UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-04282

Name of Fund: BlackRock Natural Resources Trust

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Natural

Resources Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 07/31/2015

Date of reporting period: 07/31/2015

Item 1 – Report to Stockholders

2

JULY 31, 2015

|

ANNUAL REPORT

|

|

BlackRock Equity Dividend Fund

BlackRock Natural Resources Trust

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| Table of Contents |

| Page | ||||

| 3 | ||||

| Annual Report: |

||||

| 4 | ||||

| 9 | ||||

| 10 | ||||

| Financial Statements: | ||||

| 11 | ||||

| 16 | ||||

| 18 | ||||

| 19 | ||||

| 21 | ||||

| 32 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 47 | ||||

| 50 | ||||

| 2 | ANNUAL REPORT | JULY 31, 2015 |

| The Markets in Review |

Dear Shareholder,

Diverging monetary policies and shifting economic outlooks between regions were the broader themes underlying market conditions during the 12-month period ended July 31, 2015. The period began with investors caught between the forces of low interest rates and an improving U.S. economy, high asset valuations, oil price instability and lingering geopolitical risks in Ukraine and the Middle East. As U.S. growth picked up considerably in the fourth quarter of 2014, the broader global economy showed signs of slowing. Investors favored the stability of U.S. assets despite uncertainty as to when the Federal Reserve (the “Fed”) would raise short-term interest rates. International markets continued to struggle even as the European Central Bank and the Bank of Japan eased monetary policy. Oil prices plummeted in late 2014 due to a global supply-and-demand imbalance, sparking a sell-off in energy-related assets and putting stress on emerging markets. Fixed income investors piled into U.S. Treasuries as their persistently low yields had become attractive as compared to the even lower yields on international sovereign debt.

Equity markets reversed in early 2015, with international markets outperforming the United States as global risks abated. Investors had held high expectations for the U.S. economy, but a harsh winter and west coast port strike brought disappointing first-quarter data and high valuations took their toll on U.S. stocks, while bond yields fell to extreme lows. (Bond prices rise as yields fall.) In contrast, economic reports in Europe and Asia easily beat investors’ very low expectations, and accommodative policies from central banks in those regions helped international equities rebound. Oil prices stabilized, providing some relief for emerging market stocks, although a stronger U.S. dollar continued to be a headwind for the asset class.

U.S. economic data regained momentum in the second quarter, helping U.S. stocks resume an upward path, although meaningful strength in the labor market underscored the likelihood that the Fed would raise short-term rates before the end of 2015 and bond yields moved swiftly higher. The month of June brought a sharp, but temporary, sell-off across most asset classes as Greece’s long-brewing debt troubles came to an impasse and investors feared the consequences should Greece leave the eurozone. Adding to global worries was a massive correction in Chinese equity prices despite policymakers’ attempts to stabilize the market. As these concerns abated in the later part of July, developed markets rebounded with the help of solid corporate earnings. Emerging markets, however, continued to slide as Chinese equities remained highly volatile and growth estimates for many emerging economies were revised lower. Bond markets moved back into positive territory as softer estimates for global growth and the return of falling commodity prices caused yields to move lower.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of July 31, 2015 | ||||||||

| 6-month | 12-month | |||||||

| U.S. large cap equities |

6.55 | % | 11.21 | % | ||||

| U.S. small cap equities |

6.98 | 12.03 | ||||||

| International equities |

7.19 | (0.28 | ) | |||||

| Emerging market equities |

(4.76 | ) | (13.38 | ) | ||||

| 3-month Treasury bills |

0.00 | 0.01 | ||||||

| U.S. Treasury securities |

(3.64 | ) | 5.32 | |||||

| U.S. investment-grade |

(1.47 | ) | 2.82 | |||||

| Tax-exempt municipal |

(0.97 | ) | 3.50 | |||||

| U.S. high yield bonds |

1.27 | 0.37 | ||||||

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||||||

| THIS PAGE NOT PART OF YOUR FUND REPORT | 3 |

| Fund Summary as of July 31, 2015 | BlackRock Equity Dividend Fund |

| Investment Objective |

BlackRock Equity Dividend Fund’s (the “Fund”) investment objective is to seek long-term total return and current income.

| Portfolio Management Commentary |

How did the Fund perform?

| • | For the 12-month period ended July 31, 2015, all of the Fund’s share classes outperformed the Fund’s benchmark, the Russell 1000® Value Index, except for the Fund’s Investor B Shares, which performed in-line. For the same period, the Fund underperformed the broad-market S&P 500® Index. The following discussion of relative performance pertains to the Russell 1000® Value Index. |

What factors influenced performance?

| • | The largest contributor to relative performance for the period was a combination of stock selection and an underweight in the energy sector. Notably, an underweight in the oil & gas exploration & production industry proved beneficial amid the sharp decline in the price of crude oil. Additionally, an overweight in the refiner Marathon Oil Corp. added significantly to relative performance. Stock selection in industrials also contributed positively as overweight allocations in Northrop Grumman Corp., Raytheon Co. and Lockheed Martin Corp. outperformed on stronger-than-expected earnings and optimistic earnings forecasts. Within consumer discretionary, robust earnings and macroeconomic tailwinds continued to drive outperformance by non-benchmark holding The Home Depot, Inc. Additionally, stock selection within consumer staples and utilities added modestly to relative results. |

| • | The largest detractor from relative return during the period came from a combination of stock selection and an underweight in the health care providers & services industry. Broadly, the health care providers & services industry has benefited from improving sentiment, continued below-normal utilization and rising enrollments under the Affordable Care Act. However, benchmark constituents including Cigna Corporation, Aetna, Inc. and Humana Inc. owed their outperformance in part to merger and acquisition transactions. In addition, a combination of stock selection and an underweight allocation to financials detracted from relative performance, as an underweight in diversified financial services companies and stock selection within insurers proved costly. Lastly, stock selection in information technology (“IT”) and an overweight in materials detracted from relative return. |

Describe recent portfolio activity.

| • | During the 12-month period, the Fund was positioned to take advantage of the slowly improving domestic economy and the higher (but not exceedingly high) interest rate environment that the investment manager foresees as unfolding over time. Toward that end, the Fund’s exposure to the health care, financials and IT sectors was raised. The Fund’s allocation in health care was increased by initiating positions in the managed care providers UnitedHealth Group, Inc. and Anthem, Inc. Within financials, exposure was boosted via new positions in The Goldman Sachs Group, Inc. and American International Group, Inc. The Fund’s bank exposure was also increased through additions to existing positions in Bank of America Corp., Citigroup, Inc. and JPMorgan Chase & Co. Lastly, within IT the Fund initiated positions in Samsung Electronics Co. Ltd. and Oracle Corporation. Conversely, exposure to the consumer discretionary, energy and consumer staples sectors was selectively reduced. Notable sales from the portfolio included The Walt Disney Company, Johnson Controls, Inc., Enbridge, Inc. and Kimberly-Clark Corporation. |

Describe portfolio positioning at period end.

| • | The Fund’s largest allocations were in the financials, industrials and health care sectors. Relative to the benchmark, the largest overweight positions were in industrials, consumer discretionary and health care. Conversely, the largest relative underweight positions were in the energy, financials and IT sectors. |

| • | In addition to company fundamentals, the investment advisor continues to assess the interest rate environment and inflation indicators, while monitoring overall levels of domestic equity valuation and market volatility. At period end the Fund was positioned with careful consideration of capital preservation and growth of income. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 4 | ANNUAL REPORT | JULY 31, 2015 |

| BlackRock Equity Dividend Fund |

| Portfolio Information |

| Ten Largest Holdings | Percent of Long-Term Investments |

|||

| JPMorgan Chase & Co. |

4 | % | ||

| Wells Fargo & Co. |

4 | |||

| Citigroup Inc. |

3 | |||

| Home Depot Inc. |

3 | |||

| Pfizer Inc. |

3 | |||

| General Electric Co. |

3 | |||

| Exxon Mobil Corp. |

2 | |||

| Merck & Co. Inc. |

2 | |||

| UnitedHealth Group Inc. |

2 | |||

| Microsoft Corp. |

2 | |||

| Sector Allocation | Percent of Long-Term Investments |

|||

| Financials |

27 | % | ||

| Industrials |

14 | |||

| Health Care |

14 | |||

| Energy |

9 | |||

| Information Technology |

8 | |||

| Consumer Discretionary |

8 | |||

| Consumer Staples |

8 | |||

| Utilities |

5 | |||

| Materials |

4 | |||

| Telecommunication Services |

3 | |||

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| ANNUAL REPORT | JULY 31, 2015 | 5 |

| BlackRock Equity Dividend Fund |

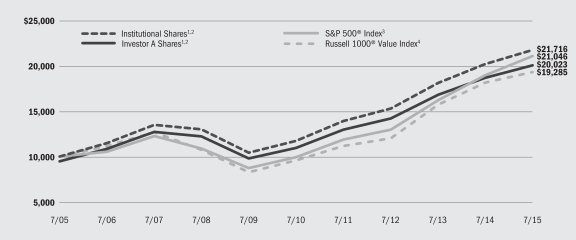

| Total Return Based on a $10,000 Investment |

| 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal circumstances, the Fund invests at least 80% of its assets in equity securities and at least 80% of its assets in dividend paying securities. |

