Exhibit

EXHIBIT 99.1

PART I

Item 1. Business.

PepsiCo, Inc. was incorporated in Delaware in 1919 and was reincorporated in North Carolina in 1986. When used in this report, the terms “we,” “us,” “our,” “PepsiCo” and the “Company” mean PepsiCo, Inc. and its consolidated subsidiaries, collectively.

We are a leading global food and beverage company with a complementary portfolio of enjoyable brands, including Frito-Lay, Gatorade, Pepsi-Cola, Quaker and Tropicana. Through our operations, authorized bottlers, contract manufacturers and other third parties, we make, market, distribute and sell a wide variety of convenient and enjoyable beverages, foods and snacks, serving customers and consumers in more than 200 countries and territories.

Performance with Purpose is our goal to deliver sustained value by providing a wide range of beverages, foods and snacks, from treats to healthy eats; finding innovative ways to minimize our impact on the environment and lower our costs through energy and water conservation as well as reduce our use of packaging material; providing a safe and inclusive workplace for our employees globally; and respecting, supporting and investing in the local communities in which we operate. PepsiCo was again recognized for its leadership in this area in 2014 by earning a place on the prestigious Dow Jones World Index for the eighth consecutive year and on the North America Index for the ninth consecutive year.

Certain terms used in this Annual Report on Form 10-K are defined in the Glossary included in Item 7. of this report.

Our Operations

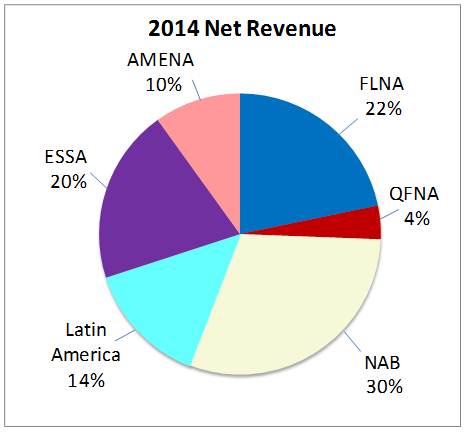

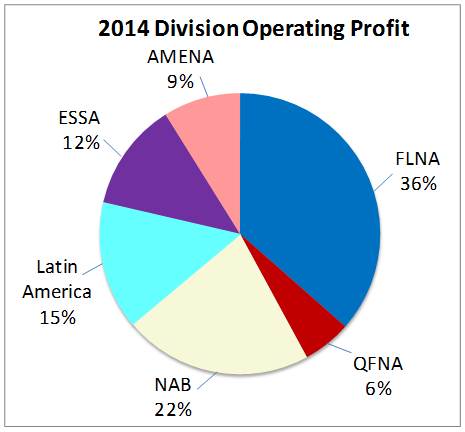

We are organized into six reportable segments (also referred to as divisions), as follows:

| |

1) | Frito-Lay North America (FLNA); |

| |

2) | Quaker Foods North America (QFNA); |

| |

3) | North America Beverages (NAB), which includes all of our beverage businesses in the United States and Canada (North America); |

| |

4) | Latin America, which includes all of our beverage, food and snack businesses in Latin America; |

| |

5) | Europe Sub-Saharan Africa (ESSA), which includes all of our beverage, food and snack businesses in Europe and Sub-Saharan Africa; and |

| |

6) | Asia, Middle East and North Africa (AMENA), which includes all of our beverage, food and snack businesses in Asia, Middle East and North Africa. |

See Note 1 to our consolidated financial statements for financial information about our divisions and geographic areas. See also “Risk Factors” in Item 1A. of our Annual Report on Form 10-K for the fiscal year ended December 27, 2014 (2014 Form 10-K) for a discussion of certain risks associated with our operations outside the United States.

Frito-Lay North America

Either independently or in conjunction with third parties, FLNA makes, markets, distributes and sells branded snack foods. These foods include Lay’s potato chips, Doritos tortilla chips, Cheetos cheese-flavored snacks, Tostitos tortilla chips, branded dips, Ruffles potato chips, Fritos corn chips and Santitas tortilla chips. FLNA’s branded products are sold to independent distributors and retailers. In addition, FLNA’s joint venture with

Strauss Group makes, markets, distributes and sells Sabra refrigerated dips and spreads. FLNA’s net revenue was $14.5 billion, $14.1 billion and $13.6 billion in 2014, 2013 and 2012, respectively, and approximated 22% of our total net revenue in 2014 and 21% of our total net revenue in both 2013 and 2012.

Quaker Foods North America

Either independently or in conjunction with third parties, QFNA makes, markets, distributes and sells cereals, rice, pasta, dairy and other branded products. QFNA’s products include Quaker oatmeal, Aunt Jemima mixes and syrups, Quaker Chewy granola bars, Quaker grits, Cap’n Crunch cereal, Life cereal, Rice-A-Roni side dishes, Quaker rice cakes, Quaker oat squares and Quaker natural granola. These branded products are sold to independent distributors and retailers. QFNA’s net revenue was $2.6 billion in each of 2014, 2013 and 2012, and approximated 4% of our total net revenue in each of 2014, 2013 and 2012.

North America Beverages

Either independently or in conjunction with third parties, NAB makes, markets, distributes and sells beverage concentrates, fountain syrups and finished goods under various beverage brands including Pepsi, Gatorade, Mountain Dew, Diet Pepsi, Aquafina, Diet Mountain Dew, Tropicana Pure Premium, Sierra Mist and Mug. NAB also, either independently or in conjunction with third parties, makes, markets and sells ready-to-drink tea and coffee products through joint ventures with Unilever (under the Lipton brand name) and Starbucks, respectively. Further, NAB manufactures and distributes certain brands licensed from Dr Pepper Snapple Group, Inc. (DPSG), including Dr Pepper, Crush and Schweppes, and certain juice brands licensed from Dole Food Company, Inc. (Dole) and Ocean Spray Cranberries, Inc. (Ocean Spray). NAB operates its own bottling plants and distribution facilities and sells branded finished goods directly to independent distributors and retailers. NAB also sells concentrate and finished goods for our brands to authorized and independent bottlers, who in turn sell our branded finished goods to independent distributors and retailers in certain markets. NAB’s net revenue was $20.2 billion, $20.1 billion and $20.4 billion in 2014, 2013 and 2012, respectively, and approximated 30% of our total net revenue in both 2014 and 2013, and 31% in 2012.

Latin America

Either independently or in conjunction with third parties, Latin America makes, markets, distributes and sells a number of snack food brands including Doritos, Cheetos, Marias Gamesa, Ruffles, Emperador, Saladitas, Lay’s, Rosquinhas Mabel, Elma Chips and Sabritas, as well as many Quaker-branded cereals and snacks. Latin America also, either independently or in conjunction with third parties, makes, markets, distributes and sells beverage concentrates, fountain syrups and finished goods under various beverage brands including Pepsi, 7UP, Gatorade, Mirinda, Diet 7UP, Manzanita Sol and Diet Pepsi. These branded products are sold to authorized bottlers, independent distributors and retailers. Latin America also, either independently or in conjunction with third parties, makes, markets and sells ready-to-drink tea through an international joint venture with Unilever (under the Lipton brand name). Latin America’s net revenue was $9.4 billion, $9.3 billion and $8.8 billion in 2014, 2013 and 2012, respectively, and approximated 14% of our total net revenue in both 2014 and 2013, and 13% in 2012.

Europe Sub-Saharan Africa

Either independently or in conjunction with third parties, ESSA makes, markets, distributes and sells a number of leading snack food brands including Lay’s, Walkers, Doritos, Cheetos and Ruffles, as well as many Quaker-branded cereals and snacks, through consolidated businesses as well as through noncontrolled affiliates. ESSA also, either independently or in conjunction with third parties, makes, markets, distributes and sells beverage concentrates, fountain syrups and finished goods under various beverage brands including Pepsi, 7UP, Pepsi Max, Mirinda, Diet Pepsi and Tropicana. These branded products are sold to authorized bottlers, independent distributors and retailers. In certain markets, however, ESSA operates its own bottling plants and distribution facilities. ESSA also, either independently or in conjunction with third parties, makes, markets

and sells ready-to-drink tea products through an international joint venture with Unilever (under the Lipton brand name). In addition, ESSA makes, markets, sells and distributes a number of leading dairy products including Domik v Derevne, Chudo and Agusha. ESSA’s net revenue was $13.4 billion, $13.8 billion and $13.5 billion in 2014, 2013 and 2012, respectively, and approximated 20% of our total net revenue in 2014, and 21% in 2013 and 2012.

