UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04347

GMO Trust

(Exact name of the registrant as specified in charter)

40 Rowes Wharf, Boston, MA 02110

(Address of principal executive offices) (Zip Code)

Tara Pari, Chief Executive Officer, 40 Rowes Wharf, Boston, MA 02110

(Name and address of agent for services)

Registrant’s telephone number, including area code: 617-346-7646

Date of fiscal year end: 02/28/21

Date of reporting period: 02/28/21

Item 1. Reports to Stockholders.

The annual reports for each series of the registrant for the period ended February 28, 2021 are filed herewith.

GMO Trust

Annual Report

February 28, 2021

Asset Allocation Bond Fund

Emerging Country Debt Fund

High Yield Fund

Multi-Sector Fixed Income Fund (formerly Core Plus Bond Fund)

Opportunistic Income Fund

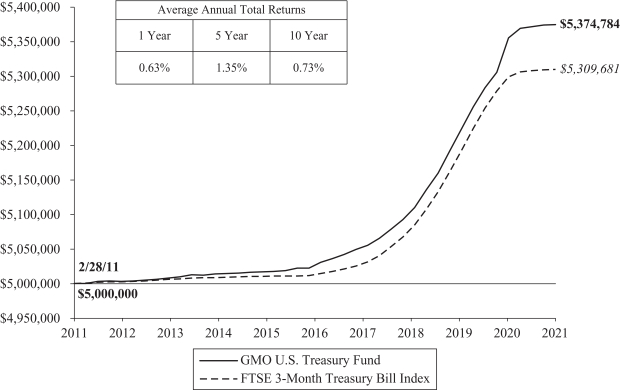

U.S. Treasury Fund

For a free copy of the Funds’ proxy voting guidelines, shareholders may call 1-617-346-7646 (collect), visit GMO’s website at www.gmo.com or visit the Securities and Exchange Commission’s website at www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 will be available without charge on GMO’s website at www.gmo.com and on the Securities and Exchange Commission’s website at www.sec.gov no later than August 31 of each year.

The Funds file their complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarter of each fiscal year on Form N-PORT which is available on the Commission’s website at www.sec.gov. The Funds have a policy with respect to disclosure of portfolio holdings under which they may also make a complete schedule of portfolio holdings available on GMO’s website at www.gmo.com.

This report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a prospectus for the GMO Trust, which contains a complete discussion of the risks associated with an investment in these Funds and other important information. The GMO Trust prospectus can be obtained at www.gmo.com. The GMO

Trust Statement of Additional Information includes additional information about the Trustees of GMO Trust and is available without charge, upon request, by calling 1-617-346-7646 (collect).

An investment in the Funds is subject to risk, including the possible loss of principal amount invested. There can be no assurance that the Funds will achieve their stated investment objectives. Please see the Funds’ prospectus regarding specific principal risks for each Fund. General risks may include: market risk-fixed income investments, management and operational risk, market risk-asset backed securities, credit risk and derivatives risk.

The Funds are distributed by Funds Distributor LLC. Funds Distributor LLC is not affiliated with GMO.

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| Multi-Sector Fixed Income Fund (formerly Core Plus Bond Fund) |

||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 61 | ||||

| 63 | ||||

| 66 | ||||

| 72 | ||||

| 118 | ||||

| 119 | ||||

| 120 | ||||

| 121 |

| 1 | ||||

GMO Asset Allocation Bond Fund

(A Series of GMO Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Asset Allocation team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

Class III shares of GMO Asset Allocation Bond Fund returned +6.33% (net) for the fiscal year ended February 28, 2021, as compared with +0.33% for the FTSE 3-Month Treasury Bill Index.

The Fund’s position in Treasury Inflation-Protected Securities drove the vast majority of gains during the fiscal year, as real 10-year yields plummeted from -0.28% at the start of the period to an incredible -0.71% at the end of the period.

The Fund also had a modest exposure to short-dated U.S. Treasuries, and these made a small positive contribution to performance.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments. All information is unaudited.

| 2 | ||||

GMO Asset Allocation Bond Fund

(A Series of GMO Trust)

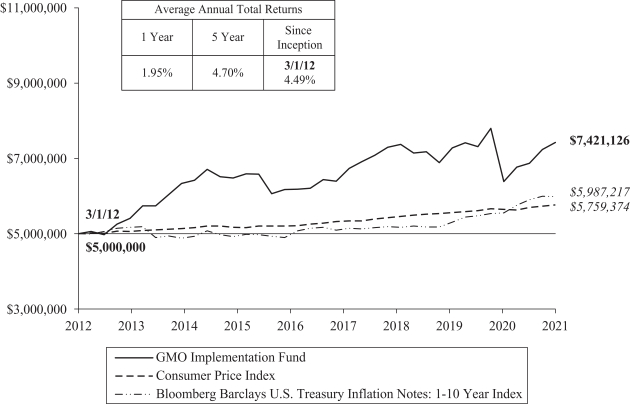

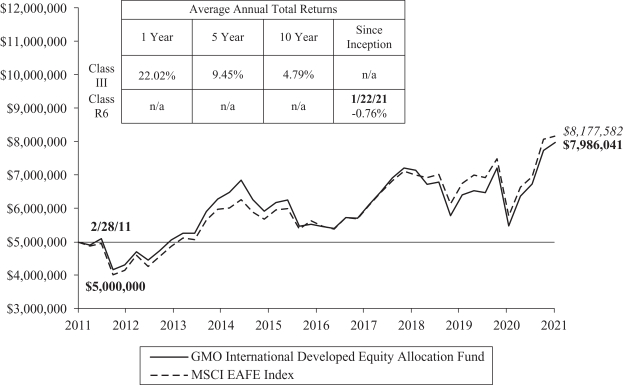

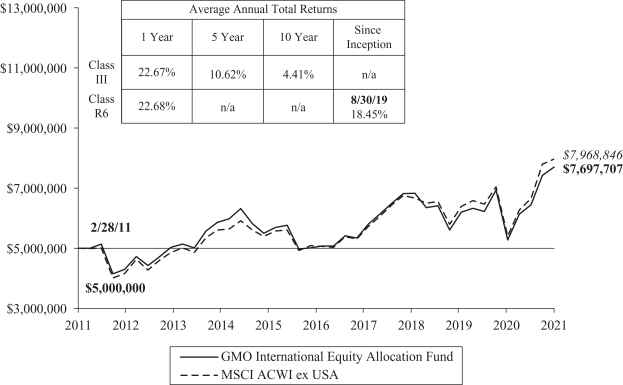

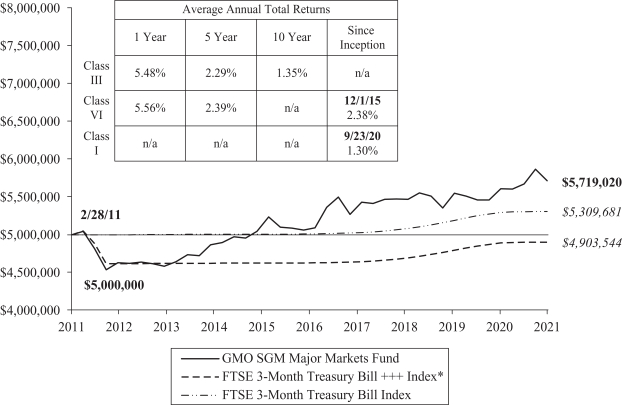

Comparison of Change in Value of a $5,000,000 Investment in

GMO Asset Allocation Bond Fund Class III Shares and the FTSE 3-Month Treasury Bill Index

As of February 28, 2021

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance shown is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. The performance information shown above only includes purchase premiums and/or redemption fees in effect as of February 28, 2021. All information is unaudited. Performance for classes may vary due to different fees.

For Class III and VI the gross expense ratio of 0.46% and 0.37%, respectively, is equal to the Fund’s Total Annual Operating Expenses set forth in the Fund’s most recent prospectus dated June 30, 2020. For the Classes listed above, the corresponding net expense ratio of 0.40% and 0.31% reflects the reduction of expenses from fee reimbursements. The fee reimbursements will continue until at least June 30, 2021. Elimination of this reimbursement will result in higher fees and lower performance.

3

GMO Asset Allocation Bond Fund

(A Series of GMO Trust)

Investment Concentration Summary

February 28, 2021 (Unaudited)

| 4 | ||||

GMO Asset Allocation Bond Fund

(A Series of GMO Trust)

(showing percentage of total net assets)

February 28, 2021

Notes to Schedule of Investments:

| † | Denominated in U.S. Dollar, unless otherwise indicated. |

| (a) | Indexed security in which price and/or coupon is linked to the price of a specific instrument or financial statistic (Note 2). |

| (b) | The rate disclosed is the 7 day net yield as of February 28, 2021. |

For a listing of definitions of acronyms, counterparty abbreviations and currency abbreviations used throughout the Schedule of Investments as well as the derivative tables, if any, please refer to page 56.

| See accompanying notes to the financial statements. | 5 | |||

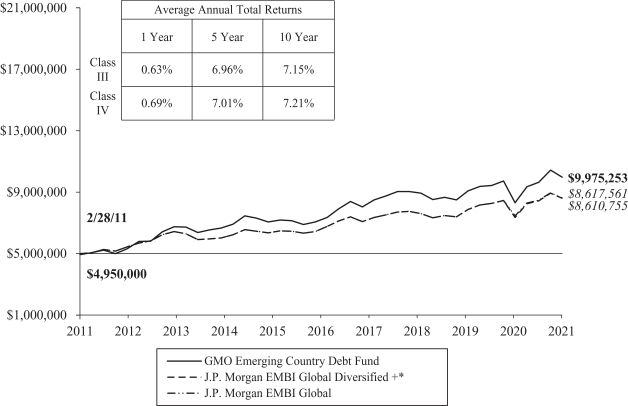

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Emerging Country Debt team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

Class III shares of GMO Emerging Country Debt Fund returned +2.67% (net) for the fiscal year ended February 28, 2021, as compared with +0.91% for the J.P. Morgan EMBI Global Diversified + (EMBIGD). As of March 1, 2020, the Fund changed its benchmark so that the Fund now seeks total return in excess of that of the EMBIGD, which GMO believes to be a more appropriate benchmark in light of the Fund’s investment strategy. The Fund formerly sought to outperform the J.P. Morgan Emerging Markets Bond Index Global (EMBIG).

