N-CSR

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file Number: 811-04338

EAGLE CAPITAL APPRECIATION FUND

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St.

Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 567-8143

SUSAN L. WALZER, PRINCIPAL EXECUTIVE OFFICER

880 Carillon Parkway

St.

Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

KATHY KRESCH INGBER,

ESQ.

K&L Gates, LLP

1601

K Street, NW

Washington, D.C. 20006

Date of

fiscal year end: October 31

Date of reporting period: October 31, 2013

Item 1. Reports to Shareholders

|

|

|

|

|

|

|

|

|

|

|

Annual

Report and Investment

Performance Review for the fiscal year

ended October 31, 2013 Eagle Capital Appreciation Fund Eagle Growth & Income Fund Eagle International Stock Fund Eagle Investment Grade Bond Fund Eagle Mid Cap Growth Fund Eagle Mid Cap Stock Fund Eagle Small Cap Growth Fund Eagle Small Cap Stock Fund Eagle Smaller Company Fund

Privacy Notice Eagle Family of Funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Go Paperless with eDelivery |

|

visit eagleasset.com/eDelivery |

|

For more information, see inside. |

|

|

Table of Contents

Visit eagleasset.com/eDelivery to receive

shareholder communications including prospectuses and fund reports with a service that helps protect the environment:

Environmentally friendly. Go green with eDelivery by reducing the number of trees used to produce paper.

Efficient. Stop waiting on regular mail. Your documents will be sent via email as soon as they are

available.

Easy. Download and save files using your home computer with a few clicks of a mouse.

President’s Letter

Dear Fellow Shareholders:

I am pleased to present the annual report and investment-performance review of the Eagle Family of Funds for the fiscal year that ended October 31, 2013 (the

“reporting period”).

The equity market has mostly gone up—“climbing the wall of worry” is how many of the funds’ Portfolio

Managers have described it—over the last year. And it did so in the face of New Year sequestration and tax-law changes, ongoing strife in the Middle East, continued economic malaise in the Eurozone, slowing growth in China and U.S. political

theater (e.g., a partial government shutdown and debates over the nation’s debt ceiling). Perhaps the market knew what many of our portfolio managers identified: the U.S. economy is growing, albeit slowly, and the fundamentals of many companies

are as strong as they’ve ever been.

On the fixed-income side, the U.S. Federal Reserve kept its overnight interest rate near 0% but not without

some drama this summer when there were hints that the Fed was thinking about starting to taper its third round of quantitative easing (often called QE3). The specter of rising interest rates was enough to roil bond markets, which recovered somewhat

after Reserve Chairman Ben Bernanke said the Fed was standing pat. The market also reacted favorably to the nomination of Janet Yellen to take the reins when Bernanke steps down early next year.

Our managers at Eagle are aware of headlines but one of the hallmarks of Eagle over its more than 35 years has been the research our managers do in constructing

portfolios. They strive to avoid getting caught up in today’s headlines and instead focus on finding individual companies they believe will help their funds meet their investment objectives.

I hope you will read the commentaries that follow in which our Portfolio Managers discuss their specific funds.

Here are just a few highlights from this year:

| • |

|

The Eagle Growth & Income Fund finished the period with a five- and 10-year four-star rating1,2 from

Morningstar®. |

| • |

|

A new Eagle-affiliated investment team assumed management of the Eagle Capital Appreciation Fund after the market closed on June 28. The new managers are

David Pavan, CFA®; Frank Feng, Ph.D.; Ed Wagner, CFA®; and Stacey Nutt, Ph.D., of ClariVest Asset Management LLC. |

| • |

|

Eagle opened two new funds, under the management of well-seasoned teams, this year: |

| |

¡

|

|

The Eagle Small Cap Stock Fund is run by Co-Portfolio Managers Charles Schwartz, CFA®; Betsy Pecor,

CFA®; and Matthew McGeary, CFA®, as well as Research Analyst Matthew Spitznagle,

CFA®. They also manage the Eagle Mid Cap Stock Fund. |

| |

¡

|

|

The Eagle International Stock Fund is run by a team of investment professionals at Eagle affiliate ClariVest Asset Management LLC. The team consists of David

Vaughn, CFA®, Co-Portfolio Manager; Stacey Nutt, Ph.D., Co-Portfolio Manager; and Alex Turner, CFA®, Assistant Portfolio Manager. |

| • |

|

High-profile media outlets continue to seek Eagle managers for input on current events and investing themes. James Camp, CFA®, who heads the Investment Grade Bond Fund, has been on CNBC many times. The Wall Street Journal and Barron’s have quoted

Charles Schwartz, CFA®, and Matthew McGeary, CFA®, who are among the managers of the Eagle Mid Cap Stock Fund and the Eagle Small Cap Stock Fund. |

I would like to remind you that investing in any mutual fund carries certain risks. The principal risk factors for each fund are described at the end of this

report. Carefully consider the investment objectives, risks, charges and expenses of any fund before you invest. Contact us at 800.421.4184 or eagleasset.com or your financial advisor for a prospectus, which contains this and other important

information about the Eagle Family of Funds. Read the prospectus carefully before you invest or send money.

We are grateful for your continued

support of and confidence in the Eagle Family of Funds.

Sincerely,

Richard J. Rossi

President

December 19, 2013

1 For the period ended October 31, 2013, the Eagle Growth & Income Fund’s Class A shares are rated 4 stars for the 10-year period; 4 stars for the

five-year period; 3 stars for the overall; and 2 stars for the three-year period among a total of 605, 922, 1,036 and 1,036 funds respectively, in the large-cap value category. Star ratings may be different for other share classes. Morningstar

Rating® is based on risk-adjusted performance adjusted for fees and loads. Past performance is no guarantee of future results. Ratings are subject to change each month.

2 Performance data

represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the

performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

* The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and

(3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Funds with at least three years of performance history

are assigned ratings from the fund’s three-, five- and 10-year average annual returns (when available) and a risk factor that reflects fund performance relative to three-month Treasury bill monthly returns. Funds returns are adjusted for fees

and sales loads. Ten percent of the funds in an investment category receive five stars, 22.5% receive four stars, 35% receive three stars, 22.5% receive two stars and the bottom 10% receive one star. Investment return and principal value will vary

so that investors have a gain or loss when shares are sold. Funds are rated for up to three time periods (three-, five- and 10-years) and these ratings are combined to produce an overall rating. Ratings may vary among share classes and are based on

past performance. Past performance does not guarantee future results.

Performance Summary and Commentary

|

|

|

|

|

| |

|

|

| Eagle Capital Appreciation Fund |

Portfolio

Managers | David J. Pavan, CFA®, C. Frank Feng, Ph.D., Ed Wagner, CFA®,

and Stacey R. Nutt, Ph.D., of ClariVest Asset Management LLC (“ClariVest”), are Co-Portfolio Managers of the Eagle Capital Appreciation Fund (the “Fund”) and assumed responsibility for the day-to-day management of the Fund’s

investment portfolio on June 28, 2013.

