Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GMO Benchmark-Free Allocation Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GMO Benchmark-Free Allocation Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment objective | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Positive total return.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and expenses | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The table below describes the fees and expenses that you may bear for each class of shares if you buy and hold shares of the Fund.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund operating expenses (expenses that you bear each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated, regardless of whether or not you redeem your shares at the end of such periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same as those shown in the table. The one year amounts shown reflect applicable expense reimbursements and waivers noted in the expense table. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio turnover | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities. A higher portfolio turnover rate may result in higher transaction costs and, for holders of Fund shares subject to U.S. taxes, higher income taxes. These transaction costs, which are not reflected in Annual Fund operating expenses or in the Example, affect the Fund’s performance. During its fiscal year ended February 29, 2020, the Fund’s portfolio turnover rate (excluding short-term investments) was 10% of the average value of its portfolio.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal investment strategies | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Fund seeks annualized returns of 5% (net of fees) above the Consumer Price Index and annualized volatility (standard deviation) of 5-10%, each over a complete market cycle. GMO does not manage the Fund to, or control the Fund’s risk relative to, any securities index or securities benchmark. GMO seeks to achieve the Fund’s investment objective by investing the Fund’s assets in asset classes GMO believes offer the most attractive return and risk opportunities. GMO uses its multi-year forecasts of returns among asset classes, together with its assessment of the relative risks of such asset classes, to determine the asset classes in which the Fund invests and how much the Fund invests in each asset class. An important component of those forecasts is GMO’s expectation that valuations ultimately revert to their fundamental fair (or intrinsic) value. GMO changes the Fund’s holdings of particular asset classes in response to changes in GMO’s investment outlook and its assessment of market valuations and may use redemptions or purchases of Fund shares to rebalance the Fund’s investments. The factors GMO considers and investment methods GMO uses can change over time. The Fund is structured as a fund of funds and gains its investment exposures primarily by investing in Implementation Fund. In addition, the Fund may invest in any other GMO Fund (together with Implementation Fund, the “underlying GMO Funds”), whether now existing or created in the future. These underlying GMO Funds may include, among others, Opportunistic Income Fund, Emerging Country Debt Fund, Special Opportunities Fund, High Yield Fund, and the Alternative Funds (see “Additional Information About the Funds’ Investment Strategies, Risks, and Expenses — Asset Allocation Funds”). Implementation Fund is permitted to invest in any asset class and may engage in merger arbitrage. The Fund also may invest directly in securities (including underlying funds) and derivatives. The Fund is permitted to invest (directly or through Implementation Fund or other underlying GMO Funds) in any asset class (e.g., U.S. equity, non-U.S. equity, emerging country equity, U.S. fixed income, non-U.S. fixed income, emerging country debt and commodities), sector, country, or region, and at times may have substantial exposure to a single asset class, sector, country, or region. In addition, the Fund is not restricted in its exposure to any particular market and may invest in securities of companies of any market capitalization, credit quality (including below investment grade securities (commonly referred to as “high yield” or “junk bonds”)), maturity or duration. The Fund may have indirect exposure to derivatives and short sales through its investment in Implementation Fund and the other underlying GMO Funds. GMO’s ability to shift investments within Implementation Fund and between Implementation Fund and the other underlying GMO Funds is not subject to any limits. In seeking to achieve the Fund’s investment objective, GMO may invest a significant portion of the Fund’s net assets in cash and cash equivalents. In addition, the Fund may lend its portfolio securities. The Fund also may invest in U.S. Treasury Fund, in money market funds unaffiliated with GMO, and directly in the types of investments typically held by money market funds.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal risks of investing in the Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The value of the Fund’s shares changes with the value of the Fund’s investments. Many factors can affect this value, and you may lose money by investing in the Fund. References to investments include those held directly by the Fund and indirectly through the Fund’s investments in underlying funds (including underlying GMO Funds). Some of the underlying funds are non-diversified investment companies under the Investment Company Act of 1940, as amended, and therefore a decline in the market price of a particular security held by those funds may affect their performance more than if they were diversified investment companies. The principal risks of investing in the Fund are summarized below. For a more complete discussion of these risks, including those risks to which the Fund is exposed as a result of its investments in the underlying funds, see “Additional Information about the Funds’ Investment Strategies, Risks, and Expenses” and “Description of Principal Risks.” • Management and Operational Risk – The Fund runs the risk that GMO’s investment techniques will fail to