EMBIGD’s spread over U.S. Treasuries tightened by 15 basis points to 359 basis points during the fiscal year, while the yield on the 10-year U.S. Treasury bond rose by 26 basis points to 1.40%.

The Fund had positive alpha from country selection during the fiscal year, driven by gains from overweights in Turkey, Oman, and Ukraine, and underweights in Angola, and Lebanon. While only partly offsetting these gains, the Fund’s overweights in Argentina, Belize, and Ecuador, and underweight in Qatar detracted alpha during the fiscal year.

In terms of security selection, gains from the choice of holdings in Ecuador, Argentina, and Qatar drove positive alpha, followed by smaller contributions from security selection in Brazil and Mexico. Negative alpha from security selection in Tunisia, Turkey, and Egypt only partly offsets these gains. The Fund had negative alpha from holding of bonds in off-benchmark countries, which we consider security selection. The most notable country in this category was Venezuela, followed by Israel and Grenada.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments. All information is unaudited.

| 6 | ||||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Comparison of Change in Value of a $5,000,000 Investment in

GMO Emerging Country Debt Fund Class III Shares, the J.P. Morgan EMBI Global Diversified +*

and the J.P. Morgan EMBI Global

As of February 28, 2021

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance shown is net of all fees after reimbursement from GMO. Each performance figure assumes a purchase at the beginning and redemption at the end of the stated period and reflects a transaction fee of 1.00% on the purchase and 1.00% on the redemption. Transaction fees are retained by the Fund to cover trading costs. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. All information is unaudited. Performance for classes may vary due to different fees.

For J.P. Morgan disclaimers please visit https://www.gmo.com/north-america/benchmark-disclaimers/

| * | As of March 1, 2020, the Emerging Country Debt Fund changed its benchmark so that the Fund now seeks total return in excess of that of the J.P. Morgan Emerging Markets Bond Index Global Diversified. The Fund formerly sought to outperform the J.P. Morgan Emerging Markets Bond Index Global. In order to present a performance comparison that tracks changes in the Fund’s benchmark over time, the J.P. Morgan Emerging Markets Bond Index Global Diversified + (composite index) is shown in the graph above and reflects the performance of the J.P. Morgan Emerging Markets Bond Index Global through 2/29/2020 and the J.P. Morgan EMBI Global Diversified thereafter. |

For Class III and IV the gross expense ratio of 0.54% and 0.49%, respectively, is equal to the Fund’s Total Annual Operating Expenses set forth in the Fund’s most recent prospectus dated June 30, 2020. For the Classes listed above, the corresponding net expense ratio of 0.54% and 0.49% reflects the reduction of expenses from fee reimbursements. The fee reimbursements will continue until at least June 30, 2021. Elimination of this reimbursement will result in higher fees and lower performance.

7

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Investment Concentration Summary

February 28, 2021 (Unaudited)

| 8 | ||||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

(showing percentage of total net assets)

February 28, 2021

| See accompanying notes to the financial statements. | 9 | |||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| 10 | See accompanying notes to the financial statements. | |||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| See accompanying notes to the financial statements. | 11 | |||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| 12 | See accompanying notes to the financial statements. | |||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| See accompanying notes to the financial statements. | 13 | |||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| 14 | See accompanying notes to the financial statements. | |||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| See accompanying notes to the financial statements. | 15 | |||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| 16 | See accompanying notes to the financial statements. | |||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| See accompanying notes to the financial statements. | 17 | |||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2021

Reverse Repurchase Agreements(j)

| Face Value |

Description |

Value ($) | ||||||||

| USD | 6,685,232 | J.P. Morgan Securities plc, (0.50)%, dated 01/06/21, (collateral: Bolivia Government International Bond, Reg S, 4.50%, due 03/20/28), to be repurchased on demand at face value plus accrued interest. | $ | (6,685,232 | ) | |||||

|

|

|

|||||||||

| Average balance outstanding | $ | (7,687,893 | ) | |||||||

| Average interest rate (net) | 0.49 | % | ||||||||

| Maximum balance outstanding | $ | (15,287,742 | ) | |||||||

Average balance outstanding was calculated based on daily face value balances outstanding during the period that the Fund had entered into reverse repurchase agreements. Average interest rate was calculated based on interest received and/or paid during the period that the Fund had entered into the reverse repurchase agreements.

Credit Linked Options

| Principal / |

Expiration Date |

Description |

Premiums Paid/ (Received) ($) |

Value ($) | ||||||||||||||

| Put Sold | USD | 46,000,000 | 04/13/2021 | Lebanon Gap Credit Linked Put Option, Fund receives premium of 0.50% (OTC) (CP-DB) (a) | (947,472 | ) | (64,608 | ) | ||||||||||

| Put Sold | USD | 9,746,000 | 01/24/2024 | Republic of Philippines Credit Linked Put Option, Fund receives premium of 0.25% (OTC) (CP-DB) (a) | (92,858 | ) | 73,886 | |||||||||||

| Put Sold | USD | 50,797,000 | 04/15/2024 | Banco do Brasil Credit Linked Put Option, Fund receives premium of 0.30% (OTC) (CP-DB) (a) | (1,094,693 | ) | 286,483 | |||||||||||

| Put Sold | USD | 100,000,000 | 04/15/2024 | Banco do Brasil Credit Linked Put Option, Fund receives premium of 0.44% (OTC) (CP-DB) (a) | (3,715,556 | ) | 94,758 | |||||||||||

|

|

|

|

|

|||||||||||||||

| $ | (5,850,579 | ) | $ | 390,519 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

Swap Contracts

Centrally Cleared Credit Default Swaps

| Reference Entity |

Notional |

Annual Premium |

Implied Credit Spread (1) |

Maximum Potential Amount of Future Payments by the Fund Under the Contract (2) |

Expiration Date |

Periodic Payment Frequency |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

|||||||||||||||||||||||||||||

| Buy Protection^: |

||||||||||||||||||||||||||||||||||||||

|

CDX-EMS.31.V1-5Y |

USD | 140,060,000 | 1.00% | 1.10% | N/A | 06/20/2024 | Quarterly | 4,376,875 | 468,501 | (3,908,374 | ) | |||||||||||||||||||||||||||

|

CDX-EMS.34.V1-5Y |

USD | 75,000,000 | 1.00% | 1.92% | N/A | 12/20/2025 | Quarterly | 2,096,250 | 3,127,650 | 1,031,400 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

| $ | 6,473,125 | $ | 3,596,151 | $ | (2,876,974 | ) | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

| 18 | See accompanying notes to the financial statements. | |||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2021

OTC Credit Default Swaps

| Reference Entity |

Counterparty |

Notional |

Annual Premium |

Implied Credit Spread (1) |

Maximum Potential Amount of Future Payments by the Fund Under the Contract (2) |

Expiration Date |

Periodic Payment Frequency |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

||||||||||||||||||||||||||||||

| Buy Protection^: |

| |||||||||||||||||||||||||||||||||||||||

| Banque Centrale de Tunisie SA |

JPM | USD | 19,500,000 | 1.00% | 6.43% | N/A | 06/20/2022 | Quarterly | 2,109,320 | 1,332,634 | (776,686 | ) | ||||||||||||||||||||||||||||

| Republic of South Africa |

GS | USD | 9,700,000 | 1.00% | 1.20% | N/A | 12/20/2022 | Quarterly | 152,652 | 35,936 | (116,716 | ) | ||||||||||||||||||||||||||||

| Republic of South Africa |

CITI | USD | 26,200,000 | 1.00% | 1.20% | N/A | 12/20/2022 | Quarterly | 659,930 | 97,065 | (562,865 | ) | ||||||||||||||||||||||||||||

| Petrobras Global Finance BV |

CITI | USD | 37,000,000 | 1.00% | 1.66% | N/A | 06/20/2024 | Quarterly | 1,923,458 | 795,597 | (1,127,861 | ) | ||||||||||||||||||||||||||||

| Commonwealth of Bahamas |

DB | EUR | 37,970,815 | 1.00% | 4.49% | N/A | 06/20/2025 | Quarterly | 5,153,296 | 3,955,465 | (1,197,831 | ) | ||||||||||||||||||||||||||||

| Republic of South Africa |

GS | USD | 41,800,000 | 1.00% | 2.38% | N/A | 12/20/2025 | Quarterly | 4,006,975 | 2,627,964 | (1,379,011 | ) | ||||||||||||||||||||||||||||

| Republic of Turkey |

CITI | USD | 15,000,000 | 1.00% | 3.15% | N/A | 12/20/2025 | Quarterly | 2,748,570 | 1,426,661 | (1,321,909 | ) | ||||||||||||||||||||||||||||

| Republic of Turkey |

GS | USD | 12,000,000 | 1.00% | 3.15% | N/A | 12/20/2025 | Quarterly | 2,223,997 | 1,141,328 | (1,082,669 | ) | ||||||||||||||||||||||||||||

| Republic of Turkey |

GS | USD | 5,000,000 | 1.00% | 3.15% | N/A | 12/20/2025 | Quarterly | 947,400 | 475,554 | (471,846 | ) | ||||||||||||||||||||||||||||

| United States of Mexico |

GS | USD | 20,000,000 | 1.00% | 1.65% | N/A | 06/20/2029 | Quarterly | 1,589,641 | 989,976 | (599,665 | ) | ||||||||||||||||||||||||||||

| United States of Mexico |

GS | USD | 20,000,000 | 1.00% | 1.82% | N/A | 09/20/2031 | Quarterly | 2,640,655 | 1,508,030 | (1,132,625 | ) | ||||||||||||||||||||||||||||

| Sell Protection^: |

||||||||||||||||||||||||||||||||||||||||

| Commonwealth of Bahamas |

DB | USD | 3,487,000 | 1.00% | 4.36% | 3,487,000 USD | 06/20/2023 | Quarterly | (641,463 | ) | (256,124 | ) | 385,339 | |||||||||||||||||||||||||||

| Commonwealth of Bahamas |

DB | USD | 6,975,000 | 1.00% | 4.36% | 6,975,000 USD | 06/20/2023 | Quarterly | (1,263,915 | ) | (512,321 | ) | 751,594 | |||||||||||||||||||||||||||

| Commonwealth of Bahamas |

DB | USD | 50,827,085 | 1.00% | 4.48% | 50,827,085 USD | 06/20/2025 | Quarterly | (5,838,385 | ) | (4,323,758 | ) | 1,514,627 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| $ | 16,412,131 | $ | 9,294,007 | $ | (7,118,124 | ) | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| ^ | Buy Protection - Fund pays a premium and buys credit protection. If a credit event occurs the Fund will, depending on the terms of the particular swap contract, either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying securities comprising the referenced index or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| Sell Protection - Fund receives a premium and sells credit protection. If a credit event occurs the Fund will, depending on the terms of the particular swap contract, either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| (1) | As of February 28, 2021, implied credit spreads in absolute terms, calculated using a model, and utilized in determining the market value of credit default swap contracts on the reference security, serve as an indicator of the current status of the payment/performance risk and reflect the likelihood or risk of default for the reference entity. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection. Wider (i.e. higher) credit spreads represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the contract. |

| (2) | The maximum potential amount the Fund could be required to pay as a seller of credit protection if a credit event occurs as defined under the terms of that particular swap contract. |

