10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 30, 2016

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 1-8897

BIG LOTS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Ohio | | 06-1119097 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

300 Phillipi Road, P.O. Box 28512, Columbus, Ohio | | 43228-5311 |

(Address of principal executive offices) | | (Zip Code) |

| | |

(614) 278-6800 |

(Registrant’s telephone number, including area code) |

| | |

Securities registered pursuant to Section 12(b) of the Act: | | |

Title of each class | | Name of each exchange on which registered |

Common Shares $0.01 par value | | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yesþ Noo

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yeso Noþ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesþ Noo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yesþ Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o Noþ

The aggregate market value of the Common Shares held by non-affiliates of the Registrant (assuming for these purposes that all executive officers and directors are “affiliates” of the Registrant) was $2,100,837,274 on August 1, 2015, the last business day of the Registrant's most recently completed second fiscal quarter (based on the closing price of the Registrant's Common Shares on such date as reported on the New York Stock Exchange).

The number of the registrant’s common shares, $0.01 par value, outstanding as of March 25, 2016, was 49,683,394.

Documents Incorporated by Reference

Portions of the registrant's Proxy Statement for its 2016 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

BIG LOTS, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED JANUARY 30, 2016

TABLE OF CONTENTS

|

| | |

| Part I | Page |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

| | |

| Part II | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| | |

| Part III | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| | |

| Part IV | |

Item 15. | | |

| | |

| | |

Part I

Item 1. Business

The Company

Big Lots, Inc., an Ohio corporation, through its wholly owned subsidiaries (collectively referred to herein as “we,” “us,” and “our” except as used in the reports of our independent registered public accounting firm included in Item 8 of this Annual Report on Form 10-K (“Form 10-K”)), is a unique, non-traditional, discount retailer operating in the United States of America (“U.S.”) (see the discussion below under the caption “Merchandise”). At January 30, 2016, we operated a total of 1,449 stores. Our goal is to exceed our core customer’s expectations by providing her with great savings on value-priced merchandise, which includes tasteful and “trend-right” import merchandise, consistent and replenishable “never out” offerings, and brand-name closeouts. You can locate us on the Internet at www.biglots.com. The contents of our websites are not part of this report.

Similar to many other retailers, our fiscal year ends on the Saturday nearest to January 31, which results in some fiscal years being comprised of 52 weeks and some being comprised of 53 weeks. Unless otherwise stated, references to years in this Form 10-K relate to fiscal years rather than to calendar years. The following table provides a summary of our fiscal year calendar and the associated number of weeks in each fiscal year:

|

| | | | | | |

Fiscal Year | | Number of Weeks | | Year Begin Date | | Year End Date |

2016 | | 52 | | January 31, 2016 | | January 28, 2017 |

2015 | | 52 | | February 1, 2015 | | January 30, 2016 |

2014 | | 52 | | February 2, 2014 | | January 31, 2015 |

2013 | | 52 | | February 3, 2013 | | February 1, 2014 |

2012 | | 53 | | January 29, 2012 | | February 2, 2013 |

2011 | | 52 | | January 30, 2011 | | January 28, 2012 |

We manage our business on the basis of one segment: discount retailing. We evaluate and report overall sales and merchandise performance based on the following key merchandising categories: Food, Consumables, Soft Home, Hard Home, Furniture, Seasonal, and Electronics & Accessories. The Food category includes our beverage & grocery, candy & snacks, and specialty foods departments. The Consumables category includes our health and beauty, plastics, paper, chemical, and pet departments. The Soft Home category includes our home décor, frames, fashion bedding, utility bedding, bath, window, decorative textile, and area rugs departments. The Hard Home category includes our small appliances, table top, food preparation, stationery, greeting cards, and home maintenance departments. The Furniture category includes our upholstery, mattress, ready-to-assemble, and case goods departments. The Seasonal category includes our lawn & garden, summer, Christmas, toys, and other holiday departments. The Electronics & Accessories category includes our electronics, jewelry, hosiery, and infant accessories departments. Please refer to the consolidated financial statements and related notes in this Form 10-K for our financial information. Specifically, see note 15 to the accompanying consolidated financial statements for our net sales results by merchandise category for 2015, 2014, and 2013.

In May 2001, Big Lots, Inc. was incorporated in Ohio and was the surviving entity in a merger with Consolidated Stores Corporation, a Delaware corporation. By virtue of the merger, Big Lots, Inc. succeeded to all the businesses, properties, assets, and liabilities of Consolidated Stores Corporation. In July 2011, we acquired 100% of the outstanding shares of Liquidation World Inc. (subsequently named Big Lots Canada, Inc.). In 2014, we completed the wind down and dissolution of Big Lots Canada, Inc.

Our principal executive offices are located at 300 Phillipi Road, Columbus, Ohio 43228, and our telephone number is (614) 278‑6800.

Merchandise

Our business has historically focused on selling value-based merchandise sourced through closeout channels, which can result in inconsistent offerings to our customers. In 2014, we implemented a merchandising strategy to improve the consistency of the value-based merchandise available in our stores by reducing our reliance on sourcing closeout offerings in certain merchandise categories. In order to improve the consistency of our merchandise, we introduced new disciplines for purchasing merchandise through the use of a ratings process that measures quality, brand, fashion, and value. This discipline requires us to focus our decision-making activities on our customers’ expectations and enables us to compare the potential performance of traditionally-sourced merchandise, either domestic or import, to closeout merchandise, which is generally sourced from production overruns, packaging changes, discontinued products, order cancellations, liquidations, returns, and other disruptions in the supply chain of manufacturers. We believe this greater level of focus on our customers’ expectations enhances our ability to provide a desirable assortment of offerings in our merchandise categories and improves our inventory turnover. For net sales and comparable store sales by merchandise category, see the discussion below under the captions “2015 Compared To 2014” and “2014 Compared To 2013” in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” (“MD&A”) of this Form 10-K.

Real Estate

The following table compares the number of our stores in operation at the beginning and end of each of the last five fiscal years:

|

| | | | | | | | | | | | | | |

| 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

Stores open at the beginning of the year | 1,460 |

| | 1,493 |

| | 1,495 |

| | 1,451 |

| | 1,398 |

|

Stores opened during the year | 9 |

| | 24 |

| | 55 |

| | 87 |

| | 92 |

|

Stores closed during the year | (20 | ) | | (57 | ) | | (57 | ) | | (43 | ) | | (39 | ) |

Stores open at the end of the year | 1,449 |

| | 1,460 |

| | 1,493 |

| | 1,495 |

| | 1,451 |

|

For additional information about our real estate strategy, see the discussion under the caption “Operating Strategy - Real Estate” in the accompanying MD&A in this Form 10-K.

In addition, in 2011, we acquired 89 stores in Canada as a result of our acquisition of Liquidation World Inc. (subsequently renamed Big Lots Canada, Inc.) (which are not included in the above table). During the first quarter of 2014, we wound down and discontinued the operations of Big Lots Canada, Inc. and closed all of our stores in Canada (which are not included in the above table).

