UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number File No. 811-04415

COLLEGE RETIREMENT EQUITIES FUND

(Exact Name of Registrant as specified in charter)

730 Third Avenue, New York, New York 10017-3206

(Address of Principal Executive Offices) (Zip code)

Terry H. Lin, Esq.

College Retirement Equities Fund

730 Third Avenue

New York, New York 10017-3206

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-490-9000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

Item 1. Reports to Stockholders.

Annual Report ■ December 31, 2018

College Retirement

Equities Fund

The annual report contains the audited financial statements.

| Account name | Class R1 | Class R2 | Class R3 |

| Stock Account | QCSTRX | QCSTPX | QCSTIX |

| Global Equities Account | QCGLRX | QCGLPX | QCGLIX |

| Growth Account | QCGRRX | QCGRPX | QCGRIX |

| Equity Index Account | QCEQRX | QCEQPX | QCEQIX |

| Bond Market Account | QCBMRX | QCBMPX | QCBMIX |

| Inflation-Linked Bond Account | QCILRX | QCILPX | QCILIX |

| Social Choice Account | QCSCRX | QCSCPX | QCSCIX |

| Money Market Account | QCMMRX | QCMMPX | QCMMIX |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the CREF Accounts’ (the “Accounts”) annual and semiannual reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, they will be made available on TIAA’s website, TIAA.org, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive these reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive reports and other communications from the Accounts electronically anytime by either updating your account settings at TIAA.org/eDelivery, if you hold your Account units through a TIAA-affiliated financial intermediary, account or retirement plan (each, a “TIAA Account”), or by contacting your financial intermediary (such as a broker/dealer or bank) through which you hold Account units.

If you invest in the Accounts through a TIAA Account, you may elect to continue to receive all future reports in paper free of charge by updating your account settings at TIAA.org/eDelivery or by calling 877-518-9161 during regular business hours. If you invest through another financial intermediary, you can contact your financial intermediary to request that you continue receiving paper copies of your reports. Your election to receive reports in paper will apply to all funds held through your financial intermediary or, if you invest through a TIAA Account, to all funds held with the Accounts and any other investment companies within the same group of related investment companies.

Contents

| Audited financial statements | ||

| Statements of assets and liabilities | 78 | |

| Statements of operations | 80 | |

| Statements of changes in net assets | 82 | |

| Financial highlights | 88 | |

| Notes to financial statements | 96 | |

| Report of independent registered public accounting firm | 114 | |

| 2018 participant meeting | 116 | |

| Trustees and officers | 117 | |

| Additional information about index providers | 123 | |

| How to reach us | Inside back cover | |

This annual report contains information about the CREF variable annuity accounts and describes their results for the twelve months ended December 31, 2018. The report contains four main sections:

| • | A letter to participants from Carol Deckbar, Principal Executive Officer, CREF; Executive Vice President, TIAA Institutional Investments and Endowment Services. | |

| • | The account performance section compares each account’s investment returns with those of its benchmark index. | |

| • | The summary portfolios of investments list the industries and types of securities in which each account had investments as of December 31, 2018. | |

| • | The financial statements provide detailed information about the operations and financial condition of each account. |

The views and opinions expressed in this report are through the end of the period, as stated on the cover of this report. They are subject to change at any time based on a variety of factors. As such, they are not guarantees of future performance or investment results and should not be taken as investment advice. To see the risks of investing in any account, please read the latest prospectus.

As always, you should carefully consider the investment objectives, risks, charges and expenses of any account before investing. For a prospectus that contains this and other important information, please visit our website at TIAA.org, or call 877-518-9161. We urge you to read the prospectus carefully before investing.

| College Retirement Equities Fund ■ 2018 Annual Report | 3 |

Global equity markets became more volatile in 2018, serving as a reminder to investors that downturns can and do occur. After nearly a decade-long stretch of strong performance, the sharp decline near the year’s end caught some investors off guard. Nevertheless, the U.S. economy remained strong with moderate inflation. The U.S. unemployment rate fell to its lowest level in nearly 50 years, and wage growth continued. In response to the economy’s strength, the Federal Reserve increased the federal funds target rate four times to 2.25%–2.50%. Overseas, growth in Europe slowed, while returns in emerging markets were hurt by rising interest rates and a stronger U.S. dollar. In the fixed-income markets, U.S. Treasury yields increased, which dampened returns as bond prices move in the opposite direction of yields.

| • | Returns for the five CREF Accounts with significant exposure to U.S. equities ranged from –12.6% for the Global Equities Account to –2.7% for the Growth Account. | |

| • | The Bond Market Account returned –0.4% for the year, and the Inflation-Linked Bond Account returned –0.7%. | |

| • | Seven out of the eight CREF Accounts lagged their respective benchmarks. | |

| • | All account returns are for Class R1. |

Most CREF Accounts produced negative returns in 2018

For the twelve-month period, seven out of eight CREF Accounts had negative performance. Among domestic equities, growth stocks performed better than value shares, and large-cap stocks generally outperformed mid- and small-cap equities. International stocks trailed U.S. stocks, while fixed-income securities generally outperformed equities.

Looking at individual account performance, the Stock Account, which is the largest CREF Account in terms of net assets, returned –9.9%, lagging its composite benchmark. The Growth Account returned –2.7%, also trailing its benchmark’s return of –1.5% due to certain stock selections.

The Equity Index Account, which returned –5.6%, and the Inflation-Linked Bond Account, which declined 0.7%, lagged their respective benchmarks by modest margins, mostly due to the effect of expenses. The Money Market Account also trailed its benchmark.

The Social Choice Account returned –4.5%, slightly outpacing the 4.6% decline of its benchmark due to advantageous portfolio allocations.

The Global Equities Account returned –12.6%, which trailed its benchmark’s return of –9.4% in a difficult environment for foreign equities.

The Bond Market Account returned –0.4%, trailing its benchmark, the Bloomberg Barclays US. Aggregate Bond Index, primarily due to an underweight allocation in U.S. Treasuries.

| 4 | 2018 Annual Report ■ College Retirement Equities Fund |

For full details on all CREF Accounts, please see the commentaries on the following pages.

Global equity markets posted losses

The broad U.S. stock market, as measured by the Russell 3000 Index, returned –5.2% for the twelve months. Concerns about rising interest rates, trade tensions with China and a decelerating global economy weighed on markets in the latter months of the period.

Foreign equities, as represented in U.S.-dollar terms by the MSCI EAFE Index, declined more sharply, posting a return of –13.8%.

U.S. investment-grade fixed-rate bonds, as measured by the Bloomberg Barclays U.S.

Aggregate Bond Index, were essentially flat for the year, reflecting the impact of four interest-rate increases by the Federal Reserve. Yields on U.S. Treasury securities were also affected by the Fed’s actions, rising during the period, with greater increases occurring among shorter-term bonds.

Carol Deckbar

Maintain perspective during periods of increased volatility

Periodic corrections are a normal part of investing in the stock market and have occurred frequently throughout the course of history. Perhaps the most important thing to remember during periods of volatility is to avoid overreacting. We believe that investment decisions should be based on a current assessment of long-term goals and personal risk tolerance, rather than emotions. Attempts to time stock market declines and rallies are rarely successful. We believe that investors who can ride out the market’s inevitable ups and downs have a greater chance of achieving more consistent investment results over the long term. The market’s strong start in 2019 illustrates this point.

As always, we recommend that you consult your financial advisor or call a TIAA financial consultant with any questions about your investments. To learn more, visit us at TIAA.org or call 800-842-2252. We would be happy to assist you.

/s/ Carol W. Deckbar

Carol W. Deckbar

Principal Executive Officer, CREF

Executive Vice President, TIAA Institutional Investments and Endowment Services

| College Retirement Equities Fund ■ 2018 Annual Report | 5 |

Information for CREF participants

Portfolio holdings

Securities and Exchange Commission (SEC) rules allow investment companies to list the top holdings of each account in their annual and semiannual reports, instead of providing complete portfolio listings. CREF also files complete portfolio listings with the SEC, and they are available to the public.

