UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-8974

Honeywell International Inc.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

22-2640650 |

|

|

|

|

(State or other jurisdiction of |

(I.R.S. Employer |

|

115 Tabor Road |

07950 |

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code (973) 455-2000

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Name of Each Exchange |

|

|

|

|

Common Stock, par value $1 per share* |

New York Stock Exchange |

|

Floating Rate Senior Notes due 2018 |

New York Stock Exchange |

|

0.650% Senior Notes due 2020 |

New York Stock Exchange |

|

1.300% Senior Notes due 2023 |

New York Stock Exchange |

|

2.250% Senior Notes due 2028 |

New York Stock Exchange |

* |

The common stock is also listed on the London Stock Exchange. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company o

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to section 13(a) of the Exchange Act. o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting stock held by nonaffiliates of the Registrant was approximately $101.4 billion at June 30, 2017.

There were 752,002,033 shares of Common Stock outstanding at January 26, 2018.

Documents Incorporated by Reference

Part III: Proxy Statement for Annual Meeting of Shareowners to be held April 23, 2018.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Item |

|

Page |

|||

|

Part I |

1. |

1 |

||||

|

|

|

|

5 |

|||

|

|

1A. |

5 |

||||

|

|

1B. |

13 |

||||

|

|

2. |

13 |

||||

|

|

3. |

13 |

||||

|

|

4. |

13 |

||||

|

Part II. |

5. |

14 |

||||

|

|

6. |

16 |

||||

|

|

7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

17 |

|||

|

|

7A. |

35 |

||||

|

|

8. |

36 |

||||

|

|

9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

90 |

|||

|

|

9A. |

90 |

||||

|

|

9B. |

90 |

||||

|

Part III. |

10. |

91 |

||||

|

|

11. |

92 |

||||

|

|

12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

92 |

|||

|

|

13. |

93 |

||||

|

|

14. |

93 |

||||

|

Part IV. |

15. |

94 |

||||

|

|

16. |

94 |

||||

95 |

||||||

PART I.

Honeywell International Inc. (“Honeywell” or “the Company”) invents and commercializes technologies that address some of the world’s most critical challenges around energy, safety, security, productivity and global urbanization. As a diversified technology and manufacturing company, we are uniquely positioned to blend physical products with software to serve customers worldwide with aerospace products and services, turbochargers, energy efficient products and solutions for homes, businesses and transportation, specialty chemicals, electronic and advanced materials, process technology for refining and petrochemicals, and productivity, sensing, safety and security technologies for buildings, homes and industries. Our products and solutions enable a safer, more comfortable and more productive world, enhancing the quality of life of people around the globe. Honeywell was incorporated in Delaware in 1985.

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports, are available free of charge on our website (www.honeywell.com) under the heading Investor Relations (see SEC Filings and Reports) immediately after they are filed with, or furnished to, the Securities and Exchange Commission (SEC). In addition, in this Annual Report on Form 10-K, the Company incorporates by reference certain information from parts of its Proxy Statement for the 2018 Annual Meeting of Stockholders, which we expect to file with the SEC on or about March 8, 2018, and which will also be available free of charge on our website.

Major Businesses

We globally manage our business operations through four segments: Aerospace, Home and Building Technologies, Performance Materials and Technologies, and Safety and Productivity Solutions. Financial information related to our segments is included in Note 21 Segment Financial Data of Notes to Consolidated Financial Statements. Effective October 2017, the Company realigned the Smart Energy business, previously part of the Home and Building Technologies segment, into the Process Solutions business within the Performance Materials and Technologies segment. The business descriptions below reflect that realignment.

The major products/services, customers/uses and key competitors of each of our segments are:

Aerospace

Aerospace is a leading global supplier of products, software and services for aircraft and vehicles that it sells to original equipment manufacturers (OEM) and other customers in a variety of end markets: air transport, regional, business and general aviation aircraft, airlines, aircraft operators, defense and space contractors and automotive and truck manufacturers. Aerospace is a leading provider of aircraft engines, integrated avionics, systems and service solutions, and related products and services for aircraft manufacturers, and turbochargers to improve the performance and efficiency of passenger cars and commercial vehicles. Aerospace also provides spare parts, repair, overhaul and maintenance services (principally to aircraft operators) for the aftermarket. Aerospace products and services include auxiliary power units, propulsion engines, environmental control systems, wireless connectivity services, electric power systems, engine controls, flight safety, communications, navigation hardware and software, radar and surveillance systems, aircraft lighting, management and technical services, advanced systems and instruments, satellite and space components, aircraft wheels and brakes, repair and overhaul services, turbochargers and thermal systems.

Home and Building Technologies

Home and Building Technologies is a leading global provider of products, software, solutions and technologies that help owners of homes stay connected and in control of their comfort, security and energy use; and enable commercial building owners and occupants to ensure their facilities are safe, energy efficient, sustainable and productive. Home and Building Technologies products and services include controls and displays for heating, cooling, indoor air quality, ventilation, humidification,

1

combustion, lighting and home automation; advanced software applications for home/building control and optimization; sensors, switches, control systems and instruments for measuring pressure, air flow, temperature and electrical current; products, services and solutions for measurement, regulation, control and metering of gases and electricity; metering and communications systems for water utilities and industries; access control; video surveillance; fire products; remote patient monitoring systems; and installation, maintenance and upgrades of systems that keep buildings safe, comfortable and productive.

Performance Materials and Technologies

Performance Materials and Technologies is a global leader in developing and manufacturing advanced materials, process technologies and automation solutions. UOP provides process technology, products, including catalysts and adsorbents, equipment and consulting services that enable customers to efficiently produce gasoline, diesel, jet fuel, petrochemicals and renewable fuels for the petroleum refining, gas processing, petrochemical, and other industries. Process Solutions is a pioneer in automation control, instrumentation, advanced software and related services for the oil and gas, refining, pulp and paper, industrial power generation, chemicals and petrochemicals, biofuels, life sciences, and metals, minerals and mining industries. Through its metering business, Process Solutions also enables utilities and distribution companies to deploy advanced capabilities that transform operations, improve reliability and environmental sustainability, and better serve customers. Advanced Materials manufactures a wide variety of high-performance products, including fluorocarbons, hydrofluoroolefins, specialty films, waxes, additives, advanced fibers, customized research chemicals and intermediates, and electronic materials and chemicals.

Safety and Productivity Solutions

Safety and Productivity Solutions is a leading global provider of products, software and connected solutions to customers around the globe that improve productivity, workplace safety and asset performance. Safety products include personal protection equipment and footwear designed for work, play and outdoor activities. Productivity Solutions products and services include gas detection technology; mobile devices and software for computing, data collection and thermal printing; supply chain and warehouse automation equipment, software and solutions; custom-engineered sensors, switches and controls for sensing and productivity solutions; and software-based data and asset management productivity solutions.