The following table details our U.S. stores by state at January 30, 2016:

|

| | | | | | | | | | |

Alabama | 29 |

| | Maine | 6 |

| | Ohio | 96 |

|

Arizona | 39 |

| | Maryland | 26 |

| | Oklahoma | 18 |

|

Arkansas | 12 |

| | Massachusetts | 21 |

| | Oregon | 15 |

|

California | 159 |

| | Michigan | 45 |

| | Pennsylvania | 69 |

|

Colorado | 19 |

| | Minnesota | 7 |

| | Rhode Island | 1 |

|

Connecticut | 13 |

| | Mississippi | 14 |

| | South Carolina | 33 |

|

Delaware | 5 |

| | Missouri | 25 |

| | Tennessee | 47 |

|

Florida | 103 |

| | Montana | 3 |

| | Texas | 116 |

|

Georgia | 54 |

| | Nebraska | 3 |

| | Utah | 9 |

|

Idaho | 6 |

| | Nevada | 13 |

| | Vermont | 4 |

|

Illinois | 34 |

| | New Hampshire | 7 |

| | Virginia | 40 |

|

Indiana | 45 |

| | New Jersey | 28 |

| | Washington | 28 |

|

Iowa | 3 |

| | New Mexico | 12 |

| | West Virginia | 17 |

|

Kansas | 8 |

| | New York | 63 |

| | Wisconsin | 12 |

|

Kentucky | 40 |

| | North Carolina | 74 |

| | Wyoming | 2 |

|

Louisiana | 24 |

| | North Dakota | 1 |

| | District of Columbia | 1 |

|

| | | | | | Total stores | 1,449 |

|

| | | | | | Number of states | 47 |

|

Of our 1,449 stores, 33% operate in four states: California, Texas, Ohio, and Florida, and net sales from stores in these states represented 35% of our 2015 net sales. We have a concentration in these states based on their size, population, and customer base.

Associates

At January 30, 2016, we had approximately 35,900 active associates comprised of 11,400 full-time and 24,500 part‑time associates. Approximately 68% of the associates employed throughout the year are employed on a part-time basis. Temporary associates hired for the holiday selling season increased the number of associates to a peak of approximately 39,900 in 2015. We consider our relationship with our associates to be good, and we are not a party to any labor agreements.

Competition

We operate in the highly competitive retail industry. We face strong sales competition from other general merchandise, discount, food, furniture, arts and crafts, and dollar store retailers, which operate in traditional brick and mortar stores and/or online. Additionally, we compete with a number of companies for retail site locations, to attract and retain quality employees, and to acquire our broad merchandising assortment from vendors.

Purchasing

Our goal is to provide great savings to our customers through value-based merchandise offerings. In 2014, we implemented a merchandising strategy to improve the consistency of the value-based merchandise available in our stores by reducing our reliance on sourcing closeout offerings in certain merchandise categories. In particular, we expanded our planned purchases in our Food, Soft Home, and Furniture merchandise categories, which provide an assortment of merchandise that our customers expect us to consistently offer in our stores at a significant value savings.

Although reduced in certain categories, the sourcing and purchasing of quality closeout merchandise directly from manufacturers and other vendors, typically at prices below those paid by traditional discount retailers, continues to represent an important competitive advantage for our business. We believe that we have built strong relationships with many brand-name vendors, and these relationships, along with our purchasing power, enable us to source merchandise that provides exceptional value to our customers. One of the key factors in building our vendor relationships is our ability to purchase significant quantities of closeout merchandise and then control its distribution throughout our broad store footprint, in accordance with our vendor’s guidelines. We believe our sourcing model, along with our strong credit profile, provide a high level of service and convenience to our vendors. We intend to continue to deepen our relationships with our top 200 vendors. Our sourcing channels also include bankruptcies, liquidations, and insurance claims. We expect that the unpredictability of the retail and manufacturing environments coupled with what we believe is our significant purchasing power position will continue to support our ability to source quality closeout merchandise at competitive prices.

During 2015, we purchased approximately 24% of our merchandise directly from overseas vendors, including approximately 20% from vendors located in China. Additionally, a significant amount of our domestically-purchased merchandise is manufactured abroad. As a result, a significant portion of our merchandise supply is subject to certain risks described in “Item 1A. Risk Factors” of this Form 10-K.

Warehouse and Distribution

The majority of our merchandise offerings are processed for retail sale and distributed to our stores from our five regional distribution centers located in Pennsylvania, Ohio, Alabama, Oklahoma, and California. We selected the locations of our distribution centers to minimize transportation costs and the distance from distribution centers to our stores. While certain of our merchandise vendors deliver directly to our stores, the large majority of our inventory is staged and delivered from our distribution centers to facilitate prompt and efficient distribution and transportation of merchandise to our stores and help maximize our sales and inventory turnover rate. During 2015, we announced our intention to open a new distribution center in California and relocating our existing California operations to this facility. This transition is anticipated to occur in 2018.

In addition to the regional distribution centers that handle merchandise, we operate a warehouse within our Ohio distribution center that distributes fixtures and supplies to our stores and our five regional distribution centers.

For additional information regarding our warehouses and distribution facilities and related initiatives, see the discussion under the caption “Warehouse and Distribution” in “Item 2. Properties” of this Form 10-K.

Advertising and Promotion

Our brand image is an important part of our marketing program. Our principal trademarks, including the Big Lots® family of trademarks, have been registered with the U.S. Patent and Trademark Office. We use a variety of marketing vehicles to promote our brand operations, including television, internet, social media, in-store point-of-purchase, and print media.

In all markets served by our stores, we design and distribute printed advertising circulars, through a combination of newspaper insertions and mailings. In 2015, we distributed multi-page circulars representing 31 weeks of advertising coverage, which resulted in a one week increase from 2014. We create regional versions of these circulars to tailor our advertising message to market differences caused by product availability, climate, and customer preferences. Our customer database, which we refer to as the Buzz Club®, is an important marketing tool that allows us to communicate in a cost effective manner with our customers, including e-mail delivery of our circulars. In addition to the Buzz Club®, we operate the Buzz Club Rewards® program (“Rewards”), which allows us to send specialized promotions to targeted customer groups with the intention of reinforcing and expanding their desire to shop at our stores.

A newer element of our marketing approach focuses on brand management through social and digital media outlets. We have devoted focused resources to communicate our message directly to our core customers through Facebook®, Twitter®, Pinterest®, and YouTube®. A more traditional element of our marketing program is our television campaign, which combines elements of strategic branding and promotion. These same elements are also used in most of our other marketing media. Our highly-targeted media placement strategy uses national cable as the foundation of our television advertising. In addition, we use in-store promotional materials, including in-store signage, to emphasize special bargains and significant values offered to our customers. Total advertising expense as a percentage of total net sales was 1.8%, 1.9%, and 1.9% in 2015, 2014, and 2013, respectively.

Seasonality

We have historically experienced, and expect to continue to experience, seasonal fluctuations in our sales and profitability, with a larger percentage of our net sales and operating profit realized in our fourth fiscal quarter. In addition, our quarterly net sales and operating profits can be affected by the timing of new store openings and store closings, the timing of advertising, and the timing of certain holidays. We historically receive a higher proportion of merchandise, carry higher inventory levels, and incur higher outbound shipping and payroll expenses as a percentage of sales in our third fiscal quarter in anticipation of increased sales activity during our fourth fiscal quarter. Performance during our fourth fiscal quarter typically reflects a leveraging effect which has a favorable impact on our operating results because net sales are higher and certain of our costs, such as rent and depreciation, are fixed and do not vary as sales levels escalate. For a quantitative view of this leveraging effect, see “Seasonality” in the accompanying MD&A in this Form 10-K.

