GMO INTERNATIONAL DEVELOPED EQUITY ALLOCATION FUND

Summary Prospectus June 30, 2024

| Share Class: |

Class R6 |

Class I |

| Ticker: |

GAAWX |

— |

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, statement of additional information and other information about the Fund online at

https://www.gmo.com/north-america/investment-capabilities/mutual-funds/. You can also get this information at no cost by calling 1-617-346-7646, by sending an email request to SHS@gmo.com, or by contacting your financial intermediary. The Fund’s prospectus and statement of additional information, each dated June 30, 2024, each as may be revised and/or supplemented from time to time, are incorporated by reference into this summary prospectus.

Investment objective

Total return greater than that of its benchmark, the MSCI EAFE

Index.

Fees and expenses

The table below describes the fees and expenses that

you may bear for each class of shares if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial

intermediaries, which are not reflected in the table and example below.

Annual Fund operating expenses

(expenses that you bear each year as a percentage of the value of your investment)

(expenses that you bear each year as a percentage of the value of your investment)

| |

Class R6 |

Class I |

| Management fee |

0.00%1 |

0.00%1 |

| Other expenses |

0.05% |

0.15%2 |

| Acquired fund fees and expenses (underlying fund expenses) |

0.62% |

0.62% |

| Total annual fund operating expenses |

0.67% |

0.77% |

| Expense reimbursement/waiver |

(0.05%)3 |

(0.05%)2,3 |

| Total annual fund operating expenses after expense reimbursement/waiver (Fund and underlying fund

expenses) |

0.62% |

0.72% |

1 Includes both management fee and class-specific

shareholder service fee, if any, for each class of shares. For additional information about the shareholder service fee applicable to each class of

shares of the Fund, please see the table included in the section of the Prospectus entitled “Multiple Classes and Eligibility.”

2 Includes estimate of payments for sub-transfer

agency, recordkeeping and other administrative services for Class I’s initial fiscal year. Grantham, Mayo, Van Otterloo & Co.

LLC ("GMO") has contractually agreed to waive its fees with respect to and/or reimburse Class I shares to the extent that amounts paid by the Fund out of the net assets attributable to Class I shares for sub-transfer agency, recordkeeping and other administrative services provided by financial intermediaries for

the benefit of Class I shareholders exceed 0.15% of the average daily net assets attributable to Class I shares. This reimbursement will

continue through at least June 30, 2025 and may not be terminated prior to this date without the action or consent of the Trust’s Board of

Trustees.

3

GMO has contractually agreed to reimburse the Fund for the following expenses: audit expenses, fund accounting expenses, pricing service expenses,

expenses of non-investment related tax services, transfer agency expenses (excluding, in the case of Class I shares, any amounts paid for

sub-transfer agency, recordkeeping and other administrative services provided by financial intermediaries for the benefit of Class I

shareholders), expenses of non-investment related legal services provided to the Fund by or at the direction of GMO, federal securities

law filing expenses, printing expenses, state and federal registration fees and custody expenses. This reimbursement will continue through at least June

30, 2025 and may not be terminated prior to this date without the action or consent of the Trust’s Board of Trustees.

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated, regardless of whether or not you redeem your shares at the end of such periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same as those shown in the table. The one year amounts shown reflect the expense reimbursement noted in the expense table. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class R6 |

$63 |

$209 |

$368 |

$830 |

| Class I |

$74 |

$241 |

$423 |

$949 |

Portfolio turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities. A higher portfolio turnover rate may result in higher transaction costs and, for holders of Fund shares subject to U.S. taxes, higher income taxes. These transaction costs,

GMO

INTERNATIONAL DEVELOPED EQUITY ALLOCATION FUND

which are not reflected in Annual Fund operating expenses or in the Example, affect the Fund’s performance. During its fiscal year ended February 29, 2024, the Fund’s portfolio turnover rate

(excluding short-term investments) was 21% of the average value of its portfolio securities.

