|

|

Summary Prospectus |

|

Natixis U.S. Equity Opportunities Fund |

|

Ticker Symbol: Class A (NEFSX), Class C (NECCX), Class N (NESNX), Class T* (NUSTX) and Class Y (NESYX) |

| * | Class T shares of the Fund are not currently available for purchase. |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you wish to continue receiving paper copies of your shareholder reports after January 1, 2021, you can inform the Fund at any time by calling 1-800-225-5478. If you hold your account with a financial intermediary and you wish to continue receiving paper copies after January 1, 2021, you should call your financial intermediary directly. Paper copies are provided free of charge, and your election to receive reports in paper will apply to all funds held with the Natixis Funds complex. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You currently may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically at www.icsdelivery.com/natixisfunds.

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders, and other information about the Fund online at im.natixis.com/fund-documents. You can also get this information at no cost by calling 800-225-5478 or by sending an e-mail request to NatixisFunds@natixis.com. The Fund’s Prospectus and Statement of Additional Information, each dated May 1, 2019, as may be revised or supplemented from time to time, are incorporated by reference into this Summary Prospectus.

Investment Goal

The Fund seeks long-term growth of capital.

Fund Fees & Expenses

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex. More information about these and other discounts is available from your financial professional and in the section “How Sales Charges Are Calculated” on page 83 of the Prospectus, in Appendix A to the Prospectus and on page 138 in the section “Reduced Sales Charges” of the Statement of Additional Information (“SAI”).

Shareholder Fees

|

(fees paid directly from your investment) |

Class A |

Class C |

Class N |

Class T |

Class Y |

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

5.75% |

None |

None |

2.50% |

None |

|

Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

None* |

1.00% |

None |

None |

None |

|

Redemption fees |

None |

None |

None |

None |

None |

| * | A 1.00% contingent deferred sales charge (“CDSC”) may apply to certain purchases of Class A shares of $1,000,000 or more that are redeemed within eighteen months of the date of purchase. |

Annual Fund Operating Expenses

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class A |

Class C |

Class N |

Class T |

Class Y |

|

Management fees |

0.75% |

0.75% |

0.75% |

0.75% |

0.75% |

|

Distribution and/or service (12b-1) fees |

0.25% |

1.00% |

0.00% |

0.25% |

0.00% |

|

Other expenses |

0.16% |

0.16% |

12.60% |

0.16%1 |

0.16% |

|

Total annual fund operating expenses |

1.16% |

1.91% |

13.35% |

1.16% |

0.91% |

|

Fee waiver and/or expense reimbursement2,3 |

0.00% |

0.00% |

12.59% |

0.00% |

0.00% |

|

Total annual fund operating expenses after fee waiver and/or expense reimbursement |

1.16% |

1.91% |

0.76% |

1.16% |

0.91% |

| 1 | Other expenses are estimated for the current fiscal year. |

| 2 | The Fund’s investment adviser has given a binding contractual undertaking to the Fund to limit the amount of the Fund’s total annual fund operating expenses to 1.20%, 1.95%, 0.90%, 1.20% and 0.95% of the Fund’s average daily net assets for Class A, C, N, T and Y shares, respectively, exclusive of brokerage expenses, interest expense, taxes, acquired fund fees and expenses, organizational and extraordinary expenses, such as litigation and indemnification expenses. This undertaking is in effect through April 30, |

1

Fund Summary

| 2020 and may be terminated before then only with the consent of the Fund’s Board of Trustees. The Fund’s investment adviser will be permitted to recover, on a class by class basis, management fees waived and/or expenses reimbursed to the extent that expenses in later periods fall below the applicable expense limitations for Class A, C, N, T and Y shares. The Fund will not be obligated to repay any such waived/reimbursed fees and expenses more than one year after the end of the fiscal year in which the fees or expenses were waived/reimbursed. |

| 3 | Natixis Advisors, L.P. (“Natixis Advisors”) has given a binding contractual undertaking to the Fund to reimburse any and all transfer agency expenses for Class N shares. This undertaking is in effect through April 30, 2020 and may be terminated before then only with the consent of the Fund’s Board of Trustees. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods (except where indicated). The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same, except that the example for Class N is based on the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement assuming that such waiver and/or reimbursement will only be in place through the date noted above and on the Total Annual Fund Operating Expenses for the remaining periods. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