The seasonality of our net sales and related merchandise inventory requirements influences the availability of and demand for cash or access to credit. We historically have drawn upon our credit facility to assist in funding our working capital requirements, which typically peak near the end of our third fiscal quarter. We historically have higher net sales, operating profits, and cash flow provided by operations in the fourth fiscal quarter which allows us to substantially repay our seasonal borrowings. In 2015, our total indebtedness (outstanding borrowings and letters of credit) peaked in November 2015 at approximately $383 million under our $700 million unsecured credit facility entered into in July 2011, and most recently amended in May 2015 (“2011 Credit Agreement”). The 2011 Credit Agreement expires in May 2020. At January 30, 2016, our total indebtedness under the 2011 Credit Agreement was $65.5 million, which included $62.3 million in borrowings and $3.2 million in outstanding letters of credit. We expect that borrowings will vary throughout 2016 depending on various factors, including our seasonal need to acquire merchandise inventory prior to the peak selling season, the timing and amount of sales to our customers, and the timing of share repurchase or dividend payment activity. For a discussion of our sources and uses of funds, see “Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” and “Capital Resources and Liquidity” in the accompanying MD&A, in this Form 10-K.

Available Information

We make available, free of charge, through the “Investor Relations” section of our website (www.biglots.com) under the “SEC Filings” caption, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), as soon as reasonably practicable after we file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). Our filings with the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. These filings are also available on the SEC’s website at http://www.sec.gov free of charge as soon as reasonably practicable after we have filed the above referenced reports.

In the “Investor Relations” section of our website (www.biglots.com) under the “Corporate Governance” and “SEC Filings” captions, the following information relating to our corporate governance may be found: Corporate Governance Guidelines; charters of our Board of Directors’ Audit, Compensation, Nominating/Corporate Governance Committees, and our Public Policy and Environmental Affairs Committee; Code of Business Conduct and Ethics; Code of Ethics for Financial Officers; Chief Executive Officer and Chief Financial Officer certifications related to our SEC filings; the means by which shareholders may communicate with our Board of Directors; and transactions in our securities by our directors and executive officers. The Code of Business Conduct and Ethics applies to all of our associates, including our directors and our principal executive officer, principal financial officer, and principal accounting officer. The Code of Ethics for Financial Professionals applies to our Chief Executive Officer and all other Senior Financial Officers (as that term is defined therein) and contains provisions specifically applicable to the individuals serving in those positions. We intend to satisfy the requirement under Item 5.05 of Form 8-K regarding disclosure of amendments to and waivers from, if any, our Code of Business Conduct and Ethics (to the extent applicable to our directors and executive officers (including our principal executive officer, principal financial officer and principal accounting officer)) and our Code of Ethics for Financial Professionals in the “Investor Relations” section of our website (www.biglots.com) under the “Corporate Governance” caption. We will provide any of the foregoing information without charge upon written request to our Corporate Secretary. The contents of our website are not incorporated into, or otherwise made a part of, this Form 10-K.

Item 1A. Risk Factors

The statements in this section describe the material risks to our business and should be considered carefully. In addition, these statements constitute cautionary statements under the Private Securities Litigation Reform Act of 1995.

Our disclosure and analysis in this Form 10-K and in our 2015 Annual Report to Shareholders contain forward-looking statements that set forth anticipated results based on management’s plans and assumptions. From time to time, we also provide forward-looking statements in other materials we release to the public as well as oral forward-looking statements. Such statements give our current expectations or forecasts of future events; they do not relate strictly to historical or current facts. Such statements are commonly identified by using words such as “anticipate,” “estimate,” “expect,” “objective,” “goal,” “project,” “intend,” “plan,” “believe,” “will,” “should,” “may,” “target,” “forecast,” “guidance,” “outlook,” and similar expressions in connection with any discussion of future operating or financial performance. In particular, forward-looking statements include statements relating to future actions, future performance, or results of current and anticipated products, sales efforts, expenses, interest rates, the outcome of contingencies, such as legal proceedings, and financial results.

We cannot guarantee that any forward-looking statement will be realized. Achievement of future results is subject to risks, uncertainties, and potentially inaccurate assumptions. If known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those anticipated, estimated, or projected results set forth in the forward-looking statements. You should bear this in mind as you consider forward-looking statements.

You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date thereof. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC.

The following cautionary discussion of material risks, uncertainties, and assumptions relevant to our businesses describes factors that, individually or in the aggregate, we believe could cause our actual results to differ materially from expected and historical results. Additional risks not presently known to us or that we presently believe to be immaterial also may adversely impact us. Should any risks or uncertainties develop into actual events, these developments could have material adverse effects on our business, financial condition, results of operations, and liquidity. Consequently, all of the forward-looking statements are qualified by these cautionary statements, and there can be no assurance that the results or developments we anticipate will be realized or that they will have the expected effects on our business or operations. We note these factors for investors as permitted by the Private Securities Litigation Reform Act of 1995. There can be no assurances that we have correctly and completely identified, assessed, and accounted for all factors that do or may affect our business, financial condition, results of operations, and liquidity, as it is not possible to predict or identify all such factors. Consequently, you should not consider the following to be a complete discussion of all potential risks or uncertainties.

Our ability to achieve the results contemplated by forward-looking statements is subject to a number of factors, any one, or a combination, of which could materially affect our business, financial condition, results of operations, or liquidity. These factors may include, but are not limited to:

If we are unable to successfully execute our operating strategies, our operating performance could be significantly impacted.

There is a risk that we will be unable to meet or exceed our operating performance targets and goals in the future if our strategies and initiatives are unsuccessful. During 2013 and early 2014, our senior leadership team developed the core principles of our new strategic plan. During 2014 and 2015, we began to execute on our strategic plan. Our ability to adapt our strategic plan to a changing marketplace and to execute the business activities associated with our operating and strategic plans, could impact our ability to meet our operating performance targets. See the accompanying MD&A in this Form 10-K for additional information concerning our operating strategy.

If we are unable to compete effectively in the highly competitive discount retail industry, our business and results of operations may be materially adversely affected.

The discount retail industry, which includes both traditional brick and mortar stores and online marketplaces, is highly competitive. As discussed in Item 1 of this Form 10-K, we compete for customers, products, employees, real estate, and other aspects of our business with a number of other companies. Some of our competitors have greater financial, broader distribution (e.g., more stores and a current online presence), marketing, and other resources than us. It is possible that increased competition, significant discounting, or improved performance by our competitors may reduce our market share, gross margin, and operating margin, and may materially adversely affect our business and results of operations.

If we are unable to compete effectively in today’s omnichannel retail marketplace, our business and results of operations may be materially adversely affected.

With the continued expansion of mobile computing devices, competition from other retailers in the online retail marketplace is expected to increase. Certain of our competitors, and a number of pure online retailers, have established online operations against which we compete for customers and products. It is possible that the increasing competition in the online retail space may reduce our market share, gross margin, and operating margin, and may materially adversely affect our business and results of operations in other ways. We currently do not offer an omnichannel experience and online retailing. Our current strategic plan includes providing an omnichannel experience and online retailing capabilities in 2016, which we intend to use to increase our total net sales. Development and implementation of an online retail channel is a complex undertaking and there is no guarantee that the resources that we have applied to this effort will result in increased revenues or improved operating performance. If our online retailing initiatives do not meet our customers’ expectations, the initiatives may reduce our customers’ desire to purchase goods from us both online and at our brick and mortar stores and may materially adversely affect our business and results of operations.

Our inability to properly manage our inventory levels and offer merchandise that our customers want may materially impact our business and financial performance.

We must maintain sufficient inventory levels to successfully operate our business. However, we also must seek to avoid accumulating excess inventory to maintain appropriate in-stock levels. We obtain approximately one quarter of our merchandise directly from vendors outside of the U.S. These foreign vendors often require lengthy advance notice of our requirements to be able to supply products in the quantities that we request. This usually requires us to order merchandise and enter into purchase order contracts for the purchase of such merchandise well in advance of the time these products are offered for sale. As a result, we may experience difficulty in responding to a changing retail environment, which makes us vulnerable to changes in price and in consumer preferences. In addition, we attempt to maximize our operating profit and operating efficiency by delivering proper quantities of merchandise to our stores in a timely manner. If we do not accurately anticipate future demand for a particular product or the time it will take to replenish inventory levels, our inventory levels may not be appropriate and our results of operations may be negatively impacted.