Principal investment strategies

The Fund is a fund of funds and invests primarily in equities traded in non-U.S. markets (including emerging markets) through its investment in Equity Funds and GMO-managed exchange-traded funds (collectively, the “underlying GMO Funds”) (see “Additional Information About the Funds’ Investment Strategies, Risks, and Expenses — Asset Allocation Funds”). The Fund also may invest directly in securities (including other underlying funds) and derivatives.

GMO uses its quantitative multi-year forecasts of returns among asset classes, together with its assessment of the relative

risks of asset classes, to determine the asset classes in which the Fund invests and how much the Fund invests in each asset class. An important component of those forecasts is GMO’s expectation that valuations ultimately revert to their fundamental fair (or intrinsic) value over a complete market cycle. GMO changes the Fund’s asset class exposures in response to changes in GMO’s investment outlook and its assessment of market valuations and may use redemptions or purchases of Fund shares to rebalance the Fund’s investments. The factors GMO considers and investment methods GMO uses can change over time. Under normal circumstances, the Fund invests (including through its investment in the underlying GMO Funds) at least 80% of its assets in equities (see “Name Policies”). In addition, under normal circumstances, the Fund invests (including through its investment in the underlying GMO Funds) at least 80% of its assets in equities tied economically to developed markets (see “Name Policies”). The term “developed markets” means those countries included in the MSCI World Index, a global developed markets equity index, and countries with similar characteristics (e.g., countries that have sustained economic development, sufficient liquidity for listed companies and accessible markets). The Fund also may invest in equities tied economically to emerging markets (which are not part of the Fund’s benchmark), but those investments typically will represent 10% or less of the Fund’s net assets measured at the time of purchase.

The Fund may invest in securities of

companies of any market capitalization. In addition, the Fund may lend its portfolio securities.

The Fund also may invest in U.S. Treasury Fund, in money

market funds unaffiliated with GMO, and directly in the types of investments typically held by money market funds.

Principal risks of investing in the Fund

The value of the Fund’s shares changes with the value

of the Fund’s investments. Many factors can affect this value, and you may lose money

by investing in the Fund. References to investments include those held directly by the Fund and indirectly through the Fund’s investments in underlying funds (including underlying GMO Funds). Some of the underlying funds are non-diversified investment companies under the Investment Company Act of 1940, as amended, and therefore a decline in the market price of a particular security held by those funds may affect their performance more than if they were diversified investment companies. The principal risks of investing in the Fund are summarized below. For a more complete discussion of these risks, including those risks to which the Fund is exposed as a result of its investments in the underlying funds, see “Additional Information about the Funds’ Investment Strategies, Risks, and Expenses” and “Description of Principal Risks.”

●

Market Risk – Equities – The market price of an equity in the Fund’s portfolio may decline due to factors affecting the issuer or its industry or the economy and equity markets generally. If the Fund purchases an equity for less than its fundamental fair (or intrinsic) value as assessed by GMO, the Fund runs the risk that the market price of the equity will not appreciate or will decline, (for example, if GMO’s assessment proves to be incorrect or the market fails to recognize the equity’s intrinsic value). The Fund also may purchase equities that typically trade at higher multiples of current earnings than other securities, and the market prices of these equities often are more sensitive to changes in future earnings expectations and interest rates than the market prices of equities trading at lower multiples. Declines in stock market prices generally are likely to reduce the net asset value of the Fund’s shares.

●

Non-U.S. Investment Risk – The market prices of many non-U.S. securities

fluctuate more than those of U.S. securities. Many non-U.S. securities markets are less stable, smaller, less liquid, and less regulated than U.S. securities markets, and

the cost of trading in those markets often is higher than in U.S. securities markets. In addition, non-U.S. securities issuers often are not subject to as much regulation as U.S. issuers, and the reporting, recordkeeping, accounting, custody, and auditing standards to which those issuers are subject often are not as rigorous as U.S. standards. In addition, the Fund is subject to taxation by countries other than the United States, including potentially on a retroactive basis, on (i) capital gains it realizes or dividends, interest, or other amounts it realizes or accrues in respect of non-U.S. investments; (ii) transactions in those investments; and (iii) repatriation of proceeds generated from the sale or other disposition of those investments. Also, the Fund needs a license to

