0000776901DEF 14AFALSE00007769012023-01-012023-12-310000776901indb:INDBChristopherOddleifsonMemberMember2023-01-012023-12-31iso4217:USD0000776901indb:INDBJeffreyTengelMemberMember2023-01-012023-12-31xbrli:pure0000776901indb:INDBChristopherOddleifsonMemberMember2022-01-012022-12-3100007769012022-01-012022-12-310000776901indb:INDBChristopherOddleifsonMemberMember2021-01-012021-12-3100007769012021-01-012021-12-310000776901indb:INDBChristopherOddleifsonMemberMember2020-01-012020-12-3100007769012020-01-012020-12-310000776901indb:AdjustmentChangeInActuarialPresentValuesOfPensionMemberindb:INDBChristopherOddleifsonMemberMember2023-01-012023-12-310000776901indb:AdjustmentChangeInActuarialPresentValuesOfPensionMemberindb:INDBJeffreyTengelMemberMember2023-01-012023-12-310000776901indb:AdjustmentChangeInActuarialPresentValuesOfPensionMemberecd:NonPeoNeoMember2023-01-012023-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentIncreaseForServiceCostAndPriorServiceCostForPensionsMember2023-01-012023-12-310000776901indb:INDBJeffreyTengelMemberMemberindb:AdjustmentIncreaseForServiceCostAndPriorServiceCostForPensionsMember2023-01-012023-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentIncreaseForServiceCostAndPriorServiceCostForPensionsMember2023-01-012023-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentDeductionForStockAwardsAndOptionAwardsMember2023-01-012023-12-310000776901indb:INDBJeffreyTengelMemberMemberindb:AdjustmentDeductionForStockAwardsAndOptionAwardsMember2023-01-012023-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentDeductionForStockAwardsAndOptionAwardsMember2023-01-012023-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearUnvestedMember2023-01-012023-12-310000776901indb:INDBJeffreyTengelMemberMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearUnvestedMember2023-01-012023-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearUnvestedMember2023-01-012023-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310000776901indb:INDBJeffreyTengelMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearVestedMember2023-01-012023-12-310000776901indb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearVestedMemberindb:INDBJeffreyTengelMemberMember2023-01-012023-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearVestedMember2023-01-012023-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310000776901indb:INDBJeffreyTengelMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMember2023-01-012023-12-310000776901indb:INDBJeffreyTengelMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMember2023-01-012023-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMember2023-01-012023-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentValueOfDividendsAndOtherEarningsPaidMember2023-01-012023-12-310000776901indb:AdjustmentValueOfDividendsAndOtherEarningsPaidMemberindb:INDBJeffreyTengelMemberMember2023-01-012023-12-310000776901indb:AdjustmentValueOfDividendsAndOtherEarningsPaidMemberecd:PeoMember2023-01-012023-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentChangeInFairValueOfAwardsModifiedMember2023-01-012023-12-310000776901indb:INDBJeffreyTengelMemberMemberindb:AdjustmentChangeInFairValueOfAwardsModifiedMember2023-01-012023-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentChangeInFairValueOfAwardsModifiedMember2023-01-012023-12-310000776901indb:INDBChristopherOddleifsonMemberMember2023-01-012023-12-310000776901indb:INDBJeffreyTengelMemberMember2023-01-012023-12-310000776901ecd:NonPeoNeoMember2023-01-012023-12-310000776901indb:AdjustmentChangeInActuarialPresentValuesOfPensionMemberindb:INDBChristopherOddleifsonMemberMember2022-01-012022-12-310000776901indb:AdjustmentChangeInActuarialPresentValuesOfPensionMemberecd:NonPeoNeoMember2022-01-012022-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentIncreaseForServiceCostAndPriorServiceCostForPensionsMember2022-01-012022-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentIncreaseForServiceCostAndPriorServiceCostForPensionsMember2022-01-012022-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentDeductionForStockAwardsAndOptionAwardsMember2022-01-012022-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentDeductionForStockAwardsAndOptionAwardsMember2022-01-012022-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearUnvestedMember2022-01-012022-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearUnvestedMember2022-01-012022-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearVestedMember2022-01-012022-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearVestedMember2022-01-012022-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMember2022-01-012022-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMember2022-01-012022-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentValueOfDividendsAndOtherEarningsPaidMember2022-01-012022-12-310000776901indb:AdjustmentValueOfDividendsAndOtherEarningsPaidMemberecd:PeoMember2022-01-012022-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentChangeInFairValueOfAwardsModifiedMember2022-01-012022-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentChangeInFairValueOfAwardsModifiedMember2022-01-012022-12-310000776901indb:INDBChristopherOddleifsonMemberMember2022-01-012022-12-310000776901ecd:NonPeoNeoMember2022-01-012022-12-310000776901indb:AdjustmentChangeInActuarialPresentValuesOfPensionMemberindb:INDBChristopherOddleifsonMemberMember2021-01-012021-12-310000776901indb:AdjustmentChangeInActuarialPresentValuesOfPensionMemberecd:NonPeoNeoMember2021-01-012021-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentIncreaseForServiceCostAndPriorServiceCostForPensionsMember2021-01-012021-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentIncreaseForServiceCostAndPriorServiceCostForPensionsMember2021-01-012021-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentDeductionForStockAwardsAndOptionAwardsMember2021-01-012021-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentDeductionForStockAwardsAndOptionAwardsMember2021-01-012021-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearUnvestedMember2021-01-012021-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearUnvestedMember2021-01-012021-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearVestedMember2021-01-012021-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearVestedMember2021-01-012021-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMember2021-01-012021-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMember2021-01-012021-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentValueOfDividendsAndOtherEarningsPaidMember2021-01-012021-12-310000776901indb:AdjustmentValueOfDividendsAndOtherEarningsPaidMemberecd:PeoMember2021-01-012021-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentChangeInFairValueOfAwardsModifiedMember2021-01-012021-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentChangeInFairValueOfAwardsModifiedMember2021-01-012021-12-310000776901indb:INDBChristopherOddleifsonMemberMember2021-01-012021-12-310000776901ecd:NonPeoNeoMember2021-01-012021-12-310000776901indb:AdjustmentChangeInActuarialPresentValuesOfPensionMemberindb:INDBChristopherOddleifsonMemberMember2020-01-012020-12-310000776901indb:AdjustmentChangeInActuarialPresentValuesOfPensionMemberecd:NonPeoNeoMember2020-01-012020-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentIncreaseForServiceCostAndPriorServiceCostForPensionsMember2020-01-012020-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentIncreaseForServiceCostAndPriorServiceCostForPensionsMember2020-01-012020-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentDeductionForStockAwardsAndOptionAwardsMember2020-01-012020-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentDeductionForStockAwardsAndOptionAwardsMember2020-01-012020-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearUnvestedMember2020-01-012020-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearUnvestedMember2020-01-012020-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearVestedMember2020-01-012020-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentIncreaseForEquityAwardsGrantedInCurrentYearVestedMember2020-01-012020-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMember2020-01-012020-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMember2020-01-012020-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentValueOfDividendsAndOtherEarningsPaidMember2020-01-012020-12-310000776901indb:AdjustmentValueOfDividendsAndOtherEarningsPaidMemberecd:PeoMember2020-01-012020-12-310000776901indb:INDBChristopherOddleifsonMemberMemberindb:AdjustmentChangeInFairValueOfAwardsModifiedMember2020-01-012020-12-310000776901ecd:NonPeoNeoMemberindb:AdjustmentChangeInFairValueOfAwardsModifiedMember2020-01-012020-12-310000776901indb:INDBChristopherOddleifsonMemberMember2020-01-012020-12-310000776901ecd:NonPeoNeoMember2020-01-012020-12-31000077690112023-01-012023-12-31000077690122023-01-012023-12-31000077690132023-01-012023-12-31000077690142023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | | | | | | | | | | | | | |

| Filed by the Registrant | x | | Filed by a Party other than the Registrant | o |

| | | | | |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Pursuant to §240.14a-12 |

| | |

| INDEPENDENT BANK CORP. |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| x | No fee required |

| |

| o | Fee paid previously with preliminary materials |

| |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)1 and 0-11 |

March 28, 2024

Dear Fellow Shareholder:

I am pleased to invite you to our 2024 Annual Shareholder Meeting (“Annual Meeting”), which will be held at 11:00 a.m. on Thursday, May 16, 2024. The 2024 Annual Meeting will be conducted solely by means of remote communication (a “virtual-only” meeting). The following pages contain information about the Annual Meeting. There will be no physical location for the Annual Meeting. Please see the Notice of Annual Shareholder Meeting and Proxy Statement for additional details. We will provide a live audio webcast of the Annual Meeting at https://meetnow.global/M5ATJMX. For further information on how to attend the Annual Meeting, Please see “How do I attend the virtual annual meeting?” on page 3 of the proxy statement.