| 3 | This unmanaged index covers 500 leading companies and captures approximately 80% coverage of available market capitalization. |

| 4 | This unmanaged index is a subset of the Russell 1000® Index that consists of those Russell 1000® securities with lower price-to-book ratios and lower expected growth values. |

| Performance Summary for the Period Ended July 31, 2015 |

| Average Annual Total Returns5 | ||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||

| 6-Month Total Returns |

w/o sales charge |

w/sales charge |

w/o sales charge |

w/sales charge |

w/o sales charge |

w/sales charge |

||||||||||||||||||||||

| Institutional |

5.54 | % | 7.55 | % | N/A | 13.15 | % | N/A | 8.06 | % | N/A | |||||||||||||||||

| Service |

5.32 | 7.19 | N/A | 12.81 | N/A | 7.77 | N/A | |||||||||||||||||||||

| Investor A |

5.36 | 7.25 | 1.62 | % | 12.84 | 11.63 | % | 7.77 | 7.19 | % | ||||||||||||||||||

| Investor B |

4.96 | 6.38 | 1.88 | 11.96 | 11.71 | 7.09 | 7.09 | |||||||||||||||||||||

| Investor C |

5.01 | 6.51 | 5.51 | 12.03 | 12.03 | 6.98 | 6.98 | |||||||||||||||||||||

| Investor C1 |

5.07 | 6.69 | 5.69 | 12.23 | 12.23 | 7.20 | 7.20 | |||||||||||||||||||||

| Class R |

5.20 | 6.96 | N/A | 12.49 | N/A | 7.45 | N/A | |||||||||||||||||||||

| S&P 500® Index |

6.55 | 11.21 | N/A | 16.24 | N/A | 7.73 | N/A | |||||||||||||||||||||

| Russell 1000® Value Index |

3.98 | 6.40 | N/A | 15.08 | N/A | 6.79 | N/A | |||||||||||||||||||||

| 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 9 for a detailed description of share classes, including any related sales charges and fees. |

| N/A — Not applicable as share class and index do not have a sales charge. |

| Past performance is not indicative of future results. |

| Expense Example |

| Actual | Hypothetical7 | |||||||||||||||||||||||||||

| Beginning Account Value February 1, 2015 |

Ending Account Value July 31, 2015 |

Expenses Paid During the Period6 |

Beginning Account Value February 1, 2015 |

Ending Account Value July 31, 2015 |

Expenses Paid During the Period6 |

Annualized Expense Ratio |

||||||||||||||||||||||

| Institutional |

$ | 1,000.00 | $ | 1,055.40 | $ | 3.52 | $ | 1,000.00 | $ | 1,021.37 | $ | 3.46 | 0.69 | % | ||||||||||||||

| Service |

$ | 1,000.00 | $ | 1,053.20 | $ | 5.09 | $ | 1,000.00 | $ | 1,019.84 | $ | 5.01 | 1.00 | % | ||||||||||||||

| Investor A |

$ | 1,000.00 | $ | 1,053.60 | $ | 4.89 | $ | 1,000.00 | $ | 1,020.03 | $ | 4.81 | 0.96 | % | ||||||||||||||

| Investor B |

$ | 1,000.00 | $ | 1,049.60 | $ | 8.64 | $ | 1,000.00 | $ | 1,016.36 | $ | 8.50 | 1.70 | % | ||||||||||||||

| Investor C |

$ | 1,000.00 | $ | 1,050.10 | $ | 8.44 | $ | 1,000.00 | $ | 1,016.56 | $ | 8.30 | 1.66 | % | ||||||||||||||

| Investor C1 |

$ | 1,000.00 | $ | 1,050.70 | $ | 7.53 | $ | 1,000.00 | $ | 1,017.46 | $ | 7.40 | 1.48 | % | ||||||||||||||

| Class R |

$ | 1,000.00 | $ | 1,052.00 | $ | 6.51 | $ | 1,000.00 | $ | 1,018.45 | $ | 6.41 | 1.28 | % | ||||||||||||||

| 6 | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). |

| 7 | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| See “Disclosure of Expenses” on page 10 for further information on how expenses were calculated. |

| 6 | ANNUAL REPORT | JULY 31, 2015 |

| Fund Summary as of July 31, 2015 | BlackRock Natural Resources Trust |

| Investment Objective |

BlackRock Natural Resources Trust’s (the “Fund”) investment objective is to seek long-term growth of capital and to protect the purchasing power of shareholders’ capital by investing in a portfolio of equity securities of domestic and foreign companies with substantial natural resource assets.

| Portfolio Management Commentary |

How did the Fund perform?

| • | For the 12-month period ended July 31, 2015, the Fund underperformed its benchmark, the MSCI Natural Resources Index, and the broad-market S&P 500® Index. The following discussion of relative performance pertains to the MSCI Natural Resources Index. |

What factors influenced performance?

| • | Underperformance over the 12-month period was largely due to the Fund’s exposure to oil & gas . The largest detractor from performance came from an overweight position in the oil & gas exploration & production industry, which declined significantly due to the sharp sell-off in crude oil prices. In addition, an overweight in the oil & gas equipment & services industry and an underweight in the chemicals industry detracted from relative return. Lastly, an underweight position in multi-utilities also weighed on relative performance during the period. |

| • | The largest contributor to relative performance during the period was the Fund’s large underweight allocation in the metals & mining industry. This was followed by strong stock selection within both the oil & gas exploration & production industry and the oil & gas equipment & services industry. Lastly, the Fund’s cash position contributed positively to performance. |

Describe recent portfolio activity.

| • | During the 12-month period, there was limited portfolio activity given the Fund’s fundamental long-term investment horizon. |

Describe portfolio positioning at period end.

| • | The Fund remained dually focused on company fundamentals and longer-term industry trends within the energy and materials sectors. Despite the recent declines in energy and commodity prices, exposure to these sectors remains important over the long term given the diversity, pricing power and potential inflation benefits naturally embedded within industry participants. |

| • | The Fund was substantially overweight relative to its benchmark in the energy exploration & production industry, and in general was more heavily allocated to oil-weighted companies as opposed to those levered to natural gas. Additionally, the Fund maintained significant weightings in integrated oil and large-cap servicers due to their diverse revenue streams and balance sheet strength. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| Portfolio Information |

| Ten Largest Holdings | Percent of Long-Term Investments |

| EOG Resources Inc. |

8 | % | ||

| Exxon Mobil Corp. |

6 | |||

| Schlumberger Ltd. |

4 | |||

| Chevron Corp. |

4 | |||

| Occidental Petroleum Corp. |

4 | |||

| Suncor Energy Inc. |

4 | |||

| Anadarko Petroleum Corp. |

4 | |||

| Marathon Petroleum Corp. |

3 | |||

| Devon Energy Corp. |

3 | |||

| Halliburton Co. |

3 |

| Industry Allocation | Percent of Long-Term Investments |

| Oil & Gas Exploration & Production |

27 | % | ||

| Oil, Gas & Consumable Fuels |

22 | |||

| Integrated Oil & Gas |

17 | |||

| Energy Equipment & Services |

12 | |||

| Metals & Mining |

6 | |||

| Oil & Gas Equipment & Services |

4 | |||

| Canadian Independents |

3 | |||

| Refining, Marketing & Transport |

2 | |||

| Chemicals |

2 | |||

| Oil & Gas Drilling |

2 | |||

| Utilities |

1 | |||

| Oil & Gas Producers |

1 | |||

| Gold |

1 |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| ANNUAL REPORT | JULY 31, 2015 | 7 |

| BlackRock Natural Resources Trust |

| Total Return Based on a $10,000 Investment |

| 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal circumstances, the Fund invests at least 80% of its assets in companies with substantial natural resource assets or in securities the value of which is related to the market value of some natural resource asset. |

| 3 | This unmanaged index covers 500 leading companies and captures approximately 80% coverage of available market capitalization. |

| 4 | This unmanaged index is an index consisting primarily of equity securities of companies engaged in the natural resources industry. |

| Performance Summary for the Period Ended July 31, 2015 |

| Average Annual Total Returns5 | ||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||

| 6-Month Total Returns |

w/o sales charge |

w/sales charge |

w/o sales charge |

w/sales charge |

w/o sales charge |

w/sales charge |

||||||||||||||||||||||

| Institutional |

(9.35 | )% | (32.68 | )% | N/A | 0.25 | % | N/A | 3.00 | % | N/A | |||||||||||||||||

| Investor A |

(9.47 | ) | (32.87 | ) | (36.40 | )% | (0.02 | ) | (1.09 | )% | 2.72 | 2.17 | % | |||||||||||||||

| Investor B |

(9.82 | ) | (33.41 | ) | (36.10 | ) | (0.81 | ) | (1.17 | ) | 2.09 | 2.09 | ||||||||||||||||