invest directly in securities traded in many non-U.S. securities markets, and the Fund is subject to the risk that its license is terminated or suspended. In some non-U.S. securities markets, prevailing custody and trade settlement practices (e.g., the requirement to pay for securities prior to receipt) expose the Fund to credit and other risks. Further, adverse changes in investment regulations, capital requirements or exchange controls could adversely affect the value of the Fund’s investments. The risks above (such as substantial price fluctuations and market instability, illiquidity and lack of regulation) and other risks (e.g., nationalization, expropriation or other confiscation of

2

GMO

INTERNATIONAL DEVELOPED EQUITY ALLOCATION FUND

assets of non-U.S. issuers, difficulties enforcing legal judgments or contractual rights

and geopolitical risks) tend to be higher for investments in the securities of issuers tied economically to emerging countries. The economies of

emerging countries often depend predominantly on only a few industries or commodities and often are more volatile than the economies of developed countries.

●

Management and Operational Risk – The Fund runs the risk that GMO’s investment techniques will fail to produce intended results. GMO uses quantitative models as part of its investment process. GMO’s models

may not accurately predict future market movements. In addition, GMO’s models rely on assumptions and data that are subject to limitations (e.g., inaccuracies,

staleness) that could adversely affect their predictive value. The Fund also runs the risk

that GMO’s assessment of an investment, including a security’s fundamental fair (or intrinsic) value, is wrong or that deficiencies in GMO’s or another

service provider’s internal systems or controls will cause losses for the Fund or impair Fund operations.

●

Currency Risk – Fluctuations in exchange rates can adversely affect the market

value of the Fund’s foreign currency holdings and investments denominated in foreign currencies.

●

Derivatives and Short Sales Risk – The use of derivatives involves the risk that their value may not change as expected relative to

changes in the value of the underlying assets, pools of assets, rates, currencies or indices. Derivatives also present other risks, including market risk, illiquidity risk, currency risk, credit risk, leveraging risk, commodities risk and counterparty risk. The market price of an option is affected by many factors, including changes in the market prices or dividend rates of underlying securities (or in the case of indices, the securities in such indices); the time remaining before expiration; changes in interest rates or exchange rates; and changes in the actual or perceived volatility of the relevant index or underlying securities. The Fund typically creates short investment exposure by selling securities short or by taking a derivative position in which the value of the derivative moves in the opposite direction from the price of an underlying asset, pool of assets, rate, currency or index. Specifically, the net asset value of the Fund’s shares will be adversely affected if the equities or other assets that are the subject of the Fund’s short exposures appreciate in value. The risk of loss associated with derivatives that provide short investment exposure and short sales of securities is theoretically unlimited.

●

Fund of Funds Risk – The Fund is indirectly exposed to all of the risks of an

investment in the underlying funds in which it invests, including the risk that those underlying funds will not perform as expected. The fees and expenses associated with

an investment in the Fund are less predictable than those associated with an investment in funds that charge a fixed management fee.

●

Smaller Company Risk – Smaller companies may have limited product lines,

markets, or financial resources, lack the competitive strength of larger companies, have less experienced managers or depend on a few key employees. The securities of

companies with smaller market capitalizations often are less widely held and trade less frequently and in lesser quantities, and their market prices often fluctuate more, than the securities of companies with larger market capitalizations.

●

Leveraging Risk – The use of derivatives, short sales and securities lending can create leverage. Leverage increases the Fund’s losses when the value of its investments (including derivatives) declines. In addition, the Fund’s portfolio will be leveraged if it exercises its right to delay payment on a redemption and the value of the Fund’s assets declines between the time a redemption request is treated as being received by the Fund and the time the Fund liquidates assets to fund that redemption.

●

Counterparty Risk – The Fund runs the risk that the counterparty to a derivatives contract or a clearing member used by the Fund to hold a cleared derivatives contract is unable or unwilling to make timely settlement payments, return the Fund’s collateral or otherwise honor its obligations.

