U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Year Ended December 31, 2013

Commission File Number: 000-14319

STANDARD METALS PROCESSING, INC.

(Exact Name of Small Business Issuer as Specified in its Charter)

Standard Gold Holdings, Inc.

(Former Company Name)

| Nevada | 84-0991764 |

| (State or Other Jurisdiction of | (I.R.S. Employer Identification Number) |

| Incorporation or Organization) |

611 Walnut Street, Gadsden, Alabama 35901

(Address of Principal Executive Offices)

Issuer’s telephone number including area code: (888) 960-7347

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

COMMON STOCK, $0.001 PAR VALUE

Title of Class

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x ..

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ¨ No x

The Registrant’s revenues for its most recent fiscal year: None.

As of March 31, 2014, the Registrant’s non-affiliates owned shares of its common stock having an aggregate market value of approximately $83,029,542.80 (based upon the closing sales price of the Registrant’s common stock on that date on the OTCQB).

On March 31, 2014 there were 95,572,216 shares of common stock issued and outstanding, which is the Registrant’s only class of voting stock.

Documents Incorporated by Reference: None.

STANDARD METALS PROCESSING, INC.

Annual Report on Form 10-K

For the Year Ended December 31, 2013

Table of Contents

| Page | ||

| PART I | ||

| Item 1. | Description of Business | 3 |

| Item 1A. | Risk Factors | 8 |

| Item 2. | Description of Properties | 11 |

| Item 3. | Legal Proceedings | 11 |

| Item 4. | Mine Safety Disclosures | 12 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | 12 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 13 |

| Item 8. | Consolidated Financial Statements and Supplementary Data | 16 |

| Item 9. | Changes and Disagreements with Accountants on Accounting and Financial Disclosure | 17 |

| Item 9A. | Controls and Procedures | 17 |

| Item 9B. | Other Information | 18 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 18 |

| Item 11. | Executive Compensation | 21 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | 23 |

| Item 13. | Certain Relationships, Related Transactions and Director Independence | 25 |

| Item 14. | Principal Accountant Fees and Services | 25 |

| Item 15. | Exhibits and Financial Statement Schedules | 26 |

| 30 |

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains both historical statements and statements that are forward-looking in nature. Historical statements are based on events that have already happened. Certain of these historical events provide some basis to our management, with which assumptions are made relating to events that are reasonably expected to happen in the future. Management also relies on information and assumptions provided by certain third party operators of our projects as well as assumptions made with the information currently available to predict future events. These future event predictions, or forward-looking statements, include (but are not limited to) statements related to the uncertainty of the quantity or quality of ore or tailings grades, the fluctuations in the market price of such reserves, as well as gold, silver and other precious minerals, general trends in our operations or financial results, plans, expectations, estimates and beliefs. You can identify forward-looking statements by terminology such as “may,” “could,” “should,” “anticipate,” “believe,” “estimate,” “continue,” “expect,” “intend,” “plan,” “predict,” “potential” and similar expressions and their variants. These forward-looking statements reflect our judgment as of the date of this Annual Report with respect to future events, the outcome of which is subject to risks, which may have a significant impact on our business, operating results and/or financial condition. Readers are cautioned that these forward-looking statements are inherently uncertain. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results or outcomes may vary materially from those described herein. We undertake no obligation to update forward-looking statements. The risks identified in Item 1A, among others, may impact forward-looking statements contained in this Annual Report.

ITEM 1. DESCRIPTION OF BUSINESS

BUSINESS OVERVIEW

Standard Metals Processing, Inc. (“we,” “us,” “our,” “Standard Metals” or the “Company”) is an exploration stage company having offices in Gadsden, Alabama, New York, New York and through its subsidiary, a property in Tonopah, Nevada. Our business plan is to purchase equipment and build a facility on our Tonopah property to serve as a permitted custom processing toll milling facility (which includes an analytical lab, pyrometallugircal plant, and hydrometallurgical recovery plant).

The Company will perform permitted custom processing toll milling which is a process whereby mined material is crushed and ground into fine particles to ease the extraction of any precious minerals contained therein, such as minerals in the gold, silver and platinum metal groups. Custom milling and refining can include many different processes that are designed specifically for each ore load and to maximize the extraction of precious metals from carbon or concentrates. These toll-processing services also distill, dry, mix, or mill chemicals and bulk materials on a contractual basis and provide a chemical production outsourcing option for industrial companies, which lack the expertise, capacity, or regulatory permits for in-house production.

We are required to obtain several permits before we can begin construction of a small scale mineral processing facility to conduct permitted processing toll milling activities and construction of the required additional buildings and well relocation necessary for us to commence operations.

Any reference herein to “Standard Metals,” “the Company,” “we,” “our,” or “us” is intended to mean Standard Metals Processing, Inc. a Nevada corporation, and all of our subsidiaries unless otherwise indicated.

Corporate History

The Company was incorporated in the State of Colorado on July 10, 1985 as Princeton Acquisitions, Inc. On December 7, 2009, the Company changed its name to Standard Gold, Inc. Effective March 5, 2013, the Company moved its domicile from Colorado to Nevada and changed its name from Standard Gold, Inc. to Standard Gold Holdings. Inc. We determined that, due to a lack of connection to Colorado, it was in the best interest of the Company to move its domicile to Nevada. Effective December 6, 2013, the Company changed its name to Standard Metals Processing, Inc. to more accurately reflect the business of the Company.

On September 29, 2009, we completed a share exchange agreement with Hunter Bates Mining Corporation, a Minnesota corporation (“Hunter Bates”) and certain of its shareholders, in which Hunter Bates’ shareholders exchanged all of their capital securities into similar capital securities of ours (the “Hunter Bates Share Exchange”) and we adopted the business model of Hunter Bates of mineral exploration and mining. Accordingly, the Hunter Bates Share Exchange represented a change in control and Hunter Bates became our wholly owned subsidiary.

Prior to September 29, 2009, Wits Basin Precious Minerals, Inc., a Minnesota corporation and public reporting company quoted on the Pink Sheets under the symbol “WITM” (“Wits Basin”) was the majority shareholder of Hunter Bates. Hunter Bates was formed in April 2008 to acquire the prior producing gold mine properties (consisting of land, buildings, equipment, mining claims and permits) located in Central City, Colorado, known as the “Bates-Hunter Mine.” On April 29, 2011 we transferred our entire interest and related debt of the Bates-Hunter Mine, to Wits Basin in exchange for the cancellation of a promissory note issued by Hunter Bates payable in favor of Wits Basin in the approximate amount of $2.5 million.

| 3 |

On March 15, 2011, we closed a series of transactions, whereby we acquired certain assets of Shea Mining & Milling, LLC (“Shea Mining”), which assets include land, buildings, a dormant milling facility, abandoned milling equipment, water permits, mine tailings, mine dumps and the assignment of a note payable, a lease and a contract agreement with permits. We completed the Shea Exchange Agreement to acquire the Shea assets and develop a permitted custom processing toll milling of precious minerals business.

On December 10, 2012, the Company filed two Statements of Correction with the state of Colorado correcting the Second Amended and Restated Articles that had been incorrectly amended in part on March 15, 2011 and in full on March 25, 2011. After the correct Articles of Incorporation were reinstated by the Statements of Correction, the Company filed Articles of Amendment with the state of Colorado on January 4, 2013 to correct and define the Series A Preferred Stock once all board approval and documentation were complete. The Series A Preferred Stock has a liquidation preference of $10,000,000, payable only upon certain liquidity events or upon achievement of a market value of our equity equaling $200,000,000 or more. Additional details regarding the Series A Preferred Stock can be found in our Articles of Amendment, which were filed with the Colorado Secretary of State on January 4, 2013 and in the Form 8-K filed with the Commission on March 13, 2013.