If shares are redeemed: |

1 year |

3 years |

5 years |

10 years | ||||

|

Class A |

$ |

686 |

$ |

922 |

$ |

1,177 |

$ |

1,903 |

|

Class C |

$ |

294 |

$ |

600 |

$ |

1,032 |

$ |

2,233 |

|

Class N |

$ |

78 |

$ |

2,633 |

$ |

4,780 |

$ |

8,762 |

|

Class T |

$ |

365 |

$ |

609 |

$ |

872 |

$ |

1,624 |

|

Class Y |

$ |

93 |

$ |

290 |

$ |

504 |

$ |

1,120 |

|

If shares are not redeemed: |

1 year |

3 years |

5 years |

10 years | ||||

|

Class C |

$ |

194 |

$ |

600 |

$ |

1,032 |

$ |

2,233 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During its most recently ended fiscal year, the Fund’s portfolio turnover rate was 23% of the average value of its portfolio.

Investments, Risks and Performance

Principal Investment Strategies

The Fund ordinarily invests at least 80% of its net assets (plus any borrowings made for investment purposes) in equity securities, including common stocks and preferred stocks. Under normal market conditions, the Fund will invest at least 80% of its net assets (plus any borrowings made for investment purposes) in securities of U.S. issuers. The Fund’s approach to equity investing combines the styles of two subadvisers in selecting securities for each of the Fund’s segments. The segments and their subadvisers are listed below.

| • | Harris Associates - Large Cap Value segment - Under normal circumstances, the Large Cap Value segment of the Fund managed by Harris Associates L.P. (“Harris Associates”) will invest primarily in the common stocks of larger- capitalization companies that Harris Associates believes are trading at a substantial discount to the company’s “intrinsic value.” By “intrinsic value,” Harris Associates means its estimate of the price a knowledgeable buyer would pay to acquire the entire business. Harris Associates believes that investing in securities priced significantly below what Harris Associates believes is a company’s intrinsic value presents the best opportunity to achieve the Fund’s investment objectives. Harris Associates usually sells a security when the price approaches its estimated value and monitors each holding and adjusts its price targets as warranted to reflect changes in the issuer’s fundamentals. In determining whether an issuer is a U.S. or foreign issuer for the Harris Associates – Large Cap Value segment, Harris Associates considers various factors, including its country of domicile, the primary stock exchange on which it trades, the location from which the majority of its revenue comes, and its reporting currency. |

| • | Loomis Sayles - All Cap Growth segment - Under normal circumstances, the All Cap Growth segment of the Fund, managed by Loomis, Sayles & Company, L.P. (“Loomis Sayles”), will invest primarily in equity securities, including common stocks, preferred stocks, convertible securities and warrants. This segment may invest in companies of any size. The segment normally invests across a wide range of sectors and industries. The segment’s portfolio manager employs a growth style of equity management that emphasizes companies with sustainable competitive advantages, long-term structural growth drivers, attractive cash flow returns on invested capital, and management teams focused on creating long-term value for shareholders. The segment’s portfolio manager aims to invest in companies when they trade at a significant discount to the estimate of intrinsic value. The segment will consider selling a portfolio investment when the portfolio manager believes an unfavorable structural change occurs within a given business or the markets in which it operates, a critical underlying investment assumption is flawed, when a more attractive reward-to-risk opportunity becomes available, when the portfolio manager believes the current price fully reflects intrinsic value, or for other investment reasons which the portfolio manager deems appropriate. |

2

Fund Summary

| Although certain equity securities purchased by the Loomis Sayles – All Cap Growth segment of the Fund may be issued by domestic companies incorporated outside of the United States, Loomis Sayles does not consider these securities to be foreign if they are included in the U.S. equity indices published by S&P Global Ratings or Russell Investments or if the security’s country of risk defined by Bloomberg is the United States. |

Subject to the allocation policy adopted by the Fund’s Board of Trustees, Natixis Advisors, L.P. (“Natixis Advisors”) generally allocates capital invested in the Fund equally (i.e., 50%) between its two segments. Under the allocation policy, Natixis Advisors may also allocate capital away from or towards each segment from time to time and may reallocate capital between the segments. Each subadviser manages its segment of the Fund’s assets in accordance with its distinct investment style and strategy.

