Table of Contents

Prospectus

February 1, 2018

|

|

Class A |

Class C |

Class N |

Class T* |

Class Y |

Admin Class |

|

Loomis Sayles Core Plus Bond Fund |

NEFRX |

NECRX |

NERNX |

LCPTX |

NERYX |

|

|

Loomis Sayles Global Allocation Fund (formerly, Loomis Sayles Global Equity and Income Fund) |

LGMAX |

LGMCX |

LGMNX |

LGMTX |

LSWWX |

|

|

Loomis Sayles Growth Fund |

LGRRX |

LGRCX |

LGRNX |

LGRTX |

LSGRX |

|

|

Loomis Sayles High Income Fund |

NEFHX |

NEHCX |

LSHNX |

NEHTX |

NEHYX |

|

|

Loomis Sayles Intermediate Duration Bond Fund |

LSDRX |

LSCDX |

|

LSDTX |

LSDIX |

|

|

Loomis Sayles Investment Grade Bond Fund |

LIGRX |

LGBCX |

LGBNX |

LIGTX |

LSIIX |

LIGAX |

|

Loomis Sayles Limited Term Government and Agency Fund |

NEFLX |

NECLX |

LGANX |

LGATX |

NELYX |

|

|

Loomis Sayles Strategic Income Fund |

NEFZX |

NECZX |

NEZNX |

LSSTX |

NEZYX |

NEZAX |

|

Loomis Sayles Value Fund |

LSVRX |

LSCVX |

LSVNX |

LTSVX |

LSGIX |

LSAVX |

| * | Class T shares of the Funds are not currently available for purchase. |

The Securities and Exchange Commission (“SEC”) has not approved or disapproved any Fund’s shares or determined whether this Prospectus is truthful or complete. Any representation to the contrary is a crime.

Fund shares are not bank deposits and are not guaranteed, endorsed or insured by the Federal Deposit Insurance Corporation or any other government agency, and are subject to investment risks, including possible loss of the principal invested.

Fund Summary

Loomis Sayles Core Plus Bond Fund

Investment Goal

The Fund seeks high total investment return through a combination of current income and capital appreciation.

Fund Fees & Expenses

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in the Natixis Fund Complex. More information about these and other discounts is available from your financial professional and in the section “How Sales Charges Are Calculated” on page 69 of the Prospectus, in Appendix A to the Prospectus and on page 115 in the section “Reduced Sales Charges” of the Statement of Additional Information (“SAI”).

Shareholder Fees

|

(fees paid directly from your investment) |

Class A |

Class C |

Class N |

Class T |

Class Y |

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

4.25% |

None |

None |

2.50% |

None |

|

Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

None* |

1.00% |

None |

None |

None |

|

Redemption fees |

None |

None |

None |

None |

None |

| * | A 1.00% contingent deferred sales charge (“CDSC”) may apply to certain purchases of Class A shares of $1,000,000 or more that are redeemed within eighteen months of the date of purchase. |

Annual Fund Operating Expenses

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class A |

Class C |

Class N |

Class T |

Class Y |

|

Management fees |

0.32% |

0.32% |

0.32% |

0.32% |

0.32% |

|

Distribution and/or service (12b-1) fees |

0.25% |

1.00% |

0.00% |

0.25% |

0.00% |

|

Other expenses |

0.16% |

0.16% |

0.07% |

0.16%1 |

0.16% |

|

Total annual fund operating expenses |

0.73% |

1.48% |

0.39% |

0.73% |

0.48% |

|

Fee waiver and/or expense reimbursement2 |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

|

Total annual fund operating expenses after fee waiver and/or expense reimbursement |

0.73% |

1.48% |

0.39% |

0.73% |

0.48% |

| 1 | Other expenses are estimated for the current fiscal year. |

| 2 | Loomis, Sayles & Company, L.P. (“Loomis Sayles” or the “Adviser”) and Natixis Advisors, L.P., the Fund’s advisory administrator, have given a binding contractual undertaking to the Fund to limit the amount of the Fund’s total annual fund operating expenses to 0.80%, 1.55%, 0.50%, 0.80% and 0.55% of the Fund’s average daily net assets for Class A, C, N, T and Y shares, respectively, exclusive of brokerage expenses, interest expense, taxes, acquired fund fees and expenses, organizational and extraordinary expenses, such as litigation and indemnification expenses. This undertaking is in effect through January 31, 2019 and may be terminated before then only with the consent of the Fund’s Board of Trustees. The Adviser will be permitted to recover, on a class by class basis, management fees waived and/or expenses reimbursed to the extent that expenses in later periods fall below the applicable expense limitations for Class A, C, N, T and Y shares. The Fund will not be obligated to repay any such waived/reimbursed fees and expenses more than one year after the end of the fiscal year in which the fees or expenses were waived/reimbursed. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods (except where indicated). The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

If shares are redeemed: |

1 year |

3 years |

5 years |

10 years | ||||

|

Class A |

$ |

496 |

$ |

648 |

$ |

814 |

$ |

1,293 |

|

Class C |

$ |

251 |

$ |

468 |

$ |

808 |

$ |

1,768 |

|

Class N |

$ |

40 |

$ |

125 |

$ |

219 |

$ |

493 |

|

Class T |

$ |

323 |

$ |

478 |

$ |

646 |

$ |

1,134 |

|

Class Y |

$ |

49 |

$ |

154 |

$ |

269 |

$ |

604 |

1

Fund Summary

|

If shares are not redeemed: |

1 year |

3 years |

5 years |

10 years | ||||

|

Class C |

$ |

151 |

$ |

468 |

$ |

808 |

$ |

1,768 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During its most recently ended fiscal year, the Fund’s portfolio turnover rate was 195% of the average value of its portfolio.

Investments, Risks and Performance

Principal Investment Strategies

Under normal market conditions, the Fund will invest at least 80% of its net assets (plus any borrowings made for investment purposes) in bonds, which include debt securities of any maturity. In addition, the Fund will invest at least 65% of its net assets in investment grade securities. “Investment grade” securities are those securities that are rated in one of the top four ratings categories at the time of purchase by at least one of the three major ratings agencies (Moody’s Investors Service, Inc. (“Moody’s”), Fitch Investors Services, Inc. (“Fitch”) or S&P Global Ratings (“S&P”)), or, if unrated, are determined by the Adviser to be of comparable quality. For purposes of this restriction, investment grade securities also include cash and cash equivalent securities. The Fund will generally seek to maintain an effective duration of +/- 2 years relative to the Bloomberg Barclays U.S. Aggregate Bond Index. Duration is a measure of the expected life of a fixed-income security that is used to determine the sensitivity of a security’s price to changes in interest rates. A fund with a longer average portfolio duration will be more sensitive to changes in interest rates than a fund with a shorter average portfolio duration. By way of example, the price of a bond fund with an average duration of five years would be expected to fall approximately 5% if interest rates rose by one percentage point. While the effective duration for the Bloomberg Barclays U.S. Aggregate Bond Index fluctuates, as of December 31, 2017, the effective duration was approximately 5.94 years. The Fund may also invest up to 20% of its assets, at the time of purchase, in bonds rated below investment grade (i.e., none of the three major ratings agencies (Moody’s, Fitch or S&P) have rated the securities in one of their top four ratings categories) (commonly known as “junk bonds”), or, if unrated, securities determined by the Adviser to be of comparable quality, and up to 10% of its assets in non-U.S. dollar-denominated securities. There is no minimum rating for the securities in which the Fund may invest.