Series B Preferred Stock

The Company designated 2,500,000 shares of Series B Preferred shares effective November 4, 2013. As of the date of this filing, no shares of our Series B Preferred Stock are issued and outstanding. Shares of our Series B Preferred Stock are entitled to receive, when and as declared by our Board of Directors, dividends at a rate of 8% per share annually, payable on October 1 of each year. Such dividends shall be cumulative and shall accrue, whether or not earned or declared, from and after the date of issuance of the Series B Preferred Stock, whichever is later. Each share of Series B Preferred Stock shall be convertible, at any time and at the option of the holder, into ten shares of common stock (the “Stock Conversion Rate”). The Stock Conversion Rate is subject to certain adjustments for stock-splits, combinations, reclassifications, exchanges, substitutions, reorganizations, mergers and/or consolidations.

Upon any liquidation, dissolution, or winding up of the Company, before any payment of cash or distribution of other property shall be made to the holders of common stock or any other class or series of stock subordinate in liquidation preference to the Company’s preferred stock, the assets of the Company shall be distributed as follows: first, the holders of the Series A Preferred Stock shall be entitled to the preferences detailed in the Certificate of Designation of Series A Preferred Stock; second, the holders of the Series B Preferred Stock shall be entitled to receive, pro rata according to the stated value of their shares, out of the assets of the Company legally available for distribution to its shareholders, the greater of: (i) the stated value per share or (ii) the amount such holder of Series B Preferred Stock would be entitled to receive if the shares of Series B Preferred Stock were converted into Common Stock at the Stock Conversion Rate.

Shares of Series B Preferred Stock shall have no rights to vote on any matter submitted to a vote of shareholders, except as required by law, in which case each share of Series B Preferred Stock shall be entitled to one vote.

Additional details regarding the Series B Preferred Stock can be found in our Articles of Amendment, which are on file with the Nevada Secretary of State.

TOLL MILLING AND THE SHEA EXCHANGE AGREEMENT

On March 15, 2011, in an effort to enter the precious metal toll milling business, we entered into an exchange agreement by and between us, Shea Mining, Afignis, LLC, Leslie Lucas Partners, LLC, Wits Basin and Alfred A. Rapetti (the “Shea Exchange Agreement”) whereby we acquired certain assets from Shea Mining, which assets include those located in Tonopah, Nevada (financed through a note payable assigned to us), mine dumps, a property lease and a contract agreement in exchange for 35,000,000 shares of our unregistered shares (an ownership interest of approximately 87% of our then currently outstanding common stock - approximately 56% ownership interest on a fully diluted basis). The Shea Exchange Agreement did not include any operable toll milling equipment, employees or operational processes and therefore has been accounted for as a purchase of a group of assets. Simultaneous with these transactions, pursuant to the Shea Exchange Agreement, Wits Basin exchanged 19,713,544 shares of our common stock it held for 10 million shares of Series A Preferred Stock.

Pursuant to the assignment of a note payable, we executed an Assignment and Assumption of Loan Documents and Loan Modification Agreement, by and between us, Shea Mining and NJB Mining, Inc. (the “Loan Modification Agreement”), dated March 15, 2011, for those assets located in Tonopah, Nevada (“Tonopah”), consisting of land, buildings, mine tailings, a dormant milling facility, abandoned milling equipment and water permits. The land encompasses 1,183 deeded acres, one of the largest private land holdings in Esmeralda County, Nevada. Approximately 334 acres of this land has an estimated 2.2 million tons of tailings known as the Millers Tailings from the historic gold rush of Goldfield and Tonopah, Nevada sitting on it.

| 4 |

The Tonopah property was subject to an existing $2.5 million first deed of trust, which was in default at the time of the Shea Exchange Agreement and included accrued interest of $375,645, which was also assumed in the transaction. As part of the assignment, NJB Mining, Inc. (“NJB”) modified the related note to allow us until May 14, 2011 to refinance this mortgage, which was subsequently extended numerous times. On July 7, 2011, we issued 555,556 shares of our unregistered common stock to NJB as a partial principal payment of $500,000 (valued at $0.90 per share). On August 31, 2011, we were still in default under the terms of the Loan Modification Agreement, and therefore entered into a forbearance agreement with NJB, (the “NJB Forbearance Agreement”), in which we agreed to issue an additional 200,000 shares of common stock valued at $180,000 and pay interest aggregating $52,952 prior to October 1, 2011. In exchange, NJB agreed to forbear from initiating legal proceedings, including forbearance of the deed of trust and enforcement of its collection remedies. The NJB Forbearance Agreement further provided for additional extensions up through December 9, 2011; subject to the issuance of additional 1,500,000 shares of common stock, $141,497 payments of additional accrued interest amounts and subject to the issuance of additional 5,000,000 shares of common stock upon default. On December 9, 2011, Pure Path Capital Management Company, LLC (“Pure Path”) purchased the Loan Modification Agreement and the NJB Forbearance Agreement directly from NJB. On December 21, 2011, we entered into an amended and restated forbearance agreement with Pure Path (the “A&R Forbearance”). In connection with the assignment of the Forbearance Agreement, the Parties executed an Agreement in Principle setting forth terms of the Forbearance Agreement (collectively the “Pure Path Agreements”). Pure Path provided an additional extension to stay any action of the A&R Forbearance until June 8, 2012; such extension was provided without additional consideration. If by June 8, 2012, the balance was not paid or another agreement executed, the Company would be required to issue 5,000,000 shares to Pure Path. The Company did not pay the balance of the mortgage on June 8, 2012 and pursuant to the terms of the A&R Forbearance Agreement, the Company was required to issue 5,000,000 shares to Pure Path. The 5,000,000 shares were approved for issuance by the Board of Directors on October 9, 2012 and were issued to Pure Path on December 6, 2012. After multiple extensions to stay any action of the Forbearance Agreement without consideration, the Company entered into a Settlement and Release Agreement (the “Agreement”) with Pure Path. On October 10, 2013. Pursuant to the Agreement, Pure Path relinquished its right to receive participation payments on a quarterly basis for seven years after the final closing at a rate of 5% of adjusted gross revenue as such terms are defined in the Pure Path Agreements, past and future consulting fees for approximately $1,150,000, collection remedies and legal proceedings against the Company including foreclosure on the Deed of Trust, registration rights, rights of first refusal, tag along rights, preemptive rights, exclusive worldwide rights pertaining to financing and joint ventures, and other negative covenants regarding approval of corporate actions. Pure Path also agreed to forbear collection remedies and legal proceedings against the Company including foreclosure on the Deed of Trust, and in connection with the settlement and release of various debts of approximately $1,500,000 and the consulting fees owed by the Company and relinquishment of rights by Pure Path, in exchange for the foregoing, the Company issued 27,000,000 restricted shares and a Promissory Note in the amount of $1,933,345 bearing interest of 8% per year for the current balance of the amounts owed under the Pure Path Agreements.

In connection with the Shea Exchange Agreement, we also were assigned the ownership of approximately 100,000 tons of tailings spread out over a six square mile section of mine dump material in Manhattan, Nevada (“Manhattan”).

The other assets we acquired consisted of a property lease, which allowed us the use of an assay lab property and the associated water permits, (with a right to purchase for $6 million) and a contract agreement, which allowed us the use of processing permits, located in Amargosa Valley, Nevada (“Amargosa”). We were required to pay a monthly base rent of $17,500 on this lease and $5,000 on the contract agreement. In January 2012, the landlord of the Amargosa lease caused to have served a Five Day Notice To Pay Rent Or Quit due to default in the monthly lease payments. The Company began immediate communications with the landlord, which resulted in a delay of further actions by the landlord to pursue any remedies. Then on February 9, 2012, the landlord caused to have served an Order For Summary Eviction (“Eviction”) due to continued default in lease payments. Effective with the Eviction, a total of $87,500 in lease payments remain unpaid as well as $23,000 in contract payments and $10,500 in late fees required pursuant to the terms of the lease. On February 10, 2012, the Beatty County Sheriff completed the Eviction at Amargosa and we as such, no longer have access to the assay lab or permits at Amargosa.

