.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________________________

FORM 10-Q

___________________________________________________

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended March 31, 2023

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

| Commission File Number: | |||||

___________________________________________________

(Exact name of registrant as specified in its charter)

___________________________________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

| Office Address: | ||||||||||||||

| Mailing Address: | 02370 | |||||||||||||

| (Address of principal executive offices, including zip code) | ||||||||||||||

(781 ) 878-6100

(Registrant’s telephone number, including area code)

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||

| Title of each Class | Trading Symbol | Name of each exchange on which registered | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| x | Accelerated Filer | ☐ | |||||||||

| Non-accelerated Filer | ☐ | Smaller Reporting Company | |||||||||

| Emerging Growth Company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) | Yes | No | ☒ | |||||||||||

As of May 1, 2023, there were 44,125,003 shares of the issuer’s common stock outstanding, par value $0.01 per share.

Table of Contents | |||||

| PAGE | |||||

Notes to Consolidated Financial Statements - March 31, 2023 | |||||

3

4

PART 1. FINANCIAL INFORMATION

Item 1. Financial Statements

INDEPENDENT BANK CORP.

CONSOLIDATED BALANCE SHEETS

(Unaudited—Dollars in thousands)

| March 31 2023 | December 31 2022 | ||||||||||

| Assets | |||||||||||

| Cash and due from banks | $ | $ | |||||||||

| Interest-earning deposits with banks | |||||||||||

| Securities | |||||||||||

| Trading | |||||||||||

| Equity | |||||||||||

Available for sale (amortized cost $ | |||||||||||

Held to maturity (fair value $ | |||||||||||

| Total securities | |||||||||||

| Loans held for sale (at fair value) | |||||||||||

| Loans | |||||||||||

| Commercial and industrial | |||||||||||

| Commercial real estate | |||||||||||

| Commercial construction | |||||||||||

| Small business | |||||||||||

| Residential real estate | |||||||||||

| Home equity - first position | |||||||||||

| Home equity - subordinate positions | |||||||||||

| Other consumer | |||||||||||

| Total loans | |||||||||||

| Less: allowance for credit losses | ( | ( | |||||||||

| Net loans | |||||||||||

| Federal Home Loan Bank stock | |||||||||||

| Bank premises and equipment, net | |||||||||||

| Goodwill | |||||||||||

| Other intangible assets | |||||||||||

| Cash surrender value of life insurance policies | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities and Stockholders' Equity | |||||||||||

| Deposits | |||||||||||

| Noninterest-bearing demand deposits | $ | $ | |||||||||

| Savings and interest checking accounts | |||||||||||

| Money market | |||||||||||

| Time certificates of deposit | |||||||||||

| Total deposits | |||||||||||

| Borrowings | |||||||||||

| Federal Home Loan Bank borrowings | |||||||||||

Junior subordinated debentures (less unamortized debt issuance costs of $ | |||||||||||

5

Subordinated debentures (less unamortized debt issuance costs of $ | |||||||||||

| Total borrowings | |||||||||||

| Other liabilities | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies | |||||||||||

| Stockholders' equity | |||||||||||

Preferred stock, $ | |||||||||||

Common stock, $ issued and outstanding: | |||||||||||

Value of shares held in rabbi trust at cost: | ( | ( | |||||||||

| Deferred compensation and other retirement benefit obligations | |||||||||||

| Additional paid in capital | |||||||||||

| Retained earnings | |||||||||||

| Accumulated other comprehensive loss, net of tax | ( | ( | |||||||||

| Total stockholders’ equity | |||||||||||

| Total liabilities and stockholders' equity | $ | $ | |||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

6

INDEPENDENT BANK CORP.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited—Dollars in thousands, except per share data)

| Three Months Ended | |||||||||||

| March 31 | |||||||||||

| 2023 | 2022 | ||||||||||

| Interest income | |||||||||||

| Interest and fees on loans | $ | $ | |||||||||

| Taxable interest and dividends on securities | |||||||||||

| Nontaxable interest and dividends on securities | |||||||||||

| Interest on loans held for sale | |||||||||||

| Interest on federal funds sold and short-term investments | |||||||||||

| Total interest and dividend income | |||||||||||

| Interest expense | |||||||||||

| Interest on deposits | |||||||||||

| Interest on borrowings | |||||||||||

| Total interest expense | |||||||||||

| Net interest income | |||||||||||

| Provision for (release of) credit losses | ( | ||||||||||

| Net interest income after provision for credit losses | |||||||||||

| Noninterest income | |||||||||||

| Deposit account fees | |||||||||||

| Interchange and ATM fees | |||||||||||

| Investment management | |||||||||||

| Mortgage banking income | |||||||||||

| Increase in cash surrender value of life insurance policies | |||||||||||

| Gain on life insurance benefits | |||||||||||

| Loan level derivative income | |||||||||||

| Other noninterest income | |||||||||||

| Total noninterest income | |||||||||||

| Noninterest expenses | |||||||||||

| Salaries and employee benefits | |||||||||||

| Occupancy and equipment expenses | |||||||||||

| Data processing and facilities management | |||||||||||

| Consulting expense | |||||||||||

| Software maintenance | |||||||||||

| Debit card expense | |||||||||||

| Amortization of intangible assets | |||||||||||

| FDIC assessment | |||||||||||

| Merger and acquisition expense | |||||||||||

| Other noninterest expenses | |||||||||||

| Total noninterest expenses | |||||||||||

| Income before income taxes | |||||||||||

| Provision for income taxes | |||||||||||

| Net income | $ | $ | |||||||||

| Basic earnings per share | $ | $ | |||||||||

| Diluted earnings per share | $ | $ | |||||||||

| Weighted average common shares (basic) | |||||||||||

| Common share equivalents | |||||||||||

| Weighted average common shares (diluted) | |||||||||||

| Cash dividends declared per common share | $ | $ | |||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

7

INDEPENDENT BANK CORP.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited—Dollars in thousands)

| Three Months Ended | |||||||||||

| March 31 | |||||||||||

| 2023 | 2022 | ||||||||||

| Net income | $ | $ | |||||||||

| Other comprehensive income (loss), net of tax | |||||||||||

| Net change in fair value of securities available for sale | ( | ||||||||||

| Net change in fair value of cash flow hedges | ( | ||||||||||

| Net change in other comprehensive income for defined benefit postretirement plans | ( | ||||||||||

| Total other comprehensive income (loss) | ( | ||||||||||

| Total comprehensive income (loss) | $ | $ | ( | ||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