The Fund’s investments may include securities issued by U.S. and non-U.S. corporations and governments, securities issued by supranational entities, U.S. government-sponsored agency debenture and pass-through securities, commercial mortgage-backed and other asset-backed securities and inflation-linked securities.

The portfolio management team seeks to build and manage a portfolio that will perform well on a benchmark-relative and, secondarily, on an absolute basis in the market environment it anticipates over the short to intermediate term. The primary factors for broad sector positioning are the Adviser’s expected performance of sectors in the benchmark and the incremental performance or diversification benefits the Fund’s portfolio managers anticipate from opportunistic allocations to securities that are not included in the Fund’s benchmark. In addition, the Fund’s portfolio managers will look at individual security selection, position size and overall duration contribution to the portfolio.

Purchase and sale considerations also include overall portfolio yield, interest rate sensitivity across different maturities held, fixed-income sector fundamentals and outlook, technical supply/demand factors, credit risk, cash flow variability, security optionality and structure, as well as potential currency and liquidity risk. The Adviser also considers economic factors. Individual securities are assessed on a risk/return basis, both on a benchmark-relative and on an absolute return basis, and on their fit within the overall portfolio strategy.

Specifically, the Adviser follows a total return-oriented investment approach and considers broad sector allocation, quality and liquidity bias, yield curve positioning and duration in selecting securities for the Fund. The Fund’s portfolio managers consider economic and market conditions as well as issuer-specific data, such as fixed-charge coverage, the relationship between cash flows and debt service obligations, the experience and perceived strength of management or security structure, price responsiveness of the security to interest rate changes, earnings prospects, debt as a percentage of assets, borrowing requirements, debt maturity schedules and liquidation value.

In selecting investments for the Fund, the Adviser’s research analysts and sector teams work closely with the Fund’s portfolio managers to develop an outlook for the economy from research produced by various financial firms and specific forecasting services or from economic data released by U.S. and foreign governments, as well as the Federal Reserve Bank. The analysts conduct a thorough review of individual securities to identify what they consider attractive values in the high quality bond market through the use of quantitative tools such as internal and external computer systems and software. The Adviser continuously monitors an issuer’s creditworthiness or cash flow stability to assess whether the obligation remains an appropriate investment for the Fund. It may relax its emphasis on quality with respect to a given security if it believes that the issuer’s financial outlook is promising. This may create an opportunity for higher returns. The Adviser seeks to balance opportunities for yield and price performance by combining macro economic analysis with individual security selection. Fund holdings are generally diversified across sectors and industry groups such as utilities or telecommunications, which tend to move independently of the ebbs and flows in economic growth.

2

Fund Summary

In connection with its principal investment strategies, the Fund may also invest in securities issued pursuant to Rule 144A under the Securities Act of 1933 (“Rule 144A securities”), structured notes, foreign securities, including those in emerging markets, mortgage-related securities, including mortgage dollar rolls, futures and swaps (including credit default swaps). The Fund may use such derivatives for hedging or investment purposes. The Fund may also engage in currency transactions, including forward currency contracts. Except as provided above or as required by applicable law, the Fund is not limited in the percentage of its assets that it may invest in these instruments.

The Fund may engage in active and frequent trading of securities and other instruments. Effects of frequent trading may include high transaction costs, which may lower the Fund’s returns, and realization of short-term capital gains, distributions of which are taxable to shareholders who are individuals as ordinary income. Trading costs and tax effects associated with frequent trading may adversely affect the Fund’s performance.

Principal Investment Risks

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

Below Investment Grade Fixed-Income Securities Risk: The Fund’s investments in below investment grade fixed-income securities, also known as “junk bonds,” may be subject to greater risks than other fixed-income securities, including being subject to greater levels of interest rate risk, credit/counterparty risk (including a greater risk of default) and liquidity risk. The ability of the issuer to make principal and interest payments is predominantly speculative for below investment grade fixed-income securities.

Credit/Counterparty Risk: Credit/counterparty risk is the risk that the issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other transaction, will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations. The Fund will be subject to credit risks with respect to the counterparties of its derivatives transactions. Many of the protections afforded to participants on organized exchanges, such as the performance guarantee of an exchange clearing house, are not available in connection with over-the-counter (“OTC”) derivatives transactions, such as foreign currency transactions. As a result, in instances when the Fund enters into OTC derivatives transactions, the Fund will be subject to the risk that its counterparties will not perform their obligations under the transactions and that the Fund will sustain losses or be unable to realize gains.

Currency Risk: Fluctuations in the exchange rates between different currencies may negatively affect an investment. The Fund may be subject to currency risk because it may invest in currency-related instruments and may invest in securities or other instruments denominated in, or that generate income denominated in, foreign currencies. The Fund may elect not to hedge currency risk, or may hedge such risk imperfectly, which may cause the Fund to incur losses that would not have been incurred had the risk been hedged.

Derivatives Risk: Derivative instruments (such as those in which the Fund may invest, including forward currency contracts, structured notes, futures and swaps (including credit default swaps)) are subject to changes in the value of the underlying assets or indices on which such instruments are based. There is no guarantee that the use of derivatives will be effective or that suitable transactions will be available. Even a small investment in derivatives may give rise to leverage risk and can have a significant impact on the Fund’s exposure to securities markets values, interest rates or currency exchange rates. It is possible that the Fund’s liquid assets may be insufficient to support its obligations under its derivatives positions. The use of derivatives for other than hedging purposes may be considered a speculative activity, and involves greater risks than are involved in hedging. The use of derivatives may cause the Fund to incur losses greater than those that would have occurred had derivatives not been used. The Fund’s use of derivatives, such as forward currency contracts, structured notes, futures transactions and swaps (including credit default swaps) involves other risks, such as the credit risk relating to the other party to a derivative contract (which is greater for forward currency contracts, swaps and other OTC derivatives), the risk of difficulties in pricing and valuation, the risk that changes in the value of a derivative may not correlate as expected with changes in the value of relevant assets, rates or indices, liquidity risk, allocation risk and the risk of losing more than the initial margin required to initiate derivatives positions. There is also the risk that the Fund may be unable to terminate or sell a derivatives position at an advantageous time or price. The Fund’s derivative counterparties may experience financial difficulties or otherwise be unwilling or unable to honor their obligations, possibly resulting in losses to the Fund.

Emerging Markets Risk: In addition to the risks of investing in foreign investments generally, emerging markets investments are subject to greater risks arising from political or economic instability, nationalization or confiscatory taxation, currency exchange restrictions, sanctions by the U.S. government and an issuer’s unwillingness or inability to make principal or interest payments on its obligations. Emerging markets companies may be smaller and have shorter operating histories than companies in developed markets.

