Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 31, 2012

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER: 1-8929

ABM INDUSTRIES INCORPORATED

(Exact name of registrant as specified in its charter)

| Delaware | 94-1369354 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 551 Fifth Avenue, Suite 300, New York, New York | 10176 | |

| (Address of principal executive offices) | (Zip Code) | |

(212) 297-0200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

x |

Accelerated filer |

¨ | |||

| Non-accelerated filer |

¨ (Do not check if a smaller reporting company) |

Smaller reporting company |

¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of April 30, 2012 (the last business day of registrant’s most recently completed second fiscal quarter), non-affiliates of the registrant beneficially owned shares of the registrant’s common stock with an aggregate market value of $1,239,067,128 computed by reference to the price at which the common stock was last sold. Number of shares of common stock outstanding as of December 11, 2012: 54,412,633.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement to be used by the Company in connection with its 2013 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

ABM Industries Incorporated

Form 10-K

For the Fiscal Year Ended October 31, 2012

Table of Contents

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report on Form 10-K, and in particular statements found in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which are not statements of historical fact constitute forward-looking statements. These statements give current expectations or forecasts of future events and are often identified by the words “will,” “may,” “should,” “continue,” “anticipate,” “believe,” “expect,” “plan,” “appear,” “project,” “estimate,” “intend,” “seek” or other words and terms of similar meaning in connection with discussions of future strategy and operating or financial performance. Such statements reflect the current views of ABM Industries Incorporated (“ABM”), and its subsidiaries (collectively, the “Company”), with respect to future events and are based on assumptions and estimates which are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these statements. Accordingly, undue reliance should not be placed on these forward-looking statements. In Item 1A, the Company has listed specific risks and uncertainties that you should carefully read and consider. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Introduction

References in this Form 10-K to “ABM”, “we”, “us”, “our”, or the “Company” refer to ABM Industries Incorporated and all of its consolidated subsidiaries, except as otherwise indicated or the context otherwise requires.

ABM is a leading provider of end-to-end integrated facility solutions services to thousands of commercial, governmental, industrial, institutional, retail, and residential facilities located primarily throughout the United States. The Company’s comprehensive capabilities include expansive facility solutions, energy solutions, commercial cleaning, maintenance and repair, HVAC, electrical, landscaping, parking and security services, provided through stand-alone or integrated solutions.

The Company was reincorporated in Delaware on March 19, 1985, as the successor to a business founded in California in 1909. The Company’s corporate headquarters are located at 551 Fifth Avenue, Suite 300, New York, New York 10176. The telephone number is (212) 297-0200. The Company’s website is www.abm.com. Through the “SEC Filings” link on the “Investors” section of the Company’s website, the following filings and amendments to those filings are made available free of charge, as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission: (1) Annual Reports on Form 10-K; (2) Quarterly Reports on Form 10-Q; (3) Current Reports on Form 8-K; (4) Proxy Statements; and (5) filings by the Company’s directors and executive officers under Section 16(a) of the Securities Exchange Act of 1934. The Company’s Corporate Governance Principles, Code of Business Conduct and the charters of its Audit, Compensation, Corporate Citizenship and Communications, and Governance Committees are available through the “Governance” link on the “Investors” section of the Company’s website and are also available in print, free of charge, to those who request them. Information contained on the Company’s website shall not be deemed incorporated into, or to be a part of, this Annual Report on Form 10-K. Unless otherwise noted, all information in this report and references to years are based on the Company’s fiscal year, which ends on October 31.

Acquisitions

On November 1, 2012, we acquired Air Serv Corporation (“Air Serv”), a provider of integrated facility solutions services for airlines and freight companies, and HHA Services, Inc. (“HHA”), a provider of food and facility management services to hospitals, healthcare systems, long-term care facilities, and retirement communities. The Air Serv and HHA acquisitions should allow the Company to significantly expand its vertical market expertise in servicing the end-to-end needs of the airlines, airport authorities, and healthcare service market.

In December 2010, the Company acquired The Linc Group, LLC (“Linc”). Linc provides end-to-end integrated facility solutions services, military base operation services, and translation and other services in support of U.S. military operations. Linc’s clients include state and federal governments, commercial entities, and residential customers throughout the United States and in select international locations. The operations of Linc are included in the Facility Solutions segment as of the acquisition date. The name of Linc was changed to ABM Facility Solutions Group, LLC in fiscal 2012.

3

Table of Contents

Segment Information

The Company has four reportable operating segments. At October 31, 2012, the four reportable operating segments were:

| • | Janitorial |

| • | Facility Solutions |

| • | Parking |

| • | Security |

The business activities of the Company by reportable operating segment are more fully described below.

Janitorial. Janitorial subsidiaries provide a wide range of essential cleaning services for clients in a variety of facilities, including commercial office buildings, industrial buildings, retail stores, shopping centers, warehouses, airport terminals, health facilities, educational institutions, stadiums and arenas, and government buildings. These services include floor cleaning and finishing, window washing, furniture polishing, carpet cleaning and dusting, and other building cleaning services. Janitorial services are provided in all 50 states, the District of Columbia, Puerto Rico, and portions of Canada. The segment has thousands of contracts, most of which are obtained by competitive bidding. These arrangements include “fixed price” arrangements, “cost-plus” arrangements, and “tag” (extra service) work. Fixed price arrangements are contracts in which the client agrees to pay a fixed fee every month over a specified contract term. A variation of a fixed price arrangement is a square-foot arrangement, under which monthly billings are based on the actual square footage serviced. Cost-plus arrangements are agreements in which the clients reimburse the Company for the agreed-upon amount of wages and benefits, payroll taxes, insurance charges, and other expenses associated with the contracted work, plus a profit percentage. Tag work generally represents supplemental services requested by clients outside of the standard service specification. Examples are cleanup after tenant moves, construction cleanup, flood cleanup, snow removal, and extermination services. The majority of the Janitorial segment’s contracts are fixed price agreements for one to three year periods and contain automatic renewal clauses, but are subject to termination by either party after 30 to 90 days’ written notice. Profit margins on contracts tend to be inversely proportional to the size of the contract, as large-scale contracts tend to be more competitively priced than small or stand-alone agreements.

Facility Solutions. Facility Solutions subsidiaries provide end-to-end integrated facility solutions services, including building operations and maintenance and bundled energy solutions, through both mobile and on-site services. The Company’s Facility Solutions subsidiaries primarily operate in all 50 states and the District of Columbia, as well as certain international locations. The on-site services include both mechanical engineering and technical services and solutions for facilities and infrastructure systems, while the mobile services include preventative maintenance, retro-commissioning, mechanical retrofits and upgrades, electric vehicle charging stations, electrical service, systems start-ups, performance testing, and energy audits. These services are designed to extend the useful life of facility fixed assets, improve equipment operating efficiencies, reduce energy consumption, lower clients overall operational costs, and enhance the sustainability of client locations. These services are essential to: federal, state and local government facilities; military installations; commercial infrastructure; airports / transportation centers; healthcare centers and hospitals; data centers; high technology manufacturing facilities; educational campuses; corporate office buildings; resorts; shopping malls; museums; and single and multi-tenant residences. Also included within the Facility Solutions segment are individual and area franchises that permit companies to perform engineering services under the Linc Network, TEGG, CurrentSAFE, and GreenHomes America brands.

