Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

UNAUDITED

(1) Basis of Presentation

The Condensed Consolidated Financial Statements do not include footnotes and certain financial information normally presented annually under accounting principles generally accepted in the United States (“GAAP”). Therefore, they should be read in conjunction with the audited consolidated financial statements and the related notes included in Tutor Perini Corporation’s (the “Company”) Annual Report on Form 10-K for the year ended December 31, 2017. The results of operations for the three months ended March 31, 2018 may not be indicative of the results that will be achieved for the full year ending December 31, 2018.

In the opinion of management, the accompanying unaudited Condensed Consolidated Financial Statements reflect all adjustments, including those of a normal recurring nature, necessary to present fairly the Company’s consolidated financial position as of March 31, 2018 and its consolidated results of operations and cash flows for the interim periods presented. All significant intercompany transactions of consolidated subsidiaries have been eliminated.

(2) Recent Accounting Pronouncements

New accounting pronouncements implemented by the Company during the three months ended March 31, 2018 are discussed below.

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers (Topic 606), as amended by subsequent ASUs (collectively, “ASC 606”). ASC 606 amends the existing accounting standards for revenue recognition and establishes principles for recognizing revenue upon the transfer of promised goods or services to customers based on the expected consideration to be received in exchange for those goods or services. The Company adopted this ASU effective January 1, 2018 using the modified retrospective transition method. The Company recognized the cumulative effect of initially applying the new revenue standard to all contracts not yet completed or substantially completed as of January 1, 2018 as an immaterial reduction to beginning retained earnings. The impacts of adoption on the Company’s opening balance sheet were primarily related to the deferral of costs incurred to fulfill certain contracts that were previously recorded in income in the period incurred, but under the new standard will be capitalized and amortized over the period of contract performance. The prior year comparative information has not been restated and continues to be reported under the accounting standards in effect for those periods; however, certain balances have been reclassified to conform to the current year presentation.

The effect of the changes made to the Company’s consolidated January 1, 2018 balance sheet for the adoption of ASC 606 were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments

|

|

|

|

|

BALANCE SHEET

|

Balance as of

|

|

due to

|

|

Balance as of

|

|

(in thousands)

|

December 31, 2017(a)

|

|

ASC 606

|

|

January 1, 2018

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Accounts receivable(b)

|

$

|

1,801,656

|

|

$

|

(535,939)

|

|

$

|

1,265,717

|

|

Retainage receivable(b)

|

|

—

|

|

|

535,939

|

|

|

535,939

|

|

Other current assets

|

|

89,316

|

|

|

32,773

|

|

|

122,089

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accounts payable(b)

|

|

961,791

|

|

|

(261,820)

|

|

|

699,971

|

|

Retainage payable(b)

|

|

—

|

|

|

261,820

|

|

|

261,820

|

|

Billings in excess of costs and estimated earnings

|

|

456,869

|

|

|

39,785

|

|

|

496,654

|

|

Deferred income taxes

|

|

108,504

|

|

|

(1,537)

|

|

|

106,967

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

Retained earnings

|

|

622,007

|

|

|

(3,762)

|

|

|

618,245

|

|

Noncontrolling interests

|

|

(8,495)

|

|

|

(1,714)

|

|

|

(10,209)

|

|

(a)

| |

Balances as previously reported on the Company’s Annual Report on Form 10-K for the year ended December 31, 2017. |

|

(b)

| |

Prior to the adoption of ASC 606, retainage receivable and payable balances were included within accounts receivable and accounts payable, respectively. |

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

In accordance with the new revenue standard requirements, the disclosure of the impacts of adoption on the Condensed Consolidated Statement of Operations and Condensed Consolidated Balance Sheet were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2018

|

|

|

|

|

|

Balance Without

|

|

|

|

STATEMENT OF OPERATIONS

|

|

|

|

Adoption of

|

|

Effect of

|

|

(in thousands)

|

|

As Reported

|

|

ASC 606

|

|

Change

|

|

REVENUE

|

|

$

|

1,028,156

|

|

$

|

1,030,268

|

|

$

|

(2,112)

|

|

COST OF OPERATIONS

|

|

|

(961,088)

|

|

|

(962,855)

|

|

|

1,767

|

|

GROSS PROFIT

|

|

|

67,068

|

|

|

67,413

|

|

|

(345)

|

|

General and administrative expenses

|

|

|

(67,993)

|

|

|

(67,993)

|

|

|

—

|

|

LOSS FROM CONSTRUCTION OPERATIONS

|

|

|

(925)

|

|

|

(580)

|

|

|

(345)

|

|

Other income, net

|

|

|

780

|

|

|

780

|

|

|

—

|

|

Interest expense

|

|

|

(15,065)

|

|

|

(15,065)

|

|

|

—

|

|

LOSS BEFORE INCOME TAXES

|

|

|

(15,210)

|

|

|

(14,865)

|

|

|

(345)

|

|

Income tax benefit

|

|

|

4,268

|

|

|

4,156

|

|

|

112

|

|

NET LOSS

|

|

|

(10,942)

|

|

|

(10,709)

|

|

|

(233)

|

|

LESS: NET INCOME ATTRIBUTABLE TO NONCONTROLLING INTERESTS

|

|

|

1,182

|

|

|

1,142

|

|

|

40

|

|

NET LOSS ATTRIBUTABLE TO TUTOR PERINI CORPORATION

|

|

$

|

(12,124)

|

|

$

|

(11,851)

|

|

$

|

(273)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2018

|

|

|

|

|

|

Balance Without

|

|

|

|

BALANCE SHEET

|

|

|

|

Adoption of

|

|

Effect of

|

|

(in thousands)

|

|

As Reported

|

|

ASC 606

|

|

Change

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

$

|

1,236,818

|

|

$

|

1,765,769

|

|

$

|

(528,951)

|

|

Retainage receivable

|

|

|

530,897

|

|

|

—

|

|

|

530,897

|

|

Costs and estimated earnings in excess of billings

|

|

|

980,896

|

|

|

982,302

|

|

|

(1,406)

|

|

Other current assets

|

|

|

132,298

|

|

|

97,758

|

|

|

34,540

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

659,290

|

|

$

|

905,323

|

|

$

|

(246,033)

|

|

Retainage payable

|

|

|

246,033

|

|

|

—

|

|

|

246,033

|

|

Billings in excess of costs and estimated earnings

|

|

|

508,616

|

|

|

466,179

|

|

|

42,437

|

|

Accrued expenses and other current liabilities

|

|

|

118,334

|

|

|

118,610

|

|

|

(276)

|

|

Deferred income taxes

|

|

|

106,763

|

|

|

108,135

|

|

|

(1,372)

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

|

Retained earnings

|

|

$

|

606,199

|

|

$

|

610,234

|

|

$

|

(4,035)

|

|

Noncontrolling interests

|

|

|

(14,076)

|

|

|

(12,402)

|

|

|

(1,674)

|

The adoption of ASC 606 had no impact on the cash flows used in operating activities in the Company’s Condensed Consolidated Statement of Cash Flows.