Centrally Cleared Interest Rate Swaps

| Fund Pays |

Fund Receives |

Notional Amount |

Expiration |

Periodic Payment Frequency |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

|||||||||||||||||||||

| 0.53% |

6 Month EURIBOR | EUR | 30,000,000 | 01/24/2050 | Semi-Annual | (29,167 | ) | (1,511,124 | ) | (1,481,957 | ) | |||||||||||||||||

| 0.82% |

GBP - SONIA - COMPOUND | GBP | 10,600,000 | 02/18/2051 | Annually | (41,304 | ) | 365,522 | 406,826 | |||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

| $ | (70,471 | ) | $ | (1,145,602 | ) | $ | (1,075,131 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

| See accompanying notes to the financial statements. | 19 | |||

GMO Emerging Country Debt Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2021

OTC Total Return Swaps

| Fund Pays |

Fund Receives | Counterparty |

Notional Amount |

Expiration |

Periodic Payment Frequency |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

||||||||||||||||||||||||

| Total Return on J.P. Morgan EMBI Global Core IG Index Short Swap |

|

3 Month USD LIBOR minus a spread of 0.45% |

|

JPM | USD | 19,000,001 | 04/13/2021 | At Maturity | $ | — | $ | 691,966 | $ | 691,966 | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

As of February 28, 2021, for the above contracts and/or agreements, the Fund had sufficient cash and/or securities to cover commitments or collateral requirements, if any, of the relevant broker or exchange.

| 20 | See accompanying notes to the financial statements. | |||

This page has been left blank intentionally.

(A Series of GMO Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Structured Products team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

Class VI shares of GMO High Yield Fund returned +7.21% (net) for the fiscal year ended February 28, 2021, as compared with +7.09% for the Markit iBoxx USD Liquid High Yield Index.

The Fund was invested in a mix of index portfolio products as well as cash high yield bonds. During the fiscal year, the Fund moved exposures between different products based on changes in the model’s alpha signals as well as other factors. Absolute performance was driven by high yield-based ETFs and fallen angel bonds (bonds originally issued as investment grade that have since been downgraded to below investment grade), which were top contributors for the period. Credit default swaps and short-dated B–CCC bonds also contributed positively during the period, while BB-rated bonds detracted.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments. All information is unaudited.

| 22 | ||||

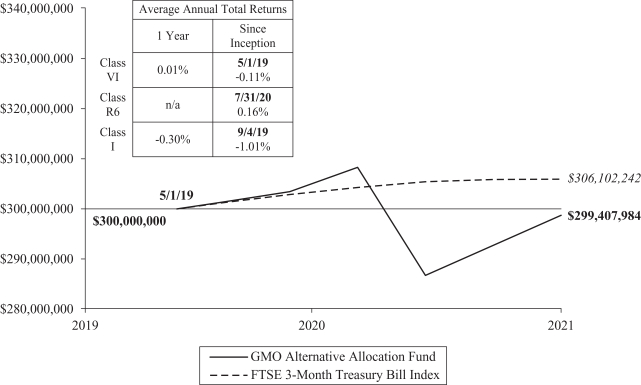

GMO High Yield Fund

(A Series of GMO Trust)

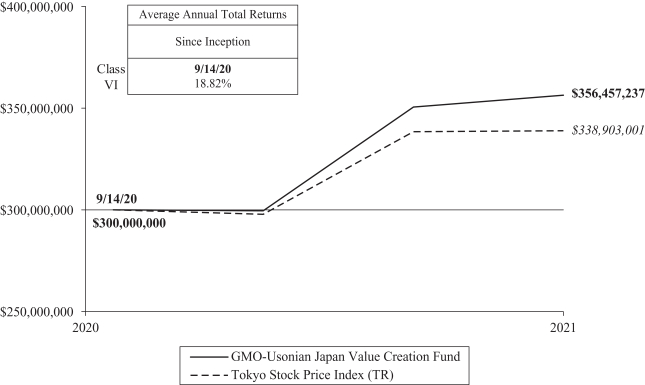

Comparison of Change in Value of a $300,000,000 Investment in

GMO High Yield Fund Class VI Shares and the Markit iBoxx USD Liquid High Yield Index

As of February 28, 2021

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance shown is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. The performance information shown above only includes purchase premiums and/or redemption fees in effect as of February 28, 2021. All information is unaudited.

For Class VI the gross expense ratio of 0.56% is equal to the Fund’s Total Annual Operating Expenses set forth in the Fund’s most recent prospectus dated June 30, 2020. For the Class listed above, the net expense ratio of 0.56% reflects the reduction of expenses from fee reimbursements. The fee reimbursements will continue until at least June 30, 2021. Elimination of this reimbursement will result in higher fees and lower performance.

23

GMO High Yield Fund

(A Series of GMO Trust)

Investment Concentration Summary

February 28, 2021 (Unaudited)

| 24 | ||||

GMO High Yield Fund

(A Series of GMO Trust)

(showing percentage of total net assets)

February 28, 2021

| See accompanying notes to the financial statements. | 25 | |||

GMO High Yield Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| 26 | See accompanying notes to the financial statements. | |||

GMO High Yield Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2021

Reverse Repurchase Agreements

| Average balance outstanding |

$ | (743,429 | ) | |

| Average interest rate (net) |

(0.21 | )% | ||

| Maximum balance outstanding |

$ | (898,268 | ) |

Average balance outstanding was calculated based on daily face value balances outstanding during the period that the Fund had entered into reverse repurchase agreements. Average interest rate was calculated based on interest received and/or paid during the period that the Fund had entered into the reverse repurchase agreements. The Fund had no reverse repurchase agreements at the end of the period.

Swap Contracts

Centrally Cleared Credit Default Swaps

| Reference Entity |

Notional |

Annual Premium |

Implied Credit Spread (1) |

Maximum Potential Amount of Future Payments by the Fund Under the Contract (2) |

Expiration Date |

Periodic Payment Frequency |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

|||||||||||||||||||||||||||||

| Sell Protection^: |

| |||||||||||||||||||||||||||||||||||||

| CDX.NA.HYS.35.V1-5Y |

USD | 26,029,000 | 5.00% | 3.11% | 23,712,000 USD | 12/20/2025 | Quarterly | $ | 1,661,291 | $ | 2,136,044 | $ | 474,753 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

| ^ | Buy Protection - Fund pays a premium and buys credit protection. If a credit event occurs the Fund will, depending on the terms of the particular swap contract, either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying securities comprising the referenced index or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| Sell Protection - Fund receives a premium and sells credit protection. If a credit event occurs the Fund will, depending on the terms of the particular swap contract, either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| (1) | As of February 28, 2021, implied credit spreads in absolute terms, calculated using a model, and utilized in determining the market value of credit default swap contracts on the reference security, serve as an indicator of the current status of the payment/performance risk and reflect the likelihood or risk of default for the reference entity. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection. Wider (i.e. higher) credit spreads represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the contract. |

| (2) | The maximum potential amount the Fund could be required to pay as a seller of credit protection if a credit event occurs as defined under the terms of that particular swap contract. |

OTC Total Return Swaps

| Fund Pays |

Fund Receives |

Counterparty |

Notional Amount |

Expiration Date |

Periodic Payment Frequency |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

||||||||||||||||||||||||

| 1 Month USD LIBOR minus a spread of 0.60% |

Total Return on iBoxx High Yield Corporate Bond ETF | GS | USD | 8,656,086 | 03/01/2021 | At Maturity | — | (60,682 | ) | (60,682 | ) | |||||||||||||||||||||

| 1 Month USD LIBOR minus a spread of 0.75% |

Total Return on iBoxx High Yield Corporate Bond ETF | GS | USD | 4,722,988 | 03/01/2021 | At Maturity | — | (36,108 | ) | (36,108 | ) | |||||||||||||||||||||

| 1 Month USD LIBOR minus a spread of 0.75% |

Total Return on iBoxx High Yield Corporate Bond ETF | GS | USD | 15,445,872 | 03/01/2021 | At Maturity | — | (31,116 | ) | (31,116 | ) | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| $ | — | $ | (127,906 | ) | $ | (127,906 | ) | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| See accompanying notes to the financial statements. | 27 | |||

GMO High Yield Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2021

As of February 28, 2021, for the above contracts and/or agreements, the Fund had sufficient cash and/or securities to cover commitments or collateral requirements, if any, of the relevant broker or exchange.

| 28 | See accompanying notes to the financial statements. | |||

This page has been left blank intentionally.