You can obtain a complete list of CREF’s holdings (Schedules of Investments) as of the most recently completed fiscal quarter in the following ways:

| • | By visiting our website at TIAA.org; or | |

| • | By calling us at 800-842-2252 to request a copy, which will be provided free of charge. |

You can also obtain a complete list of CREF’s portfolio holdings as of the most recently completed fiscal quarter, and for prior quarter-ends, from our SEC Form N-CSR and Form N-Q filings. Form N-CSR filings are as of December 31 or June 30; Form N-Q filings are as of March 31 or September 30. Copies of these forms are available:

| • | Through the Electronic Data Gathering and Retrieval System (EDGAR) on the SEC’s website at sec.gov; or | |

| • | From the SEC’s Office of Investor Education and Advocacy. Call 202-551-8090 for more information. |

Proxy voting

CREF’s ownership of stock gives it the right to vote on proxy issues of companies in which it invests. A description of our proxy voting policies and procedures can be found on our website at TIAA.org or on the SEC’s website at sec.gov. You can also call us at 800-842-2252 to request a free copy. A report of how the accounts voted during the most recently completed twelve-month period ended June 30 can be found on our website or on Form N-PX at sec.gov.

Contacting TIAA

There are three easy ways to contact us: by email, using the Contact Us link at the top of our home page; by mail at TIAA, 730 Third Avenue, New York, NY 10017-3206; or by phone at 800-842-2252.

Account management

The CREF Accounts are managed by the portfolio management teams of TIAA-CREF Investment Management, LLC. The members of these teams are responsible for the day-to-day investment management of the accounts.

| 6 | 2018 Annual Report ■ College Retirement Equities Fund |

About the accounts’ benchmarks

CREF Stock Account

The Account’s composite benchmark is a weighted average of two unmanaged indexes: the Russell 3000® Index, which measures the performance of the broad U.S. stock market, and the MSCI All Country World ex USA Investable Market Index, which measures the performance of small-, mid- and large-cap stocks in 46 developed- and emerging-markets nations throughout the world, excluding the United States.

The Morningstar Aggressive Target Risk Index is a broad-based securities market index for the Stock Account and has a 95% global equity market exposure and a multi-asset class exposure that is similar to the Stock Account.

CREF Global Equities Account

On May 1, 2018, the benchmark for the Global Equities Account changed from the MSCI World Index to the MSCI All Country World Index (ACWI). The MSCI ACWI measures the performance of large- and mid-capitalization stocks in 23 developed-markets countries and 24 emerging-markets countries.

CREF Growth Account

The Account’s benchmark is the Russell 1000® Growth Index, a subset of the Russell 1000 Index, which measures the performance of the stocks of the 1,000 largest companies in the Russell 3000 Index, based on market capitalization. The Russell 1000 Growth Index measures the performance of those stocks of the Russell 1000 Index with higher relative forecasted growth rates and price/book ratios.

CREF Equity Index Account

The Account’s benchmark is the Russell 3000 Index, which measures the performance of the stocks of the 3,000 largest publicly traded U.S. companies, based on market capitalization. The index measures the performance of about 98% of the total market capitalization of the publicly traded U.S. equity market.

CREF Bond Market Account

The Account’s benchmark is the Bloomberg Barclays U.S. Aggregate Bond Index, which measures the performance of the domestic investment-grade fixed-rate bond market, including government and corporate securities, agency mortgage pass-through securities, asset-backed securities and commercial mortgage-backed securities.

| College Retirement Equities Fund ■ 2018 Annual Report | 7 |

About the accounts’ benchmarks

CREF Inflation-Linked Bond Account

The Account’s benchmark is the Bloomberg Barclays U.S. Treasury Inflation Protected Securities (TIPS) 1–10 Year Index, which measures the performance of fixed-income securities with maturities between 1 and 10 years that are adjusted for inflation, as measured by the Consumer Price Index for All Urban Consumers (CPI-U).

CREF Social Choice Account

The Account’s composite benchmark is a weighted average of three unmanaged indexes: the Russell 3000® Index, which measures the performance of the broad U.S. stock market; the Bloomberg Barclays U.S. Aggregate Bond Index, which measures the performance of the domestic investment-grade, fixed-rate bond market; and the MSCI EAFE+Canada Index, which measures stock performance in 22 developed-markets nations, excluding the United States.

On May 1, 2018, the Morningstar Moderate Target Risk Index was added as a broad-based securities market index for the Social Choice Account. This index is part of a family of five indexes covering equity risk preferences ranging from aggressive to conservative. The index has a multi-asset class exposure (60% global equity, 40% global fixed income) that is similar to the Social Choice Account.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

Russell 1000® and Russell 3000 are trademarks and service marks of Frank Russell Company. TIAA products are not promoted or sponsored by, or affiliated with, Frank Russell Company. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. This report is not approved, reviewed or produced by MSCI. EAFE stands for Europe, Australasia, Far East.

| 8 | 2018 Annual Report ■ College Retirement Equities Fund |

Important information about expenses

All participants in the CREF Accounts incur ongoing costs, including management fees and other account expenses.

The expense examples for each Class that appear in this report are intended to help you understand your ongoing costs (in U.S. dollars) and do not reflect transactional costs. The examples are designed to help you compare these ongoing costs with the ongoing costs of investing in other variable annuity accounts and mutual funds. Participants in the CREF Accounts do not incur a sales charge for purchases or other distributions.

The examples are based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (July 1, 2018–December 31, 2018).

Actual expenses

The first section in each table uses the Account’s actual expenses and its actual rate of return. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the six-month period.

Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses paid during period” to estimate the expenses you paid during the six-month period.

Hypothetical example for comparison purposes

The second section in the table shows hypothetical account values and expenses based on the Account’s actual expense ratio for each Class for the six-month period and an assumed 5%-per-year rate of return before expenses. This was not the Account’s actual return.

This hypothetical example cannot be used to estimate the actual expenses you paid for the period, but rather allows you to compare the ongoing costs of investing in the Account with the costs of other accounts. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other variable annuity accounts and mutual funds.

| College Retirement Equities Fund ■ 2018 Annual Report | 9 |

Performance for the twelve months ended December 31, 2018

The CREF Stock Account returned –9.86% for the year, compared with the –8.12% return of its composite benchmark, a weighted average of the Russell 3000® Index and the MSCI All Country World (ACWI) ex USA Investable Market Index (IMI). (All returns for the Account are for Class R1.)

The U.S. economy grew at a solid pace in 2018, while inflation remained moderate. The unemployment rate fell to 3.7%—its lowest level in nearly 50 years—before ending the period at 3.9% on December 31, 2018. Wage growth increased and consumer confidence was strong. The Federal Reserve raised the federal funds target rate four times during the year, increasing the key short-term interest-rate measure to 2.25%–2.50%. Oil prices declined, while concerns over rising rates and slower global economic growth caused volatility late in the period. The broad U.S. stock market, as measured by the Russell 3000 Index, declined 5.24%. Growth stocks outperformed value shares, and large-cap stocks surpassed mid- and small-cap equities. (Returns by investment style and capitalization size are based on the Russell indexes.)

The MSCI ACWI ex USA IMI, which measures the performance of mid- and large-cap stocks in 46 developed- and emerging-markets countries outside the United States, declined 14.76% in U.S.-dollar terms for the twelve months, underperforming U.S. stocks. Equity prices fell in both developed- and emerging-markets countries.

Account trailed its composite benchmark

The Account lagged its benchmark for the twelve-month period as certain holdings did not perform as anticipated. An out-of-benchmark investment in Australia-based titanium dioxide producer Tronox was the leading detractor, followed by overweight positions in U.S. shale producer Parsley Energy and information technology services firm DXC Technology. On the positive side, the Account benefited from an overweight in salesforce.com, a developer of customer relationship management software. An underweight position in industrial conglomerate General Electric and an overweight in electricity generator FirstEnergy were also beneficial.