Competition

We are subject to competition in substantially all product and service areas. Some of our key competitors are:

• |

Aerospace: Borg-Warner (automotive), Garmin, General Electric, Rockwell Collins, Thales and United Technologies |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Home and Building Technologies: Emerson Electric, Itron, Johnson Controls, Schneider and Siemens |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Performance Materials and Technologies: Albemarle, BASF, Dow, Dupont, Emerson and Sinopec |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Safety and Productivity Solutions: 3M, Mine Safety Appliances (MSA), Kion Group, TE Connectivity and Zebra Technologies |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Our businesses compete on a variety of factors such as price, quality, reliability, delivery, customer service, performance, applied technology, product innovation and product recognition. Brand identity, service to customers and quality are important competitive factors for our products and services, and there is considerable price competition. Other competitive factors include breadth of product line, research and development efforts and technical and managerial capability. While our competitive position varies among our products and services, we believe we are a significant competitor in each of our major product and service classes. Many of our competitors have substantial

2

financial resources and significant technological capabilities. In addition, some of our products compete with the captive component divisions of OEMs.

Aerospace Sales

Our Aerospace segment sales were 36%, 38% and 39% of our total sales in 2017, 2016 and 2015. Our sales to commercial aerospace OEMs were 6%, 6% and 8% of our total sales in 2017, 2016 and 2015. In addition, our sales to commercial aftermarket customers of aerospace products and services were 13%, 12% and 12% of our total sales in 2017, 2016 and 2015.

U.S. Government Sales

Sales to the U.S. Government (principally by Aerospace), acting through its various departments and agencies and through prime contractors, amounted to $3,203 million, $3,330 million and $3,743 million in 2017, 2016 and 2015, which included sales to the U.S. Department of Defense, as a prime contractor and subcontractor, of $2,546 million, $2,647 million and $2,680 million in 2017, 2016 and 2015. U.S. defense spending decreased in 2017 compared to 2016. We do not expect our overall operating results to be significantly affected by any proposed changes in 2018 federal defense spending due principally to the varied mix of the government programs which impact us (OEMs’ production, engineering development programs, aftermarket spares and repairs and overhaul programs), as well as our diversified commercial businesses.

Backlog

Our total backlog at December 31, 2017 and 2016 was $17,690 million and $17,277 million. We anticipate that approximately $12,337 million of the 2017 backlog will be filled in 2018. We believe that backlog is not necessarily a reliable indicator of our future sales because a substantial portion of the orders constituting this backlog may be canceled at the customer’s option. The 2016 backlog previously disclosed has been revised to apply the methodology used for the 2017 backlog and excludes certain previously included amounts that do not meet the criteria for inclusion.

International Operations

We are engaged in manufacturing, sales, service and research and development (R&D) globally. U.S. exports and non-U.S. manufactured products are significant to our operations. U.S. exports comprised 12% of our total sales in 2017, 13% in 2016 and 14% in 2015. Non-U.S. manufactured products and services, mainly in Europe and Asia, were 44% of our total sales in 2017, 43% in 2016 and 39% in 2015.

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Manufactured Products and Systems and |

Year Ended December 31, 2017 |

|||||||||||||||||||||||||||

Aerospace |

Home and |

Performance |

Safety and |

|||||||||||||||||||||||||

|

|

(% of Segment Sales) |

|||||||||||||||||||||||||||

|

U.S. Exports |

|

|

21 |

% |

|

|

|

1 |

% |

|

|

|

15 |

% |

|

|

|

4 |

% |

|

||||||||

|

Non-U.S. |

|

|

34 |

% |

|

|

|

50 |

% |

|

|

|

54 |

% |

|

|

|

41 |

% |

|

||||||||

Information related to risks attendant to our foreign operations is included in Item 1A. Risk Factors under the caption “Macroeconomic and Industry Risks.”

Raw Materials

The principal raw materials used in our operations are generally readily available. Although we occasionally experience disruption in raw materials supply, we experienced no significant problems in the purchase of key raw materials or commodities in 2017. We are not dependent on any one supplier for a material amount of our raw materials.

The costs of certain key raw materials, including R240, fluorspar, copper, ethylene and perchloroethylene in Performance Materials and Technologies and nickel, steel, titanium and other metals in Aerospace, are expected to continue to fluctuate. We will continue to attempt to offset raw

3

material cost increases with formula or long-term supply agreements, price increases and hedging activities where feasible. We do not presently anticipate that a shortage of raw materials will cause any material adverse impacts during 2018.

Patents, Trademarks, Licenses and Distribution Rights

Our segments are not dependent upon any single patent or related group of patents, or any licenses or distribution rights. In our judgment, our intellectual property rights are adequate for the conduct of our business. We believe that, in the aggregate, the rights under our patents, trademarks and licenses are generally important to our operations, but we do not consider any individual patent, trademark or any licensing or distribution rights related to a specific process or product to be of material importance in relation to our total business.

Research and Development

The Company’s principal research and development activities are in the U.S., India, Europe, and China. Research and development expense totaled $1,835 million, $1,864 million and $1,856 million in 2017, 2016 and 2015. R&D expense was 5% of sales in each of 2017, 2016 and 2015. Customer-sponsored (principally by the U.S. Government) R&D activities amounted to an additional $876 million, $967 million and $998 million in 2017, 2016 and 2015.

Environment

We are subject to various federal, state, local and foreign government requirements regarding protection of human health and the environment. We believe that, as a general matter, our policies, practices and procedures are properly designed to prevent unreasonable risk of environmental damage, and of resulting financial liability, in connection with our business. Some risk of environmental damage is, however, inherent in some of our operations and products, as it is with other companies engaged in similar businesses.

We are and have been engaged in the handling, manufacturing, use and disposal of many substances classified as hazardous by one or more regulatory agencies. We believe that, as a general matter, our policies, practices and procedures are properly designed to prevent unreasonable risk of environmental damage and personal injury, and that our handling, manufacture, use and disposal of these substances are in accord with environmental and safety laws and regulations. It is also possible that future knowledge or other developments, such as improved capability to detect substances in the environment or increasingly strict environmental laws and standards and enforcement policies, could bring into question our current or past handling, manufacture, use or disposal of these substances.

Among other environmental requirements, we are subject to the federal Superfund and similar state and foreign laws and regulations, under which we have been designated as a potentially responsible party that may be liable for cleanup costs associated with current and former operating sites and various hazardous waste sites, some of which are on the U.S. Environmental Protection Agency’s National Priority List. Although there is a possibility that a responsible party might have to bear more than its proportional share of the cleanup costs if it is unable to obtain appropriate contribution from other responsible parties, we do not anticipate having to bear significantly more than our proportional share in multi-party situations taken as a whole.

We do not believe that existing or pending climate change legislation, regulation, or international treaties or accords are reasonably likely to have a material effect in the foreseeable future on the Company’s business or markets that it serves, nor on its results of operations, capital expenditures, earnings, competitive position or financial standing. We will continue to monitor emerging developments in this area.