Asia, Middle East and North Africa

Either independently or in conjunction with third parties, AMENA makes, markets, distributes and sells a number of leading snack food brands including Lay’s, Kurkure, Chipsy, Doritos, Cheetos and Crunchy through consolidated businesses as well as through noncontrolled affiliates. Further, either independently or in conjunction with third parties, AMENA makes, markets, distributes and sells many Quaker-branded cereals and snacks. AMENA also makes, markets, distributes and sells beverage concentrates, fountain syrups and finished goods under various beverage brands including Pepsi, Mirinda, 7UP, Mountain Dew, Aquafina and Tropicana. These branded products are sold to authorized bottlers, independent distributors and retailers. However, in certain markets, AMENA operates its own bottling plants and distribution facilities. AMENA also, either independently or in conjunction with third parties, makes, markets, distributes and sells ready-to-drink tea products through an international joint venture with Unilever (under the Lipton brand name). Further, we license the Tropicana brand for use in China on co-branded juice products in connection with a strategic alliance with Tingyi (Cayman Islands) Holding Corp. (Tingyi). AMENA’s net revenue was $6.6 billion, $6.4 billion and $6.6 billion in 2014, 2013 and 2012, respectively, and approximated 10% of our total net revenue in each of 2014, 2013 and 2012.

See Note 15 to our consolidated financial statements for additional information about our transaction with Tingyi in 2012.

Our Distribution Network

Our products are brought to market through direct-store-delivery (DSD), customer warehouse and distributor networks. The distribution system used depends on customer needs, product characteristics and local trade practices.

Direct-Store-Delivery

We, our independent bottlers and our distributors operate DSD systems that deliver beverages, foods and snacks directly to retail stores where the products are merchandised by our employees or our independent bottlers. DSD enables us to merchandise with maximum visibility and appeal. DSD is especially well-suited to products that are restocked often and respond to in-store promotion and merchandising.

Customer Warehouse

Some of our products are delivered from our manufacturing plants and warehouses to customer warehouses and retail stores. These less costly systems generally work best for products that are less fragile and perishable, and have lower turnover.

Distributor Networks

We distribute many of our products through third-party distributors. Third-party distributors are particularly effective when greater distribution reach can be achieved by including a wide range of products on the delivery vehicles. For example, our foodservice and vending business distributes beverages, foods and snacks to restaurants, businesses, schools and stadiums through third-party foodservice and vending distributors and operators.

Ingredients and Other Supplies

The principal ingredients we use in our beverage, food and snack products are apple, orange and pineapple juice and other juice concentrates, aspartame, corn, corn sweeteners, flavorings, flour, grapefruit and other fruits, oats, oranges, potatoes, raw milk, rice, seasonings, sucralose, sugar, vegetable and essential oils, and wheat. We also use water in the manufacturing of our products. Our key packaging materials include plastic resins, including polyethylene terephthalate (PET) and polypropylene resins used for plastic beverage bottles and film packaging used for snack foods, aluminum used for cans, glass bottles, closures, cardboard and paperboard cartons. Fuel and natural gas are also important commodities for us due to their use in our facilities and in the trucks delivering our products. We employ specialists to secure adequate supplies of many of these items and have not experienced any significant continuous shortages. Many of these ingredients, raw materials and commodities are purchased in the open market. The prices we pay for such items are subject to fluctuation, and we manage this risk through the use of fixed-price contracts and purchase orders, pricing agreements and derivative instruments, including swaps and futures. In addition, risk to our supply of certain raw materials is mitigated through purchases from multiple geographies and suppliers. When prices increase, we may or may not pass on such increases to our customers. See Note 10 to our consolidated financial statements for additional information on how we manage our exposure to commodity costs. See also “Item 1A. Risk Factors – Our business, financial condition or results of operations may be adversely affected by increased costs, disruption of supply or shortages of raw materials or other supplies”, in our 2014 Form 10-K.

Our Brands and Intellectual Property Rights

We own numerous valuable trademarks which are essential to our worldwide businesses, including Agusha, Amp Energy, Aquafina, Aquafina Flavorsplash, Aunt Jemima, Cap’n Crunch, Cheetos, Chester’s, Chipsy, Chudo, Cracker Jack, Crunchy, Diet Mountain Dew, Diet Mug, Diet Pepsi, Diet 7UP, Diet Sierra Mist, Domik v Derevne, Doritos, Duyvis, Elma Chips, Emperador, Frito-Lay, Fritos, Fruktovy Sad, Frustyle, G Series, G2, Gatorade, Grandma’s, Imunele, Izze, Kurkure, Lay’s, Life, Lubimy, Manzanita Sol, Marias Gamesa, Matutano, Mirinda, Miss Vickie’s, Mother’s, Mountain Dew, Mountain Dew Code Red, Mountain Dew Kickstart, Mug, Munchies, Naked, Near East, O.N.E., Paso de los Toros, Pasta Roni, Pepsi, Pepsi Max, Pepsi Next, Propel, Quaker, Quaker Chewy, Rice-A-Roni, Rold Gold, Rosquinhas Mabel, Ruffles, Sabritas, Sakata, Saladitas, Sandora, Santitas, 7UP (outside the United States) and 7UP Free (outside the United States), Sierra Mist, Simba, Smartfood, Smith’s, Snack a Jacks, SoBe, SoBe Lifewater, SoBe V Water, Sonric’s, Stacy’s, Sting, SunChips, Tonus, Tostitos, Trop 50, Tropicana, Tropicana Farmstand, Tropicana Pure Premium, Tropicana Twister, Vesely Molochnik, Walkers and Ya. We also hold long-term licenses to use valuable trademarks in connection with our products in certain markets, including Dole and Ocean Spray. We also distribute Rockstar Energy drinks, Muscle Milk protein shakes and certain DPSG brands, including Dr Pepper, Crush and Schweppes, in certain markets. Joint ventures in which we have an ownership interest either own or have the right to use certain trademarks, such as Lipton, Müller, Sabra and Starbucks. Trademarks remain valid so long as they are used properly for identification purposes, and we emphasize correct use of our trademarks. We have authorized, through licensing arrangements, the use of many of our trademarks in such contexts as snack food joint ventures and beverage bottling appointments. In addition, we license the use of our trademarks on merchandise that is sold at retail, which enhances brand awareness.

We either own or have licenses to use a number of patents which relate to certain of our products, their packaging, the processes for their production and the design and operation of various equipment used in our businesses. Some of these patents are licensed to others. See also “Item 1A. Risk Factors – Our intellectual property rights could be infringed or challenged and reduce the value of our products and brands and have an adverse impact on our business, financial condition or results of operations”, in our 2014 Form 10-K.

Seasonality

Our businesses are affected by seasonal variations. For instance, our beverage sales are higher during the warmer months and certain food and dairy sales are higher in the cooler months. Weekly beverage and snack sales are generally highest in the third quarter due to seasonal and holiday-related patterns, and generally lowest in the first quarter. However, taken as a whole, seasonality does not have a material impact on our consolidated financial results.

Our Customers

Our primary customers include wholesale and other distributors, foodservice customers, grocery stores, drug stores, convenience stores, discount/dollar stores, mass merchandisers, membership stores and authorized independent bottlers. We normally grant our independent bottlers exclusive contracts to sell and manufacture certain beverage products bearing our trademarks within a specific geographic area. These arrangements provide us with the right to charge our independent bottlers for concentrate, finished goods and Aquafina royalties and specify the manufacturing process required for product quality. We also grant distribution rights to our independent bottlers for certain beverage products bearing our trademarks for specified geographic areas.

Since we do not sell directly to the consumer, we rely on and provide financial incentives to our customers to assist in the distribution and promotion of our products. For our independent distributors and retailers, these incentives include volume-based rebates, product placement fees, promotions and displays. For our independent bottlers, these incentives are referred to as bottler funding and are negotiated annually with each bottler to support a variety of trade and consumer programs, such as consumer incentives, advertising support, new product support, and vending and cooler equipment placement. Consumer incentives include coupons, pricing discounts and promotions, and other promotional offers. Advertising support is directed at advertising programs and supporting independent bottler media. New product support includes targeted consumer and retailer incentives and direct marketplace support, such as point-of-purchase materials, product placement fees, media and advertising. Vending and cooler equipment placement programs support the acquisition and placement of vending machines and cooler equipment. The nature and type of programs vary annually.