The Account’s returns may sometimes diverge from the returns of its benchmark more than would be expected. This divergence may be the result of the Account’s fair value pricing adjustments or of the timing of foreign currency valuations. Many foreign exchanges close for trading before the Account’s accumulation unit value (AUV) is calculated (see the current CREF prospectus for more details on AUV calculations). In the intervening hours, the values of foreign securities can change, and these changes are not reflected immediately in the returns of the Account’s benchmark. These changes are, however, taken into account to value the Account’s portfolio holdings at the time the Account’s AUV is calculated; these are known as fair value pricing adjustments.

| 10 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Stock Account

Performance as of December 31, 2018

| CREF Stock Account | Total | Average annual | Estimated annual | |||||||||||||||

| return | total return | operating | ||||||||||||||||

| Inception date | 1 year | 5 years | 10 years | expenses | * | |||||||||||||

| Class R1 | 7/31/1952 | –9.86 | % | 4.88 | % | 10.70 | % | 0.580 | % | |||||||||

| Class R2 | 4/24/2015 | –9.69 | 5.08 | † | 10.80 | † | 0.370 | |||||||||||

| Class R3 | 4/24/2015 | –9.65 | 5.14 | † | 10.83 | † | 0.305 | |||||||||||

| CREF Stock Composite Benchmark‡ | –8.12 | 5.81 | 11.21 | — | ||||||||||||||

| Broad market index | ||||||||||||||||||

| Morningstar Aggressive Target Risk Index | –8.17 | 5.01 | 10.61 | — | ||||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

| ‡ | As of the close of business on December 31, 2018, the CREF Stock Composite Benchmark consisted of: 70.0% Russell 3000 Index and 30.0% MSCI All Country World ex USA Investable Market Index. The Account’s benchmark, the components that make up the composite benchmark and the method of calculating the composite benchmark’s performance may vary over time. |

| College Retirement Equities Fund ■ 2018 Annual Report | 11 |

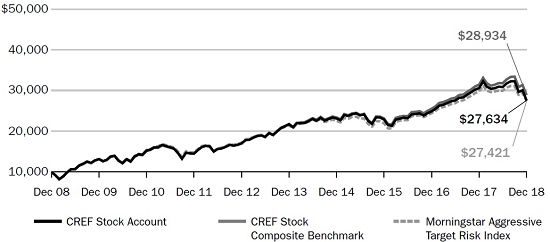

CREF Stock Account

$10,000 over 10 years (Class R1)

For the purpose of comparison, the graph also shows the change in the values of the Account’s composite benchmark and a broad market index during the same period. The performance of other Classes varies due to differences in expense charges.

Expense example

Six months ended December 31, 2018

| Beginning account value | Ending account value | Expenses

paid during period | * | |||||||||

| CREF Stock Account | (7/1/18 | ) | (12/31/18 | ) | (7/1/18–12/31/18 | ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $1,000.00 | $ 894.06 | $2.43 | |||||||||

| Class R2 | 1,000.00 | 894.86 | 1.58 | |||||||||

| Class R3 | 1,000.00 | 895.07 | 1.39 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,022.63 | 2.60 | |||||||||

| Class R2 | 1,000.00 | 1,023.54 | 1.68 | |||||||||

| Class R3 | 1,000.00 | 1,023.74 | 1.48 | |||||||||

| * | Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2018. The Account’s annualized six-month expense ratios for that period were 0.51% for Class R1, 0.33% for Class R2 and 0.29% for Class R3. |

For more information about this expense example, please see page 9.

| Actual expenses | |

| Net expense ratio for the one-year period ended 12/31/2018 | |

| Class R1 | 0.53% |

| Class R2 | 0.34% |

| Class R3 | 0.30% |

| 12 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Stock Account

| Account profile | ||

| as of 12/31/2018 | ||

| Net assets | $103.84 billion | |

| Portfolio turnover rate | 55% | |

| Number of holdings | 9,605 | |

| Weighted median market capitalization | $43.80 billion | |

| Price/earnings ratio (weighted 12-month trailing average)* | 17.74 | |

| * | Price/earnings ratio is the price of a stock divided by its earnings per share for the past twelve-month period. |

| Portfolio composition | ||

| Sector | % of net assets as of 12/31/2018 | |

| Information technology | 16.9 | |

| Financials | 15.3 | |

| Health care | 13.0 | |

| Industrials | 10.6 | |

| Consumer discretionary | 10.6 | |

| Communication services | 8.5 | |

| Consumer staples | 7.2 | |

| Energy | 5.6 | |

| Materials | 4.8 | |

| Real estate | 3.8 | |

| Utilities | 2.9 | |

| Short-term investments, other assets & liabilities, net | 0.8 | |

| Total | 100.0 |

| Holdings by company size | ||

| Market capitalization | % of equity investments as of 12/31/2018 | |

| More than $50 billion | 45.4 | |

| More than $15 billion-$50 billion | 23.6 | |

| More than $2 billion-$15 billion | 24.1 | |

| $2 billion or less | 6.9 | |

| Total | 100.0 |

| Holdings by country | ||

| % of portfolio investments as of 12/31/2018 | ||

| United States | 66.6 | |

| Japan | 5.3 | |

| United Kingdom | 3.7 | |

| China | 2.4 | |

| France | 2.3 | |

| Canada | 2.0 | |

| Germany | 1.6 | |

| Switzerland | 1.6 | |

| 65 other nations | 12.5 | |

| Short-term investments | 2.0 | |

| Total | 100.0 |

| College Retirement Equities Fund ■ 2018 Annual Report | 13 |

Performance for the twelve months ended December 31, 2018

The CREF Global Equities Account returned –12.56% for the year, compared with the –9.42% return of its benchmark, the MSCI All Country World Index (ACWI). (All returns for the Account are for Class R1.)

During the twelve-month period, declines in foreign equities exceeded those of U.S. equities amid slowing economic growth in many parts of the world and rising global trade tensions. Stock prices fell in both developed- and emerging-markets countries. GDP in the 19-nation euro area grew at its slowest pace in four years during the third quarter of 2018, with notable contractions in the economies of Germany and Italy. China’s economic growth slowed to 6.5% in the third quarter, its worst year-over-year performance since 2009, while Japan struggled with natural disasters and declining exports. Emerging-markets countries wrestled with the effects of rising interest rates and a stronger U.S. dollar.

The U.S. Federal Reserve raised the federal funds target rate four times during the period, increasing the key short-term interest-rate measure to 2.25%–2.50%. In September, the European Central Bank indicated it would leave benchmark interest rates at their low levels until at least the summer of 2019. The Bank of England raised its benchmark interest rate to 0.75% in August; toward the end of the year, however, the bank noted that uncertainty over the United Kingdom’s plan to exit the European Union was evident in financial markets.

In this challenging period, all 23 of the developed markets and most of the 24 emerging markets in the MSCI ACWI declined in U.S.-dollar terms.

Account trailed its benchmark

Many of the Account’s holdings had negative performance during the period. The largest detractors were overweight positions in Netherlands-based bank ING Groep, Las Vegas-based casino resort operator Wynn Resorts and U.S. information technology services provider DXC Technology.

On the positive side, the top contributors were overweight positions in networking giant Cisco Systems, software developer salesforce.com and digital transactions pioneer PayPal.

