A. | Intel, a manufacturer of semiconductor components, conducts a foundry, packaging, assembly and test business whereby Intel performs foundry, packaging, assembly and test services for the manufacture of integrated circuits designed by its foundry customers; and |

B. | The Parties desire that (1) Intel manufacture and sell Products (defined below) containing such integrated circuits designed by Customer and (2) Customer purchase such Products, subject to the provisions of this Agreement. |

1. | DEFINITIONS |

1.1 | "Acceptance Specification" means the agreed technical and quality specifications pertaining to a particular Product or service, which specifications will be attached to the applicable Product Attachment. A sample Acceptance Specification is attached hereto as Exhibit A. |

1.2 | “Affiliate” means, for an identified entity, any entity: (a) that is a Subsidiary of such identified entity; or (b) that Controls or is under common Control with such identified entity, but such entity shall be deemed to be an Affiliate only for so long as such Control exists. |

1.3 | “Background IP Rights” means all IP Rights owned, controlled, or licensed by either Party, (i) developed, conceived, obtained, licensed, or acquired prior to the Effective Date of this Agreement, or (ii) developed, conceived, obtained, licensed, or acquired independently of this Agreement. |

1.4 | "Confidential Information" is as defined in accordance with the CNDA referenced on the first page of this Agreement and any applicable separate nondisclosure agreements between the Parties. |

1.5 | “Control” (including “Controlled” and other forms) of an entity means: (a) beneficial ownership (whether directly or indirectly through entities or other means) of more than fifty percent (50%) of the outstanding voting securities of that entity; or (b) in the case of an entity that has no outstanding voting securities, having the power (whether directly or indirectly through entities or other means) presently to designate more than fifty percent (50%) of the directors of a corporation, or in the case of unincorporated entities, of individuals exercising similar functions. |

1.6 | “Copyrights” means all worldwide copyrights, copyright applications, copyright registrations, or any right analogous to those described in this definition in foreign jurisdictions. |

1.7 | “Creating Party” means the party who conceives, creates, or authors an invention or work. |

1.8 | "Customer Provided Deliverables" means the Customer deliverables set forth on a Product-by-Product basis in the particular Product's Product Attachment . |

1.9 | "Database" means the machine readable code which represents the layout, schematic, Netlist, or other software description of a specific design for a Product. |

1.10 | "Delivery" means when a Product is delivered pursuant to the applicable shipment terms. |

1.11 | Intentionally Deleted. |

1.12 | "Die Product(s)" means an integrated circuit that is the subject of a Product Attachment, in die form, manufactured with a distinct Customer-provided design at Intel pursuant to this Agreement, which passes the Customer approved sort test program. |

1.13 | "Engineering Samples" means limited quantities of a specific Product which are manufactured prior to Production Qualification of such Product, upon Customer’s request. |

1.14 | "Engineering Wafers" means Wafers that are not Risk Production Wafers or Production Wafers. |

1.15 | "Excluded Product(s)" means integrated circuits primarily marketed as the primary application processing device for products in the following |

1.15.1 | [*****], regardless of form factor (e.g. [*****] or [*****]) or physical media (e.g. [*****]); |

1.15.2 | [*****]; |

1.15.3 | [*****]; |

1.15.4 | [*****]; |

1.15.5 | [*****]; |

1.15.6 | [*****]; and |

1.15.7 | [*****] |

1.16 | "Finished Product" means the Die Product assembled and tested by Intel. |

1.17 | “Foreground IP Rights” means all IP Rights: (1) for patentable subject matter, to or in inventions first conceived; (2) for copyrightable subject matter or mask works, authored; or (3) for trade secrets, developed, obtained, or acquired, by Intel, Customer or jointly by the Parties in the course of work performed by either Party during the term and in the course of their performance of this Agreement or the associated Product Attachments. |

1.18 | "Foreground Packaging IP Rights" means Foreground IP Rights to or in Packaging Technology |

1.19 | "Foreground Process IP Rights" means Foreground IP Rights to or in Process Technology. |

1.20 | "Foreground Product IP Rights" means Foreground IP Rights to or in (i) designs and specifications for Products or Customer Provided Deliverables; or (ii) improvements to any of the foregoing. |

1.21 | “Foundry Workplan” means a document setting forth, for a particular Product, the activities and deliverables that Customer can expect from Intel, and the activities and deliverables that Intel would need from Customer in order to complete the development and manufacturing of that Product and deliver the Product to Customer expeditiously. |

1.22 | "Intel Licensable Technical Collateral" means Technical Collateral which Intel owns or has licensed from a third party that Intel can rightfully sublicense to Customer for development and design of Product(s), and which is identified as Intel Licensable Technical Collateral in a Foundry Workplan or Product Attachment. |

1.23 | "Intel Provided Deliverables" for a particular Product means the Intel deliverables set forth in the Product Attachment pertaining to such Product. |

1.24 | “IP Rights” means all intellectual property rights worldwide arising under statutory or common law, including without limitation Copyrights, Patent Rights, Trade Secret Rights or any analogous right in foreign jurisdictions. For purposes of this Agreement, IP Rights excludes trademarks, trade names, service marks, trade dress, or other forms of corporate or product identification whether or not recognized |

1.25 | "Joint Foreground IP Rights" means all IP Rights: (1) for patentable subject matter, to or in inventions first conceived; (2) for copyrightable subject matter or mask works, authored; or (3) for trade secrets, developed, obtained, or acquired, jointly by the Parties in the course of work performed during the term and in the course of their performance of this Agreement or the associated Product Attachments; provided, however, that Joint Foreground IP Rights does not include Foreground Product IP Rights. |

1.26 | "Joint Foreground Uncategorized IP Rights" means all IP Rights: (1) for patentable subject matter, to or in inventions first conceived; (2) for copyrightable subject matter or mask works, authored; or (3) for trade secrets, developed, obtained, or acquired, jointly by the Parties in the course of work performed during the term and in the course of their performance of this Agreement or the associated Product Attachments which is not described in Sections 1.18, 1.19, or 1.20. |

1.27 | “Lead Time" means the number of days required by Intel to fulfill an Order for manufacture and Delivery of a particular Product under normal operating conditions, taking into account the applicable |

1.28 | "Line Item" means the specific quantity of a particular Product stated in an Order which is scheduled or requested to be manufactured and Delivered, on a particular date, where each Delivery date for each different Product represents a separate Line Item. |

1.29 | "Manufacturing Cycle Time" for a particular production segment (e.g., Wafer fab cycle time, sort cycle time, assembly/test cycle time) means the number of days allotted, under normal operating conditions, to perform the production steps comprising such segment. |

1.30 | "Megacells" means the hardware implementation of functional blocks. |

1.31 | "Megafunctions" means the software implementation of functional blocks. |

1.32 | "Netlist" means the list form of a circuit schematic describing the transistor to transistor connections. |

1.33 | “Non-Selecting Party,” as to an invention, is the Party who does not select to own that invention in the selection process described in Section 7.12 |

1.34 | "Order" means Customer’s written authorization to Intel to perform the identified services or deliver the identified Products and to invoice Customer therefor as further provided herein. |

1.35 | “Packaging Technology” means technology relating to (i) semiconductor device assembly and packaging, including without limitation, package design and tools, single and multi-chip packages, package on package (POP), package in package (PIP), die stacking, other 2.5/3D packaging, die bonding, package thermal solutions, integrated heat sinks/spreaders, through silicon via, and package to board assembly techniques; and (ii) packaging, substrate, interposer, bonding, solder, solderballs, copper pillar/stud, underfill, and other materials and assembly techniques. |

1.36 | “Patent Indemnity Jurisdiction” means the United States, Republic of China, People’s Republic of China, Canada, Japan, South Korea, Russia, Israel, Mexico, Brazil, European Community, Switzerland, Austria, Sweden, Finland, Norway, India, Vietnam, Cambodia, Malaysia, Singapore, Philippines, and Indonesia. |

1.37 | “Patent Rights” means all rights in patents, including issued patents and pending patent applications whether domestic or foreign, including all |

1.38 | "Process Excursion" means a process deviation outside of specified range. |

1.39 | “Process Technology” means technology relating to semiconductor manufacturing processes, process recipes, and device manufacturing, assembly and test techniques. |