GMO Multi-Sector Fixed Income Fund (formerly Core Plus Bond Fund)

(A Series of GMO Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Developed Rates & FX team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

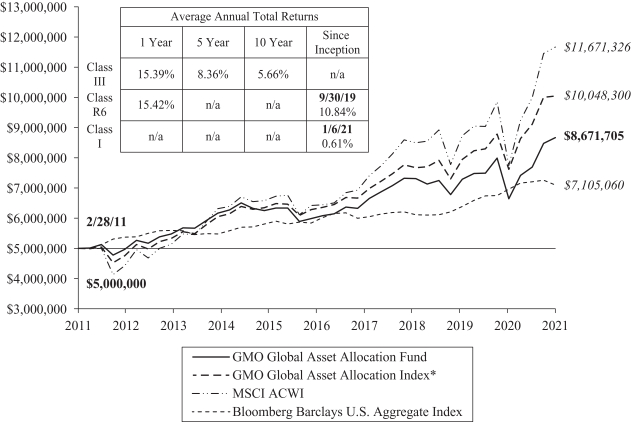

Class III shares of GMO Multi-Sector Fixed Income Fund returned +0.59% (net) for the fiscal year ended February 28, 2021, as compared with +1.38% for the Bloomberg Barclays U.S. Aggregate Index.

The Fund’s investment exposure was achieved through global interest rate and currency derivatives, as well as indirect (through ETFs and other GMO Funds, including GMO Opportunistic Income Fund, GMO Emerging Country Debt Fund, and GMO U.S. Treasury Fund) and direct fixed income investments.

Developed markets interest rate positioning contributed negatively during the fiscal year. The Fund’s active duration positions in New Zealand, Switzerland, and Canada detracted value, while positions in European and U.K. rates provided some support. Slope positions (2-year vs. 10-year) in New Zealand and Canada compounded losses in rates.

The Fund’s positions in developed market currencies added value during the fiscal year. Exposure to Swedish krona added to performance, but exposure to New Zealand dollar paired gains. Exposure to emerging market currencies resulted in a net positive contribution to performance. Positioning in South African rand and Brazilian real drove gains.

The Fund’s overweight positioning to securitized products and emerging country debt also added value during the year.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments. All information is unaudited.

| 30 | ||||

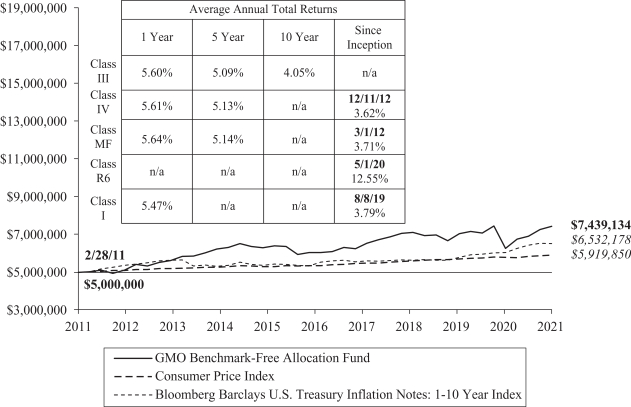

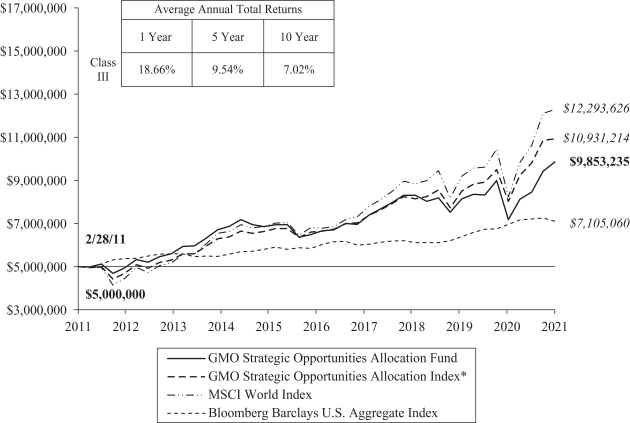

GMO Multi-Sector Fixed Income Fund (formerly GMO Core Plus Bond Fund)

(A Series of GMO Trust)

Comparison of Change in Value of a $5,000,000 Investment in

GMO Multi-Sector Fixed Income Fund (Formerly GMO Core Plus Bond Fund) Class III Shares and the Bloomberg Barclays U.S. Aggregate Index

As of February 28, 2021

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance shown is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. The performance information shown above only includes purchase premiums and/or redemption fees in effect as of February 28, 2021. All information is unaudited. Performance for classes may vary due to different fees.

For Class III and IV the gross expense ratio of 0.61% and 0.56%, respectively, is equal to the Fund’s Total Annual Operating Expenses set forth in the Fund’s most recent prospectus dated June 30, 2020. For the Classes listed above, the corresponding net expense ratio of 0.45% and 0.40% reflects the reduction of expenses from fee reimbursements. The fee reimbursements will continue until at least June 30, 2021. Elimination of this reimbursement will result in higher fees and lower performance.

31

GMO Multi-Sector Fixed Income Fund (formerly GMO Core Plus Bond Fund)

(A Series of GMO Trust)

Investment Concentration Summary

February 28, 2021 (Unaudited)

| 32 | ||||

GMO Multi-Sector Fixed Income Fund (formerly Core Plus Bond Fund)

(A Series of GMO Trust)

(showing percentage of total net assets)

February 28, 2021

| See accompanying notes to the financial statements. | 33 | |||

GMO Multi-Sector Fixed Income Fund (formerly Core Plus Bond Fund)

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| 34 | See accompanying notes to the financial statements. | |||

GMO Multi-Sector Fixed Income Fund (formerly Core Plus Bond Fund)

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| See accompanying notes to the financial statements. | 35 | |||

GMO Multi-Sector Fixed Income Fund (formerly Core Plus Bond Fund)

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2021

Swap Contracts

Centrally Cleared Interest Rate Swaps

| Fund Pays |

Fund Receives | Notional |

Expiration Date |

Periodic |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

|||||||||||||||||||

| 3 Month CAD LIBOR |

0.52% | CAD | 3,100,000 | 03/13/2023 | Semi-Annually | — | (7,441 | ) | (7,441 | ) | ||||||||||||||||

| 0.49% |

3 Month CAD LIBOR | CAD | 51,430,000 | 03/13/2023 | Semi-Annually | 13,060 | 147,535 | 134,475 | ||||||||||||||||||

| 6 Month EURIBOR |

(0.55)% | EUR | 10,260,000 | 03/15/2023 | Semi-Annually | (2,541 | ) | (22,623 | ) | (20,082 | ) | |||||||||||||||

| 6 Month GBP LIBOR |

0.10% | GBP | 48,020,000 | 03/15/2023 | Semi-Annually | 2,482 | (235,470 | ) | (237,952 | ) | ||||||||||||||||

| 6 Month GBP LIBOR |

0.10% | GBP | 1,900,000 | 03/15/2023 | Semi-Annually | — | (9,422 | ) | (9,422 | ) | ||||||||||||||||

| 6 Month GBP LIBOR |

0.18% | GBP | 2,010,000 | 03/15/2023 | Semi-Annually | 36 | (5,337 | ) | (5,373 | ) | ||||||||||||||||

| 0.23% |

3 Month USD LIBOR | USD | 12,010,000 | 03/15/2023 | Quarterly | 454 | 4,768 | 4,314 | ||||||||||||||||||

| 0.21% |

3 Month USD LIBOR | USD | 15,040,000 | 03/15/2023 | Quarterly | (1,683 | ) | 11,963 | 13,646 | |||||||||||||||||

| 0.21% |

3 Month USD LIBOR | USD | 4,800,000 | 03/15/2023 | Quarterly | (1,899 | ) | 4,105 | 6,004 | |||||||||||||||||

| 0.12% |

3 Month AUD BBSW | AUD | 5,740,000 | 03/17/2023 | Quarterly | — | 7,926 | 7,926 | ||||||||||||||||||

| 0.07% |

3 Month AUD BBSW | AUD | 10,400,000 | 03/17/2023 | Quarterly | 139 | 21,794 | 21,655 | ||||||||||||||||||

| 3 Month AUD BBSW |

0.10% | AUD | 2,300,000 | 03/17/2023 | Quarterly | (272 | ) | (3,795 | ) | (3,523 | ) | |||||||||||||||

| 0.09% |

3 Month AUD BBSW | AUD | 4,920,000 | 03/17/2023 | Quarterly | — | 9,252 | 9,252 | ||||||||||||||||||

| 6 Month CHF LIBOR |

(0.70)% | CHF | 2,370,000 | 03/17/2023 | Semi-Annually | — | (4,870 | ) | (4,870 | ) | ||||||||||||||||

| (0.72)% |

6 Month CHF LIBOR | CHF | 1,770,000 | 03/17/2023 | Semi-Annually | (259 | ) | 4,305 | 4,564 | |||||||||||||||||

| 0.39% |

3 Month NZD Bank Bill Rate | NZD | 42,710,000 | 03/17/2023 | Quarterly | (11,255 | ) | 64,978 | 76,233 | |||||||||||||||||

| 3 Month SEK STIBOR |

(0.03)% | SEK | 256,890,000 | 03/17/2023 | Quarterly | 5,873 | (32,878 | ) | (38,751 | ) | ||||||||||||||||

| 6 Month AUD BBSW |

1.01% | AUD | 1,200,000 | 03/17/2031 | Semi-Annually | — | (72,038 | ) | (72,038 | ) | ||||||||||||||||

| 6 Month AUD BBSW |

0.99% | AUD | 1,030,000 | 03/17/2031 | Semi-Annually | — | (63,743 | ) | (63,743 | ) | ||||||||||||||||

| 6 Month AUD BBSW |

1.95% | AUD | 15,000,000 | 03/17/2031 | Semi-Annually | 102,315 | 121,723 | 19,408 | ||||||||||||||||||

| 6 Month AUD BBSW |

1.26% | AUD | 2,180,000 | 03/17/2031 | Semi-Annually | 1,362 | (92,500 | ) | (93,862 | ) | ||||||||||||||||