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash, which requires restricted cash to be included with cash and cash equivalent balances in the statement of cash flows. The Company retrospectively adopted this ASU effective January 1, 2018. The adoption of this ASU resulted in a decrease of net cash used in investing activities of $9.7 million for the quarter ended March 31, 2017.

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

In May 2017, the FASB issued ASU 2017-09, Compensation—Stock Compensation (Topic 718): Scope of Modification Accounting. This ASU clarifies the scope of modification accounting under Topic 718 with respect to changes to the terms or conditions of a share-based payments award. Under this new guidance, modification accounting would not apply if a change to an award does not affect the total current fair value, vesting conditions or the classification of the award. The Company adopted this ASU effective January 1, 2018. The adoption of this ASU did not have a material impact on the Company’s consolidated financial statements.

In March 2018, the FASB issued ASU 2018-05, Income Taxes (Topic 740)—Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 118. This ASU provides guidance for companies that may not have completed their accounting for the income tax effects of the Tax Cut and Jobs Act of 2017 (the “Tax Act”) in the period of enactment. Staff Accounting Bulletin (“SAB”) No. 118 provides for a provisional one year measurement period to finalize the accounting for certain income tax effects related to the Tax Act and requires disclosure of the reasons for incomplete accounting. The Company applied the guidance provided in SAB No. 118 in 2017 and adopted this ASU effective January 1, 2018. The adoption of this ASU did not have a material impact on the Company’s consolidated financial statements.

New accounting pronouncements requiring implementation in future periods are discussed below.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which amends the existing guidance in Accounting Standards Codification (“ASC”) 840, Leases. This amendment requires the recognition of lease assets and lease liabilities by lessees for those leases currently classified as operating leases. Other significant provisions of the amendment include (i) defining the “lease term” to include the non-cancellable period together with periods for which there is a significant economic incentive for the lessee to extend or not terminate the lease; (ii) defining the initial lease liability to be recorded on the balance sheet to contemplate only those variable lease payments that depend on an index or that are in substance “fixed”; and (iii) a dual approach for determining whether lease expense is recognized on a straight-line or accelerated basis, depending on whether the lessee is expected to consume more than an insignificant portion of the leased asset’s economic benefits. This guidance will be effective for interim and annual reporting periods beginning after December 15, 2018 and will be applied using the modified retrospective transition method for existing leases. The Company is currently evaluating the effect that the adoption of this ASU will have on its consolidated financial statements.

In January 2017, the FASB issued ASU 2017-04, Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment (“ASU 2017-04”). This ASU simplifies the calculation of goodwill impairment by eliminating Step 2 of the impairment test prescribed by ASC 350, Intangibles—Goodwill and Other. Step 2 requires companies to calculate the implied fair value of their goodwill by estimating the fair value of their assets, other than goodwill, and liabilities, including unrecognized assets and liabilities, following the procedure that would be required in determining the fair value of assets acquired and liabilities assumed in a business combination. The calculated net fair value of the assets would then be compared to the fair value of the reporting unit to determine the implied fair value of goodwill, and to the extent that the carrying value of goodwill was less than the implied fair value, a loss would be recognized. Under ASU 2017-04, however, goodwill is impaired when the calculated fair value of a reporting unit is less than its carrying value, and the impairment charge will equal that difference (i.e., impairment will be calculated at the reporting unit level and there will be no need to estimate the fair value of individual assets and liabilities). This guidance will be effective for any goodwill impairment tests performed in fiscal years beginning after December 15, 2019; however, early adoption is permitted for tests performed on testing dates after January 1, 2017. The Company does not expect the adoption of this ASU to have a material impact on its consolidated financial statements.

In February 2018, the FASB issued ASU 2018-02, Income Statement—Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from the Accumulated Other Comprehensive Income. This ASU gives entities the option to reclassify to retained earnings tax effects related to items in accumulated other comprehensive income that the FASB refers to as having been stranded in accumulated other comprehensive income as a result of the Tax Act. Entities can apply the provisions of this ASU either in the period of adoption or retrospectively. The guidance is effective for interim and annual reporting periods beginning after December 15, 2018, with early adoption permitted. The Company is currently evaluating the effect that the adoption of this ASU will have on its consolidated financial statements.

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

(3) Revenue

Revenue Recognition

The Company derives revenue from long-term construction contracts with public and private customers primarily in the United States and its territories and in certain other international locations. The Company’s construction contracts are generally each accounted for as a single unit of account (i.e., as a single performance obligation).

Throughout the execution of construction contracts, the Company and its affiliated entities recognize revenue with the continuous transfer of control to the customer. The customer typically controls the asset under construction by either contractual termination clauses or by the Company’s rights to payment for work already performed on the asset under construction that does not have an alternative use for the Company.

Because control transfers over time, revenue is recognized to the extent of progress towards completion of the performance obligations. The selection of the method to measure progress towards completion requires judgment and is based on the nature of the products or services provided. The Company generally uses the cost-to-cost method for its contracts, which measures progress towards completion for each performance obligation based on the ratio of costs incurred to date to the total estimated costs at completion for the respective performance obligation. Incurred cost represents work performed, which corresponds with, and thereby best depicts, the transfer of control to the customer. Revenue, including estimated fees or profits, is recorded proportionately as costs are incurred. Cost of operations includes labor, materials, subcontractor costs, and other direct and indirect costs, including depreciation and amortization.

Due to the nature of the work required to be performed on many of the Company’s performance obligations, estimating total revenue and cost at completion is complex, subject to many variables and requires significant judgment. The estimates used during the contract performance period require judgment and making assumptions as to the occurrence of future events and the likelihood of variable consideration, including the impact of change orders, claims, contract disputes and the achievement of contractual performance criteria, and award or other incentive fees. The Company estimates variable consideration at the most likely amount to which it expects to receive. The Company includes estimated amounts in the transaction price to the extent it is probable that a significant reversal of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is resolved. Estimates of variable consideration and determination of whether to include estimated amounts in the transaction price are based largely on an assessment of anticipated performance and all information (historical, current and forecasted) that is reasonably available to management.

Disaggregation of Revenue

The following tables disaggregate revenue by end market, customer type and contract type, which the Company believes best depicts how the nature, amount, timing and uncertainty of its revenue and cash flows are affected by economic factors.

