DEF 14A0000077360false00000773602023-01-012023-12-31iso4217:USD00000773602022-01-012022-12-3100000773602021-01-012021-12-3100000773602020-01-012020-12-310000077360pnr:AdjustmentToCompensationForPensionAdjustmentMemberecd:PeoMember2023-01-012023-12-310000077360pnr:AdjustmentToCompensationForChangeInPensionValueFromSCTMemberecd:PeoMember2023-01-012023-12-310000077360pnr:AdjustmentToCompensationForServiceCostMemberecd:PeoMember2023-01-012023-12-310000077360pnr:AdjustmentToCompensationForEquityAdjustmentMemberecd:PeoMember2023-01-012023-12-310000077360ecd:NonPeoNeoMemberpnr:AdjustmentToCompensationForEquityAdjustmentMember2023-01-012023-12-310000077360pnr:EquityAwardsDeductionOfSCTStockAwardsAndOptionAwardsMemberecd:PeoMember2023-01-012023-12-310000077360ecd:NonPeoNeoMemberpnr:EquityAwardsDeductionOfAverageSCTStockAwardsAndOptionAwardsMember2023-01-012023-12-310000077360pnr:EquityAwardsFairValueOfEquityAwardsMemberecd:PeoMember2023-01-012023-12-310000077360ecd:NonPeoNeoMemberpnr:EquityAwardsAverageFairValueOfEquityAwardsMember2023-01-012023-12-310000077360pnr:EquityAwardsChangeInValueOfPriorYearsAwardsUnvestedMemberecd:PeoMember2023-01-012023-12-310000077360ecd:NonPeoNeoMemberpnr:EquityAwardsChangeInAverageValueOfPriorYearsAwardsUnvestedMember2023-01-012023-12-310000077360pnr:EquityAwardsChangeInValueOfPriorYearsAwardsThatVestedMemberecd:PeoMember2023-01-012023-12-310000077360ecd:NonPeoNeoMemberpnr:EquityAwardsChangeInAverageValueOfPriorYearsAwardsThatVestedMember2023-01-012023-12-310000077360ecd:NonPeoNeoMemberpnr:EquityAwardsAverageDividendsOrOtherEarningsNotIncludedInTotalCompensationForCurrentYearMember2023-01-012023-12-31000007736012023-01-012023-12-31000007736022023-01-012023-12-31000007736032023-01-012023-12-31000007736042023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| | | | | |

CHECK THE APPROPRIATE BOX: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

Pentair plc

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | | | |

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

☑ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | | | | | | | | | | |

David A. Jones Pentair Chairman of the Board John L. Stauch Pentair President and CEO | | | | |

| | | |

| | You are cordially invited to attend the Annual General Meeting of Shareholders of Pentair plc on Tuesday, May 7, 2024, at 7:00 a.m. local time (BST). The Annual General Meeting of Shareholders will be held at Claridge’s, Brook Street, Mayfair, London, W1K 4HR, United Kingdom. The enclosed notice of annual general meeting and proxy statement describe the items of business that we will conduct at the meeting and provide you with important information about Pentair plc, including our practices in the areas of corporate governance and executive compensation. We strongly encourage you to read these materials and then to vote your shares. We oversaw execution of our transformation program to deliver margin expansion In 2023, our balanced water portfolio, combined with our transformation initiatives, delivered notable margin expansion. Our Flow and Water Solutions businesses partially offset volume declines in our Pool business. We continued to accelerate our transformation initiatives around pricing excellence, strategic sourcing, operations excellence and organizational effectiveness. The integration of the Manitowoc Ice acquisition has exceeded our expectations, and we are enhancing performance accountability throughout the organization. The Board continues to focus on opportunities to advance as an industry leader for providing sustainable water solutions that positively impact people and the planet while we drive operational efficiencies and growth in our business. These dynamics, together with our high performance and Win Right values, position us to continue delivering on our commitments and create long-term value despite ongoing complexities in the operating environment. We appointed a new director, adding to the financial expertise and diversity on our Board Effective August 15, 2023, Tracey Doi joined our Board as an independent director. Tracey is a seasoned director and operational leader with skilled experience in strategic planning, finance, transformations, enterprise systems, and business analytics. She most recently served as Group Vice President and Chief Financial Officer of Toyota Motor North America until her retirement in 2022, where she developed deep experience with global manufacturing in a complex industry. Our Board is delivering on our commitment to governance and sustainability Our Board continues to monitor best practices in corporate governance and executive compensation which are also informed by our ongoing shareholder engagement. In 2023, we revised our executive compensation clawback policy applicable to financial restatements to align with the recently adopted NYSE rules. We also enhanced our director overboarding policy and summarized it in the proxy statement. We recognize that our purpose of creating a better world for people and the planet through smart, sustainable water solutions, and our mission to helping the world sustainably move, improve, and enjoy water, life’s most essential resource, allow us to deliver value for our shareholders while also leading on social responsibility. We believe we are well positioned to continue on this leadership journey. On behalf of the entire Board, we thank you for your confidence in us. We value your investment, your input and your support. |

| | | David A. Jones Pentair Chairman of the Board | John L. Stauch Pentair President and CEO |

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 1 |

| | | | | |

| Notice of Annual General Meeting of Shareholders |

| | | | | | | | | | | | | | | | | |

| Date and Time May 7, 2024 (Day) 7:00 a.m. local time (BST) | | Location Claridge’s Brook Street Mayfair London, W1K 4HR United Kingdom | | Who Can Vote Shareholders as of March 8, 2024 are entitled to vote |

| | | | | |

| | | | | | | | | | | |

| Voting Items | | |

| | | |

| | | |

| Proposal | | Page Reference |

| | | |

1.By separate resolutions, to re-elect the following director nominees: | |

(i)Mona Abutaleb Stephenson (ii)Melissa Barra (iii)Tracey C. Doi (iv)T. Michael Glenn (v)Theodore L. Harris | (vi)David A. Jones (vii)Gregory E. Knight (viii)Michael T. Speetzen (ix)John L. Stauch (x)Billie I. Williamson |

| | | |

| | | |

| | | |

2.To approve, by nonbinding, advisory vote, the compensation of the named executive officers. | |

| | | |

| | | |

3.To ratify, by nonbinding, advisory vote, the appointment of Deloitte & Touche LLP as the independent auditor of Pentair plc and to authorize, by binding vote, the Audit and Finance Committee of the Board of Directors to set the auditor’s remuneration. | |

| | | |

| | | |

4.To authorize the Board of Directors to allot new shares under Irish law. | |

| | | |

| | | |

5.To authorize the Board of Directors to opt-out of statutory preemption rights under Irish law. | |

| | | |

| | | |

6.To authorize the price range at which Pentair plc can re-allot shares it holds as treasury shares under Irish law. | |

| | | |

In addition, shareholders will consider and act on such other business as may properly come before the Annual General Meeting or any adjournment.

Proposals 1, 2, 3, and 4 are ordinary resolutions, requiring the approval of a simple majority of the votes cast at the meeting. Proposals 5 and 6 are special resolutions, requiring the approval of not less than 75% of the votes cast.

Only shareholders of record as of the close of business on March 8, 2024 are entitled to receive notice of and to vote at the Annual General Meeting. If you are a shareholder entitled to attend and vote at the Annual General Meeting, you are entitled to appoint a proxy or proxies to attend, speak and vote on your behalf. A proxy need not be a shareholder. If you wish to appoint as proxy any person other than the individuals specified on the proxy card to attend and vote at the Annual General Meeting on your behalf, please contact our Corporate Secretary at our registered office or deliver to the Corporate Secretary at our registered office a proxy card in the form set out in section 184 of the Irish Companies Act 2014 (the “Companies Act”).

At the Annual General Meeting, management will review Pentair plc’s affairs and will also present Pentair plc’s Irish Statutory Financial Statements for the fiscal year ended December 31, 2023 and the reports of the directors and the statutory auditors thereon.

By Order of the Board of Directors,

Karla C. Robertson, Secretary

March 22, 2024

| | | | | | | | |

2 | | Pentair | 2024 Proxy Statement |

| | | | | |

| Notice of Annual General Meeting of Shareholders |

How to Vote

| | | | | |

By Internet You can vote over the Internet at www.proxyvote.com. | Vote in Person If you plan to attend the Annual General Meeting and wish to vote your ordinary shares in person, we will give you a ballot at the meeting. |

| |

| |

By Telephone You can vote by telephone from the United States or Canada by calling the telephone number in the Notice of Internet Availability of Proxy Materials or on the proxy card. | By Mail You can vote by mail by marking, signing and dating your proxy card or voting instruction form and returning it in the postage-paid envelope, the results of which will be forwarded to Pentair plc’s registered address electronically. |

| |

| |

Whether or not you plan to attend the Annual General Meeting, we encourage you to vote your shares by submitting a proxy as soon as possible. IF YOU PLAN TO SUBMIT A PROXY, YOU MUST SUBMIT YOUR PROXY BY INTERNET OR TELEPHONE, OR YOUR PRINTED PROXY CARD MUST BE RECEIVED AT THE ADDRESS STATED ON THE CARD, BY NO LATER THAN: u4:59 A.M. (BRITISH SUMMER TIME) ON MAY 2, 2024 (11:59 P.M. EASTERN DAYLIGHT TIME ON MAY 1, 2024) FOR SHARES HELD IN THE COMPANY’S RETIREMENT PLANS OR EMPLOYEE STOCK PURCHASE PLAN u4:59 A.M. (BRITISH SUMMER TIME) ON MAY 6, 2024 (11:59 P.M. EASTERN DAYLIGHT TIME ON MAY 5, 2024) FOR SHARES HELD OF RECORD OR THROUGH A BROKER OR BANK |

| |

| |

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on May 7, 2024. The Annual Report, Notice of Annual General Meeting, Proxy Statement, and Irish Statutory Financial Statements and Related Reports are available by Internet at www.proxyvote.com. | Shareholders in Ireland may participate in the Annual General Meeting by audio link at Arthur Cox LLP, Ten Earlsfort Terrace, Dublin 2, D02 T380, Ireland, at 7:00 a.m. local time (Irish Standard Time). See “Questions and Answers about the Annual General Meeting and Voting” for further information on participating in the Annual General Meeting in Ireland. |

| |

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 3 |

| | | | | | | | |

| | |

| Frequently Requested Information |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | | | | | | |

4 | | Pentair | 2024 Proxy Statement |

| | | | | |

| Business and Financial Results |

Business Overview

At Pentair, we help the world sustainably move, improve and enjoy water, life’s most essential resource. From our residential and commercial water solutions to industrial water management and everything in between, Pentair is focused on smart, sustainable water solutions that help people and the planet thrive.

Strategy

Our vision is to be the world’s most valued sustainable water solutions company for our employees, customers and shareholders. As a company, we:

uFocus on growth in our core businesses and strategic initiatives;

uAccelerate digital, innovation, technology and environmental, social and governance (“ESG”) investments;

uExpedite growth and drive margin expansion through our Transformation Program; and

uBuild a high performance growth culture and deliver on our commitments while living our Win Right values.

