Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

PENN VIRGINIA CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

PENN VIRGINIA CORPORATION

Four Radnor Corporate Center

Suite 200

100 Matsonford Road

Radnor, Pennsylvania 19087

NOTICE OF 2011 ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

You are cordially invited to attend the Annual Meeting of Shareholders of Penn Virginia Corporation (the “Company”) to be held at the Radnor Hotel, 591 E. Lancaster Avenue, St. David’s, Pennsylvania on Wednesday, May 4, 2011, at 10:00 a.m., prevailing time, to consider and act on the following matters:

| 1. | The election of eight directors, each to serve until the next Annual Meeting of Shareholders and until their respective successors are duly elected and qualified; |

| 2. | The approval of an amendment to the Penn Virginia Corporation Seventh Amended and Restated 1999 Employee Stock Incentive Plan; |

| 3. | The holding of an advisory vote on executive compensation; |

| 4. | The holding of an advisory vote on the frequency of future advisory votes on executive compensation; and |

| 5. | The transaction of such other business as may properly come before the meeting or any adjournment thereof. |

Only shareholders of record at the close of business on March 3, 2011 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment, postponement or continuation thereof.

A majority of the issued and outstanding shares of Common Stock of the Company must be represented at the meeting to constitute a quorum. Therefore, all shareholders are urged to attend the meeting or to be represented by proxy.

A copy of the Company’s Annual Report for the year ended December 31, 2010 is being mailed to shareholders together with this Notice.

Whether or not you plan to attend the Annual Meeting, please complete, date and sign the enclosed proxy card and return it promptly in the accompanying envelope or vote your proxy using the Internet. If you later find that you will be present at the meeting and wish to vote in person or for any other reason desire to revoke your proxy, you may revoke your proxy at any time before the voting at the Annual Meeting.

| By Order of the Board of Directors |

|

| Nancy M. Snyder Corporate Secretary |

Radnor, Pennsylvania

April 4, 2011

Table of Contents

| Page | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| PROPOSAL NO. 4 ADVISORY VOTE ON FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION |

16 | |||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| Executive Sessions and Meetings of Independent Directors; Communications with the Board |

18 | |||

| 18 | ||||

| Policies and Procedures Regarding Transactions with Related Persons |

18 | |||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 35 | ||||

| 36 | ||||

| 38 | ||||

| 38 | ||||

Table of Contents

| Page | ||||

| 40 | ||||

| Stock Option Exercises and Vesting of Restricted Stock and Restricted Units |

42 | |||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 48 | ||||

| 48 | ||||

| 48 | ||||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| 53 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

Table of Contents

PENN VIRGINIA CORPORATION

PROXY STATEMENT

Annual Meeting of Shareholders

To Be Held on May 4, 2011

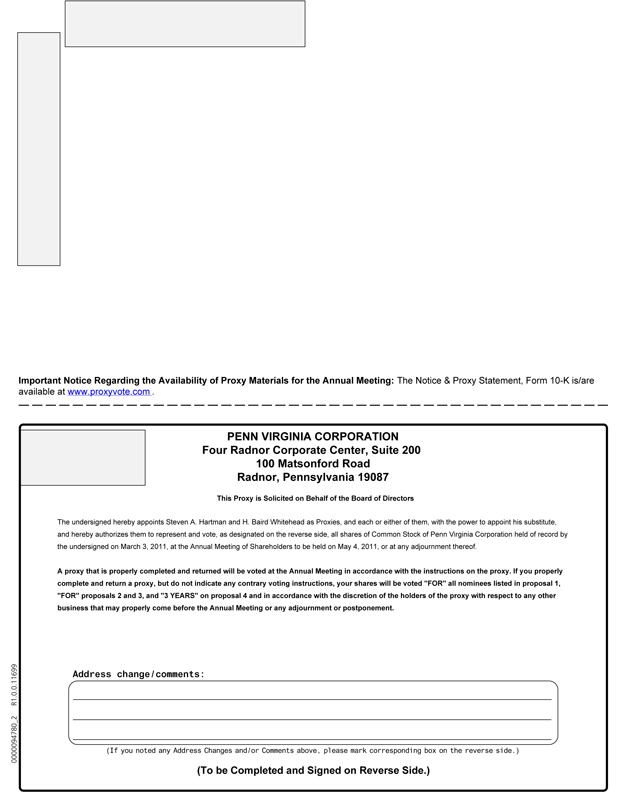

This Proxy Statement and the accompanying proxy are being furnished to shareholders of Penn Virginia Corporation, which is referred to in this Proxy Statement as the “Company,” “we,” “us” or “our,” in connection with the solicitation by or on behalf of the Board of Directors of the Company, or the “Board,” of proxies to be voted at the Annual Meeting of Shareholders, or the “Annual Meeting,” to be held at 10:00 a.m., prevailing time, on May 4, 2011 and at any adjournment, postponement or continuation thereof. The Annual Meeting will be held at the Radnor Hotel, 591 E. Lancaster Avenue, St. David’s, Pennsylvania. This Proxy Statement and the accompanying proxy card are first being mailed on or about April 4, 2011. Our principal executive offices are located at Four Radnor Corporate Center, Suite 200, 100 Matsonford Road, Radnor, Pennsylvania 19087.

Only shareholders of record at the close of business on March 3, 2011 will be entitled to vote at the Annual Meeting. On that date, there were outstanding 45,642,079 shares of our common stock, par value $0.01 per share.

Holders of our common stock will vote as a single class at the Annual Meeting. Each outstanding share will entitle the holder to one vote. All shares represented by properly executed and delivered proxies will be voted at the meeting.

The presence, in person or by proxy, of shareholders holding a majority of the votes entitled to be cast on matters to be considered at the Annual Meeting constitutes a quorum. If a share is represented for any purpose at the Annual Meeting, it is deemed to be present for quorum purposes for all matters considered at the Annual Meeting. If a quorum is not present at the Annual Meeting, the holders of a majority of the shares of our common stock entitled to vote who are present or represented by proxy have the power to adjourn the Annual Meeting from time to time without notice, other than an announcement at the meeting of the time and place of the adjourned meeting, until a quorum is present. In addition, under our Bylaws, our Chairman has the power to adjourn the Annual Meeting for any reason from time to time without notice, other than an announcement of the time and place of the adjourned meeting, provided that a new record date is not set. At any such adjourned meeting at which a quorum is present, any business may be transacted that may have been transacted at the Annual Meeting.

Assuming a quorum is present at the Annual Meeting, our shareholders will elect directors (Proposal No. 1) by a plurality of the eligible votes present or represented by proxy at the Annual Meeting. Approval of the amendment to our Seventh Amended and Restated 1999 Employee Stock Incentive Plan, or the “PVA Equity Plan” (Proposal No. 2), requires the affirmative vote of at least a majority of the votes cast on the proposal at the Annual Meeting; provided that the total votes cast on the proposal represent more than 50% of the total outstanding shares of our common stock. The advisory votes on our executive compensation (Proposal No. 3) and the frequency of future executive compensation votes (Proposal No. 4) are non-binding so no specific vote is required.

1

Table of Contents

Broker Non-Votes and Abstentions

Brokers who hold shares in street name for customers are required to vote those shares as the customers instruct. Under the rules and regulations promulgated by the New York Stock Exchange, or the “NYSE,” and approved by the Securities and Exchange Commission, or the “SEC,” brokers are permitted to vote on “routine” matters even if they have not received voting instructions from their customers, but they are not permitted to vote on “non-routine” matters absent specific voting instructions from their customers. A “broker non-vote” occurs when a broker holds shares for a customer, which are present at the meeting, but lacks discretionary voting power with respect to a particular proposal because the customer has not given the broker instructions regarding how to vote those shares.

All of the proposals set forth in this Proxy Statement are considered non-routine matters under the rules and regulations promulgated by the NYSE and approved by the SEC. Consequently, brokers may not vote uninstructed shares on any the proposals and there may be broker non-votes on some or all of the proposals.