Foreign Securities Risk: Investments in foreign securities may be subject to greater political, economic, environmental, credit/counterparty and information risks. The Fund’s investments in foreign securities also are subject to foreign currency fluctuations and other foreign currency-related risks. Foreign securities may be subject to higher volatility than U.S. securities, varying degrees of regulation and limited liquidity.

Interest Rate Risk: Interest rate risk is the risk that the value of the Fund’s investments will fall if interest rates rise. Generally, the value of fixed-income securities rises when prevailing interest rates fall and falls when interest rates rise. Interest rate risk generally is greater for funds that invest in fixed-income securities with relatively longer durations than for funds that invest in fixed-income securities with shorter durations. In addition, an economic downturn or period of rising interest rates could adversely affect the market for these securities and reduce the Fund’s ability to sell them, negatively impacting the performance of the Fund. Potential future changes in government monetary policy may affect the level of interest rates, and the current historically low interest rate environment increases the likelihood of interest rates rising in the future.

3

Fund Summary

Leverage Risk: Use of derivative instruments may involve leverage. Leverage is the risk associated with securities or practices that multiply small index, market or asset-price movements into larger changes in value. The use of leverage increases the impact of gains and losses on a fund’s returns, and may lead to significant losses if investments are not successful.

Liquidity Risk: Liquidity risk is the risk that the Fund may be unable to find a buyer for its investments when it seeks to sell them or to receive the price it expects. Decreases in the number of financial institutions willing to make markets in the Fund’s investments or in their capacity or willingness to transact may increase the Fund’s exposure to this risk. Events that may lead to increased redemptions, such as market disruptions or increases in interest rates, may also negatively impact the liquidity of the Fund’s investments when it needs to dispose of them. If the Fund is forced to sell its investments at an unfavorable time and/or under adverse conditions in order to meet redemption requests, such sales could negatively affect the Fund. Securities acquired in a private placement, such as Rule 144A securities, are generally subject to significant liquidity risk because they are subject to strict restrictions on resale and there may be no liquid secondary market or ready purchaser for such securities. Non-exchange traded derivatives are generally subject to greater liquidity risk as well. Liquidity issues may also make it difficult to value the Fund’s investments.

Management Risk: A strategy used by the Fund’s portfolio managers may fail to produce the intended result.

Market/Issuer Risk: The market value of the Fund’s investments will move up and down, sometimes rapidly and unpredictably, based upon overall market and economic conditions, as well as a number of reasons that directly relate to the issuers of the Fund’s investments, such as management performance, financial condition and demand for the issuers’ goods and services.

Mortgage-Related and Asset-Backed Securities Risk: In addition to the risks associated with investments in fixed-income securities generally (for example, credit, liquidity and valuation risk), mortgage-related and asset-backed securities are subject to the risks of the mortgages and assets underlying the securities as well as prepayment risk, the risk that the securities may be prepaid and result in the reinvestment of the prepaid amounts in securities with lower yields than the prepaid obligations. Conversely, there is a risk that a rise in interest rates will extend the life of a mortgage-related or asset-backed security beyond the expected prepayment time, typically reducing the security’s value, which is called extension risk. The Fund also may incur a loss when there is a prepayment of securities that were purchased at a premium. The Fund’s investments in other asset-backed securities are subject to risks similar to those associated with mortgage-related securities, as well as additional risks associated with the nature of the assets and the servicing of those assets.

Risk/Return Bar Chart and Table

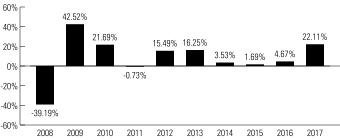

The bar chart and table shown below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year-to-year and by showing how the Fund’s average annual returns for the one-year, five-year, ten-year and life-of-class periods (as applicable) compare to those of a broad measure of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at im.natixis.com and/or by calling the Fund toll-free at 800-225-5478.

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund’s shares. A sales charge will reduce your return.

Total Returns for Class Y Shares

|

|

Highest Quarterly Return: Second Quarter 2009, 7.96% |

4

Fund Summary

|

Average Annual Total Returns |

|

|

|

|

|

(for the periods ended December 31, 2017) |

Past 1 Year |

Past 5 Years |

Past 10 Years |

Life of Class N |

|

Class Y - Return Before Taxes |

5.22% |

2.83% |

6.10% |

- |

|

Return After Taxes on Distributions |

3.90% |

1.31% |

4.30% |

- |

|

Return After Taxes on Distributions and Sale of Fund Shares |

2.94% |

1.46% |

4.04% |

- |

|

Class A - Return Before Taxes |

0.47% |

1.68% |

5.37% |

- |

|

Class C - Return Before Taxes |

3.20% |

1.80% |

5.04% |

- |

|

Class N - Return Before Taxes |

5.31% |

- |

- |

2.97% |

|

Class T - Return Before Taxes |

2.33% |

2.05% |

5.56% |

- |

|

Bloomberg Barclays U.S. Aggregate Bond Index |

3.54% |

2.10% |

4.01% |

2.30% |

The Fund did not have Class T shares outstanding during the periods shown above. The returns of Class T shares would have been substantially similar to the returns of the Fund’s other share classes because they would have been invested in the same portfolio of securities and would only differ to the extent the other share classes did not have the same expenses. Performance of Class T shares shown above is that of Class A shares, which have the same expenses as Class T shares, restated to reflect the different sales load applicable to Class T shares. Prior to February 1, 2018, Total Returns in the bar chart and Return After Taxes on Distributions and Return After Taxes on Distributions and Sale of Fund Shares in the table were presented for Class A shares; such returns are now presented for Class Y shares, the largest share class in the Natixis Fund Complex.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The after-tax returns are shown for only one class of the Fund. After-tax returns for the other classes of the Fund will vary. Index performance reflects no deduction for fees, expenses or taxes.

Management

Investment Adviser

Loomis, Sayles & Company, L.P.

Portfolio Managers

Peter W. Palfrey, CFA®, Vice President of the Adviser, has served as co-portfolio manager of the Fund since 1996.

Richard G. Raczkowski, Vice President of the Adviser, has served as co-portfolio manager of the Fund since 1999.

Purchase and Sale of Fund Shares

Class A and C

Shares

The following chart shows the investment minimums for various types of accounts:

|

Type of Account |

Minimum Initial Purchase |

Minimum Subsequent Purchase | ||

|

Any account other than those listed below |

$ |

2,500 |

$ |

50 |

|

For shareholders participating in Natixis Funds’ Investment Builder Program |

$ |

1,000 |

$ |

50 |

|

For Traditional IRA, Roth IRA, Rollover IRA, SEP-IRA and Keogh plans using the Natixis Funds’ prototype document (direct accounts, not held through intermediary) |

$ |

1,000 |

$ |

50 |

|

Coverdell Education Savings Accounts using the Natixis Funds’ prototype document (direct accounts, not held through intermediary) |

$ |

500 |

$ |

50 |

There is no initial or subsequent investment minimum for:

• Wrap Fee Programs of certain broker-dealers, the advisers or Natixis Distribution, L.P. Please consult your financial representative to determine if

your wrap fee program is subject to additional or different conditions or fees.

• Certain Retirement Plans. Please consult your retirement plan administrator to determine if your retirement plan is subject to additional or different

conditions or fees.