produce desired results, including annualized returns and annualized volatility. In addition, the Fund could produce results consistent with its annualized volatility objective over a complete market cycle yet experience shorter periods of significantly higher or lower volatility. GMO uses quantitative models as part of its investment process. GMO’s models may not accurately predict future market movements or characteristics. In addition, they are based on assumptions that can limit their effectiveness, and they rely on data that is subject to limitations (e.g., inaccuracies, staleness) that could adversely affect their predictive value. The Fund also runs the risk that GMO’s assessment of an investment (including a security’s fundamental fair (or intrinsic) value) is wrong or that deficiencies in GMO’s or another service provider’s internal systems or controls will cause losses for the Fund or impair Fund operations. • Market Risk – Equities – The market price of an equity may decline due to factors affecting the issuer or its industry or the economy and equity markets generally. If an underlying fund purchases an equity for less than its fundamental fair (or intrinsic) value as assessed by GMO, the Fund runs the risk that the market price of the equity will not appreciate or will decline due to GMO’s incorrect assessment. An underlying fund also may purchase equities that typically trade at higher multiples of current earnings than other securities, and the market prices of these equities often are more sensitive to changes in future earnings expectations than the market prices of equities trading at lower multiples. Declines in stock market prices generally are likely to reduce the net asset value of the Fund’s shares. • Non-U.S. Investment Risk – The market prices of many non-U.S. securities (particularly of companies tied economically to emerging countries) fluctuate more than those of U.S. securities. Many non-U.S. securities markets (particularly emerging markets) are less stable, smaller, less liquid, and less regulated than U.S. securities markets, and the cost of trading in those markets often is higher than in U.S. securities markets. In addition, issuers of non-U.S. securities (particularly those tied economically to emerging countries) often are not subject to as much regulation as U.S. issuers, and the reporting, accounting, custody, and auditing standards to which those issuers are subject often are not as rigorous as U.S. standards. Transactions in non-U.S. securities generally involve higher commission rates, transfer taxes, and custodial costs than similar transactions in U.S. securities. In addition, the Fund may be subject to non-U.S. taxes, potentially on a retroactive basis, on (i) capital gains it realizes or dividends, interest, or other amounts it realizes or accrues in respect of non-U.S. investments; (ii) transactions in those investments; and (iii) repatriation of proceeds generated from the sale or other disposition of those investments. Also, the Fund needs a license to invest directly in securities traded in many non-U.S. securities markets, and the Fund is subject to the risk that it could not invest if its license were terminated or suspended. In some non-U.S. securities markets, prevailing custody and trade settlement practices (e.g., the requirement to pay for securities prior to receipt) expose the Fund to credit and other risks. Further, adverse changes in investment regulations, capital requirements or exchange controls could adversely affect the value of the Fund’s investments. These and other risks (e.g., nationalization, expropriation or other confiscation of assets of non-U.S. issuers, difficulties in obtaining and enforcing legal judgments) tend to be greater for investments in the securities of companies tied economically to emerging countries. The economies of emerging countries may be predominantly based on only a few industries or dependent on revenues from particular commodities, and often are more volatile than the economies of developed countries. • Market Risk – Fixed Income – The market price of a fixed income investment can decline due to market-related factors, including rising interest rates and widening credit spreads, or decreased liquidity due, for example, to market uncertainty about the value of a fixed income investment (or class of fixed income investments). • Derivatives and Short Sales Risk – The use of derivatives involves the risk that their value may not change as expected relative to changes in the value of the underlying assets, pools of assets, rates, currencies or indices. Derivatives also present other risks, including market risk, illiquidity risk, currency risk, credit risk, and counterparty risk. The market price of an option is affected by many factors, including changes in the market prices or dividend rates of underlying securities (or in the case of indices, the securities in such indices); the time remaining before expiration; changes in interest rates or exchange rates; and changes in the actual or perceived volatility of the relevant stock market and underlying securities. The Fund may create short investment exposure by selling securities short or by taking a derivative position in which the value of the derivative moves in the opposite direction from the price of an underlying asset, pool of assets, rate, currency or index. The risks of loss associated with derivatives that provide short investment exposure and short sales of securities are theoretically unlimited. • Smaller Company Risk – Smaller companies may have limited product lines, markets, or financial resources, lack the competitive strength of larger companies, have inexperienced managers or depend on a few key employees. The securities of companies with smaller market capitalizations often are less widely held and trade less frequently and in lesser quantities, and their market prices often fluctuate more, than the securities of companies with larger market capitalizations. • Futures Contracts Risk – The risk of loss to the Fund resulting from its use of futures contracts is potentially unlimited. Futures markets are highly volatile, and the use of futures contracts increases