The Fund may also:

| • | Invest in securities offered in initial public offerings (“IPOs”) and securities issued pursuant to Rule 144A under the Securities Act of 1933 (“Rule 144A securities”). |

| • | Invest in convertible preferred stock and convertible debt securities. |

| • | Invest in real estate investment trusts (“REITs”). |

| • | Invest in fixed-income securities, including U.S. government bonds and below-investment grade fixed-income securities (commonly known as “junk bonds”). |

| • | Hold securities of foreign issuers traded over-the-counter or on foreign exchanges, including securities in emerging markets and related currency hedging transactions. |

| • | Invest in equity securities of Canadian issuers. |

Principal Investment Risks

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

Allocation Risk: The Fund’s investment performance depends on how its assets are allocated. The allocation, as set forth above, may not be optimal in every market condition. You could lose money on your investment in the Fund as a result of this allocation.

Credit Risk: Credit risk is the risk that the issuer or the guarantor of a fixed-income security, or the counterparty to a derivatives or other transaction, will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations.

Emerging Markets Risk: In addition to the risks of investing in foreign investments generally, emerging markets investments are subject to greater risks arising from political or economic instability, nationalization or confiscatory taxation, currency exchange restrictions, sanctions by the U.S. government and an issuer’s unwillingness or inability to make principal or interest payments on its obligations. Emerging markets companies may be smaller and have shorter operating histories than companies in developed markets.

Equity Securities Risk: The value of the Fund’s investments in equity securities could be subject to unpredictable declines in the value of individual securities and periods of below-average performance in individual securities or in the equity market as a whole. Securities issued in IPOs tend to involve greater market risk than other equity securities due, in part, to public perception and the lack of publicly available information and trading history. Growth stocks are generally more sensitive to market movements than other types of stocks primarily because their stock prices are based heavily on future expectations. If the subadviser’s assessment of the prospects for a company’s growth is wrong, or if the subadviser’s judgment of how other investors will value the company’s growth is wrong, then the price of the company’s stock may fall or not approach the value that the subadviser has placed on it. Value stocks can perform differently from the market as a whole and from other types of stocks. Value stocks also present the risk that their lower valuations fairly reflect their business prospects and that investors will not agree that the stocks represent favorable investment opportunities, and they may fall out of favor with investors and underperform growth stocks during any given period. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer’s bonds generally take precedence over the claims of those who own preferred stock or common stock.

Foreign Securities Risk: Investments in foreign securities may be subject to greater political, economic, environmental, credit/counterparty and information risks. The Fund’s investments in foreign securities also are subject to foreign currency fluctuations and other foreign currency-related risks. Foreign securities may be subject to higher volatility than U.S. securities, varying degrees of regulation and limited liquidity.

Liquidity Risk: Liquidity risk is the risk that the Fund may be unable to find a buyer for its investments when it seeks to sell them or to receive the price it expects. Decreases in the number of financial institutions willing to make markets in the Fund’s investments or in their capacity or willingness to transact may increase the Fund’s exposure to this risk. Events that may lead to increased redemptions, such as market disruptions or increases in interest rates, may also negatively impact the liquidity of the Fund’s investments when it needs to dispose of them. If the Fund is forced to sell its investments at an unfavorable time and/or under adverse conditions in order to meet redemption requests, such sales could negatively affect the Fund. Securities acquired in a private placement, such as Rule 144A securities, are generally subject to greater liquidity risk because they are subject to strict restrictions on resale and there may be no liquid secondary market or ready purchaser for such securities. Non-exchange traded derivatives are generally subject to greater liquidity risk as well. Liquidity issues may also make it difficult to value the Fund’s investments.

Management Risk: A strategy used by the Fund’s portfolio managers may fail to produce the intended result.

3

Fund Summary

Market/Issuer Risk: The market value of the Fund’s investments will move up and down, sometimes rapidly and unpredictably, based upon overall market and economic conditions, as well as a number of reasons that directly relate to the issuers of the Fund’s investments, such as management performance, financial condition and demand for the issuers’ goods and services.

REITs Risk: Investments in the real estate industry, including REITs, are particularly sensitive to economic downturns and are sensitive to factors such as changes in real estate values, property taxes and tax laws, interest rates, cash flow of underlying real estate assets, occupancy rates, government regulations affecting zoning, land use and rents and the management skill and creditworthiness of the issuer. Companies in the real estate industry also may be subject to liabilities under environmental and hazardous waste laws. In addition, the value of a REIT is affected by changes in the value of the properties owned by the REIT or mortgage loans held by the REIT. REITs are also subject to default and prepayment risk. Many REITs are highly leveraged, increasing their risk. The Fund will indirectly bear its proportionate share of expenses, including management fees, paid by each REIT in which it invests in addition to the expenses of the Fund.

