Table of Contents

Securities and Exchange Commission

Washington, D.C. 20549

Form 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d/16

of the Securities Exchange Act of 1934

June 2017

AEGON N.V.

Aegonplein 50

2591 TV THE HAGUE

The Netherlands

Table of Contents

Aegon’s 2016 Solvency and Financial Condition Report, dated June 30, 2017, are included as appendix and incorporated herein by reference.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| AEGON N.V. | ||||||

| (Registrant) | ||||||

| Date: June 30, 2017 | By | /s/ J.H.P.M. van Rossum | ||||

| J.H.P.M. van Rossum | ||||||

| Head of Corporate Financial Center | ||||||

Table of Contents

Table of Contents

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

2 Introduction Scope of the report

Scope of the report

This report is Aegon N.V.’s Group Solvency and Financial Condition Report (SFCR) for the year ending December 31, 2016. This report informs Aegon N.V.’s stakeholders about Aegon N.V.’s:

| • | Business and performance; |

| • | System of governance; |

| • | Risk profile; |

| • | Valuation for solvency purposes; and |

| • | Capital Management. |

The material differences between the scope of Aegon Group used for the consolidated financial statements based on IFRS-EU and the scope of Aegon Group for the consolidated data determined in accordance with Article 335 of the Delegated Regulation Solvency II, are discussed in more detail in chapter D. Valuation for solvency purposes.

Basis of presentation

This report is prepared in accordance with the requirements of Solvency II Directive and Delegated Regulation (in particular article 256 of the Solvency II Directive, articles 359 – 371 and articles 290-298 of the Delegated Regulation, and relevant EIOPA Guidelines, in particular ‘Guidelines on reporting and public disclosure’ (EIOPA-BoS-15/109) as issued by the European Insurance and Occupational Pensions Authority (EIOPA).

Aegon N.V. is referred to in this document as ‘Aegon’, or ‘the Company’, and is together with its member companies referred to as ‘Aegon Group’ or ‘the Group’. For such purposes ‘member companies’ means, in relation to Aegon, those companies required to be consolidated in accordance with Solvency II requirements.

The figures reflecting monetary amounts in the SFCR are presented in euro (unless stated otherwise). Aegon discloses monetary amounts in millions of units for disclosing purposes. All values are rounded to the nearest million unless otherwise stated. The rounded amounts may therefore not add up to the rounded total in all cases. All ratios and variances are calculated using the underlying amount rather than the rounded amount.

In case IFRS figures are disclosed, the figures are prepared in accordance with the International Financial Reporting Standards as adopted by the European Union (IFRS-EU).

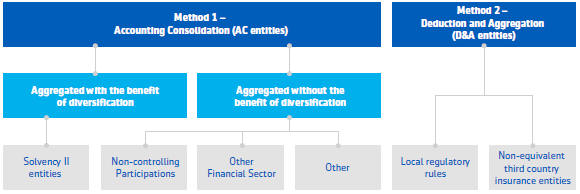

Under Solvency II, Aegon uses a combination of method 1 (Accounting Consolidation) and method 2 (Deduction & Aggregation) for the calculation of the Solvency II group solvency. The Solvency II consolidated data (the data included in accordance with method 1) does not include the entities that are included in the group solvency calculation in accordance with method 2 (for entities in the US, Bermuda, Mexico, Brazil, China, India and Turkey). The most notable difference in this respect for Aegon are the US insurance and reinsurance entities. Furthermore, joint ventures are partially consolidated under Solvency II, whereas joint ventures are not consolidated under IFRS. As part of method 1 under Solvency II, other financial sector (OFS) entities are included as related undertakings based on local sectorial rules, whereas, when OFS are controlled entities, such are consolidated under IFRS.

The consolidation under Solvency II is set out in more detail in chapter D. Valuation for solvency purposes and E. Capital management of the SFCR.

The 2016 SFCR of Aegon Group has been prepared and disclosed under the responsibility of the Executive Board.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

3 Introduction Summary

Summary

The 2016 Solvency Financial Condition Report provides Aegon’s stakeholders insight in:

In 2016, Aegon made further progress in transforming the Company in delivering on its strategy, despite a challenging macro-economic environment. The Solvency II ratio remained well within the target range of 140 to 170 percent throughout the year. The ratio on December 31, 2016 of 157 percent was above the midpoint of Aegon’s target range. While Aegon experienced some significant headwinds during 2016 in the form of market volatility and some adverse claim experience the reported underlying earnings before tax amounted to EUR 1,913 million.

During 2016, the Aegon UK business has gone through a significant transformation in which the Company sold its annuity portfolio and acquired two new businesses.

This sale to Rothesay and Legal & General consisted of two separate transactions where Aegon initially reinsured GBP 9 billion of liabilities. This will be followed by Part VII transfers which conclude the sale.

Aegon announced the acquisition of BlackRock’s UK Defined Contribution (DC) pension and administration platform business in May 2016. This transaction is subject to court approval. In August 2016, Aegon announced the acquisition of Cofunds from Legal & General. This transaction completed the strategic transformation of Aegon’s operations in the United Kingdom from traditional life insurance to platform business, and firmly establishes the company as the number one provider in the retail platform market. The acquisition was successfully closed on January 1, 2017 following regulatory approval, adding 750,000 platform customers representing over GBP 80 billion assets under administration. As a result of this transaction, Aegon will serve over 3 million customers in the United Kingdom.

Aegon’s underlying earnings before tax increased compared with 2015 to EUR 1,913 million in 2016. This was mainly driven by lower amortization of deferred policy acquisition costs related to upgrading customers to the retirement platform in the United Kingdom compared to 2015. The net income amounted to EUR 586 million in 2016 driven by underlying earnings before tax, and was impacted by the book loss on the divestment of the UK annuity portfolio and fair value losses, partly offset by gains on investments.

Commissions and expenses decreased in 2016 compared with 2015 to EUR 6.4 billion, mainly driven by lower amortization of deferred policy acquisition costs in the United Kingdom. Operating expenses increased by 1% in 2016 compared with 2015 to EUR 3.6 billion.

Policyholder claims and benefits amounted to EUR 42.0 billion in 2016, which is comprised of EUR 23.9 billion claims and benefits paid for Aegon’s life business and EUR 2.1 billion of claims and benefits paid for non-life business. In addition, policyholder claims and benefits were significantly impacted by market movements (equity markets and interest rates) and reflect changes in technical provisions resulting from fair value changes on for account of policyholder financial assets included in results from financial transactions of EUR 15.1 billion.

Full details on the Aegon’s business and performance are described in chapter A. Business and performance.

General governance

Aegon is incorporated and established in the Netherlands and therefore must comply with Dutch law and is subject to the Dutch Corporate Governance Code.

Aegon’s Executive Board is charged with the overall management of the Company and is therefore responsible for achieving Aegon’s aims and developing the strategy and its associated risk profile, in addition to overseeing any relevant sustainability issues and the development of the Aegon’s earnings, Aegon’s Executive Board is assisted in its work by the Management Board. Aegon’s Management Board is comprised of the Executive Board, the Group CRO and CEOs of the Americas, the Netherlands, United Kingdom and CEE. During 2016, the Management Board was expanded by the CEO of Asset management, General Counsel, Global Head of HR and the

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

4 Introduction Summary

Chief Technology Officer. Aegon’s CFO Darryl Button was a member of the Management Board until he concluded his tenure with Aegon on December 1, 20161.