Performance discussion | The following commentary covers the fiscal year ended October 31, 2013. For the period November 1, 2012 through

June 28, 2013, the Fund was subadvised by Goldman Sachs Asset Management, L.P. ClariVest assumed responsibility of the day-to-day management of the Fund’s investment portfolio as of the close of business on June 28, 2013, and

subadvised the Fund through the fiscal year end. For the fiscal year ended October 31, 2013, the Fund’s Class A shares returned 28.41% (excluding front-end sales charges of 4.75%) outperforming its benchmark index, the Russell 1000® Growth Index, which returned 28.30%. The Fund posted positive absolute performance in all sectors for the period.

Outperformance, relative to the benchmark, was led by the information technology, consumer discretionary, consumer staples, and energy sectors. In information technology, despite being hurt by an overweight position, strong security selection helped

the Fund’s relative performance. In both the consumer sectors, outperformance was led by solid security selection. In energy, an overweight position coupled with solid security selection helped bolster returns. The Fund primarily lagged the

benchmark in the health care, materials and industrials sectors. In health care, the Fund was hurt by an underweight positioning and weak stock selection. In materials, the Fund was negatively impacted by stock selection. An underweight position

within industrials was a drag on performance, while solid security selection within the sector was positive, helping temper relative returns. Please keep in mind that an index is not available for direct investment; therefore its performance does

not reflect the expenses associated with the active management of an actual portfolio.

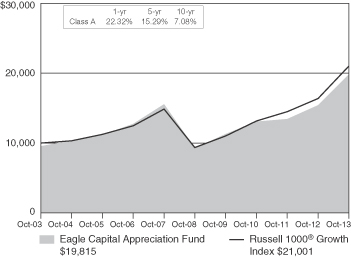

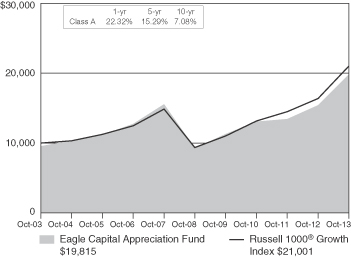

Growth of a

$10,000 investment from 10/31/03 to 10/31/13 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment

of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges

and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an

investment will fluctuate, and you may have a gain or loss when you

sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at

eagleasset.com.

Top performers | Google, Inc. (Class A) focuses on improving the ways people connect with information by providing a variety of services and tools for advertisers of all sizes, from simple text ads to display and

mobile advertising and to publishers. Overall ad impression and click volume continued to increase during the period driving the stock higher. NIKE, Inc. (Class B) designs, develops, markets and sells high quality footwear, apparel, and equipment,

accessories and services. The company had better-than-expected gross margins through the year which drove the stock’s earnings higher. Order demand has been strong as the company executes on the global consumer’s growing demand for

innovation and performance in athletic footwear and apparel. One strong area of growth was emerging markets where Nike saw a 16% revenue increase in fiscal 2013. Schlumberger Ltd. operates as an oilfield services company, which supplies technology,

project management and information solutions for the oil and gas industry. Shares have rallied on strong North American deep-water oil services demand and a renewed share buyback. Chipotle Mexican Grill, Inc. operates fast-casual Mexican-food

restaurants across the United States. Same store sales grew 5.8% in the third quarter of 2013, faster than the 4.6% consensus. Long-term opportunities appear strong as the company is looking to expand into the breakfast area. American Express Co. is

a global payments and travel company. The company was a positive contributor in the Fund as the company appears to have benefited from strong tailwinds towards plastic money instead of cash and the explosion in online shopping. Card member spending

remained strong in the United States despite events in Washington that could have led to fiscal drag. Credit quality has been high with the company reporting historically low net write-offs worldwide. The Fund continues to hold each of the

securities noted above as “top performers.”

Underperformers | St. Jude Medical, Inc., a developer of medical technology and services, was a negative contributor to the Fund as the stock was volatile given uncertainty around the U.S. Food and Drug

Administration’s approval for the company’s next generation implantable cardioverter-defibrillators. The Fund no longer holds this security. Teva Pharmaceutical Industries Ltd, Sponsored ADR develops, manufactures, markets and distributes

pharmaceutical products worldwide. The company reported disappointing earnings and cash flows, and has been hampered due to a $1.6 billion settlement with Pfizer Inc. related to patent-infringement damages. The Fund no longer holds the security.

Devon Energy Corp. is an independent energy company engaged primarily in exploration, development and production of oil and natural gas. The company’s stock price fluctuated with volatile energy prices, and both the company and the industry

proved to be difficult to time correctly during the period. The Fund no longer holds this security. Rackspace Hosting, Inc., a leading provider of managed hosting and cloud computing services, detracted from performance during the period. The

slowdown in sales growth highlights the challenges the company has been experiencing gaining traction with its new cloud offering and, more specifically, transitioning large enterprise customers to the new offering. The company also indicated that

it would have to spend more to acquire new customers. The Fund no longer holds the security. Apple, Inc. designs, manufactures and markets mobile communication and media devices, personal computing products, and portable digital music players.

Shares of the stock were hurt during the early part of 2013 as earnings estimates came down from the $60 range to the $40s due to a maturing smartphone market. In the third quarter, shares rose sharply due in part to strong iPhone sales and news of

investor Carl Icahn taking a stake in the company’s shares. The Fund continues to hold this security.

Performance Summary and Commentary

|

|

|

|

|

| |

|

|

| Eagle Growth & Income Fund |

Portfolio

Managers | Edmund Cowart, CFA®, David Blount, CFA®, CPA, John Pandtle,

CFA®, and Jeff Vancavage, CFA®, are Co-Portfolio Managers of the Eagle Growth & Income Fund (the “Fund”). Messrs. Cowart, Blount, and Pandtle have been responsible for the

day-to-day management of the Fund’s investment portfolio since June 2011 and Mr. Vancavage since July 2013.

Performance

discussion | For the fiscal year ended October 31, 2013, the Fund’s Class A shares returned

25.14% (excluding front-end sales charges of 4.75%) underperforming its benchmark index, the S&P 500® Index, which

returned 27.18%. Though the Portfolio Management team (“PM team”) was not satisfied with trailing the benchmark, the PM team was pleased with absolute performance during the period, as well as the Fund’s ability to mostly keep pace

with the benchmark despite heavy yield-based headwinds. Stocks with no dividends appreciated nearly twice as much as stocks with dividend yields higher than the weighted average yield of the benchmark at the start of the period. Relative to the

benchmark, performance was particularly strong within the technology, industrials and materials sectors. Stock selection was strong in all three sectors; however, the Fund also benefited from a relative underweight position within the technology

sector, as well as an overweight within industrials. The Fund’s weakest performing sectors on a relative basis were financials and consumer discretionary. The Fund’s allocation within these two sectors was not a significant factor;

however, the stock selection within these sectors detracted from relative performance. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active

management of an actual portfolio.

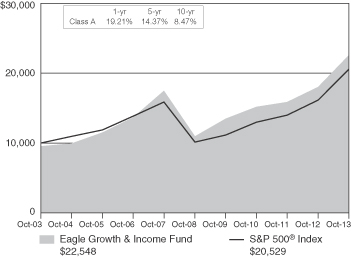

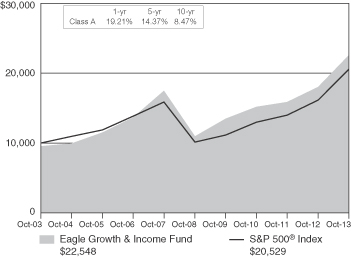

Growth of a $10,000 investment from 10/31/03 to 10/31/13 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment

of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges

and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an

investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our

website at eagleasset.com.

