Exhibit

Annual

Information

Form

For the Year

Ended December 31, 2017

March 22, 2018

1500-625 Howe Street

Vancouver, British Columbia

V6C 2T6

www.panamericansilver.com

PAN AMERICAN SILVER CORP.

ANNUAL INFORMATION FORM

WHAT'S INSIDE

|

| |

WHAT'S INSIDE | |

IMPORTANT INFORMATION ABOUT THIS DOCUMENT | |

CORPORATE STRUCTURE | |

GENERAL DEVELOPMENT OF THE BUSINESS | |

NARRATIVE DESCRIPTION OF THE BUSINESS | |

RISKS RELATED TO OUR BUSINESS | |

DIVIDENDS | |

MARKET FOR SECURITIES | |

EXCEPTIONS FROM NASDAQ CORPORATE GOVERNANCE REQUIREMENTS | |

DIRECTORS AND EXECUTIVE OFFICERS | |

LEGAL PROCEEDINGS AND REGULATORY ACTIONS | |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | |

TRANSFER AGENTS AND REGISTRAR | |

MATERIAL CONTRACTS | |

INTERESTS OF EXPERTS | |

ADDITIONAL INFORMATION | |

GLOSSARY OF TERMS | |

APPENDIX “A” – AUDIT COMMITTEE CHARTER | A-1 |

IMPORTANT INFORMATION ABOUT THIS DOCUMENT

This annual information form (“AIF”) provides important information about Pan American Silver Corp. It describes our business, including its history, our operations and development projects, our mineral reserves and mineral resources, sustainability, the regulatory environment that we operate in, the risks we face, and the market for our products and shares, among other things.

|

| | |

We have prepared this document to meet the requirements of Canadian securities laws, which are different from what US securities laws require.

| | Throughout this document, the term Pan American means Pan American Silver Corp. and the terms we, us, and our mean Pan American and its subsidiaries. |

Reporting Currency and Financial Information

Unless we have specified otherwise, all references to dollar amounts or $ or USD are United States dollars. Any references to CAD or CAD$ mean Canadian dollars.

All financial information presented in this AIF was prepared in accordance with international financial reporting standards (“IFRS”) as issued by the International Accounting Standards Board.

Non-GAAP Measures

This AIF refers to various non-generally accepted accounting principles (“non-GAAP”) measures, such as cash cost per payable ounce of silver, net of by-product credits (“cash costs”), all-in sustaining costs per silver ounce sold (“AISCSOS”), working capital and total debt.

Cash Costs

This AIF presents information about our cash costs for our operating mines. Except as otherwise noted, cash costs is calculated by dividing total cash costs net of by-product credits by total payable silver ounces produced at the relevant mine or mines. Total cash costs include mine operating costs such as mining, processing, administration and royalties, but exclude amortization, reclamation costs, financing costs and capital development and exploration. Certain amounts of stock-based compensation are excluded as well.

Cash costs is included in this AIF because certain investors use this information to assess our performance and also to determine our ability to generate cash flow for use in investing and other activities. The inclusion of cash costs may enable investors to better understand year-over-year changes in our production costs, which in turn affect profitability and cash flow. Cash costs does not have a standardized meaning or a consistent basis of calculation prescribed by IFRS. Investors are cautioned that cash costs should not be considered in isolation or construed as a substitute to costs determined under IFRS as an indicator of performance. Our method of calculating cash costs may differ from the methods used by other entities and, accordingly, our cash costs may not be comparable to similarly titled measures used by other entities. Readers should refer to our management’s discussion and analysis for the year ended December 31, 2017 (the “2017 MD&A”) for a detailed description and reconciliation of this non-GAAP measure.

All-In Sustaining Costs Per Silver Ounce Sold

This AIF includes information about our calculation of AISCSOS. The Company believes that AISCSOS reflects a comprehensive measure of the full cost of operating its consolidated business given it includes the cost of replacing ounces through exploration, the cost of ongoing capital investment (sustaining capital), general and administrative expenses, direct operating costs, as well as other items that affect the Company’s consolidated earnings and cash flow. AISCSOS does not have a standardized meaning or a consistent basis of calculation prescribed by IFRS. Our

method of calculating AISCSOS may differ from the methods used by other entities and, accordingly, our AISCSOS may not be comparable to similarly titled measures used by other entities. Readers should refer to the 2017 MD&A for a detailed description and reconciliation of this non-GAAP measure.

Working Capital

Working capital is a non-GAAP measure calculated as current assets less current liabilities. Working capital does not have any standardized meaning prescribed by IFRS and is therefore unlikely to be comparable to similar measures presented by other companies. The Company and certain investors use this information to evaluate whether the Company is able to meet its current obligations using its current assets.

Total Debt

Total debt is a non-GAAP measure calculated as the total current and non-current portions of long-term debt, finance lease liabilities, and loans payable. Total debt does not have any standardized meaning prescribed by GAAP and is therefore unlikely to be comparable to similar measures presented by other companies. The Company and certain investors use this information to evaluate the financial debt leverage of the Company.

Glossary of Terms

The glossary of terms under "Glossary of Terms" of this AIF contains definitions of certain scientific or technical terms used in this AIF that might be useful for your understanding.

Caution About Forward-Looking Information

Our AIF includes statements and information about our expectations for the future. When we discuss our strategy, plans and future financial and operating performance, or other things that have not yet taken place, we are making statements considered to be forward-looking information or forward-looking statements under Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995. We refer to them together in this AIF as forward-looking information.

Key things to understand about the forward-looking information in this AIF are:

| |

• | It typically includes words and phrases about the future, such as believe, estimate, anticipate, expect, plan, intend, predict, goal, target, forecast, project, scheduled, potential, strategy and proposed (see examples starting on page 3). |

| |

• | It is based on a number of material assumptions, including, but not limited to, those we have listed below, that may prove to be incorrect. |

| |

• | Actual results and events may be significantly different from what we currently expect, because of, among other things, the risks associated with our business. We list a number of these material risks below under “Material Risks and Assumptions”. We recommend you also review other parts of this AIF, including "Risks Related to Our Business" starting on page 75, and our 2017 MD&A, which include a discussion of other material risks that could cause our actual results to differ from current expectations. |

Forward-looking information is designed to help you understand management’s current views of our near and longer term prospects. It may not be appropriate for other purposes. We do not intend to update forward-looking information unless we are required to do so by applicable securities laws.

Examples of Forward-Looking Information in this AIF:

| |

• | the price of silver and other metals; |

| |

• | the sufficiency of our current working capital, anticipated operating cash flow or our ability to raise necessary funds; |

| |

• | the accuracy of mineral reserve and mineral resource estimates, estimates of future production and future cash, and total costs of production, as applicable, at La Colorada, Dolores, Huaron, Morococha, San Vicente, Manantial Espejo, Navidad, Joaquin or other properties; |

| |

• | estimated production rates for silver and other payable metals we produce, timing of production and estimated cash and total costs of production, including forecast cash costs of production; |

| |

• | the estimated cost of and availability of funding for ongoing capital replacement, improvement or remediation programs, and the availability of funding for future construction and development projects; |

| |

• | estimated costs of construction, development and ramp-up of our projects; |

| |

• | future successful development of the Cap-Oeste Sur Este (“COSE”), Joaquin, Navidad and other development projects; |

| |

• | the effects of laws, regulations and government policies affecting our operations, including, without limitation, expectations relating to or the effect of certain highly restrictive laws and regulations applicable to mining in the Province of Chubut, Argentina; |

| |

• | the estimates of expected or anticipated economic returns from a mining project, as reflected in preliminary economic assessments, pre-feasibility, and feasibility studies or other reports prepared in relation to development of projects; |

| |

• | estimated exploration expenditures to be incurred on our various silver exploration properties; |

| |

• | compliance with environmental, health, safety and other regulations; |

| |

• | estimated future closure, reclamation and remediation costs; |

| |

• | forecast capital and non-operating spending; |

| |

• | estimates of foreign exchange rates and future income tax rates; |

| |

• | future sales of the metals, concentrates or other products produced by us; |

| |

• | our ability to maintain transparent relationships of trust with our stakeholders and community support for our activities; |

| |

• | continued access to necessary infrastructure, including, without limitation, access to power, water, lands and roads to carry on activities as planned; |

| |

• | our plans and expectations for our properties and operations, including, without limitation, production estimates, forecasts regarding investment activities, and other matters discussed under the heading “Outlook for 2018” and under the headings “Capital and Operating Costs” and “Exploration, Development, and Production” with respect to each of our material properties; |

| |

• | the results of investment and development activities at the La Colorada and Dolores mines, and at our development projects such as Joaquin and COSE; and |

| |

• | the ability to obtain permits, including for current or future project development and expansion. |

Material Risks and Assumptions:

The forward-looking information in this AIF reflects our current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking information contained in this AIF and documents incorporated by reference, and we have made assumptions based on or related to many of these factors.