Aegon’s Supervisory Board oversees the management of the Executive Board, in addition to the Company’s business and corporate strategy. The Supervisory Board members, eight members as per December 31, 2016, are appointed by the General Meeting of Shareholders and Aegon aims to the Supervisory Board to be well-balanced in terms of professional background, geography and gender. The following committees exist, exclusively comprised of Supervisory Board members, in dealing with specific issues related to Aegon’s financial accounts, risk management, executive remuneration and appointments:

| • | Audit Committee; |

| • | Risk Committee; |

| • | Remuneration Committee; and |

| • | Nomination and Governance Committee. |

Risk management

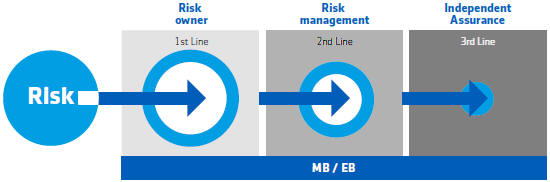

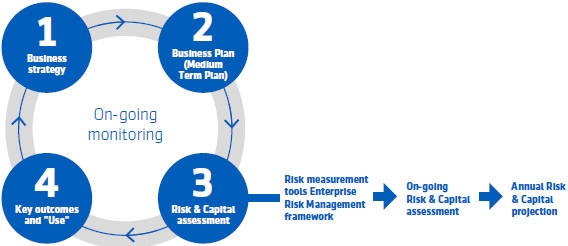

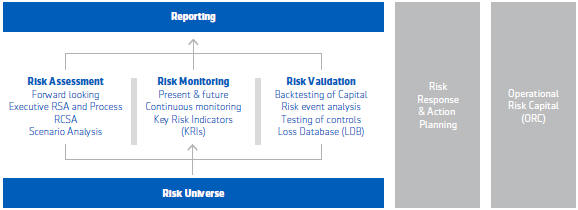

Aegon’s risk management framework is designed and applied to identify and manage potential events and risks that may affect Aegon. This is established in the Enterprise Risk Management (ERM) framework; which aims to identify and manage individual and aggregate risks within Aegon’s risk tolerance in order to provide reasonable assurance regarding the achievement of Aegon’s objectives. The ERM framework applies to all material businesses of Aegon for which it has operational control. Aegon’s businesses are required to either adopt the Group level ERM framework directly, or tailor it to local needs, while meeting the requirements of the Group level ERM framework. Aegon’s ERM framework is based on a well-defined risk governance structure:

| • | Supervisory Board; |

| • | Executive and Management Boards; |

| • | Group Risk & Capital Committee and its sub-committees; and |

| • | Regional Risk & Capital Committees. |

In 2016, the Group Risk & Capital Committee (GRCC) structure was restructured with the aim to further integrate governance for risk, actuarial and finance matters. The scope of the GRCC has been extended and representation of the Risk function was strengthened. The scope includes both financial and non-financial (operational) risks.

Control environment

In addition to risk management, Aegon’s Solvency II control environment consist of an internal control system, an actuarial function and an internal audit function. The internal control system serves to facilitate compliance with applicable laws, regulation and administrative processes and it provides for an adequate control environment including appropriate control activities for key processes. The actuarial function has end-to-end accountability for the adequacy and reliability of reported technical provisions, including policy setting and monitoring of compliance regarding actuarial risk tolerances. Aegon’s internal audit function is independent and objective in performing its duties in evaluating the effectiveness of Aegon’s internal control system.

Full details on the Aegon’s system of governance are described in chapter B. System of governance.

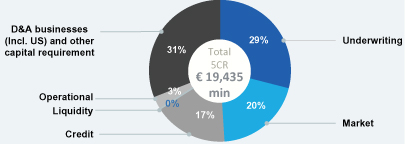

As an insurance group, Aegon accepts and manages risk for the benefit of its customers and other stakeholders. Aegon’s risk management and control systems are designed to ensure that these risks are managed effectively and efficiently in a way that is aligned with the Company’s strategy. The targeted risk profile is determined by customer needs, Aegon’s competence to manage the risk, the preference of Aegon for the risk, and whether there is sufficient capacity to take the risk. Aegon currently targets an equal balance between financial market and credit risks and underwriting risks. The targeted risk profile is set at Aegon Group level and developed in more detail within the subsidiaries where insurance business is written. Aegon’s risk strategy provides direction for the targeted Aegon risk profile while supporting Aegon’s business strategy. The Company is exposed to a range of underwriting, market, credit, liquidity and operational risks.

| 1 | On September 6, 2016, Aegon announced Mr. Button’s decision to step down as CFO and to leave the Company on December 1, 2016. |

Aegon’s Supervisory Board appointed Matthew J. Rider (1963, US Citizen) as CFO and member of the Executive Board at its Annual General Meeting of Shareholders on May 19, 2017.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

5 Introduction Summary

The sale of the majority of the UK annuity business in 2016 reduced the exposure to longevity risk, interest rate risk arising from this business. As a result of the transaction, which is expected to be completed during 2017, Aegon entered into reinsurance contracts with Rothesay Life and Legal & General. These temporary reinsurance contracts resulted in an additional counterparty risk exposure up until completion.

Full details on the Aegon’s risk profile are described in chapter C. Risk profile.

D. Valuation for solvency purposes

Aegon values its Solvency II balance sheet items on a basis that reflects their economic value. Where the IFRS fair value is consistent with Solvency II requirements, Aegon follows IFRS for valuing assets and liabilities other than technical provisions.

The reconciliation of Excess Assets over Liabilities (Solvency II basis) and Shareholder’s Equity (IFRS-EU basis) can be summarized as follows:

| • | Revaluation differences on mainly insurance liabilities and other assets which are valued other than fair value in the IFRS balance sheet; |

| • | Differences in scope, where Aegon’s Non-EEA (re)insurance entities are aggregated based on the Deduction & Aggregation method and the net asset values is represented in the line Participation on Aegon’s Solvency II economic balance sheet; and |

| • | De-recognition of items on the Solvency II economic balance sheet which are admissible on the IFRS balance sheet, for instance Deferred policy acquisition costs, Goodwill and Intangible assets. |

Aegon applies the matching adjustment, in Aegon UK and Aegon Spain, which has a positive impact to the Group own funds of EUR 107 million as of December 31, 2016 and an impact of EUR (105) million on the Group solvency capital requirement. The matching adjustment methodology has been approved by local regulators. In addition, Aegon applies the volatility adjustment, in Aegon the Netherlands, Aegon UK and Aegon Spain, which has a positive impact to the Group own funds of EUR 651 million and an impact of EUR (1,636) million on the Group solvency capital requirement.

The combined positive impact of the matching adjustment and volatility adjustment on the Group Solvency II ratio is 26%.

Full details on the reconciliation between Aegon’s economic balance sheet based on Solvency II and consolidated financial statements based on IFRS-EU are described in chapter D. Valuation for solvency purposes.

Aegon maintains a target capital ratio between 140%—170%. At December 31, 2016, the Solvency II ratio of 157% was above the midpoint of this target range.

In the following table the Solvency II key figures for Aegon are presented as at December 31, 2016:

| Total eligible own funds Amounts in EUR millions |

||||

| Tier 1 unrestricted own funds |

10,656 | |||

| Tier 1 restricted own funds |

2,517 | |||

| Tier 2 own funds |

3,309 | |||

| Tier 3 own funds |

1,638 | |||

|

|

|

|||

| Total eligible own funds |

18,119 | |||

|

|

|

|||

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

| 6 Introduction Summary |

| Group SCR/Solvency II ratio | ||||

| Amounts in EUR millions |

||||

| Investment & counterparty risk |

2,730 | |||

| Mismatch risk |

81 | |||

| Underwriting risk |

1,127 | |||

| Standard formula |

2,892 | |||

| Other capital requirement |

6,036 | |||

| LAC-DT and other |

(1,302 | ) | ||

|

|

|

|||

| Group PIM SCR |

11,563 | |||

|

|

|

|||

| Group Solvency II ratio |

157 | % | ||

|

|

|

|||

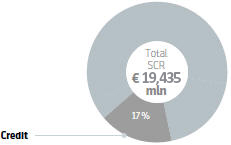

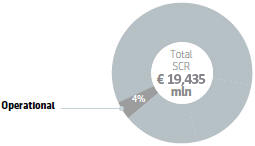

Aegon uses a combination of Accounting Consolidation (method 1) and Deduction & Aggregation (method 2) for the calculation of the Solvency II group solvency. In addition, Aegon uses a Partial Internal Model (PIM) to calculate the solvency position of its EU-domiciled (re)insurance activities under Accounting Consolidation. In the table above, Aegon’s PIM is reflected in Investment & counterparty risk, Mismatch risk and Underwriting risk.

In Aegon’s Non-EEA regions, (re)insurance entities domiciled in third countries deemed (provisional) equivalent (US, Bermuda, Japan, Mexico and Brazil) the capital requirement is based on local capital requirements. For other Non-EEA (re)insurance entities domiciled in China, India and Turkey, the capital requirement is based on Solvency II. In the table above, Aegon’s Non-EEA regions, is reflected as Other capital requirement.

Aegon’s internal model was approved by the College of Supervisors as part of the Internal Model Application Process. Aegon believes a (partial) internal model is a better representation of the actual risk since this contains Company specific modelling and sensitivities as opposed to industry-wide approximations included in the standard formula methodology.

It is noted that Aegon’s Solvency II capital is subject to final interpretations of Solvency II regulations including the assumptions underlying Aegon’s factor for the loss absorbing capacity of deferred taxes in the Netherlands. New guidance from the Dutch Central Bank issued in February 2017 is under review. At December 31, 2016, the worst case tax factor of LAC-DT is assumed 75% for Aegon the Netherlands. In addition, the Group own funds do not include any contingent liability potentially arising from unit-linked products sold, issued or advised on by Aegon in the Netherlands in the past as the potential liability cannot be reliably quantified at this point.

