Table of Contents

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JUNE 27, 2014

File Nos. 002-98772

811-04347

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT

UNDER

| THE SECURITIES ACT OF 1933 | x | |||

| Pre-Effective Amendment No. | ¨ | |||

| Post-Effective Amendment No. 174 | x |

REGISTRATION STATEMENT

UNDER

| THE INVESTMENT COMPANY ACT OF 1940 | x | |||

| Amendment No. 218 | x |

GMO TRUST

(Exact Name of Registrant as Specified in Charter)

40 Rowes Wharf, Boston, Massachusetts 02110

(Address of principal executive offices)

617-330-7500

(Registrant’s telephone number, including area code)

J.B. Kittredge, Esq.

GMO Trust

40 Rowes Wharf

Boston, Massachusetts 02110

(Name and address of agent for service)

with a copy to:

Thomas R. Hiller, Esq.

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, Massachusetts 02199

It is proposed that this filing will become effective:

| ¨ | Immediately upon filing pursuant to paragraph (b) |

| x | On June 30, 2014, pursuant to paragraph (b) |

| ¨ | 60 days after filing pursuant to paragraph (a)(1) |

| ¨ | On , pursuant to paragraph (a)(1) |

| ¨ | 75 days after filing pursuant to paragraph (a)(2) |

| ¨ | On , pursuant to paragraph (a)(2) of Rule 485. |

This filing relates solely to the 32 series of the Registrant listed on the front cover of the GMO Trust Prospectus, dated June 30, 2014 and filed herewith. No information contained herein is intended to amend or supersede any prior filing relating to any other series of the Registrant.

Table of Contents

Grantham, Mayo, Van Otterloo & Co. LLC

40 Rowes Wharf • Boston, Massachusetts 02110

The Securities and Exchange Commission and the Commodity Futures Trading Commission have not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Grantham, Mayo, Van Otterloo & Co. LLC (“GMO”) is not offering or placing interests in the Funds to or with or otherwise promoting the Funds to any natural or legal persons domiciled or with a registered office in any European Economic Area (“EEA”) Member State where the Alternative Investment Fund Managers Directive (Directive 2011/61/EU) is in force and effect. GMO, in its discretion, may accept any such investor into a Fund, but only if it satisfied that, by accepting such investor, it would not be in breach of any law, rule, regulation or other legislative or administrative measure in or otherwise applicable to the relevant EEA Member State and such investor is otherwise eligible under the laws of such EEA Member State to invest in the Fund. None of the Funds, GMO, their respective affiliates or any natural or legal person acting on their behalf have been registered with, have been approved by or have made a notification to any EEA Member State, European Union or other regulatory, governmental or similar body with respect to the Funds, and no such body has approved, endorsed, reviewed, acquiesced or taken any similar action with respect to any offering, marketing or other promotional materials relating to the Funds.

Table of Contents

| Page | ||||

| FUND SUMMARIES | ||||

| 1 | ||||

| 1 | ||||

| 6 | ||||

| 10 | ||||

| 10 | ||||

| 14 | ||||

| 18 | ||||

| 22 | ||||

| 25 | ||||

| 29 | ||||

| 33 | ||||

| 37 | ||||

| 41 | ||||

| 45 | ||||

| 49 | ||||

| 53 | ||||

| 57 | ||||

| 60 | ||||

| 64 | ||||

| 67 | ||||

| 71 | ||||

| 75 | ||||

| 79 | ||||

| 79 | ||||

| 83 | ||||

| 87 | ||||

| 91 | ||||

| 95 | ||||

| 99 | ||||

| 103 | ||||

| 103 | ||||

| 107 | ||||

| 111 | ||||

| 115 | ||||

| 119 | ||||

| 123 | ||||

| 126 | ||||

| ADDITIONAL INFORMATION ABOUT THE FUNDS’ INVESTMENT STRATEGIES, RISKS, AND EXPENSES |

128 | |||

| 131 | ||||

| 144 | ||||

| 148 | ||||

| 150 | ||||

| 150 | ||||

| 151 | ||||

| 153 | ||||

| 155 | ||||

| 156 | ||||

| 158 | ||||

| 161 | ||||

| 166 | ||||

| 203 | ||||

| 207 | ||||

| inside back cover |

| back cover | ||||

| back cover | ||||

| back cover |

i

Table of Contents

[This page intentionally left blank.]

ii

Table of Contents

GMO BENCHMARK-FREE ALLOCATION FUND

Investment objective

Positive total return not “relative” return.

Fees and expenses

The tables below describe the fees and expenses that you may pay for each class of shares if you buy and hold shares of the Fund.

Shareholder fees

(fees paid directly from your investment)

| Class III | Class IV | Class MF | ||||||||||

| Purchase premium (as a percentage of amount invested) |

0.13 | % | 0.13 | % | 0.13 | % | ||||||

| Redemption fee (as a percentage of amount redeemed) |

0.13 | % | 0.13 | % | 0.13 | % | ||||||

Annual Fund operating expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class III | Class IV | Class MF | ||||||||||

| Management fee |

0.65 | %1 | 0.65 | %1 | 0.65 | %1 | ||||||

| Shareholder service fee |

0.15 | %1 | 0.10 | %1 | N/A | |||||||

| Supplemental support fee |

N/A | N/A | 0.10 | %1 | ||||||||

| Other expenses |

0.01 | % | 0.01 | % | 0.01 | % | ||||||

| Acquired fund fees and expenses (underlying fund expenses) |

0.27 | %2 | 0.27 | %2 | 0.27 | %2 | ||||||

| Total annual operating expenses |

1.08 | % | 1.03 | % | 1.03 | % | ||||||

| Expense reimbursement/waiver |

(0.22 | %)1 | (0.22 | %)1 | (0.22 | %)1 | ||||||

| Total annual operating expenses after expense reimbursement/waiver |

0.86 | % | 0.81 | % | 0.81 | % | ||||||

1 Grantham, Mayo, Van Otterloo & Co. LLC (“GMO”) has contractually agreed to reimburse the Fund for the following expenses: audit expenses, fund accounting expenses, pricing service expenses, expenses of non-investment related tax services, transfer agency expenses, expenses of non-investment related legal services provided to the Fund by or at the direction of GMO, federal securities law filing expenses, printing expenses, state and federal registration fees and custody expenses. This reimbursement will continue through at least June 30, 2015, and may not be terminated prior to this date without the action or consent of the Fund’s Board of Trustees. GMO also has agreed to waive or reduce the Fund’s management, shareholder service, and supplemental support fees to the extent necessary to offset the management fees and shareholder service fees paid to GMO that are directly or indirectly borne by the Fund or a class of shares of the Fund as a result of the Fund’s direct or indirect investments in other series of GMO Trust (“GMO Funds”).

2 These indirect expenses include interest expense that may be incurred by certain underlying funds and also include, to the extent applicable, purchase premiums and redemption fees (“transaction fees”) charged by certain underlying funds. Net fees and expenses of underlying funds (before addition of interest expense and transaction fees), indirect interest expense, and indirect transaction fees were approximately 0.22%, less than 0.01%, and 0.05%, respectively.

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same as those shown in the table. The amounts shown reflect the applicable expense reimbursements and waivers noted in the expense table. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| If you sell your shares | If you do not sell your shares | |||||||||||||||||||||||||||||||

| 1 Year* | 3 Years** | 5 Years** | 10 Years** | 1 Year* | 3 Years** | 5 Years** | 10 Years** | |||||||||||||||||||||||||

| Class III |

$ | 114 | $ | 379 | $ | 664 | $ | 1,475 | $ | 101 | $ | 364 | $ | 648 | $ | 1,457 | ||||||||||||||||

| Class IV |

$ | 109 | $ | 363 | $ | 637 | $ | 1,419 | $ | 96 | $ | 348 | $ | 621 | $ | 1,400 | ||||||||||||||||

| Class MF |

$ | 109 | $ | 363 | $ | 637 | $ | 1,419 | $ | 96 | $ | 348 | $ | 621 | $ | 1,400 | ||||||||||||||||

* After expense reimbursements/waivers noted in the expense table

** Reflects fee reductions set forth in the Fund’s management contract and servicing and supplemental support agreement

Portfolio turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities. A higher portfolio turnover rate may result in higher transaction costs and, when Fund shares are held in a taxable account, higher taxes. These costs, which are not reflected in Annual Fund operating expenses or in the Example, affect the Fund’s performance. During its fiscal year ended February 28, 2014, the Fund’s portfolio turnover rate (including the accounts of the wholly-owned subsidiary GMO Implementation Fund (“Implementation Fund”), another series of GMO Trust not offered by this Prospectus, and excluding short-term investments) was 52% of the average value of its portfolio.