| Investor C |

(9.82 | ) | (33.38 | ) | (33.98 | ) | (0.80 | ) | (0.80 | ) | 1.92 | 1.92 | ||||||||||||||||

| S&P 500® Index |

6.55 | 11.21 | N/A | 16.24 | N/A | 7.73 | N/A | |||||||||||||||||||||

| MSCI Natural Resources Index |

(5.47 | ) | (20.92 | ) | N/A | 3.61 | N/A | 4.72 | N/A | |||||||||||||||||||

| 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 9 for a detailed description of share classes, including any related sales charges and fees. |

| N/A — Not applicable as share class and index do not have a sales charge. |

| Past performance is not indicative of future results. |

| Expense Example |

| Actual | Hypothetical7 | |||||||||||||||||||||||||||

| Beginning Account Value February 1, 2015 |

Ending Account Value July 31, 2015 |

Expenses Paid During the Period6 |

Beginning Account Value February 1, 2015 |

Ending Account Value July 31, 2015 |

Expenses Paid During the Period6 |

Annualized Expense Ratio |

||||||||||||||||||||||

| Institutional |

$ | 1,000.00 | $ | 906.50 | $ | 3.97 | $ | 1,000.00 | $ | 1,020.63 | $ | 4.21 | 0.84 | % | ||||||||||||||

| Investor A |

$ | 1,000.00 | $ | 905.30 | $ | 5.20 | $ | 1,000.00 | $ | 1,019.34 | $ | 5.51 | 1.10 | % | ||||||||||||||

| Investor B |

$ | 1,000.00 | $ | 901.80 | $ | 9.10 | $ | 1,000.00 | $ | 1,015.22 | $ | 9.64 | 1.93 | % | ||||||||||||||

| Investor C |

$ | 1,000.00 | $ | 901.80 | $ | 8.91 | $ | 1,000.00 | $ | 1,015.42 | $ | 9.44 | 1.89 | % | ||||||||||||||

| 6 | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). |

| 7 | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| See “Disclosure of Expenses” on page 10 for further information on how expenses were calculated. |

| 8 | ANNUAL REPORT | JULY 31, 2015 |

| About Fund Performance | ||||

| • | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| • | Service Shares (available only in BlackRock Equity Dividend Fund) are not subject to any sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee) and are available only to eligible investors. Prior to October 2, 2006, Service Share performance results are those of Institutional Shares (which have no distribution or service fees) restated to reflect the Service Share fees. |

| • | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. |

| • | Investor B Shares are subject to a maximum CDSC of 4.50% declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares automatically convert to Investor A Shares after approximately eight years. (There is no initial sales charge for automatic share conversions.) All returns for periods greater than eight years reflect this conversion. |

| • | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. |

| • | Investor C1 Shares (available only in BlackRock Equity Dividend Fund) are subject to a distribution fee of 0.55% per year and a service fee of 0.25% per year. Prior to September 12, 2011, Investor C1 Shares performance results are those of Institutional Shares (which have no distribution or service fees) restated to reflect the Investor C1 Share fees. |

| • | Class R Shares (available only in BlackRock Equity Dividend Fund) are not subject to any sales charge. These shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. These Shares are available only to certain employer-sponsored retirement plans. |

Investor B and C1 Shares are only available through distribution reinvestments by current holders and for purchase by certain employer-sponsored retirement plans.

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance tables on the previous pages assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Funds’ investment advisor, waived a portion of the Funds’ expenses. Without such waiver, the Funds’ performance would have been lower. The Manager is under no obligation to waive or to continue waiving its fees and such voluntary waiver may be reduced or discontinued at any time. See Note 5 of the Notes to Financial Statements for additional information on waivers.

| ANNUAL REPORT | JULY 31, 2015 | 9 |

| Disclosure of Expenses |

Shareholders of these Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses and other Fund expenses. The expense examples on previous pages (which are based on a hypothetical investment of $1,000 invested on February 1, 2015 and held through July 31, 2015) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| 10 | ANNUAL REPORT | JULY 31, 2015 |