Underperformers | American Campus Communities, Inc., is a real estate investment trust (“REIT”) which manages on-campus and off-campus housing facilities for students at various universities in the

United States. With interest rates expected to rise, REITs in general have been punished by the market. The company took on an acquisition whose integration proved to be more complicated than anticipated. As a result, the company was unable to

execute efficiently during an important leasing window, necessitating increased marketing expenditures which caused the company to miss earnings. The Fund continues to own the stock as the PM team sees tremendous cash flow potential and believes the

marketing expenses were temporary in nature. Digital Realty Trust, Inc., also a REIT that has felt the impact of expected interest rate increases, is a company that operates data centers in the United States. The Fund sold the stock in an effort to

reduce its exposure to the industry, but also because the PM team believed pricing was soft and the uneven economic recovery has led to companies deferring leasing decisions. CenturyLink, Inc., an integrated telecommunications company, surprised

investors with the announcement of a major shift in the company’s capital allocation plan, which included a dividend cut. The Fund continues to hold the stock; however, the PM team is actively monitoring the situation. Abbott Laboratories, a

global leading health care company, split into two companies, a medical device company and a pharmaceuticals company. The Fund sold the stock during the period as the PM team believed the medical device company was too richly valued and the

pharmaceuticals company to be too risky. International oil and gas company, Exxon Mobil Corp, was sold during the period, as the company’s management had positioned it for a scenario which did not come to pass: low oil prices, a natural gas

shortage and petrochemicals produced in Asia. The PM team saw better investment opportunities available in the space.

Top performers | Applied Materials, Inc. is a dominant player in its core business providing semiconductor fabrication tools to chipmakers. The

company competes in nearly every segment of the market whereas peers mostly specialize in one segment or another. The stock had already been rewarded strongly for its strong fundamentals, when it announced a merger with Tokyo Electron. The merger is

expected to widen the company’s base of expertise, while carrying the potential for cost synergies as well as a lower tax rate as the company incorporates in the Netherlands. Medical device company, St. Jude Medical, Inc., has enjoyed

solid execution with earnings above expectations due to margin expansion and strong revenue streams from its product lines. The industrials sector also performed strongly throughout the year. In this regard, 3M Company, a diversified technology

company serving customers and communities with innovative products and services, outperformed its peers due to solid execution despite some foreign exchange and demand-based headwinds. In addition, revenues were on target in a recent earnings

release despite the market expecting a miss. JPMorgan Chase & Co., a financial holding company that provides financial and investment banking services, is diverse and well-managed with a superior capital position, excess reserves and strong

earnings momentum. It has been gaining market share across retail, commercial, investment banking, and capital markets businesses and it remains one of the least expensive large capitalization United States banks on a price to earnings basis. Regal

Entertainment Group, the largest and most geographically diverse theatre circuit in the United States with 6,854 screens in 537 theatres in 37 states, appears to have benefited from digital technology allowing for 3-D and alternative content to

incrementally increase revenues. The Fund continues to hold each of the securities noted above as “top performers.”

Performance Summary and Commentary

|

|

|

|

|

| |

|

|

| Eagle International Stock Fund |

Portfolio

Managers | David V. Vaughn, CFA®, and Stacey R. Nutt, Ph.D., are Co-Portfolio Managers of the Eagle International Stock Fund (the “Fund”). Mr. Vaughn has been responsible for the

day-to-day management of the Fund’s investment portfolio since its inception and Dr. Nutt since June 2013. Alex Turner,

CFA®, has served as Assistant Portfolio Manager of the Fund since its inception.

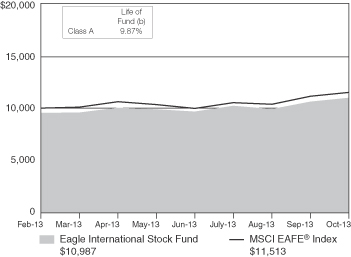

Performance

discussion | From its inception on February 28, 2013 through October 31, 2013, the fiscal year end,

the Fund’s Class A shares had a cumulative return of 15.33% (excluding front-end sales charges of 4.75%) outperforming its benchmark index, the MSCI EAFE® Index, which returned 15.13% for the same time period. Sector selection was positive, where an overweight to telecommunication services and an underweight in

materials helped performance. Conversely, an overweight in industrials and an underweight in utilities detracted from performance. Country selection was flat, where an underweight to Spain hurt performance and an underweight to Australia helped

performance. Value measures were strong across the globe, while momentum struggled in Asia. Growth worked modestly well. Overall factor performance was positive during the period. Please keep in mind that an index is not available for direct

investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

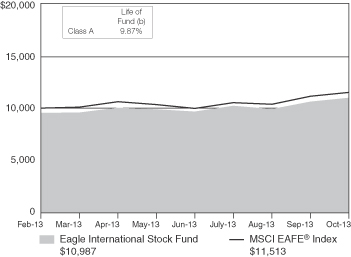

Growth of a $10,000 investment from 2/28/13 to 10/31/13 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment

of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges

and expenses. (b) Not annualized because the Fund has been operational for less than one year.

Performance data represented is historical and

does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To

obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Top performers | Japanese company Fuji Heavy Industries Ltd. is the owner of Subaru automobile manufacturing as well as aerospace, industrial products and eco-technology, trains, and housing. The majority of the

company’s sales are generated overseas, but most of its production is in Japan. The company has been improving in car manufacturing surveys and has been gaining market share in the United States. At the same time, there initially was skepticism

around the company as it is one of the smallest Japanese car manufacturers. Additionally, the company appears to have benefitted from the weak yen and analysts have repeatedly raised numbers to keep up with fundamentals. British company Vodafone

Group PLC, a worldwide provider of mobile telecommunications, helped performance as the company sold off its stake in Verizon Wireless and pledged to return 65% of the proceeds to its shareholders. KDDI Corporation, a Japanese mobile communication

company and the second-largest wireless carrier in Japan, boosted performance as the company delivered strong earnings and outlook during the period. Sumitomo Corporation, a leading integrated Japanese trading company engaged in diverse businesses

based on its global network, appears to have benefited from a weaker yen and increased global demand for metals and commodities. German company, Allianz SE, an international financial services provider, was able to increase profits in part due to

focusing on higher margin asset management products and its non-life insurance division benefited from pricing improvements in Germany. The Fund continues to hold each of the securities noted above as “top performers.”

Underperformers |

Kanematsu Corp., a Japan-based trading company that provides electronic components and materials, semiconductors, liquid crystal and solar cell manufacturing equipment, and communication technology systems, was a drag on performance. Specifically, a

lack of transparency into Kanematsu’s earnings was worrisome and, in general, the distribution/wholesale industry experienced downward revisions. Shares of Austrian semiconductor manufacturer ams AG fell after the company announced that

operating profits would fall as clients delayed orders. Costs were also higher than expected as the company transitioned to a new CEO and experienced write-downs on equity investments. Two Australian companies with significant exposure to

commodities hurt performance during the period. The first, Silver Lake Resources Ltd., a large gold producing and exploration company with multiple mines and multiple mills operating in the Eastern Goldfields and Murchison districts of Western

Australia, hurt performance as gold prices fell sharply during the second quarter. The second, Downer EDI Ltd., an engineering and infrastructure management service firm, also fell as many of its materials sector clients cut back spending due to

falling commodity prices. Similarly, another Australian-based firm, Skilled Group Ltd., the largest provider of workforce solutions, detracted from performance as shares fell during the second quarter due in part to its exposure to the mining

sector, which experienced reduced working hours. The Fund no longer holds any of the securities noted above as “underperformers.”