8

INDEPENDENT BANK CORP.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

Three Months Ended March 31, 2023 and 2022

(Unaudited—Dollars in thousands, except per share data)

| Common Stock Outstanding | Common Stock | Value of Shares Held in Rabbi Trust at Cost | Deferred Compensation Obligation | Additional Paid in Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Total | ||||||||||||||||||||||||||||||||||||||||

| Balance December 31, 2022 | $ | $ | ( | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

Common dividend declared ($ | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Proceeds from exercise of stock options, net of cash paid | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Stock based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Restricted stock awards issued, net of awards surrendered | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||

| Shares issued under direct stock purchase plan | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Shares repurchased under share repurchase program (1) | ( | ( | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Deferred compensation and other retirement benefit obligations | — | — | ( | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Balance March 31, 2023 | $ | $ | ( | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||

| Balance December 31, 2021 | $ | $ | ( | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||

Common dividend declared ($ | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||

| Stock based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Restricted stock awards issued, net of awards surrendered | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||||

| Shares issued under direct stock purchase plan | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Shares repurchased under share repurchase program | ( | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||

| Deferred compensation and other retirement benefit obligations | — | — | ( | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Balance March 31, 2022 | $ | $ | ( | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||

(1) Inclusive of $1.2 million impact of excise tax attributable to share repurchases made during the three months ended March 31, 2023.

The accompanying notes are an integral part of these unaudited consolidated financial statements.

9

INDEPENDENT BANK CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited—Dollars in thousands)

| Three Months Ended | |||||||||||

| March 31 | |||||||||||

| 2023 | 2022 | ||||||||||

| Cash flow from operating activities | |||||||||||

| Net income | $ | $ | |||||||||

| Adjustments to reconcile net income to net cash provided by operating activities | |||||||||||

| Depreciation and amortization | |||||||||||

| Change in unamortized net loan costs and fees | ( | ( | |||||||||

| Accretion of acquired loans | ( | ( | |||||||||

| Provision for (release of) credit losses | ( | ||||||||||

| Deferred income tax expense | |||||||||||

| Net (gain) loss on equity securities | ( | ||||||||||

| Net loss on bank premises and equipment | |||||||||||

| Realized gain on sale leaseback transaction | ( | ( | |||||||||

| Stock based compensation | |||||||||||

| Increase in cash surrender value of life insurance policies | ( | ( | |||||||||

| Operating lease payments | ( | ( | |||||||||

| Change in fair value on loans held for sale | |||||||||||

| Net change in: | |||||||||||

| Trading assets | ( | ( | |||||||||

| Loans held for sale | |||||||||||

| Other assets | |||||||||||

| Other liabilities | ( | ( | |||||||||

| Total adjustments | ( | ||||||||||

| Net cash provided by operating activities | |||||||||||

| Cash flows used in investing activities | |||||||||||

| Purchases of equity securities | ( | ( | |||||||||

| Proceeds from maturities and principal repayments of securities available for sale | |||||||||||

| Purchases of securities available for sale | ( | ||||||||||

| Proceeds from maturities and principal repayments of securities held to maturity | |||||||||||

| Purchases of securities held to maturity | ( | ||||||||||

| Net purchase of Federal Home Loan Bank stock | ( | ||||||||||

| Investments in low income housing projects | ( | ( | |||||||||

| Purchases of life insurance policies | ( | ( | |||||||||

| Net (increase) decrease in loans | ( | ||||||||||

| Purchases of bank premises and equipment | ( | ( | |||||||||

| Proceeds from the sale of bank premises and equipment | |||||||||||

| Net cash used in investing activities | ( | ( | |||||||||

| Cash flows provided by (used in) financing activities | |||||||||||

| Net increase (decrease) in time deposits | ( | ||||||||||

| Net decrease in other deposits | ( | ( | |||||||||

| Proceeds from short-term Federal Home Loan Bank borrowings | |||||||||||

| Repayments of long-term debt, net of issuance costs | ( | ||||||||||

| Net proceeds from exercise of stock options | |||||||||||

10

| Restricted stock awards issued, net of awards surrendered | ( | ( | |||||||||

| Proceeds from shares issued under direct stock purchase plan | |||||||||||

| Payments for shares repurchased under share repurchase program | ( | ( | |||||||||

| Common dividends paid | ( | ( | |||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||

| Net increase (decrease) in cash and cash equivalents | ( | ||||||||||

| Cash and cash equivalents at beginning of year | |||||||||||

| Cash and cash equivalents at end of period | $ | $ | |||||||||

| Supplemental schedule of noncash investing and financing activities | |||||||||||

| Net increase (decrease) in capital commitments relating to low income housing project investments | $ | $ | ( | ||||||||

| Recognition of operating lease at commencement and/or at extension | $ | $ | |||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

11

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 - BASIS OF PRESENTATION

Independent Bank Corp. (the “Company”) is a state chartered, federally registered bank holding company, incorporated in 1985. The Company is the sole stockholder of Rockland Trust Company (“Rockland Trust” or the “Bank”), a Massachusetts trust company chartered in 1907.

All material intercompany balances and transactions have been eliminated in consolidation. Certain previously reported amounts have been reclassified to conform to the current year’s presentation.

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP") for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation of the financial statements, primarily consisting of normal recurring adjustments, have been included. Results for the three months ended March 31, 2023 are not necessarily indicative of the results that may be expected for the year ending December 31, 2023 or any other interim period.

NOTE 2 - RECENT ACCOUNTING STANDARDS UPDATES

12

NOTE 3 - SECURITIES

Trading Securities

The Company had trading securities of $4.5 million and $3.9 million as of March 31, 2023 and December 31, 2022, respectively. These securities are held in a rabbi trust and will be used for future payments associated with the Company’s non-qualified 401(k) Restoration Plan and Non-qualified Deferred Compensation Plan.

Equity Securities

The Company had equity securities of $21.5 million and $21.1 million as of March 31, 2023 and December 31, 2022, respectively. These securities consist primarily of mutual funds held in a rabbi trust and will be used for future payments associated with the Company’s supplemental executive retirement plans.