Such factors include, without limitation:

| |

• | fluctuations in spot and forward markets for silver, gold, base metals and certain other commodities (such as natural gas, fuel oil and electricity); |

| |

• | restrictions on mining in the jurisdictions in which we operate; |

| |

• | laws and regulations governing our operation, exploration and development activities; |

| |

• | our ability to obtain or renew the licenses and permits necessary for the operation and expansion of our existing operations and for the development, construction and commencement of new operations; |

| |

• | risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, potential unintended releases of contaminants, industrial accidents, unusual or unexpected geological or structural formations, pressures, cave-ins and flooding); |

| |

• | inherent risks associated with tailings facilities and heap leach operations, including failure or leakages; |

| |

• | the speculative nature of mineral exploration and development; |

| |

• | diminishing quantities or grades of mineral reserves as properties are mined; |

| |

• | the inability to determine, with certainty, the production of metals or the price to be received before mineral reserves or mineral resources are actually mined; |

| |

• | the inability to determine, with certainty, production and cost estimates; |

| |

• | inadequate or unreliable infrastructure (such as roads, bridges, power sources and water supplies); |

| |

• | environmental regulations and legislation; |

| |

• | reclamation and ongoing post-closure monitoring and maintenance requirements; |

| |

• | the effects of climate change, extreme weather events, water scarcity, and seismic events, and the effectiveness of strategies to deal with these issues; |

| |

• | risks relating to our operations in Mexico, Peru, Bolivia, Argentina and other foreign jurisdictions where we may operate; |

| |

• | risks relating to the creditworthiness and financial condition of our suppliers, refiners and other parties; |

| |

• | fluctuations in currency markets (such as the Peruvian nuevo sol (“PEN”), Mexican peso (“MXN”), Argentine peso (“ARS”) and Bolivian boliviano (“BOB”) versus the USD and CAD); |

| |

• | the volatility of the metals markets, and its potential to impact our ability to meet our financial obligations; |

| |

• | the inability to recruit and retain qualified personnel; |

| |

• | disputes as to the validity of mining or exploration titles or claims or rights, which constitute most of our property holdings; |

| |

• | our ability to complete and successfully integrate acquisitions; |

| |

• | increased competition in the mining industry for properties and equipment; |

| |

• | limited supply of materials and supply chain disruptions; |

| |

• | relations with and claims by indigenous populations; |

| |

• | relations with and claims by local communities and non-governmental organizations; |

| |

• | the effectiveness of our internal control over financial reporting; |

| |

• | claims and legal proceedings arising in the ordinary course of business activities; and |

| |

• | those factors identified under the caption “Risks Related to our Business” in this AIF and the documents incorporated by reference herein, if any. |

You should not attribute undue certainty to forward-looking information. Although we have attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as described. We do not intend to update forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such information, other than as required by applicable law.

Please see “Cautionary Note to U.S. Investors Concerning Estimates of Mineral Reserves and Mineral Resources” on page 7 of this AIF.

Conversion Table

In this AIF, metric units are used with respect to mineral properties located in Mexico, Peru, Bolivia, Argentina and elsewhere, unless otherwise indicated. Conversion rates from imperial measures to metric units and from metric units to imperial measures are provided in the table set out below.

|

| | | | |

Imperial Measure = Metric Unit | | Metric Unit = Imperial Measure |

2.47 acres | 1 hectare | | 0.4047 hectares | 1 acre |

3.28 feet | 1 metre | | 0.3048 metres | 1 foot |

0.62 miles | 1 kilometre | | 1.609 kilometres | 1 mile |

0.032 ounces (troy) | 1 gram | | 31.1 grams | 1 ounce (troy) |

1.102 tons (short) | 1 tonne | | 0.907 tonnes | 1 ton (short) |

0.029 ounces (troy)/

ton (short) | 1 gram/tonne | | 34.28 grams/tonne | 1 ounce (troy)/ton (short) |

2205 pounds | 1 tonne | | | |

Scientific and Technical Information

Mineral reserve and mineral resource estimates in this AIF relating to La Colorada, Dolores, Huaron, Morococha, San Vicente, Manantial Espejo, and Joaquin are based on information prepared under the supervision of, or have been reviewed by, Christopher Emerson, FAusIMM, Vice President of Business Development and Geology of Pan American, and Martin Wafforn, P.Eng., Senior Vice President, Technical Services and Process Optimization of Pan American. Scientific or technical information in this AIF relating to La Colorada and Manantial Espejo is based on information prepared under the supervision of, or has been reviewed by, Michael Steinmann, P.Geo., President and Chief Executive Officer of Pan American, and Martin Wafforn. Scientific and technical information relating to Huaron, Morococha, and San Vicente is based on information prepared and reviewed by Michael Steinmann, Martin Wafforn and Americo Delgado, P. Eng., Director of Metallurgy of Pan American. Scientific and technical information relating to Dolores and Joaquin is based on information prepared and reviewed by Martin Wafforn, Christopher Emerson, and Americo Delgado. Scientific or technical information relating to the geology of particular properties, and the current and planned exploration programs described in this AIF, are prepared and/or designed and carried out under the supervision of, or have been reviewed by, Christopher Emerson. Scientific and technical information herein relating to the Navidad property is based on information contained in the Navidad Report (as defined below) and the disclosure in this AIF about the Navidad property has been reviewed and consented to by Michael Steinmann, Martin Wafforn and Pamela De Mark, P.Geo., Director of Resources of Pan American, the experts involved in the preparation of the applicable sections of the Navidad Report. In particular, scientific or technical information in this AIF relating to the estimation of mineral resources for the Navidad property was prepared by Pamela De Mark. All other disclosures of scientific and technical information contained in the descriptions of our mineral properties were prepared under the supervision of or have been reviewed by Christopher Emerson and Martin Wafforn. Each of Christopher Emerson, Michael Steinmann, Martin Wafforn, Pamela De Mark, and Americo Delgado is a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). A “Qualified Person” means an engineer or geoscientist with a university degree, or equivalent accreditation, in an area of geoscience, or engineering, relating to mineral exploration or mining, with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these, that is relevant to his or her professional degree or area of practice, has experience relevant to the subject matter of the mineral project, and is a member in good standing of a professional association.

Scientific and technical disclosure in this AIF for our material properties is based on technical reports prepared for those properties in accordance with NI 43-101 (collectively, the “Technical Reports”). The Technical Reports have been filed on SEDAR at www.sedar.com. The technical information in our AIF has been updated with current information where applicable. The Technical Reports are as follows:

| |

• | a report entitled “Technical Report – Preliminary Economic Analysis for the Expansion of the La Colorada Mine, Zacatecas, Mexico”, dated effective December 31, 2013 (the “La Colorada Report”) relating to the La Colorada mine; |

| |

• | a report entitled “Technical Report for the Dolores Property, Chihuahua, Mexico”, dated effective December 31, 2016 (the “Dolores Report”) relating to the Dolores mine; |

| |

• | a report entitled “Technical Report for the Huaron Property, Pasco, Peru” dated effective June 30, 2014 (the “Huaron Report”) relating to the Huaron mine; |

| |

• | a report entitled “Technical Report for the Morococha Property, Yauli, Peru” dated effective June 30, 2014 (the “Morococha Report”) relating to the Morococha mine; |

| |

• | a report entitled “Technical Report for San Vicente Property, Potosi, Bolivia” dated effective December 31, 2014 (the “San Vicente Report”) relating to the San Vicente mine; |

| |

• | a report entitled “Manantial-Espejo Project Canadian Standard NI 43-101, Santa Cruz Province, Argentina” dated March 2006 (the “Manantial Report”) relating to the Manantial Espejo mine; |

| |

• | a report entitled “Pan American Silver Corp.: Navidad Project, Chubut Province, Argentina: Preliminary Assessment” dated January 14, 2011 (the “Navidad Report”) relating to the Navidad property; and |

| |

• | a report entitled “Technical Report for the Joaquin Property, Santa Cruz, Argentina – Pre-feasibility Study” dated effective November 30, 2017 (the “Joaquin Report”) relating to the Joaquin property. |

Cautionary Note to U.S. Investors Concerning Estimates of Mineral Reserves and Mineral Resources