Performance Summary and Commentary

|

|

|

|

|

| |

|

|

| Eagle Investment Grade Bond Fund |

Portfolio

Managers | James C. Camp, CFA®, and Joseph Jackson, CFA®, are

Co-Portfolio Managers of the Eagle Investment Grade Bond Fund (the “Fund”) and have been responsible for the day-to-day management of the Fund’s investment portfolio since its inception.

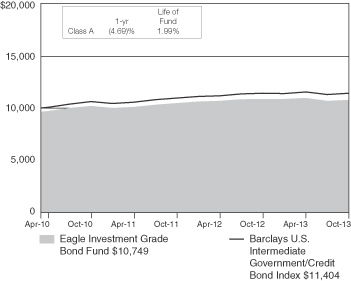

Performance

discussion | For the fiscal year ended October 31, 2013, the Fund’s Class A shares returned

(1.00)% (excluding front-end sales charges of 3.75%) underperforming its benchmark index, the Barclays U.S. Intermediate Government/Credit Bond Index, which returned (0.03)%. The rumored ‘tapering’ of Fed bond purchases was by far the

largest determinant of market returns in fixed income during the period. The notion of tapering purchases drove a significant steepening of the yield curve causing underperformance in ten-year bonds and low-coupon mortgage backed securities

(“MBS”). The main factor in relative performance for the Fund during the period was the underperformance of the MBS holdings. The Fund’s positions in low-coupon collateralized mortgage obligations (“CMOs”) as interest rates

spiked during May and June drove underperformance. The Fund earned positive relative returns in the Treasury, government-related and corporate sectors due largely to its underweight in the seven- and ten- year duration buckets within these sectors.

Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

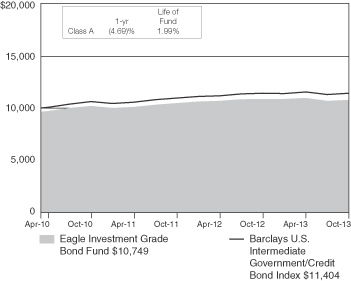

Growth of a $10,000 investment from 3/1/10 to 10/31/13 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 3.75%, fund expenses and the reinvestment

of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges

and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an

investment will fluctuate, and you may have a gain or loss when

you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at

eagleasset.com.

Underperformers | Federal agency MBS, including Freddie Mac, REMICs, Series 4105, Class KB, 2.25%, 08/15/41, and Fannie Mae, REMICs, Series 2012-96, Class PD, 2.00%, 07/25/41, were low-coupon CMOs which

underperformed as interest rates moved above their coupon rates. Compounding the problem, the negative convexity inherent with these types of securities caused the duration of the bonds to extend as rates increased. Corporate bond, Newmont Mining

Corp., 5.13%, 10/01/19, one of the world’s largest gold producers with significant assets or operations on five continents, generated negative absolute returns and underperformance relative to the industrial sector as the price of gold fell in

May and June of this year. U.S. Treasury Note, 1.13%, 04/30/20, along with other seven- and ten-year U.S. Treasuries, fell as rumors that the Federal Reserve may taper, or reduce, the size of the bond-buying program surfaced in May. The Fund’s

holding of corporate bond, U.S. Bancorp, 2.95%, 07/15/22, a regional financial services holding company operating in the Midwest and Western U.S. underperformed largely due to its curve positioning. The Portfolio Management team does not believe the

security’s underperformance was related to a fundamental credit issue; it was simply that the bond was longer in duration compared to the average bond in the benchmark. The Fund no longer holds any of the securities noted above as

“underperformers.”

Top performers | Baidu Inc., 3.25% 08/06/18, an Internet search engine operator serving the Chinese market, was a leading performer during the period thanks to attractive pricing in the primary market. The Fund

continues to own this security. Corporate bond Broadridge Financial Solutions Inc., 3.95%, 09/01/20 is a leading global provider of investor communications and technology-driven solutions to banks, broker-dealers, mutual funds and corporate issuers.

The security generated high returns, which the Portfolio Managers believe was due to curve positioning. The Fund purchased Broadridge as the long end began to recover from the early-summer selloff. The Fund continues to own this security.

Asset-backed security, Ford Credit Auto Owner Trust, Series 2012-C, Class D, 2.43% 01/15/19, the financial services arm of the Ford Motor Company, performed in-line with similar maturity asset-backed securities, earning positive absolute

returns when compared to the benchmark and other structured product sectors. The Fund continues to own this security. The Goldman Sachs Group, Inc., 6.25%, 09/01/17, a leading global investment banking, securities and investment management firm, was

a top performer in a period when the financials sector outperformed the industrials and utilities sectors within the benchmark. The Fund’s specific holding, a four-year issue, also generated positive relative returns while the long-end of the

curve sold off. The Fund no longer holds this security. Although for Treasury holding, U.S. Treasury Note, 2.50%, 08/15/23, the long end underperformed the short end for the entire duration of the period, the timing of the purchase of this security

in the Fund (near the highs in ten year interest rates) generated high relative returns. The Fund continues to own this security.

Performance Summary and Commentary

|

|

|

|

|

| |

|

|

| Eagle Mid Cap Growth Fund |

Portfolio

Managers | Bert L. Boksen, CFA®, and Eric Mintz, CFA®, are Co-Portfolio

Managers of the Eagle Mid Cap Growth Fund (the “Fund”). Mr. Boksen has been responsible for the day-to-day management of the Fund’s investment portfolio since its inception. Mr. Mintz has been co-managing the portfolio since

2011, and previously had served as Assistant Portfolio Manager beginning in 2008. Christopher Sassouni, D.M.D., has served as Assistant Portfolio Manager of the Fund since 2006.

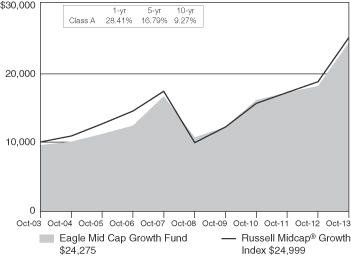

Performance

discussion | For the fiscal year ended October 31, 2013, the Fund’s Class A shares returned

34.81% (excluding front-end sales charges of 4.75%) outperforming its benchmark index, the Russell MidCap® Growth Index,

which returned 33.93%. The Fund generated positive returns in all sectors, especially benefitting from strong absolute and relative performance within the industrials and financials sectors, while being slightly overweight. In contrast,

underperformance within the consumer staples and energy sectors somewhat tempered the Fund’s performance as both sectors failed to keep up with the benchmark. Please keep in mind that an index is not available for direct investment; therefore

its performance does not reflect the expenses associated with the active management of an actual portfolio.