| BlackRock Equity Dividend Fund (Percentages shown are based on Net Assets) |

| Common Stocks | Shares | Value | ||||||

| Aerospace & Defense — 7.5% |

||||||||

| Honeywell International, Inc. |

3,534,897 | $ | 371,340,930 | |||||

| Lockheed Martin Corp. |

1,759,760 | 364,446,296 | ||||||

| Northrop Grumman Corp. |

2,262,422 | 391,421,630 | ||||||

| Raytheon Co. |

4,647,829 | 507,031,666 | ||||||

| United Technologies Corp. |

2,487,274 | 249,498,455 | ||||||

|

|

|

|||||||

| 1,883,738,977 | ||||||||

| Air Freight & Logistics — 1.1% |

||||||||

| United Parcel Service, Inc., Class B |

2,652,902 | 271,551,049 | ||||||

| Banks — 16.1% |

||||||||

| Bank of America Corp. |

17,684,976 | 316,207,371 | ||||||

| Citigroup, Inc. |

14,103,338 | 824,481,139 | ||||||

| JPMorgan Chase & Co. |

15,109,460 | 1,035,451,294 | ||||||

| SunTrust Banks, Inc. |

10,473,713 | 464,404,434 | ||||||

| US Bancorp |

9,257,453 | 418,529,450 | ||||||

| Wells Fargo & Co. |

16,541,365 | 957,248,793 | ||||||

|

|

|

|||||||

| 4,016,322,481 | ||||||||

| Beverages — 1.7% |

||||||||

| The Coca-Cola Co. |

6,114,147 | 251,169,159 | ||||||

| Diageo PLC |

6,663,497 | 186,796,058 | ||||||

|

|

|

|||||||

| 437,965,217 | ||||||||

| Capital Markets — 2.2% |

||||||||

| The Goldman Sachs Group, Inc. |

1,299,078 | 266,401,925 | ||||||

| Morgan Stanley |

7,309,701 | 283,908,787 | ||||||

|

|

|

|||||||

| 550,310,712 | ||||||||

| Chemicals — 2.5% |

||||||||

| The Chemours Co. |

1,074,878 | 11,737,668 | ||||||

| The Dow Chemical Co. |

3,565,706 | 167,802,124 | ||||||

| E.I. du Pont de Nemours & Co. |

5,352,892 | 298,477,258 | ||||||

| Praxair, Inc. |

1,328,504 | 151,635,447 | ||||||

|

|

|

|||||||

| 629,652,497 | ||||||||

| Commercial Services & Supplies — 0.4% |

||||||||

| Tyco International PLC |

2,757,718 | 104,765,707 | ||||||

| Communications Equipment — 2.1% |

||||||||

| Motorola Solutions, Inc. |

2,877,973 | 173,138,855 | ||||||

| QUALCOMM, Inc. |

5,333,307 | 343,411,638 | ||||||

|

|

|

|||||||

| 516,550,493 | ||||||||

| Consumer Finance — 0.6% |

||||||||

| American Express Co. |

1,935,343 | 147,202,189 | ||||||

| Diversified Financial Services — 0.9% |

||||||||

| CME Group, Inc. |

2,349,603 | 225,655,872 | ||||||

| Diversified Telecommunication Services — 1.9% |

|

|||||||

| BCE, Inc. |

1,639,068 | 67,431,257 | ||||||

| Verizon Communications, Inc. |

8,705,002 | 407,307,044 | ||||||

|

|

|

|||||||

| 474,738,301 | ||||||||

| Electric Utilities — 1.9% |

||||||||

| Eversource Energy |

2,176,901 | 108,235,518 | ||||||

| ITC Holdings Corp. |

1,921,707 | 64,915,262 | ||||||

| NextEra Energy, Inc. |

2,779,621 | 292,416,129 | ||||||

|

|

|

|||||||

| 465,566,909 | ||||||||

| Electrical Equipment — 0.4% |

||||||||

| Rockwell Automation, Inc. |

832,179 | $ | 97,181,864 | |||||

| Energy Equipment & Services — 0.5% |

||||||||

| Schlumberger Ltd. |

1,476,717 | 122,301,702 | ||||||

| Food & Staples Retailing — 1.3% |

||||||||

| The Kroger Co. |

8,594,496 | 337,248,023 | ||||||

| Food Products — 0.6% |

||||||||

| Mondelez International, Inc., Class A |

3,155,243 | 142,396,116 | ||||||

| Health Care Equipment & Supplies — 1.1% |

|

|||||||

| Abbott Laboratories |

2,138,771 | 108,414,302 | ||||||

| Becton Dickinson & Co. |

1,055,462 | 160,588,543 | ||||||

|

|

|

|||||||

| 269,002,845 | ||||||||

| Health Care Providers & Services — 4.0% |

||||||||

| Anthem, Inc. |

1,316,457 | 203,089,821 | ||||||

| Quest Diagnostics, Inc. |

3,372,328 | 248,911,530 | ||||||

| UnitedHealth Group, Inc. |

4,437,711 | 538,738,115 | ||||||

|

|

|

|||||||

| 990,739,466 | ||||||||

| Hotels, Restaurants & Leisure — 0.8% |

||||||||

| McDonald’s Corp. |

1,943,802 | 194,108,068 | ||||||

| Household Products — 1.9% |

||||||||

| The Procter & Gamble Co. |

5,705,326 | 437,598,504 | ||||||

| Unilever NV — NY Shares |

1,196,360 | 53,632,819 | ||||||

|

|

|

|||||||

| 491,231,323 | ||||||||

| Industrial Conglomerates — 3.2% |

||||||||

| 3M Co. |

1,145,656 | 173,383,579 | ||||||

| General Electric Co. |

24,032,785 | 627,255,689 | ||||||

|

|

|

|||||||

| 800,639,268 | ||||||||

| Insurance — 6.2% |

||||||||

| ACE Ltd. |

2,306,687 | 250,898,345 | ||||||

| American International Group, Inc. |

5,320,973 | 341,180,789 | ||||||

| MetLife, Inc. |

5,740,127 | 319,954,679 | ||||||

| Prudential Financial, Inc. |

3,470,445 | 306,648,520 | ||||||

| The Travelers Cos., Inc. |

3,084,329 | 327,308,993 | ||||||

|

|

|

|||||||

| 1,545,991,326 | ||||||||

| IT Services — 0.6% |

||||||||

| International Business Machines Corp. |

948,328 | 153,619,653 | ||||||

| Media — 1.7% |

||||||||

| Comcast Corp., Special Class A |

6,690,877 | 417,109,272 | ||||||

| Metals & Mining — 0.4% |

||||||||

| BHP Billiton Ltd. |

4,714,156 | 91,018,121 | ||||||

| Multi-Utilities — 2.5% |

||||||||

| CMS Energy Corp. |

3,149,300 | 107,895,018 | ||||||

| Dominion Resources, Inc. |

3,712,740 | 266,203,458 | ||||||

| Sempra Energy |

1,324,608 | 134,818,602 | ||||||

| WEC Energy Group, Inc. |

2,252,552 | 110,375,048 | ||||||

|

|

|

|||||||

| 619,292,126 | ||||||||

| Multiline Retail — 1.6% |

||||||||

| Dollar General Corp. |

4,997,100 | 401,616,927 | ||||||

See Notes to Financial Statements.

| ANNUAL REPORT | JULY 31, 2015 | 11 |

| Portfolio Abbreviations |

| ADR | American Depositary Receipts |

| Schedule of Investments (continued) |

BlackRock Equity Dividend Fund (Percentages shown are based on Net Assets) |

| Common Stocks | Shares | Value | ||||||

| Oil, Gas & Consumable Fuels — 7.8% |

|

|||||||

| Chevron Corp. |

1,340,815 | $ | 118,635,311 | |||||

| ConocoPhillips |

1,832,474 | 92,246,741 | ||||||

| Exxon Mobil Corp. |

6,934,337 | 549,268,834 | ||||||

| Marathon Oil Corp. |

5,397,501 | 113,401,496 | ||||||

| Marathon Petroleum Corp. |

5,507,768 | 301,109,677 | ||||||

| Occidental Petroleum Corp. |

4,649,729 | 326,410,976 | ||||||

| Spectra Energy Corp. |

3,050,476 | 92,307,404 | ||||||

| Total SA — ADR |

7,223,936 | 356,067,805 | ||||||

|

|

|

|||||||

| 1,949,448,244 | ||||||||

| Paper & Forest Products — 1.0% |

||||||||

| International Paper Co. |

5,020,720 | 240,341,866 | ||||||

| Pharmaceuticals — 8.7% |

||||||||

| AbbVie, Inc. |

2,138,771 | 149,735,358 | ||||||

| Bristol-Myers Squibb Co. |

6,162,797 | 404,525,995 | ||||||

| Johnson & Johnson |

4,125,342 | 413,400,522 | ||||||

| Merck & Co., Inc. |

9,173,930 | 540,894,913 | ||||||

| Pfizer, Inc. |

18,123,887 | 653,547,365 | ||||||

|

|

|

|||||||

| 2,162,104,153 | ||||||||

| Professional Services — 0.4% |

||||||||

| Nielsen NV |

2,091,488 | 101,353,508 | ||||||

| Real Estate Investment Trusts (REITs) — 0.4% |

|

|||||||

| Weyerhaeuser Co. |

3,482,502 | 106,877,986 | ||||||

| Road & Rail — 0.8% |

||||||||

| Union Pacific Corp. |

2,161,429 | 210,933,856 | ||||||

| Semiconductors & Semiconductor Equipment — 2.5% |

|

|||||||

| Intel Corp. |

16,077,065 | 465,431,032 | ||||||

| Samsung Electronics Co. Ltd. |

163,670 | 166,052,390 | ||||||

|

|

|

|||||||

| 631,483,422 | ||||||||

| Software — 2.7% |

||||||||

| Microsoft Corp. |

11,380,893 | $ | 531,487,703 | |||||

| Oracle Corp. |

3,646,000 | 145,621,240 | ||||||

|

|

|

|||||||

| 677,108,943 | ||||||||

| Specialty Retail — 3.5% |

||||||||

| The Gap, Inc. |

4,892,500 | 178,478,400 | ||||||

| The Home Depot, Inc. |

5,861,724 | 685,997,560 | ||||||

|

|

|

|||||||

| 864,475,960 | ||||||||

| Tobacco — 1.8% |

||||||||

| Altria Group, Inc. |

2,908,229 | 158,149,493 | ||||||

| Philip Morris International, Inc. |

1,383,940 | 118,368,388 | ||||||

| Reynolds American, Inc. |

1,914,475 | 164,242,677 | ||||||

|

|

|

|||||||

| 440,760,558 | ||||||||

| Water Utilities — 0.7% |

||||||||

| American Water Works Co., Inc. |

3,619,174 | 187,871,322 | ||||||

| Wireless Telecommunication Services — 0.5% |

|

|||||||

| SK Telecom Co. Ltd. |

544,210 | 116,794,927 | ||||||

| Total Long-Term Investments (Cost — $16,717,522,804) — 96.5% |

24,087,071,249 | |||||||

| Short-Term Securities | ||||||||

| BlackRock Liquidity Funds, TempFund, Institutional Class, 0.08% (a)(b) |

870,929,449 | 870,929,449 | ||||||

| Total Short-Term Securities (Cost — $870,929,449) — 3.5% |

870,929,449 | |||||||

| Total Investments (Cost — $17,588,452,253) — 100.0% | 24,958,000,698 | |||||||

| Liabilities in Excess of Other Assets — (0.0)% | (11,481,626 | ) | ||||||

|

|

|

|||||||

| Net Assets — 100.0% | $ | 24,946,519,072 | ||||||

|

|

|

|||||||

| Notes to Schedule of Investments |

| (a) | During the year ended July 31, 2015, investments in issuers considered to be an affiliate of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940 act, as amended, were as follows: |

| Affiliate |

Shares/Beneficial Interest Held at |

Net Activity |

Shares/Beneficial Interest Held at |

Income | ||||||||||||

| BlackRock Liquidity Funds, TempFund, Institutional Class |

85,056,698 | 785,872,751 | 870,929,449 | $ | 504,871 | |||||||||||

| BlackRock Liquidity Series, LLC, Money Market Series |

— | — | — | $ | 166,519 | 1 | ||||||||||

| 1 Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of other fees and collateral investment expenses, and other payments to and from borrowers of securities. |

| |||||||||||||||

| (b) | Represents the current yield as of report date. |

See Notes to Financial Statements.

| 12 | ANNUAL REPORT | JULY 31, 2015 |

| Schedule of Investments (concluded) |

BlackRock Equity Dividend Fund |

| Fair Value Hierarchy as of July 31, 2015 |

Various inputs are used in determining the fair value of investments. For information about the Fund’s policy regarding valuation of investments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s investments categorized in the disclosure hierarchy:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets: |