Subsidiaries in the Facility Solutions segment also provide programs in support of U.S. Government operations, such as leadership development, education, and training; language support services; medical support services; and construction management. In fiscal 2012, approximately 18% of the Facility Solutions segment revenues were generated from contracts with the U.S. Government.

The Facility Solutions contracts are structured as cost-plus arrangements, fixed-price arrangements, fixed-price repair and refurbishment arrangements, and franchise arrangements. In cost-plus arrangements, clients reimburse the Company for the agreed-upon amount of wages and benefits, payroll taxes, insurance charges, and other expenses associated with the contracted work, plus a profit percentage. Fixed-price agreements are contracts in which the client agrees to pay a fixed fee for a defined scope of services. Certain fixed-price repair and refurbishment arrangements are accounted for under the percentage-of-completion method of accounting most often based on the cost-to-cost method. For franchise operations, initial franchise fees are recognized when the Company has performed substantially all initial services required by the franchise agreement and continuing franchise royalty fees are based on a percentage of the franchisees’ revenues, which is recognized in the period in which the revenue is reported to have occurred, or on a flat rate charged to franchisees, recognized as earned.

4

Table of Contents

The majority of Facility Solutions contracts are for three-year periods and may contain renewal clauses, but are subject to termination by either party after 30 to 90 days’ written notice. U.S. Government contracts are normally structured as one year contracts with multiple option years and contain the contractual right for the U.S. Government to terminate or reduce the amount of work at any time.

Parking. Parking subsidiaries provide parking and transportation services in 39 states and the District of Columbia. The Company operates parking lots and garages at many facilities, including office buildings, hotels, medical centers, retail centers, sports and entertainment arenas, educational institutions, municipalities, and airports. Nearly all contracts are obtained by competitive bidding. There are three types of arrangements for parking services: managed locations, leased locations, and allowance locations.

Under the managed locations arrangements, the Company manages the underlying parking facility for the owner in exchange for a management fee. Contract terms for managed locations arrangements are generally from one to three years, can usually be terminated upon 30 days’ notice, and may also contain renewal clauses. The Company passes through revenues and expenses from managed locations to the facility owner under the terms and conditions of the contract. The Company reports revenues and expenses, in equal amounts, for costs directly reimbursed from its managed locations. Such amounts comprised approximately 49.7% of the Parking segment revenues in the year ended October 31, 2012.

Under leased locations arrangements, the Company leases parking facilities from the owner and is responsible for a majority of the operating expenses incurred. Under these arrangements, the Company retains all revenues from monthly and transient parkers and pays rent to the owner per the terms and conditions of the lease. The lease terms generally range from one to five years and provide for payment of a fixed amount of rent plus a percentage of revenues. The leases usually contain renewal options and may be terminated by the owner for various reasons, including development of real estate. Leases that expire may continue on a month-to-month basis.

Under allowance locations arrangements, the Company is paid a fixed or hourly fee to provide parking services and is then responsible for the agreed-upon operating expenses based upon the agreement terms. Allowance contract terms are generally from one to three years, can usually be terminated upon 30 days’ notice, and may also contain renewal clauses.

The Company continues to improve parking operations through the increased use of technology, including: enhancements to the proprietary revenue control software, SCORE4; implementation of the Company’s client access software, ABM4WD.com; and on-line payment software.

Security. The Company’s Security subsidiary provides security services to a wide range of businesses. The Company’s Security subsidiary operates in 40 states and the District of Columbia. Security services include: staffing of security officers; mobile patrol services; investigative services; electronic monitoring of fire, life safety systems, and access control devices; and security consulting services. Clients served include Class “A” high rise, commercial, industrial, retail, medical, petro-chemical, and residential facilities. Security staffing, or “guarding,” is the provision of dedicated security officers to a client facility. This component is the core of the security business and represents the largest portion of its revenues. The Company has a technology platform that is utilized to augment guard force operations. Mobile patrol is the use of roving security officers in vehicles that serve multiple locations and clients across a pre-defined geographic area. Investigative services include white collar crime investigation, undercover operations, and background screening services. Electronic monitoring is primarily achieved through the subsidiary’s partnership with a major systems integrator. The revenues for Security are generally based on actual hours of service at contractually specified rates. In some cases, flat monthly billing or single rate billing is used, especially in the case of mobile patrol and investigative services. The majority of Security contracts are for one year periods and generally contain automatic renewal clauses, but are subject to termination by either party after 30 to 90 days’ written notice. Nearly all Security contracts are obtained by competitive bidding.

See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Note 16 of the Notes to Consolidated Financial Statements contained in Item 8, “Financial Statements and Supplementary Data,” for the operating results of the reportable operating segments.

5

Table of Contents

Trademarks

The Company believes that it owns or is licensed to use all corporate names, trade names, trademarks, service marks, copyrights, patents, and trade secrets that are material to the Company’s operations.

Competition

The Company believes that each aspect of its business is highly competitive and that such competition is based primarily on price and quality of service. The Company provides nearly all its services under contracts originally obtained through competitive bidding. The low cost of entry in the facility services business results in a very competitive market, and the Company experiences competition from a large number of mostly regional and local owner-operated companies, primarily located in major cities throughout the United States. The Company also competes on a national basis with the operating divisions of a few large, diversified facility services and manufacturing companies. Indirectly, the Company competes with building owners and tenants who can perform one or more of the Company’s services internally. Furthermore, competitors may have lower costs because privately owned companies operating in a limited geographic area may have significantly lower labor and overhead costs. These strong competitive pressures could inhibit the Company’s success in bidding for profitable business and its ability to increase prices as costs rise, thereby reducing margins.

Sales and Marketing

The Company’s sales and marketing efforts are conducted by its corporate, subsidiary, regional, branch, and district offices. Sales, marketing, management, and operations personnel in each of these offices participate directly in selling to and servicing clients. The broad geographic coverage of these offices enables the Company to provide a full range of facility solutions services through intra-company sales referrals, multi-service “bundled” sales, and national account sales.

In fiscal 2012, we launched a re-branding initiative to illustrate ABM’s transformation through strategic acquisitions and organic development. This transformation has brought us into new markets and expanded our expertise and end-to-end service capabilities including domestic and international energy solutions, additional technical building solutions, industry-specific solutions, and government services.

No client accounted for more than 10% of our consolidated revenues during the years ended October 31 2012, 2011, or 2010.

Employees

As of October 31, 2012, the Company employed approximately 95,000 employees. Approximately 46,000 of these employees are covered under collective bargaining agreements. Approximately 6,000 of the Company’s employees have executive, managerial, supervisory, administrative, professional, sales, marketing, office, or clerical responsibilities. As a result of the acquisitions completed on November 1, 2012, the total number of employees increased to approximately 108,500.

Environmental Matters

The Company’s operations are subject to various federal, state, and/or local laws regulating the discharge of materials into the environment or otherwise relating to the protection of the environment, such as discharge into soil, water, and air, and the generation, handling, storage, transportation, and disposal of waste and hazardous substances. These laws generally have the effect of increasing costs and potential liabilities associated with the conduct of the Company’s operations. In addition, from time to time, the Company is involved in environmental matters at certain of its locations or in connection with its operations. Historically, the cost of complying with environmental laws or resolving environmental issues relating to United States locations or operations has not had a material adverse effect on the Company’s financial position, results of operations, or cash flows. The Company does not believe that the resolution of known matters at this time will be material.