The Account’s returns may sometimes diverge from the returns of its benchmark more than would be expected. This divergence may be the result of the Account’s fair value pricing adjustments or of the timing of foreign currency valuations. Many foreign exchanges close for trading before the Account’s accumulation unit value (AUV) is calculated (see the current CREF prospectus for more details on AUV calculations). In the intervening hours, the values of foreign securities can change, and these changes are not reflected immediately in the returns of the Account’s benchmark. These changes are, however, taken into account to value the Account’s portfolio holdings at the time the Account’s AUV is calculated; these are known as fair value pricing adjustments.

| 14 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Global Equities Account

Performance as of December 31, 2018

| CREF Global Equities Account | Total return | Average annual total return | Estimated annual operating | |||||||||||||||

| Inception date | 1 year | 5 years | 10 years | expenses | * | |||||||||||||

| Class R1 | 5/1/1992 | –12.56 | % | 3.35 | % | 9.36 | % | 0.610 | % | |||||||||

| Class R2 | 4/24/2015 | –12.40 | 3.54 | † | 9.46 | † | 0.400 | |||||||||||

| Class R3 | 4/24/2015 | –12.36 | 3.60 | † | 9.49 | † | 0.335 | |||||||||||

| MSCI ACWI Index‡ | — | –9.42 | 4.26 | 9.46 | — | |||||||||||||

| MSCI World Index | — | –8.71 | 4.56 | 9.67 | — | |||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of the Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

| ‡ | On May 1, 2018, the benchmark for the Global Equities Account changed from the MSCI World Index to the MSCI All Country World Index (ACWI). For more information, please see the Account’s current prospectus. |

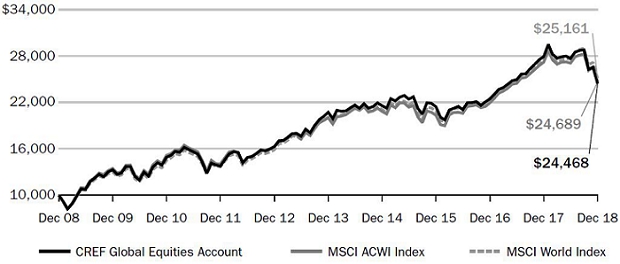

$10,000 over 10 years (Class R1)

For the purpose of comparison, the graph also shows the change in the values of the Account’s new and old benchmarks during the same period. The performance of other Classes varies due to differences in expense charges.

| College Retirement Equities Fund ■ 2018 Annual Report | 15 |

CREF Global Equities Account

Expense example

Six months ended December 31, 2018

| CREF Global Equities Account | Beginning account value (7/1/18 | ) | Ending account value (12/31/18 | ) | Expenses paid during period (7/1/18–12/31/18 | * ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $1,000.00 | $ 881.61 | $2.37 | |||||||||

| Class R2 | 1,000.00 | 882.40 | 1.52 | |||||||||

| Class R3 | 1,000.00 | 882.61 | 1.28 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,022.68 | 2.55 | |||||||||

| Class R2 | 1,000.00 | 1,023.59 | 1.63 | |||||||||

| Class R3 | 1,000.00 | 1,023.84 | 1.38 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2018. The Account’s annualized six-month expense ratios for that period were 0.50% for Class R1, 0.32% for Class R2 and 0.27% for Class R3. |

For more information about this expense example, please see page 9.

Actual expenses

| Net expense ratio for the one-year period ended 12/31/2018 | ||||

| Class R1 | 0.53 | % | ||

| Class R2 | 0.35 | % | ||

| Class R3 | 0.30 | % | ||

| 16 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Global Equities Account

Account profile

| as of 12/31/2018 | |||

| Net assets | $18.21 billion | ||

| Portfolio turnover rate | 77% | ||

| Number of holdings | 2,925 | ||

| Weighted median market capitalization | $56.33 billion | ||

| Price/earnings ratio (weighted 12-month trailing average)* | 16.59 | ||

| * | Price/earnings ratio is the price of a stock divided by its earnings per share for the past twelve-month period. |

Portfolio composition

| Sector | % of net assets as of 12/31/2018 | ||

| Information technology | 16.6 | ||

| Financials | 14.6 | ||

| Consumer discretionary | 13.2 | ||

| Health care | 13.1 | ||

| Industrials | 11.0 | ||

| Communication services | 7.8 | ||

| Consumer staples | 7.7 | ||

| Energy | 6.1 | ||

| Materials | 5.3 | ||

| Real estate | 1.7 | ||

| Utilities | 1.5 | ||

| Short-term investments, other assets & liabilities, net | 1.4 | ||

| Total | 100.0 | ||

Holdings by company size

| Market capitalization | % of equity investments as of 12/31/2018 | ||

| More than $50 billion | 52.0 | ||

| More than $15 billion–$50 billion | 23.1 | ||

| More than $2 billion–$15 billion | 22.6 | ||

| $2 billion or less | 2.3 | ||

| Total | 100.0 | ||

Holdings by country

| % of portfolio investments as of 12/31/2018 | |||

| United States | 57.0 | ||

| Japan | 6.7 | ||

| United Kingdom | 5.5 | ||

| China | 3.5 | ||

| France | 3.2 | ||

| Switzerland | 2.5 | ||

| Canada | 2.3 | ||

| Netherlands | 2.1 | ||

| 49 other nations | 14.4 | ||

| Short-term investments | 2.8 | ||

| Total | 100.0 | ||

| College Retirement Equities Fund ■ 2018 Annual Report | 17 |

Performance for the twelve months ended December 31, 2018

The CREF Growth Account returned –2.69% for the year, compared with the –1.51% return of its benchmark, the Russell 1000® Growth Index. (All returns for the Account are for Class R1.)

The U.S. economy grew at a solid pace in 2018, while inflation remained moderate. The unemployment rate fell to 3.7%—its lowest level in nearly 50 years—before ending the period at 3.9% on December 31, 2018. Wage growth increased and consumer confidence was strong. The Federal Reserve responded to the growing economy by raising the federal funds target rate four times during the period, increasing the key short-term interest-rate measure to 2.25%–2.50%. Oil prices declined for the year, falling sharply over the final three months of the period. Concerns over rising interest rates, trade tensions with China and a decelerating global economy weighed on markets in the latter months of the period.

The broad U.S. stock market, as measured by the Russell 3000® Index, declined 5.24% for the twelve-month period as performance was negative across investment styles and capitalization sizes. Growth stocks performed better than value shares, and large-cap stocks surpassed mid- and small-cap equities. (Returns by investment style and capitalization size are based on the Russell indexes.)

For the ten years ended December 31, 2018, the Russell 1000 Growth Index recorded an annual average return of 15.29%, compared with the 11.18% average annual return of the Russell 1000 Value Index.

Account trailed its benchmark

Seven of the eleven industry sectors in the Russell 1000 Growth Index posted losses for the year. Energy (down 29.9%) was the worst-performing sector, reflecting the decline in oil prices. Next came materials (down 14.6%), communication services (down 11.1%) and industrials (down 10.1%), the latter detracting most from the benchmark’s return. Together, these four sectors represented more than one-quarter of the benchmark’s total market capitalization on December 31, 2018. The sectors with positive performance were utilities (up 9.2%)—the benchmark’s smallest sector—consumer discretionary (up 5.2%), information technology (up 4.5%) and health care (up 4.1%).

The Account underperformed its benchmark mostly due to security selections that did not perform as anticipated. An underweight position in Starbucks had the greatest negative impact on relative performance. Holdings in semiconductor maker Broadcom and an out-of-index position in Chinese Internet provider Tencent Holdings also detracted from relative performance.