This AIF and the documents incorporated by reference in it, if any, have been prepared in accordance with the requirements of Canadian securities laws that differ from the requirements of United States securities laws. Unless otherwise indicated, all mineral reserve and mineral resource estimates included in this AIF and the documents incorporated by reference herein have been disclosed in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) - Definition Standards adopted by the CIM Council. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Canadian public disclosure standards, including NI 43-101, differ significantly from the requirements of the U.S. Securities and Exchange Commission (the “SEC”), and information with respect to mineralization and mineral reserves and mineral resources contained or incorporated by reference herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, these documents use the terms ‘‘Measured Resources’’, ‘‘Indicated Resources’’ and ‘‘Inferred Resources’’. U.S. investors are advised that, while such terms are recognized and required by Canadian securities laws, the SEC does not recognize them. The requirements of NI 43-101 for identification of ‘‘reserves’’ are not the same as those of the SEC, and reserves reported by Pan American in compliance with NI 43-101 may not qualify as ‘‘reserves’’ under SEC standards. Under U.S. standards, mineralization may not be classified as a ‘‘reserve’’ unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that any part of a ‘‘Measured Resource’’ or ‘‘Indicated Resource’’ will ever be converted into a ‘‘reserve’’. U.S. investors should also understand that ‘‘Inferred Resources’’ have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of ‘‘Inferred Resources’’ exist, are economically or legally mineable or will ever be upgraded to a higher category. Under Canadian securities laws, ‘‘Inferred Resources’’ may not form the basis of feasibility or pre-feasibility studies except in certain cases. Disclosure of ‘‘contained ounces’’ in a mineral resource is a permitted disclosure under Canadian securities laws, however, the SEC normally only permits issuers to report mineralization that does not constitute ‘‘reserves’’ by SEC standards as in place tonnage and grade, without reference to unit measures. Accordingly, information concerning mineral deposits set forth in this AIF and the documents incorporated by reference herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

CORPORATE STRUCTURE

Incorporation

Pan American is the continuing corporation of Pan American Energy Corporation, which was incorporated under the Company Act (British Columbia) on March 7, 1979. Pan American underwent two name changes, the last occurring on April 11, 1995, when the present name of Pan American Silver Corp. was adopted. Amendments to the constating documents of Pan American to that date had been limited to name changes and capital alterations. In May 2006, Pan American obtained shareholder approval to amend our memorandum and articles, including the increase in our authorized share capital from 100,000,000 to 200,000,000 common shares without par value (“Common Shares”), in connection with Pan American’s required transition under the Business Corporations Act (British Columbia).

Pan American’s head office is situated at 1440 - 625 Howe Street, Vancouver, British Columbia, Canada, V6C 2T6 and our registered and records offices are situated at 1200 Waterfront Centre, 200 Burrard Street, Vancouver, British Columbia, Canada, V7X 1T2. Our website is www.panamericansilver.com.

Capital Structure

Pan American’s authorized share capital consists of 200,000,000 Common Shares. The holders of Common Shares are entitled to: (i) one vote per Common Share at all meetings of shareholders; (ii) receive dividends as and when declared by the directors of Pan American; and (iii) receive a pro rata share of the assets of Pan American available for distribution to the shareholders in the event of the liquidation, dissolution or winding-up of Pan American. There are no pre-emptive, conversion or redemption rights attached to the Common Shares.

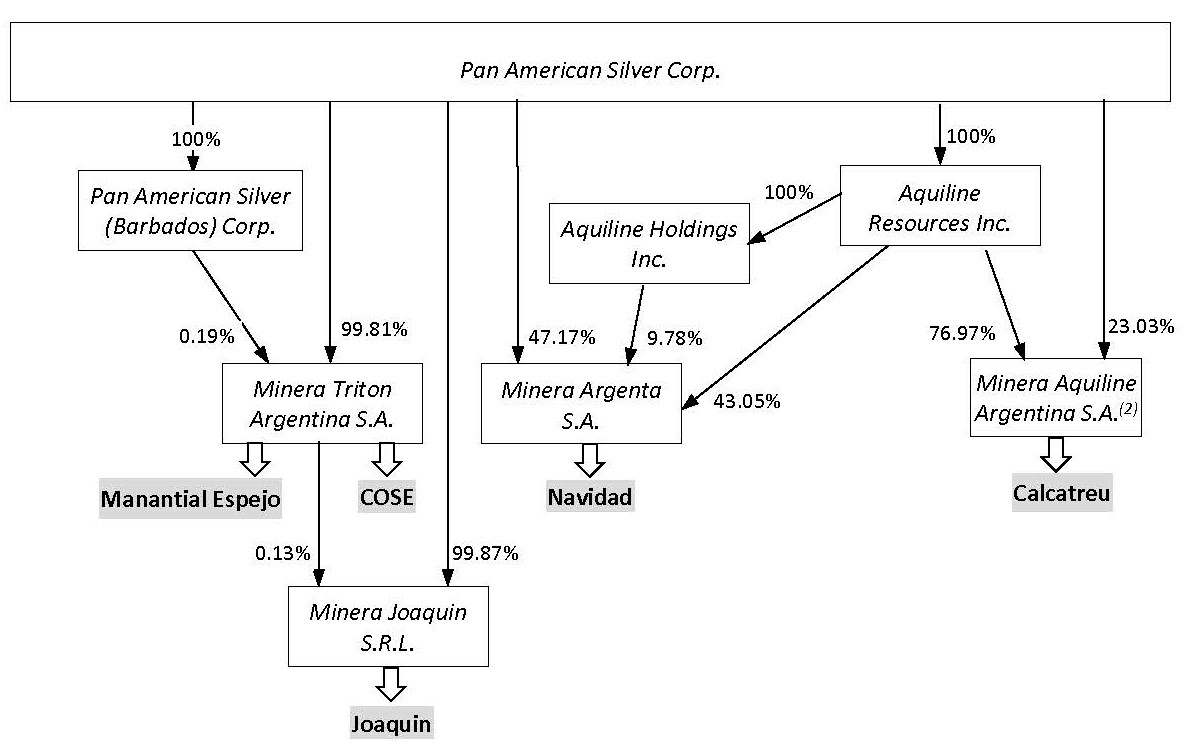

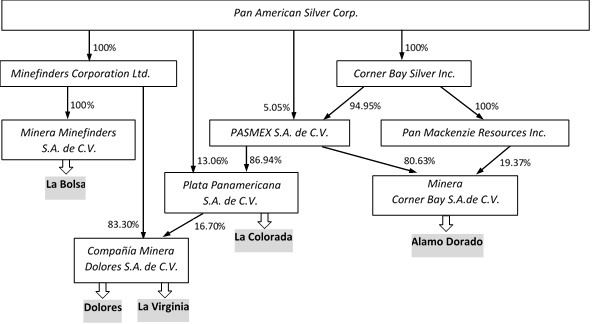

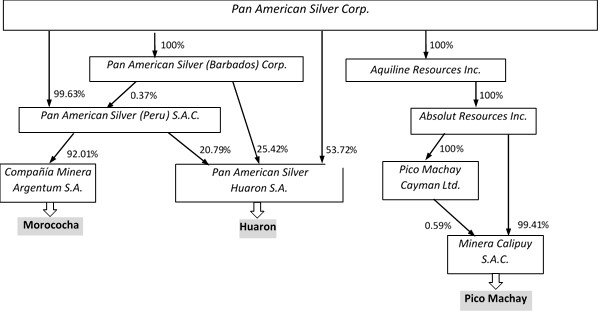

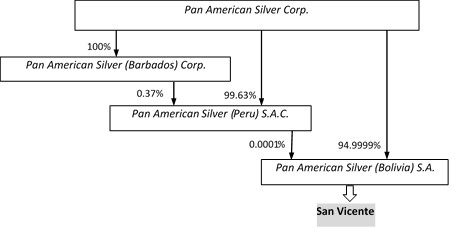

Subsidiaries

A significant portion of our business is carried on through various subsidiaries. The table below lists our significant subsidiaries and their jurisdiction of organization, and the chart following shows the structure of our organization as it relates to the country of our material mineral properties. This information is provided as at December 31, 2017.

