UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-1A

File No. 002-97889

File No. 811-04304

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | /X/ | |||

|

|

| ||

| Pre-Effective Amendment No. |

|

| / / |

| Post-Effective Amendment No. | 69 |

| /X/ |

|

|

| ||

|

| and/or | ||

|

|

| ||

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | /X/ | |||

|

|

| ||

| Amendment No. | 69 |

|

|

| ||||

(Check appropriate box or boxes) | ||||

|

|

| ||

DELAWARE GROUP GOVERNMENT FUND | ||||

(Exact Name of Registrant as Specified in Charter) | ||||

|

|

| ||

100 Independence, 610 Market Street, Philadelphia, PA | 19106-2354 | |||

(Address of Principal Executive Offices) | (Zip Code) | |||

|

|

| ||

Registrant’s Telephone Number, including Area Code: | (800) 523-1918 | |||

|

|

| ||

David F. Connor, Esq., 100 Independence, 610 Market Street, Philadelphia, PA 19106-2354 | ||||

(Name and Address of Agent for Service) | ||||

|

|

| ||

Please send copies of all communications to:

Jonathan M. Kopcsik, Esq. Taylor Brody, Esq. Stradley, Ronon, Stevens & Young, LLP 2005 Market Street, Suite 2600, Philadelphia, PA 19103-7018 (215) 564-8099 (215) 564-8071 | ||||

Approximate Date of Proposed Public Offering: | November 28, 2022 | |||

|

|

| ||

It is proposed that this filing will become effective (check appropriate box): | ||||

| ||||

/X/ | immediately upon filing pursuant to paragraph (b) | |||

/ / | on November 28, 2022 pursuant to paragraph (b) | |||

/ / | 60 days after filing pursuant to paragraph (a)(1) | |||

/ / | on (date) pursuant to paragraph (a)(1) | |||

/ / | 75 days after filing pursuant to paragraph (a)(2) | |||

/ / | on (date) pursuant to paragraph (a)(2) of Rule 485. | |||

|

|

| ||

If appropriate, check the following box: | ||||

| ||||

/ / | this post-effective amendment designates a new effective date for a previously filed post-effective amendment. | |||

--- C O N T E N T S ---

This Post-Effective Amendment No. 69 to Registration File No. 002-97889 includes the following:

| 1. | Facing Page |

| 2. | Contents Page |

| 3. | Part A – Prospectuses (2) |

| 4. | Part B - Statement of Additional Information (1) |

| 5. | Part C - Other Information |

| 6. | Signatures |

| 7. | Exhibits |

Delaware Emerging Markets Debt Corporate Fund

Fixed income mutual fund

Nasdaq ticker symbols | |

Class A | |

Class C | |

Class R | |

Institutional Class | |

The US Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Prospectus.

Any representation to the contrary is a criminal offense.

Get shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Table of contents

Fund summary | 1 |

Delaware Emerging Markets Debt Corporate Fund | 1 |

How we manage the Fund | 6 |

Our principal investment strategies | 6 |

The securities in which the Fund typically invests | 6 |

Other investment strategies | 9 |

The risks of investing in the Fund | 9 |

Disclosure of portfolio holdings information | 15 |

Who manages the Fund | 16 |

Investment manager | 16 |

Sub-advisors | 16 |

Portfolio managers | 16 |

Manager of managers structure | 17 |

Who’s who | 17 |

About your account | 19 |

Investing in the Fund | 19 |

Choosing a share class | 19 |

Dealer compensation | 21 |

Payments to intermediaries | 22 |

How to reduce your sales charge | 22 |

Buying Class A shares at net asset value | 23 |

Waivers of contingent deferred sales charges | 24 |

How to buy shares | 25 |

Calculating share price | 26 |

Fair valuation | 26 |

Retirement plans | 26 |

Document delivery | 27 |

Inactive accounts | 27 |

How to redeem shares | 27 |

Low balance accounts | 28 |

Investor services | 28 |

Frequent trading of Fund shares (market timing and disruptive trading) | 30 |

Dividends, distributions, and taxes | 31 |

Certain management considerations | 33 |

Financial highlights | 34 |

Additional information | 45 |

Fund summary

Delaware Emerging Markets Debt Corporate Fund, a series of Delaware Group® Government Fund

Delaware Emerging Markets Debt Corporate Fund primarily seeks current income and, secondarily, capital appreciation.

The table below describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

The Fund’s distributor, Delaware Distributors, L.P. (Distributor), has voluntarily agreed to waive 12b-1 fees for the Fund’s Class R shares from November 29, 2019 until such time as the voluntary expense cap is discontinued. The Distributor’s waivers and/or reimbursements may be discontinued at any time because they are voluntary.

Class | A | C | R | Inst. |

Maximum sales charge (load) imposed on purchases as a percentage of offering price | ||||

Maximum contingent deferred sales charge (load) as a percentage of original purchase price or redemption price, whichever is lower |

Class | A | C | R | Inst. | |

Management fees | |||||

Distribution and service (12b-1) fees | |||||

Other expenses | |||||

Total annual fund operating expenses | |||||

Fee waivers and expense reimbursements | ( | ( | ( | ( | |

Total annual fund operating expenses after fee waivers and expense reimbursements | |||||

1 | |||||

2 | |||||

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. In addition, the example shows expenses for Class C shares, assuming those shares were not redeemed at the end of those periods. The example also assumes that your investment has a 5% return each year and reflects the Manager’s expense waivers and reimbursements for the 1-year contractual period and the total operating expenses without waivers for years 2 through 10. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Class | A | (if not | C | R | Inst. |

1 year | $ | $ | $ | $ | $ |

3 years | $ | $ | $ | $ | $ |

5 years | $ | $ | $ | $ | $ |

10 years | $ | $ | $ | $ | $ |

1

Fund summary

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was

Under normal circumstances, the Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, in emerging markets corporate debt securities (80% policy). For purposes of the 80% policy, emerging markets corporate debt securities include those that are (1) economically tied to an emerging market country or countries, (2) issued or guaranteed by a company domiciled or conducting significant business activities in an emerging market country, or (3) derivatives or pooled structures (such as exchange-traded funds (ETFs)) that are linked to emerging markets corporate debt securities. Emerging market countries include those currently considered to be developing or emerging countries by the World Bank, the United Nations, the countries’ governments, or in the judgment of the Fund’s investment manager, Delaware Management Company (Manager). These debt instruments will be denominated primarily in the currencies of members of the Organization for Economic Cooperation and Development (OECD) and in other emerging markets’ currencies and may include a significant percentage of high yield (junk) corporate bonds. While there is no percentage limit on the amount of the Fund’s assets that may be invested in high yield (junk) corporate bonds, the Manager generally expects that 50% of the Fund’s assets will be invested in high yield corporate bonds.

The Fund may also use a wide variety of derivatives instruments, including credit linked notes, interest rate, index and credit default swaps, forward foreign currency contracts, futures, and options. The Fund will use derivatives for both hedging and nonhedging purposes. For example, the Fund may invest in: futures and options to manage duration and for defensive purposes, such as to protect gains or hedge against potential losses in the Fund without actually selling a security, or to stay fully invested; forward foreign currency contracts to manage foreign currency exposure; interest rate swaps to neutralize the impact of interest rate changes; credit default swaps to hedge against a credit event, to gain exposure to certain securities or markets, or to enhance total return; and index swaps to enhance return or to effect diversification. The Manager may also establish short positions through derivatives in an attempt to isolate, manage, or reduce the risk of individual positions, or positions in the aggregate, or to take advantage of an anticipated deterioration in the creditworthiness of an issuer. The Fund may employ leverage, such as by entering into reverse repurchase transactions, to attempt to take advantage of or increase the total return of attractive investment opportunities.

In addition, the Manager may seek investment advice and recommendations from its affiliates: Macquarie Investment Management Austria Kapitalanlage AG (MIMAK), Macquarie Investment Management Europe Limited (MIMEL), and Macquarie Investment Management Global Limited (MIMGL) (together, the “Affiliated Sub-Advisors”). The Manager may also permit these Affiliated Sub-Advisors to execute Fund security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where the Manager believes it will be beneficial to utilize an Affiliated Sub-Advisor's specialized market knowledge.