Additionally, we obtained the right to transfer our entire interest and related debt of the Bates-Hunter Mine, at any time prior to June 13, 2011, to Wits Basin in exchange for the cancellation of a promissory note issued by Hunter Bates payable in favor of Wits Basin in the approximate amount of $2.5 million. On April 29, 2011, our Board of Directors approved this transfer back to Wits Basin due to the following: (1) the amount of liabilities directly attached to the Bates-Hunter Mine, (2) the prior failed attempts to drain the single mine shaft, (3) the metallurgical results of the approximately 12,000 feet drilling program, (4) its location at approximately 9,000 feet in elevation and (5) the estimated capital required to simply begin sampling below ground. The Company filed a Form 8-K with the Commission on May 5, 2011, regarding the transfer.

Furthermore, Wits Basin had entered into certain commitments which involved shares of our common stock and as a result of their exchange of substantially all of the Company’s common stock they held for Series A Preferred, they could no longer honor those commitments. In consideration of Wits Basin agreeing to the exchange, the Company agreed to enter into two stock option agreements as follows: (1) the Company granted to one of Wits Basin’s major lenders a replacement stock option, on substantially the same terms as the stock option issued by Wits Basin, to purchase 1,299,000 shares of the Company’s common stock at an exercise price of $1.00 per share expiring on December 14, 2014 and (2) the Company granted to Wits Basin a replacement stock option, expiring on December 19, 2014, to purchase up to 630,000 shares of the Company’s common stock, at an exercise price of $0.50 per share.

SUBSIDIARIES

The Company has two wholly owned subsidiaries, Tonopah Milling and Metals Group, Inc. (“TMMG”), a Nevada corporation, incorporated on January 7, 2013 and Standard Renewable Energy, Inc., a Nevada corporation, incorporated on November 21, 2013. TMMG has three wholly owned subsidiaries, Tonopah Resources, Inc., a Nevada corporation, incorporated on January 10, 2013, Tonopah Custom Processing, Inc., a Nevada corporation, incorporated on January 10, 2013, and Standard Metals Acquisitions, Inc., a Nevada corporation, incorporated on January 6, 2014.

WATER POLLUTION CONTROL PERMIT WITH THE NEVADA DEPARTMENT OF ENVIRONMENTAL PROTECTION

Through the Company’s wholly owned subsidiary, Tonopah Custom Processing, Inc. (“TCP”), it filed a Water Pollution Control Permit (“WPCP”) Application with the Nevada Department of Environmental Protection (“NDEP”) Bureau of Mines and Mining Reclamation (“BMMR”) on August 28, 2013 for the approval of the permits necessary for a small-scale mineral processing facility planned for the Tonopah Property. The plant will perform laboratory testing, pilot testing, and custom processing of precious metal ores and concentrates from mining industry clients. Processing of ore materials will employ standard mineral processing techniques including gravity concentration, froth flotation and chemical leaching and carbon stripping.

| 5 |

The WPCP must be approved prior to commencing the planned construction of our processing plant in Tonopah, Nevada. We are still in the technical review stage of our WPCP. While the Company awaits approval, we are preparing for construction of our processing facility which includes working with contractors that will be building the new 21,875 square foot processing plant, cleaning and preparing the property, and refurbishing a trailer that will act as our construction office.

In connection with our WPCP application, NDEP suggested that we take the following actions: (i) retain a Nevada Certified Environmental Manager (“CEM”), (ii) perform Meteoric Profile II water testing on ground water directly below the mill as well as surrounding wells located off site, and (iii) determine baseline values of water using the Meteoric Profile II results. NDEP requested that the Company delay any new construction planned for “metal extraction” until after the permits are in place. We hired Allstate-Nevada Environmental Management, Inc., as our CEM to assist us with obtaining an NDEP WPCP and to help us fulfill all the requirements of NDEP including the Meteoric Profile II analysis, as well as advise on the overall site cleanup and assisting with any other NDEP requirements.

NDEP’s review of the WPCP application typically takes 225 days. However, a backlog of permit applications may cause a delay.

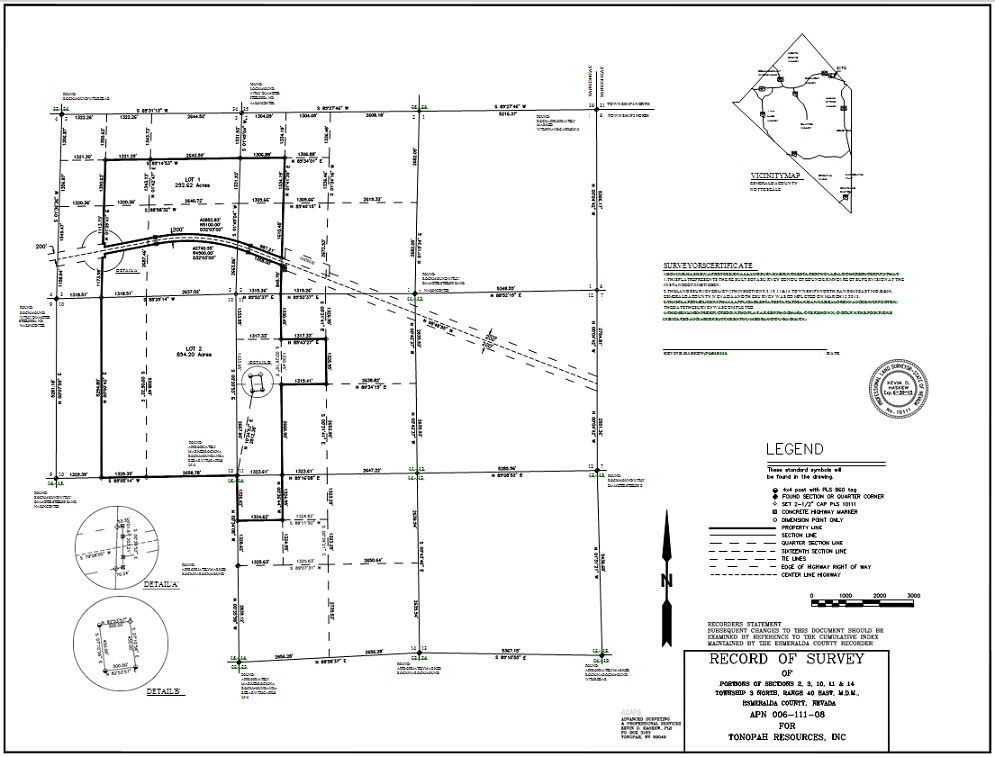

Survey

In March 2013, Advanced Surveying & Professional Services, as our Professional Land Surveyor (“PLS”), completed surveys and testing of the Tonopah property required for the application of our required permits. After completion of the survey, it was determined the property is 1,183 acres. The scope of work our PLS completed includes: (i) setting a total of 19 permanent monuments at angle points along lines, (ii) setting eight permanent monuments locating US Hwy 95, (iii) recording a professional map indicating longitude and latitude for all corners, and (iv) providing a digital map accessible in AutoCad software.

Facility and Site Preparation

On August 1, 2013, the Company received leased heavy equipment, which was used to begin cleanup of the site to prepare it for the new construction. We ordered a pre-fabricated building on November 4, 2013. The building arrived at the Tonopah property on March 21, 2014. Upon receipt of our WPCP, we will begin erecting the building, which could take up to 120 days to complete.

We requested several drilling companies provide us with a bid on drilling the monitoring wells needed for construction and moving the point of diversion on the fresh water well per our NDEP permit. The existing water rights on the property utilize two wells (points of diversion). The historic production well has not been used in recent years and is too far away from our new production plant. We are moving the point of diversion closer to our proposed production plant site to provide a localized source of fresh water.