|

| |

Name of Subsidiary | Jurisdiction |

Corner Bay Silver Inc. (“Corner Bay”) | Canada |

Aquiline Resources Inc. (“Aquiline”) | Ontario |

Minefinders Corporation Ltd. (“Minefinders”) | Ontario |

Absolut Resources Inc. | Yukon |

Pan MacKenzie Resources Inc. | Delaware |

PAS (Lux) S.á r.l.1 | Luxembourg |

Pan American Silver (Barbados) Corp. | Barbados |

Aquiline Holdings Inc. | Barbados |

PASCAP Insurance (Barbados) Ltd. (“PASCAP”)1 | Barbados |

Pico Machay Cayman Ltd. | Cayman Islands |

Minera Triton Argentina S.A. (“MTA”) | Argentina |

Minera Argenta S.A. (“MASA”) | Argentina |

Minera Joaquin S.R.L. | Argentina |

Minera Aquiline Argentina S.A.2 | Argentina |

PASMEX, S.A. de C.V. | Mexico |

Minera Corner Bay S.A. de C.V. | Mexico |

Plata Panamericana S.A. de C.V. (“Plata Panamericana”) | Mexico |

Compañía Minera Dolores, S.A. de C.V. (“CMD”) | Mexico |

Minera Minefinders S.A. de C.V. | Mexico |

Pan American Silver (Peru) S.A.C. (“Pan American Peru”) | Peru |

Pan American Silver Huaron S.A. (“PAS Huaron”) | Peru |

Compañía Minera Argentum S.A. (“Argentum”) | Peru |

Minera Calipuy S.A.C. | Peru |

Pan American Silver (Bolivia) S.A. (“PASB”) | Bolivia |

Note:

PAS (Lux) S.á r.l. and PASCAP are 100% owned by Pan American, but do not appear on the following organization charts.

| |

2 | Minera Aquiline Argentina S.A., holder of the Calcatreu project, was sold to a subsidiary of Patagonia Gold Plc subsequent to December 31, 2017. |

Corporate Organization by Material Mineral Property Location

The following charts depict the corporate organizational structure of our significant subsidiaries as they relate to the country of our material mineral properties as at December 31, 2017, and identifies the main property asset interests held by the respective entities1.

Argentina Properties

Mexico Properties

Peru Properties

Bolivia Properties

Note:

In some jurisdictions in which we operate, laws require that a company operating mineral properties must have more than one shareholder. For those jurisdictions, a nominal interest may be held by an individual or other affiliated entity and this may not be represented on the charts. Percentages shown indicate ownership of common shares and other voting interests and do not include holdings of investment shares in Peru or other non-voting shares. Percentages are rounded (in most cases, to a maximum of two decimal places).

| |

2 | Minera Aquiline Argentina S.A., holder of the Calcatreu project, was sold to a subsidiary of Patagonia Gold Plc subsequent to December 31, 2017. |

GENERAL DEVELOPMENT OF THE BUSINESS

Business of Pan American

We are principally engaged in the operation and development of, and exploration for, silver producing properties and assets. Our principal product is silver, although we also produce and sell gold, zinc, lead, and copper. At present, we carry on mining operations and are developing mining projects in Mexico, Peru, Argentina and Bolivia, and have control over non-producing silver assets in each of those jurisdictions and in the United States. Exploration work is carried out in all of those countries, as well as elsewhere throughout the world. The following map depicts the location of our operating mines and certain of our exploration projects.

Corporate Strategy and Objectives

Our mission is to be the world’s preeminent silver producer with a reputation for excellence in discovery, engineering, innovation and sustainable development. We will continue to strengthen our position as one of the world’s leading primary silver mining companies by acquiring or discovering silver resources that have the potential to be developed economically and to add meaningfully to our production profile while lowering consolidated unit costs of production.

The key objectives of our strategy are to:

|

| |

Strategy Objective | Implementation |

Increase production | After acquiring our first operating mine (Quiruvilca in Peru) in 1995, we have increased annual silver production almost every year. We also increased gold production to a record high 183,900 ounces in 2016. This long-term growth has been accomplished through a combination of acquisition, development and expansion efforts. In 2018, Pan American expects to produce between 25.0 and 26.5 million ounces of silver and between 175,000 and 185,000 ounces of gold. |

Increase mineral reserves and mineral resources | Historically, we have achieved annual increases in our mineral reserves and mineral resources through exploration and acquisitions. In 2017, we added about 33.2 million ounces of new silver mineral reserves, more than replacing the 30.6 million ounces depleted through mining. Pan American’s history of replacing silver ounces mined reflects our ability to invest in mine and near-mine exploration programs throughout the silver price cycle and the exploration potential of our asset portfolio. At December 31, 2017, our proven and probable silver and gold mineral reserves were approximately 288.4 million and 1.9 million ounces, respectively, up from the 285.8 million ounces of silver and slightly down from the 2.0 million ounces of gold at the end of 2016. Our measured and indicated mineral resources were approximately 686.2 million ounces of silver and 519.6 thousand ounces of gold as at the end of 2017. Please refer to the complete mineral resource and mineral reserve information under each of our material properties contained in this AIF, and to the “Reserves & Resources” page of our website at www.panamericansilver.com for additional information. |

Continue to be a “Low Cost Producer” | Full year 2017 consolidated cash costs1 to produce an ounce of silver were $4.55, net of by-product credits, which was 28% lower than 2016 cash costs. AISCSOS1 for the full year 2017 was $10.79, slightly higher than the full year 2016 AISCSOS of $10.17. Our strategy continues to emphasize maintaining low overall unit production costs. For the full year 2018, consolidated cash costs are forecast to be between $3.60 and $4.60 per ounce of silver, net of by-product credits, while AISCSOS is expected to be between $9.30 and $10.80. |

Acquire additional silver properties | We actively investigate and evaluate strategic opportunities to acquire promising silver production, development and exploration properties in those jurisdictions where we are presently active as well as elsewhere throughout the world. This includes our acquisition of the Joaquin and COSE projects in 2017, our acquisition of the Dolores mine and the La Bolsa property by virtue of acquiring Minefinders in 2012, and the acquisition of the Navidad property pursuant to our acquisition of Aquiline in 2010. |

Maintain strong financial performance from mining operations | In an effort to ensure we continue to have a strong and prosperous business, financial performance is monitored against targets for operating earnings and cash flow from operations, as well as against operating measures such as production and cash costs. |

Continue to be a responsible company, committed to sustainable development | We are committed to operating our business in accordance with the highest standards of governance and ethics, and the principles of sustainable development. We also place a high priority and particular emphasis on the health and safety of our personnel. We have operations in a number of countries and across diverse cultures that have the potential to both positively and negatively impact their host communities and nearby populations. Our goal is to minimize the negative impacts and maximize the benefits garnered to local populations, while at the same time achieving success from a business perspective. We conscientiously strive to operate within a framework of moral principles and values and to engage and interact regularly, and in an open and honest way, with governments, shareholders, employees, local communities, business partners and other stakeholders affected by our operations. We have initiated the implementation of the Mining Association of Canada’s (“MAC”) “Towards Sustainable Mining” ("TSM"), a three-year project designed to enhance our community engagement processes, drive industry-leading environmental practices and reinforce our commitment to the safety and health of our employees and surrounding communities. We have adopted, among other things, a Global Code of Ethical Conduct and a Global Anti-Corruption Policy, an Environmental Policy and a Corporate Social Responsibility Policy, that formalize how we must conduct our business and interact with stakeholders and others. We are aware that our business is in many ways dependent on these various stakeholders and we view establishing relationships of mutual trust and respect as important. By building such relationships and conducting ourselves in a transparent manner, we can further the exchange of information, address specific concerns of stakeholders and work cooperatively and effectively towards achieving mutual goals. We report annually on our sustainable development performance according to the Global Reporting Initiative Framework, with the current report available on Pan American’s website. |

Note:

| |

1 | Cash costs and AISCSOS are non-GAAP measures and do not have standardized meanings prescribed by IFRS. For additional information, please see “Non-GAAP Measures” on page 2 of this AIF. |

Key Developments Over the Last Three Financial Years

|

| |

Year | Key Developments |

2015 | • Achieved record annual silver production of just over 26.1 million ounces and increased gold production to 183,700 ounces. La Colorada was our largest silver producer at approximately 5.3 million ounces for the year. Dolores was our second largest silver producer with 4.3 million ounces of silver. • Established a $300 million revolving credit facility in the second quarter of 2015. • Paid total cash dividends of $41.7 million on our Common Shares. • Spent $10.9 million on mine-site exploration and completed over 105 kilometres of diamond drilling. • Announced that we would proceed with the Dolores expansion project and made a number of advances throughout the year, including on the underground ramp and power line construction. We also continued the La Colorada expansion activities, with the shaft 50% complete by year-end, and the new sulphide processing plant approximately 70% complete. • Spent approximately $76.1 million in long-term project capital to advance the La Colorada and Dolores mine expansions. |