By contrast, the Account’s relative performance benefited from overweight positions in software firm salesforce.com and financial software developer Intuit. An overweight in media holding company IAC/Interactive also contributed.

| 18 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Growth Account

Performance as of December 31, 2018

| CREF Growth Account | Total return | Average annual total return | Estimated annual operating | |||||||||||||||

| Inception date | 1 year | 5 years | 10 years | expenses | * | |||||||||||||

| Class R1 | 4/29/1994 | –2.69 | % | 9.61 | % | 14.67 | % | 0.530 | % | |||||||||

| Class R2 | 4/24/2015 | –2.51 | 9.81 | † | 14.78 | † | 0.320 | |||||||||||

| Class R3 | 4/24/2015 | –2.46 | 9.87 | † | 14.81 | † | 0.255 | |||||||||||

| Russell 1000® Growth Index | — | –1.51 | 10.40 | 15.29 | — | |||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of the Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

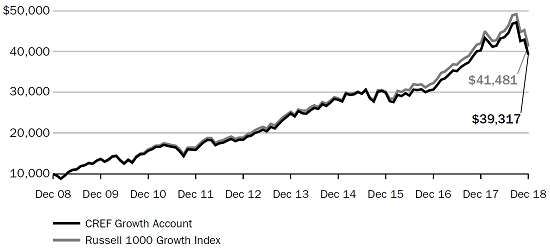

$10,000 over 10 years (Class R1)

For the purpose of comparison, the graph also shows the change in the value of the Account’s benchmark during the same period. The performance of other Classes varies due to differences in expense charges.

| College Retirement Equities Fund ■ 2018 Annual Report | 19 |

CREF Growth Account

Expense example

Six months ended December 31, 2018

| CREF Growth Account | Beginning account value (7/1/18 | ) | Ending account value (12/31/18 | ) | Expenses paid during period (7/1/18–12/31/18 | * ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $1,000.00 | $ 901.00 | $2.11 | |||||||||

| Class R2 | 1,000.00 | 901.81 | 1.25 | |||||||||

| Class R3 | 1,000.00 | 902.03 | 1.05 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,022.99 | 2.24 | |||||||||

| Class R2 | 1,000.00 | 1,023.89 | 1.33 | |||||||||

| Class R3 | 1,000.00 | 1,024.10 | 1.12 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2018. The Account’s annualized six-month expense ratios for that period were 0.44% for Class R1, 0.26% for Class R2 and 0.22% for Class R3. |

For more information about this expense example, please see page 9.

Actual expenses

| Net expense ratio for the one-year period ended 12/31/2018 | ||

| Class R1 | 0.46% | |

| Class R2 | 0.28% | |

| Class R3 | 0.24% |

| 20 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Growth Account

Account profile

| as of 12/31/2018 | ||

| Net assets | $23.23 billion | |

| Portfolio turnover rate | 62% | |

| Number of holdings | 598 | |

| Weighted median market capitalization | $90.11 billion | |

| Price/earnings ratio (weighted 12-month trailing average)* | 26.45 |

| * | Price/earnings ratio is the price of a stock divided by its earnings per share for the past twelve-month period. |

Portfolio composition

| Sector | % of net assets as of 12/31/2018 | |

| Information technology | 34.4 | |

| Consumer discretionary | 16.3 | |

| Health care | 13.9 | |

| Communication services | 13.6 | |

| Industrials | 10.7 | |

| Financials | 3.9 | |

| Consumer staples | 3.9 | |

| Materials | 1.9 | |

| Energy | 0.6 | |

| Real estate | 0.5 | |

| Short-term investments, other assets & liabilities, net | 0.3 | |

| Total | 100.0 |

Holdings by company size

| Market capitalization | % of equity investments as of 12/31/2018 | |

| More than $50 billion | 62.5 | |

| More than $15 billion–$50 billion | 22.2 | |

| More than $2 billion–$15 billion | 15.1 | |

| $2 billion or less | 0.2 | |

| Total | 100.0 |

| College Retirement Equities Fund ■ 2018 Annual Report | 21 |

Performance for the twelve months ended December 31, 2018

The CREF Equity Index Account returned –5.59% for the year, compared with the –5.24% return of its benchmark, the Russell 3000® Index. (All returns for the Account are for Class R1.)

For the twelve-month period, the Account’s return underperformed that of its benchmark index due to the effect of expenses. The Account’s return includes a deduction for expenses, while the benchmark’s does not. The Account had a risk profile similar to that of its benchmark.

The U.S. economy grew at a solid pace in 2018, while inflation remained moderate. The unemployment rate fell to 3.7%—its lowest level in nearly 50 years—before ending the period at 3.9% on December 31, 2018. Wage growth increased and consumer confidence was strong. The Federal Reserve responded to the growing economy by raising the federal funds target rate four times during the period, increasing the key short-term interest-rate measure to 2.25%–2.50%. Oil prices declined for the year, falling sharply over the final three months of the period. Concerns over rising interest rates, trade tensions with China and a decelerating global economy weighed on markets in the latter months of the period.

The performance of the broad U.S. stock market, as measured by the Russell 3000 Index, was negative across investment styles and capitalization sizes. Growth stocks performed better than value shares, and large-cap stocks surpassed mid- and small-cap equities. (Returns by investment style and capitalization size are based on the Russell indexes.)

Financials and industrials led the benchmark’s decline

Eight of the eleven industry sectors in the Russell 3000 Index posted losses for the year. The worst-performing sectors were energy (down 19.8%), materials (down 17.4%) and industrials (down 14.0%). Financials (down 12.7%)—the benchmark’s second-largest sector—detracted most from the index’s return amid concerns that rising short-term interest rates would reduce banks’ profits. Together, these four sectors represented more than one-third of the benchmark’s total market capitalization on December 31, 2018. The sectors with positive performance were health care (up 5.2%), utilities (up 4.5%) and information technology (up 3.1%), which was the index’s largest sector.

For the twelve-month period, four of the benchmark’s five largest stocks outperformed the benchmark’s overall return. Amazon.com performed best with strong double-digit gains, followed by Microsoft. Berkshire Hathaway posted a single-digit rise. Johnson & Johnson declined amid uncertainty about drug prices but outpaced the benchmark’s return. Apple slightly underperformed the index as concerns about U.S.-Chinese trade issues and slowing global growth weighed on the stock.

| 22 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Equity Index Account

Performance as of December 31, 2018

| CREF Equity Index Account | Total | Average annual | Estimated annual | |||||||||||||||

| return | total return | operating | ||||||||||||||||

| Inception date | 1 year | 5 years | 10 years | expenses | * | |||||||||||||

| Class R1 | 4/29/1994 | –5.59 | % | 7.40 | % | 12.69 | % | 0.505 | % | |||||||||

| Class R2 | 4/24/2015 | –5.41 | 7.60 | † | 12.80 | † | 0.295 | |||||||||||

| Class R3 | 4/24/2015 | –5.37 | 7.66 | † | 12.83 | † | 0.230 | |||||||||||

| Russell 3000® Index | — | –5.24 | 7.91 | 13.18 | — | |||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of the Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

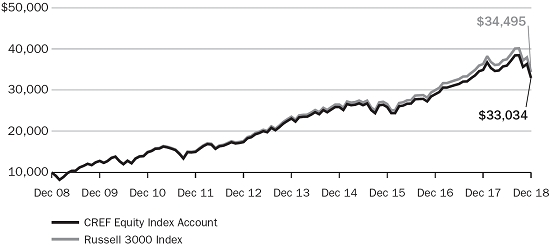

$10,000 over 10 years (Class R1)

For the purpose of comparison, the graph also shows the change in the value of the Account’s benchmark during the same period. The performance of other Classes varies due to differences in expense charges.

| College Retirement Equities Fund ■ 2018 Annual Report | 23 |

CREF Equity Index Account

Expense example

Six months ended December 31, 2018

| Beginning | Ending | Expenses paid | ||||||||||

| account value | account value | during period | * | |||||||||

| CREF Equity Index Account | (7/1/18 | ) | (12/31/18 | ) | (7/1/18–12/31/18 | ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $1,000.00 | $ 916.69 | $2.03 | |||||||||

| Class R2 | 1,000.00 | 917.51 | 1.16 | |||||||||

| Class R3 | 1,000.00 | 917.73 | 0.92 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,023.09 | 2.14 | |||||||||

| Class R2 | 1,000.00 | 1,024.00 | 1.22 | |||||||||

| Class R3 | 1,000.00 | 1,024.25 | 0.97 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2018. The Account’s annualized six-month expense ratios for that period were 0.42% for Class R1, 0.24% for Class R2 and 0.19% for Class R3. |

For more information about this expense example, please see page 9.