1.40 | "Product" means Die Product, Finished Product [*****]. |

1.41 | "Product Attachment” means a Product Family specific agreement which details the obligations and deliverables of each Party and terms and conditions in addition to those in this Agreement applying to one or more specific Products within a Product Family pursuant to Intel's quotation. The Product Attachment, and corresponding quotation, may be amended in writing from time to time by signed written agreement of the Parties. |

1.42 | A “Product Family” includes any products that are substantially similar to, or a successor to, a Product that is the subject of a Product Attachment signed by both parties, provided a product will only be deemed within a Product Family so long as such product is not an Excluded Product. The Parties intend that the Product Attachment for the first Product(s) in a particular Product Family will set out the scope of that Product Family, and that all Products in the Product Family will tape out within three years of Tape In of that first Product. |

1.43 | "Production" means the manufacture of a specified Product by Intel under this Agreement which takes place only after Production Qualification of a Product in accordance with this Agreement. |

1.44 | "Production Product" means a Product manufactured by Intel under this Agreement after Production Qualification for such Product has been completed in accordance with this Agreement. |

1.45 | "Production Qualification" means the quality and reliability status achieved when a specified Product meets the Customer's quality and reliability criteria and such status is certified in writing by Customer to Intel. |

1.46 | "Prototypes" means the initial units of a specified Product which are used to determine the functionality and performance of such Product. |

1.47 | “Release” means a release to manufacturing issued under a blanket Order. |

1.48 | "Risk Product" means Product that Customer authorizes Intel to produce before Production Qualification for a specified Product. |

1.49 | "Risk Production Wafers" means Wafers produced for Risk Product that are subject to Production Product pricing, production lot sizes and production Lead Times. |

1.50 | “Selecting Party,” as to an invention, means the Party who selects to own that invention in the selection process described in Section 7.12. |

1.51 | “Subsidiary” means, for an identified entity, any entity Controlled by the identified entity, but such entity shall be deemed to be a Subsidiary only for so long as such Control exists. |

1.52 | "Tape In" means the delivery by Customer to Intel of the GDSII Database or other Database for Intel’s use in creating masks and tooling for the manufacture of a Product. |

1.53 | "Technical Collateral" means technical documents, files, models, schematics, software tools, and layouts useful in the design or manufacture of integrated circuits. |

1.54 | “Trade Secret Rights” means all worldwide rights in trade secrets arising under statutory or common law, or any right analogous to U.S. trade secret rights in foreign jurisdictions. |

1.55 | "Wafers" means silicon wafers, the individual die of which embody Die Products, manufactured by Intel in accordance with a Product Attachment. |

1.56 | "WIP" means work in process with respect to a Product. This includes all Wafers and Product in Wafer fabrication, sort test, assembly and final test and all completed Product units not yet delivered to Customer. |

2. | OVERVIEW |

2.1 | This Agreement states the terms under which Customer and Intel agree to undertake the manufacture of one or more Product(s) as agreed in writing from time to time, using Intel’s fabrication processes. The Parties may make this Agreement applicable to a Product by executing a Product Attachment which identifies the Product or Products and which references this Agreement. All the terms of this Agreement will apply to each separate Product unless an amendment to this Agreement is made in writing. This is not a "requirement contract": unless otherwise agreed in writing, Customer is not obligated to have all |

2.2 | The Parties anticipate that, for each Product or Product Family, the Parties will jointly maintain a Foundry Workplan. Foundry Workplans are nonbinding, working documents which are periodically updated and revised to reflect the Parties' developing joint best understanding of their intentions based on available information. To the extent activities and/or deliverables are revised during the course of a project to a degree that the quotation is affected, the parties will negotiate and revise the Product Attachment accordingly. |

2.3 | It is Customer’s intention to purchase [*****] from Intel. [*****], both Parties will make reasonable accommodations to [*****] and [*****] Products to suitable [*****] and [*****] designated by [*****] (provided that Customer will not provide Products in [*****] to [*****] other than [*****]). Based on the Parties’ respective future business and manufacturing needs, however, the Parties will negotiate in good faith regarding terms for [*****] to [*****] designated [*****]. |

2.4 | Each Product Attachment will specify whether applicable Products will be delivered as [*****] or [*****] (solely to Customer’s own sites for use solely at such sites), as [*****] Products, or as Finished Products, provided that: |

2.4.1 | For [*****] Products as to which Customer will not utilize Intel [*****], provision by Intel or by Customer [*****] Products to Customer’s [*****] will be pursuant to a nondisclosure agreement with such [*****] which meets Intel’s reasonable requirements (for purposes of this section, a nondisclosure agreement at least as protective of Intel as the CNDA referenced on the first page of this Agreement, and which names Intel as a third party beneficiary, will be deemed to meet Intel’s requirements) and, in any event, Intel will not be required to [*****] Products on any leading edge node until [*****] after Intel’s [*****] on that node has been [*****]; and |

2.4.2 | Customer will be responsible for all costs of enabling Customer’s [*****], and, as between Intel and Customer, will be responsible for all aspects of, and liabilities created by, [*****] interaction or integration, and will not look to Intel for failure analysis or [*****] for any issues to the extent arising from such [*****] interaction or integration. |

3. | INTEL LICENSABLE TECHNICAL COLLATERAL |

3.1 | To the extent Customer requires access to, or use of, third party Technical Collateral which is sublicensable to Customer by Intel, Customer may be required to agree in writing to terms imposed by such third party as a prerequisite to such access or use. Prior to using any third party Technical Collateral, Intel will notify Customer and receive Customer’s written approval of such use, including any additional terms that may apply to such third party Technical Collateral. |

3.2 | Customer will [*****] development non-reoccurring engineering (“NRE”) or support [*****] for test program development, or for base Intel IP required to enable a Product (e.g., standard cell) that is part of Intel’s standard foundry IP offering, [*****] for integration of such IP into lead Products. The parties will negotiate in good faith with respect to charges for NRE, license fees (at market rates), integration and support for advanced or custom IP and other collateral. |

3.3 | Intel will provide commercially reasonable support for Customer’s use of third party-developed IP blocks, tools, and other technology referenced |

4. | PRODUCTION PERIOD |

4.1 | Forecasting |

4.1.1 | Demand Forecast. Customer will provide to Intel a twelve (12) month rolling demand forecast for Wafer-outs each month, taking into account applicable Lead Times for each Product, with the month in which the forecast is provided being “Month 1” of the forecast, commencing six months prior to anticipated Product Tape-In. If Customer does not provide an updated forecast for a given month, the most recently provided forecast will be deemed Customer’s current forecast. Customer’s forecast will state monthly requirements for Risk Wafers and Products. Customer is not required to forecast Prototypes. Except as set forth herein, each Customer forecast is non-binding on either Party and for capacity planning and material ordering purposes only, provided that Customer shall make good faith efforts to ensure that all forecasts are reasonable estimates of its anticipated needs. Subject to this obligation, and except as expressly stated in this Section 4.1, all such forecasts (and any responses to them) will be for planning purposes only, and will not create any obligation to purchase and/or sell. Customer is only liable for manufacture of Wafers ordered pursuant to an Order submitted and accepted under the terms of this Agreement. |

4.1.2 | Supply Assurance. Pursuant to the forecasting schedule in the Policy & Procedure document that will be made accessible to Customer via the Intel Foundry Services (IFS) portal, as such document may be modified by agreement of the Parties, Intel will provide a monthly rolling response to Customer's demand forecast. Intel's response may accept or reduce quantities forecast for any month for which a forecast has not previously been received. So long as Customer’s forecasts for any given month are equal to or less than amounts previously accepted for that month, Intel will accept the amounts forecast for each |

4.1.3 | Supply Upside. Intel agrees to consider requests to support upsides within Lead Time in Production or to expedite manufacture of any Wafers. If Intel agrees to accommodate Customer’s request for upside or expedited processing within Lead Time, Customer may incur expedite charges as set forth in the applicable price quote. |

4.1.4 | In the event either Party fails to meet its commitments pursuant to this Section 4.1, the sole remedy for the other Party is, at its discretion, to adjust future capacity and/or Order commitments, as the case may be, in an amount reasonably related to the amount of the shortfall, and taking into account the other’s ordering/fulfillment patterns and any information the other wishes to share regarding its forecasted needs or capacities, and neither Party shall have any right to bring any action in law or in equity to enforce any provision of this Section 4.1 other than this subsection 4.1.4. Notwithstanding the foregoing, in the event Intel fails to meet its Delivery commitments pursuant to this Section 4.1, Intel may not adjust committed quantities, and Intel may only |