||||||||||||||||

| Investments: | ||||||||||||||||

| Long-Term Investments |

||||||||||||||||

| Common Stocks: |

||||||||||||||||

| Aerospace & Defense |

$ | 1,883,738,977 | — | — | $ | 1,883,738,977 | ||||||||||

| Air Freight & Logistics |

271,551,049 | — | — | 271,551,049 | ||||||||||||

| Banks |

4,016,322,481 | — | — | 4,016,322,481 | ||||||||||||

| Beverages |

251,169,159 | $ | 186,796,058 | — | 437,965,217 | |||||||||||

| Capital Markets |

550,310,712 | — | — | 550,310,712 | ||||||||||||

| Chemicals |

629,652,497 | — | — | 629,652,497 | ||||||||||||

| Commercial Services & Supplies |

104,765,707 | — | — | 104,765,707 | ||||||||||||

| Communications Equipment |

516,550,493 | — | — | 516,550,493 | ||||||||||||

| Consumer Finance |

147,202,189 | — | — | 147,202,189 | ||||||||||||

| Diversified Financial Services |

225,655,872 | — | — | 225,655,872 | ||||||||||||

| Diversified Telecommunication Services |

474,738,301 | — | — | 474,738,301 | ||||||||||||

| Electric Utilities |

465,566,909 | — | — | 465,566,909 | ||||||||||||

| Electrical Equipment |

97,181,864 | — | — | 97,181,864 | ||||||||||||

| Energy Equipment & Services |

122,301,702 | — | — | 122,301,702 | ||||||||||||

| Food & Staples Retailing |

337,248,023 | — | — | 337,248,023 | ||||||||||||

| Food Products |

142,396,116 | — | — | 142,396,116 | ||||||||||||

| Health Care Equipment & Supplies |

269,002,845 | — | — | 269,002,845 | ||||||||||||

| Health Care Providers & Services |

990,739,466 | — | — | 990,739,466 | ||||||||||||

| Hotels, Restaurants & Leisure |

194,108,068 | — | — | 194,108,068 | ||||||||||||

| Household Products |

491,231,323 | — | — | 491,231,323 | ||||||||||||

| Industrial Conglomerates |

800,639,268 | — | — | 800,639,268 | ||||||||||||

| Insurance |

1,545,991,326 | — | — | 1,545,991,326 | ||||||||||||

| IT Services |

153,619,653 | — | — | 153,619,653 | ||||||||||||

| Media |

417,109,272 | — | — | 417,109,272 | ||||||||||||

| Metals & Mining |

— | 91,018,121 | — | 91,018,121 | ||||||||||||

| Multi-Utilities |

619,292,126 | — | — | 619,292,126 | ||||||||||||

| Multiline Retail |

401,616,927 | — | — | 401,616,927 | ||||||||||||

| Oil, Gas & Consumable Fuels |

1,949,448,244 | — | — | 1,949,448,244 | ||||||||||||

| Paper & Forest Products |

240,341,866 | — | — | 240,341,866 | ||||||||||||

| Pharmaceuticals |

2,162,104,153 | — | — | 2,162,104,153 | ||||||||||||

| Professional Services |

101,353,508 | — | — | 101,353,508 | ||||||||||||

| Real Estate Investment Trusts (REITs) |

106,877,986 | — | — | 106,877,986 | ||||||||||||

| Road & Rail |

210,933,856 | — | — | 210,933,856 | ||||||||||||

| Semiconductors & Semiconductor Equipment |

465,431,032 | 166,052,390 | — | 631,483,422 | ||||||||||||

| Software |

677,108,943 | — | — | 677,108,943 | ||||||||||||

| Specialty Retail |

864,475,960 | — | — | 864,475,960 | ||||||||||||

| Tobacco |

440,760,558 | — | — | 440,760,558 | ||||||||||||

| Water Utilities |

187,871,322 | — | — | 187,871,322 | ||||||||||||

| Wireless Telecommunication Services |

— | 116,794,927 | — | 116,794,927 | ||||||||||||

| Short-Term Securities |

870,929,449 | — | — | 870,929,449 | ||||||||||||

|

|

|

|||||||||||||||

| Total |

$ | 24,397,339,202 | $ | 560,661,496 | — | $ | 24,958,000,698 | |||||||||

|

|

|

|||||||||||||||

The Fund may hold assets in which the fair value approximates the carrying amount for financial statement purposes. As of July 31, 2015, foreign currency at value of $1,168 is categorized as Level 1 within the disclosure hierarchy.

During the year ended July 31, 2015, there were no transfers between levels.

See Notes to Financial Statements.