1

Table of Contents

GMO BENCHMARK-FREE ALLOCATION FUND

Principal investment strategies

GMO seeks to achieve the Fund’s investment objective by investing in asset classes GMO believes offer the most attractive return and risk opportunities. GMO uses its multi-year forecasts of returns among asset classes, together with its assessment of the risk of such asset classes, to determine the Fund’s allocations. An important component of those forecasts is the expectation that market prices ultimately revert to their historical mean (average). The factors considered and investment methods used by GMO can change over time.

The Fund is structured as a fund of funds and gains its investment exposures primarily by investing in Implementation Fund. In addition, the Fund may invest in any other GMO Fund (together with Implementation Fund, the “underlying Funds”), whether now existing or created in the future, including GMO Funds not offered by or described in this Prospectus. These additional underlying Funds may include, among others, Alpha Only Fund, Debt Opportunities Fund, Emerging Country Debt Fund, and GMO Systematic Global Macro Opportunity Fund, a series of GMO Trust not offered by this Prospectus (see “Additional Information About the Funds’ Investment Strategies, Risks, and Expenses — Asset Allocation Funds”). Implementation Fund is permitted to invest in any asset class. The Fund also may invest in securities or derivatives directly.

The Fund seeks annualized excess returns of 5% (net of fees) above the Consumer Price Index and expects annualized volatility of 5-10% over a complete market cycle. GMO does not manage the Fund to, or control the Fund’s risk relative to, any securities index or securities benchmark.

The Fund is permitted to invest (through Implementation Fund, another underlying Fund or directly) in any asset class (including, for example, U.S. and non-U.S. equities (including emerging country equities), U.S. and non-U.S. fixed income securities (including emerging country debt securities) and commodities), country, or sector and at times may have substantial exposure to a single asset class, country, or sector. In addition, the Fund is not restricted in its exposure to any particular market and may invest in securities of companies of any market capitalization. The Fund may have indirect exposure to derivatives and short sales through its investment in Implementation Fund and the other underlying Funds. GMO’s ability to shift investments within Implementation Fund and between it and the other underlying Funds is not subject to any limits.

Prior to January 1, 2012, the Fund served as a principal component of a broader GMO real return strategy that also included a pooled investment vehicle with a cash-like benchmark. Since January 1, 2012, the Fund has been managed as a standalone investment.

The Fund also may invest in U.S. Treasury Fund and money market funds that are unaffiliated with GMO.

Principal risks of investing in the Fund

The value of the Fund’s shares changes with the value of the Fund’s investments. Many factors can affect this value, and you may lose money by investing in the Fund. References to investments include those held directly by the Fund and indirectly through the Fund’s investments in the underlying Funds. Some of the underlying Funds are non-diversified investment companies under the Investment Company Act of 1940, as amended, and therefore a decline in the market price of a particular security held by those underlying Funds may affect their performance more than if they were diversified investment companies. The principal risks of investing in the Fund are summarized below. For a more complete discussion of these risks, including those risks to which the Fund is exposed as a result of its investments in the underlying Funds, see “Description of Principal Risks.”

| • | Market Risk – Equities – The market prices of equities may decline due to factors affecting the issuing companies, their industries, or the economy and equity markets generally. If an underlying Fund purchases equities for less than their value as determined by GMO, the Fund runs the risk that the market prices of these equities will not appreciate or will decline for a variety of reasons, one of which may be GMO’s overestimation of those investments. An underlying Fund also may purchase equities that typically trade at higher multiples of current earnings than other securities, and the market prices of these equities often are more sensitive to changes in future earnings expectations than the market prices of equities trading at lower multiples. Declines in stock market prices generally are likely to reduce the net asset value of the Fund’s shares. |

| • | Management and Operational Risk – The Fund runs the risk that GMO’s investment techniques will fail to produce desired results (including the annualized excess returns the Fund seeks above the Consumer Price Index). GMO often uses quantitative analyses and models as part of its investment process, and any imperfections, errors, or limitations in those analyses and models could affect the Fund’s performance. By necessity, these analyses and models make simplifying assumptions that limit their efficacy. Models that appear to explain prior market data can fail to predict future market events. Further, the data used in models may be inaccurate and may not include the most recent information about a company or a security. The Fund also runs the risk that GMO’s assessment of an investment may be wrong or that deficiencies in GMO’s or another service provider’s internal systems or controls will cause losses for the Fund or impair Fund operations. |

| • | Non-U.S. Investment Risk – The market prices of many non-U.S. securities fluctuate more than those of U.S. securities. Many non-U.S. markets are less stable, smaller, less liquid, and less regulated than U.S. markets, and the cost of trading in those markets often is higher than in U.S. markets. Non-U.S. portfolio transactions generally involve higher commission rates, transfer taxes, and custodial costs than similar transactions in the United States. In addition, the Fund may be subject to non-U.S. taxes, including potentially on a retroactive |

2

Table of Contents

GMO BENCHMARK-FREE ALLOCATION FUND

| basis, on (i) capital gains it realizes or dividends or interest it receives on non-U.S. investments, (ii) transactions in those investments, and (iii) the repatriation of proceeds generated from the sale of those investments. Also, many non-U.S. markets require a license for the Fund to invest directly in those markets, and the Fund is subject to the risk that it could not invest if its license were terminated or suspended. In some non-U.S. markets, prevailing custody and trade settlement practices (e.g., the requirement to pay for securities prior to receipt) expose the Fund to credit and other risks with respect to brokers, custodians, clearing banks or other clearing agents, escrow agents and issuers. Further, adverse changes in investment regulations, capital requirements or exchange controls could adversely affect the value of the Fund’s investments. These and other risks (e.g., nationalization, expropriation or other confiscation of assets of non-U.S. issuers) tend to be greater for investments in companies tied economically to emerging countries, the economies of which tend to be more volatile than the economies of developed countries. |

| • | Market Risk – Fixed Income Investments – The market price of a fixed income investment can decline due to a number of market-related factors, including rising interest rates and widening credit spreads, or decreased liquidity stemming from the market’s uncertainty about the value of a fixed income investment (or class of fixed income investments). |

| • | Market Risk – Asset-Backed Securities – The market price of fixed income investments with complex structures, such as asset-backed securities, can decline due to a number of factors, including market uncertainty about their credit quality and the reliability of their payment streams. Payment streams associated with asset-backed securities held by the Fund depend on many factors (e.g., the cash flow generated by the assets backing the securities, the deal structure, the credit worthiness of any credit-support provider, and the reliability of various other service providers with access to the payment stream), and a problem in any one of these areas can lead to a reduction in the payment stream GMO expected the Fund to receive at the time the Fund purchased the asset-backed security. |

| • | Derivatives Risk – The use of derivatives involves the risk that their value may not move as expected relative to changes in the value of the underlying assets, rates, or indices. Derivatives also present other risks, including market risk, illiquidity risk, currency risk, credit risk, and counterparty risk. The market price of written options will be affected by many factors, including changes in the market price or dividend rates of underlying securities (or in the case of indices, the securities comprising such indices); changes in interest rates or exchange rates; changes in the actual or perceived volatility of the relevant stock market and underlying securities; and the time remaining before an option’s expiration. In addition, the risks of loss associated with derivatives that provide short investment exposure and short sales of securities are theoretically unlimited. |

| • | Smaller Company Risk – Smaller companies may have limited product lines, markets, or financial resources, may lack the competitive strength of larger companies, may have inexperienced managers or depend on a few key employees. The securities of companies with smaller market capitalizations often are less widely held and trade less frequently and in lesser quantities, and their market prices often fluctuate more, than the securities of companies with larger market capitalizations. |

| • | Illiquidity Risk – Low trading volume, lack of a market maker, large position size, or legal restrictions may limit or prevent the Fund or an underlying Fund from selling particular securities or closing derivative positions at desirable prices. |