Small- and Mid-Capitalization Companies Risk: Compared to large-capitalization companies, small- and mid-capitalization companies are more likely to have limited product lines, markets or financial resources. Stocks of these companies often trade less frequently and in limited volume and their prices may fluctuate more than stocks of large-capitalization companies. As a result, it may be relatively more difficult for the Fund to buy and sell securities of small- and mid-capitalization companies.

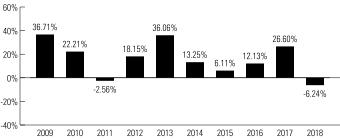

Risk/Return Bar Chart and Table

The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year-to-year and by showing how the Fund’s average annual returns for the one-year, five-year, ten-year, and life-of-class periods compare to those of two broad measures of market performance. The Russell 1000® Index is an unmanaged index that measures the performance of the large-capitalization segment of the U.S. equity universe. A subset of the Russell 3000® Index, it includes approximately 1,000 of the largest stocks based on a combination of market capitalization and current index membership. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at im.natixis.com and/or by calling the Fund toll-free at 800-225-5478.

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund’s shares. A sales charge will reduce your return.

Total Returns for Class Y Shares

|

|

Highest Quarterly Return: |

|

Average Annual Total Returns |

|

|

|

|

|

(for the periods ended December 31, 2018) |

Past 1 Year |

Past 5 Years |

Past 10 Years |

Life of Class N |

|

Class Y - Return Before Taxes |

-6.24% |

9.85% |

15.39% |

- |

|

Return After Taxes on Distributions |

-8.28% |

7.39% |

13.75% |

- |

|

Return After Taxes on Distributions and Sale of Fund Shares |

-2.28% |

7.28% |

12.70% |

- |

|

Class A - Return Before Taxes |

-11.85% |

8.28% |

14.43% |

- |

|

Class C - Return Before Taxes |

-7.97% |

8.76% |

14.25% |

- |

|

Class N - Return Before Taxes |

-6.11% |

- |

- |

5.67% |

|

Class T - Return Before Taxes |

-8.82% |

9.02% |

14.81% |

- |

|

S&P 500® Index |

-4.38% |

8.49% |

13.12% |

5.03% |

|

Russell 1000® Index |

-4.78% |

8.21% |

13.28% |

4.68% |

The Fund uses multiple subadvisers. The performance results shown above reflect results achieved by previous subadvisers using different investment strategies.

4

Fund Summary

The Fund did not have Class T shares outstanding during the periods shown above. The returns of Class T shares would have been substantially similar to the returns of the Fund’s other share classes because they would have been invested in the same portfolio of securities and would only differ to the extent the other share classes did not have the same expenses. Performance of Class T shares shown above is that of Class A shares, which have the same expenses as Class T shares, restated to reflect the different sales load applicable to Class T shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The after-tax returns are shown for only one class of the Fund. The Return After Taxes on Distributions and Sale of Fund Shares for the 1-year period exceeds the Return Before Taxes due to an assumed tax benefit from losses on a sale of Fund shares at the end of the measurement period. After-tax returns for the other classes of the Fund will vary. Index performance reflects no deduction for fees, expenses or taxes.

Management

Investment Adviser

Natixis Advisors, L.P. (“Natixis Advisors”)

Subadvisers

Harris Associates L.P. (“Harris Associates”)

Loomis, Sayles & Company, L.P.

Portfolio Managers

Harris Associates

William C. Nygren, CFA®, Vice President, Chief Investment Officer, U.S. Equity and portfolio manager of Harris Associates, has served as co-manager of the Harris Associates Large Cap Value segment of the Fund since 2014.

Kevin G. Grant, CFA®, Co-Chairman, portfolio manager and analyst of Harris Associates, has served as co-manager of the Harris Associates Large Cap Value segment of the Fund since 2014.

M. Colin Hudson, CFA®, Vice President, portfolio manager and analyst of Harris Associates, has served as co-manager of the Harris Associates Large Cap Value segment of the Fund since 2014.

Michael J. Mangan, CFA®, CPA, portfolio manager of Harris Associates, served as co-manager of the Harris Associates Large Cap Value segment of the Fund from 2005 until February 2014 and since August 2014.

Loomis Sayles

Aziz V. Hamzaogullari, CFA®, Chief Investment Officer and founder of the Growth Equities Strategies Team at Loomis Sayles, has served as a manager of the Fund since 2011 and of the Loomis Sayles All Cap Growth segment of the Fund since 2014.