Full details on the Aegon’s available and eligible own funds are described in section E.1 Own funds on the Aegon’s PIM SCR is described in section E.2.1 Solvency capital requirement.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

7 Business and performance Business

A.1 Business

A.1.1 Overview

Aegon N.V. is a public limited liability company with its corporate seat and head office in The Hague, the Netherlands. Aegon’s common shares are listed on stock exchanges in Amsterdam (Euronext) and New York (NYSE).

A.1.2 Regulators and auditor

The supervisory authority responsible for Solvency II group supervision on the Aegon Group and for supplementary group supervision in accordance with the EU Financial Conglomerates Directive (FCD) is:

De Nederlandsche Bank (DNB), the Dutch Central Bank

Address: Westeinde 1, 1017 ZN, Amsterdam

Telephone: +31(0)20 524 91 11

Aegon’s external auditor is PricewaterhouseCoopers Accountants N.V. The external auditor’s mandate does not cover an audit on the information disclosed in this SFCR. Their contact details are:

PricewaterhouseCoopers Accountants N.V.

Address: Thomas R. Malthusstraat 5, 1066 JR, Amsterdam

Telephone: +31 (0)88 792 00 20

A.1.3 Holders of qualifying holdings

A qualifying holding means a direct or indirect holding in an undertaking which represents 10% or more of the capital or of the voting rights or which makes it possible to exercise a significant influence over the management of that undertaking. Only Vereniging Aegon qualifies based on this definition.

Vereniging Aegon, a Dutch association located in The Hague, the Netherlands, with a special purpose to protect the broader interests of Aegon N.V. and its stakeholders. On December 31, 2016, Vereniging Aegon, Aegon’s largest shareholder, held a total of 279,236,609 common shares and 567,697,200 common shares B. Under the terms of the 1983 Merger Agreement as amended in May 2013, Vereniging Aegon has the option to acquire additional common shares B. Vereniging Aegon may exercise its call option to keep or restore its total stake to 32.6% of the voting rights, irrespective of the circumstances that caused the total shareholding to be or become lower than 32.6%. In the absence of a ‘Special Cause’ Vereniging Aegon may cast one vote for every common share it holds and one vote only for every 40 common shares B it holds. As ‘Special Cause’ qualifies the acquisition of a 15% interest in Aegon N.V., a tender offer for Aegon N.V. shares or a proposed business combination by any person or group of persons, whether individually or as a group, other than in a transaction approved by the Executive Board and the Supervisory Board. If, in its sole discretion, Vereniging Aegon determines that a Special Cause has occurred, Vereniging Aegon will notify the General Meeting of Shareholders and retain its right to exercise the full voting power of one vote per common share B for a limited period of six months. Accordingly, at December 31, 2016, the voting power of Vereniging Aegon under normal circumstances amounted to approximately 14.4%, based on the number of outstanding and voting shares (excluding issued common shares held in treasury by Aegon N.V.). In the event of a Special Cause, Vereniging Aegon’s voting rights will increase, currently to 32.6%, for up to six months.

A.1.4 Aegon’s Group structure

Aegon’s main operating units are separate legal entities and operate under the laws of their respective countries. The shares of these legal entities are directly or indirectly held by three intermediate holding companies incorporated under Dutch law: Aegon Europe Holding B.V., the holding company for all European activities; Aegon International B.V., which serves as a holding company for the Aegon Group companies of all non-European countries; and Aegon Asset Management Holding B.V., the holding company for a number of its asset management entities.

Aegon has the following operating segments: the Americas, which includes the United States, Mexico and Brazil; the Netherlands; the United Kingdom; Central & Eastern Europe; Spain & Portugal; Asia and Aegon Asset Management. The separate operating segments of the Netherlands, the United Kingdom, Central & Eastern Europe and Spain & Portugal may be referred together as ‘Europe’, but Europe is not an operating segment.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

8 Business and performance Business

A.1.5 List of material related undertakings

The principal undertakings of the parent company Aegon N.V. are listed by geographical segment. All are wholly owned, directly or indirectly, unless stated otherwise, and are involved in insurance or reinsurance business, asset management or services related to these activities. The voting power in these undertakings held by Aegon is equal to the shareholdings.

Americas

| • | Transamerica Advisors Life Insurance Company (Little Rock, Arkansas); |

| • | Transamerica Casualty Insurance Company (Columbus, Ohio). |

| • | Transamerica Corporation (Wilmington, Delaware); |

| • | Transamerica Financial Life Insurance Company (Albany, New York); |

| • | Transamerica Life Insurance Company (Cedar Rapids, Iowa); |

| • | Transamerica Premier Life Insurance Company (Cedar Rapids, Iowa); |

| • | Akaan-Aegon S.A.P.I. de C.V. (Mexico City, Mexico) (99.99%); and |

| • | Mongeral Aegon, Seguros e Previdencia S.A. (Rio de Janeiro, Brazil) (50%). |

Europe

The Netherlands

| • | Aegon Bank N.V. (The Hague); |

| • | Aegon Hypotheken B.V. (The Hague); |

| • | Aegon Levensverzekering N.V. (The Hague); |

| • | Aegon PPI B.V. (The Hague); |

| • | Aegon Schadeverzekering N.V. (The Hague); |

| • | Aegon Spaarkas N.V. (The Hague); |

| • | Cappital Premiepensioeninstelling B.V. (Groningen). |

| • | Optas Pensioenen N.V. (Rotterdam); |

| • | TKP Pensioen B.V. (Groningen); |

| • | Unirobe Meeùs Groep B.V. (The Hague); |

| • | AMVEST Vastgoed B.V. (Utrecht) (50%), property management and development; and |

| • | N.V. Levensverzekering-Maatschappij ‘De Hoop’ (The Hague) (33.3%). |

United Kingdom

| • | Aegon Investment Solutions Ltd (Edinburgh, Scotland). |

| • | Scottish Equitable PLC (Edinburgh, Scotland); |

| • | Stonebridge International Insurance Ltd (London, United Kingdom); and |

| • | Tenet Group Limited (Leeds, United Kingdom) (22%). |

Central & Eastern Europe

| • | Aegon Czech Life (Aegon Poišt’ovna, a.s) (Prague, Czech Republic); |

| • | Aegon Hungary Composite Insurance Co. (Aegon Magyarország Általános Biztosító Zártkörüen Müködö Részvénytársaság) (Budapest, Hungary); |

| • | Aegon Poland Life (Aegon Towarzystwo Ubezpieczeñ na Zycie Spótka Akcyjna) (Warsaw, Poland); |

| • | Aegon Poland Pension Fund Management Co. (Aegon Powszechne Towarzystwo Emerytalne Spótka Akcyjna) (Warsaw, Poland); |

| • | Aegon Romania Pension Administrator Co. (Aegon Pensii Societate de Administrare a Fondurilor de Pensii Private S.A) (Cluj, Romania); |

| • | Aegon Slovakia Life (Aegon Životná poist’ovña, a.s.) (Bratislava, Slovakia); |

| • | Aegon Slovakia Pension Management Co. (Aegon, d.s.s., a.s) (Bratislava, Slovakia); and |

| • | Aegon Turkey (Aegon Emeklilik ve Hayat A.§.) (Istanbul, Turkey); |

Spain & Portugal

| • | Aegon Activos A.V., S.A. (Madrid, Spain); |

| • | Aegon Administracion y Servicios A.I.E. (Madrid, Spain); |

| • | Aegon España S.A.U. de Seguros y Reaseguros (Madrid, Spain); |

| • | Aegon Santander Generales Seguros y Reaseguros S.A. (Madrid, Spain) (51%); |

| • | Aegon Santander Portugal Não Vida-Companhia de Seguros S.A. (Lisbon, Portugal) (51%); |

| • | Aegon Santander Portugal Vida-Companhia de Seguros de Vida S.A. (Lisbon, Portugal) (51%); |

| • | Aegon Santander Vida Seguros y Reaseguros S.A. (Madrid, Spain) (51%); and |

| • | Liberbank Vida y Pensiones, Seguros y Reaseguros, S.A. (Oviedo, Spain) (50%). |