Abstentions, withheld votes and broker non-votes are treated as shares that are present for purposes of determining whether a quorum is present at the Annual Meeting. However, for purposes of determining whether a proposal is approved, abstentions, withheld votes and broker non-votes are tabulated separately. The effect of abstentions, withheld votes and broker non-votes depends on the vote required for a particular proposal. See the “Vote Required” section of each proposal in this Proxy Statement for a description of the effect of abstentions, withheld votes and broker non-votes on such proposals.

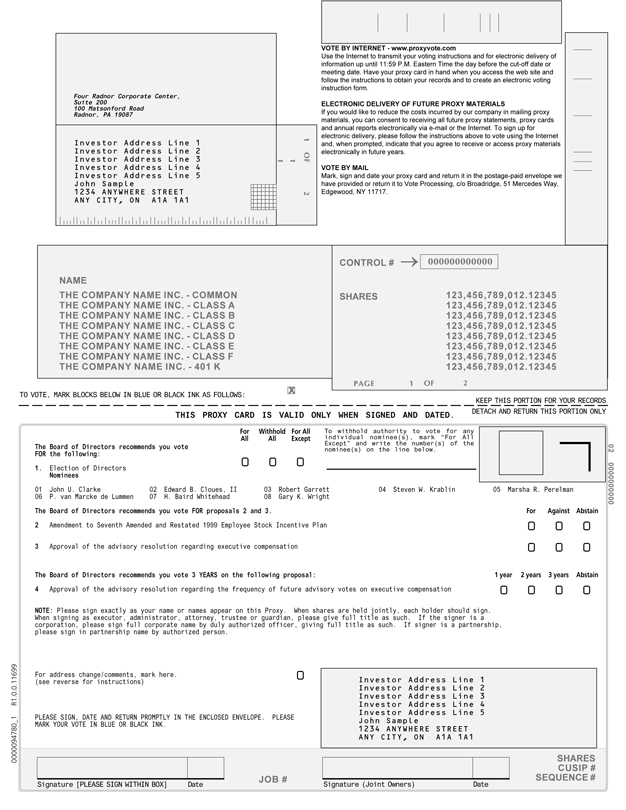

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered the shareholder of record with respect to those shares, and these proxy materials are being sent directly to you. As the shareholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the meeting. We have enclosed a proxy card for you to use. You can also vote by via the Internet. If you desire to vote via the Internet, instructions for using this service are provided on the proxy card. If you desire to vote by mail, you should mark your votes on the proxy card and date, sign and promptly return the proxy card in the accompanying envelope.

If your shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or nominee, together with a voting instruction card. As the beneficial owner, you have the right to direct your broker or nominee how to vote and are also invited to attend the Annual Meeting. See “Broker Non-Votes and Abstentions” above.

Because a beneficial owner is not the shareholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting.

Shares held in your name as the shareholder of record may be voted in person at the Annual Meeting. Shares held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions so that your vote will be counted if you later decide not to attend the Annual Meeting.

2

Table of Contents

A proxy that is properly completed and returned will be voted at the Annual Meeting in accordance with the instructions on the proxy. If you properly complete and return a proxy, but do not indicate any contrary voting instructions, your shares will be voted “FOR” the election of the eight nominees for the Board (Proposal No. 1), “FOR” the amendment to the PVA Equity Plan (Proposal No. 2), “FOR” the resolution relating to executive compensation (Proposal No. 3), for the holding of future advisory votes on executive compensation every “THREE” years (Proposal No. 4) and in accordance with the discretion of the holders of the proxy with respect to any other business that may properly come before the Annual Meeting or any adjournment or postponement. If we propose to adjourn the Annual Meeting, proxy holders will vote all shares for which they have voting authority in favor of adjournment. The Board knows of no matters other than those stated in the Notice of Annual Meeting of Shareholders and described in this Proxy Statement to be presented for consideration at the Annual Meeting.

A shareholder executing and returning a proxy may revoke it at anytime before it is exercised at the Annual Meeting by giving written notice of the revocation to our Corporate Secretary or by executing and delivering to our Corporate Secretary a later dated proxy. Attendance at the Annual Meeting will not be effective to revoke the proxy unless written notice of revocation has also been delivered to our Corporate Secretary before the proxy is exercised. If you hold your shares in a brokerage account or by other nominee and deliver voting instructions to the record holder of those shares, you may only revoke the voting of those shares in accordance with your instructions if such record holder revokes the original proxy as directed above and either resubmits a proxy reflecting your voting instructions or delivers to you a legal proxy giving you the right to vote the shares.

Written notices to us must be addressed to Penn Virginia Corporation, Attention: Corporate Secretary, Four Radnor Corporate Center, Suite 200, 100 Matsonford Road, Radnor, Pennsylvania 19087. No revocation by written notice will be effective unless such notice has been received by our Corporate Secretary prior to the day of the Annual Meeting or by the inspector of election at the Annual Meeting.

The expenses of solicitation of proxies, including the cost of preparing and mailing this Proxy Statement and the accompanying materials, will be paid by us. Such expenses may also include the charges and expenses of banks, brokerage houses and other custodians, nominees or fiduciaries for forwarding proxies and proxy material to beneficial owners of shares. Some of our officers and employees may solicit proxies personally or by telephone, mail or other method of communication and will not be additionally compensated therefor. We have retained Morrow & Co., LLC to aid in the distribution and solicitation of proxies. We will pay Morrow & Co., LLC a fixed fee of $6,000 plus reasonable expenses for these services.

ELECTION OF DIRECTORS

Eight directors have been nominated by the Board for election at the Annual Meeting, all of whom are current directors of the Company. Detailed information on each nominee is provided below. The nominees, if elected, will serve until the next Annual Meeting of Shareholders and until their respective successors are duly elected and qualified. Although all nominees have consented to serve if elected, if any nominee should ultimately decline or be unable to serve, the Board will, if practicable, designate a substitute nominee, and the persons named in the accompanying proxy card will vote for each such substitute nominee. We have no reason to believe that any nominee will decline or be unable to serve.

3

Table of Contents

Information Regarding Nominees for Election as Directors

The following table sets forth certain information regarding the nominees for election as directors:

| Age, Business Experience, Other Directorships and Qualifications |

Director of the Company Since | |

| John U. Clarke, age 58 Mr. Clarke has served as President of Concept Capital Group, Inc., a financial and strategic consulting firm founded by him in 1995, since November 2009, a position he also held from 2001 to 2004 and from 1995 to 1996. From 2004 until its sale in November 2009, Mr. Clarke served as Chairman and Chief Executive Officer of NATCO Group Inc., an oil services company. Previously, Mr. Clarke served as Managing Director of SCF Partners, a private equity investment firm (2000 to 2001), Executive Vice President and Chief Financial Officer of Dynegy, Inc., an energy trading company (1997 to 2000), Managing Director of Simmons & Co. International, an energy investment banking firm (1996 to 1997), and Executive Vice President and Chief Financial and Administrative Officer of Cabot Oil & Gas Corporation, an oil and gas exploration and production company (1993 to 1995). He was employed by Transco Energy Company, an interstate pipeline company, from 1981 to 1993, last serving as Senior Vice President and Chief Financial Officer, and by Tenneco Inc., an interstate pipeline company, from 1977 to 1981 in the finance department.

In the last five years, Mr. Clarke has served on the boards of directors of Harvest Natural Resources, Inc. (October 2000 to May 2008), The Houston Exploration Company (December 2003 to June 2007) and NATCO Group Inc. (February 2000 to November 2009).