4.1.5 | The Parties will attempt to settle or resolve any claim or controversy arising from this Section 4.1 through consultation and negotiation in good faith and a spirit of mutual cooperation. Pursuant to this process, in the event of any material dissatisfaction or assertion by either Party of the other’s failure to perform any commitment under this Section 4.1, or any concern that a Party is not placing, accepting or fulfilling Orders consistent with the letter or spirit of this Section 4.1, the senior managers shall immediately take action to address the issue, and, failing that, will thereupon escalate the issue to executive level management and each Party will expeditiously obtain executive level review and resolution of the concern or situation. |

4.1.6 | Forecasting for manufacture of Products in other than Wafer form will be negotiated in good faith at an appropriate time. |

4.1.7 | For new product Tape Ins Intel will provide the fastest available cycle times, which are the same or better than standard Intel new product introduction cycle times. |

4.2 | Ordering |

4.2.1 | Customer will from time to time issue blanket Orders for manufacture of Production Products against which Customer may, outside of the applicable Lead Time(s) for the Product(s) involved, issue Releases referencing the applicable blanket Order, each of which, upon acceptance by Intel, will constitute an Order and, accordingly, authorization to Intel to start Wafers, and to enter a corresponding Line Item in the blanket Order corresponding to the Release. |

4.2.2 | Each Order (including Releases) will reference this Agreement. Additionally, each Order will include (a) Intel’s assigned part number and Customer’s assigned part number, (b) the Product(s) to be manufactured and quantity, (c) the requested Delivery date, and (d) the applicable price and agreed payment terms. For avoidance of confusion, under no circumstances, except as provided in Sections 2.3 and 8.5, will Intel be obligated to ship Products in Wafer form. |

4.2.3 | Orders must be received at Intel at least [*****] calendar days ahead of Tape-In for lead lots and at least [*****] calendar days ahead of silicon starts for additional engineering lots. |

4.2.4 | Orders may be issued on Customer’s behalf by Customer’s Subsidiaries, and Intel is authorized to accept, fulfill, and invoice for such Orders as if they had been issued by Customer. Orders issued by Subsidiaries, and services performed pursuant to such Orders, will be treated in all respects as if they had been issued by and performed for Customer. Customer agrees to consolidate warranty and indemnity requests on behalf of Customer’s Subsidiaries, and to communicate those requests to Intel, provided that this will not be deemed to diminish nor increase Intel’s warranty or indemnity obligations under this Agreement. Customer will be responsible to Intel for any failure by any Customer Subsidiary to comply with any term of this Agreement, including but not limited to failure to timely pay invoices. |

4.3 | Acknowledgement |

4.3.1 | Intel will acknowledge the Order and inform the Customer of Intel’s committed Delivery date within [*****] business days. Provided that Orders are timely, Intel must accept the quantity of Products ordered by Customer, provided that Intel’s committed Delivery dates may be scheduled in accordance with Intel’s supply commitment obligations set forth in this Agreement. Order acknowledgements by Intel that do not meet the requested Delivery dates will only be effective if Customer sends Intel a written acceptance notice within [*****] business days after Customer’s receipt of such deviating Order acknowledgement from Intel. |

4.3.2 | Each Order acknowledgment will reference this Agreement and include (a) Intel’s assigned part number and Customer’s assigned part number, (b) the Product(s) to be manufactured and order quantity in the Order, (c) the applicable price and agreed payment terms, (d) the Intel committed quantity and Delivery date. |

4.3.3 | Orders and Order acknowledgments are only deemed valid (i) if sent to the other Party’s designated department responsible for such Party’s Order processing under this Agreement and (ii) if provided in writing or in the electronic data interchange |

4.3.4 | A calendar for the demand forecast, supply assurance, Order and Order acknowledgment will be provided in the Policy & Procedure document that will be made accessible to Customer via the Intel Foundry Services (IFS) portal. |

4.4 | Cancellations and Reschedules. |

4.4.1 | Customer’s Orders for manufacture of Product(s) (including Risk Production Wafers, Engineering Wafers or Engineering Samples) that are within Lead Time and already in WIP may be canceled subject to payment upon invoice of the Cancellation Fees set forth in Section 4.4.2. Except as otherwise provided, forecasted requirements and Orders for manufacture of Product(s) outside of Lead Time are cancelable by Customer in whole or in part at any time without liability. However, if Intel starts Wafers outside of Lead Time in response to Customer’s written instructions, Customer will be responsible for cancellation liability pursuant to Section 4.4.2. |

4.4.2 | Cancellation Fees |

4.4.2.1 | If the production or delivery of Products are cancelled by the Customer within the Lead Time and after Products are already in WIP, then Customer shall pay to Intel a cancellation charge based on the following formula: |

4.4.2.2 | Cancellation charge per Wafer = Base cancellation fee + [percentage of manufacturing segments completed) * (Wafer sell price under contract - Base cancellation fee)]. |

4.4.2.3 | Total Cancellation fees = (Cancellation charge per Wafer * number of Wafers) |

4.4.2.4 | The Base cancellation fee shall be [*****] dollars. If Wafers have not been started, Intel shall waive the cancellation fee. |

4.4.2.5 | Masks. Mask cancellation fees, if applicable, will be based on the number and cost of reticles completed and /or started. |

4.4.2.6 | Late Line Item Cancellations. Intel will use commercially reasonable efforts to meet Delivery Dates specified in each Order accepted hereunder. Customer may cancel without liability any late items or shipments if and only if the delay is not caused by Customer and the delay exceeds the committed manufacturing Lead Time by more than [*****] calendar days, and if late shipment is not subject to force majeure under Section 14.2. |

4.4.2.7 | Line Item Reschedules. Customer may on occasion reschedule any Order Line Item from Intel’s committed Delivery date. Wafers in the manufacturing line will be held only at technically permissible hold locations and the hold time will not exceed maximum time allowed in the given technology node so as to avoid quality degradation of the Product and risk to the manufacturing line. Customer may reschedule an Order Line Item for [*****], and for a maximum of [*****] for Die Products to be released from existing die bank inventory at the time of such [*****] Order, and for a maximum of [*****] for other Finished Products Orders. Customer may reschedule an Order Line Item for Wafers or Die Products for up to [*****] from Customer’s original requested Delivery date or from Intel’s committed Delivery date, whichever is later. If Delivery is rescheduled, Intel’s invoice dates may not be earlier than the rescheduled Delivery dates described in this section. In the event Customer takes excessive advantage of its right to reschedule under this Section, the |

4.5 | Delivery Performance. |

4.5.1 | On-time delivery. Intel’s on time delivery performance goal will be [*****] as measured by on time shipment (per Intel’s committed delivery date) to Intel dock (package ready to be picked up by Customer arranged carrier). Intel will absorb all internal expedite costs to meet as closely as possible Intel’s original delivery commitment in Intel’s Order confirmation pursuant to Section 4.3 unless such failure was caused by force majeure as described in Section 14.2 or in direct response to customer hold instructions. Intel’s payment of such expedite costs will be Customer’s sole remedy in the event of a failure to meet Intel’s Delivery commitment. |

4.5.2 | Lead Time and Manufacturing Cycle Times. Intel will provide Customer Order Lead Times which will be reviewed on a periodic basis with Customer. |

4.6 | Shipping Terms. |

4.6.1 | The shipment terms will be as set forth in Exhibit B with title transferring over the high seas prior to entry at the port of disembarkation and risk of loss for Products passing to customer upon Delivery by Intel to Customer, except that, for [*****] Products only, the Parties will negotiate in good faith as to the place of title transfer, provided that title to [*****] Products will pass, if it all, at an agreed time no earlier than the earlier of (1) [*****] calendar days from invoice or (2) Delivery to Customer or Customer's designee. For purposes of section 199 of the U.S. Internal Revenue Code of 1986 (as amended), the Parties agree that Intel should be considered to have the benefits and burdens of ownership of the Product during the production phase. Accordingly, for purposes of clarity, Intel (and not Customer) should be the Party entitled to take the deduction attributable to domestic production activities provided for by section 199 of the U.S. Internal Revenue Code of 1986 (as amended). |