The 80% policy is nonfundamental and may be changed without shareholder approval. Fund shareholders would be given at least 60 days’ notice prior to any such change.

Market risk — The risk that all or a majority of the securities in a certain market — such as the stock or bond market — will decline in value because of factors such as adverse political or economic conditions, future expectations, investor confidence, or heavy institutional selling.

Interest rate risk — The risk that the prices of bonds and other fixed income securities will increase as interest rates fall and decrease as interest rates rise. Interest rate changes are influenced by a number of factors, such as government policy, monetary policy, inflation expectations, and the supply and demand of bonds. Bonds and other fixed income securities with longer maturities or duration generally are more sensitive to interest rate changes. A fund may be subject to a greater risk of rising interest rates when interest rates are low or inflation rates are high or rising.

Credit risk — The risk that an issuer of a debt security, including a governmental issuer or an entity that insures a bond, may be unable to make interest payments and/or repay principal in a timely manner.

High yield (junk bond) risk — The risk that high yield securities, commonly known as “junk bonds,” are subject to reduced creditworthiness of issuers, increased risk of default, and a more limited and less liquid secondary market. High yield securities may also be subject to greater price volatility and risk of loss of income and principal than are higher-rated securities.

2

Foreign and emerging markets risk — The risk that international investing (particularly in emerging markets) may be adversely affected by political instability; changes in currency exchange rates; inefficient markets and higher transaction costs; foreign economic conditions; the imposition of economic or trade sanctions; or inadequate or different regulatory and accounting standards. The risk associated with international investing will be greater in emerging markets than in more developed foreign markets because, among other things, emerging markets may have less stable political and economic environments. In addition, there often is substantially less publicly available information about issuers and such information tends to be of a lesser quality. Economic markets and structures tend to be less mature and diverse and the securities markets may also be smaller, less liquid, and subject to greater price volatility.

Geographic focus risk — The risk that local political and economic conditions could adversely affect the performance of a fund investing a substantial amount of assets in securities of issuers located in a single country or a limited number of countries.

Industry and sector risk — The risk that the value of securities in a particular industry or sector (such as banking or energy) will decline because of changing expectations for the performance of that industry or sector.

IBOR risk — The risk that changes related to the use of the London Interbank Offered Rate (LIBOR) or similar interbank offered rates (“IBORs,” such as the Euro Overnight Index Average (EONIA)) could have adverse impacts on financial instruments that reference LIBOR or a similar rate. While some instruments may contemplate a scenario where LIBOR or a similar rate is no longer available by providing for an alternative rate setting methodology, not all instruments have such fallback provisions and the effectiveness of replacement rates is uncertain. The abandonment of LIBOR and similar rates could affect the value and liquidity of instruments that reference such rates, especially those that do not have fallback provisions. The use of alternative reference rate products may impact investment strategy performance.

Derivatives risk — Derivatives contracts, such as futures, forward foreign currency contracts, options, and swaps, may involve additional expenses (such as the payment of premiums) and are subject to significant loss if a security, index, reference rate, or other asset or market factor to which a derivatives contract is associated, moves in the opposite direction from what the portfolio manager anticipated. When used for hedging, the change in value of the derivatives instrument may also not correlate specifically with the currency, rate, or other risk being hedged, in which case a fund may not realize the intended benefits. Derivatives contracts are also subject to the risk that the counterparty may fail to perform its obligations under the contract due to, among other reasons, financial difficulties (such as a bankruptcy or reorganization).

Leveraging risk — The risk that certain fund transactions, such as reverse repurchase agreements, short sales, loans of portfolio securities, and the use of when-issued, delayed delivery or forward commitment transactions, or derivatives instruments, may give rise to leverage, causing a fund to be more volatile than if it had not been leveraged, which may result in increased losses to the fund.

Portfolio turnover risk — High portfolio turnover rates may increase a fund’s transaction costs and lower returns.

Liquidity risk — The possibility that investments cannot be readily sold within seven calendar days at approximately the price at which a fund has valued them.

Active management and selection risk — The risk that the securities selected by a fund’s management will underperform the markets, the relevant indices, or the securities selected by other funds with similar investment objectives and investment strategies. The securities and sectors selected may vary from the securities and sectors included in the relevant index.

None of the entities noted in this document is an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia) and the obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (Macquarie Bank). Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these entities. In addition, if this document relates to an investment (a) each investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group company guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

A privately offered fund was reorganized into the Fund and the Fund commenced operations on September 30, 2013. This privately offered fund commenced operations on November 3, 2010 and had an investment objective and strategies that were, in all material respects, the same as those of the Fund, and was managed in a manner that, in all material respects, complied with the investment guidelines and restrictions of the Fund. However, the privately offered fund was not registered as an investment company under the Investment Company Act of 1940 (1940 Act). As a result, the privately offered fund was not subject to certain investment limitations, diversification requirements, liquidity requirements, and other restrictions imposed by the

3

Fund summary

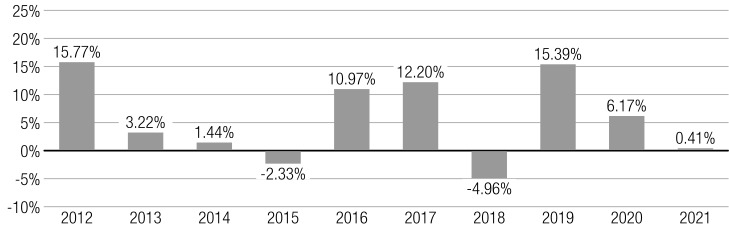

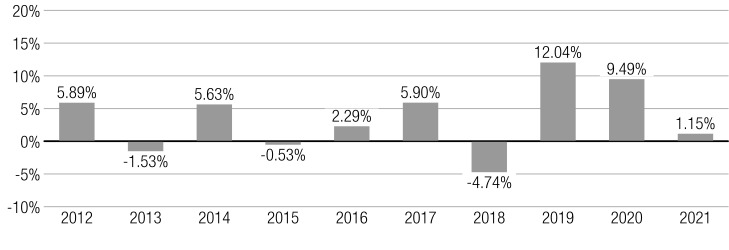

1940 Act and the Internal Revenue Code of 1986, as amended, which, if applicable, may have adversely affected its performance. The Fund’s performance for the periods prior to its commencement of operations on September 30, 2013 is that of the privately offered fund. Because the privately offered fund was a master fund that did not charge any management or other asset-based fees, the privately offered fund’s performance shown below has been restated, on a one-time basis, to reflect the fees, expenses, and waivers and reimbursements for each class of the Fund at the commencement of the Fund’s operations. If the performance of the privately offered fund had not been restated, the performance for such classes may have been higher than the performance shown in the bar chart and average annual total returns table below.

The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual total returns for the 1-year, 5-year and lifetime periods compare with those of a broad measure of market performance.

Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

Year total Return | - | - |

As of

1 year | 5 years | 10 years | |

Class A return before taxes | - | ||

Class A return after taxes on distributions | - | ||

Class A return after taxes on distributions and sale of Fund shares | - | ||

Class C return before taxes | - | ||

Class R return before taxes | |||

Institutional Class return before taxes | |||

J.P. Morgan Corporate Emerging Markets Bond Index Broad Diversified |

4

Who manages the Fund?

Investment manager

Delaware Management Company, a series of Macquarie Investment Management Business Trust (a Delaware statutory trust)

Portfolio manager | Title with Delaware Management Company | Start date on the Fund |

Alex Kozhemiakin, CFA | Managing Director, Head of Emerging Markets Debt | September 2019 |

Mansur Z. Rasul | Senior Vice President, Senior Portfolio Manager | July 2016 |

Sean M. Simmons, CFA, CMT | Vice President, Foreign Exchange Strategist and Trader | July 2016 |

Sub-advisors

Macquarie Investment Management Austria Kapitalanlage AG

Macquarie Investment Management Europe Limited

Macquarie Investment Management Global Limited

Purchase and redemption of Fund shares

You may purchase or redeem shares of the Fund on any day that the New York Stock Exchange (NYSE) is open for business (Business Day). Shares may be purchased or redeemed: through your financial intermediary; through the Fund’s website at delawarefunds.com/account-access; by calling 800 523-1918; by regular mail (c/o Delaware Funds by Macquarie®, P.O. Box 9876, Providence, RI 02940-8076); by overnight courier service (c/o Delaware Funds by Macquarie Service Center, 4400 Computer Drive, Westborough, MA 01581-1722); or by wire.