6

Table of Contents

RISKS RELATING TO OUR OPERATIONS

Risks relating to our acquisition strategy may adversely impact our results of operations. A significant portion of our historic growth has been generated by acquisitions and we expect to continue to acquire businesses in the future as part of our growth strategy. A slowdown in the pace of our acquisitions could lead to a slower growth rate and constant or lower margins. There can be no assurance that any acquisition we make in the future will provide us with the benefits that we anticipate when entering into the transaction. The process of integrating an acquired business may create unforeseen difficulties and expenses. The areas in which we may face risks in connection with any potential acquisitions of a business include, but are not limited to:

| • | The acquisition may divert management time and focus from operating our business to acquisition integration; |

| • | Key employees may not remain, which could negatively impact our ability to grow the acquired business; |

| • | We may fail to integrate the acquired business’s accounting, information technology, human resources, and other administrative systems to permit effective management and reduce expenses; |

| • | We may fail to implement or improve internal controls, procedures, and policies appropriate for a public company at a business that prior to the acquisition lacked some of these controls, procedures, and policies; |

| • | We may incur additional indebtedness as a result of an acquisition, which could impact our financial position, results of operations, and cash flows; and |

| • | We may encounter unanticipated or unknown liabilities relating to the acquired business. |

Our strategy of moving to an integrated facility solutions provider platform, focusing on vertical market strategy, may not generate the growth in revenues or profitability that we expect. We believe that in the long term an integrated facility solutions approach will yield important benefits to the Company and our clients, including enhanced service quality, contract simplicity, and flexibility, as well as improved innovations in the delivery of services, resulting in increased revenue growth and increased profitability. However, revenues from market segments characterized by commodity driven purchasing decisions may generate lower levels of profitability. In addition, we may not be able to execute on this strategy as a result of, among other things, client resistance to an integrated approach, including our vertical marketing strategy, difficulty in penetrating certain market segments, inability to deliver comprehensive services requested, inability to acquire vertical market expertise, competition from existing integrated facility solutions providers, as well as increased competition from single service providers or module providers who provide specialized solutions based on bundled services. Any organizational change relating to this strategy may give rise to additional costs.

We are subject to intense competition that can constrain our ability to gain business, as well as our profitability. We believe that each aspect of our business is highly competitive and that such competition is based primarily on price and quality of service. We provide nearly all our services under contracts originally obtained through competitive bidding. The low cost of entry to the facility services business has led to strongly competitive markets consisting primarily of regional and local owner-operated companies. We also compete with a few large, diversified facility services and manufacturing companies on a national basis. Indirectly, we compete with building owners and tenants who can perform internally one or more of the services that we provide. These building owners and tenants have an increased advantage in locations where our services are subject to sales tax and internal operations are not. Competitors may have lower costs because privately owned companies operating in a limited geographic area may have significantly lower labor and overhead costs. In addition, our Facility Solutions business requires persons with specialized skills, and our ability to retain and attract qualified employees depends on workforce availability and our ability to successfully compete for qualified persons having the necessary skills. These strong competitive pressures could impede our success in bidding for profitable business and our ability to increase prices even as costs rise, thereby reducing margins.

Increases in costs that we cannot pass on to clients could affect our profitability. We negotiate many contracts under which our clients agree to pay certain costs, including those related to workers’ compensation, other insurance where we self-insure much of our risk, labor, payroll taxes, and petroleum. If actual costs exceed the rates specified in the contracts, our profitability may decline unless we can negotiate increases in these rates. In addition, if our costs exceed those of our competitors, we may lose existing business unless we reduce our rates to levels that may not fully cover our costs.

7

Table of Contents

We have high deductibles for certain insurable risks, and therefore we are subject to volatility associated with those risks. We use a combination of insurance and self-insurance programs to provide for a number of risks, including workers’ compensation, general liability, property insurance, automobile liability and certain employee–related health care benefits plans. We are responsible for claims in excess of our insurance coverage, and while we endeavor to purchase insurance coverage that is appropriate to our assessment of risk, we are unable to predict with certainty the frequency, nature, or magnitude of claims for direct or consequential damages. Our business may be negatively affected if in the future our insurance proves to be inadequate or unavailable. We attempt to mitigate certain of these risks by the implementation of companywide loss control efforts designed to decrease the incidence of events that might give rise to liability. These loss control efforts include fostering a climate of safety awareness, proactive pre-job hazard assessments, the dissemination of safety training materials and other employee engagement tools.

Should we be unable to renew our umbrella and other commercial insurance policies at competitive rates, it would have a material adverse impact on our business, as would the incurrence of catastrophic uninsured claims or the inability or refusal of our insurance carriers to pay otherwise insured claims. Further, to the extent that we self-insure, deterioration in claims management could increase claim costs, particularly in the workers’ compensation area. A material change in our insurance costs due to a change in the number of claims, costs, premiums, or regulatory changes could have a material adverse effect on our financial position, results of operations, or cash flows.

Although we engage third-party experts to assist us in estimating appropriate insurance accounting reserves, the determination of those reserves is dependent upon significant actuarial judgments that have a material impact on our reserves. For example, quantitative assessments of the impact of recently enacted legislation/regulation and/or court rulings require a great deal of actuarial judgment, which is then updated as actual experience becomes available. Changes in our insurance reserves as a result of our periodic evaluations of the related liabilities will likely cause significant volatility in our operating results that might not be indicative of the operations of our ongoing business.

We primarily provide our services pursuant to agreements that are cancelable by either party upon 30 to 90 days’ notice. Our clients can unilaterally decrease the amount of services we provide or terminate all services pursuant to the terms of our service agreements. Any loss of a significant number of clients could in the aggregate materially adversely affect our results of operations.

Our success depends on our ability to preserve our long-term relationships with clients. The business associated with long-term relationships is generally more profitable than that associated with short-term relationships because we incur start-up costs under many new contracts. Once these costs are expensed or fully depreciated over the appropriate periods, the underlying contracts become more profitable. Our loss of long-term clients could have an adverse impact on our profitability even if we generate equivalent revenues from new clients.

Our international business exposes us to additional risks. Although substantially all of our operations are conducted in the United States, our international business, which includes operations through subsidiaries, joint ventures, as well as business operations by our franchisees, are subject to U.S. and foreign laws and regulations, including, without limitation, regulations relating to exchange controls, the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act, and similar laws in other foreign jurisdictions. Failure by our employees, representatives, or agents, as well as by our joint venture partners, to comply with these laws and regulations could result in administrative, civil, or criminal liabilities and could result in suspension or debarment from government contracts, which could have a material adverse effect on us. Additionally, the services we provide internationally, including through the use of subcontractors, are sometimes in areas of military conflict or at military installations, which increases the risk of a situation causing injury or loss of life to our employees, subcontractors, or other third parties. Any accidents or incidents that occur in connection with our international operations could adversely affect our reputation, make it more difficult for us to compete for future contracts, or result in the loss of existing and future contracts. The impact of these factors is difficult to predict, but any one or more of them could have an adverse effect on our financial position, results of operations, or cash flows as well as our reputation and our ability to conduct business.