4.6.2 | Export Regulation. Customer and Intel agree that the distribution and export/re-export of Products and technical data provided by either Party to the other will comply with all |

4.7 | End of Life Requirements. |

4.7.1 | Except in accordance with Intel’s express termination rights in this Agreement, Intel will not terminate manufacture of any Product that is subject to a Product Attachment if Intel is still manufacturing products at the applicable production node. |

4.7.2 | Notwithstanding the provisions of Section 4.7.1, if Intel decides to terminate production on a given technology node, then Intel will notify Customer in writing at least [*****] months in advance of the termination date, if Intel intends to cease providing any process technology required for the manufacture of a Product(s) provided, however, that Intel will not end of life Intel's applicable manufacturing, packaging, assembly and test technologies earlier than twelve (12) years from the later of the quarter following production launch of Intel’s lead product in the node or availability of initial foundry design kits for the applicable technology node to be used by Customer. Termination of this Agreement other than for Customer's material breach will not act to shorten such twelve (12) year period. Customer may order the manufacturing of their expected demand for the affected Product(s) throughout the life of the Product by the last-time Order date, which will be [*****] months in advance of the termination date, and will take Delivery by the date which is [*****] following the termination date. Customer will notify Intel in writing of last-time Order quantity in the form of a last-time Order. If a last-time Order is not received by the last-time Order date, then existing Orders will constitute the last- time Order quantity and Intel will manufacture only enough to ship those volumes. |

4.7.3 | Notwithstanding the provisions of Sections 4.7.1and 4.7.2, if Customer fails to place an Order for manufacture of any Products of a Product Family for twelve (12) consecutive months, Intel may, at its option, cease manufacturing such Product Family, and may transmit a request, to Customer’s last known address, that Customer pay reasonable storage charges for any Customer owned masks related to such Product Family. In the event Customer fails to arrange for such payment within 30 calendar days of transmission of such notice, Intel may, without liability, scrap the masks. In addition, upon Customer request, Intel will destroy all masks for the requested Product. |

4.7.4 | Intentionally Deleted. |

4.7.5 | Notwithstanding anything else in this Agreement, Intel may terminate work under any Product Attachment: |

4.7.5.1 | Without liability for the termination of technology nodes that are larger than 14nm or smaller than the full Moore’s law node smaller than 10nm, which is currently projected to be called 7nm; or |

4.7.5.2 | Without liability for the termination in the event of a material uncured breach by Customer; or |

4.7.5.3 | Without liability for the termination at any time prior to the later of (1) expiration of [*****] calendar days after execution of the Product Attachment or (2) [*****] calendar days before the then-scheduled date of the first Product Tape In under the Product Attachment; or |

4.7.5.4 | Without liability for the termination at Customer's written request; or |

4.7.5.5 | At any other time, subject to payment of the Product Design Termination Fee described below. In the event of termination of a Product Attachment pursuant to this subsection 4.7.5.5, Customer will invoice Intel |

4.7.5.6 | In the event Intel elects to terminate work under one or more Product Attachments pursuant to subsection 4.7.5.5 above (whether or not terminated simultaneously), the Product Design Termination Fee for each such termination, payable by Intel to Customer will be: |

4.7.6 | Notwithstanding anything else in this Agreement, Intel may terminate manufacture of any Product as to which Tape In has been completed prior to the expiration of the periods identified in Sections 4.7.1 and 4.7.2 of this Agreement: |

4.7.6.1 | Without liability for the termination in the event of a material uncured breach by Customer; or |

4.7.6.2 | Without liability for the termination as permitted by Section 4.7.2 of this Agreement, provided that Intel provides the last time buy opportunity described by that section; or |

4.7.6.3 | Without liability for the termination at Customer's written request; or |

4.7.6.4 | At any other time prior to the expiration of the periods identified in Section 4.7.2 of this Agreement, provided that in the event of termination pursuant to this subsection 4.7.6.4, Intel will provide notice 24 months in advance of such termination, Customer will be permitted to make [*****] involving one or more masks to any terminated Products covered under this subsection 4.7.6.4 within [*****] days of such termination notice, and Intel will [*****] terminated Products at the time of such termination to meet Customer's anticipated production needs for the remainder of the 12 year period for which Intel had [*****] to [*****] pursuant to Section 4.7.2. To determine Customer's [*****], Intel and Customer will negotiate in good faith to reach, within [*****] of Intel's notice of termination, a reasonable [*****], based on Customer’s [*****] and [*****] to the product from the [*****] process technology platform which was [*****] to the same [*****]. Specific product mix within the technology node will be solely determined by Customer. Intel will [*****] of [*****]. All Product in the [*****] will be [*****] by Intel. Customer will [*****] at least the quantity of said material that it projected to be [*****] over the first [*****] following termination when ________________________________________ |

4.7.7 | Intel's compliance with Section 4.7.6 will fully satisfy Customer with respect to any losses incurred by Customer in connection with or as a result of Intel's termination of the manufacture of any Product as to which Production has commenced prior to the expiration of the later of the periods identified in Sections 4.7.1 and 4.7.2 of this Agreement and, subject to Intel’s compliance, Customer will have no cause of action or remedy with respect to such termination or losses resulting from such termination, nor may Customer elect to pursue, nor be entitled to, actual damages or any other measure of damages in lieu of or in addition to Intel's obligations set forth in subsection 4.7.6. |

4.7.8 | Intel will not raise the quoted price for any Product after providing the [*****] end of life notice for that Product. |

4.7.9 | In no event will Intel be required to provide the remedies described by both subsections 4.7.5.6 and 4.7.6.4 in connection with the same Product. |

5. | PRICE AND PAYMENT |

5.1 | Price. Price will be as stated on the applicable Intel quotation unless otherwise agreed in writing. Quotations will be issued in compliance with a multiyear pricing agreement to be negotiated separately. |

5.2 | Invoicing. Intel will invoice Customer for [*****] upon Delivery to Customer, [*****] Products upon Delivery to die bank [*****] (subject to subsection 4.4.2.7), and for [*****] upon Delivery per the applicable shipment terms. |

5.3 | Tax. All payments will be made free and clear without deduction for any and all present and future taxes imposed by any taxing authority. In the |

5.4 | Payment Terms. |

5.4.1 | Invoices will be issued at the time of Delivery. Invoices will include Customer’s full Order number, Line Item number, Customer’s part number, quantity as stated in the Order, and ship to address as provided by Customer. |

5.4.2 | Invoices will be payable net thirty (30) calendar days. Intel may charge and Customer agrees to pay upon demand the |

5.4.3 | Customer has received and reviewed a copy of the Intel Corporation Money Laundering Prevention Policy (the "Policy") and with respect to its transactions with Intel, agrees to abide by all of the payment terms and conditions therein. Customer understands that Intel may refuse to accept forms of payment specified as unacceptable in the Policy. |

5.4.4 | If at any time the financial condition of Customer materially changes, or if Customer fails to make payment(s) to Intel when due, Intel may condition further shipments upon payment of any past due amounts and/or suspend credit. In the event Intel is obliged to pursue litigation to obtain payment, after Intel has provided written notice to Customer of its failure to make payment(s) when due and an opportunity to cure consistent with subsection 12.2.1, Intel will be entitled to reimbursement from Customer for all expenses incurred by Intel in respect thereof, including, without limitation, reasonable attorneys’ fees and costs. |

5.5 | The NRE or equipment charges, if any, will be subject to written agreement. |

6. | PRODUCTION SUPPORT |

6.1 | WIP Status Reporting. For each Product, Intel will provide to Customer WIP and inventory status information to show production lot progress at the key processing steps: FE (Diff, Poly, GCN); BE ( M1, M3, M5, M7, M9, V10, C4). Separate expectations will be set for monitoring shuttle progress. Intel will provide lot status flags for holds and scrap at lot level (but not rework information). Intel will promptly notify Customer of any significant scraps and holds which, despite standard Intel dynamic adjustments, can reasonably be expected to impact Delivery commitments. |

6.2 | To intercept backend changes, Intel will support lot holds for up to the maximum period allowed in the given technology node, so as to avoid quality degradation of the product, in safe locations in front end (pre-contact) and backend. |

6.3 | Process Excursions. Intel will notify Customer in the event of Process Excursions which have a materially negative impact to performance, |