• Clients of a

Registered Investment Adviser where the Registered Investment Adviser receives an advisory, management or consulting fee.

5

Fund Summary

Class N Shares

Class N shares of the Fund are subject to a $1,000,000 initial investment minimum. There is no initial investment minimum for Certain Retirement Plans and funds of funds that are distributed by Natixis Distribution, L.P. There is no subsequent investment minimum for these shares. In its sole discretion, Natixis Distribution, L.P. may waive the investment minimum requirement for accounts as to which the relevant financial intermediary has provided assurances, in writing, that the accounts will be held in omnibus fashion beginning no more than two years following the establishment date of such accounts in Class N.

Class T

Shares

Class T shares of the Fund are not currently available for purchase.

Class T shares of the Fund may only be purchased by investors who are investing through an authorized third party, such as a broker-dealer or other financial intermediary, that has entered into a selling agreement with Natixis Distribution, L.P. Investors may not hold Class T shares directly with the Fund. Class T shares are subject to a minimum initial investment of $2,500 and a minimum subsequent investment of $50. Not all financial intermediaries make Class T shares available to their clients.

Class Y Shares

Class Y shares of the Fund are generally subject to a minimum initial investment of $100,000 and a minimum subsequent investment of $50, except there is no minimum initial or subsequent investment for:

• Wrap Fee Programs of certain broker-dealers, the advisers or Natixis Distribution, L.P. Please consult your financial representative to determine if

your wrap fee program is subject to additional or different conditions or fees.

• Certain Retirement Plans. Please consult your retirement plan administrator to determine if your retirement plan is subject to additional or different

conditions or fees.

• Certain Individual Retirement Accounts if the amounts invested represent rollover distributions from investments by any of the retirement plans invested in the

Fund.

• Clients of a Registered Investment Adviser where the Registered Investment Adviser receives an advisory, management or consulting fee.

• Fund Trustees, former Fund trustees, employees of affiliates of the Natixis Funds and other individuals who are affiliated with any Natixis Fund

(this also applies to any spouse, parents, children, siblings, grandparents, grandchildren and in-laws of those

mentioned) and Natixis affiliate employee benefit plans.

At the discretion of Natixis Advisors, L.P., clients of Natixis Advisors, L.P. and its affiliates may purchase Class Y shares of the Fund below the stated minimums.

Due to operational limitations at your financial intermediary, certain wrap fee programs, retirement plans, individual retirement

accounts and accounts of registered investment advisers may be subject to the investment minimums described

above.

The Fund’s shares are available for purchase and are redeemable on any business day through your investment dealer, directly

from the Fund by writing to the Fund at Natixis Funds, P.O. Box 219579, Kansas City, MO 64121-9579, by exchange, by

wire, by internet at im.natixis.com (certain restrictions may apply), through the Automated Clearing House system, or,

in the case of redemptions, by telephone at 800-225-5478 or by the Systematic Withdrawal Plan.

Tax Information

Fund distributions are generally taxable to you as ordinary income or capital gains, except for distributions to retirement plans and other investors that qualify for tax-advantaged treatment under U.S. federal income tax law generally. Investments in such tax-advantaged plans will generally be taxed only upon withdrawal of monies from the tax-advantaged arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of the Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

6

Fund Summary

Loomis Sayles Global Allocation Fund

Investment Goal

The Fund’s investment goal is high total investment return through a combination of capital appreciation and current income.

Fund Fees & Expenses

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex. More information about these and other discounts is available from your financial professional and in the section “How Sales Charges Are Calculated” on page 69 of the Prospectus, in Appendix A to the Prospectus and on page 115 in the section “Reduced Sales Charges” of the Statement of Additional Information (“SAI”).

Shareholder Fees

|

(fees paid directly from your investment) |

Class A |

Class C |

Class N |

Class T |

Class Y |

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

5.75% |

None |

None |

2.50% |

None |

|

Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

None* |

1.00% |

None |

None |

None |

|

Redemption fees |

None |

None |

None |

None |

None |

| * | A 1.00% contingent deferred sales charge (“CDSC”) may apply to certain purchases of Class A shares of $1,000,000 or more that are redeemed within eighteen months of the date of purchase. |

Annual Fund Operating Expenses

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class A |

Class C |

Class N |

Class T |

Class Y |

|

Management fees |

0.75% |

0.75% |

0.75% |

0.75% |

0.75% |

|

Distribution and/or service (12b-1) fees |

0.25% |

1.00% |

0.00% |

0.25% |

0.00% |

|

Other expenses |

0.18% |

0.18% |

0.12% |

0.18%1 |

0.18% |

|

Total annual fund operating expenses |

1.18% |

1.93% |

0.87% |

1.18% |

0.93% |

|

Fee waiver and/or expense reimbursement2,3 |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

|

Total annual fund operating expenses after fee waiver and/or expense reimbursement |

1.18% |

1.93% |

0.87% |

1.18% |

0.93% |

| 1 | Other expenses are estimated for the current fiscal year. |

| 2 | Loomis, Sayles & Company, L.P. (“Loomis Sayles” or the “Adviser”) has given a binding contractual undertaking to the Fund to limit the amount of the Fund’s total annual fund operating expenses to 1.25%, 2.00%, 0.95%, 1.25% and 1.00% of the Fund’s average daily net assets for Class A, C, N, T and Y shares, respectively, exclusive of brokerage expenses, interest expense, taxes, acquired fund fees and expenses, organizational and extraordinary expenses, such as litigation and indemnification expenses. This undertaking is in effect through January 31, 2019 and may be terminated before then only with the consent of the Fund’s Board of Trustees. The Adviser will be permitted to recover, on a class by class basis, management fees waived and/or expenses reimbursed to the extent that expenses in later periods fall below the applicable expense limitations for Class A, C, N, T and Y shares. The Fund will not be obligated to repay any such waived/reimbursed fees and expenses more than one year after the end of the fiscal year in which the fees or expenses were waived/reimbursed. |

| 3 | Natixis Advisors, L.P. has given a binding contractual undertaking to the Fund to reimburse any and all transfer agency expenses for Class N shares. This undertaking is in effect through January 31, 2019 and may be terminated before then only with the consent of the Fund’s Board of Trustees. |

7

Fund Summary

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods (except where indicated). The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

If shares are redeemed: |

1 year |

3 years |

5 years |

10 years | ||||

|

Class A |

$ |

688 |

$ |

928 |

$ |

1,187 |

$ |

1,924 |

|

Class C |

$ |

296 |

$ |

606 |

$ |

1,042 |

$ |

2,254 |

|

Class N |

$ |

89 |

$ |

278 |

$ |

482 |

$ |

1,073 |

|

Class T |

$ |

367 |

$ |

615 |

$ |

883 |

$ |

1,646 |

|

Class Y |

$ |

95 |

$ |

296 |

$ |

515 |

$ |

1,143 |

|

If shares are not redeemed: |

1 year |

3 years |

5 years |

10 years | ||||

|

Class C |

$ |

196 |

$ |

606 |

$ |

1,042 |

$ |

2,254 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During its most recently ended fiscal year, the Fund’s portfolio turnover rate was 35% of the average value of its portfolio.