The following table represents a summary of the gains and losses recognized within non-interest income and non-interest expense within the consolidated statements of income that relate to equity securities for the periods indicated:

| Three Months Ended | |||||||||||

| March 31 | |||||||||||

| 2023 | 2022 | ||||||||||

| Dollars in thousands | |||||||||||

| Net gains (losses) recognized during the period on equity securities | $ | $ | ( | ||||||||

| Less: net gains recognized during the period on equity securities sold during the period | |||||||||||

| Unrealized gains (losses) recognized during the reporting period on equity securities still held at the reporting date | $ | $ | ( | ||||||||

Available for Sale Securities

The following table summarizes the amortized cost, allowance for credit losses, and fair value of available for sale securities and the corresponding amounts of gross unrealized gains and losses recognized in accumulated other comprehensive income (loss) as of the dates indicated:

| March 31, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Allowance for credit losses | Fair Value | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Allowance for credit losses | Fair Value | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. government agency securities | $ | $ | $ | ( | $ | $ | $ | $ | — | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| U.S. treasury securities | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agency mortgage-backed securities | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agency collateralized mortgage obligations | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| State, county, and municipal securities | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pooled trust preferred securities issued by banks and insurers | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Small business administration pooled securities | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total available for sale securities | $ | $ | $ | ( | $ | $ | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||

Excluded from the table above is accrued interest on available for sale securities of $3.2 million and $3.6 million at March 31, 2023 and December 31, 2022, respectively, which is included within other assets on the consolidated balance sheets. Additionally, the Company did not no

13

When securities are sold, the adjusted cost of the specific security sold is used to compute the gain or loss on the sale. The Company had no sales of securities available for sale during the three months ended March 31, 2023 and 2022, and therefore no

The following tables show the gross unrealized losses and fair value of the Company’s available for sale securities in an unrealized loss position, and for which the Company has not recorded a provision for credit losses, as of the dates indicated. These available for sale securities are aggregated by major security type and length of time that individual securities have been in a continuous unrealized loss position:

| March 31, 2023 | |||||||||||||||||||||||||||||||||||||||||

| Less than 12 months | 12 months or longer | Total | |||||||||||||||||||||||||||||||||||||||

| # of holdings | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

| U.S. government agency securities | $ | $ | ( | $ | $ | ( | $ | $ | ( | ||||||||||||||||||||||||||||||||

| U.S. treasury securities | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Agency mortgage-backed securities | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||

| Agency collateralized mortgage obligations | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||

| Pooled trust preferred securities issued by banks and insurers | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Small business administration pooled securities | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||

| Total impaired available for sale securities | $ | $ | ( | $ | $ | ( | $ | $ | ( | ||||||||||||||||||||||||||||||||

| December 31, 2022 | |||||||||||||||||||||||||||||||||||||||||

| Less than 12 months | 12 months or longer | Total | |||||||||||||||||||||||||||||||||||||||

| # of holdings | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

| U.S. government agency securities | $ | $ | ( | $ | $ | ( | $ | $ | ( | ||||||||||||||||||||||||||||||||

| U.S. treasury securities | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||

| Agency mortgage-backed securities | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||

| Agency collateralized mortgage obligations | ( | ( | |||||||||||||||||||||||||||||||||||||||

| State, county, and municipal securities | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Pooled trust preferred securities issued by banks and insurers | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Small business administration pooled securities | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||

| Total impaired available for sale securities | $ | $ | ( | $ | $ | ( | $ | $ | ( | ||||||||||||||||||||||||||||||||

The Company does not intend to sell these investments and has determined, based upon available evidence, that it is more likely than not that the Company will not be required to sell each security before the recovery of its amortized cost basis. In addition, management does not believe that any of the securities are impaired due to reasons of credit quality. As a result, the Company did not

14

As a result of the Company’s review of these qualitative and quantitative factors, the causes of the impairments listed in the table above by category were as follows at March 31, 2023:

•U.S. Government Agency Securities, U.S. Treasury Securities, Agency Mortgage-Backed Securities, Agency Collateralized Mortgage Obligations and Small Business Administration Pooled Securities: These portfolios have contractual terms that generally do not permit the issuer to settle the securities at a price less than the current par value of the investment. The decline in market value of these securities is attributable to changes in interest rates and not credit quality. Additionally, these securities are implicitly guaranteed by the U.S. Government or one of its agencies.

•Pooled Trust Preferred Securities: This portfolio consists of one below investment grade security which is performing. The unrealized loss on this security is attributable to the illiquid nature of the trust preferred market in the current economic and regulatory environment. Management evaluates collateral credit and instrument structure, including current and expected deferral and default rates and timing. In addition, discount rates are determined by evaluating comparable spreads observed currently in the market for similar instruments.

Held to Maturity Securities

The following table summarizes the amortized cost, fair value and allowance for credit losses of held to maturity securities and the corresponding amounts of gross unrealized gains and losses recognized at the dates indicated:

| March 31, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Allowance for credit losses | Fair Value | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Allowance for credit losses | Fair Value | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. government agency securities | $ | $ | $ | ( | $ | $ | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||

| U.S. treasury securities | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agency mortgage-backed securities | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agency collateralized mortgage obligations | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Single issuer trust preferred securities issued by banks | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Small business administration pooled securities | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total held to maturity securities | $ | $ | $ | ( | $ | $ | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||

Substantially all held to maturity securities held by the Company are guaranteed by the U.S. federal government or other government sponsored agencies and have a long history of no credit losses. As a result, management has determined these securities to have a zero loss expectation and therefore the Company did not 4.5 million and $4.4 million as of March 31, 2023 and December 31, 2022, respectively, which is included within other assets on the consolidated balance sheets. Additionally, the Company did not no

While management has the positive intent and ability to hold the Company's held to maturity securities until maturity, if a decision were made to sell a security within this portfolio, the adjusted cost of the specific security sold would be used to compute the gain or loss on the sale. The Company had no sales of held to maturity securities during the three months ended March 31, 2023 and 2022, and therefore no

The Company monitors the credit quality of held to maturity securities through the use of credit ratings. Credit ratings are monitored by the Company on at least a quarterly basis. As of March 31, 2023, all held to maturity securities held by the Company were rated investment grade or higher.

15

The actual maturities of certain available for sale or held to maturity securities may differ from the contractual maturities because borrowers may have the right to call or prepay obligations with or without call or prepayment penalties. A schedule of the contractual maturities of available for sale and held to maturity securities as of March 31, 2023 is presented below:

| Due in one year or less | Due after one year to five years | Due after five to ten years | Due after ten years | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortized Cost | Fair Value | Amortized Cost | Fair Value | Amortized Cost | Fair Value | Amortized Cost | Fair Value | Amortized Cost | Fair Value | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Available for sale securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. government agency securities | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. treasury securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agency mortgage-backed securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agency collateralized mortgage obligations | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| State, county, and municipal securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pooled trust preferred securities issued by banks and insurers | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Small business administration pooled securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total available for sale securities | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

| Held to maturity securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. government agency securities | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. treasury securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agency mortgage-backed securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agency collateralized mortgage obligations | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Single issuer trust preferred securities issued by banks | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Small business administration pooled securities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total held to maturity securities | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

Included in the table above are $25.0 million of callable securities at March 31, 2023.