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

9 Business and performance Business

Asia

| • | Transamerica Life (Bermuda) Ltd. (TLB) (Hamilton, Bermuda); |

| • | Aegon Life Insurance Company (Mumbai, India) (49%); |

| • | Aegon Sony Life Insurance Co. Ltd. (Tokyo, Japan) (50%); |

| • | Aegon THTF Life Insurance Co. Ltd. (Shanghai, China) (50%); and |

| • | SA Reinsurance Ltd. (Hamilton, Bermuda) (50%). |

Asset Management

| • | Aegon Asset Management Holding B.V. (The Hague); |

| • | Kames Capital Holdings Ltd (Edinburgh, Scotland); |

| • | TKP Investments B.V. (Groningen); |

| • | Aegon Industrial Fund Management Company (AIFMC) (Shanghai, China) (49%); and |

| • | La Banque Postale Asset Management (Paris, France) (25%). |

For a complete list of related undertakings, please refer to QRT S.32.01.22—Undertakings in scope of the group. A list of Aegon’s branches is provided below:

| Aegon’s branches |

Ownership | Registered Office town/city |

Registered Office country |

|||||||||

| Company name |

||||||||||||

| AEGON Asia B.V. - Hong Kong Branch |

100 | % | Island East | Hong Kong | ||||||||

| AEGON CEE B.V., Hungarian Branch Office |

100 | % | Budapest | Hungary | ||||||||

| Aegon Direct Marketing Services - German Branch (being closed) |

100 | % | Frankfurt am Main | Germany | ||||||||

| Aegon Direct Marketing Services - Spanish Branch (being closed) |

100 | % | Madrid | Spain | ||||||||

| Aegon Insights Limited - Singapore Branch |

100 | % | Singapore | Singapore | ||||||||

| AEGON Ireland plc. - German Branch |

99.99 | % | Frankfurt am Main | Germany | ||||||||

| AEGON Magyarország Általános Biztosító Zártkörüen Csehországi Fióktelepe - Czech Branch |

100 | % | Prague | Czech Republic | ||||||||

| AEGON Magyarország Általános Biztosító Zártkörüen Szlovákiai Fióktelepe - Slovakian Branch |

100 | % | Bratislava | Slovakia | ||||||||

| AEGON Ubezpieczenia Majátkowe Oddziat w Polsce Zaktadu AEGON Magyarország Általános Biztosító Spótka Akcyjna w Budapeszcie - Polish Branch |

100 | % | Chorzów | Poland | ||||||||

| AEGON UK Corporate Services Limited - Irish Branch |

100 | % | Dublin | Ireland | ||||||||

| S.C. AEGON Towarzystwo Ubezpieczeñ na Žycie S.A. Varsovia-Sucursala Floresti - Romanian Branch |

100 | % | Floresti | Romania | ||||||||

| Transamerica Life (Bermuda) Ltd. - Hong Kong Branch |

100 | % | Island East | Hong Kong | ||||||||

| Transamerica Life (Bermuda) Ltd. - Singapore Branch |

100 | % | Singapore | Singapore | ||||||||

A.1.6 Material lines of business and material geographical areas

Following below, per geographical area, a high level overview of the countries and their material lines of business is provided.

Americas

Life

Products offering protection against mortality, morbidity and longevity risks, including traditional and universal life, in addition to endowment, term, and whole life insurance products.

Accident & health

Products offering supplemental health, accidental death and dismemberment insurance, critical illness, cancer treatment, credit/disability, income protection, travel and long-term care insurance.

Mutual funds

Wide range of specialized mutual funds, including asset allocation, US equity, global/international equity, alternative investments, hybrid allocation, fixed income and target date funds.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

10 Business and performance Business

Retirement plans

Comprehensive and customized retirement plan services to employers across the entire spectrum of defined benefit, defined contribution and non-qualified deferred compensation plans. Includes services to individuals rolling over funds from other qualified retirement funds or Individual Retirement Accounts (IRAs).

Variable annuities

Variable annuities allow the holder to accumulate assets for retirement on a tax-deferred basis and to participate in equity or bond market performance, in addition to receiving one of many payout options designed to provide income in retirement.

Fixed annuities

Fixed annuities allow customers to make a lump-sum payment or a series of payments and receive income in the form of periodic payments that can begin immediately or after a period of time.

Stable value solutions

Synthetic Guaranteed Investment Contracts (GICs) in the United States offered primarily to tax-qualified institutional entities such as 401(k) plans and other retirement plans.

Brazil

Life and critical illness insurance; private and company pensions; pension scheme administration; and investment funds.

Mexico

Individual life, group life, and health insurance; and saving plans.

Europe

The Netherlands

Life

Products with mortality, morbidity, and longevity risks, including traditional and universal life, in addition to employer, endowment, term, whole life insurance products; mortgages; annuity products; and banking products, including saving deposits.

Pensions

Individual and group pensions usually sponsored by, or obtained via, an employer. Administration-only services are offered to company and industry pension funds.

Non-life

General insurance, consisting mainly of automotive, liability, disability, household insurance, and fire protection.

Distribution

Independent distribution channel, offering both life and non-life insurance solutions.

United Kingdom

Life

Individual protection products, such as term insurance, critical illness, income protection and international/offshore bonds.

Pension

Individual pensions, including self-invested personal pensions and drawdown products, such as guaranteed income drawdown products; group pensions, sponsored by, or obtained via, an employer. Also includes the tied-agent distribution business.

Central & Eastern Europe

Activities in the Czech Republic, Hungary, Poland, Romania, Slovakia, and Turkey. Includes life insurance, individual and group pension products, savings and investments, in addition to general insurance.

Spain & Portugal

Distribution partnerships with Santander in Spain & Portugal and with Liberbank in Spain. Includes life insurance, accident and health insurance, general insurance and investment products.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

11 Business and performance Business

Asia

High net worth businesses

Life insurance marketed to high-net-worth individuals in Hong Kong and Singapore.

Aegon Insights

Full range of direct insurance solutions from product design, customer analytics insights, marketing campaign design and multi-channel product distribution to policy administration and claims management.

Strategic partnerships

Joint ventures in China and India offering (term) life insurance and savings products, and in Japan offering variable annuities.

Aegon Asset Management

Americas

Investment products covering third-party customers, insurance-linked solutions, and Aegon’s own insurance companies.

The Netherlands

Investment products covering third-party customers, insurance-linked solutions, and Aegon’s own insurance companies in addition to manager selection and tailored advice on balance sheet solutions for the pension market.

United Kingdom

Fixed income, equities, real estate and multi-asset solutions to Aegon’s own insurance companies as well as external UK and international customers.

Rest of the world

Asset management activities in Central & Eastern Europe and Spain & Portugal and distribution in Asia.

Strategic partnerships

China

Aegon Asset Management owns 49% of the shares of Aegon Industrial Fund Management Company, a Shanghai-based asset manager.

France

Aegon Asset Management has a strategic asset management partnership with La Banque Postale through its 25% equity stake in La Banque Postale Asset Management.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

12 Business and performance Business

A.1.7 Results of operations

Results 2016 (IFRS-EU)

| Underlying earnings geographically Amounts in EUR millions |

2016 | 2015 | % | |||||||||

| Net underlying earnings |

1,483 | 1,481 | — | |||||||||

| Tax on underlying earnings |

429 | 386 | 11 | % | ||||||||

| Underlying earnings before tax geographically |

||||||||||||

| Americas |

1,249 | 1,278 | (2 | %) | ||||||||

| The Netherlands |

534 | 537 | (1 | %) | ||||||||

| United Kingdom |

59 | (27 | ) | — | ||||||||

| Central & Eastern Europe |

55 | 37 | 51 | % | ||||||||

| Spain & Portugal |

8 | 12 | (38 | %) | ||||||||

| Europe |

655 | 559 | 17 | % | ||||||||

| Asia |

21 | 20 | 3 | % | ||||||||

| Asset Management |

149 | 170 | (12 | %) | ||||||||

| Holding and other activities |

(162 | ) | (161 | ) | — | |||||||

|

|

|

|

|

|

|

|||||||

| Underlying earnings before tax |

1,913 | 1,867 | 2 | % | ||||||||

| Fair value items |

(645 | ) | (771 | ) | 16 | % | ||||||

| Gains / (losses) on investments |

340 | 346 | (2 | %) | ||||||||

| Net impairments |

(54 | ) | 49 | — | ||||||||

| Other income / (charges) |

(771 | ) | (2,180 | ) | 65 | % | ||||||

| Run-off businesses |

54 | 88 | (39 | %) | ||||||||

|

|

|

|

|

|

|

|||||||

| Income before tax (excluding income tax from certain proportionately consolidated joint ventures and associates) |

836 | (601 | ) | — | ||||||||

| Income tax from certain proportionately consolidated joint ventures and associates included in income before tax |

31 | 33 | (6 | %) | ||||||||

| Income tax |

(250 | ) | 78 | — | ||||||||

| Of which Income tax from certain proportionately consolidated joint ventures and associates included in income before tax |

(31 | ) | (33 | ) | 6 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Net income |

586 | (523 | ) | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Commissions and expenses |