On March 10, 2014, we retained Interflow Hydrology, Inc. (“Interflow”) to engineer, design and oversee the installation of our monitoring wells. Interflow will also provide us with an interpretation of groundwater gradient under our processing plant.

After receiving a temporary permit, the Company accepted delivery of additional large heavy equipment and broke ground on April 1, 2014. With the additional large heavy equipment onsite, we have aggressively started to remove all of the extra and unnecessary materials and old equipment that have accumulated on the land. We were also able to place a new 14,600 gallon water tank on the Tonopah property and will begin the plumbing of the existing water well to fill the new tank. This tank will provide water for all of our dirt work and construction.

As of April 1, 2014, the WPCP application is expected to continue under review for another 60 to70 days. Although the official permit is not yet issued, NDEP has allowed us to start with the grading, vegetation clearing, and construction of a perimeter security fence, new process water, and monitoring wells. Once these items are complete and we have received the final permit we can start the building erection.

PRODUCTS AND SERVICES

The Company’s business plan is to become a full service permitted custom toll milling and processing company that facilitates the extraction of precious, and strategic minerals from mined material. The Company is in the process of obtaining the permits needed for construction and operation of our permitted custom processing toll milling facility with state of the art equipment capable of processing gold, silver and platinum metal groups.

While Nevada has a historic role as a mining center with good proximate geology and ample mined product, very little custom processing toll milling capacity remains in the state. During the last several decades, other processing facilities have been shuttered due to high costs of regulations and the vertical integration of milling within large mining companies leaving junior miners with few options for local milling services. As a result, Standard Metals is in a unique position among processing facilities because it is capable of true permitted custom processing. We have the only ball mill located within a custom toll milling facility within 300 miles allowing us to serve miners in the western United States, Canada, Mexico, and Central America.

Many junior miners are undercapitalized, have limited access to capital markets and have a large supply of mined material that requires milling be performed. Many large mining companies reserve their milling capacity for their inventory, which does not make providing third party services worthwhile. This provides the Company with an opportunity to provide these potential customers with badly needed milling and processing services.

| 6 |

Currently, the Company is waiting for the approval of pending applications for the permits required for us to commence construction of our facilities to conduct permitted custom processing toll milling operations. As operations have not yet begun, the Company does not currently have any customers, but has signed a Memorandum of Understanding (“MOU”) with Adriat Management Group, Inc. (“Adriat”). The MOU sets forth terms the Company and Adriat will enter into upon the execution of a Definitive Processing Agreement whereby the Company will process source material supplied by Adriat on an exclusive basis in the United States.

TOLL MILLING

Toll milling is a process whereby mined material is crushed and ground into fine particles to ease the extraction of any precious minerals contained therein, such as minerals in the gold, silver and platinum metal groups. Custom milling and refining that are designed specifically for each ore load can include many different processes to maximize the extraction of precious metals from ore, carbon or concentrates.

Procedure

Ore is sent to our facility at the responsibility and cost of the customer. The Company will take a sample of the ore through a specific ore sampling procedure. The Company’s metallurgist will test the sample on site. To obtain a quantitative determination of the amount of a given substance in a particular sample, the Company can perform wet methods and dry methods. In the wet method, the sample is dissolved in a reagent, like acid, until the purified metal is separated out. In the dry method, the sample is mixed with a flux (a substance such as borax or silica that helps lower the melting temperature) and then heated so that the impurities in the metal fuse with the flux, leaving the purified metal as residue.

If it is determined that the sample is approved for processing, the customer and the Company will then agree upon a value of the metal grade per ton. If there is any disagreement on the value, a third party referee determines the value by testing the sample. The Company charges either a flat fee per ton of the ore processed or a percentage of the precious metals extracted during processing, or a combination of both based on the amount of work that is performed.

There are various methods of extraction. The Company determines which method to use based upon the sample sent to the Company. In most situations, a series of tests will be performed on a bulk sample ranging in size from 250 to 1,000 pounds. A metallurgist will determine the best process or processes to use for the extraction based on several factors. These include the composition of the host rock, mineralization of the host rock, whether or not it is an oxide or sulphide ore body, and the particle size of the precious metal. After the metallurgist reviews these characteristics, the Company will run ore on a gold table and assays the concentrates, middlings, and tails. An assay is an investigative procedure for qualitatively assessing or quantitatively measuring the presence or amount of precious metals in ore. If there is too much gold in the middling or tails, the size of the grind is adjusted to increase yield or if there is not enough gold in the middlings or tails the Company grinds the material to a coarser mesh.

Some of our miner customers will be able to take their tailings (the material left over after the desired minerals have been extracted) from the material they deposited with the Company and put it back in the exact same mines those particular tailings came from. This eliminates the need for the Company to dispose of those tailings.

Concentrate/Leach Circuit

Concentration is the separation of precious minerals from other materials by utilizing different properties of the minerals to be separated including density, magnetic or electric and physiochemical. The Company will attempt to create a “concentrate” of minerals to reduce the size of each ton processed. The Company may also receive concentrates from customers, especially those where transport of tons of raw ore is not feasible.

The leaching process uses chemicals to extract the metals from the solid materials (concentrates) and bring them into a solution. Once the metals are in the solution, it is passed through carbon or resin columns where the precious metals are deposited onto the carbon/resin.

The metals will then be stripped from the carbon back into a different solution where they are pumped through an electrowinning circuit in a process called carbon stripping. The metals are then deposited onto stainless steel in the electrowinning circuit. After this stage, the metals are either sold or further refined off-site. The solution is recycled and used again to process additional material.

EMPLOYEES

As of December 31, 2013, we did not have any employees. The Company’s and its subsidiaries’ officers, directors and independent contractors conduct all operations.

| 7 |

FINANCIAL INFORMATION IN INDUSTRY SEGMENTS

During the year ended December 31, 2013, our operations included one reportable segment: that of the development of the related services of custom permitted processing toll milling.

AVAILABLE INFORMATION

We make available free of charge, through our Internet web site at www.standardgoldmining.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material, or furnish it to the Securities and Exchange Commission (“SEC”). You can also request a free copy of the above filings by writing or calling us at:

Standard Metals Processing, Inc.

611 Walnut Street

Gadsden, Alabama 35901

(888) 960-7347

ITEM 1A. RISK FACTORS

An investment in our common stock is highly speculative and involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below together with all of the other information included in this prospectus. The statements contained in or incorporated into this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the value of our common stock could decline, and an investor in our securities may lose all or part of their investment.

RISKS RELATING TO OUR CAPITAL STOCK

INVESTORS MAY BE UNABLE TO ACCURATELY VALUE OUR COMMON STOCK.

Investors often value companies based on the stock prices and results of operations of other comparable companies. Currently, we do not believe another publicly traded permitted custom processing toll milling company exists that is directly comparable to our size and scale. Prospective investors, therefore, have limited historical information about our permitted custom processing toll milling capabilities on which to base an evaluation of our performance and prospects and an investment in our common stock. As such, investors may find it difficult to accurately value our common stock.

Investors may face significant restrictions on the resale of our common stock due to federal regulation of penny stocks.

The SEC has defined any equity security with a market price of less than $5.00 per share as a “penny stock.” Penny stocks are subject to the requirements or Rule 15(g)-9 of the Securities Exchange Act of 1934. Our common stock is quoted on the OTCQB under the symbol SMPR and is currently below $5.00 per share. Therefore our common stock is deemed a “penny stock” and is subject to the requirements of Rule 15(g)-9. Under such rule, broker-dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that they make an individualized written suitability determination for the purchaser and receive the purchaser’s consent prior to the transaction. The required penny stock disclosures include the delivery, prior to any transaction, of a disclosure schedule explaining the penny stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the ability of purchasers to sell their securities in the secondary market.

WE DO NOT INTEND TO PAY DIVIDENDS FOR THE FORESEEABLE FUTURE.