We conduct some of our operations through joint ventures, and our ability to do business may be affected by the failure of our joint venture partners to perform their obligations or the improper conduct of joint venture employees, joint venture partners, or agents. The success of our joint ventures depends, in large degree, on the satisfactory performance by our joint venture partners of their joint venture obligations, including their obligation to commit capital, equity, or credit support as required by the joint venture agreements. If a joint venture partner fails to perform its joint venture obligations as a result of financial or other difficulties or any other reason, the joint venture may be unable to perform or deliver its contracted services. In addition, we also participate in joint ventures where we are not a controlling party, and in these cases, we may have limited control over the joint venture. We also may not be able to prevent and detect acts committed by joint venture employees, joint venture partners or agents that would violate the laws of the United States or other jurisdictions in which we operate, and any such violation could have a negative effect on our business. Any improper actions could result in civil or criminal investigations and monetary and non-monetary penalties and could have an adverse effect on our financial position, results of operations, or cash flows and our reputation and our ability to conduct business.

8

Table of Contents

Significant delays or reductions in appropriations for our government contracts may negatively affect our business and could have an adverse effect on our financial position, results of operations or cash flows. The funding of U.S. Government programs are subject to annual congressional budget authorization and appropriation processes. In many situations, Congress appropriates funds on a fiscal year basis even though the contract performance period may extend over several fiscal years. Accordingly, programs are often partially funded and additional funds are committed only as Congress makes further appropriations. If we incur costs in excess of funds committed on a contract, we may not receive reimbursement of those costs unless additional funds are appropriated. In the event that government funding for any of the programs relating to our U.S. Government contracts is reduced or delayed, the U.S. Government could terminate or adjust our contracts or subcontracts under such program, which could have an adverse effect on our financial position, results of operations, and cash flows.

We are subject to a number of procurement rules and regulations relating to our business with the U.S. Government and if we fail to comply with those rules, our business and our reputation could be adversely affected. We must comply with laws and regulations relating to the award, administration, and performance of U.S. Government contracts. These contract laws and regulations are complex and, in some instances, impose added costs on our business. A violation of certain laws and regulations could harm our reputation and result in the imposition of fines and penalties, the termination of our contracts with the U.S. Government, or debarment from bidding on government contracts.

Negative or unexpected tax consequences could adversely affect our results of operations. Adverse changes in the underlying profitability and financial outlook of our operations could lead to changes in our valuation allowances against deferred tax assets on our consolidated balance sheet, which could materially and adversely affect our results of operations. Additionally, changes in tax laws in the United States where we have significant operations could have an adverse effect on deferred tax assets and liabilities on our consolidated balance sheets and results of operations. We are also subject to tax audits by governmental authorities in the United States. Negative unexpected results from one or more such tax audits could have an adverse effect on our results of operations.

We are subject to business continuity risks associated with centralization of certain administrative functions. Certain administrative functions, primarily in North America, have been regionally centralized to improve efficiency and reduce costs. To the extent that these central locations are disrupted or disabled, key business processes, such as accounts payable, payroll and general management operations, could be interrupted.

RISKS RELATED TO MARKET AND ECONOMIC CONDITIONS

A decline in commercial office building occupancy and rental rates could affect our revenues and profitability. Our revenues are affected by commercial real estate occupancy levels. In certain geographic areas and service segments, our most profitable revenues are known as tag jobs, which are services performed for tenants in buildings in which our business performs building services for the property owner or management company. A decline in occupancy rates could result in a decline in fees paid by landlords, as well as tag work, which would lower revenues and create pricing pressures and therefore lower margins. Additionally, adverse changes in occupancy rates may further reduce demand, depress prices for our services and cause our clients to cancel their agreements to purchase our services, thereby possibly reducing earnings and adversely affecting our business and results of operations. Moreover, in those areas where the workers are unionized, decreases in revenues can be accompanied by relative increases in labor costs if we are obligated by collective bargaining agreements to retain workers with seniority and consequently higher compensation levels and cannot pass on these costs to clients.

Deterioration in economic conditions in general could reduce the demand for facility services and, as a result, reduce our earnings and adversely affect our financial condition. Continued slow domestic and international economic growth or other negative changes in global, national and local economic conditions could have a negative impact on our business. Specifically, adverse economic conditions may result in clients cutting back on discretionary spending, such as tag work. Additionally, since a significant portion of Parking revenues is tied to the number of airline passengers, hotel guests, and attendees at sports arenas, Parking results could be adversely affected by curtailment of business or personal travel and cutbacks in discretionary spending.

9

Table of Contents

A variety of factors could adversely affect the results of operations of our building and energy services business. Any of the following could materially and adversely impact the results of operations of our building and energy services business: changes in energy costs or government regulations that would decrease the incentive for clients to update or improve their building control systems; revisions to energy efficiency legislation; increased competition; a decline in the outsourcing of facility management services; and the availability of labor to support growth of our energy service business.

Financial difficulties or bankruptcy of one or more of our major clients could adversely affect our results. Future revenues and our ability to collect accounts receivable depend, in part, on the financial strength of our clients. We estimate an allowance for accounts we do not consider collectible and this allowance adversely impacts profitability. In the event clients experience financial difficulty, and particularly if bankruptcy results, profitability is further impacted by our failure to collect accounts receivable in excess of the estimated allowance. Additionally, our future revenues would be reduced by the loss of these clients.

Our ability to operate and pay our debt obligations depends upon our access to cash. Because ABM conducts business operations through operating subsidiaries, we depend on those entities to generate the funds necessary to meet financial obligations. Delays in collections, which could be heightened by disruption in the credit markets and the financial services industry, or legal restrictions could restrict our subsidiaries’ ability to make distributions or loans to ABM. The earnings from, or other available assets of, these operating subsidiaries may not be sufficient to fund operations and make distributions to enable us to pay interest on debt obligations when due or to pay the principal of such debt. We have standby letters of credit and insurance deposits that represent amounts collateralizing self-insurance claims that we cannot access for operations. In addition, $20.0 million original principal amount of our investment portfolio is invested in auction rate securities that are not actively traded. In the event we need to liquidate our auction rate securities prior to a successful auction, our expected holding period, or their scheduled maturity, we might not be able to do so without realizing further losses.

Future declines in the fair value of our investments in auction rate securities could negatively impact our earnings. Future declines in the fair value of our investments in auction rate securities that we consider temporary will be recorded to accumulated other comprehensive income, net of taxes. We have experienced declines in the fair value of our investments in auction rate securities that we have determined to be other-than-temporary. If at any time in the future we determine that a further decline in fair value is other-than-temporary, we will record a charge to earnings for the credit loss portion of the impairment. In addition, the significant assumptions used in estimating credit losses may be different than actual realized losses, which could impact our earnings.

Uncertainty in the credit markets may negatively impact our costs of borrowing, our ability to collect receivables on a timely basis and our cash flow. The United States and global economies continue to experience slow growth, and the financial and credit markets could continue to experience significant declines that could diminish liquidity and credit availability. Any such diminishment may have a material adverse effect on our operations and our costs of borrowing. In addition, any tightening of credit in financial markets may adversely affect the ability of our clients to obtain financing, which could adversely impact our ability to collect amounts due from such clients or result in a decrease, or cancellation, of our services under our client contracts. Declines in our ability to collect receivables or in the level of client spending could adversely affect the results of our operations and our liquidity.