6,696 | 6,916 | (3 | %) | ||||||||

| of which operating expenses |

3,764 | 3,734 | 1 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| New life sales Amounts in EUR millions |

2016 | 2015 | % | |||||||||

| Americas |

542 | 599 | (9 | %) | ||||||||

| The Netherlands |

111 | 130 | (15 | %) | ||||||||

| United Kingdom |

66 | 72 | (8 | %) | ||||||||

| Central & Eastern Europe |

83 | 91 | (9 | %) | ||||||||

| Spain & Portugal |

39 | 39 | 1 | % | ||||||||

| Europe |

299 | 332 | (10 | %) | ||||||||

| Asia |

128 | 173 | (26 | %) | ||||||||

|

|

|

|

|

|

|

|||||||

| Total recurring plus 1/10 single |

969 | 1,104 | (12 | %) | ||||||||

|

|

|

|

|

|

|

|||||||

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

13 Business and performance Business

| Gross deposits (on and off balance) Amounts in EUR millions |

2016 | 2015 | % | |||||||||

| Americas |

40,881 | 36,999 | 10 | % | ||||||||

| The Netherlands |

6,686 | 5,137 | 30 | % | ||||||||

| United Kingdom |

5,791 | 6,096 | (5 | %) | ||||||||

| Central & Eastern Europe |

265 | 227 | 17 | % | ||||||||

| Spain & Portugal |

31 | 29 | 8 | % | ||||||||

| Europe |

12,773 | 11,489 | 11 | % | ||||||||

| Asia |

304 | 408 | (25 | %) | ||||||||

| Asset Management |

46,366 | 33,722 | 37 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| Total gross deposits |

100,325 | 82,618 | 21 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| Worldwide revenues Amounts in EUR millions |

Americas | The Nether- lands |

United King- dom |

Central & Eastern Europe |

Spain & Portu- gal |

Europe | Asia | Asset Man- age- ment |

Holding, other activities and elimina- tions |

Seg- ment total |

Associ- ates and Joint Ventures elimina- tions |

Con- soli- dated |

||||||||||||||||||||||||||||||||||||

| Total life insurance gross premiums |

7,363 | 2,015 | 9,888 | 399 | 191 | 12,493 | 1,121 | — | (78 | ) | 20,898 | (498 | ) | 20,400 | ||||||||||||||||||||||||||||||||||

| Accident and health insurance premiums |

2,204 | 210 | 36 | 1 | 73 | 320 | 104 | — | (4 | ) | 2,624 | (15 | ) | 2,609 | ||||||||||||||||||||||||||||||||||

| General insurance premiums |

— | 266 | — | 179 | 92 | 536 | — | — | — | 536 | (92 | ) | 444 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total gross premiums |

9,567 | 2,491 | 9,924 | 578 | 355 | 13,348 | 1,225 | — | (82 | ) | 24,058 | (606 | ) | 23,453 | ||||||||||||||||||||||||||||||||||

| Investment income |

3,717 | 2,135 | 1,661 | 45 | 45 | 3,886 | 232 | 3 | 3 | 7,841 | (54 | ) | 7,788 | |||||||||||||||||||||||||||||||||||

| Fees and commission income |

1,651 | 350 | 95 | 36 | 14 | 495 | 61 | 632 | (242 | ) | 2,596 | (188 | ) | 2,408 | ||||||||||||||||||||||||||||||||||

| Other revenue |

4 | — | — | — | 2 | 2 | — | 1 | 3 | 11 | (4 | ) | 7 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total revenues |

14,940 | 4,976 | 11,680 | 659 | 416 | 17,732 | 1,517 | 636 | (318 | ) | 34,507 | (852 | ) | 33,655 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Number of employees, including agent employees |

11,943 | 4,464 | 2,673 | 2,317 | 600 | 10,054 | 5,579 | 1,474 | 330 | 29,380 | ||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Underlying earnings before tax by line of business Amounts in EUR millions |

2016 | 2015 | % | |||||||||

| Life |

779 | 774 | 1 | % | ||||||||

| Individual Savings & Retirement |

534 | 604 | (12 | %) | ||||||||

| Pensions |

555 | 440 | 26 | % | ||||||||

| Non-life |

34 | 17 | 99 | % | ||||||||

| Asset management |

149 | 170 | (12 | %) | ||||||||

| Other |

(139 | ) | (139 | ) | — | |||||||

|

|

|

|

|

|

|

|||||||

| Underlying earnings before tax |

1,913 | 1,867 | 2 | % | ||||||||

|

|

|

|

|

|

|

|||||||

Net income

The net income amounted to EUR 586 million in 2016 driven by underlying earnings before tax of EUR 1,913 million, and was impacted by the book loss on the divestment of the UK annuity portfolio and fair value losses, partly offset by gains on investments.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

14 Business and performance Business

Underlying earnings before tax

Aegon’s underlying earnings before tax increased compared with 2015 to EUR 1,913 million in 2016. This was mainly driven by lower amortization of deferred policy acquisition costs (DPAC) in the United Kingdom following the write down of DPAC in the fourth quarter of 2015.

| • | Underlying earnings before tax from the Americas declined compared with 2015 to EUR 1,249 million in 2016. Expense reductions and an improvement in claims experience offset lower variable annuities underlying earnings before tax compared with 2015 and the impact on recurring underlying earnings before tax of the actuarial assumption changes and model updates implemented in the third quarter of 2015; |

| • | In Europe, underlying earnings before tax in 2016 increased by 17% compared with 2015 to EUR 655 million. This was mainly driven by lower amortization of deferred policy acquisition costs in the United Kingdom related to upgrading customers to the retirement platform compared to 2015; |

| • | In Asia, underlying earnings before tax increased in 2016 compared with 2015 to EUR 21 million as a result of increased underlying earnings before tax from the High Net Worth business. This was partly offset by lower underlying earnings before tax from Strategic Partnerships compared with 2015 mainly a result of the increase in ownership from 26% to 49% in India, which is currently loss-making; |

| • | Underlying earnings before tax from asset management decreased by 12% in 2016 compared with 2015 to EUR 149 million. This decline was mainly driven by lower underlying earnings before tax from Aegon’s Chinese asset management joint venture AIFMC due to the normalization of performance fees; and |

| • | Total holding costs remained stable compared with 2015 at EUR 162 million in 2016. |

Fair value items

The results from fair value items amounted to a loss of EUR 645 million in 2016, and were mainly driven by fair value losses in the United States. EUR 521 million fair value losses in the United States in 2016 were driven by the loss on hedging programs and the underperformance of alternative investments. Included in the loss on hedging programs in the United States is the loss on fair value hedges without accounting match in the Americas (EUR 322 million). This was mainly driven by the loss on equity hedges, which were set up to protect Aegon’s capital position. Underperformance of fair value investments of EUR 226 million was primarily driven by investments related to hedge funds in the United States. In addition, the loss on interest rate swaps was the main driver of the EUR 74 million fair value losses in 2016 at the holding.

Realized gains on investments

Realized gains on investments amounted to EUR 340 million in 2016 and were primarily related to a rebalancing of the investment portfolio in the United Kingdom and gains resulting from asset-liability management adjustments in the Netherlands.

Impairment charges

Net impairments of EUR (54) million in 2016 primarily related to investments in the energy industry in the United States.

Other charges

Other charges amounted to EUR 771 million in 2016. These were mostly caused by the book loss on the divestment of the annuity portfolio in the United Kingdom (EUR 682 million), and assumption changes and model updates (EUR (118) million).

Run-off businesses

The results of run-off businesses declined to EUR 54 million in 2016 mainly as a result of an adjustment to the intangible balances for BOLI/COLI business.

Income tax

Income tax amounted to EUR 250 million in 2016, and included one-time tax benefits in the United States and the United Kingdom. The effective tax rate on underlying earnings before tax and total income for 2016 was 22% and 30%, respectively.

Commissions and expenses

Commissions and expenses decreased by 3% in 2016 compared with 2015 to EUR 6.4 billion, mainly driven by lower amortization of deferred policy acquisition costs in the United Kingdom. Operating expenses increased by 1% in 2016 compared with 2015 to EUR 3.6 billion. Increased variable personnel expenses compared with 2015 and the acquisition of the defined contribution business from Mercer more than offset expense savings.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

15 Business and performance Business

Production

In 2016, compared with 2015, gross deposits were up 21% to EUR 100.3 billion, driven by higher gross deposits in asset management and Retirement Plans in the United States. Net deposits, excluding run-off businesses, declined to EUR 3.5 billion in 2016 compared with 2015, mostly due to lower gross deposits in variable annuities, anticipated contract discontinuances from the business acquired from Mercer, and low asset management net flows. The latter were mainly driven by market insecurity following the Brexit vote and a reduction in flows from money market funds in China. New life sales declined by 12% compared with 2015 to EUR 969 million in 2016, mostly driven by lower universal life and term life production in the United States, fewer pension buy-out sales in the Netherlands, and lower sales in Asia as a result of Aegon’s strict pricing policy in a low rate environment. New premium production for accident & health and general insurance decreased by 9% compared with 2015 to EUR 954 million in 2016, mainly as a result of several product exits and a lower contribution from portfolio acquisitions.