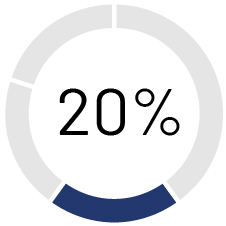

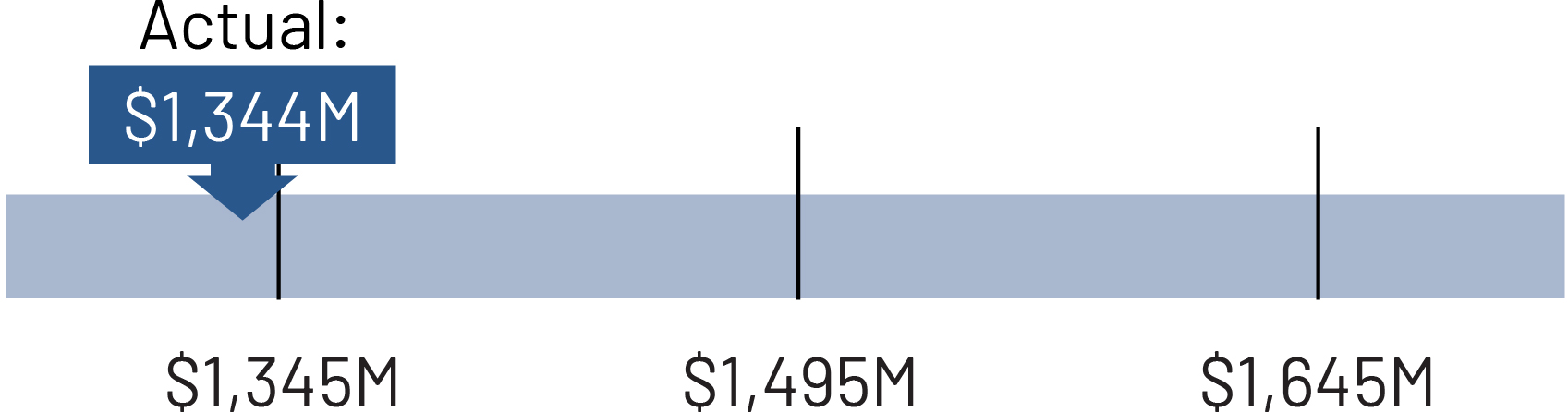

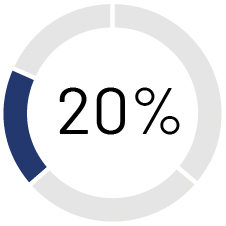

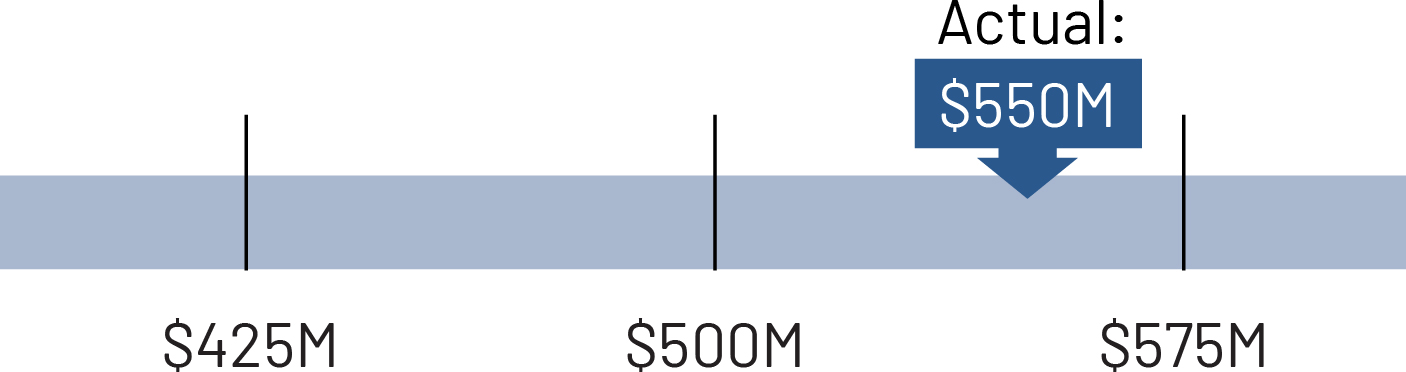

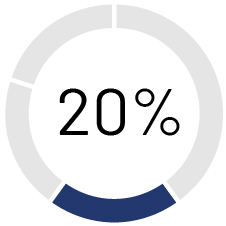

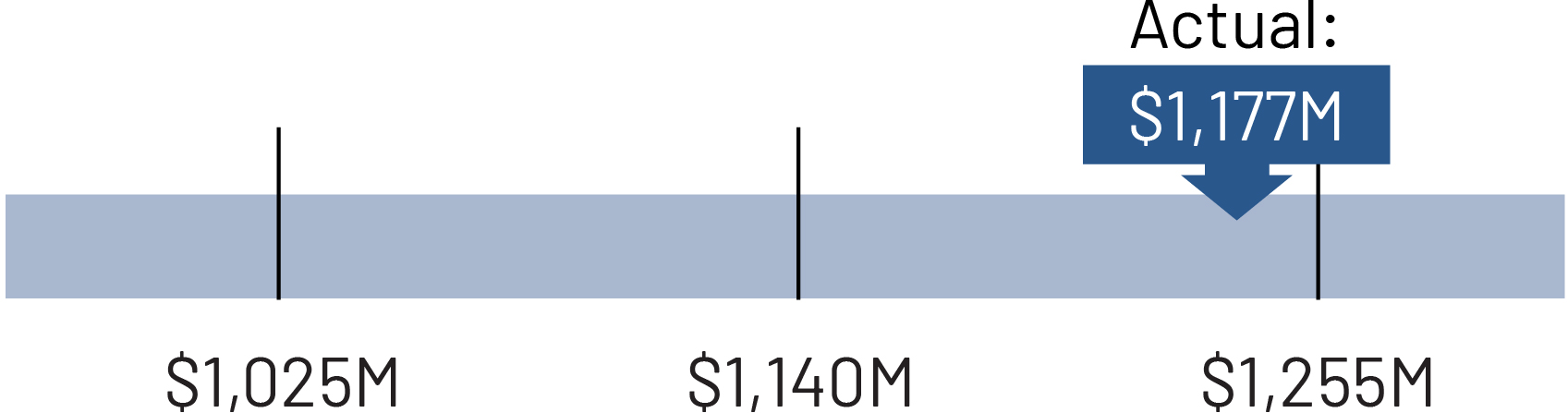

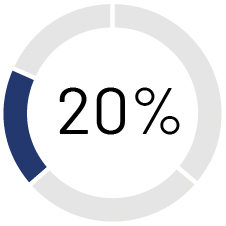

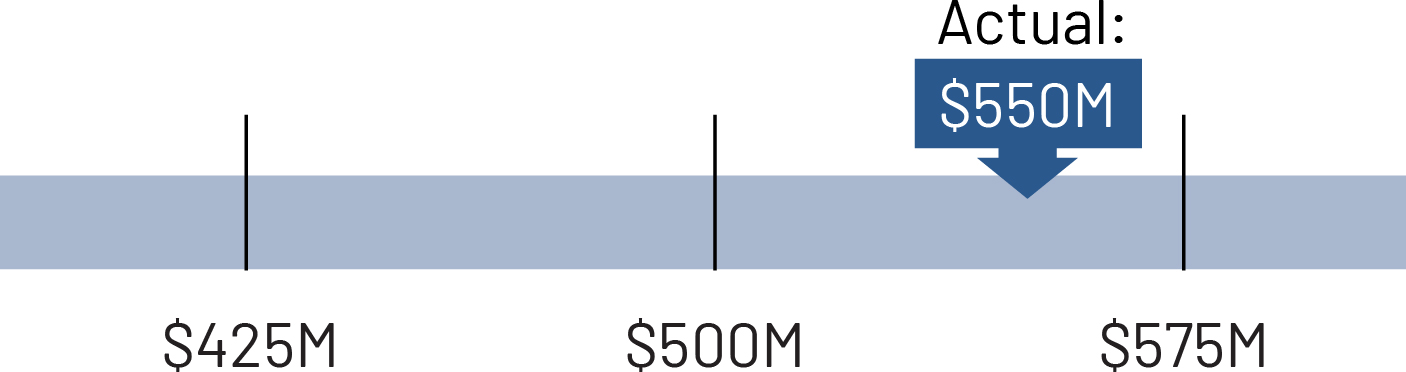

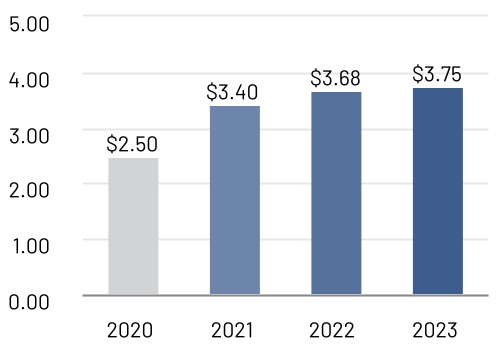

2023 Business Results Highlights*

| | | | | | | | | | | |

| | | |

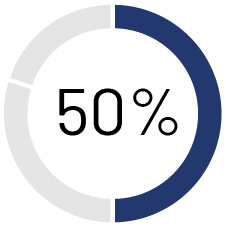

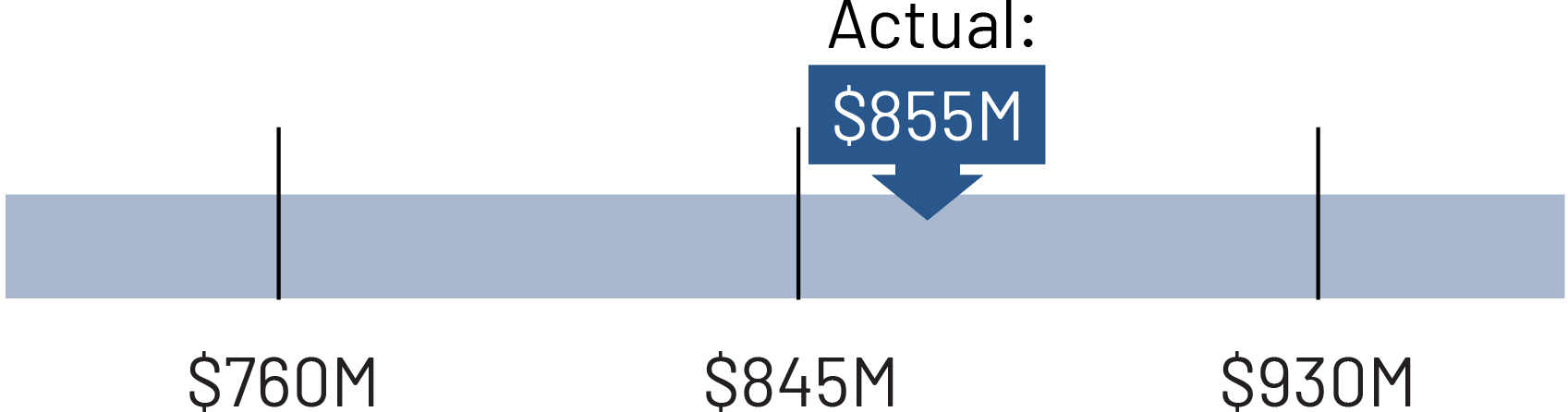

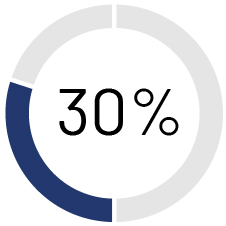

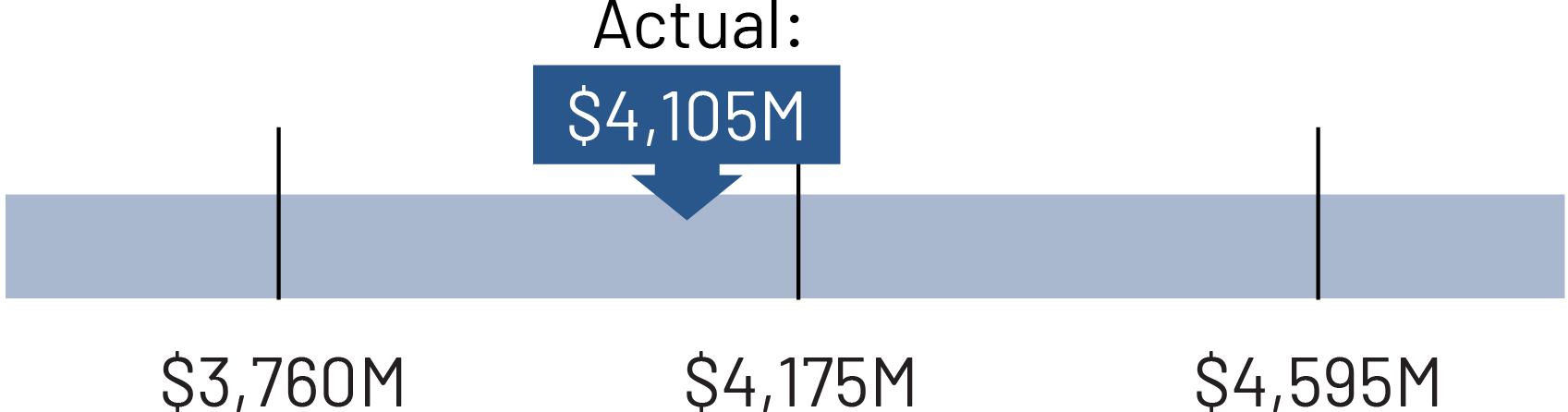

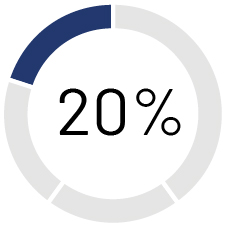

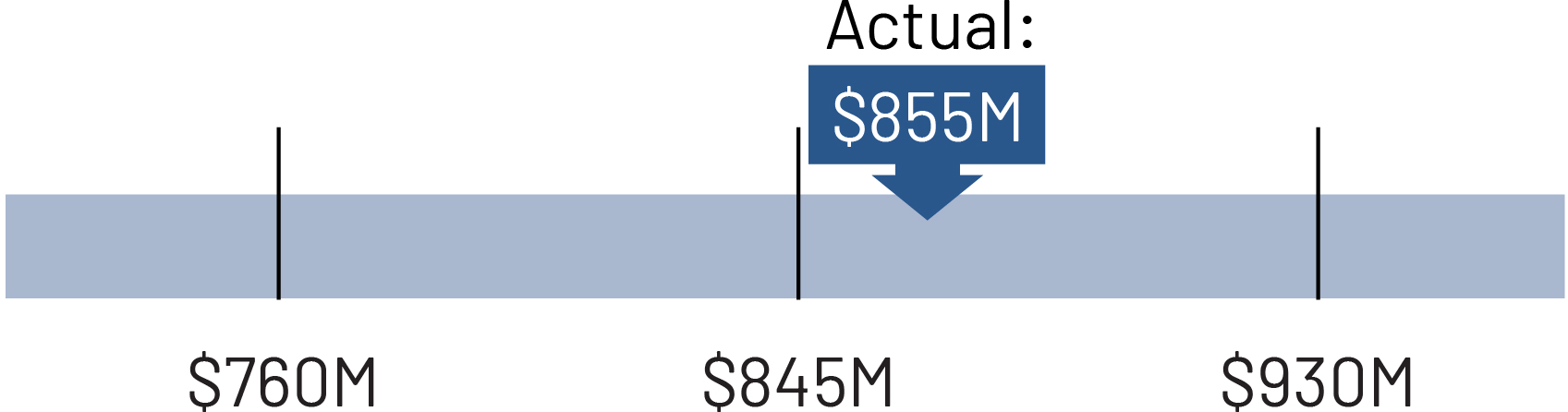

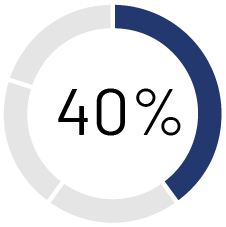

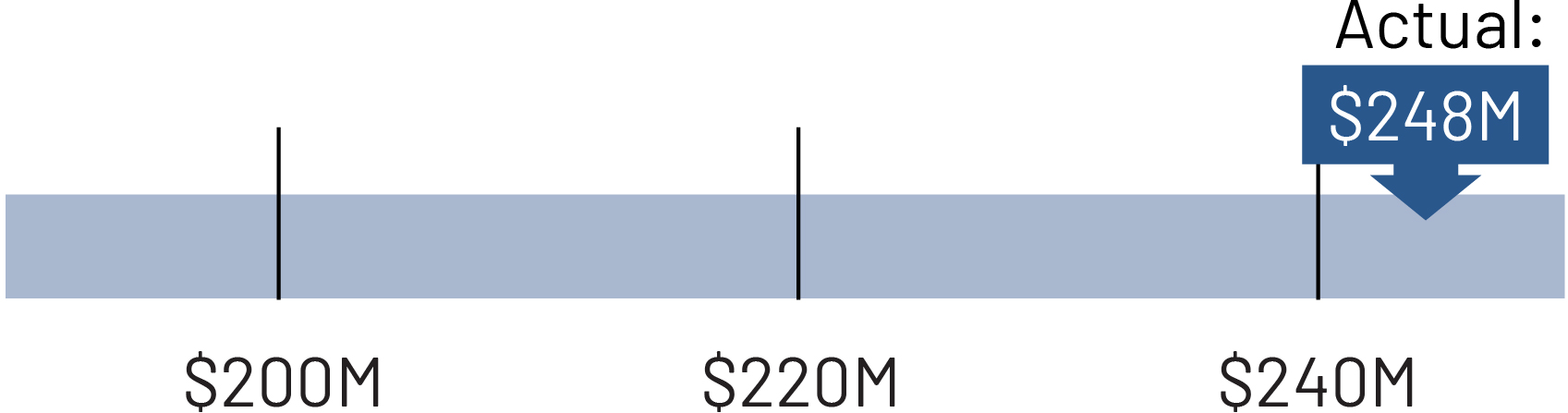

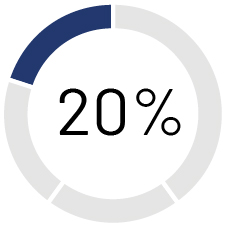

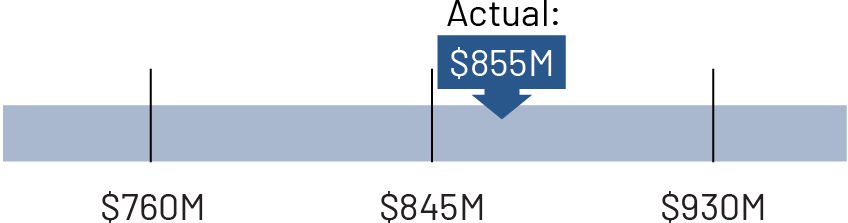

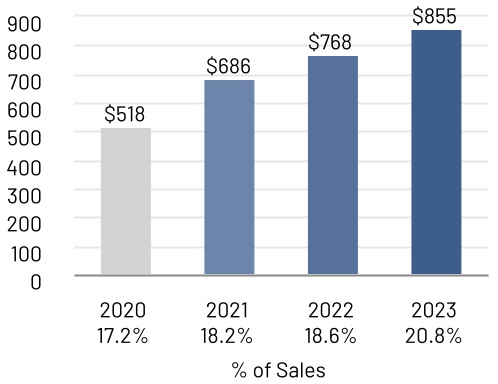

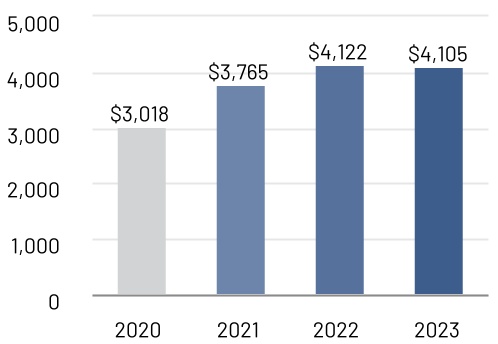

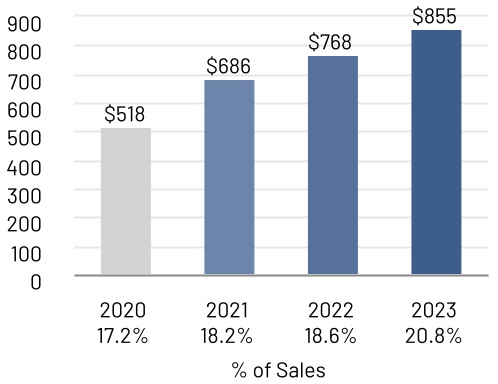

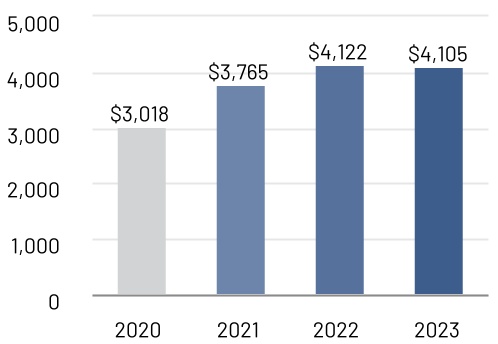

| $4.1 billion OF SALES Flat compared to FY2022 | $855.1 million OF SEGMENT INCOME*  11% from FY2022 11% from FY2022 | |