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

|

|

|

|

Ended March 31,

|

|

(in thousands)

|

|

2018

|

|

Civil segment revenue by end market:

|

|

|

|

|

Mass transit

|

|

$

|

150,126

|

|

Bridges

|

|

|

62,811

|

|

Highways

|

|

|

17,257

|

|

Other

|

|

|

32,920

|

|

Total Civil segment revenue

|

|

$

|

263,114

|

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

|

|

|

|

Ended March 31,

|

|

(in thousands)

|

|

2018

|

|

Building segment revenue by end market:

|

|

|

|

|

Office

|

|

$

|

147,322

|

|

Hospitality and gaming

|

|

|

81,765

|

|

Health care facilities

|

|

|

75,081

|

|

Municipal and government

|

|

|

50,452

|

|

Mixed use

|

|

|

41,777

|

|

Education facilities

|

|

|

32,482

|

|

Industrial and commercial

|

|

|

26,425

|

|

Other

|

|

|

34,937

|

|

Total Building segment revenue

|

|

$

|

490,241

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

|

|

|

|

Ended March 31,

|

|

(in thousands)

|

|

2018

|

|

Specialty Contractors segment revenue by end market:

|

|

|

|

|

Mass transit

|

|

$

|

75,182

|

|

Mixed use

|

|

|

47,857

|

|

Industrial and commercial

|

|

|

39,339

|

|

Transportation

|

|

|

33,985

|

|

Education facilities

|

|

|

25,304

|

|

Condominiums

|

|

|

23,089

|

|

Health care facilities

|

|

|

16,365

|

|

Other

|

|

|

13,680

|

|

Total Specialty Contractors segment revenue

|

|

$

|

274,801

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2018

|

|

|

|

|

|

|

|

|

|

Specialty

|

|

|

|

|

(in thousands)

|

|

Civil

|

|

Building

|

|

Contractors

|

|

Total

|

|

Revenue by customer type:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State and local agencies

|

|

$

|

226,351

|

|

$

|

115,986

|

|

$

|

106,320

|

|

$

|

448,657

|

|

Federal agencies

|

|

|

9,855

|

|

|

44,311

|

|

|

18,723

|

|

|

72,889

|

|

Private owners

|

|

|

26,908

|

|

|

329,944

|

|

|

149,758

|

|

|

506,610

|

|

Total revenue

|

|

$

|

263,114

|

|

$

|

490,241

|

|

$

|

274,801

|

|

$

|

1,028,156

|

State and local agencies. The Company’s state and local government customers include state transportation departments, metropolitan authorities, cities, municipal agencies, school districts and public universities. Services provided to state and local customers are primarily pursuant to contracts awarded through competitive bidding processes. Construction services for state and local government customers have included mass-transit systems, bridges, highways, judicial and correctional facilities, schools and dormitories, health care facilities, convention centers, parking structures and other municipal buildings. The vast majority of the Company’s civil contracting and building construction services are provided in locations throughout the United States and its territories.

Federal agencies. The Company’s federal government customers include the U.S. State Department, the U.S. Navy, the U.S. Army Corps of Engineers, the U.S. Air Force and the National Park Service. Services provided to federal agencies are primarily pursuant to contracts for specific or multi-year assignments that involve new construction or infrastructure repairs or improvements. A portion of revenue from federal agencies is derived from projects in overseas locations.

Private owners. The Company’s private customers include real estate developers, health care companies, technology companies, hospitality and gaming resort owners, Native American sovereign nations, public corporations and private universities. Services are provided to private customers through negotiated contract arrangements, as well as through competitive bids.

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

Most federal, state and local government contracts contain provisions that permit the termination of contracts, in whole or in part, for the convenience of the government, among other reasons.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2018

|

|

|

|

|

|

|

|

|

|

Specialty

|

|

|

|

|

(in thousands)

|

|

Civil

|

|

Building

|

|

Contractors

|

|

Total

|

|

Revenue by contract type:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed price

|

|

$

|

183,904

|

|

$

|

79,001

|

|

$

|

247,424

|

|

$

|

510,329

|

|

Guaranteed maximum price

|

|

|

5,072

|

|

|

262,028

|

|

|

15,579

|

|

|

282,679

|

|

Unit price

|

|

|

68,754

|

|

|

8,816

|

|

|

6,658

|

|

|

84,228

|

|

Cost plus fee and other

|

|

|

5,384

|

|

|

140,396

|

|

|

5,140

|

|

|

150,920

|

|

Total revenue

|

|

$

|

263,114

|

|

$

|

490,241

|

|

$

|

274,801

|

|

$

|

1,028,156

|

Fixed price. Fixed price or lump sum contracts are most commonly used for projects in the Civil and Specialty Contractors segments and generally commit the Company to provide all of the resources required to complete a project for a fixed sum. Usually, fixed price contracts transfer more risk to the Company, but offer the opportunity for greater profits. Billings on fixed price contracts are typically based on estimated progress against predetermined contractual milestones.

Guaranteed maximum price (“GMP”). GMP contracts provide for a cost plus fee arrangement up to a maximum agreed upon price. These contracts place risks on the Company for amounts in excess of the GMP, but may permit an opportunity for greater profits than under cost plus fee contracts through sharing agreements with the owner on any cost savings that may be realized. Services provided by our Building segment to various private customers are often performed under GMP contracts. Billings on GMP contracts typically occur on a monthly basis and are based on actual costs incurred plus a negotiated margin.

Unit price. Unit price contracts are most prevalent for projects in the Civil and Specialty Contractors segments and generally commit the Company to provide an undetermined number of units or components that comprise a project at a fixed price per unit. This approach shifts the risk of estimating the quantity of units required to the project owner, but the risk of increased cost per unit is borne by the Company, unless otherwise allowed for in the contract. Billings on unit price contracts typically occur on a monthly basis and are based on actual quantity of work performed or completed during the billing period.

Cost plus fee. Cost plus fee contracts are used for many projects in the Building and Specialty Contractors segments. Cost plus fee contracts include cost plus fixed fee contracts and cost plus award fee contracts. Cost plus fixed fee contracts provide for reimbursement of approved project costs plus a fixed fee. Cost plus award fee contracts provide for reimbursement of the project costs plus a base fee, as well as an incentive fee based on cost and/or schedule performance. Cost plus fee contracts serve to minimize the Company’s financial risk, but may also limit profits. Billings on cost plus fee contracts typically occur on a monthly basis based on actual costs incurred plus a negotiated margin.

Changes in Contract Estimates that Impact Revenue

Changes to the total estimated contract revenue or cost, either due to unexpected events or revisions to management’s initial estimates, for a given project are recognized in the period in which they are determined. Net revenue recognized during the three months ended March 31, 2018 related to performance obligations satisfied (or partially satisfied) in prior periods was immaterial.

Remaining Performance Obligations

Remaining performance obligations represent the transaction price of firm orders for which work has not been performed and excludes unexercised contract options. As of March 31, 2018, the aggregate amounts of the transaction prices allocated to the remaining performance obligations of the Company’s construction contracts are $4.5 billion, $2.2 billion and $1.8 billion, for the Civil, Building and Specialty Contractors segments, respectively. The Company typically recognizes revenue on Civil segment projects over a period of three to five years, whereas for projects in the Building and Specialty Contractors segments, the Company typically recognizes revenue over a period of one to three years.