| • | Currency Risk – Fluctuations in exchange rates can adversely affect the market value of foreign currency holdings and investments denominated in foreign currencies. |

| • | Fund of Funds Risk – The Fund is indirectly exposed to all of the risks of an investment in the underlying Funds in which it invests, including the risk that those underlying Funds will not perform as expected. |

| • | Credit Risk – The Fund runs the risk that the issuer or guarantor of a fixed income investment or the obligor of an obligation underlying an asset-backed security will be unable or unwilling to satisfy its obligation to pay principal and interest or otherwise to honor its obligations in a timely manner. The market price of a fixed income investment will normally decline as a result of the issuer’s, guarantor’s, or obligor’s failure to meet its payment obligations. Below investment grade securities have speculative characteristics, and changes in economic conditions or other circumstances are more likely to impair the capacity of issuers of those securities to make principal and interest payments than is the case with issuers of investment grade securities. |

| • | Counterparty Risk – The Fund runs the risk that the counterparty to a derivatives contract, a clearing member used by the Fund to hold a cleared derivatives contract, or a borrower of the Fund’s securities will be unable or unwilling to make timely settlement payments, return the Fund’s margin or otherwise honor its obligations. |

| • | Commodities Risk – Commodities prices can be extremely volatile, and exposure to commodities can cause the net asset value of the Fund’s shares to decline or fluctuate in a rapid and unpredictable manner. |

| • | Merger Arbitrage Risk – If a Fund purchases securities in anticipation of a proposed merger, exchange offer, tender offer, or other similar transaction, and that transaction later appears unlikely to be consummated or in fact is not consummated or is delayed, the market price of the security purchased by the Fund may decline sharply and result in losses to the Fund if such securities are sold, transferred or exchanged for securities or cash, the value of which is less than the purchase price. There is typically asymmetry in the risk/reward payout of merger arbitrage strategies – the losses that can occur in the event of deal break-ups can far exceed the gains to be had if deals close successfully. The consummation of mergers, exchange offers, tender offers, and similar transactions can be prevented or delayed by a variety of factors, including regulatory and antitrust restrictions, political motivations, industry weakness, stock specific events, |

3

Table of Contents

GMO BENCHMARK-FREE ALLOCATION FUND

| failed financings, and general market declines. During periods when merger activity is low, it may be difficult or impossible to identify opportunities for profit or to identify a sufficient number of such opportunities to provide diversification among potential merger transactions. Merger arbitrage strategies are also subject to the risk of overall market movements. To the extent that a general increase or decline in equity market values affects the securities involved in a merger arbitrage position differently, the position may be exposed to loss. A Fund’s hedging strategies and short sales of securities may not perform as expected, which can lead to inadvertent market-related losses. Also, a Fund may not be able to hedge against market fluctuations or other risks. |

| • | Leveraging Risk – The use of reverse repurchase agreements and other derivatives and securities lending creates leverage. Leverage increases the Fund’s losses when the value of its investments (including derivatives) declines. |

| • | Market Disruption and Geopolitical Risk – Geopolitical and other events may disrupt securities markets and adversely affect global economies and markets. Those events, as well as other changes in non-U.S. and U.S. economic and political conditions, could adversely affect the value of the Fund’s investments. |

| • | Focused Investment Risk – Focusing investments in countries, regions, sectors, companies, or industries that are subject to the same or similar risk factors creates more risk than if the Fund’s investments were more diversified. |

| • | Large Shareholder Risk – To the extent that a large number of shares of the Fund is held by a single shareholder (e.g., an institutional investor), the Fund is subject to the risk that a redemption by that shareholder of all or a large portion of its Fund shares will disrupt the Fund’s operations. |

Performance

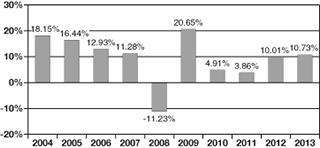

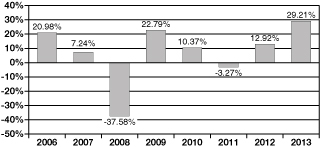

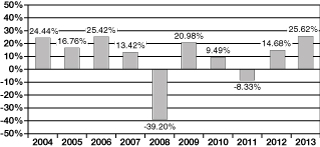

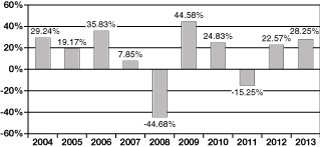

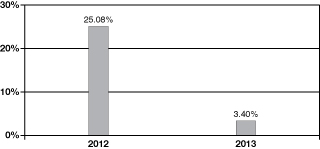

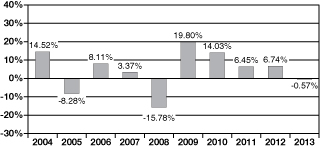

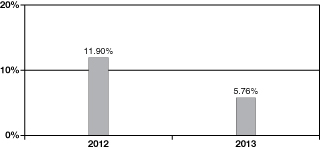

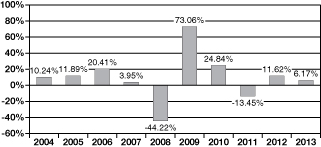

The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s annual total returns from year to year for the periods indicated and by comparing the Fund’s average annual total returns for different calendar periods with those of the Barclays U.S. Treasury Inflation Notes: 1-10 Year Index and the Consumer Price Index. Purchase premiums and redemption fees are not reflected in the bar chart, but are reflected in the table; as a result, the returns in the table are lower than the returns in the bar chart. Returns in the table reflect current purchase premiums and redemption fees. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant if you are tax-exempt or if you hold your Fund shares through tax-deferred arrangements (such as a 401(k) plan or individual retirement account). After-tax returns are shown for Class III shares only; after-tax returns for other classes will vary. Updated performance information for the Fund is available at www.gmo.com. Past performance (before and after taxes) is not an indication of future performance.

4

Table of Contents

GMO BENCHMARK-FREE ALLOCATION FUND

a The returns shown for periods prior to January 1, 2012 are for Class III shares of the Fund under the Fund’s prior fee arrangement. Under the Fund’s current fee arrangement, the returns for periods prior to January 1, 2012 would have been lower.

Management of the Fund

Investment Adviser: Grantham, Mayo, Van Otterloo & Co. LLC

Investment Team and Senior Members of GMO primarily responsible for portfolio management of the Fund:

| Investment Team | Senior Member (Length of Service with Fund) | Title | ||

| Asset Allocation | Ben Inker (since the Fund’s inception) | Co-Head, Asset Allocation Team, GMO. | ||

| Asset Allocation | Sam Wilderman (since 2012) | Co-Head, Asset Allocation Team, GMO. |

Additional information

For important information about purchase and sale of Fund shares, taxes, and financial intermediary compensation, please see “Additional Summary Information About the Funds” on page 126 of this Prospectus.

5

Table of Contents

GMO GLOBAL ASSET ALLOCATION FUND

Investment objective

Total return greater than that of its benchmark, the GMO Global Asset Allocation Index, an internally maintained index computed by GMO, consisting of 65% MSCI ACWI and 35% Barclays U.S. Aggregate Index.

Fees and expenses

The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder fees

(fees paid directly from your investment)

| Class III | ||||

| Purchase premium (as a percentage of amount invested) |

0.11 | % | ||

| Redemption fee (as a percentage of amount redeemed) |

0.11 | % | ||

Annual Fund operating expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class III | ||||

| Management fee |

0.00 | % | ||

| Shareholder service fee |

0.00 | % | ||

| Other expenses |

0.01 | % | ||

| Acquired fund fees and expenses (underlying fund expenses) |

0.55 | %1,2 | ||

| Total annual operating expenses |

0.56 | % | ||

| Expense reimbursement |

(0.01 | %)3 | ||

| Total annual operating expenses after expense reimbursement (Fund and underlying fund expenses) |

0.55 | % | ||

1 These indirect expenses include interest expense that may be incurred by certain underlying funds and also include, to the extent applicable, purchase premiums and redemption fees (“transaction fees”) charged by certain underlying funds. Net fees and expenses of underlying funds (before addition of interest expense and transaction fees), indirect interest expense, and indirect transaction fees were approximately 0.53%, less than 0.01%, and 0.02%, respectively.