We incur accounting and other control costs that reduce profitability. As a publicly traded corporation, we incur certain costs to comply with regulatory requirements. If regulatory requirements were to become more stringent or if accounting or other controls thought to be effective later fail, we may be forced to make additional expenditures, the amounts of which could be material. Most of our competitors are privately owned, so our accounting and control costs can be a competitive disadvantage.

Sequestration under the Budget Control Act of 2011 (the “Budget Control Act”) or alternative measures that may be adopted in lieu of sequestration may negatively impact our business. The Budget Control Act contains a variety of measures intended to reduce the deficit over the U.S. fiscal years 2012-2021, including statutory caps on discretionary spending. In light of the Budget Control Act and deficit reduction pressures generally, it is possible that discretionary spending by the U.S. Government will remain constrained for a number of years. This could have a negative impact on the growth of our business with the U.S. Government, and in particular, the Department of Defense. In addition, without Congressional intervention, the Budget Control Act, or “sequestration,” takes effect on January 2, 2013. Some observers believe that sequestration could cause the U.S. economy to go into recession and could have material negative consequences to the global economy. Accordingly, the macro-economic effects of the Budget Control Act could have a material negative impact on our business if our clients reduce spending for our services in light of either continuing uncertainty or recession.

10

Table of Contents

RISKS RELATING TO INDEBTEDNESS AND IMPAIRMENT CHARGES

Any future increase in the level of our debt or in interest rates can affect our results of operations. Any future increase in the level of our debt will likely increase our interest expense. Unless the operating income associated with the use of these funds exceeds the debt expense, borrowing money will have an adverse impact on our results. In addition, incurring debt requires that a portion of cash flow from operating activities be dedicated to interest payments and principal payments. Debt service requirements could reduce our ability to use our cash flow to fund operations and capital expenditures or to capitalize on future business opportunities, including additional acquisitions. Because current interest rates on our debt are variable, an increase in prevailing rates would increase our interest costs. Further, our credit facility agreement contains both financial covenants and covenants that limit our ability to engage in specified transactions, which may also constrain our flexibility.

An impairment charge could have a material adverse effect on our financial condition and results of operations. Under Accounting Standards Codification Topic 350, Intangibles – Goodwill and Other, we are required to test goodwill for impairment on an annual basis based upon a fair value approach. Goodwill represents the excess of the amount we paid to acquire our subsidiaries and other businesses over the fair value of their net assets at the dates of the acquisitions. We have chosen to perform our annual impairment reviews of goodwill at the beginning of the fourth quarter of each fiscal year. We also are required to test goodwill for impairment between annual tests if events occur or circumstances change that would more likely than not reduce the fair value of any reporting unit below its carrying amount. In addition, we test certain intangible assets for impairment annually or if events occur or circumstances change that would indicate the remaining carrying amount of these intangible assets might not be recoverable. These events or circumstances could include, but are not limited to, a significant change in the business climate, legal factors, operating performance indicators, competition, and sale or disposition of a significant portion of one of our businesses. If the fair value of one of our businesses is less than its carrying amount, we could be required to record an impairment charge. The valuation of the businesses requires judgment in evaluating, among other things, recent indications of market activity, and estimating future cash flows, discount rates and other factors. In making these judgments, we evaluate the financial health of our business, including such factors as market performance, changes in our client base and operating cash flows. The amount of any impairment could have a material adverse effect on our reported financial results for the period in which the charge is taken.

RISKS RELATED TO LABOR AND LEGAL PROCEEDINGS

We are defendants in class and representative actions and other lawsuits alleging various claims that could cause us to incur substantial liabilities. Our business involves placing our employees in the workplaces of our clients. We incur risks relating to these activities, including, but not limited to, claims by our employees of violations of wage and hour requirements, claims arising out of the actions or inactions of our employees, including matters that we have indemnified a client for, and claims relating to discrimination or harassment of our employees. Some or all of these claims may lead to litigation, including class action litigation, and these matters may cause us to incur negative publicity with respect to these problems. Our insurance may not cover all claims that may be asserted against us. In addition, it is not possible to predict the outcome of these lawsuits or any other proceeding to which we may be subject. These lawsuits and other proceedings may consume substantial amounts of our financial and managerial resources, regardless of the ultimate outcome of the lawsuits and other proceedings. In addition, we may become subject to similar lawsuits in the same or other jurisdictions. An unfavorable outcome with respect to these lawsuits and any future lawsuits could, individually or in the aggregate, cause us to incur substantial liabilities that may have a material adverse effect upon our business, reputation, financial condition or results of operations.

Federal health care reform legislation may adversely affect our business and results of operations. In March 2010, the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 were signed into law in the United States (collectively, the “Health Care Reform Laws”). The Health Care Reform Laws include a large number of health-related provisions, including requiring most individuals to have health insurance and establishing new regulations on health plans. Although the Health Care Reform Laws do not mandate that employers offer health insurance, beginning in 2014 penalties will be assessed on large employers who do not offer health insurance that meets certain affordability or benefit requirements. Providing such additional health insurance benefits to our employees, or the payment of penalties if such coverage is not provided, would increase our expense. If we are unable to raise the rates we charge our clients to cover this expense, such increases in expense could reduce our operating profit.

In addition, under the Health Care Reform Laws employers will have to file a significant amount of additional information with the Internal Revenue Service and will have to develop systems and processes to track requisite information. We will have to modify our current systems, which could increase our general and administrative expense.

11

Table of Contents

Changes in immigration laws or enforcement actions or investigations under such laws could significantly adversely affect our labor force, operations and financial results. Because many jobs in our Company do not require the ability to read or write English, we are an attractive employer for recent émigrés to this country and many of our jobs are filled by such. Adverse changes to existing laws and regulations applicable to employment of immigrants, enforcement requirements or practices under those laws and regulations, and inspections or investigations by immigration authorities or the prospects or rumors of any of the foregoing, even if no violations exist, could negatively impact the availability and cost of personnel and labor to the Company and the Company’s reputation.

Labor disputes could lead to loss of revenues or expense variations. At October 31, 2012, approximately 48% of our employees were subject to various local collective bargaining agreements, some of which will expire or become subject to renegotiation during the year. In addition, at any given time, we may face a number of union organizing drives. When one or more of our major collective bargaining agreements becomes subject to renegotiation or when we face union organizing drives, we and the union may disagree on important issues that, in turn, could lead to a strike, work slowdown or other job actions at one or more of our locations. In a market where we and a number of major competitors are unionized, but other competitors are not unionized, we could lose clients to competitors who are not unionized. A strike, work slowdown or other job action could in some cases disrupt us from providing services, resulting in reduced revenues. If declines in client service occur or if our clients are targeted for sympathy strikes by other unionized workers, contract cancellations could result. The result of negotiating a first time agreement or renegotiating an existing collective bargaining agreement could result in a substantial increase in labor and benefits expenses that we may be unable to pass through to clients.