We rely on manufacturers located in foreign countries for significant amounts of merchandise and a significant amount of our domestically-purchased merchandise is manufactured abroad. Our business may be materially adversely affected by risks associated with international trade.

Global sourcing of many of the products we sell is an important factor in driving higher operating profit. During 2015, we purchased approximately 24% of our products directly from overseas vendors, including 20% from vendors located in China, and a significant amount of our domestically-purchased merchandise is manufactured abroad. Our ability to identify qualified vendors and to access products in a timely and efficient manner is a significant challenge, especially with respect to goods sourced outside of the U.S. Global sourcing and foreign trade involve numerous factors and uncertainties beyond our control including increased shipping costs, increased import duties, more restrictive quotas, loss of most favored nation trading status, currency and exchange rate fluctuations, work stoppages, transportation delays, economic uncertainties such as inflation, foreign government regulations, political unrest, natural disasters, war, terrorism, trade restrictions (including retaliation by the United States against foreign practices), political instability, the financial stability of vendors, merchandise quality issues, and tariffs. These and other issues affecting our international vendors could materially adversely affect our business and financial performance.

Changes by vendors related to the management of their inventories may reduce the quantity and quality of brand-name closeout merchandise available to us or may increase our cost to acquire brand-name closeout merchandise, either of which may materially adversely affect our revenues and gross margin.

We have very little control over the supply, design, function, availability, or cost of much of the closeout merchandise that we source for sale in our stores. Our ability to meet or exceed our operating performance targets depends upon the sufficient availability of closeout merchandise, in certain merchandise categories that we can acquire and offer at prices that represent a value to our customers. To the extent that certain of our vendors are better able to manage their inventory levels and reduce the amount of their excess inventory, the amount of closeout merchandise available to us could be materially reduced. Shortages or disruptions in the availability of closeout merchandise of a quality acceptable to our customers and us would likely have a material adverse effect on our sales and gross margin and may result in customer dissatisfaction.

Disruption to our distribution network, the capacity of our distribution centers, and the timely receipt of merchandise inventory could adversely affect our operating performance.

We rely on our ability to replenish depleted merchandise inventory through deliveries to our distribution centers and from the distribution centers to our stores by various means of transportation, including shipments by sea, rail and truck carriers. A decrease in the capacity of carriers and/or labor strikes (e.g., the West Coast ports), disruptions or shortages in the transportation industry could negatively affect our distribution network, the timely receipt of merchandise and transportation costs. In addition, long-term disruptions to the U.S. and international transportation infrastructure from wars, political unrest, terrorism, natural disasters, governmental budget constraints and other significant events that lead to delays or interruptions of service could adversely affect our business. Also, a fire, earthquake, or other disaster at one of our distribution centers could disrupt our timely receipt, processing and shipment of merchandise to our stores which could adversely affect our business. Additionally, as we seek to expand our operation through the implementation of our online retail capabilities, we may face increased or unexpected demands on distribution center operations, as well as new demands on our distribution network.

If we are unable to secure customer, employee, vendor and company data, our systems could be compromised, our reputation could be damaged, and we could be subject to penalties or lawsuits.

In the normal course of business, we process and collect relevant data about our customers, employees and vendors. During 2016, our normal activities will expand to include conducting sales transactions through an online channel. The protection of our customer, employee, vendor and company data is critical to us. We have implemented procedures, processes and technologies designed to safeguard our customers’ debit and credit card information and other private data, our employees’ and vendors’ private data, and the Company’s records and intellectual property. We also utilize third-party service providers in connection with certain technology related activities, including credit card processing, website hosting, data encryption and software support. We require these providers to take appropriate measures to secure such data and information and assess their ability to do so.

Despite our procedures, technologies and other information security measures, we cannot be certain that our information technology systems or the information technology systems of our third-party service providers are or will be able to prevent, contain or detect all cyberattacks, cyberterrorism, or security breaches. As evidenced by other retailers who have suffered serious security breaches, we may be vulnerable to data security breaches and data loss, including cyberattacks. A material breach of our security measures or our third-party service providers’ security measures, the misuse of our customer, employee, vendor and company data or information or our failure to comply with applicable privacy and information security laws and regulations could result in the exposure of sensitive data or information, attract a substantial amount of negative media attention, damage our customer or employee relationships and our reputation and brand, distract the attention of management from their other responsibilities, subject the Company to government enforcement actions, private litigation, penalties and costly response measures, and result in lost sales and a reduction in the market value of our common shares. While we have insurance, in the event we experience a material data or information security breach, our insurance may not be sufficient to cover the impact to our business, or insurance proceeds may not be paid timely.

In addition, the regulatory environment surrounding data and information security and privacy is increasingly demanding, as new and revised requirements are frequently imposed across our business. Compliance with more demanding privacy and information security laws and standards may result in significant expense due to increased investment in technology and the development of new operational processes.

If we are unable to maintain or upgrade our computer systems or if we are unable to convert to alternate systems in an efficient and timely manner, our operations may be disrupted or become less efficient.

We depend on a variety of information technology and computer systems for the efficient functioning of our business. We rely on certain hardware, telecommunications and software vendors to maintain and periodically upgrade many of these systems so that we can continue to support our business. Various components of our information technology and computer systems, including hardware, networks, and software, are licensed to us by third party vendors. We rely extensively on our information technology and computer systems to process transactions, summarize results, and manage our business. Our information technology and computer systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, cyberattacks or other security breaches, catastrophic events such as fires, floods, earthquakes, tornados, hurricanes, acts of war or terrorism, and usage errors by our employees or our contractors. In recent years, we have begun using hosted solutions for certain of our information technology and computers systems, which are more exposed to telecommunication failures. If our information technology or computer systems are damaged or cease to function properly, we may have to make a significant investment to fix or replace them, and we may suffer loss of critical data and interruptions or delays in our operations as a result. Any material interruption experienced by our information technology or computer systems could negatively affect our business and results of operations. Costs and potential interruptions associated with the implementation of new or upgraded systems and technology or with maintenance or adequate support of our existing systems could disrupt or reduce the efficiency of our business.

Declines in general economic condition, disposable income levels, and other conditions could lead to reduced consumer demand for our merchandise thereby materially affecting our revenues and gross margin.

Our results of operations can be directly impacted by the health of the U.S. economy. Our business and financial performance may be adversely impacted by current and future economic conditions, including factors that may restrict or otherwise negatively impact consumer financing, disposable income levels, unemployment levels, energy costs, interest rates, recession, inflation, the impact of unseasonable weather, natural disasters or terrorist activities and other matters that influence consumer spending. Specifically, our Soft Home, Hard Home, Furniture and Seasonal merchandise categories may be threatened when disposable income levels are negatively impacted by economic conditions. Additionally, the net sales of cyclical product offerings in our Seasonal category may be threatened when we experience extended periods of unseasonable weather. In particular, the economic conditions and weather patterns of four states (Ohio, Texas, California, and Florida) are important as approximately 33% of our current stores operate and 35% of our 2015 net sales occurred in these states.

Changes in federal or state legislation and regulations, including the effects of legislation and regulations on product safety and hazardous materials, could increase our cost of doing business and adversely affect our operating performance.