the volatility of the Fund’s net asset value. A liquid secondary market may not exist for any particular futures contract at any particular time, and the Fund might be unable to effect closing transactions to terminate its exposure to the contract. When the Fund uses futures contracts for hedging purposes, it runs the risk that changes in the prices of the contracts will not correlate perfectly with changes in the securities, index, or other asset underlying the contracts or movements in the prices of the Fund’s investments that are the subject of the hedge. In addition, the Fund may be unable to recover or may be delayed in recovering margin or other amounts deposited with a futures commission merchant or futures clearinghouse. Foreign futures contracts are often less liquid and more volatile than U.S. contracts. • Credit Risk – The Fund runs the risk that the issuer or guarantor of a fixed income investment or the obligors of obligations underlying an asset-backed security will be unable or unwilling to satisfy their obligations to pay principal and interest or otherwise to honor their obligations in a timely manner. The market price of a fixed income investment will normally decline as a result of the issuer’s, guarantor’s, or obligors’ failure to meet their payment obligations or in anticipation of such failure. Below investment grade investments have speculative characteristics, and negative changes in economic conditions or other circumstances are more likely to impair the ability of issuers of those investments to make principal and interest payments than issuers of investment grade investments. • Currency Risk – Fluctuations in exchange rates can adversely affect the market value of the Fund’s foreign currency holdings and investments denominated in foreign currencies. • Fund of Funds Risk – The Fund is indirectly exposed to all of the risks of an investment in the underlying funds (including underlying GMO Funds) in which it invests, including the risk that those underlying funds will not perform as expected. Because the Fund bears the fees and expenses of the underlying funds in which it invests, the increase in fees and expenses of an underlying fund or a reallocation of the Fund’s investments to underlying funds with higher fees or expenses will increase the Fund’s total expenses. • Commodities Risk – Commodity prices can be extremely volatile, and exposure to commodities can cause the value of the Fund’s shares to decline or fluctuate in a rapid and unpredictable manner. • Merger Arbitrage Risk – If the Fund purchases securities in anticipation of a proposed merger, exchange offer, tender offer, or other similar transaction and that transaction later appears unlikely to be consummated or, in fact, is not consummated or is delayed, the market price of the securities purchased by the Fund is likely to decline sharply, resulting in losses to the Fund. The risk/reward payout of merger arbitrage strategies typically is asymmetric, with the losses in failed transactions often far exceeding the gains in successful transactions. Merger arbitrage strategies are subject to the risk of overall market movements, and the Fund may experience losses even if a transaction is consummated. • Illiquidity Risk – Low trading volume, lack of a market maker, large position size, or legal restrictions may limit or prevent the Fund or an underlying fund from selling particular securities or closing derivative positions at desirable prices. • Leveraging Risk – The use of derivatives, short sales and securities lending creates leverage. Leverage increases the Fund’s losses when the value of its investments (including derivatives) declines. In addition, the Fund’s portfolio will be leveraged if it exercises its right to delay payment on a redemption, and losses will result if the value of the Fund’s assets declines between the time a redemption request is deemed to be received by the Fund and the time the Fund liquidates assets to meet that request. • Counterparty Risk – The Fund runs the risk that the counterparty to a derivatives contract, a clearing member used by the Fund to hold a cleared derivatives contract, or a borrower of the Fund’s securities is unable or unwilling to make timely settlement payments, return the Fund’s margin or otherwise honor its obligations. • Market Disruption and Geopolitical Risk – Geopolitical and other events (e.g., wars, pandemics, terrorism) may disrupt securities markets and adversely affect global economies and markets. Those events, as well as other changes in non-U.S. and U.S. economic and political conditions, could reduce the value of the Fund’s investments. • Market Risk – Asset-Backed Securities – The market price of asset-backed securities, like that of other fixed income investments with complex structures, can decline for a variety of reasons, including market uncertainty about their credit quality and the reliability of their payment streams. Payment streams associated with asset-backed securities held by the Fund depend on many factors (e.g., the cash flow generated by the assets backing the securities, deal structure, creditworthiness of any credit-support provider, and reliability of various other service providers with access to the payment stream), and a problem in any of these factors can lead to a reduction in the payment stream GMO expected the Fund to receive when the Fund purchased the asset-backed security. • Focused Investment Risk – Investments focused in asset classes, countries, regions, sectors, industries, or issuers that are subject to the same or similar risk factors and investments whose prices are closely correlated are subject to greater overall risk than investments that are more diversified or whose prices are not as closely correlated. • Large Shareholder Risk – To the extent that a large number of shares of the Fund is held by a single shareholder (e.g., an institutional investor), the Fund is subject to the risk that a redemption by that shareholder of all or a large portion of its Fund shares will require the Fund to sell securities at disadvantageous prices or otherwise disrupt the Fund’s operations.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