Mr. Clarke has served for over 30 years as a director or executive officer at numerous companies engaged in several businesses in or related to the energy industry. In his various capacities, Mr. Clarke has provided these companies with strategic, financial and operational oversight and leadership. This experience allows him to provide guidance to the Board on a wide spectrum of strategic, financial and operational matters. |

2009 (2)(3) | |

| Edward B. Cloues, II, age 63 Mr. Cloues is currently retired. Prior to his retirement, Mr. Cloues served as Chairman of the Board and Chief Executive Officer of K-Tron International, Inc., a provider of material handling equipment and systems, from January 1998 to April 2010. Prior to joining K-Tron International, Inc., Mr. Cloues was a Partner at Morgan, Lewis & Bockius LLP, a global law firm, from October 1979 to January 1998.

Mr. Cloues currently serves as Non-executive Chairman of the Board of AMREP Corporation (director since September 1994 and Chairman since January 1996) and as a director of Hillenbrand, Inc. (since April 2010). He also serves on the board of directors of Penn Virginia Resource GP, LLC, the general partner of Penn Virginia Resource Partners, L.P. (since January 2003). Mr. Cloues also served on the board of directors of K-Tron International, Inc. from July 1985 until its acquisition by Hillenbrand, Inc. in April 2010.

As a former law firm partner specializing in business law matters, the former Chairman of the Board and Chief Executive Officer of K-Tron International, Inc. and a director of multiple public companies, Mr. Cloues has extensive leadership experience and familiarity with complex mergers and acquisitions and other transactions, as well as considerable background in financial, corporate governance and executive compensation matters. |

2001 (1)(3) | |

4

Table of Contents

| Age, Business Experience, Other Directorships and Qualifications |

Director of the Company Since | |

| Robert Garrett, age 74 Mr. Garrett has served as Non-executive Chairman of the Board of the Company since March 2000. He has also served as President of Robert Garrett & Sons, Inc., a private investing and financial advisory company, since 1986. Mr. Garrett served as Managing Director of AdMedia Partners, Inc., an investment banking firm founded by him serving media, advertising and marketing services businesses, from 2005 to 2007 and as President of AdMedia Partners, Inc. from 1990 to 2005. He is also a partner at Media Advisory Partners, LLC, a specialty investment banking firm, from 2010.

Mr. Garrett previously served on the board of directors of PVG GP, LLC from its initial public offering in December 2006 to June 2010.

Mr. Garrett has served as a director since 1997 and as our Chairman for over 10 years, during which time we have grown substantially in size and scope. His long tenure with the Company gives him insight when helping to guide the Board in making decisions about the Company’s future strategic direction. In addition to his experience with us, Mr. Garrett has served on the boards of directors of several public companies and has an extensive background in investment banking, which he has used to assist the Board in evaluating financial and other transactions for us and our affiliates. |

1997 (1)(2) | |

| Steven W. Krablin, age 60 Mr. Krablin served as President, Chief Executive Officer and Chairman of the Board of T-3 Energy Services, Inc., a provider of a broad range of oilfield products and services used in the drilling and completion of new oil and gas wells, the workover of existing wells and the production and transportation of oil and gas, from March 2009 until its sale in January 2011. He was a private investor from April 2005 to March 2009. From April 2008 to August 2008, Mr. Krablin served as Executive Vice President and Chief Financial Officer of IDM Group Limited, a provider of drilling equipment and other goods and services to the oil and gas industry. From January 1996 to his retirement in April 2005, Mr. Krablin served as Senior Vice President and Chief Financial Officer of National-Oilwell, Inc., a manufacturer and distributor of oil and gas drilling equipment. From 1986 to 1996, Mr. Krablin was employed by Enterra Corporation, a provider of rental and fishing tools to the oil and gas industry, last serving as Vice President and Chief Financial Officer.

Mr. Krablin currently serves on the boards of directors of Chart Industries, Inc. (since July 2006) and Hornbeck Offshore Services, Inc. (since August 2005). He previously served as Chairman of the Board of T-3 Energy Services, Inc. from March 2009 until its acquisition in January 2011. He also previously served as a director of us from December 2004 to March 2009.

Mr. Krablin has extensive energy industry experience, having served as the chief executive officer of an oilfield products company and as the chief financial officer of several oil and gas equipment companies. The Board utilizes this experience when considering a broad range of financial and operational matters. In addition, Mr. Krablin also previously served as a director of us for five years. Mr. Krablin’s knowledge of us, our history, our operations and our personnel assist him in providing valuable guidance to the Board. |

2010 (2)(3) | |

5

Table of Contents

| Age, Business Experience, Other Directorships and Qualifications |

Director of the Company Since | |

| Marsha R. Perelman, age 60 Ms. Perelman has served as Chief Executive Officer of Woodforde Management, Inc., a holding company founded by her, since 1993. From 1983 to 1990, Ms. Perelman served as President of Clearfield Ohio Holdings, Inc., a gas gathering and distribution company co-founded by her, and as Vice President of Clearfield Energy, Inc., a crude oil gathering and distribution company co-founded by her.

Ms. Perelman currently serves on the board of directors of Penn Virginia Resource GP, LLC (since May 2005).

Ms. Perelman’s background in the energy and other industries has enabled her to contribute significantly to our strategic direction. In addition, Ms. Perelman’s professional and personal contacts have helped the Nominating and Governance Committee identify and recruit director candidates. |

1998 (1)(3) | |

| Philippe van Marcke de Lummen, age 67 Mr. van Marcke has served as President of Universitas, Ltd., a manager of funds for the benefit of Belgian universities, since 2007 and as Secretary of Universitas, Ltd. from 1995 to 2007. He has also worked as a private consultant since 2004. From 2005 to 2008, Mr. van Marcke was an advisor to Cheniere Energy, Inc., a liquefied natural gas terminal business. Prior to his work with Cheniere, Mr. van Marcke served as Founder and Chairman of Tractebel LNG Trading S.A., a global energy and services business (2002 to 2004), as Founder and Chief Executive Officer of Tractebel LNG Ltd. (London) (2001 to 2002), as Executive Vice President, President of Strategy Committee and Head of Mergers and Acquisitions of Tractebel North America, Inc. (1999 to 2001), as Founder and Chief Executive Officer of Tractebel Energy Marketing, Inc. (1996 to 1999) and as President of American Tractebel Corporation (1990 to 1996).

Mr. van Marcke has an extensive background in the energy industry, specifically including the oil and gas industry and the liquefied natural gas (LNG) industry, which competes with the domestic natural gas industry to supply natural gas to U.S. markets. Mr. van Marcke also has substantial experience working with foreign and multinational organizations. Mr. van Marcke’s background and experiences provides the Board with a unique perspective and diverse viewpoint on the oil and gas industry. |

2006 (1)(2) | |

| H. Baird Whitehead, age 60 Mr. Whitehead has served as our President since February 2011, as our Chief Operating Officer since February 2009 and as President of Penn Virginia Oil & Gas Corporation since January 2001. He also served as our Executive Vice President from January 2001 to February 2011. Prior to joining the Company, Mr. Whitehead served in various positions with Cabot Oil & Gas Corporation, or “Cabot.” From 1998 to 2001, Mr. Whitehead served as Senior Vice President during which time he oversaw Cabot’s drilling, production and exploration activity in the Appalachian, Rocky Mountain, Mid-Continent and Texas and Louisiana Gulf Coast areas. From 1992 to 1998, Mr. Whitehead served as Vice President and Regional Manager of Cabot’s Appalachian business. From 1989 to 1992, Mr. Whitehead served as Vice President and Regional Manager of Cabot’s Anadarko business unit.