The carrying value of securities pledged to secure public funds, trust deposits, and for other purposes, as required or permitted by law, was $946.7 million and $959.8 million at March 31, 2023 and December 31, 2022, respectively.

At March 31, 2023 and December 31, 2022, the Company had no

16

NOTE 4 - LOANS, ALLOWANCE FOR CREDIT LOSSES AND CREDIT QUALITY

Loans Held for Investment and Allowance for Credit Losses

The following table summarizes the change in allowance for credit losses by loan category, and bifurcates the amount of loans allocated to each loan category for the period indicated:

| Three Months Ended March 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and Industrial | Commercial Real Estate | Commercial Construction | Small Business | Residential Real Estate | Home Equity | Other Consumer | Total | ||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | |||||||||||||||||||||||||||||||||||||||||||||||

| Beginning balance | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| Charge-offs | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||

| Recoveries | |||||||||||||||||||||||||||||||||||||||||||||||

| Provision for (release of) credit losses | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||

| Ending balance (1) | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and Industrial | Commercial Real Estate | Commercial Construction | Small Business | Residential Real Estate | Home Equity | Other Consumer | Total | ||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | |||||||||||||||||||||||||||||||||||||||||||||||

| Beginning balance | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| Charge-offs | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||

| Recoveries | |||||||||||||||||||||||||||||||||||||||||||||||

| Provision for (release of) credit losses | ( | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||

| Ending balance (1) | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

(1)Balances of accrued interest receivable excluded from amortized cost and the calculation of allowance for credit losses amounted to $52.7 million and $39.4 million as of March 31, 2023 and March 31, 2022, respectively.

The balance of allowance for credit losses increased to $159.1 million as of March 31, 2023 compared to $152.4 million at December 31, 2022, due primarily to an additional reserve allocation associated with further credit deterioration of a large commercial and industrial credit that migrated to nonperforming status during 2022, resulting in a full specific reserve allocation on the loan.

For the purpose of estimating the allowance for credit losses, management segregated the loan portfolio into the portfolio segments detailed in the above tables. Each of these loan categories possesses unique risk characteristics that are considered when determining the appropriate level of allowance for each segment. Some of the characteristics unique to each loan category include:

Commercial Portfolio

•Commercial and Industrial: Consists of revolving and term loan obligations extended to business and corporate enterprises for the purpose of financing working capital and/or capital investment. Collateral generally consists of accounts receivable, inventory, plant and equipment, real estate, or other business assets. The primary source of repayment is operating cash flow and, secondarily, liquidation of assets.

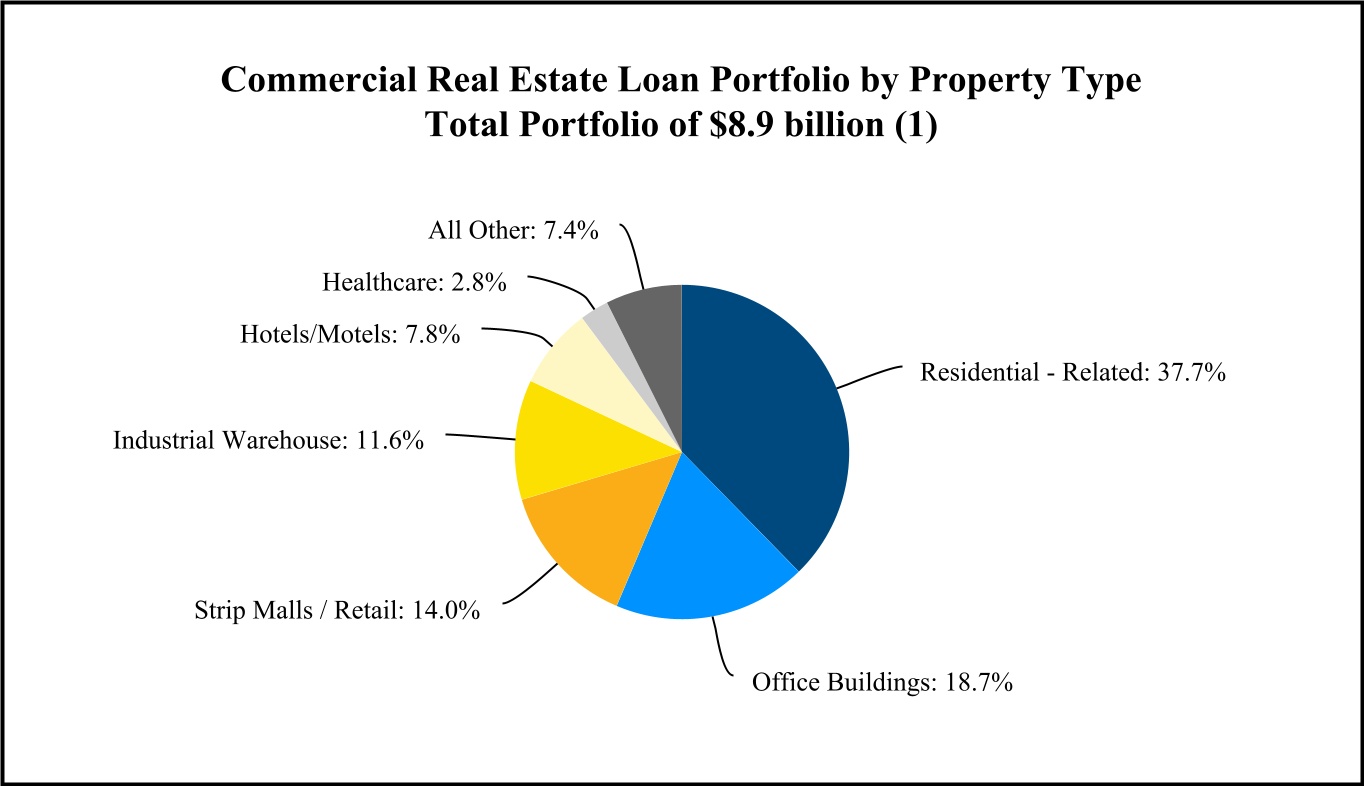

•Commercial Real Estate: Consists of mortgage loans to finance investment in real property such as multi-family residential, commercial/retail, office, industrial, hotels, educational and healthcare facilities and other specific use properties and is inclusive of owner-occupied commercial properties. Loans are typically written with amortizing payment structures. Collateral values are determined based upon third party appraisals and evaluations. Permissible loan to value ratios at origination are governed by Company policy and regulatory guidelines. The primary source of repayment is cash flow from operating leases and rents and, secondarily, liquidation of assets.