2016 | • Produced 25.4 million ounces of silver and achieved record annual gold production of 183,900 ounces. La Colorada was our largest silver producer at approximately 5.8 million ounces for the year, followed by San Vicente with 4.4 million ounces of silver. • Completed the divestiture of 13 non-core royalties, streams and payment agreements to Maverix Metals Inc. (“Maverix”) in exchange for shares and warrants in Maverix (the “Maverix Transaction”). • Commissioned the new Beaty Cimarron mine shaft and sulphide plant at La Colorada, and made significant advancements at the Dolores mine expansion project. • Sold 75% of our interest in the Shalipayco project in Peru to Votorantim Metais – Cajamarquilla S.A. for $15 million cash, a free carried interest of our remaining 25% to commercial production, and a one percent (1%) net smelter returns (“NSR”) royalty (which we subsequently sold to Maverix). |

2017 | • Produced 25.0 million ounces of silver and 160,000 ounces of gold. La Colorada was our largest silver producer at approximately 7.1 million ounces for the year, followed by Dolores with 4.2 million ounces of silver. Dolores also produced 103,000 ounces of gold. • Completed the acquisition of the Joaquin and COSE projects in Santa Cruz, Argentina. These projects will utilize the processing facilities of Manantial Espejo, and both are currently expected to begin production in 2019. • Construction of the La Colorada mine expansion was completed. Full design processing rates of 1,800 tonnes per day were achieved in mid-2017, about six months ahead of schedule. Average throughput exceeded design rates by about 5% during the last six months of 2017. • Construction of the Dolores pulp agglomeration plant was completed and commissioning commenced. Heap leach pad stacking rates achieved 97% of the expanded capacity of 20,000 tonnes per day during the last four months of 2017. • Acquired an approximate 12% interest in New Pacific Metals Corp. (approximately 16% fully diluted), providing exposure to the Silver Sand project in Bolivia. • Final production from Alamo Dorado occurred in 2017 and mining activities concluded. The mine transitioned into the reclamation phase. |

Outlook for 2018

In 2018, Pan American expects to produce between 25.0 and 26.5 million ounces of silver at consolidated cash costs of between $3.60 and $4.60 per ounce of silver, net of by-product credits. In addition, we expect to produce between 175,000 and 185,000 ounces of gold. Consolidated AISCSOS are expected to be between $9.30 and $10.80 for 2018. The Company has assumed prices of Ag $16.50/oz, Au $1,250/oz, Zn $3,100/tonne, Pb $2,350/tonne and Cu $6,500/tonne in the calculation of the forecast 2018 cash costs and AISCSOS.

Pan American's 2018 capital budget is targeting a total spend of $150 to $155 million, comprised of $100 to $105 million in sustaining capital and approximately $50 million in project capital. We anticipate spending approximately $21 million on near-mine and regional exploration in 2018, drilling a total of approximately 115,000 metres.

In the first half of 2017, Pan American completed the acquisition of the Joaquin and COSE properties in Santa Cruz, Argentina. At Joaquin, we completed an exploration drill program and engineering analysis, and in December 2017, approved a $37.8 million capital investment to construct an underground mine to exploit the La Morocha deposit and truck the ore to the Manantial Espejo plant for processing. In 2018, we plan to obtain the necessary exploitation permits, construct surface facilities and acquire mining equipment, and start developing the access decline. We are also proceeding with a $23.9 million capital investment at the COSE property (excluding the final $7.5 million project acquisition payment due on the earlier of May 31, 2018, or the commencement of commercial production) to develop an underground mine. Development of the decline was started in the fourth quarter of 2017 and mining equipment, surface infrastructure and development permits are in place. During 2018, the Company plans to continue to develop the decline and obtain the exploitation permits. Production from COSE and Joaquin is expected to commence in 2019 with a life of mine of approximately 18 months for COSE and approximately three years for Joaquin.

Cash costs and AISCSOS are non-GAAP measures and do not have standardized meanings prescribed by Canadian accounting standards. For additional information, please see “Non-GAAP Measures” on page 2 of this AIF.

NARRATIVE DESCRIPTION OF THE BUSINESS

Principal Products and Operations

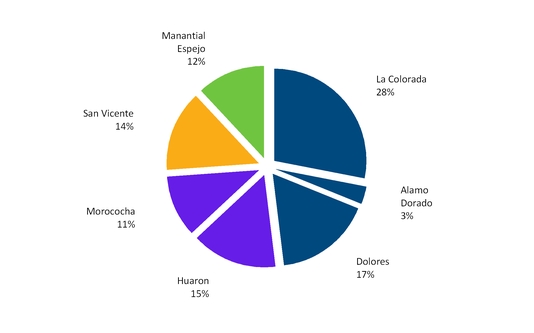

Our principal products and sources of sales are silver and gold doré and silver bearing zinc, lead, and copper concentrates. In 2017, the La Colorada, Dolores, Alamo Dorado, Huaron, Morococha, Manantial Espejo and San Vicente mines accounted for all of our production of concentrates and doré.

Consolidated production for the year ended December 31, 2017 was as follows:

|

| | | | | | | | |

| La Colorada | Dolores | Alamo Dorado | Huaron | Morococha1 | San Vicente2 | Manantial Espejo | Total3 |

Tonnes Milled4 | 655,000 | 6,605,000 | 452,000 | 928,000 | 677,000 | 328,000 | 793,000 | 10,438,000 |

Grade | | | | | | | | |

Silver - g/t | 368 | 38 | 43 | 146 | 137 | 374 | 134 | |

Gold - g/t | 0.32 | 0.66 | 0.17 | 0.23 | 0.28 | | 1.88 | |

Zinc % | 2.81 | | | 2.70 | 3.01 | 1.94 | | |

Lead % | 1.54 | | | 1.23 | 0.78 | 0.29 | | |

Copper % | | | | 0.84 | 1.20 | 0.43 | | |

Production | | | | | | | | |

Ounces Silver4 | 7,056,000 | 4,232,000 | 641,000 | 3,684,000 | 2,634,000 | 3,610,000 | 3,123,000 | 24,979,000 |

Ounces Gold5 | 4,290 | 103,020 | 2,120 | 1,150 | 3,530 | 510 | 45,340 | 159,960 |

Tonnes Zinc5 | 15,440 | | | 19,370 | 16,130 | 4,360 | | 55,300 |

Tonnes Lead5 | 8,800 | | | 8,770 | 3,460 | 470 | | 21,510 |

Tonnes Copper5 | | | 10 | 6,090 | 6,640 | 630 | | 13,380 |

___________

Notes:

1 Morococha data represents our 92.3% interest in mine production based on ownership of the operating entity.

2 San Vicente data represents our 95% interest in mine production based on ownership of the operating entity.

3 Totals may not add due to rounding.

4 Rounded to the nearest thousand.

5 Rounded to the nearest ten.

Our approximate revenue by product category for the financial years ended December 31, 2017 and December 31, 2016 was as follows:

|

| | |

Product Revenue | 2017 | 2016 |

| ($000’s) | ($000’s) |

Silver and Gold Doré | 345,756 | 399,339 |

Zinc Concentrate | 140,315 | 93,237 |

Lead Concentrate | 161,981 | 125,123 |

Copper Concentrate | 114,564 | 95,123 |

Silver Concentrate1 | 54,212 | 61,953 |

Total | 816,828 | 774,775 |

___________

Notes:

| |

1 | Silver concentrate was included in the lead and copper concentrates in the 2016 and 2017 condensed interim consolidated financial statements, and in the annual financial statements and annual information form for the year ended December 31, 2016. |

Additional segmented information is set forth in Note 26 to Pan American’s Audited Consolidated Financial Statements for the year ended December 31, 2017, and further information on individual mine performance and other metrics is presented in the 2017 MD&A under the heading “2017 Operating Performance”.

Silver and Gold Doré

Our principal buyers of silver and gold doré produced from our La Colorada, Dolores, Alamo Dorado, and Manantial Espejo mines, once refined, are international bullion banks and traders, except for the gold produced from La Colorada, which is sold to Maverix pursuant to the Maverix Gold Stream as discussed on page 22 herein. Silver and gold doré is delivered to refineries in Mexico, Germany, and the United States, and subsequently transferred to the accounts of our buyers.

Zinc, Lead, Copper and Silver Concentrates

We have contracts with a number of smelters and traders in connection with the metals produced by our operations.

Our principal markets for copper concentrates produced from Morococha and Huaron, as well as a unique copper precipitant product from Alamo Dorado, are Canada, Chile, and China. Copper concentrates are delivered to customers first via truck to seaports, and from there by ship.