We are exposed to the risk that new federal or state legislation, including new product safety and hazardous material laws and regulations, may negatively impact our operations and adversely affect our operating performance. Changes in product safety legislation or regulations may lead to product recalls and the disposal or write-off of merchandise, as well as fines or penalties and reputational damage. If our merchandise, including food and consumable products, do not meet applicable governmental safety standards or our customers’ expectations regarding quality or safety, we could experience lost sales, increased costs and be exposed to legal and reputational risk.

In addition, if we discard or dispose of our merchandise, particularly that which is non-salable, in a fashion that is inconsistent with jurisdictional standards, we could expose ourselves to certain fines and litigation costs related to hazardous material regulations. Our inability to comply on a timely basis with regulatory requirements, execute product recalls in a timely manner, or consistently implement waste management standards, could result in fines or penalties which could have a material adverse effect on our financial results. In addition, negative customer perceptions regarding the safety of the products we sell could cause us to lose market share to our competitors. If this occurs, it may be difficult for us to regain lost sales.

We are subject to periodic litigation and regulatory proceedings, including Fair Labor Standards Act, state wage and hour, and shareholder class action lawsuits, which may adversely affect our business and financial performance.

From time to time, we are involved in lawsuits and regulatory actions, including various collective or class action lawsuits that are brought against us for alleged violations of the Fair Labor Standards Act, state wage and hour laws, sales tax and consumer protection laws, False Claims Act, and federal securities laws. We also are involved in shareholder derivative lawsuits and investigations concerning our compliance with environmental and hazardous waste regulations. Due to the inherent uncertainties of litigation, we may not be able to accurately determine the impact on us of any future adverse outcome of such proceedings. The ultimate resolution of these matters could have a material adverse impact on our financial condition, results of operations, and liquidity. In addition, regardless of the outcome, these proceedings could result in substantial cost to us and may require us to devote substantial attention and resources to defend ourselves. For a description of certain current legal proceedings, see note 10 to the accompanying consolidated financial statements.

Our current insurance program may expose us to unexpected costs and negatively affect our financial performance.

Our insurance coverage is subject to deductibles, self-insured retentions, limits of liability and similar provisions that we believe are prudent based on the dispersion of our operations. However, we may incur certain types of losses that we cannot insure or which we believe are not economically reasonable to insure, such as losses due to acts of war, employee and certain other crime, and some natural disasters. If we incur these losses and they are material, our business could suffer. Certain material events may result in sizable losses for the insurance industry and adversely impact the availability of adequate insurance coverage or result in excessive premium increases. To offset negative cost trends in the insurance market, we may elect to self-insure, accept higher deductibles or reduce the amount of coverage in response to these market changes. In addition, we self-insure a significant portion of expected losses under our workers’ compensation, general liability, including automobile, and group health insurance programs. Unanticipated changes in any applicable actuarial assumptions and management estimates underlying our recorded liabilities for these losses, including potential increases in medical and indemnity costs, could result in materially different amounts of expense than expected under these programs, which could have a material adverse effect on our financial condition and results of operations. Although we continue to maintain property insurance for catastrophic events, we are self-insured for losses up to the amount of our deductibles. If we experience a greater number of self-insured losses than we anticipate, our financial performance could be adversely affected.

If we are unable to attract, train, and retain highly qualified associates while also controlling our labor costs, our financial performance may be negatively affected.

Our customers expect a positive shopping experience, which is driven by a high level of customer service from our associates and a quality presentation of our merchandise. To grow our operations and meet the needs and expectations of our customers, we must attract, train, and retain a large number of highly qualified associates, while at the same time control labor costs. We compete with other retail businesses for many of our associates in hourly and part-time positions. These positions have historically had high turnover rates, which can lead to increased training and retention costs. In addition, our ability to control labor costs is subject to numerous external factors, including prevailing wage rates, the impact of legislation or regulations governing labor relations or benefits, and health insurance costs.

The loss of key personnel may have a material impact on our future results of operations.

We believe that we benefit substantially from the leadership and experience of our senior executives. The loss of services of these individuals could have a material adverse impact on our business. Competition for key personnel in the retail industry is intense and our future success will depend on our ability to recruit, train, and retain our senior executives and other qualified personnel.

If we are unable to retain existing and secure suitable new store locations under favorable lease terms, our financial performance may be negatively affected.

We lease almost all of our stores and a significant number of these leases expire or are up for renewal each year, as noted below in “Item 2. Properties” in this Form 10-K. Our strategy to improve our financial performance includes sales growth while managing the occupancy cost of each of our stores. The primary component of our sales growth strategy revolves around increasing our comparable store sales, which will require renewing many leases each year. Additional components of our sales growth strategy are to relocate certain stores to a new location within an existing market and to open new store locations, either as an expansion in an existing market or as an entrance into a new market. If the commercial real estate market does not allow for us to negotiate favorable lease renewals and new store leases, our financial position, results of operations, and liquidity may be negatively affected.

Our inability, if any, to comply with the terms of the 2011 Credit Agreement may have a material adverse effect on our capital resources, financial condition, results of operations, and liquidity.

We have the ability to borrow funds under the 2011 Credit Agreement, and we utilize this ability at various times depending on operating or other cash flow requirements. The 2011 Credit Agreement contains financial and other covenants, including, but not limited to, limitations on indebtedness, liens, and investments, as well as the maintenance of a leverage ratio and a fixed charge coverage ratio. A violation of any of these covenants may permit the lenders to restrict our ability to further access loans and letters of credit and may require the immediate repayment of any outstanding loans. Our failure to comply with these covenants may have a material adverse effect on our capital resources, financial condition, results of operations, and liquidity.

A significant decline in our operating profit and taxable income may impair our ability to realize the value of our long-lived assets and deferred tax assets.

We are required by accounting rules to periodically assess our property and equipment and deferred tax assets for impairment and recognize an impairment loss or valuation charge, if necessary. In performing these assessments, we use our historical financial performance to determine whether we have potential impairments or valuation concerns and as evidence to support our assumptions about future financial performance. A significant decline in our financial performance could negatively affect the results of our assessments of the recoverability of our property and equipment and our deferred tax assets and trigger the impairment of these assets. Impairment or valuation charges taken against property and equipment and deferred tax assets could be material and could have a material adverse impact on our capital resources, financial condition, results of operations, and liquidity (see the discussion under the caption “Critical Accounting Policies and Estimates” in the accompanying MD&A in this Form 10-K for additional information regarding our accounting policies for long-lived assets and income taxes).

Changes in accounting guidance could significantly affect our results of operations and the presentation of those results.

Changes in accounting standards, including new interpretations and applications of accounting standards, may have adverse effects on our financial condition, results of operations, and liquidity. The Financial Accounting Standards Board (“FASB”) has issued and/or adopted new guidance that proposes numerous significant changes to current accounting standards. This new guidance could significantly change the presentation of financial information and our results of operations. Additionally, the new guidance may require us to make systems and other changes that could increase our operating costs. Specifically, implementing future accounting guidance related to leases could require us to make significant changes to our lease management system or other accounting systems.

The price of our common shares as traded on the New York Stock Exchange may be volatile.

Our stock price may fluctuate substantially as a result of factors beyond our control, including but not limited to, general economic and stock market conditions, risks relating to our business and industry as discussed above, strategic actions by our competitors, variations in our quarterly operating performance, and investor perceptions of the investment opportunity associated with our common shares relative to other investment alternatives. Additionally, our stock price may reflect the expectation that we will declare cash dividends at the current level or greater levels in the future. Future dividends are subject to the discretion of our Board of Directors, and will depend on our financial condition, results of operations, capital requirements, compliance with applicable laws and agreements and any other factors deemed relevant by our Board. If we fail to meet any of the expectations related to future growth, profitability, or dividends, our stock price may decline significantly, which could have a material adverse impact on investor confidence and employee retention.