We are once again pleased to reduce the environmental impact of our proxy materials and lower delivery costs by furnishing you with instructions on how to access proxy materials over the internet and vote online. On or about April 3, 2024, we will mail a Notice of Internet Availability of Proxy Materials (Notice) to all holders of our common stock at the close of business on March 22, 2024, the record date for our annual meeting, and will post our proxy materials on the website that the Notice references. If you would like to receive a printed copy of our proxy materials, the Notice describes how to request them.

Your vote is important. You can ensure that your shares are represented at the Annual Meeting by voting and submitting your proxy in advance of the Annual Meeting. Voting procedures and instructions for how to attend the virtual-only Annual Meeting are described in the proxy statement.

Cordially,

Jeffrey Tengel

President and Chief Executive Officer

Independent Bank Corp.

Chief Executive Officer

Rockland Trust Company

NOTICE OF 2024 ANNUAL SHAREHOLDER MEETING

The Annual Shareholder Meeting of Independent Bank Corp. will be held solely

by means of remote communication, in a live audio webcast format at

https://meetnow.global/M5ATJMX

on May 16, 2024 at 11:00 a.m. Eastern Time

There will be no physical location for the annual meeting.

Online access to the annual meeting will begin at 10:45 a.m. Eastern Time.

At the annual meeting we will ask you to:

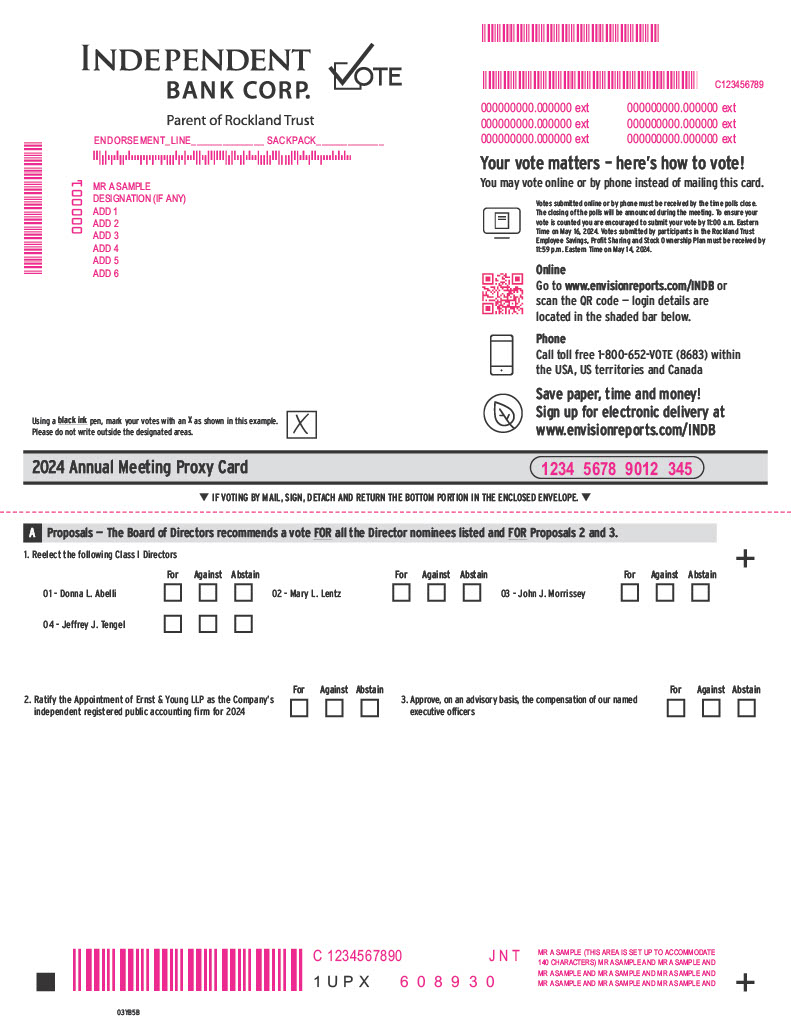

(1) Reelect Donna L. Abelli, Mary L. Lentz, John J. Morrissey and Jeffrey J. Tengel as Class I Directors;

(2) Ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2024;

(3) Approve, on an advisory basis, the compensation of our named executive officers;

(4) Transact any other business that may properly come before the annual meeting.

You may vote at the annual meeting if you were a shareholder of record at the close of business on March 22, 2024.

Attending the annual meeting:

The annual meeting will be held in a virtual meeting format only on May 16, 2024 at 11:00 a.m. Eastern Time. You can virtually attend the live audio webcast of the annual meeting at https://meetnow.global/M5ATJMX. To vote and ask questions at the annual meeting, you will need to login with your 15-digit control number, which can be found on the Notice of Internet Availability of Proxy Materials or your proxy card.

Online access to the annual meeting will begin at 10:45 a.m. Eastern Time. There will be no physical location for the annual meeting.

Beneficial stockholders whose shares are registered in the name of a bank, broker or other nominee may need to obtain the information required to be able to participate in, and vote at, the annual meeting, including their control number, from their bank, broker or other nominee. If a beneficial holder has any questions regarding attendance at the annual meeting, they should contact their broker, bank or other nominee who holds their shares.

Important Notice Regarding Internet Availability of Proxy Materials: The Proxy Statement and our Annual Report to Shareholders for the year ended December 31, 2023 are available at www.envisionreports.com/INDB.

| | | | | |

| By Order of the Independent Bank Corp. Board of Directors |

| | | | | |

| Rockland, Massachusetts | Patricia M. Natale |

| March 28, 2024 | Executive Vice President, General Counsel and Corporate Secretary |

YOUR VOTE IS IMPORTANT REGARDLESS OF HOW MANY SHARES YOU OWN. Please vote your shares promptly, even if you plan to attend the annual meeting. The proxy statement describes voting procedures.

INDEPENDENT BANK CORP. PROXY STATEMENT

TABLE OF CONTENTS

| | | | | |

| Page |

| THE ANNUAL MEETING AND VOTING PROCEDURES | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| PROPOSALS TO BE VOTED UPON AT ANNUAL MEETING | |

| |

| |

| |

| |

| |

| BOARD OF DIRECTORS INFORMATION | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | |

| |

| |

| |

| |

| |

| EXECUTIVE OFFICER INFORMATION | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| STOCK OWNERSHIP AND OTHER MATTERS | |

| |

| |

| |

| |

| | | | | | | | | | | | | | |

| PROXY SUMMARY |

| This page summarizes information described in more detail elsewhere in this proxy statement. You should read the entire proxy statement carefully before voting. Please review our 2023 Annual Report on Form 10-K for more information about our Company and its financial performance. |

| | | | |

| 2024 Annual Shareholder Meeting | | | |

| | | | |

| Date and Time: | Thursday, May 16, 2024, at 11:00 a.m. Eastern Time | |

| Place: | The 2024 Annual Meeting will be held solely by means of remote communication, in a live audio webcast format at https://meetnow.global/M5ATJMX. Please refer to the proxy statement for more details about our virtual-only meeting. |

| Record Date: | March 22, 2024 | | | |

| | | | | | | | | | | | | | |

| Voting Matters and Board Recommendations |

| Proposal | Board Recommendation | For More Information |

| Proposal 1 - | Reelect Donna L. Abelli, Mary L. Lentz, John J. Morrissey and Jeffrey J. Tengel to serve as Class I Directors | “FOR” all nominees | Page | |

| | | | | | | | | | | | | | | | | | | | | | | |

|

|

| | | | |

| | | | |

| Name | Age | Director Since | Primary Occupation | Committee Memberships | Independent |

| Donna L. Abelli | 66 | 2005 | Certified Public Accountant and Associate Professor | C, E, N, R | ü |

| Mary L. Lentz | 70 | 2016 | Commercial Real Estate Consultant | A, T | ü |

| John J. Morrissey | 57 | 2012 | Lawyer | N, R, T | ü |

| Jeffrey J. Tengel | 61 | 2023 | CEO and President of Independent Bank Corp. | E | |

| A - Audit Committee C - Compensation Committee E - Executive Committee N - Nominating & Corporate Governance Committee R - Risk Committee T - Trust Committee |

| | | | | | | | | | | | | | |

| Proposal 2 - | Ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2024 | “FOR” | Page | |

| Proposal 3 - | Approve, on an advisory basis, the compensation of our named executive officers | “FOR” | Page | |

| | |

| How to Cast Your Vote |

The Independent Bank Corp. Board of Directors is soliciting proxies for the May 16, 2024 Annual Shareholder Meeting, and for any adjournment or postponement of that meeting for which no new record date is set. We are making proxy materials available on or about April 3, 2024.