Our principal markets for zinc concentrates produced from La Colorada, Morococha, Huaron, and San Vicente are Peru, South Korea, Mexico, and Japan. Zinc concentrates are delivered to Peruvian and Mexican customers by truck. Zinc concentrates are delivered to customers in South Korea and Japan first via truck, or truck and train, to seaports, and from there by ship.

Our principal markets for lead concentrates produced from La Colorada, Morococha, and Huaron are Japan, South Korea, China, and Belgium. Lead concentrates are delivered first via truck to seaports and from there by ship.

Our principal markets for silver concentrates produced from San Vicente are Japan, South Korea, China, and Belgium. Silver concentrates are delivered first via truck to seaports and from there by ship.

Employees and Contractors

At the end of 2017, we had approximately 4,360 employees and just over 3,270 contractors. The majority of those employees and contractors were working at our operations in South America and in Mexico. Pan American also had 44 employees and 1 contractor at our head office in Vancouver as at December 31, 2017. Our Peruvian operations had just over 2,900 total employees and contractors, while our Bolivian operations had almost 630 employees and

contractors, our Argentinean operations had approximately 630 employees and contractors. Our Mexican operations had the largest workforce with over 3,400 employees and contractors.

Research and Development

While we conduct feasibility work and operational enhancement evaluations in order to improve production processes and exploration and mining operations, we do not, in the normal course, embark on any research and development activities in relation to products or services. Costs associated with this work would usually be expensed as incurred. As such, we did not incur any significant research and development costs during 2015, 2016 or 2017.

Working Capital and Liquidity Position

As at December 31, 2017, we had cash and cash equivalents and short-term investment balances of $227.5 million and working capital of $410.8 million, and our total debt outstanding at the end of 2017 was $10.6 million.

On April 15, 2015, we entered into a senior secured revolving credit facility (the "Facility") with a syndicate of eight lenders. The Facility is a USD$300 million secured revolving line of credit available for general corporate purposes, including acquisitions, and originally had a 4-year term. In 2016, we amended the Facility to extend the term by an additional year. The terms of the Facility provide the Company with the flexibility of various borrowing and letter of credit options. With respect to loans drawn based on the average annual rate of interest at which major banks in the London interbank market are offering deposits in US dollars ("LIBOR"), the interest margin on such loan is between 2.125% and 3.125% over LIBOR, depending on the Company's leverage ratio at the time of a specified reporting period. As of December 31, 2017, no amounts were outstanding under the Facility.

Our financial position at December 31, 2017, and the operating cash flows that are expected over the next twelve months lead management to believe that our liquid assets are sufficient to satisfy our 2018 working capital requirements, fund currently planned capital expenditures (including both sustaining and project capital) for existing operations, and to discharge liabilities as they come due. We also remain well positioned to take advantage of further strategic opportunities as they become available.

Environment, Community and Sustainability

All phases of our operations are subject to environmental regulation in the various jurisdictions in which we operate. To the best of management’s knowledge, our activities in 2017 were, and continue to be, in compliance in all material respects with such environmental regulations applicable to our mining operations, development, and exploration activities. We have implemented an environmental policy, a corporate social responsibility policy, and a health and safety policy in which we accept our corporate responsibility to practice environmental stewardship, community engagement and development, and provide a safe and healthy workplace for our employees. We also commit to complying with all relevant industry standards, legislation and regulations in the countries where we carry on business and have begun implementation of the best practice TSM program at all our operations.

During 2017, reviews of the environmental and social performance of all our operations were led by Pan American’s Vice President, Environment and Sustainability. The reviews included inspections of our mine sites and surrounding areas with key operations personnel, review of monitoring programs and operating procedures and evaluation of the principal environmental and social issues related to each of these operations. The key observations and recommendations from the reviews are reported monthly to senior management and quarterly to the Board of Directors of Pan American (the “Board of Directors”) and its Health, Safety, Environment and Communities Committee (the “HSEC Committee”). In addition to the periodic reviews, detailed Corporate Environmental Audits and Social Reviews are conducted at each mine at least once every two years, in accordance with the charter of the HSEC Committee. These audits review environmental compliance and implementation of best practice procedures and management systems. During 2016, audits were undertaken at the Morococha, San Vicente, and Huaron mines, and in 2017, the La Colorada, Dolores, and Manantial Espejo mines were audited. In intervening years between audits, the implementation of the corrective actions required by each audit is checked. The Morococha, San Vicente and Huaron mines’ corrective actions were found to be satisfactory in 2016. Social reviews were completed at the Huaron, Morococha, and San Vicente mines in 2017 and no material issues were identified.

Our Huaron, Morococha, La Colorada, Alamo Dorado, Dolores, and San Vicente operations were all inspected by government agencies in 2017 and no material environmental issues were recorded as a result of these inspections.

The Peruvian government modified its receiving water quality limits in December 2015. The new limits remove a controversial sulphate limit which was previously proposed, bringing the limits in line with current international standards and significantly reducing potential cost impacts to our Peruvian operations. We continue to comply with a modified “Adaptation Plan” process to ensure any discharges at our Peruvian operations remain in compliance with the water quality limits. We do not expect that any future water treatment upgrades necessary to meet the limits will have a material impact on either of our Peruvian mines.

We completed our comprehensive Sustainability Report for 2016 in accordance with the Global Reporting Initiative G4 guidelines and improved our disclosure and report quality. The report includes detailed information on our environmental, social, economic, and health and safety performance. The complete Sustainability Report is available on our website at www.panamericansilver.com.

In the financial year-end dated December 31, 2017, our environmental expenditures for concurrent reclamation were approximately $8.7 million. The closure and decommissioning liabilities were prepared using the standard reclamation cost estimator methodology developed in the State of Nevada, USA, using quantity estimates and cost data obtained at each mine site. We currently estimate the aggregate present value of expenditures required for closure and reclamation costs in respect of the Huaron, Morococha, Alamo Dorado, La Colorada, Dolores, Manantial Espejo, and San Vicente mines, along with our development properties, to be approximately $65.4 million.

Other than specific environmental and social concerns discussed in more detail elsewhere in this AIF, we are not aware of any material environment or social related matter requiring significant capital or operating outlays in the immediate future. Closure and reclamation costs and actual costs may vary, perhaps materially, from estimates and investors are cautioned against attributing undue certainty to these estimates. The reclamation and closure costs estimate for each of the operating mines and development projects was updated to reflect the conditions as of December 31, 2017.

Health and Safety

We have implemented a health and safety policy in which we accept corporate responsibility to provide a safe and healthy workplace for our employees and contractors, and commit to comply with all relevant industry standards, legislation, and regulations in the countries where we carry on business. The policy is reviewed annually to ensure that we remain current, if not ahead, of industry standards and best practices.

Periodically, both formal and informal corporate health and safety audits are conducted at our operating mines and active development properties. In 2017, six of our operating mines were subject to internal safety audits conducted by a team of safety managers and operations supervisors from some of our other operations and led by Pan American’s Director of Health and Safety. Management reports health and safety findings and mitigation progress to our Board of Directors on a regular basis.

During 2017, we continued to focus on introducing new safety programs and training at our operating mines, as well as maintaining excellent safety records at our development projects. The total hours worked at operating mines and active development and exploration projects was 18.3 million, higher than the 17.5 million hours worked during 2016 due to increased hours worked on the Dolores expansion projects, only partially offset by fewer hours worked at La Colorada following the completion of the expansion projects there. The number of lost time injuries (“LTIs”) increased to 23, which resulted in a lost time injury frequency (“LTIF”) of 1.26 during 2017, compared to 0.74 during 2016 and 1.09 during 2015. LTIF is calculated as follows:

|

| | |

| | (# of accidents) * (1,000,000)

Total hours worked |

LTIF | = |

| | |

During 2017, the Company continued efforts on mine safety and continued with the implementation of a fatal accident reduction initiative to bolster existing programs and to create even greater awareness amongst our personnel in order to significantly reduce the occurrences of unpredictable events that are often at the root of serious incidents. Unfortunately, despite these efforts, there was a fatality at our San Vicente mine and at our La Colorada mine during the year.

In 2005, we introduced the “Chairman’s Safety Award” which is presented to our mine with the best overall safety performance. In 2017, our Dolores mine in Mexico, our Manantial Espejo mine in Argentina, and our Huaron mine in Peru each had excellent safety records. The winner of the Chairman’s Safety Award for 2017 was not yet determined as at the date of this AIF.

Operating and Development Properties

Pursuant to National Instrument 51-102 – Continuous Disclosure Obligations, (“NI 51-102”), we have identified the following properties and projects as being material: the La Colorada mine, the Dolores mine, the Huaron mine, the Morococha mine, the San Vicente mine, and the Manantial Espejo mine. We have also identified the Navidad property and Joaquin property as material properties for 2017. We do not consider any of our other development or investment properties to be material properties for the purposes of NI 51-102.