6.4 | Production or Business Plan Change Mitigation. In the event of an Intel-initiated change in Intel’s manufacturing, assembly or test process that, per applicable industry standards, necessitates product requalification, Intel will reimburse Customer for requalification, not to exceed [*****] per affected Product die type and not to exceed [*****] Product die types per product change notification. Intel will also cover all costs related to new masks, qualification Wafer lots and Wafer test at Intel during qualification. Intel will also agree to build and hold die bank or FGI inventory buffers, up to [*****] fully yielded Wafer equivalents, to help Customer’s customers with their product transitions due to any resulting product change notification. |

6.5 | Failure Analysis Correlation Request ("FACR"). |

6.5.1 | Intel agrees to support physical failure analysis for silicon and [*****], with Customer support. Customer will provide adequate fault isolation support to assist Intel with physical failure analysis (FA). Intel will use commercially reasonable efforts in performing correlation and failure analysis needed for all Intel related issues and defects. |

6.5.2 | If the FACR process concludes the failure root cause is due to Intel process, Intel will determine and take appropriate containment, corrective and preventative actions. |

6.5.3 | Customer and Intel will negotiate in good faith with respect to [*****], provided that FA services shall be [*****] of work [*****]. |

6.6 | Yield and Yield Improvement Support |

6.6.1 | For Products in Production, Intel final sort yield “reject limits” will be statistically derived from a minimum volume of Production Wafers which have been run on a production sort test program, and reference Intel’s baseline yield distribution. |

6.6.2 | Intel will provide good die per Wafer projections for each Product based on key product attributes from first silicon through peak yields. |

6.6.3 | Intel will not be obligated to share [*****]. |

6.6.4 | Intel’s fab engineers will support collaboration with Customer’s technology team on agreed yield enhancement activities, including product yield and performance improvement based on agreed upon benefit threshold and effort/risk analysis. |

6.6.5 | To facilitate communication regarding engineering issues between Intel and Customer (and specifically not for the purposes of, e.g., auditing/managing production practices), Intel will cooperate with Customer’s assignment of a limited number of resident Customer engineers in close physical proximity to Intel’s fab site(s) where Products are manufactured, and provide those engineers with routine access to Intel personnel familiar with day-to-day issues arising in the course of Product manufacture for the purpose of discussing such matters as product feedback, improvement splits, and FA results. To the extent Customer personnel are provided access to Intel facilities, whether to enable Customer to perform its responsibilities or otherwise, such access will be governed by the terms of Exhibit E hereto. |

6.7 | Intel Information. Intel agrees to provide to Customer information set forth in a Product Attachment as required by Customer or Customer’s end customers to confirm product quality and manufacturing process controls pertaining to Products. Further, Intel agrees to discuss in good faith providing to Customer additional information required by Customer or Customer’s end customers to confirm product quality and manufacturing process controls pertaining to Products, subject to Intel's reasonable concerns regarding the confidentiality of its proprietary manufacturing processes. |

7. | OWNERSHIP |

7.1 | Project Materials. Title to all tangible embodiments of Technical Collateral, including but not limited to specifications, Netlists, Databases, cells, IP blocks, test vectors and/or test tapes furnished by a Party, and all IP rights in such Technical Collateral, shall remain with the Party that furnished them. Each Party shall not use Technical Collateral furnished by the other Party for any purpose other than for performance of its obligations under this Agreement and the associated Product Attachments and Foundry Workplans. Customer agrees that nothing in this Agreement will limit or restrict Intel with respect to the development and use of Process Technology or Packaging Technology even if such Process Technology or Packaging Technology was developed in the performance of Intel’s obligations under this Agreement; provided, however, that nothing in this sentence will be deemed a grant of any license under any intellectual property rights of Customer or its Affiliates. |

7.2 | Intel will not supply any Products nor WIP to any other party without Customer’s prior written consent. |

7.3 | Background Intellectual Property. This Agreement does not change the Parties’ ownership of their Background IP Rights. Except as expressly provided by this Agreement or by a separate written agreement between Customer and Intel, neither Party shall have any right or license under the other's Background IP Rights. |

7.4 | Foreground Intellectual Property. Except as otherwise expressly set forth in a Product Attachment specifically referencing this Section 7.4, Customer and Intel agree that the ownership of Foreground IP Rights shall be allocated as set forth in Sections 7.5 through 7.13 of this Agreement. For purposes of this Agreement, inventorship shall be determined in accordance with United States patent laws. |

7.5 | Independent Foreground IP and Joint Foreground IP. |

7.5.1 | Independent Foreground IP. Except as specified in Sections 7.6 through 7.8, all Foreground IP Rights arising from inventions or works first conceived, for patentable subject matter, or authored, for copyrightable subject matter or mask works; or developed, obtained, or acquired, for trade secrets, solely by a Party shall be solely and exclusively owned (as between the Parties) by the Creating Party. |

7.5.2 | IP Rights License to Joint Foreground IP. Each Party (the “First Party”) hereby grants to the other Party and its Subsidiaries (collectively, the “Second Party”) a non-exclusive, non-transferable (except as permitted by Section 14.4), non-sublicensable, irrevocable, perpetual, worldwide, royalty-free, fully paid up license under the First Party’s Joint Foreground IP Rights (but not under its other Foreground IP Rights or its Background IP Rights, even in the Second Party’s exercise of the licensed Joint Foreground IP Rights, and even if such other Foreground IP Rights or Background IP Rights are required to use or exploit the licensed Joint Foreground IP Rights) to make, have made, use, offer to sell, sell, import, copy, make derivative works of, publicly display, publicly perform, and otherwise dispose of its products and to perform services in connection therewith |

7.6 | Foreground Product IP. Customer shall be the sole and exclusive owner of all Foreground Product IP Rights. Intel agrees to assign and hereby assigns to Customer all of Intel’s right, title and interest in and to such Foreground Product IP Rights. Customer hereby grants to Intel a non-exclusive, non-transferable (except as permitted by Section 14.4), non-sublicensable, irrevocable, perpetual, worldwide, royalty-free, fully paid up license under its Foreground Product IP Rights to or in subject matter that is conceived, authored or developed solely by Intel or jointly |

7.7 | Joint Foreground Process IP. Intel shall be the sole and exclusive owner of all Foreground Process IP Rights to or in subject matter that is conceived, authored or developed jointly by Intel and Customer. Customer agrees to assign and hereby assigns to Intel all of Customer’s right, title and interest in and to such Foreground Process IP Rights. |

7.8 | Joint Foreground Packaging IP. Intel shall be the sole and exclusive owner of all Foreground Packaging IP Rights to or in subject matter that is conceived, authored or developed jointly by Intel and Customer. Customer agrees to assign and hereby assigns to Intel all of Customer’s right, title and interest in such Foreground Packaging IP Rights. |

7.9 | Foreground IP Rights in Customer’s Improvements. Customer grants Intel a non-exclusive, non-transferable (except as permitted by Section 14.4), non-sublicensable, irrevocable, perpetual, worldwide, royalty-free, fully paid up license under Customer’s Patent Rights in any modifications Customer makes to any Intel Licensable Technical Collateral or Intel Provided Deliverables (but not under Customer’s or its Subsidiaries’ other Foreground IP Rights or its Background IP Rights, even in Intel’s exercise of the licensed Patent Rights in such modifications, and even if such other Foreground IP Rights or Background IP Rights are required to use or exploit the licensed Patent Rights) to make, have made, use, offer to sell, sell, import, and otherwise dispose of Intel’s products and to perform services in connection therewith. |

7.10 | Disclosure of Joint Inventions. Periodically, the Parties will disclose in writing to one another all jointly created inventions first conceived during the term, and in the course of their performance, of this Agreement or the associated Product Attachments (each a “Collaboration Invention”). |

7.11 | Uncategorized IP Rights. The ownership of Joint Foreground Uncategorized IP Rights is addressed in Sections 7.12 and 7.13 below. |

7.12 | Ownership of and Licenses to Patent Rights in Joint Inventions. Ownership of any Patent Rights in Joint Foreground Uncategorized IP |

7.12.1 | Assignment and Representation of Rights. The Non-Selecting Party hereby assigns all of its rights, title and interest in the Patent Rights of the selected Collaboration Invention to the Selecting Party on behalf of itself and its employees or agents. The Non-Selecting Party further represents and warrants to the Selecting Party that all of Non-Selecting Party’s employees or agents have assigned, and are obligated to assign, all of its employee’s or agent’s rights, title and interest in the selected Collaboration Invention and all IP Rights therein to the Non-Selecting Party. |