17

•Commercial Construction: Consists of short-term construction loans, revolving and nonrevolving credit lines and construction/permanent loans to finance the acquisition, development and construction or rehabilitation of real property. Project types include residential land development, one-to-four family, condominium, and multi-family home construction, commercial/retail, office, industrial, hotels, educational and healthcare facilities and other specific use properties. Loans may be written with nonamortizing or hybrid payment structures depending upon the type of project. Collateral values are determined based upon third party appraisals and evaluations. Permissible loan to value ratios at origination are governed by Company policy and regulatory guidelines. Repayment sources vary depending upon the type of project and may consist of proceeds from the sale or lease of units, operating cash flows or liquidation of other assets.

•Small Business: Consists of revolving, term loan and mortgage obligations extended to sole proprietors and small businesses for purposes of financing working capital and/or capital investment. Collateral generally consists of pledges of business assets including, but not limited to, accounts receivable, inventory, plant and equipment, or real estate if applicable. The primary source of repayment is operating cash flows and, secondarily, liquidation of assets.

For the commercial portfolio it is the Company’s policy to obtain personal guarantees for payment from individuals holding material ownership interests in the borrowing entities.

Consumer Portfolio

•Residential Real Estate: Residential mortgage loans held in the Company’s portfolio are made to borrowers who demonstrate the ability to make scheduled payments with full consideration to underwriting factors such as current and expected income, employment status, current assets, other financial resources, credit history and the value of the collateral. Collateral consists of mortgage liens on one-to-four family residential properties. Residential mortgage loans also include loans to construct owner-occupied one-to-four family residential properties.

•Home Equity: Home equity loans and credit lines are made to qualified individuals and are primarily secured by senior or junior mortgage liens on owner-occupied one-to-four family homes, condominiums or vacation homes. Each home equity loan has a fixed rate and is billed in equal payments comprised of principal and interest. The majority of home equity lines of credit have a variable rate and are billed in interest-only payments during the draw period. At the end of the draw period, the home equity line of credit is billed as a percentage of the then outstanding principal balance plus all accrued interest over a predetermined repayment period, as set forth in the note. Additionally, the Company has the option of renewing each line of credit for additional draw periods. Borrower qualifications include favorable credit history combined with supportive income requirements and combined loan to value ratios within established policy guidelines.

•Other Consumer: Other consumer loan products include personal lines of credit and amortizing loans made to qualified individuals for various purposes such as debt consolidation, personal expenses or overdraft protection. Borrower qualifications include favorable credit history combined with supportive income and collateral requirements within established policy guidelines. These loans may be secured or unsecured.

Credit Quality

The Company continually monitors the asset quality of the loan portfolio using all available information. Based on this information, loans demonstrating certain payment issues or other weaknesses may be categorized as adversely risk-rated, delinquent, nonperforming and/or put on nonaccrual status. Additionally, in the course of resolving such loans, the Company may choose to restructure the contractual terms of certain loans to match the borrower’s ability to repay the loan based on their current financial condition.

The Company reviews numerous credit quality indicators when assessing the risk in its loan portfolio. For the commercial portfolio, the Company utilizes a 10-point credit risk-rating system, which assigns a risk-grade to each loan obligation based on a number of quantitative and qualitative factors associated with a commercial or small business loan transaction. Factors considered include industry and market conditions, position within the industry, earnings trends, operating cash flow, asset/liability values, debt capacity, guarantor strength, management and controls, financial reporting, collateral, and other considerations. The risk-rating categories for the commercial portfolio are defined as follows:

•Pass: Risk-rating “1” through “6” comprises of loans ranging from ‘Substantially Risk Free’ which indicates borrowers are of unquestioned credit standing and the pinnacle of credit quality, well established companies with a very strong financial condition, and loans fully secured by cash collateral, through ‘Acceptable Risk’, which indicates borrowers may exhibit declining earnings, strained cash flow, increasing or above average leverage and/or weakening market fundamentals that indicate below average asset quality, margins and market share. Collateral coverage is protective.

18

•Potential Weakness: Borrowers exhibit potential credit weaknesses or downward trends deserving management’s close attention. If not checked or corrected, these trends will weaken the Company’s asset and position. While potentially weak, currently these borrowers are marginally acceptable; no loss of principal or interest is envisioned.

•Definite Weakness Loss Unlikely: Borrowers exhibit well defined weaknesses that jeopardize the orderly liquidation of debt. Loans may be inadequately protected by the current net worth and paying capacity of the obligor or by the collateral pledged, if any. Normal repayment from the borrower is in jeopardy, although no loss of principal is envisioned. However, there is a distinct possibility that a partial loss of interest and/or principal will occur if the deficiencies are not corrected. Collateral coverage may be inadequate to cover the principal obligation.

•Partial Loss Probable: Borrowers exhibit well defined weaknesses that jeopardize the orderly liquidation of debt with the added provision that the weaknesses make collection of the debt in full, on the basis of currently existing facts, conditions, and values, highly questionable and improbable. Serious problems exist to the point where partial loss of principal is likely.

•Definite Loss: Borrowers deemed incapable of repayment. Loans to such borrowers are considered uncollectible and of such little value that continuation as active assets of the Company is not warranted.

The Company utilizes a comprehensive, continuous strategy for evaluating and monitoring commercial credit quality. Initially, credit quality is determined at loan origination and is re-evaluated when subsequent actions, such as renewals, modifications or reviews, occur. Actively managed commercial borrowers are required to provide updated financial information at least annually which is carefully evaluated for any changes in credit quality. Larger loan relationships are subject to a full annual credit review by experienced credit professionals, while continuous portfolio monitoring techniques are employed to evaluate changes in credit quality for smaller loan relationships. Any changes in credit quality are reflected in risk-rating changes. Additionally, the Company retains an independent loan review firm to evaluate the credit quality of the commercial loan portfolio. The independent loan review process achieves significant penetration into the commercial loan portfolio and reports the results of these reviews to the Audit Committee of the Board of Directors on a quarterly basis.

For the Company’s consumer portfolio, the quality of the loan is best indicated by the repayment performance of an individual borrower. As a result, for this portfolio the Company utilizes a pass/default risk-rating system, based on an age analysis (i.e., days past due) associated with each consumer loan. Under this structure, consumer loans less than 90 days past due are assigned a "pass" rating, while any consumer loans 90 days or more past due are assigned a "default" rating.