●

Market Disruption and Geopolitical Risk – Geopolitical and other events (e.g., wars, pandemics, sanctions, terrorism) often disrupt

securities markets and adversely affect the general economy or particular economies and markets. Those events, as well as other changes in non-U.S. and U.S. economic and political conditions, could exacerbate other risks or otherwise reduce the value of the Fund’s investments.

●

Focused Investment Risk – Investments in countries, regions, asset classes, sectors, industries, currencies, or issuers that are subject to the same or similar risk factors and investments whose market prices are closely correlated are subject to higher overall risk than investments that are more diversified or whose market prices are not as closely correlated.

●

Large Shareholder Risk – To the extent that a large number of shares of the Fund is held by a single shareholder (e.g., an

institutional investor or another GMO Fund) or a group of shareholders with a common investment strategy (e.g., GMO asset allocation accounts), the Fund is subject to the risk that a redemption by that shareholder or group will require the Fund to sell investments at disadvantageous prices, disrupt the Fund’s operations, or force the Fund’s liquidation.

●

Illiquidity Risk – Low trading volume, lack of a market maker, large position size, or legal restrictions increase the risk that the Fund or an underlying fund is limited or prevented from selling particular securities or closing derivative positions at desirable prices at a particular time or at all.

●

Market Risk – Fixed Income – The market price of a fixed income investment can decline due to market-related factors, including rising interest or inflation rates and widening credit spreads, or decreased liquidity due, for example, to market uncertainty about the value of a fixed income investment (or class of fixed income investments).

3

GMO

INTERNATIONAL DEVELOPED EQUITY ALLOCATION FUND

●

Credit Risk – The Fund runs the risk that the issuer or guarantor of a fixed income investment (including a sovereign or quasi-sovereign debt issuer) or the obligor of an obligation underlying an asset-backed security will be unable or unwilling to satisfy its obligation to pay principal and interest or otherwise to honor its obligations in a timely manner or at all. The market price of a fixed income investment will normally decline as a result of the failure of an issuer, guarantor, or obligor to meet its payment obligations or in anticipation of such a failure. Below investment grade investments have speculative characteristics, and negative changes in economic conditions or other circumstances are more likely to impair the ability of issuers of those investments to make principal and interest payments than issuers of investment grade investments.

Performance

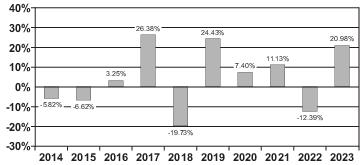

The bar chart and table below provide some indication of the

risks of investing in the Fund by showing changes in the Fund’s annual total returns from year to year for the periods indicated and by comparing the Fund’s

average annual total returns for different calendar periods with those of the Fund’s benchmark, a broad-based index. Share classes not shown would have substantially similar annual returns to those below because all

share classes invest in the same portfolio of securities. Annual returns vary among share classes to the extent that they bear different expenses. Share classes that bear

higher expenses than the share classes shown below would have lower returns. After-tax

returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. After-tax

returns shown are not relevant if you are tax-exempt or if you hold your Fund shares through tax-advantaged arrangements (such as a 401(k) plan or individual retirement

account). After-tax returns are shown for Class III shares only; after-tax returns for other classes will vary. Updated performance information for the Fund is available at www.gmo.com. Past

performance (before and after taxes) is not an indication of future performance.