Your vote is important. Even if you plan to attend our Annual Shareholder Meeting, please cast your vote as soon as possible by: |

| | | | | | | | |

| | |

Internet

www.envisionreports.com/INDB | Telephone

1-800-652-8683 | Mail |

| | |

You can also vote at the Annual Shareholder Meeting.

Stock in the Rockland Trust Company Employee Savings, Profit Sharing and Stock Ownership Plan must be voted by 11:59 p.m., Eastern Time, on May 14, 2024. |

Independent Bank Corp. 2024 Proxy Statement - 1

288 Union Street

Rockland, Massachusetts 02370

2024 PROXY STATEMENT

| | |

| THE ANNUAL MEETING AND VOTING PROCEDURES |

This proxy statement contains information about the Independent Bank Corp. 2024 Annual Shareholder Meeting. For ease of reference, this proxy statement refers to the Independent Bank Corp. 2024 Annual Shareholder Meeting as the “meeting”, to Independent Bank Corp. as the “Company,” “we,” “our,” and “us,” to Rockland Trust Company, our wholly-owned bank subsidiary, as “Rockland Trust,” and to the Company’s Board of Directors as the “Board.”

When and where will the annual meeting be held?

The 2024 annual meeting will be held solely by means of remote communication on Thursday, May 16, 2024 in a live audio webcast format at https://meetnow.global/M5ATJMX. There will be no physical location for the annual meeting. Online access to the annual meeting will begin at 10:45 a.m. Eastern Time. See below under “How do I attend the virtual annual meeting?” for detailed instructions on accessing the live webcast.

What is the purpose of the meeting?

At the meeting, shareholders will vote upon the matters summarized in the formal meeting notice. This proxy statement contains important information for you to consider when deciding how to vote. Please read it carefully.

Who can vote?

Shareholders of record at the close of business on March 22, 2024 are entitled to vote. Each share of common stock is entitled to one vote at the annual meeting. On March 22, 2024, there were 42,453,427 shares of our common stock outstanding and eligible to vote.

How do I vote?

If you are a registered shareholder (that is, if you hold shares directly registered in your own name) you have four voting options:

•Over the internet at the internet address shown on your Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”);

•By telephone, by calling the telephone number on your proxy form;

•By mail, by completing, signing, dating, and returning your proxy form; or

Independent Bank Corp. 2024 Proxy Statement - 2

•By attending the virtual annual meeting and logging in as a “shareholder” using your 15-digit control number, and voting your shares by clicking on the “Cast Your Vote” link on the meeting center site. Please note if you log in to the virtual annual meeting as a “guest”, you will be able to listen to the meeting but will not be able to vote or ask questions. See instructions for “How do I attend the virtual annual meeting?” below.

Whether or not you plan to attend the virtual annual meeting, we strongly encourage you to vote your shares in advance of the meeting date by internet, telephone or by mail.

If a bank, broker, or other nominee holds your shares, which is known as being held in “street name,” that bank, broker, or other nominee will provide you with voting instructions. If you hold your shares in street name, your ability to vote by internet or by telephone depends on the voting process of the entity that holds your shares. Although most banks, brokers, and nominees also offer internet and telephone voting, availability and specific procedures will depend on their voting arrangements. Please follow their directions carefully. If you want to vote shares that you hold in street name at the meeting, you must request a legal proxy from the entity that holds your shares and present that proxy, along with proof of your identity, at the meeting. If you need assistance in obtaining a legal proxy from your bank, broker, or other nominee, please contact our proxy solicitor Georgeson LLC at 1-866-357-0732.

If the Rockland Trust Company Employee Savings, Profit Sharing and Stock Ownership Plan holds your shares, we must receive your proxy card or voting instructions by 11:59 p.m., Eastern Time, on May 14, 2024.

We will vote your shares if you provide timely instructions by the applicable deadline. Even if you plan to attend the virtual meeting, we strongly encourage you to vote by proxy prior to the meeting.

How do I attend the virtual annual meeting?

All shareholders can listen to the live webcast by signing into the annual meeting at https://meetnow.global/M5ATJMX as a guest. However, if you wish to vote or ask questions at the annual meeting, the process for doing so will depend on if you are a shareholder of record or if you are a beneficial owner of shares of our common stock held in “street name. If you are unsure if you were a shareholder of record as of the record date, you may contact Computershare at 1-877-373-6374.

Shareholders of Record:

If you were a shareholder of record of our common stock as of the close of business on March 22, 2024, you are entitled to notice and to vote at the annual meeting. To do so, you must access the live webcast at https://meetnow.global/M5ATJMX and sign in to the meeting by entering the 15-digit control number, which can be found on your proxy card or Notice of Internet Availability that was sent to you.

Beneficial Owners:

If you were a beneficial owner of shares of our common stock held in “street name” as of the close of business on March 22, 2024, if you wish to vote or ask questions at the annual meeting, you will need to obtain a legal proxy from your bank, broker or other nominee. You should contact your bank, broker or other nominee for instructions regarding how to obtain a legal proxy. You must submit the legal proxy to Computershare in advance of the annual meeting and obtain a control number from Computershare that will enable you to register to vote or ask questions at the annual meeting. Once you have received a legal proxy from your bank, broker or other nominee, you should submit it, along with your name and email address, to Computershare at legalproxy@computershare.com. Email requests for registration should be labeled as “Legal Proxy” and must be received by Computershare by 5:00 p.m., Eastern Time, on May 10, 2024. You will receive a confirmation email from Computershare with a 15-digit control number. To access the live webcast of the annual meeting to vote or ask questions at the annual meeting, you should go to https://meetnow.global/M5ATJMX and enter your 15-digit control number. If you need assistance obtaining a legal proxy from your bank, broker or other nominee, please contact our proxy solicitor Georgeson LLC at 1-866-357-0732.

Independent Bank Corp. 2024 Proxy Statement - 3

How do I submit questions during the virtual annual meeting?

If you are a shareholder of record or a beneficial owner that has received a legal proxy and has registered to attend the meeting as described above, you may submit questions during the annual meeting by logging in to the live webcast at https://meetnow.global/M5ATJMX as a “shareholder” and not as a “guest.” To do so, you will enter your 15-digit control number. Questions can be asked by clicking on the message icon in the upper right-hand corner of your screen after logging into the meeting. To return to the main page, click the “I” icon at the top of the screen.

Will technical assistance be available during the annual meeting?

The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Note: Internet Explorer is not a supported browser. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. For further assistance should you need it you may call 1-888-724-2416.

If you have any questions about the proxy statement, the Notice of Internet Availability or the virtual annual meeting, or if you need assistance with voting procedures, including casting or changing your vote, please contact:

Ms. Meagan Silva

Investor Relations Contact

Independent Bank Corp.

288 Union Street

Rockland, MA 02370

Direct Line: (781) 982-6737

Can I revoke or change my vote?

You may revoke your proxy and change your vote at any time before voting begins at the meeting.

Any shareholder may revoke a proxy before we exercise it by (i) filing a written notice of revocation with our Secretary at least one business day prior to the meeting, (ii) submitting a duly executed proxy bearing a later date received by our Secretary prior to the deadline noted above, or (iii) attending the meeting and voting electronically.

If your shares are held in street name, you should contact your bank, broker, or other nominee to revoke your proxy or, if you have obtained a legal proxy from the entity that holds your shares giving you the right to vote your shares at the meeting, you may change your vote by attending the meeting and voting electronically.

Who is asking for my vote?

The Company Board requests your vote. We filed a definitive proxy statement with the United States Securities and Exchange Commission (“SEC”) on March 28, 2024, a copy of which will be made available via the internet on April 3, 2024 at the website referenced in the Notice of Internet Availability.

Independent Bank Corp. 2024 Proxy Statement - 4

What are the Board’s voting recommendations?