We have never declared or paid any dividends on our common stock. We intend to retain all of our earnings, if any, for the foreseeable future to finance the operation and expansion of our business, and we do not anticipate paying any cash dividends in the future. Our Board of Directors retains the discretion to change this policy.

THE MARKET FOR OUR COMMON STOCK MAY FLUCTUATE.

Currently, our common stock is traded on the Over the Counter Venture Capital Market (“OTCQB”). Stock prices on the Over the Counter Markets can be more volatile than stocks trading on national market systems such as NSADAQ, NYSE or AMEX. Our stock price may be affected by factors outside of our control and unrelated to our business operations.

| 8 |

OUR SERIES A PREFERRED STOCK HAS A SIGNIFICANT LIQUIDATION PREFERENCE.

The Series A Preferred Stock has a liquidation preference of $10,000,000, payable only upon certain liquidity events or upon achievement of a market value of our equity equaling $200,000,000 or more. Upon any liquidation, dissolution or winding up of the Company, and after paying or adequately providing for the payment of all its obligations, the remainder of the assets of the Company shall be distributed, either in cash or in kind, first pro rata to the holders of the Series A Preferred Stock in an amount equal to the Liquidation Value; then, to any other series of Preferred Stock, until an amount to be determined by a resolution of the Board of Directors prior to issuances of such Preferred Stock, has been distributed per share, and, then, the remainder pro rata to the holders of the common stock.

Although there are requirements that must be met before the liquidation preference is payable to holders of the Series A Preferred Stock, if we are successful in the operation of our business and our market value increases, or if we consummate a change of control transaction that requires payment of the $10,000,000 liquidation preference (plus accrued interest), there may be significantly less funds remaining after the payment of the liquidation preference for holders of our common stock or we could be forced to accrue this liability on our financials.

RISKS RELATING TO OUR FINANCIAL CONDITION

WE CURRENTLY DO NOT HAVE ENOUGH CASH TO FUND OPERATIONS AND/OR REDUCE OUR DEBT DURING 2014.

We have very limited funds, and such funds are not adequate to develop our current business plan, or even to satisfy our existing working capital requirements. We will be required to raise additional funds to effectuate our current business plan for permitted custom processing toll milling and to satisfy our working capital requirements. Without significant additional capital, we will be unable to start operations. With respect to our proposed permitted custom processing toll milling operations, the costs and ability to successfully operate have not been fully verified because none of our proposed tolling operations have begun and we may incur unexpected costs or delays in connection with starting operations. The cost of designing and building our operations and of finding customers and sources of ore for our toll milling sources can be extensive and will require us to obtain additional financing, and there is no assurance that we will have the resources necessary or the financing available to attain operations or to acquire customers and ore sources necessary for our long-term business. Our ultimate success will depend on our ability to raise additional capital. Additionally, such additional capital may not be available to us at acceptable terms or at all. Further, if we increase our capitalization and sell additional shares of our capital stock, a shareholder’s position in our Company will be subject to dilution. In the event that we are unable to obtain additional capital, we may be forced to cease our search for additional business opportunities, reduce our operating expenditures or to cease operations altogether.

WE ARE A DEVELOPMENT AND EXPLORATION STAGE COMPANY WITH LITTLE HISTORY OF OPERATIONS AND WE EXPECT TO INCUR LOSSES FOR THE FORESEEABLE FUTURE.

We are a development and exploration stage company, and have yet to commence active operations. As of December 31, 2013, we have incurred an aggregate net loss of $35,827,720 since our inception. We have no prior operating history from which to evaluate our success, or our likelihood of success in operating our business, generating any revenues, or achieving profitability. This provides a limited basis for you to assess our ability to commercialize our services and the advisability of investing in our securities. We have not generated revenue from our toll milling services to date and there can be no assurance that our plans for permitted custom processing toll milling will be successful, or that we will ever attain significant revenue or profitability. Also, toll milling is a new area of business for us, and our management team has little experience in permitted custom processing toll milling operations. Although we intend to hire knowledgeable and experienced employees and/or consultants with significant experience in toll milling operations, there is no guarantee that we will reach profitability in the near future, if at all. As a development and exploration stage company, we are subject to unforeseen costs, expenses, problems and difficulties inherent in new business ventures.

OUR INDEPENDENT AUDITORS HAVE SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

The financial statements for each of these periods were prepared assuming that we would continue as a going concern. We have had net losses for each of the years ended December 31, 2013 and 2012, and we have an accumulated a deficit as of December 31, 2013. In the view of our independent auditors, these conditions raise substantial doubt about our ability to continue as a going concern. Furthermore, since we do not expect to generate any significant revenues from operations for the foreseeable future, our ability to continue as a going concern depends, in large part, on our ability to raise additional capital through equity or debt financing transactions. If we are unable to raise additional capital, we may be forced to discontinue our business.

RISKS RELATED TO THE COMPANY

WE HAVE VERY LIMITED ASSETS.

Our assets to be used in the development of a toll milling service have not yet been utilized, we will need to acquire additional equipment and construct additional facilities and there can be no guarantee that we will be successful in utilizing our current assets or obtaining the additional equipment and facilities that we will need to operate going forward. We do not anticipate having any revenues from our permitted custom toll milling processing for the foreseeable future. Additionally, without adequate funding, we may never produce any significant revenues.

| 9 |

OUR ASSETS ARE ENCUMBERED UNDER A DEED OF TRUST.

The Tonopah property is subject to a $2,500,000 first deed of trust held by Pure Path. Pursuant to the terms of the Pure Path Settlement Agreement, Pure Path has agreed to forbear collection remedies and legal proceedings against the Company for this deed of trust until April 10, 2015.

OUR MANAGEMENT TEAM MAY NOT BE ABLE TO SUCCESSFULLY IMPLEMENT OUR BUSINESS STRATEGIES.

If our management team is unable to execute our business strategies, then our development could be materially and adversely affected. In addition, we may encounter difficulties in effectively managing the budgeting, forecasting and other process control issues presented by any future growth. We may seek to augment or replace members of our management team or we may lose key members of our management team, and we may not be able to attract new management talent with sufficient skill and experience.

OUR SUCCESS IN THE FUTURE MAY DEPEND ON OUR ABILITY TO ESTABLISH AND MAINTAIN STRATEGIC ALLIANCES, AND ANY FAILURE ON OUR PART TO ESTABLISH AND MAINTAIN SUCH RELATIONSHIPS WOULD ADVERSELY AFFECT OUR MARKET PENETRATION AND REVENUE GROWTH.

We may be required to establish strategic relationships with third parties in the mining and toll milling industries. Our ability to establish strategic relationships will depend on a number of factors, many of which are outside our control, such as the suitability of our property, facilities and equipment relative to our competitors, or the quality grade of precious minerals we are able to extract from the ore we process. We can provide no assurance that we will be able to establish strategic relationships in the future.

In addition, any strategic alliances that we establish, will subject us to a number of risks, including risks associated with sharing proprietary information, loss of control of operations that are material to developed business and profit-sharing arrangements. Moreover, strategic alliances may be expensive to implement and subject us to the risk that the third party will not perform its obligations under the relationship, which may subject us to losses over which we have no control or expensive termination arrangements. As a result, even if our strategic alliances with third parties are successful, our business may be adversely affected by a number of factors that are outside of our control.

RISKS RELATING TO OUR BUSINESS

WE WILL REQUIRE ADDITIONAL FINANCING TO FUND OUR PERMITTED CUSTOM PROCESSING TOLL MILLING DEVELOPMENT AND OPERATIONS.

Substantial additional financing will be needed in order to fund the current plan to begin toll milling services and develop and maintain the Tonopah property. Our means of acquiring investment capital is limited to private equity and debt transactions. We have no significant sources of currently available funds to engage in additional development. Without significant additional capital, we will be unable to fund our current property interests or effectuate our current business plan for permitted custom processing toll milling and mining services. See “—Risks Relating to Our Financial Condition – We Currently Do Not Have Enough Cash to Fund Operations, and/or Reduce Debt During 2014.”