| | | |

| | | |

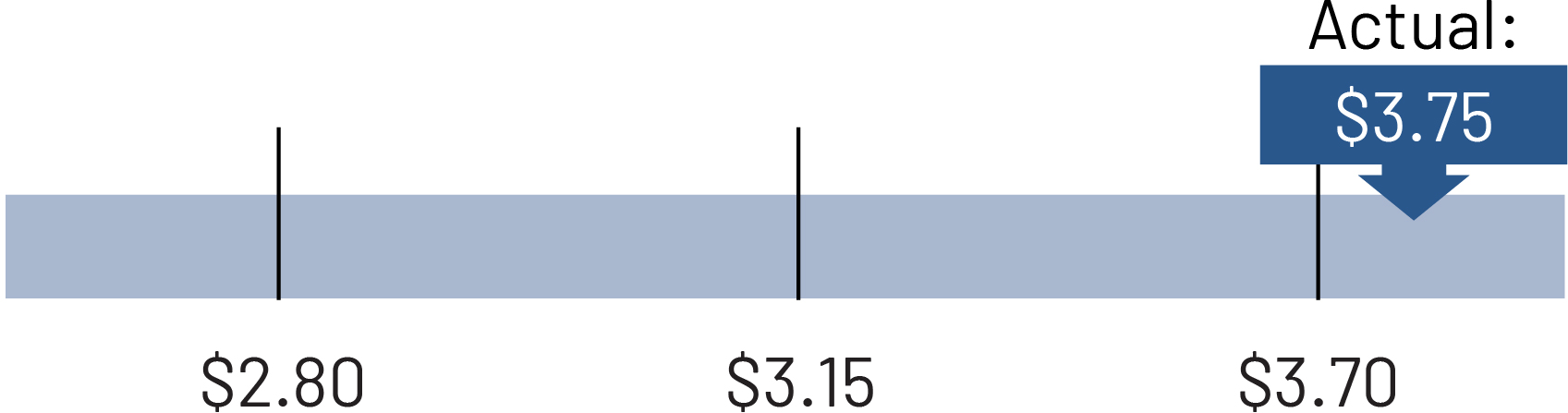

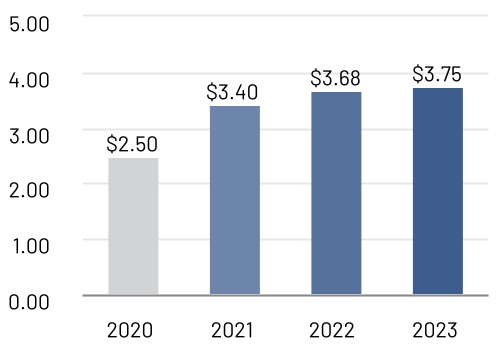

| $3.75 ADJUSTED EARNINGS PER SHARE*  2% from FY2022 2% from FY2022 | INCREASED QUARTERLY CASH DIVIDEND from $0.21  $0.22 $0.22 per share | |

| | | |

| | | |

| RETURN ON SALES* of 20.8%  220bps from FY2022 220bps from FY2022 | $145.2 million CASH RETURNED TO SHAREHOLDERS in cash dividends in FY2023 | |

| | | |

| | | |

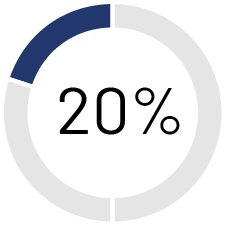

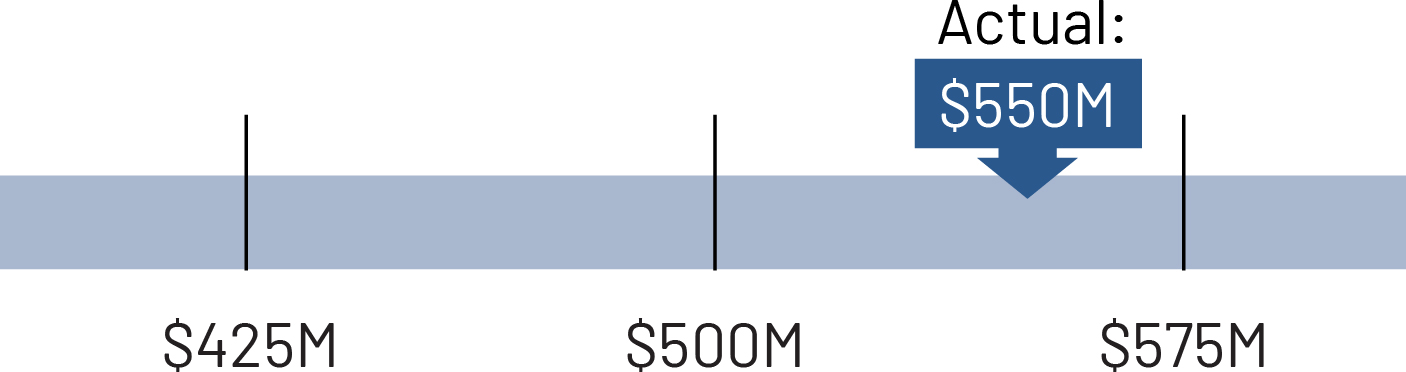

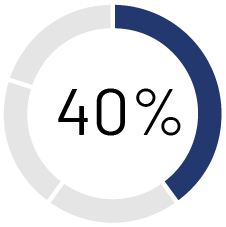

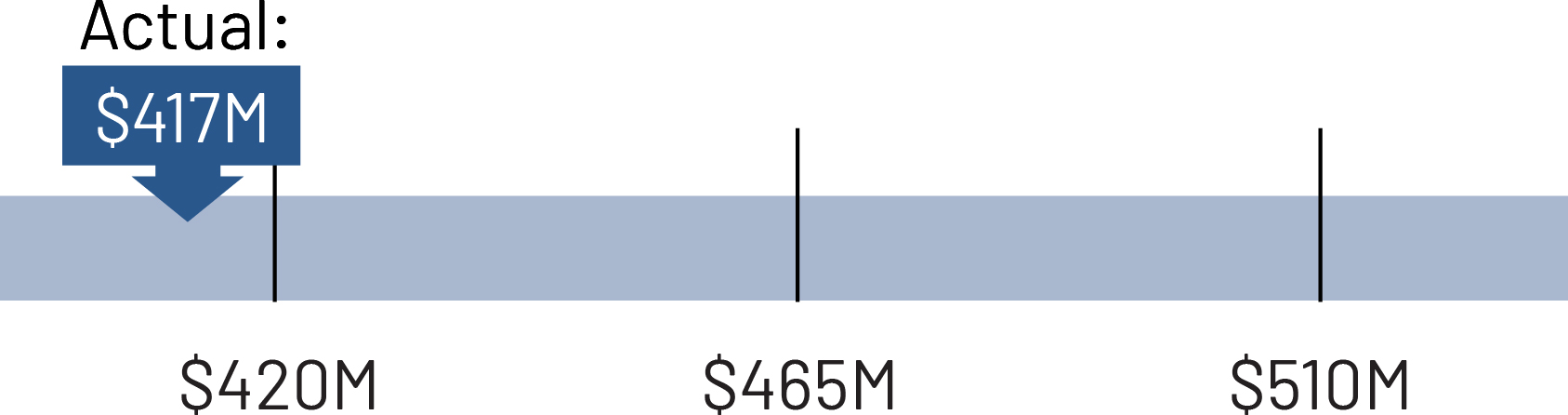

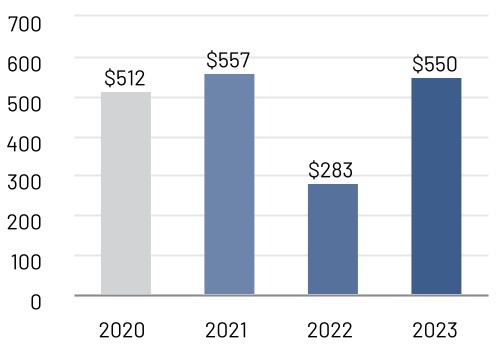

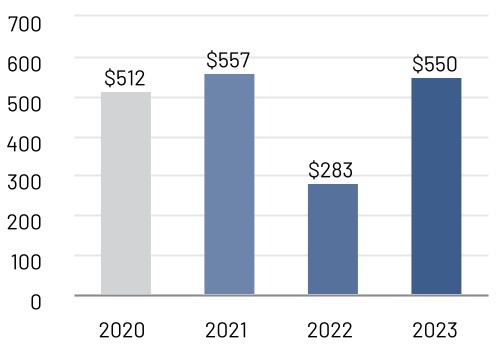

| FREE CASH FLOW* from continuing operations of $550.4 million  94% from FY2022 94% from FY2022 | |

| | | |

| | | |

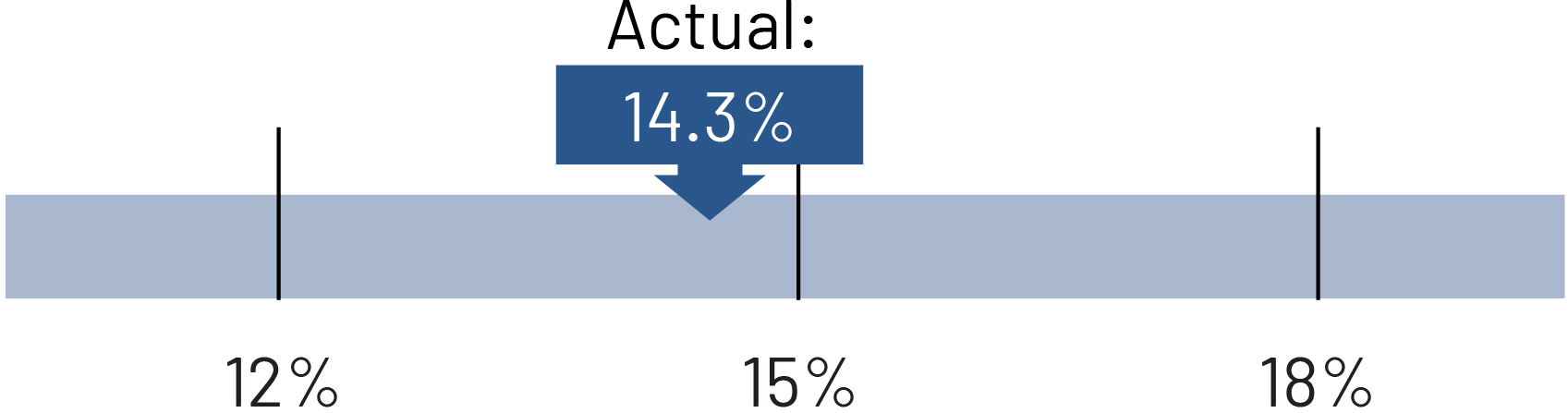

| ROIC of 14.3% | | |

| * Please see Appendix A for reconciliation of GAAP to non-GAAP financial measures included in this section. | |

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 5 |

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider, and you should read the entire Proxy Statement before voting.

Voting Matters

| | | | | | | | | | | |

| Proposal | Board Vote Recommendation | Vote Required | Page Reference |

1.Re-Elect Director Nominees | FOR each nominee | Majority of votes cast | |

2.Approve, by Nonbinding, Advisory Vote, the Compensation of the Named Executive Officers | FOR | Majority of votes cast | |

3.Ratify, by Nonbinding, Advisory Vote, the Appointment of the Independent Auditor and Authorize, by Binding Vote, the Audit and Finance Committee to Set the Auditor’s Remuneration | FOR | Majority of votes cast | |

4.Authorize the Board of Directors to Allot New Shares | FOR | Majority of votes cast | |

5.Authorize the Board of Directors to Opt-Out of Statutory Preemption Rights | FOR | 75% of votes cast | |

6.Authorize the Price Range at Which Pentair Can Re-allot Treasury Shares | FOR | 75% of votes cast | |

Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Primary Occupation | Age* | Director Since | Diversity Information | | Committee Memberships |

| Gender | Race/Ethnicity | | AFC | CC | GC |

| Mona Abutaleb Stephenson IND Chief Executive Officer, Medical Technology Solutions, LLC | 61 | 2019 | F | Middle Eastern | | | | |

| Melissa Barra IND Executive Vice President, Chief Sales and Services Officer, Sleep Number Corporation | 52 | 2021 | F | Two or More Races** | | | | |

| Tracey C. Doi IND Retired Group Vice President and Chief Financial Officer, Toyota Motor North America | 63 | 2023 | F | Asian | | | | |

| T. Michael Glenn IND Retired Executive Vice President, FedEx Corporation and Chief Executive Officer, FedEx Services | 68 | 2007 | M | White | | | | |

| Theodore L. Harris IND Chief Executive Officer, Balchem Corporation | 59 | 2018 | M | White | | | | |

| David A. Jones (Chairman) IND Senior Advisor, Oak Hill Capital Partners | 74 | 2003 | M | White | | | | |

| Gregory E. Knight IND Senior Advisor, Digital Transformation, Boston Consulting Group, Inc. | 56 | 2021 | M | Black / African American | | | | |

| Michael T. Speetzen IND Chief Executive Officer, Polaris Inc. | 54 | 2018 | M | White | | | | |

| John L. Stauch President and Chief Executive Officer, Pentair plc | 59 | 2018 | M | White | | | | |

| Billie I. Williamson IND Retired Senior Assurance Partner, Ernst & Young LLP | 71 | 2014 | F | White | | | | |

| | | | | | | | |

AFC – Audit and Finance Committee CC – Compensation Committee | GC – Governance Committee IND – Independent |  – Committee Member – Committee Member – Committee Chair – Committee Chair |

