile

| as of 12/31/2021 | |

| Net assets | $7.82 billion |

| Portfolio turnover rate | 24% |

| Number of issues | 128 |

| Option-adjusted duration‡ | 4.40 years |

| Average maturity§ | 4.53 years |

| ‡ | Option-adjusted duration estimates how much the value of a bond portfolio would be affected by a change in prevailing interest rates, taking into account the options embedded in the individual securities. The longer a portfolio’s duration, the more sensitive it is to changes in interest rates. |

| § | Average maturity is a simple average of the maturities of all the bonds in an account’s portfolio. The maturity of a bond is the amount of time until the bond’s principal becomes due or payable. |

Portfolio composition

| Sector | % of net assets as of 12/31/2021 |

| U.S. Treasury securities | 92.7 |

| Mortgage-backed securities | 3.1 |

| Commercial mortgage-backed securities | 1.3 |

| Corporate bonds | 1.0 |

| Foreign government & corporate bonds denominated in U.S. dollars | 0.5 |

| Bank loan obligations | 0.4 |

| Asset-backed securities | 0.4 |

| U.S. agency securities | 0.2 |

| Short-term investments, other assets & liabilities, net | 0.4 |

| Total | 100.0 |

Holdings by maturity

| % of fixed-income investments (excluding short-term investments) as of 12/31/2021 | |

| Less than 1 year | 3.5 |

| 1–3 years | 25.7 |

| 3–5 years | 28.8 |

| 5–10 years | 39.4 |

| Over 10 years | 2.6 |

| Total | 100.0 |

Holdings by credit quality

| % of fixed-income investments (excluding short-term investments) as of 12/31/2021 | ||

| U.S. Treasury & U.S. agency securities* | 93.0 | |

| Aaa/AAA | 2.5 | |

| Aa/AA | 0.2 | |

| A/A | 1.0 | |

| Baa/BBB | 0.9 | |

| Ba/BB | 1.3 | |

| B/B | 0.3 | |

| Non-rated | 0.8 | |

| Total | 100.0 | |

| * | These securities are guaranteed by the full faith and credit of the U.S. government. |

Credit quality ratings are based on the Bloomberg methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

| 34 | 2021 Annual Report ■ College Retirement Equities Fund |

Performance for the twelve months ended December 31, 2021

The CREF Social Choice Account returned 12.42% for the year, compared with the 11.97% return of its composite benchmark, a weighted average of the Russell 3000® Index, the MSCI EAFE+Canada Index and the Bloomberg U.S. Aggregate Bond Index. The Account utilizes environmental, social and governance (ESG) criteria, while the benchmark does not. (All returns for the Account are for Class R1.)

Because of its ESG criteria, the Account did not invest in a number of stocks and bonds that were included in the indexes that comprise its composite benchmark. Avoiding these investments produced mixed results, but the net effect was that the Account outperformed its benchmark.

Relative to the Russell 3000 Index, the performance of the Account’s domestic equity component benefited from avoiding Amazon.com, credit card issuer Visa and AT&T. In contrast, the omissions of drug maker Pfizer, Exxon Mobil and Bank of America were detrimental. Relative to the MSCI EAFE+Canada Index, the Account’s international holdings were helped by excluding Japanese conglomerate Softbank Group, Swiss drug maker Novartis and British consumer products giant Unilever. Conversely, avoiding French luxury goods firm LVMH, Toronto-Dominion Bank and British beverage company Diageo was disadvantageous.

Account outperformed its composite benchmark

To compensate for the Account’s exclusion of some stocks, its managers use quantitative (mathematical) modeling and other techniques in an attempt to match the overall investment characteristics of the portfolio with those of its composite benchmark.

Compared to the Russell 3000 Index, the Account’s domestic equity holdings benefited most from overweight positions in semiconductor companies NVIDIA and Applied Materials, as well as software provider Intuit. By contrast, the largest detractors were an underweight position in Apple and overweight positions in PayPal and video game firm Activision Blizzard.

Relative to the MSCI EAFE+Canada Index, the Account’s foreign holdings were helped most by an overweight position in Japanese marine transportation company Nippon Yusen, an underweight position in Hong Kong insurer AIA Group and an overweight position in Canada’s Cenovus Energy. Conversely, overweight positions in French digital services company Atos, Japan’s Chugai Pharmaceutical and Danish wind farm developer Orsted detracted most from relative performance.