Changes to the retail landscape, including increased consolidation of retail ownership, and the current economic environment continue to increase the importance of major customers. See “Item 1A. Risk Factors – The loss of any key customer or changes to the retail landscape could adversely affect our business, financial condition or results of operations”, in our 2014 Form 10-K. In 2014, sales to Wal-Mart Stores, Inc. (Wal-Mart), including Sam’s Club (Sam’s), represented approximately 12% of our total net revenue. Our top five retail customers represented approximately 31% of our 2014 North American net revenue, with Wal-Mart (including Sam’s) representing approximately 18%. These percentages include concentrate sales to our independent bottlers, which were used in finished goods sold by them to these retailers.

See Note 8 to our consolidated financial statements for more information on our customers, including our independent bottlers.

Our Competition

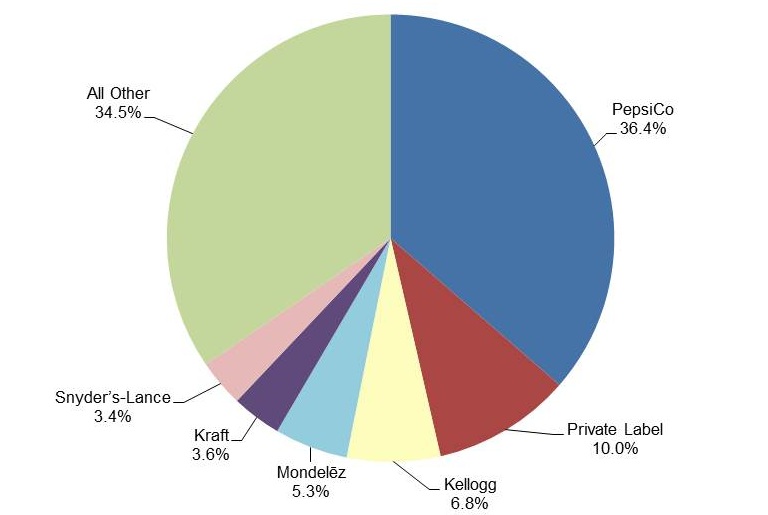

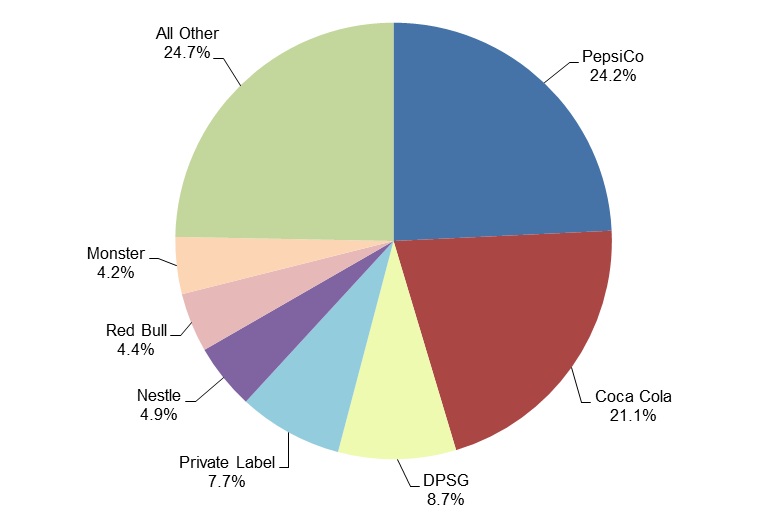

Our beverage, food and snack products are in highly competitive industries and markets and compete against products of international beverage, food and snack companies that, like us, operate in multiple geographies, as well as regional, local and private label manufacturers and other value competitors. In many countries in which our products are sold, including the United States, The Coca-Cola Company is our primary beverage competitor. Other beverage, food and snack competitors include, but are not limited to, DPSG, Kellogg Company, Kraft Foods Group, Inc., Mondelēz International, Inc., Monster Beverage Corporation, Nestlé S.A., Red Bull GmbH and Snyder’s-Lance, Inc.

Many of our food and snack products hold significant leadership positions in the food and snack industry worldwide. However, The Coca-Cola Company has significant carbonated soft drink (CSD) share advantage in many markets outside the United States.

Our beverage, food and snack products compete primarily on the basis of brand recognition, taste, price, quality, product variety, distribution, advertising, marketing and promotional activity, packaging, convenience, service and the ability to anticipate and respond to consumer trends. Success in this competitive environment is dependent on effective promotion of existing products, introduction of new products and the effectiveness of our advertising campaigns, marketing programs, product packaging, pricing, increased efficiency in production techniques, new vending and dispensing equipment and brand and trademark development and protection. We believe that the strength of our brands, innovation and marketing, coupled with the quality of our products and flexibility of our distribution network, allows us to compete effectively. See also “Item 1A. Risk Factors – Our business, financial condition or results of operations could suffer if we are unable to compete effectively”, in our 2014 Form 10-K.

|

| |

U.S. Savory Snacks % Retail Sales in Measured Channels (1) Includes salty snacks (including potato, tortilla, corn, pita, bagel and veggie chips, pretzels, fruit crisps and cheese puffs), snack nuts, seeds, corn nuts, meat snacks, crackers (excluding graham), popcorn, dips, trail mixes, rice cakes and soy chips. | U.S. Liquid Refreshment Beverage Category Share % Retail Sales in Measured Channels (1)(2) |

| |

| |

(1) | The categories and category share information in the charts above are through December 2014 based on data provided and verified by Information Resources, Inc. (IRI). The above charts include data from most major retail chains (including Wal-Mart) but exclude data from certain retailers that do not report to this service. |

| |

(2) | Does not sum due to rounding. |

Research and Development

We engage in a variety of research and development activities and continue to invest to accelerate growth to drive innovation globally. These activities principally involve production, processing and packaging and include: development of new ingredients and products; reformulation and improvement in the quality of existing products; improvement and modernization of manufacturing processes; improvements in product quality, safety and integrity; development of, and improvements in, packaging technology and dispensing equipment; and efforts focused on identifying opportunities to transform, grow and broaden our product portfolio, including the development of sweetener alternatives and flavor modifiers to reduce added sugar, and recipes that allow us to reduce sodium levels in certain of our products. Our research centers are located around the world, including in Brazil, China, Germany, India, Mexico, Russia, the United Arab Emirates, the United Kingdom and the United States, and leverage nutrition science, food science, engineering and consumer insights to meet our strategy to develop nutritious, convenient beverages, foods and snacks. In 2014, we continued to refine our beverage, food and snack portfolio to meet changing consumer needs by

developing a broader portfolio of product choices, including building on our important nutrition platforms and brands – Quaker (grains), Tropicana (fruits and vegetables), Gatorade (sports nutrition for athletes) and Naked Juice (super-premium juice and protein smoothies) – and expanding our portfolio of nutritious products in growing categories, such as dairy, hummus and other fresh dips, and baked grain snacks. We also made investments to minimize our impact on the environment, including innovation in our packaging to make it increasingly sustainable, and developed and implemented new technologies to enhance the quality and value of our current and future products, as well as made investments to incorporate into our operations best practices and technology to support sustainable agriculture and to minimize our impact on the environment. We continue to make investments to conserve energy and raw materials, reduce waste in our facilities, recycle containers, use renewable resources and optimize package design to use fewer materials. Consumer research is excluded from research and development costs and included in other marketing costs. Research and development costs were $718 million, $665 million and $552 million in 2014, 2013 and 2012, respectively, and are reported within selling, general and administrative expenses. See also “Item 1A. Risk Factors – Demand for our products may be adversely affected by changes in consumer preferences or any inability on our part to innovate or market our products effectively and any significant reduction in demand could adversely affect our business, financial condition or results of operations”, in our 2014 Form 10-K.

Regulatory Environment and Environmental Compliance

The conduct of our businesses, including the production, storage, distribution, sale, display, advertising, marketing, labeling, quality and safety of our products, occupational safety and health practices, transportation and use of many of our products, are subject to various laws and regulations administered by federal, state and local governmental agencies in the United States, as well as to laws and regulations administered by government entities and agencies outside the United States in markets in which our products are made, manufactured, distributed or sold. It is our policy to abide by the laws and regulations around the world that apply to our businesses.