For Class A and Class C shares, the minimum initial investment is generally $1,000 and subsequent investments can be made for as little as $100. The minimum initial investment for IRAs, Uniform Gifts/Transfers to Minors Act accounts, direct deposit purchase plans, and automatic investment plans is $250 and through Coverdell Education Savings Accounts is $500, and subsequent investments in these accounts can be made for as little as $25. For Class R and Institutional Class shares (except those shares purchased through an automatic investment plan), there is no minimum initial purchase requirement, but certain eligibility requirements must be met. The eligibility requirements are described in this Prospectus under “Choosing a share class” and on the Fund’s website. We may reduce or waive the minimums or eligibility requirements in certain cases.

Tax information

The Fund’s distributions generally are taxable to you as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an IRA, in which case your distributions may be taxed as ordinary income when withdrawn from the tax-advantaged account.

Payments to broker/dealers and other financial intermediaries

If you purchase shares of the Fund through a broker/dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

5

How we manage the Fund

The Manager takes a disciplined approach to investing, combining investment strategies and risk-management techniques that it believes can help shareholders meet their goals.

Our principal investment strategies

The Fund will invest in a wide variety of emerging markets corporate debt. The Fund generally does not intend to invest directly in equities, although it may purchase convertible bonds and debt instruments with warrants on equities.

The Manager analyzes economic and market conditions, seeking to identify the securities or market sectors that it thinks are the best investments for the portfolio. The Manager may establish positions based on the opportunistic individual risk/reward characteristics of the investment, as determined by the Manager, based on the perception that the asset has relative value, an intrinsic dynamic, or another reason that suggests that the asset will be accretive to total return. Before selecting bonds, the Manager carefully evaluates each bond, including its income potential and the size of the bond issuance. The Manager carries out a thorough credit analysis of the obligor to determine whether the obligor has the financial ability to meet the bond's repayments.

The Manager intends to maintain a reasonably fully invested position consistent with the Fund's investment policies, however, the Fund may at times, for temporary defensive purposes, invest in cash, cash equivalents, or short-term obligations. The Fund may also establish long or short positions through the use of derivatives, which have implicit leverage and increase total exposure to issuers relative to the Fund's net asset value (NAV).

In addition, the Manager may seek investment advice and recommendations from its Affiliated Sub-Advisors. The Manager may also permit these Affiliated Sub-Advisors to execute Fund security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where the Manager believes it will be beneficial to utilize an Affiliated Sub-Advisor's specialized market knowledge.

The Fund will engage in an active trading strategy which may result in higher portfolio turnover rates. The Fund generally invests for the long term but also may take advantage of short-term opportunities to acquire and dispose of assets and realize capital gains.

The Fund will generally limit its investments to: a maximum allocation to a single region of 50% of the Fund's net assets; a maximum aggregate allocation to investments within a single country (excluding the US) of 25% of the Fund's net assets; a maximum allocation to a single industry of 25% of the Fund's net assets; a maximum allocation to a single corporate or private obligor of 10% of the Fund's net assets; a maximum exposure of 15% of the Fund's net assets to a single emerging markets currency; and a maximum aggregate exposure of 30% of the Fund's net assets to emerging markets currencies. For purposes of the single industry guideline, the securities issued or guaranteed as to principal and interest by any single foreign government alone, and not combined with the securities of the government of any other country, are considered securities of issuers in the same industry.

The Fund's investment objectives and 80% policy are nonfundamental. This means that the Fund's Board of Trustees (Board) may change the objectives without obtaining shareholder approval. If the objectives or the 80% policy were changed, the Fund would notify shareholders at least 60 days before the change became effective.

The securities in which the Fund typically invests

Fixed income securities offer the potential for greater income payments than stocks, and also may provide capital appreciation. Please see the Fund's SAI for additional information about certain of the securities described below as well as other securities in which the Fund may invest.

|

Asset-backed securities (ABS) |

ABS are bonds or notes backed by accounts receivable, including home equity, automobile, or credit loans.

How the Fund uses them: The fixed income securities in which the Fund may invest include ABS.

|

Bank loans and other indebtedness |

A bank loan represents an interest in a loan or other direct indebtedness, such as an assignment, that entitles the acquiror of such interest to payments of interest, principal, and/or other amounts due under the structure of the loan or other direct indebtedness. In addition to being structured as secured or unsecured loans, such investments could be structured as novations or assignments or represent trade or other claims owed by a company to a supplier.

How the Fund uses them: The Fund may invest without restriction in bank loans that meet the credit standards established by the Manager. The Manager performs its own independent credit analysis on each borrower and on the collateral securing each loan. The Manager considers the nature of the industry in which the borrower operates, the nature of the borrower's assets, and the general quality and creditworthiness of the borrower. The Fund may invest in bank loans in order to enhance total return, to effect diversification, or to earn additional income. The Fund will not use bank loans for reasons inconsistent with the Fund's investment objective.

6

|

Corporate notes and bonds |

Corporate notes and bonds are debt obligations issued by a corporation.

How the Fund uses them: The Fund may invest in corporate bonds rated BBB- or higher by Standard & Poor's Financial Services LLC (S&P), Baa3 by Moody's Investors Service, Inc. (Moody's), or similarly rated by another nationally recognized statistical rating organization (NRSRO), or those that are deemed to be of comparable quality by the Manager.

|

Foreign corporate and government and supranational securities |

Foreign corporate and government securities are securities issued by a non-US company or a government or by an agency, instrumentality, or political subdivision of such government.

A supranational security is a security issued by a supranational entity established or financially supported by the national governments of one or more countries. The International Bank for Reconstruction and Development (more commonly known as the World Bank) is one example of a supranational entity.

How the Fund uses them: The Fund may invest in securities of foreign companies or governments or supranational entities to achieve its investment objectives and consistent with its 80% policy.

|

Forward foreign currency contracts |

A fund may invest in securities of foreign issuers and may hold foreign currency. In addition, a fund may enter into contracts to purchase or sell foreign currencies at a future date (a “forward foreign currency” contract or “forward” contract). A forward contract involves an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract, agreed upon by the parties, at a price set at the time of the contract.

How the Fund uses them: Although the Manager values the Fund's assets daily in terms of US dollars, it does not intend to convert the Fund's holdings of foreign currencies into US dollars on a daily basis. The Fund is permitted to, however, from time to time, purchase or sell foreign currencies and/or engage in forward foreign currency contracts in order to facilitate or expedite settlement of Fund transactions and to minimize currency value fluctuations.

|

Futures and options |

Futures contracts are agreements for the purchase or sale of a security or a group of securities at a specified price, on a specified date. Unlike purchasing an option, a futures contract must be executed unless it is sold before the settlement date.

Options represent a right to buy or sell a swap agreement, a futures contract, or a security or a group of securities at an agreed-upon price at a future date. The purchaser of an option may or may not choose to go through with the transaction. The seller of an option, however, must go through with the transaction if the purchaser exercises the option.

Certain options and futures may be considered illiquid.

How the Fund uses them: The Fund may invest in futures, options, and closing transactions related thereto. These activities will be entered into for hedging purposes and to facilitate the ability to quickly deploy into the market the Fund's cash, short-term debt securities, and other money market instruments at times when the Fund's assets are not fully invested. The Fund may only enter into these transactions for hedging purposes if they are consistent with its investment objective and policies. In addition, the Fund may enter into futures contracts, purchase or sell options on futures contracts, trade in options on foreign currencies, and enter into closing transactions with respect to such activities to hedge or “cross hedge” the currency risks associated with their investments. Generally, futures contracts on foreign currencies operate similarly to futures contracts concerning securities, and options on foreign currencies operate similarly to options on securities. The Fund intends to limit its investments in futures contracts such that (a) no more than 5% of the Fund's net assets are required as initial margin deposits on all such contracts in the aggregate and (b) the obligations and/or notional values under such contracts do not at any time represent more than 40% of the Fund's net assets.