We also may be subject to a number of other factors which may, individually or in the aggregate, materially adversely affect our business. These factors include, but are not limited to:

| |

• | Fluctuating commodity prices, including but not limited to diesel fuel and other fuels used to generate power by utilities, may affect our gross profit and operating profit margins; |

| |

• | Changes in governmental laws and regulations, including matters related to taxation. In particular, income tax reform in which the marginal tax rates are significantly reduced could adversely impact the value of our net deferred tax assets; |

| |

• | A downgrade in our credit rating could negatively affect our ability to access capital or could increase our borrowing costs; |

| |

• | Events or circumstances could occur which could create bad publicity for us or for types of merchandise offered in our stores which may negatively impact our business results including our sales; |

| |

• | Infringement of our intellectual property, including the Big Lots trademarks, could dilute their value; and |

| |

• | Other risks described from time to time in our filings with the SEC. |

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Retail Operations

All of our stores are located in the U.S., predominantly in strip shopping centers, and have an average store size of approximately 31,000 square feet, of which an average of 21,900 is selling square feet. For additional information about the properties in our retail operations, see the discussion under the caption “Real Estate” in “Item 1. Business” in this Form 10-K.

The average cost to open a new store in a leased facility during 2015 was approximately $1.3 million, including the cost of inventory. All of our stores are leased, except for the 55 owned stores that are located in the following states:

|

| | |

State | Stores Owned |

Arizona | 2 |

|

California | 39 |

|

Colorado | 3 |

|

Florida | 3 |

|

Louisiana | 1 |

|

Michigan | 1 |

|

New Mexico | 2 |

|

Ohio | 1 |

|

Texas | 3 |

|

Total | 55 |

|

Store leases generally obligate us for fixed monthly rental payments plus the payment, in most cases, of our applicable portion of real estate taxes, common area maintenance costs (“CAM”), and property insurance. Some leases require the payment of a percentage of sales in addition to minimum rent. Such payments generally are required only when sales exceed a specified level. Our typical store lease is for an initial minimum term of five to ten years with multiple five-year renewal options. Sixty-three store leases have sales termination clauses which can result in our exiting a location at our option if certain sales volume results are not achieved.

The following table summarizes the number of store lease expirations in each of the next five fiscal years and the total thereafter. As stated above, many of our store leases have renewal options. The table also includes the number of leases that are scheduled to expire each year that do not have a renewal option. The information includes stores with more than one lease and leases for stores not yet open. It excludes 18 month-to-month leases and 55 owned locations.

|

| | | |

Fiscal Year: | Expiring Leases | | Leases Without Options |

2016 | 266 | | 62 |

2017 | 228 | | 41 |

2018 | 265 | | 47 |

2019 | 223 | | 6 |

2020 | 232 | | 11 |

Thereafter | 167 | | 15 |

Warehouse and Distribution

At January 30, 2016, we owned approximately 9.0 million square feet of distribution center and warehouse space. We own and operate five regional distribution centers strategically located across the United States in Ohio, California, Alabama, Oklahoma, and Pennsylvania. The regional distribution centers utilize warehouse management technology, which we believe enables high accuracy and efficient processing of merchandise from vendors to our retail stores. The combined output of our regional distribution centers was approximately 2.6 million merchandise cartons per week in 2015. Certain vendors deliver merchandise directly to our stores when it supports our operational goal to deliver merchandise from our vendors to the sales floor in the most efficient manner.

The number of owned distribution centers and warehouse space and the corresponding square footage of the facilities by state at January 30, 2016, were as follows:

|

| | | | | | | |

| | | | | Square Footage |

State | Owned | Leased | Total | | Owned | Leased | Total |

| | | | | (Square footage in thousands) |

Ohio | 1 | — | 1 | | 3,559 | — | 3,559 |

California | 1 | — | 1 | | 1,423 | — | 1,423 |

Alabama | 1 | — | 1 | | 1,411 | — | 1,411 |

Oklahoma | 1 | — | 1 | | 1,297 | — | 1,297 |

Pennsylvania | 1 | — | 1 | | 1,295 | — | 1,295 |

Total | 5 | — | 5 | | 8,985 | — | 8,985 |

Corporate Office

We own the facility in Columbus, Ohio that serves as our general office for corporate associates.

Item 3. Legal Proceedings

Item 103 of SEC Regulation S-K requires that we disclose actual or known contemplated legal proceedings to which a governmental authority and we are each a party and that arise under laws dealing with the discharge of materials into the environment or the protection of the environment, if the proceeding reasonably involves potential monetary sanctions of $100,000 or more. Accordingly, please refer to the discussion in note 10 to the accompanying consolidated financial statements regarding the subpoena we received from the District Attorney for the County of Alameda, State of California and the matter regarding the California Air Resources Board.

Aside from these matters, no response is required under Item 103 of Regulation S-K. For a discussion of certain litigated matters, also see note 10 to the accompanying consolidated financial statements

Item 4. Mine Safety Disclosures

None.

Supplemental Item. Executive Officers of the Registrant

Our executive officers at March 29, 2016 were as follows:

|

| | | |

Name | Age | Offices Held | Officer Since |

David J. Campisi | 60 | Chief Executive Officer and President | 2013 |

Lisa M. Bachmann | 54 | Executive Vice President, Chief Merchandising and Operating Officer | 2002 |

Timothy A. Johnson | 48 | Executive Vice President, Chief Administrative Officer and Chief Financial Officer | 2004 |

Michael A. Schlonsky | 49 | Executive Vice President, Human Resources and Store Operations | 2000 |

Ronald A. Robins, Jr. | 52 | Senior Vice President, General Counsel and Corporate Secretary | 2015 |

Andrew D. Stein | 50 | Senior Vice President, Chief Customer Officer | 2013 |

David J. Campisi is our Chief Executive Officer and President. Before joining Big Lots in May 2013, Mr. Campisi served as the Chairman and Chief Executive Officer of Respect Your Universe, Inc., an activewear retailer. Mr. Campisi previously served as the Chairman, President and Chief Executive Officer of The Sports Authority, Inc., a sporting goods retailer. Prior to that, Mr. Campisi served as Executive Vice President and General Merchandise Manager, Women’s Apparel, Accessories, Intimates and Cosmetics of Kohl’s Corporation, a department store retailer. Additionally, Mr. Campisi served as Senior Vice President and General Merchandise Manager, Apparel, Home, and Home Electronics of Fred Meyer’s Corporation, a department store retailer.

Lisa M. Bachmann is responsible for merchandising and global sourcing, information technology, and merchandise planning and allocation. Ms. Bachmann was promoted to Executive Vice President, Chief Merchandising and Operating Officer in August 2015, at which time she assumed responsibility for merchandising and global sourcing. Prior to that, Ms. Bachmann was promoted to Executive Vice President, Chief Operating Officer in August 2012 and Executive Vice President, Supply Chain Management and Chief Information Officer in March 2010. Ms. Bachmann joined us as Senior Vice President, Merchandise Planning, Allocation and Presentation in March 2002.

Timothy A. Johnson is responsible for financial reporting and controls, financial planning and analysis, treasury, risk management, tax, internal audit, investor relations, real estate, asset protection and distribution and transportation services. Mr. Johnson was promoted to Executive Vice President, Chief Administrative Officer and Chief Financial Officer in August 2015, at which time he assumed responsibility for distribution and transportation services. Prior to that Mr. Johnson was promoted to Executive Vice President, Chief Financial Officer in March 2014. Mr. Johnson assumed responsibility for real estate in June 2013 and asset protection in November 2013. Mr. Johnson was promoted to Senior Vice President, Chief Financial Officer in August 2012, at which time he assumed responsibility for our treasury and risk management. He was promoted to Senior Vice President of Finance in July 2011. He joined us in August 2000 as Director of Strategic Planning.