2 During the year (as a result of the Fund’s investment in an underlying fund), the Fund incurred non-recurring indirect legal expenses in connection with the final settlement of pending litigation. Subsequent to the receipt of the settlement proceeds, the underlying fund was liquidated.

3 Grantham, Mayo, Van Otterloo & Co. LLC (“GMO”) has contractually agreed to reimburse the Fund for the following expenses: audit expenses, fund accounting expenses, pricing service expenses, expenses of non-investment related tax services, transfer agency expenses, expenses of non-investment related legal services provided to the Fund by or at the direction of GMO, federal securities law filing expenses, printing expenses, state and federal registration fees and custody expenses. This reimbursement will continue through at least June 30, 2015, and may not be terminated prior to this date without the action or consent of the Fund’s Board of Trustees.

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same as those shown in the table. The one year amounts shown reflect the expense reimbursement noted in the expense table. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| If you sell your shares | If you do not sell your shares | |||||||||||||||||||||||||||||||

| 1 Year* | 3 Years | 5 Years | 10 Years | 1 Year* | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||

| Class III |

$ | 79 | $ | 226 | $ | 386 | $ | 850 | $ | 67 | $ | 213 | $ | 372 | $ | 833 | ||||||||||||||||

* After reimbursement

Portfolio turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities. A higher portfolio turnover rate may result in higher transaction costs and, when Fund shares are held in a taxable account, higher taxes. These costs, which are not reflected in Annual Fund operating expenses or in the Example, affect the Fund’s performance. During its fiscal year ended February 28, 2014, the Fund’s portfolio turnover rate (excluding short-term investments) was 46% of the average value of its portfolio.

Principal investment strategies

The Fund is a fund of funds and invests primarily in shares of other series of GMO Trust (collectively, the “underlying Funds”), which may include the Equity Funds, the Fixed Income Funds, and the Implementation Funds, as well as GMO High Quality Short-Duration Bond Fund, GMO Special Situations Fund, GMO Systematic Global Macro Opportunity Fund, and GMO World Opportunity Overlay Fund, each a series of GMO Trust not offered by this Prospectus (see “Additional Information About the Funds’ Investment Strategies, Risks, and Expenses — Asset Allocation Funds”). In addition, the Fund may invest in securities and derivatives directly.

The Fund is permitted to invest in any asset class, including, for example, U.S. and non-U.S. equities (including emerging country equities), U.S. and non-U.S. fixed income securities (including emerging country debt securities) and commodities. The term “equities”

6

Table of Contents

GMO GLOBAL ASSET ALLOCATION FUND

refers to direct and indirect investments in common and preferred stocks and other stock-related securities, such as convertible securities, depositary receipts, and exchange-traded equity real estate investment trusts (REITs) and income trusts.

GMO uses its multi-year forecasts of returns among asset classes, together with its assessment of the risk of such asset classes, to select the underlying Funds in which the Fund invests and to decide how much to invest in each. An important component of those forecasts is the expectation that market prices ultimately revert to their historical mean (average). GMO changes the Fund’s holdings of the underlying Funds in response to changes in its investment outlook and market valuations and may use redemptions or purchases of Fund shares to rebalance the Fund’s investments. Under normal circumstances, GMO intends to invest not more than 85% of the Fund’s assets in the Equity Funds. The factors considered and investment methods used by GMO can change over time.

The Fund also may invest in money market funds that are unaffiliated with GMO.

Principal risks of investing in the Fund

The value of the Fund’s shares changes with the value of the Fund’s investments. Many factors can affect this value, and you may lose money by investing in the Fund. References to investments include those held directly by the Fund and indirectly through the Fund’s investments in the underlying Funds. Some of the underlying Funds are non-diversified investment companies under the Investment Company Act of 1940, as amended, and therefore a decline in the market price of a particular security held by those underlying Funds may affect their performance more than if they were diversified investment companies. The principal risks of investing in the Fund are summarized below. For a more complete discussion of these risks, including those risks to which the Fund is exposed as a result of its investments in the underlying Funds, see “Description of Principal Risks.”

| • | Market Risk – Equities – The market prices of equities may decline due to factors affecting the issuing companies, their industries, or the economy and equity markets generally. If an underlying Fund purchases equities for less than their value as determined by GMO, the Fund runs the risk that the market prices of these equities will not appreciate or will decline for a variety of reasons, one of which may be GMO’s overestimation of those investments. An underlying Fund also may purchase equities that typically trade at higher multiples of current earnings than other securities, and the market prices of these equities often are more sensitive to changes in future earnings expectations than the market prices of equities trading at lower multiples. Declines in stock market prices generally are likely to reduce the net asset value of the Fund’s shares. |

| • | Management and Operational Risk – The Fund runs the risk that GMO’s investment techniques will fail to produce desired results. GMO often uses quantitative analyses and models as part of its investment process, and any imperfections, errors, or limitations in those analyses and models could affect the Fund’s performance. By necessity, these analyses and models make simplifying assumptions that limit their efficacy. Models that appear to explain prior market data can fail to predict future market events. Further, the data used in models may be inaccurate and may not include the most recent information about a company or a security. The Fund also runs the risk that GMO’s assessment of an investment may be wrong or that deficiencies in GMO’s or another service provider’s internal systems or controls will cause losses for the Fund or impair Fund operations. |

| • | Non-U.S. Investment Risk – The market prices of many non-U.S. securities fluctuate more than those of U.S. securities. Many non-U.S. markets are less stable, smaller, less liquid, and less regulated than U.S. markets, and the cost of trading in those markets often is higher than in U.S. markets. Non-U.S. portfolio transactions generally involve higher commission rates, transfer taxes, and custodial costs than similar transactions in the United States. In addition, the Fund may be subject to non-U.S. taxes, including potentially on a retroactive basis, on (i) capital gains it realizes or dividends or interest it receives on non-U.S. investments, (ii) transactions in those investments, and (iii) the repatriation of proceeds generated from the sale of those investments. Also, many non-U.S. markets require a license for the Fund to invest directly in those markets, and the Fund is subject to the risk that it could not invest if its license were terminated or suspended. In some non-U.S. markets, prevailing custody and trade settlement practices (e.g., the requirement to pay for securities prior to receipt) expose the Fund to credit and other risks with respect to brokers, custodians, clearing banks or other clearing agents, escrow agents and issuers. Further, adverse changes in investment regulations, capital requirements or exchange controls could adversely affect the value of the Fund’s investments. These and other risks (e.g., nationalization, expropriation or other confiscation of assets of non-U.S. issuers) tend to be greater for investments in companies tied economically to emerging countries, the economies of which tend to be more volatile than the economies of developed countries. |

| • | Market Risk – Fixed Income Investments – The market price of a fixed income investment can decline due to a number of market-related factors, including rising interest rates and widening credit spreads, or decreased liquidity stemming from the market’s uncertainty about the value of a fixed income investment (or class of fixed income investments). |

| • | Market Risk – Asset-Backed Securities – The market price of fixed income investments with complex structures, such as asset-backed securities, can decline due to a number of factors, including market uncertainty about their credit quality and the reliability of their payment streams. Payment streams associated with asset-backed securities held by the Fund depend on many factors (e.g., the cash flow generated by the assets backing the securities, the deal structure, the credit worthiness of any credit-support provider, and the reliability of various other service providers with access to the payment stream), and a problem in any one of these areas can lead to a reduction in the payment stream GMO expected the Fund to receive at the time the Fund purchased the asset-backed security. |