Certain statements in the following property summaries are based on and, in some cases, extracted directly from the relevant Technical Reports identified under the heading “Scientific and Technical Information” beginning on page 6.

Mineral Reserve and Mineral Resource Estimate Information

The process for estimating mineral reserves and mineral resources at our properties is described below in each property section. Although we believe that our mineral reserve and mineral resource estimates will not be materially impacted by external factors such as metallurgical, safety, environmental, permitting, legal, taxation, and other factors disclosed in this AIF, there can be no assurance that these factors will not have an impact. There are numerous uncertainties inherent in estimating mineral reserves and mineral resources. The accuracy of any mineral reserve and mineral resource estimate is the function of the quality and quantity of available data and of engineering and geological interpretation and judgment. Results from drilling, testing, and production, as well as a material change in metal prices or a change in the planned mining method, subsequent to the date of the estimate, may justify revision of such estimates and may differ, perhaps materially, and investors are cautioned against attributing undue certainty to mineral reserves and mineral resources.

I. Operating Properties

A. Mexico

(i) La Colorada Mine

Project Description, Location, and Access

The La Colorada underground silver mine is located in the Chalchihuites district in Zacatecas State, Mexico, approximately 99 kilometres south of the city of Durango and 156 kilometres northwest of the city of Zacatecas. The La Colorada mine is accessed primarily from the cities of Durango and Zacatecas by paved highway and all weather gravel roads.

Our wholly-owned subsidiary, Plata Panamericana, owns and operates the mine. The La Colorada property, including certain exploration concessions outside the mining area, is comprised of 56 mining claims totalling approximately 8,395 hectares. We pay an annual fee to maintain the claims in good standing, and to our knowledge, we have met all of the necessary obligations to retain the property.

We have control over approximately 1,119 hectares of surface rights covering the main workings. All of the La Colorada mineral reserves and mineral resources and all of the known mineralized zones, mine workings, the processing plant, effluent management and treatment systems, and tailings disposal areas are located within the mining claims controlled by us.

In 2016, as part of the Maverix Transaction, Maverix acquired a gold stream equivalent of one hundred percent (100%) of the payable gold production from the La Colorada mine, less a fixed price of USD$650 per ounce for the life of the mine (the “Maverix Gold Stream”). In 2017, the Maverix Gold Stream resulted in Maverix acquiring 2,347 ounces of gold.

To the best of our knowledge, La Colorada is not subject to any other royalties, overrides, back-in rights, payments, or other agreements and encumbrances, other than governmental taxes, fees and duties. The Company’s Mexican

operations are subject to governmental taxes, fees and duties, including: (i) a special mining duty (“SMD”) of 7.5% applied to taxable earnings before interest, inflation, taxes, depreciation, and amortization; and (ii) a deductible extraordinary mining duty (“EMD”) of 0.5% that is applied to the sale of gold, silver, and platinum.

In late December 2016, the Zacatecas state government also enacted a new set of ecological taxes which took effect on January 1, 2017 (the “Zacatecas Tax”). The Zacatecas Tax applies broadly across a number of industries in the State of Zacatecas that involve extraction, emissions to the air, soil or water, and deposits of residue or waste. The Zacatecas Tax primarily effects the La Colorada mine in respect of the materials placed in its tailings storage facility. We paid approximately $1.0 million in respect of the Zacatecas Tax in 2017, however the validity of the Zacatecas Tax has been challenged on constitutional grounds.

While there are no known significant factors or risks that we currently anticipate will affect access or title, or the right or ability to perform work on the property, including permitting and environmental liabilities, please refer to "Risks Related to Our Business" starting on page 75 for a general discussion of the risks relating to our operations.

History

In 1925, the Dorado family operated mines at two locations on the La Colorada property. From 1929 to 1955, Candelaria y Canoas S.A., a subsidiary of Fresnillo S.A., installed a 100 tonne per day (“tpd”) flotation plant and worked the old dumps of two previous mines on the La Colorada property. From 1933 to the end of World War II, La Compañía de Industrias Peñoles also conducted mining operations on the property. From 1949 to 1993, Compañía de Minas Victoria Eugenia S.A. de C.V. operated a number of mines on the La Colorada property. In 1994, Minas La Colorada S.A. de C.V. (“MLC”) acquired the exploration and exploitation claims and surface rights of Compañía de Minas Victoria Eugenia S.A. de C.V. Until 1997, MLC conducted mining operations on three of the old mines on the La Colorada property at a rate of approximately 150 tpd.

Historically, exploration has been in the form of development drifting on the veins. Prior to our ownership, 131 diamond drill holes had been drilled. In 1997, we entered into an option agreement with MLC, during which time we conducted exploration and diamond drilling programs as part of our due diligence reviews. We acquired the La Colorada mine from MLC in April 1998 and have focussed our production on the Candelaria, Estrella, and Recompensa mines. No activity takes place at the Campaña mine.

Geological Setting, Mineralization, and Deposit Types

The La Colorada property is located on the eastern flanks of the Sierra Madre Occidental mountain range at the contact between the Lower Volcanic Complex and the Upper Volcanic Supergroup. The oldest rocks exposed in the mine area are carbonates and calcareous clastic rocks overlain by a conglomerate unit. Most of the outcrop in the mine area is altered dacite of the regional Lower Volcanic Complex. The stratigraphically highest rocks in the mine area are felsic tuffs correlated with the Upper Volcanic sequence.

Thirteen breccia pipes up to 100 metres in diameter have been identified on the property, which can extend vertically more than 400 metres below the surface. The breccias contain clasts of limestone and trachyte, often mineralized, in an altered trachyte matrix. Clasts of vein material have been found in the breccias, suggesting that the pipes postdate the vein emplacement.

East to northeast striking faults dipping mostly moderately to steeply to the south form the dominant structures in the property area and controlled the deposition of mineralization by acting as conduits for mineralizing hydrothermal fluids.

La Colorada is a typical epithermal silver-gold deposit, with a transition in the lower reaches of the deposit to a more base metal predominant system. There are three separate active mining areas on the property, including the Candelaria, Estrella, and Recompensa areas. The main structure at Candelaria strikes generally east west. The west part of the vein is referred to as HW and the east part is referred to as NC2, and there are a number of off-splits from these veins. The Estrella area includes the Amolillo vein, which is a split from the HW vein, and the Palomas vein, which is a split from Amolillo. The Recompensa zone produces or has produced from three areas: the Recompensa vein; Erika, which is a split from the Recompensa vein; and the Yuri replacement body, which lies between Erika and Recompensa.

Four dominant styles of mineralization are present at La Colorada, including breccia pipes, vein-hosted mineralization, replacement mantos within limestone, and deeper seated transitional mineralization.

Mineralization in the breccia pipes generally has lower silver values and elevated base metal values. Mineralization is associated with intense silicification and occurs as disseminated galena and sphalerite with minor chalcopyrite and bornite. Sulphides are found in the clasts and the matrix.

Most mineralized veins on the property strike east to northeast and dip moderately to steeply to the south and are generally less than two metres in width. The HW Corridor at the Candelaria mine strikes east-west and dips moderately to the south, with true widths of approximately up to 15 metres, but most of the economic mineralization is located in quartz veins, which are on average one to two metres wide. Where the veins are unoxidised, galena, sphalerite, pyrite, native silver, and silver sulphosalts are present. The major mineralized veins are strongly brecciated and locally oxidised.

Manto style mineralization is found near vein contacts where the primary host rock is limestone. This style of mineralization was previously mined at Recompensa and is also present in areas of the Candelaria zone. The mantos can form bodies up to six metres wide. The mineralogy of the mantos is characterized by galena and sphalerite with minor pyrite and chalcopyrite.

The deep seated transition mineralization, also known as NC2 Deep at the Candelaria mine, consists of both vein type mineralization and more diffuse stockwork and breccia zones.

Deep drilling has defined a restricted manto replacement body with lower silver-gold grades and higher lead zinc grades at the 1,000 metre level and remains open to depth. It is adjacent to the known vein system which continues at that depth.

The current mineral resource and mineral reserve currently comprises vein and manto hosted mineralization. The economically most important veins are the NC2 and NCPHW veins at the Candelaria mine, which together comprise 30% of the total mineral reserve ounces of silver as well as the Amolillo vein at the Estrella mine, which contains a further 30% of the total mineral reserve. The majority of the silver mineralization is found in quartz veins that range from 2.0 to 2.9 metres wide.