A.1.8 Related party transactions

This section provides information about the material transactions during the reporting period with Aegon’s shareholders, with persons who exercise a significant influence on Aegon and with members of the administrative, management or supervisory body. The second part of this section provides information on relevant operations and transactions within the Group.

Material transactions with shareholders

Referring to section A.1.3 Holders of qualifying holdings, Aegon largest and only material holder of qualifying holdings is Vereniging Aegon. All other qualifying holdings in Aegon are less than 10% and considered not material. The transactions with Vereniging Aegon during the financial year 2016 were:

| • | On May 19, 2016, Aegon N.V. repurchased 13,450,835 Common Shares from Vereniging Aegon for the amount of EUR 58 million, being the Value Weighted Average Price of the common shares of the 5 trading days preceding this transaction, as part of the EUR 400 million Share Buy Back program, initiated by Aegon N.V. in January 2016 to neutralize the dilutive effect of the cancellation of Aegon N.V.’s preferred shares in 2013. Also the amount of EUR 58 million is 14.5% of EUR 400 million, which percentage is equal to the percentage of shares held by Vereniging Aegon in the total number of outstanding and voting shares Aegon N.V. at the time of this transaction; and |

| • | On June 6, 2016, Aegon N.V. repurchased 17,324,960 Common Shares B from Vereniging Aegon for the amount of EUR 1,968,332, being 1/40th of the Value Weighted Average Price of the common shares of the 5 trading days preceding this transaction. The repurchase of common shares B was executed to align the aggregate shareholding of Vereniging Aegon in Aegon N.V. with its special cause voting rights of 32.6%. |

Material transactions with persons who exercise a significant influence on the undertaking

There are no material transactions with other persons who exercise a significant influence on the undertaking.

Remuneration of and transaction with Aegon’s Boards

The transactions during 2016 that classify as being transactions with members of the Executive, Management and Supervisory Board consist of transactions related to the remuneration (fixed compensation / conditional variable compensation) of the members of the Executive and Management Board and the remuneration of active and retired members of the Supervisory Board.

Executive Board

Through 2016, the Executive Board consisted of Mr. Wynaendts and Mr. Button. Mr. Button stepped down as CFO and member of Aegon’s Executive Board with effect from December 1, 2016. Amounts are disclosed for the period Mr. Button has been part of the Executive Board and are reflective of his time with Aegon till December 1, 2016. The total amount of remuneration, consisting of the fixed compensation, conditional variable compensation awards, other benefits and pension contributions, for Mr. Wynaendts related to 2016 was EUR 4,538 thousand and for Mr. Button EUR 2,793 thousand.

At the reporting date, Mr. Wynaendts had no loans with Aegon (mortgage loan 2015: EUR 249,158). In 2016, Mr. Wynaendts made a repayment on the mortgage loan totalling EUR 249,158. No other outstanding balances such as guarantees or advanced payments exist.

Management Board

On December 31, 2016, The Management Board, which assists the Executive Board in pursuing Aegon’s strategic goals, is formed by members of the Executive Board, the CEOs of Aegon USA, Aegon the Netherlands, Aegon UK and Aegon Central & Eastern Europe, Aegon’s Chief Risk Officer, CEO Asset Management, Chief Technology Officer, Global Head HR and the General Counsel. The total remuneration for the members of the Management Board over 2016 was EUR 18.6 million, consisting of EUR 7.0 million fixed compensation, EUR 6.4 million variable compensation awards, EUR 1.9 million other benefits and EUR 3.4 million pension benefits.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

16 Business and performance Business

Supervisory Board

The total remuneration in 2016 of active and retired members of the Supervisory Board amounted to EUR 935,875 excluding VAT. Aegon’s Supervisory Board members are entitled to a base fee for membership of the Supervisory Board. No separate attendance fees are paid to members for attendance at the regular Supervisory Board meetings. For each extra Board meeting attended, be it in person or by video and/or telephone conference, an attendance fee of EUR 3,000 is paid. Not included in the total remuneration is a premium for state health insurance paid on behalf of Dutch Supervisory Board members. There are no outstanding balances such as loans, guarantees or advanced payments.

Relevant operations and transactions within the Group

Aegon facilitates intra-group transactions (IGTs) to support intra group efficiencies, including optimizing economies of scale, processes, liquidity and capital management. Due to the nature of these activities, there is interaction with business units and affiliates within the Group, resulting in a diverse set of IGTs. These include amongst other intercompany loans, derivatives, guarantees, internal reinsurance and capital distributions. Governance of Aegon’s IGT Policy establishes definitions, governance, reporting and monitoring of IGTs ensuring a consistent standard of IGT usage across the Aegon Group for new and existing IGTs. All IGTs are further covered by the Aegon Global Transfer Pricing policy in order to ensure compliance with the internationally accepted at arm’s length principle, which dictates that related entities transact with each other as if they are third parties.

Loans

Aegon utilizes intercompany loans for operational liquidity and capital purposes. Within the Group, the following material uncollateralized intra-group loans are granted:

| • | Loans granted by Aegon N.V. to Transamerica Corporation, for an amount of EUR 3,666 million, to finance activities in the US; |

| • | Loans granted by Coöperatieve Aegon Financieringsmaatschappij U.A. (Coop) to Transamerica Corporation for an amount of EUR 662 million, to finance activities in the US; |

| • | A subordinated loan from Aegon Nederland N.V. to Aegon Levensverzekering N.V. for an amount of EUR 636 million to provide Aegon Levensverzekering N.V. with capital; and |

| • | A loan from Optas Pensioenen N.V. to Aegon Nederland N.V. for an amount of EUR 850 million. |

Current account balances

Within the Group, the following material (uncollateralized) current account balances exist on December 31, 2016: A position from Aegon Nederland N.V. to Aegon Levensverzekeringen N.V.; a position from Aegon Leven Beleggingen B.V. to Aegon Nederland N.V. and a position from Aegon Global Investment Fund B.V. to Aegon Nederland N.V. for an amount of EUR 2,985 million, EUR 2,474 million and EUR 2,692 million respectively.

Derivatives

Aegon Derivatives N.V., a 100% pass-through vehicle, centralizes and mitigates counterparty risk related to the use of OTC derivatives across the Aegon Group in one entity. Primarily European entities (except UK domiciled entities), make use of Aegon Derivatives N.V. In addition, foreign exchange derivatives are centrally managed within Aegon N.V. ensuring netting advantages. As of December 31, 2016, the net (credit) exposure on the abovementioned internal arrangements were very limited as most of these are supported by collateral arrangements.

Guarantees

Aegon N.V. and its subsidiaries provide guarantees for performance under contracts for certain aspects of the business transacted within the group. The agreements include, but are not limited to, letters of credit, (re)insurance contracts, maintenance of liquidity, capital and net worth. The performance of the various entities under the terms of the agreements are regularly assessed to ensure that the entity has sufficient resources on a best estimate basis to meet the obligations guaranteed under the agreement. As a result there is minimum exposure for these guarantees to the group.

Reinsurance

Subsidiaries of Aegon N.V. enter into reinsurance agreements in the normal course of business to (among other reasons), segregate or pool risks, manage volatility, and efficiently manage capital. Reinsurance exposures are evaluated based on the resources available within the assumptive entity and, in many cases, the reinsurance is supported by trusts, funds withheld, letters of credit and guarantees. Any exposure above these amounts are assessed based on Aegon N.V.’s IGT policy to ensure the exposure is within policy limits. There are currently no exposures greater than the policy levels set for affiliated reinsurance.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

17 Business and performance Underwriting performance

Capital distributions

Upstreaming of cash to a Holding Company is in general a capital distribution and can be in the form of a dividend. In addition, there may be situations in which an Aegon entity provided a loan to a Holding Company or when an Aegon entity repays (part of) a loan provided by a Holding Company. The decision whether or not to upstream cash to a Holding Company requires various considerations such as, but not limited to, ratings agency capital, regulatory capital, accounting and tax treatment.