OUR PERFORMANCE MAY BE SUBJECT TO FLUCTUATIONS IN MINERAL PRICES.

The profitability of any permitted custom processing toll milling services could be significantly affected by changes in the market price of minerals. Demand for minerals can be influenced by economic conditions and attractiveness as an investment vehicle. Other factors include the level of interest rates, exchange rates and inflation. The aggregate effect of these factors is impossible to predict with accuracy.

In particular, mine production and the willingness of third parties such as central banks to sell or lease gold affects the supply of gold. Worldwide production levels also affect mineral prices. In addition, the price of gold, silver and other precious minerals have, on occasion, been subject to very rapid short-term changes due to speculative activities.

OUR PERMITTED CUSTOM PROCESSING TOLL MILLING OPERATIONS ARE SUBJECT TO ENVIRONMENTAL REGULATIONS AND PERMITTING, WHICH COULD RESULT IN THE INCURRENCE OF ADDITIONAL COSTS AND OPERATIONAL DELAYS.

All phases of our operations are subject to current environmental protection regulation. There is no assurance that future changes in environmental regulation, such as greenhouse gas emissions, carbon footprint and the like, will not adversely affect our operations. Some of our proposed operations will require additional permits, which could incur additional cost and may delay startup and cash flow. In addition, each toll milling mineral source must be fully permitted for its own operation, a process over which we have no control.

OUR PERMITTED CUSTOM PROCESSING TOLL MILLING OPERATIONS WILL REQUIRE US TO DEPEND ON THIRD PARTIES AND OTHER ELEMENTS BEYOND OUR CONTROL, WHICH COULD RESULT IN HARM TO OUR BUSINESS.

Our permitted custom processing toll milling operations will rely on mineral material produced by others, and we have no control over their operations. Delivery of ore to our processing facilities is also subject to the risks of transportation, including trucking and aviation operations run by others, regulations and permits, fuel cost, weather, and travel conditions. Toll milling requires that the mineral producer and the mineral processor agree on the grade of the incoming material, which can be a source of conflict between parties. Although a third party will be utilized for any such conflict, any disagreements with mineral producers, or problems with the delivery of ore, could result in additional costs, disruptions and other problems in the operation of our business.

| 10 |

U.S. FEDERAL LAWS

Under the U.S. Resource Conservation and Recovery Act, companies such as ours may incur costs for generating, transporting, treating, storing, or disposing of hazardous waste. Our permitted custom processing toll milling operations may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, storage facilities, and the use of mobile sources such as trucks and heavy construction equipment which are subject to review, monitoring and/or control requirements under the Federal Clean Air Act and state air quality laws. Permitting rules may impose limitations on our production levels or create additional capital expenditures in order to comply with the rules.

The U.S. Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended (CERCLA) imposes strict joint and several liability on parties associated with releases or threats of releases of hazardous substances. The groups who could be found liable include, among others, the current owners and operators of facilities which release hazardous substances into the environment and past owners and operators of properties who owned such properties at the time the disposal of the hazardous substances occurred. This liability could include the cost of removal or remediation of the release and damages for injury to the surrounding property. We cannot predict the potential for future CERCLA liability with respect to our property.

THE GLOBAL FINANCIAL CRISIS MAY HAVE IMPACTS ON OUR BUSINESS AND FINANCIAL CONDITION THAT WE CURRENTLY CANNOT PREDICT.

The continued credit crisis and related instability in the global financial system has had, and may continue to have, an impact on our business and our financial condition. We may face significant challenges if conditions in the financial markets do not improve. Our ability to access the capital markets may be severely restricted at a time when we would like, or need, to access such markets, which could have an impact on our flexibility to react to changing economic and business conditions. The credit crisis could have an impact on any potential lenders or on our customers, causing them to fail to meet their obligations to us.

ITEM 2. DESCRIPTION OF PROPERTIES

On March 15, 2011, in an effort to enter the precious metal toll milling business, we completed the Shea Exchange Agreement, whereby we acquired the Tonopah property, consisting of land, buildings, mining tailings, a dormant milling facility, abandoned milling equipment and water permits.

Our Tonopah property consists of 1,183 acres of land, buildings, mining tailings, a dormant milling facility, abandoned milling equipment and water permits. The Tonopah property was transferred to Tonopah Milling and Metals Group, Inc. (“TMMG”), the Company’s wholly owned subsidiary, and then transferred to Tonopah Resources, Inc. (“TRI”), a wholly owned subsidiary of TMMG.

Our corporate office is located at 611 Walnut Street, Gadsden, Alabama 35901. We are using the office space of the Company’s secretary, Tina Gregerson. Our New York office is located at 114 West 47th Street, 17th Floor, New York, New York 10036. We believe that our facilities are adequate for our current needs.

ITEM 3. LEGAL PROCEEDINGS

Mark Dacko

Mark Dacko, the Company’s former Chief Financial Officer, made a Demand for Arbitration on December 21, 2012 with the American Arbitration Association for legal claims against the Company involving his previous employment. The Company and Mr. Dacko were in dispute regarding his employment with the Company as well as the details of his termination. On December 30, 2013, the Company entered into a settlement agreement with Mark Dacko.

Midwest Investment Partners, LLC

On September 6, 2013, Midwest Investment Partners, LLC filed suit against the Company alleging a breach of the Company’s obligations under a $50,000 6% Convertible Promissory Note, dated April 5, 2011, and a $25,000 6% Convertible Promissory Note, dated September 2, 2011, by (i) failing to repay the April 5, 2011 Note when due on October 6, 2011, and (ii) failing to repay the September 2, 2011 Note when due on February 29, 2012. On January 10, 2014, Defendant filed its Answer with Affirmative and Other Defenses to Plaintiff’s Complaint and Demand for Jury Trial. There was an initial pre-trial conference on February 18, 2014. At the initial conference, the parties filed and the Court approved a Joint Case Management Plan setting the timing and sequence of discovery in the action. A settlement conference was held on March 28, 2014. The parties did not reach a settlement agreement. The Company plans to vigorously defend the claim.

On March 17, 2014, Midwest Investment Partners, LLC filed suit against Standard Metals Processing, Inc. alleging that Standard Metals had wrongfully refused to remove a transfer restriction on Midwest’s shares of Standard Metals stock pursuant to Rule 144 of the Securities Act. On March 27, 2014, Standard Metals filed in the United States District Court, Southern District of Indiana, Evansville Division a Verified Notice of Removal of a Civil Action requesting that the case proceed in the Court as an action properly removed pursuant to 28 U.S.C. §§ 1441 (a) and (b). Standard Metals plans to vigorously defend the claim.

| 11 |

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

PRICE RANGE OF COMMON STOCK

Our common stock is quoted on the OTCQB under the symbol “SMPR.” As of March 31, 2014, the last closing sale price of our common stock as reported by OTCQB was $2.05 per share. The following table sets forth for the periods indicating the range of high and low closing sale prices of our common stock:

| Period | High | Low | ||||||

| Quarter Ended March 31, 2012 | $ | 0.83 | $ | 0.25 | ||||

| Quarter Ended June 30, 2012 | $ | 0.65 | $ | 0.15 | ||||

| Quarter Ended September 30, 2012 | $ | 0.40 | $ | 0.13 | ||||

| Quarter Ended December 31, 2012 | $ | 0.30 | $ | 0.11 | ||||

| Quarter Ended March 31, 2013 | $ | 0.51 | $ | 0.15 | ||||

| Quarter Ended June 30, 2013 | $ | 0.58 | $ | 0.19 | ||||

| Quarter Ended September 30, 2013 | $ | 0.51 | $ | 0.38 | ||||

| Quarter Ended December 31, 2013 | $ | 1.20 | $ | 0.34 | ||||

The quotations from the OTCQB above reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not reflect actual transactions.