7

How we manage the Fund

Use of these strategies can increase the operating costs of the Fund and can lead to loss of principal.

|

High yield corporate bonds (junk bonds) |

High yield corporate bonds are debt obligations issued by a corporation and rated below investment grade (lower than BBB- by S&P and lower than Baa3 by Moody's, or similarly rated by another NRSRO). High yield bonds, also known as “junk bonds,” are issued by corporations that have lower credit quality and may have difficulty repaying principal and interest.

How the Fund uses them: The Fund may invest a significant portion of its net assets in high yield corporate bonds.

The Manager carefully evaluates an individual company's financial situation, its management, the prospects for its industry, and the technical factors related to its bond offering. The Manager's goal is to identify those companies that it believes will be able to repay their debt obligations in spite of poor ratings. The Manager may invest in unrated bonds if it believes their credit quality is comparable to the rated bonds the Fund is permitted to invest in. Unrated bonds may be more speculative in nature than rated bonds.

|

Illiquid investments |

Illiquid investments are any investment that a fund reasonably expects cannot be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment.

How the Fund uses them: The Fund may invest up to 15% of its net assets in illiquid investments.

|

Interest rate swap, index swap, and credit default swap agreements |

In an interest rate swap, a fund receives payments from another party based on a variable or floating interest rate, in return for making payments based on a fixed interest rate. An interest rate swap can also work in reverse with a fund receiving payments based on a fixed interest rate and making payments based on a variable or floating interest rate.

In an index swap, a fund receives gains or incurs losses based on the total return of a specified index, in exchange for making interest payments to another party. An index swap can also work in reverse with a fund receiving interest payments from another party in exchange for movements in the total return of a specified index.

In a credit default swap, a fund may transfer the financial risk of a credit event occurring (a bond default, bankruptcy, or restructuring, for example) on a particular security or basket of securities to another party by paying that party a periodic premium; likewise, a fund may assume the financial risk of a credit event occurring on a particular security or basket of securities in exchange for receiving premium payments from another party.

Interest rate swaps, index swaps, and credit default swaps may be considered illiquid.

How the Fund uses them: The Fund may use interest rate swaps to adjust its sensitivity to interest rates or to hedge against changes in interest rates. Index swaps may be used to gain exposure to markets that the Fund invests in, such as the corporate bond market. The Fund may also use index swaps as a substitute for futures or options contracts if such contracts are not directly available to the Fund on favorable terms. The Fund may enter into credit default swaps in order to hedge against a credit event, to enhance total return, or to gain exposure to certain securities or markets.

At times when the Manager anticipates adverse conditions, the Manager may want to protect gains on securities without actually selling them. The Manager might use swaps to neutralize the effect of any price declines without selling a bond or bonds. Use of these strategies can increase the operating costs of the Fund and can lead to loss of principal.

|

Repurchase and reverse repurchase agreements |

A repurchase agreement is an agreement between a buyer of securities, such as a fund, and a seller of securities, in which the seller agrees to buy the securities back within a specified time at the same price the buyer paid for them, plus an amount equal to an agreed-upon interest rate. Repurchase agreements are often viewed as equivalent to cash.

How the Fund uses them: Typically, the Fund may use repurchase agreements as short-term investments for the Fund's cash position. In order to enter into these repurchase agreements, the Fund must have collateral of at least 102% of the repurchase price. The Fund will only enter into repurchase

8

agreements in which the collateral is composed of US government securities. In the Manager's discretion, the Fund may invest overnight cash balances in short-term discount notes issued or guaranteed by the US government, its agencies or instrumentalities, or government-sponsored corporations.

The Fund is also authorized to enter into reverse repurchase agreements. In a reverse repurchase transaction, the Fund will sell a security and will agree to repurchase the security at a specified time and price.

|

Restricted securities |

Restricted securities are privately placed securities whose resale is restricted under US securities laws.

How the Fund uses them: The Fund may invest in privately placed securities, including those that are eligible for resale only among certain institutional buyers without registration, which are commonly known as “Rule 144A Securities.” Restricted securities that are determined to be illiquid may not exceed the Fund's limit on investments in illiquid investments.

|

Short-term debt investments |

These instruments include: (1) time deposits, certificates of deposit, and banker's acceptances issued by US banks; (2) time deposits and certificates of deposit issued by foreign banks; (3) commercial paper with the highest quality rating; (4) short-term debt obligations with the highest quality rating; (5) US government securities; and (6) repurchase agreements collateralized by those instruments.

How the Fund uses them: The Fund may invest in these instruments either as a means of achieving its investment objective or, more commonly, as temporary defensive investments or pending investment in the Fund's principal investment securities. When investing all or a significant portion of the Fund's assets in these instruments, the Fund may not be able to achieve its investment objective.

Other investment strategies

|

Borrowing from banks |

The Fund may borrow money from banks as a temporary measure for extraordinary or emergency purposes or to facilitate redemptions. The Fund will be required to pay interest to the lending banks on the amount borrowed. As a result, borrowing money could result in the Fund being unable to meet its investment objective. The Fund will not borrow money in excess of one-third of the value of its total assets.

|

Temporary defensive positions |

In response to unfavorable market conditions, the Fund may make temporary investments in cash or cash equivalents or other high-quality, short-term instruments. These investments may not be consistent with the Fund's investment objective. To the extent that the Fund holds such instruments, it may be unable to achieve its investment objective.

The risks of investing in the Fund

Investing in any mutual fund involves risk, including the risk that you may receive little or no return on your investment, and the risk that you may lose part or all of the money you invest. Before you invest in the Fund, you should carefully evaluate the risks. Because of the nature of the Fund, you should consider your investment to be a long-term investment that typically provides the best results when held for a number of years. The information below describes the principal risks you assume when investing in the Fund. Please see the SAI for a further discussion of these risks and other risks not discussed here.

9

How we manage the Fund

|

Market risk |

Market risk is the risk that all or a majority of the securities in a certain market — such as the stock or bond market — will decline in value because of factors such as adverse political or economic conditions, future expectations, investor confidence, or heavy institutional selling.

Index swaps are subject to the same market risks as the investment market or sector that the index represents. Depending on the actual movements of the index and how well the portfolio manager forecasts those movements, a fund could experience a higher or lower return than anticipated.

How the Fund strives to manage it: The Manager generally invests for the long-term, focusing on securities that it believes can continue to provide returns over an extended time frame, but may also take advantage of short-term opportunities to acquire and dispose of assets and realize capital gains. Generally, the Manager does not try to predict overall market movements.

In evaluating the use of an index swap for the Fund, the Manager carefully considers how market changes could affect the swap and how that compares to investing directly in the market the swap is intended to represent. When selecting counterparties with whom the Manager would make interest rate or index swap agreements for the Fund, the Manager does careful credit analysis on the counterparty before engaging in the transaction.

|

Interest rate risk |

Interest rate risk is the risk that the prices of bonds and other fixed income securities will increase as interest rates fall and decrease as interest rates rise. Interest rate changes are influenced by a number of factors, such as government policy, monetary policy, inflation expectations, and the supply and demand of bonds. Bonds and other fixed income securities with longer maturities or duration generally are more sensitive to interest rate changes. A fund may be subject to a greater risk of rising interest rates when interest rates are low or inflation rates are high or rising.

Swaps may be particularly sensitive to interest rate changes. Depending on the actual movements of interest rates and how well the portfolio manager anticipates them, a fund could experience a higher or lower return than anticipated. For example, if a fund holds interest rate swaps and is required to make payments based on variable interest rates, it will have to make interest payments if interest rates rise, which will not necessarily be offset by the fixed-rate payments it is entitled to receive under the swap agreement.

How the Fund strives to manage it: The Manager limits the amount of the Fund's assets invested in any one industry and in any individual security.

The Manager cannot eliminate this risk, but tries to address it by monitoring economic conditions, especially interest rate trends and their potential impact on the Fund. The Manager does not try to increase returns on the Fund's investments in debt securities by predicting and aggressively capitalizing on interest rate movements.