The Board recommends that you vote as follows:

| | | | | |

| (1) | “FOR” the reelection of each of Donna L. Abelli, Mary L. Lentz, John J. Morrissey and Jeffrey J. Tengel to serve as Class I Directors. |

| (2) | “FOR” the proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2024. |

| (3) | “FOR” approval of the advisory vote on the compensation of our named executive officers. |

| |

How will you vote my proxy?

The Board will vote each proxy in accordance with the instructions it contains. If you submit your proxy but do not specify how you want your shares voted, the Board will vote them in accordance with the Board voting recommendations stated above. The Board will only use proxies prior to or at the meeting and any adjournments or postponements of the meeting for which no new record date is set. If any other matters properly come before the meeting, the persons appointed as proxies will vote in accordance with their best judgment.

How many shareholders need to attend the meeting?

In order to conduct the meeting, a majority of shares entitled to vote as of the record date, an amount known as a quorum comprised of at least 21,226,714 shares, must be present in person or by proxy. Virtual attendance at the annual meeting will be considered presence “in person” for purposes of determining a quorum. If you return valid proxy instructions or vote electronically at the meeting, you will be considered part of the quorum. Abstentions and broker non-votes are counted as being present for purposes of determining the presence of a quorum.

How many votes are needed?

Assuming a quorum is present, the vote required for approval of the proposals is:

| | | | | |

| Proposal 1: | A majority of votes cast, at the meeting or by proxy, is required for the election of directors in uncontested elections. |

| Proposal 2: | A majority of votes cast, at the meeting or by proxy, is required to ratify the appointment of our independent registered accounting firm. |

| Proposal 3: | A majority of votes cast, at the meeting or by proxy, is required to approve the advisory proposal on the compensation of our named executive officers. |

| |

Abstentions and broker non-votes are not considered votes cast and as such have no impact on the outcome of a proposal. Approval by a “majority of votes cast” means that the number of votes cast “FOR” must exceed the number of votes cast “AGAINST.”

Banks, brokers, or other nominees may vote shares held for a customer in street name on “routine” proposals even if they have not received voting instructions. If a proposal is not “routine,” the bank, broker, or other nominee may not vote shares with respect to that proposal without customer instructions. A broker “non-vote” occurs when a bank, broker, or other nominee does not have customer voting instructions and cannot vote on a non-routine proposal.

The only proposal before the meeting this year deemed a “routine” proposal is the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm. If your bank, broker, or other nominee holds your shares, they can vote them on that proposal even if you do not provide voting instructions. All other proposals are non-routine matters. If you return your voting instruction card but do not instruct your bank, broker, or nominee how to vote on those proposals, a broker “non-vote” will occur.

Independent Bank Corp. 2024 Proxy Statement - 5

Who can attend the meeting?

Shareholders of record and beneficial owners at the close of business on March 22, 2024 are entitled to notice of and to vote at the annual meeting. Even if you plan to attend the virtual meeting, we encourage you to vote your shares in advance by proxy. If you choose to attend the virtual meeting, please refer to the section entitled “How do I attend the virtual annual meeting” above for instructions as to how to attend the virtual meeting.

Where can I find the voting results from the meeting?

The voting results will be reported in a Form 8-K, which will be filed with the SEC within four business days of the meeting.

Householding of meeting materials

Some banks, brokers, and other nominee record holders participate in the practice of “householding” proxy statements and annual reports. If a household participates in a householding program, it will receive one envelope containing the Notices of Internet Availability for all shareholders in the household (or, as the case may be, one set of proxy statement materials and a separate proxy card for each shareholder account in the household). If applicable, please vote all proxy cards enclosed in such a package. We will promptly deliver the Notice of Internet Availability separately, or deliver multiple copies of the proxy statement materials, to you if you contact us at the following address or telephone number: Patricia M. Natale, Executive Vice President and General Counsel, Independent Bank Corp., 288 Union Street, Rockland, Massachusetts 02370; telephone: (781) 982-6549. If you hold your shares in street name and want to receive the Notice of Internet Availability separately or receive separate copies of the proxy statement materials in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker, or other nominee.

Participation in householding will not affect or apply to any of your other shareholder mailings. Householding saves us money by reducing printing and postage costs and is environmentally friendly. It also creates less paper for shareholders to manage. If you are a beneficial holder, you can request information about householding from your broker, bank or other nominee.

Shareholder List

A list of shareholders entitled to vote at the annual meeting will be available for inspection by shareholders during the meeting at https://meetnow.global/M5ATJMX. To access the shareholder list at our principal offices beginning April 5, 2024 and until the meeting, shareholders should contact Independent Bank Corp., Investor Relations at (781) 982-6737. Shareholders submitting any such request must include their 15-digit control number.

Election of Directors (Proposal 1):

Our Board of Directors currently has 12 members. The Company’s articles of organization divide the Board into three classes of directors as nearly equal in number as possible, with the members of each class elected to serve a three year term.

Directors continue to serve until their three-year term expires and until their successors are elected and qualified, unless they earlier reach the mandatory retirement age of 72, die, resign, or are removed from office. We elect one class of directors annually.

Independent Bank Corp. 2024 Proxy Statement - 6

The Board or the Nominating and Corporate Governance Committee of the Board, which this proxy statement refers to as the “Nominating Committee”, selects director nominees to be presented for shareholder approval at the meeting, including the nomination of incumbent directors for reelection and the consideration of any director nominations submitted by shareholders. For information relating to shareholder director nomination, or recommendation for nomination, see “Board of Directors Information - Shareholder Director Nominations and Recommendations” below.

You may view the Company’s Governance Principles by accessing the Investor Relations link under the About Us category on the Rockland Trust website: http://www.rocklandtrust.com. (We have included references to the Rockland Trust website address at different points in this proxy statement as an inactive textual reference and do not intend it to be an active link to our website. This proxy statement does not incorporate by reference information contained on our website.). Section 5 of our Governance Principles is entitled “Director Qualifications” and states in its opening paragraph:

The Board values diversity of backgrounds, including race, ethnicity, gender, age, and sexual orientation and believes a diversity of backgrounds strengthens the Board. Diversity including race, ethnicity, gender, age, and sexual orientation is a consideration in the Board’s Director recruitment efforts. Directors should bring to the Board a diversity of backgrounds in terms of occupations, skills, and experiences, and possess a mature business judgment that enables them to make a positive contribution to the Board. Directors are expected to bring an inquisitive and objective perspective to their duties. Directors should possess, and demonstrate through their actions on the Board, exemplary ethics, integrity, and values.

In evaluating the qualifications of potential new directors, the Nominating Committee considers a set of recruitment criteria intended to complement existing Board qualifications. Recruitment focuses on identifying nominees with relevant professional experience, expertise, and diverse perspectives. For incumbent directors, the Board and the Nominating Committee also consider the director’s response to a self-assessment questionnaire and the director’s attendance and participation in, and overall contribution to, the work of the Board. Directors must devote sufficient time to their duties and responsibilities and should commit to serve on the Board for an extended period.

The Company’s By-Laws and Governance Principles provide for majority voting in uncontested director elections. In an uncontested election, if a majority of the votes cast does not reelect an incumbent director standing for election, the director is required to promptly tender a notice of resignation to the Board. The resignation is not effective unless accepted by the Board. The Nominating Committee would then recommend whether the Board should accept or reject a tendered resignation. In determining whether to accept a tendered resignation, the Board would consider the potential impact of the resignation on compliance with applicable legal and listing standards and any other relevant factors. The Company would promptly disclose the Board decision in a Form 8-K. In contested director elections, the vote standard would be a plurality of votes cast.

All nominees currently serve on our Board. The Board and the Nominating Committee, with the directors up for reelection abstaining, have nominated Donna L. Abelli, Mary L. Lentz, John J. Morrissey and Jeffrey J. Tengel, whom the proxy statement refers to as the “board nominees,” for reelection at the meeting to the class of directors whose terms will expire at the 2027 annual meeting.

In nominating each of the board nominees for reelection, the Nominating Committee determined that the board nominees possess the specific experience, qualifications, attributes, and skills described below under “Board of Directors Information” to serve as a director of the Company and Rockland Trust. There are no agreements or arrangements between any director or director nominee and any third party other than the Company relating to compensation or other payments in connection with service as a director.