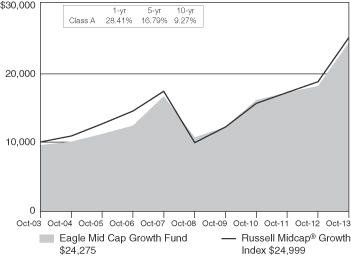

Growth of a $10,000 investment from 10/31/03 to 10/31/13 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment

of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges

and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an

investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our

website at eagleasset.com.

Top performers | Ameriprise Financial Inc. offers asset-management and insurance products through a substantial financial-advisor network. In addition to being aided by general strength in equity

markets, the company continued to reallocate a portion of its revenue stream away from the capital-intensive annuity business toward asset-management offerings, reflecting what the Portfolio

Management team (“PM team”) believed to be a more balanced and attractive return profile as a result. Harman International Industries, Inc., a leader in the car-audio and infotainment-systems industry, continued its strong run as the firm

announced record backlogs and raised earnings guidance projections for its approaching budget year. The PM team believes that TD Ameritrade Holding Corp, a banking and securities-brokerage firm, benefited from continued strength in the equity

markets which has encouraged an increased amount of trading activity in recent periods, as investors look to put previously sidelined cash to work. Chicago Bridge & Iron Company N.V. develops and fabricates a comprehensive range of

structures and components used primarily by the energy and petrochemical industries. The petrochemical industry is experiencing a dramatic shift in the global competitive landscape as low-cost feedstock-advantaged plants based in North America are

experiencing record margins and driving a significant wave of new investment. The Portfolio Managers believe that the company is well-aligned with this development and has substantially benefitted as a result. Delta Air Lines, Inc., a domestic and

international passenger and cargo air transportation company, was up sharply during the period as the firm benefitted from strong leisure and business travel demand as well as better-than-expected execution on strategic cost-cutting initiatives. The

Fund continues to hold each of the securities noted above as “top performers.”

Underperformers | Fusion-io, Inc., a producer of commercial data storage using “flash” memory, continued to have customer-concentration

issues, which plagued the firm in recent periods, exacerbated by multiple management departures earlier in the year. Despite a solid product offering, Fusion-io appears to have lost its strategic footing for the time being and the stock has suffered

as a result. Shares of Edwards Lifesciences Corp., a company which develops and manufactures medical devices used in the treatment of structural heart disease, were down as the firm missed estimates and reduced guidance earlier in the period. The PM

team believes that this reduction was primarily a result of lighter-than-expected transcatheter aortic valve replacement revenues despite strong year-over-year as well as sequential growth. ARIAD Pharmaceuticals, Inc. is a company that focuses on

therapies used to treat drug-resistant, difficult-to-treat cancers. The PM team believes that investors were caught off-guard by an unexpected Food & Drug Administration (“FDA”) halt placed on ARIAD’s late-stage clinical

trial, which was analyzing the firm’s leukemia drug candidate Iclusig. Axiall Corp., a manufacturer of a variety of specialty chemicals and building products, had substantial capacity expansion in recent periods which, the PM team believes, has

inadvertently resulted in an oversupply of a key chemical used in the production of plastics, adhesives and coatings used by the construction industry. The company’s margins failed to meet expectations as a result of the supply glut and have

clouded the firm’s near-term growth trajectory. Cobalt International Energy, Inc. is a global oil & gas exploration and production company primarily active in deep water Gulf of Mexico and offshore Angola and Gabon in West Africa.

Despite optimistic expectations, the company encountered disappointing well results at two of its drill sites, which, the PM team believes, materially weighed on investor sentiment and, subsequently, the stock price during the period. The Fund no

longer holds any of the securities noted above as “underperformers.”

Performance Summary and Commentary

Portfolio

Managers | Charles Schwartz, CFA®, Betsy Pecor, CFA®, and Matthew

McGeary, CFA®, are Co-Portfolio Managers of the Eagle Mid Cap Stock Fund (the “Fund”) and have been responsible

for the day-to-day management of the Fund’s investment portfolio since October 2012.

Performance discussion | For the fiscal year ended October 31, 2013, the Fund’s Class A shares returned 30.90% (excluding front-end sales

charges of 4.75%), underperforming both benchmark indices, the S&P MidCap 400® Index and, secondarily, the Russell

Midcap® Index, which returned 33.48% and 33.79%, respectively. The Fund benefitted from positive absolute performance in

all sectors, and most returns were greater than 20%, with the consumer staples sector delivering returns of over 50%. The Fund’s performance, relative to the benchmark, benefitted from solid performance in the consumer discretionary and

staples, energy, financials, materials and utilities sectors. Telecommunications services returned in-line relative results for the period. Health care, industrials, and information technology put up positive returns but lagged the benchmark for the

period. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 10/31/03 to 10/31/13 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment

of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges

and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an

investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our

website at eagleasset.com.

Underperformers | Energy XXI Bermuda Ltd., an exploration and production company, stumbled early in the year when oil production suffered due to infrastructure issues with a few of its assets. The Fund

continues to hold the stock as the Portfolio Management team (“PM team”) believes that the company is well positioned heading into 2014. Riverbed Technology, Inc. is a company offering

solutions for enhancing network performance. While the company continues to show good top line growth, its income guidance has fallen short of expectations. The PM team believes the company’s products still have growth potential and investor

concerns are reflected in the current share price; as such, the Fund continues to hold the stock. Ascena Retail Group, Inc. is a leading specialty retailer offering clothing, shoes, and accessories for women and tweens under multiple brand names.

The PM team believes that the company underperformed given the challenging retail environment. The Fund no longer holds this stock. SolarWinds, Inc. is a leading provider of powerful and affordable IT management software. While the company continues

to grow, the PM team believes that some investors have been disappointed with the moderation in the growth rate, as well as dilution effects from the recent N-able acquisition. The PM team believes there is still good growth potential for the

company and that its management may be able to reverse the recent sales force execution issues and get the company’s license sales back on track. The Fund continues to hold this stock. Nuance Communications Inc. is a leading provider of voice

recognition and other language solutions for both the consumer and corporate marketplaces. The company’s results and outlook have been challenged and are primarily below expectations this year. The PM team feels the long term outlook for the

company is solid. The Fund continues to hold this stock.

Top

performers | Flower Foods, Inc., the second largest producer and marketer of fresh packaged bakery foods in the

United States, performed well driven by the liquidation of Hostess Brands, which the PM team believes allowed the company’s snack brands to enjoy nice market share gains and profits in the absence of Hostess products on store shelves. The

company also acquired 20 of Hostess’ 38 bread facilities giving it plenty of opportunity to grow both its own bread business as well as that of Hostess’ flagship Wonder bread line in the long term. Hanesbrands Inc., a consumer goods

company, performed well this year driven by lower cotton costs, increased product innovation, and by leveraging its new global supply chain to lower costs. The company recently acquired Maidenform Brands, Inc. and the PM team believes that its

strong free cash flow generation may result in dividends, share buybacks and future acquisitions. IDEX Corporation, a diversified, engineered products company serving high-growth niche markets, has been a consistent performer over time with industry

leading margins, returns and cash flow dynamics. The PM team believes the company is very well positioned to take advantage of slowly improving industrial fundamentals globally. B/E Aerospace, Inc. is a leading aerospace equipment provider with a

focus on various cabin interior systems and parts for the commercial aerospace and business jet markets. Given the company’s content on current new build aircraft and solutions for retrofits, the PM team believes the company remains very well

positioned for continued profitable growth. Jarden Corporation, a company that engages in the manufacturing, sourcing, marketing, and distribution of consumer products used in and around the home, performed well driven by accelerating organic sales

growth, aggressive share buybacks and the announcement of a strategic deal. The PM team believes that the company’s rising free cash flow position may result in future mergers and acquisitions and share buybacks. The Fund continues to hold each

of the securities noted above as “top performers.”