By investing in swaps, the Fund is subject to additional interest rate risk.

|

Prepayment risk |

Prepayment risk is the risk that the principal on a bond that is held by a fund will be prepaid prior to maturity at a time when interest rates are lower than what the bond was paying. A fund may then have to reinvest that money at a lower interest rate.

How the Fund strives to manage it: In order to manage this risk, when the Manager thinks interest rates are low, or that rates will be declining, the Manager will typically look for securities that it believes are less likely to be prepaid. The Fund will be more or less subject to this risk depending on how much it has allocated to fixed income securities.

|

Credit risk |

Credit risk is the risk that an issuer of a debt security, including a governmental issuer or an entity that insures the bond, may be unable to make interest payments and/or repay principal in a timely manner. Changes in an issuer's financial strength or in a security's credit rating may affect a security's value, which would impact fund performance.

Investing in so-called “junk” or “high yield” bonds entails the risk of principal loss because they are rated below investment grade, which may be greater than the risk involved in investment grade bonds. High yield bonds are sometimes issued by companies whose earnings at the time the bond is issued are less than the projected debt payments on the bonds. A protracted economic downturn may severely disrupt the market for high yield bonds, adversely affect the value of outstanding bonds, and adversely affect the ability of high yield issuers to repay principal and interest. Investment by a fund in defaulted securities poses additional risk of loss should nonpayment of principal and interest continue in respect of such securities. Even if such securities are held to maturity, recovery by a fund of its initial investment and any anticipated income or appreciation may be uncertain. A fund also may incur additional expenses in seeking recovery on defaulted securities. Defaulted securities may be considered illiquid.

10

How the Fund strives to manage it: Any portion of the Fund that is invested in junk bonds is subject to greater credit risk. The Manager strives to manage that risk through careful bond selection, and by maintaining a diversified portfolio of bonds representing a variety of industries and issuers.

When selecting dealers with whom the Manager would make interest rate or index swap agreements, the Manager focuses on those with high quality ratings and does careful credit analysis before investing.

|

High yield corporate (junk) bond risk |

High yield corporate bonds (commonly known as “junk” bonds), while generally having higher yields, are subject to reduced creditworthiness of issuers, increased risks of default, and a more limited and less liquid secondary market than higher rated securities. These securities are subject to greater price volatility and risk of loss of income and principal than are higher rated securities because they are rated below investment grade. Lower rated and unrated fixed income securities tend to reflect short-term corporate and market developments to a greater extent than higher rated fixed income securities, which react primarily to fluctuations in the general level of interest rates. Fixed income securities of this type are considered to be of poor standing and primarily speculative. Such securities are subject to a substantial degree of credit risk.

How the Fund strives to manage it: The Manager attempts to reduce the risk associated with investment in high yield debt securities through credit analysis and attention to trends in the economy, industries, and financial markets.

|

Loans and other indebtedness risk |

Loans and other indebtedness risk is the risk that a fund will not receive payment of principal, interest, and other amounts due in connection with these investments and will depend primarily on the financial condition of the borrower. Loans that are fully secured offer a fund more protection than unsecured loans in the event of nonpayment of scheduled interest or principal, although there is no assurance that the liquidation of collateral from a secured loan would satisfy the corporate borrower's obligation, or that the collateral can be liquidated. Some loans or claims may be in default at the time of purchase. Certain of the loans and the other indebtedness acquired by a fund may involve revolving credit facilities or other standby financing commitments that obligate a fund to pay additional cash on a certain date or on demand. These commitments may require a fund to increase its investment in a company at a time when that fund might not otherwise decide to do so (including at a time when the company's financial condition makes it unlikely that such amounts will be repaid).

As a fund may be required to rely upon another lending institution to collect and pass on to the fund amounts payable with respect to the loan and to enforce the fund's rights under the loan and other indebtedness, an insolvency, bankruptcy, or reorganization of the lending institution may delay or prevent the fund from receiving such amounts. The highly leveraged nature of many such loans and other indebtedness may make them especially vulnerable to adverse changes in economic or market conditions. Investments in such loans and other indebtedness may involve additional risk to the fund.

A fund's ability to sell its loans or to realize their full value upon sale may also be impaired due to the lack of an active trading market, irregular trading activity, wide bid/ask spreads, contractual restrictions, and extended trade settlement periods. Extended trade settlement periods may result in cash not being immediately available to a fund. As a result of these factors, a fund may have to sell other investments or engage in borrowing transactions to raise cash to meet its obligations.

Federal securities laws provide protections against fraud and misrepresentation in connection with the offering and sale of a “security.” Loans in which a fund may invest may not be deemed to be “securities” for purposes of such anti-fraud protections. A fund may therefore not have the protection of the anti-fraud provisions of the federal securities laws in the event of fraud or misrepresentation by a borrower. However, a fund in such a scenario may be able to rely on contractual provisions in the loan documents for alternative protections, or use common-law fraud protections under applicable state law.

How the Fund strives to manage it: These risks may not be completely eliminated, but the Manager will attempt to reduce them through portfolio diversification, credit analysis, and attention to trends in the economy, industries, and financial markets. Should the Manager determine that any of these securities are illiquid, they would be subject to the Fund's restriction on illiquid investments.

|

Foreign risk |

As described in more detail below, foreign risk is the risk that foreign securities may be adversely affected by political instability, changes in currency exchange rates, foreign economic or government conditions, the imposition of economic or trade sanctions, increased transaction costs, inadequate regulatory and accounting standards, and the possibility that significant events in foreign markets, including broad market moves, may affect the value of fund shares. In addition, there is the possibility of expropriation, nationalization, or confiscatory taxation, taxation of income earned in foreign nations, or other taxes imposed with respect to investments in foreign nations, foreign exchange controls, which may include suspension of the ability to transfer currency from a given country, and default in foreign government securities. As a result of these factors, foreign securities markets may be less liquid and more volatile than US markets and a portfolio may experience difficulties and delays in converting foreign currencies back into US dollars. Such events may cause the value of certain foreign securities to fluctuate widely and may make it difficult to accurately value foreign securities.

11

How we manage the Fund

Foreign investment risk includes these specific risks:

As a result of the military action by Russia in Ukraine, the US and many other countries have imposed sanctions on Russia and certain Russian individuals, banks and corporations. The ongoing hostilities and resulting sanctions are expected to have a severe adverse effect on the region's economies and more globally, including significant negative impact on markets for certain securities and commodities, such as oil and natural gas. Any cessation of trading on the Russian securities markets will impact the value and liquidity of certain portfolio holdings. The extent and duration of military action, sanctions, and resulting market disruptions are impossible to predict, but could be substantial and prolonged and impact your Fund's performance.

How the Fund strives to manage it: The Manager attempts to reduce the risks presented by such investments by conducting worldwide fundamental research. In addition, the Manager monitors current economic and market conditions and trends, the political and regulatory environment, and the value of currencies in different countries in an effort to identify the most attractive countries and securities. Additionally, when currencies appear significantly overvalued compared to average real exchange rates, the Manager may hedge exposure to those currencies for defensive purposes. In addition, the Fund may frequently value many foreign equity securities using fair value prices based on third-party vendor modeling tools, to the extent available, to account for significant market events that may occur after the close of a foreign market but before the Fund's shares are priced.

|

Emerging markets risk |

Emerging markets risk is the possibility that the risks associated with international investing will be greater in emerging markets than in more developed foreign markets because, among other things, emerging markets may have less stable political and economic environments. In addition, in many emerging markets there is substantially less publicly available information about issuers and the information that is available tends to be of a lesser quality. Economic markets and structures tend to be less mature and diverse and the securities markets, which are subject to less government regulation or supervision, may also be smaller, less liquid, and subject to greater price volatility.

How the Fund strives to manage it: The Manager cannot eliminate these risks but will attempt to reduce these risks through portfolio diversification, credit analysis, and attention to trends in the economy, industries, and financial markets, and other relevant factors.

|

Geographic focus risk |

Geographic focus risk is the risk that local political and economic conditions could adversely affect the performance of a fund investing a substantial amount of assets in securities of issuers located in a single country or a limited number of countries.