Independent Bank Corp. 2024 Proxy Statement - 7

Unless we receive contrary instructions, the Board will vote shares represented by proxies for reelection of the board nominees. Each of the board nominees has agreed to serve, and we have no reason to believe that any of the board nominees will be unable to serve if elected. If any of the board nominees are not available for election the persons named as proxies intend to vote for the election of such other person or persons as the Board may designate or may in its discretion determine unless a proxy withholds or limits the authority to do so.

| | |

The Board unanimously recommends that you vote FOR the reelection of each of the board nominees. |

Ratification of Appointment of Independent Registered Public Accounting Firm (Proposal 2):

The Audit Committee has appointed the firm Ernst & Young LLP (“EY”) to serve as the Company’s independent registered public accounting firm for 2024. While shareholder ratification of EY as our independent registered public accounting firm is not required, the Board considers the selection of the independent registered public accounting firm to be an important matter, and believes that it is a good corporate practice to provide shareholders with the opportunity to ratify the selection of EY.

The Audit Committee has appointed EY as the Company’s independent registered public accounting firm since 2009. The Audit Committee is involved in selecting the lead EY partner for the Company, and the current lead EY partner was selected in 2021. The Audit Committee considers the impact of changing auditors when assessing whether to retain the current external auditor.

The following table shows the fees paid or accrued by us for professional services provided by EY during 2023 and 2022:

| | | | | | | | |

| 2023 | 2022 |

| Audit Fees | $ | 1,750,000 | | $ | 1,660,000 | |

| Audit-Related Fees (1) | 44,000 | | 44,000 | |

| Tax Fees (2) | 30,000 | | — | |

| All Other Fees | — | | — | |

| Total Fees | $ | 1,824,000 | | $ | 1,704,000 | |

(1) Audit-related fees are associated with the employee benefit plan.

(2) Tax fees represent services performed related to the Employee Retention Tax Credit filing with the Internal Revenue Service.

The Audit Committee has considered the nature of other services provided by EY and determined that they are compatible with the provision of independent audit services. The Audit Committee has discussed the other services with EY and management to determine that they are permitted under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002. The Audit Committee pre-approved all services described above as “Audit-Related Fees,” “Tax Fees,” and “All Other Fees” in accordance with the process described in the Audit Committee Report portion of this proxy statement.

The Board recommends that shareholders vote to ratify EY as our independent registered public accounting firm and believes that the choice of EY as the Company’s independent auditor is in the best interests of the Company and its shareholders. If shareholders do not ratify the selection of our independent registered public accounting firm, the Audit Committee will reconsider the appointment of EY when appropriate. We anticipate, however, that the Audit Committee would not make an immediate change in our independent registered public accounting firm this year if shareholders do not ratify the selection of EY because of the practical difficulty and expense associated with making such a change mid-year. Even if shareholders ratify the selection of EY, the Audit Committee may in its discretion change our independent registered public accounting firm at any time if it determines that it would be in the best interests of the Company and its shareholders to do so.

The Company expects that an EY representative will be present at the virtual annual meeting.

Independent Bank Corp. 2024 Proxy Statement - 8

| | |

The Board unanimously recommends that you vote FOR the ratification of the appointment of EY as the Company’s independent registered public accounting firm. |

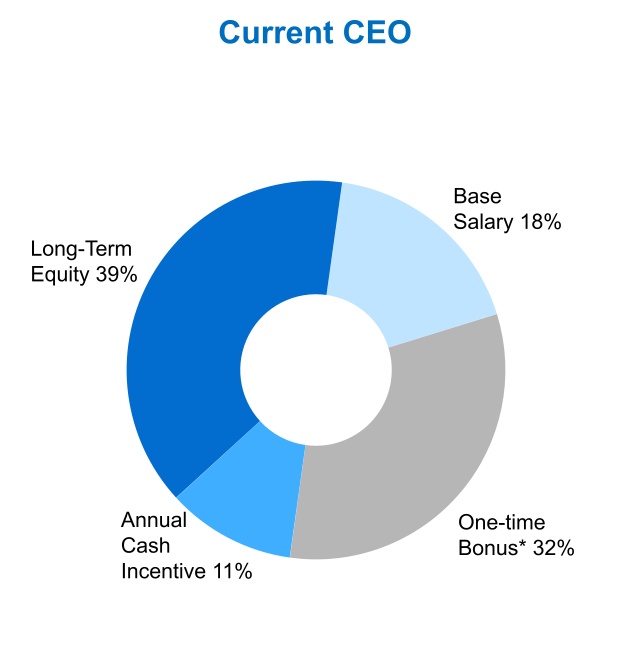

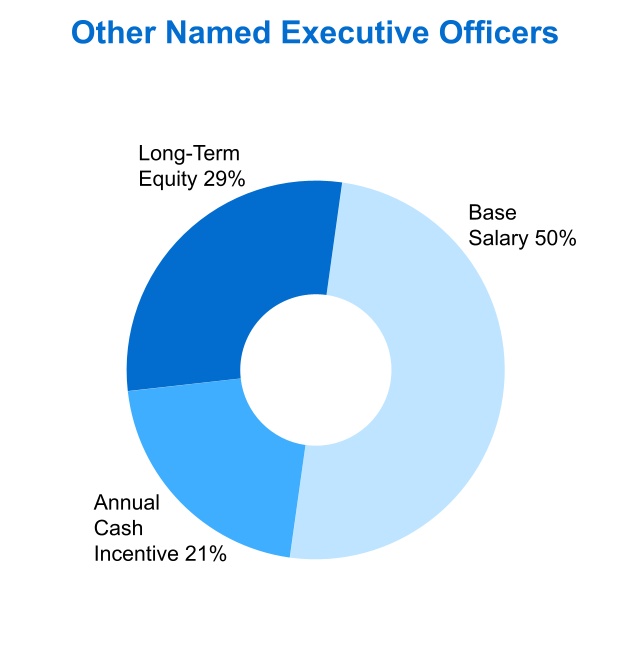

Advisory Vote on Executive Compensation (Proposal 3):

The Company is providing shareholders with the opportunity to cast an advisory (non-binding) vote on the compensation of our named executive officers (sometimes referred to as our “say on pay” vote) as disclosed in this proxy statement. We currently hold an annual say on pay vote. Accordingly, you may vote on the following proposal at the meeting:

“Resolved, that the shareholders approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the Compensation Discussion and Analysis, the accompanying compensation tables, and the related narrative disclosure in this proxy statement.”

This vote is nonbinding. The Board and the Compensation Committee, which is comprised of independent directors, expect to take into account the outcome of the vote when considering future executive compensation decisions.

As discussed in the Compensation Discussion and Analysis in this proxy statement, the Board believes that our compensation policies and procedures are designed to provide a strong link between executive officer compensation and our short- and long-term performance. The objective of the Company’s compensation program is to provide compensation that is competitive, variable based on the Company’s performance and individual performance, and aligned with the long-term interests of shareholders. Shareholders are encouraged to read the Compensation Discussion and Analysis, the accompanying compensation tables, and the related narrative disclosure.

| | |

The Board unanimously recommends that you vote FOR the approval, on an advisory basis, of the compensation of our named executive officers. |

Other Matters:

The proxy also confers discretionary authority with respect to any other business that may properly come before the meeting, including rules for the conduct of the meeting. The Board knows of no other matter to be presented at the meeting other than those described in this proxy statement. It is the intention of the person named as proxy to vote the shares to which the proxies relate according to their best judgment if any matters not included in this proxy statement come before the meeting.

Independent Bank Corp. 2024 Proxy Statement - 9

| | |

| BOARD OF DIRECTORS INFORMATION |

Current Board Members

For purposes of this proxy statement, we have computed director ages as of the meeting date.

The Board of the Company is currently comprised of the individuals listed below:

Class I Directors (Nominated for Reelection at this Meeting for a Term Expiring in 2027):

| | | | | |

| Experience: Ms. Abelli, 66, is a certified public accountant and has since September 2017 been an Associate professor at Ricciardi College of Business, Bridgewater State University. Ms. Abelli previously served on an interim basis as the Chief Financial Officer of publicly-traded companies and various private companies, primarily in the life sciences industries, and as the Chief Financial Officer of a publicly-traded company. Ms. Abelli began her accounting career at Coopers & Lybrand (now PwC LLP) where she was named a partner and, from 1998 to 1999, was President of the Massachusetts Society of CPAs. Ms. Abelli was named Chair of the Board of Rockland Trust and the Company in 2012 and has served as a director of the Company and of Rockland Trust since 2005.