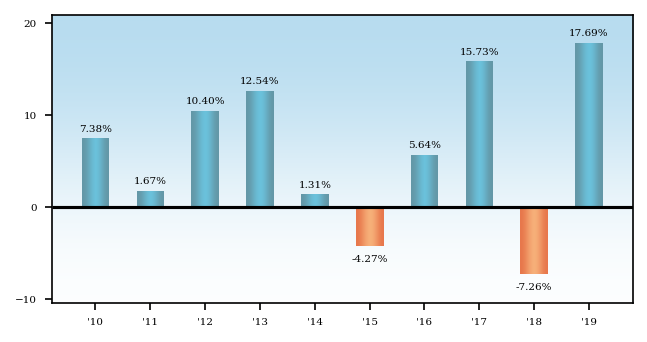

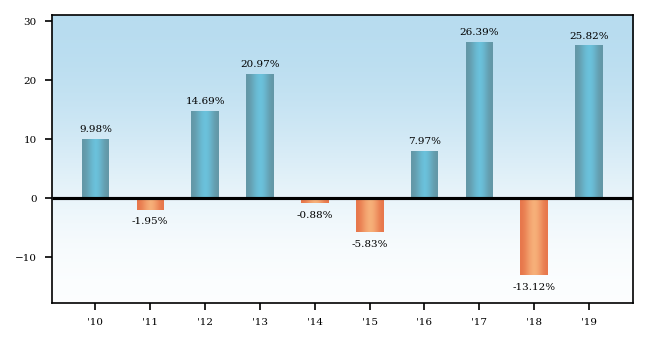

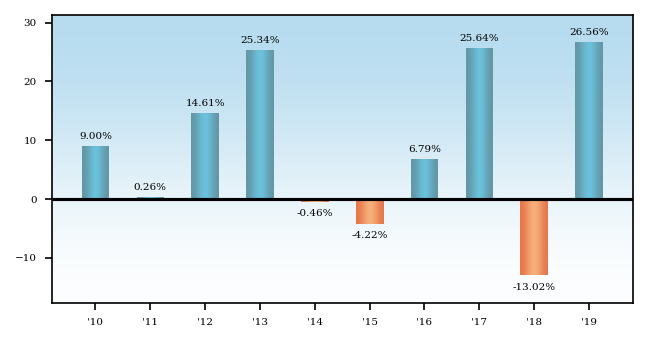

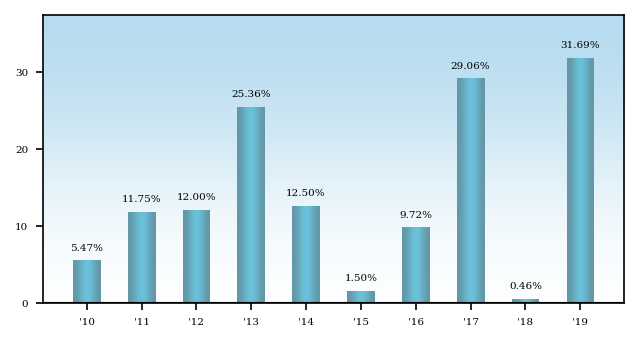

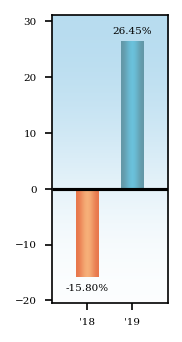

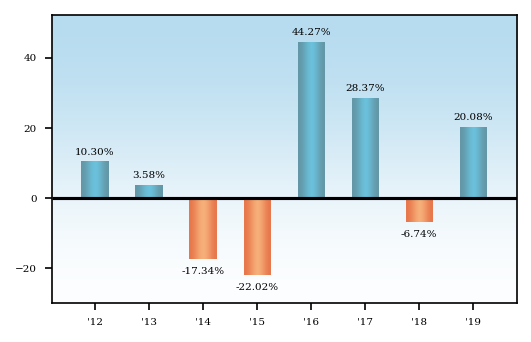

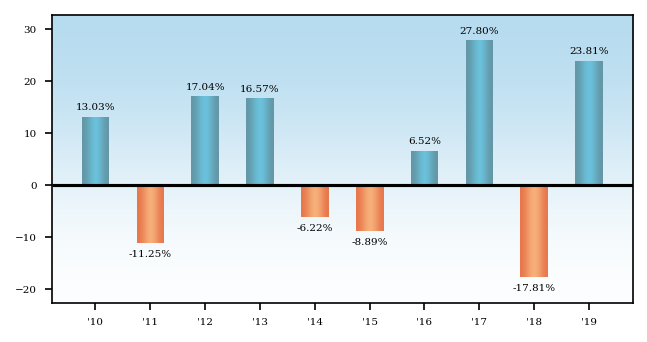

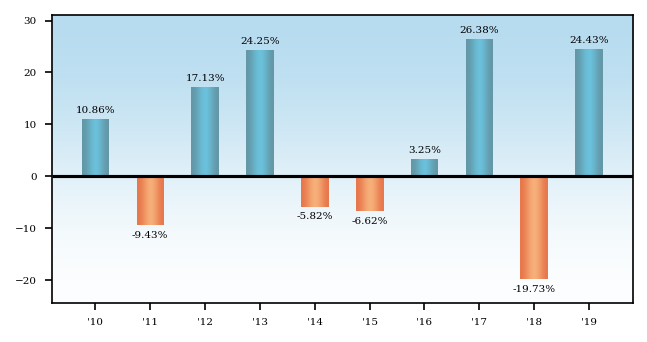

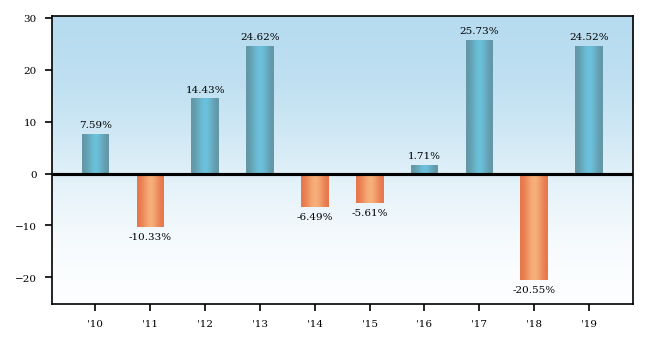

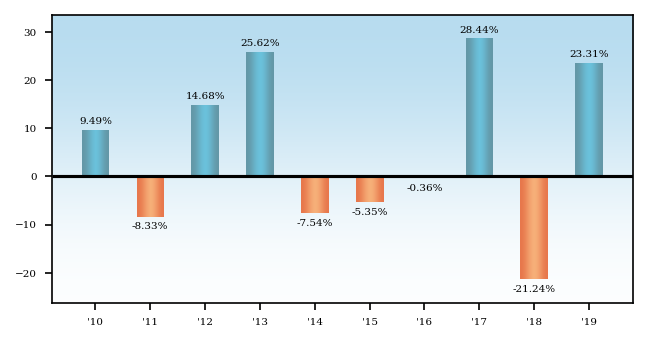

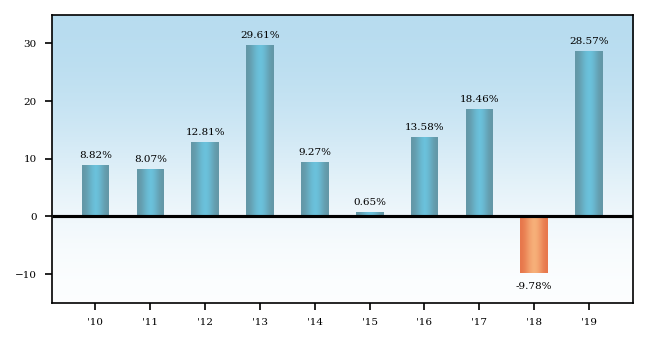

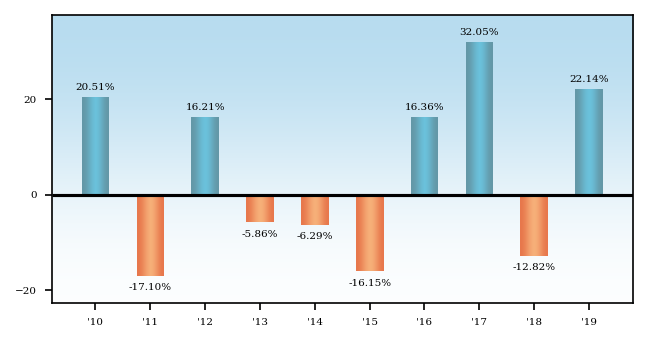

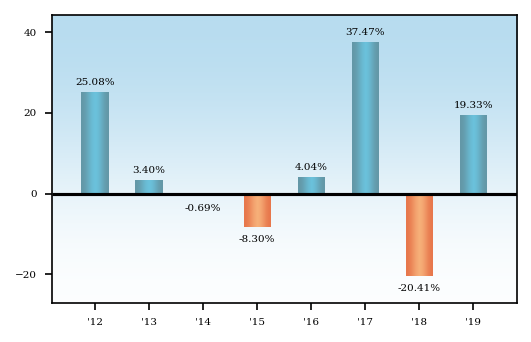

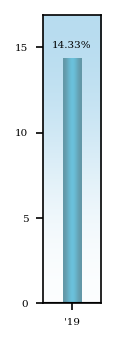

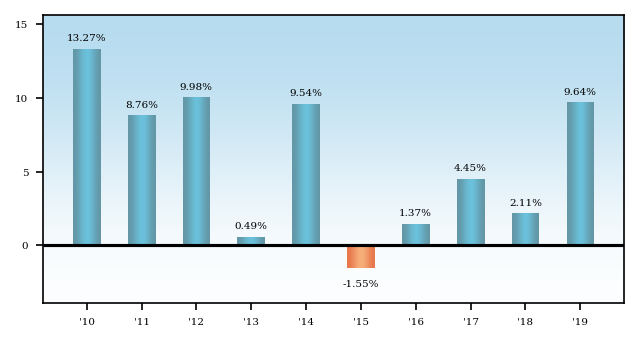

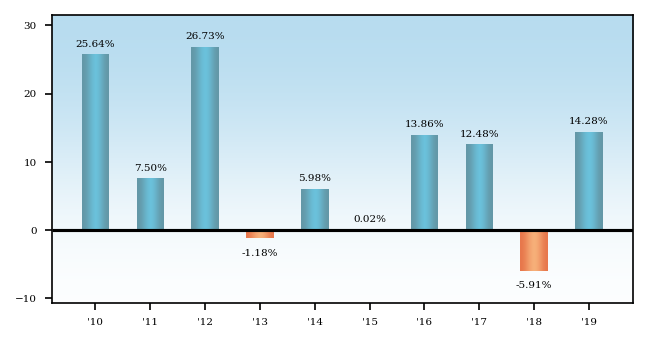