Employees

We have approximately 131,000 employees at December 31, 2017, of whom approximately 46,000 are located in the United States.

4

Executive Officers of the Registrant

The executive officers of Honeywell, listed as follows, are elected annually by the Board of Directors. There are no family relationships among them.

|

|

|

Name, Age, |

Business Experience |

|

Darius Adamczyk, 52 |

President and Chief Executive Officer since April 2017. Chief Operating Officer since from April 2016 to March 2017. President and Chief Executive Officer Performance Materials and Technologies from April 2014 to April 2016. President of Honeywell Process Solutions from April 2012 to April 2014. President of Honeywell Scanning & Mobility from July 2008 to April 2012. |

|

Rajeev Gautam, 65 |

President and Chief Executive Officer Performance Materials and Technologies since April 2016. President of Honeywell UOP from January 2009 to April 2016. |

|

Mark R. James, 56 |

Senior Vice President Human Resources, Procurement and Communications since November 2007. |

|

Anne T. Madden, 53 |

Senior Vice President and General Counsel since October 2017. Vice President of Corporate Development and Global M&A from January 2002 to October 2017. |

|

Timothy O. Mahoney, 61 |

President and Chief Executive Officer Aerospace since September 2009. |

|

Gary S. Michel, 55 |

President and Chief Executive Officer Home and Building Technologies since October 2017. |

|

Krishna Mikkilineni, 58 |

Senior Vice President Engineering, Operations and Information Technology since April 2013. Senior Vice President Engineering and Operations from April 2010 to April 2013 and President Honeywell Technology Solutions from January 2009 to April 2013. |

|

Thomas A. Szlosek, 54 |

Senior Vice President and Chief Financial Officer since April 2014. Vice President of Corporate Finance from April 2013 to April 2014. Chief Financial Officer of Automation and Control Solutions from February 2007 to April 2013. |

|

John F. Waldron, 42 |

President and Chief Executive Officer, Safety and Productivity Solutions since July 2016. President of Sensing and Productivity Solutions from July 2015 to July 2016. President of Scanning and Mobility from April 2012 to July 2015. Vice President and General Manager of Americas Scanning and Mobility from January 2012 to April 2012.

|

(a) |

Also a Director. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Cautionary Statement About Forward-Looking Statements

We describe many of the trends and other factors that drive our business and future results in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and in other parts of this report (including this Item 1A). Such discussions contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements are those that address activities, events or developments that management intends, expects, projects, believes or anticipates will or may occur in the future. They

5

are based on management’s assumptions and assessments in light of past experience and trends, current economic and industry conditions, expected future developments and other relevant factors. They are not guarantees of future performance, and actual results, developments and business decisions may differ significantly from those envisaged by our forward-looking statements, including with respect to any changes in or abandonment of the proposed spin-offs. We do not undertake to update or revise any of our forward-looking statements. Our forward-looking statements are also subject to risks and uncertainties that can affect our performance in both the near-and long-term. These forward-looking statements should be considered in light of the information included in this Form 10-K, including, in particular, the factors discussed below. These factors may be revised or supplemented in subsequent reports on Forms 10-Q and 8-K.

Risk Factors

Our business, operating results, cash flows and financial condition are subject to the principal risks and uncertainties set forth below, any one of which could cause our actual results to vary materially from recent results or from our anticipated future results.

Macroeconomic and Industry Risks

Industry and economic conditions may adversely affect the markets and operating conditions of our customers, which in turn can affect demand for our products and services and our results of operations.

• |

Aerospace—Operating results of Aerospace are directly tied to cyclical industry and economic conditions, as well as changes in customer buying patterns of aftermarket parts, supplier stability, factory transitions and capacity constraints. The operating results of our Commercial Aviation business unit may be adversely affected by downturns in the global demand for air travel which impacts new aircraft production or the delay or cancellation of new aircraft orders, delays in launch schedules for new aircraft, the retirement of aircraft and global flying hours, which impact air transport, regional, business and general aviation aircraft utilization rates. Operating results could also be impacted by changes in overall trends related to end market demand for the product portfolio, as well as, new entrants and non-traditional players entering the market. Operating results in our Defense and Space business unit may be affected by the mix of U.S. and foreign government appropriations for defense and space programs and by compliance risks. Results may also be impacted by the potential introduction of counterfeit parts into our global supply chain. Operating results in our Transportation Systems business unit may be affected by the level of production and demand for automobiles and trucks equipped with turbochargers, regulatory changes regarding automobile and truck emissions and fuel economy, growing importance of automotive electrification, consumer demand and spending for automotive aftermarket products and delays in launch schedules for new automobile and truck platforms. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Home and Building Technologies—Operating results may be adversely impacted by downturns in the level of global residential and commercial construction activity (including retrofits and upgrades), lower capital spending and operating expenditures on building projects, less industrial plant expansion, changes in the competitive landscape including new market entrants and new technologies, and fluctuations in inventory levels in distribution channels. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Performance Materials and Technologies—Operating results may be adversely impacted by downturns in capacity utilization for chemical, industrial, refining, petrochemical and semiconductor plants, our customers’ availability of capital for refinery construction and expansion, raw material demand and supply volatility, product commoditization, and our ability to maximize our facilities’ production capacity and minimize downtime. In particular, the volatility in oil and natural gas prices have and will continue to impact our customers’ operating levels and capital spending and thus demand for our products and services. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Safety and Productivity Solutions—Operating results may be adversely impacted by downturns in the level of global capital spending and operating expenditures, including in the |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

6

|

oil and gas industry, reduced investments in process automation, safety monitoring, and plant capacity utilization initiatives, fluctuations in retail markets, lower customer demand due to the failure to anticipate and respond to overall trends related to end market demand, changes in the competitive landscape including new market entrants and technology that may lead to product commoditization, and adverse industry economic conditions, all of which could result in lower market share, reduced selling prices and lower margins. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

An increasing percentage of our sales and operations is in non-U.S. jurisdictions and is subject to the economic, political, regulatory, foreign exchange and other risks of international operations.

Our international operations, including U.S. exports, represent more than half of the Company’s sales. Risks related to international operations include exchange control regulations, wage and price controls, antitrust regulations, employment regulations, foreign investment laws, import, export and other trade restrictions (such as sanctions and embargoes), violations by our employees of anti-corruption laws (despite our efforts to mitigate these risks), changes in regulations regarding transactions with state-owned enterprises, nationalization of private enterprises, acts of terrorism, and our ability to hire and maintain qualified staff and maintain the safety of our employees in these regions. Instability and uncertainties arising from the global geopolitical environment, including the United Kingdom referendum in favor of exiting the European Union and the evolving international and domestic political, regulatory and economic landscape, the potential for changes in global trade policies including sanctions and trade barriers, trends such as populism, economic nationalism and negative sentiment toward multinational companies, and the cost of compliance with increasingly complex and often conflicting regulations worldwide can impair our flexibility in modifying product, marketing, pricing or other strategies for growing our businesses, as well as our ability to improve productivity and maintain acceptable operating margins.