| ANNUAL REPORT | JULY 31, 2015 | 13 |

| Schedule of Investments July 31, 2015 |

BlackRock Natural Resources Trust (Percentages shown are based on Net Assets) |

| Common Stocks | Shares | Value | ||||||

| Canadian Independents — 3.0% |

||||||||

| Canadian Natural Resources Ltd. |

267,500 | $ | 6,528,730 | |||||

| Crew Energy, Inc. (a) |

278,300 | 1,021,401 | ||||||

| Encana Corp. |

76,322 | 580,067 | ||||||

| Husky Energy, Inc. |

87,100 | 1,590,357 | ||||||

| Paramount Resources Ltd., Class A (a) |

24,100 | 363,016 | ||||||

|

|

|

|||||||

| 10,083,571 | ||||||||

| Chemicals — 1.8% |

||||||||

| The Chemours Co. |

11,700 | 127,764 | ||||||

| E.I. du Pont de Nemours & Co. |

61,900 | 3,451,544 | ||||||

| Praxair, Inc. |

20,900 | 2,385,526 | ||||||

|

|

|

|||||||

| 5,964,834 | ||||||||

| Energy Equipment & Services — 11.4% |

||||||||

| Cameron International Corp. (a) |

126,900 | 6,403,374 | ||||||

| Dril-Quip, Inc. (a) |

71,800 | 4,193,838 | ||||||

| Halliburton Co. |

241,200 | 10,079,748 | ||||||

| National Oilwell Varco, Inc. |

63,701 | 2,683,723 | ||||||

| Rowan Cos. PLC, Class A |

74,500 | 1,283,635 | ||||||

| Schlumberger Ltd. |

153,215 | 12,689,266 | ||||||

| Seahawk Drilling, Inc. |

4,713 | 6,033 | ||||||

| Trican Well Service Ltd. |

85,000 | 182,628 | ||||||

| Weatherford International PLC (a) |

95,752 | 1,022,631 | ||||||

|

|

|

|||||||

| 38,544,876 | ||||||||

| Gold — 0.5% |

||||||||

| Eldorado Gold Corp. |

460,500 | 1,584,471 | ||||||

| Integrated Oil & Gas — 15.9% |

||||||||

| Chevron Corp. |

139,291 | 12,324,468 | ||||||

| ConocoPhillips |

68,175 | 3,431,929 | ||||||

| Exxon Mobil Corp. |

231,090 | 18,304,639 | ||||||

| Hess Corp. |

117,600 | 6,939,576 | ||||||

| Marathon Oil Corp. |

194,300 | 4,082,243 | ||||||

| Murphy Oil Corp. |

58,700 | 1,924,773 | ||||||

| Total SA — ADR |

140,500 | 6,925,245 | ||||||

|

|

|

|||||||

| 53,932,873 | ||||||||

| Metals & Mining — 5.5% |

||||||||

| BHP Billiton Ltd. |

131,600 | 2,540,855 | ||||||

| First Quantum Minerals Ltd. |

267,211 | 2,135,073 | ||||||

| Franco-Nevada Corp. |

75,000 | 3,045,074 | ||||||

| Goldcorp, Inc. |

215,382 | 2,873,736 | ||||||

| HudBay Minerals, Inc. |

159,100 | 1,025,510 | ||||||

| Newcrest Mining Ltd. (a) |

181,800 | 1,503,794 | ||||||

| Newmont Mining Corp. |

35,400 | 607,818 | ||||||

| Southern Copper Corp. |

152,354 | 4,244,582 | ||||||

| Vale SA — ADR |

143,300 | 753,758 | ||||||

|

|

|

|||||||

| 18,730,200 | ||||||||

| Oil & Gas Drilling — 1.7% |

||||||||

| Helmerich & Payne, Inc. |

97,100 | 5,606,554 | ||||||

| Oil & Gas Equipment & Services — 3.5% |

||||||||

| Baker Hughes, Inc. |

93,580 | 5,441,677 | ||||||

| FMC Technologies, Inc. (a) |

193,000 | 6,322,680 | ||||||

|

|

|

|||||||

| 11,764,357 | ||||||||

| Oil & Gas Exploration & Production — 25.2% |

||||||||

| Anadarko Petroleum Corp. |

161,200 | 11,985,220 | ||||||

| Antero Resources Corp. (a) |

29,100 | 800,541 | ||||||

| Apache Corp. |

123,712 | 5,673,433 | ||||||

| Cabot Oil & Gas Corp. |

366,800 | 9,595,488 | ||||||

| Common Stocks | Shares | Value | ||||||

| Oil & Gas Exploration & Production (concluded) |

||||||||

| Carrizo Oil & Gas, Inc. (a) |

84,100 | $ | 3,206,733 | |||||

| Cimarex Energy Co. |

55,594 | 5,788,447 | ||||||

| Devon Energy Corp. |

214,198 | 10,585,665 | ||||||

| Kosmos Energy Ltd. (a) |

195,700 | 1,409,040 | ||||||

| Newfield Exploration Co. (a) |

77,300 | 2,534,667 | ||||||

| Noble Energy, Inc. |

162,600 | 5,728,398 | ||||||

| Occidental Petroleum Corp. |

173,200 | 12,158,640 | ||||||

| Pioneer Natural Resources Co. |

67,700 | 8,582,329 | ||||||

| Range Resources Corp. |

157,400 | 6,192,116 | ||||||

| Southwestern Energy Co. (a) |

47,800 | 889,080 | ||||||

|

|

|

|||||||

| 85,129,797 | ||||||||

| Oil & Gas Producers — 0.6% |

||||||||

| Whiting Petroleum Corp. (a) |

107,400 | 2,200,626 | ||||||

| Oil, Gas & Consumable Fuels — 20.7% |

||||||||

| Cenovus Energy, Inc. |

139,922 | 2,039,159 | ||||||

| CNOOC Ltd. — ADR |

13,300 | 1,631,245 | ||||||

| CONSOL Energy, Inc. |

68,800 | 1,136,576 | ||||||

| EOG Resources, Inc. |

312,780 | 24,143,488 | ||||||

| EQT Corp. |

118,400 | 9,099,040 | ||||||

| Marathon Petroleum Corp. |

199,800 | 10,923,066 | ||||||

| MEG Energy Corp. |

49,400 | 529,562 | ||||||

| Murphy USA, Inc. (a) |

32,675 | 1,789,283 | ||||||

| Phillips 66 |

68,737 | 5,464,592 | ||||||

| Suncor Energy, Inc. |

431,104 | 12,143,496 | ||||||

| Surge Energy, Inc. |

272,700 | 494,169 | ||||||

| Uranium Energy Corp. (a) |

261,724 | 350,710 | ||||||

| Vaalco Energy, Inc. (a) |

205,400 | 271,128 | ||||||

|

|

|

|||||||

| 70,015,514 | ||||||||

| Refining, Marketing & Transport — 2.2% |

||||||||

| Valero Energy Corp. |

115,200 | 7,557,120 | ||||||

| Utilities — 0.7% |

||||||||

| The Williams Cos., Inc. |

48,500 | 2,545,280 | ||||||

| Total Common Stocks — 92.7% | 313,660,073 | |||||||

| Investment Companies — 0.3% | ||||||||

| Sprott Physical Silver Trust (a) |

187,400 | 1,060,684 | ||||||

| Total Long-Term Investments (Cost — $174,484,882) — 93.0% |

314,720,757 | |||||||

| Short-Term Securities | ||||||||

| BlackRock Liquidity Funds, TempFund, Institutional Class, 0.08% (b)(c) |

23,865,097 | 23,865,097 | ||||||

| Total Short-Term Securities (Cost — $23,865,097) — 7.1% |

23,865,097 | |||||||

| Total Investments (Cost — $198,349,979) — 100.1% | 338,585,854 | |||||||

| Liabilities in Excess of Other Assets — (0.1)% | (412,153 | ) | ||||||

|

|

|

|||||||

| Net Assets — 100.0% | $ | 338,173,701 | ||||||

|

|

|

|||||||

See Notes to Financial Statements.

| 14 | ANNUAL REPORT | JULY 31, 2015 |

| Schedule of Investments (concluded) |

BlackRock Natural Resources Trust |

| Notes to Schedule of Investments |

| (a) | Non-income producing security. |

| (b) | During the year ended July 31, 2015, investments in issuers considered to be an affiliate of the Fund for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| Affiliate |

Shares/Beneficial Interest Held at |

Net Activity |

Shares/Beneficial Interest Held at |

Income | ||||||||||||

| BlackRock Liquidity Funds, TempFund, Institutional Class |

4,339,592 | 19,525,505 | 23,865,097 | $ | 10,017 | |||||||||||

| BlackRock Liquidity Series, LLC, Money Market Series |

$ | 2,180,425 | $ | (2,180,425 | ) | — | $ | 5,760 | 1 | |||||||

| 1 Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of other fees and collateral investment expenses, and other payments to and from borrowers of securities. |

| |||||||||||||||

| (c) | Represents the current yield as of report date. |

| Fair Value Hierarchy as of July 31, 2015 |

Various inputs are used in determining the fair value of investments. For information about the Fund’s policy regarding valuation of investments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s investments categorized in the disclosure hierarchy:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets: |

||||||||||||||||

| Investments: | ||||||||||||||||

| Long-Term Investments |

||||||||||||||||

| Common Stocks: |

||||||||||||||||

| Canadian Independents |

$ | 10,083,571 | — | — | $ | 10,083,571 | ||||||||||

| Chemicals |

5,964,834 | — | — | 5,964,834 | ||||||||||||

| Energy Equipment & Services |

38,538,843 | $ | 6,033 | — | 38,544,876 | |||||||||||

| Gold |

1,584,471 | — | — | 1,584,471 | ||||||||||||

| Integrated Oil & Gas |

53,932,873 | — | — | 53,932,873 | ||||||||||||

| Metals & Mining |

14,685,551 | 4,044,649 | — | 18,730,200 | ||||||||||||

| Oil & Gas Drilling |

5,606,554 | — | — | 5,606,554 | ||||||||||||

| Oil & Gas Equipment & Services |

11,764,357 | — | — | 11,764,357 | ||||||||||||

| Oil & Gas Exploration & Production |

85,129,797 | — | — | 85,129,797 | ||||||||||||

| Oil & Gas Producers |

2,200,626 | — | — | 2,200,626 | ||||||||||||

| Oil, Gas & Consumable Fuels |

69,135,242 | 880,272 | — | 70,015,514 | ||||||||||||

| Refining, Marketing & Transport |

7,557,120 | — | — | 7,557,120 | ||||||||||||

| Utilities |

2,545,280 | — | — | 2,545,280 | ||||||||||||

| Investment Companies |

1,060,684 | — | — | 1,060,684 | ||||||||||||

| Short-Term Securities |

23,865,097 | — | — | 23,865,097 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 333,654,900 | $ | 4,930,954 | — | $ | 338,585,854 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The Fund may hold assets in which the fair value approximates the carrying amount for financial statement purposes. As of July 31, 2015, foreign currency at value of $574 is categorized as Level 1 within the disclosure hierarchy.

During the year ended July 31, 2015, there were no transfers between levels.

See Notes to Financial Statements.