Actual expenses

| Net expense ratio for the one-year period ended 12/31/2018 | ||

| Class R1 | 0.44% | |

| Class R2 | 0.26% | |

| Class R3 | 0.21% |

| 24 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Equity Index Account

Account profile

| as of 12/31/2018 | ||

| Net assets | $16.83 billion | |

| Portfolio turnover rate | 3% | |

| Number of holdings | 2,839 | |

| Weighted median market capitalization | $67.26 billion | |

| Price/earnings ratio (weighted 12-month trailing average)* | 19.89 | |

| * | Price/earnings ratio is the price of a stock divided by its earnings per share for the past twelve-month period. |

| Portfolio composition | ||

| % of net assets | ||

| Sector | as of 12/31/2018 | |

| Information technology | 19.8 | |

| Health care | 14.9 | |

| Financials | 13.8 | |

| Consumer discretionary | 10.2 | |

| Industrials | 9.9 | |

| Communication services | 9.1 | |

| Consumer staples | 6.6 | |

| Energy | 4.9 | |

| Real estate | 3.9 | |

| Utilities | 3.3 | |

| Materials | 3.0 | |

| Short-term investments, other assets & liabilities, net | 0.6 | |

| Total | 100.0 |

Holdings by company size

| % of equity investments | ||

| Market capitalization | as of 12/31/2018 | |

| More than $50 billion | 54.4 | |

| More than $15 billion-$50 billion | 22.6 | |

| More than $2 billion-$15 billion | 19.0 | |

| $2 billion or less | 4.0 | |

| Total | 100.0 |

| College Retirement Equities Fund ■ 2018 Annual Report | 25 |

Performance for the twelve months ended December 31, 2018

The CREF Bond Market Account returned –0.41% for the year, compared with the 0.01% return of its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index. (All returns for the Account are for Class R1.)

During the twelve-month period, the U.S. economy continued to grow at a solid pace. The unemployment rate fell to 3.7%, its lowest level in nearly 50 years, before ending the period at 3.9% on December 31, 2018. Wages grew at the fastest rate in nearly a decade, and, in October, consumer confidence reached its highest level since 2000 before declining in November. Annual core inflation, which includes all items except food and energy, was moderate at 2.2% in December. The price of oil declined for the year, falling sharply over the final three months of the period, while the U.S. dollar strengthened.

The Federal Reserve raised the federal funds target rate four times during the period, increasing the key short-term interest-rate measure to 2.25%–2.50%. Fed policymakers were criticized for rate increases amid declining stock markets and evidence of a slowing global economy late in the year. Chairman Jerome Powell said the Fed would be “patient” with monetary policy in 2019. Yields on U.S. Treasury securities of all maturities rose during the period, but the increases were greatest among shorter-term investments. In August, the Bank of England raised its benchmark rate to 0.75%, while in September, the European Central Bank indicated it would leave benchmark interest rates unchanged until at least the summer of 2019.

Account underperformed its benchmark during the period

For the twelve-month period, the Account’s benchmark returns were driven primarily by mortgaged-backed securities, which gained 1.0% and accounted for 27.7% of the index’s total market capitalization at period-end. U.S. Treasuries, the largest index sector with a weighting of 37.6%, and asset-backed securities (ABS), one of the smallest sectors at 0.5%, rose 0.9% and 1.8%, respectively. By contrast, corporate bonds, which represented 25.2% of the index, declined 2.5%, while the smallest sector in the benchmark, municipal bonds, fell 1.6%.

The Account underperformed its benchmark during the period, primarily as a result of an underweight position in U.S. Treasuries, which outperformed the index. Overweighted positions in government credit securities, commercial mortgage-backed securities and corporate bonds also detracted.

These negative effects were tempered by positive factors, including overweight positions in the stronger-performing ABS, municipals and government agency sectors. In general, the Account’s yield curve positioning across the portfolio also contributed to its relative returns, as did a small exposure to derivatives instruments.

| 26 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Bond Market Account

Performance as of December 31, 2018

| CREF Bond Market Account | Total | Average annual | Estimated annual | |||||||||||||||

| return | total return | operating | ||||||||||||||||

| Inception date | 1 year | 5 years | 10 years | expenses | * | |||||||||||||

| Class R1 | 3/1/1990 | –0.41 | % | 2.42 | % | 3.57 | % | 0.580 | % | |||||||||

| Class R2 | 4/24/2015 | –0.23 | 2.60 | † | 3.66 | † | 0.370 | |||||||||||

| Class R3 | 4/24/2015 | –0.19 | 2.66 | † | 3.69 | † | 0.305 | |||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index | — | 0.01 | 2.52 | 3.48 | — | |||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. | |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of the Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

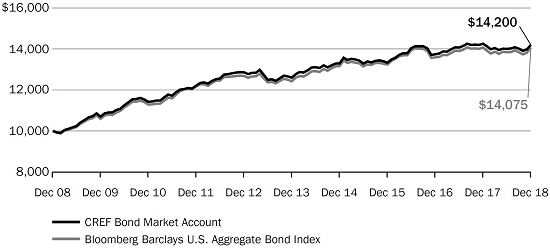

$10,000 over 10 years (Class R1)

For the purpose of comparison, the graph also shows the change in the value of the Account’s benchmark during the same period. The performance of other Classes varies due to differences in expense charges.

| College Retirement Equities Fund ■ 2018 Annual Report | 27 |

CREF Bond Market Account

Expense example

Six months ended December 31, 2018

| Beginning | Ending | Expenses paid | ||||||||||

| account value | account value | during period | * | |||||||||

| CREF Bond Market Account | (7/1/18 | ) | (12/31/18 | ) | (7/1/18–12/31/18 | ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $1,000.00 | $1,013.81 | $2.49 | |||||||||

| Class R2 | 1,000.00 | 1,014.73 | 1.57 | |||||||||

| Class R3 | 1,000.00 | 1,014.96 | 1.37 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,022.74 | 2.50 | |||||||||

| Class R2 | 1,000.00 | 1,023.64 | 1.58 | |||||||||

| Class R3 | 1,000.00 | 1,023.84 | 1.38 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2018. The Account’s annualized six-month expense ratios for that period were 0.49% for Class R1, 0.31% for Class R2 and 0.27% for Class R3. |

For more information about this expense example, please see page 9.

Actual expenses

| Net expense ratio for the one-year period ended 12/31/2018 | |

| Class R1 | 0.52% |

| Class R2 | 0.33% |

| Class R3 | 0.29% |

| 28 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Bond Market Account

| Account profile | |

| as of 12/31/2018 | |

| Net assets | $13.22 billion |

| Portfolio turnover rate | 106% |

| Portfolio turnover rate, excluding mortgage dollar roll transactions | 91% |

| Number of issues | 1,800 |

| Option-adjusted duration* | 5.75 years |

| Average maturity† | 8.05 years |

| * | Option-adjusted duration estimates how much the value of a bond portfolio would be affected by a change in prevailing interest rates, taking into account the options embedded in the individual securities. The longer a portfolio’s duration, the more sensitive it is to changes in interest rates. |

| † | Average maturity is a simple average of the maturities of all the bonds in an account’s portfolio. The maturity of a bond is the amount of time until the bond’s principal becomes due or payable. |

| Portfolio composition | |

| % of net assets | |

| Sector | as of 12/31/2018 |

| Corporate bonds | 23.5 |

| Mortgage-backed securities | 21.1 |

| U.S. Treasury securities | 16.2 |

| Foreign government & corporate bonds denominated in U.S. dollars | 14.4 |

| Asset-backed securities | 9.5 |

| Commercial mortgage-backed securities | 6.6 |

| Municipal bonds | 4.0 |

| U.S. agency securities | 2.3 |

| Bank loan obligations | 0.4 |

| Preferred stock | 0.1 |

| Short-term investments, other assets & liabilities, net | 1.9 |

| Total | 100.0 |

Holdings by maturity

| % of fixed-income investments | |

| (excluding short-term investments) | |

| as of 12/31/2018 | |

| Less than 1 year | 5.8 |

| 1-3 years | 17.8 |

| 3-5 years | 18.4 |

| 5-10 years | 41.7 |

| Over 10 years | 16.3 |

| Total | 100.0 |

Holdings by credit quality

| % of fixed-income investments | |

| (excluding short-term investments) | |

| as of 12/31/2018 | |

| U.S. Treasury & U.S. agency securities* | 36.8 |

| Aaa/AAA | 15.9 |

| Aa/AA | 7.6 |

| A/A | 13.1 |

| Baa/BBB | 21.9 |

| Ba/BB | 1.9 |

| B/B | 1.2 |

| Below B/B | 0.4 |

| Non-rated | 1.2 |

| Total | 100.0 |

| * | These securities are guaranteed by the full faith and credit of the U.S. government. |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

| College Retirement Equities Fund ■ 2018 Annual Report | 29 |

CREF Inflation-Linked Bond Account

Performance for the twelve months ended December 31, 2018

The CREF Inflation-Linked Bond Account returned –0.72% for the period, compared with the –0.25% return of its benchmark, the Bloomberg Barclays U.S. Treasury Inflation Protected Securities (TIPS) 1–10 Year Index. (All returns for the Account are for Class R1.)