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

(4) Contract Assets and Liabilities

Contract assets include amounts due under retainage provisions, costs and estimated earnings in excess of billings and capitalized contract costs. The amounts as included on the Condensed Consolidated Balance Sheets consist of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31,

|

|

As of January 1,

|

|

(in thousands)

|

|

2018

|

|

2018

|

|

Retainage receivable

|

|

$

|

530,897

|

|

$

|

535,939

|

|

Costs and estimated earnings in excess of billings:

|

|

|

|

|

|

|

|

Claims

|

|

|

577,811

|

|

|

549,849

|

|

Unapproved change orders

|

|

|

324,851

|

|

|

296,591

|

|

Other unbilled costs and profits

|

|

|

78,234

|

|

|

86,318

|

|

Total costs and estimated earnings in excess of billings

|

|

|

980,896

|

|

|

932,758

|

|

Capitalized contract costs

|

|

|

35,746

|

|

|

32,773

|

|

Total contract assets

|

|

$

|

1,547,539

|

|

$

|

1,501,470

|

Retainage receivables represent amounts invoiced to customers where payments have been withheld pending the completion of certain milestones, other contractual conditions or upon the completion of the project. Retainage agreements vary from project to project and balances could be outstanding for several months or years depending on a number of circumstances such as contract-specific terms, project performance and other variables that may arise as the Company makes progress towards completion.

Costs and estimated earnings in excess of billings represent the excess of contract costs and profits (or contract revenue) over the amount of contract billings to date and are classified as a current asset. Costs and estimated earnings in excess of billings result when either: 1) the appropriate contract revenue amount has been recognized over time in accordance with ASC 606, but a portion of the revenue recorded cannot be billed currently due to the billing terms defined in the contract, or 2) costs are incurred related to certain claims and unapproved change orders. Claims occur when there is a dispute regarding both a change in the scope of work and the price associated with that change. Unapproved change orders occur when a change in the scope of work results in additional work being performed before the parties have agreed on the corresponding change in the contract price. The Company routinely estimates recovery related to claims and unapproved change orders as a form of variable consideration at the most likely amount it expects to receive and to the extent it is probable that a significant reversal of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is resolved. Claims and unapproved change orders are billable upon the agreement and resolution between the contractual parties and after the execution of contractual amendments. Increases in claims and unapproved change orders typically result from costs being incurred against existing or new positions; decreases normally result from resolutions and subsequent billings. As discussed in Note 9, Commitments and Contingencies, the resolution of these claims and unapproved change orders may require litigation or other forms of dispute resolution proceedings. Other unbilled costs and profits are billable in accordance with the billing terms of each of the existing contractual arrangements and, as such, the timing of contract billing cycles can cause fluctuations in the balance of unbilled costs and profits. Ultimate resolution of other unbilled costs and profits typically involves incremental progress toward contractual requirements or milestones. The amount of costs and estimated earnings in excess of billings as of March 31, 2018 estimated by management to be collected beyond one year is $465.8 million.

Capitalized contract costs primarily represent costs to fulfill a contract that (1) directly relate to an existing or anticipated contract, (2) generate or enhance resources that will be used in satisfying performance obligations in the future and (3) are expected to be recovered through the contract, and are included in other current assets. Capitalized contract costs are generally expensed to the associated contract over the period of anticipated use on the project. During the three months ended March 31, 2018, $4.1 million of previously capitalized contract costs were amortized and recognized as expense on the related contracts.

Contract liabilities include amounts owed under retainage provisions and billings in excess of costs and estimated earnings. The amount as reported on the Condensed Consolidated Balance Sheets consist of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31,

|

|

As of January 1,

|

|

(in thousands)

|

|

2018

|

|

2018

|

|

Retainage payable

|

|

$

|

246,033

|

|

$

|

261,820

|

|

Billings in excess of costs and estimated earnings

|

|

|

508,616

|

|

|

496,654

|

|

Total contract liabilities

|

|

$

|

754,649

|

|

$

|

758,474

|

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

Retainage payables represent amounts invoiced to the Company by subcontractors where payments have been withheld pending the completion of certain milestones, other contractual conditions or upon the completion of the project. Generally, retainage payables are not remitted to subcontractors until the associated retainage receivables from customers are collected.

Billings in excess of costs and estimated earnings represent the excess of contract billings to date over the amount of contract costs and profits (or contract revenue) recognized to date. The balance may fluctuate depending on the timing of contract billings and the recognition of contract revenue. The amount of revenue recognized during the three months ended March 31, 2018 that was included in the opening billings in excess of costs and estimated earnings balance was $222.9 million.

(5) Cash, Cash Equivalents and Restricted Cash

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the Condensed Consolidated Balance Sheets to the amounts shown in the Condensed Consolidated Statements of Cash Flows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31,

|

|

As of December 31,

|

|

(in thousands)

|

|

2018

|

|

2017

|

|

Cash and cash equivalents available for general corporate purposes

|

|

$

|

75,423

|

|

$

|

94,713

|

|

Joint venture cash and cash equivalents

|

|

|

98,917

|

|

|

98,155

|

|

Cash and cash equivalents

|

|

|

174,340

|

|

|

192,868

|

|

Restricted cash

|

|

|

4,090

|

|

|

4,780

|

|

Total cash, cash equivalents and restricted cash

|

|

$

|

178,430

|

|

$

|

197,648

|

Cash equivalents include short-term, highly liquid investments with maturities of three months or less when acquired. Cash and cash equivalents consist of amounts available for the Company’s general purposes, the Company’s proportionate share of cash held by the Company’s unconsolidated joint ventures and 100% of amounts held by the Company’s consolidated joint ventures. In both cases, cash held by joint ventures is available only for joint venture-related uses, including future distributions to joint venture partners.

Amounts included in restricted cash are primarily held as collateral to secure insurance-related contingent obligations, such as insurance claim deductibles, in lieu of letters of credit.