Annual Total

Returns/Class III Shares

Years Ending December 31

Years Ending December 31

| Highest Quarter: |

17.89% |

4Q 2022 | |

| Lowest Quarter: |

-23.99% |

1Q 2020 | |

| Year-to-Date: |

6.31% |

As of |

3/31/2024 |

Average Annual

Total Returns

Periods Ending December 31, 2023

Periods Ending December 31, 2023

| |

1 Year |

5 Years |

10 Years |

Incept. |

| Class III |

|

|

|

6/5/2006

|

| Return Before Taxes |

20.98% |

9.50% |

3.79% |

4.10% |

| Return After Taxes on

Distributions |

19.04% |

8.15% |

2.83% |

3.06% |

| Return After Taxes on

Distributions and Sale of Fund

Shares |

13.51% |

7.35% |

2.92% |

3.20% |

| MSCI EAFE Index1 (Fund

benchmark) (returns reflect no

deduction for fees or expenses,

but are net of withholding tax on

dividend reinvestments) |

18.24% |

8.17% |

4.28% |

3.88% |

| Class R6 |

|

|

|

1/22/2021 |

| Return Before Taxes |

20.98% |

N/A |

N/A |

4.39% |

| MSCI EAFE Index1 (Fund

benchmark) (returns reflect no

deduction for fees or expenses,

but are net of withholding tax on

dividend reinvestments) |

18.24% |

N/A |

N/A |

3.24% |

1

MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability

hereunder.

Management of the Fund

Investment Adviser: Grantham, Mayo, Van Otterloo & Co. LLC

Investment Team and Senior Members of GMO primarily responsible for portfolio management of the Fund:

Investment Team and Senior Members of GMO primarily responsible for portfolio management of the Fund:

| Investment Team |

Senior Member (Length of Service with Fund)

|

Title |

| Asset Allocation |

Ben Inker (since the Fund’s inception in 2006) |

Co-Head, Asset Allocation Team, GMO. |

| Asset Allocation |

John Thorndike (since 2019) |

Co-Head, Asset Allocation Team, GMO. |

Purchase and sale of Fund shares

Under ordinary circumstances, you may purchase the Fund’s shares on days when the New York Stock Exchange

(“NYSE”) is open for business. Purchase orders should be submitted directly to GMO Trust (the “Trust”) or through a broker or agent authorized to

accept purchase and redemption orders on the Funds’ behalf. Investors who have entered into agreements with the Trust may purchase shares of the Fund through the National Securities Clearing Corporation (“NSCC”).

Class R6 shares and Class I shares are available for purchase by (i) eligible retirement plans (e.g., 401(k) plans, 457 plans,

employer-sponsored 403(b) plans, profit-sharing and money purchase pension plans, defined benefit plans and non-qualified deferred compensation plans), (ii) section 529 plans, and (iii) other investors whose accounts are maintained by the Fund through third-party platforms or intermediaries. Purchases of Class R6 shares or Class I shares are not subject to any minimum dollar amount.

4

GMO

INTERNATIONAL DEVELOPED EQUITY ALLOCATION FUND

Fund shares are redeemable. Under ordinary circumstances, you may redeem the Fund’s shares on days when the NYSE is open for business. Redemption orders should be submitted directly to the Trust unless the Fund shares to be redeemed were purchased through a broker or agent, in which case the redemption order should be submitted to that broker or agent. Investors who have entered into agreements with the Trust may redeem shares of the Fund through the NSCC. For instructions on redeeming shares directly, call the Trust at 1-617-346-7646 or send an email to SHS@GMO.com.

U.S. tax information

The Fund has elected to be treated, and intends to qualify and be treated each year, as a regulated investment company (a “RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”) for U.S. federal income tax purposes and to distribute net investment income and net realized capital gains, if any, to shareholders. These distributions are taxable as ordinary income or capital gain to U.S. shareholders that are not exempt from U.S. income tax or that are not investing through a tax-advantaged account. U.S. shareholders who are investing through a tax-advantaged account may be taxed upon withdrawals from that account.

Financial intermediary compensation

The Fund makes payments out of the net assets attributable to

Class I shares for sub-transfer agency, recordkeeping and other administrative services provided by financial intermediaries for the benefit of Class I shareholders. In

addition, GMO pays brokers, agents, or other financial intermediaries for transfer agency and related services. These payments create a conflict of interest by creating

a financial incentive for the broker, agent or other financial intermediary and salesperson to recommend the purchase of Fund shares over another investment. GMO also makes payments to financial intermediaries for the purchase of Fund shares, which creates a similar conflict of interest. Ask your salesperson or consult your financial intermediary’s website for more information.

5