We are required to comply with a variety of U.S. laws and regulations, including but not limited to: the Federal Food, Drug and Cosmetic Act and various state laws governing food safety; the Food Safety Modernization Act; the Occupational Safety and Health Act; the Clean Air Act; the Clean Water Act; the Resource Conservation and Recovery Act; the Comprehensive Environmental Response, Compensation and Liability Act; the Federal Motor Carrier Safety Act; the Lanham Act; various federal and state laws and regulations governing competition and trade practices; various federal and state laws and regulations governing our employment practices, including those related to equal employment opportunity, such as the Equal Employment Opportunity Act and the National Labor Relations Act; customs and foreign trade laws and regulations; and laws regulating the sale of certain of our products in schools. In our business dealings, we are also required to comply with the Foreign Corrupt Practices Act, the U.K. Bribery Act and the Trade Sanctions Reform and Export Enhancement Act. We are also subject to various state and local statutes and regulations, including state consumer protection laws such as Proposition 65 in California which requires that, unless a safe harbor level exists and has been met, a specific warning appear on any product that contains a substance listed by the State of California as having been found to cause cancer or birth defects. See also “Item 1A. Risk Factors – Changes in the legal and regulatory environment could limit our business activities, increase our operating costs, reduce demand for our products or result in litigation”, in our 2014 Form 10-K.

We are also subject to numerous similar and other laws and regulations outside the United States, including but not limited to laws and regulations governing food safety, health and safety, anti-corruption and data privacy. In many jurisdictions, compliance with competition laws is of special importance to us due to our competitive position in those jurisdictions, as is compliance with anti-corruption laws. We rely on legal and operational compliance programs, as well as in-house and outside counsel, to guide our businesses in

complying with applicable laws and regulations of the countries in which we do business. See also “Item 1A. Risk Factors – Changes in the legal and regulatory environment could limit our business activities, increase our operating costs, reduce demand for our products or result in litigation.” and “Item 1A. Risk Factors – Our business, financial condition or results of operations could be adversely affected if we are unable to grow our business in developing and emerging markets or as a result of unstable political conditions, civil unrest or other developments and risks in the markets where our products are made, manufactured, distributed or sold”, in our 2014 Form 10-K.

Certain jurisdictions in which our products are sold have either imposed, or are considering imposing, taxes or other limitations on, or regulations pertaining to, the sale of certain of our products, ingredients or substances contained in our products or commodities used in the production of our products, including certain of our products that contain added sugar, exceed specified caloric content or include specified ingredients such as caffeine; this includes regulations imposing additional labeling requirements. For example, in 2014, Mexico imposed a tax on sugar-sweetened beverages and certain packaged foods. In addition, certain jurisdictions require or are considering proposals to require labeling of foods that are, or contain ingredients that are, genetically modified and to restrict the use of benefit programs, such as the Supplemental Nutrition Assistance Program, to purchase certain beverages and foods. In addition, legislation has been enacted in certain U.S. states and in certain other countries in which our products are sold that requires collection and recycling of containers or that prohibits the sale of our beverages in certain non-refillable containers, unless a deposit or other fee is charged. It is possible that similar or more restrictive legal requirements may be proposed or enacted in the future. In addition, we are subject to taxes in the United States and numerous foreign jurisdictions. Economic and political conditions may result in changes in tax rates which could affect our financial performance. See also “Item 1A. Risk Factors – Changes in the legal and regulatory environment could limit our business activities, increase our operating costs, reduce demand for our products or result in litigation.” and “Item 1A. Risk Factors – Imposition of new taxes, disagreements with tax authorities or additional tax liabilities could adversely affect our business, financial condition or results of operations”, in our 2014 Form 10-K.

The cost of compliance with U.S. and foreign laws does not have a material financial impact on our consolidated results of operations.

We are also subject to national and local environmental laws in the United States and in foreign countries in which we do business, including laws related to water consumption and treatment, wastewater discharge and air emissions. In the United States, our facilities must comply with the Clean Air Act, the Comprehensive Environmental Response, Compensation and Liability Act, the Resource Conservation and Recovery Act and other federal and state laws regarding handling, storage, release and disposal of wastes generated on-site and sent to third-party owned and operated off-site licensed facilities and our facilities outside the United States must comply with similar laws and regulations. Our policy is to meet all applicable environmental compliance requirements, and we have internal programs in place to enhance our global environmental compliance. We have made, and plan to continue making, necessary expenditures for compliance with applicable laws. While these expenditures have not had a material impact on our business, financial condition or results of operations, changes in environmental compliance requirements, and any expenditures necessary to comply with such requirements, could affect our financial performance. In addition, we and our subsidiaries are subject to environmental remediation obligations in the normal course of business, as well as remediation and related indemnification obligations in connection with certain historical activities and contractual obligations, including those of businesses acquired by our subsidiaries. While these environmental and indemnification obligations cannot be predicted with certainty, environmental compliance costs have not had, and are not expected to have, a material impact on our capital expenditures, earnings or competitive position. See also “Item 1A. Risk Factors – Changes in the legal and regulatory environment could limit our

business activities, increase our operating costs, reduce demand for our products or result in litigation”, in our 2014 Form 10-K.

The Iran Threat Reduction and Syria Human Rights Act of 2012 (ITRA) requires disclosure of certain activities relating to Iran by PepsiCo or its affiliates that occurred during our 2014 fiscal year. As previously disclosed, one of our foreign subsidiaries historically maintained a small office in Iran, which provided sales support to independent bottlers in Iran in connection with in-country sales of foreign-owned beverage brands, and which was not in contravention of any applicable U.S. sanctions laws. The office ceased all commercial activity since the enactment of ITRA. In addition, the office of the foreign subsidiary had one local bank account, containing aggregate deposits of approximately $180, with a bank identified on the list of “Specially Designated Nationals” maintained by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC). During our 2014 fiscal year, our foreign subsidiary received a license from OFAC authorizing it to engage in activities related to the winding down of the office in Iran and to close the bank account. Following receipt of this license, our foreign subsidiary restarted the process of winding down its office and closed the bank account. Subsequent to the end of 2014, this license expired and the foreign subsidiary ceased the process of winding down its office upon expiration of the license. The foreign subsidiary has applied for a license from OFAC to authorize continuation and completion of wind-down activities and intends to continue such activities upon receipt thereof. The foreign subsidiary did not engage in any activities in Iran other than wind-down activities in 2014, or have any revenues or profits attributable to activities in Iran during 2014.

Employees

As of December 27, 2014, we employed approximately 271,000 people worldwide, including approximately 107,000 people within the United States. Our employment levels are subject to seasonal variations. We or our subsidiaries are a party to numerous collective bargaining agreements. We expect that we will be able to renegotiate these collective bargaining agreements on satisfactory terms when they expire. We believe that relations with our employees are generally good.

Available Information

We are required to file annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission (SEC). The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and amendments to those documents filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (Exchange Act), are also available free of charge on our Internet site at http://www.pepsico.com as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. The information on our website is not, and shall not be deemed to be, a part hereof or incorporated into this or any of our other filings with the SEC.

PART II

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

| |

OUR BUSINESS | |

Executive Overview | |

Our Operations | |

Our Business Risks | |

OUR CRITICAL ACCOUNTING POLICIES | |

Revenue Recognition | |

Goodwill and Other Intangible Assets | |

Income Tax Expense and Accruals | |

Pension and Retiree Medical Plans | |

OUR FINANCIAL RESULTS | |

Items Affecting Comparability | |

Results of Operations – Consolidated Review | |

Results of Operations – Division Review | |

Frito-Lay North America | |

Quaker Foods North America | |

North America Beverages | |

Latin America | |

Europe Sub-Saharan Africa | |

Asia, Middle East and North Africa | |

Our Liquidity and Capital Resources | |

|

| |

Consolidated Statement of Income | |

Consolidated Statement of Comprehensive Income | |

Consolidated Statement of Cash Flows | |

Consolidated Balance Sheet | |

Consolidated Statement of Equity | |

Notes to Consolidated Financial Statements | |

Note 1 – Basis of Presentation and Our Divisions | |

Note 2 – Our Significant Accounting Policies | |

Note 3 – Restructuring, Impairment and Integration Charges | |

Note 4 – Property, Plant and Equipment and Intangible Assets | |

Note 5 – Income Taxes | |

Note 6 – Stock-Based Compensation | |

Note 7 – Pension, Retiree Medical and Savings Plans | |

Note 8 – Related Party Transactions | |

Note 9 – Debt Obligations and Commitments | |

Note 10 – Financial Instruments | |

Note 11 – Net Income Attributable to PepsiCo per Common Share | |

Note 12 – Preferred Stock | |

Note 13 – Accumulated Other Comprehensive Loss Attributable to PepsiCo | |

Note 14 – Supplemental Financial Information | |

Note 15 – Acquisitions and Divestitures | |

MANAGEMENT’S RESPONSIBILITY FOR FINANCIAL REPORTING | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

SELECTED FINANCIAL DATA | |

FIVE-YEAR SUMMARY | |

GLOSSARY | |

Our discussion and analysis is intended to help the reader understand our results of operations and financial condition and is provided as an addition to, and should be read in connection with, our consolidated financial statements and the accompanying notes. Definitions of key terms can be found in the glossary beginning on page 95. Tabular dollars are presented in millions, except per share amounts. All per share amounts reflect common stock per share amounts, assume dilution unless otherwise noted, and are based on unrounded amounts. Percentage changes are based on unrounded amounts.