(6) Earnings Per Common Share (EPS)

Basic EPS and diluted EPS are calculated by dividing net income attributable to Tutor Perini Corporation by the following: for basic EPS, the weighted-average number of common shares outstanding during the period; and for diluted EPS, the sum of the weighted-average number of both outstanding common shares and potentially dilutive securities, which for the Company can include restricted stock units, unexercised stock options and the Convertible Notes, as defined in Note 8. The Company calculates the effect of these potentially dilutive securities using the treasury stock method for restricted stock units and stock options.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

(in thousands, except per common share data)

|

2018

|

|

2017

|

|

Net income (loss) attributable to Tutor Perini Corporation

|

$

|

(12,124)

|

|

$

|

13,764

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding, basic

|

|

49,814

|

|

|

49,282

|

|

Effect of dilutive restricted stock units and stock options

|

|

—

|

|

|

1,666

|

|

Weighted-average common shares outstanding, diluted

|

|

49,814

|

|

|

50,948

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Tutor Perini Corporation per common share:

|

|

|

|

|

|

|

Basic

|

$

|

(0.24)

|

|

$

|

0.28

|

|

Diluted

|

$

|

(0.24)

|

|

$

|

0.27

|

|

|

|

|

|

|

|

|

Anti-dilutive securities not included above

|

|

4,507

|

|

|

930

|

All restricted stock units and stock options that were outstanding during the three months ended March 31, 2018 were excluded from weighted-average diluted shares outstanding as the shares would have an anti-dilutive effect on the net loss for the period. With regard to diluted EPS and the impact of the Convertible Notes on the diluted EPS calculation, because the Company has the intent and ability

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

to settle the principal amount of the Convertible Notes in cash, per ASC 260, Earnings Per Share, the settlement of the principal amount has no impact on diluted EPS.

(7) Income Taxes

The Company’s effective income tax rate for the three months ended March 31, 2018 was 28.1% compared to 37.1% for the three months ended March 31, 2017. The effective tax rate for the 2018 period reflects the reduction in the federal statutory income tax rate from 35% to 21% effective January 1, 2018 as a result of the Tax Act, and the rate for the 2017 period was favorably impacted by certain tax benefits associated with share-based compensation. For the three months ended March 31, 2018 and 2017, the effective tax rate was higher than the federal statutory rate primarily due to state income taxes, while the 2017 period was also favorably impacted by the tax benefits associated with share-based compensation mentioned above.

(8) Financial Commitments

Long-Term Debt

Long-term debt consisted of the following as of the dates of the Condensed Consolidated Balance Sheets presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31,

|

|

As of December 31,

|

|

(in thousands)

|

2018

|

|

2017

|

|

2017 Senior Notes

|

$

|

492,926

|

|

$

|

492,734

|

|

Convertible Notes

|

|

164,010

|

|

|

161,635

|

|

2017 Credit Facility

|

|

86,500

|

|

|

—

|

|

Equipment financing and mortgages

|

|

70,629

|

|

|

76,820

|

|

Other indebtedness

|

|

3,219

|

|

|

5,087

|

|

Total debt

|

|

817,284

|

|

|

736,276

|

|

Less: Current maturities

|

|

27,165

|

|

|

30,748

|

|

Long-term debt, net

|

$

|

790,119

|

|

$

|

705,528

|

The following table reconciles the outstanding debt balance to the reported debt balances as of March 31, 2018 and December 31, 2017:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2018

|

|

As of December 31, 2017

|

|

(in thousands)

|

Outstanding Long-Term Debt

|

|

Unamortized Discount and Issuance Costs

|

|

Long-Term

Debt,

as reported

|

|

Outstanding Long-Term Debt

|

|

Unamortized Discount and Issuance Costs

|

|

Long-Term

Debt,

as reported

|

|

2017 Senior Notes

|

$

|

500,000

|

|

$

|

(7,074)

|

|

$

|

492,926

|

|

$

|

500,000

|

|

$

|

(7,266)

|

|

$

|

492,734

|

|

Convertible Notes

|

|

200,000

|

|

|

(35,990)

|

|

|

164,010

|

|

|

200,000

|

|

|

(38,365)

|

|

|

161,635

|

The unamortized issuance costs related to the 2017 Credit Facility were $5.8 million and $6.2 million as of March 31, 2018 and December 31, 2017, respectively, and is included in other assets in the Condensed Consolidated Balance Sheets.

2017 Senior Notes

On April 20, 2017, the Company issued $500 million in aggregate principal amount of 6.875% Senior Notes due 2025 (the “2017 Senior Notes”) in a private placement. Interest on the 2017 Senior Notes is payable in arrears semi-annually in May and November of each year, beginning in November 2017.

Prior to May 1, 2020, the Company may redeem the 2017 Senior Notes at a redemption price equal to 100% of their principal amount plus a “make-whole” premium described in the indenture. In addition, prior to May 1, 2020, the Company may redeem up to 40% of the original aggregate principal amount of the notes at a redemption price of 106.875% of their principal amount with the proceeds received by the Company from any offering of the Company’s equity. After May 1, 2020, the Company may redeem the 2017 Senior Notes at specified redemption prices described in the indenture. Upon a change of control, holders of the 2017 Senior Notes may require the Company to repurchase all or part of the 2017 Senior Notes at 101% of the principal amount thereof, plus accrued and unpaid interest to the redemption date.

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

The 2017 Senior Notes are senior unsecured obligations of the Company and are guaranteed by substantially all of the Company’s existing and future subsidiaries that also guarantee obligations under the Company’s 2017 Credit Facility, as defined below. In addition, the indenture for the 2017 Senior Notes provides for customary covenants, including events of default and restrictions on the payment of dividends and share repurchases.

2017 Credit Facility

On April 20, 2017, the Company entered into a credit agreement (the “2017 Credit Facility”) with SunTrust Bank as Administrative Agent, Swing Line Lender and L/C Issuer and a syndicate of other lenders. The 2017 Credit Facility provides for a $350 million revolving credit facility (the “2017 Revolver”) and a sublimit for the issuance of letters of credit and swingline loans up to the aggregate amount of $150 million and $10 million, respectively, both maturing on April 20, 2022, unless any of the Convertible Notes, as defined below, are outstanding on December 17, 2020, in which case all such borrowings will mature on December 17, 2020 (subject to certain further exceptions). In addition, the 2017 Credit Facility permits additional borrowings in an aggregate amount of $150 million, which can be in the form of increased capacity on the 2017 Revolver or the establishment of one or more term loans.

Borrowings under the 2017 Revolver bear interest, at the Company’s option, at a rate equal to a margin over (a) the London Interbank Offered Rate (“LIBOR”) plus a margin of between 1.50% and 3.00% or (b) a base rate (determined by reference to the highest of (i) the administrative agent’s prime lending rate, (ii) the federal funds effective rate plus 50 basis points, (iii) the LIBOR rate for a one-month interest period plus 100 basis points and (iv) 0%), plus a margin of between 0.50% and 2.00%, in each case based on the Consolidated Leverage Ratio (as defined in the 2017 Credit Facility). In addition to paying interest on outstanding principal under the 2017 Credit Facility, the Company will pay a commitment fee to the lenders under the 2017 Revolver in respect of the unutilized commitments thereunder. The Company will pay customary letter of credit fees. If an event of default occurs and is continuing, the otherwise applicable margin and letter of credit fees will be increased by 2% per annum. The weighted-average annual interest rate on borrowings under the 2017 Revolver was approximately 4.33% during the three months ended March 31, 2018.