We participate in multiemployer pension plans, which under certain circumstances could result in material liabilities being incurred. We participate in various multiemployer pension plans under union and industry–wide agreements that generally provide defined pension benefits to employees covered by collective bargaining agreements. Because of the nature of multiemployer plans, there are risks associated with participation in these plans that differ from single-employer plans. Assets contributed by an employer to a multiemployer plan are not segregated into a separate account and are not restricted to provide benefits only to employees of that contributing employer. In the event that a participating employer to a multiemployer plan no longer contributes to the plan, the unfunded obligations of the plan may be borne by the remaining participating employers. In the event of the termination of a multiemployer pension plan or if we withdraw from a multiemployer pension plan, under applicable law we potentially could incur material liabilities.

OTHER

Natural disasters or acts of terrorism could disrupt services. Storms, earthquakes, drought, floods or other natural disasters or acts of terrorism may result in reduced revenues or property damage. Disasters may also cause economic dislocations throughout the country. In addition, natural disasters or acts of terrorism may increase the volatility of financial results, either due to increased costs caused by the disaster with partial or no corresponding compensation from clients or, alternatively, increased revenues and profitability related to tag jobs, special projects and other higher margin work necessitated by the disaster.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

The Company owns or leases properties in domestic and foreign locations. As of October 31, 2012, the Company had corporate, subsidiary, regional, branch or district offices in over 300 locations throughout the United States, the Commonwealth of Puerto Rico, Canada, the United Arab Emirates, and the Kingdom of Saudi Arabia. At October 31, 2012, the Company owned 14 facilities which were located in: (1) Jacksonville and Tampa, Florida; (2) Portland, Oregon; (3) Houston and San Antonio, Texas; (4) Lake Tansi, Tennessee; (5) Kennewick, Spokane and Tacoma, Washington; (6) Spartanburg, South Carolina; (7) Huntsville, Alabama; and (8) Alpharetta, Georgia.

12

Table of Contents

The Company is involved in various inquiries, administrative proceedings and litigation arising in the ordinary course of business relating to labor and employment, contracts, personal injury, and other matters, some of which allege substantial monetary damages. Some of these actions may be brought as a class action on behalf of a purported class of employees.

The Company is, or during 2012 was, a defendant in a number of lawsuits, including but not limited to the following lawsuits related to alleged violations of federal and/or state wage-and-hour laws or allegations of sexual harassment, discrimination or retaliation:

| • | the consolidated cases of Augustus, Hall and Davis v. American Commercial Security Services (ACSS) filed July 12, 2005, in the Superior Court of California, Los Angeles County (the “Augustus case”); |

| • | Bojorquez v. ABM Industries Incorporated and ABM Janitorial Services—Northern California, Inc. filed on January 13, 2010, in the San Francisco Superior Court (the “Bojorquez case”); |

| • | the consolidated cases of Bucio and Martinez v. ABM Janitorial Services filed on April 7, 2006, in the Superior Court of California, County of San Francisco (the “Bucio case”); |

| • | the consolidated cases of Diaz/Morales/Reyes v. Ampco System Parking filed on December 5, 2006, in L.A. Superior Court (the “Diaz case”); |

| • | Khadera v. American Building Maintenance Co.-West and ABM Industries filed on March 24, 2008, in U.S District Court of Washington, Western District (the “Khadera case”); |

| • | Las and Yanez v. ABM Industries Incorporated, et al., filed on April 6, 2011 in Illinois state court and subsequently removed to the U.S. District Court for the Northern District of Illinois (the “Las/Yanez case”); and |

| • | Simpson v. ABM Janitorial Services-Northwest, Inc., and ABM Industries Incorporated filed on September 24, 2010 in the Superior Court for the State of Washington in and for King County (the “Simpson case”). |

Cases Concluded in Fiscal Year 2012

Diaz

The Diaz case involved allegations that the Company failed to provide meal and rest breaks. On June 22, 2011, the parties accepted a mediator’s proposal which involved settling all the claims made in the first amended complaint for the period of October 1, 2002 to December 13, 2011, the date on which the Superior Court granted preliminary approval of the settlement. On January 27, 2012, the notices to the class of the settlement were mailed. The Superior Court approved the final settlement on May 21, 2012. The amount of the settlement, including payments to plaintiffs’ attorneys, was approximately $3.1 million and has been paid.

Khadera and Simpson

The Khadera case was a collective action and involved allegations relating to unpaid overtime and meal and rest claims. It was an opt-in class under the Fair Labor Standards Act. The parties settled this matter during the year ended October 31, 2012 for $2.0 million, which includes payments to plaintiffs’ attorneys. The U.S. District Court of Washington, Western District, approved the settlement on October 19, 2012, and the settlement was paid on November 7, 2012.

The Simpson case involved allegations relating to unpaid overtime, off-the-clock work, and failure to provide meal and rest periods under Washington state law. The parties have settled this matter for $1.0 million, which includes payments to plaintiffs’ attorneys. The Superior Court for the State of Washington in and for King County approved the settlement on September 28, 2012, and the settlement was paid on November 7, 2012.

Las/Yanez

The Las/Yanez case involved allegations relating to unpaid overtime and off-the-clock work under federal and state law. It was filed as a collective action, but was not certified as a class action or collective action. On May 4, 2012, the parties accepted a mediator’s proposal, which involved settling all the claims made in the operative complaint for the period of April 6, 2008 through May 7, 2012. During July and August, the notices to the class of the settlement were mailed. The U.S. District Court for the Northern District of Illinois granted final approval of the settlement on October 17, 2012. The amount of the settlement, including attorneys’ fees, was approximately $2.3 million. The settlement was paid in November 2012.

13

Table of Contents

Ongoing Cases

Augustus

The Augustus case is a certified class action involving allegations that the Company violated certain state laws relating to rest breaks. On February 8, 2012, the plaintiffs filed a motion for summary judgment on the rest break claim, which sought damages in the amount of $103.1 million, and the Company filed a motion for decertification of the class. On July 6, 2012, the Superior Court of California, Los Angeles County (the “Superior Court”) heard plaintiffs’ motion for damages on the rest break claim and the Company’s motion to decertify the class. On July 31, 2012, the Superior Court denied the Company’s motion and entered judgment in favor of plaintiffs in the amount of approximately $89.7 million. This amount did not include plaintiffs’ counsels’ fees. The Company filed a notice of appeal on August 29, 2012. The plaintiffs have filed three separate motions for attorneys’ fees. One motion seeks attorneys’ fees from the common fund. The common fund refers to the approximately $89.7 million judgment entered in favor of the plaintiffs. The other two motions seek attorneys’ fees from the Company in an aggregate amount of $11.7 million. On October 12, 2012, the Company filed oppositions to the two fee motions seeking attorneys’ fees from the Company. The Company strongly disagrees with the decisions of the Superior Court, and firmly believes that it has complied with applicable law.

Bojorquez

The Company is a defendant in the Bojorquez case. Plaintiff brought suit for sexual harassment, retaliation, and failure to prevent harassment and discrimination. On May 17, 2012, a jury awarded the plaintiff approximately $0.8 million in damages. The Company filed a notice of intent to appeal on October 11, 2012. On October 17, 2012, plaintiff filed an application for attorneys’ fees and costs with the San Francisco Superior Court seeking approximately $4.8 million in fees and expenses. The Company has filed a response vigorously contesting plaintiffs application for attorneys’ fees.