Michael A. Schlonsky is responsible for store operations, talent management and oversight of human resources. He was promoted to Executive Vice President in August 2015, at which time he assumed responsibility for store operations. He was promoted to Senior Vice President, Human Resources in August 2012 and promoted to Vice President, Associate Relations and Benefits in 2010. Prior to that, Mr. Schlonsky was promoted to Vice President, Associate Relations and Risk Management in 2005. Mr. Schlonsky joined us in 1993 as Staff Counsel and was promoted to Director, Risk Management in 1998, and to Vice President, Risk Management and Administrative Services in 2000.

Ronald A. Robins, Jr. is responsible for legal affairs and compliance. Mr. Robins joined us in 2015 as Senior Vice President, General Counsel and Corporate Secretary. Prior to joining us, Mr. Robins was a partner at Vorys, Sater, Seymour and Pease LLP and also previously served as General Counsel, Chief Compliance Officer, and Secretary of Abercrombie & Fitch Co., an apparel retailer.

Andrew D. Stein is responsible for marketing, advertising, brand development and merchandise presentation. Mr. Stein joined us in 2013 as Senior Vice President, Chief Customer Officer. Prior to joining us, Mr. Stein was the Chief Marketing Officer at Kmart, a division of Sears Holding Corporation, a retailer.

Part II

| |

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “BIG.” The following table reflects the high and low sales prices for our common shares as reported on the NYSE composite tape for the fiscal periods indicated:

|

| | | | | | | | | | | | | | | |

| 2015 | | 2014 |

| High | | Low | | High | | Low |

First Quarter | $ | 51.11 |

| | $ | 44.45 |

| | $ | 40.24 |

| | $ | 25.50 |

|

Second Quarter | 48.53 |

| | 41.37 |

| | 46.39 |

| | 36.76 |

|

Third Quarter | 50.15 |

| | 39.77 |

| | 48.52 |

| | 41.23 |

|

Fourth Quarter | $ | 48.14 |

| | $ | 33.78 |

| | $ | 51.75 |

| | $ | 38.15 |

|

In June 2014, we announced that our Board of Directors commenced a cash dividend program. Since the commencement of the program, we have declared and paid seven consecutive quarterly cash dividends.

|

| | | | | | | |

| 2015 | | 2014 |

First Quarter | $ | 0.19 |

| | $ | — |

|

Second Quarter | 0.19 |

| | 0.17 |

|

Third Quarter | 0.19 |

| | 0.17 |

|

Fourth Quarter | 0.19 |

| | 0.17 |

|

Total | $ | 0.76 |

| | $ | 0.51 |

|

In the first quarter of 2016, our Board of Directors declared a dividend payable on April 1, 2016 to holders of record on March 18, 2016 and increased the amount of the dividend from $0.19 to $0.21 per share. Although it is the present intention of our Board of Directors to continue to pay a quarterly cash dividend in the future, the determination to pay future dividends will be at the discretion of our Board of Directors and will depend on our financial condition, results of operations, capital requirements, compliance with applicable laws and agreements and any other factors deemed relevant by our Board.

After making investments in the business and paying declared dividends, the Company has utilized its excess cash for share repurchase programs. Any future decisions on the uses of excess cash will be determined by our Board of Directors taking into account business conditions then existing, including our earnings, financial requirements and condition, opportunities for reinvesting cash, and other factors.

The following table sets forth information regarding our repurchase of our common shares during the fourth fiscal quarter of 2015:

|

| | | | | | | | | | | |

(In thousands, except price per share data) | | | | |

Period | (a) Total Number of Shares Purchased (1) | | (b) Average Price Paid per Share (1) | (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | (d) Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs |

November 1, 2015 - November 28, 2015 | — |

| | $ | 43.92 |

| — |

| $ | — |

|

November 29, 2015 - December 26, 2015 | — |

| | — |

| — |

| — |

|

December 27, 2015 - January 30, 2016 | — |

|

| 38.02 |

| — |

| — |

|

Total | — |

| | $ | 41.25 |

| — |

| $ | — |

|

| |

(1) | In November 2015 and January 2016, in connection with the vesting of certain outstanding restricted stock awards and restricted stock units, we acquired 239 and 198 of our common shares, respectively, which were withheld to satisfy minimum statutory income tax withholdings. |

On March 1, 2016, our Board of Directors authorized a program for the repurchase of up to $250.0 million of our common shares (“2016 Repurchase Program”). The 2016 Repurchase Program has no scheduled termination date.

At the close of trading on the NYSE on March 25, 2016, there were approximately 701 registered holders of record of our common shares.

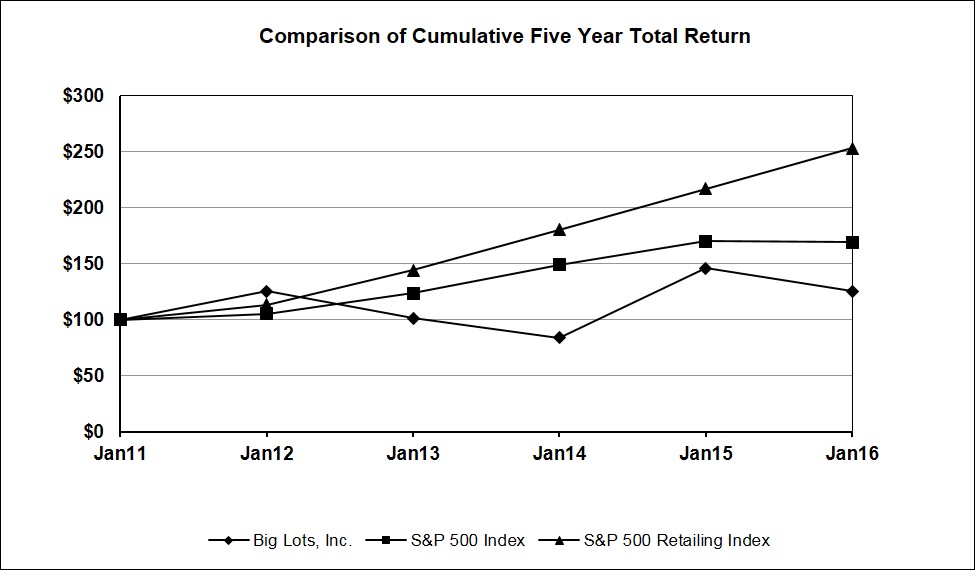

The following graph and table compares, for the five fiscal years ended January 30, 2016, the cumulative total shareholder return for our common shares, the S&P 500 Index, and the S&P 500 Retailing Index. Measurement points are the last trading day of each of our fiscal years ended January 28, 2012, February 2, 2013, February 1, 2014, January 31, 2015 and January 30, 2016. The graph and table assume that $100 was invested on January 29, 2011, in each of our common shares, the S&P 500 Index, and the S&P 500 Retailing Index and reinvestment of any dividends. The stock price performance on the following graph and table is not necessarily indicative of future stock price performance.

|

| | | | | | | | | | | | | | | | | | |

| Indexed Returns |

| Years Ended |

| Base Period | | | | | |

| January | January | January | January | January | January |

Company / Index | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

Big Lots, Inc. | $ | 100.00 |

| $ | 125.71 |

| $ | 101.63 |

| $ | 84.19 |

| $ | 145.97 |

| $ | 125.39 |

|

S&P 500 Index | 100.00 |

| 105.33 |

| 123.86 |

| 149.21 |

| 170.43 |

| 169.30 |

|

S&P 500 Retailing Index | $ | 100.00 |

| $ | 113.42 |

| $ | 144.15 |

| $ | 180.69 |

| $ | 216.99 |

| $ | 253.44 |

|

Item 6. Selected Financial Data

The following statements of operations and balance sheet data have been derived from our consolidated financial statements and should be read in conjunction with MD&A and the consolidated financial statements and related notes included herein.