The 2017 Credit Facility contains customary covenants for credit facilities of this type, including maximum consolidated leverage ratios ranging from 4.00:1.00 to 3.25:1.00 over the life of the facility and a minimum consolidated fixed charge coverage ratio of 1.25:1.00. Substantially all of the Company’s subsidiaries unconditionally guarantee the obligations of the Company under the 2017 Credit Facility; additionally, the obligations are secured by a lien on all personal property of the Company and its subsidiaries guaranteeing these obligations.

As of March 31, 2018, there was $264 million available under the 2017 Revolver, and the Company had not utilized the 2017 Credit Facility for letters of credit. The Company was in compliance with the financial covenants under the 2017 Credit Facility as of March 31, 2018.

Repurchase and Redemption of 2010 Senior Notes and Termination of 2014 Credit Facility

On April 20, 2017, the Company used proceeds from the 2017 Senior Notes and 2017 Revolver to repurchase or redeem its 2010 Senior Notes ($300 million of 7.625% Senior Notes due November 1, 2018), to pay off its 2014 Credit Facility ($300 million revolving credit facility and a $250 million term loan, both maturing on May 1, 2018), and to pay accrued but unpaid interest and fees. In addition, the indenture governing the 2010 Senior Notes was satisfied and discharged, and the Company terminated the 2014 Credit Facility.

Convertible Notes

On June 15, 2016, the Company issued $200 million of 2.875% Convertible Senior Notes due June 15, 2021 (the “Convertible Notes”) in a private placement offering. The Convertible Notes are unsecured obligations and do not contain any financial covenants or restrictions on the payments of dividends, the incurrence of indebtedness or the issuance or repurchase of securities by the Company. The Convertible Notes bear interest at a rate of 2.875% per year, payable in cash semi-annually in June and December.

Prior to January 15, 2021, the Convertible Notes will be convertible only under the following circumstances: (1) during the five business day period after any ten consecutive trading day period in which the trading price per $1,000 principal amount of Convertible Notes for such trading day was less than 98% of the product of the last reported sale price of the Company’s common stock and the conversion rate on each such trading day; (2) if the last reported sale price of the common stock for at least 20 trading days (whether or not consecutive) during a period of 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter is greater than or equal to 130% of the conversion rate of 33.0579 (or $39.32) on each applicable trading day; or (3)

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

upon the occurrence of specified corporate events. On or after January 15, 2021 until the close of business on the second scheduled trading day immediately preceding the maturity date, holders may convert all or any portion of their notes, in multiples of $1,000 principal amount, at the option of the holder regardless of the foregoing circumstances.

The Convertible Notes will be convertible at an initial conversion rate of 33.0579 shares of the Company’s common stock per $1,000 principal amount of the Convertible Notes, which is equivalent to an initial conversion price of approximately $30.25. The conversion rate will be subject to adjustment for some events but will not be adjusted for any accrued and unpaid interest. In addition, following certain corporate events that occur prior to the maturity date, the Company is required to increase, in certain circumstances, the conversion rate for a holder who elects to convert their Convertible Notes in connection with such a corporate event including customary conversion rate adjustments in connection with a “make-whole fundamental change” described in the indenture. Upon conversion, and at the Company’s election, the Company may satisfy its conversion obligation by paying or delivering, as applicable, cash, shares of its common stock or a combination of cash and shares of its common stock. As of March 31, 2018, the conversion provisions of the Convertible Notes have not been triggered.

Interest Expense

Interest expense as reported in the Condensed Consolidated Statements of Operations consists of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

March 31,

|

|

(in thousands)

|

2018

|

|

2017

|

|

Cash interest expense:

|

|

|

|

|

|

|

Interest on 2017 Senior Notes

|

$

|

8,594

|

|

$

|

—

|

|

Interest on Convertible Notes

|

|

1,438

|

|

|

1,438

|

|

Interest on 2017 Credit Facility

|

|

1,349

|

|

|

—

|

|

Interest on 2010 Senior Notes

|

|

—

|

|

|

5,719

|

|

Interest on 2014 Credit Facility

|

|

—

|

|

|

3,709

|

|

Other interest

|

|

757

|

|

|

862

|

|

Total cash interest expense

|

|

12,138

|

|

|

11,728

|

|

|

|

|

|

|

|

|

Non-cash interest expense:(a)

|

|

|

|

|

|

|

Amortization of discount and debt issuance costs on Convertible Notes

|

|

2,376

|

|

|

2,164

|

|

Amortization of debt issuance costs on 2017 Credit Facility

|

|

360

|

|

|

—

|

|

Amortization of debt issuance costs on 2017 Senior Notes

|

|

191

|

|

|

—

|

|

Amortization of debt issuance costs on 2014 Credit Facility

|

|

—

|

|

|

1,418

|

|

Amortization of discount and debt issuance costs on 2010 Senior Notes

|

|

—

|

|

|

254

|

|

Total non-cash interest expense

|

|

2,927

|

|

|

3,836

|

|

|

|

|

|

|

|

|

Total interest expense

|

$

|

15,065

|

|

$

|

15,564

|

|

(a)

| |

The combination of cash and non-cash interest expense produces effective interest rates that are higher than contractual rates. Accordingly, the effective interest rates for the 2017 Senior Notes and the Convertible Notes were 7.13% and 9.39%, respectively, for the three months ended March 31, 2018. |

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

(9) Commitments and Contingencies

The Company and certain of its subsidiaries are involved in litigation and various forms of dispute resolution, and are contingently liable for commitments and performance guarantees arising in the ordinary course of business. In addition, other activities inherent to the Company’s business may result in litigation or dispute resolution proceedings when there is a disagreement regarding a change in the scope of work and/or the price associated with that change. In accordance with ASC 606, the Company makes assessments of these types of disputes on a routine basis and estimates and records recovery related to these disputes at the most likely amount it expects to receive, as discussed further in Note 3, Revenue, and Note 4, Contract Assets and Liabilities. These assessments require judgments concerning matters such as litigation developments and outcomes, the anticipated outcome of negotiations and the estimated cost of resolving such disputes. In addition, because most contingencies are resolved over long periods of time, assets and liabilities may change in the future due to various factors. Management believes that, based on current information and discussions with the Company’s legal counsel, the ultimate resolution of these matters is not expected to have a material adverse effect on the Company’s financial position, results of operations or cash flows.

Several matters are in the litigation and dispute resolution processes that include characteristics which management consider to be other than ordinary routine contract performance related issues. The following discussion provides a background and current status of such material matters.

Long Island Expressway/Cross Island Parkway Matter

The Company reconstructed the Long Island Expressway/Cross Island Parkway Interchange for the New York State Department of Transportation (the “NYSDOT”). The $130 million project was substantially completed in January 2004 and was accepted by the NYSDOT as complete in February 2006. The Company incurred significant added costs in completing its work and suffered extended schedule costs due to numerous design errors, undisclosed utility conflicts, lack of coordination with local agencies and other interferences for which the Company believes the NYSDOT is responsible.