| 1.05% |

6 Month AUD BBSW | AUD | 490,000 | 03/17/2031 | Semi-Annually | (230 | ) | 28,097 | 28,327 | |||||||||||||||||

| 3 Month CAD LIBOR |

1.50% | CAD | 18,230,000 | 03/17/2031 | Semi-Annually | 1,892 | (514,926 | ) | (516,818 | ) | ||||||||||||||||

| 3 Month CAD LIBOR |

1.51% | CAD | 9,830,000 | 03/17/2031 | Semi-Annually | (9,035 | ) | (270,422 | ) | (261,387 | ) | |||||||||||||||

| 3 Month CAD LIBOR |

1.61% | CAD | 1,740,000 | 03/17/2031 | Semi-Annually | — | (35,057 | ) | (35,057 | ) | ||||||||||||||||

| 3 Month CAD LIBOR |

1.75% | CAD | 18,850,000 | 03/17/2031 | Semi-Annually | (23,104 | ) | (185,495 | ) | (162,391 | ) | |||||||||||||||

| 6 Month CHF LIBOR |

(0.25)% | CHF | 6,880,000 | 03/17/2031 | Semi-Annually | (3,319 | ) | (261,976 | ) | (258,657 | ) | |||||||||||||||

| 6 Month CHF LIBOR |

(0.27)% | CHF | 350,000 | 03/17/2031 | Semi-Annually | 765 | (13,990 | ) | (14,755 | ) | ||||||||||||||||

| (0.21)% |

6 Month CHF LIBOR | CHF | 470,000 | 03/17/2031 | Semi-Annually | — | 15,541 | 15,541 | ||||||||||||||||||

| (0.19)% |

6 Month CHF LIBOR | CHF | 690,000 | 03/17/2031 | Semi-Annually | — | 21,431 | 21,431 | ||||||||||||||||||

| (0.12)% |

6 Month CHF LIBOR | CHF | 2,390,000 | 03/17/2031 | Semi-Annually | (970 | ) | 54,798 | 55,768 | |||||||||||||||||

| 0.09% |

6 Month CHF LIBOR | CHF | 720,000 | 03/17/2031 | Semi-Annually | — | 107 | 107 | ||||||||||||||||||

| (0.23)% |

6 Month CHF LIBOR | CHF | 1,730,000 | 03/17/2031 | Semi-Annually | — | 61,442 | 61,442 | ||||||||||||||||||

| 36 | See accompanying notes to the financial statements. | |||

GMO Multi-Sector Fixed Income Fund (formerly Core Plus Bond Fund)

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2021

| Fund Pays |

Fund Receives | Notional |

Expiration Date |

Periodic |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

|||||||||||||||||||

| (0.25)% |

6 Month CHF LIBOR | CHF | 690,000 | 03/17/2031 | Semi-Annually | — | 25,659 | 25,659 | ||||||||||||||||||

| 3 Month NZD Bank Bill Rate |

1.10% | NZD | 9,000,000 | 03/17/2031 | Quarterly | (26,566 | ) | (546,849 | ) | (520,283 | ) | |||||||||||||||

| 3 Month NZD Bank Bill Rate |

2.15% | NZD | 22,990,000 | 03/17/2031 | Quarterly | 154,861 | 230,103 | 75,242 | ||||||||||||||||||

| 3 Month NZD Bank Bill Rate |

1.70% | NZD | 5,350,000 | 03/17/2031 | Quarterly | (18,838 | ) | (108,718 | ) | (89,880 | ) | |||||||||||||||

| 0.54% |

3 Month SEK STIBOR | SEK | 13,500,000 | 03/17/2031 | Annually | (421 | ) | 44,240 | 44,661 | |||||||||||||||||

| 0.82% |

3 Month SEK STIBOR | SEK | 6,900,000 | 03/17/2031 | Quarterly | — | 362 | 362 | ||||||||||||||||||

| 3 Month SEK STIBOR |

0.49% | SEK | 10,790,000 | 03/17/2031 | Quarterly | 2,621 | (41,448 | ) | (44,069 | ) | ||||||||||||||||

| 3 Month SEK STIBOR |

0.48% | SEK | 4,400,000 | 03/17/2031 | Quarterly | — | (17,282 | ) | (17,282 | ) | ||||||||||||||||

| 0.41% |

3 Month SEK STIBOR | SEK | 42,210,000 | 03/17/2031 | Quarterly | 1,950 | 201,031 | 199,081 | ||||||||||||||||||

| (0.03)% |

6 Month EURIBOR | EUR | 670,000 | 03/19/2031 | Semi-Annually | — | 6,928 | 6,928 | ||||||||||||||||||

| 0.02% |

6 Month EURIBOR | EUR | 31,420,000 | 03/19/2031 | Semi-Annually | (9,524 | ) | 128,226 | 137,750 | |||||||||||||||||

| 0.05% |

6 Month EURIBOR | EUR | 570,000 | 03/19/2031 | Semi-Annually | — | (88 | ) | (88 | ) | ||||||||||||||||

| (0.25)% |

6 Month EURIBOR | EUR | 2,040,000 | 03/19/2031 | Semi-Annually | 1,381 | 75,931 | 74,550 | ||||||||||||||||||

| 0.69% |

6 Month GBP LIBOR | GBP | 410,000 | 03/19/2031 | Semi-Annually | 95 | 17,815 | 17,720 | ||||||||||||||||||

| 0.92% |

6 Month GBP LIBOR | GBP | 14,090,000 | 03/19/2031 | Semi-Annually | 25,158 | 173,075 | 147,917 | ||||||||||||||||||

| 0.48% |

6 Month GBP LIBOR | GBP | 9,130,000 | 03/19/2031 | Semi-Annually | (190 | ) | 655,287 | 655,477 | |||||||||||||||||

| 0.54% |

6 Month GBP LIBOR | GBP | 920,000 | 03/19/2031 | Semi-Annually | 3,303 | 58,302 | 54,999 | ||||||||||||||||||

| 1.46% |

3 Month USD LIBOR | USD | 15,800,000 | 03/19/2031 | Quarterly | (8,978 | ) | 107,718 | 116,696 | |||||||||||||||||

| 1.51% |

3 Month USD LIBOR | USD | 850,000 | 03/19/2031 | Quarterly | — | 1,621 | 1,621 | ||||||||||||||||||

| 1.52% |

3 Month USD LIBOR | USD | 970,000 | 03/19/2031 | Quarterly | — | 786 | 786 | ||||||||||||||||||

| 1.52% |

3 Month USD LIBOR | USD | 970,000 | 03/19/2031 | Quarterly | — | 1,155 | 1,155 | ||||||||||||||||||

| 3 Month USD LIBOR |

1.45% | USD | 6,480,000 | 03/19/2031 | Quarterly | (2,530 | ) | (50,358 | ) | (47,828 | ) | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||

| $ | 196,133 | $ | (288,722 | ) | $ | (484,855 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||

OTC Total Return Swaps

| Fund Pays |

Fund Receives |

Counterparty |

Notional |

Expiration Date |

Periodic |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

||||||||||||||||||||

| Total Return on iShares Core S&P 500 ETF |

1 Month USD LIBOR plus a spread of 0.24% | GS | USD | 29,934,120 | 03/18/2021 | At Maturity | $ | — | $ | 921,917 | $ | 921,917 | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

As of February 28, 2021, for the above contracts and/or agreements, the Fund had sufficient cash and/or securities to cover commitments or collateral requirements, if any, of the relevant broker or exchange.

| See accompanying notes to the financial statements. | 37 | |||

(A Series of GMO Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Structured Products team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

Although the Fund is not managed relative to any securities market index or benchmark, a discussion of the Fund’s performance relative to the Bloomberg Barclays U.S. Securitized + Index* is included for comparative purposes.

Class VI shares of GMO Opportunistic Income Fund returned +2.95% (net) for the fiscal year ended February 28, 2021, as compared with +1.56% for the Bloomberg Barclays U.S. Securitized + Index.

Absolute performance was driven by sector allocations such as Residential Mortgage-Backed Securities, Commercial Mortgage-Backed Securities, and Student Loans, which were among the top contributors of the fiscal year. The Fund’s relative value synthetic trades and credit hedge positions also contributed positively during the fiscal year, as did securitizations related to corporate debt markets, such as Collateralized Loan Obligations. Finally, in asset-backed products, such as Small Balance Commercial Asset-Backed Securities (ABS), the Fund added value in less volatile, shorter duration markets.

*The Bloomberg Barclays U.S. Securitized + Index is an internally maintained benchmark computed by GMO, comprised of the J.P. Morgan U.S. 3-Month Cash Index through 12/30/2016 and the Bloomberg Barclays U.S. Securitized: MBS, ABS, CMBS Index thereafter.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments. All information is unaudited.

| 38 | ||||

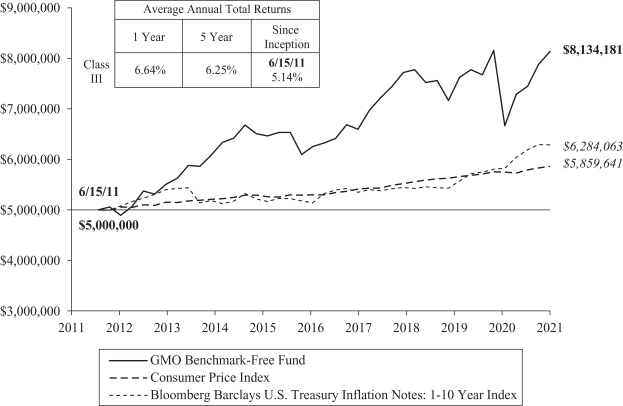

GMO Opportunistic Income Fund

(A Series of GMO Trust)

Comparison of Change in Value of a $300,000,000 Investment in

GMO Opportunistic Income Fund^ Class VI Shares, the Bloomberg Barclays U.S. Securitized + Index*

and the Bloomberg Barclays U.S. Securitized Index

As of February 28, 2021

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance shown is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. All information is unaudited. Performance for classes may vary due to different fees.

| ^ | Effective February 12, 2014, GMO Opportunistic Income Fund (the “Acquired Fund”) merged into GMO Short-Duration Collateral Fund and the surviving entity was renamed GMO Opportunistic Income Fund. For accounting and financial reporting purposes, the Acquired Fund is the surviving entity, meaning that the combined entity adopted the historical financial reporting and performance history of the Acquired Fund. The information shown prior to February 12, 2014 is that of the Acquired Fund and reflects the Acquired Fund’s performance. |

| * | The Bloomberg Barclays U.S. Securitized + Index is a composite benchmark computed by GMO and comprised of the J.P. Morgan U.S. 3 Month Cash Index through December 30, 2016 and the Bloomberg Barclays U.S. Securitized Index thereafter. |

| ** | Beginning December 21, 2015 the pricing source for certain fixed income assets of the Fund changed, which may have had a material impact on the Fund’s performance for the period shown. |

For J.P. Morgan disclaimers please visit https://www.gmo.com/north-america/benchmark-disclaimers/

For Class VI and I the gross expense ratio of 0.51% and 0.73%, respectively, is equal to the Fund’s Total Annual Operating Expenses set forth in the Fund’s most recent prospectus dated June 30, 2020. For the Classes listed above, the corresponding net expense ratio of 0.47% and 0.67% reflects the reduction of expenses from fee reimbursements. The fee reimbursements will continue until at least June 30, 2021. Elimination of this reimbursement will result in higher fees and lower performance.