The following table details the amortized cost balances of the Company's loan portfolios, presented by credit quality indicator and origination year as of the dates indicated below:

| March 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2021 | 2020 | 2019 | Prior | Revolving Loans | Revolving converted to Term | Total (1) | |||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass (2) | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Potential weakness | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite weakness - loss unlikely | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Partial loss probable | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite loss | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total commercial and industrial | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Current-period gross write-offs | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Potential weakness | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite weakness - loss unlikely | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Partial loss probable | |||||||||||||||||||||||||||||||||||||||||||||||||||||

19

| Definite loss | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total commercial real estate | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Current-period gross write-offs | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial construction | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Potential weakness | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite weakness - loss unlikely | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Partial loss probable | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite loss | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total commercial construction | $ | $ | $ | $ | $ | $ | $ | $ | — | $ | |||||||||||||||||||||||||||||||||||||||||||

| Current-period gross write-offs | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Small business | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Potential weakness | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite weakness - loss unlikely | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Partial loss probable | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite loss | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total small business | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Current-period gross write-offs | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Residential real estate | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Default | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total residential real estate | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Current-period gross write-offs | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Home equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Default | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total home equity | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Current-period gross write-offs | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Other consumer (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Default | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total other consumer | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Current-period gross write-offs | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Total current-period gross write-offs | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

20

| March 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | Prior | Revolving Loans | Revolving converted to Term | Total (1) | |||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass (2) | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Potential weakness | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite weakness - loss unlikely | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Partial loss probable | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite loss | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total commercial and industrial | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Potential weakness | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite weakness - loss unlikely | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Partial loss probable | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite loss | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total commercial real estate | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial construction | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass | $ | $ | $ | $ | $ | $ | $ | $ | — | $ | |||||||||||||||||||||||||||||||||||||||||||

| Potential weakness | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite weakness - loss unlikely | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Partial loss probable | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite loss | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total commercial construction | $ | $ | $ | $ | $ | $ | $ | $ | — | $ | |||||||||||||||||||||||||||||||||||||||||||

| Small business | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Potential weakness | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite weakness - loss unlikely | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Partial loss probable | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Definite loss | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total small business | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Residential real estate | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Default | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total residential real estate | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Home equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Default | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total home equity | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Other consumer (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pass | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Default | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total other consumer | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

21

(1)Loan origination dates in the tables above reflect the original origination date, or the date of a material modification of a previously originated loan.

(2)Loans originated as part of the Paycheck Protection Program ("PPP") established by the Coronavirus Aid, Relief and Economic Security Act (the "CARES Act")t are included within commercial and industrial under the 2021 and 2020 vintage year and "pass" category as these loans are 100% guaranteed by the U.S. Government. Outstanding PPP loans totaled $6.6 million and $99.6 million as of March 31, 2023 and 2022, respectively.

For the Company’s consumer portfolio, the quality of the loan is best indicated by the repayment performance of an individual borrower. However, the Company does supplement performance data with current Fair Isaac Corporation (“FICO”) scores and Loan to Value (“LTV”) estimates. Current FICO data is purchased and appended to all consumer loans on a regular basis. In addition, automated valuation services and broker opinions of value are used to supplement original value data for the residential real estate and home equity portfolios, periodically. The following table shows the weighted average FICO scores and the weighted average combined LTV ratios at the dates indicated below:

| March 31 2023 | December 31 2022 | ||||||||||

| Residential real estate portfolio | |||||||||||

| FICO score (re-scored)(1) | |||||||||||

| LTV (re-valued)(2) | % | % | |||||||||

| Home equity portfolio | |||||||||||

| FICO score (re-scored)(1) | |||||||||||

| LTV (re-valued)(2)(3) | % | % | |||||||||

(1)The average FICO scores at March 31, 2023 are based upon rescores from March 2023, as available for previously originated loans, or origination score data for loans booked in March 2023. The average FICO scores at December 31, 2022 were based upon rescores available from December 2022, as available for previously originated loans, or origination score data for loans booked in December 2022.

(2)The combined LTV ratios for March 31, 2023 are based upon updated automated valuations as of February 2023, when available, and/or the most current valuation data available. The combined LTV ratios for December 31, 2022 were based upon updated automated valuations as of November 2022, when available, and/or the most current valuation data available as of such date. The updated automated valuations provide new information on loans that may be available since the previous valuation was obtained. If no new information is available, the valuation will default to the previously obtained data or most recent appraisal.

(3)For home equity loans and lines in a subordinate lien, the LTV data represents a combined LTV, taking into account the senior lien data for loans and lines.

Unfunded Commitments

Management evaluates the need for a reserve on unfunded lending commitments in a manner consistent with loans held for investment. At March 31, 2023 and December 31, 2022, the Company's estimated reserve for unfunded commitments amounted to $1.6 million and $1.3 million, respectively.

Asset Quality

The Company’s philosophy toward managing its loan portfolios is predicated upon careful monitoring, which stresses early detection and response to delinquent and default situations. Delinquent loans are managed by a team of collection specialists and the Company seeks to make arrangements to resolve any delinquent or default situation over the shortest possible time frame. As a general rule, loans 90 days or more past due with respect to principal or interest are classified as nonaccrual loans. The Company also may use discretion regarding other loans 90 days or more delinquent if the loan is well secured and/or in process of collection.

22

The following table shows information regarding nonaccrual loans as of the dates indicated:

| Nonaccrual Balances | |||||||||||||||||||||||||||||||||||

| March 31, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||||||||

| With Allowance for Credit Losses | Without Allowance for Credit Losses | Total | With Allowance for Credit Losses | Without Allowance for Credit Losses | Total (1) | ||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Commercial real estate | |||||||||||||||||||||||||||||||||||

| Small business | |||||||||||||||||||||||||||||||||||

| Residential real estate | — | ||||||||||||||||||||||||||||||||||

| Home equity | |||||||||||||||||||||||||||||||||||

| Other consumer | |||||||||||||||||||||||||||||||||||

| Total nonaccrual loans | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

It is the Company's policy to reverse any accrued interest when a loan is put on nonaccrual status, and, as such, the Company did not record any interest income on nonaccrual loans during the three months ended March 31, 2023 and 2022, except for instances where nonaccrual loans were paid off in excess of the recorded book balance.

The following table shows information regarding foreclosed residential real estate property at the dates indicated:

| March 31, 2023 | December 31, 2022 | ||||||||||

| (Dollars in thousands) | |||||||||||

| Foreclosed residential real estate property held by the creditor | $ | $ | |||||||||

| Recorded investment in mortgage loans collateralized by residential real estate property that are in the process of foreclosure | $ | $ | |||||||||

The following tables show the age analysis of past due financing receivables as of the dates indicated:

| March 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 30-59 days | 60-89 days | 90 days or more | Total Past Due | Total Financing Receivables | Amortized Cost >90 Days and Accruing | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Loans | Principal Balance | Number of Loans | Principal Balance | Number of Loans | Principal Balance | Number of Loans | Principal Balance | Current | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan Portfolio | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial construction | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Small business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Residential real estate | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other consumer (1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

23

| December 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 30-59 days | 60-89 days | 90 days or more | Total Past Due | Total Financing Receivables | Recorded Investment >90 Days and Accruing | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Loans | Principal Balance | Number of Loans | Principal Balance | Number of Loans | Principal Balance | Number of Loans | Principal Balance | Current | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan Portfolio | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial construction | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Small business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Residential real estate | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other consumer (1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1)Other consumer portfolio is inclusive of deposit account overdrafts recorded as loan balances.