7

Table of Contents

GMO GLOBAL ASSET ALLOCATION FUND

| • | Derivatives Risk – The use of derivatives involves the risk that their value may not move as expected relative to changes in the value of the underlying assets, rates, or indices. Derivatives also present other risks, including market risk, illiquidity risk, currency risk, credit risk, and counterparty risk. The market price of written options will be affected by many factors, including changes in the market price or dividend rates of underlying securities (or in the case of indices, the securities comprising such indices); changes in interest rates or exchange rates; changes in the actual or perceived volatility of the relevant stock market and underlying securities; and the time remaining before an option’s expiration. In addition, the risks of loss associated with derivatives that provide short investment exposure and short sales of securities are theoretically unlimited. |

| • | Illiquidity Risk – Low trading volume, lack of a market maker, large position size, or legal restrictions may limit or prevent the Fund or an underlying Fund from selling particular securities or closing derivative positions at desirable prices. |

| • | Fund of Funds Risk – The Fund is indirectly exposed to all of the risks of an investment in the underlying Funds in which it invests, including the risk that those underlying Funds will not perform as expected. Because the Fund bears the fees and expenses of the underlying Funds in which it invests, a reallocation of the Fund’s investments to underlying Funds with higher fees or expenses will increase the Fund’s total expenses. The fees and expenses associated with an investment in the Fund are less predictable than those associated with an investment in funds that charge a fixed management fee. |

| • | Smaller Company Risk – Smaller companies may have limited product lines, markets, or financial resources, may lack the competitive strength of larger companies, may have inexperienced managers or depend on a few key employees. The securities of companies with smaller market capitalizations often are less widely held and trade less frequently and in lesser quantities, and their market prices often fluctuate more, than the securities of companies with larger market capitalizations. |

| • | Commodities Risk – Commodities prices can be extremely volatile, and exposure to commodities can cause the net asset value of the Fund’s shares to decline or fluctuate in a rapid and unpredictable manner. |

| • | Merger Arbitrage Risk – If a Fund purchases securities in anticipation of a proposed merger, exchange offer, tender offer, or other similar transaction, and that transaction later appears unlikely to be consummated or in fact is not consummated or is delayed, the market price of the security purchased by the Fund may decline sharply and result in losses to the Fund if such securities are sold, transferred or exchanged for securities or cash, the value of which is less than the purchase price. There is typically asymmetry in the risk/reward payout of merger arbitrage strategies – the losses that can occur in the event of deal break-ups can far exceed the gains to be had if deals close successfully. The consummation of mergers, exchange offers, tender offers, and similar transactions can be prevented or delayed by a variety of factors, including regulatory and antitrust restrictions, political motivations, industry weakness, stock specific events, failed financings, and general market declines. During periods when merger activity is low, it may be difficult or impossible to identify opportunities for profit or to identify a sufficient number of such opportunities to provide diversification among potential merger transactions. Merger arbitrage strategies are also subject to the risk of overall market movements. To the extent that a general increase or decline in equity market values affects the securities involved in a merger arbitrage position differently, the position may be exposed to loss. A Fund’s hedging strategies and short sales of securities may not perform as expected, which can lead to inadvertent market-related losses. Also, a Fund may not be able to hedge against market fluctuations or other risks. |

| • | Large Shareholder Risk – To the extent that a large number of shares of the Fund is held by a single shareholder (e.g., an institutional investor), the Fund is subject to the risk that a redemption by that shareholder of all or a large portion of its Fund shares will disrupt the Fund’s operations. |

| • | Currency Risk – Fluctuations in exchange rates can adversely affect the market value of foreign currency holdings and investments denominated in foreign currencies. |

| • | Leveraging Risk – The use of reverse repurchase agreements and other derivatives and securities lending creates leverage. Leverage increases the Fund’s losses when the value of its investments (including derivatives) declines. |

| • | Credit Risk – The Fund runs the risk that the issuer or guarantor of a fixed income investment or the obligor of an obligation underlying an asset-backed security will be unable or unwilling to satisfy its obligation to pay principal and interest or otherwise to honor its obligations in a timely manner. The market price of a fixed income investment will normally decline as a result of the issuer’s, guarantor’s, or obligor’s failure to meet its payment obligations. Below investment grade securities have speculative characteristics, and changes in economic conditions or other circumstances are more likely to impair the capacity of issuers of those securities to make principal and interest payments than is the case with issuers of investment grade securities. |

| • | Counterparty Risk – The Fund runs the risk that the counterparty to a derivatives contract, a clearing member used by the Fund to hold a cleared derivatives contract, or a borrower of the Fund’s securities will be unable or unwilling to make timely settlement payments, return the Fund’s margin or otherwise honor its obligations. |

| • | Market Disruption and Geopolitical Risk – Geopolitical and other events may disrupt securities markets and adversely affect global economies and markets. Those events, as well as other changes in non-U.S. and U.S. economic and political conditions, could adversely affect the value of the Fund’s investments. |

8

Table of Contents

GMO GLOBAL ASSET ALLOCATION FUND

| • | Focused Investment Risk – Focusing investments in countries, regions, sectors, companies, or industries that are subject to the same or similar risk factors creates more risk than if the Fund’s investments were more diversified. |

Performance

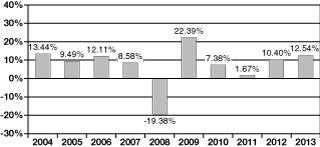

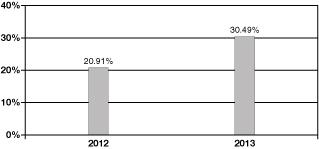

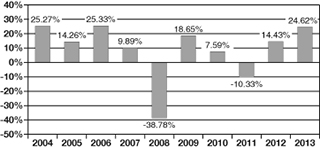

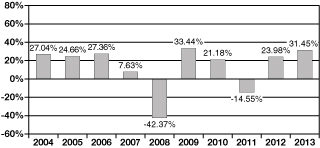

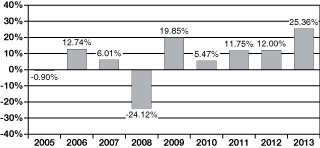

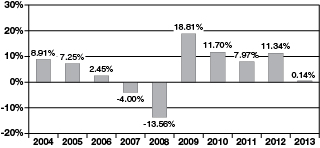

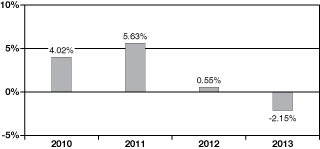

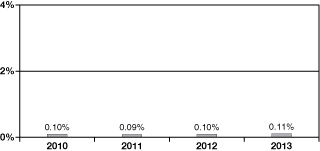

The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s annual total returns from year to year for the periods indicated and by comparing the Fund’s average annual total returns for different calendar periods with those of broad-based indices and the Fund’s benchmark (which is a composite index computed by GMO). Purchase premiums and redemption fees are not reflected in the bar chart, but are reflected in the table; as a result, the returns in the table are lower than the returns in the bar chart. Returns in the table reflect current purchase premiums and redemption fees. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant if you are tax-exempt or if you hold your Fund shares through tax-deferred arrangements (such as a 401(k) plan or individual retirement account). Updated performance information for the Fund is available at www.gmo.com. Past performance (before and after taxes) is not an indication of future performance.

Management of the Fund

Investment Adviser: Grantham, Mayo, Van Otterloo & Co. LLC

Investment Team and Senior Members of GMO primarily responsible for portfolio management of the Fund:

| Investment Team | Senior Member (Length of Service with Fund) | Title | ||

| Asset Allocation | Ben Inker (since the Fund’s inception) | Co-Head, Asset Allocation Team, GMO. | ||

| Asset Allocation | Sam Wilderman (since 2012) | Co-Head, Asset Allocation Team, GMO. |

Additional information

For important information about purchase and sale of Fund shares, taxes, and financial intermediary compensation, please see “Additional Summary Information About the Funds” on page 126 of this Prospectus.

9

Table of Contents

GMO GLOBAL EQUITY ALLOCATION FUND

Investment objective

Total return greater than that of its benchmark, the MSCI ACWI.

Fees and expenses

The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder fees

(fees paid directly from your investment)

| Class III | ||||

| Purchase premium (as a percentage of amount invested) |

0.11 | % | ||

| Redemption fee (as a percentage of amount redeemed) |

0.11 | % | ||

Annual Fund operating expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class III | ||||

| Management fee |

0.00 | % | ||

| Shareholder service fee |

0.00 | % | ||

| Other expenses |

0.01 | % | ||

| Acquired fund fees and expenses (underlying fund expenses) |

0.57 | %1,2 | ||

| Total annual operating expenses |

0.58 | % | ||

| Expense reimbursement |

(0.01 | %)3 | ||

| Total annual operating expenses after expense reimbursement (Fund and underlying fund expenses) |

0.57 | % | ||

1 These indirect expenses include, to the extent applicable, purchase premiums and redemption fees (“transaction fees”) charged by certain underlying funds. Net fees and expenses of underlying funds (before addition of transaction fees) and indirect transaction fees were approximately 0.54% and 0.03%, respectively.