RECORD HOLDERS

As of March 31, 2014, there were approximately 150 record holders of our common stock, excluding shareholders holding securities in “street name.”

DIVIDENDS

We have never paid cash dividends on our common stock and have no present intention of doing so in the foreseeable future. Rather, we intend to retain all future earnings to provide for the growth of our Company. Payment of cash dividends in the future, if any, will depend, among other things, upon our future earnings, requirements for capital improvements and financial condition.

RECENT SALES OF UNREGISTERED SECURITIES

In addition to the sales of unregistered securities that we reported in Quarterly Reports on Form 10-Q and Current Reports on Form 8-K during fiscal year ended 2013, we made the following sales of unregistered securities during the fourth quarter ended December 31, 2013:

Warrant Exercises

We issued 1,875,138 shares of unregistered common stock pursuant to common stock purchase warrants (the “Warrants”) issued by the Company, of these, 1,775,138 Warrants were exercised at a price of $0.25 per share and 100,000 were exercised at a price of $0.50 per share totaling an aggregate purchase price of $493,785.

Note Conversions and Debt Settlements

On October 10, 2013 we issued 27,000,000 shares of restricted common stock in connection with a settlement with our secured creditor (see Note 10 Related Party Transactions)

On October 29, 2013, we issued 53,995 shares of common stock from a conversion of a Promissory Note at a conversion price of $0.50 per share.

On December 5, 2013, we issued 57,463 shares of common stock from a conversion of a Promissory Note.

On December 5, 2013, we issued 56,649 shares of common stock from a settlement of an existing Debt of the Company.

Sales of the securities identified above were made pursuant to privately negotiated transactions that did not involve a public offering of securities and, accordingly, we believe that these transactions were exempt from the registration requirements of the Securities Act pursuant to Sections 4(a)(2) and 3(a)(9) thereof and rules promulgated thereunder. Based on representations from the above-referenced lenders, we have determined that such lenders were “accredited investors” (as defined by Rule 501 under the Securities Act) and were acquiring the shares for investment and not distribution, and that they could bear the risks of the investment and could hold the securities for an indefinite period of time. The lenders received written disclosures that the securities had not been registered under the Securities Act and that any resale must be made pursuant to a registration or an available exemption from such registration. All of the foregoing securities are deemed restricted securities for purposes of the Securities Act.

| 12 |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion should be read in conjunction with the Financial Statements of the Company and notes thereto included elsewhere in this Annual Report. See “Consolidated Financial Statements and Supplementary Data.”

Cautionary Notice Regarding Forward Looking Statements

Readers are cautioned that the following discussion contains certain forward-looking statements and should be read in conjunction with the “Special Note Regarding Forward-Looking Statements” appearing at the beginning of this Annual Report.

The information contained in Item 7 contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Actual results may materially differ from those projected in the forward-looking statements as a result of certain risks and uncertainties set forth in this report. Although management believes that the assumptions made and expectations reflected in the forward-looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual results will not be different from expectations expressed in this report.

We desire to take advantage of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. This filing contains a number of forward-looking statements, which reflect management’s current views and expectations with respect to our business, strategies, products, future results and events, and financial performance. All statements made in this filing other than statements of historical fact, including statements addressing operating performance, events, or developments which management expects or anticipates will or may occur in the future, including statements related to distributor channels, volume growth, revenues, profitability, new products, adequacy of funds from operations, statements expressing general optimism about future operating results, and non-historical information, are forward looking statements. In particular, the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “may,” variations of such words, and similar expressions identify forward-looking statements, but are not the exclusive means of identifying such statements, and their absence does not mean that the statement is not forward-looking. These forward-looking statements are subject to certain risks and uncertainties, including those discussed below. Our actual results, performance or achievements could differ materially from historical results as well as those expressed in, anticipated, or implied by these forward-looking statements. We do not undertake any obligation to revise these forward-looking statements to reflect any future events or circumstances.

Readers should not place undue reliance on these forward-looking statements, which are based on management’s current expectations and projections about future events, are not guarantees of future performance, are subject to risks, uncertainties and assumptions (including those described below), and apply only as of the date of this filing. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors which could cause or contribute to such differences include, but are not limited to, the risks to be discussed in our Annual Report on form 10-K and in the press releases and other communications to shareholders issued by us from time to time which attempt to advise interested parties of the risks and factors which may affect our business. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

History

Standard Metals Processing, Inc. (formerly known as Standard Gold Holdings, Inc., Standard Gold, Inc. and Princeton Acquisitions, Inc.) was incorporated in the State of Colorado on July 10, 1985. On September 29, 2009, we completed a share exchange agreement with Hunter Bates Mining Corporation, a Minnesota corporation (“Hunter Bates”) and certain of its shareholders, in which Hunter Bates’ shareholders exchanged all of their capital securities into similar capital securities of ours (the “Hunter Bates Share Exchange”) and we adopted the business model of Hunter Bates of minerals exploration and mining. Accordingly, the Hunter Bates Share Exchange represented a change in control and Hunter Bates became a wholly owned subsidiary of Standard Gold.

Prior to September 29, 2009, Wits Basin Precious Minerals Inc., a Minnesota corporation and public reporting company quoted on the Pink Sheets under the symbol “WITM” (“Wits Basin”) was the majority shareholder of Hunter Bates. Hunter Bates was formed in April 2008 to acquire the prior producing gold mine properties (consisting of land, buildings, equipment, mining claims and permits) located in Central City, Colorado, known as the “Bates-Hunter Mine.”

On March 15, 2011, we closed a series of transactions, whereby we acquired certain assets of Shea Mining & Milling, LLC (“Shea Mining”), which assets include land, buildings, a dormant milling facility, abandoned milling equipment, water permits, mine tailings, mine dumps and the assignment of a note payable, a lease and a contract agreement with permits. We completed the Shea Exchange Agreement in order to offer toll milling services of precious minerals. Toll milling is a process whereby mined material is crushed and ground into fine particles to ease the extraction of any precious minerals contained therein, such as gold, silver, and platinum group metals. Custom milling and refining can include many different processes to extract precious metals from carbon or concentrates. These toll-processing services also distill, dry, mix, or mill chemicals and bulk materials on a contractual basis and provide a chemical production outsourcing option for industrial companies which lack the expertise, capacity, or regulatory permits for in-house production.

| 13 |

The Company re-domiciled from Colorado to Nevada in March 2013. We determined that, due to a lack of connection to Colorado, it was in the best interest of the Company to move its domicile to Nevada.

Overview of the Company

Through the Company’s wholly owned subsidiary, Tonopah Custom Processing, Inc. (“TCP”), it filed a Water Pollution Control Permit Application (“WPCP”) with the Nevada Department of Environmental Protection (“NDEP”) Bureau of Mines and Mining Reclamation (“BMMR”) on August 28, 2013 for the approval of the permits necessary for a small-scale mineral processing facility planned for the Tonopah Property. The plant will perform laboratory testing, pilot testing, and custom processing of precious metal ores and concentrates from mining industry clients. Processing of ore materials will employ standard mineral processing techniques including gravity concentration, froth flotation and chemical leaching and carbon stripping.

The WPCP must be approved prior to commencing the planned construction of our processing plant in Tonopah, Nevada. We are still in the technical review stage of our WPCP. While the Company awaits approval, we are preparing for construction of our processing facility which includes working with contractors that will be building the new 21,875 square foot processing plant, cleaning and preparing the property, and refurbishing a trailer that will act as our construction office.