Operating outside of the United States also exposes us to foreign exchange risk, which we monitor and seek to reduce through hedging activities. However, foreign exchange hedging activities bear a financial cost and may not always be available to us or be successful in eliminating such volatility. Finally, we generate significant amounts of cash outside of the United States that is invested with financial and non-financial counterparties. While we employ comprehensive controls regarding global cash management to guard against cash or investment loss and to ensure our ability to fund our operations and commitments, a material disruption to the counterparties with whom we transact business could expose Honeywell to financial loss.

Risks related to our defined benefit pension plans may adversely impact our results of operations and cash flow.

Significant changes in actual investment return on pension assets, discount rates, and other factors could adversely affect our results of operations and require cash pension contributions in future periods. Changes in discount rates and actual asset returns different than our anticipated asset returns can result in significant non-cash actuarial gains or losses which we record in the fourth quarter of each fiscal year, and, if applicable, in any quarter in which an interim re-measurement is triggered. With regard to cash pension contributions, funding requirements for our pension plans are largely dependent upon interest rates, actual investment returns on pension assets and the impact of legislative or regulatory changes related to pension funding obligations.

Operational Risks

Raw material price fluctuations, the ability of key suppliers to meet quality and delivery requirements, or catastrophic events can increase the cost of our products and services, impact our ability to meet commitments to customers and cause us to incur significant liabilities.

The cost of raw materials is a key element in the cost of our products, particularly in Performance Materials and Technologies (R240, fluorspar, copper, ethylene and perchloroethylene) and in

7

Aerospace (nickel, steel, titanium and other metals). Our inability to offset material price inflation through increased prices to customers, formula or long-term fixed price contracts with suppliers, productivity actions or through commodity hedges could adversely affect our results of operations.

Many major components, product equipment items and raw materials, particularly in Aerospace, are procured or subcontracted on a single or sole-source basis. Although we maintain a qualification and performance surveillance process and we believe that sources of supply for raw materials and components are generally adequate, it is difficult to predict what effects shortages or price increases may have in the future. Our ability to manage inventory and meet delivery requirements may be constrained by our suppliers’ inability to scale production and adjust delivery of long-lead time products during times of volatile demand. Our inability to fill our supply needs would jeopardize our ability to fulfill obligations under commercial and government contracts, which could, in turn, result in reduced sales and profits, contract penalties or terminations, and damage to customer relationships.

We may be unable to successfully execute or effectively integrate acquisitions, and divestitures may not occur as planned.

We regularly review our portfolio of businesses and pursue growth through acquisitions and seek to divest non-core businesses. We may not be able to complete transactions on favorable terms, on a timely basis, or at all, and during integration we may discover cybersecurity and compliance issues. In addition, our results of operations and cash flows may be adversely impacted by (i) the failure of acquired businesses to meet or exceed expected returns, including risk of impairment; (ii) the failure to integrate multiple acquired businesses into Honeywell simultaneously and on schedule and/or to achieve expected synergies; (iii) the inability to dispose of non-core assets and businesses on satisfactory terms and conditions; and (iv) the discovery of unanticipated liabilities, labor relations difficulties or other problems in acquired businesses for which we lack contractual protections, insurance or indemnities, or with regard to divested businesses, claims by purchasers to whom we have provided contractual indemnification.

The proposed spin-offs of our Homes and Global Distribution business and of our Transportation Systems business into two stand-alone, publicly-traded companies are each contingent upon the satisfaction of a number of conditions, may not be completed on the currently contemplated timeline, or at all, and may not achieve the intended benefits.

On October 10, 2017, the Company announced its intention to separately spin-off our Homes and Global Distribution business, which is part of our Home and Building Technologies segment, and our Transportation Systems business, which is part of our Aerospace segment, into two stand-alone, publicly-traded companies. Completion of each proposed spin-off is subject to readiness of each spin-off to operate as an independent public company, finalization of the financial statements of the spun-off business, assurance that the separation will be tax-free to our shareowners for U.S. federal income tax purposes, finalization of the capital structure of the three corporations, the effectiveness of appropriate filings with the U.S. Securities and Exchange Commission, final approval of the Board of Directors, and other customary matters. Each proposed spin-off is complex in nature, and may be affected by unanticipated developments, credit and equity markets, or changes in market conditions. These or other unanticipated developments could delay or prevent the proposed spin-offs or cause the proposed spin-offs to occur on terms or conditions that are less favorable than anticipated, including without limitation, the failure to qualify as tax-free to our shareowners, and the inability of the two spun-off companies to incur sufficient indebtedness to allow for a distribution to Honeywell of proceeds concurrently with the consummation of the spin-offs or to make ongoing cash contributions towards the satisfaction of certain of our legacy asbestos and environmental remediation liabilities. Furthermore, if the spin-offs are completed, we cannot assure you that each will be successful in meeting its objectives. There is the potential for business disruption and significant separation costs. Any of these factors could have a material adverse effect on our business, financial condition, results of operations, cash flows and/or the price of our common stock.

8

Our future growth is largely dependent upon our ability to develop new technologies and introduce new products that achieve market acceptance in increasingly competitive markets with acceptable margins.

Our future growth rate depends upon a number of factors, including our ability to (i) identify and evolve with emerging technological and broader industry trends in our target end-markets, (ii) develop and maintain competitive products, (iii) defend our market share against an ever-expanding number of competitors including many new and non-traditional competitors, (iv) enhance our products by adding innovative features that differentiate our products from those of our competitors and prevent commoditization of our products, (v) develop, manufacture and bring compelling new products to market quickly and cost-effectively, (vi) monitor disruptive technologies and business models, (vii) achieve sufficient return on investment for new products introduced based on capital expenditures and research and development spending, (viii) respond to changes in overall trends related to end market demand, and (x) attract, develop and retain individuals with the requisite technical expertise and understanding of customers’ needs to develop new technologies and introduce new products.

The failure of our technologies or products to gain market acceptance due to more attractive offerings by our competitors could significantly reduce our revenues and adversely affect our competitive standing and prospects.

Failure to increase productivity through sustainable operational improvements, as well as an inability to successfully execute repositioning projects or to effectively manage our workforce, may reduce our profitability or adversely impact our businesses.

Our profitability and margin growth are dependent upon our ability to drive sustainable improvements. In addition, we seek productivity and cost savings benefits through repositioning actions and projects, such as consolidation of manufacturing facilities, transitions to cost-competitive regions and product line rationalizations. Risks associated with these actions include delays in execution of the planned initiatives, additional unexpected costs, realization of fewer than estimated productivity improvements and adverse effects on employee morale. We may not realize the full operational or financial benefits we expect, the recognition of these benefits may be delayed and these actions may potentially disrupt our operations. In addition, organizational changes, attrition, labor relations difficulties, or workforce stoppage could have a material adverse effect on our business, reputation, financial position and results of operations.