Investments, Risks and Performance

Principal Investment Strategies

Under normal market conditions, the Fund will invest at least 80% of its net assets (plus any borrowings made for investment purposes) in equity and fixed-income securities of U.S. and foreign issuers. Equity securities purchased by the Fund may include common stocks, preferred stocks, depositary receipts, warrants, securities convertible into common or preferred stocks, interests in real estate investment trusts (“REITs”) and/or real estate-related securities and other equity-like interests in an issuer. Fixed-income securities purchased by the Fund may include bonds and other debt obligation of U.S. and foreign issuers, including but not limited to corporations, governments and supranational entities. The Fund will invest a significant portion of its assets outside the U.S., including securities of issuers located in emerging market countries.

The portfolio managers reallocate the Fund’s assets between equity and fixed income securities based on their assessment of current market conditions and the relative opportunities within each asset class, among other factors. In deciding which equity securities to buy and sell, the Adviser generally looks to purchase quality companies at attractive valuations with the potential to grow intrinsic value over time. The Adviser uses discounted cash flow analysis, among other methods of analysis, to determine a company’s intrinsic value. In deciding which fixed-income securities to buy and sell, the Adviser generally looks for securities that it believes are undervalued and have the potential for credit upgrades, which may include securities that are below investment grade (also known as “junk bonds”).

The Fund may also invest in foreign currencies, collateralized mortgage obligations, zero-coupon securities, when-issued securities, REITs, securities issued pursuant to Rule 144A under the Securities Act of 1933 (“Rule 144A securities”), mortgage-related securities, convertible securities and structured notes. The Fund may also engage in active and frequent trading of securities and engage in options or foreign currency transactions (such as forward currency contracts) for hedging and investment purposes and futures transactions and swap transactions (including credit default swaps). Frequent trading may produce high transaction costs and a high level of taxable capital gains, including short-term capital gains taxable as ordinary income, which may lower the Fund’s return. The Adviser may hedge currency risk for the Fund (including “cross hedging” between two or more foreign currencies) if it believes the outlook for a particular foreign currency is unfavorable. Except as provided above or as required by applicable law, the Fund is not limited in the percentage of its assets that it may invest in these instruments.

Principal Investment Risks

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

Allocation Risk: The Fund’s allocations between asset classes and market exposures may not be optimal in every market condition and may adversely affect the Fund’s performance.

Below Investment Grade Fixed-Income Securities Risk: The Fund’s investments in below investment grade fixed-income securities, also known as “junk bonds,” may be subject to greater risks than other fixed-income securities, including being subject to greater levels of interest rate risk,

8

Fund Summary

credit/counterparty risk (including a greater risk of default) and liquidity risk. The ability of the issuer to make principal and interest payments is predominantly speculative for below investment grade fixed-income securities.

Credit/Counterparty Risk: Credit/counterparty risk is the risk that the issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other transaction, will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations. The Fund will be subject to credit risks with respect to the counterparties of its derivatives transactions. Many of the protections afforded to participants on organized exchanges, such as the performance guarantee of an exchange clearing house, are not available in connection with over-the-counter (“OTC”) derivatives transactions, such as foreign currency transactions. As a result, in instances when the Fund enters into OTC derivatives transactions, the Fund will be subject to the risk that its counterparties will not perform their obligations under the transactions and that the Fund will sustain losses or be unable to realize gains.

Currency Risk: Fluctuations in the exchange rates between different currencies may negatively affect an investment. The Fund may be subject to currency risk because it may invest in currency-related instruments and may invest in securities or other instruments denominated in, or that generate income denominated in, foreign currencies. The Fund may elect not to hedge currency risk, or may hedge such risk imperfectly, which may cause the Fund to incur losses that would not have been incurred had the risk been hedged.

Derivatives Risk: Derivative instruments (such as those in which the Fund may invest, including options, forward currency contracts, futures transactions, structured notes and swap transactions (including credit default swaps)) are subject to changes in the value of the underlying assets or indices on which such instruments are based. There is no guarantee that the use of derivatives will be effective or that suitable transactions will be available. Even a small investment in derivatives may give rise to leverage risk and can have a significant impact on the Fund’s exposure to securities markets values, interest rates or currency exchange rates. It is possible that the Fund’s liquid assets may be insufficient to support its obligations under its derivatives positions. The use of derivatives for other than hedging purposes may be considered a speculative activity, and involves greater risks than are involved in hedging. The use of derivatives may cause the Fund to incur losses greater than those that would have occurred had derivatives not been used. The Fund’s use of derivatives, such as options, forward currency contracts, futures transactions, structured notes and swap transactions (including credit default swaps) involves other risks, such as the credit risk relating to the other party to a derivative contract (which is greater for forward currency contracts, swaps and other OTC derivatives) the risk of difficulties in pricing and valuation, the risk that changes in the value of a derivative may not correlate as expected with changes in the value of relevant assets, rates or indices, liquidity risk, allocation risk and the risk of losing more than the initial margin required to initiate derivatives positions. There is also the risk that the Fund may be unable to terminate or sell a derivatives position at an advantageous time or price. The Fund’s derivative counterparties may experience financial difficulties or otherwise be unwilling or unable to honor their obligations, possibly resulting in losses to the Fund.

Emerging Markets Risk: In addition to the risks of investing in foreign investments generally, emerging markets investments are subject to greater risks arising from political or economic instability, nationalization or confiscatory taxation, currency exchange restrictions, sanctions by the U.S. government and an issuer’s unwillingness or inability to make principal or interest payments on its obligations. Emerging markets companies may be smaller and have shorter operating histories than companies in developed markets.

Equity Securities Risk: The value of the Fund’s investments in equity securities could be subject to unpredictable declines in the value of individual securities and periods of below-average performance in individual securities or in the equity market as a whole. Value stocks can perform differently from the market as a whole and from other types of stocks. Value stocks also present the risk that their lower valuations fairly reflect their business prospects and that investors will not agree that the stocks represent favorable investment opportunities, and they may fall out of favor with investors and underperform growth stocks during any given period. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer’s bonds generally take precedence over the claims of those who own preferred stock or common stock.

Foreign Securities Risk: Investments in foreign securities may be subject to greater political, economic, environmental, credit/counterparty and information risks. The Fund’s investments in foreign securities also are subject to foreign currency fluctuations and other foreign currency-related risks. Foreign securities may be subject to higher volatility than U.S. securities, varying degrees of regulation and limited liquidity.

Interest Rate Risk: Interest rate risk is the risk that the value of the Fund’s investments will fall if interest rates rise. Generally, the value of fixed-income securities rises when prevailing interest rates fall and falls when interest rates rise. Interest rate risk generally is greater for funds that invest in fixed-income securities with relatively longer durations than for funds that invest in fixed-income securities with shorter durations. The value of zero-coupon securities and securities with longer maturities are generally more sensitive to fluctuations in interest rates than other fixed-income securities. In addition, an economic downturn or period of rising interest rates could adversely affect the market for these securities and reduce the Fund’s ability to sell them, negatively impacting the performance of the Fund. Potential future changes in government monetary policy may affect the level of interest rates, and the current historically low interest rate environment increases the likelihood of interest rates rising in the future.