OUR BUSINESS

Executive Overview

We are a leading global food and beverage company with a complementary portfolio of enjoyable brands, including Frito-Lay, Gatorade, Pepsi-Cola, Quaker and Tropicana. Through our operations, authorized bottlers, contract manufacturers and other third parties, we make, market, distribute and sell a wide variety of convenient and enjoyable beverages, foods and snacks, serving customers and consumers in more than 200 countries and territories.

Our management monitors a variety of key indicators to evaluate our business results and financial condition. These indicators include growth in volume, revenue, organic revenue, operating profit, EPS (as reported and excluding certain items and the impact of foreign exchange translation), retail sales, market share, safety, innovation, product and service quality, organizational health, brand equity, media viewership and engagement, employee diversity, net commodity inflation, productivity savings, net capital spending, free cash flow and free cash flow excluding certain items, cash returned to shareholders in the forms of share repurchases and dividends, advertising and marketing expenses, return on invested capital (ROIC), and gross and operating margin change.

During 2014, we continued to take steps to position ourselves for sustainable value creation over the long-term and continued our progress against our key business priorities - brand building, innovation, productivity, execution and talent management. For example, in 2014 we:

| |

• | Drove growth for our retail customers. Among the largest 30 food and beverage manufacturers, PepsiCo was the largest contributor to U.S. retail sales in 2014. |

| |

• | Continued to increase our investment in global research and development. Innovation in 2014 accounted for 9% of our net revenue in 2014, up from approximately 8% since 2012. |

| |

• | Continued our multi-year productivity programs. In 2014, we delivered over $1 billion in productivity savings. |

| |

• | Continued our efforts to harmonize our food and beverage businesses, enhancing the effectiveness of our execution and driving growth for PepsiCo and our customers. In 2014, we launched our largest-ever global campaign for Pepsi and Lay’s, cross-promoting these brands in 28 markets. |

| |

• | Continued to expand our globally integrated talent management infrastructure that provides insight into our workforce planning at the global and local levels. In 2014, we continued to enhance PepsiCo University, which helps our associates develop the leadership and functional skills they, and PepsiCo, need to succeed and grow. |

We successfully continued these initiatives during 2014 while returning $8.7 billion to shareholders through dividends and share repurchases.

As we look to 2015 and beyond, we remain focused on positioning our Company for long-term sustainable growth while continuing to deliver strong financial results. Our business strategies are designed to address key challenges facing our Company, including: uncertain macroeconomic conditions, including geopolitical, economic and social instability; evolving consumer tastes and preferences, including continued consumer focus on nutritious products and changes in customer channels, including the growth of e-commerce; and resource scarcity. See also “Item 1A. Risk Factors” in our 2014 Form 10-K for additional information about risks and uncertainties that the Company faces. We believe that many of these challenges create new growth opportunities for our Company. For example, we believe that continued consumer focus on health and wellness and changes in consumer and distribution channels will provide us with new opportunities to expand our product offerings and interact with our customers and consumers. In order to address these challenges and capitalize on these opportunities, we intend to do the following:

Strengthen our presence around the world.

Continued global expansion will be critical to our continued growth. The global middle class is growing rapidly. With three billion people projected to join the middle class in growth markets in the next 20 years, we believe we have the opportunity to continue to expand our business around the world. Although this presents growth opportunities in the long-term, the global economic landscape remains volatile, with many of the markets in which our products are sold continuing to experience unstable economic, political and social conditions. To address these challenges, we plan to continue building a portfolio that is balanced across geographies and categories to help navigate short-term volatility and uncertainty in these markets.

Continue to broaden the range of our product portfolio, including expanding our offerings of more nutritious products.

We anticipate that the consumer demand for convenient, functional nutrition, fruits, vegetables, protein and value-added dairy, local and natural ingredients, and better-for-you snacking and beverage options will continue to grow as consumer tastes and preferences continue to evolve. To meet this growing demand, we plan to continue to grow our portfolio of more nutritious products as well as to reduce added sugar, sodium and saturated fat in certain key brands, while continuing to focus on the great taste consumers expect from our beverages, foods and snacks. At the end of 2014, approximately 20% of our net revenue came from our nutrition businesses. We expect that our increased investments in global research and development will enable us to continue to meet the growing demand for convenient, nutritious products and a broad variety of snack and beverage options.

Continue to adapt to changing customer channels.

Digital technology continues to change the retail landscape and the way in which we interact with retailers, shoppers and consumers. As part of this shift, e-commerce is emerging as a significant factor. To help retailers navigate this changing landscape, and to build relationships with consumers through emerging channels, we plan on increasing our e-commerce presence, developing tailored customer strategies and utilizing the size and scale of our distribution system.

Continue to focus on productivity.

We also intend to focus on productivity and lowering the cost base of the Company over the long term and, by utilizing our global scale, eliminating duplication, deploying new technologies and capitalizing on everyday opportunities to lower our cost base. We achieved our targeted productivity savings of $1 billion for 2014 and have successfully completed the three-year, $3 billion productivity program we launched in 2012. We are focused on our five-year, $5 billion productivity program, which we expect will extend annual savings of $1 billion from 2015 through 2019. This next generation of productivity initiatives will focus on the following areas: increasing automation in our operations to reduce costs and increase capacity; expanding shared services, restructuring our manufacturing operations to optimize our assets and capabilities globally;

restructuring our go-to-market systems to optimize our distribution network; and increasing organizational effectiveness and efficiencies through the ongoing evolution of our operating model.

Continue to embrace sustainable business practices across our supply chain.

We expect the demand for finite natural resources will continue to rise as the global population continues to grow. To address this concern, we plan to continue developing and deploying innovative ways to conserve and replenish water, reduce energy consumption and greenhouse gas emissions, promote sustainable agriculture and decrease waste sent to landfills.

Build and retain top talent.

We expect that the global competition for talent will continue to accelerate. Global companies like PepsiCo need strong general managers in local markets, leaders who can collaborate effectively on multi-disciplinary teams and employees who can solve complex, multi-faceted challenges. To meet the future needs of our business, we remain focused on systematically developing the functional, technical and leadership skills we need for sustainable long-term performance.

Deliver on the promise of Performance with Purpose.

Performance with Purpose is our goal to deliver top-tier financial performance while creating sustainable growth and shareholder value. In practice, Performance with Purpose means providing a wide range of beverages, foods and snacks, from treats to healthy eats; finding innovative ways to minimize our impact on the environment and reduce our operating costs; providing a safe and inclusive workplace for our employees globally; and respecting, supporting and investing in the local communities in which we operate. PepsiCo was again recognized for its leadership in this area in 2014 by earning a place on the prestigious Dow Jones Sustainability World Index for the eighth consecutive year and on the North America Index for the ninth consecutive year.

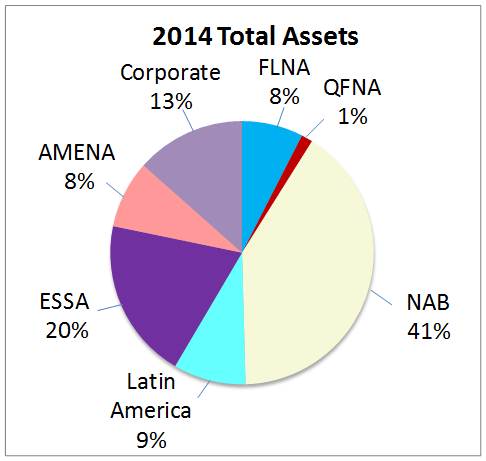

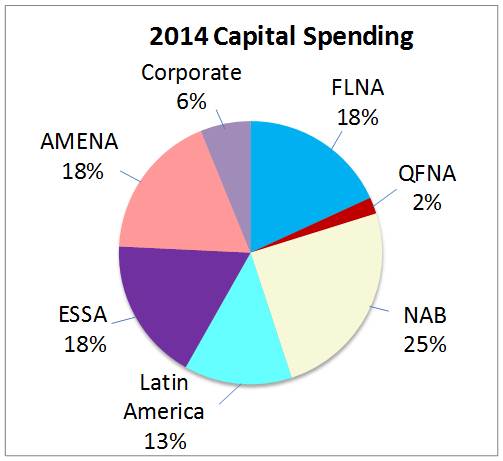

Our Operations

We are organized into six reportable segments (also referred to as divisions), as follows:

| |

1) | Frito-Lay North America (FLNA); |

| |

2) | Quaker Foods North America (QFNA); |

| |

3) | North America Beverages (NAB), which includes all of our beverage businesses in North America; |

| |

4) | Latin America, which includes all of our beverage, food and snack businesses in Latin America; |

| |

5) | Europe Sub-Saharan Africa (ESSA), which includes all of our beverage, food and snack businesses in Europe and Sub-Saharan Africa; and |

| |

6) | Asia, Middle East and North Africa (AMENA), which includes all of our beverage, food and snack businesses in Asia, Middle East and North Africa. |

See “Item 1. Business.” for more information on our divisions and a description of our distribution network, ingredients and other supplies, brands and intellectual property rights, seasonality, customers and competition. In addition, see Note 1 to our consolidated financial statements for financial information about our divisions and geographic areas.