Performance Summary and Commentary

|

|

|

|

|

| |

|

|

| Eagle Small Cap Growth Fund |

Portfolio

Managers | Bert L. Boksen, CFA®, and Eric Mintz, CFA®, are Co-Portfolio

Managers of the Eagle Small Cap Growth Fund (the “Fund”). Mr. Boksen has been responsible for the day-to-day management of the Fund’s investment portfolio since 1995 and Mr. Mintz since March 2011.

Performance

discussion | For the fiscal year ended October 31, 2013, the Fund’s Class A shares returned

32.09% (excluding front-end sales charges of 4.75%), underperforming its benchmark index, the Russell 2000® Growth Index,

which returned 39.84%. The Fund underperformed most in the information technology, industrials, and consumer staples sectors. Within these sectors, the Fund was hurt by weak stock selection, while being slightly underweight. In contrast, the energy

and health care sectors were bright spots for the Fund to an extent, with very strong absolute and relative performance generated in both sectors, while being slightly overweight. Please keep in mind that an index is not available for direct

investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 10/31/03 to 10/31/13 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment

of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges

and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an

investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our

website at eagleasset.com.

Underperformers | ARIAD Pharmaceuticals, Inc. is a company that focuses on therapies used to treat drug-resistant, difficult-to-treat cancers. The Portfolio Managers believe that investors were caught off-guard by

an unexpected Food and Drug Administration (“FDA”) halt

placed on ARIAD’s late-stage clinical trial which was analyzing the firm’s leukemia drug candidate Iclusig. The Fund’s position was sold. Fusion-io, Inc., a producer of commercial

data storage using “flash” memory, continued to have customer-concentration issues which plagued the firm in recent periods, exacerbated by multiple management departures earlier in the year. Despite a solid product offering, Fusion-io

appears to have lost its strategic footing for the time being and the stock has suffered. As a result, the Fund’s position was sold. Vitamin Shoppe, Inc. is a specialty retailer of vitamins, sports nutrition, and health and beauty aids

products. The stock had been a strong long term performer for the Fund, but it suffered a sharp sell-off early in the year as the firm back-end-loaded guidance for 2013. The company has continued to gain market share and maintain solid earnings

growth. The Fund continues to hold this position. Monster Worldwide, Inc. provides online employment solutions through offerings such as searchable job postings for prospective employees and resume database access for recruiters. The firm has

proceeded with some selective restructuring as part of a cost-savings initiative while continuing to entertain and evaluate strategic alternatives through a possible sale of the company. Shares of the stock have waned as the anticipated sale of the

company has taken longer than expected. The Fund sold its position in the stock. Walter Energy, Inc., a producer of metallurgical coal used by the steel industry, softened manufacturing expectations, hampered by weakness in China’s economic

outlook. This resulted in elevated metallurgical-coal supply levels that weighed heavily on the pricing environment for the company as well as others in the industry. The Fund’s position in the stock was sold.

Top

performers | Medidata Solutions, Inc. provides technology used to enhance its customers’ efficiency in

clinical development and research processes. The firm continues to experience solid demand for its clinical trial software and is taking market share from competitors at a substantial rate as it leverages its differentiated product offerings. The

Fund continues to hold the stock. United Therapeutics Corp. is a biotechnology company focused on the development and commercialization of unique products to address the medical needs of patients with chronic and life threatening conditions such as

pulmonary arterial hypertension. The Portfolio Managers believe that the company has benefitted from better-than-expected growth of its core marketed product portfolio as its diverse revenue base provides solid visibility from one period to the

next. The Fund continues to hold the stock. Lufkin Industries, Inc., is a manufacturer of pump jacks used in the enhanced oil-recovery process. Its stock advanced when General Electric Co. announced its intention to purchase the stock at a

substantial premium. The stock was sold prior to the acquisition. Gulfport Energy Corp., an independent oil and natural-gas exploration and production company, continues to see positive well results within its Utica acreage in Ohio. The Portfolio

Management team expects the company to benefit from production increases on several of those wells as they begin to ramp. The Fund continues to hold this position. Colfax Corp., a manufacturer of fluid and gas handling and fabrication technology,

has benefitted from close alignment with the secular growth tailwinds of low-cost natural gas in North America, which has fostered substantial capital investments as firms pour resources into building out. The Fund continues to hold this position.

Performance Summary and Commentary

|

|

|

|

|

| |

|

|

| Eagle Small Cap Stock Fund |

|

|

Portfolio

Managers | Charles Schwartz, CFA®, Betsy Pecor, CFA®, and Matthew

McGeary, CFA®, are Co-Portfolio Managers of the Eagle Small Cap Stock Fund (the “Fund”) and have been

responsible for the day-to-day management of the Fund’s investment portfolio since its inception.

Performance

discussion | From its inception on December 31, 2012 through October 31, 2013, the fiscal year end,

the Fund’s Class A shares had a cumulative return of 29.46% (excluding front-end sales charges of 4.75%) underperforming its benchmark index, the Russell 2000® Index, which returned 30.90% for the same time period. The Fund benefitted from positive absolute and relative performance in most sectors, including good performance

in the consumer staples, energy, financials, materials and utilities sectors relative to the Fund’s benchmark. Consumer discretionary, information technology, and telecommunications services returned in-line relative results for the period. The

health care and industrials sectors put up nicely positive returns, but lagged the benchmark. The Fund underperformed most in the health care and industrials sectors. Please keep in mind that an index is not available for direct investment;

therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 12/31/12 to 10/31/13 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment

of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges

and expenses. (b) Not annualized because the Fund has been operational for less than one year.

Performance data represented is historical and

does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To

obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | Mistras Group, Inc. provides highly technical products and services that test the structural integrity and reliability of

infrastructure in the energy, industrial and public marketplaces. The company’s business was negatively impacted by the slow economy in the United States and very low activity levels in the oil refining industry throughout the year. The

Fund continues to hold the security

due to the company’s niche focus and growth potential. The Portfolio Management team (“PM team”) believes that ValueClick, Inc., a digital marketing services provider, has

experienced a tough combination of an increasingly competitive landscape and some self-inflicted sales execution issues. Additionally, there was a less-than-anticipated windfall to the company from Google Inc. in connection with the company’s

exit from the affiliate marketing business. Vitamin Shoppe, Inc., a specialty retailer of vitamins, sports nutrition, and health and beauty aids products, underperformed due to a deceleration in sales, declining new store productivity,

margin-dilutive investments and increased promotional activity; all of these factors led to back-end-loaded guidance for 2013. The PM team continues to like the company’s positioning in the vitamin, minerals and supplements market, its

specialized niche as the industry leader based on its broad assortment and well-trained sales associates plus its square footage growth potential. Volcano Corporation, a developer of devices designed to assist with percutaneous coronary

intervention, has had inconsistent performance this year. The PM team believes that much of the blame is on general industry malaise, and that there has been a significant decrease in volumes, which appears to have been reported by other larger

companies that focus in the space. The company also has a large exposure to Japan, and has been hurt on foreign currency exchange rates. Vocera Communications, Inc. is a leader in hands-free, instant communication solutions with a focus on the

healthcare industry. The company believes this is a $6 billion global market opportunity, where they are less than 2% penetrated. It has over 750 customers and a 95% retention rate. Unfortunately, being a young company, it is still learning the ways

of its customers and, as such, reported first quarter financial results and guidance that did not meet investor expectations. The PM team believes that the company had a nice second quarter, and remains conservative on forward guidance. The Fund

continues to hold each of the securities noted above as “underperformers.”