Purchase and Sale of Fund Shares

Class A and C Shares

The following chart shows the investment minimums for various types of accounts:

|

Type of Account |

Minimum Initial Purchase |

Minimum Subsequent Purchase | ||

|

Any account other than those listed below |

$ |

2,500 |

$ |

50 |

|

For shareholders participating in Natixis Funds’ Investment Builder Program |

$ |

1,000 |

$ |

50 |

|

For Traditional IRA, Roth IRA, Rollover IRA, SEP-IRA and Keogh plans using the Natixis Funds’ prototype document (direct accounts, not held through intermediary) |

$ |

1,000 |

$ |

50 |

|

Coverdell Education Savings Accounts using the Natixis Funds’ prototype document (direct accounts, not held through intermediary) |

$ |

500 |

$ |

50 |

There is no initial or subsequent investment minimum for:

• Fee Based Programs (such as wrap accounts) where an advisory fee is paid to the broker-dealer or other financial intermediary. Please consult your financial representative to determine if your fee based program is subject to additional or different conditions or fees.

• Certain Retirement Plans. Please consult your retirement plan administrator to determine if your retirement plan is subject to additional or different

conditions or fees.

• Clients of a Registered Investment Adviser where the Registered Investment Adviser receives an advisory, management or consulting fee.

5

Class N Shares

Class N shares of the Fund are subject to a $1,000,000 initial investment minimum. There is no initial investment minimum for Certain Retirement Plans and funds of funds that are distributed by Natixis Distribution, L.P. (the “Distributor”). Sub-accounts held within an omnibus account, where the omnibus account has at least $1,000,000, are not required to meet the investment minimum. There is no subsequent investment minimum for these shares. In its sole discretion, the Distributor may waive the investment minimum requirement for accounts as to which the Distributor reasonably believes will have enough assets to exceed the investment minimum requirement within a relatively short period of time following the establishment date of such accounts in Class N. If, after two years, an account’s value does not exceed the investment minimum requirement, the Distributor and the Fund reserve the right to redeem such account.

Class T Shares

Class T shares of the Fund are not currently available for purchase.

Class T shares of the Fund may only be purchased by investors who are investing through an authorized third party, such as a broker-dealer or other financial intermediary, that has entered into a selling agreement with Natixis Distribution, L.P. Investors may not hold Class T shares directly with the Fund. Class T shares are subject to a minimum initial investment of $2,500 and a minimum subsequent investment of $50. Not all financial intermediaries make Class T shares available to their clients.

Class Y Shares

Class Y shares of the Fund are generally subject to a minimum initial investment of $100,000 and a minimum subsequent investment of $50, except there is no minimum initial or subsequent investment for:

• Fee Based Programs (such as wrap accounts) where an advisory fee is paid to the broker-dealer or other financial intermediary. Please consult your financial representative to determine if your fee based program is subject to additional or different conditions or fees.

• Certain Retirement Plans. Please consult your retirement plan administrator to determine if your retirement plan is subject to additional or different

conditions or fees.

• Certain Individual Retirement Accounts if the amounts invested represent rollover distributions from investments by any of the retirement plans invested in the Fund.

• Clients of a Registered Investment Adviser where the Registered Investment Adviser receives an advisory, management or consulting fee.

• Fund Trustees, former Fund trustees, employees of affiliates of the Natixis Funds and other individuals who are affiliated with any Natixis Fund

(this also applies to any spouse, parents, children, siblings, grandparents, grandchildren and in-laws of those

mentioned) and Natixis affiliate employee benefit plans.

At the discretion of Natixis Advisors, L.P., clients of Natixis Advisors, L.P. and its affiliates may purchase Class Y shares of the Fund below the stated minimums.

Due to operational limitations at your financial intermediary, certain fee based programs, retirement plans, individual retirement

accounts and accounts of registered investment advisers may be subject to the investment minimums described

above.

The Fund’s shares are available for purchase and are redeemable on any business day through your

investment dealer, directly from the Fund by writing to the Fund at Natixis Funds, P.O. Box 219579, Kansas City, MO

64121-9579, by exchange, by wire, by internet at im.natixis.com (certain restrictions may apply), through the

Automated Clearing House system, or, in the case of redemptions, by telephone at 800-225-5478 or by the Systematic Withdrawal Plan.

Tax Information

Fund distributions are generally taxable to you as ordinary income or capital gains, except for distributions to retirement plans and other investors that qualify for tax-advantaged treatment under U.S. federal income tax law generally. Investments in such tax-advantaged plans will generally be taxed only upon withdrawal of monies from the tax-advantaged arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of the Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

|

|

USMC77-0519R |