How the Fund strives to manage it: The Manager will attempt to reduce this risk by diversifying portfolios by country and sector.

|

Asia-Pacific region risk |

Investments in companies located or operating in the Asia-Pacific region (which consists of Hong Kong, the People's Republic of China, Republic of Korea, and Taiwan, among other countries) may involve risks and considerations not typically associated with investments in the U.S. and other Western nations. These risks include, among others: the inability of the Public Company Accounting Oversight Board (“PCAOB”) to inspect audit work and practices of PCAOB-registered public accounting firms in China; the use of variable interest equity (“VIE”) organizational structures; political, legal and regulatory uncertainty; differing shareholder rights based on company structure and/or location of operations; or the institution of additional tariffs, prohibitions or other trade barriers (or the threat thereof) as a result of trade tensions between China and the United States.

How the Fund strives to manage it: The Manager evaluates the political situations in the Asia-Pacific region and take into account any potential risks before they select securities for the Fund. However, there is no way to eliminate risk when investing in China-based issuers or in the Asia-Pacific region.

12

|

Foreign government securities risk |

Foreign government securities risk relates to the ability of a foreign government or government-related issuer to make timely principal and interest payments on its external debt obligations. This ability to make payments will be strongly influenced by the issuer's balance of payments, including export performance, its access to international credits and investments, fluctuations in interest rates, and the extent of its foreign reserves.

How the Fund strives to manage it: The Manager attempts to reduce the risks associated with investing in foreign governments by limiting the portion of portfolio assets that may be invested in such securities.

|

Derivatives risk |

Derivatives risk is the possibility that a fund may experience a significant loss if it employs a derivatives strategy (including a strategy involving equity-linked securities, futures, options, forward foreign currency contracts, or swaps such as interest rate swaps, index swaps, or credit default swaps) related to a security, index, reference rate, or other asset or market factor (collectively, a “reference instrument”) and that reference instrument moves in the opposite direction from what the portfolio manager had anticipated. If a market or markets, or prices of particular classes of investments, move in an unexpected manner, a fund may not achieve the anticipated benefits of the transaction and it may realize losses. Derivatives also involve additional expenses, which could reduce any benefit or increase any loss to a fund from using the strategy. In addition, changes in government regulation of derivatives could affect the character, timing, and amount of a fund's taxable income or gains. A fund's transactions in derivatives may be subject to one or more special tax rules. These rules may: (i) affect whether gains and losses recognized by a fund are treated as ordinary or capital or as short-term or long-term, (ii) accelerate the recognition of income or gains to the fund, (iii) defer losses to the fund, and (iv) cause adjustments in the holding periods of the fund's securities. A fund's use of derivatives may be limited by the requirements for taxation of the fund as a regulated investment company.

Investing in derivatives may subject a fund to counterparty risk. Please refer to “Counterparty risk” for more information. Other risks include illiquidity, mispricing or improper valuation of the derivatives contract, and imperfect correlation between the value of the derivatives instrument and the underlying reference instrument so that the fund may not realize the intended benefits. In addition, since there can be no assurance that a liquid secondary market will exist for any derivatives instrument purchased or sold, a fund may be required to hold a derivatives instrument to maturity and take or make delivery of an underlying reference instrument that the Manager would have otherwise attempted to avoid, which could result in losses. When used for hedging, the change in value of the derivatives instrument may also not correlate specifically with the currency, rate, or other risk being hedged, in which case a fund may not realize the intended benefits.

How the Fund strives to manage it: The Fund will use derivatives for defensive purposes, such as to protect gains or hedge against potential losses in the portfolio without actually selling a security, to neutralize the impact of interest rate changes, to effect diversification, or to earn additional income.

The Manager has claimed an exclusion from the definition of the term “commodity pool operator” with respect to the Fund under the Commodity Exchange Act (CEA) and, therefore, is not subject to registration or regulation as a commodity pool operator under the CEA.

|

Counterparty risk |

Counterparty risk is the risk that if a fund enters into a derivatives contract (such as a futures, options, or swap contract) or a repurchase agreement, the counterparty to such a contract or agreement may fail to perform its obligations under the contract or agreement due to, among other reasons, financial difficulties (such as a bankruptcy or reorganization). As a result, a fund may experience significant delays in obtaining any recovery, may obtain only a limited recovery, or may obtain no recovery at all.

How the Fund strives to manage it: The Manager seeks to minimize this risk by considering the creditworthiness of all counterparties before the Fund enters into transactions with them. The Fund will hold collateral from counterparties consistent with applicable regulations. Other than transactions settling in less than seven Business Days, the Fund's exposure to a single counterparty will not exceed 25% of its net assets. For purposes of this policy, an exchange, clearinghouse, clearing broker for exchange-traded derivatives contracts, and the Fund's custodian will not be considered counterparties.

13

How we manage the Fund

|

Leveraging risk |

Leveraging risk is the risk that certain fund transactions, such as reverse repurchase agreements, short sales, loans of portfolio securities, and the use of when-issued, delayed delivery or forward commitment transactions, or derivatives instruments, may give rise to leverage, causing a fund to be more volatile than if it had not been leveraged. While it is anticipated that leverage may increase profitability, it may also accentuate the consequences of adverse price movements, resulting in increased losses.

How the Fund strives to manage it: The Fund will, consistent with industry practice, designate and mark-to-market daily cash or other liquid assets having an aggregate market value at least equal to the exposure created by these transactions.

|

IBOR risk |

The risk that changes related to the use of the London Interbank Offered Rate (LIBOR) or similar interbank offered rates (“IBORs,” such as the Euro Overnight Index Average (EONIA)) could have adverse impacts on financial instruments that reference such rates. While some instruments may contemplate a scenario where LIBOR or a similar rate is no longer available by providing for an alternative rate setting methodology, not all instruments have such fallback provisions and the effectiveness of replacement rates is uncertain. The abandonment of LIBOR and similar rates could affect the value and liquidity of instruments that reference such rates, especially those that do not have fallback provisions. The use of alternative reference rate products may impact investment strategy performance.

How the Fund strives to manage it: Due to uncertainty regarding the future use of LIBOR or similar rates (such as the EONIA), the impact of the abandonment of such rates on the Fund or the financial instruments in which the Fund invests cannot yet be determined. However, the Fund tries to address such risk by monitoring the economic, political and regulatory climate in jurisdictions relevant to the Fund and the financial instruments in which the Fund invests in order to minimize any potential impact on the Fund. In addition, the Fund typically invests in a number of different securities in a variety of sectors in order to minimize the impact to the Fund of any legislative or regulatory development affecting particular countries, issuers, or market sectors.

|

Liquidity risk |

Liquidity risk is the possibility that investments cannot be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. Illiquid investments may trade at a discount from comparable, more liquid investments, and may be subject to wide fluctuations in market value. A fund also may not be able to dispose of illiquid investments at a favorable time or price during periods of infrequent trading of an illiquid investment.

There is generally no established retail secondary market for high yield securities. As a result, the secondary market for high yield securities is more limited and less liquid than other secondary securities markets. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds, and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons.

Adverse publicity and investor perceptions may also disrupt the secondary market for high yield securities.

14

How the Fund strives to manage it: The Fund limits its exposure to illiquid investments to no more than 15% of its net assets.

|

Portfolio turnover risk |

High portfolio turnover rates may increase a fund's transaction costs which may lower returns. Higher portfolio turnover rates could result in corresponding increases in brokerage commissions, may generate short-term capital gains taxable as ordinary income, and cause dividends received on portfolio securities to not be qualified dividends eligible for reduced federal income tax rates under the Internal Revenue Code.

How the Fund strives to manage it: The Fund will not attempt to achieve or be limited to a predetermined rate of portfolio turnover. Such turnover always will be incidental to transactions undertaken with a view to achieving the Fund's investment objective.

|

Government and regulatory risks |

Governments or regulatory authorities may take actions that could adversely affect various sectors of the securities markets and affect fund performance. Government involvement in the private sector may, in some cases, include government investment in, or ownership of, companies in certain commercial business sectors; wage and price controls; or imposition of trade barriers and other protectionist measures. For example, an economic or political crisis may lead to price controls, forced mergers of companies, expropriation, the creation of government monopolies, foreign exchange controls, the introduction of new currencies (and the redenomination of financial obligations into those currencies), or other measures that could be detrimental to the investments of a fund.