| ANNUAL REPORT | JULY 31, 2015 | 15 |

| Statements of Assets and Liabilities |

| July 31, 2015 | BlackRock Equity Dividend Fund |

BlackRock Natural Resources Trust |

||||||

| Assets | ||||||||

| Investments at value — unaffiliated1 |

$ | 24,087,071,249 | $ | 314,720,757 | ||||

| Investments at value — affiliated2 |

870,929,449 | 23,865,097 | ||||||

| Receivables: | ||||||||

| Investments sold |

43,220,071 | — | ||||||

| Dividends |

21,902,764 | 188,180 | ||||||

| Capital shares sold |

20,816,859 | 806,823 | ||||||

| Securities lending income — affiliated |

— | 156 | ||||||

| Foreign currency at value3 |

1,168 | 574 | ||||||

| Prepaid expenses |

234,691 | 33,479 | ||||||

|

|

|

|||||||

| Total assets |

25,044,176,251 | 339,615,066 | ||||||

|

|

|

|||||||

| Liabilities | ||||||||

| Payables: | ||||||||

| Capital shares redeemed |

68,204,113 | 903,974 | ||||||

| Transfer agent fees |

11,953,932 | 186,254 | ||||||

| Investment advisory fees |

11,126,820 | 180,073 | ||||||

| Service and distribution fees |

4,880,337 | 97,075 | ||||||

| Other affiliates |

150,185 | 2,152 | ||||||

| Officer’s and Trustees’ fees |

59,667 | 6,097 | ||||||

| Other accrued expenses |

1,282,125 | 65,740 | ||||||

|

|

|

|||||||

| Total liabilities |

97,657,179 | 1,441,365 | ||||||

|

|

|

|||||||

| Net Assets |

$ | 24,946,519,072 | $ | 338,173,701 | ||||

|

|

|

|||||||

| Net Assets Consist of | ||||||||

| Paid-in capital |

$ | 15,196,120,082 | $ | 180,849,649 | ||||

| Undistributed (distributions in excess of) net investment income |

9,088,075 | (1,561,828 | ) | |||||

| Accumulated net realized gain |

2,371,783,881 | 18,650,067 | ||||||

| Net unrealized appreciation (depreciation) |

7,369,527,034 | 140,235,813 | ||||||

|

|

|

|||||||

| Net Assets |

$ | 24,946,519,072 | $ | 338,173,701 | ||||

|

|

|

|||||||

| 1 Investments at cost — unaffiliated |

$ | 16,717,522,804 | $ | 174,484,882 | ||||

| 2 Investments at cost — affiliated |

$ | 870,929,449 | $ | 23,865,097 | ||||

| 3 Foreign currency at cost |

$ | 1,173 | $ | 574 | ||||

| See Notes to Financial Statements. | ||||||

| 16 | ANNUAL REPORT | JULY 31, 2015 | ||||

| Statements of Assets and Liabilities (concluded) |

| July 31, 2015 | BlackRock Equity Dividend Fund |

BlackRock Natural Resources Trust |

||||||

| Net Asset Value | ||||||||

| Institutional: | ||||||||

| Net assets |

$ | 13,242,101,290 | $ | 80,863,743 | ||||

|

|

|

|||||||

| Shares outstanding4 |

531,025,722 | 1,719,581 | ||||||

|

|

|

|||||||

| Net asset value |

$ | 24.94 | $ | 47.03 | ||||

|

|

|

|||||||

| Service: | ||||||||

| Net assets |

$ | 99,271,274 | — | |||||

|

|

|

|||||||

| Shares outstanding4 |

3,992,900 | — | ||||||

|

|

|

|||||||

| Net asset value |

$ | 24.86 | — | |||||

|

|

|

|||||||

| Investor A: | ||||||||

| Net assets |

$ | 7,226,832,914 | $ | 198,815,678 | ||||

|

|

|

|||||||

| Shares outstanding4 |

290,443,628 | 4,360,680 | ||||||

|

|

|

|||||||

| Net asset value |

$ | 24.88 | $ | 45.59 | ||||

|

|

|

|||||||

| Investor B: | ||||||||

| Net assets |

$ | 21,394,503 | $ | 1,468,209 | ||||

|

|

|

|||||||

| Shares outstanding4 |

851,862 | 36,507 | ||||||

|

|

|

|||||||

| Net asset value |

$ | 25.11 | $ | 40.22 | ||||

|

|

|

|||||||

| Investor C: | ||||||||

| Net assets |

$ | 3,361,650,876 | $ | 57,026,071 | ||||

|

|

|

|||||||

| Shares outstanding4 |

138,509,108 | 1,444,590 | ||||||

|

|

|

|||||||

| Net asset value |

$ | 24.27 | $ | 39.48 | ||||

|

|

|

|||||||

| Investor C1: | ||||||||

| Net assets |

$ | 7,340,380 | — | |||||

|

|

|

|||||||

| Shares outstanding4 |

302,782 | — | ||||||

|

|

|

|||||||

| Net asset value |

$ | 24.24 | — | |||||

|

|

|

|||||||

| Class R: | ||||||||

| Net assets |

$ | 987,927,835 | — | |||||

|

|

|

|||||||

| Shares outstanding4 |

39,508,736 | — | ||||||

|

|

|

|||||||

| Net asset value |

$ | 25.01 | — | |||||

|

|

|

|||||||

| 4 Unlimited number of shares authorized, $0.10 par value. |

||||||||

| See Notes to Financial Statements. | ||||||

| ANNUAL REPORT | JULY 31, 2015 | 17 | ||||

| Statements of Operations |

| Year Ended July 31, 2015 | BlackRock Equity Dividend Fund |

BlackRock Trust |

||||||

| Investment Income | ||||||||

| Dividends — unaffiliated |

$ | 722,998,829 | $ | 7,635,076 | ||||

| Dividends — affiliated |

504,871 | 10,017 | ||||||

| Securities lending — affiliated — net |

166,519 | 5,760 | ||||||

| Foreign taxes withheld |

(7,383,931 | ) | (299,238 | ) | ||||

|

|

|

|

|

|||||

| Total income |

716,286,288 | 7,351,615 | ||||||

|

|

|

|

|

|||||

| Expenses | ||||||||

| Investment advisory |

151,855,019 | 2,560,297 | ||||||

| Service — Service |

643,624 | — | ||||||

| Service — Investor A |

20,952,794 | 606,853 | ||||||

| Service and distribution — Investor B |

281,859 | 24,564 | ||||||

| Service and distribution — Investor C |

34,941,151 | 726,938 | ||||||

| Service and distribution — Investor C1 |

60,452 | — | ||||||

| Service and distribution — Class R |

5,633,930 | — | ||||||

| Transfer agent — Institutional |

19,507,159 | 149,182 | ||||||

| Transfer agent — Service |

518,910 | — | ||||||

| Transfer agent — Investor A |

12,934,537 | 382,402 | ||||||

| Transfer agent — Investor B |

43,455 | 6,050 | ||||||

| Transfer agent — Investor C |

3,577,553 | 136,323 | ||||||

| Transfer agent — Investor C1 |

9,024 | — | ||||||

| Transfer agent — Class R |

2,430,152 | — | ||||||

| Accounting services |

2,978,156 | 98,392 | ||||||

| Custodian |

1,249,846 | 33,091 | ||||||

| Printing |

549,674 | 28,785 | ||||||

| Professional |

540,646 | 117,677 | ||||||

| Registration |

492,615 | 85,161 | ||||||

| Officer and Trustees |

372,177 | 23,982 | ||||||

| Miscellaneous |

433,869 | 25,792 | ||||||

|

|

|

|

|

|||||

| Total expenses |

260,006,602 | 5,005,489 | ||||||

| Less fees waived by the Manager |

(1,527,967 | ) | (8,780 | ) | ||||

| Less fees paid indirectly |

(156 | ) | (9 | ) | ||||

|

|

|

|

|

|||||

| Total expenses after fees waived and paid indirectly |

258,478,479 | 4,996,700 | ||||||

|

|

|

|

|

|||||

| Net investment income |

457,807,809 | 2,354,915 | ||||||

|

|

|

|

|

|||||

| Realized and Unrealized Gain (Loss) | ||||||||

| Net realized gain (loss) from: | ||||||||

| Investments |

3,342,568,542 | 22,075,683 | ||||||

| Foreign currency transactions |

(3,400,679 | ) | (22,832 | ) | ||||

|

|

|

|

|

|||||

| 3,339,167,863 | 22,052,851 | |||||||

|

|

|

|

|

|||||

| Net change in unrealized appreciation (depreciation) on: | ||||||||

| Investments |

(1,761,798,882 | ) | (197,198,286 | ) | ||||

| Foreign currency translations |

(21,408 | ) | 8 | |||||

|

|

|

|

|

|||||

| (1,761,820,290 | ) | (197,198,278 | ) | |||||

|

|

|

|

|

|||||

| Net realized and unrealized gain (loss) |

1,577,347,573 | (175,145,427 | ) | |||||

|

|

|

|

|

|||||

| Net Increase (Decrease) in Net Assets Resulting from Operations |

$ | 2,035,155,382 | $ | (172,790,512 | ) | |||

|

|

|

|

|

|||||

| See Notes to Financial Statements. | ||||||

| 18 | ANNUAL REPORT | JULY 31, 2015 | ||||

| Statements of Changes in Net Assets | BlackRock Equity Dividend Fund |

| Year Ended July 31, | ||||||||

| Increase (Decrease) in Net Assets: | 2015 | 2014 | ||||||

| Operations | ||||||||

| Net investment income |

$ | 457,807,809 | $ | 533,972,710 | ||||

| Net realized gain |

3,339,167,863 | 272,065,530 | ||||||

| Net change in unrealized appreciation (depreciation) |

(1,761,820,290 | ) | 2,403,283,780 | |||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from operations |

2,035,155,382 | 3,209,322,020 | ||||||

|

|

|

|

|

|||||

| Distributions to Shareholders From1 | ||||||||

| Net investment income: |

||||||||

| Institutional |

(274,869,937 | ) | (295,768,757 | ) | ||||

| Service |

(3,822,640 | ) | (5,359,779 | ) | ||||

| Investor A |

(131,790,737 | ) | (187,267,755 | ) | ||||

| Investor B |

(210,735 | ) | (387,871 | ) | ||||

| Investor C |

(33,474,244 | ) | (38,884,066 | ) | ||||

| Investor C1 |

(86,938 | ) | (102,332 | ) | ||||

| Class R |

(14,245,399 | ) | (17,908,936 | ) | ||||

| Net realized gain: |

||||||||

| Institutional |

(655,224,706 | ) | (13,391,696 | ) | ||||

| Service |

(11,735,392 | ) | (301,877 | ) | ||||

| Investor A |

(360,625,429 | ) | (9,793,847 | ) | ||||

| Investor B |

(1,290,098 | ) | (38,713 | ) | ||||

| Investor C |

(154,480,564 | ) | (3,156,741 | ) | ||||

| Investor C1 |

(336,253 | ) | (7,242 | ) | ||||

| Class R |

(50,501,947 | ) | (1,135,064 | ) | ||||

|

|

|

|

|

|||||

| Decrease in net assets resulting from distributions to shareholders |

(1,692,695,019 | ) | (573,504,676 | ) | ||||

|

|

|

|

|

|||||

| Capital Share Transactions | ||||||||

| Net decrease in net assets derived from capital share transactions |

(5,122,723,571 | ) | (2,795,106,790 | ) | ||||

|

|

|

|

|

|||||

| Net Assets | ||||||||

| Total decrease in net assets |

(4,780,263,208 | ) | (159,289,446 | ) | ||||

| Beginning of year |

29,726,782,280 | 29,886,071,726 | ||||||

|

|

|

|

|

|||||

| End of year |

$ | 24,946,519,072 | $ | 29,726,782,280 | ||||

|

|

|

|

|

|||||

| Undistributed net investment income, end of year |

$ | 9,088,075 | $ | 13,181,575 | ||||

|

|

|

|

|

|||||

| 1 Distributions for annual periods determined in accordance with federal income tax regulations. |