7.12.2 | Cooperation. Each Party will cause its employees, subcontractors and agents who are co-inventors of Collaboration Inventions selected by the other Party to cooperate with the Party filing the patent application. The Party filing the application will not be charged for the time of the non-filing Party’s employees, subcontractors and agents or for their participation in the preparation for filing and prosecution of any applications. The filing Party will only contact employees, subcontractors or agents of the other Party through that Party’s designated representative or legal counsel. |

7.12.3 | Specific Assistance. On request from a Party, the other Party will promptly: |

i. | Deliver to the requesting Party the records, data, or other documents reasonably requested; |

ii. | Execute and deliver assignments of all patents required to be assigned; |

iii. | Make its employees, agents, and consultants reasonably available to the requesting Party or its attorneys, agents, or representatives; |

iv. | Take necessary actions to perfect the other Party’s rights to a Collaboration Invention that other Party has selected; |

v. | Complete any procedures required by local jurisdictions for claiming employer invention rights with respect to a Party’s employees; and |

vi. | Pay any compensation relating to its use of its employee’s, subcontractor’s, or agent’s invention rights without right of reimbursement from the other Party regardless of which Party has selected the Collaboration Invention. |

7.12.4 | Filing Patent Applications. The Party selecting a Collaboration Invention may, at its sole discretion, file patent applications claiming Patent Rights to the selected Collaboration Invention anywhere in the world, solely in its own name, and at its own expense. |

7.12.5 | No Registration or Filing Obligations. The Non-Selecting Party will not have any obligation to the Selecting Party for any of the following items related to that invention: |

i. | filing patents or registering copyrights; |

ii. | maintaining a filed patent application; or |

iii. | accountings. |

7.12.6 | Intentionally Deleted. |

7.12.7 | Right to Challenge Validity. If a Party or its employees have assigned Patent Rights to the other Party pursuant to this Section 7.12, the assigning Party expressly reserves the right to challenge the validity or enforceability of any Patent Rights resulting from the applicable invention(s), and the assignee Party expressly waives all rights to assert the doctrine of “assignor estoppel” in any dispute or legal action involving assigned Patent Rights. |

7.12.8 | Reliance on Waiver of Rights to Assert Assignor Estoppel. No assignment under this Section 7.12 will prevent the assignor |

7.13 | Other IP Rights in Joint Uncategorized IP. Both Parties will jointly own any Copyrights and Trade Secret Rights comprising Joint Foreground Uncategorized IP Rights. |

7.13.1 | Use and Disclosure. In its sole discretion, either Party may reproduce, distribute, publicly display, publicly perform, create derivative works, use or disclose works in which it is a joint owner of the Copyrights and Trade Secret Rights comprising Joint Foreground Uncategorized IP Rights as if the Copyrights and Trade Secret Rights were solely owned by that Party, without any duty of accounting, compensation, or consent of the other party. Neither Party, however, grants to the other Party any license or authorization under its Patent Rights under this subsection 7.13.1, even in the other Party’s exercise of Copyright and Trade Secret Rights granted in this section and that may be granted elsewhere in this agreement. |

7.13.2 | Confidential Treatment in Certain Cases. Either Party may request that a work to which Copyrights or Trade Secret Rights comprising Joint Foreground Uncategorized IP Rights pertain be maintained as Confidential Information by both parties. The requesting Party must make its request in writing and must describe with reasonable particularity the specific work proposed to be maintained as confidential. Both parties agree that information will be protected by each Party in the same manner in which that Party protects its own Confidential Information of a similar nature. |

7.14 | Confidential Treatment for a Limited Time. The Party that did not select any particular Collaboration Invention pursuant to the process described in Section 7.12 agrees that it will not disclose Confidential Information about the Collaboration Invention to third parties and it will protect such information in the same manner in which it protects its own confidential information of a similar nature for three years or until a patent application for the Collaboration Invention is published, whichever is earlier. For a Collaboration Invention that the Party did not select, the Non-Selecting Party may request in writing to the Selecting Party that it need not maintain the confidentiality of the Collaboration Invention. If the Selecting Party agrees, the Non-Selecting Party need not keep the information confidential. |

7.15 | No Other Rights or Obligations. Nothing contained in this Section 7: |

7.15.1 | is a warranty or representation by either Party about the validity, enforceability, or scope of any IP Right; |

7.15.2 | imposes an obligation on either Party to institute any legal action for infringement or defense of any IP Rights or to defend any legal action brought by a third party with respect to the validity, enforceability, or scope of any IP Right; |

7.15.3 | imposes an obligation on either Party to file a patent application or register any copyright to secure, maintain, or enforce any IP Right; or |

7.15.4 | imposes an obligation to furnish any technical information or know-how. |

7.16 | Disclaimer of CREATE Act. This is not a joint research agreement as that term is defined in the CREATE Act, Public Law No., 108-453 (currently codified at 35 United States Code §103(c)(2)), including any similar provisions of applicable law and any amendments to the foregoing. Each Party expressly disclaims the right to amend a patent application to name the other Party for the purpose of claiming the benefit of the CREATE Act. |

7.17 | Intel will destroy masks using Intel’s standard procedure upon EOL of Product, as permitted by Section 4.7.3. |

7.18 | Except as specifically stated in this Agreement, nothing contained in this Agreement grants to either Party or any third party, either directly or by implication, estoppel, or otherwise, any license under, or assignment of, any IP Rights. |

7.19 | Customer authorizes Intel to ship, import, export, and otherwise transfer work in process between and among Intel and its contracted manufacturing sites. After title to the Product passes in accordance with Section 4.6.1, if Customer requests in writing that Intel retain possession of Products, Products will: (i) be held by Intel for the sole benefit of Customer; (ii) remain Customer’s property; (iii) be used by Intel exclusively for Orders by Customer; (iv) be clearly marked as Customer property; and (v) be kept in good condition at Intel's expense. In addition, Intel will not represent or assert any ownership interest in Customer property and upon request of Customer will execute any documents necessary to perfect Customer’s ownership interest in such Customer property. Intel will keep the Customer property free of liens, attachments, and other encumbrances while in Intel’s control. |

8. | CONFIDENTIALITY |

8.1 | Confidential Information exchanged between the parties will be governed by the Corporate Non-Disclosure Agreement ("CNDA") # 6203681 dated January 3, 2001 in effect between the Parties. The existence of this Agreement and the content hereof is the Confidential Information (as defined in the CNDA) of the Parties. |

8.2 | The disclosure of certain sensitive Confidential Information may be subject to and governed by the terms of one or more Restricted Secret Non-Disclosure Agreement(s) or Restricted Use Non Disclosure Agreement(s) executed or to be executed between the Parties, (collectively "Custom NDA(s)"). For the Confidential Information disclosed under a Custom NDA, in the event of a conflict between the terms of this Agreement, the CNDA and the Custom NDA the following order of precedence (from highest to lowest) will apply: (1) the applicable Custom NDA (2) this Agreement and (3) the CNDA. |

8.3 | However, notwithstanding Section 8.2 above, in order to facilitate disclosures which would otherwise be prohibited in furtherance of projects of benefit to both Parties, the Parties agree: |

8.3.1 | Subject to the terms of this Section 8.3, but notwithstanding any other use restrictions and other provisions relating to confidentiality in this or any other agreement between the Parties, including but not limited to the CNDA, any Custom NDA, license agreements, manufacturing agreements, and development agreements, whether entered prior to or during the term of this Agreement (collectively, "Other Agreements"), and to the extent not otherwise permitted by the Other Agreements, or any of them, each Party hereto (each a "Discloser") may share Confidential Information (as that term is defined in the Other Agreement pursuant to which such Discloser received the information) received from the other (each a "Source") with third parties (including but not limited to contractors, IP vendors, and EDA vendors) (each an "Agreed Third Party"), on a need-to-know basis, solely for the purposes of debugging tool issues relating to, and otherwise supporting, the design, manufacture, test, and packaging of, foundry products at Intel, provided that: |

8.3.1.1 | Prior to any disclosure to an Agreed Third Party, the Discloser confirms in writing (including by email) with the Source that the Source consents to disclosure of the particular information to the Agreed Third Party, and obtains from the Source the title and date of |