Large Investor Risk: Ownership of shares of the Fund may be concentrated in one or a few large investors. Such investors may redeem shares in large quantities or on a frequent basis. Redemptions by a large investor can affect the performance of the Fund, may increase realized capital gains, including short-term capital gains taxable as ordinary income, may accelerate the realization of taxable income to shareholders and may increase transaction costs. These transactions potentially limit the use of any capital loss carryforwards and certain other losses to offset future realized capital gains (if any). Such transactions may also increase the Fund’s expenses.

Leverage Risk: Use of derivative instruments may involve leverage. Leverage is the risk associated with securities or practices that multiply small index, market or asset-price movements into larger changes in value. The use of leverage increases the impact of gains and losses on a fund’s returns, and may lead to significant losses if investments are not successful.

9

Fund Summary

Liquidity Risk: Liquidity risk is the risk that the Fund may be unable to find a buyer for its investments when it seeks to sell them or to receive the price it expects. Decreases in the number of financial institutions willing to make markets in the Fund’s investments or in their capacity or willingness to transact may increase the Fund’s exposure to this risk. Events that may lead to increased redemptions, such as market disruptions or increases in interest rates, may also negatively impact the liquidity of the Fund’s investments when it needs to dispose of them. If the Fund is forced to sell its investments at an unfavorable time and/or under adverse conditions in order to meet redemption requests, such sales could negatively affect the Fund. Securities acquired in a private placement, such as Rule 144A securities, are generally subject to significant liquidity risk because they are subject to strict restrictions on resale and there may be no liquid secondary market or ready purchaser for such securities. Non-exchange traded derivatives are generally subject to greater liquidity risk as well. Liquidity issues may also make it difficult to value the Fund’s investments.

Management Risk: A strategy used by the Fund’s portfolio managers may fail to produce the intended result.

Market/Issuer Risk: The market value of the Fund’s investments will move up and down, sometimes rapidly and unpredictably, based upon overall market and economic conditions, as well as a number of reasons that directly relate to the issuers of the Fund’s investments, such as management performance, financial condition and demand for the issuers’ goods and services.

Mortgage-Related Securities Risk: In addition to the risks associated with investments in fixed-income securities generally (for example, credit, liquidity and valuation risk), mortgage-related securities are subject to the risks of the mortgages underlying the securities as well as prepayment risk, the risk that the securities may be prepaid and result in the reinvestment of the prepaid amounts in securities with lower yields than the prepaid obligations. Conversely, there is a risk that a rise in interest rates will extend the life of a mortgage-related security beyond the expected prepayment time, typically reducing the security’s value. The Fund also may incur a loss when there is a prepayment of securities that were purchased at a premium. The Fund’s investments in other asset-backed securities are subject to risks similar to those associated with mortgage-related securities, as well as additional risks associated with the nature of the assets and the servicing of those assets.

REITs Risk: Investments in the real estate industry, including REITs, are particularly sensitive to economic downturns and are sensitive to factors such as changes in real estate values, property taxes and tax laws, interest rates, cash flow of underlying real estate assets, occupancy rates, government regulations affecting zoning, land use and rents and the management skill and creditworthiness of the issuer. Companies in the real estate industry also may be subject to liabilities under environmental and hazardous waste laws. In addition, the value of a REIT is affected by changes in the value of the properties owned by the REIT or mortgage loans held by the REIT. REITs are also subject to default and prepayment risk. Many REITs are highly leveraged, increasing their risk. The Fund will indirectly bear its proportionate share of expenses, including management fees, paid by each REIT in which it invests in addition to the expenses of the Fund.

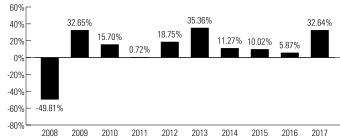

Risk/Return Bar Chart and Table

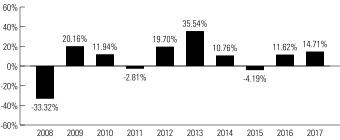

The bar chart and table shown below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year-to-year and by showing how the Fund’s average annual returns for the one-year, five-year, ten-year and life-of-class periods (as applicable) compare to those of two broad measures of market performance. The Blended Index is an unmanaged, blended index composed of the following weights: 60% MSCI All Country World Index (Net) and 40% Bloomberg Barclays Global Aggregate Bond Index. The two indices composing the Blended Index measure, respectively, the performance of global equity securities and global investment grade fixed income securities. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance information is available online at im.natixis.com and/or by calling the Fund toll-free at 800-225-5478.

The chart does not reflect any sales charge that you may be required to pay when you buy or redeem the Fund’s shares. A sales charge will reduce your return.

Total Returns for Class Y Shares

|

|

Highest Quarterly Return: Second Quarter 2009, 19.91% |

10

Fund Summary

|

Average Annual Total Returns |

|

|

|

|

|

(for the periods ended December 31, 2017) |

Past 1 Year |

Past 5 Years |

Past 10 Years |

Life of Class

N |

|

Class Y - Return Before Taxes |

22.11% |

9.36% |

6.58% |

- |

|

Return After Taxes on Distributions |

21.42% |

8.30% |

5.75% |

- |

|

Return After Taxes on Distributions and Sale of Fund Shares |

13.05% |

7.15% |

5.03% |

- |

|

Class A - Return Before Taxes |

14.79% |

7.80% |

5.69% |

- |

|

Class C - Return Before Taxes |

19.90% |

8.27% |

5.52% |

- |

|

Class N - Return Before Taxes |

- |

- |

- |

18.38% |

|

Class T - Return Before Taxes |

18.71% |

8.53% |

6.05% |

- |

|

MSCI All Country World Index (Net) |

23.97% |

10.80% |

4.65% |

20.55% |

|

Blended Index |

17.09% |

6.81% |

4.32% |

14.80% |

The Fund did not have Class T shares outstanding during the periods shown above. The returns of Class T shares would have been substantially similar to the returns of the Fund’s other share classes because they would have been invested in the same portfolio of securities and would only differ to the extent the other share classes did not have the same expenses. Performance of Class T shares shown above is that of Class A shares, which have the same expenses as Class T shares, restated to reflect the different sales load applicable to Class T shares.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares through tax-advantaged arrangements, such as 401(k) plans, qualified plans, education savings accounts, such as 529 plans, or individual retirement accounts. The after-tax returns are shown for only one class of the Fund. After-tax returns for the other classes of the Fund will vary. Index performance reflects no deduction for fees, expenses or taxes.

Management

Investment Adviser

Loomis, Sayles & Company, L.P.

Portfolio Managers

Daniel J. Fuss, CFA®, CIC, Vice Chairman, Director and Managing Partner of the Adviser, has served as portfolio manager of the domestic fixed-income securities sector of the Fund since 1996.

Eileen N. Riley, CFA®, Vice President of the Adviser, has served as portfolio manager of the global equity sector of the Fund since 2013.

David W. Rolley, CFA®, Vice President of the Adviser, has served as portfolio manager of the international fixed-income securities sector of the Fund since 2000.

Lee M. Rosenbaum, Vice President of the Adviser, has served as portfolio manager of the global equity sector of the Fund since 2013.