2 During the year (as a result of the Fund’s investment in an underlying fund), the Fund incurred non-recurring indirect legal expenses in connection with the final settlement of pending litigation. Subsequent to the receipt of the settlement proceeds, the underlying fund was liquidated.

3 Grantham, Mayo, Van Otterloo & Co. LLC (“GMO”) has contractually agreed to reimburse the Fund for the following expenses: audit expenses, fund accounting expenses, pricing service expenses, expenses of non-investment related tax services, transfer agency expenses, expenses of non-investment related legal services provided to the Fund by or at the direction of GMO, federal securities law filing expenses, printing expenses, state and federal registration fees and custody expenses. This reimbursement will continue through at least June 30, 2015, and may not be terminated prior to this date without the action or consent of the Fund’s Board of Trustees.

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same as those shown in the table. The one year amounts shown reflect the expense reimbursement noted in the expense table. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| If you sell your shares | If you do not sell your shares | |||||||||||||||||||||||||||||||

| 1 Year* | 3 Years | 5 Years | 10 Years | 1 Year* | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||

| Class III |

$ | 81 | $ | 221 | $ | 374 | $ | 819 | $ | 69 | $ | 209 | $ | 360 | $ | 802 | ||||||||||||||||

* After reimbursement

Portfolio turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities. A higher portfolio turnover rate may result in higher transaction costs and, when Fund shares are held in a taxable account, higher taxes. These costs, which are not reflected in Annual Fund operating expenses or in the Example, affect the Fund’s performance. During its fiscal year ended February 28, 2014, the Fund’s portfolio turnover rate (excluding short-term investments) was 51% of the average value of its portfolio.

Principal investment strategies

The Fund is a fund of funds and invests primarily in shares of the Equity Funds, Alpha Only Fund and Risk Premium Fund (collectively, the “underlying Funds”) (see “Additional Information About the Funds’ Investment Strategies, Risks, and Expenses — Asset Allocation Funds”). The Fund also may invest in securities and derivatives directly.

GMO uses its multi-year forecasts of returns among asset classes, together with its assessment of the risk of such asset classes, to build a portfolio that invests primarily in equities traded in non-U.S. and U.S. markets. An important component of those forecasts is the expectation that market prices ultimately revert to their historical mean (average). GMO changes the Fund’s holdings of the underlying Funds in response to changes in its investment outlook and market valuations and may use redemptions or purchases of Fund shares to rebalance the Fund’s investments. The factors considered and investment methods used by GMO can change over time.

10

Table of Contents

GMO GLOBAL EQUITY ALLOCATION FUND

Under normal circumstances, the Fund invests (including through investment in the underlying Funds) at least 80% of its assets in equities (see “Name Policies”). The term “equities” refers to direct and indirect (e.g., through the underlying Funds) investments in common and preferred stocks and other stock-related securities, such as convertible securities, depositary receipts, and exchange-traded equity real estate investment trusts (REITs) and income trusts.

The Fund also may invest in U.S. Treasury Fund and money market funds that are unaffiliated with GMO.

Principal risks of investing in the Fund

The value of the Fund’s shares changes with the value of the Fund’s investments. Many factors can affect this value, and you may lose money by investing in the Fund. References to investments include those held directly by the Fund and indirectly through the Fund’s investments in the underlying Funds. Some of the underlying Funds are non-diversified investment companies under the Investment Company Act of 1940, as amended, and therefore a decline in the market price of a particular security held by those underlying Funds may affect their performance more than if they were diversified investment companies. The principal risks of investing in the Fund are summarized below. For a more complete discussion of these risks, including those risks to which the Fund is exposed as a result of its investments in the underlying Funds, see “Description of Principal Risks.”

| • | Market Risk – Equities – The market prices of equities may decline due to factors affecting the issuing companies, their industries, or the economy and equity markets generally. If an underlying Fund purchases equities for less than their value as determined by GMO, the Fund runs the risk that the market prices of these equities will not appreciate or will decline for a variety of reasons, one of which may be GMO’s overestimation of those investments. An underlying Fund also may purchase equities that typically trade at higher multiples of current earnings than other securities, and the market prices of these equities often are more sensitive to changes in future earnings expectations than the market prices of equities trading at lower multiples. Declines in stock market prices generally are likely to reduce the net asset value of the Fund’s shares. |

| • | Management and Operational Risk – The Fund runs the risk that GMO’s investment techniques will fail to produce desired results. GMO often uses quantitative analyses and models as part of its investment process, and any imperfections, errors, or limitations in those analyses and models could affect the Fund’s performance. By necessity, these analyses and models make simplifying assumptions that limit their efficacy. Models that appear to explain prior market data can fail to predict future market events. Further, the data used in models may be inaccurate and may not include the most recent information about a company or a security. The Fund also runs the risk that GMO’s assessment of an investment may be wrong or that deficiencies in GMO’s or another service provider’s internal systems or controls will cause losses for the Fund or impair Fund operations. |

| • | Non-U.S. Investment Risk – The market prices of many non-U.S. securities fluctuate more than those of U.S. securities. Many non-U.S. markets are less stable, smaller, less liquid, and less regulated than U.S. markets, and the cost of trading in those markets often is higher than in U.S. markets. Non-U.S. portfolio transactions generally involve higher commission rates, transfer taxes, and custodial costs than similar transactions in the United States. In addition, the Fund may be subject to non-U.S. taxes, including potentially on a retroactive basis, on (i) capital gains it realizes or dividends or interest it receives on non-U.S. investments, (ii) transactions in those investments, and (iii) the repatriation of proceeds generated from the sale of those investments. Also, many non-U.S. markets require a license for the Fund to invest directly in those markets, and the Fund is subject to the risk that it could not invest if its license were terminated or suspended. In some non-U.S. markets, prevailing custody and trade settlement practices (e.g., the requirement to pay for securities prior to receipt) expose the Fund to credit and other risks with respect to brokers, custodians, clearing banks or other clearing agents, escrow agents and issuers. Further, adverse changes in investment regulations, capital requirements or exchange controls could adversely affect the value of the Fund’s investments. These and other risks (e.g., nationalization, expropriation or other confiscation of assets of non-U.S. issuers) tend to be greater for investments in companies tied economically to emerging countries, the economies of which tend to be more volatile than the economies of developed countries. |

| • | Illiquidity Risk – Low trading volume, lack of a market maker, large position size, or legal restrictions may limit or prevent the Fund or an underlying Fund from selling particular securities or closing derivative positions at desirable prices. |

| • | Derivatives Risk – The use of derivatives involves the risk that their value may not move as expected relative to changes in the value of the underlying assets, rates, or indices. Derivatives also present other risks, including market risk, illiquidity risk, currency risk, credit risk, and counterparty risk. The market price of written options will be affected by many factors, including changes in the market price or dividend rates of underlying securities (or in the case of indices, the securities comprising such indices); changes in interest rates or exchange rates; changes in the actual or perceived volatility of the relevant stock market and underlying securities; and the time remaining before an option’s expiration. In addition, the risks of loss associated with derivatives that provide short investment exposure and short sales of securities are theoretically unlimited. |

| • | Fund of Funds Risk – The Fund is indirectly exposed to all of the risks of an investment in the underlying Funds in which it invests, including the risk that those underlying Funds will not perform as expected. Because the Fund bears the fees and expenses of the underlying Funds in which it invests, a reallocation of the Fund’s investments to underlying Funds with higher fees or expenses will increase the Fund’s total expenses. The fees and expenses associated with an investment in the Fund are less predictable than those associated with an investment in funds that charge a fixed management fee. |