8.3.1.2 | When disclosing Confidential Information provided by the Source, the Discloser identifies it to the Agreed Third Party as being the Source's Confidential Information, and designates it as being subject to the agreement identified by the Source pursuant to subsection 8.3.1.1 above; |

8.3.1.3 | A Party may not disclose Confidential Information which that Party received pursuant to an Other Agreement (including but not limited to a Restricted Secret Non Disclosure Agreement or Restricted Use Non Disclosure Agreement) which limits disclosure by such Party to particular individuals (collectively, "Highly Sensitive Information"), to any employee of an Agreed Third Party who is not authorized to access such information under his own employer's agreements with the owner of such Highly Sensitive Information, and each Party will be responsible to put procedures in place to prevent such disclosure, such as assigning a gatekeeper to ensure that only authorized persons attend meetings at which such Highly Sensitive Information can reasonably be anticipated to be discussed. To effectuate this Section, the Parties may disclose to one another the identities of the persons authorized to have access to one another's Highly Sensitive Information; and |

8.3.1.4 | Each Party agrees to treat Agreed Third Party-provided Confidential Information received from the other Party pursuant to this Agreement as required by its agreements with the Source of the Confidential Information involved. |

8.4 | Customer acknowledges that Wafers in process will embody Intel trade secrets that Intel does not normally disclose. To protect the Intel trade |

8.4.1 | be entitled to take physical possession of the Wafer for any reason even if Customer otherwise would be entitled to take such possession under any applicable law, except as otherwise agreed by Intel pursuant to this Agreement; |

8.4.2 | place any lien or other encumbrance on the Wafer that would enable a third party to take possession of the Wafer; nor |

8.4.3 | have any right to inspect the Wafer or otherwise gain access to the Wafer, except as otherwise agreed by Intel pursuant to this Agreement. |

8.5 | Notwithstanding Section 8.4, and subject to Customer’s commitment to comply with security measures as reasonably required by Intel, Intel will [*****] a reasonable number of [*****] to Customer locations solely for development of [*****] and [*****]. Applicable security measures will include, but not be limited to, secure storage of [*****], and all [*****] (including [*****]) being returned to Intel promptly after use. Customer will allow access to [*****] solely by its employees on a strict need-to-know basis solely for the purpose of performing activities permitted by this Agreement, and will maintain as Intel Confidential Information, and not attempt to reverse engineer, debug or analyze any Intel in [*****] variation and [*****] on [*****]. |

9. | WARRANTY |

9.1 | Warranty. |

9.1.1 | Die Products [*****]. Intel warrants that Intel’s manufacture of all Die Product(s) [*****] Delivered shall meet the Acceptance Specification referenced in Exhibit A for twelve (12) months following the date of Intel's invoice therefor. |

9.1.2 | Finished Product. Intel warrants that the assembly process and materials used in the manufacture of Finished Product(s) shall meet the Acceptance Specification referenced in Exhibit A for twelve (12) months following the date of Delivery. For avoidance of doubt, assembly process and materials shall not include Die Products, which are covered under the warranty in Section 9.1.1 even when they are incorporated into Finished Products. |

9.1.3 | Exclusions. Products which have been subject (other than by Intel or Intel’s subcontractors) to abuse, misuse, accident, alteration, neglect, electromigration effects or other conditions outside specifications, radiation-induced damage, unauthorized or improper repair or improper application are not covered by any warranty. There is no warranty extended for damage resulting from environmental or externally induced degradation. Intel will not be responsible for claims pursuant to this warranty caused by acts not performed by Intel or Intel’s subcontractors; or by design or application; or by combination of Products with other things if such combination was the cause of the damage. |

9.1.4 | Conflict Minerals. Intel shall define, implement and communicate to its suppliers a Conflict Mineral Policy that outlines Intel’s commitment to responsible sourcing and measures for implementation of Intel’s policy. Intel shall work with its suppliers to ensure traceability of these metals at least to smelter level. Traceability data shall be maintained and recorded for five (5) years and provided to Customer upon request. Once such mechanisms are available, Intel and its suppliers shall ensure that purchased metals originate from smelters validated by Intel and its suppliers as being conflict mineral free. Intel is encouraged to support industry efforts to enhance traceability and responsible practices in global minerals supply chains. Further, upon Customer’s reasonable request, Intel agrees to exercise commercially reasonable efforts to provide information regarding its conformance efforts with applicable Conflict Minerals regulatory requirements. |

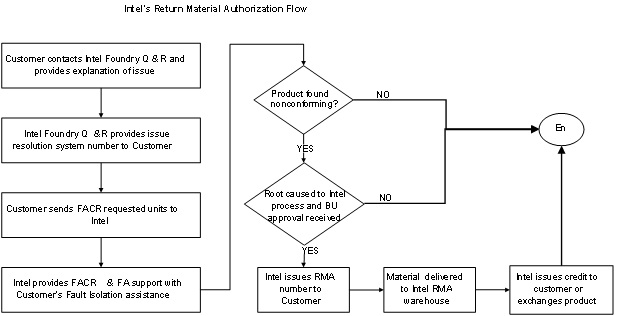

9.2 | Warranty Claims. Pursuant to the procedure set forth in Section 9.3 herein, if any Product, for which process qualification has been completed, furnished by Intel, fails to conform to the warranty set forth in Section 9.1, Intel's sole and exclusive liability will be, at Intel's option (provided however that Customer will not be required to accept replacement Products if Customer no longer has a need for such Products), to repair, replace or credit Customer's account with an amount equal to the price paid for any such Product which fails to conform during the applicable warranty period provided that (i) Customer returns the Product in accordance with Intel’s RMA procedure referenced in Exhibit C. If such Product is nonconforming, transportation and other charges for the shipment of replacement or repaired Product to Customer will be paid by Intel (excluding customs clearance charges for ex-USA locations, which charges will be paid by Customer). Intel will have a reasonable time to make repairs or to replace Product or to credit Customer's account. All warranty claims must be made within six months of the date Customer learns, or with |

9.3 | RMA Procedure. All Product returned to Intel by Customer will be in accordance with Intel’s return material authorization ("RMA") procedure referenced in Exhibit C. Intel will pay all freight charges on returned materials. Intel is responsible for (i) secure storage in a segregated facility, handling, processing and return of Product and packaged units incorporating Product, and (ii) the return (or certified destruction) of all scrap or rejects to Customer. Intel will be liable for any loss of Product received by Intel pursuant to such RMA procedure, including, but not limited to, theft, destruction, and deterioration. |

9.4 | WARRANTY DISCLAIMERS. |

9.4.1 | THE WARRANTY SET FORTH IN SECTION 9.1 IS IN LIEU OF ANY OTHER WARRANTY, WHETHER EXPRESS, IMPLIED OR STATUTORY, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTY OF MERCHANTABILITY, FITNESS FOR ANY PARTICULAR PURPOSE, OR ANY WARRANTY OTHERWISE ARISING OUT OF ANY PROPOSAL, SPECIFICATION OR SAMPLE. THERE IS ALSO NO IMPLIED WARRANTY OF NONINFRINGEMENT. INTEL NEITHER ASSUMES NOR AUTHORIZES ANY PERSON TO ASSUME FOR IT ANY OTHER LIABILITY. |

9.4.2 | Products are not intended for use in, and no warranty is made with respect to, applications where failure to perform can reasonably be expected to result in significant injury (including, without limitation, automatic navigation control systems, weaponry, aviation or nuclear equipment, or for surgical implant or to support or sustain life). |

9.4.3 | Customer is not relying on any statements or information in Intel’s literature, and Customer will test all parts and applications under extended field and laboratory conditions and to ensure reasonable margins over a range of conditions, including for warranty life and to provide guard bands extending beyond normally expected conditions as appropriate. Notwithstanding any cross-reference or statements of compatibility, functionality, interchangeability, and the like, Intel-made goods, embedded devices and processes may differ from similar goods, devices and processes from other vendors in performance, function or operation, or as to matters, ranges and conditions not stated in and/or outside the applicable Product Acceptance Specification; and Customer agrees that Intel makes no |