39

GMO Opportunistic Income Fund

(A Series of GMO Trust)

Investment Concentration Summary

February 28, 2021 (Unaudited)

| 40 | ||||

GMO Opportunistic Income Fund

(A Series of GMO Trust)

(showing percentage of total net assets)

February 28, 2021

| See accompanying notes to the financial statements. | 41 | |||

GMO Opportunistic Income Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| 42 | See accompanying notes to the financial statements. | |||

GMO Opportunistic Income Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| See accompanying notes to the financial statements. | 43 | |||

GMO Opportunistic Income Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| 44 | See accompanying notes to the financial statements. | |||

GMO Opportunistic Income Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

| See accompanying notes to the financial statements. | 45 | |||

GMO Opportunistic Income Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

(showing percentage of total net assets)

February 28, 2021

PURCHASED OPTIONS — 0.0%

| Description | Counterparty | Exercise Rate |

Expiration Date |

Principal/ Notional Amount |

Floating Rate Index |

Pay/Receive Floating Rate |

Value ($) | |||||||||||||||

| Option on Credit Default Swaps – Calls — 0.0% | ||||||||||||||||||||||

| CDX.NA.IGS.35.V1-5Y |

BOA | 47.50 | % | 04/21/21 | USD | 53,190,000 | Fixed Spread | Receive | 17,437 | |||||||||||||

|

| ||||||||||||||||||||||

| TOTAL PURCHASED OPTIONS (COST $58,509) |

|

17,437 | ||||||||||||||||||||

|

| ||||||||||||||||||||||

|

TOTAL INVESTMENTS — 95.5% |

|

854,101,206 | ||||||||||||||||||||

|

| ||||||||||||||||||||||

|

SECURITIES SOLD SHORT — (0.6)% |

|

|||||||||||||||||||||

|

DEBT OBLIGATIONS — (0.6)% |

|

|||||||||||||||||||||

|

U.S. Government Agency — (0.6)% |

|

|||||||||||||||||||||

| (5,000,000) Fannie Mae or Freddie Mac, TBA, 3.00%, due 04/14/51 |

|

(5,234,961) | ||||||||||||||||||||

|

| ||||||||||||||||||||||

|

TOTAL SECURITIES SOLD SHORT (PROCEEDS $5,272,656) |

|

(5,234,961) | ||||||||||||||||||||

|

| ||||||||||||||||||||||

|

Other Assets and Liabilities (net) — 5.1% |

|

45,740,987 | ||||||||||||||||||||

|

| ||||||||||||||||||||||

|

TOTAL NET ASSETS — 100.0% |

|

$894,607,232 | ||||||||||||||||||||

|

| ||||||||||||||||||||||

A summary of outstanding financial instruments at February 28, 2021 is as follows:

Forward Currency Contracts

| Settlement Date |

Counter-party |

Currency Sold |

Currency Purchased |

Net Unrealized Appreciation (Depreciation) ($) |

||||||||||||||||||

| 03/19/2021 | BOA | EUR | 2,738,070 | USD | 3,299,225 | (5,689 | ) | |||||||||||||||

| 03/19/2021 | BOA | USD | 2,892,505 | EUR | 2,400,528 | 4,988 | ||||||||||||||||

|

|

|

|||||||||||||||||||||

| $ | (701 | ) | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||

| 46 | See accompanying notes to the financial statements. | |||

GMO Opportunistic Income Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2021

Written Options

| Description |

Counterparty | Exercise |

Expiration Date |

Principal/ Notional Amount |

Floating Rate Index |

Pay/Receive |

Value ($) | |||||||||||||||||||

| Written Option on Credit Default Swaps – Calls |

| |||||||||||||||||||||||||

| CDX.NA.HYS.35.V1-5Y |

JPM | 109.50% | 03/17/21 | USD | (15,880,000 | ) | Fixed Spread | Receive | (21,720 | ) | ||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Written Options on Credit Default Swaps – Puts |

| |||||||||||||||||||||||||

| CDX.NA.HYS.35.V1-5Y |

JPM | 109.00% | 03/17/21 | USD | (15,880,000 | ) | Fixed Spread | Pay | (200,837 | ) | ||||||||||||||||

| CDX.NA.IGS.35.V1-5Y |

MSCI | 55.00% | 03/17/21 | USD | (59,146,500 | ) | Fixed Spread | Pay | (103,385 | ) | ||||||||||||||||

| CDX.NA.IGS.35.V1-5Y |

BOA | 70.00% | 04/21/21 | USD | (53,190,000 | ) | Fixed Spread | Pay | (68,555 | ) | ||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Total Written Options on Credit Default Swaps – Puts | (372,777 | ) | ||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| TOTAL WRITTEN OPTIONS (Premiums $487,628) | $ | (394,497 | ) | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

Swap Contracts

Centrally Cleared Credit Default Swaps

| Reference Entity |

Notional |

Annual Premium |

Implied Credit Spread (1) |

Maximum Potential Amount of Future Payments by the Fund Under the Contract (2) |

Expiration Date |

Periodic Payment Frequency |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

|||||||||||||||||||||||||||||

| Buy Protection^: |

| |||||||||||||||||||||||||||||||||||||

| ITRAXX.XOVERS.30.V3-5Y |

EUR | 21,745,573 | 5.00% | 1.98% | N/A | 12/20/2023 | Quarterly | (2,273,176 | ) | (2,176,213 | ) | 96,963 | ||||||||||||||||||||||||||

| CDX.NA.IGS.33.V1-5Y |

USD | 49,070,000 | 1.00% | 0.57% | N/A | 12/20/2024 | Quarterly | (417,804 | ) | (799,693 | ) | (381,889 | ) | |||||||||||||||||||||||||

| ITRAXX.EUROPES.32.V1-5Y |

EUR | 29,470,000 | 1.00% | 0.45% | N/A | 12/20/2024 | Quarterly | (859,948 | ) | (752,067 | ) | 107,881 | ||||||||||||||||||||||||||

| CDX.NA.HYS.35.V1-5Y |

USD | 15,880,000 | 5.00% | 3.11% | N/A | 12/20/2025 | Quarterly | (1,468,900 | ) | (1,303,176 | ) | 165,724 | ||||||||||||||||||||||||||

| CDX.NA.IGS.35.V1-5Y |

USD | 53,190,000 | 1.00% | 0.56% | N/A | 12/20/2025 | Quarterly | (1,287,376 | ) | (1,102,629 | ) | 184,747 | ||||||||||||||||||||||||||

| CDX.NA.IGS.35.V1-5Y |

USD | 59,146,500 | 1.00% | 0.56% | N/A | 12/20/2025 | Quarterly | (1,281,546 | ) | (1,226,107 | ) | 55,439 | ||||||||||||||||||||||||||

| ITRAXX.EUROPES.34.V1-5Y |

EUR | 20,633,760 | 1.00% | 0.51% | N/A | 12/20/2025 | Quarterly | (648,690 | ) | (588,185 | ) | 60,505 | ||||||||||||||||||||||||||

| Sell Protection^: |

| |||||||||||||||||||||||||||||||||||||

| CDX.NA.IGS.28.V1-5Y |

USD | 17,200,000 | 1.00% | 0.34% | 17,200,000 USD | 06/20/2022 | Quarterly | 300,982 | 149,382 | (151,600 | ) | |||||||||||||||||||||||||||

| CDX.NA.HYS.33.V3-5Y |

USD | 2,300,650 | 5.00% | 2.59% | 2,300,650 USD | 12/20/2024 | Quarterly | 78,900 | 197,840 | 118,940 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

| $ | (7,857,558 | ) | $ | (7,600,848 | ) | $ | 256,710 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

| See accompanying notes to the financial statements. | 47 | |||

GMO Opportunistic Income Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2021