Skills and Qualifications: The Board and the Nominating Committee have determined that Ms. Abelli is qualified to serve as a director based upon her prior service as a director of the Company and of Rockland Trust, her mature business judgment, her inquisitive and objective perspective, her familiarity with the communities that Rockland Trust serves, her prior service as a chief financial officer of publicly-traded companies, and her designation as a certified public accountant. |

Donna L. Abelli Director since 2005 Chair since 2012 Committees Ø Compensation Ø Executive, Chair Ø Nominating Ø Risk |

| | | | | |

| Experience: Ms. Lentz, 70, worked for 22 years at and served as an Executive Vice President and Partner of McCall & Almy, a Boston-based commercial real estate brokerage and advisory services firm, until 2018, when she moved to a commercial real estate consultant role. Ms. Lentz has over 37 years of commercial real estate experience, including prior work as Chief Operating Officer of a publicly-traded real estate investment trust. Ms. Lentz specializes in advising healthcare, corporate, and non-profit institutions with real estate leasing, acquisition, and disposition strategies. Ms. Lentz has served as a director of the Company and of Rockland Trust since 2016.

Skills and Qualifications: The Board and the Nominating Committee have determined that Ms. Lentz is qualified to serve as a director based upon her prior service as a director of the Company and of Rockland Trust, her mature business judgment, her inquisitive and objective perspective, her familiarity with the communities that Rockland Trust serves, and her extensive experience and knowledge in the area of commercial real estate. |

Mary L. Lentz Director since 2016 Committees Ø Audit Ø Trust, Chair |

Independent Bank Corp. 2024 Proxy Statement - 10

| | | | | |

| Experience: Mr. Morrissey, 57, is a practicing attorney and is a founding partner of the Braintree, Massachusetts law firm Morrissey, Wilson & Zafiropoulos LLP, practicing in the areas of litigation, bankruptcy and creditors’ rights, and real estate. Mr. Morrissey is member of the Joint Bar Committee on Judicial Appointments. Made up of representatives appointed from state bar associations, the Committee independently reviews, evaluates, and reports to the Governor on the qualifications of individuals under consideration for judicial appointments. Mr. Morrissey previously served as a Chair of the Massachusetts Board of Bar Overseers of the Supreme Judicial Court. The Board of Bar Overseers was established as an independent administrative body to investigate complaints against attorneys and act as an administrative tribunal to consider disciplinary charges brought against attorneys practicing in Massachusetts. Mr. Morrissey is the former President of the Massachusetts Bar Association and Member of its Executive Management Board. Mr. Morrissey previously served as a director of Central Bancorp, Inc. and its wholly owned subsidiary Central Co-operative Bank d/b/a Central Bank until November 2012, when Central Bancorp, Inc. was merged with and into the Company. Mr. Morrissey has served as a director of the Company and of Rockland Trust since 2012.

Skills and Qualifications: The Board and the Nominating Committee have determined that Mr. Morrissey is qualified to serve as a director based upon his prior service as a director of the Company and of Rockland Trust, his mature business judgment, his inquisitive and objective perspective, his familiarity with the communities Rockland Trust serves, and his prior service as a director of another bank. |

John J. Morrissey Director since 2012 Committees Ø Nominating, Chair Ø Trust Ø Risk |

| | | | | |

| Experience: Mr. Tengel, 61, joined the Company as Chief Executive Officer and President of the Company and Chief Executive Officer of Rockland Trust in February of 2023. Prior to joining the Company and Rockland Trust, he served as Senior Executive Vice President, Head of Commercial Specialty Banking at M&T Bank from April 2022 to February 2023. Before M&T’s acquisition of People’s United Financial in April 2022, Mr. Tengel was President of People’s United from May 2018 to April 2022 where he was responsible for commercial banking, retail banking, and wealth management. He joined People’s United in 2010 from PNC Bank where he served as Executive Vice President.

Mr. Tengel currently serves on the Board of Directors at FamilyAid, Massachusetts Business Roundtable and The New England Council. He previously served on the Board of Trustees at Quinnipiac University, Wakeman Boys & Girls Club, Kolbe Cathedral High School and Bridgeport Hospital. Mr. Tengel received his Bachelor of Science degree in accounting from Marquette University and his Master’s Degree in Business Administration from the Weatherhead School of Management at Case Western Reserve University.

Skills and Qualifications: The Board and the Nominating Committee have determined that Mr. Tengel is qualified to serve as a director based upon his robust experience in commercial banking, mature business judgment, demonstrated ability to lead growing organizations, and his familiarity with the New England marketplace. |

Jeffrey J. Tengel Director since February 2023 Committees Ø Executive |

Independent Bank Corp. 2024 Proxy Statement - 11

Class II Directors Continuing in Office (Term Expiring in 2025):

| | | | | |

| Experience: Mr. Hogan, 64, is a real estate developer. From October 2019 to December 2021, Mr. Hogan served as the President and CEO of Agawam Development Company, the owner and developer of Redbrook, a sustainably designed mixed-use village consisting of luxury single homes, townhomes, apartments and commercial development and from 2004 to October 2019, he served as the President and Chief Executive Officer of the A.D. Makepeace Company, based in Wareham, Massachusetts and the world’s largest cranberry grower and the largest private property owner in eastern Massachusetts. Prior to joining A.D. Makepeace, Mr. Hogan served as President of MassDevelopment, the economic development authority for the Commonwealth of Massachusetts, from 1997 to 2003. While at MassDevelopment, he served as cabinet officer for two Massachusetts governors. Mr. Hogan serves as Director and Vice Chair of the Ocean Spray Board of Directors and as a Director of Old Colony YMCA and previously served on the Executive Board of the Associated Industries of Massachusetts. Previously, he served as Mayor of Marlborough, Massachusetts. Mr. Hogan has served as a director of the Company and of Rockland Trust since 2017.

Skills and Qualifications: The Board and the Nominating Committee have determined that Mr. Hogan is qualified to serve as a director based upon his prior service as a director of the Company and of Rockland Trust, his mature business judgment, his inquisitive and objective perspective, and his familiarity and involvement with the communities that Rockland Trust serves. |

Michael P. Hogan Director since 2017 Committees Ø Compensation Ø Executive Ø Nominating |

| | | | | |

| Experience: Ms. Miskell, 66, is a certified public accountant and presently serves as the Treasurer of Eight Cousins, Inc. Ms. Miskell previously served as the Treasurer of The Wood Lumber Company, a lumber company based in Falmouth, Massachusetts. Ms. Miskell was previously appointed a director of Falmouth Bancorp, Inc., the holding company of Falmouth Bank, which was merged with and into the Company in 2004. Ms. Miskell, while a Falmouth Bancorp Director, served as the chair of its audit committee. Ms. Miskell has served as a director of the Company and of Rockland Trust since 2005.

Skills and Qualifications: The Board and the Nominating Committee have determined that Ms. Miskell is qualified to serve as a director based upon her prior service as a director of the Company and of Rockland Trust, her mature business judgment, her inquisitive and objective perspective, her familiarity with the communities that Rockland Trust serves, her prior service as a director of another bank, and her designation as a certified public accountant.

|

Eileen C. Miskell Director since 2005 Committees Ø Audit, Chair Ø Compensation Ø Risk |

| | | | | |

| Experience: Mr. Nadeau, 65, was named the President of Rockland Trust in 2017. Mr. Nadeau previously served as the Executive Vice President, Commercial Lending of Rockland Trust since 2007. Mr. Nadeau has worked at Rockland Trust in a variety of capacities since 1984, serving as a Senior Vice President of Commercial Lending from 1992 until 2007. Mr. Nadeau has served as a director of the Company and of Rockland Trust since 2017.

Mr. Nadeau’s community activities include: board member of Southeastern Massachusetts Economic Development Corporation and of the Southeastern Massachusetts Affordable Housing Group, long time member of the Board of Directors of the Metro South Boys & Girls Club, President and board member of the Montello Affordable Housing Corp., member of the Executive Committee for development at Stonehill College, member of the Board of Directors and Executive Committee of the Old Colony YMCA, member of the Board of Directors of the Boston Chamber of Commerce, the Chunilal Initiative and New Beginnings for Families Inc and trust advisor of the Shields Foundation. Mr. Nadeau holds a Bachelor’s Degree in Business from Bentley University.