Top performers | Evercore Partners Inc., an independent investment banking firm, performed well, driven by strong revenue production, a growing

advisory backlog, and opportunistic hiring of advisory senior managing directors. The Middleby Corporation provides a diversified suite of cooking equipment to the commercial food service and food processing industries. The company posted

better-than-expected results all year driven by solid growth in its core businesses and through its purchase of Viking Range Corp., which is the company’s first foray into the high-end residential market. Carrizo Oil & Gas, Inc., a

domestic oil and gas exploration and production company, posted strong results this year. The company spent the year divesting non-core assets and focusing its attention on its core growth assets in the Eagle Ford, Utica and Niobrara basins. The PM

team believes that production growth has been very strong and the company’s balance sheet has improved. Buffalo Wild Wings, Inc. is the largest sports bar restaurant chain in the domestic casual dining industry, with nearly 1,000 units. The

stock has performed well recently due to better-than-expected margins as a result of moderating traditional wing prices, as well as the firm’s July rollout of ordering wings by the portion, which has benefited margins with no significant

customer pushback. Additionally, the stock has outperformed as same-store-sales trends have been better than expected. J2 Global, Inc., a company offering internet business solutions primarily to the small business market, performed well as a result

of improved financial metrics in its core cloud-based business solutions as well as having better-than-expected results from its digital media segment. The Fund continues to hold each of the securities noted above as “top performers.”

Performance Summary and Commentary

|

|

|

|

|

| |

|

|

| Eagle Smaller Company Fund |

|

|

Portfolio

Managers | David M. Adams, CFA®, and John “Jack” McPherson,

CFA®, are Co-Portfolio Managers of the Eagle Smaller Company Fund (the “Fund”) and have been responsible for the

day-to-day management of the Fund’s investment portfolio since its inception.

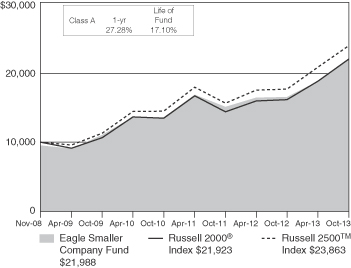

Performance discussion | For the fiscal year ended October 31, 2013, the Fund’s Class A shares returned 33.60% (excluding front-end sales

charges of 4.75%) underperforming both benchmark indices, the Russell 2000® Index and, secondarily, the Russell

2500TM Index, which returned 36.28% and 35.41%, respectively. The Fund

benefitted from positive performance in eight of ten sectors, including strong performance in the industrials, financials, consumer staples and utilities sectors relative to the Fund’s benchmark. The Fund’s holdings in materials, health

care, energy, consumer discretionary, information technology and telecommunication services lagged their index peers. In materials, the Fund was hurt by weak stock selection, while being neutrally weighted. In health care, the Fund’s stock

selections underperformed, while being underweight. In energy, the Fund underperformed due to weak stock selection, while being modestly overweight. Please keep in mind that an index is not available for direct investment; therefore its performance

does not reflect the expenses associated with the active management of an actual portfolio.

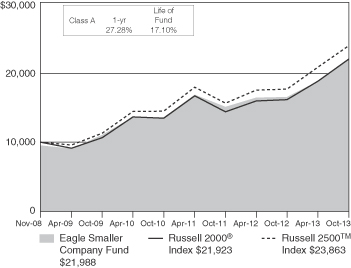

Growth of

a $10,000 investment from 11/03/08 to 10/31/13 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment

of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges

and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an

investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our

website at eagleasset.com.

Underperformers | IAMGOLD Corporation, a leading gold mining company, declined 66% due to falling gold prices that the Portfolio

Management (“PM team”) believes drove investors away from gold mining companies and company-specific project cost over-runs. As the PM team investment thesis was never predicated on a

gold “bet”, we continue to believe the cost over-run issues are transitory and believe the company can extract value from its asset base over time. Therefore the Fund continues to hold this security. Net1 UEPS Technologies, Inc., an

electronic transactions provider in under-banked developing nations, fell 54% after the company announced it was being investigated by the Department of Justice, FBI and SEC for violations of the Foreign Corrupt Practices Act. The Fund no longer

holds this security. Tower Group International, LTD., a property/casualty insurance company, fell 76% due to the fallout after the company announced it would be increasing prior period loss reserves for its legacy insured portfolio. As of the period

end, the PM team is evaluating their options and the Fund continues to hold this security. AuRico Gold Inc., a gold and silver mining company, declined 50% as falling gold prices drove investors away from gold mining companies, and there was a

disappointing earnings outlook as the company absorbed production cost increases. The PM team continues to believe the company can extract value from its asset base, and therefore, the Fund continues to hold the security. Coal producer, Arch Coal,

Inc., fell 46% as the company lowered its earnings outlook due to weak demand in the United States, as well as lower-than-expected profitability in some of its operations. The Fund continues to hold the position as the PM team believes that demand

destruction has reached its trough and the company continues to enjoy solid growth in overseas demand.

Top performers | Dycom Industries, Inc., a provider of engineering and construction services for telecommunications companies, rose 108% as the

company is enjoying a multi-year tailwind of an improved outlook for capital spending by its largest customers. In addition, the company’s recent sizeable acquisition of the telecommunications infrastructure services subsidiaries of Quanta

Services, Inc. should provide it greater scale when bidding on new contracts. Euronet Worldwide, Inc., an electronic transaction processing company, rose 114% after posting several strong earnings reports. The PM team believes that the company is

benefitting from strong secular demand trends in most of its businesses as well as from its own fundamental execution efforts. On Assignment, Inc., a leading specialty staffing company that places professionals in the technology, life sciences, and

health care sectors, appreciated 77% as the company is executing well and posting strong results. The PM team believes that the company continues to benefit from skill-set imbalances and high demand for temporary workers in each of its markets. The

PM team believes the company is poised to benefit from strong synergies and a higher growth profile of its recent transformational acquisition, a continuation of strong demand trends in its end markets, and the expansion of its workforce. Nu Skin

Enterprises, Inc., a multi-level marketer of primarily personal care products, rose 152% after several impressive earnings reports. The PM team believes that the company should continue to benefit from recent new product introductions, a robust new

product pipeline, promising sales force growth and diverse end-market demand both domestically and in emerging markets such as China. Oceaneering International, Inc., a provider of oilfield services and equipment, appreciated 66% as a result of

strong underlying fundamentals and a favorable long-term outlook for the company’s various businesses. The Fund continues to hold each of the securities noted above as “top performers.”