In connection with our WPCP application, NDEP suggested that we take the following actions: (i) retain a Nevada Certified Environmental Manager (“CEM”), (ii) perform Meteoric Profile II water testing on ground water directly below the mill as well as surrounding wells located off site, and (iii) determine baseline values of water using the Meteoric Profile II results. NDEP requested that the Company delay any new construction planned for “metal extraction” until after the permits are in place. We hired Allstate-Nevada Environmental Management, Inc., as our CEM to assist us with obtaining an NDEP WPCP and to help us fulfill all the requirements of NDEP including the Meteoric Profile II analysis, as well as advise on the overall site cleanup and assisting with any other NDEP requirements.

NDEP’s review of the WPCP application typically takes 225 days. However, a backlog of permit applications may cause delays.

In March 2013, we completed surveys and testing of the Tonopah property required for the application of our required permits. After completion of the survey, it was determined the property is 1183 acres. We retained Advanced Surveying & Professional Services as our Professional Land Surveyor (“PLS”) on February 5, 2013. The scope of work our PLS completed includes: (i) setting a total of Nineteen (19) permanent monuments at angle points along lines, (ii) setting Eight (8) permanent monuments locating US Hwy 95, (iii) recording a professional map indicating longitude and latitude for all corners, and (iv) providing a digital map accessible in AutoCad software.

Our business plan is to build out a facility to serve as a custom permitted processing toll milling facility (which includes an analytical lab and hydrometallurgical recovery plant) located in Tonopah, Nevada.

As of August 1, 2013, the Company received leased heavy equipment, which was used to begin cleanup of the site to prepare it for the new construction. We ordered a pre-fabricated building on November 4, 2013 and took delivery on March 21, 2014. Upon receipt of our WPCP, we will begin erecting the building, which could take up to 120 days to complete.

We requested several drilling companies provide us with a bid on drilling the monitoring wells and moving the point of diversion on the fresh water well per our NDEP permit. The existing water rights on the property utilize two wells (points of diversion). The historic production well has not been used in recent years and is too far away from our new production plant. We are moving the point of diversion closer to our proposed production plant site to provide a localized source of fresh water.

On March 10, 2014, we retained Interflow Hydrology, Inc. (“Interflow”) to engineer, design and oversee the installation of our monitoring wells. Interflow will also provide us with an interpretation of groundwater gradient under our processing plant.

| 14 |

RESULTS OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2013 COMPARED TO THE YEAR ENDED DECEMBER 31, 2012.

Revenues

We had no revenues from operations for the years 2013 and 2012. Furthermore, we do not anticipate having any significant future revenues until we have sufficiently funded operations.

Operating Expenses

General and administrative expenses were $6,044,263 for 2013 as compared to $1,469,355 for 2012. Of the $6,040,484 in 2013, we recorded $4,107,806 of compensation expense related to options and warrants as compared to $265,000 of compensation expenses related to options in 2012. In 2013, compensation expenses as well as operating expenses increased due to the employment agreements the Company entered into with its key officers and the increase in preparation for building infrastructure through permits, research, agreements and construction. We anticipate that future compensation expenses will increase and that certain operating expenses will continue to increase for fiscal 2014 as we continue to build the infrastructure to proceed with custom processing tolling milling services and possible entrance into other properties.

Depreciation and amortization expenses were $0 for 2013 as compared to $0 for 2012. We currently have no depreciation and amortization expenses. Should we acquire mine properties or begin custom permitted processing toll milling services, then we will begin recording depreciation expense.

Other Income and Expenses

Interest Expense

Interest expense for 2013 was $332,665 compared to 2012, which was $1,262,188. The 2013 and 2012 amounts relate to the interest due on the following notes payable: (i) the $2,500,000 secured, convertible promissory note issued to Pure Path on October 10, 2013 in accordance with the settlement agreement of same date. All prior debt was subsumed under this note, the outstanding of which was $2,092,097 plus accrued interest at 8% per annum on December 31, 2013; (ii) the short-term note payable; and (iii) the convertible notes issued in 2011 and 2012.

The conversion of all but $275,000 of item (iii) above contributed to the significant decreases from the 2012 amounts. The non-cash interest expense for the year ended December 31, 2013 was $0 compared to $883,848 for the same period in 2012.

The exchange of outstanding unsecured convertible promissory notes and accompanying warrants to purchase common stock the issuance of restricted common stock for the settlement of the balance of the note (principal and interest as of: June 30, 2013) at $0.50 per share and the issuance of new warrants to purchase common stock equal to the number of shares received under the conversion of the Eligible Note, exercisable for two years with an exercise price of $0.25 per share for the first 60 days following the tender offer and $0.50 per share thereafter, with substantially the same terms as the original warrants except the new warrants contain a call provision that may be exercised at $0.80 if the Company’s common stock trades above $0.80 for ten consecutive days contributed to the significant decreases from the 2012 amounts.

LIQUIDITY AND CAPITAL RESOURCES

Liquidity is a measure of an entity’s ability to secure enough cash to meet its contractual and operating needs as they arise. We have funded our operations and satisfied our capital requirements through advances from Pure Path Capital Management, LLC. We do not anticipate generating sufficient net positive cash flows from our operations to fund the next 12 months. We had a working capital deficit of $2,778,862 at December 31, 2013. Cash and cash equivalents were $143,099 at December 31, 2013, representing an increase of $143,005 from the cash and cash equivalents of $94 at December 31, 2012.

We receive monthly payments of $529 from American Tower Corporation for a cellular tower located on our Tonopah land.

Our cash reserves will not be sufficient to meet our operational needs and thus, we need to raise additional capital to pay for our operational expenses and provide for capital expenditures. Our basic operational expenses are estimated at approximately $200,000 per month and we continue to have debt service commitments, which include $2,092,097 (plus accrued interest) due to Pure Path and $275,000 (plus accrued interest) if none of the convertible note holders convert any portion of their notes payable. Above the basic operational expenses, we estimate that we need approximately $4,500,000 to begin limited tolling operations. If we are not able to raise additional working capital, we may have to cease operations altogether.

For the years ended December 31, 2013 and 2012, we had net cash used in operating activities of $648,081 and $359,103 respectively.

For the years ended December 31, 2013 and 2012, we had net cash used in investing activities of $89,349 and $0, respectively. The amount in 2013 was due to the funds require to purchase equipment and make down payment on our first new building in Nevada.

For the years ended December 31, 2013 and 2012, we had net cash provided by financing activities of $903,653 and $358,577 respectively.

During 2013, we received $497,785 in cash proceeds from the exercise of warrants to purchase common stock and $382,650 from proceeds from debt. During 2012 we entered into a short-term notes payable, resulting in cash proceeds of $358,577.

| 15 |

The following table summarizes our debt as of December 31, 2013:

| Outstanding Amount | Interest Rate | Unamortized Discounts | Accrued Interest | Maturity Date | Type | |||||||||||||||

| $ | 25,000 | (1) | 5 | % | $ | — | $ | 4,147 | (1) | November 30, 2010 | Conventional | |||||||||

| $ | 2,092,097 | (2) | 8 | % | $ | — | $ | 35,105 | April 10, 2015 | Convertible | ||||||||||

| $ | 275,000 | (3) | 6 | % | $ | — | $ | 46,755 | (4) | Convertible | ||||||||||

| (1) | Promissory note issued on September 7, 2010, to Stephen Flechner, our President at the time. The promissory note was paid in full on February 13, 2014. |

| (2) | Represents the outstanding balance of the original note payable to NJB Mining Inc. that was purchased directly by Pure Path Capital Management and restructured with their other short term debt into the 8% Senior Secured Convertible Promissory Note maturing on April 10, 2015 (for the assets located in Tonopah). |

| (3) | Beginning in January 2011, we entered into various six-month convertible promissory notes convertible at a price of $0.50 per share and issued a two-year stock purchase warrant with an exercise price of $0.50 per share at a rate of 2 warrants per $1 of note. |

| (4) | The outstanding convertible promissory notes began maturing on July 26, 2011 through March 2, 2012. These convertible notes are currently past due and original terms apply in the default period. |

Summary