Mr. Whitehead has served in senior management positions with oil and gas exploration and production companies for over 20 years, including the past 10 years as the president of our oil and gas subsidiary. His broad experience in the exploration and production industry and detailed knowledge of our operations lends critical support to the Board’s decision making process. |

2011 | |

6

Table of Contents

| Age, Business Experience, Other Directorships and Qualifications |

Director of the Company Since | |

| Gary K. Wright, age 66 Mr. Wright has acted as an independent consultant since 2004. From 2003 to 2004, he served as President of LNB Energy Advisors, a provider of bank credit facilities and strategic advice to small to mid-sized oil and gas producers. From 2001 to 2003, Mr. Wright was an independent consultant to the energy industry. From 1992 to 2001, Mr. Wright served in various capacities with the Global Oil and Gas Group of Chase Manhattan Bank, including as North American Credit Deputy from 1998 to 2001 and as Managing Director and Senior Client Manager in the Southwest from 1992 to 1998. Prior to joining Chase Manhattan Bank, Mr. Wright served as Manager of the Chemical Bank Worldwide Energy Group (1990 to 1992), as Manager of Corporate Banking with Texas Commerce Bank (1987 to 1990) and as Manager of the Energy Group of Texas Commerce Bank (1982 to 1990).

In the last five years, Mr. Wright has served on the board of directors of Maritrans Inc. (April 2006 to January 2007).

Mr. Wright has broad experience providing financial and strategic advice to oil and gas producers and other companies in the energy business. The Board draws on this experience when it considers financial and economic analyses related to financing and other transactions. In addition, Mr. Wright’s financial expertise assists him in effectively chairing the Audit Committee. |

2003 (2)(3) |

| (1) | Member of the Nominating and Governance Committee |

| (2) | Member of the Compensation and Benefits Committee |

| (3) | Member of the Audit Committee |

Directors are elected by a plurality of the votes cast by holders of our common stock at a meeting at which a quorum is present. Votes that are withheld and broker non-votes will not be included in determining the number of votes cast in the election of directors and will not have any effect on the outcome of voting on director elections. Cumulative voting rights do not exist with respect to the election of directors.

The Board recommends that our shareholders vote FOR the election of the eight nominees.

7

Table of Contents

APPROVAL OF AN AMENDMENT TO OUR

SEVENTH AMENDED AND RESTATED 1999 EMPLOYEE STOCK INCENTIVE PLAN

On February 16, 2011, the Compensation and Benefits Committee of the Board, or the “Committee,” approved an amendment to our Seventh Amended and Restated 1999 Employee Stock Incentive Plan, or the “PVA Equity Plan.” The PVA Equity Plan was amended to (i) increase the number of shares of our common stock issuable thereunder from 6,335,000 to 7,500,000; (ii) increase the aggregate number of shares of restricted stock and restricted stock units issuable thereunder from 350,000 to 600,000; and (iii) extend the termination date of the PVA Equity Plan from December 31, 2013 to December 31, 2015. The amendments described above were made subject to shareholder approval. Consequently, if shareholder approval of the amendment to the PVA Equity Plan is not obtained, the amendments described above will not be effective. We believe that the foregoing amendments are necessary to ensure that a sufficient and reasonable number of shares will be available over a reasonable period of time to fund our compensation programs. If the amendment to the PVA Equity Plan is not approved, we will not have sufficient shares in the PVA Equity Plan to provide employees with annual long-term compensation awards consistent with prior practices.

To affect such amendments, Sections 4 and 21 of the PVA Equity Plan would be amended and restated in their entirety as follows:

| 4. | Stock Subject to Plan |

Subject to Section 13, not more than 7,500,000 Shares in the aggregate may be issued pursuant to the Plan and of the foregoing 7,500,000 Shares, no more than 600,000 Shares in the aggregate may be issued as Restricted Stock Awards or pursuant to Restricted Stock Unit Awards. For purposes of determining the number of Shares issued under the Plan, no Shares shall be deemed issued until they are actually delivered to a Participant, Optionee or any other person in accordance with Section 8(b). Shares covered by Options, Restricted Stock Awards or Restricted Stock Unit Awards that either wholly or in part expire or are forfeited or terminated shall be available for future issuance under the Plan. Any Shares tendered to or withheld by the Company in connection with the exercise of Options, or the payment of tax withholding on any Option, Restricted Stock Award or Restricted Stock Unit Award shall not be available for future issuance under the Plan.

| 21. | Effective Date and Term of Plan |

The Plan became effective on May 4, 1999 and shall expire on December 31, 2015 unless sooner terminated by the Board.

The following is a summary description of the PVA Equity Plan, as amended.

Purpose. The purpose of the PVA Equity Plan is to foster and promote our long-term success and increase shareholder value by providing long-term incentives and rewards to employees who contribute to our growth and success, attracting and retaining individuals of outstanding ability and enabling employees to participate in our long-term growth and financial success.

Term. The Plan was effective on May 4, 1999 and is currently scheduled to terminate on December 31, 2013. No awards may be granted after the termination date; however, awards outstanding on that date may be exercised and/or paid in accordance with their terms. If the amendment to the PVA Equity Plan is approved, the termination date of the PVA Equity Plan will be extended to December 31, 2015.

8

Table of Contents

Administration. The Plan is administered by the Committee. Each member of the Committee is required to be a “non-employee director” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, or the “Exchange Act.”

Type of Awards. Awards under the PVA Equity Plan may be in the form of stock options, restricted stock or restricted stock units.

Participation and Awards. All of our employees are eligible to receive stock options under the PVA Equity Plan. Eligibility to receive restricted stock and restricted stock units under the PVA Equity Plan is limited to key employees selected from time to time by the Committee or the Board. The granting of awards under the PVA Equity Plan is at the discretion of the Committee; therefore, it is not possible to indicate which employees may receive awards under the PVA Equity Plan in the future or the amount of the awards. Approximately 80 employees are currently eligible for selection by the Committee to receive stock options and approximately four are eligible to receive restricted stock and restricted stock units; however, additional participants may be added as is necessary or appropriate based upon our size and structure.

Shares Available for Awards. The maximum number of shares of our common stock which may be issued for all purposes under the PVA Equity Plan is currently 6,335,000, no more than 350,000 of which may issued as restricted stock or restricted stock units. Shares with respect to the unexercised or undistributed portion of any terminated, expired or forfeited award may be reissued under the PVA Equity Plan. As of March 3, 2011, non-forfeited options to purchase 5,255,369 shares of our common stock, 120,327 shares of restricted stock and 229,673 restricted stock units had been granted under the PVA Equity Plan, leaving 729,631 shares available for issuance under the PVA Equity Plan, none of which are available for the issuance of restricted stock or restricted stock units. On February 17, 2011, the Committee granted 6,622 restricted stock units subject to shareholder approval of the amendment to the PVA Equity Plan. These restricted stock units are described in the New Plans Benefit table on page 11.

Stock Options. The Plan provides that the exercise price of a stock option will be the NYSE closing price of our common stock on the date the stock option is awarded. Stock options will be exercisable as determined by the Committee and specified in an award agreement; however, no stock option is exercisable before one year, unless otherwise determined by the Committee, or after 10 years after the date of grant unless (i) the grantee’s employment terminates for any reason other than cause, death, disability or retirement as provided in (iv) below, in which event all unvested options are forfeited and all vested options immediately become exercisable and remain exercisable until the earlier of (A) 90 days after the date of such termination or (B) 10 years after the grant date, (ii) we terminate the grantee’s employment for cause, in which event all such options are forfeited, (iii) the grantee dies or becomes disabled, in which event all such options immediately become exercisable and remain exercisable until the earlier of (A) one year after the date of death or disability or (B) 10 years after the grant date, (iv) the grantee retires after reaching age 62 and completing 10 years of consecutive service with us or our affiliate, in which event all such options immediately become exercisable and remain exercisable until 10 years after the grant date (or, if the grantee dies during this period, as provided in (ii) above), or (v) there occurs a change in control of us, in which event all such options become immediately exercisable and remain exercisable for three years or until the end of their term, whichever is less.