In the course of resolving nonperforming loans, the Company may choose to restructure the contractual terms of certain loans. The Company attempts to work out an alternative payment schedule with the borrower in order to avoid foreclosure actions. Terms may be modified to fit the ability of the borrower to repay in line with its current financial status and the restructuring of the loan may include principal forgiveness, interest rate reductions, term extensions, other-than-insignificant payment delays, and/or any combinations thereof. Any loans that are modified are reviewed by the Company to determine whether the modification is the direct result of a borrower experiencing financial difficulty, as the Company adopted the accounting and disclosure requirements for loan modifications made to borrowers experiencing financial difficulty and ceased to recognize TDRs effective January 1, 2023.

Loan modifications made to borrowers experiencing financial difficulty are evaluated on a collective basis with loans sharing similar risk characteristics in accordance with the current expected credit loss ("CECL") methodology. Under previously applicable accounting guidance, the Company determined the amount of allowance for credit losses on TDRs using a discounted cash flow analysis or a fair value of collateral approach if the loan was determined to be individually evaluated. This change in methodology did not have a material impact on the Company's allowance for credit loss estimate.

24

The following table presents the amortized cost basis at March 31, 2023 of loans modified to borrowers experiencing financial difficulty during the three month period then ended, disaggregated by class of financing receivable and type of modification granted:

| Term Extension | |||||||||||

| Amortized Cost Basis | % of Total Class of Financing Receivable | ||||||||||

| Loan Category | (Dollars in thousands) | ||||||||||

| Commercial real estate | $ | ||||||||||

| Small business | |||||||||||

| Total | $ | ||||||||||

| Other-Than-Insignificant Payment Delay | |||||||||||

| Amortized Cost Basis | % of Total Class of Financing Receivable | ||||||||||

| Loan Category | (Dollars in thousands) | ||||||||||

| Commercial and industrial | $ | ||||||||||

| Commercial real estate | |||||||||||

| Total | $ | ||||||||||

| Combination - Interest Rate Reduction and Term Extension | |||||||||||

| Amortized Cost Basis | % of Total Class of Financing Receivable | ||||||||||

| Loan Category | (Dollars in thousands) | ||||||||||

| Small business | $ | ||||||||||

| Total | $ | ||||||||||

The following table describes the financial effect of the modifications made to borrowers experiencing financial difficulty for the period ending March 31, 2023:

| Term Extension | ||||||||

| Loan Category | Financial Effect | |||||||

| Commercial real estate | Added a weighted-average contractual term of | |||||||

| Small business | Added a weighted-average contractual term of | |||||||

| Interest Rate Reduction | ||||||||

| Loan Category | Financial Effect | |||||||

| Small business | Reduced weighted-average contractual interest rate from | |||||||

The following table shows the Company’s total TDRs and other pertinent information as of the date indicated:

| December 31, 2022 | |||||||||||

| (Dollars in thousands) | |||||||||||

| TDRs on accrual status | $ | ||||||||||

| TDRs on nonaccrual | |||||||||||

| Total TDRs | $ | ||||||||||

25

There were no new TDRs during the three months ended March 31, 2022.

At March 31, 2023, the Company did not have any additional commitments to lend to borrowers experiencing financial difficulty who were party to a loan modification. At December 31, 2022, the Company had additional commitments to lend to borrowers who had been a party to a TDR of $64,000 .

NOTE 5 - BORROWINGS

NOTE 6 - STOCK BASED COMPENSATION

During the three months ended March 31, 2023, the Company had the following activity related to stock based compensation:

Time Vested Restricted Stock Awards

The Company made the following awards of time vested restricted stock:

| Date | Shares Granted | Plan | Grant Date Fair Value Per Share | Vesting Period | ||||||||||||||||||||||

| 2/16/2023 | 2005 Employee Stock Plan | $ | ||||||||||||||||||||||||

| 2/16/2023 | 2005 Employee Stock Plan | $ | ||||||||||||||||||||||||

Performance-Based Restricted Stock Awards

On February 16, 2023, the Company granted 32,200 performance-based restricted stock awards, representing the maximum number of shares that may be earned under the awards, to certain executive level employees. These performance-based restricted stock awards were issued from the 2005 Employee Stock Plan and were determined to have a grant date fair value per share of $80.65 . The number of shares to be vested is contingent upon the Company's attainment of certain performance criteria to be measured at the end of a three year performance period ending December 31, 2025. The awards will vest upon the earlier of the date on which it is determined if the performance goal is achieved subsequent to the performance period or March 31, 2026.

26

NOTE 7 - DERIVATIVE AND HEDGING ACTIVITIES

The Company’s derivative financial instruments are used to manage differences in the amount, timing, and duration of the Company’s known or expected cash receipts and its known or expected cash payments principally to manage the Company’s interest rate risk. Additionally, the Company enters into interest rate derivatives, foreign exchange contracts and risk participation agreements to accommodate the business requirements of its customers (“customer related positions”). The Company minimizes the market and liquidity risks of customer related positions by entering into similar offsetting positions with broker-dealers. Derivative instruments are carried at fair value in the Company's financial statements. The accounting for changes in the fair value of a derivative instrument is dependent upon whether or not it qualifies as a hedge for accounting purposes, and further, by the type of hedging relationship.

The Company does not enter into proprietary trading positions for any derivatives.

The Company is subject to over-the-counter derivative clearing requirements which require certain derivatives to be cleared through central clearing houses. Accordingly, the Company clears certain derivative transactions through the Chicago Mercantile Exchange Clearing House ("CME"). This clearing house requires the Company to post initial and variation margin to mitigate the risk of non-payment, the latter of which is received or paid daily based on the net asset or liability position of the contracts.

Interest Rate Positions

The Company may utilize various interest rate derivatives as hedging instruments against interest rate risk associated with the Company’s borrowings and loan portfolios. An interest rate derivative is an agreement whereby one party agrees to pay a floating rate of interest on a notional principal amount in exchange for receiving a fixed rate of interest on the same notional amount, for a predetermined period of time, from a second party. The amounts relating to the notional principal amount are not actually exchanged.