9.4.4 | IN NO EVENT WILL INTEL BE LIABLE FOR ANY OTHER COSTS ASSOCIATED WITH THE REPLACEMENT OR REPAIR OF PRODUCT, INCLUDING LABOR, INSTALLATIONS OR OTHER COSTS, AND IN PARTICULAR, ANY COSTS RELATING TO THE REMOVAL OR REPLACEMENT OF ANY PRODUCT SOLDERED OR OTHERWISE PERMANENTLY AFFIXED TO ANY PRINTED CIRCUIT BOARD. |

9.5 | Root Cause Analysis. The Parties acknowledge and agree that it is in their best interest to promptly identify and address the root cause of any repetitive failures that occur with the Products. Each Party agrees to promptly notify the other of any repetitive failures of the Products it becomes aware of, and the Parties will act in good faith to identify and address the root cause of any such repetitive failures as soon as reasonably practicable, even if such failures are identified outside of the applicable warranty period. |

10. | INDEMNIFICATION |

10.1 | Intel Intellectual Property Infringement. Intel will defend Customer and its Subsidiaries against any claim or discovery brought in any suit or proceeding against Customer or its Subsidiaries by a third party based on an allegation that any Intel Licensable Technical Collateral, Intel Provided Deliverables or the Intel manufacturing process used to manufacture a Product misappropriates a trade secret or infringes a copyright, mask work right or Patent Indemnity Jurisdiction patent (hereinafter "Intel Covered Claims"), and indemnify Customer and its Subsidiaries from and against any damages awarded or paid in settlement of any Intel Covered Claims. |

10.2 | Exclusions from Intel Intellectual Property Infringement. Intel will not be liable for any costs or damages, and will not indemnify or defend Customer or its Subsidiaries, from any expenses, damages, costs or losses resulting from any Intel Covered Claim to the extent based upon a claim arising from: |

10.2.1 | an allegation that any Product manufactured using any Customer Provided Deliverables, without modification, infringes a copyright, trademark, trade secret, mask work or patent as a result of the use by Intel of any such Customer Provided Deliverables in the manufacture of Products; |

10.2.2 | the combination of the Intel Licensable Technical Collateral, Intel Provided Deliverables or Intel manufacturing process (i) with any Customer provided process, or (ii) with anything not provided or procured by Intel, if the infringement or misappropriation would not have occurred but for such combination; |

10.2.3 | the combination or use of Product(s) with other services or devices if the infringement or misappropriation would not have occurred but for such combination; |

10.2.4 | the combination or use of Product(s) with any software, or resulting from programming by Customer or any third party, if the infringement or misappropriation would not have occurred but for such combination or programming; |

10.2.5 | a Product’s alleged compliance with or use of memory or a memory interface compliant with a DDR standard (including but not limited to DDR, DDR2 and DDR3) or a cellular communication or wireless wide area network standard, including but not limited to any version of IEEE 802.16 (a.k.a. "Wi-MAX"), UMTS, EDGE, GPRS, GSM, CDMA, TD-SCDMA, WCDMA, HSxPA, LTE, ‘2G,’ ‘3G,’ ‘4G’ or their successors; |

10.2.6 | an allegation that Intel, Customer, or a Product indirectly infringes, including by inducing or contributing to another’s infringement; |

10.2.7 | a Product’s compliance with any media decoding, encoding, or transcoding technology (inter alia, an audio or video codec); or |

10.2.8 | modification of the Product by a party other than Intel after delivery by Intel if infringement or misappropriation would not have occurred but for such modification. |

10.3 | In the event that any Intel Licensable Technical Collateral, Intel Provided Deliverables or Intel manufacturing process used to manufacture Products is held by a court of competent jurisdiction to constitute an infringement, or Intel’s use of such Intel Licensable Technical Collateral, Intel Provided Deliverables or manufacturing process used to manufacture Products is enjoined due to infringement, Intel will, at its sole discretion and at its own expense (i) obtain the right to continue using the Intel Licensable Technical Collateral, Intel Provided Deliverables or manufacturing process to manufacture Products, (ii) modify or replace the Intel Licensable Technical Collateral, Intel Provided Deliverables or manufacturing process so that it becomes non-infringing, or (iii) credit Customer the amounts paid by Customer to Intel for any Product(s) manufactured using the Intel Licensable Technical Collateral, Intel Provided Deliverables or manufacturing process that are affected by the claim, in which case Customer will further cease all further sale of the applicable Product(s). |

10.4 | Customer Indemnification. |

10.4.1 | Customer will defend Intel against any claim or discovery brought in any suit or proceeding against Intel by a third party based on an allegation that any Customer Provided Deliverables used to manufacture a Product misappropriates a trade secret or infringes a copyright, mask work right or Patent Indemnity Jurisdiction patent (hereinafter "Customer Covered Claims"), and indemnify Intel from and against any damages awarded or paid in settlement of any Customer Covered Claims. |

10.4.2 | Customer will defend Intel against any claim brought in any suit or proceeding against Intel by a third party based on Customer’s breach of Section 9.4.2, and indemnify Intel from and against any damages awarded or paid in settlement of any such suit or proceeding. |

10.4.3 | In the event that any Customer Provided Deliverables are held to constitute an infringement, or Intel’s use of such Customer Provided Deliverables is enjoined due to infringement, Intel will cease all infringing uses of the applicable Customer Provided Deliverables. Intel will not be deemed in breach of its supply obligations under this Agreement if Intel ceases to manufacture Products as a result of this Section 10.4.3. |

10.5 | Exclusions from Customer Intellectual Property Infringement. Customer will not be liable for any costs or damages, and will not indemnify or defend Intel from any expenses, damages, costs or losses resulting from any suit or proceeding based upon a claim arising from any claim |

10.5.1 | the combination or use of Customer Provided Deliverables with any devices or software not provided or procured by Customer if the infringement or misappropriation would not have occurred but for such combination; |

10.5.2 | Intel’s willful infringement of any United States patent or copyright, except to the extent such willful infringement arises from compliance with Customer’s written instructions relating to a Customer Covered Claim; or |

10.5.3 | modification of the Customer Provided Deliverables by a party other than Customer after delivery by Customer if infringement or misappropriation would not have occurred but for such modification. |

10.6 | Obligations of Indemnitee. The Party seeking indemnity ("Indemnitee") from the Party obligated to provide indemnity under Sections 10.1 or 10.4 ("Indemnitor") will (i) promptly notify Indemnitor in writing of such claim; (ii) cooperate and provide all reasonably requested authority, information and assistance to Indemnitor; and (iii) obtain Indemnitor’s written consent before incurring any costs or expenses or entering into any compromise or settlement of such claim. |

10.7 | Obligations of Indemnitor |

10.7.1 | Indemnitor may, in its sole discretion, control the defense and settlement of any action involving an indemnified claim. If Indemnitor controls defense or settlement, Indemnitee may retain its own counsel to monitor such defense or settlement, at Indemnitee’s own expense, but such Indemnitee’s counsel will not be entitled to control defense or settlement. |

10.7.2 | Indemnitor will pay reasonable attorneys’ and experts fees and costs incurred in the course of defense or settlement, and any damages and costs finally awarded against Indemnitee or amounts agreed by Indemnitor to be paid in settlement, for any indemnified claim only to the extent such damages and costs are awarded or such settlement is paid for the Intel Covered Claim or the Customer Covered Claim, respectively. |

10.8 | Exclusive Remedy. The foregoing states the entire set of obligations and remedies flowing between Customer and its Subsidiaries and Intel arising from any intellectual property claim by a third party. |

10.9 | Intel and Customer will cooperate in connection with any issue raised with respect to intellectual property rights of third parties relating to Products and/or to services under this Agreement. In the event there is a finding by a court of competent jurisdiction that either Party infringed any third party patent or copyright and/or misappropriated any third party trade secrets which affects the production of Products, the other (the "Concerned Party") may, at its sole option and without liability, terminate and/or suspend ordering or production of the relevant Products, as the case may be, provided however the Concerned Party will, prior to such termination and/or suspension, provide the other a commercially reasonable opportunity to address and/or offset the risks and costswhich the Concerned Party reasonably believes it may incur but for such termination and/or suspension. In the event of a disagreement over whether the Concerned Party has provided reasonable opportunity to address and/or offset the risks and costs, the matter will be promptly escalated on each side to the highest levels of management, including, if necessary, each party's CEO, prior to any termination and/or suspension of ordering or producing of the relevant Products. |

11. | USE OF CONTRACTORS. |