The exercise price for a stock option must be paid in full at the time of exercise. Payment must be made in cash or, subject to the approval of the Committee, in shares of our common stock valued at their fair market value, or a combination thereof. Any taxes required to be withheld must also be paid at the time of exercise. An optionee may enter into an agreement with a brokerage firm acceptable to us whereby the optionee will simultaneously exercise the stock option and sell the shares acquired thereby and the brokerage firm executing the sale will remit to us from the proceeds of sale the exercise price of the shares as to which the stock option has been exercised as well as the required amount of withholding.

9

Table of Contents

Restricted Stock. Restricted stock awards consist of shares of our common stock that are issued in the name of the holder, but that may not be sold or otherwise transferred by the holder until the termination of the restriction period relating to such shares. The restriction periods for restricted stock will terminate as determined by the Committee and specified in an award agreement; however, restriction periods will not terminate before one year or after five years after the date of grant unless (i) the grantee’s employment terminates for any reason other than death or disability, in which event any unvested shares of such restricted stock are forfeited unless otherwise determined by the Committee and specified in the award agreement, or (ii) the grantee dies, becomes disabled or become retirement eligible, which is defined as reaching age 62 and completing 10 years of consecutive service with us or our affiliate, or there occurs a change in control of us, in which events all restrictions terminate.

Restricted Stock Units. Restricted stock unit awards represent the right to receive shares of our common stock or an amount of cash equal to the fair market value of our shares of common stock, as determined by the Committee and subject to the termination of the restriction period relating to such restricted stock units. The restriction periods for restricted stock units will terminate as determined by the Committee and evidenced in an award agreement; however, restriction periods will not terminate before one year or after five years after the date of grant unless (i) the grantee’s employment terminates for any reason other than death or disability, in which event any unvested restricted stock units are forfeited unless otherwise determined by the Committee and specified in the award agreement, or (ii) the grantee dies, becomes disabled or becomes retirement eligible, which is defined as reaching age 62 and completing 10 years of consecutive service with us or our affiliate, or there occurs a change in control of us, in which events all restrictions terminate. Payments with respect to restricted stock unit awards will be made in cash, shares or any combination thereof, as determined by the Committee. The Committee may grant dividend equivalent rights in tandem with restricted stock unit awards.

Other Provisions.

Deferrals. The Committee may require or permit a Plan participant to defer receipt of the payment of cash or the delivery of shares of our common stock that would otherwise be due to such participant in connection with any grant made under the PVA Equity Plan.

Certain Adjustments. The PVA Equity Plan provides for adjustments upon certain changes in our capitalization, including by reason of stock dividend, stock split, recapitalization or combination.

Transferability. No stock option awarded under the PVA Equity Plan is transferable by a plan participant prior to vesting unless otherwise determined by the Committee and specified in an option agreement. Unless otherwise determined by the Committee and specified in an option agreement, no vested stock option is transferrable by a plan participant other than by will or the laws of descent and distribution or to the spouse, children or grandchildren of an optionee or a trust for the exclusive benefit of any such family member. No restricted stock or restricted stock unit is transferable prior to the termination of the restriction period unless otherwise determined by the Committee.

Amendment and Termination. The Board or the Committee may at any time amend, suspend or terminate the PVA Equity Plan provided that no amendment shall (i) without shareholder approval, effectuate a change for which shareholder approval is or may be required by any national securities exchange on which our common stock may be listed, (ii) disqualify any member of the Committee from being a “non-employee director’ as defined in Rule 16b-3 under the Exchange Act or (iii) adversely effect any then outstanding stock option, restricted stock or restricted stock unit award.

Federal Income Tax Consequences

The rules governing the tax treatment of stock options, restricted stock and restricted stock units are complex. Therefore, the description of the federal income tax consequences set forth below is necessarily general

10

Table of Contents

in nature and does not purport to be complete. Moreover, statutory provisions are subject to change, as are their interpretation, and their applications may vary in individual circumstances. Finally, the tax consequences under applicable state and local income tax laws may not be the same as under the federal income tax laws.

Stock Options. With respect to stock options, the holder will recognize no taxable income at the time of grant. Upon exercise of a stock option, the holder will recognize ordinary income equal to the difference between the exercise price and the fair market value of our common stock on the date of exercise. We will be entitled to deduct an amount equal to the difference between the exercise price and the fair market value of our common stock on the date of exercise. The holder will recognize as a capital gain or loss any profit or loss realized on the subsequent sale or exchange of any share disposed of or sold.

Restricted Stock. A holder of restricted stock is not required to include the value of such shares in income until the first time such holder’s rights in the shares are transferable or are not subject to a substantial risk of forfeiture, whichever occurs earlier, unless such holder timely files an election under Section 83(b) of the Internal Revenue Code to be taxed on the receipt of the shares. In either case, the amount of such income will be equal to the fair market value of our common stock at the time the income is recognized. Subject to Section 162(m) of the Internal Revenue Code as described above in “Executive Compensation—Compensation Discussion and Analysis—Tax Implications,” we will generally be entitled to a deduction, in the amount of the ordinary income recognized by the holder, for our taxable year in which the participant recognizes such income. The holder will recognize as a capital gain or loss any profit or loss realized on the subsequent sale or exchange of any share disposed of or sold.

Restricted Stock Units. A holder of restricted stock units will recognize no taxable income at the time of grant. Upon vesting of a restricted stock unit, the holder will recognize ordinary income equal to the fair market value of our common stock on the vesting date. Subject to Section 162(m) of the Internal Revenue Code, we will generally be entitled to a deduction, in the amount of the ordinary income recognized by the holder, for our taxable year in which the participant recognizes such income. The holder will recognize as a capital gain or loss any profit or loss realized on the subsequent sale or exchange of any share disposed of or sold.

The following table sets forth the number of restricted stock units granted under the PVA Equity Plan subject to shareholder approval of the amendment to the PVA Equity Plan.

New Plan Benefits

| Name and Position |

Number of Restricted Stock Units Granted Subject to Shareholder Approval |

|||

| A. James Dearlove, Chief Executive Officer |

0 | |||

| H. Baird Whitehead, President and Chief Operating Officer |

3,066 | |||

| Steven A. Hartman, Senior Vice President and Chief Financial Officer |

1,472 | |||

| Nancy M. Snyder, Executive Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary |

2,085 | |||

| All executive officers as a group |

6,622 | |||

| All non-executive directors as a group |

0 | |||

| All non-executive officers as a group |

0 | |||

11

Table of Contents

Approval of the amendment to the PVA Equity Plan will require the affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting; provided that the total votes cast on the proposal represent more than 50% of total outstanding shares of our common stock. Abstentions will be treated as votes cast, while broker non-votes will not be treated as votes cast, for determining whether the total votes cast on the proposal represent more than 50% of the total outstanding shares of our common stock. Accordingly, abstentions and broker non-votes will have the effect of a negative vote on the proposal unless holders of more than 50% of the total outstanding shares of our common stock cast votes, in which event neither an abstention nor a broker non-vote will have any effect on the result of the vote.