11

Table of Contents

GMO GLOBAL EQUITY ALLOCATION FUND

| • | Smaller Company Risk – Smaller companies may have limited product lines, markets, or financial resources, may lack the competitive strength of larger companies, may have inexperienced managers or depend on a few key employees. The securities of companies with smaller market capitalizations often are less widely held and trade less frequently and in lesser quantities, and their market prices often fluctuate more, than the securities of companies with larger market capitalizations. |

| • | Currency Risk – Fluctuations in exchange rates can adversely affect the market value of foreign currency holdings and investments denominated in foreign currencies. |

| • | Leveraging Risk – The use of reverse repurchase agreements and other derivatives and securities lending creates leverage. Leverage increases the Fund’s losses when the value of its investments (including derivatives) declines. |

| • | Counterparty Risk – The Fund runs the risk that the counterparty to a derivatives contract, a clearing member used by the Fund to hold a cleared derivatives contract, or a borrower of the Fund’s securities will be unable or unwilling to make timely settlement payments, return the Fund’s margin or otherwise honor its obligations. |

| • | Market Disruption and Geopolitical Risk – Geopolitical and other events may disrupt securities markets and adversely affect global economies and markets. Those events, as well as other changes in non-U.S. and U.S. economic and political conditions, could adversely affect the value of the Fund’s investments. |

| • | Market Risk – Fixed Income Investments – The market price of a fixed income investment can decline due to a number of market-related factors, including rising interest rates and widening credit spreads, or decreased liquidity stemming from the market’s uncertainty about the value of a fixed income investment (or class of fixed income investments). |

| • | Market Risk – Asset-Backed Securities – The market price of fixed income investments with complex structures, such as asset-backed securities, can decline due to a number of factors, including market uncertainty about their credit quality and the reliability of their payment streams. Payment streams associated with asset-backed securities held by the Fund depend on many factors (e.g., the cash flow generated by the assets backing the securities, the deal structure, the credit worthiness of any credit-support provider, and the reliability of various other service providers with access to the payment stream), and a problem in any one of these areas can lead to a reduction in the payment stream GMO expected the Fund to receive at the time the Fund purchased the asset-backed security. |

| • | Credit Risk – The Fund runs the risk that the issuer or guarantor of a fixed income investment or the obligor of an obligation underlying an asset-backed security will be unable or unwilling to satisfy its obligation to pay principal and interest or otherwise to honor its obligations in a timely manner. The market price of a fixed income investment will normally decline as a result of the issuer’s, guarantor’s, or obligor’s failure to meet its payment obligations. Below investment grade securities have speculative characteristics, and changes in economic conditions or other circumstances are more likely to impair the capacity of issuers of those securities to make principal and interest payments than is the case with issuers of investment grade securities. |

| • | Focused Investment Risk – Focusing investments in countries, regions, sectors, companies, or industries that are subject to the same or similar risk factors creates more risk than if the Fund’s investments were more diversified. |

| • | Large Shareholder Risk – To the extent that a large number of shares of the Fund is held by a single shareholder (e.g., an institutional investor), the Fund is subject to the risk that a redemption by that shareholder of all or a large portion of its Fund shares will disrupt the Fund’s operations. |

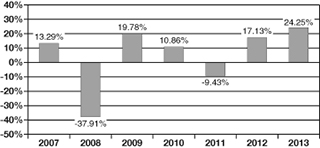

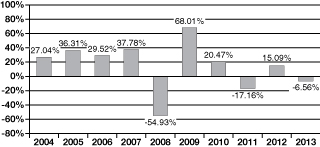

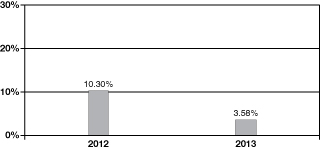

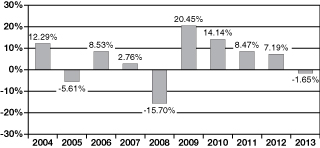

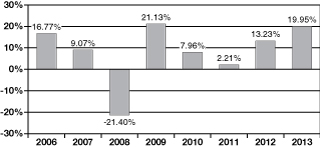

Performance

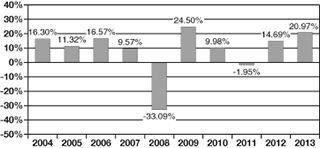

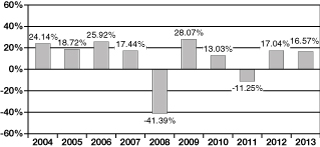

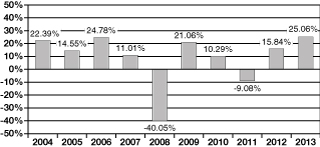

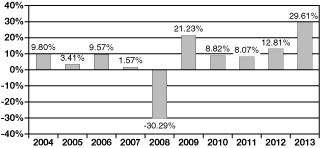

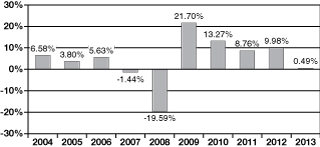

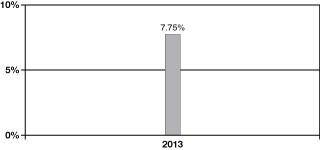

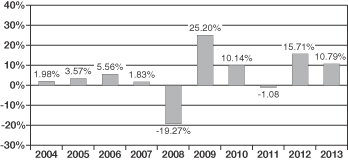

The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s annual total returns from year to year for the periods indicated and by comparing the Fund’s average annual total returns for different calendar periods with those of the Fund’s benchmark (which is a broad-based index) and a composite index computed by GMO. Purchase premiums and redemption fees are not reflected in the bar chart, but are reflected in the table; as a result, the returns in the table are lower than the returns in the bar chart. Returns in the table reflect current purchase premiums and redemption fees. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant if you are tax-exempt or if you hold your Fund shares through tax-deferred arrangements (such as a 401(k) plan or individual retirement account). Updated performance information for the Fund is available at www.gmo.com. Past performance (before and after taxes) is not an indication of future performance.

12

Table of Contents

GMO GLOBAL EQUITY ALLOCATION FUND

Management of the Fund

Investment Adviser: Grantham, Mayo, Van Otterloo & Co. LLC

Investment Team and Senior Members of GMO primarily responsible for portfolio management of the Fund:

| Investment Team | Senior Member (Length of Service with Fund) | Title | ||

| Asset Allocation | Ben Inker (since the Fund’s inception) | Co-Head, Asset Allocation Team, GMO. | ||

| Asset Allocation | Sam Wilderman (since 2012) | Co-Head, Asset Allocation Team, GMO. |

Additional information

For important information about purchase and sale of Fund shares, taxes, and financial intermediary compensation, please see “Additional Summary Information About the Funds” on page 126 of this Prospectus.

13

Table of Contents

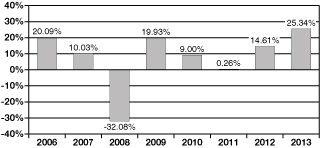

GMO GLOBAL DEVELOPED EQUITY ALLOCATION FUND

(formerly known as GMO World Opportunities Equity Allocation Fund)

Investment objective

Total return greater than that of its benchmark, the MSCI World Index.

Fees and expenses

The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder fees

(fees paid directly from your investment)

| Class III | ||||

| Purchase premium (as a percentage of amount invested) |

0.08 | % | ||

| Redemption fee (as a percentage of amount redeemed) |

0.08 | % | ||

Annual Fund operating expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class III | ||||

| Management fee |

0.00 | % | ||

| Shareholder service fee |

0.00 | % | ||

| Other expenses |

0.01 | % | ||

| Acquired fund fees and expenses (underlying fund expenses) |

0.56 | %1 | ||

| Total annual operating expenses |

0.57 | % | ||

| Expense reimbursement |

(0.01 | %)2 | ||

| Total annual operating expenses after expense reimbursement (Fund and underlying fund expenses) |

0.56 | % | ||

1 These indirect expenses include, to the extent applicable, purchase premiums and redemption fees (“transaction fees”) charged by certain underlying funds. Net fees and expenses of underlying funds (before addition of transaction fees) and indirect transaction fees were approximately 0.50% and 0.06%, respectively.

2 Grantham, Mayo, Van Otterloo & Co. LLC (“GMO”) has contractually agreed to reimburse the Fund for the following expenses: audit expenses, fund accounting expenses, pricing service expenses, expenses of non-investment related tax services, transfer agency expenses, expenses of non-investment related legal services provided to the Fund by or at the direction of GMO, federal securities law filing expenses, printing expenses, state and federal registration fees and custody expenses. This reimbursement will continue through at least June 30, 2015, and may not be terminated prior to this date without the action or consent of the Fund’s Board of Trustees.