OTC Credit Default Swaps

| Reference Entity |

Counter- |

Notional |

Annual Premium |

Implied Credit Spread (1) |

Maximum Potential Amount of Future Payments by the Fund Under the Contract (2) |

Expiration Date |

Periodic Payment Frequency |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

||||||||||||||||||||||||||||||

| Buy Protection^: |

| |||||||||||||||||||||||||||||||||||||||

| CDX.NA.HYS.27.V2-5Y |

GS | USD | 4,458,000 | 5.00% | 1.29% | N/A | 12/20/2021 | Quarterly | 11,145 | (135,612 | ) | (146,757 | ) | |||||||||||||||||||||||||||

| CDX.NA.HYS.27.V2-5Y |

JPM | USD | 4,300,000 | 5.00% | 1.29% | N/A | 12/20/2021 | Quarterly | (11,825 | ) | (130,805 | ) | (118,980 | ) | ||||||||||||||||||||||||||

| D.R. Horton, Inc. |

BCLY | USD | 17,200,000 | 1.00% | 0.17% | N/A | 06/20/2022 | Quarterly | (165,250 | ) | (189,280 | ) | (24,030 | ) | ||||||||||||||||||||||||||

| CDX.NA.HYS.29.V1-5Y |

JPM | USD | 6,425,250 | 5.00% | 2.92% | N/A | 12/20/2022 | Quarterly | (282,711 | ) | (241,165 | ) | 41,546 | |||||||||||||||||||||||||||

| CDX.NA.HYS.29.V1-5Y |

JPM | USD | 870,000 | 5.00% | 2.92% | N/A | 12/20/2022 | Quarterly | (51,765 | ) | (32,655 | ) | 19,110 | |||||||||||||||||||||||||||

| CDX.NA.HYS.29.V1-5Y |

MORD | USD | 3,450,800 | 5.00% | 2.92% | N/A | 12/20/2022 | Quarterly | (188,413 | ) | (129,522 | ) | 58,891 | |||||||||||||||||||||||||||

| Navient Corp. |

BCLY | USD | 2,082,800 | 5.00% | 2.45% | N/A | 12/20/2022 | Quarterly | (160,628 | ) | (94,434 | ) | 66,194 | |||||||||||||||||||||||||||

| Navient Corp. |

BCLY | USD | 3,435,200 | 5.00% | 2.45% | N/A | 12/20/2022 | Quarterly | (264,646 | ) | (155,751 | ) | 108,895 | |||||||||||||||||||||||||||

| Navient Corp. |

GS | USD | 2,700,000 | 5.00% | 2.45% | N/A | 12/20/2022 | Quarterly | (277,471 | ) | (122,417 | ) | 155,054 | |||||||||||||||||||||||||||

| Navient Corp. |

GS | USD | 4,050,000 | 5.00% | 2.45% | N/A | 12/20/2022 | Quarterly | (421,122 | ) | (183,626 | ) | 237,496 | |||||||||||||||||||||||||||

| CDX.NA.HYS.31.V14-5Y |

CITI | USD | 3,941,000 | 5.00% | 5.21% | N/A | 12/20/2023 | Quarterly | (15,370 | ) | 22,708 | 38,078 | ||||||||||||||||||||||||||||

| ITRAXX.EUROPES.32.V1-5Y |

BOA | EUR | 10,000,000 | 1.00% | 1.64% | N/A | 12/20/2024 | Quarterly | 748,704 | 294,512 | (454,192 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.A.7 |

CGMI | USD | 1,420,000 | 2.00% | 4.70% | N/A | 01/17/2047 | Monthly | 89,177 | 95,337 | 6,160 | |||||||||||||||||||||||||||||

| CMBX.NA.AA.7 |

GS | USD | 5,000,000 | 1.50% | 2.15% | N/A | 01/17/2047 | Monthly | 7,975 | 83,414 | 75,439 | |||||||||||||||||||||||||||||

| CMBX.NA.AS.7 |

DB | USD | 7,608,000 | 1.00% | 0.81% | N/A | 01/17/2047 | Monthly | (119,899 | ) | (36,745 | ) | 83,154 | |||||||||||||||||||||||||||

| CMBX.NA.AS.7 |

BOA | USD | 4,505,000 | 1.00% | 0.81% | N/A | 01/17/2047 | Monthly | 47,352 | (21,758 | ) | (69,110 | ) | |||||||||||||||||||||||||||

| CMBX.NA.AS.7 |

DB | USD | 16,677,794 | 1.00% | 0.81% | N/A | 01/17/2047 | Monthly | 197,705 | (80,550 | ) | (278,255 | ) | |||||||||||||||||||||||||||

| CMBX.NA.AS.7 |

GS | USD | 4,400,000 | 1.00% | 0.81% | N/A | 01/17/2047 | Monthly | 112,812 | (21,251 | ) | (134,063 | ) | |||||||||||||||||||||||||||

| CMBX.NA.AS.7 |

MORD | USD | 13,270,000 | 1.00% | 0.81% | N/A | 01/17/2047 | Monthly | 205,782 | (64,092 | ) | (269,874 | ) | |||||||||||||||||||||||||||

| CMBX.NA.AA.11 |

CGMI | USD | 4,626,000 | 1.50% | 1.25% | N/A | 11/18/2054 | Monthly | (63,740 | ) | (73,009 | ) | (9,269 | ) | ||||||||||||||||||||||||||

| CMBX.NA.AA.11 |

MORD | USD | 4,624,500 | 1.50% | 1.25% | N/A | 11/18/2054 | Monthly | (61,372 | ) | (72,986 | ) | (11,614 | ) | ||||||||||||||||||||||||||

| CMBX.NA.AA.11 |

MORD | USD | 4,624,500 | 1.50% | 1.25% | N/A | 11/18/2054 | Monthly | (67,279 | ) | (72,985 | ) | (5,706 | ) | ||||||||||||||||||||||||||

| CMBX.NA.AA.8 |

CSI | USD | 8,892,000 | 1.50% | 1.61% | N/A | 10/17/2057 | Monthly | 247,717 | 34,949 | (212,768 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.AS.8 |

CGMI | USD | 8,892,000 | 1.00% | 0.89% | N/A | 10/17/2057 | Monthly | 73,095 | (36,087 | ) | (109,182 | ) | |||||||||||||||||||||||||||

| CMBX.NA.AS.8 |

MORD | USD | 3,384,000 | 1.00% | 0.89% | N/A | 10/17/2057 | Monthly | 140,432 | (13,733 | ) | (154,165 | ) | |||||||||||||||||||||||||||

| CMBX.NA.BBB-.8 |

GS | USD | 6,889,000 | 3.00% | 8.00% | N/A | 10/17/2057 | Monthly | 1,034,610 | 1,078,839 | 44,229 | |||||||||||||||||||||||||||||

| CMBX.NA.BBB-.8 |

GS | USD | 4,224,000 | 3.00% | 8.00% | N/A | 10/17/2057 | Monthly | 400,909 | 661,492 | 260,583 | |||||||||||||||||||||||||||||

| CMBX.NA.AAA.9 |

GS | USD | 902,300 | 0.50% | 0.28% | N/A | 09/17/2058 | Monthly | (4,411 | ) | (8,752 | ) | (4,341 | ) | ||||||||||||||||||||||||||

| CMBX.NA.AAA.9 |

MSCI | USD | 3,328,000 | 0.50% | 0.28% | N/A | 09/17/2058 | Monthly | (31,983 | ) | (32,281 | ) | (298 | ) | ||||||||||||||||||||||||||

| CMBX.NA.AAA.9 |

GS | USD | 10,000,000 | 0.50% | 0.28% | N/A | 09/17/2058 | Quarterly | (102,116 | ) | (96,997 | ) | 5,119 | |||||||||||||||||||||||||||

| CMBX.NA.AAA.9 |

MORD | USD | 2,000,000 | 0.50% | 0.28% | N/A | 09/17/2058 | Monthly | (20,423 | ) | (19,399 | ) | 1,024 | |||||||||||||||||||||||||||

| CMBX.NA.BBB-.9 |

CGMI | USD | 2,500,000 | 3.00% | 5.79% | N/A | 09/17/2058 | Monthly | 290,110 | 281,226 | (8,884 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.BBB-.9 |

CGMI | USD | 1,500,000 | 3.00% | 5.79% | N/A | 09/17/2058 | Monthly | 175,119 | 168,735 | (6,384 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.BBB-.9 |

MORD | USD | 5,116,800 | 3.00% | 5.79% | N/A | 09/17/2058 | Monthly | 584,727 | 575,591 | (9,136 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.BBB-.9 |

MORD | USD | 2,585,000 | 3.00% | 5.79% | N/A | 09/17/2058 | Monthly | 63,490 | 290,788 | 227,298 | |||||||||||||||||||||||||||||

| CMBX.NA.BBB-.9 |

CGMI | USD | 3,425,200 | 3.00% | 5.79% | N/A | 09/17/2058 | Monthly | 955,105 | 385,302 | (569,803 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.BBB-.9 |

DB | USD | 4,263,000 | 3.00% | 5.79% | N/A | 09/17/2058 | Monthly | 517,160 | 479,546 | (37,614 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.A.6 |

CGMI | USD | 2,840,000 | 2.00% | 6.74% | N/A | 05/11/2063 | Monthly | 340,958 | 191,169 | (149,789 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.AA.6 |

GS | USD | 5,000,000 | 1.50% | 2.28% | N/A | 05/11/2063 | Monthly | 35,145 | 57,390 | 22,245 | |||||||||||||||||||||||||||||

| CMBX.NA.BBB-.6 |

CGMI | USD | 4,274,000 | 3.00% | 22.45% | N/A | 05/11/2063 | Monthly | 1,357,351 | 1,056,590 | (300,761 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.BBB-.13 |

GS | USD | 4,960,000 | 3.00% | 4.05% | N/A | 12/16/2072 | Monthly | 1,011,544 | 367,318 | (644,226 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.BBB-.13 |

GS | USD | 2,000,000 | 3.00% | 4.05% | N/A | 12/16/2072 | Monthly | 268,842 | 148,112 | (120,730 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.BBB-.13 |

MORD | USD | 2,000,000 | 3.00% | 4.05% | N/A | 12/16/2072 | Monthly | 408,836 | 148,112 | (260,724 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.BBB-.13 |

MORD | USD | 2,000,000 | 3.00% | 4.05% | N/A | 12/16/2072 | Monthly | 332,412 | 148,112 | (184,300 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.BBB-.13 |