As a supplier to the U.S. Government, we are subject to unique risks, such as the right of the U.S. Government to terminate contracts for convenience and to conduct audits and investigations of our operations and performance.

U.S. Government contracts are subject to termination by the government, either for the convenience of the government or for our failure to perform consistent with the terms of the applicable contract. Our contracts with the U.S. Government are also subject to government audits that may recommend downward price adjustments and other changes. When appropriate and prudent, we have made adjustments and paid voluntary refunds in the past and may do so in the future.

We are also subject to government investigations of business practices and compliance with government procurement regulations. If, as a result of any such investigation or other government investigations (including investigation of violations of certain environmental, employment or export laws), Honeywell or one of its businesses were found to have violated applicable law, then it could be suspended from bidding on or receiving awards of new government contracts, suspended from contract performance pending the completion of legal proceedings and/or have its export privileges suspended.

Our operations and the prior operations of predecessor companies expose us to the risk of material environmental liabilities.

Mainly because of past operations and operations of predecessor companies, we are subject to potentially material liabilities related to the remediation of environmental hazards and to claims of

9

personal injuries or property damages that may be caused by hazardous substance releases and exposures. We continue to incur remedial response and voluntary clean-up costs for site contamination and are a party to lawsuits and claims associated with environmental and safety matters, including past production of products containing hazardous substances. Additional lawsuits, claims and costs involving environmental matters are likely to continue to arise in the future. Various federal, state, local and foreign governments regulate the discharge of materials into the environment and can impose substantial fines and criminal sanctions for violations, and require installation of costly equipment or operational changes to limit emissions and/or decrease the likelihood of accidental hazardous substance releases. In addition, changes in laws, regulations and enforcement of policies, the discovery of previously unknown contamination or new technology or information related to individual sites, the establishment of stricter state or federal toxicity standards with respect to certain contaminants, or the imposition of new clean-up requirements or remedial techniques could require us to incur additional costs in the future that would have a negative effect on our financial condition or results of operations.

Cybersecurity incidents could disrupt business operations, result in the loss of critical and confidential information, and adversely impact our reputation and results of operations.

Global cybersecurity threats and incidents can range from uncoordinated individual attempts to gain unauthorized access to information technology (IT) systems to sophisticated and targeted measures known as advanced persistent threats, directed at the Company, its products, its customers and/or its third party service providers, including cloud providers. Our customers, including the U.S. government, are increasingly requiring cybersecurity protections and mandating cybersecurity standards in our products, and we may incur additional costs to comply with such demands. While we have experienced, and expect to continue to experience, these types of threats and incidents, none of them to date have been material to the Company. We seek to deploy comprehensive measures to deter, prevent, detect, respond to and mitigate these threats, including identity and access controls, data protection, vulnerability assessments, product software designs which we believe are less susceptible to cyber attacks, continuous monitoring of our IT networks and systems and maintenance of backup and protective systems. Despite these efforts, cybersecurity incidents, depending on their nature and scope, could potentially result in the misappropriation, destruction, corruption or unavailability of critical data and confidential or proprietary information (our own or that of third parties) and the disruption of business operations. Cybersecurity incidents aimed at the software imbedded in our products could lead to third party claims that our product failures have caused a similar range of damages to our customers, and this risk is enhanced by the increasingly connected nature of our products. The potential consequences of a material cybersecurity incident include financial loss, reputational damage, litigation with third parties, theft of intellectual property, fines levied by the Federal Trade Commission, diminution in the value of our investment in research, development and engineering, and increased cybersecurity protection and remediation costs due to the increasing sophistication and proliferation of threats, which in turn could adversely affect our competitiveness and results of operations.

Data privacy, identity protection, and information security may require significant resources and presents certain risks.

We collect, store, have access to and otherwise process certain confidential or sensitive data, including proprietary business information, personal data and other information that is subject to privacy and security laws, regulations and/or customer-imposed controls. Despite our efforts to protect such data, we may be vulnerable to material security breaches, theft, misplaced or lost data, programming errors, or employee errors that could potentially lead to the compromising of such data, improper use of our systems, software solutions or networks, unauthorized access, use, disclosure, modification or destruction of information, defective products, production downtimes and operational disruptions. In addition, we operate in an environment in which there are different and potentially conflicting data privacy laws in effect in the various U.S. states and foreign jurisdictions in which we operate and we must understand and comply with each law and standard in each of these jurisdictions while ensuring the data is secure. Government enforcement actions can be costly and interrupt the

10

regular operation of our business, and violations of data privacy laws can result in fines, reputational damage and civil lawsuits, any of which may adversely affect our business, reputation and financial statements.

A material disruption of our operations, particularly at our manufacturing facilities or within our information technology infrastructure, could adversely affect our business.

Our facilities, supply chains, distribution systems and information technology systems are subject to catastrophic loss due to natural disasters including hurricanes and floods, power outages, fires, explosions, terrorism, equipment failures, sabotage, adverse weather conditions, public health crises, labor disputes, critical supply failure, inaccurate downtime forecast, political disruption, and other reasons, which can result in undesirable consequences, including financial losses and damaged relationships with customers. We employ information technology systems and networks to support the business and rely on them to process, transmit and store electronic information, and to manage or support a variety of business processes and activities. Disruptions to our information technology infrastructure from system failures, shutdowns, power outages, telecommunication or utility failures, and other events, including disruptions at our cloud computing, server, systems and other third party IT service providers, could interfere with our operations, interrupt production and shipments, damage customer and business partner relationships, and negatively impact our reputation.

Legal and Regulatory Risks

Our U.S. and non-U.S. tax liabilities are dependent, in part, upon the distribution of income among various jurisdictions in which we operate.

Our future results of operations could be adversely affected by changes in the effective tax rate as a result of a change in the mix of earnings in countries with differing statutory tax rates, changes in tax laws, regulations and judicial rulings (or changes in the interpretation thereof), changes in generally accepted accounting principles, changes in the valuation of deferred tax assets and liabilities, changes in the amount of earnings permanently reinvested offshore, the results of audits and examinations of previously filed tax returns and continuing assessments of our tax exposures and various other governmental enforcement initiatives. Our tax expense includes estimates of tax reserves and reflects other estimates and assumptions, including assessments of future earnings of the Company which could impact the valuation of our deferred tax assets. Changes in tax laws or regulations, including further regulatory developments arising from U.S. tax reform legislation as well as multi-jurisdictional changes enacted in response to the action items provided by the Organization for Economic Co-operation and Development (OECD), will increase tax uncertainty and impact our provision for income taxes.

Changes in legislation or government regulations or policies can have a significant impact on our results of operations.