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same as those shown in the table. The one year amounts shown reflect the expense reimbursement noted in the expense table. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| If you sell your shares | If you do not sell your shares | |||||||||||||||||||||||||||||||

| 1 Year* | 3 Years | 5 Years | 10 Years | 1 Year* | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||

| Class III |

$ | 74 | $ | 214 | $ | 366 | $ | 810 | $ | 65 | $ | 205 | $ | 357 | $ | 798 | ||||||||||||||||

* After reimbursement

Portfolio turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities. A higher portfolio turnover rate may result in higher transaction costs and, when Fund shares are held in a taxable account, higher taxes. These costs, which are not reflected in Annual Fund operating expenses or in the Example, affect the Fund’s performance. During its fiscal year ended February 28, 2014, the Fund’s portfolio turnover rate (excluding short-term investments) was 36% of the average value of its portfolio.

Principal investment strategies

The Fund is a fund of funds and invests primarily in shares of the Equity Funds, Alpha Only Fund and Risk Premium Fund (collectively, the “underlying Funds”) (see “Additional Information About the Funds’ Investment Strategies, Risks, and Expenses — Asset Allocation Funds”). The Fund also may invest in securities and derivatives directly.

GMO uses its multi-year forecasts of returns among asset classes, together with its assessment of the risk of such asset classes, to build a portfolio that primarily invests in equities traded in non-U.S. and U.S. markets. An important component of those forecasts is the expectation that market prices ultimately revert to their historical mean (average). GMO changes the Fund’s holdings of the underlying Funds in response to changes in its investment outlook and market valuations and may use redemptions or purchases of Fund shares to rebalance the Fund’s investments. The factors considered and investment methods used by GMO can change over time.

14

Table of Contents

GMO GLOBAL DEVELOPED EQUITY ALLOCATION FUND

Under normal circumstances, the Fund invests (including through investment in the underlying Funds) at least 80% of its assets in equities (see “Name Policies”). In addition, under normal circumstances, the Fund invests (including through investment in the underlying Funds) at least 80% of its assets in equities tied economically to developed markets (see “Name Policies”). The Fund also may invest in equities in emerging markets, but those investments typically will represent 10% or less of the Fund’s net assets measured at the time of purchase. The term “equities” refers to direct and indirect (e.g., through the underlying Funds) investments in common and preferred stocks and other stock-related securities, such as convertible securities, depositary receipts, and exchange-traded equity real estate investment trusts (REITs) and income trusts. The term “developed markets” means those countries included in the MSCI World Index, a global developed markets equity index, and countries with similar characteristics (e.g., countries that have sustained economic development, sufficient liquidity for listed companies and accessible markets).

The Fund also may invest in U.S. Treasury Fund and money market funds that are unaffiliated with GMO.

Principal risks of investing in the Fund

The value of the Fund’s shares changes with the value of the Fund’s investments. Many factors can affect this value, and you may lose money by investing in the Fund. References to investments include those held directly by the Fund and indirectly through the Fund’s investments in the underlying Funds. Some of the underlying Funds are non-diversified investment companies under the Investment Company Act of 1940, as amended, and therefore a decline in the market price of a particular security held by those underlying Funds may affect their performance more than if they were diversified investment companies. The principal risks of investing in the Fund are summarized below. For a more complete discussion of these risks, including those risks to which the Fund is exposed as a result of its investments in the underlying Funds, see “Description of Principal Risks.”

| • | Market Risk – Equities – The market prices of equities may decline due to factors affecting the issuing companies, their industries, or the economy and equity markets generally. If an underlying Fund purchases equities for less than their value as determined by GMO, the Fund runs the risk that the market prices of these equities will not appreciate or will decline for a variety of reasons, one of which may be GMO’s overestimation of those investments. An underlying Fund also may purchase equities that typically trade at higher multiples of current earnings than other securities, and the market prices of these equities often are more sensitive to changes in future earnings expectations than the market prices of equities trading at lower multiples. Declines in stock market prices generally are likely to reduce the net asset value of the Fund’s shares. |

| • | Management and Operational Risk – The Fund runs the risk that GMO’s investment techniques will fail to produce desired results. GMO often uses quantitative analyses and models as part of its investment process, and any imperfections, errors, or limitations in those analyses and models could affect the Fund’s performance. By necessity, these analyses and models make simplifying assumptions that limit their efficacy. Models that appear to explain prior market data can fail to predict future market events. Further, the data used in models may be inaccurate and may not include the most recent information about a company or a security. The Fund also runs the risk that GMO’s assessment of an investment may be wrong or that deficiencies in GMO’s or another service provider’s internal systems or controls will cause losses for the Fund or impair Fund operations. |

| • | Non-U.S. Investment Risk – The market prices of many non-U.S. securities fluctuate more than those of U.S. securities. Many non-U.S. markets are less stable, smaller, less liquid, and less regulated than U.S. markets, and the cost of trading in those markets often is higher than in U.S. markets. Non-U.S. portfolio transactions generally involve higher commission rates, transfer taxes, and custodial costs than similar transactions in the United States. In addition, the Fund may be subject to non-U.S. taxes, including potentially on a retroactive basis, on (i) capital gains it realizes or dividends or interest it receives on non-U.S. investments, (ii) transactions in those investments, and (iii) the repatriation of proceeds generated from the sale of those investments. Also, many non-U.S. markets require a license for the Fund to invest directly in those markets, and the Fund is subject to the risk that it could not invest if its license were terminated or suspended. In some non-U.S. markets, prevailing custody and trade settlement practices (e.g., the requirement to pay for securities prior to receipt) expose the Fund to credit and other risks with respect to brokers, custodians, clearing banks or other clearing agents, escrow agents and issuers. Further, adverse changes in investment regulations, capital requirements or exchange controls could adversely affect the value of the Fund’s investments. These and other risks (e.g., nationalization, expropriation or other confiscation of assets of non-U.S. issuers) tend to be greater for investments in companies tied economically to emerging countries, the economies of which tend to be more volatile than the economies of developed countries. |

| • | Illiquidity Risk – Low trading volume, lack of a market maker, large position size, or legal restrictions may limit or prevent the Fund or an underlying Fund from selling particular securities or closing derivative positions at desirable prices. |

| • | Derivatives Risk – The use of derivatives involves the risk that their value may not move as expected relative to changes in the value of the underlying assets, rates, or indices. Derivatives also present other risks, including market risk, illiquidity risk, currency risk, credit risk, and counterparty risk. The market price of written options will be affected by many factors, including changes in the market price or dividend rates of underlying securities (or in the case of indices, the securities comprising such indices); changes in interest rates or exchange rates; changes in the actual or perceived volatility of the relevant stock market and underlying securities; and the time remaining before an option’s expiration. In addition, the risks of loss associated with derivatives that provide short investment exposure and short sales of securities are theoretically unlimited. |

15

Table of Contents

GMO GLOBAL DEVELOPED EQUITY ALLOCATION FUND

| • | Fund of Funds Risk – The Fund is indirectly exposed to all of the risks of an investment in the underlying Funds in which it invests, including the risk that those underlying Funds will not perform as expected. Because the Fund bears the fees and expenses of the underlying Funds in which it invests, a reallocation of the Fund’s investments to underlying Funds with higher fees or expenses will increase the Fund’s total expenses. The fees and expenses associated with an investment in the Fund are less predictable than those associated with an investment in funds that charge a fixed management fee. |

| • | Smaller Company Risk – Smaller companies may have limited product lines, markets, or financial resources, may lack the competitive strength of larger companies, may have inexperienced managers or depend on a few key employees. The securities of companies with smaller market capitalizations often are less widely held and trade less frequently and in lesser quantities, and their market prices often fluctuate more, than the securities of companies with larger market capitalizations. |

| • | Currency Risk – Fluctuations in exchange rates can adversely affect the market value of foreign currency holdings and investments denominated in foreign currencies. |

| • | Leveraging Risk – The use of reverse repurchase agreements and other derivatives and securities lending creates leverage. Leverage increases the Fund’s losses when the value of its investments (including derivatives) declines. |

| • | Counterparty Risk – The Fund runs the risk that the counterparty to a derivatives contract, a clearing member used by the Fund to hold a cleared derivatives contract, or a borrower of the Fund’s securities will be unable or unwilling to make timely settlement payments, return the Fund’s margin or otherwise honor its obligations. |