* As of the date of the filing of this Proxy Statement ** Hispanic / Latinx and White

| | | | | | | | |

6 | | Pentair | 2024 Proxy Statement |

| | |

|

Tracey C. Doi Appointed as a New Director in 2023 In 2023, the Board of Directors appointed Tracey C. Doi to serve as a member of the Board and on the Company’s Audit and Finance Committee. Ms. Doi is a seasoned Director and operational leader with skilled experience in strategic planning, finance, transformations, enterprise systems, and business analytics. More information about Ms. Doi can be found in the “2024 Board Nominees” section of this Proxy Statement. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director Dashboard |

|

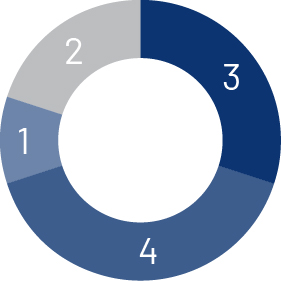

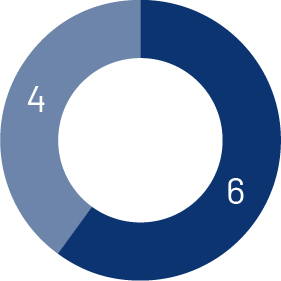

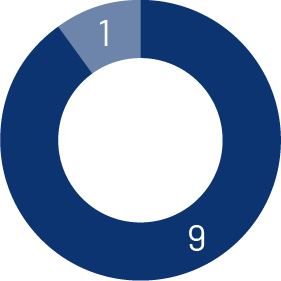

| Tenure Balance | | Race / Ethnicity | | Gender Diversity | | Director Independence | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| n | ≤3 Years | n | 7-9 Years | | n | White | n | Asian | | n | Male | n | Female | | n | Independent | n | Not Independent | |

| n | 4-6 Years | n | ≥10 Years | | n | Black / African American | n | Two or More Races* | | | | | | | | | | | |

| | | | | | n | Middle Eastern | | | | | | | | | | | | | |

| * Hispanic / Latinx and White | |

| | | | | | | | | | | | | | | | | | | | |

Corporate Governance Strengths

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 7 |

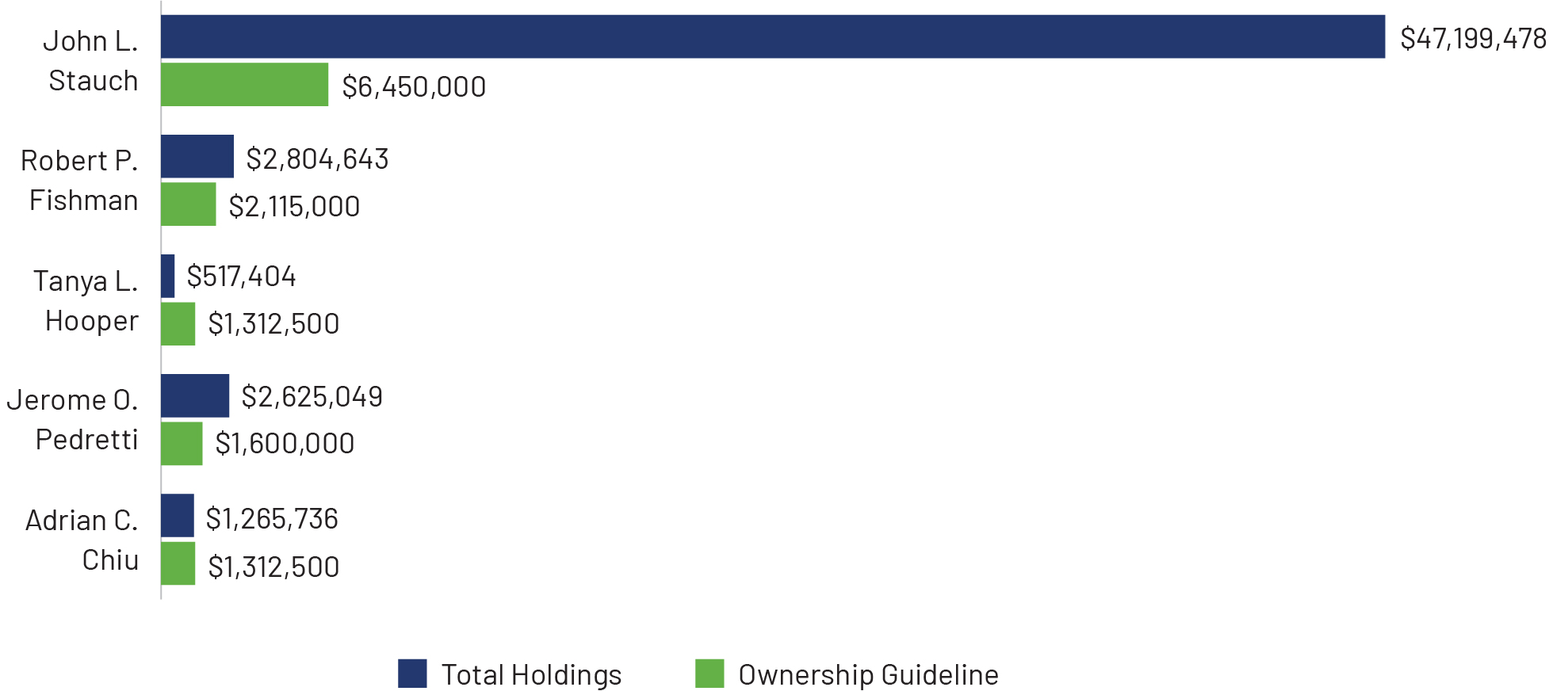

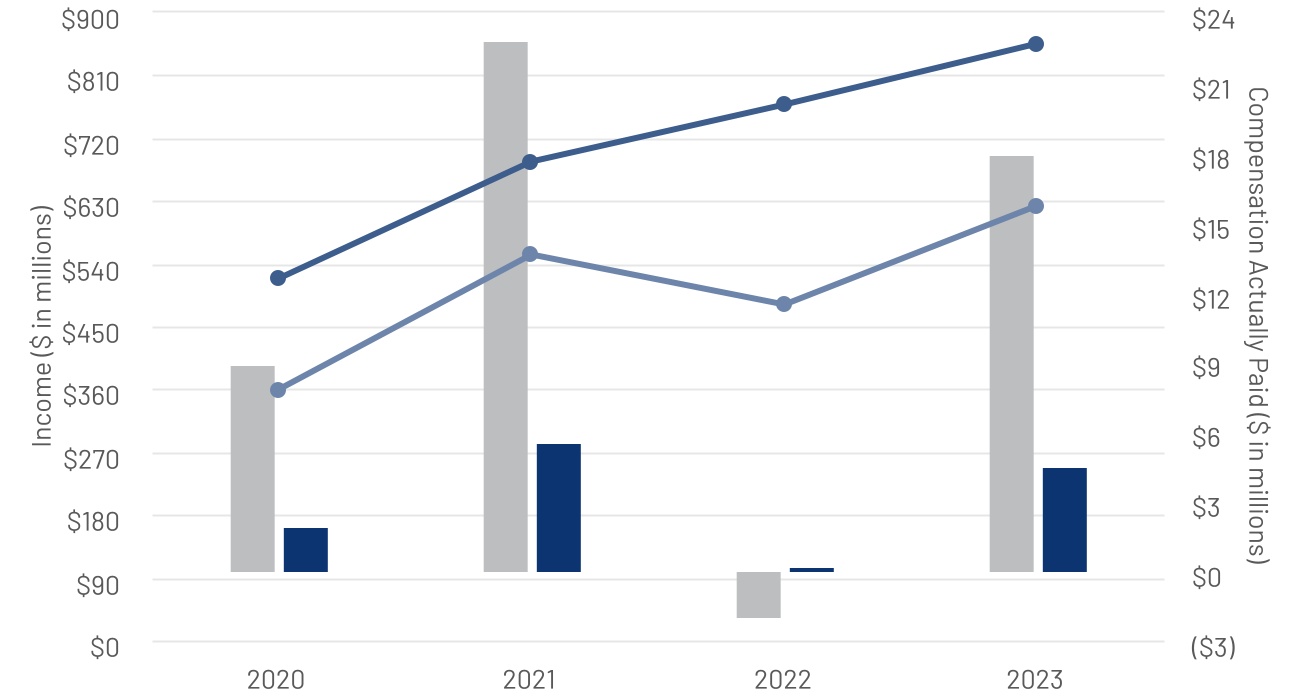

Fiscal 2023 Executive Compensation

The Compensation Committee believes that the most effective executive compensation program aligns executive initiatives with shareholders’ interests. The Compensation Committee seeks to accomplish this objective by rewarding the achievement of specific annual, long-term, and strategic goals that create lasting shareholder value.