During the twelve-month period, the U.S. economy continued to grow at a solid pace. The unemployment rate fell to 3.7%, its lowest rate in nearly 50 years, before ending the period at 3.9% on December 31, 2018. Wages grew at the fastest rate in nearly a decade, and, in October, consumer confidence reached its highest level since 2000 before declining in November. Annual core inflation, which includes all items except food and energy, was moderate at 2.2% in December. The price of oil declined for the year, falling sharply over the final three months of the period, while the U.S. dollar strengthened.

The Federal Reserve raised the federal funds target rate four times during the period, increasing the key short-term interest-rate measure to 2.25%–2.50%. Fed policymakers were criticized by the White House for rate increases amid declining stock markets and evidence of a slowing global economy late in the year. Chairman Jerome Powell said the Fed would be “patient” with monetary policy in 2019. Yields on U.S. Treasury securities of all maturities rose during the period, but the increases were greatest among shorter-term investments. In August, the Bank of England raised its benchmark rate to 0.75%, while in September, the European Central Bank indicated it would leave benchmark interest rates unchanged until at least the summer of 2019.

TIPS underperformed the broader bond market

In 2018, the performance of the TIPS 1–10 Year Index fell short of the 0.01% return of the broad U.S. investment-grade fixed-rate bond market, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index. Most fixed-income securities struggled to record gains amid rising interest rates and a strong U.S. economy. Inflation-protected securities were restrained by continued moderate inflation.

The Account underperformed its benchmark primarily due to its expense charge. The Account’s return includes a deduction for expenses, while the benchmark’s does not. Since the Account’s portfolio resembled the composition of its benchmark, the above discussion of the benchmark’s performance also applies to the Account’s performance. Security selection and yield curve positioning among the Account’s U.S. Treasury holdings also detracted slightly from relative performance.

During the period, the Account’s portfolio managers kept the Account’s duration—a measure of its sensitivity to interest-rate changes—close to that of the TIPS 1–10 Year Index. This strategy helped the Account’s risk and reward characteristics to more closely resemble those of its benchmark.

| 30 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Inflation-Linked Bond Account

Performance as of December 31, 2018

| CREF Inflation-Linked Bond Account | |

Total return |

|

Average annual total return |

Estimated annual operating |

|||||||||||||

| Inception date | 1 year | 5 years | 10 years | expenses | * | |||||||||||||

| Class R1 | 5/1/1997 | –0.72 | % | 1.18 | % | 3.03 | % | 0.515 | % | |||||||||

| Class R2 | 4/24/2015 | –0.53 | 1.36 | † | 3.12 | † | 0.305 | |||||||||||

| Class R3 | 4/24/2015 | –0.49 | 1.42 | † | 3.15 | † | 0.240 | |||||||||||

| Bloomberg Barclays U.S. Treasury Inflation Protected Securities (TIPS) 1–10 Year Index | — | –0.25 | 1.20 | 3.06 | — | |||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of the Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

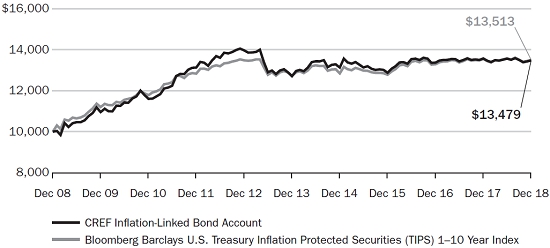

$10,000 over 10 years (Class R1)

For the purpose of comparison, the graph also shows the change in the value of the Account’s benchmark during the same period. The performance of other Classes varies due to differences in expense charges.

| College Retirement Equities Fund ■ 2018 Annual Report | 31 |

CREF Inflation-Linked Bond Account

Expense example

Six months ended December 31, 2018

| CREF Inflation-Linked Bond Account | Beginning account value (7/1/18 | ) | Ending account value (12/31/18 | ) | Expenses paid during period (7/1/18–12/31/18 | * ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $1,000.00 | $ 993.31 | $2.16 | |||||||||

| Class R2 | 1,000.00 | 994.21 | 1.26 | |||||||||

| Class R3 | 1,000.00 | 994.44 | 1.01 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,023.04 | 2.19 | |||||||||

| Class R2 | 1,000.00 | 1,023.95 | 1.28 | |||||||||

| Class R3 | 1,000.00 | 1,024.20 | 1.02 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2018. The Account’s annualized six-month expense ratios for that period were 0.43% for Class R1, 0.25% for Class R2 and 0.20% for Class R3. |

For more information about this expense example, please see page 9.

| Actual expenses | ||||

| Net expense ratio for the one-year period ended 12/31/2018 | ||||

| Class R1 | 0.45% | |||

| Class R2 | 0.26% | |||

| Class R3 | 0.22% |

| 32 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Inflation-Linked Bond Account

| Account profile | |||

| as of 12/31/2018 | |||

| Net assets | $6.34 billion | ||

| Portfolio turnover rate | 21% | ||

| Number of issues | 43 | ||

| Option-adjusted duration* | 4.85 years | ||

| Average maturity† | 5.16 years | ||

| * | Option-adjusted duration estimates how much the value of a bond portfolio would be affected by a change in prevailing interest rates, taking into account the options embedded in the individual securities. The longer a portfolio’s duration, the more sensitive it is to changes in interest rates. |

| † | Average maturity is a simple average of the maturities of all the bonds in an account’s portfolio. The maturity of a bond is the amount of time until the bond’s principal becomes due or payable. |

| Portfolio composition | |||

| % of net assets | |||

| Sector | as of 12/31/2018 | ||

| U.S. Treasury securities | 98.0 | ||

| U.S. agency securities | 0.7 | ||

| Mortgage-backed securities | 0.7 | ||

| Foreign government & corporate bonds denominated in U.S. dollars | 0.1 | ||

| Short-term investments, other assets & liabilities, net | 0.5 | ||

| Total | 100.0 | ||

Holdings by maturity

| % of fixed-income investments | |||

| (excluding short-term investments) | |||

| as of 12/31/2018 | |||

| 1–3 years | 26.1 | ||

| 3–5 years | 27.5 | ||

| 5–10 years | 39.6 | ||

| Over 10 years | 6.8 | ||

| Total | 100.0 | ||

Holdings by credit quality

| % of fixed-income investments | |||

| (excluding short-term investments) | |||

| as of 12/31/2018 | |||

| U.S. Treasury & U.S. agency securities* | 99.7 | ||

| Non-rated | 0.3 | ||

| Total | 100.0 | ||

| * | These securities are guaranteed by the full faith and credit of the U.S. government. |

Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

| College Retirement Equities Fund ■ 2018 Annual Report | 33 |

Performance for the twelve months ended December 31, 2018

The CREF Social Choice Account returned –4.51% for the year, compared with the –4.56% return of its composite benchmark, a weighted average of the Russell 3000® Index, the MSCI EAFE+Canada Index and the Bloomberg Barclays U.S. Aggregate Bond Index. The Account utilizes environmental, social and governance (ESG) criteria, while the benchmark does not. (All returns for the Account are for Class R1.)