The Compensation and Benefits Committee unanimously approved the amendment to the PVA Equity Plan, subject to shareholder approval, and has determined that the amendment is advisable and in the best interests of the Company and our shareholders. The Board recommends that our shareholders vote FOR the amendment to the PVA Equity Plan for the following reasons:

| • | The failure by our shareholders to approve the amendment of the PVA Equity Plan will preclude further grants of restricted stock and restricted stock units and will limit our ability to make future grants of stock options. |

| • | We have granted all of our available restricted stock and restricted stock units under the PVA Equity Plan. In the event that the amendment to the PVA Equity Plan is not approved by our shareholders, we will not be able to grant any further restricted stock or restricted stock units. |

| • | After giving effect to our regular stock option grants made in February 2011, we only have 729,641 shares available for the issuance of stock options under the PVA Equity Plan. |

| • | Our use of equity has been, and will continue to be, judicious and reasonable. |

| • | The value of the annual equity awards to our executive officers and other participating employees is determined based on, among other factors, specific Company and individual performance measures. |

| • | We make equity grants once each year in connection with our annual long-term incentive awards. We only granted an aggregate of 215,280 shares of restricted stock and restricted stock units in the years ended December 31, 2008, 2009 and 2010, 20,665 of which were forfeited upon the resignation of our former Chief Financial Officer. We had 45,556,854 shares of common stock outstanding as of December 31, 2010. |

| • | Restricted stock and restricted stock unit grants have generally been limited to our executive officers. |

| • | Our policy is that our executive officers may not take more than 50% of their total equity awards in the form of restricted stock or restricted stock units. |

| • | Our burn rate is well within industry guidelines established by Institutional Shareholder Services. Burn rate is equal to total awards granted divided by the weighted average shares outstanding. For the years ended December 31, 2008, 2009 and 2010, our annual burn rates for shares underlying awards granted has been 1.4%, 3.3% and 1.7%, with a three-year average burn rate of 2.2%. |

| • | Approval of the amendment of the PVA Equity Plan will result in a moderate dilution level of 10.6%. |

| • | The total cost of our equity plans, including both our employees’ equity plan and director’s equity plan, is reasonable. We calculate that the cost of our equity plans, as a percentage of the market |

12

Table of Contents

| value of our common stock, after giving effect to the amendment to the PVA Equity Plan, is less than 7%. |

| • | In February 2011, the Committee increased the cash bonus of our Chief Executive Officer, or our “CEO,” with regard to 2010 and did not make any equity award to him given that he will retire in May 2011. |

| • | The use of restricted stock and restricted stock unit grants is a critical component of our executive compensation practices. |

| • | Competition for quality employees within the energy industry is intense. The executive compensation practices of most of the members of our Peer Group (as defined under the heading “Executive Compensation—Compensation Discussion and Analysis—Peer Benchmarks”) include a component of restricted stock or restricted stock units. Our failure to provide such a component will place us at a disadvantage relative to our peers in attracting, motivating and retaining our executive officers. While motivating and retaining our executive officers is always important, it is particularly important now and will remain so during the next few years. Our long-time CEO will retire in May 2011, and we have just completed a transformational year and are in the early process of implementing a new business strategy. This strategy is described in detail under “Executive Compensation—Compensation Discussion and Analysis—Overview of Our 2010 Performance.” Continuity of leadership will be a key factor related to the success of this strategy. |

| • | Restricted stock and restricted stock units have a significant retention effect because, unlike stock options, they retain value even if our stock price declines. As of December 31, 2010, we had 2,140,357 outstanding employee stock options. Based on the NYSE closing price of our common stock on such date, only about 40% of our outstanding employee stock options were in the money and it would require a 45% increase in the market price of our common stock from such date for over half of our outstanding stock options to be in the money. Because so many of our stock options are significantly out of the money, they fail to incent or retain our employees. Our ability to balance stock option grants with restricted stock or restricted stock unit grants allows us to provide meaningful equity awards even during periods of great economic volatility. |

| • | The use of restricted stock and restricted stock units as part of the equity compensation of our executive officers enables us to issuer fewer shares of restricted stock or restricted stock units than stock options to deliver comparable value, which reduces overhang and potential shareholder dilution. |

| • | We have executive stock ownership guidelines to encourage stock ownership among our executive officers and align their interests with those of our shareholders. Restricted stock and restricted stock unit grants are an important means for our executive officers to meet those guidelines. |

| • | The PVA Equity Plan includes many provisions designed to protect shareholder interests and promote effective corporate governance including: |

| • | The PVA Equity Plan authorizes a fixed number of shares of common stock available for grant, thereby requiring shareholder approval of any additional authorization of shares. |

| • | All options to purchase our common stock must be granted at the NYSE closing prices of our common stock on the dates of grant. |

| • | As an NYSE-listed company, we may not reprice any outstanding stock options without shareholder approval. We have never repriced any outstanding stock options. |

| • | The PVA Equity Plan requires a minimum vesting period of one year for restricted stock, restricted stock unit and stock option grants. All restricted stock and restricted stock units ever |

13

Table of Contents

| granted under the PVA Equity Plan have had a three-year vesting period, and all stock options granted since 2004 under the PVA Equity Plan have had a three-year vesting period. |

| • | The PVA Equity Plan contains a customary and reasonable definition of change of control, upon which outstanding unvested equity awards vest. |

| • | Pursuant to NYSE Listing Standards, all material amendments to the PVA Equity Plan require shareholder approval. |

| • | The PVA Equity Plan is administered by the Committee, which is composed entirely of Independent Directors. |

| • | The PVA Equity Plan is not a vehicle for, and we do not engage in, problematic pay practices. |

| • | None of our executive officers have employment contracts. |

| • | The Committee has historically approved cash bonuses and equity awards based on the level of achievement of several specific corporate and individual goals and objectives, as disclosed in detail in our annual proxy statements. Beginning in 2011, cash bonuses and equity awards will be granted under new guidelines approved by the Committee, which provide for the manner in which equity awards to our executive officers and other employees are determined. The new guidelines are described in detail under the heading “Executive Compensation—Compensation Discussion and Analysis—2011 Annual Incentive Cash Bonus and Long-Term Equity Compensation Guidelines.” |

| • | We do not have a pension plan, and, except for an aggregate $43,816 contributed by us in connection with hirings made in 2001 and 2002, we have never contributed to our Supplemental Employee Retirement Plan. |

| • | We do not provide excessive perquisites to our executive officers, other employees or retired executives. |

| • | The Change of Control Severance Agreements for our executive officers provide for double-triggered three-times salary plus bonus payouts with no tax gross ups. See “Executive Compensation—Change-in-Control Arrangements—Company Executive Change of Control Severance Agreements.” |

| • | We do not reimburse our executive officers for any tax obligations. |

| • | We prohibit our executive officers and other employees from engaging in any hedging activities. See “Executive Compensation—Compensation Discussion and Analysis—Policy Prohibiting Hedging.” |

| • | The compensation of our executive officers is comparable to that of our Peer Group. See “Executive Compensation—Compensation Discussion and Analysis—Peer Benchmarks.” |

| • | The differential between our CEO’s total annual compensation and that of all of our other employees is appropriate. See “Executive Compensation—Compensation Discussion and Analysis—Internal Pay Equity at Our Company.” |

| • | We have never repriced or replaced options, and we are not permitted to do so under NYSE rules without shareholder approval. |

14

Table of Contents

ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with the requirements of Section 14A of the Exchange Act (which was added by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, referred to as the “Dodd-Frank Act”) and the related rules of the SEC, we are providing our shareholders with the opportunity to vote on a non-binding, advisory resolution to approve the compensation of our named executive officers, or our “NEOs,” as disclosed in this Proxy Statement. This advisory vote, commonly known as a “say-on-pay” vote, gives our shareholders the opportunity to express their views on our NEOs’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs and the philosophy, policies and practices described in this Proxy Statement.

We invite you to review carefully the “Executive Compensation” section of this Proxy Statement beginning on page 25, including the Compensation Discussion and Analysis, compensation tables and related narrative discussion. As described in detail under the heading “Executive Compensation—Compensation Discussion and Analysis,” our executive compensation program is designed to attract, retain and develop employees with the appropriate experience, motivation and skills to grow an oil and natural gas exploration and production company that operates safely in a cost and time efficient manner and has the ability to react to economic and other developments in a cyclical and volatile industry. We believe that our executive compensation program fulfills these objectives. Accordingly, we are asking our shareholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the shareholders approve, on an advisory basis, the compensation paid to the Company’s named executive officers, as disclosed in the Company’s Proxy Statement for the 2011 Annual Meeting of Stockholders pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion.”

The vote is advisory, and it will not be binding on the Board or the Committee. Accordingly, neither the Board nor the Committee will be required to take any action as a result of the outcome of the vote on this proposal. However, the Board and the Committee value the opinions of our shareholders, and the Committee will carefully consider the outcome of the vote when making future executive compensation decisions for our NEOs.