How the Fund strives to manage them: The Manager evaluates the economic and political climate in the relevant jurisdictions before selecting securities for the Fund. The Manager typically diversifies the Fund's assets among a number of different securities in a variety of sectors in order to minimize the impact to the Fund of any legislative or regulatory development affecting particular countries, issuers, or market sectors.

|

Valuation risk |

A less liquid secondary market as described above can make it more difficult to obtain precise valuations of certain securities. During periods of reduced liquidity, judgment plays a greater role in valuing less liquid investments.

How the Fund strives to manage it: The Manager will strive to manage this risk by carefully evaluating individual bonds and by limiting the amount of the Fund's assets that can be allocated to difficult-to-value securities.

|

Natural disaster and epidemic risk |

Natural disaster and epidemic risk is the risk that the value of a fund's investments may be negatively affected by natural disasters, epidemics, or similar events. Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis, and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and can be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of a fund's investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries. These disruptions could prevent a fund from executing advantageous investment decisions in a timely manner and could negatively impact the fund's ability to achieve its investment objective.

How the Fund strives to manage it: The Fund maintains a long-term investment approach. Generally, the portfolio managers do not try to predict overall market movements, but the portfolio managers do note trends in the economy, industries, and financial markets. Although the Fund may hold securities for any amount of time, it generally does not trade for short-term purposes.

Disclosure of portfolio holdings information

A description of the Fund's policies and procedures with respect to the disclosure of its portfolio securities is available in the SAI.

15

Who manages the Fund

Investment manager

The Manager, located at 100 Independence, 610 Market Street, Philadelphia, PA 19106-2354, is the Fund's investment manager. Together, the Manager and the other subsidiaries of Macquarie Management Holdings, Inc. (MMHI) manage, as of September 30, 2022, approximately $192.2 billion in assets, including mutual funds, separate accounts, and other investment vehicles. The Manager and its predecessors have been managing Delaware Funds since 1938. The Manager is a series of Macquarie Investment Management Business Trust (a Delaware statutory trust), which is a subsidiary of MMHI. MMHI is a wholly owned subsidiary of Macquarie Group Limited. The Manager makes investment decisions for the Fund, manages the Fund's business affairs, and provides daily administrative services. For its services to the Fund, the Manager was paid an aggregate fee, net of fee waivers (if applicable), of 0.36% of average daily net assets during the last fiscal year.

A discussion of the basis for the Board's approval of the Fund's investment advisory contract is available in the Fund's semiannual report to shareholders for the period ended January 31, 2022.

Sub-advisors

MIMAK, located at Kaerntner Strasse 28, 1010 Vienna, Austria, is an affiliate of the Manager and a part of Macquarie Asset Management (MAM). MAM is the marketing name for certain companies comprising the asset management division of Macquarie Group Limited. As of September 30, 2022, MAM managed more than $333.0 billion in assets for institutional and individual clients. Although the Manager has principal responsibility for the Manager's portion of the Fund, the Manager may seek investment advice and recommendations from MIMAK and the Manager may also permit MIMAK to execute Fund security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where the Manager believes it will be beneficial to utilize MIMAK's specialized market knowledge.

MIMEL, located at 28 Ropemaker Street, London, England, is an affiliate of the Manager and a part of MAM. Although the Manager has principal responsibility for the Manager's portion of the Fund, the Manager may seek investment advice and recommendations from MIMEL and the Manager may also permit MIMEL to execute Fund security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where the Manager believes it will be beneficial to utilize MIMEL's specialized market knowledge.

MIMGL, located at 50 Martin Place, Sydney, Australia, is an affiliate of the Manager and a part of MAM. Although the Manager has principal responsibility for the Manager's portion of the Fund, the Manager may seek investment advice and recommendations from MIMGL and the Manager may also permit MIMGL to execute Fund security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where the Manager believes it will be beneficial to utilize MIMGL's specialized market knowledge.

A discussion of the basis for the Board's approval of the sub-advisory contracts with MIMEL, MIMGL and MIMAK is available in the Fund's semiannual report to shareholders for the period ended January 31, 2022.

Portfolio managers

Alex Kozhemiakin and Mansur Z. Rasul have primary responsibility for making day-to-day investment decisions for the Fund. In making investment decisions for the Fund, Messrs. Kozhemiakin and Rasul regularly consult with Sean M. Simmons.

Alex Kozhemiakin, CFA Managing Director, Head of Emerging Markets Debt

Alex Kozhemiakin is head of the Macquarie Asset Management Fixed Income (MFI) Emerging Markets Debt team. He has overall responsibility for the team, which manages the full spectrum of emerging markets debt solutions including sovereign, local currency, and corporate. Prior to joining Macquarie Asset Management in December 2018, Kozhemiakin was the head of emerging markets debt at Standish Mellon Asset Management from 2007 to 2016. Before that, he also worked as an emerging markets debt portfolio manager at Putnam Investments and as a sovereign analyst at Citibank. Kozhemiakin's research on fixed income has been published in leading finance journals. He has had a postdoctoral fellowship in International Relations and National Security Studies at Harvard University, and he holds a Ph.D. in political science from the University of Illinois.

Mansur Z. Rasul, Senior Vice President, Senior Portfolio Manager

Mansur Z. Rasul is a senior portfolio manager for the emerging markets credit strategy within Macquarie Asset Management Fixed Income (MFI), a role he assumed in July 2016. He rejoined the firm in April 2012 as head of emerging markets trading for MFI. During his previous time at Macquarie Asset Management from 2004 to 2007, he was an analyst for MFI. From May 2011 to December 2011, Rasul worked with ING Financial Markets, where he was responsible for emerging markets credit trading and structuring. Prior to that, he worked for Daiwa Capital Markets America as director of the firm's fixed income syndicate, responsible for the placement of all fixed income products to US-based accounts from 2009 to 2011. Previously, he worked with Merrill Lynch as an associate responsible for Asian credit trading from 2007 to 2009. Rasul received his bachelor's degree in economics, with a minor in political science, from Northwestern University.

16

Sean M. Simmons, CFA, CMT Vice President, Foreign Exchange Strategist and Trader

Sean M. Simmons is a foreign exchange strategist and trader for the Emerging Markets Debt team. He has been with Macquarie Asset Management Fixed Income (MFI) since 2007, and is responsible for trading across all Emerging Markets Debt strategies. Previously, Simmons worked as a derivatives strategist for Susquehanna International Group and as a proprietary derivatives trader for Wolverine Trading. Simmons received a Master's in Finance from London Business School and Bachelor of Economics from Rutgers University. He also holds the CFA designation and is a member of the CFA Society of Philadelphia.

The SAI provides additional information about each portfolio manager's compensation, other accounts managed by each portfolio manager, and each portfolio manager's ownership of Fund shares.

Manager of managers structure

The Fund and the Manager have received an exemptive order from the US Securities and Exchange Commission (SEC) to operate under a manager of managers structure that permits the Manager, with the approval of the Fund's Board, to appoint and replace both affiliated and unaffiliated sub-advisors, and to enter into and make material amendments to the related sub-advisory contracts on behalf of the Fund without shareholder approval (Manager of Managers Structure). Under the Manager of Managers Structure, the Manager has ultimate responsibility, subject to oversight by the Board, for overseeing the Fund's sub-advisors and recommending to the Board their hiring, termination, or replacement.

The Manager of Managers Structure enables the Fund to operate with greater efficiency and without incurring the expense and delays associated with obtaining shareholder approvals for matters relating to sub-advisors or sub-advisory agreements. The Manager of Managers Structure does not permit an increase in the overall management and advisory fees payable by the Fund without shareholder approval. Shareholders will be notified of the hiring of any new sub-advisor within 90 days of the hiring.

The Fund and the Manager also have an exemptive order from the SEC that allows the approval of a new sub-advisor to be taken at a Board of Trustees meeting held via any means of communication that allows the Trustees to hear each other simultaneously during the meeting. If a new unaffiliated sub-adviser is hired for the Fund, shareholders will receive information about the new sub-advisor within 90 days of the change.