The sales and margins of each of our segments are directly impacted by government regulations including safety, performance and product certification regulations. Within Aerospace, the operating results of Commercial Original Equipment and Commercial Aftermarket may be impacted by, among other things, mandates of the Federal Aviation Administration and other similar international regulatory bodies requiring the installation of equipment on aircraft. Our Defense and Space business unit may be affected by changes in government procurement regulations, while emissions, fuel economy and energy efficiency standards for motor vehicles can impact Transportation Systems. Within Home and Building Technologies, the demand for and cost of providing products, services and solutions can be impacted by fire, security, safety, health care, environmental and energy efficiency standards and regulations. Performance Materials and Technologies’ results of operations can be impacted by environmental standards, regulations, and judicial determinations. Growth in all our businesses within emerging markets may be adversely impacted by the inability to acquire and retain qualified employees where local employment law mandates may be restrictive. Noncompliance with legislation and regulations can result in fines and penalties.

11

We cannot predict with certainty the outcome of litigation matters, government proceedings and other contingencies and uncertainties.

We are subject to a number of lawsuits, investigations and disputes (some of which involve substantial amounts claimed) arising out of the conduct of our business, including matters relating to commercial transactions, government contracts, product liability (including asbestos), prior acquisitions and divestitures, employment, employee benefits plans, intellectual property, antitrust, import and export, and environmental, health and safety matters. Our potential liabilities are subject to change over time due to new developments, changes in settlement strategy or the impact of evidentiary requirements, and we may become subject to or be required to pay damage awards or settlements that could have a material adverse effect on our results of operations, cash flows and financial condition. While we maintain insurance for certain risks, the amount of our insurance coverage may not be adequate to cover the total amount of all insured claims and liabilities. The incurrence of significant liabilities for which there is no or insufficient insurance coverage could adversely affect our results of operations, cash flows, liquidity and financial condition.

12

Item 1B. Unresolved Staff Comments

None

We have approximately 1,287 locations, of which 296 are manufacturing sites. Our properties and equipment are in good operating condition and are adequate for our present needs. We do not anticipate difficulty in renewing existing leases as they expire or in finding alternative facilities.

We are subject to a number of lawsuits, investigations and claims (some of which involve substantial amounts) arising out of the conduct of our business. See a discussion of environmental, asbestos and other litigation matters in Note 19 Commitments and Contingencies of Notes to Consolidated Financial Statements.

Item 4. Mine Safety Disclosures

Not applicable.

13

Part II.

Honeywell’s common stock is listed on the New York Stock Exchange. Market and dividend information for Honeywell’s common stock is included in Note 24 Unaudited Quarterly Financial Information of Notes to Consolidated Financial Statements.

The number of record holders of our common stock at December 31, 2017 was 47,678.

Information regarding securities authorized for issuance under equity compensation plans is included in Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters under the caption “Equity Compensation Plans.”

Honeywell purchased 10,300,000 shares of its common stock, par value $1 per share, in the quarter ending December 31, 2017. In December 2017, the Board of Directors authorized the repurchase of up to a total of $8 billion of Honeywell common stock, which included amounts remaining under and replaced the previously approved share repurchase program. $7.7 billion remained available as of as of December 31, 2017 for additional share repurchases. Honeywell presently expects to repurchase outstanding shares from time to time to generally offset the dilutive impact of employee stock based compensation plans, including option exercises, restricted unit vesting and matching contributions under our savings plans. Additionally, we seek to reduce share count via share repurchases as and when attractive opportunities arise. The amount and timing of future repurchases may vary depending on market conditions and the level of our operating, financing and other investing activities.

The following table summarizes Honeywell’s purchase of its common stock for the three months ended December 31, 2017:

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Issuer Purchases of Equity Securities |

||||||||||||||||||||||||||||

|

Period |

Total |

Average |

Total Number |

Approximate Dollar |

||||||||||||||||||||||||

|

October 2017 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

||||||||||||||||

|

November 2017 |

|

|

4,200,000 |

|

|

$ |

|

146.89 |

|

|

4,200,000 |

|

|

$ |

|

2,125 |

||||||||||||

|

December 2017 |

|

|

6,100,000 |

|

|

$ |

|

153.54 |

|

|

6,100,000 |

|

|

$ |

|

7,737 |

||||||||||||

14

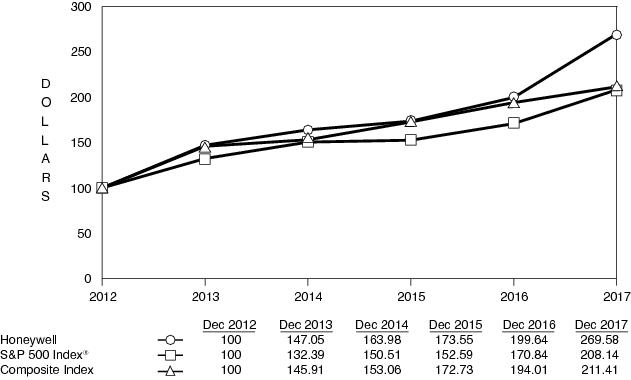

Performance Graph

The following graph compares the five-year cumulative total return on our common stock to the total returns on the Standard & Poor’s (S&P) 500 Stock Index and a composite of S&P’s Industrial Conglomerates and Aerospace and Defense indices, on a 65%/35% weighted basis (the Composite Index). The weighting of the components of the Composite Index are based on our segments’ relative contribution to total segment profit. The selection of the Industrial Conglomerates component of the Composite Index reflects the diverse and distinct range of non-aerospace businesses conducted by Honeywell. The annual changes for the five-year period shown in the graph are based on the assumption that $100 had been invested in Honeywell stock and each index on December 31, 2012 and that all dividends were reinvested.

COMPARISON OF CUMULATIVE FIVE YEAR TOTAL RETURN

15

HONEYWELL INTERNATIONAL INC.

This selected financial data should be read in conjunction with Honeywell’s Consolidated Financial Statements and related Notes included elsewhere in this Annual Report as well as the section of this Annual Report titled Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Item 6. Selected Financial Data

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

Years Ended December 31, |

||||||||||||||||||||||||||||||||||

2017(1) |

2016 |

2015 |

2014 |

2013 |

|||||||||||||||||||||||||||||||

|

|

(Dollars in millions, except per share amounts) |

||||||||||||||||||||||||||||||||||

|

Results of Operations |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Net sales |

|

|

$ |

|

40,534 |

|

|

$ |

|

39,302 |

|

|

$ |

|

38,581 |

|

|

$ |

|

40,306 |

|

|

$ |

|

39,055 |

||||||||||

|

Net income attributable to Honeywell |

|

|

1,655 |

|

|

4,809 |

|

|

4,768 |

|

|

4,239 |

|

|

3,924 |

||||||||||||||||||||

|

Earnings Per Common Share |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Earnings from continuing operations: |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Basic |