Purchase and Sale of Fund Shares

Class A and C

Shares

The following chart shows the investment minimums for various types of accounts:

|

Type of Account |

Minimum Initial Purchase |

Minimum Subsequent Purchase | ||

|

Any account other than those listed below |

$ |

2,500 |

$ |

50 |

|

For shareholders participating in Natixis Funds’ Investment Builder Program |

$ |

1,000 |

$ |

50 |

|

For Traditional IRA, Roth IRA, Rollover IRA, SEP-IRA and Keogh plans using the Natixis Funds’ prototype document (direct accounts, not held through intermediary) |

$ |

1,000 |

$ |

50 |

|

Coverdell Education Savings Accounts using the Natixis Funds’ prototype document (direct accounts, not held through intermediary) |

$ |

500 |

$ |

50 |

There is no initial or subsequent investment minimum for:

• Wrap Fee Programs of certain broker-dealers, the advisers or Natixis Distribution, L.P. Please consult your financial representative to determine if

your wrap fee program is subject to additional or different conditions or fees.

11

Fund Summary

• Certain Retirement Plans. Please consult your retirement plan administrator to determine if your retirement plan is subject to additional or different

conditions or fees.

• Clients of a

Registered Investment Adviser where the Registered Investment Adviser receives an advisory, management or consulting fee.

Class N Shares

Class N shares of the Fund are subject to a $1,000,000 initial investment minimum. There is no initial investment minimum for Certain Retirement Plans and funds of funds that are distributed by Natixis Distribution, L.P. There is no subsequent investment minimum for these shares. In its sole discretion, Natixis Distribution, L.P. may waive the investment minimum requirement for accounts as to which the relevant financial intermediary has provided assurances, in writing, that the accounts will be held in omnibus fashion beginning no more than two years following the establishment date of such accounts in Class N.

Class T

Shares

Class T shares of the Fund are not currently available for purchase.

Class T shares of the Fund may only be purchased by investors who are investing through an authorized third party, such as a broker-dealer or other financial intermediary, that has entered into a selling agreement with Natixis Distribution, L.P. Investors may not hold Class T shares directly with the Fund. Class T shares are subject to a minimum initial investment of $2,500 and a minimum subsequent investment of $50. Not all financial intermediaries make Class T shares available to their clients.

Class Y Shares

Class Y shares of the Fund are generally subject to a minimum initial investment of $100,000 and a minimum subsequent investment of $50, except there is no minimum initial or subsequent investment for:

• Wrap Fee Programs of certain broker-dealers, the advisers or Natixis Distribution, L.P. Please consult your financial representative to determine if

your wrap fee program is subject to additional or different conditions or fees.

• Certain Retirement Plans. Please consult your retirement plan administrator to determine if your retirement plan is subject to additional or different

conditions or fees.

• Certain Individual Retirement Accounts if the amounts invested represent rollover distributions from investments by any of the retirement plans invested in the

Fund.

• Clients of a Registered Investment Adviser where the Registered Investment Adviser receives an advisory, management or consulting fee.

• Fund Trustees, former Fund trustees, employees of affiliates of the Natixis Funds and other individuals who are affiliated with any Natixis Fund

(this also applies to any spouse, parents, children, siblings, grandparents, grandchildren and in-laws of those

mentioned) and Natixis affiliate employee benefit plans.

At the discretion of Natixis Advisors, L.P., clients of Natixis Advisors, L.P. and its affiliates may purchase Class Y shares of the Fund below the stated minimums.

Due to operational limitations at your financial intermediary, certain wrap fee programs, retirement plans, individual retirement

accounts and accounts of registered investment advisers may be subject to the investment minimums described

above.

The Fund’s shares are available for purchase and are redeemable on any business day through your investment dealer, directly

from the Fund by writing to the Fund at Natixis Funds, P.O. Box 219579, Kansas City, MO 64121-9579, by exchange, by

wire, by internet at im.natixis.com (certain restrictions may apply), through the Automated Clearing House system, or,

in the case of redemptions, by telephone at 800-225-5478 or by the Systematic Withdrawal Plan.

Tax Information

Fund distributions are generally taxable to you as ordinary income or capital gains, except for distributions to retirement plans and other investors that qualify for tax-advantaged treatment under U.S. federal income tax law generally. Investments in such tax-advantaged plans will generally be taxed only upon withdrawal of monies from the tax-advantaged arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of the Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

12

Fund Summary

Investment Goal

The Fund’s investment goal is long-term growth of capital.

Fund Fees & Expenses

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Natixis Fund Complex. More information about these and other discounts is available from your financial professional and in the section “How Sales Charges Are Calculated” on page 69 of the Prospectus, in Appendix A to the Prospectus and on page 115 in the section “Reduced Sales Charges” of the Statement of Additional Information (“SAI”).

Shareholder Fees

|

(fees paid directly from your investment) |

Class A |

Class C |

Class N |

Class T |

Class Y |

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

5.75% |

None |

None |

2.50% |

None |

|

Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) |

None* |

1.00% |

None |

None |

None |

|

Redemption fees |

None |

None |

None |

None |

None |

| * | A 1.00% contingent deferred sales charge (“CDSC”) may apply to certain purchases of Class A shares of $1,000,000 or more that are redeemed within eighteen months of the date of purchase. |

Annual Fund Operating Expenses

|

(expenses that you pay each year as a percentage of the value of your investment) |

Class A |

Class C |

Class N |

Class T |

Class Y |

|

Management fees |

0.50% |

0.50% |

0.50% |

0.50% |

0.50% |

|

Distribution and/or service (12b-1) fees |

0.25% |

1.00% |

0.00% |

0.25% |

0.00% |

|

Other expenses |

0.16% |

0.16% |

0.08% |

0.16%1 |

0.16% |

|

Total annual fund operating expenses |

0.91% |

1.66% |

0.58% |

0.91% |

0.66% |

|

Fee waiver and/or expense reimbursement2,3 |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

|

Total annual fund operating expenses after fee waiver and/or expense reimbursement |

0.91% |

1.66% |

0.58% |

0.91% |

0.66% |

| 1 | Other expenses are estimated for the current fiscal year. |

| 2 | Loomis, Sayles & Company, L.P. (“Loomis Sayles” or the “Adviser”) has given a binding contractual undertaking to the Fund to limit the amount of the Fund’s total annual fund operating expenses to 1.25%, 2.00%, 0.95%, 1.25% and 1.00% of the Fund’s average daily net assets for Class A, C, N, T and Y shares, respectively, exclusive of brokerage expenses, interest expense, taxes, acquired fund fees and expenses, organizational and extraordinary expenses, such as litigation and indemnification expenses. This undertaking is in effect through January 31, 2019 and may be terminated before then only with the consent of the Fund’s Board of Trustees. The Adviser will be permitted to recover, on a class by class basis, management fees waived and/or expenses reimbursed to the extent that expenses in later periods fall below the applicable expense limitations for Class A, C, N, T and Y shares. The Fund will not be obligated to repay any such waived/reimbursed fees and expenses more than one year after the end of the fiscal year in which the fees or expenses were waived/reimbursed. |

| 3 | Natixis Advisors, L.P. has given a binding contractual undertaking to the Fund to reimburse any and all transfer agency expenses attributable to accounts admitted to Class N via a prospectus provision that allows Natixis Distribution, L.P., at its sole discretion, to waive the investment minimum for accounts as to which the relevant financial intermediary has provided assurances, in writing, that the accounts will be held in omnibus fashion beginning no more than two years following the establishment date of such accounts in Class N. This undertaking is in effect through June 30, 2019 and may be terminated before then only with the consent of the Fund’s Board of Trustees. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods (except where indicated). The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