Bucio

The Bucio case is a purported class action involving allegations that the Company failed to track work time and provide breaks. On April 19, 2011, the trial court held a hearing on plaintiffs motion to certify the class. At the conclusion of that hearing, the trial court denied plaintiffs motion to certify the class. On May 11, 2011, the plaintiffs filed a motion to reconsider, which was denied. The plaintiffs have appealed the class certification issues. The trial court stayed the underlying lawsuit for the individual plaintiffs pending the decision in the appeal. On August 30, 2012, the plaintiffs filed their appellate brief on the class certification issues. The Company filed its responsive brief on November 15, 2012.

The Company expects to prevail in these ongoing cases. However, as litigation is inherently unpredictable, there can be no assurance in this regard. If the plaintiffs in one or more of these cases, or other cases, do prevail, the results may have a material effect on our financial position or cash flows.

Other

During October 2011, the Company began an internal investigation into matters relating to compliance with the U.S. Foreign Corrupt Practices Act and the Company’s internal policies in connection with services provided by a foreign entity affiliated with a former Linc joint venture partner. Such services commenced prior to the acquisition of Linc. As a result of the investigation, the Company caused Linc to terminate its association with the arrangement. In December 2011, the Company contacted the U.S. Department of Justice and the Securities and Exchange Commission to voluntarily disclose the results of its internal investigation, and it is cooperating with the government’s investigation. The Company cannot reasonably estimate the potential liability, if any, related to these matters. However, based on the facts currently known, the Company does not believe that these matters will have a material adverse effect on its business, financial condition, results of operations or cash flows.

In June 2012, the Company settled certain matters arising under a contract related to a prior divestiture and, in connection therewith, made a payment of $1.8 million to the other party to the contract primarily in exchange for a release from certain restrictive covenants.

ITEM 4. MINE SAFETY DISCLOSURES

None.

14

Table of Contents

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information and Dividends

The Company’s common stock is listed on the New York Stock Exchange (NYSE: ABM). The following table sets forth the high and low intra-day prices of the Company’s common stock on the New York Stock Exchange and quarterly cash dividends declared on shares of common stock for the periods indicated:

| Fiscal Quarter | ||||||||||||||||

| (In dollars) |

First | Second | Third | Fourth | ||||||||||||

| Fiscal Year 2012 |

||||||||||||||||

| Price range of common stock: |

||||||||||||||||

| High |

$ | 22.96 | $ | 24.61 | $ | 23.41 | $ | 20.83 | ||||||||

| Low |

$ | 18.98 | $ | 21.73 | $ | 17.85 | $ | 17.95 | ||||||||

| Dividends declared per share |

$ | 0.145 | $ | 0.145 | $ | 0.145 | $ | 0.145 | ||||||||

| Fiscal Year 2011 |

||||||||||||||||

| Price range of common stock: |

||||||||||||||||

| High |

$ | 27.00 | $ | 27.14 | $ | 24.53 | $ | 22.78 | ||||||||

| Low |

$ | 21.50 | $ | 22.80 | $ | 21.74 | $ | 17.29 | ||||||||

| Dividends declared per share |

$ | 0.140 | $ | 0.140 | $ | 0.140 | $ | 0.140 | ||||||||

To the Company’s knowledge, there are no current factors that are likely to materially limit the Company’s ability to pay comparable dividends for the foreseeable future.

Stockholders

At December 11, 2012, there were 3,592 registered holders of the Company’s common stock.

15

Table of Contents

Performance Graph

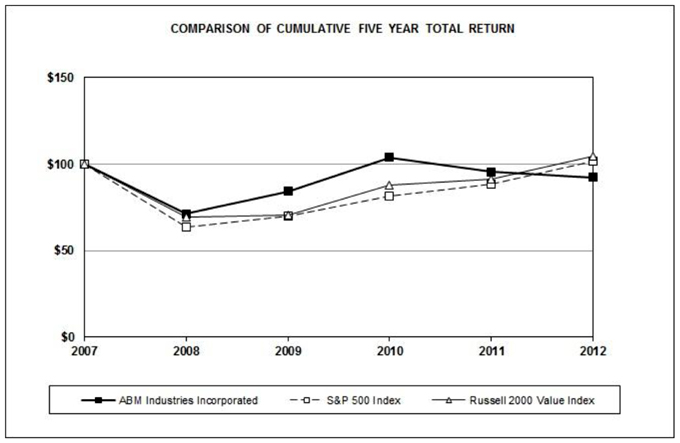

The following graph compares a $100 investment in the Company’s stock on October 31, 2007 with a $100 investment in each of the Standard & Poor’s 500 Index (“S&P 500 Index”) and the Russell 2000 Value Index, also made on October 31, 2007. The graph portrays total return, 2007–2012, assuming reinvestment of dividends. The comparisons in the following graph are based on historical data and are not indicative of, or intended to forecast, the possible future performance of the Company’s common stock. This graph shows returns based on fiscal years ended October 31.

| INDEXED RETURNS Years Ending | ||||||||||||||||||||||||||||||

| Company / Index | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||||||||||

| ABM Industries Incorporated |

100 | 71.17 | 84.36 | 103.92 | 95.47 | 92.28 | ||||||||||||||||||||||||

| S&P 500 Index |

100 | 63.90 | 70.17 | 81.76 | 88.37 | 101.81 | ||||||||||||||||||||||||

| Russell 2000 Value Index |

100 | 69.46 | 70.82 | 88.12 | 91.25 | 104.45 | ||||||||||||||||||||||||

This performance graph shall not be deemed “soliciting material,” be deemed “filed” with the Commission or subject to Regulation 14A or 14C, or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended.

16

Table of Contents

Issuer Purchases of Equity Securities

On September 5, 2012, the Company’s Board of Directors approved a share repurchase program authorizing up to $50 million in share repurchases. Under this repurchase program, the Company may purchase its common shares from time to time in open market purchases or privately negotiated transactions and may make all or part of the purchases pursuant to Rule 10b5-1 plans. The timing of repurchases will depend upon several factors, including market and business conditions, and the repurchases may be discontinued at any time. No stock repurchases were made in the fourth quarter of 2012.

17

Table of Contents

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data are derived from the Company’s consolidated financial statements. The data below should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8, “Financial Statements and Supplementary Data.”

| Years Ended October 31, | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Statement of Income Data |

||||||||||||||||||||

| Revenues (1) |

$ | 4,300,265 | $ | 4,246,842 | $ | 3,495,747 | $ | 3,481,823 | $ | 3,623,590 | ||||||||||

| Operating profit (2) |

96,566 | 117,568 | 108,839 | 92,107 | 99,509 | |||||||||||||||

| Income from continuing operations |

62,718 | 68,698 | 63,870 | 55,490 | 52,731 | |||||||||||||||

| Per Share Data |

||||||||||||||||||||

| Net income per common share—Basic |

||||||||||||||||||||

| Income from continuing operations |

$ | 1.16 | $ | 1.29 | $ | 1.23 | $ | 1.08 | $ | 1.04 | ||||||||||

| Loss from discontinued operations |

— | — | — | (0.02 | ) | (0.14 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income |

$ | 1.16 | $ | 1.29 | $ | 1.23 | $ | 1.06 | $ | 0.90 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income per common share—Diluted |

||||||||||||||||||||

| Income from continuing operations |

$ | 1.14 | $ | 1.27 | $ | 1.21 | $ | 1.07 | $ | 1.03 | ||||||||||

| Loss from discontinued operations |

— | — | — | (0.02 | ) | (0.15 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income |