|

|

2.17 |

|

|

6.29 |

|

|

6.11 |

|

|

5.40 |

|

|

4.99 |

||||||||||||||||||||

|

Assuming dilution |

|

|

2.14 |

|

|

6.20 |

|

|

6.04 |

|

|

5.33 |

|

|

4.92 |

||||||||||||||||||||

|

Dividends per share |

|

|

2.74 |

|

|

2.45 |

|

|

2.15 |

|

|

1.87 |

|

|

1.68 |

||||||||||||||||||||

|

Financial Position at Year-End |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Property, plant and equipment-net |

|

|

5,926 |

|

|

5,793 |

|

|

5,789 |

|

|

5,383 |

|

|

5,278 |

||||||||||||||||||||

|

Total assets |

|

|

59,387 |

|

|

54,146 |

|

|

49,316 |

|

|

45,451 |

|

|

45,435 |

||||||||||||||||||||

|

Short-term debt |

|

|

5,309 |

|

|

3,593 |

|

|

6,514 |

|

|

2,637 |

|

|

2,028 |

||||||||||||||||||||

|

Long-term debt |

|

|

12,573 |

|

|

12,182 |

|

|

5,554 |

|

|

6,046 |

|

|

6,801 |

||||||||||||||||||||

|

Total debt |

|

|

17,882 |

|

|

15,775 |

|

|

12,068 |

|

|

8,683 |

|

|

8,829 |

||||||||||||||||||||

|

Redeemable noncontrolling interest |

|

|

5 |

|

|

3 |

|

|

290 |

|

|

219 |

|

|

167 |

||||||||||||||||||||

|

Shareowners’ equity |

|

|

17,439 |

|

|

19,547 |

|

|

18,418 |

|

|

17,784 |

|

|

17,579 |

||||||||||||||||||||

(1) |

2017 Net Income attributable to Honeywell and Earnings Per Common Share were impacted by the Tax Cuts and Jobs Act; see Note 5 Income Taxes of Notes to Consolidated Financial Statements for further details. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

16

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

(Dollars in millions, except per share amounts)

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations is intended to help the reader understand the results of operations and financial condition of Honeywell International Inc. and its consolidated subsidiaries (“Honeywell” or “the Company”) for the three years ended December 31, 2017. All references to Notes relate to Notes to Consolidated Financial Statements in Item 8. Financial Statements and Supplementary Data.

In October 2017, the Company announced the results of a comprehensive portfolio review which included the announcement of our intent to spin-off our Homes and Global Distribution business, as well as our Transportation Systems business, into two stand-alone, publicly traded companies.

Effective October 2017, we realigned the Smart Energy business, previously part of the Home and Building Technologies segment, into the Process Solutions business within the Performance Materials and Technologies segment. Effective July 2016, the Company realigned the business units comprising its Automation and Control Solutions segment by forming two new segments: Home and Building Technologies and Safety and Productivity Solutions. These realignments have no impact on the Company’s historical consolidated financial position, results of operations or cash flows. Prior period amounts have been reclassified to conform to current period segment presentation.

On October 1, 2016, the Company completed the tax-free spin-off of its Resins and Chemicals business, part of Performance Materials and Technologies, into a standalone, publicly-traded company (named AdvanSix Inc. (“AdvanSix”)) to Honeywell shareowners. The assets and liabilities associated with AdvanSix have been removed from the Company’s Consolidated Balance Sheet as of the effective date of the spin-off. The results of operations for AdvanSix are included in the Consolidated Statement of Operations through the effective date of the spin-off.

On September 16, 2016, the Company completed the sale of the Aerospace government services business, Honeywell Technology Solutions Inc (“HTSI” or “government services business”). The assets and liabilities associated with HTSI have been removed from the Company’s Consolidated Balance Sheet as of the effective date of the sale. The results of operations for HTSI are included in the Consolidated Statement of Operations through the effective date of the sale.

EXECUTIVE SUMMARY

During 2017, Honeywell continued to successfully deliver on its financial commitments while still creating long-term value for our shareowners. We grew net sales 3% to $40,534 million and grew income before taxes 7% to $6,902 million. The improvement in year over year income before taxes was attributable to both organic sales growth as well as operational improvements that increased operating margins. We believe our ability to consistently grow earnings derives from the consistent, rigorous deployment of the Honeywell Operating System as well as a long history of identifying and investing in productivity initiatives. We have made concerted efforts to revitalize our commercial excellence processes, such as Velocity Product Development (“VPD”), which enables higher organic revenue at better margins.

We are careful to not allow the attainment of short-term financial results imperil the creation of long-term, sustainable shareowner value. Hence, as part of the announcement in October 2017 of the results of our portfolio review, we affirmed our commitment to a strategy and investments that are intended to enable us to become one of the world’s leading software industrial companies. Our refocused strategy and investments are intended to take better advantage of our core technological and software strengths in high growth businesses that participate in six attractive industrial end markets. Each of these end markets is characterized by favorable global mega-trends including energy efficiency, infrastructure investment, urbanization and safety.

17

In 2017 we deployed capital of over $6 billion, including the following:

• |

Share Repurchases—we continue to repurchase our shares with the goal of keeping share count flat by offsetting the dilutive impact of employee stock based compensation and savings plans. Additionally, we seek to reduce share count via share repurchases as and when attractive opportunities arise. In 2017, we repurchased 20.5 million shares for $2.9 billion. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Dividend—In 2017, we paid cash dividends of $2.1 billion and increased our annual dividend rate by 12%, as we seek to continue to grow the dividend faster than earnings. Since 2010, we have increased the dividend rate by 10% or more eight times. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Capital Investment in Facilities—we invested over $1 billion in capital expenditures focused on high return projects. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CONSOLIDATED RESULTS OF OPERATIONS

Net Sales

|

|

|

|

|

|

|

|||||||||||||||

|

|

2017 |

2016 |

2015 |

||||||||||||||||||

|

Net sales |

|

|

$ |

|

40,534 |

|

|

$ |

|

39,302 |

|

|

$ |

|

38,581 |

||||||

|

% change compared with prior period |

|

|

3 |

% |

|

|

|

2 |

% |

|

|

|

|||||||||

The change in net sales is attributable to the following:

|

|

|

|

|

||||||||||

|

|

2017 |

2016 |

||||||||||||

|

Volume |

|

|

3% |

|

|

(2)% |

||||||||

|

Price |

|

|

1% |

|

|

— |

||||||||

|

Acquisitions/Divestitures |

|

|

(1)% |

|

|

5% |

||||||||

|

Foreign Currency Translation |

|

|

— |

|

|

(1)% |

||||||||

|

|

|

|

|

|

||||||||||

|

|

3% |

|

|

2% |

|||||||||

|

|

|

|

|

|

||||||||||

A discussion of net sales by segment can be found in the Review of Business Segments section of this MD&A.

The foreign currency translation impact in 2017 compared with 2016 was flat. The strengthening of the Euro was offset by the weakening of the British Pound against the U.S. Dollar.

The foreign currency translation impact in 2016 compared with 2015 is principally driven by the weakening of the British Pound, Chinese Renminbi and Canadian Dollar, partially offset by the strengthening of the Japanese Yen against the U.S. Dollar.