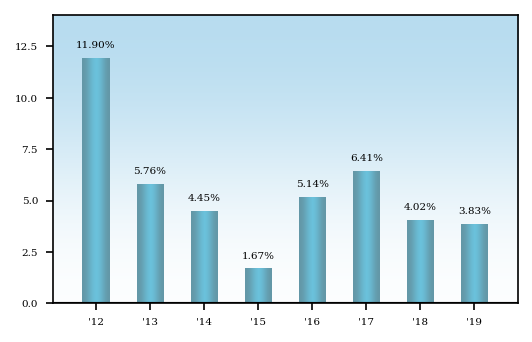

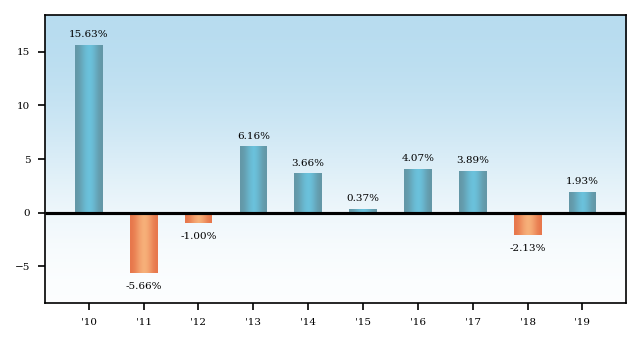

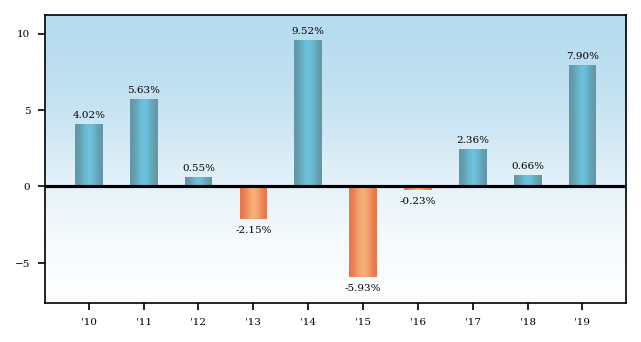

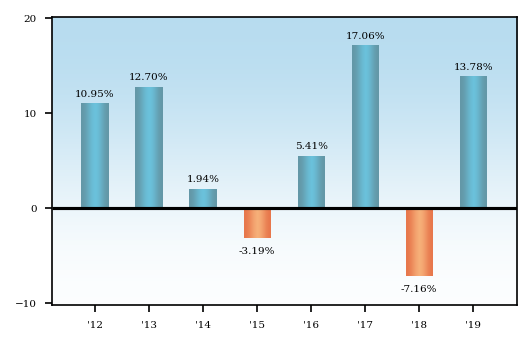

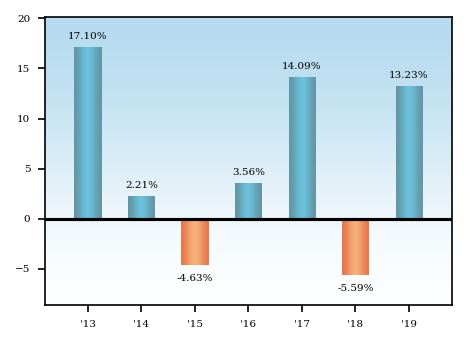

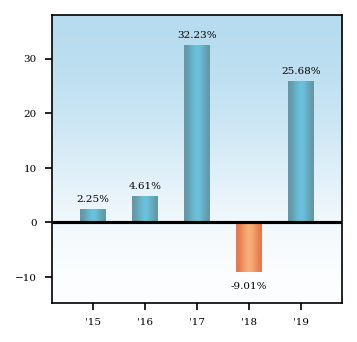

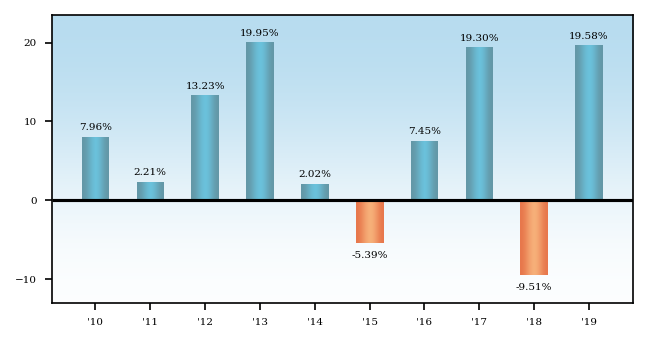

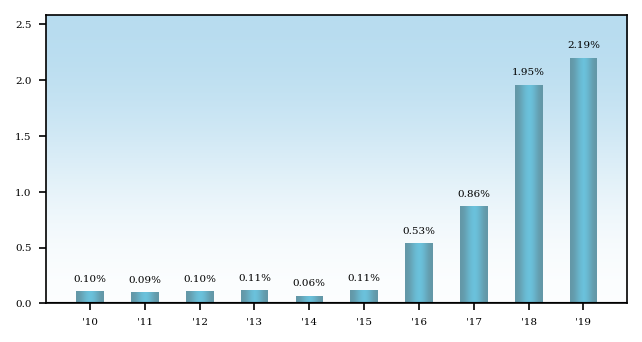

The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s annual total returns from year to year for the periods indicated and by comparing the Fund’s average annual total returns for different calendar periods with those of the Bloomberg Barclays U.S. Treasury Inflation Notes: 1-10 Year Index and the Consumer Price Index. As of the date of this Prospectus, there