| | |

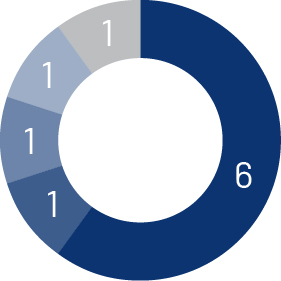

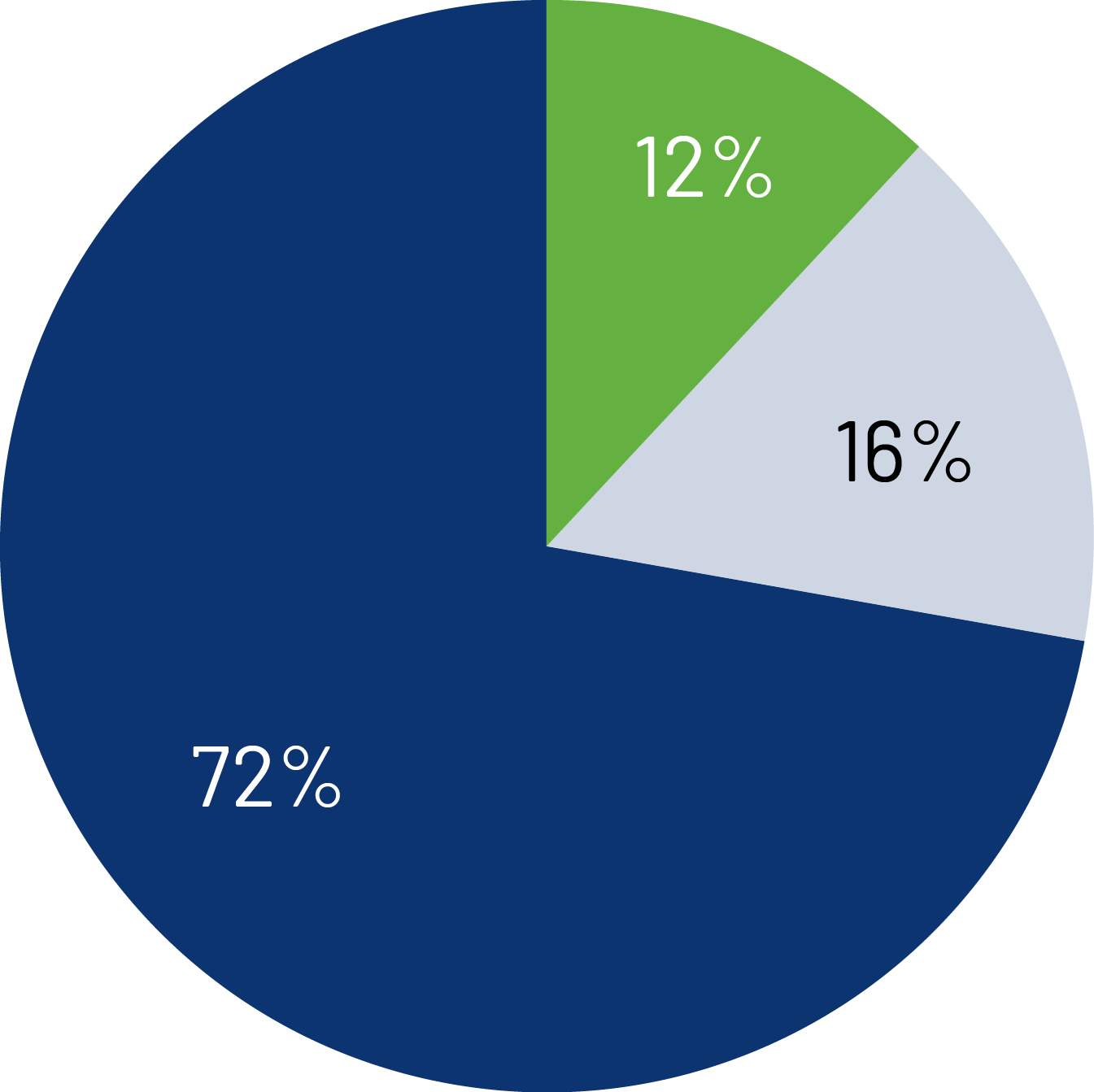

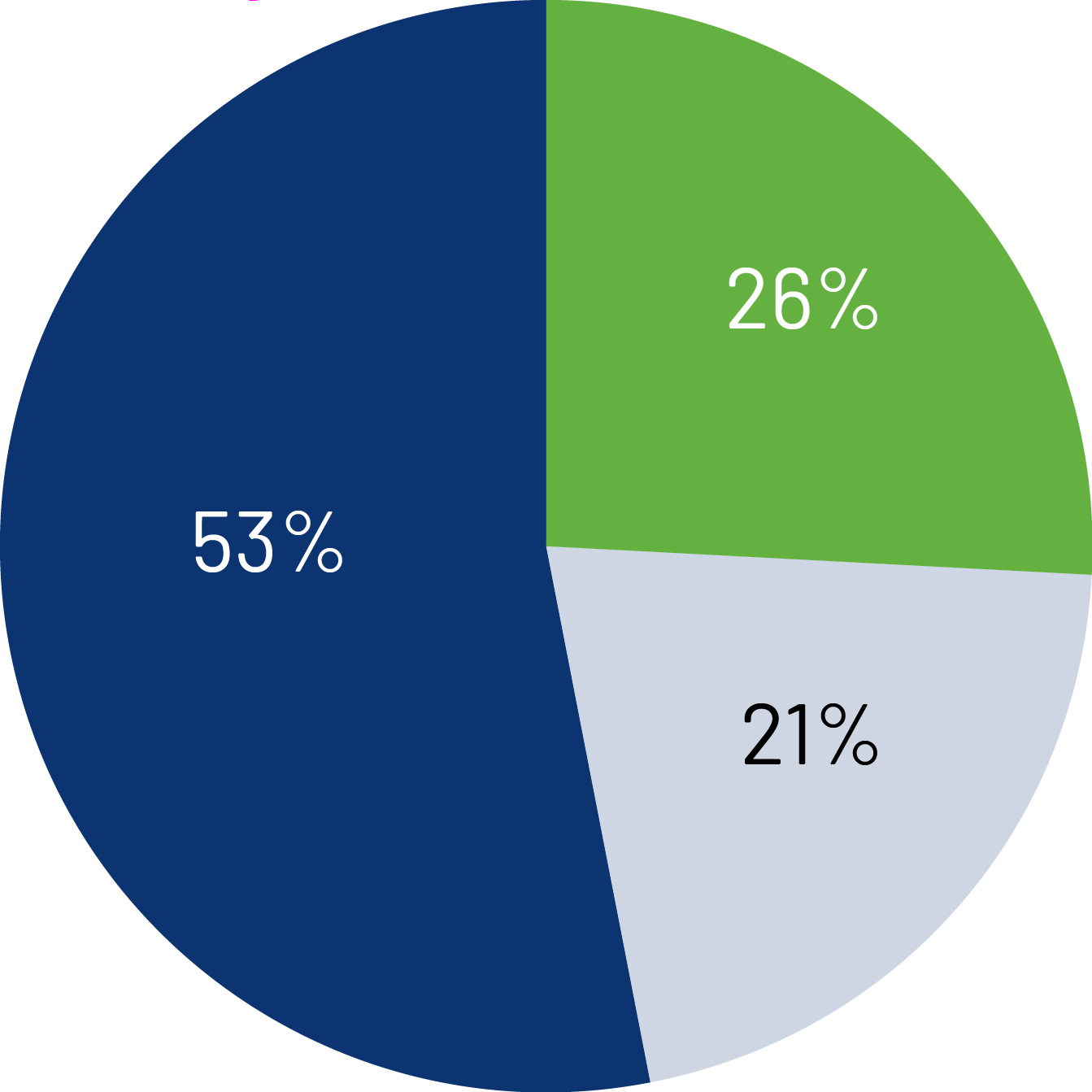

| Elements of Compensation and Pay Mix |

|

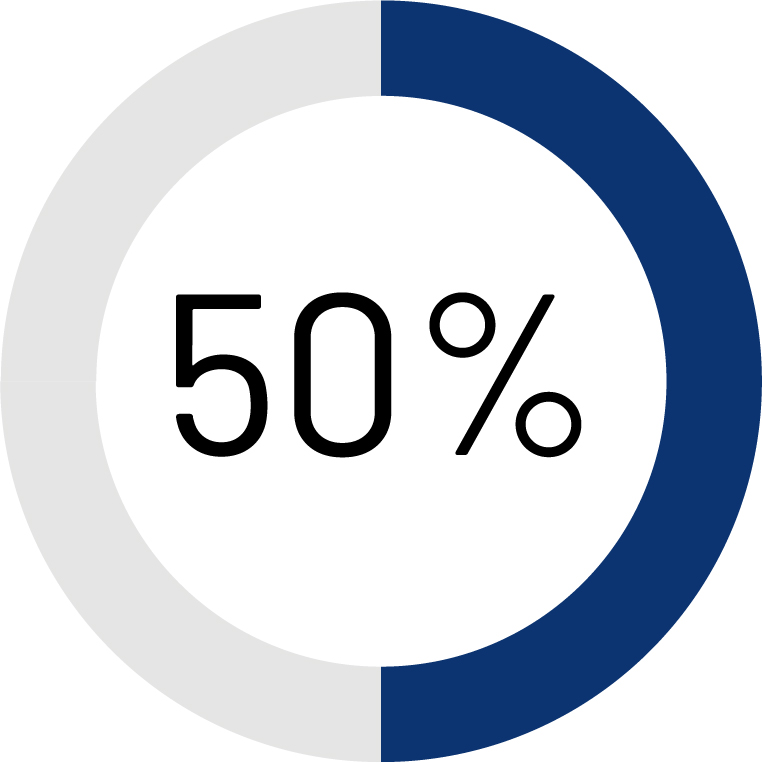

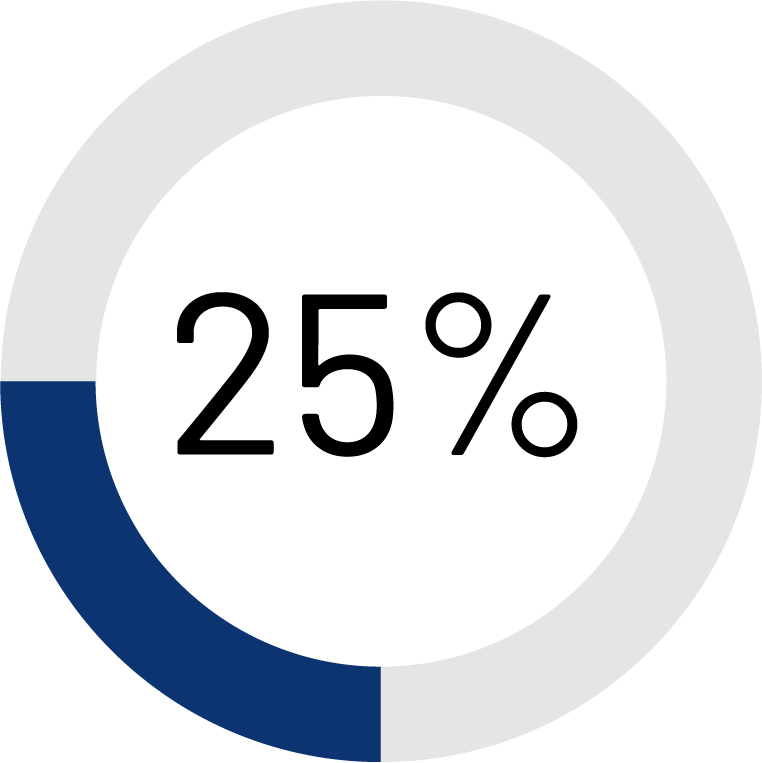

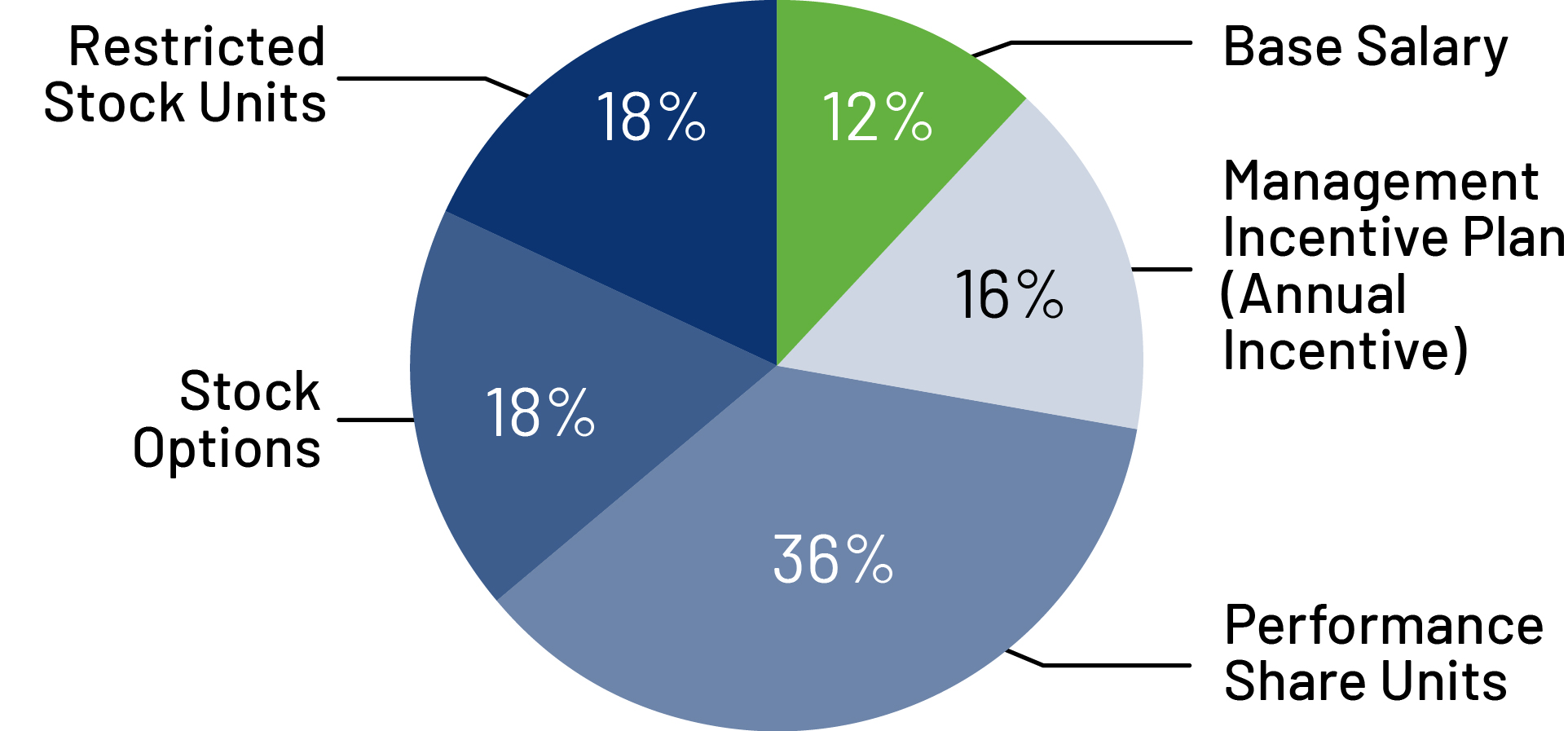

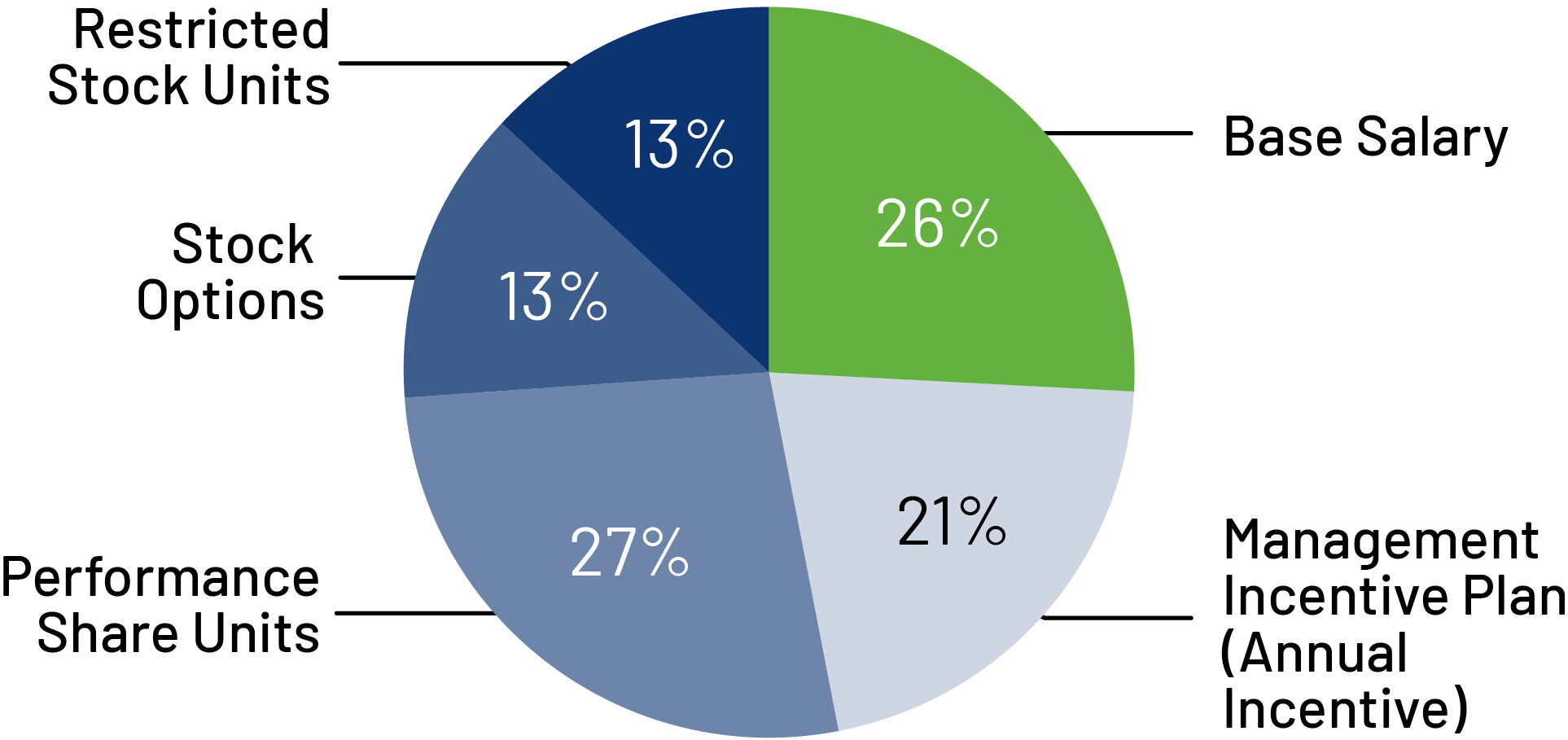

The graphics describe the elements of our executive compensation program and illustrate the approximate targeted mix of fixed, annual, and long-term incentive compensation we provided in 2023 to our Chief Executive Officer and our other executive officers who are named in the Summary Compensation Table (the “Named Executive Officers” or “NEOs”). These graphics also illustrate the approximate amount of target direct compensation considered at risk. This summary of fiscal 2023 compensation should be read in connection with the “Compensation Discussion and Analysis” (see page 31). | | | | | | | | |

Base Salary | Annual Incentives | Long-Term Incentives |

| | |

Purpose: To provide fixed compensation competitive in the marketplace Features: uDetermined based on numerous factors such as competitive market conditions, level of responsibility, experience, and individual performance | Purpose: To reward short-term performance against specific financial targets Features: uPaid after end of one-year performance period uBased on achievement against annual enterprise and/or segment financial performance targets uPayout range of 50% of target (at threshold) to 200% of target (at maximum), subject to a +/- 10% ESG modifier | Purpose: To link management incentives to long-term value creation and shareholder return Features: u50% performance share units based on achievement against three-year financial performance targets paid after end of three-year performance period u25% stock options with a 10-year term vesting ratably on first three grant date anniversaries u25% restricted stock units vesting ratably on first three grant date anniversaries |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CEO | AVERAGE OF OTHER NEOs |

| n | Base Salary | n | Management Incentive Plan (Annual Incentive) | n | Long-Term Incentives | n | Base Salary | n | Management Incentive Plan (Annual Incentive) | n | Long-Term Incentives |

| | | | | | | | | |

| | |

|

Annual Incentive Award ESG Modifier Since 2022, the Compensation Committee has approved the inclusion of an ESG component in the Company’s annual incentive program for executive officers. The ESG component addresses progress toward our five social responsibility strategic targets announced in 2021 in the form of a potential modifier to the final annual incentive program calculation based on financial targets. |

|

| | | | | | | | |

8 | | Pentair | 2024 Proxy Statement |

Shareholder Engagement

| | | | | | | | |

Who we engaged | How we engaged | What we learned |

| | |

In the fall of 2023, we reached out to our largest shareholders representing 55% of our outstanding shares to engage on corporate governance, executive compensation, and ESG matters. | Shareholders representing approximately 19% of our outstanding shares accepted our invitation to meet and participated in individual conference calls. | Based on our shareholder engagement, and other feedback from investors throughout the year, we believe we continue to be focused on what matters to our shareholders, including: ucreating and delivering value for our customers and shareholders, and uensuring that our ESG efforts are aligned with driving sustainable and resilient business operations. |

| | |

| | | | | | | | | | | | | | |

Shareholder support of our executive compensation program was reflected in our 2023 “say-on-pay vote” with 91% of votes cast in favor of our proposal. In 2023, the Compensation Committee maintained the majority of changes adopted over the last number of years, which reflected the Committee’s focus on pay for performance, shareholder feedback, and industry and market practices. | Say-on-Pay |

| 2021 | 2022 | 2023 |

Votes “For” as Percent of Votes Cast | 91% | 94% | 91% |

| | |

| Communicating with Directors |

|

Interested parties may communicate with the Board, non-employee directors as a group, or any individual director, including the Chairman, by sending a letter addressed to the relevant party, c/o Corporate Secretary, Pentair plc, Regal House, 70 London Road, Twickenham, London, TW1 3QS, United Kingdom. Any such communications will be forwarded directly to the relevant addressee(s).