Cost of Products and Services Sold

|

|

|

|

|

|

|

|||||||||||||||

|

|

2017 |

2016 |

2015 |

||||||||||||||||||

|

Cost of products and services sold |

|

|

$ |

|

27,575 |

|

|

$ |

|

27,150 |

|

|

$ |

|

26,747 |

||||||

|

% change compared with prior period |

|

|

2 |

% |

|

|

|

2 |

% |

|

|

|

|||||||||

|

Gross Margin percentage |

|

|

32.0 |

% |

|

|

|

30.9 |

% |

|

|

|

30.7 |

% |

|

||||||

Cost of products and services sold increased in 2017 compared with 2016 principally due to increased direct material costs of approximately $290 million (driven by higher sales volume and acquisitions partially offset by divestitures and productivity, net of inflation), higher repositioning and other charges of approximately $260 million and higher depreciation and amortization of approximately $90 million, partially offset by higher pension and other postretirement benefits income, and lower pension mark-to-market expense, allocated to cost of products and services sold of approximately $110 million, and decreased indirect material costs of approximately $70 million.

Gross margin percentage increased in 2017 compared with 2016 principally due to higher gross margin in Aerospace and Performance Materials and Technologies (approximately 1.7 percentage point impact collectively) and higher pension and other postretirement benefits income and lower pension market to market expense allocated to cost of products and services sold (approximately 0.3 percentage point impact), partially offset by higher repositioning and other charges (approximately

18

0.6 percentage point impact) and by lower gross margin in Home and Building Solutions and Safety and Productivity Solutions (approximately 0.3 percentage point impact collectively).

Cost of products and services sold increased in 2016 compared with 2015 principally due to increased direct material costs of approximately $380 million (driven primarily by acquisitions, net of divestitures, partially offset by the favorable impact of productivity, net of inflation, and foreign currency translation), higher depreciation and amortization attributable to acquisitions of approximately $135 million and increased pension mark-to-market expense allocated to cost of products and services sold of $70 million, partially offset by higher pension and other postretirement benefits income allocated to cost of products and services sold of $200 million.

Gross margin percentage increased in 2016 compared with 2015 principally due to higher gross margin in Performance Materials and Technologies (approximately 0.2 percentage point impact) and higher pension and other postretirement benefits income allocated to cost of products and services sold (approximately 0.5 percentage point impact), partially offset by lower gross margin in Aerospace, Home and Building Technologies and Safety and Productivity Solutions an (approximately 0.3 percentage point impact collectively) and increased pension mark-to-market expense allocated to cost of products and services sold (approximately 0.2 percentage point impact).

Selling, General and Administrative Expenses

|

|

|

|

|

|

|

|||||||||||||||

|

|

2017 |

2016 |

2015 |

||||||||||||||||||

|

Selling, general and administrative expense |

|

|

$ |

|

5,808 |

|

|

$ |

|

5,469 |

|

|

$ |

|

5,006 |

||||||

|

% of sales |

|

|

14.3 |

% |

|

|

|

13.9 |

% |

|

|

|

13.0 |

% |

|

||||||

Selling, general and administrative expenses (SG&A) increased in 2017 compared with 2016 primarily due to increased labor costs (driven primarily by acquisitions, net of divestitures, investment for growth and merit increases), and higher repositioning charges, partially offset by decreased pension mark-to-market expense allocated to SG&A.

SG&A increased in 2016 compared with 2015 primarily due to increased labor costs (driven primarily by acquisitions, net of divestitures, investment for growth and merit increases), increased pension mark-to-market expense allocated to SG&A and higher repositioning charges, partially offset by the favorable impact from foreign currency translation and increased pension income allocated to SG&A.

Tax Expense

|

|

|

|

|

|

|

|||||||||||||||

|

|

2017 |

2016 |

2015 |

||||||||||||||||||

|

Tax expense |

|

|

$ |

|

5,204 |

|

|

$ |

|

1,601 |

|

|

$ |

|

1,739 |

||||||

|

Effective tax rate |

|

|

75.4 |

% |

|

|

|

24.8 |

% |

|

|

|

26.4 |

% |

|

||||||

On December 22, 2017, the U.S. enacted the Tax Cuts and Jobs Act (“Tax Act”) that instituted fundamental changes to the U.S. tax system. The Tax Act includes changes to the taxation of foreign earnings by implementing a dividend exemption system, expansion of the current anti-deferral rules, a minimum tax on low-taxed foreign earnings and new measures to deter base erosion. The Tax Act also permanently reduces the corporate tax rate from 35% to 21%, imposes a one-time mandatory transition tax on the historical earnings of foreign affiliates and implements a territorial style tax system. The impacts of these changes are reflected in the 2017 tax expense which resulted in a provisional charge of approximately $3.8 billion, which is subject to adjustment given the provisional nature of the charge. This resulted in an effective tax rate higher than the statutory rate in 2017.

The effective tax rates for 2016 and 2015 were lower than the U.S. statutory rate of 35% primarily due to lower tax rates on non-U.S. earnings.

The Company currently expects the effective tax rate for 2018 to be in the range of 22.0% and 23.0%. The effective tax rate may vary from quarter to quarter due to unusual or infrequently occurring items, the resolution of income tax audits, changes in tax laws, the tax impact from employee share-based payments, taxes incurred in connection to the territorial style tax system, or other items such as pension mark-to-market adjustments.

19

For further discussion of changes in the effective tax rate, see Note 5 Income Taxes of Notes to Consolidated Financial Statements.

Net Income Attributable to Honeywell

|

|

|

|

|

|

|

|||||||||||||||

|

|

2017 |

2016 |

2015 |

||||||||||||||||||

|

Net income attributable to Honeywell |

|

|

$ |

|

1,655 |

|

|

$ |

|

4,809 |

|

|

$ |

|

4,768 |

||||||

|

Earnings per share of common stock–assuming dilution |

|

|

$ |

|

2.14 |

|

|

$ |

|

6.20 |

|

|

$ |

|

6.04 |

||||||

Earnings per share of common stock–assuming dilution decreased in 2017 compared with 2016 primarily driven by additional income tax expense from the Tax Act, higher repositioning and other charges, partially offset by higher segment profit across all segments, lower pension mark-to-market expense and increased pension and other postretirement income.

Earnings per share of common stock–assuming dilution increased in 2016 compared with 2015 primarily driven by increased pension and other postretirement income, higher segment profit in Home and Building Technologies and Performance Materials and Technologies, the gain related to the Honeywell Technology Solutions, Inc. divestiture, a decrease in the weighted average shares outstanding and the tax benefit from adoption of the Financial Accounting Standards Board’s (FASB) accounting standard related to employee share-based payment accounting, partially offset by lower segment profit in Aerospace and Safety and Productivity Solutions, increased pension mark-to-market expense and higher repositioning and other charges.

BUSINESS OVERVIEW

Our consolidated results are principally impacted by:

• |