Notwithstanding the advisory nature of this vote, the foregoing resolution will be deemed approved, on an advisory basis, with the affirmative vote of the majority of the votes cast on the proposal at the Annual Meeting. Abstentions and broker non-votes will not be included in determining the number of votes cast and, therefore, will not have any effect on the outcome of the vote.

The Board recommends that our shareholders vote FOR the approval of the resolution set forth in this proposal relating to the compensation of our NEOs as disclosed in this Proxy Statement.

15

Table of Contents

ADVISORY VOTE ON FREQUENCY OF FUTURE ADVISORY VOTES

ON EXECUTIVE COMPENSATION

In accordance with the requirements of Section 14A of the Exchange Act (which was added by the Dodd-Frank Act) and the related rules of the SEC, we are providing our shareholders with the opportunity to cast vote a non-binding, advisory vote on whether a “say-on-pay” vote should occur every year, every two years or every three years. In considering their vote, shareholders may wish to carefully review the information presented in connection with Proposal No. 3 and the information regarding our compensation policies and decisions regarding our NEOs presented in “Executive Compensation—Compensation Discussion and Analysis.”

After careful consideration, the Board, on recommendation from the Committee, has determined that an advisory vote on executive compensation that occurs once every three years, or a triennial vote, is the most appropriate alternative for the Company for the following reasons:

| • | Our executive compensation program is designed to reward not only short-term, but also long-term performance. An annual say-on-pay vote would tend to shift the focus of our shareholders’ evaluation to short-term financial and operational results rather than longer-term results which are more indicative of whether we have created long-term value for our shareholders. |

| • | A triennial vote will provide our shareholders with sufficient time to evaluate, in a more thoughtful and informed manner, the effectiveness of our both our short-term and long-term compensation strategies and our related business and financial performance. |

| • | A triennial vote will give the Board and the Committee sufficient time to thoughtfully consider the results of the advisory vote regarding executive compensation, understand and respond to prior voting results and implement any desired changes to our executive compensation program. |

| • | Other mechanisms, such as requirements for shareholder approval of equity compensation plans and procedures for communicating with the Board, allow shareholders to provide input on an ongoing basis, including in years when say-on-pay votes do not occur. |

Accordingly, we are asking our shareholders to vote for a frequency of once every THREE years when voting on the following resolution at the Annual Meeting:

“RESOLVED, that the shareholders approve, on an advisory basis, that the frequency with which they prefer to have an advisory vote on the compensation of the Company’s named executive officers is once every one year, every two years or every three years as reflected by their votes for each of these alternatives in connection with this resolution.”

In voting on this resolution, shareholders may cast their vote on their preferred voting frequency by choosing the option of one year, two years or three years or they may abstain from voting. Shareholders are not voting to approve or disapprove of the Board’s recommendation.

The vote is advisory, and it will not be binding upon the Board or the Committee. Accordingly, neither the Board nor the Committee will be required to take any action as a result of the outcome of the vote on this proposal, and the Board may decide that it is in the best interests of our shareholders to hold an advisory vote on executive compensation more or less frequently than the option approved by shareholders. However, the Board and the Committee value the opinions of our shareholders, and the Committee will carefully consider the outcome of the vote when making future determinations regarding the frequency of future advisory votes on executive compensation.

16

Table of Contents

Notwithstanding the advisory nature of this vote, if any of the three options described in the foregoing resolution receives a majority of the votes cast on the proposal at the Annual Meeting, then that option will be deemed approved, on an advisory basis, by our shareholders. Abstentions and broker non-votes will not be included in determining the number of votes cast and, therefore, will not have any effect on the outcome of the vote.

The Board recommends that our shareholders vote to hold future advisory votes on executive compensation every THREE YEARS.

17

Table of Contents

Our business is managed under the direction of the Board. The Board has adopted Corporate Governance Principles describing its duties. A current copy of our Corporate Governance Principles is available at the “Governance” section of our website, http://www.pennvirginia.com. The Board meets regularly to review significant developments affecting the Company and to act on matters requiring Board approval. The Board held 14 meetings in 2010. During 2010, each director attended at least 75% of the aggregate of all meetings of the Board and committees of the Board on which he or she served. Our informal policy is for all directors to attend shareholder meetings. All of the directors serving on the Board on May 5, 2010 attended our Annual Meeting of Shareholders held on that date.

The Nominating and Governance Committee of the Board has determined that Messrs. Clarke, Cloues, Garrett, Krablin, van Marcke and Wright and Ms. Perelman are “independent directors,” as defined by NYSE Listing Standards and SEC rules and regulations. We refer to those directors as “Independent Directors.” The Board has determined that none of the Independent Directors has any relationship with us other than as a director of us.

Executive Sessions and Meetings of Independent Directors; Communications with the Board

Our Independent Directors meet in executive sessions without management during regularly scheduled Board meetings and may do so, if appropriate, during Board meetings which are scheduled on an as needed basis. Robert Garrett, Chairman of the Board and an Independent Director, presides over executive sessions. Shareholders and other interested parties may communicate any concerns they have regarding us by contacting Mr. Garrett in writing c/o Corporate Secretary, Penn Virginia Corporation, Four Radnor Corporate Center, Suite 200, 100 Matsonford Road, Radnor, Pennsylvania 19087.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics as its “code of ethics” as defined in Item 406 of Regulation S-K, which applies to all of our directors, officers, employees and consultants, including our Chief Executive Officer, or our “CEO,” Chief Financial Officer, or our “CFO,” principal accounting officer or controller or persons performing similar functions. A current copy of our Code of Business Conduct and Ethics is available at the “Governance” section of our website, http://www.pennvirginia.com. We intend to satisfy the disclosure requirement for any future amendments to, or waivers of, our Code of Business Conduct and Ethics by posting such information on our website.

Policies and Procedures Regarding Transactions with Related Persons

Under our Corporate Governance Principles, all directors must recuse themselves from any decision affecting their personal, business or professional interests. In addition, as a general matter, our practice is that any transaction with a related person is approved by disinterested directors. For example, with respect to the transactions between us or any of our subsidiaries and our former affiliates, Penn Virginia GP Holdings, L.P., or “PVG,” or Penn Virginia Resource Partners, L.P., or “PVR,” or any of their subsidiaries, any director of us who served as a director or executive officer of the general partner of PVG or the general partner of PVR at the time of such transaction did not vote on such transaction. See “Transactions with Related Persons.” Our General Counsel advises the Board as to which transactions, if any, involve related persons and which directors are prohibited from voting on a particular transaction. All of the related transactions described below in “Transactions with Related Persons” were approved in accordance with the foregoing policies and procedures.

18

Table of Contents

Board Leadership Structure and Risk Oversight

We have had separate Chairmen of the Board and CEOs since 1996. We believe that this Board leadership structure has been and continues to be the best for us and our shareholders. As the oversight responsibility of directors continues to grow, we believe that it is most prudent to have an independent chairman whose primary service to us is Board leadership and a CEO who can focus all of his time on overseeing our management and day-to-day business.

The Board has seven Independent Directors, including our Chairman. A number of our Independent Directors are currently serving or have served as directors or members of senior management of other public companies. We also have three board committees comprised solely of Independent Directors, each with a different Independent Director serving as chairman of the committee. See “—Committees of the Board.” We believe that having seven experienced Independent Directors and strong committees contributes to the leadership of the Board.

The Audit Committee is primarily responsible for overseeing our risk management processes on behalf of the full Board. The Audit Committee receives reports from management at least quarterly regarding our assessment of risks and reports regularly to the full Board, which also considers our risk profile. The Audit Committee and the full Board focus on and discuss with management the most significant risks facing us and our general risk management strategy, and also ensure that risks undertaken by us are consistent with the Board’s view of risk.