Our Business Risks

We are subject to risks in the normal course of business. During 2014 and 2013, certain countries in which our products are sold operated in a challenging environment, experiencing unstable economic and political conditions, civil unrest, debt and credit issues, and currency fluctuations. We continue to monitor the economic, operating and political environment in these markets closely and have identified actions to potentially mitigate the unfavorable impact, if any, on our future results. See also “Risk Factors” in Item 1A. in our 2014 Form 10-K, “Executive Overview” above and “Market Risks” below for more information about these risks and the actions we have taken to address key challenges.

Risk Management Framework

The achievement of our strategic and operating objectives involves taking risks. To identify, assess, prioritize, address, manage, monitor and communicate these risks across the Company’s operations, we leverage an integrated risk management framework. This framework includes the following:

| |

• | PepsiCo’s Board of Directors has oversight responsibility for PepsiCo’s integrated risk management framework. One of the Board’s primary responsibilities is overseeing and interacting with senior management with respect to key aspects of the Company’s business, including risk assessment and risk mitigation of the Company’s top risks. The Board receives updates on key risks throughout the year. In addition, the Board has tasked designated Committees of the Board with certain categories of risk management, and the Committees report to the Board regularly on these matters. |

| |

◦ | The Audit Committee of the Board reviews and assesses the guidelines and policies governing PepsiCo’s risk management and oversight processes, and assists the Board’s oversight of financial, compliance and employee safety risks facing PepsiCo; and |

| |

◦ | The Compensation Committee of the Board periodically reviews PepsiCo’s employee compensation policies and practices to assess whether such policies and practices could lead to unnecessary risk-taking behavior. |

| |

• | The PepsiCo Risk Committee (PRC), which is comprised of a cross-functional, geographically diverse, senior management group, meets regularly to identify, assess, prioritize and address our top strategic, financial, operating, business, compliance, safety, reputational and other risks. The PRC is also responsible for reporting progress on our risk mitigation efforts to the Board; |

| |

• | Division Risk Committees (DRC), comprised of cross-functional senior management teams, meet regularly to identify, assess, prioritize and address division-specific business risks; |

| |

• | PepsiCo’s Risk Management Office, which manages the overall risk management process, provides ongoing guidance, tools and analytical support to the PRC and the DRCs, identifies and assesses potential risks and facilitates ongoing communication between the parties, as well as with PepsiCo’s Board of Directors and the Audit Committee of the Board; |

| |

• | PepsiCo’s Corporate Audit Department evaluates the ongoing effectiveness of our key internal controls through periodic audit and review procedures; and |

| |

• | PepsiCo’s Compliance & Ethics Department leads and coordinates our compliance policies and practices. |

Market Risks

We are exposed to market risks arising from adverse changes in:

| |

• | commodity prices, affecting the cost of our raw materials and energy; |

| |

• | foreign exchange rates and currency restrictions; and |

In the normal course of business, we manage commodity price, foreign exchange and interest rate risks through a variety of strategies, including productivity initiatives, global purchasing programs and hedging. Ongoing productivity initiatives involve the identification and effective implementation of meaningful cost-saving opportunities or efficiencies, including the use of derivatives. Our global purchasing programs include fixed-price purchase orders and pricing agreements. See “Unfavorable economic conditions may have an adverse impact on our business, financial condition or results of operations.” and “Our business, financial condition or results of operations may be adversely affected by increased costs, disruption of supply or shortages of raw materials or other supplies.” in “Risk Factors” in Item 1A. in our 2014 Form 10-K. See Note 9 to our consolidated financial statements for further information on our non-cancelable purchasing commitments.

The fair value of our derivatives fluctuates based on market rates and prices. The sensitivity of our derivatives to these market fluctuations is discussed below. See Note 10 to our consolidated financial statements for further discussion of these derivatives and our hedging policies. See “Our Critical Accounting Policies” for a discussion of the exposure of our pension and retiree medical plan assets and liabilities to risks related to market fluctuations.

Inflationary, deflationary and recessionary conditions impacting these market risks also impact the demand for and pricing of our products. See “Risk Factors” in Item 1A. in our 2014 Form 10-K for further discussion.

Commodity Prices

Our open commodity derivative contracts had a notional value of $1.2 billion as of December 27, 2014 and $1.4 billion as of December 28, 2013. At the end of 2014, the potential change in fair value of commodity derivative instruments, assuming a 10% decrease in the underlying commodity price, would have increased our net unrealized losses in 2014 by $103 million.

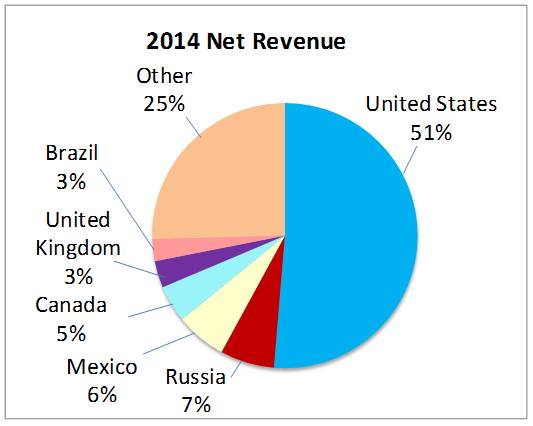

Foreign Exchange

Our operations outside of the U.S. generate 49% of our net revenue, with Russia, Mexico, Canada, the United Kingdom and Brazil comprising approximately 23% of our net revenue in 2014. As a result, we are exposed to foreign exchange risks in certain of the international markets in which we operate. In addition, unstable economic, political and social conditions and civil unrest in certain markets in which our products are sold, including in Russia, Ukraine and the Middle East, and currency fluctuations in certain of these international markets, as well as Venezuela (discussed below), Argentina and Turkey continue to result in challenging operating environments. During 2014, unfavorable foreign exchange reduced net revenue growth by 3 percentage points, primarily due to depreciation of the Russian ruble, Canadian dollar, Venezuelan bolivar, Argentine peso and Mexican peso. Currency declines against the U.S. dollar which are not offset could adversely impact our future results.

The results of our Venezuelan businesses have been reported under highly inflationary accounting since the beginning of our 2010 fiscal year, at which time the functional currency of our Venezuelan entities was changed from the bolivar to the U.S. dollar.

In February 2013, the Venezuelan government devalued the bolivar by resetting the exchange rate of government-operated National Center of Foreign Commerce (CENCOEX) (“fixed exchange rate”), formerly the Foreign Exchange Administration Board (CADIVI), from 4.3 bolivars per U.S. dollar to 6.3 bolivars per U.S. dollar, resulting in an after-tax net charge of $111 million in the first quarter of 2013 (see “Items Affecting Comparability”). In January 2014, the Venezuelan government announced the expansion of its auction-based foreign exchange system (SICAD 1) to include additional items, including foreign investments. In March 2014, the Venezuelan government introduced an additional auction-based foreign exchange system (SICAD 2) which permitted all companies incorporated or domiciled in Venezuela to bid for U.S. dollars for any purpose. As a result, as of December 27, 2014, there was a three-tiered exchange rate mechanism in Venezuela, and the SICAD 1 rate was 12 bolivars per U.S. dollar and the SICAD 2 rate was 50 bolivars per U.S. dollar. On February 11, 2015, the Venezuelan government announced that the transactions for the sale or purchase of foreign currency under the SICAD 2 exchange system would no longer be available and created a new open market foreign exchange system (SIMADI).