||||||||

| See Notes to Financial Statements. | ||||||

| ANNUAL REPORT | JULY 31, 2015 | 19 | ||||

| Statements of Changes in Net Assets | BlackRock Natural Resources Trust |

| Year Ended July 31, | ||||||||

| Increase (Decrease) in Net Assets: | 2015 | 2014 | ||||||

| Operations | ||||||||

| Net investment income |

$ | 2,354,915 | $ | 1,607,567 | ||||

| Net realized gain |

22,052,851 | 34,553,505 | ||||||

| Net change in unrealized appreciation (depreciation) |

(197,198,278 | ) | 58,434,988 | |||||

|

|

|

|||||||

| Net increase (decrease) in net assets resulting from operations |

(172,790,512 | ) | 94,596,060 | |||||

|

|

|

|||||||

| Distributions to Shareholders From1 | ||||||||

| Net investment income: | ||||||||

| Institutional |

(630,696 | ) | (607,459 | ) | ||||

| Investor A |

(1,077,452 | ) | (1,130,822 | ) | ||||

| Investor B |

(2,489 | ) | (2,149 | ) | ||||

| Investor C |

(139,363 | ) | (109,172 | ) | ||||

| Net realized gain: | ||||||||

| Institutional |

(8,497,039 | ) | (788,301 | ) | ||||

| Investor A |

(18,561,542 | ) | (1,936,403 | ) | ||||

| Investor B |

(231,702 | ) | (35,884 | ) | ||||

| Investor C |

(6,555,562 | ) | (670,277 | ) | ||||

|

|

|

|||||||

| Decrease in net assets resulting from distributions to shareholders |

(35,695,845 | ) | (5,280,467 | ) | ||||

|

|

|

|||||||

| Capital Share Transactions | ||||||||

| Net decrease in net assets derived from capital share transactions |

(5,544,324 | ) | (34,980,766 | ) | ||||

|

|

|

|||||||

| Net Assets | ||||||||

| Total increase (decrease) in net assets |

(214,030,681 | ) | 54,334,827 | |||||

| Beginning of year |

552,204,382 | 497,869,555 | ||||||

|

|

|

|||||||

| End of year |

$ | 338,173,701 | $ | 552,204,382 | ||||

|

|

|

|||||||

| Distributions in excess of net investment income, end of year |

$ | (1,561,828 | ) | $ | (2,043,911 | ) | ||

|

|

|

|||||||

| 1 Distributions for annual periods determined in accordance with federal income tax regulations. |

| |||||||

| See Notes to Financial Statements. | ||||||

| 20 | ANNUAL REPORT | JULY 31, 2015 | ||||

| Financial Highlights | BlackRock Equity Dividend Fund |

| Institutional | ||||||||||||||||||||

| Year Ended July 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Per Share Operating Performance | ||||||||||||||||||||

| Net asset value, beginning of year |

$ | 24.71 | $ | 22.64 | $ | 19.52 | $ | 18.17 | $ | 15.66 | ||||||||||

|

|

|

|||||||||||||||||||

| Net investment income1 |

0.47 | 0.48 | 0.48 | 0.43 | 0.37 | |||||||||||||||

| Net realized and unrealized gain |

1.34 | 2.10 | 3.12 | 1.34 | 2.53 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Net increase from investment operations |

1.81 | 2.58 | 3.60 | 1.77 | 2.90 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Distributions from:2 | ||||||||||||||||||||

| Net investment income |

(0.48 | ) | (0.49 | ) | (0.47 | ) | (0.41 | ) | (0.39 | ) | ||||||||||

| Net realized gain |

(1.10 | ) | (0.02 | ) | (0.01 | ) | (0.01 | ) | — | |||||||||||

|

|

|

|||||||||||||||||||

| Total distributions |

(1.58 | ) | (0.51 | ) | (0.48 | ) | (0.42 | ) | (0.39 | ) | ||||||||||

|

|

|

|||||||||||||||||||

| Net asset value, end of year |

$ | 24.94 | $ | 24.71 | $ | 22.64 | $ | 19.52 | $ | 18.17 | ||||||||||

|

|

|

|||||||||||||||||||

| Total Return3 | ||||||||||||||||||||

| Based on net asset value |

7.55% | 11.49% | 18.63% | 9.90% | 18.62% | |||||||||||||||

|

|

|

|||||||||||||||||||

| Ratios to Average Net Assets | ||||||||||||||||||||

| Total expenses |

0.70% | 0.70% | 0.73% | 0.71% | 0.75% | |||||||||||||||

|

|

|

|||||||||||||||||||

| Total expenses after fees waived and paid indirectly |

0.69% | 0.70% | 0.72% | 0.70% | 0.75% | |||||||||||||||

|

|

|

|||||||||||||||||||

| Net investment income |

1.86% | 2.00% | 2.28% | 2.34% | 2.10% | |||||||||||||||

|

|

|

|||||||||||||||||||

| Supplemental Data | ||||||||||||||||||||

| Net assets, end of year (000) |

$ | 13,242,101 | $ | 14,595,350 | $ | 14,610,283 | $ | 11,068,796 | $ | 6,122,019 | ||||||||||

|

|

|

|||||||||||||||||||

| Portfolio turnover rate |

25% | 6% | 15% | 3% | 5% | |||||||||||||||

|

|

|

|||||||||||||||||||

| 1 | Based on average shares outstanding. |

| 2 | Distributions for annual periods determined in accordance with federal income tax regulations. |

| 3 | Where applicable, assumes the reinvestment of distributions. |

| See Notes to Financial Statements. | ||||||

| ANNUAL REPORT | JULY 31, 2015 | 21 | ||||

| Financial Highlights (continued) | BlackRock Equity Dividend Fund |

| Service | ||||||||||||||||||||

| Year Ended July 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Per Share Operating Performance | ||||||||||||||||||||

| Net asset value, beginning of year |

$ | 24.63 | $ | 22.56 | $ | 19.46 | $ | 18.12 | $ | 15.63 | ||||||||||

|

|

|

|||||||||||||||||||

| Net investment income1 |

0.39 | 0.40 | 0.42 | 0.37 | 0.33 | |||||||||||||||

| Net realized and unrealized gain |

1.33 | 2.10 | 3.10 | 1.36 | 2.51 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Net increase from investment operations |

1.72 | 2.50 | 3.52 | 1.73 | 2.84 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Distributions from:2 | ||||||||||||||||||||

| Net investment income |

(0.39 | ) | (0.41 | ) | (0.41 | ) | (0.38 | ) | (0.35 | ) | ||||||||||

| Net realized gain |

(1.10 | ) | (0.02 | ) | (0.01 | ) | (0.01 | ) | — | |||||||||||

|

|

|

|||||||||||||||||||

| Total distributions |

(1.49 | ) | (0.43 | ) | (0.42 | ) | (0.39 | ) | (0.35 | ) | ||||||||||

|

|

|

|||||||||||||||||||

| Net asset value, end of year |

$ | 24.86 | $ | 24.63 | $ | 22.56 | $ | 19.46 | $ | 18.12 | ||||||||||

|

|

|

|||||||||||||||||||

| Total Return3 | ||||||||||||||||||||

| Based on net asset value |

7.19% | 11.17% | 18.23% | 9.68% | 18.24% | |||||||||||||||

|

|

|

|||||||||||||||||||

| Ratios to Average Net Assets | ||||||||||||||||||||

| Total expenses |

1.02% | 1.01% | 1.01% | 1.02% | 1.01% | |||||||||||||||

|

|

|

|||||||||||||||||||

| Total expenses after fees waived and paid indirectly |

1.01% | 1.01% | 1.01% | 1.01% | 1.01% | |||||||||||||||

|

|

|

|||||||||||||||||||

| Net investment income |

1.58% | 1.69% | 1.99% | 2.00% | 1.85% | |||||||||||||||

|

|

|

|||||||||||||||||||

| Supplemental Data | ||||||||||||||||||||

| Net assets, end of year (000) |

$ | 99,271 | $ | 295,017 | $ | 323,071 | $ | 207,027 | $ | 67,367 | ||||||||||

|

|

|

|||||||||||||||||||

| Portfolio turnover rate |

25% | 6% | 15% | 3% | 5% | |||||||||||||||

|

|

|

|||||||||||||||||||

| 1 | Based on average shares outstanding. |

| 2 | Distributions for annual periods determined in accordance with federal income tax regulations. |

| 3 | Where applicable, assumes the reinvestment of distributions. |

| See Notes to Financial Statements. | ||||||

| 22 | ANNUAL REPORT | JULY 31, 2015 | ||||

| Financial Highlights (continued) | BlackRock Equity Dividend Fund |

| Investor A | ||||||||||||||||||||

| Year Ended July 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Per Share Operating Performance | ||||||||||||||||||||

| Net asset value, beginning of year |

$ | 24.65 | $ | 22.59 | $ | 19.48 | $ | 18.13 | $ | 15.63 | ||||||||||

|

|

|

|||||||||||||||||||

| Net investment income1 |

0.40 | 0.42 | 0.42 | 0.38 | 0.33 | |||||||||||||||

| Net realized and unrealized gain |

1.33 | 2.09 | 3.11 | 1.34 | 2.53 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Net increase from investment operations |

1.73 | 2.51 | 3.53 | 1.72 | 2.86 | |||||||||||||||

|

|

|

|||||||||||||||||||