Description of Indices

The Barclays U.S. Intermediate Government/Credit Bond Index includes U.S.

government and investment grade credit securities that have a greater than or equal to one year and less than ten years remaining to maturity and have $250,000,000 or more of outstanding face value. The returns of the index do not include the effect

of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The MSCI EAFE® Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada.

As of November 27, 2013, the index consisted of 21 developed market country indices. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell 1000® Growth Index measures the

performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. Its returns do not include the effect of any sales charges.

That means that actual returns would be lower if they included the effect of sales charges.

The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the

smallest securities based on a combination of their market cap and current index membership. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell

2500TM Index measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as

“smid” cap. The Russell 2500 is a subset of the Russell 3000® Index. It includes approximately 2,500 of the

smallest securities based on a combination of their market cap and current index membership. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell 2000® Growth Index measures the

performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 Index companies with higher price-to-value ratios and higher forecasted growth values. Its returns do not include the effect of any sales

charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index

membership. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell Midcap® Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes

those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales

charges.

The S&P 500® Index is an

unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The S&P MidCap 400® Index is an unmanaged

index that measures the performance of the mid-sized company segment of the U.S. market. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

Investment Portfolios

|

|

|

|

|

|

|

|

|

|

|

| EAGLE CAPITAL APPRECIATION FUND |

|

|

|

|

|

|

|

|

| COMMON STOCKS—99.5% |

|

|

|

Shares |

|

|

Value |

|

| Aerospace/defense—1.6% |

|

|

|

|

|

|

|

|

|

|

| Northrop Grumman Corp. |

|

|

|

|

49,300 |

|

|

|

$5,300,243 |

|

|

|

|

|

| Apparel—3.4% |

|

|

|

|

|

|

|

|

|

|

| Hanesbrands, Inc. |

|

|

|

|

31,000 |

|

|

|

2,111,720 |

|

| NIKE, Inc., Class B |

|

|

|

|

117,752 |

|

|

|

8,920,892 |

|

|

|

|

|

| Auto manufacturers—1.0% |

|

|

|

|

|

|

|

|

|

|

| Ford Motor Co. |

|

|

|

|

187,900 |

|

|

|

3,214,969 |

|

|

|

|

|

| Auto parts & equipment—1.8% |

|

|

|

|

|

|

|

|

|

|

| Johnson Controls, Inc. |

|

|

|

|

82,100 |

|

|

|

3,788,915 |

|

| Lear Corp. |

|

|

|

|

26,500 |

|

|

|

2,050,835 |

|

|

|

|

|

| Beverages—2.3% |

|

|

|

|

|

|

|

|

|

|

| PepsiCo, Inc. |

|

|

|

|

90,221 |

|

|

|

7,586,684 |

|

|

|

|

|

| Biotechnology—5.0% |

|

|

|

|

|

|

|

|

|

|

| Amgen, Inc. |

|

|

|

|

29,300 |

|

|

|

3,398,800 |

|

| Celgene Corp.* |

|

|

|

|

25,100 |

|

|

|

3,727,099 |

|

| Gilead Sciences, Inc.* |

|

|

|

|

56,700 |

|

|

|

4,025,133 |

|

| Vertex Pharmaceuticals, Inc.* |

|

|

|

|

69,727 |

|

|

|

4,974,324 |

|

|

|

|

|

| Chemicals—1.3% |

|

|

|

|

|

|

|

|

|

|

| Praxair, Inc. |

|

|

|

|

34,348 |

|

|

|

4,283,539 |

|

|

|

|

|

| Commercial services—2.2% |

|

|

|

|

|

|

|

|

|

|

| MasterCard, Inc., Class A |

|

|

|

|

10,133 |

|

|

|

7,266,374 |

|

|

|

|

|

| Computers—7.9% |

|

|

|

|

|

|

|

|

|

|

| Apple, Inc. |

|

|

|

|

43,138 |

|

|

|

22,533,134 |

|

| Western Digital Corp. |

|

|

|

|

46,000 |

|

|

|

3,202,980 |

|

|

|

|

|

| Cosmetics/personal care—1.0% |

|

|

|

|

|

|

|

|

|

|

| The Procter & Gamble Co. |

|

|

|

|

41,891 |

|

|

|

3,382,698 |

|

|

|

|

|

| Diversified financial services—3.4% |

|

|

|

|

|

|

|

|

|

|

| American Express Co. |

|

|

|

|

83,575 |

|

|

|

6,836,435 |

|

| IntercontinentalExchange, Inc.* |

|

|

|

|

22,285 |

|

|

|

4,294,988 |

|

|

|

|

|

| Electronics—2.3% |

|

|

|

|

|

|

|

|

|

|

| Honeywell International, Inc. |

|

|

|

|

83,980 |

|

|

|

7,283,585 |

|

|

|

|

|

| Food—1.1% |

|

|

|

|

|

|

|

|

|

|

| The Kroger Co. |

|

|

|

|

81,800 |

|

|

|

3,504,312 |

|

|

|

|

|

| Healthcare services—2.9% |

|

|

|

|

|

|

|

|

|

|

| Aetna, Inc. |

|

|

|

|

79,800 |

|

|

|

5,003,460 |

|

| Cigna Corp. |

|

|

|

|

57,000 |

|

|

|

4,387,860 |

|

|

|

|

|

| Internet—14.4% |

|

|

|

|

|

|

|

|

|

|

| Amazon.com, Inc.* |

|

|

|

|

25,431 |

|

|

|

9,257,647 |

|

| Equinix, Inc.* |

|

|

|

|

36,466 |

|

|

|

5,888,530 |

|

| Facebook, Inc., Class A* |

|

|

|

|

100,200 |

|

|

|

5,036,052 |

|

| Google, Inc., Class A* |

|

|

|

|

20,252 |

|

|

|

20,871,306 |

|

| priceline.com, Inc.* |

|

|

|

|

5,360 |

|

|

|

5,648,529 |

|

|

|

|

|

| Lodging—1.8% |

|

|

|

|

|

|

|

|

|

|

| Marriott International, Inc., Class A |

|

|

|

|

129,195 |

|

|

|

5,824,111 |

|

|

|

|

|

| Media—1.8% |

|

|

|

|

|

|

|

|

|

|

| Comcast Corp., Class A |

|

|

|

|

70,500 |

|

|

|

3,354,390 |

|

| DIRECTV* |

|

|

|

|

40,800 |

|

|

|

2,549,592 |

|

|

|

|

|

| Metal fabricate/hardware—1.1% |

|

|

|

|

|

|

|

|

|

|

| Precision Castparts Corp. |

|

|

|

|

13,480 |

|

|

|

3,416,506 |

|

|

|

|

|

| Oil & gas—2.7% |

|

|

|

|

|

|

|

|

|

|

| Anadarko Petroleum Corp. |

|

|

|

|

28,564 |

|

|

|

2,721,863 |

|

| Pioneer Natural Resources Co. |

|

|

|

|

18,524 |

|

|

|

3,793,345 |

|

| Valero Energy Corp. |

|

|

|

|

50,400 |

|

|

|

2,074,968 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|