At December 27, 2014, we had pending requests with an agency of the Venezuelan government for remittance of dividends of approximately $310 million at the fixed exchange rate. These requests pertain to the years from 2006 to 2012. We are unable to predict the likelihood of Venezuelan government approvals of these requests or any requests that we may file in the future or, if any such requests are approved, the estimated time for remittance.

At the end of each period, we remeasure the net monetary assets of our Venezuela entities at the rate at which we expect them to be settled, including the payment of dividends. During the fourth quarter of 2014, certain of our pending dividend requests at the fixed exchange rate were denied by CENCOEX. We analyzed the exchange rates available to our Venezuela entities, including for payment of future dividend requests. As a result of this analysis, we believe that, except as noted below, the SICAD 1 exchange rate is the most appropriate rate to remeasure our net monetary assets. Therefore, during the fourth quarter of 2014, we incurred an after-tax net charge of $105 million to remeasure certain of the net monetary assets of our Venezuela entities at the SICAD 1 rate (see “Items Affecting Comparability”). We remeasure certain other net monetary assets at the fixed exchange rate, since we believe that dividends submitted to CENCOEX in prior years at the fixed exchange rate and payables for imports of essential goods approved by CENCOEX continue to qualify for settlement at the fixed exchange rate.

In 2014, our results of operations in Venezuela generated 2% of our net revenue and 4% of our operating profit. As of December 27, 2014, our operations in Venezuela comprised 9% of our cash and cash equivalents balance. Our bolivar-denominated net monetary assets in Venezuela, which primarily include cash and cash equivalents, approximated $480 million at December 27, 2014. Our non-monetary assets in Venezuela, which primarily include equity investments, intangible assets, property, plant and equipment and inventory, approximated $650 million at December 27, 2014. We continue to evaluate available options to obtain U.S. dollars to meet our operational needs in Venezuela.

We believe that significant uncertainty exists regarding the exchange mechanisms in Venezuela, including the nature of transactions that are eligible to flow through CENCOEX, SICAD 1 or SIMADI, or any other new exchange mechanism that may emerge (whether as a result of the Venezuelan government’s announcement on February 11, 2015 or otherwise), as well as how any such mechanisms will operate in the future and the availability of U.S. dollars under each mechanism. We continue to monitor developments closely and may determine in the future that rates other than the SICAD 1 rate or the fixed exchange rate, as applicable, are appropriate for remeasurement of the net monetary assets of our Venezuelan entities. If, at December 27, 2014, we had used the SICAD 1 rate to remeasure the net monetary assets that remain at the fixed exchange rate, we would have incurred an additional net charge of approximately $160 million. If, at December 27, 2014, we had remeasured all net monetary assets of our Venezuela businesses at 50 bolivars

per U.S. dollar (which was the SICAD 2 rate at December 27, 2014), we would have incurred an additional net charge of approximately $400 million. Any such remeasurement charge, if recognized, would be reflected in “Items Affecting Comparability.” Any further devaluation of the bolivar, change in the currency exchange mechanisms or fluctuation of the SICAD 1 auction-based rate, which may vary throughout the year, could adversely affect our financial position, including a potential impairment of non-monetary assets, and results of operations, both for any period in which we determine to remeasure using another rate and on a going forward basis following any such remeasurement.

In 2014, the Venezuelan government also issued a new Law on Fair Pricing, establishing a maximum profit margin of 30%. The new law did not and is not expected to have a material impact on our consolidated results or financial position.

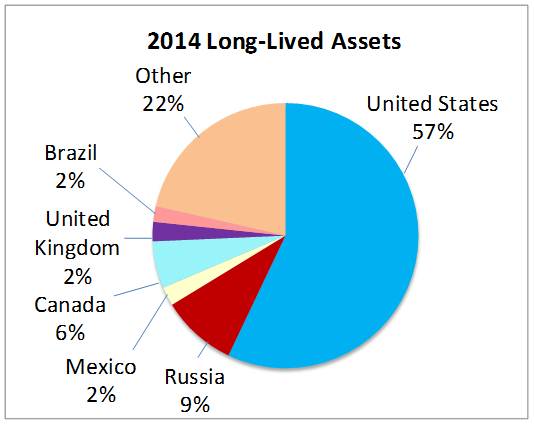

During 2014, Russia announced economic sanctions against the United States and other nations that include a ban on imports of certain ingredients and finished goods from specific countries. We do not anticipate the current sanctions to have a material impact on the results of our operations in Russia or our consolidated results or financial position, and we will continue to monitor the economic, operating and political environment in Russia closely. For both years ending December 27, 2014 and December 28, 2013, 7% of our total net revenue was generated by our operations in Russia. As of December 27, 2014, our long-lived assets in Russia were $4.5 billion. Our operations in Ukraine are not significant in relation to our consolidated results or financial position.

Our foreign currency derivatives had a total notional value of $2.7 billion as of December 27, 2014 and $2.5 billion as of December 28, 2013. At the end of 2014, we estimate that an unfavorable 10% change in the underlying exchange rates would have decreased our net unrealized gains by $141 million.

Interest Rates

The notional values of the interest rate derivative instruments outstanding as of December 27, 2014 and December 28, 2013 were $9.3 billion and $7.9 billion, respectively. Assuming year-end 2014 investment levels and variable rate debt, a 1-percentage-point increase in interest rates would have decreased net interest expense by $17 million in 2014 due to higher cash and cash equivalents and short-term investments levels as compared with our variable rate debt.

OUR CRITICAL ACCOUNTING POLICIES

An appreciation of our critical accounting policies is necessary to understand our financial results. These policies may require management to make difficult and subjective judgments regarding uncertainties, and as a result, such estimates may significantly impact our financial results. The precision of these estimates and the likelihood of future changes depend on a number of underlying variables and a range of possible outcomes. Other than our accounting for pension and retiree medical plans, our critical accounting policies do not involve a choice between alternative methods of accounting. We applied our critical accounting policies and estimation methods consistently in all material respects, and for all periods presented, and have discussed these policies with our Audit Committee.

Our critical accounting policies are:

| |

• | goodwill and other intangible assets; |

| |

• | income tax expense and accruals; and |

| |

• | pension and retiree medical plans. |

Revenue Recognition

Our products are sold for cash or on credit terms. Our credit terms, which are established in accordance with local and industry practices, typically require payment within 30 days of delivery in the U.S., and generally within 30 to 90 days internationally, and may allow discounts for early payment. We recognize revenue upon shipment or delivery to our customers based on written sales terms that do not allow for a right of return. However, our policy for DSD and certain chilled products is to remove and replace damaged and out-of-date products from store shelves to ensure that consumers receive the product quality and freshness they expect. Similarly, our policy for certain warehouse-distributed products is to replace damaged and out-of-date products. Based on our experience with this practice, we have reserved for anticipated damaged and out-of-date products.

Our policy is to provide customers with product when needed. In fact, our commitment to freshness and product dating serves to regulate the quantity of product shipped or delivered. In addition, DSD products are placed on the shelf by our employees with customer shelf space and storerooms limiting the quantity of product. For product delivered through our other distribution networks, we monitor customer inventory levels.

As discussed in “Our Customers” in “Item 1. Business.”, we offer sales incentives and discounts through various programs to customers and consumers. Total marketplace spending includes sales incentives, discounts, advertising and other marketing activities. Sales incentives and discounts are primarily accounted for as a reduction of revenue and totaled $35.8 billion in 2014 and $34.7 billion in both 2013 and 2012. Sales incentives and discounts include payments to customers for performing merchandising activities on our behalf, such as payments for in-store displays, payments to gain distribution of new products, payments for shelf space and discounts to promote lower retail prices. Sales incentives and discounts also include support provided to our independent bottlers through funding of advertising and other marketing activities. A number of our sales incentives, such as bottler funding to independent bottlers and customer volume rebates, are based on annual targets, and accruals are established during the year for the expected payout. These accruals are based on contract terms and our historical experience with similar programs and require management judgment with respect to estimating customer participation and performance levels. Differences between estimated expense and actual incentive costs are normally insignificant and are recognized in earnings in the period such differences are determined. In addition, certain advertising and marketing costs are also based on annual targets and recognized during the year as incurred. The terms of most of our incentive arrangements do not exceed a year, and therefore do not require highly uncertain long-term estimates. Certain arrangements, such as fountain pouring rights, may extend beyond one year. Payments made to obtain these rights are recognized over the shorter of the economic or contractual life, primarily as a reduction of revenue, and the remaining balances of $355 million as of December 27, 2014 and $410 million as of December 28, 2013 are included in prepaid expenses and other current assets and other assets on our balance sheet.