Skills and Qualifications: The Board and the Nominating Committee have determined that Mr. Nadeau is qualified to serve as a director based upon his prior service as a director of the Company and Rockland Trust, his experience as a long-tenured employee and executive of the Company, his mature business judgment, his inquisitive and objective perspective, his familiarity with the communities that Rockland Trust serves, and his commercial lending expertise. |

Gerard F. Nadeau Director since 2017 Committees Ø Executive |

Independent Bank Corp. 2024 Proxy Statement - 12

| | | | | |

| Experience: Ms. O’Day, 64, serves as the CEO of A.W. Perry Inc., a Boston-based real estate investment and services firm and as President of A.W. Perry Management Corporation and A.W. Perry Security Corporation. Prior to assuming her current role in October 2020, Ms. O’Day served as Executive Vice President and Chief Information Officer at The Walt Disney Company for over 12 years. At Disney, she led the planning, implementation and operations of IT systems and infrastructure. Before that, Ms. O’Day served in senior leadership positions at both Bristol Myers Squibb and CSX Transportation. Ms. O’Day serves as a Trustee on the Board of Trustees of Miss Hall’s School, the Columbia Realty Trust and the Brio Condominium Trust. Ms. O’Day previously served on the Board of Directors and the Executive Committee of the 2022 USA Games Special Olympics. Ms. O’Day has also served as a Manager of Perry South Shore Development, LLC and and as an Advisor to MEEM, LLC. Ms. O’Day has served as a director of the Company and Rockland Trust since 2021.

Skills and Qualifications: The Board and the Nominating Committee have determined that Ms. O’Day is qualified to serve as a director based upon her prior service as a director of the Company and of Rockland Trust, her mature business judgment, her inquisitive and objective perspective, her familiarity with the communities that Rockland Trust serves, and her extensive background and knowledge in the area of IT systems and infrastructure and cybersecurity. |

Susan Perry O’Day Director since 2021 Committees Ø Executive Ø Risk |

| | | | | |

| Experience: Mr. Venables, 69, served as the President and CEO and as a director of Benjamin Franklin Bancorp, Inc. and its wholly-owned subsidiary Benjamin Franklin Bank from 2002 until 2009, when Benjamin Franklin Bancorp, Inc. was merged with and into the Company. Prior to 2002, Mr. Venables co-founded Lighthouse Bank of Waltham, Massachusetts in 1999 and served as its President and CEO and as a director. From 1998 to 1999, Mr. Venables was employed as a banking consultant with Marsh and McLennan Capital, Inc. He was employed by Grove Bank of Newton, Massachusetts from 1974 until it was acquired by Citizens Bank in 1997, serving as its President and CEO and as a director for the last 11 years of his tenure. Mr. Venables has served as a director of the Company and Rockland Trust since 2009.

Skills and Qualifications: The Board and the Nominating Committee have determined that Mr. Venables is qualified to serve as a director based upon his prior service as a director of the Company and of Rockland Trust, his mature business judgment, his inquisitive and objective perspective, his familiarity with the communities that Rockland Trust serves, and his prior service as a director and executive of other banks. |

Thomas R. Venables Director since 2009 Committees Ø Executive Ø Risk, Chair |

Class III Directors Continuing in Office (Term Expiring in 2026):

| | | | | |

| Experience: Mr. Morton, 69, recently retired as the 13th President and Chief Executive Officer of the YMCA of Greater Boston after approximately 7.5 years of service. Prior to the foregoing role, Mr. Morton served as President and CEO of the YMCA Greater Hartford (CT) and the YMCA of Greater Springfield (MA) for a total of 9 years. In these roles, he worked to stabilize and grow the organization, increase philanthropic support, develop innovative programming, improve the membership experience, and create and implement a strategic vision. Mr. Morton has served on numerous boards and committees, including the Massachusetts Board of Elementary and Secondary Education, Boston After School and Beyond, The Lynch Foundation, My Brother’s Keeper Advisory Board, Beth Israel Deaconess Medical Center Community Advisory Board, and the Massachusetts COVID-19 Relief Board. He is currently a member of the Springfield Empowerment Zone Partnership Board and the Cape Cod Foundation. In addition, he is and has been an active participant on numerous Y-USA committees on youth development, executive leadership development, and multiculturalism. He is an active member of the African-American YMCA CEO Network. Mr. Morton has served as a director of the Company and Rockland Trust since 2021.

Skills and Qualifications: The Board and the Nominating Committee have determined that Mr. Morton is qualified to serve as a director based upon his prior service as a director of the Company and of Rockland Trust, his mature business judgment, his inquisitive and objective perspective, his executive experience, and his familiarity and deep involvement with the communities that Rockland Trust serves. |

James O’Shanna Morton Director since 2021 Committees Ø Nominating |

Independent Bank Corp. 2024 Proxy Statement - 13

| | | | | |

| Experience: Mr. O’Brien, 68, is a certified public accountant and, for at least the last five years, has been owner and President of O’Brien, Riley and Ryan, a CPA firm located in Braintree, Massachusetts. Mr. O’Brien is also the manager of Advanced Planning Consultants, LLC, a financial services company. Mr. O’Brien is also a practicing attorney. Mr. O’Brien previously served as a director and member of the audit committee of Benjamin Franklin Bancorp, Inc. and its wholly-owned subsidiary Benjamin Franklin Bank until 2009, when Benjamin Franklin Bancorp, Inc. was merged with and into the Company. Mr. O’Brien also previously served as a director of Chart Bank until it was merged with and into Benjamin Franklin Bank, and served as chair of the Chart Bank audit committee. Mr. O’Brien has served as a director of the Company and of Rockland Trust since 2009.

Skills and Qualifications: The Board and the Nominating Committee have determined that Mr. O’Brien is qualified to serve as a director based upon his prior service as a director of the Company and of Rockland Trust, his mature business judgment, his inquisitive and objective perspective, his familiarity with the communities that Rockland Trust serves, his prior service as a director of other banks, and his designation as a certified public accountant. |

Daniel F. O’Brien Director since 2009 Committees Ø Audit Ø Compensation, Chair |

| | | | | |

| Experience: Mr. Smith, 58, is currently the President and Chief Executive Officer of The SC Group, which he co-founded in 2013. The SC Group provides services to philanthropic organizations throughout New England with respect to strategic planning, program development, board development, Executive Director searches, and fund raising. Mr. Smith has over 30 years of experience in the philanthropic sector and has previously held Chief Executive Officer, Executive Director, and Vice President of Operations positions. Mr. Smith previously served as a director, a member of the audit committee and Chairperson of the compensation committee of Blue Hills Bancorp, Inc. and its wholly-owned subsidiary, Blue Hills Bank, until April 2019, when Blue Hills Bancorp, Inc. was merged with and into the Company. Mr. Smith is a past Board Chair of the Thomas M. Menino YMCA in Boston, serves on the Lt. Governor’s Interagency Council and the Mayor’s Commission on Homelessness, is the Co-Chair of the Hyde Park 150th Anniversary Committee and is the Chair of Consalvo for Boston. Mr. Smith is a graduate of Salisbury University.

Skills and Qualifications: The Board and the Nominating Committee have determined that Mr. Smith is qualified to serve as a director based upon his prior service as a director of the Company and of Rockland Trust, his mature business judgment, his inquisitive and objective perspective, his familiarity and deep involvement with the communities that Rockland Trust serves, and his prior service as a director of another bank. |