27

The following tables reflect the Company's derivative positions at the dates indicated below for interest rate swaps which qualify as cash flow hedges for accounting purposes:

| March 31, 2023 | ||||||||||||||||||||||||||||||||

| Weighted Average Rate | ||||||||||||||||||||||||||||||||

| Notional Amount | Average Maturity | Current Rate Received | Pay Fixed Swap Rate | Fair Value | ||||||||||||||||||||||||||||

| (in thousands) | (in years) | (in thousands) | ||||||||||||||||||||||||||||||

| Interest rate swaps on borrowings | $ | % | % | $ | ( | |||||||||||||||||||||||||||

| Current Rate Paid | Receive Fixed Swap Rate | |||||||||||||||||||||||||||||||

| Interest rate swaps on loans | $ | % | % | $ | ( | |||||||||||||||||||||||||||

| Current Rate Paid | Receive Fixed Swap Rate Cap - Floor | |||||||||||||||||||||||||||||||

| Interest rate collars on loans | % | ( | ||||||||||||||||||||||||||||||

| Total | $ | $ | ( | |||||||||||||||||||||||||||||

| December 31, 2022 | ||||||||||||||||||||||||||||||||

| Weighted Average Rate | ||||||||||||||||||||||||||||||||

| Notional Amount | Average Maturity | Current Rate Paid | Receive Fixed Swap Rate | Fair Value | ||||||||||||||||||||||||||||

| (in thousands) | (in years) | (in thousands) | ||||||||||||||||||||||||||||||

| Interest rate swaps on loans | % | % | ( | |||||||||||||||||||||||||||||

| Current Rate Paid | Receive Fixed Swap Rate Cap - Floor | |||||||||||||||||||||||||||||||

| Interest rate collars on loans | % | ( | ||||||||||||||||||||||||||||||

| Total | $ | $ | ( | |||||||||||||||||||||||||||||

The maximum length of time over which the Company is currently hedging its exposure to the variability in future cash flows for forecasted transactions related to the payment of variable interest on existing financial instruments is 6.0 years.

For derivative instruments that are designated and qualify as cash flow hedging instruments, the effective portion of the gains or losses is reported as a component of other comprehensive income and is subsequently reclassified into earnings in the period that the hedged forecasted transaction affects earnings. The Company expects approximately $3.1 million (pre-tax) to be reclassified as an increase to interest income and $25.0 million (pre-tax) to be reclassified as an increase to interest expense, from OCI related to the Company’s cash flow hedges in the twelve months following March 31, 2023. This reclassification is due to anticipated payments that will be made and/or received on the swaps based upon the forward curve at March 31, 2023.

The Company had no

Customer Related Positions

Loan level derivatives, primarily interest rate swaps, offered to commercial borrowers through the Company’s loan level derivative program do not qualify as hedges for accounting purposes. The Company believes that its exposure to commercial customer derivatives is limited because these contracts are simultaneously matched at inception with an offsetting dealer transaction. Derivatives with dealer counterparties are then either cleared through a clearinghouse or settled directly with a single counterparty. The commercial customer derivative program allows the Company to retain variable-rate commercial loans while allowing the customer to synthetically fix the loan rate by entering into a variable-to-fixed interest rate swap. The amounts relating to the notional principal amount are not actually exchanged.

28

Foreign exchange contracts offered to commercial borrowers through the Company’s derivative program do not qualify as hedges for accounting purposes. The Company acts as a seller and buyer of foreign exchange contracts to accommodate its customers. To mitigate the market and liquidity risk associated with these derivatives, the Company enters into similar offsetting positions. The amounts relating to the notional principal amount are exchanged.

The Company has entered into risk participation agreements with other dealer banks in commercial loan agreements. Participating banks guarantee the performance on borrower-related interest rate swap contracts. These derivatives are not designated as hedges and, therefore, changes in fair value are recognized in earnings. Under a risk participation-out agreement, a derivative asset, the Company participates out a portion of the credit risk associated with the interest rate swap position executed with the commercial borrower for a fee paid to the participating bank. Under a risk participation-in agreement, a derivative liability, the Company assumes, or participates in, a portion of the credit risk associated with the interest rate swap position with the commercial borrower for a fee received from the other bank.

29

The following table reflects the Company’s customer related derivative positions at the dates indicated below for those derivatives not designated as hedging:

| Notional Amount Maturing | |||||||||||||||||||||||||||||||||||||||||||||||

| Number of Positions (1) | Less than 1 year | Less than 2 years | Less than 3 years | Less than 4 years | Thereafter | Total | Fair Value | ||||||||||||||||||||||||||||||||||||||||

| March 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

| Loan level swaps | |||||||||||||||||||||||||||||||||||||||||||||||

| Receive fixed, pay variable | $ | $ | $ | $ | $ | $ | $ | ( | |||||||||||||||||||||||||||||||||||||||

| Pay fixed, receive variable | |||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange contracts | |||||||||||||||||||||||||||||||||||||||||||||||

| Buys foreign currency, sells U.S. currency | |||||||||||||||||||||||||||||||||||||||||||||||

| Buys U.S. currency, sells foreign currency | ( | ||||||||||||||||||||||||||||||||||||||||||||||

| Risk participation agreements | |||||||||||||||||||||||||||||||||||||||||||||||

| Participation out | |||||||||||||||||||||||||||||||||||||||||||||||

| Participation in | — | ( | |||||||||||||||||||||||||||||||||||||||||||||

| Notional Amount Maturing | |||||||||||||||||||||||||||||||||||||||||||||||

| Number of Positions (1) | Less than 1 year | Less than 2 years | Less than 3 years | Less than 4 years | Thereafter | Total | Fair Value | ||||||||||||||||||||||||||||||||||||||||

| December 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

| Loan level swaps | |||||||||||||||||||||||||||||||||||||||||||||||

| Receive fixed, pay variable | $ | $ | $ | $ | $ | $ | $ | ( | |||||||||||||||||||||||||||||||||||||||

| Pay fixed, receive variable | |||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange contracts | |||||||||||||||||||||||||||||||||||||||||||||||

| Buys foreign currency, sells U.S. currency | |||||||||||||||||||||||||||||||||||||||||||||||

| Buys U.S. currency, sells foreign currency | ( | ||||||||||||||||||||||||||||||||||||||||||||||

| Risk participation agreements | |||||||||||||||||||||||||||||||||||||||||||||||

| Participation out | |||||||||||||||||||||||||||||||||||||||||||||||

| Participation in | ( | ||||||||||||||||||||||||||||||||||||||||||||||

(1)The Company may enter into one dealer swap agreement which offsets multiple commercial borrower swap agreements.

Mortgage Derivatives