The NC2 vein contains approximately 13% of the mineral resource and mineral reserve ounces of silver. It is a narrow, one to seven metre wide mainly sulphide and partly oxide vein with a strike length of over 900 metres. It is open to the east where it is cut by a trachyte dyke, and has been confirmed by drilling and drifting to continue in both width and grade on the other side of the dike. We drilled a hole that intersected the vein 300 metres below the current mineral reserves and believe the down-dip exploration potential is significant. There are a number of other splits from this vein numbered NC1 to NC11 that, including NC2, contain approximately 38% of the mineral resource and mineral reserve ounces of silver.

The HW vein, also at the Candelaria mine, is a one to two metre thick vein with a strike length of over 1.1 kilometres. The HW Corridor consists of four structures. The majority of the silver mineralization is found in quartz veins which average two metres wide but can widen up to six to seven metres at the intersections with the HW vein.

At the Estrella mine, the Amolillo oxide/sulphide vein is located 500 metres north of the NC2 and HW vein complex and approximately along strike to the east of the Recompensa vein. The vein has an average width of 1.8 metres and a strike length of approximately 1,300 metres. Our drilling results indicate that the Amolillo vein could be key to a possible mine expansion. Diamond drilling has intersected the vein 300 metres below the deepest mining level, and expanded the lateral extension to the east and west by 900 metres for a total of 1,300 metres of current strike length.

The Recompensa mine contributes the fewest silver ounces to the mineral resources and mineral reserves. The main zones being exploited are the Recompensa and Erika veins and the Yuri manto replacement body located between the two veins. The Recompensa and Yuri are located more than a kilometre northwest of the NC2 and HW vein complex. The vein mineralization averages about 1.6 metres wide in the economically mineable zones, and contains a minor amount of oxide but mostly sulphide material. Erika is a hangingwall split from the Recompensa vein and is relatively narrow at an average width of 0.7 metres in the economically mined zone. It contains only sulphide material.

Exploration

Mining had taken place at La Colorada for several decades prior to any modern exploration work, which identified most of the major structures. For this reason there has been little surface sampling, geophysics, or other surveys. For the past several years we have typically drilled on the order of 25,000 - 30,000 metres each year from surface and underground.

Drilling

The mine undertakes drilling on an annual basis for mineral resource and reserve definition. The drilling database contains on the order of thousands of drillholes. All drilling at La Colorada is diamond core drilling and is performed from both surface and underground by either mine employees using a Company owned drill or by specialized drilling contractors under the supervision of the mine geology department. In the past, underground holes were drilled BQ size until 2000 when the drillhole diameter in the HW corridor was increased to HQ size to improve core recovery. From 2008 to present the surface hole size has been increased to HQ and underground holes are drilled either at HQ, NQ or BQ sizes depending on the location and/or depth of the holes.

Sampling, Analysis, and Data Verification

Channel sampling is performed in ore development areas and stopes by sampling crews under the supervision of the mine geologist. Both channel and drill core sample intervals are approximately a metre in width. There are no known drilling, sampling, or recovery issues that could materially impact the reliability of the results. Underground channel samples are brought directly to the on-site laboratory at the end of each shift. Underground drill cores are brought to the core shack, which is fenced and locked when there are no geology department employees present. Once the drillhole has been logged and sampled, the samples are transported to the on-site laboratory. We have no reason to believe that the integrity of the samples has been compromised.

We have used four commercial labs in the past for exploration assaying at La Colorada, including Bondar Clegg (Vancouver, B.C.), ALS Chemex (Vancouver, B.C.), Luismin (Durango, Mexico) and ALS Chemex de México (Guadalajara, México). All gold and silver assays by the commercial labs have been done using fire assay with either an atomic absorption (“AA”) or gravimetric finish. Base metals were assayed using acid digestion and AA determination. All samples are now prepared at the La Colorada mine laboratory, which is ISO9001:2008 certified and operated by our employees. Samples are analyzed for gold and silver using fire assay with gravimetric finish, and for lead, zinc, and copper by acid digestion followed by AA.

The mine geology department conducts a quality assurance/quality control (“QAQC”) program that is independent from the laboratory. The program includes the insertion of standards and blanks to the on-site laboratory and the submission of pulp duplicate samples to an external laboratory. The results of the QAQC samples demonstrate acceptable accuracy and precision and that no significant contamination is occurring at the mine laboratory.

Mineral Processing and Metallurgical Testing

As part of normal plant operation procedures, metallurgical analysis and testing is undertaken as required. The majority of these analyses are to assess mill performance and metallurgical recovery. Metal recovery forecasts used in our mine plans are based on the historical performance of the plant operations and the tonnes and grade of material that is planned to be mined.

Mineral Resource and Mineral Reserve Estimates

Management estimates that mineral reserves at La Colorada, as at December 31, 2017, are as follows:

|

| | | | | |

La Colorada Mineral Reserves 1, 2, 3 |

Reserve Category |

Tonnes (Mt) | Grams of Silver per tonne | Grams of Gold per tonne | % Zinc | % Lead |

Proven | 3.7 | 413 | 0.33 | 2.97 | 1.65 |

Probable | 4.1 | 378 | 0.31 | 2.14 | 1.23 |

TOTAL | 7.7 | 395 | 0.32 | 2.54 | 1.43 |

Notes:

| |

1 | Estimated using a price of $18.50 per ounce of silver, $1,300 per ounce of gold, $2,600 per tonne of zinc and $2,200 per tonne of lead. Totals may not add due to rounding. |

| |

2 | Mineral reserve estimates for La Colorada have been prepared under the supervision or were reviewed by Christopher Emerson, FAusIMM, and Martin Wafforn, P. Eng., as Qualified Persons as that term is defined in NI 43-101. |

| |

3 | Lead and zinc grades shown are the average for the deposit. However, the base metals are only payable in the concentrates produced from the sulphide ores and not in the doré produced from the oxide ores. |

Management estimates that mineral resources at La Colorada, as at December 31, 2017, are as follows:

|

| | | | | |

La Colorada Mineral Resources 1, 2, 3 |

Resource Category |

Tonnes (Mt) | Grams of Silver per tonne | Grams of Gold per tonne | % Zinc | % Lead |

Measured | 0.5 | 220 | 0.22 | 1.04 | 0.74 |

Indicated | 1.8 | 221 | 0.19 | 0.66 | 0.39 |

Inferred | 3.7 | 247 | 0.25 | 3.39 | 2.11 |

Notes:

| |

1 | These mineral resources are in addition to mineral reserves. Estimated using a price of $18.50 per ounce of silver, $1,300 per ounce of gold, $2,600 per tonne of zinc and $2,200 per tonne of lead. |

| |

2 | Mineral resource estimates for La Colorada have been prepared under the supervision, or were reviewed by Christopher Emerson, FAusIMM, and Martin Wafforn, P. Eng., as Qualified Persons, as that term is defined in NI 43-101. |

| |

3 | Lead and zinc grades shown are the average for the deposit. However, the base metals are only payable in the concentrates produced from the sulphide ores and not in the doré produced from the oxide ores. |

Mineral resources are estimated using a polygonal method based on the data collected from both diamond drilling and underground channel samples. A long section is produced of each structure and then divided into mineable blocks. The volume of the block is estimated from the average width of the vein or mineralization intersection of each drillhole or channel located within a 30 metre radius of the mining block. The grade of each block is estimated using inverse distance squared from the centre of the block by the length weighted average of the grade of the vein or mineralization of each intersection within a 30 metre radius of the block. The samples are assessed and treated for extreme sample grades prior to averaging. Average bulk density values from samples selected from spatially and geologically representative locations are applied to each mining block volume to estimate the tonnes of each block. The data is processed using Excel software for each structure, then combined to arrive at the total tonnes and grade of the mineral resource estimate. The mineral resource estimates are updated annually with new information and updated geological interpretations and depleted annually for mining in the previous year.

Planned dilution is applied to each intersection to achieve a minimum mining width and to account for backfill, some of which is mucked each lift during the cut and fill stoping. Additional unplanned dilution is also applied in order to correlate with the reconciliation between the mineral reserve and the plant results. Mining recovery is estimated depending on vein width and based on experience and observation at each mining area. A value per tonne is calculated in each block considering the value paid for each metal, the expected metallurgical recovery of each metal to concentrate or to doré, and costs including insurance, penalties, refining, and transport.

Mineral resource confidence classifications are based on the proximity and density of sample information in each block, as well as the interpretation and the experience of the mine geologist. Mineral resources are then converted to mineral reserves depending on the resource classification and whether they can be economically mined.