are no Class R6 shares or Class I shares outstanding or such shares have not been outstanding for a full calendar year. The returns information below is for the Fund’s Class III shares. Class R6 and Class I shares would have substantially similar annual returns to Class III shares because they invest in the same portfolio of securities. Their annual returns would differ from Class III shares to the extent that they bear different expenses. While Class R6 shares are expected to bear the same expenses as Class III shares, Class I shares bear higher expenses than Class III shares and therefore would have lower returns. Prior to January 1, 2012, the Fund served as a principal component of a broader GMO real return strategy that also included a pooled investment vehicle with a cash-like benchmark. Since January 1, 2012, the Fund has been managed as a standalone investment. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant if you are tax-exempt or if you hold your Fund shares through tax-advantaged arrangements (such as a 401(k) plan or individual retirement account). After-tax returns are shown for Class III shares only; after-tax returns for other classes will vary. Updated performance information for the Fund is available at www.gmo.com. Past performance (before and after taxes) is not an indication of future performance.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Total Returns/Class III Shares* Years Ending December 31 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

a The returns shown for periods prior to January 1, 2012 are for Class III shares of the Fund under the Fund’s prior fee arrangement. Under the Fund’s current fee arrangement, the returns for periods prior to January 1, 2012 would have been lower.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Highest Quarter: 6.66% (3Q2010)

Lowest Quarter: -6.66% (3Q2015) Year-to-Date (as of 3/31/20): -16.05% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns Periods Ending December 31, 2019 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||