MORD | USD | 2,000,000 | 3.00% | 4.05% | N/A | 12/16/2072 | Monthly | 145,818 | 148,112 | 2,294 | |||||||||||||||||||||||||||||

| Sell Protection^: |

| |||||||||||||||||||||||||||||||||||||||

| CDX.NA.HYS.27.V2-5Y |

GS | USD | 2,084,000 | 5.00% | 0.18% | 2,084,000 USD | 12/20/2021 | Quarterly | 268,315 | 82,709 | (185,606 | ) | ||||||||||||||||||||||||||||

| CDX.NA.HYS.27.V2-5Y |

JPM | USD | 8,600,000 | 5.00% | 0.18% | 8,600,000 USD | 12/20/2021 | Quarterly | 1,143,800 | 341,314 | (802,486 | ) | ||||||||||||||||||||||||||||

| CDX.NA.HYS.27.V3-5Y |

BOA | USD | 8,545,000 | 5.00% | 0.18% | 8,545,000 USD | 12/20/2021 | Quarterly | 1,369,764 | 339,132 | (1,030,632 | ) | ||||||||||||||||||||||||||||

| CDX.NA.HYS.27.V3-5Y |

JPM | USD | 7,735,000 | 5.00% | 0.18% | 7,735,000 USD | 12/20/2021 | Quarterly | 1,096,050 | 306,985 | (789,065 | ) | ||||||||||||||||||||||||||||

| CDX.NA.HYS.29.V1-5Y |

MORD | USD | 4,264,000 | 5.00% | 0.66% | 4,264,000 USD | 12/20/2022 | Quarterly | 644,717 | 337,915 | (306,802 | ) | ||||||||||||||||||||||||||||

| CDX.NA.HYS.29.V1-5Y |

BOA | USD | 5,115,600 | 5.00% | 0.66% | 5,115,600 USD | 12/20/2022 | Quarterly | 742,274 | 405,403 | (336,871 | ) | ||||||||||||||||||||||||||||

| CDX.NA.HYS.29.V6-5Y |

CITI | USD | 5,994,100 | 5.00% | 0.66% | 5,994,100 USD | 12/20/2022 | Quarterly | 229,274 | 475,022 | 245,748 | |||||||||||||||||||||||||||||

| 48 | See accompanying notes to the financial statements. | |||

GMO Opportunistic Income Fund

(A Series of GMO Trust)

Schedule of Investments — (Continued)

February 28, 2021

| Reference Entity |

Counter- |

Notional |

Annual Premium |

Implied Credit Spread (1) |

Maximum Potential Amount of Future Payments by the Fund Under the Contract (2) |

Expiration Date |

Periodic Payment Frequency |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

||||||||||||||||||||||||||||||

| CDX.NA.HYS.31.V1-5Y |

JPM | USD | 18,156,815 | 5.00% | 0.24% | 18,156,815 USD | 12/20/2023 | Quarterly | 3,615,022 | 2,412,239 | (1,202,783 | ) | ||||||||||||||||||||||||||||

| CDX.NA.HYS.31.V14-5Y |

CITI | USD | 2,866,000 | 5.00% | 1.41% | 2,866,000 USD | 12/20/2023 | Quarterly | 293,765 | 288,770 | (4,995 | ) | ||||||||||||||||||||||||||||

| CDX.NA.HYS.31.V14-5Y |

CITI | USD | 4,657,000 | 5.00% | 1.41% | 4,657,000 USD | 12/20/2023 | Quarterly | 492,478 | 469,226 | (23,252 | ) | ||||||||||||||||||||||||||||

| ITRAXX.XOVERS.30.V3-5Y |

JPM | EUR | 655,580 | 5.00% | 34.87% | 655,580 EUR | 12/20/2023 | Quarterly | (487,841 | ) | (439,816 | ) | 48,025 | |||||||||||||||||||||||||||

| ITRAXX.XOVERS.30.V4-5Y |

JPM | EUR | 158,684 | 5.00% | 34.87% | 158,684 EUR | 12/20/2023 | Quarterly | (110,801 | ) | (106,458 | ) | 4,343 | |||||||||||||||||||||||||||

| CDX.NA.HYS.33.V1-5Y |

GS | USD | 25,938,066 | 5.00% | 0.47% | 25,938,066 USD | 12/20/2024 | Quarterly | 5,736,852 | 4,388,006 | (1,348,846 | ) | ||||||||||||||||||||||||||||

| CDX.NA.HYS.33.V12-5Y |

CITI | USD | 10,746,000 | 5.00% | 0.47% | 10,746,000 USD | 12/20/2024 | Quarterly | 1,826,953 | 1,817,927 | (9,026 | ) | ||||||||||||||||||||||||||||

| CDX.NA.HYS.33.V12-5Y |

MORD | USD | 2,840,000 | 5.00% | 0.47% | 2,840,000 USD | 12/20/2024 | Quarterly | 481,871 | 480,450 | (1,421 | ) | ||||||||||||||||||||||||||||

| CDX.NA.HYS.33.V3-5Y |

CITI | USD | 4,185,325 | 5.00% | 0.47% | 4,185,325 USD | 12/20/2024 | Quarterly | 442,877 | 708,042 | 265,165 | |||||||||||||||||||||||||||||

| CDX.NA.HYS.33.V3-5Y |

GS | USD | 9,506,516 | 5.00% | 0.47% | 9,506,516 USD | 12/20/2024 | Quarterly | 1,343,307 | 1,608,241 | 264,934 | |||||||||||||||||||||||||||||

| CDX.NA.HYS.33.V8-5Y |

GS | USD | 6,508,491 | 5.00% | 0.47% | 6,508,491 USD | 12/20/2024 | Quarterly | 1,066,328 | 1,101,057 | 34,729 | |||||||||||||||||||||||||||||

| CDX.NA.IGS.33.V1-5Y |

CITI | USD | 1,472,000 | 1.00% | 11.8% | 1,472,000 USD | 12/20/2024 | Quarterly | (820,051 | ) | (506,998 | ) | 313,053 | |||||||||||||||||||||||||||

| ITRAXX.EUROPES.32.V1-5Y |

BOA | EUR | 25,000,000 | 1.00% | 0.76% | 25,000,000 EUR | 12/20/2024 | Quarterly | 114,434 | 279,900 | 165,466 | |||||||||||||||||||||||||||||

| ITRAXX.EUROPES.32.V1-5Y |

GS | EUR | 58,940,000 | 1.00% | 0.17% | 58,940,000 EUR | 12/20/2024 | Quarterly | 2,667,689 | 2,294,018 | (373,671 | ) | ||||||||||||||||||||||||||||

| ITRAXX.EUROPES.34.V1-5Y |

BOA | EUR | 36,846,000 | 1.00% | 0.23% | 36,846,000 USD | 12/20/2025 | Quarterly | 1,774,799 | 1,680,834 | (93,965 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.A.9 |

CGMI | USD | 2,500,000 | 2.00% | 2.51% | 2,500,000 USD | 09/17/2058 | Monthly | (74,374 | ) | (55,875 | ) | 18,499 | |||||||||||||||||||||||||||

| CMBX.NA.A.9 |

GS | USD | 6,822,400 | 2.00% | 2.51% | 6,822,400 USD | 09/17/2058 | Monthly | 89,487 | (152,478 | ) | (241,965 | ) | |||||||||||||||||||||||||||

| CMBX.NA.A.9 |

CGMI | USD | 4,000,000 | 2.00% | 2.51% | 4,000,000 USD | 09/17/2058 | Monthly | (100,230 | ) | (89,399 | ) | 10,831 | |||||||||||||||||||||||||||

| CMBX.NA.AAA.13 |

MORD | USD | 7,399,200 | 0.50% | 0.47% | 7,399,200 USD | 12/16/2072 | Monthly | 30,439 | 16,787 | (13,652 | ) | ||||||||||||||||||||||||||||

| CMBX.NA.AAA.13 |

MORD | USD | 7,399,200 | 0.50% | 0.47% | 7,399,200 USD | 12/16/2072 | Monthly | 30,439 | 16,787 | (13,652 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| $ | 31,401,245 | $ | 23,151,202 | $ | (8,250,043 | ) | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

| ^ | Buy Protection - Fund pays a premium and buys credit protection. If a credit event occurs the Fund will, depending on the terms of the particular swap contract, either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying securities comprising the referenced index or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| Sell Protection - Fund receives a premium and sells credit protection. If a credit event occurs the Fund will, depending on the terms of the particular swap contract, either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| (1) | As of February 28, 2021, implied credit spreads in absolute terms, calculated using a model, and utilized in determining the market value of credit default swap contracts on the reference security, serve as an indicator of the current status of the payment/performance risk and reflect the likelihood or risk of default for the reference entity. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection. Wider (i.e. higher) credit spreads represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the contract. |

| (2) | The maximum potential amount the Fund could be required to pay as a seller of credit protection if a credit event occurs as defined under the terms of that particular swap contract. |

Centrally Cleared Interest Rate Swaps

| Fund Pays |

Fund Receives | Notional Amount |

Expiration Date |

Periodic |

Premiums Paid/ (Received) ($) |

Value ($) | Net Unrealized Appreciation/ (Depreciation) ($) |

|||||||||||||||||||||

| 0.25% |

3 Month USD LIBOR | USD | 9,700,000 | 11/10/2022 | Quarterly | (4,539 | ) | (5,614 | ) | (1,075 | ) | |||||||||||||||||

| 0.30% |

3 Month USD LIBOR | USD | 9,750,000 | 08/17/2024 | Quarterly | — | 78,311 | 78,311 | ||||||||||||||||||||

| 0.33% |

3 Month USD LIBOR | USD | 12,520,000 | 10/20/2024 | Quarterly | 3,562 | 110,298 | 106,736 | ||||||||||||||||||||

| 0.35% |

3 Month USD LIBOR | USD | 17,370,000 | 04/19/2025 | Quarterly | 14 | 241,235 | 241,221 | ||||||||||||||||||||

| 0.40% |

3 Month USD LIBOR | USD | 26,300,000 | 10/08/2025 | Quarterly | (3,685 | ) | 465,623 | 469,308 | |||||||||||||||||||

| 0.82% |

3 Month USD LIBOR | USD | 5,480,000 | 01/12/2028 | Quarterly | — | 136,398 | 136,398 | ||||||||||||||||||||

| 0.88% |

3 Month USD LIBOR | USD | 6,595,000 | 03/06/2028 | Quarterly | (15,632 | ) | 147,082 | 162,714 | |||||||||||||||||||

| 0.65% |

3 Month USD LIBOR | USD | 6,770,000 | 06/04/2028 | Quarterly | (34,587 | ) | 283,432 | 318,019 | |||||||||||||||||||

| 0.65% |

3 Month USD LIBOR | USD | 5,790,000 | 07/30/2028 | Quarterly | (25,115 | ) | 255,792 | 280,907 | |||||||||||||||||||

| 1.30% |