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 9 |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| PROPOSAL 1 | | | | |

| Re-Elect Director Nominees | | | |

| | The Board recommends a vote FOR each director nominee. | |

| | | | |

| Our Board currently has ten members. The size of our Board is limited to no fewer than seven and no more than eleven members. Accordingly, the Board has set the number of directors that will constitute the Board effective at the Annual General Meeting at ten. On the recommendation of the Governance Committee, our Board has nominated the ten director nominees named in the resolutions below, all of whom are current directors, for re-election for a one-year term expiring on completion of the 2025 Annual General Meeting. If any of the director nominees should become unable to accept election, your proxy or proxies may vote for other persons selected by the Board. Management has no reason to believe that any of the director nominees named below will be unable to serve his or her full term if elected. Biographies of the director nominees follow. These biographies include for each director his or her age (as of the date of the filing of this Proxy Statement); his or her business experience; his or her directorships in public companies and other organizations within the past five years; and a discussion of the specific experience, qualifications, attributes or skills that led to the conclusion that each should serve as a director. Tracey C. Doi is standing for election by our shareholders for the first time. In July 2023, Ms. Doi was appointed by our Board to serve as a director effective August 15, 2023. Ms. Doi was identified as a potential candidate for the Board by a non-employee director and referred to the independent search firm that assisted the Governance Committee in identifying and evaluating potential candidates. The text of the resolutions with respect to Proposal 1 is as follows: “IT IS RESOLVED, by separate resolutions to re-elect the following ten director nominees for a term expiring on completion of the 2025 Annual General Meeting: | |

| | | | |

| | | | |

| uMona Abutaleb Stephenson uMelissa Barra uTracey C. Doi uT. Michael Glenn | uTheodore L. Harris uDavid A. Jones uGregory E. Knight | uMichael T. Speetzen uJohn L. Stauch uBillie I. Williamson.” | |

| | | | |

| | | | |

| | | | | |

| The Board recommends a vote FOR re-election of each director nominee. | |

| | | | | |

| | | | | | | | |

10 | | Pentair | 2024 Proxy Statement |

2024 Board Nominees

| | |

| Director Qualifications, Skills and Expertise |

|

The Governance Committee and the Board recognize that the Board’s contributions and effectiveness depend on the character and abilities of each director individually as well as on their collective strengths. Accordingly, the Governance Committee and the Board evaluate candidates based on several criteria. Directors are chosen with a view to bringing to the Board a diversity of skills, qualifications, experiences, perspectives and backgrounds. In this regard, the Governance Committee and the Board consider diversity of age, gender, race, ethnicity and other characteristics. The Governance Committee and the Board seek to establish a core of strategic and business advisers with financial and management expertise, and also consider candidates with substantial experience outside the business community, such as in the public, academic or scientific communities. In addition, the Governance Committee and the Board consider the tenure of incumbent directors, with the goal of having a mix of shorter-tenured directors who provide fresh perspectives and longer-tenured directors who provide institutional knowledge regarding our company and our business.

When considering candidates for election as directors, the Governance Committee and the Board are guided by the following principles, found in our Corporate Governance Principles:

uat least a majority of the Board must consist of independent directors;

ueach director should be an individual of the highest character and integrity and have an inquiring mind, vision and the ability to work well with others;

ueach director should be free of any conflict of interest that would violate any applicable law or regulation or interfere with the proper performance of his or her responsibilities as a director;

ueach director should possess substantial and significant experience that could be important to us in the performance of his or her duties;

ueach director should have sufficient time available to devote to our affairs; and

ueach director should have the capacity and desire to represent the balanced, best interests of the shareholders as a whole and not primarily the interests of a special interest group or constituency and be committed to enhancing long-term shareholder value.

The Governance Committee in the first instance is charged with observing these policies and strives in reviewing each candidate to assess the fit of his or her qualifications with the needs of the Board and our company at that time, given the then-current mix of directors’ attributes. Board composition, effectiveness and processes are all subject areas of our annual Board self-assessment, which is described in more detail below under “Board and Committee Self-Assessments.”

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 11 |

| | | | | | | | | | | | | | |

| | | | |

MONA ABUTALEB STEPHENSON Chief Executive Officer, Medical Technology Solutions, LLC Independent Age: 61 Director Since: 2019 Committees Served: Audit and Finance Gender; Race/Ethnicity: Female (Middle Eastern) Other Current Public Board Service: Sandy Spring Bancorp, Inc. (2015–present) | | Biography: uChief Executive Officer of Medical Technology Solutions, LLC, a provider of technology solutions for the healthcare industry, from 2019 to present uChief Executive Officer of mindSHIFT Technologies, Inc., an IT outsourcing/managed services and cloud services provider, from 2013 to 2018 uPresident and Chief Operating Officer of mindSHIFT from 2006 to 2013 uSenior Vice President of Ricoh USA from 2015 to 2017 and Executive Vice President of Ricoh Global Services from 2017 to 2018 uIn 2012, mindSHIFT was acquired by Best Buy Co., Inc. and then later, in 2014, was acquired by Ricoh Company, Ltd., a leading provider of document management solutions, IT services, printing, digital cameras and industrial systems | |

| | | |

| | | |

| Skills & Qualifications: Ms. Abutaleb has significant executive leadership experience, including in the areas of technology, cyber risk management and strategic planning. Ms. Abutaleb’s experience serving on the board of a company operating in a highly regulated industry contributes to her experience overseeing governance and risk. | |

| | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

MELISSA BARRA Executive Vice President, Chief Sales and Services Officer, Sleep Number Corporation Independent Age: 52 Director Since: 2021 Committees Served: Audit and Finance Gender; Race/Ethnicity: Female (Two or More Races*) | | Biography: uExecutive Vice President, Chief Sales and Services Officer for Sleep Number Corporation, a provider of smart sleep technology, from 2020 to present uVice President, Strategy and Consumer Insights from 2013 to 2015, Senior Vice President, Chief Strategy and Customer Relationship Officer from 2015 to 2019, and Senior Vice President, Chief Sales, Services and Strategy Officer from 2019 to 2020, since joining Sleep Number in 2013 uSenior leadership roles in strategy, corporate development and finance for Best Buy Co., Inc., a multinational consumer electronics retailer, from 2005 to 2012 uStrategy leadership and corporate finance roles at Grupo Futuro, Citibank and GE Capital | |

| | | | |

| | | | |

| Skills & Qualifications: Ms. Barra has a strong background in customer experience, sales, services and strategy, as well as experience in digital transformation and information technology. Ms. Barra’s operating and leadership experience, including with other public companies, allows her to provide insight on a variety of growth, customer, human capital and diversity strategies important to our business. | |

| |

| | | | |

* Hispanic / Latinx and White

| | | | | | | | |

12 | | Pentair | 2024 Proxy Statement |

| | | | | | | | | | | | | | |

| | | | |

TRACEY C. DOI Retired Group Vice President and Chief Financial Officer, Toyota Motor North America Independent Age: 63 Director Since: 2023 Committees Served: Audit and Finance Gender; Race/Ethnicity: Female (Asian) Other Current Public Board Service: Quest Diagnostics Incorporated (2021–present) | | Biography: uGroup Vice President and Chief Financial Officer of Toyota Motor North America, an automobile designer and manufacturer, from 2003 to 2022 uVice President, Corporate Controller of Toyota Motor Sales, USA from 2000 to 2003 uMember of the board of directors of Quest Diagnostics Incorporated from 2021 to present uIndependent trustee for SunAmerica Series Trust and Seasons Series Trust from 2021 to present uMember of the board of directors of City National Bank, a Royal Bank of Canada Company from 2016 to 2021 | |

| | | |

| | | |

| Skills & Qualifications: Ms. Doi has a significant executive background in corporate finance, strategic planning, transformation, operations, enterprise systems, and business analytics, and brings to our Board deep experience with a global manufacturer operating in a complex industry. | |

| | | |

| | | | | | | | | | | | | | |

| | | | |

T. MICHAEL GLENN Retired Executive Vice President, FedEx Corporation and Chief Executive Officer, FedEx Services Independent Age: 68 Director Since: 2007 Committees Served: Compensation (Chair) Governance Gender; Race/Ethnicity: Male (White) Other Current Public Board Service: Lumen Technologies, Inc. (2017–present) | | Biography: uMember of the board of directors of Lumen Technologies, Inc. (formerly CenturyLink, Inc.), a global communications and information technology services company, from 2017 to present, including as Chairman of the board of directors since May 2020 uSenior Advisor to Oak Hill Capital Partners, a private equity firm, from 2017 to 2020 uServed as Chief Executive Officer of FedEx Services, responsible for all marketing, sales, customer service and retail operation functions for FedEx Corporation, from 2000 to 2016 uExecutive Vice President, FedEx Corporation and member of the Executive Committee, from 1998 to 2016 uVarious marketing, sales and customer service roles including senior leadership positions, from 1981 to 1998 at FedEx Corporation, a global leader of supply chain, transportation and relations information services | |

| | | |

| | | |

| Skills & Qualifications: Mr. Glenn brings extensive strategic, marketing and communications experience to our Board from his service as one of the top leaders at FedEx Corporation. He has been an active participant in the development of our strategic plans and a strong proponent for strengthening our branding and marketing initiatives. | |

| | | |

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 13 |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

THEODORE L. HARRIS Chief Executive Officer, Balchem Corporation Independent Age: 59 Director Since: 2018 Committees Served: Compensation Governance Gender; Race/Ethnicity: Male (White) Other Current Public Board Service: Balchem Corporation (2015–present) | | Biography: uChief Executive Officer and member of the board of directors of Balchem Corporation, a provider of specialty performance ingredients and products for the food, nutritional, feed, pharmaceutical, medical sterilization and industrial industries, from 2015 to present, and Chairman of Balchem’s board of directors, from 2017 to present u11 years of various senior management positions at Ashland, Inc., a global specialty chemical provider in a wide variety of markets and applications, such as architectural coatings, adhesives, automotive, construction, energy, food and beverage, personal care, and pharmaceutical, including most recently as Senior Vice President and President, Performance Materials, from 2014 to 2015 uSenior Vice President and President, Performance Materials & Ashland Supply Chain from 2011 to 2014, and prior to that, Vice President and President, Performance Materials & Ashland Supply Chain uVariety of senior level roles for FMC Corporation, a global provider of crop-protection products, from 1993 to 2004, including General Manager of the Food Ingredients Business | |

| | | | | | |

| | | | | | |

| Skills & Qualifications: Mr. Harris brings to our Board broad managerial, international, operational, financial and sales experience, as well as his track record of leading businesses with complex, global supply chains, and developing worldwide marketing strategies and his strong connectivity to consumer end markets. | |

| | | | | | |

| | | | | | | | | | | | | | |

| | | | |

DAVID A. JONES Chairman of the Board and Senior Advisor, Oak Hill Capital Partners Independent Age: 74 Director Since: 2003 Committees Served: Compensation Governance Gender; Race/Ethnicity: Male (White) | | Biography: uSenior Advisor to Oak Hill Capital Partners, a leading private equity firm, from 2008 to present uMember of the board of directors of Checker’s/Rally’s Drive In Restaurants, Inc., a leading national restaurant chain, from 2017 to 2023 uMember of the board of directors of The Hillman Group, a provider of fasteners and hardware items to large North American retailers, from 2012 to 2016 uMember of the board of directors of Earth Fare, Inc., a leading natural and organic food retailer, from 2012 to 2020, and member of the board of directors of Imagine! Print Solutions, a provider of in-store marketing solutions to leading national retailers, from 2016 to 2019, all Oak Hill Capital portfolio companies uChairman and Chief Executive Officer of Spectrum Brands, Inc. (formerly Rayovac Corporation), a global consumer product company with major business segments in batteries, lighting, shaving/grooming, personal care, small appliances, lawn and garden, household insecticides and various pet supply categories, from 1996 to 2007 uLeadership roles with Spectrum Brands, Rayovac, Thermoscan, The Regina Company, Electrolux Corp and General Electric | |

| | | |

| | | |

| Skills & Qualifications: Mr. Jones’ extensive management experience with both public and private companies and private equity, coupled with his global operational, financial, and mergers and acquisitions expertise, have given the Board invaluable insight into a wide range of business situations. Mr. Jones has served on each of our Board committees, which allows him to bring to the Board insight into a wide range of business and governance situations. | |

| | | |

| | | | | | | | |

14 | | Pentair | 2024 Proxy Statement |

| | | | | | | | | | | | | | | | | |

| | | | | |

GREGORY E. KNIGHT Senior Advisor, Digital Transformation, Boston Consulting Group, Inc. Independent Age: 56 Director Since: 2021 Committees Served: Audit and Finance Gender; Race/Ethnicity: Male (Black/ African American) | | Biography: uSenior Advisor, Digital Transformation at Boston Consulting Group, Inc., a global consulting firm, from 2023 to present uExecutive Vice President, Customer Transformation and Business Services of CenterPoint Energy, Inc., an energy delivery company, from 2020 to 2023 uChief Customer Officer, US Energy and Utilities, of National Grid US, an energy delivery company, from 2019 to 2020 uSenior Vice President and Chief Customer Officer, Utility and Commercial Businesses, from 2014 to 2019 and Division Vice President, Customer Services, from 2009 to 2014, at CenterPoint Energy uVarious management positions at Ricoh Americas Corporation, from 2004 to 2009, Reliant retail energy, from 2001 to 2004, Allen Knight Inc., from 2000 to 2001, and Verizon, from 1992 to 2000 | |

| | | | |

| | | | |

| Skills & Qualifications: Mr. Knight brings to our Board a strong background in sales, brand, marketing and customer experience in both business-to-business and business-to-customer environments in retail energy and utilities. Mr. Knight also brings executive leadership in large-scale enterprise information technology, digital transformation and cyber security. | |

| | | | |

| | | | | | | | | | | | | | |

| | | | |

MICHAEL T. SPEETZEN Chief Executive Officer, Polaris Inc. Independent Age: 54 Director Since: 2018 Committees Served: Audit and Finance (Chair) Gender; Race/Ethnicity: Male (White) Other Current Public Board Service: Polaris Inc. (2021–present) | | Biography: uChief Executive Officer and a member of the board of directors of Polaris Inc., a global powersports leader with a product line-up that includes side-by-side and all-terrain off-road vehicles, motorcycles, boats, and snowmobiles, from 2021 to present uInterim Chief Executive Officer, from January to May 2021, and Executive Vice President, Finance and Chief Financial Officer, from 2015 to 2020, prior to his current role at Polaris uSenior Vice President, Finance and Chief Financial Officer of Xylem Inc., a leading global water technology equipment and service provider, from 2011 to 2015 uVice President and Chief Financial Officer of ITT Fluid and Motion Control, from 2009 to 2011, Chief Financial Officer for the StandardAero division of the private equity firm Dubai Aerospace Enterprise Ltd., from 2007 to 2009, and various positions of increasing responsibility in the finance functions at Honeywell International Inc. and General Electric Company, prior to joining Xylem | |