A.2 Underwriting performance

| 2016 | 2015 | |||||||||||||||||||||||||||||||||||||||

| Underwriting performance by line of business Amounts in EUR millions |

Group | Life | Non- Life |

Other1) | Group | Life | Non-Life | Other1) | ||||||||||||||||||||||||||||||||

| Premium income |

23,453 | 20,400 | 3,053 | — | 22,925 | 19,583 | 3,342 | — | ||||||||||||||||||||||||||||||||

| Premiums paid to reinsurers |

3,176 | 2,932 | 244 | — | 2,979 | 2,694 | 286 | — | ||||||||||||||||||||||||||||||||

| Policyholder claims and benefits |

|

41,974 | 39,620 | 2,354 | — | 26,443 | 23,847 | 2,596 | — | |||||||||||||||||||||||||||||||

| Commissions and expenses |

||||||||||||||||||||||||||||||||||||||||

| Commissions |

2,929 | 2,495 | 662 | (228 | ) | 3,313 | 2,845 | 731 | (263 | ) | ||||||||||||||||||||||||||||||

| Operating expenses |

3,560 | 2,363 | 513 | 684 | 3,558 | 2,324 | 549 | 685 | ||||||||||||||||||||||||||||||||

| Deferred expenses |

(1,203 | ) | (1,110 | ) | (92 | ) | — | (1,533 | ) | (1,419 | ) | (108 | ) | (6 | ) | |||||||||||||||||||||||||

| Amortization of intangibles |

1,065 | 978 | 83 | 4 | 1,261 | 1,151 | 106 | 3 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total Commissions and expenses |

|

6,351 | 4,726 | 1,166 | 460 | 6,598 | 4,901 | 1,278 | 419 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

1 Includes Holding and Asset Management. |

| |||||||||||||||||||||||||||||||||||||||

| 2016 | 2015 | |||||||||||||||||||||||||||||||||||||||

| Underwriting performance by geographical Amounts in EUR millions |

Group | Americas | The Nether- lands |

United King- dom |

Other1) | Group | Americas | The Nether- lands |

United Kingdom |

Other1) | ||||||||||||||||||||||||||||||

| Premium income |

23,453 | 9,433 | 2,491 | 9,924 | 1,605 | 22,925 | 9,195 | 2,947 | 8,512 | 2,271 | ||||||||||||||||||||||||||||||

| Premiums paid to reinsurers |

3,176 | 2,609 | 13 | 593 | (39 | ) | 2,979 | 2,552 | 13 | 474 | (60 | ) | ||||||||||||||||||||||||||||

| Policyholder claims and benefits |

41,974 | 15,497 | 5,713 | 18,874 | 1,889 | 26,443 | 10,220 | 3,495 | 10,574 | 2,154 | ||||||||||||||||||||||||||||||

| Commissions and expenses |

||||||||||||||||||||||||||||||||||||||||

| Commissions |

2,929 | 2,613 | 149 | 175 | (8 | ) | 3,313 | 2,805 | 213 | 234 | 61 | |||||||||||||||||||||||||||||

| Operating expenses |

3,560 | 1,609 | 821 | 394 | 736 | 3,558 | 1,619 | 831 | 398 | 710 | ||||||||||||||||||||||||||||||

| Deferred expenses |

(1,203 | ) | (970 | ) | (11 | ) | (79 | ) | (143 | ) | (1,533 | ) | (1,205 | ) | (13 | ) | (102 | ) | (213 | ) | ||||||||||||||||||||

| Amortization of intangibles |

1,065 | 761 | 32 | 177 | 95 | 1,261 | 731 | 39 | 377 | 114 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Commissions and expenses |

6,351 | 4,013 | 991 | 667 | 680 | 6,598 | 3,950 | 1,070 | 907 | 672 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| 1 | includes all other businesses except for Americas, NL and UK. |

Premium income

Americas’ total premium income for the year 2016 amounted to EUR 9.4 billion and is comprised of recurring premiums for an amount of EUR 8.9 billion and single premiums for an amount of EUR 0.6 billion. The main lines of businesses contributing to Americas’ total premium income are Life (EUR 6.4 billion) and Individual Savings & Retirement (EUR 1.3 billion). Premiums related to run-off business for the Americas amounted to EUR 1.7 billion, and were mainly driven by the run-off for Life reinsurance. The increase in Americas’ premium income compared to 2015 is the result of an increase in renewal premiums, partly offset by a decrease in first year premiums. Total premium income of Aegon the Netherlands amounted to EUR 2.5 billion and almost entirely reflects recurring premiums. Most of Aegon the Netherlands’ premium income relates to the Pensions (EUR 1.3 billion) and Life business (EUR 0.7 billion), both reported in the Life segment, and the Non-life segment with EUR 0.5 billion. The decrease in premium income compared to 2015 is mainly caused by the decrease in premium income in the Pensions business (2015: EUR 1.5 billion) and the Non-life segment (2015: EUR 0.7 billion). Total premium income of Aegon UK amounted to EUR 9.9 billion of which EUR 2.8 billion relates to recurring premiums and EUR 7.2 billion to single premiums (including premiums related to insurance policies upgraded to the retirement platform in the UK – EUR 5.3 billion). Most of Aegon UK’s premium income relates to the Pensions business (EUR 9.3 billion).

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

18 Business and performance Investment performance

The increase in premium income compared to 2015 is driven by Pensions, as the total premium income for Pensions in 2015 amounted to EUR 7.8 billion.

Commissions and expenses

In 2016, commissions and expenses in the Americas increased by 2% compared with 2015 to EUR 4.0 billion. Operating expenses in the Americas decreased by 1% compared with 2015 to EUR 1.6 billion in 2016. Expense savings and lower restructuring charges compared with 2015 were partly offset by increased variable personnel expense and the acquisition of the defined contribution business acquired from Mercer. Commissions and expenses in the Netherlands decreased compared with 2015 to EUR 991 million in 2016. Operating expenses in the Netherlands were down compared with 2015 to EUR 821 million in 2016 as the non-recurrence of one-time charges in 2015 and expense savings were partly offset by investments in new business initiatives, Solvency II related expenses, and the cost of an IT project that will result in annual expense savings going forward. Commissions and expenses in the UK decreased by 27% in 2016 to EUR 667 million compared with 2015. Operating expenses in the UK decreased by 1% in 2016 to EUR 394 million compared with 2015, mainly due to favorable currency movements, partly offset by expenses related to the acquisitions of Cofunds and BlackRock’s defined contribution business.

Policyholder claims and benefits

Total policyholder claims and benefits amounted to EUR 42.0 billion in 2016 compared to EUR 26.4 billion in 2015. The increase of EUR 15.5 billion is mainly attributable to changes in the valuation of liabilities of insurance contracts (2016: EUR 16.2 billion and 2015: EUR 7.9 billion) and investment contracts (2016: EUR (0.1) billion) and 2015: EUR (6.7 billion). These movements are primarily driven by market impacts (equity markets and interest rates) and reflect changes in technical provisions resulting from fair value changes on for account of policyholder financial assets included in results from financial transactions of EUR 15.1 billion (2015: EUR (0.1) billion) (please see section A.3.2 Investment related results and impairments). In addition, the change in valuation of liabilities for insurance contracts includes an increase in technical provisions for life insurance contracts of EUR 2.3 billion (2015: increase of EUR 3.4 billion).

Total Claims and benefits paid amounted to EUR 25.9 billion (2015: EUR 25.3 billion) and is comprised of claims and benefits paid for Aegon’s life business amounting to EUR 23.9 billion (2015: EUR 23.1 billion) and claims and benefits paid for Aegon’s non-life business amounting to EUR 2.1 billion (2015: EUR 2.1 billion).

Of the total policyholder claims and benefits of EUR 42.0 billion, EUR 15.5 billion relates to the Americas, EUR 5.7 billion to the Netherlands and EUR 18.9 billion to the UK.

A.3 Investment performance

| Investment performance recognized in income statement | ||||||||||||

| Amounts in EUR millions |

Note | 2016 | 2015 | |||||||||

| Investment income |

A.3.1 | 7,788 | 8,525 | |||||||||

| Results from financial transactions |

A.3.2 | 15,949 | 401 | |||||||||

| Gains/(losses) on investments |

A.3.2 | 334 | 338 | |||||||||

| Net impairments |

A.3.2 | (54 | ) | 49 | ||||||||

The following sections will provide more detail about Aegon’s investment income in general and by asset class (section A.3.1) and its investment related results and impairments (section A.3.2). Section A.3.3 provides information about Aegon’s gains and losses of investments recognized directly in equity. Finally, the last section A.3.4 provides information about Aegon’s investments in securitizations.

A.3.1 Investment income

Americas is the largest contributor to the investment income with EUR 3,717 million (2015: EUR 3,680 million). Aegon Americas is followed by Aegon the Netherlands, EUR 2,135 million (2015: EUR 2,277 million), and Aegon UK with EUR 1,661 million (EUR 2,331 million).