Scott K. Smith Director since 2019 Committees Ø Trust |

Independent Bank Corp. 2024 Proxy Statement - 14

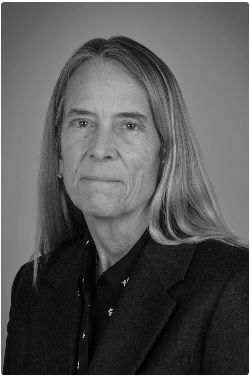

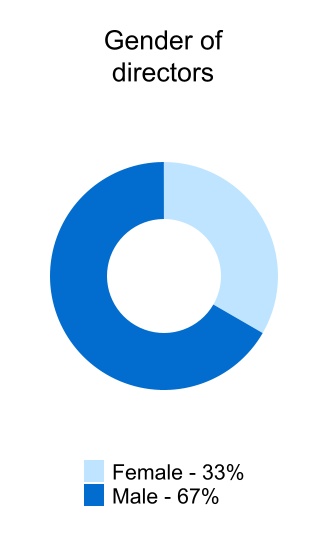

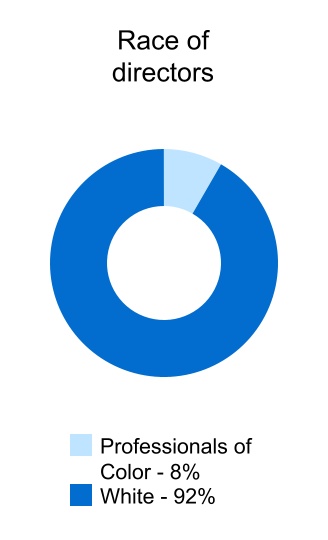

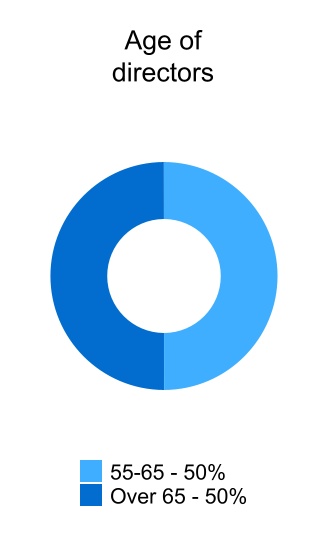

Board Composition, Tenure and Experience

We value and promote diversity and inclusion in every aspect of our business and at every level of our organization. Our commitment to a diverse and inclusive environment starts at the top with our Board and executive leadership, who play key roles in the oversight of our culture and our growth as a diverse workplace and an inclusive workplace. We strive to build a diverse pipeline of candidates for positions at all levels, including leadership positions. Our Nominating and Corporate Governance Committee has committed to considering diversity when evaluating director candidates. The following Board Diversity Matrix provides the diversity statistics for our Board in the format required by Nasdaq rules, as anticipated at May 16, 2024.

| | | | | | | | | | | | | | |

| Board Diversity Matrix |

| Total Number of Directors | 12 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | |

| Directors | 4 | 8 | 0 | 0 |

| | | | |

| Part II: Demographic Background | | | | |

| African American or Black | 0 | 1 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latinx | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 4 | 7 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 |

| Did Not Disclose Demographic Background | 0 |

Information concerning the diversity of our Board in 2023 was included in the Company’s Proxy Statement for the 2023 annual meeting filed with the SEC on March 30, 2023, which may be viewed by accessing the Investor Relations link under the About Us category on the Rockland Trust website (http://www.rocklandtrust.com) under SEC filings.

Independent Bank Corp. 2024 Proxy Statement - 15

Corporate Governance Information

The Board has adopted Governance Principles, and written charters for all Board committees, including the Audit Committee, the Nominating Committee, the Risk Committee, and the Compensation Committee. You may view our Governance Principles, as well as the charter for each Board committee, by accessing the Investor Relations link under the About Us category on the Rockland Trust website

(http://www.rocklandtrust.com) under Governance Documents.

The Company has adopted a written Code of Ethics to guide directors, officers, and employees in adhering to their ethical and legal responsibilities. You may view the current version of our Code of Ethics by accessing the Investor Relations link under the About Us category on the Rockland Trust website (http://www.rocklandtrust.com) under Governance Documents. The Company will disclose in a timely manner any amendment to or waiver from a provision of the Code of Ethics required under applicable SEC rules and regulations and the rules of the Nasdaq Stock Market (“Nasdaq”) at that same website location.

Environmental, Social and Governance (“ESG”)

Our commitment to Environmental, Social and Governance (“ESG”) matters begins at the top of our organization with the Board. The Board oversees our ESG strategy, policies, and initiatives. In addition, we have established a management-level ESG working group, including representatives from major business units, who are responsible for identifying ESG priorities as well as assessing and monitoring key performance indicators within the appropriate ESG Related frameworks.

We remain focused on ESG matters and recognize the importance of understanding the social and environmental impact of our activities on all of our stakeholders, including investors, employees, customers, and the communities we serve. We also acknowledge the potential impact of ESG matters on our long-term strategy and operations. We expect that our developing ESG strategy will align with the nature and scale of our business and the evolution of ESG standards and trends in our industry, and will incorporate insight on key ESG issues derived from shareholder engagement.

In 2023, the Company’s ESG working group continued to collaborate with an external consultant as part of its strategy to further the Company’s ESG priorities and initiatives. Headlining these efforts in 2023 was the issuance of our inaugural ESG report, which showcased our key ESG highlights achieved during 2022. Additional efforts in 2023 included continued monitoring and analysis of the Company’s performance on major ESG ratings, as well as proactive outreach to both rating agencies and investors with respect to the Company’s progress on key ESG matters. For more information, please see our 2022 ESG Report by accessing the Investor Relations link under the About Us category on the Rockland Trust website (http://www.rocklandtrust.com) under Environmental, Social, and Governance (ESG).

Anti-Hedging and Anti-Pledging Policy

Our insider trading policy expressly prohibits:

•Any director, officer, or employee of the Company or of Rockland Trust from, directly or indirectly, engaging in any transaction that is designed to or has the effect of hedging or offsetting or profiting from any decrease in the market value of the Company’s stock, including transactions involving prepaid variable forward contracts, equity swaps, collars, exchange funds, short sales, puts, calls, or other derivative securities; and

•Any director or executive officer from either pledging Company stock or from holding Company stock in a margin account without the prior permission of the Company’s General Counsel or the General Counsel’s designee.

Independent Bank Corp. 2024 Proxy Statement - 16

Board Leadership Structure, Executive Sessions and Oversight of Risk Management

The Board has appointed an independent director as its Chair and believes that structure segregates the Board’s oversight role from management. The Board oversees the Chief Executive Officer and other management of the Company and Rockland Trust to ensure that the long-term interests of shareholders are being served through 12 regularly scheduled meetings and one all-day strategic planning meeting with management each year, and additional meetings when necessary or advisable. At these meetings, the Board reviews reports on the management and performance of the Company and Rockland Trust, including reports regarding liquidity, interest rate risk, credit quality, loan loss provision, regulatory compliance, and other risks. During each regularly-scheduled Board meeting, our independent non-employee directors meet in executive session, without the Chief Executive Officer or any other member of management present. Our Chair presides at these sessions. The Board also regularly meets with the Chief Executive Officer alone to discuss topics without other members of management present.

The Board has also established the Board committees described below which regularly meet and report back to the Board on the responsibilities delegated to them. Each Board committee has the authority to engage outside experts, advisors, and counsel if needed to assist the committee in its work. During each meeting committees have the opportunity to hold executive sessions without the Chief Executive Officer or any other member of management present.

The Board has approved an Enterprise Risk Management Policy to state the Company’s goals and objectives in identifying, measuring, and managing risks associated with the Company’s current and near future anticipated size and complexity. Management is responsible for comprehensive enterprise risk management, and continually strives to adopt and implement practices that strike an appropriate balance between risk and reward and permit the achievement of strategic goals in a controlled environment. The Board, with the assistance of its Risk Committee, oversees management’s enterprise risk management practices.

The Company has implemented the “three lines of defense” enterprise risk management model. The first line of defense is comprised of the executives in charge of business units, operational areas, and corporate functions who, sometimes assisted by management committees, teams, and working groups, own and manage risks. The second line of defense monitors and provides risk management advice across all risk domains, and is comprised of the enterprise risk department, with oversight from the Chief Risk Officer, who reports to the Chief Executive Officer. The third line of defense is independent assurance performed by the Chief Internal Auditor, who reports to the Audit Committee, supported by the Company’s internal audit department.

In addition to its general oversight role, the Board also: selects, evaluates, and compensates, upon recommendation of the Compensation Committee, the Chief Executive Officer and oversees Chief Executive Officer succession planning; reviews, monitors, and, when necessary or appropriate, approves fundamental financial and business strategies and major corporate actions; assesses major risks facing the Company or Rockland Trust and options for their mitigation; and seeks to maintain the integrity of financial statements and the integrity of compliance with law and ethics of the Company and Rockland Trust.

Shareholder Communications to Board

The Board will give appropriate attention to written communications on issues that shareholders submit and will respond as appropriate. Absent unusual circumstances or as expressly contemplated by committee charters, the General Counsel of the Company will (1) be primarily responsible for monitoring communications from shareholders and (2) provide copies or summaries of shareholder communications to the Board as the General Counsel considers appropriate.

Communications will be forwarded to all directors or specified individual directors if they relate to substantive matters and include suggestions or comments that the General Counsel of the Company considers to be appropriate for Board consideration. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded to directors for review.

Independent Bank Corp. 2024 Proxy Statement - 17

Shareholders who wish to send communications to the Board should submit them, in writing, to Patricia M. Natale, Executive Vice President and General Counsel, Independent Bank Corp., 288 Union Street, Rockland, Massachusetts 02370.

Shareholder Director Nominations and Recommendations