For interim reporting, our policy is to allocate our forecasted full-year sales incentives for most of our programs to each of our interim reporting periods in the same year that benefits from the programs. The allocation methodology is based on our forecasted sales incentives for the full year and the proportion of each interim period’s actual gross revenue or volume, as applicable, to our forecasted annual gross revenue or volume, as applicable. Based on our review of the forecasts at each interim period, any changes in estimates and the related allocation of sales incentives are recognized beginning in the interim period that they are identified. In addition, we apply a similar allocation methodology for interim reporting purposes for certain advertising and other marketing activities. See Note 2 to our consolidated financial statements for additional information on our total marketplace spending. Our annual financial statements are not impacted by this interim allocation methodology.

We estimate and reserve for our bad debt exposure based on our experience with past due accounts and collectibility, the aging of accounts receivable and our analysis of customer data. Bad debt expense is classified within selling, general and administrative expenses in our income statement.

Goodwill and Other Intangible Assets

We sell products under a number of brand names, many of which were developed by us. The brand development costs are expensed as incurred. We also purchase brands and other intangible assets in acquisitions. In a business combination, the consideration is first assigned to identifiable assets and liabilities, including brands and other intangible assets, based on estimated fair values, with any excess recorded as goodwill. Determining fair value requires significant estimates and assumptions based on an evaluation of a number of factors, such as marketplace participants, product life cycles, market share, consumer awareness, brand history and future expansion expectations, amount and timing of future cash flows and the discount rate applied to the cash flows.

We believe that a brand has an indefinite life if it has a history of strong revenue and cash flow performance and we have the intent and ability to support the brand with marketplace spending for the foreseeable future. If these perpetual brand criteria are not met, brands are amortized over their expected useful lives, which generally range from five to 40 years. Determining the expected life of a brand requires management judgment and is based on an evaluation of a number of factors, including market share, consumer awareness, brand history, future expansion expectations and regulatory restrictions, as well as the macroeconomic environment of the countries in which the brand is sold.

In connection with previous acquisitions, we reacquired certain franchise rights which provided the exclusive and perpetual rights to manufacture and/or distribute beverages for sale in specified territories. In determining the useful life of these franchise rights, many factors were considered, including the pre-existing perpetual bottling arrangements, the indefinite period expected for these franchise rights to contribute to our future cash flows, as well as the lack of any factors that would limit the useful life of these franchise rights to us, including legal, regulatory, contractual, competitive, economic or other factors. Therefore, certain of these franchise rights are considered as indefinite-lived, with the balance amortized over the remaining contractual period of the contract in which the right was granted.

Indefinite-lived intangible assets and goodwill are not amortized and are assessed for impairment at least annually, using either a qualitative or quantitative approach. We perform this annual assessment during our third quarter. Where we use the qualitative assessment, first we determine if, based on qualitative factors, it is more likely than not that an impairment exists. Factors considered include macroeconomic, industry and competitive conditions, legal and regulatory environment, historical financial performance and significant changes in the brand or reporting unit. If the qualitative assessment indicates that it is more likely than not that an impairment exists, then a quantitative assessment is performed.

The quantitative assessment requires an analysis of several estimates including future cash flows or income consistent with management’s strategic business plans, annual sales growth rates and the selection of assumptions underlying a discount rate (weighted average cost of capital) based on market data available at the time. Significant management judgment is necessary to estimate the impact of competitive operating, macroeconomic and other factors to estimate future levels of sales, operating profit or cash flows. All assumptions used in our impairment evaluations for nonamortizable intangible assets, such as forecasted growth rates and weighted average cost of capital, are based on the best available market information and are consistent with our internal forecasts and operating plans. These assumptions could be adversely impacted by certain of the risks described in “Risk Factors” in Item 1A. in our 2014 Form 10-K, and “Our Business Risks.”

See Note 2 to our consolidated financial statements for additional information on performing the quantitative assessment.

Amortizable intangible assets are only evaluated for impairment upon a significant change in the operating or macroeconomic environment. If an evaluation of the undiscounted future cash flows indicates impairment, the asset is written down to its estimated fair value, which is based on its discounted future cash flows or another income-based approach.

We did not recognize any impairment charges for goodwill in each of the fiscal years ended December 27, 2014, December 28, 2013 and December 29, 2012. In 2014, we performed the impairment analysis for goodwill for all our reporting units using the qualitative approach and concluded that it was more likely than not that the estimated fair values of our reporting units were greater than their carrying amounts. After reaching this conclusion, no further testing was performed.

In 2014 and 2012, we recognized pre-tax impairment charges in ESSA for nonamortizable intangible assets of $23 million in each year. We recognized no impairment charges for nonamortizable intangible assets in 2013. As of December 27, 2014, the estimated fair values of our indefinite-lived reacquired and acquired franchise rights recorded at NAB exceeded their carrying values. However, there could be an impairment of the carrying value of NAB’s reacquired and acquired franchise rights if future revenues and their contribution to the operating results of NAB’s CSD business do not achieve our expected estimated future cash flows or if macroeconomic conditions result in a future increase in the weighted-average cost of capital used to estimate fair value. We have also analyzed the impact of the recent economic and political developments in Russia on the estimated fair value of our indefinite-lived intangible assets in Russia and have concluded that there is no impairment as of December 27, 2014. However, a further deterioration in these conditions in Russia could potentially require us to record an impairment charge for these assets in the future.

Income Tax Expense and Accruals

Our annual tax rate is based on our income, statutory tax rates and tax planning opportunities available to us in the various jurisdictions in which we operate. Significant judgment is required in determining our annual tax rate and in evaluating our tax positions. We establish reserves when, despite our belief that our tax return positions are fully supportable, we believe that certain positions are subject to challenge and that we likely will not succeed. We adjust these reserves, as well as the related interest, in light of changing facts and circumstances, such as the progress of a tax audit. See “Imposition of new taxes, disagreements with tax authorities or additional tax liabilities could adversely affect our business, financial condition or results of operations.” in “Risk Factors” in Item 1A. in our 2014 Form 10-K.

An estimated annual effective tax rate is applied to our quarterly operating results. In the event there is a significant or unusual item recognized in our quarterly operating results, the tax attributable to that item is separately calculated and recorded at the same time as that item. We consider the tax adjustments from the resolution of prior year tax matters to be among such items.

Tax law requires items to be included in our tax returns at different times than the items are reflected in our financial statements. As a result, our annual tax rate reflected in our financial statements is different than that reported in our tax returns (our cash tax rate). Some of these differences are permanent, such as expenses that are not deductible in our tax return, and some differences reverse over time, such as depreciation expense. These temporary differences create deferred tax assets and liabilities. Deferred tax assets generally represent items that can be used as a tax deduction or credit in our tax returns in future years for which we have already recorded the tax benefit in our income statement. We establish valuation allowances for our deferred tax assets if, based on the available evidence, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax liabilities generally represent tax expense recognized in our

financial statements for which payment has been deferred, or expense for which we have already taken a deduction in our tax return but have not yet recognized as expense in our financial statements.

In 2014, our annual tax rate was 25.1% compared to 23.7% in 2013, as discussed in “Other Consolidated Results.” The tax rate increased 1.4 percentage points compared to the prior year, primarily due to lapping the prior year impact of the favorable resolution with the IRS of audits for taxable years 2003 through 2009 partially offset by the favorable resolution of certain tax matters in the current year.

Pension and Retiree Medical Plans

Our pension plans cover certain full-time employees in the U.S. and certain international employees. Benefits are determined based on either years of service or a combination of years of service and earnings. Certain U.S. and Canada retirees are also eligible for medical and life insurance benefits (retiree medical) if they meet age and service requirements. Generally, our share of retiree medical costs is capped at specified dollar amounts, which vary based upon years of service, with retirees contributing the remainder of the cost. In addition, the Company has been phasing out certain Company subsidies of retiree medical benefits.

In the fourth quarters of 2014 and 2012, the Company offered certain former employees who had vested benefits in our U.S. defined benefit pension plans the option of receiving a one-time lump sum payment equal to the present value of the participant’s pension benefit (payable in cash or rolled over into a qualified retirement plan or Individual Retirement Account (IRA)). In 2014, we recorded a pension lump sum settlement charge in corporate unallocated expenses of $141 million ($88 million after-tax or $0.06 per share). In 2012, we recorded a pension lump sum settlement charge in corporate unallocated expenses of $195 million ($131 million after-tax or $0.08 per share). See “Items Affecting Comparability” and Note 7 to our consolidated financial statements.

Our Assumptions