$ | 1.14 | $ | 1.27 | $ | 1.21 | $ | 1.05 | $ | 0.88 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted-average common and common equivalent shares outstanding |

||||||||||||||||||||

| Basic |

53,987 | 53,121 | 52,117 | 51,373 | 50,519 | |||||||||||||||

| Diluted |

54,914 | 54,103 | 52,908 | 51,845 | 51,386 | |||||||||||||||

| Dividends declared per common share |

$ | 0.58 | $ | 0.56 | $ | 0.54 | $ | 0.52 | $ | 0.50 | ||||||||||

| Cash Flow Data |

||||||||||||||||||||

| Net cash provided by continuing operating activities |

$ | 148,947 | $ | 156,800 | $ | 140,746 | $ | 121,255 | $ | 62,275 | ||||||||||

| As of October 31, | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Balance Sheet Data |

||||||||||||||||||||

| Total assets |

$ | 1,869,251 | $ | 1,879,598 | $ | 1,548,670 | $ | 1,521,153 | $ | 1,575,944 | ||||||||||

| Trade accounts receivable, net of allowances (3) |

561,317 | 552,098 | 450,513 | 445,241 | 473,263 | |||||||||||||||

| Insurance recoverables |

64,500 | 70,610 | 76,098 | 72,117 | 71,617 | |||||||||||||||

| Goodwill (4) |

751,610 | 750,872 | 593,983 | 547,237 | 535,772 | |||||||||||||||

| Other intangible assets, net of accumulated amortization (5) |

109,138 | 128,994 | 65,774 | 60,199 | 62,179 | |||||||||||||||

| Investments in auction rate securities |

17,780 | 15,670 | 20,171 | 19,531 | 19,031 | |||||||||||||||

| Investments in unconsolidated affiliates, net (6) |

14,863 | 14,423 | — | — | — | |||||||||||||||

| Line of credit (7) |

215,000 | 300,000 | 140,500 | 172,500 | 230,000 | |||||||||||||||

| Insurance claims |

$ | 343,804 | $ | 341,401 | $ | 348,314 | $ | 346,327 | $ | 346,157 | ||||||||||

18

Table of Contents

| (1) | Revenues in the year ended October 31, 2011 include $512.9 million associated with The Linc Group, LLC (“Linc”), which was acquired on December 1, 2010. Revenues in the year ended October 31, 2010 include approximately $43.0 million associated with the acquisitions of Five Star Parking, Network Parking Company Ltd., and System Parking, Inc. (collectively, this asset acquisition is referred to as “L&R”), and Diversco, Inc., which were acquired on October 1, 2010 and June 30, 2010, respectively. Revenues in the year ended October 31, 2008 include $836.6 million associated with the acquisition of OneSource Services Inc. (“OneSource”) and Healthcare Parking Services America, which were acquired on November 14, 2007 and April 2, 2007, respectively. |

| (2) | Operating profit in the year ended October 31, 2012 reflected $7.8 million in certain legal and settlement fees and a $7.3 million adjustment to increase self-insurance reserves related to prior year claims. |

Operating profit in the year ended October 31, 2011 reflected the impact of the Linc acquisition, which included $417.7 million of operating expenses, $72.7 million of selling, general and administrative expenses, and $11.3 million of amortization expense.

Operating profit in the year ended October 31, 2009 included the impact of a $21.8 million expense associated with (a) the implementation of a new payroll and human resources information system, and the upgrade of the Company’s accounting systems; (b) the transition of certain back office functions to the Company’s Shared Services Center in Houston, Texas; and (c) the move of the Company’s corporate headquarters to New York. Additionally, operating profit reflected a $9.4 million adjustment to increase self-insurance reserves related to prior year claims.

Operating profit in the year ended October 31, 2008 reflected the impact of the OneSource acquisition which included $728.7 million of operating expenses, $63.4 million of selling, general and administrative expenses, and $5.3 million of amortization expense. Additionally, operating profit in fiscal 2008 included the impact of a $24.3 million expense associated with (a) the implementation of a new payroll and human resources information system, and the upgrade of the Company’s accounting systems; (b) the transition of certain back office functions to the Company’s Shared Services Center in Houston, Texas; (c) the move of the Company’s corporate headquarters to New York; and (d) integration costs associated with the acquisition of OneSource.

| (3) | Trade accounts receivable, net of allowances increased by $86.3 million on December 1, 2010 as a result of the acquisition of Linc. |

| (4) | Goodwill in the years ended October 31, 2011 and 2008 increased by $156.1 million and $273.8 million, respectively, associated with the acquisitions of Linc and OneSource, respectively. |

| (5) | Other intangible assets, net of accumulated amortization, in the years ended October 31, 2011 and 2008 increased by $87.0 million and $48.7 million, respectively, in connection with the acquisitions of Linc and OneSource, respectively. |

| (6) | Investments in unconsolidated affiliates relate to investments in certain unconsolidated affiliated entities which were acquired as a result of the Linc acquisition. |

| (7) | As of October 31, 2012 and October 31, 2011, we had outstanding borrowings under our line of credit of $215.0 million and $300.0 million, respectively, which is primarily associated with acquisitions. |

19

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following Management’s Discussion and Analysis (“MD&A”) is intended to facilitate an understanding of the results of operations and financial condition of ABM Industries Incorporated and its consolidated subsidiaries (hereinafter collectively referred to as “ABM”, “we”, “us”, “our”, or the “Company”). This MD&A should be read in conjunction with the consolidated financial statements and the accompanying notes (“Financial Statements”) contained in Item 8, “Financial Statements and Supplementary Data”. The following discussion and analysis of our financial condition and results of operations may contain forward-looking statements about our business, operations and industry that involve risks and uncertainties, such as statements regarding our plans, objectives, expectations and intentions. Our future results and financial condition may differ materially from those we currently anticipate. See the “Forward-Looking Statements” and “Risk Factors” sections of this Annual Report on Form 10-K. Unless otherwise indicated, all information in the discussion and references to years are based on the Company’s fiscal year, which ends on October 31.

Business Overview

ABM is a leading provider of end-to-end integrated facility solutions services to thousands of commercial, governmental, industrial, institutional, retail, and residential client facilities located primarily throughout the United States. The Company’s comprehensive capabilities include expansive facility solutions, energy solutions, commercial cleaning, maintenance and repair, HVAC, electrical, landscaping, parking, and security services, provided through stand-alone or integrated solutions.

Strategy and Outlook

In fiscal 2012, we further developed a platform to deliver an end-to-end service model to our clients. As a result, we began to realign our operational structure to an on-site, mobile and on-demand market based structure. During fiscal 2013, this realignment will continue and should improve our long-term growth prospects and provide higher margin opportunities by giving us the ability to better deliver end-to-end services to our clients located in urban, suburban and rural areas.

Our on-site service lines will include Janitorial, Security, Parking and a portion of our Facility Solutions business, which will allow us to focus and better cross sell our end-to-end services to clients. The mobile and on-demand service lines, which include building and energy solutions, will provide end-to-end service to clients with multiple locations or having specific service needs related to the maintenance and on-going operations of their facilities.