In March 2011, the Company filed its claim and complaint with the New York State Court of Claims and served to the New York State Attorney General’s Office, seeking damages in the amount of $53.8 million. In May 2011, the NYSDOT filed a motion to dismiss the Company’s claim on the grounds that the Company had not provided required documentation for project closeout and filing of a claim. In September 2011, the Company reached agreement on final payment with the Comptroller’s Office on behalf of the NYSDOT, which resulted in an amount of $0.5 million payable to the Company and formally closed out the project allowing the Company to re-file its claim. The Company re-filed its claim in the amount of $53.8 million with the NYSDOT in February 2012 and with the Court of Claims in March 2012. In May 2012, the NYSDOT served its answer and counterclaims in the amount of $151 million alleging fraud in the inducement and punitive damages related to disadvantaged business enterprise (“DBE”) requirements for the project. The Court subsequently ruled that NYSDOT’s counterclaims may only be asserted as a defense and offset to the Company’s claims and not as affirmative claims. In November 2014, the Appellate Division First Department affirmed the dismissal of the City’s affirmative defenses and affirmative counterclaims based on DBE fraud. The Company does not expect the counterclaims to have any material effect on its consolidated financial statements. Discovery was completed during 2017 and the Company is currently awaiting the court to set a trial date.

Management has made an estimate of the total anticipated recovery on this project, and such estimate is included in revenue recorded to date. To the extent new facts become known or the final recovery included in the claim settlement varies from the estimate, the impact of the change will be reflected in the consolidated financial statements at that time.

Fontainebleau Matter

Desert Mechanical, Inc. (“DMI”) and Fisk Electric Company (“Fisk”), wholly owned subsidiaries of the Company, were subcontractors on the Fontainebleau Project in Las Vegas (“Fontainebleau”), a hotel/casino complex with approximately 3,800 rooms. In June 2009, Fontainebleau filed for bankruptcy protection, under Chapter 11 of the U.S. Bankruptcy Code, in the Southern District of Florida.

DMI and Fisk filed liens in Nevada for approximately $44 million, representing unreimbursed costs to date and lost profits, including anticipated profits. Other unaffiliated subcontractors have also filed liens. In June 2009, DMI filed suit against Turnberry West Construction, Inc., the general contractor, in the 8th Judicial District Court, Clark County, Nevada (the “District Court”), and in May 2010, the court entered an order in favor of DMI for approximately $45 million.

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

In January 2010, the Bankruptcy Court approved the sale of the property to Icahn Nevada Gaming Acquisition, LLC, and this transaction closed in February 2010. As a result of a July 2010 ruling relating to certain priming liens, there was approximately $125 million set aside from this sale that is available for distribution to satisfy the creditor claims based on seniority. At that time, the total estimated sustainable lien amount was approximately $350 million. The project lender filed suit against the mechanic’s lien claimants, including DMI and Fisk, alleging that certain mechanic’s liens are invalid and that all mechanic’s liens are subordinate to the lender’s claims against the property. The Nevada Supreme Court ruled in October 2012 in an advisory opinion at the request of the Bankruptcy Court that lien priorities would be determined in favor of the mechanic lien holders under Nevada law.

In October 2013, a settlement was reached by and among the Statutory Lienholders and the other interested parties. The Bankruptcy Court appointed a mediator to facilitate the execution of that settlement agreement, but the parties were unable to settle. During the third quarter of 2017, DMI filed a motion seeking permission to file an action in Nevada to enforce the Company’s lien rights; the motion was granted by the Bankruptcy Court.

Management has made an estimate of the total anticipated recovery on this project, and such estimate is included in revenue recorded to date. To the extent new facts become known or the final recovery included in the claim settlement varies from the estimate, the impact of the change will be reflected in the consolidated financial statements at that time.

Westgate Planet Hollywood Matter

Tutor-Saliba Corporation (“TSC”), a wholly owned subsidiary of the Company, was contracted to construct a timeshare development project in Las Vegas, which was substantially completed in December 2009. The Company’s claims against the owner, Westgate Planet Hollywood Las Vegas, LLC (“WPH”), relate to unresolved owner change orders and other claims. The Company filed a lien on the project in the amount of $23.2 million and filed its complaint with the District Court, Clark County, Nevada. Several subcontractors have also recorded liens, some of which have been released by bonds and some of which have been released as a result of subsequent payment. WPH has posted a mechanic’s lien release bond for $22.3 million.

WPH filed a cross-complaint alleging non-conforming and defective work for approximately $51 million, primarily related to alleged defects, misallocated costs and liquidated damages. WPH revised the amount of their counterclaims to approximately $45 million.

Following multiple post-trial motions, final judgment was entered in this matter on March 20, 2014. TSC was awarded total judgment in the amount of $19.7 million on its breach of contract claim, which includes an award of interest up through the date of judgment, plus attorney’s fees and costs. WPH was awarded total judgment in the amount of $3.1 million on its construction defect claims, which includes interest up through the date of judgment. WPH and its Sureties have filed a notice of appeal. TSC has filed a notice of appeal on the defect award. In July 2014, the Court ordered WPH to post an additional supersedeas bond on appeal, in the amount of $1.7 million, in addition to the lien release bond of $22.3 million, which increases the security up to $24.0 million. In May 2017, the Nevada Supreme Court issued its ruling on the appeal by WPH and its Sureties. With only minor adjustments, the Nevada Supreme Court affirmed the lower district court’s judgment, and following further proceedings in the lower district court, the anticipated final recovery to the Company is estimated to exceed $20 million, including interest and recovery of certain attorneys’ fees and costs of which the Company collected more than $16 million in 2017. In December 2017 and in January 2018, the Court issued several post-appeal orders confirming its previous rulings. Some of those matters are subject to a current further appeal. Once resolved, TSC will seek an order from the Court seeking a remaining $4 million in interest and fees associated with the matter.

The Company does not expect ultimate resolution of this matter to have any material effect on its consolidated financial statements. Management has made an estimate of the total anticipated recovery on this project and such estimate is included in revenue recorded to date. To the extent new facts become known or the final recovery included in the claim settlement varies from the estimate, the impact of the change will be reflected in the consolidated financial statements at that time.

Five Star Electric Matter

In the third quarter of 2015, Five Star Electric Corp. ("Five Star"), a wholly owned subsidiary of the Company that was acquired in 2011, entered into a tolling agreement (which has since expired) related to an ongoing investigation being conducted by the United States Attorney’s Office for the Eastern District of New York (“USAO EDNY”). Five Star has been cooperating with the USAO EDNY since late June 2014, when it was first made aware of the investigation, and has provided information requested by the government related to its use of certain minority-owned, women-owned, small and disadvantaged business enterprises and certain of Five Star’s employee compensation, benefit and tax practices.