13

Fund Summary

|

If shares are redeemed: |

1 year |

3 years |

5 years |

10 years | ||||

|

Class A |

$ |

663 |

$ |

848 |

$ |

1,050 |

$ |

1,630 |

|

Class C |

$ |

269 |

$ |

523 |

$ |

902 |

$ |

1,965 |

|

Class N |

$ |

59 |

$ |

186 |

$ |

324 |

$ |

726 |

|

Class T |

$ |

341 |

$ |

533 |

$ |

741 |

$ |

1,342 |

|

Class Y |

$ |

67 |

$ |

211 |

$ |

368 |

$ |

822 |

|

If shares are not redeemed: |

1 year |

3 years |

5 years |

10 years | ||||

|

Class C |

$ |

169 |

$ |

523 |

$ |

902 |

$ |

1,965 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During its most recently ended fiscal year, the Fund’s portfolio turnover rate was 8% of the average value of its portfolio.

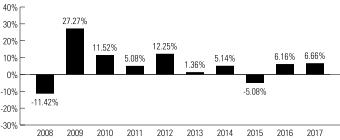

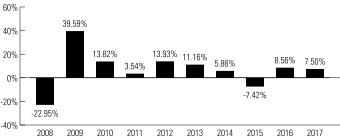

Investments, Risks and Performance

Principal Investment Strategies

Under normal market conditions, the Fund will invest primarily in equity securities, including common stocks, convertible securities and warrants. The Fund focuses on stocks of large capitalization companies, but the Fund may invest in companies of any size.

The Fund normally invests across a wide range of sectors and industries. The Fund’s portfolio manager employs a growth style of equity management, which means that the Fund seeks to invest in companies with sustainable competitive advantages, long-term structural growth drivers, attractive cash flow returns on invested capital, and management teams focused on creating long-term value for shareholders. The Fund’s portfolio manager also aims to invest in companies when they trade at a significant discount to the estimate of intrinsic value.

The Fund will consider selling a portfolio investment when the portfolio manager believes an unfavorable structural change occurs within a given business or the markets in which it operates, a critical underlying investment assumption is flawed, when a more attractive reward-to-risk opportunity becomes available, when the current price fully reflects intrinsic value, or for other investment reasons which the portfolio manager deems appropriate.

The Fund may also invest up to 20% of its assets in foreign securities, including depositary receipts and emerging market securities. Although certain equity securities purchased by the Fund may be issued by domestic companies incorporated outside of the United States, the Adviser does not consider these securities to be foreign if they are included in the U.S. equity indices published by S&P Global Ratings or Russell Investments or if the security’s country of risk defined by Bloomberg is the United States. The Fund may also engage in foreign currency transactions (including foreign currency forwards and foreign currency futures) for hedging purposes, invest in options for hedging and investment purposes and invest in securities issued pursuant to Rule 144A under the Securities Act of 1933 (“Rule 144A securities”). Except as provided above or as required by applicable law, the Fund is not limited in the percentage of its assets that it may invest in these instruments.

Principal Investment Risks

The principal risks of investing in the Fund are summarized below. The Fund does not represent a complete investment program. You may lose money by investing in the Fund.

Credit/Counterparty Risk: Credit/counterparty risk is the risk that the issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other transaction, will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations. The Fund will be subject to credit risks with respect to the counterparties of its derivatives transactions. Many of the protections afforded to participants on organized exchanges, such as the performance guarantee of an exchange clearing house, are not available in connection with over-the-counter (“OTC”) derivatives transactions, such as foreign currency transactions. As a result, in instances when the Fund enters into OTC derivatives transactions, the Fund will be subject to the risk that its counterparties will not perform their obligations under the transactions and that the Fund will sustain losses or be unable to realize gains.

Currency Risk: Fluctuations in the exchange rates between different currencies may negatively affect an investment. The Fund may be subject to currency risk because it may invest in currency related instruments and may invest in securities or other instruments denominated in, or that generate income denominated in, foreign currencies. The Fund may elect not to hedge currency risk, or may hedge such risk imperfectly, which may cause the Fund to incur losses that would not have been incurred had the risk been hedged.

Derivatives Risk: Derivative instruments (such as those in which the Fund may invest, including foreign currency forwards, foreign currency futures and options) are subject to changes in the value of the underlying assets or indices on which such instruments are based. There is no guarantee that the use of derivatives will be effective or that suitable transactions will be available. Even a small investment in derivatives may give rise to leverage risk and can have

14

Fund Summary

a significant impact on the Fund’s exposure to securities market values, interest rates or currency exchange rates. It is possible that the Fund’s liquid assets may be insufficient to support its obligations under its derivatives positions. The use of derivatives for other than hedging purposes may be considered a speculative activity, and involves greater risks than are involved in hedging. The use of derivatives may cause the Fund to incur losses greater than those that would have occurred had derivatives not been used. The Fund’s use of derivatives, such as foreign currency forwards, foreign currency futures and options involves other risks, such as the credit risk relating to the other party to a derivative contract (which is greater for forward currency contracts and other OTC derivatives), the risk of difficulties in pricing and valuation, the risk that changes in the value of a derivative may not correlate as expected with changes in the value of relevant assets, rates or indices, liquidity risk, allocation risk and the risk of losing more than the initial margin required to initiate derivatives positions. There is also the risk that the Fund may be unable to terminate or sell a derivatives position at an advantageous time or price. The Fund’s derivative counterparties may experience financial difficulties or otherwise be unwilling or unable to honor their obligations, possibly resulting in losses to the Fund.

Emerging Markets Risk: In addition to the risks of investing in foreign investments generally, emerging markets investments are subject to greater risks arising from political or economic instability, nationalization or confiscatory taxation, currency exchange restrictions, sanctions by the U.S. government and an issuer’s unwillingness or inability to make principal or interest payments on its obligations. Emerging markets companies may be smaller and have shorter operating histories than companies in developed markets.

Equity Securities Risk: The value of the Fund’s investments in equity securities could be subject to unpredictable declines in the value of individual securities and periods of below-average performance in individual securities or in the equity market as a whole. Growth stocks are generally more sensitive to market movements than other types of stocks primarily because their stock prices are based heavily on future expectations. If the Adviser’s assessment of the prospects for a company’s growth is wrong, or if the Adviser’s judgment of how other investors will value the company’s growth is wrong, then the price of the company’s stock may fall or not approach the value that the Adviser has placed on it. Value stocks also present the risk that their lower valuations fairly reflect their business prospects and that investors will not agree that the stocks represent favorable investment opportunities, and they may fall out of favor with investors and underperform growth stocks during any given period. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer’s bonds generally take precedence over the claims of those who own preferred stock or common stock.