| | | |

| | | |

| Skills & Qualifications: Mr. Speetzen brings to our Board extensive financial experience as well as knowledge of global markets, transacting international business, and broad managerial and operational experience. | |

| | | |

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 15 |

| | | | | | | | | | | | | | | | | |

| | | | | |

JOHN L. STAUCH President and Chief Executive Officer, Pentair plc Age: 59 Director Since: 2018 Gender; Race/Ethnicity: Male (White) Other Current Public Board Service: Deluxe Corporation (2016–present) | | Biography: uPresident and Chief Executive Officer of Pentair plc, from 2018 to present, having previously served as Chief Financial Officer of Pentair, from 2007 to 2018 uChief Financial Officer of the Automation and Control Systems unit of Honeywell International Inc., from 2005 to 2007 uChief Financial Officer and Information Technology Director of PerkinElmer Optoelectronics and various executive, investor relations and managerial finance positions within Honeywell and its predecessor, AlliedSignal Inc., from 1994 to 2005 uDirector of Deluxe Corporation, from 2016 to present, where he is currently chair of the audit committee and a member of the finance committee | |

| | | | |

| | | | |

| Skills & Qualifications: Mr. Stauch brings to our Board extensive knowledge of Pentair as our President and Chief Executive Officer and former Chief Financial Officer and extensive experience as a financial executive with many aspects of public company strategy and operations. | |

| | | | |

| | | | | | | | | | | | | | |

| | | | |

BILLIE I. WILLIAMSON Retired Senior Assurance Partner, Ernst & Young LLP Independent Age: 71 Director Since: 2014 Committees Served: Governance (Chair) Compensation Gender; Race/Ethnicity: Female (White) Other Current Public Board Service: Cricut Inc. (2021–present) Cushman & Wakefield plc (2018–present) | | Biography: uOver three decades of experience auditing public companies as an employee and partner of Ernst & Young LLP uMember of the board of directors of Cricut Inc. from 2021 to present uMember of the board of directors of Cushman & Wakefield from 2018 to present uSenior Assurance Partner at Ernst & Young from 1998 to 2011 uWas also Ernst & Young’s Americas Inclusiveness Officer, a member of its Americas Executive Board, which functions as the board of directors for Ernst & Young dealing with strategic and operational matters, and a member of the Ernst & Young U.S. Executive Board responsible for partnership matters for the firm uMember of the boards of directors of Kraton Corporation from 2018 to 2022, XL Group Ltd., in 2018, CSRA Inc., from 2015 to 2018, Janus Capital Group Inc., from 2015 to 2017, Exelis Inc., from 2012 to 2015, and Annie’s Inc., from 2012 to 2014 | |

| | | |

| Skills & Qualifications: Ms. Williamson brings to our Board extensive financial and accounting knowledge and experience, including her service as a principal financial officer and an independent auditor to numerous Fortune 250 companies and her professional training and standing as a Certified Public Accountant, as well as her broad experience with SEC reporting and governance matters. | |

| | | |

| | | | | | | | |

16 | | Pentair | 2024 Proxy Statement |

The Board, based on the recommendation of the Governance Committee, determines the independence of each director based upon the New York Stock Exchange (“NYSE”) listing standards and the categorical standards of independence included in our Corporate Governance Principles. Based on these standards, the Board has affirmatively determined that all of our non-employee directors (i.e., Mses. Abutaleb, Barra, Doi, and Williamson and Messrs. Glenn, Harris, Jones, Knight, and Speetzen) are independent and have no material relationship with us (including our directors and officers) that would interfere with their exercise of independent judgment. Mr. Stauch, our President and Chief Executive Officer, is the only director who is not independent.

In determining independence, our Board and Governance Committee consider circumstances where a director serves as an employee of another company that is a customer or supplier. The Board and Governance Committee have reviewed each of these relationships, which are set forth below. In every case, the relationship involves sales to or purchases from the other company that, for each of 2021, 2022, and 2023, were (a) less than the greater of $1 million or 2% of that organization’s consolidated gross revenues during each of 2021, 2022, and 2023; and (b) not of an amount or nature that impeded the director’s exercise of independent judgment.

| | | | | |

| Director | Relationship(s) Considered |

| Mr. Jones | Senior Advisor, Oak Hill Capital Partners |

| Mr. Knight | Former Executive Vice President, Customer Transformation and Business Services of CenterPoint Energy, Inc. |

| Mr. Speetzen | Chief Executive Officer, Polaris Inc. |

| | |

Shareholder Recommendations, Nominations and Proxy Access |

|

Our Corporate Governance Principles provide that the Governance Committee will consider persons properly recommended by shareholders to become nominees for election as directors in accordance with the criteria described above under “Director Qualifications, Skills and Expertise.” Recommendations for consideration by the Governance Committee, together with appropriate biographical information concerning each proposed nominee, should be sent in writing to c/o Corporate Secretary, Pentair plc, Regal House, 70 London Road, Twickenham, London, TW1 3QS, United Kingdom.

Our Articles of Association set forth procedures to be followed by shareholders who wish to nominate candidates for election as directors in connection with an Annual General Meeting. All such nominations must be accompanied by certain background and other information specified in the Articles of Association and submitted within the timing requirements set forth in the Articles of Association. See “Shareholder Proposals and Nominations for the 2025 Annual General Meeting of Shareholders” below for more information.

In addition, eligible shareholders may under certain circumstances be able to nominate and include in our proxy materials a specified number of candidates for election as directors under the proxy access provisions in our Articles of Association. All such nominations must be accompanied by certain background and other information specified in our Articles of Association and submitted within the timing requirements set forth in our Articles of Association. See “Shareholder Proposals and Nominations for the 2025 Annual General Meeting of Shareholders” below for more information.

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 17 |

As a leading provider of water treatment and sustainable water solutions and with a foundation of Win Right values, we recognize that the work we do and the products and services we provide improve lives and the environment around the world. Pentair strives to be a positive influence on the social and environmental issues of today. As we progress, we are committed to building on our Win Right values and culture by contributing to the development of a sustainable and responsible society that we believe will also drive our future growth.

We are focused on further integrating our environmental, social, and governance (“ESG”) goals throughout our business by fostering broad accountability for our social responsibility strategy and creating shared commitments and targets. Pentair has set social responsibility strategic targets reflecting ESG topics of importance to our shareholders, customers, suppliers, employees, and communities.

| | | | | | | | | | | |

| | | |

| Environmental | | Social |

We are focused on reducing our impact on climate change by reducing greenhouse gas emissions while increasing energy and water use efficiency measures throughout our operations. We also seek to continue reducing waste from operations; increase reuse and recycling; support the use of sustainable, renewable natural resources; and design products that facilitate environmental sustainability. | We are focused on enhancing our efforts to engage our suppliers, customers and employees. We partner with our suppliers to build a more sustainable supply chain, including through our supplier code of conduct and assessments. We are also focused on continuing our employee engagement efforts and executing our inclusion and diversity strategies and initiatives. We also remain committed to providing a safe workplace for all our employees. |

| | | |

| Governance |

| | | |

Our Board provides ESG oversight by periodically reviewing our ESG strategy, including social responsibility strategic targets, communications, and risks. In addition, the Governance Committee oversees ESG strategy and risks, including business sustainability risks. We publish an annual corporate responsibility report that reports on ESG and our accomplishments. We also maintain a formal social responsibility program to further advance our social responsibility goals. Karla Robertson, our Executive Vice President, General Counsel, and Secretary, serves in the additional role of Chief Social Responsibility Officer. She leads Pentair’s social responsibility program and regular ESG updates are provided at least quarterly to the Governance Committee and at least annually to the full Board. As part of the social responsibility program, we have a team of professionals dedicated to executing our ESG strategy and managing sustainability policies, initiatives, and public reporting. Cross functional leaders work with our dedicated social responsibility team of professionals to integrate ESG into their functions and businesses and drive the ESG culture. Through our business risk review process, we assess climate risks across our portfolio. Our risk assessments provide us with insights for determining applicable | mitigation measures so that we can take appropriate preventative steps to improve and promote business continuity for our operations and our customers. We have internal audit and third-party assurance processes to assess our procedures. Specifically, we have worked to receive third-party limited assurance for data related to our social responsibility strategic targets. As part of our shareholder engagement in 2023, in the fall, we reached out to our largest shareholders representing 55% of our shares to engage specifically around corporate governance, executive compensation and ESG matters, and shareholders representing approximately 19% percent of our shares accepted our invitation to meet and participated in individual conference calls. Based on this engagement, and other feedback from investors throughout the year, we believe we continue to be focused on what matters to our shareholders, which is creating and delivering value for our customers and shareholders, and ensure that our ESG efforts are aligned with driving sustainable and resilient business operations. Our efforts center around our culture of Winning Right. This includes focusing on compliance and continuing to prioritize providing a safe environment for our employees. |

| | | | | | | | |

18 | | Pentair | 2024 Proxy Statement |

Board Structure and Processes

We and our Board are committed to the highest standards of corporate governance and ethics. As part of this commitment, the Board has adopted a set of Corporate Governance Principles that sets forth our policies on:

uselection and composition of the Board;

uBoard leadership;

uBoard performance;

uresponsibilities of the Board;

uthe Board’s relationship to senior management;

umeeting procedures;

uBoard committee matters; and

usuccession planning and leadership development.

The Board regularly reviews and, if appropriate, revises the Corporate Governance Principles and other governance documents, including the charters of its Audit and Finance, Compensation, and Governance Committees, in accordance with rules of the Securities and Exchange Commission (“SEC”), the NYSE and Irish law.

Copies of these documents are available, free of charge, on our website at https://www.pentair.com/en-us/about-pentair/corporate-governance.html.

| | |

Board Leadership Structure |

|

We do not have a policy requiring the positions of Chairman of the Board and Chief Executive Officer to be held by different persons. Rather, the Board has the discretion to determine whether the positions should be combined or separated. Since 2018, the positions of Chief Executive Officer and Chairman of the Board have been separated. The Board considers this leadership structure each year and continues to believe that it remains appropriate for our company to serve our shareholders by allowing our Chief Executive Officer to focus on business operations.

Mr. Stauch is our Chief Executive Officer, and Mr. Jones, an independent member of the Board, serves as Chairman of the Board. The role of the Chairman is to provide independent leadership to the Board, act as liaison between and among the non-employee directors and our company, and seek to ensure that the Board operates independently of management.

| | | | | | | | | | | |

| | | |

| | The Chairman’s principal responsibilities include: uleading meetings of the Board; upresiding over all executive sessions of the Board; uin conjunction with the Chair of the Compensation Committee, reporting to the Chief Executive Officer on the Board’s annual review of his performance; uapproving the agenda for Board meetings, including scheduling to assure sufficient time for discussion of all agenda items; uin conjunction with the Committee Chairs, ensuring an appropriate flow of information to the Board; uholding one-on-one discussions with individual directors when requested by directors or the Board; and ucarrying out other duties as requested by the Board. | |

David A. Jones Chairman of the Board | | |

| | | |

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 19 |

Committees of the Board

The Board has three standing committees comprised solely of independent directors: the Audit and Finance Committee, the Compensation Committee, and the Governance Committee. The committee members also meet in executive session without management present at each regularly scheduled meeting.

The information below reflects the number of meetings of the Board and each committee held during fiscal year 2023. The information below regarding committee membership lists the current members.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 6 | Meetings of

the Board of

Directors | | 8 | Meetings of the Audit and Finance Committee | | 4 | Meetings of the Compensation Committee | | 4 | Meetings of the Governance Committee |

| | | | | |

| |

Audit and Finance Committee |

| |

| |

Role: | uResponsible for, among other things, assisting the Board with oversight of our accounting and financial reporting processes, oversight of our financing strategy, investment policies, and financial condition, and audits of our financial statements. These responsibilities include the integrity of the financial statements, compliance with legal and regulatory requirements, the independence and qualifications of our external auditor, and the performance of our internal audit function and of the external auditor. uMeets periodically with management to review and oversee risk exposures related to information security, cyber security and data protection, and the steps management has taken to monitor and control such exposures. uReviews and discusses disclosure of non-GAAP measures. uDirectly responsible for the appointment, compensation, evaluation, terms of engagement (including retention and termination), and oversight of the independent registered public accounting firm. uDiscusses with the independent auditor any critical audit matters. uHolds meetings regularly with our independent and internal auditors, the Board, and management to review and monitor the adequacy and effectiveness of reporting, internal controls, risk assessment, and compliance with our Code of Business Conduct and Ethics and other policies. |

| |

| |

Members: | Michael T. Speetzen (Chair), Mona Abutaleb Stephenson, Melissa Barra, Tracey C. Doi, and Gregory E. Knight. All members have been determined to be independent under SEC and NYSE rules. |

| |

| |

Report: | You can find the Audit and Finance Committee Report under “Audit and Finance Committee Report.” |

| |

| |

Financial Experts: | The Board has determined that all members of the Committee are financially literate under NYSE rules and that Ms. Doi and Mr. Speetzen qualify as “audit committee financial experts” under SEC standards. |

| |

| | | | | | | | |

20 | | Pentair | 2024 Proxy Statement |

| | | | | |

| |

Compensation Committee |

| |

| |

Role: | uApproves, amends, and administers the policies that govern executive compensation. This includes establishing and reviewing executive base salaries and administering cash bonus and equity-based compensation under the Pentair plc 2020 Share and Incentive Plan (the “2020 Plan”). uSets the Chief Executive Officer’s compensation in conjunction with the Board’s annual evaluation of his performance. uHas engaged Aon Consulting, a human resources consulting firm, to aid the Committee in its annual review of our executive compensation program for continuing appropriateness and reasonableness and to make recommendations regarding executive officer compensation levels and structures. In reviewing our executive compensation program, the Committee also considers other sources to evaluate external market, industry and peer-company practices. Information regarding the independence of Aon Consulting is included under the “Compensation Discussion and Analysis — Compensation Consultant” section of this Proxy Statement. A more complete description of the Committee’s practices can be found under the “Compensation Discussion and Analysis” section of this Proxy Statement under the headings “Comparative Framework” and “Compensation Consultant.” |

| |

| |

Members: | T. Michael Glenn (Chair), Theodore L. Harris, David A. Jones, and Billie I. Williamson. All members have been determined to be independent under SEC and NYSE rules. |

| |

| |

Report: | You can find the Compensation Committee Report under the “Compensation Committee Report” section of this Proxy Statement. |

| |

| | | | | |

| |

Governance Committee |

| |

| |

Role: | uResponsible for, among other things, identifying individuals suited to become directors and recommending nominees to the Board for election at Annual General Meetings. uMonitors developments in director compensation and, as appropriate, recommends changes in director compensation to the Board. uResponsible for reviewing annually and recommending to the Board changes to our Corporate Governance Principles and administering the annual Board and Board committee self-assessments. uOversees public policy matters and compliance with our Code of Business Conduct and Ethics and other policies. uOversees ESG-related matters. |

| |

| |

Members: | Billie I. Williamson (Chair), T. Michael Glenn, Theodore L. Harris, and David A. Jones. All members have been determined to be independent under NYSE rules. |

| |

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 21 |

Attendance at Meetings

Members of the Board are expected to attend all scheduled meetings of the Board and the committees on which they serve and all Annual and Extraordinary General Meetings. All current directors attended at least 80% of all of the meetings of the Board and meetings of the committees on which they served in 2023. In each regularly scheduled Board meeting, the independent directors also met in executive session, without the Chief Executive Officer or other members of management present. Eight of the current directors who were then-serving attended the 2023 Annual General Meeting in person.