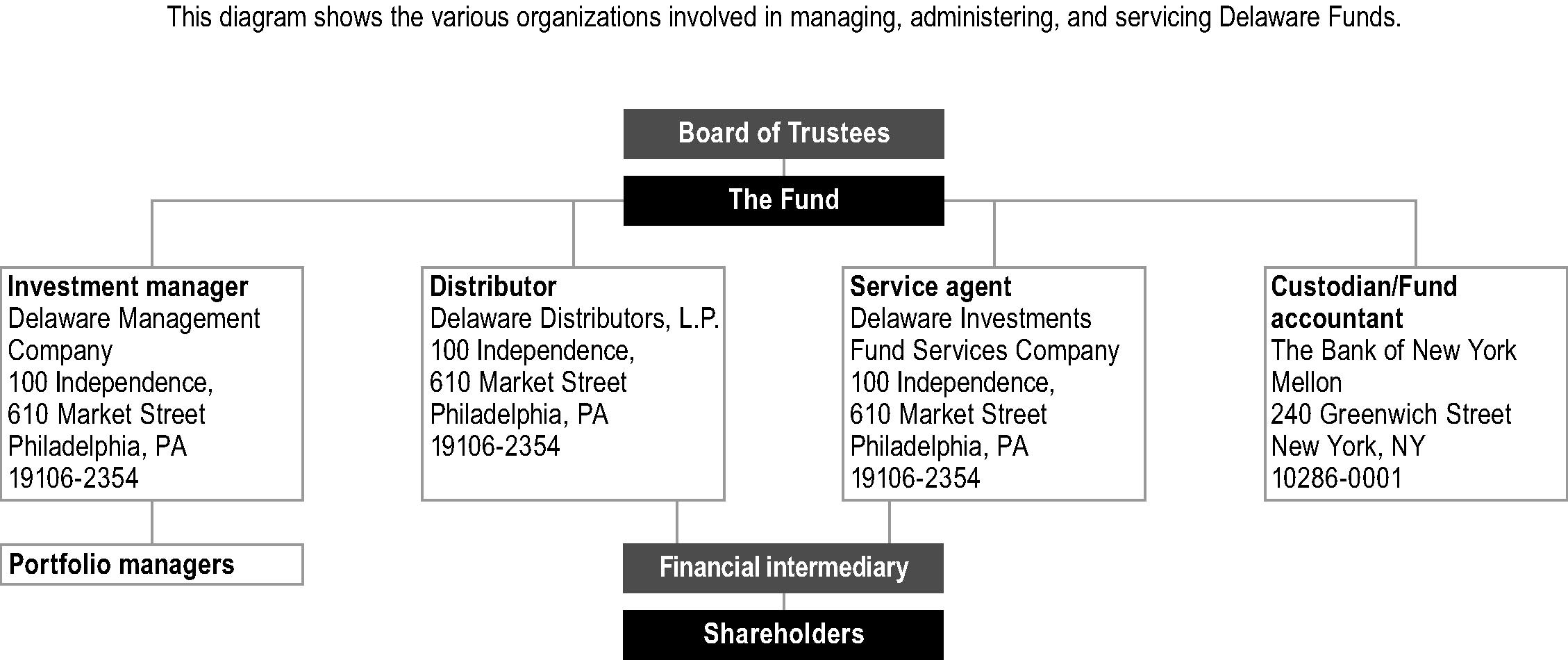

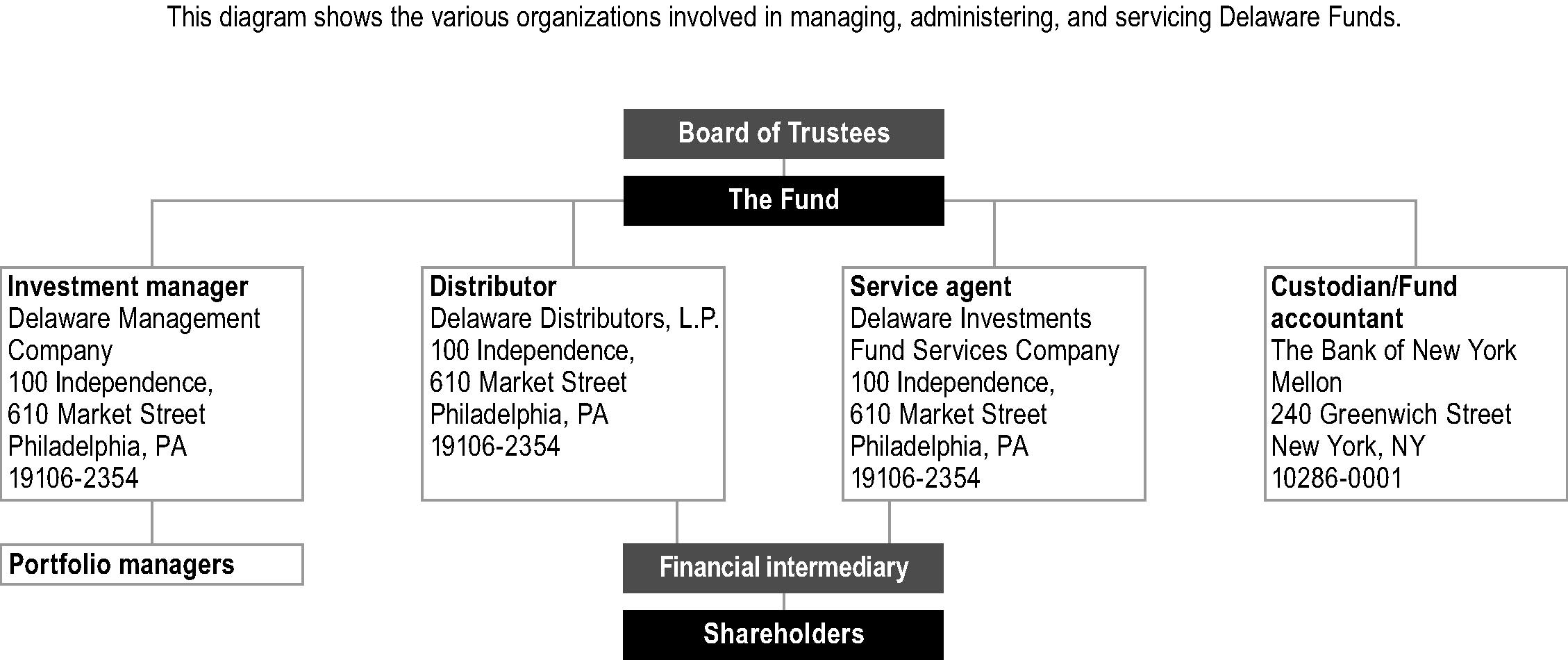

Who's who

Board of trustees: A mutual fund is governed by a board of trustees, which has oversight responsibility for the management of the fund's business affairs. Trustees establish procedures and oversee and review the performance of the fund's service providers.

Investment manager: An investment manager is a company responsible for selecting portfolio investments consistent with the objective and policies stated in the mutual fund's prospectus. A written contract between a mutual fund and its investment manager specifies the services the investment manager performs and the fee the manager is entitled to receive.

Portfolio managers: Portfolio managers make investment decisions for individual portfolios.

17

Who manages the Fund

Distributor: Most mutual funds continuously offer new shares to the public through distributors that are regulated as broker/dealers and are subject to the Financial Industry Regulatory Authority (FINRA) rules governing mutual fund sales practices.

Service agent: Mutual fund companies employ service agents (sometimes called transfer agents) to maintain records of shareholder accounts, calculate and disburse dividends and capital gains, and prepare and mail shareholder statements and tax information, among other functions. Many service agents also provide administrative services to a fund and oversight of other fund service providers.

Custodian/Fund accountant: Mutual funds are legally required to protect their portfolio securities, and most funds place them with a qualified bank custodian that segregates fund securities from other bank assets. The fund accountant provides services such as calculating a fund's net asset value (NAV) and providing financial reporting information for the fund.