The Board has a Nominating and Governance Committee, a Compensation and Benefits Committee and an Audit Committee. Each of the Board’s committees acts under a written charter, which was adopted and approved by the Board. Current copies of the committees’ charters are available at the “Governance” section of our website, http://www.pennvirginia.com.

Nominating and Governance Committee. Messrs. Cloues, Garrett and van Marcke and Ms. Perelman are the members of the Nominating and Governance Committee, and each is an Independent Director. The Nominating and Governance Committee (i) seeks, identifies and evaluates individuals who are qualified to become members of the Board, (ii) recommends to the Board candidates to fill vacancies on the Board, as such vacancies occur and (iii) recommends to the Board the slate of nominees for election as directors by our shareholders at each Annual Meeting of Shareholders. The Committee will consider nominees recommended by shareholders. Shareholder recommendations for director nominees will receive the same consideration by the Board’s Nominating and Governance Committee that other nominations receive. See “Miscellaneous—Shareholder Proposals” for a description of the procedures to be followed in making such a recommendation. The Committee recommends individuals as director nominees based on professional, business and industry experience, ability to contribute to some aspect of our business and willingness to commit the time and effort required of a director. The Committee may also consider whether and how a director candidate’s views, experience, skill, education or other attributes may contribute to the Board’s diversity. While the Committee does not require that each individual director candidate contribute to the Board’s diversity, the Committee in general strives, and has succeeded, to ensure that the Board, as a group, is comprised of individuals with diverse backgrounds and experience conducive to understanding and being able to contribute to all financial, operational, strategic and other aspects of our business. Director nominees must possess good judgment, strength of character, a reputation for integrity and personal and professional ethics and an ability to think independently while contributing to a group process. The Committee also recommends to the Board the individual to serve as Chairman of the Board. Additionally, the Committee assists the Board in implementing our Corporate Governance Principles, confirms that the Compensation and Benefits Committee evaluates senior management, oversees Board self-evaluation through an annual review of Board and committee performance and assists the Independent Directors in establishing succession policies in the event of an emergency or retirement of our CEO.

19

Table of Contents

The Committee may obtain advice and assistance from outside director search firms as it deems necessary to carry out its duties. The Nominating and Governance Committee met twice in 2010.

Compensation and Benefits Committee. Messrs. Clarke, Garrett, Krablin, van Marcke and Wright are the members of the Compensation and Benefits Committee, and each is an Independent Director. The Compensation and Benefits Committee is responsible for determining the compensation of our executive officers. The Committee reviews and discusses with management the information contained in this Proxy Statement under the heading “Compensation Discussion and Analysis” and recommends that such information be included herein. The Committee also periodically reviews and makes recommendations or decisions regarding our incentive compensation and equity-based plans, provides oversight with respect to our other employee benefit plans and reports its decisions and recommendations with respect to such plans to the Board. The Committee also reviews and makes recommendations to the Board regarding our director compensation policy. The Committee may obtain advice and assistance from outside compensation consultants and other advisors as it deems necessary to carry out its duties. The Compensation and Benefits Committee met 16 times in 2010.

Audit Committee. Messrs. Clarke, Cloues, Krablin and Wright and Ms. Perelman are the members of the Audit Committee, and each is an Independent Director. Mr. Wright is an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K. The Audit Committee is responsible for the appointment, compensation, evaluation and termination of our independent registered public accounting firm, and oversees the work, internal quality-control procedures and independence of our independent registered public accounting firm. The Committee discusses with management and our independent registered public accounting firm our annual audited and quarterly unaudited financial statements and recommends to the Board that our annual audited financial statements be included in our Annual Report on Form 10-K. The Committee also discusses with management earnings press releases and guidance provided to analysts. The Committee appoints, replaces, dismisses and, after consulting with management, approves the compensation of our outside internal audit firm. The Committee also provides oversight with respect to business risk matters, compliance with ethics policies and compliance with legal and regulatory requirements. The Committee has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, auditing and other matters and the confidential anonymous submission by employees of concerns regarding questionable accounting, auditing and other matters. The Committee may obtain advice and assistance from outside legal, accounting or other advisors as it deems necessary to carry out its duties. The Audit Committee met 11 times in 2010.

The following table sets forth the aggregate compensation paid to our non-employee directors during 2010:

2010 Director Compensation

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($) (1) |

All Other Compensation ($) (2) |

Total ($) (3) |

||||||||||||

| John U. Clarke |

26,000 | (4) | 123,352 | (5) | 0 | 149,352 | ||||||||||

| Edward B. Cloues, II |

90,993 | 135,000 | (6) | 2,500 | 228,493 | |||||||||||

| Robert Garrett |

107,000 | 135,000 | (7) | 4,000 | 246,000 | |||||||||||

| Steven W. Krablin |

1,000 | — | (8) | 0 | 1,000 | |||||||||||

| Marsha R. Perelman |

— | (9) | 214,000 | (10) | 4,000 | 218,000 | ||||||||||

| William H. Shea, Jr. (11) |

19,250 | 22,500 | 0 | 41,750 | ||||||||||||

| Philippe van Marcke de Lummen |

35,500 | 90,000 | (12) | 0 | 125,500 | |||||||||||

| Gary K. Wright |

76,000 | 90,000 | (13) | 1,650 | 167,650 | |||||||||||

| (1) | Represents the aggregate grant date fair value of shares of common stock, deferred common stock units, PVR common units, deferred PVR common units and deferred PVG common units granted to our |

20

Table of Contents

| non-employee directors. These amounts were computed in accordance with FASB ASC Topic 718 and were based on the NYSE closing prices of our common stock, PVR’s common units and PVG’s common units on the dates of grant. See Note 15 in the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2010. |

| (2) | Represents amounts paid by us as matching contributions under our Matching Gifts Program, which we sponsor for our directors and officers to encourage financial support of educational institutions and civic, cultural and medical or science organizations. Under the program, we will match gifts on a three-for-one basis for the first $100 given in a calendar year to an eligible charity and on a one-for-one basis for any additional contributions made to the same charity. The minimum gift which will be matched is $10. The total annual matching dollars to all charities is limited to $4,000 per director or officer. The program is available to officers for so long as they are officers of ours and to directors for their lifetimes. We may suspend, change, revoke or terminate the program at any time. |

| (3) | Mr. Cloues and Ms. Perelman also serve as directors of the general partner of PVR. The amounts shown in this table for Mr. Cloues and Ms. Perelman include the aggregate compensation they received from us and PVR’s general partner through June 7, 2010, the date on which PVR’s general partner ceased to be an affiliate of us. Mr. Garrett also served as a director of the general partner of PVG until June 7, 2010. The amounts shown in this table for Mr. Garrett include the aggregate compensation he received from us and PVG’s general partner. |

| (4) | Mr. Clarke elected to receive all of his cash compensation, other than meeting fees, in shares of our common stock. |

| (5) | As of December 31, 2010, Mr. Clarke had 4,915 deferred common stock units outstanding. |

| (6) | As of December 31, 2010, Mr. Cloues had 19,999 deferred common stock units outstanding. |

| (7) | As of December 31, 2010, Mr. Garrett had 1,600 stock options and 19,999 deferred common stock units outstanding. |

| (8) | As of December 31, 2010, Mr. Krablin had no deferred common stock units outstanding. |

| (9) | Ms. Perelman elected to receive all of her cash compensation in shares of our common stock or PVR common units. |

| (10) | As of December 31, 2010, Ms. Perelman had 800 stock options and 19,999 deferred common stock units outstanding and 470 shares held in her directors’ deferred compensation account. |

| (11) | Mr. Shea resigned from the Board on June 7, 2010. At that time, all of Mr. Shea’s outstanding deferred common stock units converted into shares of our common stock. |

| (12) | As of December 31, 2010, Mr. van Marcke had 16,099 deferred common stock units outstanding. |