Most of Aegon’s investment income relates to investment income related to general account investments for an amount of

EUR 5,737 million (2015: EUR 6,099 million), while the investment income for account of policyholders amounted to EUR 2,051 million (EUR 2,426 million), mainly due to the fact that the investments for account of policyholders are on a fair value through profit or loss (FVTPL) basis.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

19 Business and performance Investment performance

Investment income by asset class

For interest-bearing assets, interest is recognized as it accrues and is calculated using the effective interest rate method. Fees and commissions that are an integral part of the effective yield of the financial assets or liabilities are recognized as an adjustment to the effective interest rate of the instrument. Investment income includes the interest income and dividend income on financial assets carried at fair value through profit or loss. Investment income also includes rental income due, as well as fees received for security lending.

| 2016 | 2015 | |||||||||||||||||||||||||||||||

| Investment Income by asset class | Interest | Dividend | Rental | Interest | Dividend | Rental | ||||||||||||||||||||||||||

| Amounts in EUR millions |

income | income | income | Total | income | income | income | Total | ||||||||||||||||||||||||

| Shares |

— | 1,180 | — | 1,180 | — | 1,306 | — | 1,306 | ||||||||||||||||||||||||

| Debt securities and money market instruments |

4,838 | — | — | 4,838 | 5,332 | — | — | 5,332 | ||||||||||||||||||||||||

| Loans |

1,752 | — | — | 1,752 | 1,760 | — | — | 1,760 | ||||||||||||||||||||||||

| Real estate |

— | — | 129 | 129 | — | — | 133 | 133 | ||||||||||||||||||||||||

| Other |

(111 | ) | — | — | (111 | ) | (6 | ) | — | (6 | ) | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

6,479 | 1,180 | 129 | 7,788 | 7,086 | 1,306 | 133 | 8,525 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Included in interest income is EUR 230 million (2015: EUR 223 million) in respect of interest income accrued on impaired financial assets. The interest income on financial assets that are not carried at fair value through profit or loss amounted to EUR 5,642 million (2015: EUR 5,951 million).

Most of Aegon’s investment income relates to debt securities and money market instruments, namely EUR 4,838 million (2015: EUR 5,332 million), which represent 62% (2015: 63%) of total investment income. The expenses related to debt securities and money market instruments mainly consisted of transaction costs. As the transaction costs are included in the fair value at the date of recognition, these are not separately disclosed.

A.3.2 Investment related results and impairments

First, this section will provide more information about Aegon’s results from financial transactions amounting to EUR 15,949 million, followed by its gains/(losses) on investments amounting to EUR 334 million. Finally, information about Aegon’s net impairments is provided, amounted to EUR (54) million.

Results from financial transactions

The income arising from financial transactions during the years 2016 and 2015 comprises of:

| Results from financial transactions | ||||||||

| Amounts in EUR millions |

2016 | 2015 | ||||||

| Net fair value change of General Account investments at FVtPL other than derivatives |

(42 | ) | (35 | ) | ||||

| Realized gains and losses on financial investments |

327 | 349 | ||||||

| Gains and (losses) on investments in real estate |

70 | 145 | ||||||

| Net fair value change of derivatives |

435 | 3 | ||||||

| Net fair value change of policyholder’ assets at FVtPL |

15,121 | (110 | ) | |||||

| Net fair value change of investments in real estate for policyholder |

(26 | ) | 67 | |||||

| Net foreign currency gains and (losses) |

41 | (29 | ) | |||||

| Net fair value change on borrowing and other financial liabilities |

21 | 9 | ||||||

| Realized gains and (losses) on repurchased debt |

1 | 2 | ||||||

|

|

|

|

|

|||||

| Total results from financial transactions |

15,949 | 401 | ||||||

|

|

|

|

|

|||||

The net fair value change on for account of policyholder financial assets amounted to EUR 15,121 million in 2016 (2015: EUR (110) million) and is driven by equity markets and interest rate movements. Net fair value change on for account of policyholder at FVtPL are offset by changes in technical provisions.

Gains/(losses) on investments

Gains on investments amounted to EUR 334 million in 2016 (2015: EUR 338 million) and were primarily related to a rebalancing of the investment portfolio in the United Kingdom and gains resulting from asset-liability management adjustments in the Netherlands.

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

20 Business and performance Investment performance

Net impairments

Net impairments amounted to EUR (54) million in 2016 (2015: EUR 49 million), and were primarily related to investments in the energy industry in the United States.

A.3.3 Gains and losses recognized directly in equity

This section provides information about the gains and losses of investments recognized directly in equity. The gains and losses of investments recognized directly in equity consist of the unrealized gains or losses of available-for-sale investments.

| Items that may be reclassified subsequently to profit and loss | ||||||||

| Amounts in EUR millions |

2016 | 2015 | ||||||

| Gains/(losses) on revaluation of available-for-sale investments |

854 | (2,175 | ) | |||||

| (Gains)/losses transferred to income statement on disposal and impairment of available-for-sale investments |

(2,122 | ) | (485 | ) | ||||

|

|

|

|

|

|||||

Gains on revaluation of available-for-sale investments amounted to EUR 854 million (2015: EUR (2,175) million) reflecting favorable markets resulting in credit spreads tightening and an overall positive revaluation of available-for-sale investments.

As of December 2016, gains transferred to the income statement on disposal and impairment of available-for-sale investments amounted to EUR (2,122) million (2015: EUR (485) million) and reflect the previously held unrealized gains as bonds were sold mainly as part of the sale of the UK annuity portfolio.

A.3.4 Investments in securitization

This section provides information about any of Aegon’s investments in securitizations.

Residential mortgage-backed securities

Aegon Americas, Aegon the Netherlands and Aegon UK hold EUR 4,162 million (2015: EUR 5,011 million) of residential mortgage-backed securities available-for-sale (RMBS), of which EUR 3,494 million (2015: EUR 4,232 million) is held by Aegon Americas, EUR 649 million (2015: EUR 757 million) by Aegon the Netherlands, and EUR 19 million (2015: EUR 21 million) by Aegon UK. Residential mortgage-backed securities are securitizations of underlying pools of non-commercial mortgages on real estate. The underlying residential mortgages have varying credit characteristics and are pooled together and sold in tranches. The following tables show the breakdown of Aegon USA’s RMBS available-for-sale (AFS) portfolio.

| 2016 | ||||||||||||||||||||||||||||

| AFS RMBS by quality Amounts in EUR millions |

AAA | AA | A | BBB | <BBB | Total amortized cost |

Total fair value |

|||||||||||||||||||||

| GSE guaranteed |

771 | 500 | — | — | — | 1,272 | 1,271 | |||||||||||||||||||||

| Prime jumbo |

— | 1 | 1 | 11 | 170 | 182 | 194 | |||||||||||||||||||||

| Alt-A |

— | 39 | 27 | 11 | 403 | 479 | 572 | |||||||||||||||||||||

| Negative amortization floaters |

— | — | — | 1 | 679 | 679 | 712 | |||||||||||||||||||||

| Other housing |

— | 50 | 71 | 43 | 519 | 683 | 745 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| At December 31, 2016 |

771 | 589 | 98 | 65 | 1,771 | 3,295 | 3,494 | |||||||||||||||||||||

| Of which insured |

— | — | 43 | 8 | 203 | 254 | 237 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| 2015 | ||||||||||||||||||||||||||||

| AFS RMBS by quality Amounts in EUR millions |

AAA | AA | A | BBB | <BBB | Total amortized cost |

Total fair value |

|||||||||||||||||||||

| GSE guaranteed |

1,471 | — | — | — | — | 1,471 | 1,493 | |||||||||||||||||||||

| Prime jumbo |

— | 1 | 1 | 13 | 199 | 213 | 224 | |||||||||||||||||||||

| Alt-A |

— | — | 30 | 3 | 476 | 509 | 596 | |||||||||||||||||||||

| Negative amortization floaters |

— | — | — | 1 | 781 | 782 | 807 | |||||||||||||||||||||

| Other housing |

— | — | — | — | — | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| At December 31, 2015 |

1,472 | 44 | 151 | 301 | 2,121 | 4,090 | 4,232 | |||||||||||||||||||||

| Of which insured |

— | — | 66 | 10 | 268 | 343 | 333 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Solvency and Financial Condition Report Group 2016 |

|

Table of Contents

21 Business and performance Investment performance

A significant part of Aegon USA’s RMBS holdings are rated < BBB, as the issuances took place before the United States housing downturn that started in 2007. Additionally, Aegon USA has investments in RMBS of EUR 89 million (December 31, 2015: EUR 93 million), which are classified as fair value through profit or loss.