The Account’s fixed-income component declined, but its return outperformed the –1.54% result of the Bloomberg U.S. Aggregate Bond Index, mainly due to favorable yield curve positioning in the U.S. Treasuries sector.

| College Retirement Equities Fund ■ 2021 Annual Report | 35 |

CREF Social Choice Account

| Performance as of December 31, 2021 | ||||||||||||||||||||

| Social Choice Account | Average annual | Estimated | ||||||||||||||||||

| Total return | total return | annual | ||||||||||||||||||

| Inception | operating | |||||||||||||||||||

| date | 1 year | 5 years | 10 years | expenses | * | |||||||||||||||

| Class R1 | 3/1/1990 | 12.42 | % | 10.78 | % | 9.34 | % | 0.400 | % | |||||||||||

| Class R2 | 4/24/2015 | 12.59 | 10.99 | 9.49 | † | 0.245 | ||||||||||||||

| Class R3 | 4/24/2015 | 12.64 | 11.06 | 9.54 | † | 0.195 | ||||||||||||||

| CREF Social Choice Account Composite Index§ | — | 11.97 | 10.88 | 9.67 | — | |||||||||||||||

| Broad market index | ||||||||||||||||||||

| Morningstar Moderate Target Risk Index | — | 10.19 | 10.07 | 8.75 | — | |||||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Refer to the Financial highlights later in this report for the Account’s expense ratios as of the end of the reporting period. |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

| § | As of the close of business on December 31, 2021, the CREF Social Choice Composite Benchmark consisted of: 42.0% Russell 3000® Index, 40.0% Bloomberg U.S. Aggregate Bond Index and 18.0% MSCI EAFE+ Canada Index. The Account’s benchmark, the components that make up the composite benchmark and the method of calculating the composite benchmark’s performance may vary over time. |

| 36 | 2021 Annual Report ■ College Retirement Equities Fund |

CREF Social Choice Account

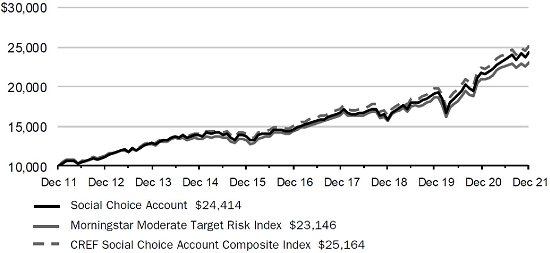

$10,000 over 10 years (Class R1)

Ending amounts are as of December 31, 2021. For the purpose of comparison, the graph also shows the change in the values of the Account’s composite benchmark and a broad market index during the same period. The performance of other classes varies due to differences in expense charges.

Expense example

Six months ended December 31, 2021

| Beginning | Ending | Expenses paid | ||||||||||

| account value | account value | during period | * | |||||||||

| Social Choice Account | (7/1/21 | ) | (12/31/21 | ) | (7/1/21-12/31/21 | ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $1,000.00 | $ | 1,044.86 | $ | 1.91 | |||||||

| Class R2 | 1,000.00 | 1,045.63 | 1.19 | |||||||||

| Class R3 | 1,000.00 | 1,045.89 | 0.93 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,023.34 | 1.89 | |||||||||

| Class R2 | 1,000.00 | 1,024.05 | 1.17 | |||||||||

| Class R3 | 1,000.00 | 1,024.30 | 0.92 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2021. The Account’s annualized six-month expense ratios for that period were 0.37% for Class R1, 0.23% for Class R2 and 0.18% for Class R3. |

For more information about this expense example, please see page 10.

| College Retirement Equities Fund ■ 2021 Annual Report | 37 |

CREF Social Choice Account

Actual expenses

| Net expense ratio for the one-year period ended 12/31/2021 | ||

| Class R1 | 0.40% | |

| Class R2 | 0.24% | |

| Class R3 | 0.19% |

| Account profile | ||

| as of 12/31/2021 | ||

| Net assets | $19.75 billion | |

| Portfolio turnover rate | 118% | |

| Portfolio turnover rate, excluding mortgage dollar-roll transactions | 57% | |

| Equity segment | ||

| Number of holdings | 1,031 | |

| Weighted median market capitalization | $75.74 billion | |

| Price/earnings ratio (weighted 12-month trailing average)† | 24.0 | |

| Fixed-income segment | ||

| Number of issues | 960 | |

| Option-adjusted duration‡ | 6.61 years | |

| Average maturity§ | 9.51 years |

| † | Price/earnings ratio is the price of a stock divided by its earnings per share for the past twelve-month period. |

| ‡ | Option-adjusted duration estimates how much the value of a bond portfolio would be affected by a change in prevailing interest rates, taking into account the options embedded in the individual securities. The longer a portfolio’s duration, the more sensitive it is to changes in interest rates. |