|

| | | | | | | | | | | | | | | |

| Fiscal Year |

(In thousands, except per share amounts and store counts) | 2015 (a) | 2014 (a) | 2013 (a) | 2012 (b) | 2011 (a) |

Net sales | $ | 5,190,582 |

| $ | 5,177,078 |

| $ | 5,124,755 |

| $ | 5,212,318 |

| $ | 5,097,144 |

|

Cost of sales (exclusive of depreciation expense shown separately below) | 3,123,396 |

| 3,133,124 |

| 3,117,386 |

| 3,157,632 |

| 3,058,442 |

|

Gross margin | 2,067,186 |

| 2,043,954 |

| 2,007,369 |

| 2,054,686 |

| 2,038,702 |

|

Selling and administrative expenses | 1,708,717 |

| 1,699,764 |

| 1,664,031 |

| 1,639,770 |

| 1,594,346 |

|

Depreciation expense | 122,737 |

| 119,702 |

| 113,228 |

| 103,146 |

| 88,324 |

|

Operating profit | 235,732 |

| 224,488 |

| 230,110 |

| 311,770 |

| 356,032 |

|

Interest expense | (3,683 | ) | (2,588 | ) | (3,293 | ) | (4,184 | ) | (2,738 | ) |

Other income (expense) | (5,199 | ) | — |

| (12 | ) | 2 |

| 163 |

|

Income from continuing operations before income taxes | 226,850 |

| 221,900 |

| 226,805 |

| 307,588 |

| 353,457 |

|

Income tax expense | 83,842 |

| 85,239 |

| 85,515 |

| 117,071 |

| 133,880 |

|

Income from continuing operations | 143,008 |

| 136,661 |

| 141,290 |

| 190,517 |

| 219,577 |

|

Loss from discontinued operations, net of tax | (135 | ) | (22,385 | ) | (15,995 | ) | (13,396 | ) | (12,513 | ) |

Net income | $ | 142,873 |

| $ | 114,276 |

| $ | 125,295 |

| $ | 177,121 |

| $ | 207,064 |

|

Earnings per common share - basic: | | | | | |

Continuing operations | $ | 2.83 |

| $ | 2.49 |

| $ | 2.46 |

| $ | 3.18 |

| $ | 3.21 |

|

Discontinued operations | — |

| (0.41 | ) | (0.28 | ) | (0.22 | ) | (0.18 | ) |

| $ | 2.83 |

| $ | 2.08 |

| $ | 2.18 |

| $ | 2.96 |

| $ | 3.03 |

|

Earnings per common share - diluted: | | | | | |

Continuing operations | $ | 2.81 |

| $ | 2.46 |

| $ | 2.44 |

| $ | 3.15 |

| $ | 3.16 |

|

Discontinued operations | — |

| (0.40 | ) | (0.28 | ) | (0.22 | ) | (0.18 | ) |

| $ | 2.80 |

| $ | 2.06 |

| $ | 2.16 |

| $ | 2.93 |

| $ | 2.98 |

|

Weighted-average common shares outstanding: | | | | | |

Basic | 50,517 |

| 54,935 |

| 57,415 |

| 59,852 |

| 68,316 |

|

Diluted | 50,964 |

| 55,552 |

| 57,958 |

| 60,476 |

| 69,419 |

|

Cash dividends declared per common share | $ | 0.76 |

| $ | 0.51 |

| $ | — |

| $ | — |

| $ | — |

|

Balance sheet data: | | | | | |

Total assets | $ | 1,640,370 |

| $ | 1,635,891 |

| $ | 1,739,599 |

| $ | 1,753,626 |

| $ | 1,641,310 |

|

Working capital (c) | 315,984 |

| 411,446 |

| 483,833 |

| 423,300 |

| 379,052 |

|

Cash and cash equivalents | 54,144 |

| 52,261 |

| 68,629 |

| 60,581 |

| 68,547 |

|

Long-term obligations under bank credit facility | 62,300 |

| 62,100 |

| 77,000 |

| 171,200 |

| 65,900 |

|

Shareholders’ equity | $ | 720,470 |

| $ | 789,550 |

| $ | 901,427 |

| $ | 758,142 |

| $ | 823,233 |

|

Cash flow data: | | | | | |

Cash provided by operating activities | $ | 342,352 |

| $ | 318.562 |

| $ | 198,334 |

| $ | 281,133 |

| $ | 318,471 |

|

Cash used in investing activities | $ | (113,193 | ) | $ | (90,749 | ) | $ | (97,495 | ) | $ | (130,357 | ) | $ | (120,712 | ) |

Store data: | | | | | |

Total gross square footage | 44,914 |

| 45,134 |

| 45,708 |

| 45,505 |

| 43,932 |

|

Total selling square footage | 31,775 |

| 32,006 |

| 32,732 |

| 32,623 |

| 31,512 |

|

Stores opened during the fiscal year | 9 |

| 24 |

| 55 |

| 87 |

| 92 |

|

Stores closed during the fiscal year | (20 | ) | (57 | ) | (57 | ) | (43 | ) | (39 | ) |

Stores open at end of the fiscal year | 1,449 |

| 1,460 |

| 1,493 |

| 1,495 |

| 1,451 |

|

| |

(a) | The period presented is comprised of 52 weeks. |

| |

(b) | The period presented is comprised of 53 weeks. |

| |

(c) | During 2015, we adopted Accounting Standards Update 2015-17 related to the presentation of deferred taxes. As such, we reclassified our current deferred tax assets and liabilities to noncurrent deferred income tax assets for all fiscal years presented. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

The discussion and analysis presented below should be read in conjunction with the accompanying consolidated financial statements and related notes. Please refer to “Item 1A. Risk Factors” of this Form 10-K for a discussion of forward-looking statements and certain risk factors that may have a material adverse effect on our business, financial condition, results of operations, and/or liquidity.

Our fiscal year ends on the Saturday nearest to January 31, which results in some fiscal years with 52 weeks and some with 53 weeks. Fiscal years 2015, 2014, and 2013 were each comprised of 52 weeks. Fiscal year 2016 will be comprised of 52 weeks.

Operating Results Summary

The following are the results from 2015 that we believe are key indicators of our operating performance when compared to 2014.

| |

• | Net sales increased $13.5 million, or 0.3%. |

| |

• | Comparable store sales for stores open at least fifteen months increased $91.1 million, or 1.8%. |

| |

• | Gross margin dollars increased $23.2 million with a 30 basis point increase in gross margin rate to 39.8% of sales. |

| |

• | Selling and administrative expenses increased $8.9 million. As a percentage of net sales, selling and administrative expenses increased 10 basis points to 32.9% of net sales. |

| |

• | Operating profit rate increased 20 basis points to 4.5%. |

| |

• | Diluted earnings per share from continuing operations increased 14.2% to $2.81 per share, compared to $2.46 per share in 2014. |

| |

• | Our return on invested capital increased to 16.6% from 14.9%. |

| |

• | Inventory of $850.0 million represented a $1.7 million decrease, or 0.2%, from 2014. |

| |

• | We acquired approximately 4.4 million of our outstanding common shares for $200.0 million, under our 2015 Repurchase Program (as defined below in “Capital Resources and Liquidity”), at a weighted average price of $45.82 per share. |

| |