Because of its ESG criteria, the Account did not invest in a number of stocks and bonds that were included in the indexes that comprise its composite benchmark. Avoiding these investments produced mixed results, but the net effect was that the Account slightly outperformed its benchmark.

The Account’s domestic equity component slightly underperformed the Russell 3000 Index. Among stocks the Account avoided, Amazon.com, Pfizer and Visa were the largest detractors, while exclusions of Facebook, General Electric and Philip Morris International made the biggest contributions. The Account’s international component outperformed the MSCI EAFE+Canada Index. Among stocks the Account excluded, British American Tobacco, German drug maker Bayer and Belgium-based Anheuser-Busch contributed the most to relative performance, while avoiding energy giant Royal Dutch Shell, Australian mining company BHP Group and pan-Asian life insurance firm AIA Group detracted most.

Account’s international and fixed-income components aided relative performance

To compensate for the Account’s exclusion of some stocks, its managers use quantitative (mathematical) modeling and other techniques in an attempt to match the overall investment characteristics of the portfolio with those of its composite benchmark.

Among the Account’s domestic holdings, underweight investments in Apple, Johnson & Johnson and Verizon detracted most from performance relative to the Russell 3000 Index. Conversely, the top-contributing domestic holdings were overweight positions in Netflix and drug makers Eli Lilly and Merck.

In the international component of the Account, the main contributors to performance relative to the MSCI EAFE+Canada Index were an underweight position in Nestlé, an overweight investment in British telecommunications firm Sky and an underweight position in French drug maker Sanofi. Somewhat offsetting these contributors, an underweight position in Swiss pharmaceutical company Novartis and overweight positions in Canadian energy producer Encana and Japanese mining company Sumitomo were the main detractors.

The Account’s fixed-income component outperformed the Bloomberg Barclays U.S. Aggregate Bond Index. Account holdings in the corporate, municipals and government agency sectors contributed most to performance relative to this index, while holdings in the U.S. Treasury and mortgage-backed securities sectors detracted.

| 34 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Social Choice Account

Performance as of December 31, 2018

| CREF Social Choice Account | Total return | Average annual total return | Estimated annual operating | |||||||||||||||

| Inception date | 1 year | 5 years | 10 years | expenses | * | |||||||||||||

| Class R1 | 3/1/1990 | –4.51 | % | 4.21 | % | 8.30 | % | 0.540 | % | |||||||||

| Class R2 | 4/24/2015 | –4.33 | 4.40 | † | 8.40 | † | 0.330 | |||||||||||

| Class R3 | 4/24/2015 | –4.29 | 4.46 | † | 8.43 | † | 0.265 | |||||||||||

| CREF Social Choice Composite Benchmark‡ | — | –4.56 | 4.69 | 8.49 | — | |||||||||||||

| Broad market indexes | ||||||||||||||||||

| Morningstar Moderate Target Risk Index§ | — | –4.76 | 4.08 | 7.97 | — | |||||||||||||

| Russell 3000® Index | — | –5.24 | 7.91 | 13.18 | — | |||||||||||||

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

| * | The estimated annual operating expenses are taken from the Account’s current prospectus. Expenses are estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. |

| † | The performance shown for Classes R2 and R3 that is prior to their inception date is based on performance of the Account’s Class R1. The performance for these periods has not been restated to reflect the lower expenses of the Classes R2 and R3. If those expenses had been reflected, the performance would have been higher. |

| ‡ | As of the close of business on December 31, 2018, the CREF Social Choice Composite Benchmark consisted of: 42.0% Russell 3000 Index; 40.0% Bloomberg Barclays U.S. Aggregate Bond Index; and 18.0% MSCI EAFE+Canada Index. The Account’s benchmark, the components that make up the composite benchmark and the method of calculating the composite benchmark’s performance may vary over time. |

| § | On May 1, 2018, the Morningstar Moderate Target Risk Index was added as an additional broad-based securities market index for the Social Choice Account. For more information, please see the Account’s current prospectus. |

| College Retirement Equities Fund ■ 2018 Annual Report | 35 |

CREF Social Choice Account

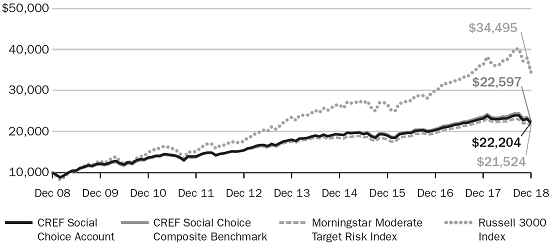

$10,000 over 10 years (Class R1)

For the purpose of comparison, the graph also shows the change in the values of the Account’s composite benchmark and broad market indexes during the same period. The performance of other Classes varies due to differences in expense charges.

Expense example

Six months ended December 31, 2018

| CREF Social Choice Account | Beginning account value (7/1/18 | ) | Ending account value (12/31/18 | ) | Expenses paid during period (7/1/18–12/31/18 | * ) | ||||||

| Actual return | ||||||||||||

| Class R1 | $1,000.00 | $ 955.23 | $2.22 | |||||||||

| Class R2 | 1,000.00 | 956.09 | 1.33 | |||||||||

| Class R3 | 1,000.00 | 956.32 | 1.08 | |||||||||

| 5% annual hypothetical return | ||||||||||||

| Class R1 | 1,000.00 | 1,022.94 | 2.29 | |||||||||

| Class R2 | 1,000.00 | 1,023.84 | 1.38 | |||||||||

| Class R3 | 1,000.00 | 1,024.10 | 1.12 | |||||||||

| * | “Expenses paid during period” is based on the Account’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2018. The Account’s annualized six-month expense ratios for that period were 0.45% for Class R1, 0.27% for Class R2 and 0.22% for Class R3. |

For more information about this expense example, please see page 9.

Actual expenses

| Net expense ratio for the one-year period ended 12/31/2018 | ||

| Class R1 | 0.47% | |

| Class R2 | 0.28% | |

| Class R3 | 0.24% |

| 36 | 2018 Annual Report ■ College Retirement Equities Fund |

CREF Social Choice Account

Account profile

| as of 12/31/2018 | ||

| Net assets | $12.86 billion | |

| Portfolio turnover rate | 52% | |

| Portfolio turnover rate, excluding mortgage dollar roll transactions | 47% | |

| Equity segment | ||

| Number of holdings | 1,113 | |

| Weighted median market capitalization | $42.33 billion | |

| Price/earnings ratio (weighted 12-month trailing average)* | 18.07 | |

| Fixed-income segment | ||

| Number of issues | 775 | |

| Option-adjusted duration† | 5.82 years | |

| Average maturity‡ | 9.34 years | |

| * | Price/earnings ratio is the price of a stock divided by its earnings per share for the past twelve-month period. |

| † | Option-adjusted duration estimates how much the value of a bond portfolio would be affected by a change in prevailing interest rates, taking into account the options embedded in the individual securities. The longer a portfolio’s duration, the more sensitive it is to changes in interest rates. |

| ‡ | Average maturity is a simple average of the maturities of all the bonds in an account’s portfolio. The maturity of a bond is the amount of time until the bond’s principal becomes due or payable. |

Portfolio composition

| Sector | % of net assets as of 12/31/2018 | |

| Equities | 57.1 | |

| Fixed-income securities | 41.9 | |

| Short-term investments, other assets & liabilities, net | 1.0 | |

| Total | 100.0 |

Holdings by company size

| Market capitalization | % of equity investments as of 12/31/2018 | |

| More than $50 billion | 42.6 | |

| More than $15 billion-$50 billion | 36.5 | |

| More than $2 billion-$15 billion | 18.8 | |

| $2 billion or less | 2.1 | |

| Total | 100.0 |