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

As of March 31, 2018, the Company cannot predict the ultimate outcome of the investigation and cannot reasonably estimate the potential loss or range of loss that Five Star or the Company may incur or the impact of the results of the investigation on Five Star or the Company.

Alaskan Way Viaduct Matter

In January 2011, Seattle Tunnel Partners (“STP”), a joint venture between Dragados USA, Inc. and the Company, entered into a design-build contract with the Washington State Department of Transportation (“WSDOT”) for the construction of a large diameter bored tunnel in downtown Seattle, King County, Washington to replace the Alaskan Way Viaduct, also known as State Route 99.

The construction of the large diameter bored tunnel required the use of a tunnel boring machine (“TBM”). In December 2013, the TBM struck a steel pipe, installed by WSDOT as a well casing for an exploratory well. The TBM was damaged and was required to be shut down for repair. STP has asserted that the steel pipe casing was a differing site condition that WSDOT failed to properly disclose. The Disputes Review Board mandated by the contract to hear disputes issued a decision finding the steel casing was a Type I differing site condition. WSDOT has not accepted that finding.

The TBM was insured under a Builder’s Risk Insurance Policy (the “Policy”) with Great Lakes Reinsurance (UK) PLC and a consortium of other insurers (the “Insurers”). STP submitted the claims to the Insurers and requested interim payments under the Policy. The Insurers refused to pay and denied coverage. In June 2015, STP filed a lawsuit in the King County Superior Court, State of Washington (“Washington Superior Court”) seeking declaratory relief concerning contract interpretation, as well as damages as a result of the Insurers’ breach of their obligations under the terms of the Policy. WSDOT is deemed a plaintiff since WSDOT is an insured under the Policy and had filed its own claim for damages. Hitachi Zosen (“Hitachi”), the manufacturer of the TBM, has also joined the case as a plaintiff for costs incurred to repair the damages to the TBM. Trial is scheduled for October 2018. Discovery is ongoing.

In March 2016, WSDOT filed a complaint against STP in Thurston County Superior Court for breach of contract alleging STP’s delays and failure to perform and declaratory relief concerning contract interpretation. STP filed its answer to WSDOT’s complaint and filed a counterclaim against WSDOT and Hitachi. Trial is set for April 2019. Discovery is stayed pending an interlocutory appeal currently taking place in the matter. A motion to lift the stay for the purposes of discovery is pending.

As of March 31, 2018, the Company has concluded that the potential for a material adverse financial impact due to the Insurers’ denial of coverage and WSDOT’s legal actions is neither probable nor remote, and the potential loss or range of loss is not reasonably estimable. With respect to STP’s claims against the Insurers, WSDOT and Hitachi, management has included an estimate of the total anticipated recovery, concluded to be both probable and reliably estimable, in receivables or costs and estimated earnings in excess of billings recorded to date. To the extent new facts become known or the final recoveries vary from the estimate, the impact of the change will be reflected in the financial statements at that time.

(10) Share-Based Compensation

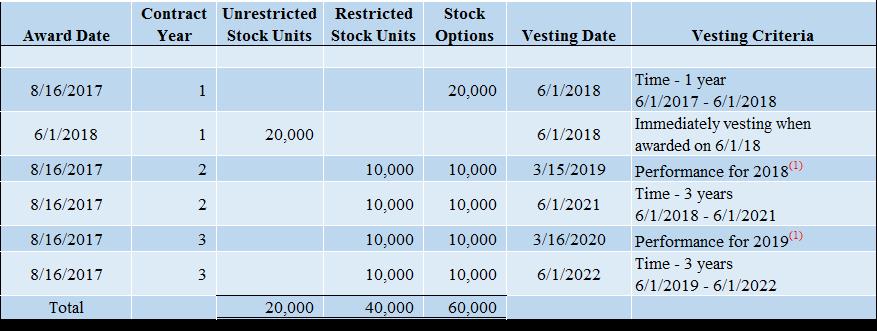

As of March 31, 2018, there were 982,458 shares of common stock available for grant under the Company’s stock incentive plans. During the first three months of 2018 and 2017, the Company issued the following share-based instruments: (1) restricted stock units of 514,000 and 665,000 with weighted-average fair values per share of $26.49 and $30.48, respectively; (2) stock options of 479,000 and 265,000 with weighted-average fair values per share of $11.82 and $13.70, respectively, and weighted-average per share exercise prices of $24.53 and $23.47, respectively. In addition, during the three months ended March 31, 2018, the Company issued 10,000 unrestricted stock units with a weighted-average fair value per share of $25.40.

The fair value of restricted stock units was based on the closing price of the Company’s common stock on the New York Stock Exchange on the date of the grant and the fair value of stock options are based on the Black-Scholes model. The fair value of certain performance-based awards were estimated taking into account the features of such awards. The fair value of stock options granted during the first three months of 2018 was determined using the Black-Scholes model based on the following weighted-average assumptions: (i) expected life of 5.2 years, (ii) expected volatility of 42.01%, (iii) risk-free rate of 2.36%, and (iv) no quarterly dividends.

For the three months ended March 31, 2018 and 2017, the Company recognized, as part of general and administrative expenses, costs for share-based payment arrangements totaling $6.1 million and $4.3 million, respectively. As of March 31, 2018, the balance of unamortized share-based compensation expense was $38.9 million, which will be recognized over a weighted-average period of 2.3 years.

Table of Contents

TUTOR PERINI CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

UNAUDITED

(11) Employee Pension Plans

The Company has a defined benefit pension plan and an unfunded supplemental retirement plan. Effective September 1, 2004, all benefit accruals under these plans were frozen; however, the current vested benefit was preserved. The pension disclosure presented below includes aggregated amounts for both of the Company’s plans.

The following table sets forth the net periodic benefit cost for the three months ended March 31, 2018 and 2017:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

(in thousands)

|

2018

|

|

2017

|

|

Interest cost

|

$

|

883

|

|

$

|

975

|

|

Expected return on plan assets

|

|

(1,077)

|

|

|

(1,088)

|

|

Amortization of net loss

|

|

513

|

|

|

456

|

|

Other

|

|

213

|

|

|

213

|

|

Net periodic benefit cost

|

$

|

532

|

|

$

|

556

|

The Company contributed $0.8 million to its defined benefit pension plan during each of the three months ended March 31, 2018 and 2017, and expects to contribute an additional $2.0 million later in 2018.

(12) Fair Value Measurements

The fair value hierarchy established by ASC 820, Fair Value Measurement, prioritizes the use of inputs used in valuation techniques into the following three levels:

|

·

| |

Level 1 inputs are observable quoted prices in active markets for identical assets or liabilities |

|

·

| |