Board and Committee Self-Assessments

The Board annually conducts a self-assessment of the Board and each committee in addition to verbal assessments conducted at the end of Board and committee meetings. In 2023, the annual assessment process consisted of individual meetings between the Chairman and each director to discuss his or her assessment of the Board, and a written evaluation of the Board and each committee by its members comprising both quantitative scoring and narrative comments on a range of topics, including:

The written evaluation responses were compiled by a third party. The committees’ evaluation results were shared with the committee Chairs who each led a discussion of the assessment at the following regular committee or Board meeting.

The results of the written Board evaluations were shared with the Chairman of the Board and Governance Committee Chair who led a discussion of the assessment at the following Board meeting.

Board Education

Board education is an ongoing, year-round process, which begins when a director joins our Board. Upon joining our Board, new directors are provided with a comprehensive orientation to our company, including our business, strategy and governance. For example, new directors typically participate in one-on-one introductory meetings with our senior business and functional leaders. On an ongoing basis, directors receive presentations on a variety of topics related to their work on the Board and within the industry, both from senior management and from experts outside of our company. Directors may also enroll in continuing education programs sponsored by third parties at our expense.

| | | | | | | | |

22 | | Pentair | 2024 Proxy Statement |

The Board’s Role and Responsibilities

The Board is responsible for general oversight of our risk management. The Board focuses on the most significant and material risks facing us and helps to ensure that management develops and implements controls and appropriate risk mitigation strategies. At the direction of the Board, we have instituted an enterprise-wide risk management process that identifies potential exposure to risks that arise in the course of our business. The Board as a whole, and not a separate committee, oversees our enterprise risk management process in order to leverage the diversity of skills, qualifications, experiences, perspectives and backgrounds of our directors in addressing the risks that our business may encounter.

Each of our Board committees has historically focused and continues to focus on specific risks within its respective area of responsibility and regularly reports to the full Board. The Board uses our enterprise-wide risk management system as a key tool for understanding the risks facing us as well as assessing whether management’s processes, procedures and practices for mitigating those risks are effective. Our General Counsel is the primary person responsible to the Board in the planning, assessment and reporting of our risk profile and this risk management system. The Board reviews and discusses an assessment of and a report on our risk profile on a regular basis, including reports on strategic, operational, financial, cybersecurity, information technology, and legal and regulatory compliance risks. We believe that our leadership structure supports the Board’s risk oversight function: There is open communication between management and the Board, and all directors are involved in the risk oversight function. The general risk oversight functions among the Board and its Committee is as follows. For more detail on the specific oversight and responsibilities of each Committee, see pages 20-21. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Board of Directors uGeneral oversight of risk management uOversight of enterprise risk management process uAssessment of management's processes, procedures and practices | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Audit and Finance Committee uAccounting and financial controls uFinancial statement integrity uFinancial risk exposures uTax policy and compliance uInformation security, cyber security and data protection uOther financial-related compliance matters | | | | Compensation Committee uRisks related to compensation programs uRisks related to compensation policies | | | | Governance Committee uRisks related to corporate governance structure and processes (including director qualifications and independence) uCode of Business Conduct and Ethics uOther corporate-related compliance matters uBusiness sustainability risks, including ESG | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Management uAssessment and oversight of potential risks uDevelopment and implementation of controls and risk mitigation strategies uAdministration of enterprise-wide risk management system | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Representative Risks Covered | |

| uStrategic uOperational | uFinancial uCybersecurity | uInformation technology uLegal and regulatory compliance | |

| | | | | | | | | | | | | |

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 23 |

At least once per year, the Board and senior management engage in an in-depth strategic review of our company’s outlook and strategy, which is designed to create long-term shareholder value and serves as the foundation upon which goals are established. Throughout the year, the Board reviews our strategy and monitors management’s progress against such goals.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| Holds annual strategy review, including presentations from, and engagement with, Company senior management | Routinely engages with senior management on critical business matters tied to Company strategy | Regularly meets with broad spectrum of senior leaders to ensure talent pipeline remains diverse and inclusive | |

| | |

Oversight of Succession Planning |

|

The Board views its role in succession planning and talent development as a key responsibility. At least once per year, usually as part of the annual talent review process, the Board discusses and reviews the succession plans for the Chief Executive Officer position and other executive officers and key contributors. The Board becomes familiar with potential successors for key management positions through various means, including annual talent reviews, presentations to the Board, and communications outside of meetings. Our succession planning process is an organization-wide practice designed to proactively identify, develop and retain the leadership talent that is critical for our future business success.

Other Governance Policies and Practices

| | |

| Code of Business Conduct and Ethics |

|

The Board has adopted a Code of Business Conduct and Ethics (“Code of Conduct”) that applies to all of our employees, contractors, directors and executive officers, including our Chief Executive Officer and senior financial officers. Pentair’s Code of Conduct requires employees to act with the highest levels of ethics and integrity and to treat others in a fair and equitable manner.

A copy of our Code of Conduct is available, free of charge, on our website at https://www.pentair.com/en-us/about-pentair/corporate-governance.html.

| | |

| Policies and Procedures Regarding Related Person Transactions |

|

Our Board has adopted written policies and procedures regarding related person transactions. For purposes of these policies and procedures:

ua “related person” means any of our directors, executive officers, or 5% shareholders or any of their immediate family members; and

ua “related person transaction” generally is a transaction with us in which a related person has a direct or indirect material interest and the amount will or may reasonably be expected to exceed $120,000 in any fiscal year.

| | | | | | | | |

24 | | Pentair | 2024 Proxy Statement |

Potential related person transactions must be disclosed and brought to the attention of the Governance Committee directly or to the General Counsel for transmission to the Governance Committee. The Governance Committee will review all related person transactions and either approve or disapprove of the entry into the related person transaction, which will occur in advance of entry into the related person transaction whenever reasonably possible. In determining whether to approve a related person transaction, the Governance Committee will consider the following factors, among others, to the extent deemed relevant by the Governance Committee:

uthe nature and extent of the related person’s interest in the transaction;

uwhether the terms of the related person transaction are fair to us and on terms at least as favorable as would apply if the other party had no affiliation with any of our directors, executive officers or 5% shareholders;

uwhether there are demonstrable business reasons for us to enter into the related person transaction;

uwhether the related person transaction could impair the independence of a director under our Corporate Governance Principles’ standards for director independence;

uwhether the related person transaction would present an improper conflict of interest for any of our directors or executive officers, taking into account the size of the transaction and the overall financial position of the director or executive officer; and

uthe direct or indirect nature of the interest of the director or executive officer in the transaction, the ongoing nature of the relationship, and any other factors the Governance Committee deems relevant.

The Governance Committee will not approve nor ratify any related person transaction that is inconsistent with our interests or those of our shareholders.

We had no related person transactions during 2023. To our knowledge, no related person transactions are currently proposed.

Our directors are encouraged to limit the number of other boards of directors on which they serve in order to permit more effective participation. Our Corporate Governance Principles provide that a director who serves as an executive officer of a public company is limited to two public company boards of directors, consisting of the director’s employer’s board and our Board. In 2023, the Board revised the Company’s Corporate Governance Principles to change the Company’s overboarding policy from five public company boards to four public company boards for directors who do not serve as public company executive officers. In each case, the Board may approve an exception to the overboarding policy.

Director Compensation

The Governance Committee annually reviews the compensation of our non-employee directors and makes recommendations to the Board. Our independent directors approve our director compensation.

We use a combination of cash and equity-based incentive compensation to attract and retain qualified directors. Compensation of our directors reflects our belief that a significant portion of directors’ compensation should be tied to long-term growth in shareholder value.

The Company provides a Products and Services Program for Directors that is intended to encourage the use and promotion of Pentair’s products and service offerings by our directors, and for our directors to have first-hand knowledge of our customers’ experiences. Directors are eligible for a maximum of $20,000 of products and services annually; we cover sales taxes on the products and services and directors are responsible for paying associated income taxes.

Mr. Stauch, our only employee-director, is not, and will not be, separately compensated for service as a member of the Board.

| | | | | | | | |

2024 Proxy Statement | Pentair |

| 25 |

The annual retainers for non-employee directors’ service on the Board and Board committees during 2023 were as follows:

Director and Board Committee Membership Cash Retainers

| | | | | |

| ($) |

| Board Retainer | 95,000 | |

Non-Employee Director Chair Retainer | 155,000 | |

| | | | | | | | | | | | | | |

| Committees | Chair (Supplemental Retainer) ($) | Member ($) |

| Audit and Finance | | 25,000 | | | 13,500 | |

Compensation | | 20,000 | | | 7,500 | |

Governance | | 20,000 | | | 7,500 | |

The above fee structure was reviewed and approved by our independent directors in December 2022 based on recommendations from the Governance Committee and from Aon Consulting who reviewed our director compensation practices against the practices of our Comparator Group, which is the same compensation benchmarking peer group referenced in the Comparative Framework. No changes were made for 2023 following the Governance Committee’s annual review of director compensation information from Aon Consulting in December 2022.

We provide a tax equalization payment to non-employee directors on any U.K. taxes that may be paid on account of our company’s payment of, or reimbursement for, travel, lodging and meal expenses incidental to Board and Board committee meetings and reimbursement of fees and expenses in connection with assistance in the preparation of U.K. tax returns and any U.K. taxes on such payment or reimbursement. In addition, for the purposes of limiting double-taxation on U.K. sourced income, non-employee directors are eligible to receive tax equalization payments if the income taxes owed on U.K. sourced income exceed the income tax rates relative to their countries of residence.

In December 2023, Aon Consulting again reviewed our director compensation with the Governance Committee based on the director compensation practices of our peer group. Based on this review, our independent directors approved the following changes to director compensation effective January 1, 2024:

uBoard retainer increased to $105,000; and

uNon-executive chair supplemental retainer increased to $175,000.

Non-employee directors receive an annual equity grant as a part of their compensation. The full value of the annual equity grant is delivered in the form of restricted stock units. The restricted stock units vest on the first anniversary of the grant date. Each restricted stock unit represents the right to receive one ordinary share upon vesting. The restricted stock units accrue dividend equivalents that will be paid out in ordinary shares if and when the award vests. The annual grant for 2023, as approved by our independent directors based on the recommendation from the Governance Committee, was valued at $150,000 and was granted on January 3, 2023 (or, August 31, 2023, in the case of the grant to Ms. Doi in connection with her appointment to the Board). Based on the review of director compensation by Aon Consulting and the recommendation of the Governance Committee, our independent directors approved an annual grant for 2024 valued at $160,000, which was granted on January 2, 2024.

| | | | | | | | |

26 | | Pentair | 2024 Proxy Statement |

| | |

| Stock Ownership Guidelines for Non-Employee Directors |

|

Our Corporate Governance Principles establish that non-employee directors should acquire and hold our company shares or share equivalents at a level of five times the annual board retainer.

Stock Ownership for Non-Employee Directors Serving as of December 31, 2023

| | | | | | | | | | | | | | |

| Share Ownership(1) | 12/31/2023 Market Value ($)(2) | Ownership Guideline ($) | Meets Guideline(3) |

| Mona Abutaleb | 13,622 | | 990,456 | | 475,000 | | Yes |

| Melissa Barra | 4,763 | | 346,318 | | 475,000 | | No |

| Tracey C. Doi | 2,143 | | 155,818 | | 475,000 | | No |

| T. Michael Glenn | 35,195 | | 2,559,028 | | 475,000 | | Yes |

| Theodore L. Harris | 14,390 | | 1,046,297 | | 475,000 | | Yes |

| David A. Jones | 82,059 | | 5,966,510 | | 475,000 | | Yes |

| Gregory E. Knight | 7,527 | | 547,288 | | 475,000 | | Yes |

| Michael T. Speetzen | 14,390 | | 1,046,297 | | 475,000 | | Yes |

| Billie I. Williamson | 20,990 | | 1,526,183 | | 475,000 | | Yes |

(1)The amounts in this column include ordinary shares owned by the director, both directly and indirectly, and unvested restricted stock units.

(2)Based on the closing market price for our ordinary shares on December 29, 2023 of $72.71.

(3)Non-employee directors have five years after their election as a director to meet the stock ownership guidelines. Ms. Barra first became a director in 2021, and Ms. Doi first became a director in 2023. All directors have met or are on track to meet the guidelines.

Director Compensation Table The table below summarizes the compensation that we paid to non-employee directors for the year ended December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) |

Name(1) | Fees Earned or

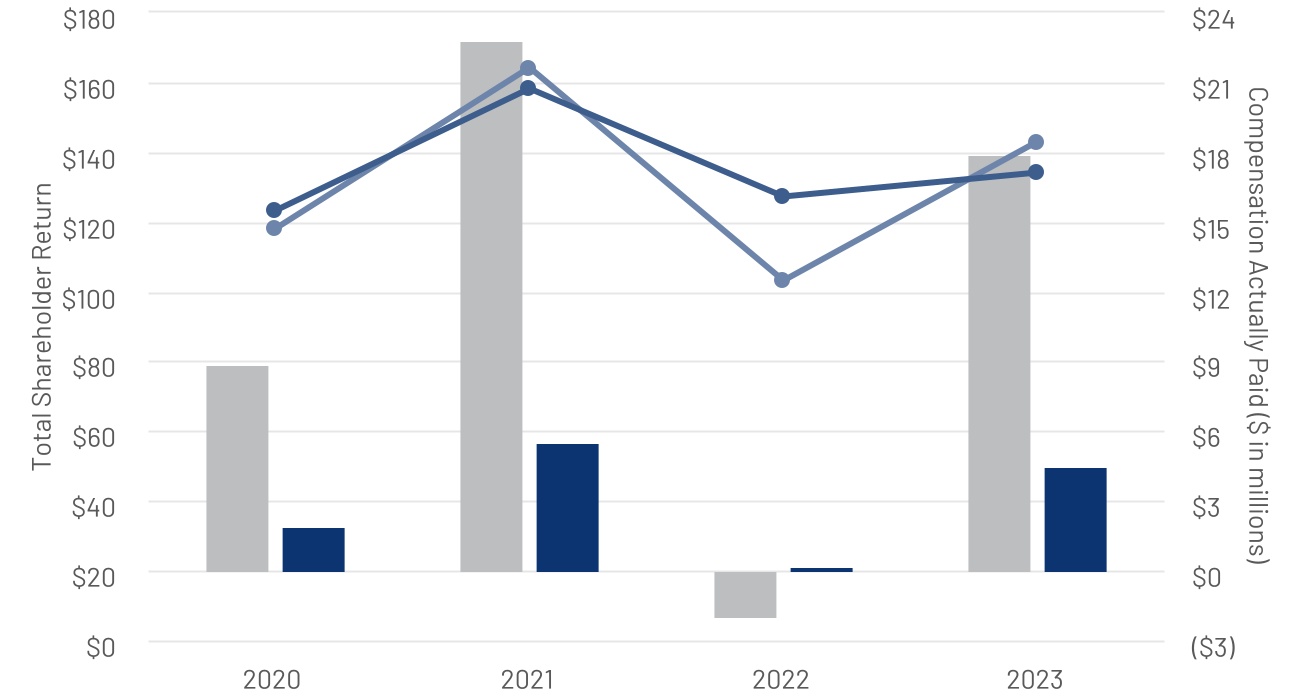

Paid in Cash